Testing the Capital Asset Pricing Model

on the Karachi Stock Exchange

Paper within Economics

Author: Awais Shah

Dawoud Asalya Tutor: Prof. Scott Hacker & PHD. Mikaela Backman

Bachelor’s Thesis in Economics

Title: Testing the Capital Asset Pricing Model on the Karachi Stock Exchange Authors: Awais Shah & Dawoud Asalya

Tutor: Prof. Scott Hacker & Ph-D. Mikaela Backman Date: May 2013

Key Words: Capital Asset pricing model (CAPM), Karachi stock exchange (KSE), ex-pected return on assets, asset pricing model, risk and return relationship, Beta, system-atic risk.

Abstract

This paper examines the testing of the Capital Asset Pricing Model (CAPM) on the Ka-rachi stock exchange (KSE-30) by using cross-sectional regression for the time period between February 2009 and January 2013 on 10 individual companies using weekly re-turns. CAPM has been tested widely for several equity markets but there is little empiri-cal evidence of CAPM testing on the emerging stock market of Pakistan.

The CAPM hypothesis regarding the intercept coefficient is that it should be equal to zero meaning the expected return of a stock equals the risk free rate when there is no systematic risk. A two sided t-test is employed on the intercept and the findings of this research are not supportive of the theory’s basic prediction that the intercept equals ze-ro. Also, the CAPM implies that average risk premium is greater than zero and using right tail t-test, a positive beta risk premium is found to be true in most periods in ac-cordance with the CAPM’s prediction. In order to further analyze the applicability of the CAPM, since it predicts a linear risk and return relationship the beta squared coeffi-cients are used in the cross-sectional regression. The results of test for non-linearity provides evidence against the CAPM and do not lend support to the linear risk-return structure.

To summarize, the test for non-systematic risk indicates that the residual variance of stocks tends to impact the returns and beta is not the only relevant risk factor contrary to the CAPM for the emerging stock market of Pakistan.

Table of Contents

1

Introduction ... 1

2

Theoretical Framework ... 4

2.1 Classic theory of the CAPM ... 4

2.2 Debate surrounding the CAPM ... 6

2.3 Challenges to the validity of the Model ... 7

2.4 Previous Research on the emerging markets... 7

3

Research Methodology ... 9

3.1 Sample selection and data collection ... 9

3.2 Method of the CAPM testing ... 10

3.3 The CAPM hypothesis ... 12

3.4 Testing ... 12

4

Empirical Data Analysis ... 13

4.1 Beta Estimation ... 13

4.11 R-square values ... 13

4.12 Estimation of SML. Non-linearity and Non-systematic test for entire testing period ... 14

4.2 Intercept and beta risk premium coefficients graph ... 15

4.3 Results from Period 2, 3 and 4 ... 17

4.4 Results from Period 5, 6, 7 and 8 ... 18

4.5 Summary of results ... 19

5

Conclusion ... 21

6

References ... 22

7

Appendix ... 25

7.1 Figures ... 25 7.2 Tables ... 271

Introduction

Estimation of expected return or cost of equity for stocks is important to investors and financial managers. The estimation is needed in order to make investment decisions and to evaluate the performance of a particular asset. Financial investment decisions in a stock market or in another company, for instance in case of a takeover by one firm, are made on the basis of getting all the necessary information regarding the project to min-imize the level of uncertainty. The role of expected returns is vital in determining the investment’s future direction of cash flows to aid decision making. With the develop-ment of modern capital theory came the emergence of the Capital Asset Pricing Model (CAPM) which helped in estimating the required rate of return demanded by investors. The theory was built upon the efficient market hypothesis and efficient portfolio theory and the major breakthrough within this field occurred with CAPM developed by Sharpe (1964), Lintner (1965) and Mossin (1966).

The purpose of this thesis is to test the Capital Asset Pricing Model on the emerging stock market of Pakistan. The CAPM has been tested to a great extent on the financial markets of US, UK, Europe and Asia but there is little empirical evidence of testing the model in the South Asian markets especially Pakistan. Moreover, this research is amongst the very few if not the first on the Karachi Stock Exchange (KSE-30 index). The Karachi stock exchange holds the reputation of the most liquid equity market and investors are rewarded for taking extra risk. Since use of the CAPM still holds a place in academics and investment decision making, our findings will be of interest to people concerning both walks of life.

The CAPM is used to assess the risk of cash flows for an investment and to estimate the cost of capital of a project. Managers are interested in knowing the estimated rate of re-turn which is earned by making a particular investment and the CAPM specifically serves this purpose. The CAPM states that expected return of an asset is a linear func-tion based on the risk free rate, systematic risk known as the beta and an estimated risk premium (Berk, Dermarzo & Harford, 2009). Bhatti and Hanif (2010) describe the CAPM concept as being based on the principle that shareholders are rewarded in two ways; the time value of money and the market risk. The model provides an estimate of the financial asset on the market while taking into account the risk averse behavior of the investors. The measure of systematic risk beta explains the relationship between an asset´s movement and those of the market. A beta coefficient higher than 1 represents that the return on an asset moves sharply and is expected to fluctuate more than the re-turn on market while a beta coefficient less than 1 indicates that the price movement of an asset is expected to be damped relative to market price movements. This model is used to assess the performance of mutual funds and other managed portfolios and still holds a central part in all mainstream finance books. Researchers and academicians have tested the model rigorously during the last forty years and this has led to several alternative model such as Fama and French (1992) three factor model and Arbitrage pricing model. Over the course of time, despite the development of several other asset pricing models, the classic CAPM is still relevant and there is no consensus in the litera-ture as there is a support in favor of the CAPM and against it too. Despite all the debate regarding the CAPM, it is one of the simplest method of calculating expected returns.

Furthermore, it is interesting to analyze how the CAPM performs as in our case on an emerging stock market of Pakistan.

Ever since the development of the model it has been widely tested to evaluate its per-formance in explaining risk and return relationship. With the emergence of several new equity markets it is essential to test the validity of the model in these markets since they can provide intriguing growth opportunities if investors take benefits of diversifying their portfolio with different investment approaches. Since the largest equity market of Pakistan is the Karachi Stock Exchange (KSE), testing the CAPM on this particular market will provide an insight on the pricing of assets in Pakistan. Iqbal and Brooks (2007) mentioned that in the case of emerging markets the effect of market inefficien-cies are prevalent as compared to developed markets. However, the lack of integration of emerging markets with the world market can provide benefits of diversifying risk to international investors only if market risk is present. The Karachi Stock exchange com-prises of four major indices. KSE-100, KSE-All share KSE-30 and KMI-30. In 1991, KSE-100 was introduced as a standard to compare prices and eventually make sure that the full market image was captured by incorporating companies representing diverse sectors of the economy based on highest market capitalization.

Research on CAPM in the context of Pakistan has presented challenges. For the testing of CAPM, the assumption of efficient markets is a problem. The concept of efficient markets in empirical testing is hard to fulfill but in our research it is more problematic due to market inefficiencies caused by government intervention, capital outflow due to political instability, insider trading influences on stock prices and infrequent or thin trading due to a volatile security situation, especially between 2007 and 2008. During these two years the market index approximately dropped 2000 points. For instance, in August 2008 as the political situation deteriorated in the country the government had to intervene to set a floor on the stock prices as they were declining sharply. The Pakistani government had to stop the plunge that had wiped out $36.9 billion within four months. Consequently, investors lost the confidence in the market until December 2008 when trading resumed again. Thus, there were difficulties in collecting data for long time frame. However, from 2009 onwards the market improved significantly and the market index (KSE-30) increased from 10,000 to approximately 15,000 points by early 2013. Another issue in collecting data was the re-composition of index biannually meaning twice in a year few companies were excluded and replaced by others. Therefore, ten companies are selected which have traded continuously on KSE-30 so that thin trading does not impact the results and true estimates are obtained.

The results of our research are not supportive of the CAPM’s prediction regarding the intercept that should be equal zero in most periods. However, regarding the average risk premium as it should be greater than zero and rewarding investors for bearing systemat-ic risk is found to be true as the CAPM predsystemat-icts. Especially the last testing periods showed sufficient evidence in favor of positive average risk premium. The test for non-linearity and the test for non-systematic risk revealed the shortcomings of the CAPM since no evidence is found that higher risk generates higher returns and beta is only the relevant risk factor in the emerging Karachi equity market.

This thesis is organized as follows. The following theoretical framework section pre-sents the relevant theories dealing with CAPM. The section also focuses on KSE. Then

of testing CAPM. Moving to the empirical data analysis section we focused on applying the methods we mentioned in the previous section to the empirical data, in order to find out whether the CAPM holds true or not. Finally, in the conclusion section we focus on summarizing the detailed outcomes of the findings from the empirical analysis, and then we conclude the results from these findings.

