The impact of New Collaboration between Airbnb and

Danish Tax Authority

BACHELOR THESIS WITHIN: Economics NUMBER OF CREDITS: 15

PROGRAMME OF STUDY: International

Economics

AUTHOR: Lawrence Hazzaa JÖNKÖPING January 2021

i

Bachelor Thesis in Economics

Title: The impact of the new collaboration between Airbnb and Danish Tax Authority. Authors: Lawrence Hazzaa

Tutor: Andrea Schneider Date: 2021-01-04

Key terms: Airbnb, Denmark, Danish Tax Authority, short-term rentals. tax agreements, tax evasion, sharing-economy.

Abstract

The study investigates the status of listings availability and prices on Airbnb following the collaboration between Airbnb and the Danish Tax Authority (The DTA). This study is important because the collaborations between tax authorities and Airbnb are still new in Denmark and worldwide. Similar studies to analyze the effect of these new collaborations are not yet widely available. It is essential for policymakers to understand better the process and the effectiveness of these new regulations on home-sharing platforms.

The study's focus is to assess the changes in prices and annual nights' availability of listings at Airbnb and to check if hosts comply with the new restriction of a maximum of 70 nights set on primary entire apartments annually. The study utilized secondary data from inside Airbnb. It employed descriptive statistics and linear regression models to assess the new collaboration's effect on Airbnb's listings. The linear regression results found a decrease in prices and annual nights' availability after adding the maximum nights' restriction as a control variable. However, the descriptive statistics show opposite results and indicate that the prices and the annual nights' availability increase after the collaboration. The study also found that 3282 entire apartments have been rented out more than 70 nights during the period of 2020.

ii

Table of Contents

1 INTRODUCTION ... 1 2 LITERATURE REVIEW ... 5 3 INSTITUTIONAL BACKGROUND ... 8 4 CONCEPTUAL FRAMEWORKS ... 105 OBJECTIVES AND HYPOTHESES ... 11

6 EMPIRICAL ANALYSIS ... 13

6.1DATA AND METHOD ... 13

6.2EMPIRICAL MODEL ... 15

6.3RESULTS ... 16

6.4DISCUSSION OF FINDINGS ... 24

7 CONCLUSION AND POLICY RECOMMENDATIONS ... 28

REFERENCE LIST ... 30

iii

Tables:

Table 1: Descriptive Statistics of Listings' prices in 11 neighborhoods in Copenhagen (n=12170) 17 Table 2: Descriptive Statistics of annual nights' availability in 11 neighborhoods in Copenhagen (n=12170) 17

Table 3: The overall mean Comparison of listings' price in Copenhagen. 18

Table 4: The overall mean Comparison of the annual nights' availability of listings in Copenhagen. 19

Appendix:

Appendix 1: Regression of price without control variable 35

Appendix 2: Regression of price with control variable 35

Appendix 3: Regression of annual nights' availability without control variable 36

Appendix 4: Regression of annual nights' availability without control variable 36

List of abbreviations:

The DTA: The Danish Tax Authority.

1

1 Introduction

The accommodation business is expanding after the emergence of shared economy opportunities, its growing business model and its influence on the global hotel and housing markets (Ključnikov, Krajčík, & Vincúrová, 2018). Sharing economy contributes to a more sustainable world, as its fundamental principle is sharing different resources, such as cars, properties, and other resources. In the accommodation business, the idea of shared economy benefits both consumers and local municipalities through increased economic benefits and tourism, but it also creates disadvantages to the housing and hotel markets (Ključnikov, Krajčík, & Vincúrová, 2018). After six years of its inception, Airbnb was the dominant figure in the shared economy, which is a group that works like Uber and Lyft (Kopczuk, Marion, Muehlegger, & Slemrod, 2016). This has great potential to benefit consumers by encouraging the sharing of assets such as cars and houses that are expensive to buy and sometimes remain inactive, where owners are not able to generate the full benefits of them and win back some of the costs of those assets (Jefferson-Jones, 2015; Kaplan & Nadler, 2017; Filippas, A. & Horton, 2018).

Businesses like Airbnb, Uber, and Lyft serve their customers through various online platforms and applications and facilitate people to share goods and services with each other on an unprecedented level. The companies operating in sharing economy facilitate their customers by offering a wide range of services but are unified by three common characteristics. They use the latest technology to meet the old needs of consumers, coexist with well-established industries, and act in the legal field where they present new issues and different situations that are not anticipated in passing laws and regulations (Kaplan & Nadler, 2017). Sharing economy platforms reduce transaction costs and make it easier for customers and service providers to match with each other, which would be too costly without these platforms (Lee, 2016). Still in their infancy, sharing economy companies are still growing rapidly, and their total income was estimated at more than USD3.5 billion in 2016 (Kaplan & Nadler, 2017). The online rental arrangements have reduced transaction costs and made short-term rentals feasible and affordable, thereby, increasing the supply of short-term rentals to

2

visitors and vacationers. The rise of Airbnb increases the number of visitors in a particular area, which generates extra economic activity. Besides homeowners' earnings, visitors spend money on other needs like restaurants, grocery stores, sightseeing, and tourist attractions (Barron et al, 2020). However, there are also drawbacks such as tax evasion which reduces tax revenues and results in serious adverse outcomes on a country’s economy. Consequently, more and more governments regulate sharing economies by collaborating with these platforms to directly report homeowners' income to the tax authorities (Bibler et al., 2018).

According to the OCED study in 2013 regarding tax evasion worldwide, tax fraud and tax evasion are a severe issue. They can be done through underreporting of income or overreporting of deductions by providing false invoices. Tax evasion can be seen in different businesses, but it is increasing widely through online companies and economy-sharing platforms. OCED estimated that tax evasion cost governments billions of dollars every year. Therefore, more tax authorities need to pass effective policies to fight tax evasion in general and specifically tax evasion through online business and economy sharing-platforms that have been getting popular in recent years. Moreover, OCED reported the experience of 21 countries (including developing countries) that introduced new policies and cost-effective technologies to fight tax evasion, and those countries experienced a substantial reduction in tax evasion, increase in tax revenues, and overall compliance by taxpayers (OECD, 2013).

For the first time in Airbnb history, The Danish Tax Authority (The DTA) requires Airbnb to report the income generated by hosts on Airbnb, which is a taxable income and can be part of income tax, rental tax, or VAT. The agreement also requires Airbnb to report the number of rental nights and its hosts' total income from July 1st, 2019. These new regulations aim to reduce tax evasions but at the same time encourage economy sharing (Airbnb, 2019; Skattestyrelsen, 2019). Related to the 2015-2019 tax minister in Denmark, Karsten Lauritzen, who released the following statement in 2018 to the BBC: "We want a flourishing, sharing economy in Denmark where it is possible for renters to earn a reasonable tax-free amount on making their property available, but it is under the condition that tax payments are in order." (BBC, 2018).

3

A brief introduction of the study's objectives: this study analyses the impact of the collaboration between Airbnb and the DTA on listings prices and availability based on data from 2018-2019 (before the collaboration) and data from 2019-2020 (after the collaboration). The study aims to check if the Danish homeowners on Airbnb reported their income honestly before the collaboration. If hosts on Airbnb are not affected by this collaboration, then it means they were honest about reporting their rental income generated via Airbnb before the collaboration, and they should be indifferent about these new regulations. However, in case I detect some changes in prices and availability of the listings after the collaboration it could indicate that Danish homeowners on Airbnb did not report their income honestly before the new regulations. This would also indicate that the new regulations are strongly needed to fight tax evasion on economy sharing platforms such as Airbnb. In my opinion regulations like this are the reason why this study is so important and why such research is required for analyzing the effects and effectiveness of such a collaboration. Also, since part of the new regulations indicates that entire primary homes can be rented for a maximum of 70 nights a year, this study analyzes if hosts on Airbnb followed these new restrictions or not.

In short, the first objective is to analyze the prices of the listings on Airbnb before and after the collaboration. The second objective is to analyze the annual nights ' availability of the listings before and after the collaboration. Another part of the second objective is to check if hosts complied with the maximum annual nights restriction of 70 nights posed on entire primary homes. (Note that the aim of the study is NOT to analyze the changes in the listings' count, rather that it analyzes the changes in the annual night' availably of the exact same number of listings for both 2019 and 2020, this will be explained in detail in the empirical analysis section).

