J

Ö N K Ö P I N GI

N T E R N A T I O N A LB

U S I N E S SS

C H O O LBusiness Developer

-What’s behind the title?

Master Thesis within Business Administration

Credits: 30 ECTSAuthor: Johannes Fyrpil

Tutor: Anders Melander, Ph.D. Jönköping January 2012

Abstract

Business development or to develop the business, sounds quite obvious what it is all about; to take it to the next level. But to take the business one step further can be done in many different ways and with this in mind the purpose of the study is to examine and increase the understanding of the phenomena business development. This was done by carrying out a qualitative study, and more specifically an exploratory one, to see what is behind the title of people working with business development. What do they do and how do they do it?

The study shows a number of focus areas that are common among these business developers, mainly to find and exploit new opportunities. This lead them towards the main goal with their positions and what they do, namely to increase profitability and growth. What also got obvious during this study is that even though they carry similar titles, they have very different responsibilities. A pattern appears among the sample, that the bigger organizations seems to have a harder focus on business development while the smaller companies have more divers work tasks that goes beyond the scope of business development.

Table of Contents

1. Introduction... 1 1.1 Purpose ... 2 2. Theoretical framework... 2 2.1 Corporate entrepreneurship... 2 2.2 Business Development ... 4 2.3 Strategy... 62.4 Relationships and modes of growth ... 7

3. Questions... 9

4. Methods ... 10

4.1 Research approach and methods ... 10

4.2 Sampling... 11

4.3 Data collection... 11

4.4 Analysis ... 12

4.5 Validity and reliability ... 13

4.6 Critic of method ... 13

5. Empirical findings... 14

5.1 Sandvik Material Technologies... 14

5.2 Realsec ... 15

5.3 Leax... 15

5.4 MPR... 16

5.5 Saab North America... 17

6. Analysis and discussion ... 18

7. Conclusion and further research ... 22

8. Afterword ... 23

9. References... 23

Figures

Figur 1 As Seen in Chiesa & Manzini (1998)... 8Figur 2 As seen in Chiesa & Manzini (1998)... 9

1

Business Developer

-What’s behind the title?

Johannes Fyrpil

11

Jönköping International Business School, P.O Box 1026, SE-551 11 Jönköping, Sweden. fyjo0911@student.hj.se

1. Introduction

When hearing the words business development or to develop the business, growth comes quickly to mind for most of us. But to grow is becoming a challenge as the world is evolving to become more and more globalized, and competition is not bound by geographic location, “[n]o company has sufficient resources itself to satisfy the requirements of any customers” (Håkansson & Ford, 2002, p.137). This requires organizations to be able to adapt more quickly to threats in markets they are present in (Ashkenas, DeMonaco, & Francis, 1998; Zahra, Hayton, Marcel, & O’Neill, 2001; Zahra, Neck & Kelley, 2004).

Growth is a big term and can indicate many different things, but as Nicholls-Nixon (2005, p. 77) mentions “[g]rowth helps to establish legitimacy, achieve economies of scale, attract investment capital, and increase profitability” and this is the desired end state one might get from growing. There are a number of different ways or modes to achieve this most wanted state of growth both internally and externally such as strategic renewal, acquisition, joint venture, and venture creation etc., but through these different modes one does not only grow if they are successful, but are also able to develop new knowledge and skills (Collins & Porras, 1996; Garvin & Levesque, 2006; Naldi, 2004; Roberts & Berry, 1985; Sharma & Chrisman, 1999; Stevenson & Jarillo, 1990; Thorén, 2007).

According to Davis and Sun (2006) business development has received little attention in scholarly work even though its importance to firm growth, and Giglierano, Vitale and McClatchy (2011) mentions that due to the early stage this concept is in, no common language or definition has yet been agreed upon. The same is also true for the organizations practicing it, but the common understanding is that business development is about creating new revenue for the company (Davis & Sun, 2006).

So who then are responsible for this development? The business development managers are today the one responsible in many organizations (Giglierano et al., 2011) and he or she might have titles such as “Head of Business Development” or “Business Developer” and others. These type of titles and positions are something that seems to be in vogue when looking at career sites and meeting people at events. But what does one do that possesses

2 such a position? What is part of the work description? Current literature on the subject suggests that “[b]usiness developers are responsible for finding opportunities and preparing new business” (Davis & Sun, 2006, p.148) and that the time-scale is more long-term than compared to marketing that covers a shorter time span (Davis & Sun, 2006).

