Mobile Payment

Adoption During

the COVID-19

Pandemic

MASTER THESIS WITHIN: Business Administration NUMBER OF CREDITS: 30

PROGRAMME OF STUDY: M.Sc. Digital Business AUTHOR: Niklas Herget & Philip Steinmüller Krey JÖNKÖPING May 2021

A Quantitative Study

in Germany

Master Thesis in Business Administration

Title: Mobile Payment Adoption during the COVID-19 Pandemic in Germany Authors: Niklas Herget and Philip Steinmüller Krey

Tutor: Marta Caccamo Date: 2021-05-24

Key terms: Mobile Payment Adoption, Germany, COVID-19, UTAUT, TAM, DOI, Intention to Use, Technology Adoption, Contactless Payments, M-Commerce, Mobile Point-of-Sale, ApplePay, Digital Wallet

Abstract

Background: Emerging in December 2019, the COVID-19 pandemic profoundly

changed consumer behaviour leading to social distancing and mitigating physical contact. Statistics show an increased use of contactless and mobile payment usage and adoption during the pandemic. It is unclear how valid previous models on mobile payment adoption explain adoption behaviour in emergency situations. While there are few studies approaching the adoption behaviour during the pandemic, there is also little previous research on mobile payment adoption prior to the pandemic in Germany.

Purpose: The present thesis intends to advance several previously researched

technological adoption frameworks to focus on and measure consumers’ perception of mobile payment technology adopting during the COVID-19 pandemic. Hence, our model provides a basis to understand mobile payment adoption in Germany during the pandemic.

Method: Based on hypotheses derived from an adapted UTAUT2 model, we

conducted quantitative deductive research reaching 258 questionnaire participants based in Germany. The empirical data was analysed through structural equation modelling.

Conclusion: The findings show that Performance Expectancy still represents the

primary driver of intention to adopt mobile payments during the pandemic, yet it is strongly supported by the initially contextualised Contamination Avoidance element and complemented by Habit, Effort Expectancy. Practitioners benefit from the study to better tailor campaigns in accordance with the main driver of adoption behaviour, while our findings contribute new

Table of Contents

1

Introduction ... 1

1.1 Background ... 1

1.2 Problem Discussion and Research Purpose ... 3

2

Literature Review ... 5

2.1 Literature Research Strategy ... 5

2.2 Introduction of Mobile Payment Services (MPS) ... 6

2.2.1 Mobile Payment Services ... 6

2.2.2 Consolidation and European Payment Initiatives ... 8

2.3 Mobile Payment Research... 9

2.3.1 Unified Theory of Acceptance and Use of Technology (UTAUT2) ... 10

2.3.1.1 Price Value ... 11 2.3.1.2 Hedonic Motivation ... 12 2.3.1.3 Habit ... 12 2.3.1.4 Effort Expectancy ... 13 2.3.1.5 Social Influence ... 13 2.3.1.6 Performance Expectancy ... 13 2.3.1.7 Facilitating Conditions ... 14 2.3.1.8 Intention to Use ... 14 2.3.1.9 Moderating Factors ... 14

2.3.2 Technology Acceptance Model (TAM) ... 15

2.3.3 Diffusion of Innovation Theory (DOI) ... 16

2.4 Mobile Payment Adoption Research ... 16

2.5 Mobile Payment Research in Germany ... 19

3

Development Research Model and Hypotheses... 21

4

Methodology ... 28

4.1 Research Philosophy ... 28 4.2 Research Approach ... 29 4.3 Research Strategy ... 30 4.4 Data Collection... 30 4.4.1 Survey Design ... 30 4.4.2 Pre-Test ... 33 4.4.3 Sampling Strategy ... 344.5 Data Analysis ... 35 4.6 Research Quality ... 36 4.6.1 Validity ... 36 4.6.2 Reliability ... 38 4.7 Ethical Considerations ... 38

5

Empirical Findings ... 41

5.1 Descriptive Analysis ... 42 5.1.1 Demographics ... 42 5.1.2 Central Tendencies ... 435.1.3 Additional Comments by Respondents ... 44

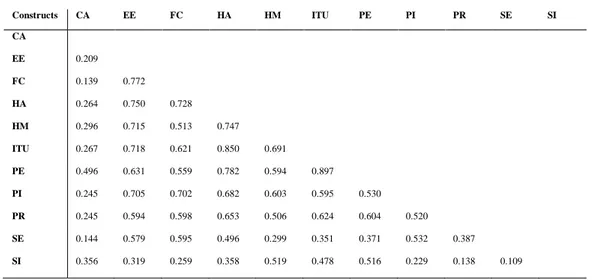

5.2 Scale Measurement ... 45

5.2.1 Test for Normality ... 45

5.2.2 Model Fit ... 45

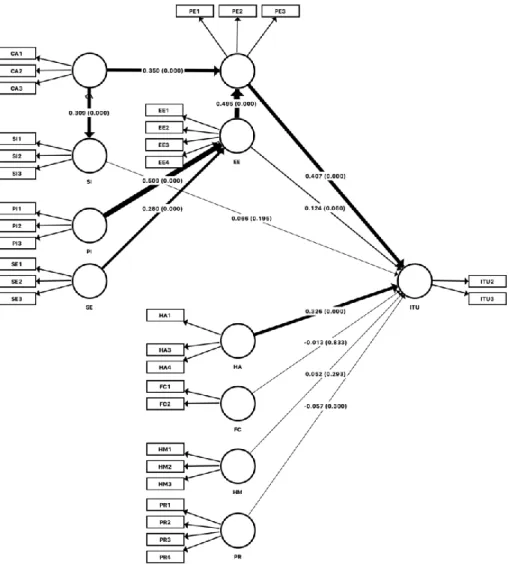

5.2.3 Outer Model Loading Factors ... 45

5.2.4 Collinearity ... 46 5.2.5 Reliability Test ... 47 5.2.6 Discriminant Validity ... 48 5.3 Structural Model... 50 5.3.1 Moderating Effects ... 52 5.3.2 Indirect Effects ... 53

