American Economic hegemony – under

threat or unsurpassable?

A statistical analysis of American Economic Hegemony and

the potential threat of China in the international economic

order.

Patrick Lewis

One-year Political Science MA programme in Global Politics and Societal Change Dept. of Global Political Studies

Course: Political Science Thesis ST632L (15 credits) [May 20th, Spring Semester, 2021]

Abstract

This essay focusses on the area of hegemonic studies in global politics, framing the discussion between the rise of China and the positioning of the United States. The purpose of this study is to show

that China does not threaten the economic hegemony of the US due to the pivotal role the US Dollar holds in the global economy, and that the Chinese Renminbi does not currently pose a threat to this positioning. A statistical analysis is undertaken with reference to contemporary theory to explain how declining rates of US dollars in currency reserves are not a symptom of a power shift in global politics

but simply an effect of fluctuations in global trade, as well as using Susan Strange’s concept of structural power to show how America holds hegemony over international finance and the economy.

Keywords: US Dollar, America, Hegemony, China, Structural Power, International order, Monetary

order.

1

Contents

1

. Introduction – The question of American Hegemony 11.1. Research problem 1

1.2. Research Aim 2

1.3. Research Question 3

2. Literature review 5

2.1. America, China, globalisation, and production 5

2.2. The US dollar, global finance and American hegemony 8

2.3 America and China, hegemonic rivals. 10

2.4. The US dollar: threats and challenges of the future 14

3. Theoretical Framework 17

3.1 Hegemony and the international order 17

3.2 The role of the US Dollar 21

3.2 The US Dollar as a reserve currency 22

4. Methodology 26

5. Analysis 32

5.1 US Dollars as a global reserve 32

5.2 US Dollars and fluctuations in Global Trade 35

5.3 Chinese Renminbi and Global Trade 40

5.4 Summary of analysis 41

6. Conclusion 44

1

Introduction – The question of American hegemony.

1.1 Research problem

The role the United States of America commands as a global power has been pivotal in defining and shaping the international order. American hegemony has created the foundations of a supposed international ‘rules-based order’. The United States of America has been the dominant global power since the beginning of the post-war era. The rise of China poses major threats to this global order in multiple ways, not only for the global economy, but also the possibility of war between two great powers.

Investigating American hegemony and its potential usurpers is a fundamental question of global politics in order to understand the current world order and the potential implications that changes to it in the future may have. This topic has been approached in the past, researchers have looked at the potential threats that the Soviet Union and Japan posed for US economic hegemony, however in contemporary discussion the most fundamental question of hegemonic studies is the question of China.

Questions have long been raised about the sustainability of American Hegemony. In order to understand and to be able to evaluate whether there is a transition of power in the global order it is important to understand what is meant by the term ‘hegemonic power’ and what propels it, before discussing whether America is in decline, or the rise of China poses a real threat. Concepts and definitions that this essay’s understanding and analysis is based on shall be detailed and explored in the literature review and theoretical framework.

2

Recent data provided from the World Bank for the year 2019, state that China’s economy (GDP) reached a value of 14.28 trillion US dollars, second only to the US itself at 21.433 trillion. (GDP (current US$) China, United States | Data, 2021). This rise to an economic superpower and the second largest economy in the world has been remarkable and quick, set alongside increasing trade liberalisation and closer ties between the two nations than previously. Yet, in 2016 with the Presidency of Donald Trump, China and America competed in a global trade war signalling an awareness in the United States of China’s threat to its hegemonic position. In 2020, the coronavirus pandemic has further weakened relations between the two nations and has severely disrupted international trade. Many scholars such as Allison (2015) have theorised about the potential rise of China usurping America as the unipolar power in global politics, and the implications of this shift. This essay shall seek to assess whether China’s rise does pose a threat to American economic hegemony.

1.2 Research Aim

The rise of China, many (Allison, 2015; Jacques, 2009) predict will achieve the task other states have failed at in surpassing American hegemony. In Joe Biden’s press conference laying out his plan for his presidency he stated, “China has an overall goal…they have an overall goal to become the leading country in the world”. (Remarks by President Biden in

Press Conference | The White House, 2021). However, although stated by the president of the

United States, this declaration does not determine whether this goal is realistic.

3

- How does the architecture and systems of hegemony function and reaffirm themselves in the global economy and in global finance?

- Is US economic hegemony under threat from China?

1.3 Research Question

The central research question this paper seeks to address is based heavily on Susan Strange’s analysis of structural power, and China’s emergence as a rising power. The question being “is America’s structural power and hegemonic position in global finance under threat from China?”.

This paper focuses on the node of financial power provided by Susan Strange’s analysis of structural power (Strange, 1990; p.565). More specifically this paper shall explore and analyse how the US Dollar works to maintain American economic hegemony, and in turn whether this economic hegemony (represented by the US Dollar) is under threat from the rise of China. The central hypothesis of the analysis undertaken is that fluctuations or declining rates of US Dollars in currency reserves can be explained through the Dollars relationship to world trade, not as a sign of shifting economic hegemony.

This question is of extreme social relevance as the coronavirus pandemic and the presidency of Donald Trump have revealed the fractures in global politics, and the pressures the international system is subject to under such external shocks. Furthermore, it highlights an important political discussion on American hegemony, decline and the weaknesses of the current international order.

As mentioned above, the discussion of American hegemony also raises the related questions of the international system and what form of relationship great powers should share. Section 2 of this essay, the literature review, shall dedicate time to explaining the international order and the role of US hegemony, before detailing how the structures of American hegemony

4

maintain the US’s position in that international order. The following parts of this essay shall seek to analyse arguments made, with reference to real-world data that China does not pose a threat to American economic hegemony.

5

2.0 Literature review

The American economy has been the dominant global power since the formation of the Bretton Woods agreement, through the oil crisis of the 70s and the financial crash of 2008, however in response to these crises paired with the election of Donald Trump in 2016 a wealth of literature has been written examining hegemony and America’s supposed decline (Sharpe, 2012; Layne, 2016). Further to this, China has emerged as a potential economic rival to America, prompting further literature on the possible usurpation of American hegemony. This review shall focus on multiple aspects of hegemonic analysis, particularly analysing the structure presented by Susan Strange of finance and the role of the US dollar, as well as literature on the international system and production.

2.1. America, Globalisation and production

Christopher Layne (2012) takes the view that America is in decline, and that the unipolar nature of the international order since the post war period is over. Layne’s first argument for this supposed decline comes in the form of new power challengers, specifically that of China. (Layne, 2012; p.205) According to Layne, America is restricted by its domestic fiscal and economic power, which will then in turn resort to undermining American military power. Layne asserts that the hard power foundations upon which American hegemony is based have crumbled and thus the post war international system of pax americana shall be challenged. (Layne, 2012; p205). A similar argument is raised by Hensman and Correggia (2005) who posit that challenging American dollar hegemony shall see a decline in American military hegemony. Which will then inevitably lead to the end of the unipolar international system (Hensman and Correggia, 2005; p.1091).

6

A response to Layne’s view that the increasing trade deficit will have a negative effect on the US’s economy and in turn result in the loss of unipolarity can be seen in the work of Sean Starrs (2013). The question of a threat to hegemony amongst worsening trade deficits is analysed by Starrs, who conducts an empirical analysis of not only the world’s largest trans-national corporations and their ownership (mostly American) but also the ownership of other nation’s largest firms (mostly American shareholders) (Starrs, 2013; p.820). Starrs’s analysis can be described simply in his words of “national accounts are no longer adequate for the power-as-resources approach prevalent in the debate on American decline” (Starrs, 2013; p.818). Starrs argues that even if relative to the rest of the world American GDP is in decline, this is not necessarily a sign that American businesses and corporations are in decline. Likewise, the same applies to China but inversely. Starrs posits that if Chinese GDP were to rise as a proportion of global GDP, this also does not mean that Chinese businesses are also increasing their global competitiveness (Starrs, 2013; p818.-819).