The study will focus on what the responsibilities people working with business development have, what they do and why they do it. So ultimately it is to explore what business development is as a concept from a business developer’s point of view.

1.1 Purpose

The purpose of this study is to examine and increase the understanding of the phenomena business development.

2. Theoretical framework

The theoretical framework aims to broaden the knowledge that is required to understand the subject of business development. And as mentioned in the introduction business development is about creating new business and growth. This is also a big portion in corporate entrepreneurship (Kuratko, Montagno & Hornsby, 1990), which is first explained in this chapter followed by a section on business development and discusses the literature on the subject. This is then followed by a section on strategy, which is important as it guides the organization towards new ground (Porter, 1996) and a final section looking into theory concerning relationships and modes of growth which is mentioned to have an important part in business development by both Davis and Sun (2006) and Håkansson and Ford (2002).

2.1 Corporate entrepreneurship

As business development is a form of corporate entrepreneurship (Davis & Sun, 2006) this is first to be explained in this theoretical framework. This particular subject has received increased attention both by scholars and by the business world (Garvin & Levesque, 2006; Naldi, 2004; Sharma & Chrisman, 1999; Stevenson & Jarillo, 1990; Thorén, 2007 and many more), but according to David and Sun (2006) not yet enough. The concept of corporate entrepreneurship had long been seen as impossible, as “[e]ntrepreneurial and administrated (“bureaucratic”) economic activity have long been considered essentially opposite forms with little if any connection.” (Burgelman, 1983, p. 1362), also mentioned by Stevelson and Jarillo (1990).

In the cradle of corporate entrepreneurship Burgelman (1983) wrote about the connection between entrepreneurship and the organization, corporate entrepreneurship. He writes about how autonomous strategic behavior and strategic context influences the concept of corporate entrepreneurship, and how this concept influences the induced strategic behavior and the structural context. Burgelman (1983, p.1350) explains that “autonomous strategic behavior provides the raw material – the requisite diversity – for strategic renewal. As such, autonomous strategic behavior is conceptually equivalent to entrepreneurial activity – generating new combinations of productive resources – in the firm”. Kuratko, Montagno and Hornsby (1990, p. 49) state that “[t]he implementation of corporate entrepreneuring or intrapreneurship is becoming an important activity for growth-oriented businesses”.

3 Burgelman (1983) also mentions that top management should tolerate corporate entrepreneurship because it might broaden the firm’s capabilities and can find synergies within the existing resources in the organization. Through these entrepreneurial activities it can help to increase competitiveness and might also help the firm to leave or enter different market segments. When Burgelman (1983) mentions the big potential that he sees in corporate entrepreneurship, I get quite surprised when he uses the word tolerates rather than encourage. One explanation can be that it is far from the daily routines needed to run a company even though it might generate a lot of advantages.

It is not easy to have focus on both the current business and to seek out and nourish the new ones, Garvin and Levesque (2006, p. 102) suggest that companies “must become Janus-like, looking in two directions at once, with one face focused on the old and the other seeking out the new”. This does not come easy for most organizations as new businesses needs to have a flexible and evolving structure and may not even be fully understood by the already existing businesses that are well defined, predictable and usually stands for the majority of a company’s revenues (Garvin & Levesque, 2006; Lei & Slocum, 2005). With this in mind one can wonder if business development can be considered the second face that is looking into the future, a way for organizations to divide the focus between the present and the future.

These differences can, according to Garvin and Levesque (2006), create a few challenges and they speak about three of them. First, most new businesses lack hard data, they are hard to forecast and it is not uncommon with large mistakes. Second, as new businesses require innovation and fresh ideas, it also requires unconventional people to lead these new businesses. But most the people suitable for leading these new businesses have a problem with separating good ideas from bad. The third is that most new businesses have a bad fit with most systems, above all systems for budgeting and human resource management, this bad fit is mostly due to the uncertainty of how the new businesses are going to evolve, so long term financing and staffing are hard to plan for.

Most organizations response to these challenges is, according to Garvin and Levesque (2006), to strong. Organizations try to either keep the new businesses within the existing pipelines with a big chance of suffocating the new and much smaller organizations. This can occur when they do not get the support needed to evolve, the existing businesses ignore their existence and without this support they will lose traction and eventually disappear.