5.3.3 Summary of the Research Model ... 54

6

Analysis ... 55

6.1 Significant Towards Intention to Use ... 55

6.1.1 Hypothesis 2 CA Predicts PE & ITU ... 55

6.1.2 Hypothesis 3 PE Strongly Explains ITU ... 57

6.1.3 Hypothesis 4 EE Predicting ITU and PE ... 58

6.1.4 Hypothesis 6 HA as a Minor Predictor for ITU ... 60

6.2 No Significance Towards Intention to Use ... 60

6.2.1 Hypothesis 5 SI on ITU not Significant ... 60

6.2.2 Hypothesis 7 FC on ITU not Significant... 61

6.2.3 Hypothesis 8 HM on ITU not Significant ... 62

6.3.1 Gender ... 64 6.3.2 Age ... 64 6.4 Indirect Effects ... 66

7

Discussion ... 67

7.1 Theoretical Implications ... 67 7.2 Practical Implications ... 697.3 Limitations and Future Research ... 70

7.3.1 Research Objective ... 70

7.3.2 Methodology & Data Collection ... 71

7.3.3 Research Model ... 72

7.3.4 Influence of the Pandemic ... 73

8

Conclusions ... 74

9

Appendices ... 76

Figures

Figure 1 Evolution of Technology Acceptance Models ... 10

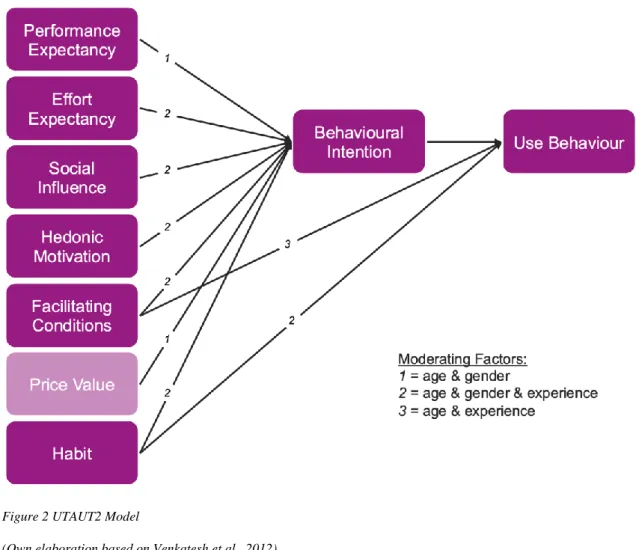

Figure 2 UTAUT2 Model... 11

Figure 3 Proposed Research Model... 21

Figure 4 Methodological Implications of Different Epistemologies... 28

Figure 5 Research Model with Path Coefficients ... 54

Tables

Table 1 Survey Questions and Sources ... 32Table 2 Descriptive Statistics: Valid Cases, Age, and Gender ... 42

Table 3 Descriptive Statistics: Previous Experience with Mobile Payment Services 43 Table 4 Reliability of Latent Variables ... 48

Table 5 HTMT Criterion for Discriminant Validity After Revision ... 50

Table 6 Summary of Results of Hypotheses ... 52

Table 7 Age as a Moderator ... 53

Table 8 Gender as a Moderator ... 53

Table 9 Total Indirect Effects ... 53

Appendices

Appendix A Literature Reviews Related to Mobile Payment (m-payment) ... 76Appendix B Definition and Root Constructs of UTAUT... 77

Appendix C Self-Administered Survey Design & Information About M-Payments . 78 Appendix D Additional Comments of Survey Participants ... 79

Appendix E VIF Factors of Constructs ... 80

Appendix F Pearson’s Correlation of Research Model ... 81

Appendix G Normality and Descriptive Statistics of Items ... 82

Appendix H Overview Questionnaire Answers ... 83

Abbreviations

#dk Germany Payment Initiative

AV Availability

AVE Average Variance Extracted

CA Contamination Avoidance

DOI Diffusion of Innovation

EE Effort Expectancy

EPI European Payment Initiative

FC Facilitating Conditions

HA Habit

HM Hedonic Motivation

HTMT Heterotrait-Monotrait Ratio

ITU Intention to Use

MPS Mobile Payment Services

NFC Near Field Communication

P27 Nordic Payment Initiative

PE Performance Expectancy

PI Personal Innovativeness

PLS-SEM Partial Least Squares Structural Equation Modelling

POS Point of Sale

PR Perceived Risk

PSD2 Payment Service Directive 2

SE Self-Efficacy

SEPA Single Euro Payments Area

SI Social Influence

SRMR Standardised Root Mean Square Residual

TAM Technology Acceptance Model

UTAUT Unified Theory of Acceptance and Use of Technology

VIF Variance Inflation Factor

1 Introduction

This chapter aims to introduce the background to mobile payment and the adoption in Germany during the COVID-19 pandemic. First, we provide information on the impact of the pandemic on daily life, followed by the developments of payment methods in Germany and the connection to the pandemic. Second, we will outline the motivation and purpose followed by the underlying research question of our study.

1.1 Background

The adoption of smartphones has lastingly changed how consumers perform everyday tasks. Smartphones have become omnipresent in today’s world, and people rely on smartphones when navigating around cities, contacting friends, conducting online shopping, or even filling out tax returns (Marques, 2016). Smartphones and digital technology have incorporated themselves into the fabric of everyday life. Several attempts have been made to understand consumers’ use of such novel technology, although more research is required regarding their adoption and Intention to Use it (McKenna et al., 2013). When considering the adoption and use intentions, it is apparent that some consumers groups tend to have resistance to innovation and scepticism of new technologies (Jahanmir & Lages, 2015, 2016), which can cause innovations to fail (Heidenreich & Spieth, 2013). Talke and Heidenreich (2014) argue that consumers’ innovation resistance must be recognised to facilitate new product adoption. There was and still is a high resistance among Germans in giving up cash, however, recent statistics show the hesitation is softening, and more transactions are conducted cashless (Deutsche Bundesbank, 2021; Esselink & Hernández, 2017).

The coronavirus disease 2019 (COVID-19) is a worldwide pandemic that emerged in December of 2019 and has consequentially and profoundly changed consumer behaviour and societal norms. As of the 24 of May 2021, nearly 3.5 million deaths and near 167 million confirmed cases of COVID-19 have been reported by the World Health Organisation (WHO) (2021). Due to the infectiveness of the SARS-CoV-2 virus, which causes the contagious COVID-19 disease, social distancing and mitigating physical contact were urged by the WHO (2020). Further, in continental Europe, social distancing

and partial or complete lockdowns had pervasive effects on everyday life and common everyday habits. On the one hand, the pandemic has drastically increased online commerce within a short time; on the other hand, offline point of sale (POS) transactions have been increasingly conducted contactless (Deutsche Bank AG, 2020a). In conjunction with high smartphone penetration levels across Europe and an affinity for undertaking financial transactions online, the pandemic has led to a growing potential user-base for mobile payments (Statista, 2021c).

Mobile payments and Near Field Communication (NFC) can mitigate transmission risk due to their contactless design and support social distancing (Celum et al., 2020). Payments are before or afterwards approved by the consumer on their mobile device, which is advantageous versus the sole use of the payment cards’ NFC functionality, which requires PIN entry depending on a transaction amount threshold up to EUR 50; these thresholds have been elevated since the pandemic and had been substantially lower before (Weimert & Saiag, 2020). In a recent German survey, 21% of respondents reported that they first used contactless payment in the pandemic (Deutsche Bundesbank, 2021). Within April 2020 alone, according to a Bundesbank survey (2021), payment behaviour changed due to COVID-19, and the share of non-cash payments increased from 25% to 43%. Further, the share of using the contactless function of Germany’s proprietary payment card Girocard grew from 39% in January 2020 to 60.4% of all Girocard transactions in December 2020 (RND/dpa, 2021). In addition, the support of other payment solutions among retailers has only begun in the last few years. Despite that, LIDL, one of Germany’s biggest retailers, has launched their mobile payment services in 2020, which gives customers coupons and other discounts in return when using their mobile payment app (Lidl Dienstleistung GmbH & Co. KG, 2020).

Even after gradually easing social restrictions and lockdowns, consumers might stick to these newly developed habits. However, the stickiness or longevity of these newly acquired temporal habits is uncertain. Further, shops and businesses try to fathom how to conduct business after COVID-19, especially the hospitality industry is expected to undergo the most significant long-term changes (Gursoy & Chi, 2020).

In the long-term, there are behavioural, societal, and regulatory hurdles to reducing cash transactions. For many consumers, cash is still viewed as more comfortable to use for smaller purchases. In addition, older consumers may be wary of digital payment methods, and the unbanked and lower-income consumers could be excluded from non-cash payment solutions. Having a more physical connection to their money is often cited to help some consumers budget and manage debt. (Weimert & Saiag, 2020)

Nonetheless, traditional banks are still among the most trusted compared to payment service providers, retailers, big tech companies, and neobanks/FinTechs (Pratz et al., 2020). In addition, there seem to be cultural belief differences in adopting contactless payment methods during the COVID-19 pandemic across Europe, as adoption rates have increased to starkly varying degrees even in countries impacted similarly severely by the COVID-19 pandemic (Pratz et al., 2020). Nevertheless, as governments and the WHO indirectly promote the use of contactless payment methods by recommending avoiding physical contact, this recommendation potentially influences consumers in use and adopting mobile payment methods (WHO, 2020).