2

Theoretical Framework

2.1

Classic theory of the CAPM

During the early 1960s, four economists John Lintner (1965a, b), Jan Mossin (1966), William Sharpe (1964), and Jack Treynor (1962) – developed a model for defining se-curity returns. Since its foundation in the early 1960s, it has provided as the basis for the CAPM and its implementation to specialist activities. The linear equation for the CAPM is as following:

(1)

where,

is the expected return on stock i; is the risk free rate;

is the systematic risk; is the market premium.

The CAPM model is built on the concept that for a given exposure to uncertain out-comes, shareholders prefer higher expected returns. This theory seems rational due to it’s predictive nature. Following the foundation of the CAPM in the late 1960s, a good agreement of performed experimental work supported the forecasting ability of the CAPM that an asset’s additional return over the risk-free rate should be proportional to its exposure to the whole market risk measured by beta (Dempsey, 2013).

Assumptions of the CAPM

The above described theory of the CAPM based on determining required rate of return of a financial asset or security, has some underlying assumptions which are listed as be-low:

Markets are in equilibrium and there are no market imperfections as there are no transaction costs for trading.

Investors pay no taxes on returns and there are no commissions.

The investor behaviour is competitive and all investors have equal access to all securities in the market where they can borrow or lend unlimited amount at the same risk free rate.

All assets are perfectly divisible and investors can hold any fraction of an asset.

All investors are risk averse and have homogenous beliefs regarding expected returns and correlation for all risky stocks in forming an optimal portfolio. However, the above mentioned assumptions of the CAPM are not always obeyed in re-ality. Since markets inefficiences are often prevalent due to several reasons such as gov-ernment interventions, protectionist laws and other external factors. Lumby and Jones (2003) acknowledges the fact that these CAPM assumptions are unrealistic. However, the main issue surrounds the predictive ability of the model and if the model has

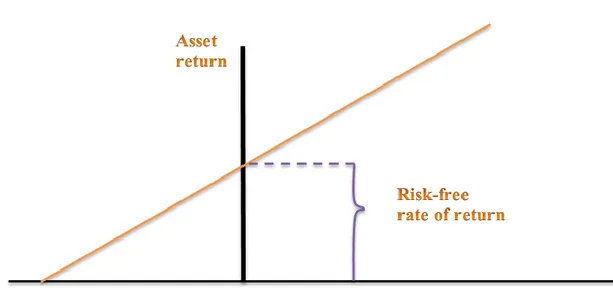

sub-The Security Market Line (SML)

The security market line (SML) shows the expected rate of return on a security as a function of systematic risk which is represented by the equation of CAPM. Theoretical-ly it shows where all capital investments lie as investors want higher expected returns in order to be compensated for bearing more risk. Lumby and Jones (2003) explain that the beta value indicates the degree of responsiveness of the expected return on the shares of an individual company relative to movements in the expected return on the market. Consequently, high beta shares will tend to outperform the return on market index and low beta shares will tend to underperform the average return on the market index de-pending upon what is happening to the return on the equity maket. Below is the figure of the security market line:

Figure 1: Security market line

Figure 1 shows the graphical representation of the CAPM where the horizontal axis rep-resents risk measured by beta and the vertical axis reprep-resents expected return on a secu-rity. The Y-intercept is the risk free rate implying rate of return on an investment with no risk of financial loss associated to it. Berk et al. (2009) describes that the slope of SML equals market risk premium and reflects risk-return trade off at a given time. The concept of SML indicates two elements, firstly the return for holding an investment with no risk at all and secondly additional returns for bearing the investment risk or the risk premium. In an efficient market portfolio, the riskiness of the investment is non-diversifiable and is referred as the ‘systematic risk’ since it is the ultimate diversified portfolio. Similarly the diversifiable risk is known as the ‘unsystematic risk’. The CAPM specifically provides the relationship between an investment’s systematic risk and its expected return.

2.2

Debate surrounding the CAPM

The capital asset pricing model (CAPM) transformed the theory and practice of invest-ments by streamlining the portfolio collection problem (Sullivan, 2006). Dempsey (2013) mentions that the CAPM has controlled financial economics to the level of being considered ‘the paradigm’. He also mentions that in a capital market, prices offer signif-icant signals for capital distribution since it is a central element of a capitalist system. Modern finance theory indicates that financial capital circulates to earn rates of return that are attractive to its shareholders where prices of securities at any time ‘completely reflect all the information available at that time’.

Lucas (1978), Breeden (1979) and Grossman and Shiller (1981) established a simple re-lation of consumption to asset returns. Moreover, the authors mentioned that consump-tion-based CAPM turned out to be a common method of the asset pricing studies. The CAPM considers that the expected return of an asset equals the rate on a risk-free secu-rity plus a risk premium. The investment should be accepted only if the expected return meets the required return demanded by the investors. The security market line designs the results of the CAPM for several types of risks (betas). Dempsey (2013) points out that alternatively initial examinations of the CAPM have indicated that higher stock re-turns were usually related to higher betas. These results supported the CAPM while out-comes denying the applicability of the model included other factors that explain average returns provided by betas.

Basu (1977) tested CAPM by sorting common stocks by their earning-price ratios and found that future returns for high earning price ratio are higher than predicted by the CAPM. Banz (1981) challenged CAPM on the basis of the size effect which explains variation in stock return since his findings showed returns on stocks of small firms were higher than compared to large firms. The empirical testing of the CAPM has led to dif-ferent opinions regarding beta and its ability to explain average returns. The inclusion of other variables such as earning price ratios, debt equity ratios, firm’s size and book to market ratios provided strong grounds of criticism for the Classic CAPM using the cross-section regression approach as performed by Fama and French (1992).

Michailidis, Tsopoglou, Papanastasiou & Mariola (2006) tested CAPM on the emerging Greek securities market and mentioned that the CAPM model was developed to clarify the variations in the risk premium across resources. According to the CAPM model, the variations in the risk premium are due to variations in the riskiness of the returns on the assets. Moreover, the authors pointed out that the CAPM was the first model that ex-plained how to estimate the risk of the cash flows of an investment. The findings of the CAPM depend on how the statistical estimation is performed. Amihudm, Christensen and Mendelson (1992) and Black (1993) clarified that the data are very ‘annoying’ to nullify the CAPM. Moreover, the authors explain that the additional usage of competent statistical methods will cause more significant relation between beta and return.

The earliest empirical evidence in favor of CAPM was Black, Jensen and Scholes (1972) where returns on equally weighted portfolios were tested on betas using cross-section regression on a monthly data. They found a linear relationship between risk and return and average returns tended to be high for high beta values as predicted by CAPM. The strong empirical support of CAPM came in from Fama and Macbeth (1973) and their results showed positive linear relation between average returns and

be-turns. Lau and Quay (1974) tested CAPM on Tokyo stock market and concluded the results predicted by CAPM are consistent and supported the theory. Also, Björn and Hordahl (1998) tested CAPM for a fourteen year time period on 80 companies and their findings accepted the CAPM.

2.3

Challenges to the validity of the Model

Richard Roll (1988) mentioned in his presidential speech to the American Finance As-sociation that the overall performance of beta in predicting portfolio returns is limited. Preceding research has considered the causes for variances in estimated betas between periods and the capability of old betas to forecast upcoming betas. The condition does not improve between professional beta providers (Reilly & Wright, 1988). This lack of agreement evidences itself in different beta estimates for similar business by different beta providers (Bruner et al., 1998). Brigham and Gapenski (1997) mentioned that a be-tas provider was confused due to seeming difference between bebe-tas provided by other companies as they could not specify accurate time period. Later, they agreed on the us-age of five year period as an accurate time period since big differences would decrease the truthfulness of everyone.

Fama and French (1992) used the same Fama and Macbeth (1973) two step method by incorporating the Banz (1981) size effect and ratios to arrive at a very different conclu-sion and found no relation at all. They concluded that the relation between beta and re-turn is too flat. Fama and French (2004) indicates that the major problem of the CAPM becomes apparent when portfolios are formed by sorting stocks on price ratios eventual-ly leading to a wide range of average returns. Moreover, the average returns are not pos-itively related to market betas. As a result, the portfolio with the lowest book-to-market ratio has the highest beta but the lowest average return. They proposed a three factor model instead of the Classic CAPM. However, Bartholdy and Peare (2004) compared five years monthly data using both CAPM and three factor Fama French model and concluded both the models perform poorly and explain on average 3% and 5% differ-ences in returns respectively. Black, Jensen and Scholes (1972) describes that the results of CAPM shall be considered in the sense that the actual market portfolio is not used ra-ther a proxy market is used. They suggested that a reasonable proxy for the market port-folio is on the minimum variance frontier. Dempsey (2013) notes that the return on stocks with higher betas are systematically lower than the CAPM’s predicton at the same time other alternative pricing models are presented as a refinement based upon the CAPM. All the models aimed at improving the empirical testing of the CAPM with dif-ferent modifications. The criticism against the CAPM’s major prediction of linear risk-return relationship poses a challenge to its validity and on the same note alternate asset pricing models have their own shortcomings.

