Mälardalen University

School of sustainable development of Society and Technology Bachelor thesis in Business Administration (15 ECTS-‐Credits) Spring Term 2010

The Aronda

“Black Box”:

Bridging the gap of mistrust

in insurance Relationships –

a study of Damage adjustment

as a critical episode

Authors: William Kumassah

Mevludin mujcinovic

Group: 2083

We would like to take this opportunity to thank the respondents of our study for their time and consideration, who’s input proved invaluable in our research. We would also like to thank Cecilia Lindh, our tutor, who gave us a chance to prove ourselves when, seemingly, nobody else would.

Most of all, we would like to thank our parents for their support and encouragement throughout our education.

Thank you all…

Subject: Bachelor thesis in Business Administration (FEA300)

Authors: William Kumassah

Mevludin Mujcinovic

Tutor: Cecilia Lindh

Title: The Aronda “Black Box”: Bridging the gap of mistrust in insurance relationships – a study of Damage adjustment as a critical episode

Problem: The nature of insurances, and indeed the customer-‐provider

relationship in insurance services, lends itself to distinctive characteristics. These characteristics have particular implications on overall perceived service and relationship quality, and thus customer retention. The arguably singular characteristic of mutual mistrust prevalent in insurance service relationships, is a source for costs and lost profitability for insurance companies in Sweden. Bridging the “gap of mistrust”, potentially offered by a seemingly simple service, could entail significant benefits for both parties in an insurance service relationship.

Research Questions: Does the Aronda Service have the potential to improve a damage adjustment process in a provider-‐customer insurance service relationship?

• Can a more effective damage adjustment process improve an insurance service relation between provider and customer?

• To what extent do the providers perceive that the damage adjustment process is critical to a customer’s stay or switch decisions in an insurance service relationship?

Purpose: The aim of the thesis is two-‐fold:

1. The aim is to investigate and describe the impact of the damage adjustment process in customer relationships between the privately insured and property insurance companies in Sweden

2. And to assess, the potential of the Aronda Service to improve customer relations for insurance companies by improving (in terms of customer satisfaction) the damage adjustment process.

Methodology: A qualitative method with deductive reasoning was used. The highly contextual nature of customer-‐provider relationships was deemed, for the purpose of the study, best suited using a qualitative method. Data collection comprised of interviewing several professionals pertaining to the field of property insurance and damage adjustment, academic literature, peer-‐ reviewed articles, and Ph.D. Dissertations.

Theoretical Approach: The theoretical approach is based on consolidation of widely used theories in the field of service and relationship in the “Critical episode on insurance relationships” perspective, presented by Mikael Gidhagen, Senior lecturer at Uppsala University, Sweden. Although the perspective is originally created for B2B relationships, proved great applicability and relevance.

Empirical foundation: The empirical foundation consisted of a number of interviews with respondents with extensive corporate and private insurance industry experience. The secondary empirical information was gathered from governmental, consumer services, and industry regulatory bodies’ websites and publications.

Keywords: Service and Relationship management and marketing,

relationship quality, critical incidents, damage adjustment, customer satisfaction, customer retention, insurance service

relationship, perceived quality, service encounters, perceived quality, private insurances

Conclusion: The uncovered prominent issues in insurance relationships between private individuals and property insurance service providers can at the very least be aided, if not solved, to the benefit of both parties by the proposed digital version of the Aronda “Black Box”. As the importance of documentation in more cases of insurance claims than not are paramount, and by decreasing the coverage knowledge gap of customers, facilitating a matching of service expectations and actual service delivery, customer satisfaction can be more readily achievable for insurance provider. A readily achievable level of customer satisfaction, in turn, means probably prolonged customer retention, and ultimately higher profitability for the insurance companies. As “it cost more to attract a customer, than it does to keep one.”