The present thesis intends to advance several previously researched technological adoption frameworks to measure the consumers’ perception of mobile payment technology adopting during the COVID-19 pandemic (Venkatesh et al., 2012).

1.2 Problem Discussion and Research Purpose

As statistics show an increased use of contactless and mobile payment usage and adoption during the pandemic, it is unclear how availability, social norms, and health mitigation strategies influenced this behaviour (Deutsche Bundesbank, 2021; RND/dpa, 2021). Our thesis wants to shed light on adopting mobile payment services during the COVID-19 pandemic through a quantitative research study approach to survey as a comprehensive sample of society. Hence, we can gain insight into the payment behaviour and attitudes towards mobile payment solutions from customers that would not have used it without the pandemic or be confronted with contactless payment methods. Moreover, we investigate attitudes and openness towards new solutions and innovations in Germany’s payment landscape, as consumers in Germany have been considered as reluctant to adopt new payment services in the past. This is exemplified by the fact that the use of invoice

in conjunction with traditional bank transfers is still the second most used or preferred online payment method in Germany (Bitkom, 2020), and there are several discontinued or failed to broadly establish mobile payment services in the past years (Humbani & Wiese, 2018). Resulting from an extensive literature analysis, we identified that research on mobile payment adoption in Germany as a gap, combined with the current phenomenon of COVID-19, justifies as a relevant objective. Guided by previous research in the domain of technology adoption, we extend the UTAUT2 framework (Venkatesh et al., 2012), which examines antecedents of technology adoption by constructs of the TAM and DOI models as well as further items of previous studies, which we expect capturing effects of the COVID-19 pandemic (Baudier et al., 2021; Davis, 1989; Rogers, 2003). Therefore, we propose the following research question guiding our research:

How is users’ intention to adopt mobile payment services in Germany determined during the COVID-19 pandemic? Do established determinants still apply?

To examine and transfer the previous theory to the situation in Germany during the COVID-19 pandemic we choose quantitative research approach. We approached the research question by conducting an online survey of 258 German consumers between March and April 2021. The questionnaire based on previous research and included a three-item structure for each element of the research model. We obtained a total of 216 usable filled-out questionnaires for the analysis utilising structural equation modelling.

2 Literature Review

The purpose of this chapter is to introduce the theoretical background of our thesis. First, we will describe our literature research strategy, followed by introducing mobile payments as a technology. Secondly, we will introduce the unified theory of acceptance and use of technology (UTAUT2), the technology acceptance model (TAM), and the diffusion of innovation theory (DOI) as models that were utilised by previous literature to explain mobile payment adoption. For reasons of clarity, if we refer to the model’s constructs, we capitalise or abbreviate them, while behaviour is uncapitalised. Lastly, we will outline relevant studies on mobile payment adoption prior to the pandemic, studies focusing on adoption during the pandemic, and studies focusing on Germany.

2.1 Literature Research Strategy

We started our research by researching relevant topics due to the significant impact on people’s everyday lives by the COVID-19 pandemic. We came across a vast array of management and finance topics, where the pandemic offered chances in the research because it impacted vast areas of research. The literature offers an extensive overview of the adoption of recent technology. After a detailed examination of the data and recent articles at hand, we defined keywords and the most important terms of our topics to get precise searching results. We researched Web of Science, Primo, EBSCOhost, Scopus, Google Scholar and further used Statista for our main statistics, and relevant pages of industry associations and institutions for further information.

References for all material were saved to EndNote Web, provided by Jönköping University, to create citations and the bibliography efficiently. Research papers, articles, statistics, and other data have been imported into the software database DEVONthink Pro 3. This platform allows for organising and saving articles and notes. Additionally, it enhances searching, classifying the contents of articles, analysing similarities and relationships between articles, and a linked and organised way of note-taking.

Primarily, there is various academic literature examining the adoption of mobile payment services, focusing on stellar examples as the M-Pesa and its innovation trajectory across time and place in Kenya and eastern Africa (Oborn et al., 2019), Swish of Sweden (Rehncrona, 2018), or AliPay and WeChat Pay adoption antecedents by integrating

context awareness (Cao & Niu, 2019) or integrating mindfulness to mobile payment adoption (Flavian et al., 2020). However, there is little recent research about the reasons for mobile payment adoption in Germany as, statistically, its adoption has been increasing at a low rate before the pandemic. Still, one relevant study has focused on mobile operator subscriber-based payment services, which, however, today are all no longer exist (Gerpott & Meinert, 2017).

Nonetheless, the pandemic has strongly influenced the adoption of other payment methods in Germany, as recent statistics by the German central bank and the German Banking Association have shown (Deutsche Bundesbank, 2021; Statista, 2021a). Accordingly, this increase can be seen in the users’ expectations of mobile payments’ contactless characteristic in contributing to social distancing and measures and personal contamination avoidance by limiting physical contact. Furthermore, due to the lockdown measures, there were increased “Click & Collect” offerings introduced by businesses as a possibility of maintaining operations and offering further social distancing, where customers pre-ordered goods online or by phone to pick them up outside of the retail store (ZEIT Magazin, 2021). Hence, as it was necessary to order by electronic means, this could further have supported mobile payment adoption.

2.2 Introduction of Mobile Payment Services (MPS)

2.2.1 Mobile Payment Services

In the following, we will present definitions and a statistical overview of the development and prediction of mobile payments in Germany in order to better understand mobile payments as technology and provide information on its status quo in Germany, thus present the underlying context. Mobile payment services are increasingly establishing within our society, increasingly gain importance as a payment method, and are projected to foster and establish further (Deutsche Bank AG, 2020b; Statista, 2021b). Looking at the definitions of mobile payment services by Henkel (2002), Schilke, Wirtz, and Schierz (2010), or Statista (2021a), they commonly emphasise the mobile device as a crucial key component for the transfer of monetary value, although there are some differences in the definition of the mobile device itself as some definitions include all mobile communication devices and others focus on the smartphone. Additionally, the significant difference between mobile payment services is the environment in which the payment

process is executed. Mobile payment services are utilised for payments between peers (P2P) in the e-commerce field, as well as for in-store mobile point-of-sale (M-POS) payments (Gerpott & Kornmeier, 2009; Henkel, 2002; Schilke et al., 2010).

While mobile payments in the P2P and m-commerce fields do not require any physical contact as they usually are executed place-independently, transactions in the mobile POS field rely on contactless interaction between a smartphone application that saved a digital payment card in a mobile wallet and a merchant’s payment terminal (Gerpott & Meinert, 2017; Schilke et al., 2010). In this case, data is transferred through, e.g., NFC or starting the payment by scanning a QR-code (Gerpott & Meinert, 2017; Statista, 2021d). Such contactless payments are not only able to be executed through a mobile wallet but also with a physical card, which is the more common use case of contactless payments but not referred to as mobile payment (RND/dpa, 2021).

In the market of mobile payment platforms, many tech companies strive to establish their services and offer payment platforms as an added feature to their existing service. Established companies like PayPal, with a primary focus on offering a payment service platform, increasingly emphasise mobile solutions, and tech companies like Apple, Amazon, and Facebook enter the market by extending their service to an integrated shopping ecosystem for their customers (McKinsey & Company, 2020; Statista, 2021b). In China, mobile payments already fostered themselves as established payment mean much more than in Europe. Social messaging services offer payment services like Alipay and WeChat Pay which cover all of the three designated mobile payment purposes and count 555.6 million users, of which have conducted mobile POS payments in 2021 with an average transaction value of $ 2,060 per user and year (Statista, 2021b). The acceptance of mobile payment solutions in European markets is projected to steadily increase over the following years (Deutsche Bank AG, 2020b; McKinsey & Company, 2020; Statista, 2021a, 2021b). When it comes to Germany, mobile payment acceptance is relatively low, and the most used payment means are cash and proprietary Girocard (Deutsche Bank AG, 2020a; Statista, 2021b).