Starrs gives the example of Apple. China may dominate the market in exports of iPhones and other technological goods due to final assembly occurring in Chinese factories. However, this does not indicate that China is the world leader in technological goods, it does not signify that the profit goes to Chinese firms, in fact assembly of such goods in Apple’s case goes to a Taiwanese corporation, but ultimately the most profit goes to Apple, a US-based company. (Starrs, 2013; p.819). This all shows how national trade statistics are not a clear sign of a country’s economic performance and in turn cannot be used as evidence of a declining American economic power.

This analysis is also put forward by Malkin who notes that although China in its rise has become home to a large quantity of technology manufacturers, a large percentage of the technology used to make these goods is owned by companies and business domiciled outside of China and are non-Chinese owned (Malkin, 2020; p.9). Taking this into account this we

7

can then refute Layne’s initial claim that America’s economic base, and platform for hegemony have crumbled and see that America is still the net beneficiary of globalization, and production occurring in China.

Starrs further states “by 2012 American firms combined own 46% of all publicly listed shares of the top 500 corporations in the world…this dominant American ownership of the top 500 corporations is despite “only” 167 with US- domicile, or 33% of the total—not to mention the United States “only” accounting for 22% of global GDP. This signifies how globalized American economic power has become. Chinese capital, by contrast, is almost entirely nationally contained, as 29 Chinese corporations make the top 500.” (Starrs, 2013; p.824). Therefore, we can see from these how American economic gains have been dispersed and are collected from all over the world, taking full advantage of liberalised markets and globalisation, meanwhile Chinese economic growth and investments are by contrast a mostly domestic affair. For there to be a realistic challenge to the American hegemony in financial markets we should expect to see more Chinese companies making up the largest corporations in the world, as well as more Chinese investments spread globally.

Furthermore, this argument can again also be seen in the work of Babones and Aberg (2019) who note that “In an economy organized around global and regional production networks and global value chains, trade in value-added (TiVA) becomes more important for understanding the global distribution of power and rewards than official international trade figures” (Babones and Aberg, 2019; p.306). Further going on to say that although China dominates at the lower portions of the global value chains, this does not translate into a central position within the global economy. (Babones and Aberg, 2019; p.306). Although, production is not the sole focus of this essays research, it is important to note and engage with current literature that references the ongoing debate on the respected positions of two major powers. The

8

simple fact that analysis of China as a production centre in the global economy compared to America, signals the rise of China and the possibility of a hegemonic shift.

Although, as previously stated production is not the central node that is being analysed in this essay, the literature above is important in signalling the wide array of actors underpinning US centrality in the international system, whether they be multi-national corporations, individual investors, or non-governmental organisations.

2.2 The US dollar, global finance and American hegemony

Spantig (2015) conducts research viewing the perilous position in which the US dollar finds itself, especially examining the role in which domestic monetary policy decisions have on the international economic system. Spantig (2015) concludes with remarks detailing how a closer Euro-Chinese relationship would challenge the hegemonic role the US dollar plays in international economics, arguing that a multipolar world financial system backed on the Chinese Renminbi and Euro could be more stable for the international economy than the current US unipolar world order. (Spantig, 2015; pp.475-476). This we can take to see as a direct challenge to the current hegemonic order that the US enjoys, from China as well as Europe. However, Spantig’s argument fails to engage with perhaps the central pillar of American hegemony, that being the US Dollars position as a global reserve currency and currency of international payment.

In order to present just how important the US Dollar is to the international order as well as continuing American hegemony, Daniel McDowell (2020) examines how the US Dollar is used as a global payment method, “the global payments system is built on a select few currencies that operate as international mediums of exchange.” (Norrlof et al, 2020; p.121). While the US only accounts for about ten percent of global trade almost half of international payments occur in the Dollar (Norrlof et al, 2020; p.121-122). Furthermore, when conducting

9

international trade in Dollars, payment must be cleared through a US domiciled financial institution which receives the payment order and credits the intended account. 95% of transactions that occur in US Dollars need to be cleared through these financial institutions which are domiciled in the US (Norrlof et al, 2020; p.122).

The importance of this is difficult to understate, as the US Dollar is the main currency in international trade, sanctions enacted on countries play major role in their ability to operate in the global economy. When sanctions are placed on a country or business, it becomes harder for them to operate in the international economy due to not being allowed to pass money through the US domiciled financial institutions which complete these payments. It is therefore clear that due to the US Dollar having such a primary role in international trade, it also has the overarching effects of states and businesses conforming to US wishes and political goals in order to avoid sanctions. This is a strong argument detailing how the US Dollar reinforces the hegemony of the United States. This point is also raised by Norrlof (2020) who notes how states such as Germany and Japan held US Dollars as reserve as a way of ensuring protection during the Cold War. (Norrlof, 2020; p111), further showing the significance the US Dollar has on the global order and underpins US hegemony.

A further strength of the US economy can be seen in bond and securities markets. The United States and United Kingdom combined make up nearly 80% of all interest rate and derivative trading globally (Babones and Aberg; p.307). This is a further signal of hegemony and America’s central role in the global economy, especially considering how American assets and investments are seen as the best way to protect investors and traders in times of crisis. The fact that American investments are demanded in time of crisis symbolises the international view as America as a safe-haven and the strongest economy in the global system. Babones and Aberg (2019) summarise with the point that due to globalisation freeing

10

people and capital to make decisions irrespective of international boundaries and borders, the networks and connections of global finance have centered around the American system (Babones and Aberg, 2019; p.307).

This conclusion can also be seen in the analysis of Fichtner (2017) who states that although the market may be global, and financial trading occurs internationally, the structures of international finance definitely have an “Anglo-American character” (Fichtner, 2017, p.12). This is a clear indication that Susan Strange’s note on structural power especially that of financial power directly applying to the US. The United States has clearly acquired hegemonic status within the domain of international finance.

Overall, Spantig’s assessment that a closer Euro-China relationship may provide a more equitable international order may be true, yet no evidence is provided to show that the Euro nor the Renminbi can function in the roles in which Norloff (2020) or Babones and Aberg (2019) describe. In the current international order, due to the US Dollar we can say with confidence that America holds a hegemonic position within the international economy.

2.3 America and China, hegemonic rivals.

Layne (2012) discusses the economic shift from America to China that has occurred, namely China overtaking America as the leading manufacturing nation in the world (p.205), although this claim has been explored further by Starrs (2013) above, showing how most economic gain from China as manufacturing hub is primarily seen in the US. More specifically relevant to this essay’s scope of research though is Layne’s argumentation concerning the US Dollar. Layne asserts that American hegemony relies on the role the US Dollar holds as the global

11

reserve currency, and a threat to this, or a removal of the Dollar reserve would therefore make American hegemony unsustainable. (Layne, 2012; P.208). Layne says that due to the US Dollar being a reserve, America does not have to work in order to pay its bills. (Layne, 2012; p.208.) This is a clear acceptance of one of the theoretical basis of this essay Susan Strange’s analysis of structural power, specifically the structure of finance. Layne’s argument follows the logic that if the US Dollar is usurped, massive cuts to spending, specifically on defence will have to be made and therefore in turn the machinery of global hegemony shall begin to crumble. (Layne, 2012; p.210.). Underpinning this analysis is the assumption and prediction that the US Dollar will be replaced as the global reserve currency, however as current indications point out this has not been the case. The scope of this essay and analysis section shall further show how the US Dollars dominant position as a global reserve is unrivalled, especially by that of the Chinese Renminbi.