Another way organizations react on new business creation is to make them a totally standalone unite without hard connections to the existing organization. This have the advantage of freedom and support with resources, the problem is when it is time to integrate the new venture in the existing organization. The new business have had time to create a culture of its own with its own routines that can be far from the ones of the mother organization.

To get corporate entrepreneurship to work one must not use either of the extremes, but a balance of both ways as suggested by Garvin and Levesque (2006). One must not be afraid to develop the strategy by trial and error, within reason. And to use existing resources be maximize benefits from the new businesses, such as experienced leaders in key positions in new businesses to get support from the parent organization, existing distribution channels and existing business networks. Garvin and Levesque (2006) also suggest that one does not have

4 to be purely entrepreneurial all the time but that is also requires disciplined management, and use both old and new processes to benefit the most from new businesses.

The globalization has made many markets change, forced technological change and driven companies to expand out on the international market in order to find growth and increased profitability (Zahra et al., 2001). This is according to Zahra et al. (2001) a good opportunity to expand not only within known technologies but also within unknown with the help of local players in either partnerships or through acquisition. This will help to improve current capabilities within the organization but at the same time create new ones and this is something that Zahra et al. (2001) state can be accomplished by applying corporate entrepreneurship, “[c]ompanies use ICE (international corporate entrepreneurship) to acquire knowledge developed in other markets and then incorporate this knowledge into their operations” (Zahra et al., 2004, p. 146). But “[o]rganizational competencies can and do decay quickly, requiring managers to invest heavily in replenishing existing competencies and building new ones” (Zahra et al., 2004, p. 166).

But this is not done easily and just as Garvin and Levesque (2006) and Zahra et al. (2001) brings up some challenges that needs to be conquered in order for this type of international corporate entrepreneurship can work. First, top management must learn how to manage the new knowledge that comes from entrepreneurship within the organization, both formal and informal. Second, top management must also consider the foreign entities local identity when implementing the corporate culture. This local identity is crucial for the entrepreneurial behavior within the organization. Third, top management must also implement systems that will make knowledge learned through entrepreneurship available within the organization. This knowledge sharing could, according to Zheng, Yang and McLean (2010), increase the effectiveness of the organization. The fourth and final challenge is to find the right form of entrepreneurial behavior.

With all these challenges, management has to find a balance between local responsiveness and integration when getting diversified during these expansions to a more international market (Zahra et al., 2001).

2.2 Business Development

As mentioned in the introduction business development is about creating new revenue to the company from new sources (Davis & Sun, 2006), this could be both new markets and new products (Roberts & Berry, 1985). These new opportunities are likely sprung from different forms of collaboration, “business success is viewed through the process of managing development” (O’Sullivan, 2002, p. 77).

There is according to Roberts and Berry (1985) a way to increase the success rate of new business creation. They mention four different factors that all dependent on the relatedness to the existing business. The first one is “the newness of technology” to the firm, the second is the “newness of a market”, the third is the “familiarity with a technology” and the fourth and last one is the “familiarity with a market” (Robert and Berry, 1985, p. 3). These factors or categories help decide the mode of entry, just like the selection process mentioned by Chiesa and Manzini (1998), which focus on the objective, content of the collaboration and finally the typology of the potential partner, further explained in the relationships and modes of growth section. But the evaluation process mentioned by Roberts and Berry (1985) has a bigger

5 focus on relatedness to existing business rather than the criteria mentioned above by Chiesa and Manzini (1998). But these two ways does not exclude one another, but rather complement each other as they focus on different aspects of a future collaboration. It is found by Keil, Maula, Schildt and Zahra (2008) that collaboration with other organizations increases the innovativeness in the company significantly, but “the benefits depend on relatedness of the partners” (Keil, et al., 2008, p. 906).

As markets evolve and requirements change, the companies playing in these markets have to change with it. It is proposed by Zook (2007) that no core business lasts forever and it is something we have all seen in our daily life. Zook (2007) gives the example of polaroid, who did not respond to the change of technology. But there are also examples of companies who have been able to respond to the change and adapted to new markets, such as Sony with the Walkman, it evolved from cassette to CD and to mp3 player.

But it is also dangerous to try to pursue to many markets in a way to find the next core business, this will according to Zook (2007) spread the resources thin and risk weakening the organization. Zook (2007) also mentions that there is a risk that organizations leave their core markets to early and thus loose a big part of their revenue.