Table of Contents

1. Introduction & Background

1

1.1 Background 2

1.1.1 The Idea of Insurances 2

1.1.2 The Swedish property insurance market and industry: a brief

overview 2

1.2 Case Company Background 3

1.2.1Bridging the gap of mistrust 3

1.2.2 The Aronda Service: The Digital Version 4

1.2.3 The Need for Partnership 5

1.3 Problem statement 5 1.4 Research Questions 5 1.5 Purpose 6 1.6 Limitations 6 1.7 Contribution 6

2. Literature Study

7

2.0.1 Prelude: Characteristics of relationship marketing 7

2.0.2 Prelude II: Using a business-to-business framework in a

business-to-customer setting 7

2.1 Theoretical Framework: An Overview 8

2.2 Part I – Understanding Services 9

2.2.1 What is a Service? 9

2.2.2 The Intangibility of Services 9

2.2.3 Service Encounters and Service Quality 10

2.2.4 Service quality and Service expectations 10

2.2.5 Relationship Quality: A Dynamic Perspective of Service Quality 11

2.3 Part II - Understanding Insurances 11

2.3.1 What is insurance? 11

2.3.2 The intangibility of Insurance services 11

2.3.3 The Insurance Service Paradox 12

2.3.4 Insurances as Distinctive Services – A Comparison 13

2.3.5 Another Actor – The Damage adjuster 14

2.4 Part III - Understanding Critical Episodes 14

2.4.1 What is an Episode? – An interpretation of Episodes 14

2.4.3 What is a Critical Episode? 15

2.5 Part IV - A Critical Episode Perspective: the Insurance

Relationship 15

2.5.1 Damage Adjustment Process: as Critical Episode 15

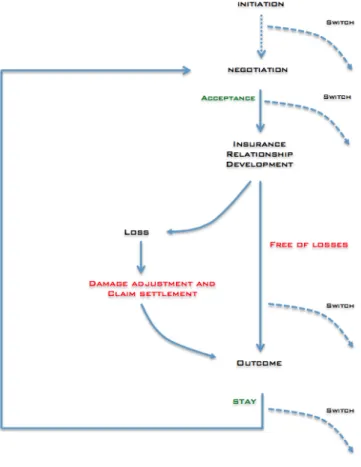

2.5.2 A Blueprint: The insurance relationship, the “stay or switch”

model 16

2.5.3 The Insurance Service quality model 17

3. Method

19

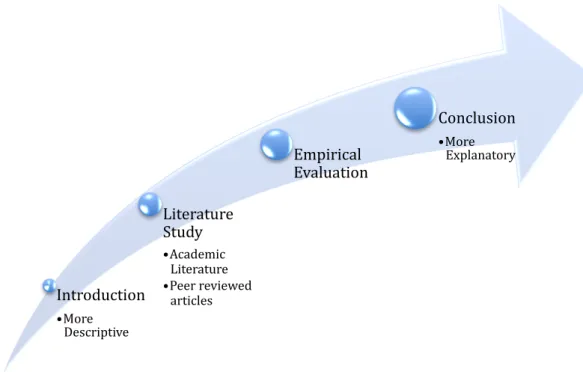

3.1 Outline of study 19

3.2 Choice of subject 20

3.3 Research Method: Qualitative 20

3.4 Deductive reasoning 21

3.5 Data Collection 21

3.5.1Primary Data – Why not survey the customers? 21

3.5.2 Interviews 22

3.5.3 Secondary Data 24

3.6 Why these questions? 24

3.7 Criticism of Sources 26

3.8 Validity 27

3.8.1 Why Gidhagen? 27

3.9 Reliability 28

4. Empirical Evaluation

29

4.1Part I - Empirical Data: Secondary Sources 29

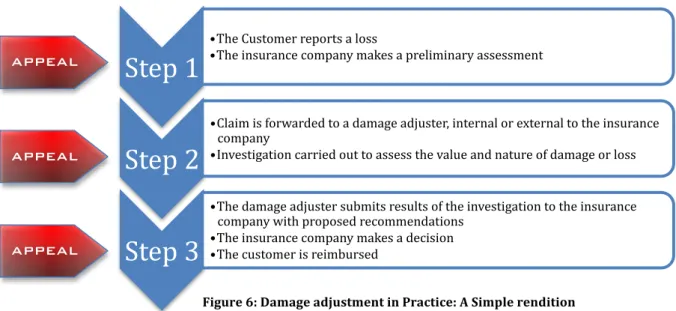

4.1.1 The Damage adjustment and Claim Settlement process in

Practice – A simple rendition 29

4.1.3 Insurance frauds 31

4.1.4 Swedish quality index – A measure of customer perceived service

quality 31

4.2 Part II – EMPIRICAL DATA: Primary Sources 33

4.2.1 FINDINGS – The Interviews 33

5.

Analysis

38

5.1 Why documentation is important 38

5.2 The Damage adjustment is critical, but not decisive 38

5.3 provider view of the criticality of damage adjustment 39

5.4 The Aronda service – Bridging the Gap of Mistrust 40

6. Conclusion

43

7. References

1

Appendices

5

Appendix A: Company Market Share - Property and liability

insurance Market 5

Appendix B: Glossary of insurance terms 6

Appendix C: Interviews 7

interview with Henrik Persson: founder of Aronda AB 7

Interview with Top Management Representative: Dina Försäkringar 9

Interview with sales representative: LÄNSFÖRSÄKRINGAR 14

Interview with Independent damage consultant 16

APPENDIX D: Customer perceived quality in insurances 20

1. Introduction & Background

In contemporary business, competition has hardened and the struggle for attaining and sustaining market share is becoming increasingly intense. As a consequence, the customer orientation towards strategizing has taken a more central role in today’s organizations (Gidhagen & Thunman, 1998). Customer retention is a goal most companies strive towards as it “costs less to retain existing customers than to attract new customers” (Stone & Woodcock, 1995, p. 95). Recognizing the substantial impact of customer retention (Peck et. Al, 2004, p. 46), in increasing numbers, organizations are employing elements of relationship marketing. Evidence to this effect can be observed in the extent to which companies employ member cards, loyalty cards, and discounts offered with repeat purchase.