2.4

Previous Research on the emerging markets

Iqbal and Brooks (2007) examined in their research the viability of the CAPM in ex-plaining the return of stocks on the Karachi Stock Exchange (KSE) between 1992 and 2006. The authors considered the KSE-100 and they collected the data of the daily, weekly and monthly prices for 101 stocks. In their research, they used the method of Fama and MacBeth (1973), by employing daily, weekly and monthly data frequencies to analyze the CAPM in three intervals. Moreover, they tested the variation in expected

returns by considering both individual stocks and beta portfolios. The authors recog-nized that the higher trading activities coupled with high liquidity offered makes the market to perform well and concluded that there was a non-linear relation between risks and return. However beta appeared to explain cross-section variation in expected returns especially with individual stocks, and a positive beta risk premium relation was found in most periods. Research conducted by Javid and Ahmad (2008) using a sample of 49 companies trading on the KSE-100 index for the time period between July 1993 and December 2004 rejected the classic CAPM. The research did not find a positive risk and return relationship and concluded that the residual risk plays an important role. They compared the results with the conditional CAPM by including macroeconomic variable and reached the conclusion that the risk premium in the Karachi equity market is a time varying type.

Bhatti and Hanif (2010) studied the validity and authenticity of the CAPM on the Kara-chi stock exchange for the time period between 2003 and 2008. They selected 60 com-panies from the KSE-100 Index and used the methodology of forecasting the expected return by calculating beta through a variance approach. The idea of using a short time period and some companies is to be able to get accurate results. According to their find-ings most of the results refuted the CAPM while just few results supported the model. The authors’ indications recommended that CAPM did not show accurate results on KSE-100 index.

In the context of emerging markets a research conducted by Grigoris and Stavros (2006) on the Greek stock market describes higher risk asset do not generate higher returns. The results did lend support to the CAPM in few periods but overall the linear risk-return relationship was not accepted. Chen (2003) tested the CAPM on the Taiwan stock market by comparing the CAPM with the consumption-based CAPM. The author found a statistically significant relation between stock returns and betas using the CAPM and concluded the market beta remains a useful measure of risk and return. However, the results from the consumption-based CAPM performed poorly and did not provide a better measure of systematic risk. Zhang and Wihlborg tested the risk-return relationship on seven emerging markets: Cyprus, Czech Republic, Greece, Hungary, Poland, Russia and Turkey. In their research they used Fama and Macebeth (1973) method of comparing the domestic CAPM with the International CAPM. The domestic CAPM revealed a significantly positive relation between beta and returns for all coun-tries while a positive beta risk premium was found only for two councoun-tries using the In-ternational CAPM.

3

Research Methodology

3.1

Sample selection and data collection

The testing of the CAPM requires selection of an index which can be used as a proxy to the market. Index construction based on free float market capitalization is regarded as the most suitable method where the level of index at any point of time reflects the free float market value of a company in relation to the base period. Several reputed index providers such as Morgan Stanley Capital International (MSCI), Financial Times Stock Exchange (FTSE) and Standard & Poor (S&P) use this method of index construction as it has become globally accepted practise. In this paper, the Karachi stock exchange (KSE-30) index launched in 2006, is used as a proxy for market portfolio since it is based on the free float market capitalization representing the thirty largest companies from diverse sectors of the economy. Additionally, the KSE-30 index is an appropriate choice as it includes all stocks of a company that are readily available to be traded on the market while closely held companies are excluded. As it is the case that the closely held corporations are controlled by few shareholders and the valuation of their share prices depends on few individuals rather than the market as a whole. Consequently, se-lection of the KSE-30 index serves the pupose of both enhancing sector and market coverage.

In this study the KSE-30 index is biannually recomposed, therefore 10 companies are selected which have been listed on the stock market during the whole sample time pe-riod between February 2009 and January 2013. Iqbal and Brooks (2007) mention the ef-fect of thin trading and argue it is often prevalent in emerging markets and to counter this probelm we opt for only those companies that have continuously traded on the mar-ket during the entire chosen time period. These companies represent sectors such as oil and gas, telecommunication, agriculture and banks which have performed remarkably well during the recent past. Moreover, the criteria for the sample companies inclusion is based upon getting the overview of the whole market to the maximum extent by select-ing stocks from different sectors of the economy.

Weekly stock returns which were collected from KSE website for all 10 companies are computed between February 2009 and January 2013. The closing price of the last trad-ing day of the week is used to calculate weekly returns. By ustrad-ing weekly returns rather than monthly returns, the aim is to obain more obervations for better estimation results (bartholdy & Peare, 2004).

The theory of the CAPM implies that the market index should comprise of all the assets in the world. In reality not all the assets are traded on the stock market; instead a proxy market is used for the empirical testing of CAPM and as argued we opt for KSE-30. The three month government bonds issued by the State Bank of Pakistan are used as a proxy to risk free interest rate. Since these bonds are issued by the government and trusted by people due to no risk of financial loss. Statistical formulas such as the mean, variance and standard deviations are applied to the proxy to risk free interest rate in determining beta.

3.2

Method of the CAPM testing

The CAPM is to be tested for the time period between February 2009 and January 2013. The method used in our testing is a combination of the methods by Black, et al. (1972) and Fama and Macbeth (1973). However, testing of CAPM will be carried upon indi-vidual securities rather than different portfolios since there is a limited number of sam-ple companies and the objective is to test the model on individual stocks. The following equation is used for a time series testing of CAPM:

(2)

where,

represents return on stock i at time t, represents risk free interest rate at time t,

represents beta of stock i (which is the systematic risk),

represents return on market at time t, represents error term at time t.

In the above equation (2), the left hand side gives the excess return on stocks and the right hand side gives the excess market returns which is the reward for an investor bear-ing extra risk. This equation provides the estimate for beta as weekly stock returns are regressed on returns based on the market index. Hence, monthly beta is obtained for each stock using weekly returns from equation 2, and a total number of 420 beta obser-vations are recorded for all stocks between February 2009 and January 2103.

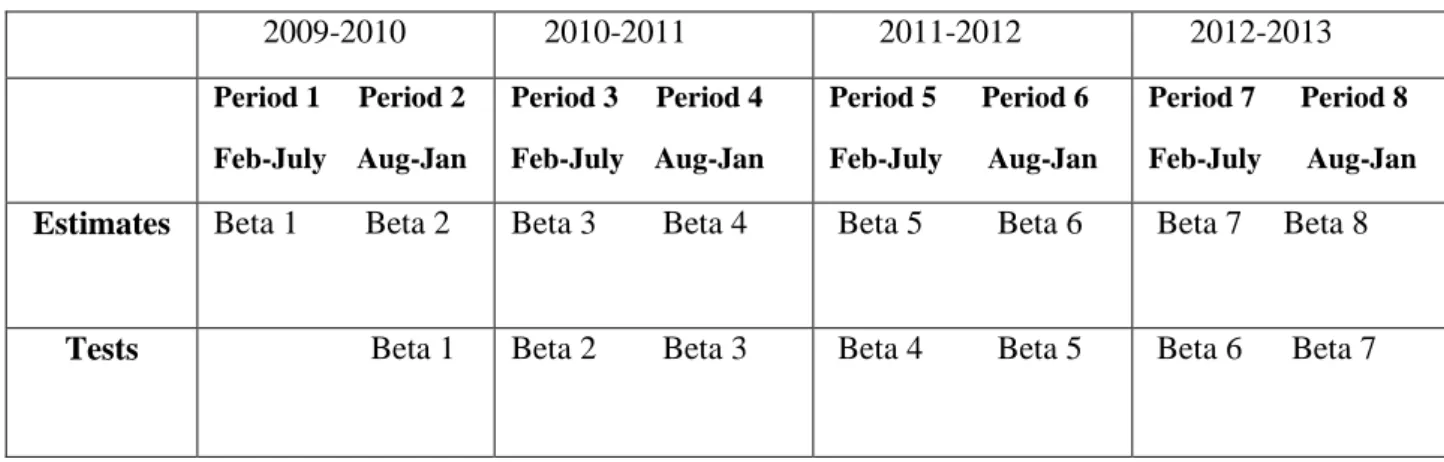

In order to minimize the inference problem caused due to the correlation of residuals we follow the Fama and Macbeth (1973) approach of cross-sectional regression. Each year is divided into two periods of six months each so that the first period provides monthly estimate of beta and the second period is used to test how well the historical betas ex-plain excess returns. Equation 2 provides the estimate of beta whereas equation 3 is a cross-sectional regression using beta as an independent variable and average returns as a dependent variable. Moreover, using the cross-sectional regression will reduce meas-urement errors. For instance, the excess returns of period 2 are regressed on 6-month prior estimated betas from period 1 in equation 3. Likewise the second period’s esti-mated betas are used for predicting excess returns in the first period of the next year. The process is continued for the entire time period where excess returns in one period are regressed on the immediately prior estimated betas from the prior period. The time period between February 2009 and January 2013 is divided into 8 periods of six months each, with table 1 summarizing the distribution of the periods.