Layne refers to an uncertain Dollar future, without necessarily stating what makes the future so uncertain. His reference to worries of Dollar value, are as of this moment unfounded, as China continues to purchase US bonds and securities, as well as owning large amounts of other US assets. Furthermore, Layne does not discuss potential issues that states have with the Renminbi’s value. The Chinese government often alter the peg at which the Renminbi’s value is set. (Mercurio and Leung, 2009; p.1298) Secondly, there is the issue of internationalisation, the Chinese currency is not an internationally sought-after currency to the same level that the US Dollar is. Regardless of whether America is in decline, this does not necessarily mean that a new Chinese hegemony lies around the corner.

Furthermore, there are the claims made by Layne in his conclusion. Layne writes in 2012 that sometime this decade the Chinese GDP will surpass the USA’s; this is yet to happen (unless looked at in PPP terms). Secondly, although Layne declares that “Unipolarity is over” (Layne, 2012; p.212), this is certainly debatable. The works of Fichtner (2017) demonstrate America’s

12

structural power over international finance, Starrs (2013) demonstrates the structural power America currently holds in the realm of production, and the American military is still the largest military force in the world. It is therefore unclear in which way unipolarity is over. Layne’s argument relies heavily on the decline of the US Dollar, an argument that the analysis section of this essay shall seek to dispel.

Hensman and Correggia (2005) also note the rising challenge of currencies to the US Dollar hegemony, conducting most of their analysis on the replacement of the Dollar system with that of the Euro, giving examples of states such as Iraq and Venezuela which turned away from using the US Dollar (Hensman and Correggia, 2005; p.1093). Hensman and Correggia predictions though remain yet to be seen, following on from their calling of the international system to replace the Dollar with the Euro, the eurozone has undergone a financial crisis as well as a currency crisis. As of 2020 Q4 international reserves by currency strand at 59.02% being in USD while the Euro makes up 21.24% (IMF Data, 2021).

One criticism of much of the literature on the concept of ‘America in decline’ is perhaps a misunderstanding of theory from the American perspective. Hensman and Correggia (2005) refer to the power of the American military and its pursuit of foreign intervention around the world, as an imperialist rogue state (Hensman and Correggia, 2005; P.1094). Taking this into account we can argue that from Hensman and Correggia perspective American foreign policy operates on an offensive realist or human nature realist perspective of the world- these are interpretations which promote the view that states actively seek to get as much power as they can (Mearsheimer, 2001; p.22). However, others may argue that American policy and specifically foreign policy has shifted from offensive realist understandings of the world to a more defensive realist understanding. Although there are still opportunities for power gains, states such as America are not as aggressive in their pursuit of power, instead America now has shifted its goal on the maintaining of the balance of power (Mearsheimer, 2001; p.22).

13

This shift from one realist position to another may be misconstrued as a supposed ‘decline’ due to America not being as aggressive in its pursuit of power, yet as the analysis and theoretical framework section of this essay shall seek to show American hegemony is still unrivalled.

Graham Allison (2015) questions America’s decline and the potential occurrence of a war with China, referencing the ancient metaphor of Thucydides who warned of the consequences of a rising power challenging a ruling power. (Allison, 2015; p.1). Allison references China’s impressive growth from the 1980s and the outperforming of American growth in GDP terms since 2008 and quoted Xi Jingping’s ambitions to threaten the unipolar American world order which in turn shall be replaced with a multipolar international system (Allison, 2015; p.2). Although this growth as Allison regards it is remarkable, and Xi Jingping’s ambitions may be true, the detail is scarce. Allison does not engage on the issue of how China would replace the current international order, which currently has many patient supporters (in Allison’s own terms Japan and Germany (Allison, 2015; p.3.)) This is a major issue, as previously stated and other scholars have analysed, the international system currently benefits America to such a degree, ambitions and reality cannot be confused. Secondly, Allison does not engage with perhaps the prominent part of this international system that maintains US hegemony, this being the US Dollar centrality. Little evidence is given that the Chinese Renminbi will pose an existential threat to this. Other scholars (Schwartz, 2019) have shown the importance of this feature to international system, and more importantly it is importance in reaffirming Strange’s concept of structural power over domains such as finance and production. If this centrality is not challenged, then it is difficult to say that China is realistically challenging American hegemony.

14

The primary focus of this essay is detailing the importance of the US Dollar and its role in hegemony, as the literature above touches on. Many theorists have posited about the decline of America and rise of China as previously mentioned, and a large body of research examines the possibilities of the US Dollar losing its benchmark as the international currency standard in the face of threats from the Chinese Renminbi.

Hung (2014) also argues the pivotal role the international Dollar system has held in defending hegemony, stating that America’s unique ability to borrow in its own domestic currency has given itself privileges, specifically the ability to act within its own domestic economy in times of stagnation as well as fund and maintain the largest war and defence programme in the world. (Hung, 2014; p.55). Hung’s analysis of the US Dollar uses the theory created by Susan Strange of currency domination, “To Strange, a currency could become hegemonic in the global economy of attaining one or more of the statuses: the status of top currency, the status of master currency, and the status as a negotiated currency” (Hung, 2014; p.53). To Hung, at one time or another since the beginning of the post-war period, the US Dollar has occupied all three of these statuses.

Hung continues his analysis to examine the potential threat the RMB poses to the US Dollar as a reserve currency, noting, “while China maintained its export-orientated growth and stable RMB over the last three years, it heightened its open support of alternatives to the Dollar in the world financial system.” (Hung, 2014; p78). Hung goes on to state the implications of this “The remaining question then would be whether the vacuum left by the Dollar’s fall would be filled by a stable new international monetary order or by chaos”. (Hung, 2014; p79). This problem has been noted in similar literature as previously mentioned and is a clear indication of why this paper’s research is of global political relevance, the fact that China has ambitions to threaten US hegemony could result in a major change of the current the international order and the possibility of chaos and uncertainty for the global economy.

15

This implication can also be seen in the work of Qiu and Zhao (2019) who also predict the end of USD centrality and with that the US focussed international monetary order, due to its supposedly inherent contradictions of capital accumulation. While also accurately labelling the USD as a problem to Chinese ambitions. In response to this Qiu and Zhao propose that China works on the internationalisation of Renminbi in order to challenge Dollar hegemony and bring about a more equitable world order. (Qiu and Zhao, 2019; p.106). Yet this hypothesis does not address the inherent contradictions within the Chinese economy, and the difficulties of internationalising a currency whose state which has become synonymous with secrecy. As Fichtner (2017) noted that London and New York are the centres of the financial world, to this issue China currently has no reply, and thus we see the difficulties of said internationalisation.

Furthermore, there is no engagement with an important debate on whether states and countries would happily take part in the internationalisation of a currency which the end result would be the challenging of a world order and bring about all the uncertainty associated with said challenge. Therefore, it is of great importance in global politics to investigate whether the warnings noted about the decline of the US Dollar as the global hegemonic currency are well founded or other explanations can be provided.