In Sweden the property insurance industry is, in part, represented by 102 national property insurance national companies, with the five largest companies accounting for a combined market share of 83.6% (försäkringsförbundet, 2008b). The industry structure is indicative of intense competition, as it is mainly comprised of a few large companies (Porter, 2008, p. 144) Thus, making the issue of customer satisfaction and retention, all the more central.

Studies have shown that customers of insurance companies place substantial emphasis on claims handling, also known as, a damage adjustment process, when forming their opinion of their respective insurance companies (Hörnell & Hjelm, 1994 p. 62) Additionally, “the speed at which claims are settled shows a

high correlation...with favorable customer opinion...” (Hörnell & Hjelm, 1994 p.

62). “Customer opinion” (hereafter perceived service/relationship quality) is of central importance in a customer-‐provider relationship as, seen from a critical perspective, each “…encounter moment…” (to which the damage adjustment process and related encounters is no exception) can potentially “…significantly

influence the future development of the relationship” (Gidhagen 2002, p. 21).

Property insurance is, in its tangible form, a contract between a customer and provider, under which the provider takes upon the risk of potential loss or damage the customer may suffer, to his property, in exchange for a fee, called a premium. Provided that the customer can prove the suffered loss or damage, the provider is contractually bound to reimburse the customer, according to the stipulations of said contract (Försäkringsförbundet 2005a). Basically, when suffering a of loss or damage to property, customer call his or her insurance company notifying this to the provider, thus making a claim, and initiating a damage adjustment process. A damage adjustment in property insurance, in the context of this thesis, is: the service episode, or process, by which through the

evidentiary provision in, predominately, the form of documentation, a suffered loss or damage to insured property under contractually predetermined conditions, is assessed, valued, and reimbursed. It is the implications of a satisfactory perceived

damage adjustment, on customer retention in a provider – customer relationship, in private property insurance service companies in Sweden, that is the topic and focus of this thesis.

1.1 Background

In this section the basic ideas of insurances, an overview of the Swedish property insurance industry and market, and a comprehensive rendition of the case company, Aronda AB is presented. The

information presented about the case company is extensively used in the empirical evaluation, presented in the proceeding “analysis” section in the thesis, in order to purposefully address the prescribed research questions.

1.1.1 The Idea of Insurances

The underlying idea with insurances is that although people are constantly at risk, the chance of an incident occurring is limited to a few within a specified time period or at once. As such, the insured can be compensated with a monetary amount exceeding the paid-‐in premiums. Premiums refer to the monetary fee paid-‐in on a regular basis to insurance companies. The price of insurance i.e. the premium is deduced from an assessment of the amount of risk the insured object or person is under. The higher assessed risk, the higher the subsequent premium. It is these premiums that are used to compensate the insured in the event of the actualization of a contingency. The ability to insure against a risk lies in the ability of the risk to be defined and attributed a monetary value. A prerequisite for this is the availability of the same information for the insurance provider and the insured. (Försäkringsförbundet, 2005a)

1.1.2 The Swedish property insurance market and

industry: a brief overview

The Swedish property insurance industry consisting of 102 national property and liability companies is as, indicated in figure 1, dominated by five large companies. The five largest companies1, compared to the remaining 97 companies, hold an 83.6 percent majority market share of total industry received premiums. The number of reported losses or damages for 2008 by

privately insured individuals amounted to 569’424 claims

(Försäkringsförbundet, 2008b). The insurance industry in Sweden employs approximately 19 000 people, with 17 000 employed by insurance companies directly. The remaining 2000 are employed by insurance brokerages, independent damage adjustment companies, and other related businesses (Försäkringsförbundet, 2005b). 1 See appendix C

Figure 1: Market share division of total property insurance market received premiums

The figure represents the market share of the total industry premiums paid in by customers, which the five largest property insurance companies have in comparison to the remaining 97 property insurance companies in Sweden.

Some 4.5 million households and 580’000 recreational homes represent the customer base of Swedish private property and liability insurance services (Försäkringsförbundet, 2005b).