Introduction of the literature that this study is built on: this study starts in general with a literature review that analyzes the effects of Airbnb and other sharing economy platforms on the housing and hotel markets. Furthermore, it is built on existing studies that have been highly appreciated for analyzing the topic of this paper. Some of the previous central studies are the one done by Duso et al. in 2020 based on Airbnb and rents in Berlin. They concluded that the policy reforms that aim to ban the misuse of short-term rentals and to reduce its substantial supply increase the rents of

4

apartments on Airbnb by at least $0,07 on average per month per square meter. Moreover, the study done by Bibler et al. in 2018 based on the USA's tax enforcements with Airbnb concluded that there is a reduction of 3.6 percent in night bookings due to the enforcement of a 10 percent tax. They also found a monthly rent increase of at least $69 per property due to tax enforcement. And finally, the study done by Bucks, D.R in 2017 analyzes Airbnb tax agreements with local authorities. Bucks, D.R concluded that there is a lack of accountability for the payment of lodging taxes as Airbnb has total control over payments and the audit process. This paper adds a more relevant literature review that will be discussed in detail in section 2.

This study contributes with new research based on a new topic regarding economy sharing in Denmark that has not been analyzed yet. It adds more data to the existing previous studies. It is based on Denmark, a country that in 2019 implemented the collaboration between Airbnb and the DTA. Besides analyzing the changes in prices and availability of listings in Copenhagen after the collaboration, this study also analyzes the maximum nights' restriction where the DTA imposed such restrictions on entire primary homes of 70 nights per year. The effect of these regulations has not been widely analyzed in previous studies; therefore, it is something new and will be appreciated by policymakers and future studies. In addition, this study provides policy recommendations that can help policymakers in Denmark and other countries understand whether these new regulations regarding economy sharing are needed and what can make these new policies more effective.

This paper's analysis is structured as follows: the section named ‘Literature Review’ includes the key factors affecting the price listings of Airbnb and the impact on Airbnb listings after the agreements with tax authorities. The prices and availability of Airbnb's listings, tax evasion, Airbnb impact on neighborhood characteristics, the hotel, and the housing market are discussed on theoretical grounds in the literature review section of the study. The institutional background includes details about these new regulations between Airbnb and the DTA and the economic advantages and disadvantages of Airbnb in Denmark. Then followed by a conceptual framework section where relevant theories are presented. The study hypotheses follow in the next section. In the following section, the empirical analysis consists of subsections explaining the data, the

5

empirical model, and the results. It consists of quantitative tools and techniques to analyze the secondary data set obtained through InsideAirbnb.com. The various tests have been applied to analyze the data described in this segment of the study. Discussion of findings is also part of this section. Finally, the last section presents the conclusion. The limitations of the study are also presented in the conclusion.

2 Literature Review

The increasing Airbnb listings that provide travelers accommodation at low market prices create disadvantages that significantly affect the housing prices, hotel markets, and tax revenues (Ključnikov, Krajčík, & Vincúrová, 2018; Bibler et al., 2018). Sharing economy platforms such as Airbnb have been getting the attention of policymakers to regulate these markets. Such regulations as the recent collaboration between Airbnb and the DTA reduce tax evasion as it makes it harder for homeowners to evade since their income is directly reported to the tax authorities by Airbnb (Duso et al., 2020; Bibler et al., 2018)

In the following paragraph, I will first summarize the literature focusing on the effect of Airbnb on rental and housing markets. The literature will then be followed by analyzing the impact of tax enforcement agreements on Airbnb's listings. Finally, I will summarize the results of Bibler et al.,2018, which is the closest study to this study.

The shared accommodation businesses made short-term rentals (STRs) more popular among vacationers and visitors (Koster et al., 2019). The high prices of hotel rooms and other types of traditional accommodations have increased the popularity of STR platforms such as Airbnb among travelers who seek more affordable accommodations (Samaan, 2015, Sheppard & Udell 2016; Koster et al., 2019). The short-term rental arrangement provides homeowners the opportunity to share their homeownership' burden in terms of defraying mortgages and real estate tax costs (Jefferson-Jones, 2015). There is a negative effect of short-term rental arrangements such as Airbnb's listings on the housing and hotel markets, since platforms such as Airbnb provide accommodations that are relatively cheaper and below the market prices offered by hotels and traditional housing businesses (Jefferson-Jones, 2015). Furthermore, the short-term rental

6

regulations that banned short-term rentals in New Orleans, USA, decreased house prices by 30 percent (Valentin (2020). It has been shown that one of the major causes of rising house prices is caused by the increase of short-rental markets such as Airbnb, which makes it more affordable for people to buy houses, and then cut down their costs by sharing those houses through short-term platforms. Such acts increase the demand for houses and therefore increase their prices as a result ((Zervas et al., 2017; Koster et al., 2018; Garcia-Lopez, et al., 2019). Airbnb has on average a modest 2.7% effect on property values in LA County in the USA (Koster et al., (2019).

For instance, Berlin introduced policy changes regarding the misuse of short-term rentals. These policies started in 2013 and were updated again in 2018. The core of these policies is to stop the abuse of short-term rentals that had severely affected the housing prices in Berlin. These policies state that Airbnb hosts are now required to obtain permission from their district that allows them to sublet their apartments. Second, to obtain a registration number from their local authorities to short-term rent their entire apartments for a maximum of 90 days a year and only if such subletting does not affect their entire home's status. Also, if they wish to rent only parts of their apartments, they can rent a maximum of 50% of their apartment permanently (Duso et al, 2020). Short-term renting via Airbnb has a causal effect on the housing markets and their prices. The policies mentioned above significantly decreased the number of entire apartments listed on Airbnb and decreased their availability per year. However, these policy reforms increased the rents at least $0,07 on average per month per square meter of apartments on Airbnb listings, and it could be because of the decreased supply of listings on Airbnb after these policies, which make the available listings on Airbnb in higher demand (Duso et al, 2020).

More studies found that Airbnb listings have caused an increase in houses' prices (Garcia-Lopez, et al., 2019; Barron et al., 2020). The popularity of accommodation sharing businesses such as Airbnb is associated with increased rents and house prices in the USA (Horn and Merante, 2017; Koster et al., 2018; Barron et al., 2020) and in Europe as well (Garcia-Lopez et al., 2019). The listed rents on Airbnb increase the rents in general in neighborhoods that have many Airbnb listings, and such effect is more substantial on apartments with two or more rooms (Horn and Merante, 2017). The rental prices in Home Sharing Ordinances (HSOs), which means neighborhoods with many home-sharing listings offered by Airbnb and similar businesses, are

7

higher on average than other areas with fewer home-sharing options (Koster et al., 2019). Airbnb listings' increment is associated with a lower rate of housing availability in the rental markets which causes rental prices to rise in the Greater Dublin Area (Lima, (2019). Another study revealed that a one percent increase in Airbnb listings increases the rents and house prices by 0.018% and 0.026%, respectively (Ključnikov et al., 2018). The rise in house prices and rental rates in the long-term markets is due to increased Airbnb listings (Ključnikov et al., 2018). To summarize the above studies, in general, Airbnb profits from illegal rentals reduced housing supply and increased accommodations' prices in places that are not listed on Airbnb (Lee, 2016).

The increasing trend of residing in shared accommodation rather than staying in hotels is the leading cause of the declining hotel tax revenues which causes a tax revenue loss for cities and states (Jefferson-Jones, 2015). Staying in shared homes offered by Airbnb and similar platforms, rather than in hotel rooms, increases the tax revenue's losses and decreases the profits of hotels and traditional accommodations (Lieber 2015; Jefferson-Jones, 2015; Williams 2016; Yrigoy, 2017; Rodas Vera & Gosling, 2017; Farronato & Fradkin, 2017; Horn & Merante, 2017; Zervas, Proserpio & Byers, 2014; Barata-Salgueiro, 2017; Gurran & Phibbs, 2017; Wegmann & Jiao, 2017; Ključnikov et al., 2018). The benefit of limited tax enforcement is shared by both hosts and renters (Dwenger et al., 2016; Bibler et al., 2018). However, as a share of the higher tax burden falls on customers through increased prices of the listings, it leads to a reduction in the number of customers on Airbnb (Ellison & Ellison, 2009; Anderson et al., 2010; Einav et al., 2014; Bibler et al., 2018).