Costigan et al (2015) speculate about the decline of US hegemony due to the threat of the US Dollar losing its reserve currency status specifically from China, referencing China’s plan to seek a new global reserve through initiatives such as the Asia Investment Bank and conducting trade with other states such as Russia and Iran without using the Dollar (Costigan et al, 2015; p.113). Dave (2019) also assesses the future of the US Dollar in international trade following the trade war enacted by President Trump, stating that other countries as a result of barriers to trade shall adopt an alternative vehicle currency. Dave supports these claims by pointing to the declining rate of USD in FOREX holdings as opposed to other

16

currencies. (Dave, 2019; p.30). This analysis leads to one of the principal hypotheses of this essay, that a decline in US Dollars as a reserve holding is a symptom of a slowdown in global trade rather than signals of a shifting hegemony. This analysis shall be further explained in the methodology section of this paper.

Together, these studies outline that there is an undeniable relationship between American hegemony and the American Dollars use in the global economy, as the American National Intelligence Council noted “the fall of the Dollar as the global reserve currency and substitution by another or a basket of currencies would be one of the sharpest indications of a loss of US global economic position, strongly undermining Washington’s political influence too.” (DNI, 2012; pXII).

Furthermore, it is important and within the scope of this essay to analyse whether the Chinese Renminbi poses a threat to the US Dollar as a global reserve, or a global payment currency. Fichtner (2017) writes that “The Renminbi will surely become more important in the future. However, the existence of capital controls is going to prevent the Chinese currency from seriously challenging the greenback”. (Fichtner, 2017; p.14). Although the author signals the Chinese currency will play a major threat in the future, it is ruled out in the short term. However, this essay shall assess whether this is reliable, or in turn the Chinese Renminbi is currently posing a threat to the USD. Therefore, further analysis monitoring rates of CNY as reserve currencies and payment currencies in relation to global trade as US Dollar holdings shall be undertaken in this essay in the analysis section.

17

3. Theoretical Framework

3.1 Hegemony and the International Order

In order to undertake the task of exploring whether China poses a threat to the US world order, it is first important to define what is meant by term ‘hegemony’. Throughout this paper reference to a hegemonic power shall borrow from the description given by Robert Gilpin in which he describes the concepts of a hierarchy of prestige and power, “The hierarchy of prestige in an international system rests on economic and military power. Prestige is the reputation for power, and military power in particular. Whereas power refers to the economic, military and related capabilities of the state, prestige refers primarily to the perceptions of other states with respect to a state’s capacities and its ability and willingness to exercise power”. (Gilpin, 1981, pp30-31). From this it can be taken to understand that when using the term American hegemony, we are referring not only to the strength of American military and economic power in relation to other states, but the perception from other states that America is willing to exercise said power. However, the concept of prestige in global politics is a contentious and debated topic that includes concepts such as soft power and roles of institutions which lies outside the remit of this essay which is focussing on the material reality of the economic power of the US as a hegemon with direct reference to Strange’s analysis of the structural power of finance not the concept of prestige. Therefore, for the purpose of this essay we shall focus on hegemony as the power of the United States’ economic capabilities.

This is an interpretation of hegemony also supported by John Mearsheimer (2001) who points out that it is within every state’s best interest to be the hegemon, as a method of protection

18

and defence against other states ambitions. (Mearsheimer, 2001; p.3). For Mearsheimer, the international system shapes the actions and decision making of states, in the sense that the international system increases the motivation for states to maximise their power as this will in turn maximise their security from other states. His theory of ‘offensive realism’ is a descriptive theory, explaining how states act and why they act this way (Mearsheimer, 2001; p.11). A central question important to Mearsheimer’s theory, and this essay’s explanation of American hegemony can be found in Mearsheimer’s analysis of power, and as mentioned above Mearsheimer’s analysis of power concludes that “Power is based on the particular material capabilities that a state possesses” (Mearsheimer, 2001; p.55).

Susan Strange presented an argument stating that hegemonic power is made up of four key structures: security, production, finance and knowledge. The main purpose of this essay shall be the investigation of America’s economic hegemony and the US Dollar and therefore mostly exploring Strange’s concepts of financial power. (Strange, 1987; p.565).

Strange’s definition of financial power is applied to a state that is “able to determine the structure of finance and credit through which (in all but the most primitive economies) it is possible to acquire purchasing power without having to either work or to trade it” (Strange, 1987; p.565). Moreover, some analysis on Strange’s concept of production is also referenced in the literature of hegemonic studies and the international system (Babones and Aberg, 2019; Starrs, 2013) therefore for the purpose of this literature review we shall also explore this concept, however the central topic of this essay is solely concentrated on Susan Strange’s concept of structural power in finance.

Noting this, the structural power of production was defined by Strange as a state “able to control the system of production of goods and services” (Strange, 1987; p565) in order to

19

assert their power and maintain their position of hegemons. This paper shall show in detail how these two structures work in the American context and seek to show how they are not under threat from China.

International finance is a key way in which America has maintained its hegemonic power, as Strange mentions “What I am comparing is the structural power to extend or restrict the range of operations open to others which has been, and still is, exercised by the United States” (Strange, 1987; p.259). In her analysis of how America holds structural power in the domain of finance, Strange refers to “the system by which credit is created, bought and sold and by which the direction and use of capital is determined”. (Strange, 1990; p259).

Strange’s work (1990) focusses on the relationship of Japan and America in the 1980s in the sphere of international finance. Although Japan in contemporary political literature is no longer considered to be a hegemonic rival to the United States, Strange’s analysis can also be used to analyse the current Sino-American relationship. Strange notes how the Japanese Yen is not widely used in international markets, a similar problem also facing the Chinese Renminbi. Strange concludes “Japanese power in finance is relational only whereas that of the United States is structural. The process of equalization if it ever happens will take a long time and would involve radical reform if the international economic organisations over which the US has a constitutional veto power.” (Strange, 1990; p.273). This conclusion, although concerning Japan, can also be applied to the case of China today. The IMF is still working under the structure in which the United States alone has veto power, therefore it can be said international institutions continuously work in a way which reinforced American dominance in the field of finance making a hegemonic challenge from China difficult.

20

Babones and Aberg (2019) further Strange’s analysis on structural power defining structural power as “the power to shape and determine the structures of the global political economy within which other actors, political institutions, economic enterprises and (not least) scientists, and other professional people have to operate.” (Babones and Aberg, 2019; p.301). This definition used of structural power can also be used in the analysis of hegemony, for example, it is clear when analysing hegemony that the hegemonic power uses it status to shape and determine the structures of the global political economy. It is also of importance to clarify what is meant by the term ‘international order’ and show how China poses a threat to such an order, in order to signify how relevant this essay’s research is to global politics. Simply put the characterisation of order can be seen to be the “interstate agreement over the norms, rules and institutions that regulate interstate behaviour” (Johnston, 2019; p.23). When discussing this supposed order therefore it is important to understand America’s role in forming and maintaining this order, to then determine how China poses a threat to it. America is the lone state which holds veto ability at the IMF, this indicates clearly the central role and power the United States has in shaping the global economy, as well as also being one of the five permanent members of the United Nations Security Council which holds veto power, again signalling the central role America has in the current international order.

Khanna and Winecoff (2020) make the important point that when analysing hegemonic orders and hegemonic powers, too often in literature analysis is concerned solely on the attributes of the dominant state not its relation to the international system; “Hegemonic powers gain influence through their structural prominence, and this is a function not only of their attributes but also of their connections to the rest of the system.” (Norrlof et al, 2020; p114). In the analysis section of this essay, this shall be taken into account as we are exploring how US Dollar centrality affects and shapes the rest of the international system to maintain hegemony.