Nevertheless, growth predictions for the German market allocate a high potential for mobile payments compared to other European countries (Statista, 2021d). The mobile

POS transaction value for 2021 is projected to reach € 18.961 billion and growing to € 55.407 billion in 2025 through an annual growth rate of 30.75%. The number of users is projected to reach 20.6 million by 2025, representing almost 25% of the German population (Statista, 2021d). Consequently, in a European comparison, Germany will have a higher amount of users compared to France (13.8m), Great Britain (18.9m), and Spain (10.2m) (Statista, 2021b). In Germany, current users of mobile payments can be categorised by three moderating factors: income, gender, and age. A study about mobile POS users in Germany showed that users are most frequently male (74.2%) between 25 and 44 years old (61.8%) and individuals who have a high income (47.5%) (Statista, 2021a, 2021b, 2021d). The impact of these moderating factors seems to be significantly stronger in Germany than, e.g., in the USA and China, as income and gender of a user in 2020 were nearly equally distributed over the different categories (Statista, 2021b). 2.2.2 Consolidation and European Payment Initiatives

Several financial and digitalisation initiatives have urged and strongly advocated a digitalisation of the European payment landscape, which can serve detrimental to the fragmentation of the European single market and allows for the implementation of auxiliary services such as eID and foster European-made technical services and products (Hackl, 2020). The European Commission is poised to reap the full potential of PSD2 and set instant payments through the SEPA Instant Credit scheme as the new standard for commerce and intra-personal credit transfers. Nonetheless, its success depends mainly on factors such as market readiness and consumer adoption. Concrete measures and incentives to increase and drive the adoption rate and building the necessary infrastructure are unclear from a consumer perspective. Current initiatives like the European Payment Initiative (EPI) or P27 in the Nordic countries aim at providing consumers within a more significant geographical area a consolidated payment scheme (EPI Interim Company SE, 2021; P27 Nordic Payments Platform, 2021). These schemes aim to provide a seamless payment experience for consumers, including actions for mobile payment services. While Europe’s current mobile payment scheme landscape is highly fragmented and increasingly dominated by players outside the EU, the sensitisation for personal data security and who is in control of sensitive data like financial information is increasing. Therefore, the introduction of a consolidated payment scheme, initiated by official European institutions and carried out by the incumbent financial institution, may impact

the adoption of mobile payment services within Europe. As these initiatives are still in conception, there is no official research of how the adoption might be impacted. Consequently, we will not focus on evaluating the success chances of the initiatives but reflect the results with the known information about the initiatives in the discussion.

2.3 Mobile Payment Research

The adoption of mobile payments is a key theme in the existing technology adoption research, hence, previous research investigated mobile payment adoption from various ankles, integrating a set of theoretical frameworks and variables (Dahlberg et al., 2015; Zhao & Bacao, 2021). Zhao and Bacao (2021) consolidated important theoretical frameworks and the including elements applied in the mobile payment adoption context, which can be derived from Appendix A. After investigating the existing literature, three models distilled as commonly accepted and suitable for the objective of our study. Thus, the Technology Acceptance Model (TAM), the Diffusion of Innovation Theory (DOI), as well as the Unified Theory of Acceptance and Use of Technology (UTAUT) will be introduced in the following. Based on Rondan-Cataluña et al.(2015) Figure 1 illustrated the evolution of the UTAUT and TAM models. While the TAM models originate in Davis’ (Davis, 1989) adoption of the Theory of Reasoned Action (TRA) (Fishbein & Ajzen, 1975), UTAUT stems from the combination of various models aiming to provide an unified view (Venkatesh et al., 2003).

Relevant empirical studies investigating consumers’ mobile payment adoption behaviour prior to and during the COVID-19 pandemic by applying these models will then be described in the upcoming sections 2.4 and 2.5.

Figure 1 Evolution of Technology Acceptance Models (Own elaboration based on Rondan-Cataluña et al. (2015))

2.3.1 Unified Theory of Acceptance and Use of Technology (UTAUT2)

Venkatesh et al. (2003) introduced “The Unified Theory of Acceptance and Use of Technology” (UTAUT), a theoretical model, which incorporates four core variables for estimating the adoption and use of novel technologies. As the purpose of that model was to gain knowledge of Information Technology Systems in corporate or work-related contexts, it was revised to depict non-corporate technology adoption, e.g., Smartphone adoption, in the extended UTAUT2 model (Venkatesh et al., 2012). The extended UTAUT2 model incorporates three additional constructs: Hedonic Motivation (HM), Price Value (PV), and Habit (HA) and moderating factors such as age, gender and experience affecting adoption are introduced.

The UTAUT2 model serves as a foundation for various research approaches within the mobile payment adoption area and is widely adapted and transferred, hence established as a valid model for the explanation of technology acceptance for mobile payment (Dahlberg et al., 2015; Mallat et al., 2008). Consequently, the core elements of the UTAUT2 model with additional relevant elements to measure the influence of COVID-19 on adoption will serve as the primary basis for our study. The relevant elements will be described in the following for our study to provide an understanding of the UTAUT2

structure. Figure 2 illustrates the UTAUT2 model and the relationships between the elements moderated by age, gender, and experience and indicated by the numbers.

Figure 2 UTAUT2 Model

(Own elaboration based on Venkatesh et al., 2012)

2.3.1.1 Price Value

In addition to the earlier UTAUT model, the UTAUT2 incorporates the factor of PV as in contrast to a corporate setting (Venkatesh et al., 2012), consumers usually are personally responsible for any monetary cost of acquiring a new technological service or product. Hence, cost and pricing structures can significantly influence consumers’ willingness to adopt or use technology. We estimate that price value will follow a conscious or unconscious trade-off between expected value derived from a technology’s monetary costs (Venkatesh et al., 2012). However, in the European Union, payment surcharges are uncommon as these a mitigated by the PSD2 directive as a consumer at online or offline POS by payment providers. However, banks can charge their customers fees for conducting payments, as some of Germany’s smaller banks levy, thus, influencing payment behaviour. Due to the few banks levying these fees, this factor will

not be relevant in the field of mobile payment services in Germany and our study, hence is illustrated in Figure 2 with a brighter colour.

2.3.1.2 Hedonic Motivation

Hedonic motivation is the pleasure or enjoyment a consumer experiences or is expected to experience using a specific technologic product or service, which has been an important motivating factor for technology acceptance and use (Brown & Venkatesh 2005). Information Systems literature has established that certain factors influence acceptance and use of technology. Similarly, in consumer contexts, HM has been established as an essential determinant to influence technology acceptance and use (Brown & Venkatesh 2005; Childers et al., 2001). Similarly, we expect the consumer to derive pleasure through visual and acoustic stimuli when paying by mobile payment solutions as visual, acoustic, and vibrotactile stimuli can nudge consumers into specific directions (Hadi & Valenzuela, 2020; Manshad & Brannon, 2021). Hence, e.g., the vibrotactile, visual, and acoustic feedback when using Apple Pay or the Confetti Screen on PayPal could lead to greater enjoyment of using mobile payment services.