Airbnb's tax agreements contain some special rules only for the benefit of Airbnb and its lodgings' owners, while these agreements did not have public disclosure, scrutiny, and participation (Bucks, 2017). There is a lack of accountability for the payment of lodging taxes as Airbnb has total control over payments and the audit process (Bucks, 2017).

The revenue of Airbnb hosts significantly increases during specific touristic seasons. The application of a seasonal tax strategy (hosts pay the higher tax rate in high touristic seasons and lower tax rate in low seasons) will lower the prices of listings on Airbnb during low seasons (due to low taxes). It can also encourage tourism during low seasons because of the low-price attraction.

8

Due to the seasonal tax strategy, prices are higher during high seasons because of the higher tax rate. Such a strategy is better for hosts (because they generate more sustainable revenue throughout the year) and guests (because of lower prices during low seasons). On the other hand, a fixed tax rate strategy (which taxes hosts a fixed rate on all their revenue throughout the whole year) results in higher listings' prices during the whole year and less sustainable revenue for hosts (Dalir et al., 2020). Furthermore, a lower rate tax is enjoyed by both hosts and renters (Dwenger et al., 2016; Bibler et al., 2018). When tax authorities impose higher taxes and tax agreements with Airbnb, a big share of the burden of increased taxes is taken by guests on Airbnb through higher prices of listings (Ellison & Ellison, 2009; Anderson et al., 2010; Einav et al., 2014; Bibler et al., 2018). The study conducted by Bibler et al., (2018) examined the variation in Airbnb listings due to the tax enforcement across time, location, and tax rate in the USA. It found that taxes were paid only by 24% of the transactions made on Airbnb in the USA and 76% of the transactions evaded paying taxes before the tax agreement with Airbnb. After the tax agreement, Bibler et al., (2018) found out that the enforcement of 10% tax on Airbnb listings caused a reduction of 3.65% in night bookings, a 7.4% increase in the listings' prices paid by guests, and a monthly increase of tax revenue of at least $69 per property. Bibler et al., (2018) concluded that tax agreements between local governments and Airbnb could significantly decrease tax evasion.

3 Institutional Background

Tax evasion is quite easy for the hosts renting out properties using online rental platforms that are still not collaborating with tax authorities (Bibler et al., 2018). The recent collaboration between Airbnb and the DTA shares hosts income with the DTA to reduce tax evasion. The Danish Parliament has approved these new regulations on April 4th, 2019. The loophole of voluntarily reporting of hosts to the tax authority is closed with this deal. The new regulations state that hosts who share their primary entire homes enjoy up to DKK 28,000 tax-free earnings for renting primary entire homes annually, and up to DKK 40,000 for holiday homes (Airbnb, 2019; Skattestyrelsen, 2019). Furthermore, the Danish government added a cap to the number of nights hosts can share their entire primary homes, which is 70 nights maximum per year, and can be increased to 100 nights by the local authorities in different municipalities if those authorities decide

9

to vote on it (Airbnb, 2019; Skattestyrelsen, 2019). However, after some research, there is no data, which tells if some counties in Denmark have voted to have 100 nights a year. Since this study is based on Copenhagen county, which has by default a maximum of 70 nights a year, I will use this number in the empirical study. Moreover, there is no nights' limit on sharing holiday homes and private rooms. (Airbnb, 2019; Skattestyrelsen, 2019).

In January 2020, the DTA (Or Skattestyrelsen: The Danish Tax Authority) received Airbnb' reports on all hosts' income for properties rented after July 1st, 2019. Those reports were only with the names of Danish citizens and without social security numbers. As a result, the DTA had to match these names with the right social security numbers to address the right citizens. The DTA managed to match about 6000 citizens and sent them letters to inform them about their rentals' activities from July 2019. However, from 2021, the DTA will no longer need to go through this complicated process. It established a reporting solution with Airbnb to make it easier for the DTA to directly allocate the concerned citizens (Skattestyrelsen, 2020). According to the new regulations stated by the DTA, after the deductions of the tax-free earnings (DKK 28,000 or DKK 40,000), the remaining rental income can be further reduced by 40%, and the remaining 60% will be considered as taxable capital income (Skattestyrelsen, 2020). The capital income tax in Denmark is between 0%-42% for 2020, depending on the annual rental income (Skattestyrelsen, 2021).

Airbnb has been getting increasingly popular in Denmark in recent years. It is estimated to positively impact the Danish economy through increased tourism, where each traveler on Airbnb spends on average DKK 891 on different goods and services (excluding the cost of accommodation) when visiting Denmark. These results are based on a survey done by Airbnb in 2018 and had 3000 participants. The spending in 2018 in Denmark went on shopping, sightseeing, and other activates, where 42% of the spending by Airbnb guests in Denmark went on food, dining, and groceries, which boosted the food sector in Denmark by DKK 1.3 billion in 2018 (Airbnb, 2019). Another survey done by Airbnb to analyze the direct economic impact on Airbnb's top 30 countries. It had responses of 237,000 hosts and guests, estimated that the direct economic impact in Denmark alone was more than M$650 in 2018 (consisting of M$508 of guests spending and M$145 of hosts earnings). Moreover, this survey estimated that 1 out of 4 Airbnb's guests were

10

Danish citizens who like traveling domestically and the rest were international visitors (Airbnb, 2019).

However, there are disadvantages to Airbnb as well. Hosts may evade paying taxes by not reporting their actual earnings on Airbnb. That is why more countries around the world are introducing new regulations on platforms such as Airbnb to eliminate tax evasion (Bibler, 2018; Duso et al., 2020; Bucks, 2017). Denmark is one of those countries that started regulating these online platforms (such as Airbnb) to reduce tax evasion (Airbnb, 2019; Skattestyrelsen, 2019). Other than these new policies imposed on Airbnb, Denmark in general has been fighting tax evasion with penalties on citizens who evade paying taxes. These penalties are as follows: If an individual evaded paying taxes up to an amount of DKK 60,000, that individual must pay that amount plus a penalty equal to the amount evaded. If the evaded amount exceeds DKK 60,000, then the penalty will be double the amount evaded. However, if the evaded amount is more than DKK 250,000, the individual can face a prison sentence and pay a penalty equal to the entire amount of the evaded taxes. These penalties can be reduced if the person evading taxes reports himself to the authorities. Otherwise, they can be stricter if the tax authorities find out malpractices on their own (BDO Denmark, 2019).

4 Conceptual frameworks

The conceptual model for this study consisted of variables that were employed to assess the impact of the new collaboration between Airbnb and the DTA. This section, therefore, presents how remediation against tax evasion when the price of listing changes after the collaboration between Airbnb and the DTA. I follow the assumptions made by Bibler et al (2018).

The assumption is that the price-setting hosts offer short-term hosting rentals across two periods. In the first period, the host is responsible for collecting revenues with the possibility of evading taxes. In the second period, the tax collection and reporting shift from the individual hosts towards Airbnb who is bound by agreement to report income to DTA. Therefore, in the second analyzed period, hosts and renters cannot evade taxes because of the collaboration between Airbnb and the tax authorities (Bibler et al., 2018).

11

The accommodations supply for hosts who comply with paying taxes in the first period is given by S!(P − t) where P stands for price renters pay to hosts and t stands for the tax paid by hosts.