1.2 Case Company Background

Aronda AB was founded in Sweden, 1996 as a private limited company by Henrik Persson as sole owner and current, only employee of the organization. Having experienced a damage adjustment and claim settlement process on more than one occasion, the unsatisfactory perception with the damage adjustment process, led to his creation of the service. Persson believes an effective way to facilitate the damage-‐adjustment process in insurance claims is through the consolidation of appropriate documentation. The service is intended to provide people with a source where all valued documentation can be organized and stored. Documentation, such as receipts, wills, appraisal documentation, etc. Although other applications for the service have been identified, specifically, the service is to provide its customers with affordable assistance in property insurance claims i.e. the damage adjustment process, claim settlement, and if needed, when appealing.

Today the service comprises of providing its customers with a pre-‐printed paper booklet serving as a template to be filled out. The booklet acts as a means to facilitate inventory of people’s personal belongings and is given to the customer in two copies. There are pre-‐printed guidelines referred to as “tips” in the beginning of every section, such as “electronics” and “misc objects”, as Persson recognized that different objects require different forms of documentation to assert value. Hence the difference between a TV needing a serial nr and an inherited painting needing appraisal documentation for value assertion. After the booklet is filled out, a copy is for individual safekeeping and the other copy is to be sent back to Aronda for storage. Once sent in the booklet can be updated by sending in the appropriate information needed for the update and will be performed by company for a small fee. The booklet, sent for storage, can be retrieved at any time by contacting the company and providing an assigned password.

1.2.1Bridging the gap of mistrust

Persson, has conceptualized and produced a simple service that, he feels, could (potentially) either partially or entirely bridge the gap between service expectations and actual service delivered due to negative connotations, i.e. “the gap of mistrust”, in insurance service relationships. Although the service is at its infancy, with what can be described as substantial product development before marketability, the Aronda service is felt to offer potential that can substantially improve a seemingly negative relationship. The basic idea of the service is to offer a platform (and potentially aid) for consolidating documents (i.e. photos, receipts, bills of ownership, etc.) to provide an evidentiary foundation to assist and possibly

improve the quality of damage adjustment processes in terms of customer satisfaction; thus customer retention. The company is at a pivotal junction where a decision needs to be made of whether to reinvest or divest. The need for product development to increase marketability is a fact that has not eluded Henrik, as his business earnings have been just enough to keep the small

business afloat.

1.2.2 The Aronda Service: The Digital Version

Side note: Readers should bear in mind that the exact specifications and technicalities of the

conceptualized digital version are, on Henrik’s request, not disclosed because of propriety concerns.

Recognizing that the service as it in its current state has limited marketability, Persson has conceptualized improvements entailing product development towards a web-‐based platform. The platform, is to open a communication channel between the insured and their respective property insurance companies, in a readily accessible and more tangible manner,” so that the customer knows

what he should get, and the company what they their customers actually have“

(appendix C). The attributes of the new service Henrik felt comfortable us disclosing entail:

Customer Benefits:

• A more accurate insured amount2, as a calculated total value of all material possession registered in the system, enables the customer to sign a contract that is accurate to what can be compensated. Having an insured amount that is higher than the calculated total value results in a higher premium than necessary. In the opposite situation, with a total value lower the insured amount can entail under-‐compensation suffering a loss.

• A more comprehensive understanding of coverage, in contrast to the terms & conditions stipulated in the contract received when signing an insurance, for the insured to understand how much compensation he or she is entitled

• A, relatively3 cheap, consolidation of necessary documentation for damage

adjustment, readily accessible and organized, entailing simply a, more or less, direct transference of the service as it is today to an internet-‐based platform, and all the adherent advantages and disadvantages of the platform.

Provider Benefits:

• A More effective handling of damage adjustment process, in terms of time and relevant costs related to asserting ownership and value of claimed loss or damage by the insured

• Possible reduction of Insurance frauds, depending on the acceptance of Persson’s proposal of a “specialized” property insurance offering by the provider, based on the service.

• Another Communication Channel, provided that the insurance companies engage in a partnership with Persson’s

2 See appendix B

1.2.3 The Need for Partnership

If made, the choice to reinvest is accompanied with a new strategy to reduce risk, entailing offering the service to consumers either through or from referrals from insurance companies; and the development of a “digital version” of service. However, the reinvestment efforts present a substantial liability (relative to personal income and assets) for Mr. Persson.

It is out of this necessity that the purpose of this thesis stems. The topic at hand is based on the (self-‐) perceived unique selling point of Henrik’s service. From which, the potential of the service to improve an insurance service relationship is to be described, investigated, and academically assessed from a theoretical foundation of the criticality of damage adjustment processes to said relationship.