Table 1: Distribution of time period for estimates and tests 2009-2010 2010-2011 2011-2012 2012-2013 Period 1 Period 2 Feb-July Aug-Jan Period 3 Period 4 Feb-July Aug-Jan Period 5 Period 6 Feb-July Aug-Jan Period 7 Period 8 Feb-July Aug-Jan

Estimates Beta 1 Beta 2 Beta 3 Beta 4 Beta 5 Beta 6 Beta 7 Beta 8

Tests Beta 1 Beta 2 Beta 3 Beta 4 Beta 5 Beta 6 Beta 7

For running the cross-sectional regression on each testing period (Period 2 to Period 8) the following equation 3 is used. Employing historical betas on next period’s returns provides an insight on how much variation in expected returns is explained by beta.

(3) where,

is the intercept at time t,

is the average risk premium at time t, is the average excess return at time t, is the monthly beta,

is the error term at time t.

Equation 3 is similar to that of security market line equation1: E[ ] = + (E[

]-) and hence , can be estimated from the above. If CAPM is true, the intercept should be equal to zero and the average risk premium should be greater than zero. To test if there is a linear relationship between beta risk and return Fama and Macebth (1973) used the beta square coefficients as another explanatory variable.

+

(4)

Consequently equation 4 is used to determine non-linearity and in order for CAPM to hold true, the coefficient , should equal to zero.

Finally for evaluating whether systematic risk only affect the returns or not, as predicted by CAPM, the following equation 5 is used:

+

(5)

where is the residual variance obtained using equation 3 and the CAPM hypothesis requires that the coefficient be equal zero which is tested using equation 5.

3.3 The CAPM hypothesis

In regard to the validation of CAPM on the KSE-30, the following hypotheses are test-ed:

Is there a linear relation between return and risk?

Is the intercept equal to zero as predicted by CAPM?

Is the average risk premium greater than zero?

Is beta the only risk variable (presence of only systematic risk)? 3.4 Testing

For testing the CAPM, we use t-tests at the 95% confidence level. First to analyze if the average risk premium is positive, a right-tail t-test is used from the cross-section regres-sion equation 3 and a two-tail t-test is used to see if the intercept equals zero or not. The linear risk-return relationship is tested on the basis of a two sided t-test on the coeffi-cient from equation 4. Then a two-tailed t-test is employed on the coefficient to determine whether the return distribution is affected by only systematic risk from equa-tion 5.

4

Empirical Data Analysis

4.1

Beta Estimation

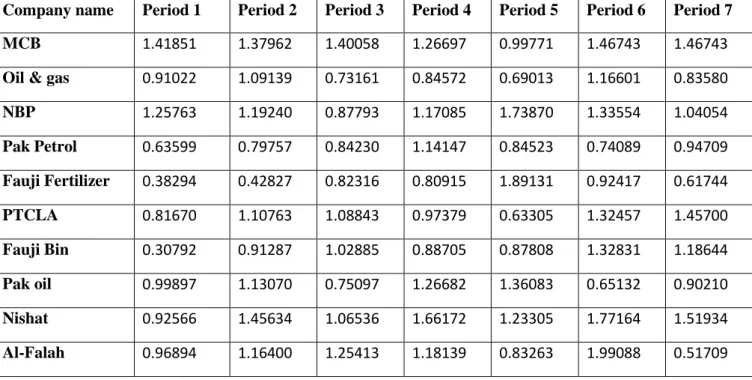

The first step requires the estimation of betas using equation 2 and for each estimation period a corresponding average beta value is obtained. Table 2 shows the beta values for each company for each estimating period. After applying descriptive statistics to the be-ta estimates in be-table 2, the minimum value of bebe-ta is 0.307927 and the maximum value is 1.990883 whereas the standard deviation is 0.346822.

Table 2: Beta estimates for Period 1 to Period 7.

Company name Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 MCB 1.41851 1.37962 1.40058 1.26697 0.99771 1.46743 1.46743

Oil & gas 0.91022 1.09139 0.73161 0.84572 0.69013 1.16601 0.83580

NBP 1.25763 1.19240 0.87793 1.17085 1.73870 1.33554 1.04054 Pak Petrol 0.63599 0.79757 0.84230 1.14147 0.84523 0.74089 0.94709 Fauji Fertilizer 0.38294 0.42827 0.82316 0.80915 1.89131 0.92417 0.61744 PTCLA 0.81670 1.10763 1.08843 0.97379 0.63305 1.32457 1.45700 Fauji Bin 0.30792 0.91287 1.02885 0.88705 0.87808 1.32831 1.18644 Pak oil 0.99897 1.13070 0.75097 1.26682 1.36083 0.65132 0.90210 Nishat 0.92566 1.45634 1.06536 1.66172 1.23305 1.77164 1.51934 Al-Falah 0.96894 1.16400 1.25413 1.18139 0.83263 1.99088 0.51709

The results for each company’s monthly beta along with average returns are found in the Appendix 7.2, Tables 15-24.

4.11 R-square values

The average R-square values are computed in table 3 from the cross-sectional regression equation 3. In general. for most of the sample companies the average R-square is be-tween 20% and 30% and for the rest it is bebe-tween 10% and 20%. R-square shows the explanatory power of the regression equation and our results indicate that values ob-tained are not too bad as 28.759% of variations in excess returns is explained by beta. for instance in the case of one particular stock (PTCLA). In the context of emerging markets where several other factors contribute in explaining returns therefore the R-square obtained is reasonable in explaining excess returns. However, R-R-square values below 20% can be regarded as having low explanatory power in explaining excess re-turns. The average R-square for all stocks is 22.108%. The study conducted by Fama and Macebth (1973) had an average R-sqaure of approximately 30%. In terms of ex-planatory power our results compare favourably with this pioneering US research.

Table 3: Average R-square values

Company Average

Minimum Maximum

MCB 0.21252 0.00402 0.50514

Oil & Gas 0.27371 0.00046 0.5626

NBP 0.27665 0.00201 0.59344 Pak Petrol 0.28015 0.00887 0.76576 Fauji Fertilizer 0.17884 0.02571 0.56676 PTCLA 0.28759 0.03000 0.88052 Fauji Bin 0.24041 0.01681 0.52012 Pak oil 0.18570 0.00551 0.43821 Nishat 0.10632 0.00647 0.20439 Al-Falah 0.16888 0.01559 0.40593 All companies 0.22108 0.01155 0.544287