However, for hosts that evade taxes in the first period, the accommodation supply is given by

S"(P − R) where R ≥ 0 is the marginal costs linked with the risks of evading taxes. We assume

that these are linear supply curves, the hosts' mass is set as one, and let Υϵ[0,1] be the proportion of tax-compliant listings. Then the market supply for accommodations is by S = (1 − Υ)S"+

ΥS# = S(P − Υt − (1 − Υ)R). We get P = P

$ as the first period equilibrium price, which is

tax-inclusive, and satisfies S(P$− Υt − (1 − Υ)R) = D(P$). Thus, the renters paid price P$ in the first

period and the average price received by hosts is P$− Υt − (1 − Υ)R. (Bibler et al., 2018). Since in the second period the tax is perfectly enforced by Airbnb through the collaboration with the DTA, then the second period equilibrium price is P = P%, which is tax-exclusive, and satisfies S(P%) = D(P% + t). The renters pay then P%+ t and hosts receive P% when hosts comply with

paying taxes in period 1, meaning that Υ = 1, then the tax-collection remains invariant, in the period 1 and 2, the equilibrium price received by the hosts, and the quantity of nights booked are the same and price that renters pay are the same. When some hosts evade taxes in period 1, meaning that Υ < 1, then from period 1 to 2, the enforcement agreement increases the tax gap from Υt − (1 − Υ)R to t, increases the average price which is paid by renters, and the average price received by hosts decreases and equilibrium quantity falls. (Bibler et al., 2018).

For the maximum nights' restriction analysis, we can apply the same concept by Bibler et al., (2018), but with adjustments towards the maximum nights' restriction. We can assume that annual nights availability for entire apartments in period one is given by M, where M is equal to any range of 0-365 nights annually before the collaboration. However, after the collaboration (period two), M is subject to a constraint where M in period two is given by Mx. Mx should be lower or equal than/to 70 nights a year. If Mx exceeds 70 nights, then it might indicate weak policy enforcement.

5 Objectives and hypotheses

My research paper is focused on analyzing the changes in Airbnb listing prices and annual nights' availability after the tax agreement between the DTA and Airbnb. Also I aim to analyze the

12

compliance of the maximum nights limit imposed on primary entire homes. This study will help us understand if Danish hosts are affected by the collaboration, reported their income honestly before the tax agreement, and how this agreement affected the status of their listing on Airbnb. If Danish hosts were honest before the collaboration between the DTA and Airbnb, they will not be affected by such an agreement and will continue renting their listings as before the agreement. However, if there are changes in prices and availability of Airbnb listings, this might point to potential tax evasion by Danish hosts.

If there is a change in prices and annual nights' availability, we would expect it to be a negative or positive change. If the change is positive, it can indicate that hosts are charging higher prices to compensate for the taxes they must pay after the collaboration. If the change is negative, it can indicate that hosts are charging lower prices and accepting fewer bookings to pay less taxes, as the higher the rental income, the higher the tax is. Finally, if there is no change in prices and annual nights' availability of listings, this can indicate that hosts are not affected by this collaboration. Based on the research problem, the different literature and the theory developed by Bibler et al (2018), the following hypotheses have been formulated to address the key research question and to help perform a before and after analysis of the new agreement between the DTA and Airbnb:

i. H0: The year 2020 has no different effect on the prices of listings than the year

2019.

ii. H0: The year 2020 has no different effect on the yearly availability of listings than

the year 2019.

iii. H0: The maximum nights restriction on entire primary homes does not affect their

annual nights' availability and the behavior of hosts regarding entire homes in 2020 compared to the year of 2019.

13

6 Empirical analysis

6.1 Data and Method

The study is based on secondary public data collected by Inside Airbnb, which is an independent and non-commercial website that gathers worldwide data on Airbnb listings and makes it available for researchers to analyze (Inside Airbnb, 2019). The collected data contains various information about the short-term rental on Airbnb, such as host' identity, neighborhood, property type, daily listings and price, booking dates, minimum nights per booking, listings availability, reviews per listing, and number of listings per host (Inside Airbnb, 2020).

The data is based on Copenhagen county, which has 11 locations across the city of Copenhagen in Denmark. The data is in a panel structure that allows one to observe properties over time. It consists of 56180 observations on property listings for 2019 and 2020. However, available data is about the last 365 days for each year, the data for 2019 is from June 2018 to June 2019. The data for 2020 is from June 2019 to June 2020. The complete data set starts in June 2018 and send in June 2020. The reason for the choice of this time window is that I intended to analyze the effect of the collaboration between Airbnb and DTA on the properties from one year prior to the one year after the collaboration. For the sake of simplicity, I will refer in the rest of the study to the periods of the dataset as 2019 and 2020.The unit of observation in the dataset is the properties.

The variables of interest for this study are:

Hosts' identity: includes data about hosts' names and id_numbers. Neighborhood: Includes data for 11 neighborhoods in Copenhagen

Property type: includes the type of the listings (shared rooms, private rooms, or entire apartments) Year: 2019 and 2020.

Listings' count: Includes how many listings each host has; it could be that the listing is in separate

rooms in the same apartment or that the hosts have multiple apartments. Hosts who own multiple listings are likely to own a business and are not just private individuals (Inside Airbnb, 2020)

Daily Price: include the daily prices of those listings, and if hosts own multiple listings, it shows

14

Availability_365: shows how many nights the listings have been rented for, in total annually. Minimum-nights shows how many nights a listing can be rented as a minimum.

The data in all variables above is based on the last 365 days for each year.

It is important to note that Airbnb did not directly report hosts' income to DTA on bookings made prior to July 2019, but it started reporting the hosts' income to DTA on all bookings made from 1st of July 2019 and onward. While considering the study objective, the original merged data of 56180 observations needed to be filtered. Three filters were applied on the dataset. The first filter applied on the dataset removed 28643 listings with zero availability (from both years), because I wanted to make my analysis based on the properties that are active before and after the collaboration. The second filter applied was to eliminate properties that do not exist as matches under the two periods (2019 and 2020), 15367 properties were removed by this process. Filtering was applied because I wanted to investigate only properties that existed in both years (2019 & 2020) and make the data comparable in the two data sets.

The last filter was to eliminate hosts with more than one listing as I aim to analyze hosts who own only one listing on Airbnb. The reason for that is those hosts with multiple listings are likely to be running a business (Inside Airbnb, 2020), and I want to base the analysis on only private individuals for two reasons. First, the maximum nights restriction only applies to ‘entire primary homes’ (homes that hosts are currently living in), and if hosts are running a business (own multiple listings), they are unlikely to be affected by this restriction. The second reason is the difficulty of comparing the annual availability and daily prices when hosts with only one listing and hosts with multiple listings are mixed in the same variable sets (hosts_listings_count variable) it makes the analysis harder to compare. By formatting the hosts_lisitngs_count variable to include only listings equal to one, I have 12170 hosts with exactly 12170 listings (consists of 10500 entire apartments and 1670 private rooms). Therefore, the listings' count is fixed and the same in both years after all the filters applied (6085 listings for each period) because one of the study objectives is to analyze the annual nights' availability of those listings and not the actual listings count. As I aim to see the before and after effect on prices and annual nights' availability based on a dataset with hosts and properties that remained active during both periods

15

To summarize, the three necessary filters described above removed 44010 observations in total and left 12170 observations for the final dataset. The 12170 observations (12170 hosts with 12170 properties) left consist of 6085 observations for 2019 and 6085 observations for 2020. Before the data filters, the total was 56180 observations and consisted of 27657 observations for 2019 and 28523 for 2020.

6.2 Empirical Model

This study follows a quantitative method. The approach used for evaluating the potential tax evasion by exploring the change in the listings' annual nights availability and prices after the new collaboration between Airbnb and the DTA is to use the multiple linear regression and other statistical tests to analyze the objectives of this study.

I first apply descriptive statistics analysis to compare the period prior to the collaboration (June 2018-June 2019) and the period effected by the collaboration (July-2019-June2020). The advantage of this method is that it helps compare the before and after of the two periods and see if there are any changes between the prices and availability, especially because the collected data is based on individuals and contains thousands of observations that help us compare the averages between the two periods. However, the disadvantage of this method is that a hypothesis cannot be answered based only by using descriptive statistics.

Therefore, I employ the following regression models:

Y!= β"+ β#∗ New$%&&'(!+ β) + ε!

Y! = β&+ β$∗ New!'(()*++ β%∗ Maximum_night++ ε+

Where,

Y+ = dependent variable for the price or the annual nights' availability of the listings.

Y!= dependent variable for the price or the annual nights' availability of the listings with control

variable added.

16

Maximum_night+ = a dummy variable standing for the maximum number of nights. It takes 1 if the annual availability of listing is greater than 70 nights, the year is 2020 and the listings type is ‘entire apartment’, and it takes 0 otherwise.