1.3 Problem statement

Insurances, being classified as a service, are as such inherently intangible (Zeithaml et. al, 2006, p. 6; Gidhagen, 2002, p. 36). Although insurances share general service characteristics such intangibility and inseparability, the nature of insurances, however, lends itself to distinction from other services. Michael Gidhagen, in his Ph. D. dissertation, critical business episodes, attributes the distinction to the proposed notion of “insurance service paradox” (2002, p. 58). Basically, the insurance service paradox stems out a mutual mistrust between parties. On behalf of the insured this can be seen in the interpretive nature of insurance policy terms. On behalf of the insurer, by the evidentiary requirement imposed (Bolding, 1983, p. 9) on the insured and the assessment process undertaken in damage adjustments. The paradox lies in the seemingly positive outcome of “safety” for the insured (Gidhagen 2002, p. 56). This notion will be more thoroughly discussed at a later stage in the thesis.

Having introduced the “distinctive” nature of the insurance service relationship as being, seemingly, based on mistrust in conjunction with the intense contemporary industry competition; further attest to the criticality of service encounters and customer satisfaction. Damage adjustment as the, arguably, most tangible element of insurance services, is argued to bare critical importance and influence on the provider-‐customer insurance service relationship. Further more, it is argued that the “criticality” of damage adjustments in insurance service relationships extends to bare significant influence on customer retention in the form of “stay (with) or switch (from provider) decisions” by customers (Gidhagen, 2002). The arguably singular characteristic of mutual mistrust prevalent in insurance service relationships, is a source for costs and lost profitability for insurance companies in Sweden. Bridging the “gap of mistrust”, potentially offered by a seemingly simple service, could entail significant benefits for both parties in an insurance service relationship.

1.4 Research Questions

This thesis aims to answer the following questions:

Does the Aronda service have the potential to improve a damage adjustment process in a provider-‐customer insurance service relationship?

• Can a more effective4 damage adjustment process improve an insurance service relationship between provider and customer?

• To what extent do the providers perceive that the damage adjustment process is critical to a customer’s stay or switch decisions in an insurance service relationship?

To answer these questions we will:

• Apply widely used and accepted theories of service and relationship and management and marketing

• Investigate and scrutinize the Swedish damage adjustment process

• Assess the viability of the Aronda service’s potential as a service to be offered by or referred to by insurance companies, based on the contemporary damage adjustment process and a theoretical foundation

1.5 Purpose

The aim of the thesis is two-‐fold:

1. The aim is to investigate and describe the impact of the damage adjustment process in customer relationships between the privately insured and property insurance companies in Sweden

2. And to assess, the potential of the Aronda Service to improve customer relations for insurance companies by improving (in terms of customer satisfaction) the damage adjustment process.

1.6 Limitations

The thesis is limited in that it only investigates the customer relationship between Swedish property insurance companies and their, privately insured, customers in Sweden. And in that the scope of the empirical investigation is confined to Sweden, and its five major property insurance companies.

1.7 Contribution

This thesis is the result of the specific situation of Aronda AB. The contribution of the thesis is limited to an insurance service relationship, as it has specific characteristics, and thereby specific implications on a customer-‐provider relationship. The application of this thesis, however, also extends to those whom have a general interest in relationship marketing, and want to gain a deeper understanding of the topic and, specifically, how it relates to the insurance industry.

4 Effective, is a reference made to a correspondence between service expectations and actual

2. Literature Study

In this section the theoretical framework against which the subsequent collected empirical data is compared and contrasted, is presented. The literature study consists of four parts, with the first three “building” upon each other, leading to a consolidated perspective in the final part.

2.0.1 Prelude: Characteristics of relationship

marketing

In relationship marketing, focus is on creating superior value of the offering in cooperation with the customer, achieved through advantages found in long-‐term relationships (Gidhagen 2002, p .44). Customer retention, in contrast to customer acquisition, is characteristic of relationship marketing, achieved by a mutual exchange of value and fulfillment of promises (Grönroos, 2000, p. 26). Establishing a relationship, according to Grönroos, involves making promises. Maintaining a relationship is based on the fulfillment of made promises, and enhancement of the relationship requires a making and keeping of a new set of promises, on behalf of both parties. (Grönroos, 2000, p. 26)

2.0.2 Prelude II: Using a business-to-business

framework in a business-to-customer setting

A business-‐to-‐business relationship (B2B) differs from a business-‐to-‐customer (B2C) relationship, as it is usually longer, more complex, involving more people, requires more service encounters, and is highly individualized (Gidhagen, 2002, p. 59-‐60; Kotler & Keller, 2006, p. 211-‐212). As mentioned, (see 2.7.1 and 2.8.1) the theoretical framework used in this thesis is an application of a framework created for business-‐to-‐business relationships. However, in the context of insurances, damage adjustment, critical incidents, and for reasons previously prescribed (see 3.8.1 and 3.9.1), these differences between B2B and B2C relationships are deemed minor.