2.3.1.3 Habit

Based on prior research on technology use, HA has been adopted in the revised UTAUT2 model. Consumers tend to habitualise and perform certain behaviours automatically because of previous practice. There are specific distinctions to make as to when to equate habit with automaticity according to Kim, Malhotra, & Narasimhan (2005) and Limayem, Hirt, & Cheung (2007). On the one hand, it is derived from a continuance and temporal aspect since technology has been used. Once it has been used for a particular passage of time, mostly several months, individual behaviour becomes automated, thus, habituated. On the other hand, once a consumer recognises certain practices as automatic, it becomes a habit. Due to the operationalisation of habit as prior use, it can also factor in the experience with technology (Kim et al., 2005). However, the experience cannot solely develop into a Habit. Concerning payment methods, we expect habit to hinder the adoption of mobile payment methods when it comes to micro-payments. However, as the UTAUT primary foci are to examine consumers’ technological expectations (Venkatesh et al., 2011), it is insufficient in explaining mental expectations of using mobile payment services complementing its technological use intention during the COVID-19 pandemic.

2.3.1.4 Effort Expectancy

As part of the UTAUT2 model, Effort Expectancy (EE) describes the degree of ease of use a person believes related to using a technological system. EE derives from the key concept of previously researched TAM constructs such as Ease of Use as well as Perceived Ease of Use and Complexity (Venkatesh et al., 2003; Venkatesh et al., 2012). Drawing on previous research on EE in the field of technology acceptance and use of technology, EE was outlined as an influencing factor for Intention to Use (ITU).

2.3.1.5 Social Influence

Social Influence (SI) in the context of the UTAUT2 model is defined as the extent to which individuals perceive other individuals believe the according technology should be used (Venkatesh et al., 2003). Hence, SI and analogous the TAM construct Social Norms refer to the explicit or implicit influence of an individual’s environment and the perception of its environment on the intention to use a certain technology. Key concepts of SI derived from previous models incorporated in the UTAUT2 model can be described as subjective norms, social factors, and image (Venkatesh et al., 2012). Current literature outlines three processes of how Social influence impacts the intentional use behaviour: compliance (comply with social pressure), internalisation (altering individual’s belief structure), and identification (responding to potential social status gains) (Venkatesh & Davis, 2000). Additionally, mandatory or voluntary use of technology is important in adopting and relying on others’ opinions as, especially in mandatory situations, external opinions are crucial (Venkatesh et al., 2012).

2.3.1.6 Performance Expectancy

Performance Expectancy (PE) describes the extent to which individuals benefit from using technology to perform certain actions (Venkatesh et al., 2012). Venkatesh et al. (2003) described usefulness, extrinsic motivation, job fit, relative advantage, and outcome expectations as significant variables for PE (Venkatesh et al., 2003). Previous studies examined especially the usefulness and rapidity of the payment process as central variables in the PE within the context of mobile and contactless payments, hence positive drivers for the intention to adopt mobile or contactless payments (Karjaluoto et al., 2019; Morosan & DeFranco, 2016; Venkatesh et al., 2012).

2.3.1.7 Facilitating Conditions

Facilitating Conditions (FC) describes the individual’s perception of available resources and support to perform or use a particular technology. Applied to mobile payment services, FC define the operational infrastructure supporting the use of mobile payments (Oliveira et al., 2016; Venkatesh et al., 2012). The higher the perceived accessibility of the resources, the higher the intention to use that technology.

2.3.1.8 Intention to Use

Core elements of the UTAUT2 are Behavioural Intention and Use Behaviour. In line with previous studies, we will refer to users’ intention to use mobile payments by the element Intention to Use (ITU) that combines Behavioural Intention and Behavioural Intention to Use from the TAM (Baudier et al., 2021; Davis, 1989; Karjaluoto et al., 2019; Venkatesh et al., 2012). Venkatesh et al. (2012) claim that the UTAUT2 model “has distilled the

critical factors and contingencies related to the prediction of behavioral intention to use a technology and technology use” (Venkatesh et al., 2012, p. 157). Consequently, the

UTAUT2 model and its elements aim at explaining the reason for an individual’s intention to use and use behaviour (Venkatesh et al., 2003; Venkatesh et al., 2012). 2.3.1.9 Moderating Factors

The UTAUT2 model describes age, gender, and experience as moderating factors that influence the model’s core elements differently (Oliveira et al., 2016; Venkatesh et al., 2012). At the same time, the model claims age and gender to be a moderating factor for the relationship between all of the model’s elements and behavioural Intention to Use technology, experience moderates the impact of EE, SI, FC, HM, and HA on Behavioural Intention to Use technology. Additionally, age and experience moderate the effect on Use Behaviour (Oliveira et al., 2016; Venkatesh et al., 2012).

Furthermore, compared to the original UTAUT, the UTAUT2 excluded voluntariness as moderating factor since when focusing on consumer behaviour, the mandatory adoption of technology does not apply. Venkatesh et al. (Oliveira et al., 2016; Venkatesh et al., 2012) describe that consumers do not inherit an organisational mandate, which provides the basis for any mandatory use of technology. In the context of COVID-19, the absolute mandatory use of contactless methods in Germany and the payment environment does not apply since the usage of such technologies in terms of hygienic measures were

recommended but not forced (WHO, 2020). Consequently, mobile payment services, especially in the context of contactless payments at the in-store point of sales during the COVID-19 pandemic, did not underly any absolute mandatory character, while the social pressure created a societal expectation for an adaption (Betsch et al., 2020). Nevertheless, this condition is covered by the UTAUT2 elements of SI and FC. Hence voluntariness will not be included in our study.

Additionally, recent statistics focusing on the demographic variables of POS mobile payment usage in Germany indicate that age, gender, and income influence the adoption of mobile payments (Statista, 2021d). Following Statista (2021d), POS mobile payment usage is exceptionally high for individuals between 25 and 44 years old, male and with high income.

2.3.2 Technology Acceptance Model (TAM)

The TAM has been developed and applied to study technology acceptance behaviours in various IT contexts and sheds light on determinants on the ITU and predicting acceptance of information systems and information technology by individuals. The TAM presents two relevant belief variables: Perceived Ease of Use and Perceived Usefulness, representing the primary driver of the user’s intention to technology use. Perceived Usefulness is the degree to which a user expects a particular technology to enhance their performance by its use; Perceived Ease of Use describes the degree to which a user expects to use a technology free of effort (Davis, 1989). This model garnered comprehensive support, and researchers have produced relatively consistent results on users’ acceptance behaviour (Di Pietro et al., 2015). Consequently, Venkatesh & Davis (2000) have further developed the TAM 2, where the factor of attitude has been removed and added subjective norm in addition to other hypotheses such as image, job relevance, or experience. Several additions and modifications of the original TAM model have been proposed to examine different phenomena and antecedents for mobile payment adoption in literature. In addition, many prior empirical studies have combined different models such as TAM and DOI and their elements, e.g., in conducting consumers attitudes towards mobile payment services in Sweden (Arvidsson, 2014). Since TAM and the UTAUT theories are closely linked, the elements can also be linked to each other, hence Appendix

B presents a more detailed view of how the elements relate to each other and from which theory they stem from.

2.3.3 Diffusion of Innovation Theory (DOI)

The diffusion of innovation theory (DOI) provides an understanding of how a product or service gains traction and disperses itself throughout a population (Johnson et al., 2018). Further, Rogers (2003) defined diffusion as a process by which an innovation spreads across a social system over time, suggesting that compatible, simple, triable, relatively practical, and innovative visual solutions were likely to be adopted quickly. Hence, academic researchers have used DOI to investigate consumers’ adoption of innovation or technology in different areas contexts such as online shopping (Bigné‐Alcañiz et al., 2008), online banking (Van der Boor et al., 2014), or multimedia messaging services (Hsu et al., 2007). Distinctively, Johnson et al. (2018) have examined limitations of rapid adoption m-payment (mobile payment) services through the lens of DOI while focusing on the impact of perceived risk. Nevertheless, the COVID-19 pandemic has been expected to have had a significant effect on the mobile payment services’ security and privacy concerns.