β$, β% = Coefficients explaining the average effect of the new collaboration between Airbnb and the the DTA, and the maximum number of nights effect on price and availability.

The model employed assessed the impact of New_collab+ on the price of listings and the annual

nights' availability of listings while controlling for Maximum_night+. I added the Maximum_night+ variable as dummy in the equation based on the new regulation which states that primary entire apartments annually cannot be rented more than 70 nights. However, the regression models lack other control variables that could have also influenced the listings' prices and availability, such as inflation, the personal income of hosts, and the economic situation worldwide due to the Covid-19 pandemic. All these missing factors may affect the regression results oppositely of what is expected.

6.3 Results

In this section, multiple imperative checks underpinning the study were performed. First, I checked for the price and availability using descriptive statistics based on the neighborhood. Then an overall descriptive statistic regardless of neighborhood type. After that comes descriptive statistics for the maximum nights' restriction, followed by the regression analysis.

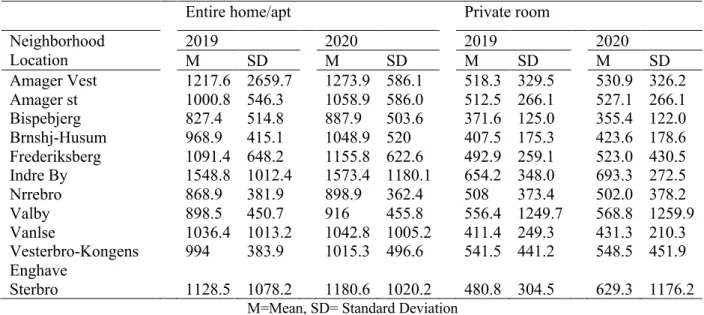

Table 1 contains the descriptive statistics of price listings by room type (entire home and private room) at Airbnb in Copenhagen. The average prices of listings posted by the hosts at Airbnb are higher for the year 2020 than the average prices in 2019 for entire homes and private rooms in 11 neighborhoods. All things equal, the lowest price of entire home apartment listings is 827.4 on average for the year 2019 and 887.9 on average for the year 2020 in the neighborhood of Bispebjerg. For the Sterbro neighborhood, the mean prices of entire apartments are DKK 1128.5 and DKK 1180.6 for 2019 and 2020, respectively. The highest price of private rooms is 654.2 on average in 2019, while it is 693.3 for 2020 in the neighborhood of Indre-By, ceteris paribus. Previous studies proved the price increase of listings after collaboration between tax authorities and Airbnb. Bibler et al. (2018) found a 7.4% increase in the listings' prices paid by guests after

17

the collaboration between Airbnb and tax authorities in the USA. Moreover, the study by Dalir et al. (2020) concluded that tax agreements between Airbnb and tax authorities lead to higher listings' prices. Furthermore, it has also been proven that Airbnb guests take a big share of the burden of increased taxes through higher prices of listings (Ellison & Ellison, 2009; Anderson et al., 2010; Einav et al., 2014; Bibler et al., 2018).

Table 1: Descriptive Statistics of Listings' prices in 11 neighborhoods in Copenhagen (n=12170)

M=Mean, SD= Standard Deviation

Table 2: Descriptive Statistics of annual nights' availability in 11 neighborhoods in Copenhagen (n=12170)

M=Mean, SD= Standard Deviation

Entire home/apt Private room

Neighborhood Location 2019 2020 2019 2020 M SD M SD M SD M SD Amager Vest 1217.6 2659.7 1273.9 586.1 518.3 329.5 530.9 326.2 Amager st 1000.8 546.3 1058.9 586.0 512.5 266.1 527.1 266.1 Bispebjerg 827.4 514.8 887.9 503.6 371.6 125.0 355.4 122.0 Brnshj-Husum 968.9 415.1 1048.9 520 407.5 175.3 423.6 178.6 Frederiksberg 1091.4 648.2 1155.8 622.6 492.9 259.1 523.0 430.5 Indre By 1548.8 1012.4 1573.4 1180.1 654.2 348.0 693.3 272.5 Nrrebro 868.9 381.9 898.9 362.4 508 373.4 502.0 378.2 Valby 898.5 450.7 916 455.8 556.4 1249.7 568.8 1259.9 Vanlse 1036.4 1013.2 1042.8 1005.2 411.4 249.3 431.3 210.3 Vesterbro-Kongens Enghave 994 383.9 1015.3 496.6 541.5 441.2 548.5 451.9 Sterbro 1128.5 1078.2 1180.6 1020.2 480.8 304.5 629.3 1176.2

Entire home/apt Private room

Neighborhood Location 2019 2020 2019 2020 M SD M SD M SD M SD Amager Vest 106.8 109.9 135.6 121.3 153.0 120.9 185.9 127.9 Amager st 119.8 118.8 134.8 121.8 160.3 135.1 180.9 130.8 Bispebjerg 123.6 121.9 152.4 127.5 178.5 118.7 206.0 123.8 Brnshj-Husum 91.7 104.7 119.3 110.8 207.2 110.7 250.2 113.1 Frederiksberg 116.3 115.2 144.0 126.3 171.7 125.3 197 131.6 Indre By 143.7 121.4 173.6 128.4 158.1 113.1 172.2 119.4 Nrrebro 108.0 109.6 132.7 119.5 146.4 111.3 181.5 118.6 Valby 109.6 112.4 136.8 124.0 185.7 117.3 214.6 129.2 Vanlse 117.0 107.6 137.7 125.1 155.4 100.6 189.8 115.8 Vesterbro-Kongens Enghave 110.4 117.3 136.4 123.8 143.9 116.2 190.9 120.6 Sterbro 126.7 119.8 157.2 128.5 181.0 113.5 196.3 137.7

18

Table 2 presents the descriptive statistics of annual listing availability by Airbnb hosts during the 2019 and 2020 periods. By looking at table 2, we can see an overall increase in the annual nights' availability of the listings in all the 11 neighborhoods in Copenhagen. If we take Indre By neighborhood as an example, we can see that the average annual availability for entire apartments is 143.7 and 173.6 nights for 2019 and 2020, respectively. For private rooms, the annual nights' availability increased from 207.2 to 250.2 nights from 2019 to 2020, respectively, in the neighborhood of Brnshj-Husum.

Based on the results above, we can see an increase in the nights´ availability of listings in 2020 compared to 2019 in Copenhagen's 11 neighborhoods. These results are opposite to what is expected for the annual nights availability of listings. We expect a decrease after these new regulations and the maximum nights' restriction. Duso et al., (2020) concluded that policy reforms that aim to ban short-term rentals abuse led to a decrease in the supply of listings and the overall night availability on Airbnb after the policies were implemented.

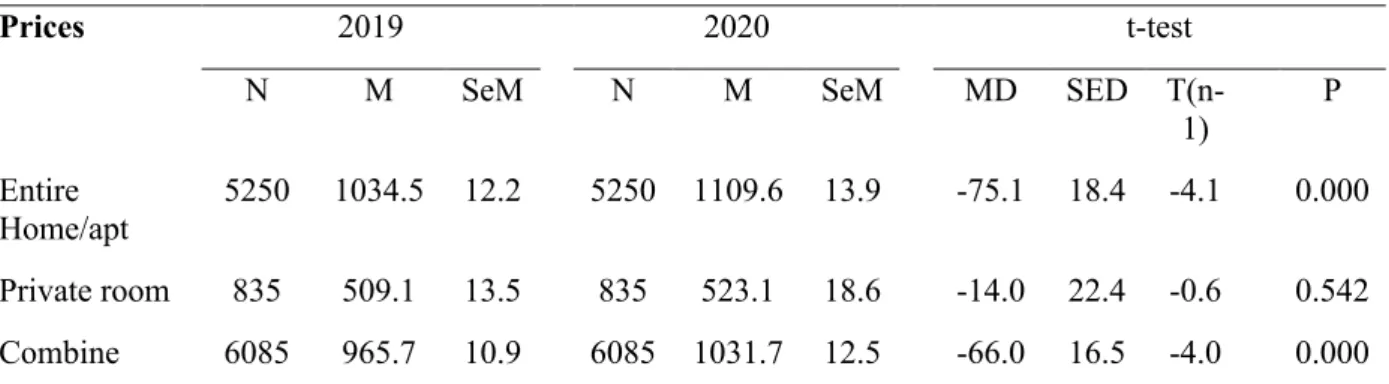

Table 3: The overall mean Comparison of listings' price in Copenhagen.