21

Khanna and Winecoff (2020) view “international orders as overlapping, multidimensional sets of durable arrangements, that can be theorised, and measured as a multilayer network” (Norrlof et al., 2020; p114). These international orders change and shift in response to unpredicted, unforeseen or even predictable damaging events. Historical cases of this can be the two world wars which resulted in a global order realignment in favour of America as the central state in the global order, replacing Britain. The early 21st century has seen a financial

crash that created economic instability throughout the international system, as well as a global pandemic which the effects of are still being recorded. These two events suggest that there could be a redrawing of lines in the global order. China remained relatively unscathed from the financial crisis and continued its strong economic growth as Khanna and Winecoff state “If there was to be a major reorganisation of the system then the critical components seemed to be in place: a rising power, a major crisis in the central status quo power, and a perceived de-legitimation of the ex ante order.” (Norrlof et al., 2020; p.115). From this we can see a view that is found in much of the literature concerning American hegemony, that being the challenge of a rising power, and a supposed decline of the United States which threatens its status specifically following a crisis such as the 2008 financial crash or the global Coronavirus pandemic

3.2 The role of the US Dollar

Much of the current literature on American hegemony pays particular attention to the role of the US Dollar in enforcing the power system of American hegemony, as shown in the literature review, many scholars (Hensman & Correggia, 2005; Spantig, 2015; Costigan et al, 2015; Qiu & Zhao, 2019) have attempted to explain the pivotal role the US Dollar plays in defending and reinforcing hegemony. This essay uses the concept of Susan Strange’s structural power (with regards to finance) to show America’s hegemony in the global

22

economy, more particularly how the US Dollar centrality defends and propagates American hegemony.

Khanna and Winecoff note that the strengths of this order stem from the Dollar, “the leading theoretical framework understands the Dollar pre-eminence as a function of particular internal aspects of the United States that supposedly generate confidence in the American market, at least relative to its potential risks. Those aspects are the large, open and stable American domestic economy; its deep and liquid financial system; its transparent and predictable political system; and its willingness to provide security guarantees within its sphere of influence”. (Norrlof et al., 2020; p117). Returning to our definition of hegemony provided by Gilpin and Mearsheimer, we can see clearly how all these factors come together to support the view that American acts as a hegemonic state, its economic power far surpasses other states and reassures the international system in times of crisis. Furthermore, the foundations of this have its roots in the American Dollar as can be shown from its use as a reserve currency and a currency of international payments.

3.3 The US Dollar as a reserve currency

Costigan et al (2015) investigate the origins of the US Dollars role in global hegemony, drawing attention to the formation of Bretton Woods which “instated a world system where the US Dollar was at the centre of the global economy, the value of a nation’s currency was determined in relation to the US Dollar”. (Costigan, 2015; 106). This simple fact demonstrates clearly the central role America has on global trade, and any states desires to be part of the global system was reliant on them holding and demanding the US Dollar. In turn propping up the American economy and sustaining American interests. Costigan et al (2015)

23

argue that the US Dollar plays a critical role in the creation of a world order that has the United States as its unipolar power. (Costigan, 2015; 115).

B.B Dave (2019), signifies the importance to the global economy of the US Dollar through their analysis of vehicle currency theory, currencies which are commonly used in foreign exchange, trade and asset holding have lower transaction costs as opposed to other currencies. Therefore, by using the US Dollar it decreases transactions costs for all parties. Dave (2019) explains how this led to and still maintains US hegemony, because all nations wished to have US Dollars which resulted in a trade deficit with the US by being ready to supply goods, whereas America was fortunate enough to create a demand for goods by creating more Dollars, which has resulted in US Dollar hegemony in global trade. (Dave, 2019; p23). This is a clear indication of the structural power in which Susan Strange mentioned, that America has achieved hegemony in finance by being able to set the terms of trade and credit without having to work for it.

Costigan et al (2015) assert this through references to global oil trade being conducted in Dollars and point to the fact that even though America as a manufacturing hub has declined there has been no real alternative at the time of writing to challenge the reserve currency status of the US Dollar. Costigan (2015) as well as Dave (2019) present an argument that has greatly influenced the research of this essay, therefore in order to further the study the role of the US Dollar a statistical analysis shall be undertaken to show the amount of US Dollars in current reserves compared to the value of global trade and specifically that of global oil trade. This shall seek to show how the US Dollar plays a pivotal role in the international system, as well as showing that the US Dollar is not under threat from another currency as becoming the

24

global reserve due to fluctuation of international Dollar holdings being explained by the fluctuations in global trade.

Fichtner (2017) declares that “the US Dollar is still the unrivalled global reserve currency” (Fichtner, 2017; p.13) by using the same datasets as this essays analysis, however Fichtner does not seek to explain the fluctuations in holdings as a reserve currency that this paper shall seek to do. Instead, the author notes how the “central reason for the dominance of the US Dollar as the global reserve currency is the position of Wall Street as one of only two truly global financial centres” (Fichtner, 2017; p.14). Although the conclusion is one this paper aligns with, there are questions regarding the decline of currency reserves in USD that have been left unanswered. Therefore, this paper shall seek to further the work of Fichtner (2017) and provide a deeper analysis on the US Dollar as a reserve currency.

In support of the central hypothesis in this essay is the work of Schwartz (2019) who explains the concept and implications of Dollar centrality in the global monetary system. Schwartz describes how countries will provide goods and services to America in return for USD that will then be stored in reserves, an assurance for future supply of goods and services returning. (Schwartz, 2019; pp.493-494). This succinct explanation supports the central thesis of this essay that a declining rate of USD in global reserves is a result of a decline in global trade, not the decline of the USD as a global reserve in the face of a threat from a changing world order or the Chinese Renminbi.

As well as this, Schwartz expands to explain how this process creates US hegemony, the more that Dollars are lent out the more banks that are located outside the US are forced to generate credit in Dollar terms. (Schwartz, 2019; P.498) This is because as Schwartz notes, the more than the international financial system deals in Dollars “the more they depend on the FED in

25

times of crisis” (Schwartz, 2019; P.498). Schwartz details how Strange’s concept of structural power and hegemony have materialised in the world of finance, rejecting the critique that the balance of payments poses a threat to US Dollar centrality, instead arguing it is a liberating tool that allows the US to avoid constraints other economies have to deal with, (Schwartz, 2019; p.512) as well as the make-up of the global economy in terms of many states’ export surpluses assuring Dollar centrality (Schwartz, 2019; P.514).

26

4. 0 Methodology

The literature discussed above shows the pivotal role the US Dollar holds in protecting and maintaining American hegemony. Therefore, it is important in the study of global politics to analyse the position that the US Dollar currently occupies in the global system. This shall be done by performing a statistical regression analysis to plot the relationship between US Dollar reserve holdings to that of total value of global trade. This shall be done in order to seek out a relationship between the two, which shall explain fluctuations in US Dollar reserve currency not as America in decline, or the US Dollar losing its reserve status but simply as a natural relation to the global economy.

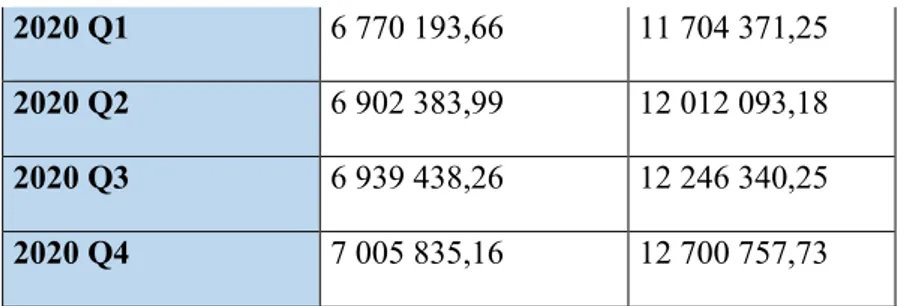

Data holding the value of currencies held as a reserve can be sourced from the IMF dating back to 2006 (extract of data from Q4 2016-Q4 2020 shown below), which shall perform the time frame for this analysis. Although data concerning the value of CNY held in reserves is only possible to be sourced from the final quarter of 2016 using this dataset provides limitations of analysis concerning the question of the threat of the Chinese Renminbi.