The relationship between private individuals and an insurance provider, we feel, encompasses all the attributes of professional services in B2B relationship, although possibly with varying extents of certain characteristics. That is to say, a business relationship might be more complex (involving more people), longer, and require more service encounters. However, the characteristic “intangibility”, for instance, we feel, is reasonable to assume is just as high5 in a B2C relationship. Because of substantially more similarities than differences, and the varying extent of certain characteristics, which is contextual, and for reasons specified (see 3.8.1 and 3.9.1), the presented theoretical framework is deemed applicable in a B2C relationship.

5 The assumption here is that since the same core service and outcome is delivered to both

business and private individuals, there is no reason to conclude that one is more intangible than the other.

2.1 Theoretical Framework: An Overview

As outlined by figure 2, the theoretical framework of our thesis is divided into four parts. The three foundational parts, namely, “understanding services, “understanding insurances”, and “critical episodes” together form the base upon which the theory “A critical Episode perspective: the insurance relationship” rests. Understanding the three foundational theoretical aspects are essential to fully grasping the implications presented by the top theory, as it encompasses aspects of all three fields.

Understanding that insurances are services entailing issues of tangibility and thereby having significant implications on customer relationships is of central importance. This is illustrated by the central position of the respective theoretical framework in the middle of the triangle base. “Understanding insurances”, offer readers a definition as to what insurance actually are and, amongst other things, what is distinctive about insurance services and the consequent paradoxes that arise. In “Understanding Critical episodes”, critical episodes are defined and describe in correlation to customer relationships. The top of our theoretical framework pyramid presents a consolidation of all preceding theory sections into one, creating essentially the backbone upon which the empirical evaluation is done.

A Critical Episode perspective: The Insurance Relationship Understanding Insurances Understanding Services Understanding critical episodes

Figure 2: The Pyramid of Understanding -‐ Theoretical framework

The theoretical framework consists of four parts, represented by the respective triangles. The theoretical aspects taken up in various sections represented by the purple, green, and blue triangle, serve as a foundation upon which the main perspective, depicted by the read triangle, is built.

2.2 Part I – Understanding Services

The following offers a definition and description of nature, characteristics and elements of services.

2.2.1 What is a Service?

Arguably, it can said that all contemporary businesses offer some kind of service, be it via offering instruction manuals, after sales support, or a teller at the bank (Gidhagen, 2002, p. 35;Zeithaml, 2006, p. 10). There are however, variations in types of services ranging from “… an interpersonally delivered service involving a

complex relationship, to a service more like a commodity with a tangible core product” (Gidhagen, 2002, p. 35). An example of the prior is, the topic at hand,

insurances and an example of the latter is a fast food restaurant. It is in part, this range, which makes services complex. But more so, it is predominately the adherent intangibility of services that contributes to their complexity (Gidhagen, 2002, p. 35).

Services can simply be defined as “deeds, processes, and performances” (Zeithaml et al, 2006 p 4). However, a more comprehensive definition describes services as being: “…A process consisting of a series of more or less intangible activities that

normally, but not necessarily always, take place in interactions between the customer and service employees and/or physical resources or goods and or systems of the service provider, which are provided as solutions to customer problems.” (Grönroos, 2000, p. 46)

2.2.2 The Intangibility of Services

It is because services are individually perceived and intangible that they commonly are expressed in abstract terms such as feeling, trust, security, and experience. That a service is intangible is often a reference made to the difficulty in it being able to be perceived through sight, hearing, taste, or smell (Gidhagen, 2002, p 36). It is a difficulty in sensory evaluation that results in a subsequent difficulty in comprehension. That services cannot be seen, smelled, heard, or tasted, makes them understandably difficulty to cognitively define, grasp, and formulate (Donnelly et. al, 1985, p. 52)

The nature of services lends itself to commonality in that they are personally (individually) perceived, in other words, to being heterogeneous. Despite the seemingly heterogeneous nature of services, there are common traits to be found (Zeithaml et. al, 2006, p. 22-‐24; Gidhagen, 2002, p. 36):

1. The customer is often directly and actively in the production process

(simultaneous production and consumption)

2. Services are more or less intangible, making the provided solutions difficult for the seller to explain and for the buyer to evaluate, both pre-‐and, in some cases, post purchase (intangibility)

3. Many non-‐standardized services are closely linked to the individuals representing the service provider (inseparability)

4. Services often consist of a subsystem of services, where quality depends on how the customer perceives the whole service entity (heterogeneity)

The predominantly heterogeneous nature of services makes comparison based on previous experience difficult. As a result any customer evaluation of a service such as financial advice or financial product recommendations, must be based on trust in the financial adviser (McKechnie, 1992, p. 5).