Prices 2019 2020 t-test

N M SeM N M SeM MD SED

T(n-1) P Entire Home/apt 5250 1034.5 12.2 5250 1109.6 13.9 -75.1 18.4 -4.1 0.000 Private room 835 509.1 13.5 835 523.1 18.6 -14.0 22.4 -0.6 0.542 Combine 6085 965.7 10.9 6085 1031.7 12.5 -66.0 16.5 -4.0 0.000

N= Number of observations, M=mean, SeM= Standard error of mean, M= Mean Difference, SED= Standard error of Mean difference

Table 3 compares between listings prices across 2019 and 2020 (based on all the listings in Copenhagen regardless of the neighborhood). Table one shows the average prices deepening on the listings type (entire home/apartments & private rooms) and the average price for combined listings. The results indicated that the prices of listings are on average significantly higher in 2020. We can see that the combined average price for the listings is DKK 1031.1 in 2020 compared to DKK 965.7 in 2019 (about a 6.7% increase in prices for 2020). The results show that statistically significant mean differences (DKK 66) exist among the entire home listings prices in 2019 and

19

2020. Ceteris paribus, the t-statistics for the mean difference of prices for the entire home is - 4.1, and the p-value is 0.000, which is statistically significant at all levels of significance.

For entire apartments, the daily average price in 2019 and 2020 is 1034.5 and 1109.6, respectively, with a mean difference of DKK 75. The mean difference for entire apartments is statistically significant with a p-value of 0.000, which is lower than all significance levels.

For private rooms, there is an increase in the prices in 2020, with a mean difference of DKK 14. However, the mean difference is insignificant, with a p-value of 0.542, which is higher than all significance levels. The reason for that might be the small share of private rooms compared to entire apartments in each period (835 private rooms, 5250 entire apartments).

To summarize, Table 3 shows an increase in the listings price on Airbnb for the year 2020 for all the listings. Previous studies have also found out an increase in the listings´ prices after the collaboration between tax authorities and Airbnb (Bibler et al., 2018; Dalir et al., 2020; Duso et al., 2020)

Table 4: The overall mean Comparison of the annual nights' availability of listings in Copenhagen.

Listings 2019 2020 t-test

N M SeM N M SeM MD SED T(n-1) P

Entire Home/apt 5250 119.6 1.61 5250 146.4 1.73 -26.7 2.36 -11.3 0.000 Private room 835 162.2 4.11 835 191.9 4.42 -29.7 6.03 -4.9 0.000 Combine 6085 125.4 1.51 6085 152.4 1.62 -27.1 2.21 -12.2 0.000

N= Number of observations, M=mean, SeM= Standard error of mean, M= Mean Difference, SED= Standard

Table 4 presents the comparison of mean listings' availability in 2019 and 2020. The average availability for all the listings in 2019 is 125.4 compared to 152.4, with a mean difference of 27. We can see that the annual listings' availability increased by 27 nights in 2020 for entire apartments and private rooms combined. The mean difference between 2019 and 2020 is statically significant with a p-value of 0.000 (t statistics -12.2), which is less than 0.05 level of significance.

Table 4 also shows that the entire apartments' mean difference is 26.7 between 2019 and 2020 with an availability mean of 119.6 and 146.4 for each year, respectively. The mean difference is

20

significant with a t-test of -4.9 and a p-value of 0.000, which is lower than the 0.05 level of significance.

Furthermore, for private rooms, the mean annual availability for 2019 and 2020 is 162.2 and 191.1, respectively, with a significant mean difference of 29.7 based on a t-test of -4.9 and a p-value 0.000, which is lower than the 0.05 level of significance.

To summarize, based on the results obtained in Table 4, we can notice an increase in the annual availability of listings combined on Airbnb in 2020 by 21.5% ((152.4/125.4)-1). These results are opposite to what is expected since policy reforms that aim to regulate short-term rentals, whether it is regarding fighting tax evasion or the abuse of short-term rentals, decrease their supply and availability (Bibler et al., 2018; Duso et al., 2020). Furthermore, the results for entire apartments. obtained in table 4 can indicate weak hosts' compliance by the maximum night limit of 70. The average annual availability for entire apartments in 2020 is 146, which exceeds the annual night limit. Further explanation will be provided by the next table.

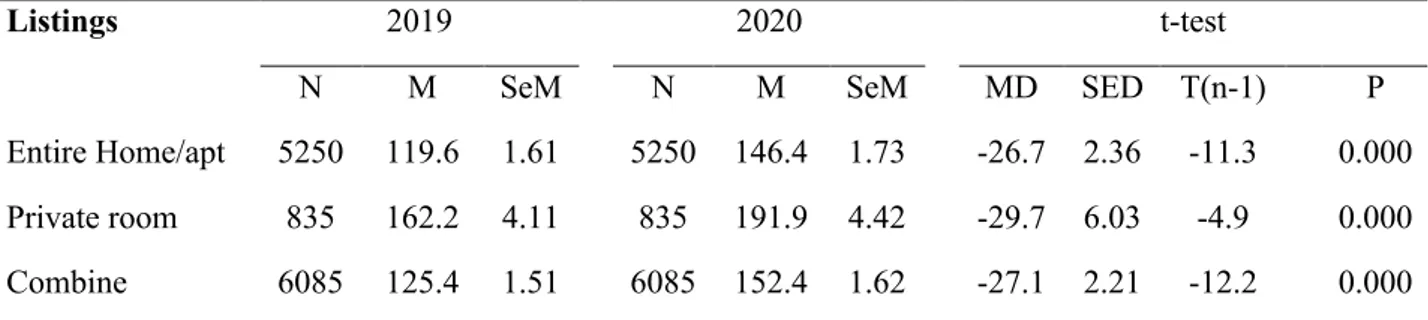

Table 5: Mean comparison of entire homes over the 70 nights' restriction.

Year 2019 2020

Total properties for each year. 6085 6085

Total entire apartments for each year 5250 5250

average annual availability for entire apartments 119 146

Total entire homes over 70 nights (%) 2737 (52%) 3282 (63%)

The above table demonstrates comparisons between 2019 and 2020 for the entire homes rented more than 70 nights a year. For 2020, we can see that 3282 entire homes out of 5250 (63%) have been rented out more than 70 nights for 2020. This might indicate that these hosts did not follow the maximum night restriction rule. Nevertheless, there is a lack of data that can show if the entire apartments of these hosts are their primary entire homes or their second homes. The regulation states that “primary entire homes” can be rented out at a maximum of 70 a year, and “primary entire home” term means that they are homes that hosts are currently living in. The restriction

21

applies to these homes (Airbnb, 2019; Skattestyrelsen, 2019) and the data available does not state if these entire apartments are primary or if hosts only listed a second apartment they own. However, the average annual availability of 146 nights per year tells us that these entire apartments have been rented on average for 146 nights a year. Therefore, it is likely that their owners lived in them for 219 nights (365-146) a year, which would increase the chance that these apartments are primary. However, they could have also been left empty 219 days a year. Therefore, it is quite uncertain to precisely tell these primary homes' situation from the available data. Duso et al., (2020) found that the compliance of the annual 90 nights restriction on primary entire homes in Berlin (which came after policy reforms that aim to ban the abuse of short-term rentals) lead to a decrease in both the annual availability of the listings and the number of listings on Airbnb.