However, analysis shall still be conducted of US Dollars as a reserve currency from the time period starting at 2006 as by increasing the time period studied this shall lead to more accurate results and more noticeable trends, which will in turn lead to stronger evidence that proves the hypothesis that declining rates of US Dollars as a reserve currency are due to fluctuations in global trade.

US Dollars

(Millions) Reserves in USD

Total Foreign Exchange

Reserves

2006 Q1 1 942 946,40 4 524 709,89

27 2006 Q3 2 078 395,82 4 953 469,83 2006 Q4 2 160 670,90 5 253 749,35 2007 Q1 2 288 985,91 5 590 709,54 2007 Q2 2 412 583,36 5 957 814,73 2007 Q3 2 491 264,13 6 300 673,47 2007 Q4 2 633 502,78 6 706 256,26 2008 Q1 2 760 057,83 7 245 076,45 2008 Q2 2 773 754,39 7 460 493,34 2008 Q3 2 797 906,33 7 499 847,57 2008 Q4 2 684 267,57 7 347 782,28 2009 Q1 2 660 234,45 7 163 561,03 2009 Q2 2 696 711,84 7 565 034,40 2009 Q3 2 743 922,92 7 881 705,34 2009 Q4 2 848 309,20 8 166 210,68 2010 Q1 2 898 630,13 8 292 675,08 2010 Q2 3 010 176,03 8 421 615,04 2010 Q3 3 164 342,11 8 991 647,00 2010 Q4 3 208 610,92 9 265 602,33 2011 Q1 3 279 607,71 9 706 760,05 2011 Q2 3 349 122,34 10 090 785,49 2011 Q3 3 468 529,54 10 170 311,88 2011 Q4 3 538 078,36 10 205 049,73 2012 Q1 3 529 112,31 10 442 431,71 2012 Q2 3 606 543,84 10 534 857,88 2012 Q3 3 693 517,27 10 788 547,83 2012 Q4 3 741 924,93 10 951 256,63 2013 Q1 3 772 298,89 11 103 334,15

28 2013 Q2 3 767 040,44 11 143 963,45 2013 Q3 3 815 599,27 11 455 092,22 2013 Q4 3 813 459,57 11 697 625,59 2014 Q1 4 383 938,73 11 862 643,41 2014 Q2 4 439 374,07 12 009 915,55 2014 Q3 4 467 603,80 11 779 626,23 2014 Q4 4 431 383,26 11 606 047,21 2015 Q1 4 452 124,56 11 446 230,90 2015 Q2 4 785 795,81 11 470 694,97 2015 Q3 4 748 089,65 11 193 315,78 2015 Q4 4 873 916,26 10 932 276,99 2016 Q1 5 082 661,97 10 935 411,46 2016 Q2 5 254 345,01 10 977 669,90 2016 Q3 5 403 945,21 11 004 823,07 2016 Q4 5 502 072,13 10 726 043,30 2017 Q1 5 713 579,84 10 912 204,99 2017 Q2 5 909 486,79 11 133 149,71 2017 Q3 6 125 852,36 11 307 920,76 2017 Q4 6 280 592,67 11 457 754,70 2018 Q1 6 531 318,53 11 617 557,48 2018 Q2 6 561 098,60 11 481 354,25 2018Q3 6 631 624,73 11 411 349,79 2018 Q4 6 623 400,66 11 436 228,34 2019 Q1 6 729 109,12 11 611 056,39 2019 Q2 6 754 558,86 11 738 610,80 2019Q3 6 729 984,57 11 657 860,40 2019 Q4 6 725 907,36 11 826 502,96

29

2020 Q1 6 770 193,66 11 704 371,25

2020 Q2 6 902 383,99 12 012 093,18

2020 Q3 6 939 438,26 12 246 340,25

2020 Q4 7 005 835,16 12 700 757,73

Fig 1. Source: (IMF Data, 2021)

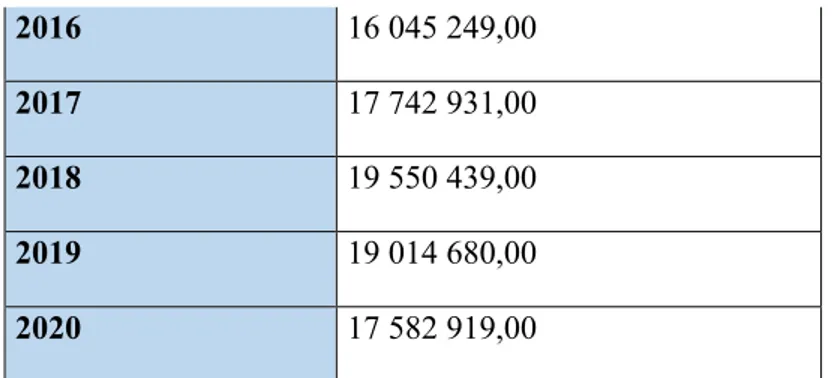

While data valuing the amount of global trade annually is provided by figures from the World Trade Organisation. This data includes the time periods from 2005 to 2020, a long enough time period to notice changes in global trade as well as long enough to draw conclusions regarding the relationship between reserve currencies and global trade.

Reporting Economy World

US Dollars (Millions) Total Merchandise trade value

2005 10 510 292,00 2006 12 131 449,00 2007 14 032 003,00 2008 16 170 529,00 2009 12 565 091,00 2010 15 303 993,00 2011 18 343 601,00 2012 18 514 486,00 2013 18 969 946,00 2014 19 011 072,00 2015 16 558 147,00

30 2016 16 045 249,00 2017 17 742 931,00 2018 19 550 439,00 2019 19 014 680,00 2020 17 582 919,00

Fig 2. Source: (WTO Data, 2021)

The purpose of this analysis shall be showing how the declining rate of USD reserve holdings is not a symptom of a removal of the USD as the global reserve currency but an effect of a fluctuations in

global trade. The data shall also be analysed for statistical significance in their relationship which will assist in showing the strength of the relationship and conclusions that can be made. Furthermore, analysis on the international holdings of the Chinese Renminbi shall be undertaken. If there is a global change in the view of the US Dollar reserve holding compared to international trade figures, this study would show that if the Chinese Renminbi is a potential threat there will be an inverse relationship between the two currencies international holdings. The findings of this analysis shall therefore be able to answer questions raised in the literature above, whether America is in decline, whether the US Dollar is under threat, and thirdly whether the Chinese Renminbi is a realistic alternative in the international economic system.

Fichtner (2017) used the same dataset in his analysis of currency composition of foreign exchange reserves describing them as “the most comprehensive data on the composition of global foreign exchange reserves” (Fichtner, 2017; p.13). However, his analysis went little further than stating the figures involved. The analysis furthered upon in this essay shall seek

31

to explain the fluctuations in global foreign exchange reserves as being a result of fluctuations in global trade, thus impacting the demand for USD which will be held as a currency reserve. For example, as can be seen from the data above, there is a decline in US Dollars being held in global reserves from 2008 Q1 to 2009 Q1, which corresponds to a decline in global trade at the same time. By providing answers to these questions regarding changes to reserves we can then apply these findings to commentary on the state of American hegemony and the position of the US Dollar as a currency base in the international monetary system.