2.2.3 Service Encounters and Service Quality

Expectations, due the difficulty in comparison with past experience, previously mentioned, serve as a predetermined standard against which customers compare a service experience. In the absence of immediate tangible evidence, there is a possibility that the service delivery process itself and its price level form the base of customer expectations, rather than the actual core service. (Gidhagen, 2002, p. 38). In service production, customers’ actively participate in the production process, and thereby have a possibility of influencing both productivity and quality. This interaction means that the value of relationship outcome is based on the contributions of both service provider and customer (Ennew & Binks, 1996, p. 12).

The service exchange process can be thought of as consisting of two aspects: The service encounter, defined as “the period of time when buyer and seller meet and

engage in behaviors and activities intended to lead to the development of a relationship (Bejou, Edvardsson & Rakowski, 1996, p. 36)” and service delivery.

Each relationship situation is unique. As such, the customer’s perception of service encounters is crucial for the evaluation of the overall service quality, thereby, the future development of the relationship (Bitner, Booms & Tereault, 1990, p. 72)

Each service encounter, also known as “moment of truth” provides the customer with a “snapshot” of the service provider’s level of quality. The accumulation of perceptions from service encounters contributes to a customers’ overall satisfaction with the quality and disposition to use the providers’ service in the future. Service encounters, therefore, offer an opportunity for service providers to display the quality of his or her service to the customer (Grönroos, 1990:42). As such, provider-‐customer interactions have a substantial impact on a customer’s future loyalty and buying behavior (Grönroos, 1990; Arantola, 2002).

2.2.4 Service quality and Service expectations

Service quality is, simply put, a comparison made by customers, comparing the predetermined expectations of the service and the actual service performance. It is important that both parties perceive value, as any relationship not perceived as mutually beneficial is probably terminated (Hougaard & Bjerre, 2002, p. 171). A more comprehensive definition of service quality defines it as: “…a cognitive

judgment of service performance, created in the interaction between the service provider and the customer, and reflecting the delivered service’s compliance with the customers’ requirements and expectations” (Gidhagen, 2002, p. 40).

Service expectations constitute a standard from which comparative judgment is made. When the service performance exceeds this subjective and predetermined standard, it can be considered to result in customer satisfaction, while the opposite can be considered to yield customer dissatisfaction. (Gidhagen, 2002, p. 41).

2.2.5 Relationship Quality: A Dynamic Perspective of

Service Quality

In contrast to a static view of service quality, relationship quality is a concept that considers service quality to be involving “continuous conscious or

unconscious re-‐evaluation of the relationship based on previous experience”

(Gidhagen, 2002, p. 42). As such, in contrast to being subject to a static standard or measure, providing a more dynamic perspective to service quality. From this perspective, the roles of separate interactions and episodes are seen in relation to the overall perceived quality, with relationship quality being defined as “the

customer’s cognitive evaluation of the service in a dynamic perspective” and

perceived relationship quality as “…a cognitive judgment of a service, seen in the

customer’s perspective, involving continuous re-‐evaluations based on, for example, previous service experience and provided information” (Liljander &

Strandvik, 1995, p. 142; Gidhagen, 2002, p. 42)

2.3 Part II - Understanding Insurances

The following offers a definition and description of nature, characteristics and elements of insurance services, and the accompanying “insurance service paradox”

2.3.1 What is insurance?

Insurances are classified as professional and financial services. Professional services have the characteristics as prescribed in table 2. Financial services refer to “services provided by the finance industry, which encompasses a broad range of

organizations, insurance companies included, that deal with the management of money” (Wikipedia, n.d.)

“The function of insurances is to, through the usage of various scientific calculation models, profitably provide an economic contingency to the collective of insured, by the division of risk” (Försäkringsförbundet, 2005a). Basically, insurances divide

the risk of non-‐regular occurring events amongst a significant amount of people.