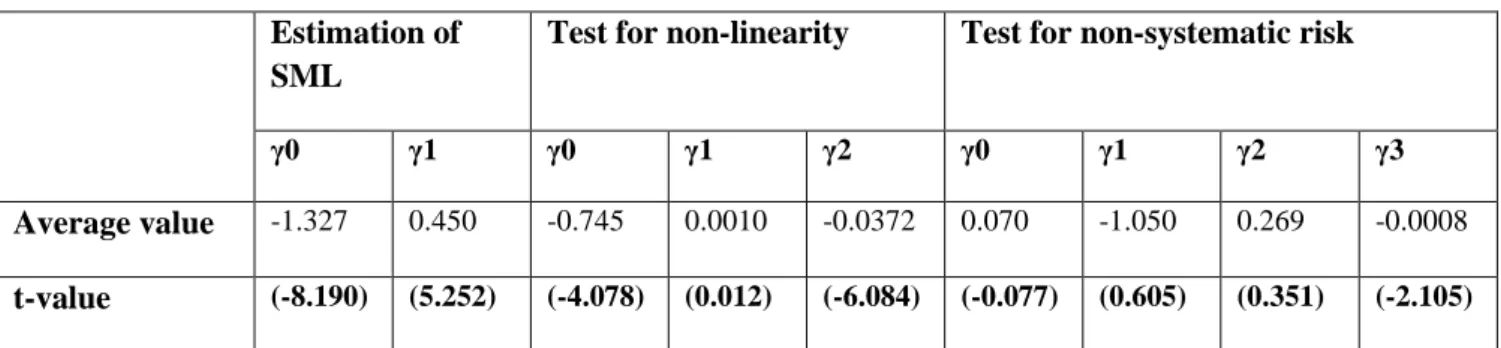

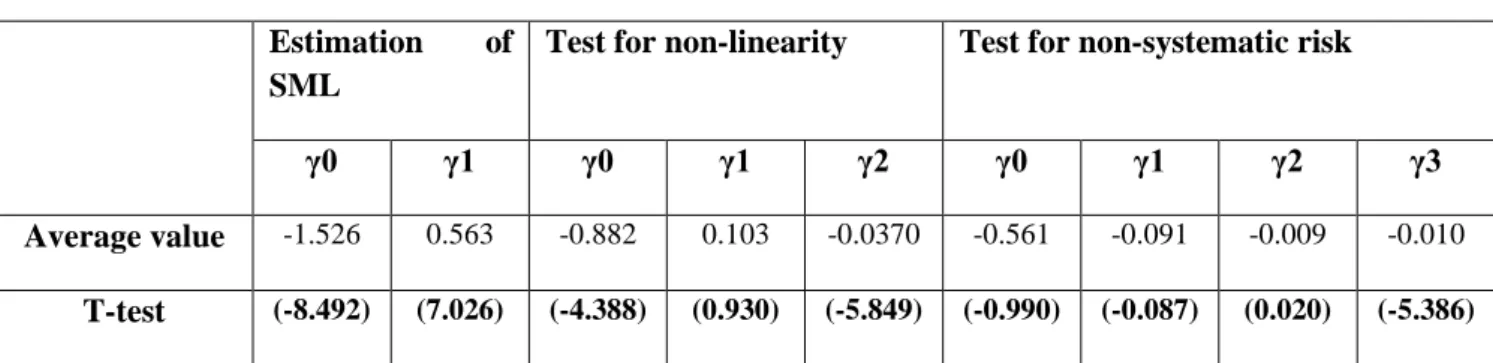

4.12 Estimation of SML. Non-linearity and Non-systematic test for entire testing period

CAPM testing is carried out on each period from Period 2 to Period 8 for all the stocks in a pooled regression. Each stock has six months of observations in each period. As a result, we obtain 60 observations for ten stocks in one period. Since we have divided the time frame into seven testing periods, a total of 420 observations is obtained The re-sults are summarized for all individual stocks in table 4 for the entire testing period. Based on the t-test, coefficients , and are analysed to see if the CAPM hy-pothesis regarding each of these variables holds true or not. Equations 3 to 5 are respec-tively used for the estimation of SML, testing for linearity and testing for non-systematic risk. The critical value used at the 5% significance level is 1.96. Additionally results for each individual company in each period are found in the Appendix 7.2. Ta-ble 8-14.

Table 4: Results for entire testing periods

Estimation of SML

Test for non-linearity Test for non-systematic risk

γ0 γ1 γ0 γ1 γ2 γ0 γ1 γ2 γ3

Average value -1.327 0.450 -0.745 0.0010 -0.0372 0.070 -1.050 0.269 -0.0008

t-value (-8.190) (5.252) (-4.078) (0.012) (-6.084) (-0.077) (0.605) (0.351) (-2.105)

Note: For each testing period. three cross-sectional regressions are used. Estimation of SML is based on equation 3. The test for non-linearity is estimated from equation 4. The test for non-systematic risk is ob-tained using equation 5.

No. of observations: 420 and the critical value: 1.96

(a) Estimation of SML

The estimated intercept is significantly different from zero as the absolute value of the t-statistic 8.190 is greater than the critical value 1.96, and hence it is inconsistent with CAPM as shown in table 4. However. CAPM also predicts that the average risk premium should be greater than zero. and the estimate for the coefficient is found to be significantly different from zero since the value of the t-statistic 5.252 exceeds the critical value. Therefore the CAPM cannot be clearly rejected.

(b) Test for non-linearity

The intercept is significant differently from zero as the absolute value of the t-statistic 4.078 is greater than the critical value. The coefficient is not significantly different from zero since the value of its t-statistic 0.012 is less than 1.96. consequently CAPM is clearly rejected as intercept is not equal to zero and the average risk premium is not greater than zero. Also there does not appear to be a linear relation between risk and return as the model predicts since coefficient has the absolute value for its t-statistic 6.084 and is therefore found to be significantly different from zero. Conse-quently, the CAPM is clearly rejected.

(c) Test for non-systematic risk

Lastly, the test for non-systematic risk also does not provide evidence in favour of the CAPM since the coefficient is found to be significantly different from zero. Conse-quently. the parameter of systematic risk is inconsistent with the model as it does not appear that beta is the only relevant risk variable for explaining excess returns.

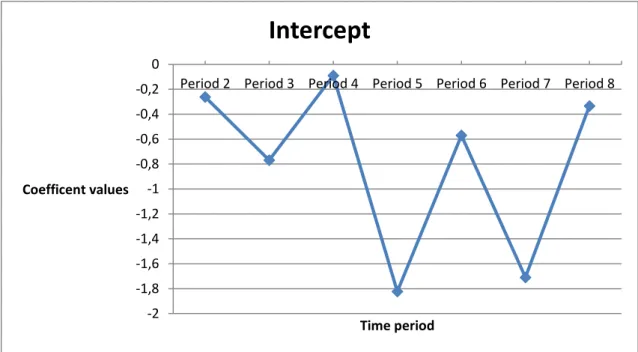

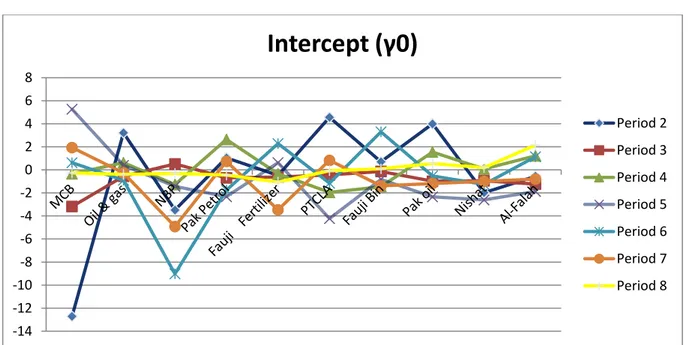

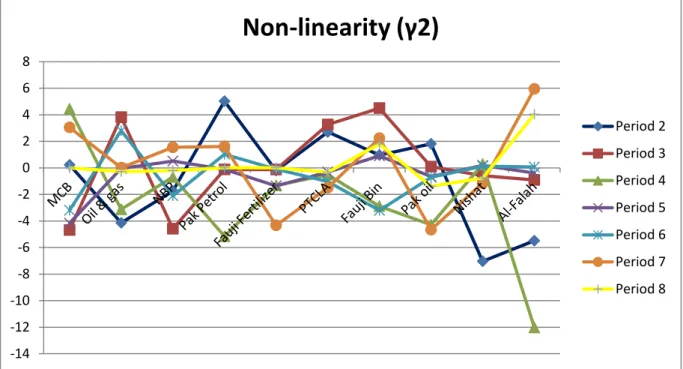

4.2 Intercept and beta risk premium coefficients graph

Figures 2 and 3 represents the estimates for the intercept and the average risk premi-um . The purpose of these figures is to evaluate under what periods the coffients and are close to CAPM predictions.

Figure 2: Intercept Estimates (Period 2 to Period 8)

Figure 2 represents the estimates for the intercept for all stocks between period 2 and period 8. As can be seen from this figure, the coefficients for the intercept are close to zero in the beginning of the testing period especially in period 2 and period 4. How-ever¸ between period 5 and period 8 the coefficients seem to be statistically signifi-cant and deviating from the CAPM’s prediction. Since the whole testing period shows deviation of the CAPM hypothesis regarding the intercept, a comparison between the periods will yield more conclusive results by applying t-statistics to analyze if the coef-ficient is significantly different from zero or not.

-2 -1,8 -1,6 -1,4 -1,2 -1 -0,8 -0,6 -0,4 -0,2 0

Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8

Coefficent values

Time period

Intercept

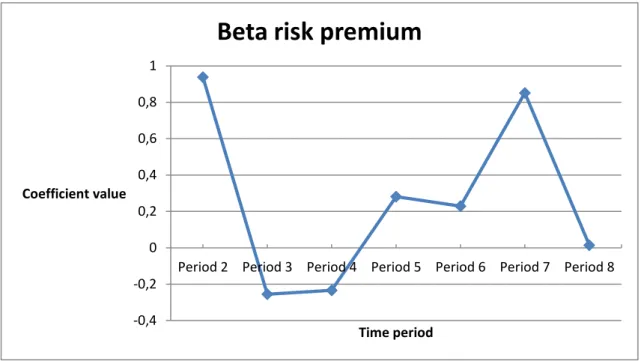

Figure 3: Beta risk premium coefficients

The beta risk premium coefficients as shown in figure 3 seems to indicate a negative risk premium in the early periods. specifically in period 3 and period 4 and in the latter half the coefficients seem to be positive. This indicates that investors are being reward-ed for bearing extra risk rather than investing in risk free assets after period 4. As a re-sult, CAPM testing results are compared between the beginning and the end of the test-ing periods to see if the results significantly change or not. Additionally, figures repre-senting all individual stocks for the intercept. beta risk premium, non-systematic risk and non-linearity are found in Appendix 7.1.