Potential limitations to the analysis may arise in finding relationship due to insufficiency of data, for example China only began to publicly disclose their foreign exchange reserves in 2016. Access to a longer span of data would provide more accurate results as well as provide the ability to draw stronger conclusions. However, this also comes with the benefit that those wishing to study the same relationship in the future can further the analysis due to have a more complete dataset. Secondly, greater results can be made from analysing more variables, as this study only concerns that of currency reserves and their relationship to world trade, more analysis can be conducted in the future using linear regression in order to find more relationships in the data.

32

5.0 Analysis

This section shall answer the research question of ‘Is American economic hegemony under threat from China?’ presented in section 1.0. As has been shown from the literature review and theoretical framework, the US Dollar is an important feature of sustained American economic hegemony. The first stage of this analysis shall show how US Dollars still are the largest and most important global reserve currency when compared to the Chinese Renminbi. Secondly, analysis shall be undertaken in order to explain fluctuations in the amount held as a reserve currency with answers related to similar fluctuations in global trade. Thirdly, this section shall show how the Chinese Renminbi is not a threat to the US Dollar due to their relation as a reserve as compared to the US Dollar and global trade.

5.1 US Dollars as a global reserve

Date Total Foreign Exchange Reserves Claims in U.S. dollars

2006Q1 4 524 709,89 1 942 946,40 2006Q2 4 762 030,43 1 997 695,62 2006Q3 4 953 469,83 2 078 395,82 2006Q4 5 253 749,35 2 160 670,90 2007Q1 5 590 709,54 2 288 985,91 2007Q2 5 957 814,73 2 412 583,36 2007Q3 6 300 673,47 2 491 264,13 2007Q4 6 706 256,26 2 633 502,78 2008Q1 7 245 076,45 2 760 057,83 2008Q2 7 460 493,34 2 773 754,39 2008Q3 7 499 847,57 2 797 906,33 2008Q4 7 347 782,28 2 684 267,57 2009Q1 7 163 561,03 2 660 234,45 2009Q2 7 565 034,40 2 696 711,84 2009Q3 7 881 705,34 2 743 922,92 2009Q4 8 166 210,68 2 848 309,20 2010Q1 8 292 675,08 2 898 630,13 2010Q2 8 421 615,04 3 010 176,03 2010Q3 8 991 647,00 3 164 342,11 2010Q4 9 265 602,33 3 208 610,92 2011Q1 9 706 760,05 3 279 607,71 2011Q2 10 090 785,49 3 349 122,34 2011Q3 10 170 311,88 3 468 529,54 2011Q4 10 205 049,73 3 538 078,36 2012Q1 10 442 431,71 3 529 112,31

33 2012Q2 10 534 857,88 3 606 543,84 2012Q3 10 788 547,83 3 693 517,27 2012Q4 10 951 256,63 3 741 924,93 2013Q1 11 103 334,15 3 772 298,89 2013Q2 11 143 963,45 3 767 040,44 2013Q3 11 455 092,22 3 815 599,27 2013Q4 11 697 625,59 3 813 459,57 2014Q1 11 862 643,41 4 383 938,73 2014Q2 12 009 915,55 4 439 374,07 2014Q3 11 779 626,23 4 467 603,80 2014Q4 11 606 047,21 4 431 383,26 2015Q1 11 446 230,90 4 452 124,56 2015Q2 11 470 694,97 4 785 795,81 2015Q3 11 193 315,78 4 748 089,65 2015Q4 10 932 276,99 4 873 916,26 2016Q1 10 935 411,46 5 082 661,97 2016Q2 10 977 669,90 5 254 345,01 2016Q3 11 004 823,07 5 403 945,21 2016Q4 10 726 043,30 5 502 072,13 2017Q1 10 912 204,99 5 713 579,84 2017Q2 11 133 149,71 5 909 486,79 2017Q3 11 307 920,76 6 125 852,36 2017Q4 11 457 754,70 6 280 592,67 2018Q1 11 617 557,48 6 531 318,53 2018Q2 11 481 354,25 6 561 098,60 2018Q3 11 411 349,79 6 631 624,73 2018Q4 11 436 228,34 6 623 400,66 2019Q1 11 611 056,39 6 729 109,12 2019Q2 11 738 610,80 6 754 558,86 2019Q3 11 657 860,40 6 729 984,57 2019Q4 11 826 502,96 6 725 907,36 2020Q1 11 704 371,25 6 770 193,66 2020Q2 12 012 093,18 6 902 383,99 2020Q3 12 246 340,25 6 939 438,26 2020Q4 12 700 757,73 7 005 835,16 (IMF Data, 2021)

US Dollars from the time period of Q1 2006 through to Q4 2020 have continuously made up the largest proportion of global reserve currencies. (43% in Q1 2006, to 55% in 2020 Q4, with a low of 33% in Q2 2011). Through conducting a linear regression analysis of the relationship between the two figures we find there is a correlation of 0.81 between total foreign exchange reserves and claims in US Dollars. The figure of 0.81 indicates that there is a strong correlation between the two sets of values, meaning that when the total foreign exchange

34

reserves increases or decreases, a similar response shall be seen in the amount of US Dollars held in global reserves.

This further reinforces the arguments made in the theoretical framework by Fichtner (2017) that the US Dollar is the primary global reserve currency and is unrivalled in this endeavour. No other currency has dominated such a large percentage of international reserves during the same time span, the USD takes the share of the biggest holdings and is the most demanded currency, as seen when countries increase their reserves it is most likely to be the reserves of the USD.

During the timespan studied we can also see a large increase in the value of overall reserves from 4.5tr in 2005 to 12.7tr in 2020, studies by the ECB have indicated this is down to both “precautionary and non-precautionary motives” (Bank, 2021).Much of this concerns response to crisis of international capital flows and global liquidity, meaning states tend to increase reserves as a protection against economic shocks as well as non-precautionary motives such as hoping to boost exports and competitiveness (Bank, 2021).

The fact that the US Dollar makes up the largest proportion of this increase in reserves is clear evidence of the US economy’s structural power in the international monetary system, as Strange noted the US can achieve financial structural power without having to work or trade for it, the US Dollar centrality is simply a part of the system.

35

5.2 US Dollars and fluctuations in global trade

When comparing the total foreign exchange reserves to that of world trade, we see a strong relation between the two. The Multiple R value, which shows the correlation and relationship between the two values shows a correlation of 0.90, signalling a very strong correlation. From this we can see that there is a clear, undeniable relationship between world trade and foreign exchange reserves. Simply put when world trade declines, the levels of global currency reserves also decline, as with an increase in world trade shall see an increase in total foreign exchange reserves.

Reporting Economy World US Dollars

(Millions) Total Merchandise trade value Total Foreign Exchange reserves

2005 10 510 292,00 3 934 953,07

2006 12 131 449,00 4 524 709,89

2007 14 032 003,00 5 590 709,54

2008 16 170 529,00 7 245 076,45

36 2010 15 303 993,00 8 292 675,08 2011 18 343 601,00 9 706 760,05 2012 18 514 486,00 10 442 431,71 2013 18 969 946,00 11 103 334,15 2014 19 011 072,00 11 862 643,41 2015 16 558 147,00 11 446 230,90 2016 16 045 249,00 10 935 411,46 2017 17 742 931,00 10 912 204,99 2018 19 550 439,00 11 617 557,48 2019 19 014 680,00 11 611 056,39 2020 17 582 919,00 11 704 371,25

Due to limitations in the data where we can only view world trade as an annual figure value, not in quarters as we can see the value of currency reserves, in order to conduct a more thorough analysis world trade figures were compared to reserve currency data for each respective quarter, for example a regression was run for Q1 currency reserves compared to world trade, then Q2, Q3, and Q4 respectively.