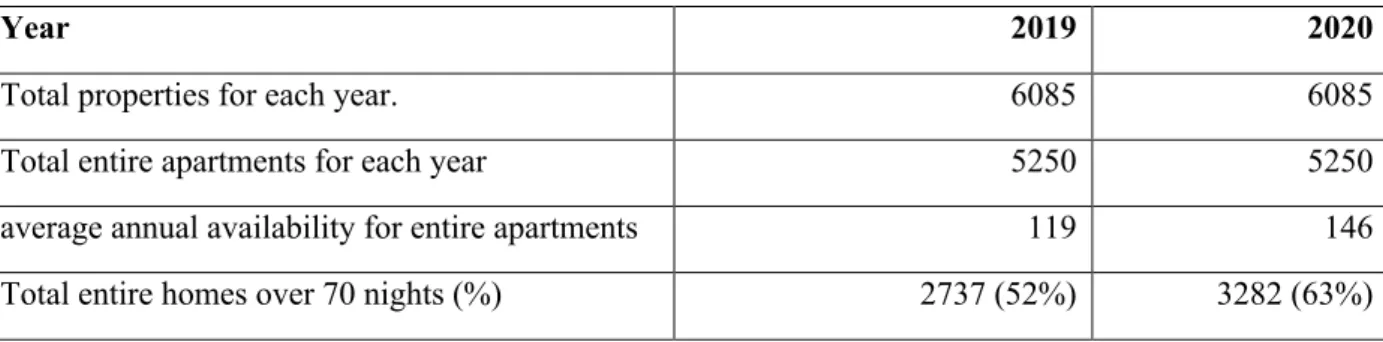

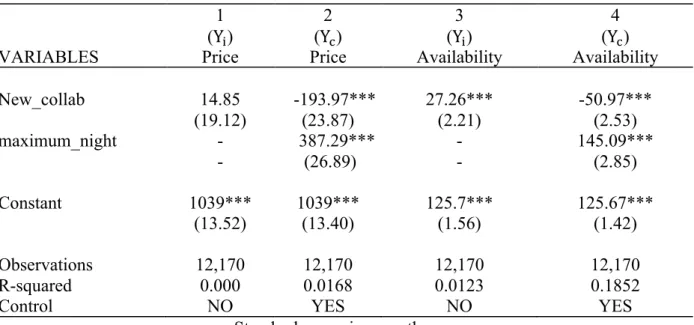

Table 6: Regression Model of price and availability for all the listings combined.

1 (Y+) 2 (Y!) 3 (Y+) 4 (Y!) VARIABLES Price Price Availability Availability New_collab 14.85 -193.97*** 27.26*** -50.97*** (19.12) (23.87) (2.21) (2.53) maximum_night - 387.29*** - 145.09*** - (26.89) - (2.85) Constant 1039*** 1039*** 125.7*** 125.67*** (13.52) (13.40) (1.56) (1.42) Observations 12,170 12,170 12,170 12,170 R-squared 0.000 0.0168 0.0123 0.1852

Control NO YES NO YES

Standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1

Table 6 reports the regressions of price and availability of listings regardless of the listing type. It has dummy variables of 1 for the period of the new collaboration between Airbnb and DTA. The dummy variables for this regression are New_Collab (dummy for years to show the before and after collaboration’s effect) and maximum_night (dummy for the maximum nights' restriction). The maximum_night restriction variable is added as a control variable. The four different columns

22

explain the effect of the collaboration on the period of 2020 (June 2019-June 2020). However, columns 1 and 3 show the regressions of price and availability of listings without covariates (Model Y+, without the control variable maximum_night ) while columns 2 and 4 report the coefficients with covariates (Model Y!, with the maximum night control variable).

After adding the maximum night as a control variable, column 2 shows a statistically significant decrease in the average daily prices by DKK 193.97 if we increase the collaboration's period by one year. Moreover, the maximum night restriction has a positive effect on the average daily prices by DKK 387.29 if we increase the maximum nights restriction limit by one night (or extend it by one year). After adding the maximum night restriction as control, we can see that the R-square went from 0.000 (column 1) to 0.0168 (column 2). However, it is a very low R-square that indicates that the model's variables only explain 1.6% in the variation in the dependent variable. Therefore, this model lacks control variables, such as inflation, demand for short-term rentals, house prices, and interest rates on mortgages. All these factors can influence the prices of short-term rentals.

Column 3 shows that the annual nights' availability after the collaboration increases by 27.26. It can be interpreted as an average annual increase of 27 in the nights' availability of listings when we increase the collaboration's period by one year. However, when we add the maximum nights' restriction as a control, the annual nights' availability decreases by 51 nights on average (50.97). Oppositely, the maximum nights restriction has a positive effect on the annual availability after the collaboration and increases it by 145 nights on average. Even though these results are significant based on the p-value, the R-square indicates that the independent variables can explain only 18.52% of the model. However, the R-square increased from 0.000 in column 3 (without control variable) to 0.1852 in column 4 (with control variables). As mentioned earlier, the model needs more control variables. Other than the missing control variables mentioned above, the Covid-19 pandemic situation may have affected the availability of listings during the period of 2020 (June 2019-June 2020). As a result, more control variables are needed for this model that would measure the worldwide pandemic effect.

The results obtained from the tests with control variables state that annual availability decreases after the new collaboration. While I obtained the opposite results based on the descriptive statistics

23

(that showed an increase in the annual availability), previous studies found out that the tax agreements between Airbnb and tax authorities decreased the annual nights' availability of listings on Airbnb (Bibler et al., 2018; Duso et al., 2020).

If I were to choose one of the above regression’s models, I would choose Model Y!, (with the control variable) since the R-square is relatively higher than model Model Y+ (without the control variable).

Based on model Model Y!, I can answer the following hypothesis as follow::Ö

i. H0: The year 2020 has no different effect on the prices of listings than the year

2019.

ii. H0: The year 2020 has no different effect on the annual availability of listings than

the year 2019.

iii. H0: The maximum nights´ restriction on entire primary homes does not affect their

availability.

Based on the New_collab's effect on prices and availability, we cannot accept the first two null hypotheses, and we assume that if we increase Airbnb’s collaboration with the DTA by one year, it decreases the prices and nights' availability of Airbnb's by DKK 193 and 51 nights, respectively. The decrease in prices means that hosts did not charge higher prices to compensate for the tax paid after the collaboration, but they are still affected by the collaboration. Hosts might have decreased their listings' prices and annual nights' availability after the collaboration to reduce the taxes paid on their rental income. The higher the rental income is, the higher the tax rate (0%-42%) (Skattestyrelsen, 2021). Hosts might also decrease their listings' prices and nights' availability to not exceed the annual tax-free thresholds (DKK 28,000 or DKK 40,000, depending on listings' type). A decrease in annual nights' availability after authorities' collaboration with Airbnb was confirmed by Bibler et al. (2018) and Duso et al. (2020).

For the third hypothesis, the maximum_night variable has a significant effect on the annual nights' availability (Model Y!, column 4). Therefore, we cannot accept the third hypothesis. We assume that the maximum night's restriction increases the annual nights' availability of listings by 145

24

nights on average when we increase the annual restriction by one night (or extend it by one year). This result aligns with the increase in the nights' availability obtained from the descriptive statistics. This result can indicate that hosts are not complying with the maximum nights' restriction, and stricter policies are needed to increase the compliance with this restriction.

6.4 Discussion of Findings

This section will discuss the empirical analysis's findings using secondary data collected from Inside Airbnb on listings based in Copenhagen, Denmark, to assess the effect of the collaboration between Airbnb and the DTA 2019 on Airbnb's listings. The findings compare the annual nights´ availability and daily prices of listings before and after the collaboration using different statistical tests. First, I will start with a summary of the results obtained from the descriptive statistics (Tables 1-5) and compare the results to previous studies. Then I will summarize the results obtained from the regression model (Table 6). Lastly, I will discuss the meaning of these results to the objectives of the study.

Results obtained from the descriptive statistics analysis on price show that there was a visible increase in prices of the listings in 2020 compared to 2019. The mean analysis of prices based on the 11 neighborhoods in Copenhagen (Table 1) showed an increase for both entire apartments and private rooms after the collaboration. For example, in the neighborhood of Bispebjerg, the lowest price of entire apartment listings is 827.4 on average for 2019 and 887.9 for 2020. The highest price of private rooms listings is DKK 1128.5 on average in 2019, while it is DKK 1180.6 on average for the year 2020 in the neighborhood of Sterbro. Another mean analysis was performed to compare the overall changes in prices regardless of the neighborhood (Table 3). The results showed that the daily listings prices increased by DKK 66 or 6.7% in 2020 (for entire apartments and private rooms combined). The price of entire apartments increased on average by DKK 75 in 2020, and private rooms had a DKK 14 increase in 2020.