2.3.2 The intangibility of Insurance services

Insurances, being services, are inherently intangible. Intangible to the extent, that the only tangible evidence of the service is a signed contract (Gidhagen, 2002, p. 55). However, the lack of physical evidence of the service, does not diminish the importance of intangibles, but increases them. As in the absence of physical evidence, the service delivery process itself forms the base of customer expectations. That being said, the intangibility of insurances makes non-‐ contractual elements of the insurance offering increasingly important. Non-‐ contractual elements can be considered consisting of pre-‐sale services, policy-‐ period services, and claims services (Meidan, 1996, p.43). Gidhagen argues, without diminishing the importance of additional services in insurances, that Meidan’s rendition is too simple and as such should encompass the damage

adjustment process in the policy-‐period. Furthermore, it is argued that an insurance service does not actually prove its value, i.e. made tangible, unless the customer suffers a loss. As, prior to a loss (initiating a damage adjustment process) the customer is, technically paying for the (highly) intangible service of risk reduction and spreading of risk. (Gidhagen, 2002, p. 56)

Signing an insurance policy can, simply, be considered as customers’ adhering to a human fundamental need of “safety” identified in Maslow’s hierarchy of needs (Kotler & Keller, 2006, p. 185). A rendition of safety needs by Gummesson (1999, p. 24) encompasses aspects such as honesty, trust, reliability, promises, and reduction of uncertainty and risk. While other authors (Liljander & Strandvik, 1997; Alford & Sherrell, 1996) consider an emotional response as the response to a core service delivered, Gidhagen (2002, p. 57) asserts that “the feeling of security (the emotion) is not only essential to service satisfaction, but comprises in itself the actual service provided during a large part of the insurance relationship.”

2.3.3 The Insurance Service Paradox

Prior to a loss, the (customer) perceived service can be considered to be the intangible feeling of security. However, after suffering a loss, the insurance service enters a new dimension, namely the damage adjustment and claim settlement process. This according to Gidhagen (2002, p. 57) is indicative that a customer perceived insurance service has two components. Namely:

1. A feeling of security – the feeling of emotional and/or economic security, as managed by the insurance provider during a relationship free of losses

2. The damage adjustment and claim settlement process – the service process delivered when a loss has occurred, constituting the more tangible part of the service. More tangible, as it results in some form of compensation to the insured, according to promises made.

Insurance services are particular in that the insurer-‐insured relationship is entered with what can be described as “generic mutual mistrust”. This Gidhagen (2002) attributes, to a traditional view of the institutionalization and bureaucracy of the insurance system, where the “small print” in policy contracts is considered very likely to be used against the insured in case of loss, as a way to avoid payouts of compensation. While from the insurance provider’s perspective, it is the risk that the insured, in instances of loss, may attempt to be over-‐ compensated by providing false or deceitful information that is the source of mistrust. That is why, in cases of loss, the insurance company are compelled to investigate the matters, prior to accepting any claims. It is this situation that Gidhagen, defines as an “insurance service paradox”. (Gidhagen, 2002, p. 58)

The paradox lies in that, despite the generally negative undertone of insurance services, something positive is created. For the insured it is the basic human need of “safety” and for the insurance provider, compensation for assumed risks in the form of premiums. Another, distinct aspect of insurance services, is the fact that both provider and customer would rather see non-‐delivery of the

complete service. In other words, the customer would preferably not sustain a loss, and the insurance provider would rather not have to compensate the insured for a sustained loss. (Gidhagen, 2002, p. 58)

They way in which the insurance provider manages the relationship both during mundane loss-‐free situations, and the damage adjustment process can be considered to have significant influence on the customer’s overall service perception. Thereby, also influencing the decision to maintain or end the relationship. These paradoxes “accentuate the significance of the insurance

representative’s role as the service provider’s relationship manager”. (Gidhagen,

2002, pg. 58)

2.3.4 Insurances as Distinctive Services – A

Comparison

Insurance services, being professional services, are characterized by a high level of intangibility and complexity, making them difficult for customers to comprehend. Professional services are also often, highly individualized and usually entail elements of a long-‐term perspective “where the services are

delivered during a continuous stream of encounters”. This mixture of qualities and

characteristics, of professional services means that customer perceived reliability and perceived trustworthiness of the relationship manager (usually the provider representative) is of outmost importance, as it greatly influences the relationship. (Gidhagen, 2002, p. 60) As previously mentioned, insurance services entail characteristics that are distinctive from other services. These characteristics or the subsequent paradoxes due to the nature of insurances, also distinguishes insurance services from, more specifically, other professional services as well. The distinction between insurance services and other professional service are presented in table 1, and 2.

Professional Services

Highly Complex Highly Intangible

Highly dependent on credence qualities Highly individualized

Often difficult for the customer to fully comprehend Customers often unsophisticated about the service Long-‐term in nature

Delivered during a continuous stream of service encounters

The relationship manager is essential for the creation of trust in the provider

Table 1: Professional services (Gidhagen, 2002, p. 60)

The table presents various general characteristics of professional services