4.3 Results from Period 2, 3 and 4

Table 5: Combined results (period 2.3 and 4)

Estimation of SML

Test for non-linearity Test for non-systematic risk γ0 γ1 γ0 γ1 γ2 γ0 γ1 γ2 γ3 Average

val-ue

-0.452 -0.358 -0.384 -0.252 -0.1033 -0.292 0.301 -1.085 0.011

T-Value (-1.298) (-1.311) (-1.060) (-0.806) (-0.697) (-0.121) (-0.052) (-0.345) (0.660)

Note: For each testing period. three cross-sectional regressions are used. Estimation of SML is based on equation 3. While test for non-linearity is estimated from equation 4. And test for non-systematic risk is obtained using equation 5.

No. of observations: 180 and the critical value: 1.96 -0,4 -0,2 0 0,2 0,4 0,6 0,8 1

Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8

Coefficient value

Time period

Beta risk premium

Table 5 shows the combined results for periods 2, 3 and 4. This allows us to make a comparison with table 4 and analyze the performance of CAPM in the early testing pe-riods.

(a) Estimation of SML

The estimated coefficient is not significantly different from zero. As a result the in-tercept is consistent with CAPM. The average risk premium coefficient is found to be significantly negative since the absolute value of the t-statistic is 1.311. Consequently, it is found to be significantly different from zero, and hence inconsistent with the CAPM.

(b) Test for non-linearity

The intercept is not significantly different from zero as the model predicts. However. negative coefficient estimate for makes the validity of the model challenging. There-fore, testing for non-linearity is important to consider. The t-value for the coefficient

has an absolute value of 0.697 which is not significantly different from zero, indicat-ing that a linear relationship between risk and return in the first three periods cannot be rejected.

(c) Test for non-systematic risk

Finally in order to validate CAPM for the first three testing periods the test for non-systematic risk is employed. The estimate for the coefficient has the t-value 0.660 and is not significantly different from zero. Therefore, only systematic risk tends to af-fect the return distribution which is consistent with the CAPM.

The combined results from period 2, 3 and 4 show that the intercept, linearity and sys-tematic risk assumptions of the model are supported. However. the negative beta risk premium brings a major challenge to the validity of CAPM. Interestingly, the results ob-tained above are different from the results of the entire testing period as computed in ta-ble 4. Hence, it is imperative to analyse CAPM during the last four testing periods to see if the results are consistent with table 4 or not.

4.4 Results from Period 5, 6, 7 and 8 Table 6: Combined results (period 5.6.7 and 8)

Estimation of SML

Test for non-linearity Test for non-systematic risk γ0 γ1 γ0 γ1 γ2 γ0 γ1 γ2 γ3 Average value -1.526 0.563 -0.882 0.103 -0.0370 -0.561 -0.091 -0.009 -0.010

T-test (-8.492) (7.026) (-4.388) (0.930) (-5.849) (-0.990) (-0.087) (0.020) (-5.386)

Note: For each testing period. three cross-sectional regressions are used. Estimation of SML is based on equation 3. The test for non-linearity is estimated from equation 4. The test for non-systematic risk is ob-tained using equation 5.

The end of sample time frame. comprising of the last four testing periods are summa-rized above in table 6.

(a) Estimation of SML

The estimate for the intercept coefficient is significantly different from zero as its t-value in absolute terms. 8.492. is greater than 1.96 so these results are inconsistent with the CAPM. However. the coefficient is significantly positive and in accordance with the CAPM. The coefficient of the average risk premium is positive as compared to early periods where it was found to be negative.

(b) Non-linearity test

The zero intercept prediction of CAPM is not accepted while the average risk premium is also not found to be greater than zero. However. the test for non-linearity reveals that there does not appear to be a linear risk and return relationship as the t-statistic for the coefficient in absolute terms, 5.849, is significant and inconsistent with CAPM. Therefore, the CAPM is clearly rejected.

(c) Test for non-systematic risk

The estimate for the coefficient is significantly different from zero and is therefore inconsistent with CAPM. Expected returns are not only affected by single risk beta as shown in table 6.

The results obtained in table 6 follows the similar pattern as in table 4. The intercept, linearity and systematic risk assumptions are not in accordance as specified by the theo-ry of CAPM for the last four testing periods. However the beta risk premium coefficient is found to be positive and significantly different from zero as predicted by the model.

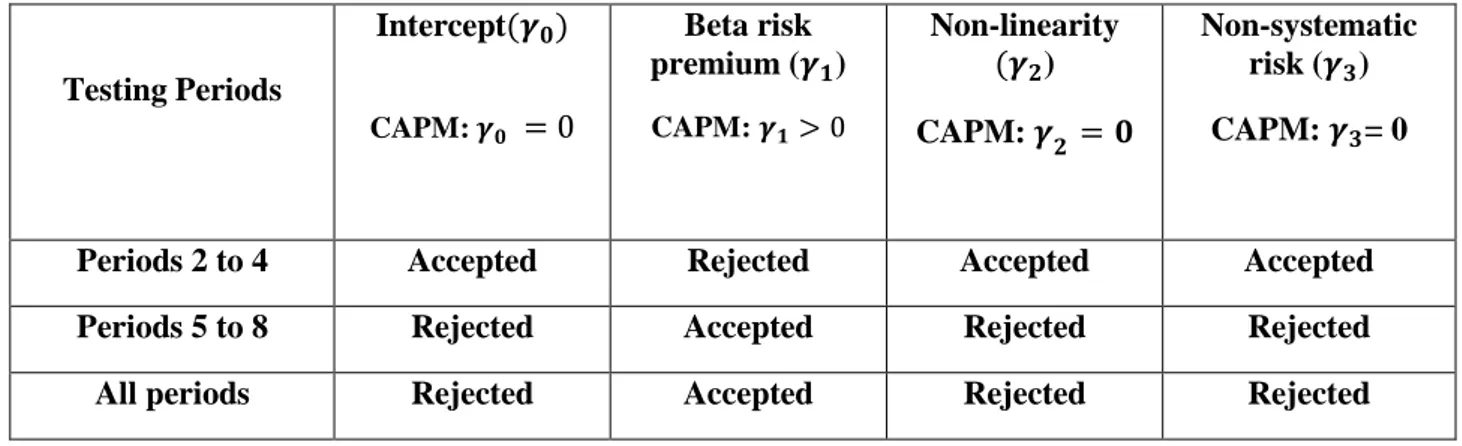

4.5 Summary of results

In table 7 the results are summarized. In periods 2 to 4 the CAPM predictions regarding the coefficents , and are accepted while the coefficient as it should be greater than zero is rejected and not found to be in accordance with the CAPM. Additionally, the coefficients estimates for , and reject the CAPM predictions for the periods 5 to 8. However, the coefficient is found to be in line with the CAPM during the last testing periods. Importantly, the results of the entire testing periods are similar to the re-sults of periods 5 to 8.

Table 7: Summary: Acceptance or Rejection of the CAPM- Associated Hypotheses Testing Periods Intercept CAPM: Beta risk premium ( ) CAPM: Non-linearity ) CAPM: Non-systematic risk ( ) CAPM: = 0

Periods 2 to 4 Accepted Rejected Accepted Accepted Periods 5 to 8 Rejected Accepted Rejected Rejected All periods Rejected Accepted Rejected Rejected

The results of the cross-section regressions by using equations 2, 3 and 4 are summa-rized above in table 7 . The most important finding is the positive beta risk premium for most periods and this result is in line with the study conducted on the Karachi stock ex-change by Iqbal and Brooks (2007) where they found risk premium to be significant for an overwhelming time periods. The beginning of the testing period indicates that inves-tors are not taking keen interest in the market due to higher interest rates prevailing where non-risky assets pay more premium. Meanwhile later testing periods show in-creased trading activity since equity investments have seemingly become more lucrative for investors where they are rewarded for bearing systematic risk. However. a non-linear relationship is found between risk and return such that when the beta risk premi-um is significant the beta square is also significant, implying assets associated with high risk generate lower returns compared to low risk assets.

The major challenge regarding the acceptance and applicability of the CAPM has been the intercept term which should not be significantly different from zero. The results re-ject this hypothesis for most sample periods as no evidence is found for stocks that are uncorrelated with the market having expected returns equal to the risk free rate as the model predicts. Lastly, in most periods beta does not appear to be the only risk factor associated with the expected returns. As is the case in most emerging markets where po-litical, social and others factors deeply affect the performance of the market and indi-vidual stocks, CAPM’s assumption of only systematic risk affects returns is not appli-cable on the Karachi stock exchange. The empirical analysis supports the positive risk premium hypothesis while the other three CAPM hypotheses regarding the intercept. linearity and systematic risk are rejected.