37

The relationship between US Dollars as a reserve currency and the value of international trade has a correlation value of 0.70094, showing a moderate to strong relationship. This result was to be as expected following on from the data showing a strong relationship between general reserve values and world trade, especially because the US Dollar makes up the largest proportions of global trade.

From this we can then extrapolate these findings of the relationship to show that when we see declining amounts of US Dollars as a reserve currency, we can, with a moderate to strong degree of certainty, attribute this to a decline in the value of global trade. These findings are in line with the work of Schwartz (2019) who wrote that export focussed economies will run up a trade surplus with the United States, this then results in them acquiring Dollars which in turn end up in reserves. This explains clearly why the analysis conducted points to a strong relationship between world trade as reserves of USD. The more trade conducted globally, the more exports from export-based economies will therefore result in more USD in global reserves. (Schwartz, 2019; p.491) This also applies conversely, as global trade reduces, this explains why we see a decrease in the value of Dollar reserves. This can be seen in the table below between the dates 2008 and 2009.

Reporting

Economy World

US Dollars

(Millions) Total Merchandise trade value USD RESERVES

2005 Q1 10 510 292,00 1 753 906,44 2006 Q1 12 131 449,00 1 942 946,40 2007 Q1 14 032 003,00 2 288 985,91 2008 Q1 16 170 529,00 2 760 057,83 2009 Q1 12 565 091,00 2 660 234,45 2010 Q1 15 303 993,00 2 898 630,13 2011 Q1 18 343 601,00 3 279 607,71 2012 Q1 18 514 486,00 3 529 112,31 2013 Q1 18 969 946,00 3 772 298,89 2014 Q1 19 011 072,00 4 383 938,73

38 2015 Q1 16 558 147,00 4 452 124,56 2016 Q1 16 045 249,00 5 082 661,97 2017 Q1 17 742 931,00 5 713 579,84 2018 Q1 19 550 439,00 6 531 318,53 2019 Q1 19 014 680,00 6 729 109,12 2020 Q1 17 582 919,00 6 770 193,66

When analysing the Q2 data compared to world trade we see a similar pattern. The multiple R value is also again at a similar rate of 0.71, again showing a moderate to strong relationship. This further provides evidence proving our hypothesis that there is a direct relationship between the composition of global reserves and the trends in world trade. Declining rates of the USD as reserve currency can be explained through trends in world trade, as can be seen between 08/09 as with all currencies, however there is no indication of another currency threatening the USD base as amount of reserve in value terms has continued to grow.

Reporting Economy World

US Dollars (Millions) Total Merchandise trade value US RESERVES

2005 Q2 10 510 292,00 1 794 800,81 2006 Q2 12 131 449,00 1 997 695,62 2007 Q2 14 032 003,00 2 412 583,36 2008 Q2 16 170 529,00 2 773 754,39 2009 Q2 12 565 091,00 2 696 711,84 2010 Q2 15 303 993,00 3 010 176,03 2011 Q2 18 343 601,00 3 349 122,34 2012 Q2 18 514 486,00 3 606 543,84 2013 Q2 18 969 946,00 3 767 040,44 2014 Q2 19 011 072,00 4 439 374,07 2015 Q2 16 558 147,00 4 785 795,81 2016 Q2 16 045 249,00 5 254 345,01 2017 Q2 17 742 931,00 5 909 486,79 2018 Q2 19 550 439,00 6 561 098,60 2019 Q2 19 014 680,00 6 754 558,86 2020 Q2 17 582 919,00 6 902 383,99

Q3 analysis also provides a multiple R value of strong-moderate correlation, 0.710556, further showing support for the hypothesis of this thesis as it returns a value which shows a

39

moderate-strong relationship between world trade and global reserve value. Fluctuations in US reserve currency can be explained through its relations to global trade, a hypothesis also supported by Schwartz (2019), not as a sign of the Dollar losing its place as the global reserve currency.

Reporting Economy World

US Dollars (Millions) Total Merchandise trade value US RESERVES

2005 Q3 10 510 292,00 1 824 345,05 2006 Q3 12 131 449,00 2 078 395,82 2007 Q3 14 032 003,00 2 491 264,13 2008 Q3 16 170 529,00 2 797 906,33 2009 Q3 12 565 091,00 2 743 922,92 2010 Q3 15 303 993,00 3 164 342,11 2011 Q3 18 343 601,00 3 468 529,54 2012 Q3 18 514 486,00 3 693 517,27 2013 Q3 18 969 946,00 3 815 599,27 2014 Q3 19 011 072,00 4 467 603,80 2015 Q3 16 558 147,00 4 748 089,65 2016 Q3 16 045 249,00 5 403 945,21 2017 Q3 17 742 931,00 6 125 852,36 2018 Q3 19 550 439,00 6 631 624,73 2019 Q3 19 014 680,00 6 729 984,57 2020 Q3 17 582 919,00 6 939 438,26

This result is also seen through analysis of Q4 which sees a multiple R value of 0.6953921, which again provides another figure that shows a moderate to strong relationship between the two sets of values. The constant moderate-strong relationship we see between US Dollars in reserve and the relationship with the value of goods sold in the global economy certainly support the arguments seen in the theoretical framework by Costigan et al (2015) and Dave (2019) that the US Dollar does have centrality in the global economy. To expand upon this, it can also be stated that since proving the US Dollar’s centrality in the global economy and international monetary order, that the US operates a structural hegemony over such international order because it is unrivalled in its position of number one currency.

40

US Dollars (Millions) Total Merchandise trade value US RESERVES

2005 Q4 10 510 292,00 1 891 335,99 2006 Q4 12 131 449,00 2 160 670,90 2007 Q4 14 032 003,00 2 633 502,78 2008 Q4 16 170 529,00 2 684 267,57 2009 Q4 12 565 091,00 2 848 309,20 2010 Q4 15 303 993,00 3 208 610,92 2011 Q4 18 343 601,00 3 538 078,36 2012 Q4 18 514 486,00 3 741 924,93 2013 Q4 18 969 946,00 3 813 459,57 2014 Q4 19 011 072,00 4 431 383,26 2015 Q4 16 558 147,00 4 873 916,26 2016 Q4 16 045 249,00 5 502 072,13 2017 Q4 17 742 931,00 6 280 592,67 2018 Q4 19 550 439,00 6 623 400,66 2019 Q4 19 014 680,00 6 725 907,36 2020 Q4 17 582 919,00 7 005 835,16

5. 3 Chinese Renminbi and global trade

The value of Chinese Renminbi in global reserves has also increased since data started being recorded in 2016. However, still only making up a fraction of total foreign exchange reserves globally. This can be explained through the literature referenced above as one of the major problems the Chinese Renminbi faces is its lack of internationalisation, as Fichtner (2017) noted that London and New York represented the home of international finance and currency trading, the Dollar is therefore the most sought-after currency. The Dollar has become a central part of the international monetary system as we can see from the above figures. The statistics show this is not the case for the Chinese Renminbi.

Value in US Dollars (millions). Total Foreign Exchange Reserves Claims in Chinese Renminbi

2016Q4 10 726 043,30 90 777,36 2017Q1 10 912 204,99 95 419,80 2017Q2 11 133 149,71 99 996,42 2017Q3 11 307 920,76 108 155,27 2017Q4 11 457 754,70 123 473,32 2018Q1 11 617 557,48 145 667,41