Furthermore, we expect Personal Innovativeness (PI), “the willingness of an individual

to try out any new IT” (Yi et al., 2006, p. 351), to play an essential role in determining

the outcomes of user acceptance of technology. Consequently, we will apply the construct PI of the DOI for understanding drivers of the recent adoption of mobile payment services in the context of our study.

2.4 Mobile Payment Adoption Research

Reviewing the relevant academic mobile payment literature, three significant research fields that so far have been targeted for empirical studies of mobile payment services appear. Dahlberg’s et al. (2015) literature study is focusing on mobile payment literature from 2007 to 2014 and outlines that strategy and ecosystems, technology, and adoption are the three major key concepts investigated, which additional studies confirm (Dahlberg et al., 2015; Flavian et al., 2020; Schilke et al., 2010). In general, the adoption of technology has been a phenomenon studied intensively, leading to various models such as the previously described UTAUT2, TAM, and DOI, trying to understand the variables of consumer adoption of technology. Screening the literature revealed that most of the

recent mobile payment literature follows these three themes outlined by Dahlberg et al. (2015) and combines the themes with various models of the information system field, hence increasingly perceive mobile payment as an interdisciplinary theme. Additionally, social sciences and psychological aspects were added to support existing understanding beliefs (Flavian et al., 2020; Sun et al., 2016). Hence, e.g., previous technology adoption models are combined with elements like mindfulness to enrich the validity of the explanation (Flavian et al., 2020; Sun et al., 2016).

Previous literature on mobile payment adoption investigated various elements, their relationship and their impact on the adoption of mobile payment services. Oliveira et al. (2016) proved in their study a significant impact of compatibility, perceived technology security, performance expectations, innovativeness, and social influence on mobile payment adoption. Additionally, they claim those elements impact the intention to recommend the technology (Oliveira et al., 2016). Further, the study did not reveal a statistically significant impact of EE, FC, HM and price value on the intention to adopt mobile payment services (Oliveira et al., 2016). Karjaluoto (2021) and Slade and Dwivedi et al. (2015) utilise similar elements, based on the UTAUT2 model explaining technology acceptance behaviour. While Karjaluoto (2021) proved a significant impact of EE, PE, and HA, they rejected the influence of HM on the intention to adopt mobile payment.

In contrast, Slade et al. (2015) rejected the influence of EE but integrated the elements of Innovativeness and Perceived Risk (PR) and reveals a significant effect on ITU. They argue that the higher the risk of using mobile payments is perceived, the lower the intention to use and the more tech-savvy and innovation drives users to perceive themselves, the higher the intention to adopt mobile payments (Slade, Dwivedi, et al., 2015). While the significance of EE as determining factor for adoption behaviour differs throughout the literature, previous research commonly highlights the major influence of PE on the intention to use mobile payment services, even though various determinants were investigated and different connections, e.g., to EE, SI or Risk as a determining constructs for PE applied (Khalilzadeh et al., 2017; Oliveira et al., 2016; Slade, Dwivedi, et al., 2015; Zhao & Bacao, 2021). Additionally, Karjaluoto (2021) integrated and confirmed, similar to Slade et al. (2015), PR, besides items of the consumer brand engagement model, thus confirmed the influence of users’ interaction with the mobile

payment service provider and the brand loyalty. As previously mentioned, Flavian et al. (2020) emphasise mindfulness as a central factor influencing the adoption behaviour. Additionally, the authors provide empirical data outlining Perceived Ease of Use, Perceived Usefulness, Subjective Norms, and Attitude to significantly influencing mobile payment adoption behaviour (Flavian et al., 2020). Mindfulness is also claimed by Sun et al. (2016) to highly emphasise the importance of the perceived usefulness of mobile payment services.

In reaction to the completely new circumstances driven by the COVID-19 pandemic, mobile payment research models and models examining the impact of COVID-19 on other technology acceptance need to be investigated for validity (Baudier et al., 2021). As the pandemic is still ongoing, there is little academic research aiming at the impact the pandemic has on current beliefs and existing models explaining the behaviour of mobile payment and technology adoption in general. Some researchers aimed to provide new insights into the impact of certain geographical areas or technologies, including mobile payment-related fields. While Baudier et al. (2021) investigate the impact of COVID-19 on patient’s perception of teleconsultation, Zhao and Bacao (2021) investigate the COVID-19 impact on mobile payments in China, and Flavian et al. (2020) focus on mobile payment adoption in Spain and the USA during the pandemic. These studies provide important insights into the impact of the pandemic on technology acceptance and adoption but utilise a specific frame.

Consequently, they argue that further research is needed to fully understand the impact of COVID-19 on mobile payment services and validate their results. At the same time, Baudier et al. (2021) claim that their results might be applied “not only in a medical

context but also for the adoption of other technologies, which help to avoid direct physical contact, such as contactless payment” (Baudier et al., 2021, p. 7), and Flavian et al. (2020)

emphasise the geographical focus of their study impacting the transferability. While Flavian et al. (2020) base their research on the technology acceptance model (TAM), Baudier et al. (2021) and Zhao and Bacao (2021) found their research model on the UTAUT model complemented with specific elements. While Baudier et al. (2021) and Zhao and Bacao (2021) commonly rejected the influence of EE on the behavioural intention to adopt mobile payment during the pandemic, they describe different results

for SI as Zhao and Bacao (2021) reveal a significant prediction power of SI for ITU as well as for the Perceived Benefits (PB) related to mobile payments while Baudier et al. (2021) outlined no relation between SI and ITU. Additionally, Baudier et al. (2021) introduced Contamination Avoidance (CA) initially and Availability (AV) as determinants for PE during the pandemic, which they confirmed as an integral predictor. Similary, Zhao and Bacao (2021) verified EE and trust as predictors for PE. Relating the Trust and PR elements, both authors confirm that the perception of security and safety connected to mobile payments influence the adoption behaviour (Baudier et al., 2021; Zhao & Bacao, 2021). Furthermore, similar to Slade’s et al. (2015) and Khalilzadeh’s et al. (2017) prior pandemic research on mobile payment adoption, Baudier et al. (2021) confirmed the impact of SE and PI while contextualising them towards EE in regards to telemedical technology acceptance during the pandemic. Conjointly Baudier et al. (2021) and Zhao and Bacao (2021) confirmed the research findings before the pandemic, that PE represents the main driver for the intention to use mobile payments, though they integrated different first-level determinants.

2.5 Mobile Payment Research in Germany

When reviewing the literature about mobile payment services, the investigated databases reveal that there has been little academic research on mobile payment services in Germany. Exemplary, when executing a basic search with the term “mobile payment” on the Web of Science database, it displays more than 2,600 results, which reduces to 12 when searched for “Germany” in any field within the search results. Additionally, applying the same search in Scopus, using “mobile” and “payment” as search terms included in title, abstract, or keywords, results in more than 4,600 research papers and reduces to 61 when adding “Germany” and limit the subject to the business, management, and accounting fields to remove technically focused research.