5

Conclusion

This paper has examined the validity of CAPM on Karachi stock exchange (KSE-30) for the time period between February 2009 and January 2013 on 10 sample companies. The method adopted is similar to Fama and Macbeth (1973) approach of cross-sectional regression of estimated betas on excess returns. In order to minimize measurement er-rors a year period was used to estimate monthly betas and in the subsequent half-year period the excess average returns was regressed on previous period’s 6-month prior estimated betas in order to test the CAPM hypothesis.

The findings of the paper are not supportive of the CAPM’s prediction that the intercept should be equal to zero. However. there is strong evidence of a positive beta risk premi-um as predicted by CAPM especially for the last four periods and such results are found for the entire testing period as well. The findings regarding the intercept, as it is signifi-cant different from zero in most periods, weakens the above results and poses a chal-lenge to the applicability of the CAPM.

The test for non-linearity in the relationship between risk and return reveals that the findings are not consistent with CAPM. There is no evidence that risk measured by beta is linearly related with stock returns for the time period between February 2009 and January 2013. The CAPM postulates that the expected stock returns are only affected by systematic risk and beta is the only relevant risk variable in the market. By including re-sidual variance of stocks our findings reject this hypothesis for the emerging stock mar-ket of Pakistan.

The validity of CAPM is not clearly supported by the empirical results of the paper. However. the Karachi stock market is rewarding the investors for bearing the extra risk especially in the recent periods. The presence of non-linearity between risk and return should be considered for investment decisions and portfolio formation. The reasons for the lack of support in favour of CAPM may be attributed to the use of market proxy ra-ther than the actual market portfolio and estimated betas rara-ther than the actual betas. Researchers have suggested that changing the market index for empirical testing of the CAPM may provide better results, but there is no consensus regarding what is the most suitable market proxy. In this research when using the KSE-30 index to represent the major stocks based on free-floating shares. the results have failed to provide strong em-pirical evidence in favour of the model as three out of four hypotheses associated with CAPM are rejected. Hence, for future research it would be of interest to use other asset pricing models such as the Generalized Autoregressive Conditional Heteroscedasticity (GARCH) model and the Fama-French three factor model to make a comparison of re-sults with those based on CAPM.

6

References

Amihud. Y. Christensen. B. & Mendelson. H. (1992). Further evidence on the risk rela-tionship. Working paper S-93-11. Salomon Brother Center for the Study of the Finan-cial Institutions. Graduate School of Business Administration. New York University. Banz. R. (1981). The relationship between returns and market value of common stock.

Journal of Financial Economics (9): 3-18

Bartholdy. J. & Peare. Paula. (2004). Estimation of expected return: CAPM vs. Fama and French. International Review of Financial Analysis 14. 407-427.

Basu. S. (1977). Investment performance of common stocks in relation to their price earnings ratios: A test of the efficient market hypothesis. Journal of Finance 32: 663-882

Berk. J.. Demarzo. P.. & Harford. J. (2009). Fundamentals of Corporate Finance (IFRS ed.). Boston: Pearson Education.

Bhatti. U. & Hanif. M. (2010).Validity of Capital Assets Pricing Model: Evidence from KSE-Pakistan. European Journal of Economics. Finance and Administrative Sciences.

20.

Bjorn. H. & Hordahl.P. (1998). “Testing the conditional CAPM using multivariate GARCH-M”. Journal of Applied Financial Economics. 8: 377-388.

Black. F. (1993). Beta and return. Journal of Portfolio Management. 20: 8-18.

Black. F.. Jensen. M. C. & Scholes. M. (1972). The Capital asset pricing model: Some empirical tests. Studies in the Theory of Capital Markets. 79-121.

Breeden. D. T. (1979). An intertemporal asset pricing model with stochastic consump-tion and investment opportunities. Journal of Financial Economics 7. 265–296.

Brigham. E.. & Gapenski. L. (1997). Financial Management. (8). The Dryden Press. New York.

Bruner. R. F.. Eades. K.. Harris. R.. & Higgins. R. (1998). Best practices in estimating the cost of capital: Survey and synthesis. Financial Practice and Education. 8(1). 13– 28.

Chen. H. M. (2003). Risk and return: CAPM vs CCAPM. The Quarterly Review of

Economics and Finance. 43(2). 369-393.

Dempsey. M. (2013). The Capital Asset Pricing Model (CAPM): The History of a Failed Revolutionary Idea in Finance. A Journal of Accounting. Finance and Business

Fama. E. F. & French. K. (1992). The cross-section of expected stock returns. Journal

of Finance. 47: 427-465.

Fama. E. F. & French. K. R. (2004). The Capital Asset Pricing Model: Theory and Evi-dence. Journal of Economic Perspectives. 18(3). 25-46.

Fama. E. F. & Macbeth. J. (1973). Risk. return and equilibrium: Empirical tests. Journal

of Political Economy 81: 607-636.

Grigoris. M. & Stavros. T. (2006). Testing the Capital Asset Pricing Model: The case of emerging Greek securities market. International Journal of Finance and Economics. 4: 78-91.

Grossman. S. & Shiller. R. J. (1981). The determinants of the variability of stock market prices. American Economic Review. 71. 222–227.

Iqbal. J. & Brooks. R. (2007). A Test of CAPM on the Karachi Stock Exchange.

Inter-national Journal of Business. 12(4). 430-444.

Jagannathan. R. & Wang. Z. (1996). The conditional CAPM and the cross-section of expected returns. Journal of Finance 51: 3-53.

Javid. Y. A. & Ahmad. E. (2008). The Conditional Capital Asset Pricing Model: Evi-dence from Karachi Stock Exchange. PIDE Working Papers. Pakistan Institute of De-velopment Economics. Quaid Azam University. Islamabad.

Lau.S & Quay.S. (1974). The Tokyo Stock exchange and capital asset pricing model.

Journal of finance 29(2): 507-514.

Lintner. J. (1965). Security Prices. Risk and Maximal Gains from Diversification.

Jour-nal of Finance. 20: 587-615.

Lucas. R. E. (1978). Asset prices in an exchange economy. Econometrica 46. 1429– 1445.

Lumby. S. & Jones. M. C. (2003). Corporate Finance: Theory and Practice (7th ed). London. Thomson Learning.

Mabrouk. H. B. & Bouri. A. (2010). The Quarrel on the CAPM. Interdisciplinary

Jour-nal of contemporary research in business. 2(2).

Michailidis. G.. Tsopoglou. S.. Papanastasiou. D. & Mariola. E. (2006). Testing the Capital Asset Pricing Model (CAPM): The Case of the Emerging Greek Securities Market. Journal of Finance and Economics. 4.

Mossin. J. (1966). Equilibrium in a capital asset market. Econometrica. 34: 768-783 Reilly. F. & Wright. D. (1988). A comparison of published betas. Journal of Portfolio

Roll. R. (1988). R2. Journal of Finance. 43(2). 541– 566.

Sharpe. W. F. (1964). Capital Asset Prices: A Theory of market Equilibrium under Condition of Risk. Journal of Finance. 19: 425-442.

Sullivan. E. J. (2006). A brief history of the Capital Asset Pricing Model. Paper present-ed at Northeastern Association of Business. Economics and Technology. Days Inn. Pennsylvannia. USA.

Zhang. J. & Wihlborg. C. (2004). Unconditional and conditional CAPM: Evidence from European emerging markets. Working Paper. Copenhagen Business School. Copenha-gen.