Previous studies found an increase in prices after the tax agreements between Airbnb and tax authorities. Bibler et al. (2018) found a 7.4% increase in the listing’s prices paid by guests after the collaboration between Airbnb and tax authorities in the USA. Duso et al., 2020 found that policy reforms (policies that aim to ban short-term rentals abuse) in Berlin increased the prices of at least seven cents on average per month per square meter of apartments listed on Airbnb.

25

Moreover, Dalir et al. (2020) concluded that tax agreements between Airbnb and tax authorities lead to higher listings prices.

The increase in the listing’s prices after the tax agreement between the DTA and Airbnb, might indicate that Danish homeowners increased the prices of their listings to compensate for the taxes that must be paid on the income (if it exceeds the annual tax-free earnings) generated by all listings on Airbnb from 1st July 2019. The act of increasing prices to compensate for paid taxes after agreements with Airbnb and tax authorities has been proven in many previous studies. It has been proven that Airbnb guests take a big share of the burden of increased taxes through higher prices of listings (Ellison & Ellison, 2009; Anderson et al., 2010; Einav et al., 2014; Bibler et al., 2018). However, even if the increase in prices might indicate that many Danish homeowners on Airbnb did not report their income honestly and did this act to compensate for taxes. However, these increases might come from inflation or other factors not controlled by this study.

Furthermore, based on comparing the annual night’s availability in Copenhagen's 11 neighborhoods (Table 1), we can notice an increase in the annual nights' availability in both entire apartments and private rooms for 2020. For Instance, Indre By's neighborhood has an increase in the average annual availability for entire apartments of 30 nights (143.7-173.6) in 2020. For private rooms, the annual nights' availability increased by 43 nights (207.2- 250.2) on average for listings based in the neighborhood of Brnshj-Husum.

In addition, based on the overall mean comparison of the listings' annual nights availability (Table 4), the analysis revealed that the new collaboration between Airbnb and DTA increases the yearly availability in 2020 by 27 nights on average for entire apartments and private rooms combined. Entire apartment' availability increases by 28 nights (26.7) on average, and private rooms' annual availability increases by 29 nights on average. These results are statistically significant with a p-value of 0.000. The results are also opposite to what is found in the literature review that stated policy reforms (that aim to regulate short-term rentals, whether it is regarding fighting tax evasion or the abuse of short-term rentals) decrease the listings availability (Bibler et al., 2018; Duso et al., 2020). However, this increase in annual listings availability might be associated with the increased listings prices since some hosts might be affected by the burden of paid taxes since they can

26

compensate for that by increasing the listings prices. It is of consideration that a significant share of the burden of increased taxes fall on Airbnb’s guests through higher prices set by hosts (Ellison & Ellison, 2009; Anderson et al., 2010; Einav et al., 2014; Bibler et al., 2018).

In addition, Table 5 shows for the year 2020 that 3282 out of 5250 hosts (63%) have rented out their entire apartments more then 70 nights (the maximum annual nights' restriction on entire primary homes), which indicate that hosts might not be complying with the maximum nights' restriction. A policy that might work in order to make hosts comply with the maximum nights' rule would be that Denmark forces it’s hosts to obtain permission from local authorities to be able to rent their entire primary homes at maximum 70 nights a year. These permissions could be renewed and granted every year if hosts comply with the maximum nights restriction or if they sign an agreement that they will comply. Such a policy exists already in Berlin, which aims to fight short-term rentals' abuse. Hosts in Berlin are only allowed to rent their entire primary homes 90 days a year, and they are required by law to obtain permission from their local authorities before they can rent their entire apartments (Duso et al., 2020).

Based on Model Y! regression results, the listings' availability and prices after the collaboration are affected negatively (opposite to the descriptive statistics results), which answers our objective that listings prices and availability are not the same before and after the collaboration. This negative effect on prices and availability can indicate a change in hosts' behavior regarding their listings due to the collaboration. It is not the same as before the collaboration and can indicate that hosts decreased their prices and availability to evade paying higher taxes that come with higher rental incomes, or to stay within the new tax-free thresholds (DKK 28,000 or DKK 40,000, depending on listings' type).

The model also indicates that hosts with entire apartments are not complying with the maximum nights' restriction (similar results found in the descriptive statistics). The average increase in the availability of entire apartments is 145 nights when we increase the annual nights' restriction by one night (or extend its period by one year). However, the regression model still has a low R-square after including a control variable (maximum nights' restriction), which might give

27

misleading results. Additional control variables are needed to answer the hypotheses more accurately.

To summarize, the results obtained from Tables 1-5 indicate that many Danish homeowners are affected by the tax agreement between the DTA and Airbnb. Not only they increased the daily prices of their listings, but they also did not comply with the maximum night restriction. The regression results (Table 6, column 4) showed that if we increase the maximum nights' restriction on entire apartments by one night (or extend it by one year), it increases annual nights' availability by 145 nights on average. Both regression and descriptive statistics results can indicate that there might be weak compliance regarding the maximum night's restriction and the policy enforcement. Authorities can solve that by imposing stricter penalties on those who rent their primary entire apartments more than 70 nights a year. Danish authorities can also use Berlin's policy, which requires hosts to obtain a registration number to be able to short-term rent their entire apartments with a maximum of 90 days a year (Duso et al., 2020).

In addition, the regression results showed a decrease in the prices and annual nights' availability (opposite to the results of the descriptive statistics) after the collaboration. We can interpret these results by assuming that hosts might have decreased their prices and accepted less booking after the collaboration to stay under the annual tax-free thresholds (DKK 28,000 or DKK 40,000, depending on listings' type), or to pay fewer taxes because the higher their rental income, the higher the tax is.

To conclude, the above results, regardless of if it is an increase in prices and annual nights' availability after the collaboration (based on the descriptive statistics), or if it is a decrease (based on model Y! regression results), indicate that hosts on Airbnb are affected by this collaboration. We assume that there is a change in the listings' prices and annual nights' availability. We also found out that hosts might not be complying with the maximum nights' restriction. If these assumptions are valid, they makes us question Danish Airbnb's hosts' honesty regarding their reported income to the DTA and their compliance with the maximum nights' restriction. Therefore, there should be stricter penalties (other than the penalties for those who evade paying taxes) imposed on hosts that abuse the economy-sharing and rent out their entire primary homes more

28

than allowed (70 nights). However, the regression models have low R-squares. They lack more control variables (inflation, demand for short-term rentals, house prices, mortgages' interest rates, effects of covid-19) to give more accurate results and indications regarding this study.

7 Conclusion and Policy Recommendations

The study investigated the changes in listings’ annual night availability and prices after the new collaboration between Airbnb and the DTA. The study aims to investigate if hosts are affected by the tax agreement between Airbnb and the DTA. The study uses data gathered on Airbnb listings for the last 365 days of 2019 (June 2018-June 2019) and 2020 (July 2019-June 2020). The study employs descriptive statistics and regression analysis to derive the objectives.

The Descriptive statistics results show an overall increase in the average daily prices by DKK 66 or 6.7%. Moreover, the descriptive statistics show that the annual average for entire apartments scored 146 nights with 3282 hosts renting their entire apartments over 70 nights a year after the collaboration. The regression results showed that if we increase maximum nights restriction by one night (or extend it by one year), it increases annual nights ‘availability by 145 nights on average. Furthermore, the regression showed when we add control variable (maximum nights’ restriction), there is a decrease in the prices and nights’ availability of Airbnb’s listings. Despite the different results between the descriptive statistics and the regressions', I presume that a change in the prices and annual nights' availability of listings on Airbnb occurs after the collaboration. It puts a question mark regarding Airbnb's Danish hosts' honesty when it comes to evading taxes and not complying with the maximum nights' restriction on primary entire apartments. Note that the regressions results might give misleading interpretations since the R-squares for regression models are very low and the models lack necessary control variables. Such control variables can be inflation, mortgages’ interest rate, house prices in Denmark, the income of hosts and guests, and to consider the economic effects of the Covid-19 situation. All these factors can influence the results and add limitations to this study.

Future studies should consider adapting a solid methodology such as the use of instrument variables or different methods with necessary data available to estimate the causal effect of the collaboration. Prospective future researchers could obtain the personal income (declared and