In the academic literature, two relevant studies investigate mobile payment services adoption in Germany. Gerpott and Meinert (2017) investigated in their study „Who signs up for NFC mobile payment service? Mobile network operator subscription in Germany” how mobile payment service users differ from non-users and how this affects their actual use behaviour. While Gerpott and Meinert (2017) investigated a sample group of mobile payment service users by accessing data from a mobile network operator, hence relying

on secondary data, Schilke et al. (2010) created a sample group representative of the German population and covering all variances. Gerpott and Meinert (2017) claim that their study further extends mobile payment adoption research as they shifted from user perceptions as determinants to objective user characteristics. Hence, they revealed that early adopters of mobile payment services tend, e.g., to own a higher-priced smartphone with a smaller screen and the intention to adopt mobile payments highly correlates with mobile communication service subscription usage like music streaming subscriptions (Gerpott & Meinert, 2017).

In contrast, Schilke et al. (2010) focused on understanding consumer acceptance of mobile payment services in Germany and outline determinants that influence the acceptance through their conceptual model based on an extension of the TAM. The authors outline “strong effects of compatibility, individual mobility, and subjective norm” (Schilke et al., 2010, p. 209) on the acceptance of mobile payment services. However, they outline perceived compatibility with accounting for 82% by far as the main driver for the intention to adopt mobile payments. Consequently, Schilke et al. (2010) and Gerpott and Meinert’s (2017) studies differ in their research objective and research design by first investigating acceptance determinants in the perceived interaction of the user with the technology and the latter investigating socio-demographic characteristics as determinants for the usage.

3 Development Research Model and Hypotheses

Based on the literature analysis, we present our proposed research model in this chapter, which combines important constructs of the UTAUT2, TAM, DOI models and relevant items derived from previous studies that are relevant within our context to explain mobile payment adoption in Germany during the pandemic. Further, we propose hypotheses describing the relationships of the elements.

The research model presented in Figure 3 utilises the results and constructs applied by previous studies described in the literature analysis. Consequently, the theoretical model for our study applies core constructs and moderating factors of the UTAUT2 model. Further, we added factors adopted from studies that focus on the impact of COVID-19 on elements of technology acceptance theories, hence complemented the seven UTAUT2 main constructs by Perceived Risk, Availability, Contamination Avoidance, Personal Innovativeness, and Self-Efficacy. While the purple elements in Figure 3 indicate elements from the UTAUT2, the dark-grey elements are items from previous studies.

Based on the extant literature on mobile payment adoption and the research approaches to understand the impact of COVID-19 on technology adoption, we developed the research model in Figure 3 and formulated hypotheses that describe the relationship between the elements of the model. The hypotheses are derived from previous research on mobile payment and technology adoption but lack proof of validity in their transferability to understand the impact of COVID-19 on the intention to adopt mobile payment in Germany (Baudier et al., 2021; Oliveira et al., 2016). Consequently, we adapted relevant elements of previous studies and models, which led to twelve main elements moderated by age and gender. The central model’s central element is Intention to Use, as it indicates the likeliness of users to adopt mobile payments. Table 1 presents the sources from which we derived each element, the hypothesis, and the questions accordingly.

Similar to the study of the adoption of teleconsultation during COVID-19 of Baudier et al. (2020), we intend to include AV as a hypothesis and factor determining the adoption of mobile payment methods. In the context of teleconsultation, AV was tested and seen as the possibility of individuals to use teleconsultation and the possibility to experience medical consultation even if quarantining or other measures hinder in-person consultation. In the field of mobile payment services, this can be seen as greater availability of financial transactions as they do not include physical elements, which increases the availability in an environment with restricted mobility. Further, with increased prominence and emphasis on contactless transactions for consumers, there is a higher perceptibility of mobile payment services, and more businesses might offer electronic payment methods. Thus, increasing the perceived PE of mobile payment services through AV. Therefore, we posit the following hypothesis:

H1: Availability has a positive effect on the Performance Expectancy to

adopt m-payments during the COVID-19 pandemic

Contamination Avoidance (CA) is defined as the extent to which an individual adjusts his behaviour by adopting technology or habits. In modern society, there are many diseases where individuals adjust their behaviour accordingly (HIV, Ebola, or other contagions) (Celum et al., 2020). The fear of contagion can even inadvertently affect individuals’ behaviour towards objects or environments by the fear of potentially be contaminated

with germs, viruses, or infections (Hazée & Van Vaerenbergh, 2020). Individuals can project disgust physical contact in various situations, such as public transport, supermarkets, or restaurants. Thus, individuals try to mitigate such situations and take appropriate actions. In the context of the COVID-19 pandemic, there worries about the longevity of the infectiousness of SARS-CoV-2 virus particles on surfaces, banknotes, and coins as several types of germs, such as the influenza virus, have been proven to be identifiable on banknotes (Riddell et al., 2020; Thomas et al., 2008). Furthermore, when exchanging banknotes or coins, there is the possibility of unintentional physical contact with the cashier or waiter if exchanged directly and without a tray or similar as has been done early during the pandemic. Therefore, the WHO and other governmental agencies promote the use of contactless payment methods such as mobile payment. We expect that some users might have already favoured contactless payment solutions over cash before the pandemic because of fear or disgust but not as prominent as during the pandemic. Hence, individuals might perceive mobile payments as a suitable payment option to reduce fear and infections during the COVID-19 pandemic. Thus, we posit the following:

H2: Contamination Avoidance has a positive effect on the Performance

Expectancy to adopt m-payments during the COVID-19 pandemic

Performance Expectancy (PE) is defined as “the degree to which an individual believes

that using the system will help him or her to attain gains in job performance” (Venkatesh

et al., 2003, p. 447). For mobile payment services, the usefulness and swiftness of the payment process reduces transaction time during checkout, where time efficiency could be considered a clear performance benefit. Moreover, in direct payment situations towards peers, it avoids the need to carry cash. Furthermore, using mobile payment services at POS’ allows to avoid the need to verify with PIN or signature, and on e-commerce one can refrain from checking into your bank account for transfers. Khalilzadeh et al. (2017) examined the determinants of NFC-based contactless payment acceptance in the restaurant industry and found that utilitarian PE has a more substantial impact on intention to use contactless payment systems than hedonic PE does. Similarly, Morosan and DeFranco (2016) found that PE is the strongest predictor of intention to use NFC-based contactless payment system in hotels. In the m-banking services adoption context, Oliveira et al. (2014) found that, inter alia, PE positively affects the behavioural intention to adopt. In addition, Herrero and San Martín (2017) found out that one main

driver of users’ Intention to Use social network sites to publish content is PE. In line with these findings, we expect PE to be the strongest predictor of Intention to Use and propose the following hypothesis:

H3:PE has a positive relationship on the Intention to Use m-payments during the COVID-19 pandemic

Effort Expectancy (EE) is “the degree of ease associated with consumers’ use of

technology” (Venkatesh et al., 2003, p. 450). Like PE, EE is also derived from the

traditional UTAUT model and variables. Several studies have investigated the relationship between EE and Intention to Use information technology and systems, such as m-banking (Alalwan et al., 2017) and mobile technologies (Oh et al., 2009). Magsamen-Conrad et al. (2015) established that EE and Facilitating Conditions (FC) positively predict tablet use intentions. Alalwan et al. (2017) showed that behavioural Intention to Use m-banking services is significantly and positively affected, inter alia, by EE. Since our study extends the original UTAUT2 model using additional constructs, we expect the constructs Personal Innovativeness (PI) and Self-Efficacy (SE) to influence EE positively. Rogers (2003) defined early adopters with a high degree of perceived personal innovativeness as comfortable with high levels of unfamiliarity and willing to experience higher levels of risk, thus, higher effort expectancy levels. In addition, SE as construct was examined in the first UTAUT model and derived from the social cognitive theory model SCT model (Venkatesh et al., 2003). It can be described as an individuals’

“judgments of their capabilities to organize and execute courses of action required to attain designated types of performances ... not with the skills, one has but with judgments of what one can do with whatever skills one possesses” (Bandura, 1986, p. 391). In prior

studies SE has been examined for predicting EE, while not continuously to be proven (Baudier et al., 2021; Maillet et al., 2015). Therefore, we posit the following hypotheses:

H4: Effort Expectancy has a positive effect on the Intention to Use to adopt

m-payments during the COVID-19 pandemic.