To avoid any of these outcomes Zook (2007) suggests the evaluation of your current core business to see what status it is in, and also mentions that sometimes one have to shrink first in order to be able to grow. This is done by selling non-core business and if needed outsource the services still needed but not necessary to have in-house. This is in line with Grant and Baden-Fuller (2004, p. 61) who state that “[a]s large companies have pulled back their corporate borders through outsourcing and divestment of ‘non-core’ activities, they have increasingly cooperated with other companies in order to engage in activities and access resources outside their own boundaries.”

Business development is occurring more and more in project form as a way to focus the effort from the organization and all the different functions that might be included and even other companies in some cases (Burgers, Van Den Bosch & Volberda, 2008). The length of these projects depends on the scope and collaboration form selected.

Davis and Sun (2006, p. 146) define business development “as a capability comprised of routines and skills that serves to enable growth by identifying opportunities and guiding the deployment of resources to extend the firm’s value-creation activities into technological or market areas that are relatively new to the firm”. Giglierano et al. (2011, p.30) got similar results from his study and mentions that business development focuses on:

Finding new opportunities

Learning about the nature of opportunities and how to address them through direct contact with potential customer-partners

Constructing a business model for addressing an opportunity Working with partners to address the opportunity

Launching the effort to address the opportunity and learning from the experience

One can put this in relation to innovation and according to Drucker (1985, p. 67) “[m]ost innovations, however, especially the successful ones, result from a conscious, purposeful search for innovation opportunities”. The same could be said about business opportunities,

6 business development is about searching for opportunities and explore them to see if they fit within the strategy of the company. Davis and Sun (2006) suggests a gated funnel process similar to a sales funnel, but instead to follow up deals they suggest one uses it to follow up opportunities. This is a way to structure the search in business development and a good way to know when to let an opportunity go and when an opportunity suites the company and its strategy. Business development is more long term and occurs before any marketing and sales people are aware of the opportunity (Davis and Sun, 2006).

2.3 Strategy

To be successful is not as hard as to be successful over a long period of time, but to be that an organization needs a plan. And since business development according to Davis and Sun (2006) is something that occurs prior to marketing from a timeline perspective, the people working with business development must have a good idea of where the organization is heading. This is where strategy comes in, to point in a direction and according to Porter (1996, p. 75) “[s]trategy is creating fit among a company’s activities. The success of a strategy depends on doing many things well – not just a few – and integrating among them. If there is no fit among activities, there is no distinctive strategy and little sustainability”. This definition from Porter (1996) shows the importance of a good fit, or a balanced portfolio to reach long term success. Porter (1996) also mentions that when decided upon a strategy one must be able to adapt it if circumstances change, the strategy has to be able to evolve in order for the organizations to adapt to the market. This is in line with Collins and Porras (1996) that also mention that strategy is something that has to evolve as industry evolves and this ability to adapt is crucial in order to stay competitive.

One way of changing the strategy can be to change the business model. Johnson, Christensen and Kagermann (2008) give Hilti as an example of this, Hilti is a power-tool maker that makes high-end products but started to loose market shares to more low-end but good enough brands making an entrance to the market. With this new threat Hilti responded by switching from selling to renting the tools, and moved from a product based to a more service based business model.

But rather than fight over market shares with competitors and try to figure out where the threat comes from next, one can make the competition irrelevant by finding a blue ocean as mentioned by Kim and Mauborgne (2004). Kim and Mauborgne (2004) talk about the existing marketplace as a red ocean were one has to eat or be eaten to survive and the blue ocean, as just mentioned, are the uncontested market(s) where one can enjoy the benefits of first mover advantage. According to Kim and Mauborgne (2004) a blue ocean is usually created by known technology that is presented to the public in a totally different way, the difficulty is to find these opportunities. One recent example of this is Apple’s iPhone, in 2007 smartphones was not a phone for everyone but marketed to business people. With the new packaging and interface Apple found or created a blue ocean that it took a long time before any competitors dived into, making them able to have high margins and a loyal customer base.

Working with a good strategy might sound easy but one should have in mind that the financial returns on the strategy only reaches 63% for most companies (Mankins & Steele, 2005). The low return is dependent on either a bad strategy and/or a weak execution and

7 according to Mankins and Steele (2005) as well as Neilson et al. (2008), to reach a higher return organizations must develop a good and viable strategy as well as educate the ones that are in charge of executing it.