E-Sources

Sharif. F. & Ho. K. C. (2008). Pakistan Sets Floor on Stock Prices to Stop Plunge. Re-trieved 2013-03-27. from

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aSz3qf2xfS14

The Karachi Stock Exchange (Guarantee) Limited. Retrieved 2013-03-25. from

http://dps.kse.com.pk/

7

Appendix

7.1

Figures

Figure 4: Intercept (Period 2 to Period 8)

-14 -12 -10 -8 -6 -4 -2 0 2 4 6 8

Intercept (γ0)

Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8Figure 5: Beta risk premium coefficients

Figure 6: Test for non-linearity

-8 -6 -4 -2 0 2 4

6

Beta risk premium (γ1)

Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 -14 -12 -10 -8 -6 -4 -2 0 2 4 6 8

Non-linearity (γ2)

Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8Figure 7: Test for non-systematic risk

7.2

Tables

Table 8: Results from Period 2

Company name

Tests

Estimation of SML Test for non-linearity Test for non-systematic risk

γ0 γ1 γ0 γ1 γ2 γ0 γ1 γ2 γ3 MCB Value -12.71131 (-6.660358) 0.1706581 (0.127193) -12.44352 (-4.03412) -0.40959 (-0.08296) 0.221377 (0.12374) -12.4736 (-3.2533) -0.49324 (-0.0780) 0.26009 (0.1106) 0.00098 (0.04519) T-test

Oil & gas

Value 3.221059 (1.778418) -2.980475 (-1.71139) -1.487556 (-0.23366) 6.604243 (0.52841) -4.13835 (-0.7753) 4.032978 (0.48801) -4.76371 (-0.2876) 2.13324 (0.26494) -0.08239 (-1.0319) T-test NBP Value -3.484482 (-1.581134) 2.490438 (1.71335) -4.529587 (-1.63879) 6.261013 (1.144371) -1.73798 (-0.7186) -4.05125 (-1.3726) 7.205726 (1.23349) -2.14942 (-0.8328) -0.00816 (-0.8541) T-test Pak Petrol Value 1.040155 (0.915704) -2.577785 (-1.88095) -0.077067 (-0.06166) -6.272113 (-2.26564) 5.020509 (1.48157) 0.501887 (0.51657) -6.11126 (-2.9921) 4.894621 (1.95882) -0.01906 (-1.8765) T-test Fauji Fertilizer Value -0.484455 (-0.768974) 0.3436012 (0.324892) -0.415355 (-0.42972) 0.3647601 (0.295502) -0.20654 (-0.1083) 2.126826 (1.90124) -1.19837 (-1.2866) -1.64867 (-1.3340) -0.02767 (-2.6271) T-test PTCLA Value 4.5629762 (1.8230881) -5.692425 (-2.05663) 7.0655726 (0.624371) -11.50164 (-0.44912) 2.700988 (0.22859) 11.60341 (2.50293) -28.6360 (-2.6015) 10.46455 (2.06576) 0.082982 (4.11664) T-test -0,4 -0,2 0 0,2 0,4 0,6 0,8

Non-systematic risk (γ3)

Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8Fauji Bin Value 0.7057525 (0.5830175) 1.3739001 (0.957915) 0.7308653 (0.538054) 0.0612663 (0.017673) 0.963685 (0.42741) -0.28325 (-0.3212) -0.66131 (-0.3242) 0.156274 (0.11573) 0.033271 (2.61265) T-test Pak oil Value 3.9931180 (1.9165751) -3.278509 (-1.76638) 5.3273403 (0.77059) -6.735552 (-0.39753) 1.809079 (0.20566) 5.254793 (0.61901) -6.57591 (-0.3163) 1.798937 (0.16731) -0.00145 (-0.0894) T-test Nishat Value -1.9742804 (-0.415519) 3.2533636 (0.78968) -8.854616 (-0.96116) 19.703709 (1.02931) -7.03426 (-0.8812) 7.960119 (0.47817) -10.1354 (-0.3271) 9.414004 (0.59571) -0.12464 (-1.1824) T-test Al-Falah Value -0.552524 (-0.292963) 0.3660644 (0.251702) -5.953158 (-2.19047) 12.438267 (2.30029) -5.48482 (-2.2732) -4.93971 (-2.2895) 8.887137 (1.93185) -3.89671 (-1.8975) 0.007143 (1.76701) T-test

Table 9: Results from Period 3

Company name

Tests

Estimation of SML Test for non-linearity Test for non-systematic risk

γ0 γ1 γ0 γ1 γ2 γ0 γ1 γ2 γ3 MCB Value -3.17482 (-1.3842) 1.62687 (1.12519) -9.60114 (-5.7593) 14.1094 (5.12237) -4.68113 (-4.6372) -9.53218 (-6.8962) 15.94555 (6.4761) -5.52202 (-5.3989) -0.03408 (-7.4101) T-test

Oil & gas

Value -0.55515 (-0.6379) 0.53544 (0.8313) 8.00332 (5.76646) -11.8847 (-5.9831) 3.817448 (6.28384) 10.2307 (7.4215) -15.1535 (-7.5743) 4.67666 (8.27498) 0.01735 (2.17963) T-test NBP Value 0.51399 (0.1276) -1.1752 (-0.4840) -10.2633 (-0.5935) 13.9796 (0.5904) -4.58405 (-0.6441) -6.5268 (-0.2722) 8.07496 (0.2362) -3.02593 (-0.3056) 0.03017 (0.3085) T-test Pak Petrol Value -0.69251 (-1.3549) -0.0656 (-0.2313) -0.19641 (-0.1428) -0.24016 (-0.4422) -0.12004 (-0.3973) 2.75121 (0.6968) -3.46233 (-0.8549) 0.82548 (0.6769) -0.17227 (-0.8038) T-test Fauji Fertilizer Value -0.61836 (-1.0186) -0.61251 (-0.6356) -0.57219 (-0.4947) -0.59648 (-0.5155) -0.12491 (-0.0501) -1.04535 (-0.6897) -0.45763 (-0.3463) -0.35442 (-0.1254) 0.04615 (0.60871) T-test PTCLA Value -0.43735 (-0.3630) -0.55438 (-0.4738) 0.41746 (0.3028) -5.61852 (-1.2337) 3.26605 (1.1477) -2.38907 (-1.1458) -3.54417 (-0.9038) 2.88004 (1.23907) 0.03117 (1.5956) T-test Fauji Bin Value -0.13382 (-0.0768) -1.34144 (-0.7651) 2.7983 (0.8155) -10.0081 (-1.1237) 4.50151 (0.99261) 0.27149 (0.05102) -5.6812 (-0.4841) 2.28925 (0.38268) 0.02491 (0.6767) T-test

Pak oil Value -0.98564 (-1.2095) 0.06959 (0.1488) -1.13181 (-1.0801) -0.05198 (-0.0776) 0.09221 (0.2994) -2.04507 (-1.2881) -0.11449 (-0.1599) 0.19394 (0.5526) 0.03176 (0.8076) T-test Nishat Value -0.94608 (-0.7397) -0.89935 (-0.9878) 0.26461 (0.10919) -0.96345 (-0.9663) -0.59134 (-0.6105) 0.14604 (0.0434) -0.87429 (-0.5139) -0.64457 (-0.4671) 0.00231 (0.0751) T-test Al-Falah Value -1.22853 (-0.7075) -0.60185 (-0.5874) -0.63827 (-0.3428) 0.98164 (0.50167) -0.90821 (-0.9540) -0.39253 (-0.1509) 1.07990 (0.4444) -0.96017 (-0.8089) -0.00526 (-0.1911) T-test

Table 10: Results from Period 4

Company name

Tests

Estimation of SML Test for non-linearity Test for non-systematic risk

γ0 γ1 γ0 γ1 γ2 γ0 γ1 γ2 γ3 MCB Value -0.33601 (-0.1375) -0.24501 (-0.1558) 3.59541 (0.6754) -7.3142 (-0.7063) 4.44043 (0.69801) 4.74305 (1.09717) -8.1649 (-1.1665) 7.05654 (1.13633) 0.09381 (1.2466) T-test

Oil & gas

Value 0.61979 (0.50612) -1.01508 (-1.0194) -1.9882 (-0.9014) 5.77073 (1.1447) -3.1289 (-1.3681) -1.81018 (-0.7801) 3.08661 (0.5025) -1.93377 (-0.6973) 0.11011 (0.85607) T-test NBP Value -1.2707 (-1.8624) 1.1629 (2.4163) 0.3661 (0.49031) 0.6221 (1.71201) -0.68603 (-2.6757) 0.64495 (0.6747) 0.59444 (1.4458) -0.7454 (-2.4497) -0.0011 (-0.6103) T-test Pak Petrol Value 2.64087 (1.3748) -3.6546 (-1.9729) 0.05886 (0.01908) 4.75531 (0.58429) -5.15709 (-1.0603) 1.05855 (0.97832) -6.8009 (-1.8448) 1.84182 (0.8312) 0.71332 (4.8262) T-test Fauji Fertilizer Value -0.34512 (-0.2275) 0.86669 (0.53369) -0.33274 (-0.1934) 2.53015 (0.47664) -1.32544 (-0.3341) 0.12081 (0.04945) 3.79036 (0.51751) -1.9918 (-0.3895) -0.12679 (-0.3405) T-test PTCLA Value -1.94695 (-2.5220) 0.72413 (1.55014) -1.66623 (-3.0721) 1.70598 (3.24001) -0.51397 (-2.3487) -0.92068 (-0.8764) 2.00194 (3.0561) -0.59693 (-2.3864) -0.04404 (-0.8450) T-test Fauji Bin Value -1.46315 (-1.3224) 2.61592 (2.0821) -1.74587 (-1.6019) 6.27013 (1.8558) -2.89327 (-1.1578) -1.30331 (-1.2705) 4.18049 (1.23235) 0.83866 (0.23466) -0.16636 (-1.3346) T-test