H4a: Effort Expectancy has a positive effect on the Performance

Expectancy to adopt m-payments during the COVID-19 pandemic

H4b: Personal Innovativeness will positively affect Effort Expectancy H4c: Self-Efficacy will positively influence Effort Expectancy

In the context of e-commerce, Guzzo, Ferri, & Grifoni (2016) have shown that Social Influence (SI) significantly predicts the frequency of use and adoption of e-commerce services in Italy. SI describes the effect on an individual’s behaviour after interaction with other people, organisation, or society. In detail, it consists of the process by which opinions can be influenced by other individuals (Friedkin & Johnsen, 2011). Thus, the concept of SI in technology adoption indicates that the external environments determine individuals’ perceived benefits of new technology. Conclusively, the opinion and advice of important peers, governments, and society can play a significant role in explaining user’s adoption of mobile payment services during the COVID-19 pandemic. Markedly, during the COVID-19, individuals are eagerly discussing recommendations, suggestions, and opinions from relevant persons, consequently, their opinions and recommendation affect the individuals’ perceptions and actions. Further, in the context of protecting oneself and the social environment, we expect an effect between CA on SI. Thus, we propose the following hypotheses:

H5: Social Influence has a positive effect on Intention to Use m-payments

during the COVID-19 pandemic.

H5a: Contamination Avoidance has a positive effect on the Social Influence

to adopt m-payments during the COVID-19 pandemic

Habits (HA) have been considerably affected by the COVID-19 pandemic and its restrictions on social contacts and routine procedures. In line with the UTAUT2 model, Venkatesh et al. (2012) proposed and validated the relationship between HA and ITU. In our context, individuals who have adopted mobile payment services prior to the pandemic will have a higher intention to use them during the pandemic. Nonetheless, even if consumers have not used mobile payment services before the pandemic, novel Habits could emerge as the new behaviour adopted during the COVID-19 pandemic could stick and displace existing habits. However, newly situation-specific adopted habits could be only temporal if users abandon mobile payment services once the cognition of the COVID-19 pandemic has weakened or one is immunised. We propose that HA is a significant driver of Intention to Use in our time frame and examination. Moreover, the effect of HA on ITU could also pose as an indicator of the strength of Habits in the context of mobile payments, thus indicating the stickiness of the adoption. Therefore, we hypothesise the following:

H6: Habit has a positive relationship with the Intention to Use.

FC refer to the potential users’ perceptions of the resources and support available to use mobile payment services (Brown & Venkatesh 2005). They are “the degree to which an

individual believes that an organizational and technical infrastructure exists to support the use of the system” (Venkatesh et al., 2003, p. 453). In the mobile context, facilitating

conditions characterise users with equipped skills for configuring and operating smartphones with mobile payment applications. The consumers who possess the operational skills and smartphone to configure and operate mobile devices will promote the use of mobile payment services. Thus, if consumers are unaware or unfamiliar with their mobile devices' specifications or their bank accounts do not support them, we expect it will affect intention to use them (Slade, Williams, et al., 2015). However, the effects of FC of mobile vary across studies in the mobile payments sector (Alalwan et al., 2017; Slade, Williams, et al., 2015) and other technology adoption (Baudier et al., 2021). Chen and Chang (2013) found that FC are positively associated with the behavioural intention to use NFC mobile phone applications. However, based on the findings from Yang (2010) and Venkatesh et al. (2012) that FC have a direct positive impact on ITU. Hence, we posit the following hypotheses:

H7: Facilitating Conditions predict the Intention to Use m-payments during

the COVID-19 pandemic.

Research on acceptance and motivation to use information technology outlines the origin of motivation to be of two types: intrinsic and extrinsic motivation. Intrinsic or hedonic motivation describes enthusiasm derived from traits like satisfaction, fun, and pleasure experienced from using technology, such as executing a payment process with a mobile device (Allam et al., 2019). Hence, the level of fun and enjoyment that mobile payment offers can predict hedonic motivation to use a service. In contrast, extrinsic motivation explains motivation created by monetarily rewarding the performance of activities, such as granting a discount for using certain payment methods. Consequently, Brown and Venkatesh (2005) and Van der Heijden (2004) argue that HM strongly influences the acceptance of technology and ITU. Sharif and Raza (2017) follow the argumentation and claim HM to impact ITU positively in the case of online banking. We argue that mobile

payment services epitomise utilitarian and hedonic values. Thus, HM supports the intention to use mobile payment services, and consequently, we propose the following:

H8: Hedonic Motivation predicts the Intention to Use m-payments during

the COVID-19 pandemic.

Perceived Risk (PR) is associated with perceived uncertainty and the expectation of losses through performing actions or using products. Hence, in the case of our study, PR refers to the perceived potential of losses and uncertainty associated with the payment process performed with a mobile device. Within digital retail contexts, PR negatively influenced ITU (Marriott & Williams, 2018). Applied to mobile payments ensuring safe procedures requires security protocols to be implemented and prevent security vulnerabilities. Common security aspects that might lower users’ trust in mobile payment services are that the transaction is performed through a mobile device, including another party in the transaction process other than the financial institution, which is the most visible participant for a user within a transaction process. More relevant aspects are the transaction authentication through the mobile device’s PIN code, which might be a vulnerability, and risks related to the NFC as a relatively new technology might arise. Hence, we posit the following:

H9: Perceived Risk has a negative relationship with the Intention to Use.

As included by Venkatesh et al. (2012) in the UTAUT2 or the Karjaluoto et al. (2019), usage intention of contactless payment systems in Finland examined the effect of gender and age on ITU with unclear significance levels. However, there is predominant support regarding previous research that male individuals are more likely than their female counterparts to use mobile payment methods (Gerpott & Meinert, 2017; Ginner, 2018). In addition, technology acceptance studies have found negative relationships between age and the inclination to use and adopt new technologies (Morris & Venkatesh, 2000; Morris et al., 2005). Thus, to test the moderating effect of gender and age we propose the following hypotheses:

H10a: Gender moderates the relationships among the constructs of the

model.

4 Methodology

In the following chapter, we outline our research method and motivate the choices. Accordingly, we describe overall concepts of research philosophies, followed by explaining our research approach and strategy. Further, we describe the applied methods for our data collection and data analysis. Lastly, we describe how we ensure the quality of the research and the measures taken to respect ethical considerations.

4.1 Research Philosophy

The research philosophy investigates and clarifies the relationship between the gathered data and the theory. There are several reasons why research philosophy has to be considered in a research study. Researchers get an understanding of the role and significance of their research methods. Furthermore, the research philosophy supports the researchers in finding and defining the right research design and guiding the research design choices (Easterby-Smith et al., 2018).

Figure 4 Methodological Implications of Different Epistemologies (Own elaboration based on Easterby-Smith et al. (2018))

Within the research philosophy framework by Easterby-Smith et al. (2018), two primary constructs, ontology, and epistemology play a significant role. The ontology explains the view onto the reality, whereas epistemology refers to the surrounding, the nature of the world, finding out what is knowledge and what we do know. The ontologies differ from another, and one can distinguish between realism, internal realism, relativism, and nominalism. The differences are the understanding of the truth and facts. Regarding