2.4 Relationships and modes of growth

As mentioned in the introduction, Davis and Sun (2006) mentions that business development is about finding new business and finding new opportunities, to do this demands good networks and relationships, but also knowledge in different ways of growing. This section gives a brief description of the above mentioned subjects.

A network can be professional or private, but can both be used in a professional setting depending on the strength of the relationship (Evans & Volery, 2001). These relationships are according to Håkansson & Ford (2002) both good and bad, they can be used to your organizations advantage but at the same time they might restrict certain areas that might have been pursued if the relationship had not existed. That it is beneficial is also stated by Chiesa and Manzini (1998, p. 199), “[t]he need for technological collaboration is increasing and benefits can be gained from participating in networks”. Håkansson & Ford (2002, p. 137) also mention that “[c]ompanies try to control the network that surrounds them and to manage their relationships to achieve their own aims.” This is also supported by Kale, Singh and Perlmutter (2000, p. 217) who state that collaborations are used “to gain competitive advantage in the marketplace, to access or internalize new technologies and know-how beyond firm boundaries, to exploit economies of scale and scope, or to share risk or uncertainty with their partners”. But before any formal collaboration exists it is normal for people to try to network at conferences and other events (Chiesa & Manzini, 1998). As networks are used to broaden the playground and with that might come new opportunities one can wonder if this is something that is used or can be used within business development.

The introduction mentioned the importance of growth and there are different kinds of modes to use in order to grow, and Sharma and Chrisman (1999) mentions that this can be done both internally and externally. And as mentioned in the introduction by Håkansson and Ford (2002, p. 137), “[n]o company has sufficient resources itself to satisfy the requirements of any customers”. This show how critical collaborations are in the business world today.

During a deep dive into literature on entrepreneurship and corporate entrepreneurship Sharma and Chrisman (1999) found three major ways an organization develop; through strategic renewal, by innovating, or by corporate venturing. They mention that these measures can be taken one by one or in a combination.

Corporate venturing can take place both within the current organization and as a standalone venture. Corporate venturing is the creation of new businesses, this make internal corporate venturing the creation of new units that resides in the already existing organizational structure (Sharma & Chrisman, 1999).

External corporate venturing is then the creation of new organizational units that resides outside of the current organizational structure (Sharma & Chrisman, 1999). Sharma and Chrisman (1999) mentions three different types of external corporate venturing: joint venture, spin-offs and venture capital initiatives. These different forms of collaboration and partnerships are far from all, Chiesa and Manzini (1998) list a few more modes for collaboration and growth, seen here in Table 1 (Some modes are also mentioned by Thorén,

8 2007; Sharma & Chrisman, 1999). Grant and Baden-Fuller (2004, p. 61) state that “[o]ne of the most important trends in industrial organization of the past quarter century has been the growth of collaboration between independent companies”.

Acquisition a company acquires another company in order to access a technology (or technological competence) of interests

Educational acquisition a company recruits experts in a certain technological discipline or acquires a smaller company, in order to obtain people familiar with a certain technological or managerial competence

Merger a company merges with another one that possesses a technology (or technological competence) or interest, and a new company emerges from the two existing companies

Licensing a company acquires a license for a specific technology

Minority equity a company buys an equity in the source organization in which a technology (or technological competence) of interest is embedded, but does not have management control

Joint venture a company establishes a formal joint venture with equity involvement and a third corporation is created, with a definite objective of technological innovation

Joint R&D a company agrees with others to jointly carry out research and development on a definite technology (or technological discipline), with no equity involvement

R&D contract a company agrees to fund cost of R&D at a research institute or university or small innovative firm, for a definite technology

Research funding a company funds exploratory research at a research institute or university or small innovative firm to pursue opportunities and idea for innovation

Alliance a company shares technological resources with other companies in order to achieve a common objective of technological innovation (without equity involvement)

Consortium several companies and public institutions join their efforts in order to achieve a common objective of technological innovation (without equity involvement)

Network a company establishes a network of relationships, in order to keep the pace in a technological discipline and to capture technological opportunities and evolutionary trends

Outsourcing a company externalizes technological activities and, then, simply acquires the relative output

Figur 1 As Seen in Chiesa & Manzini (1998)

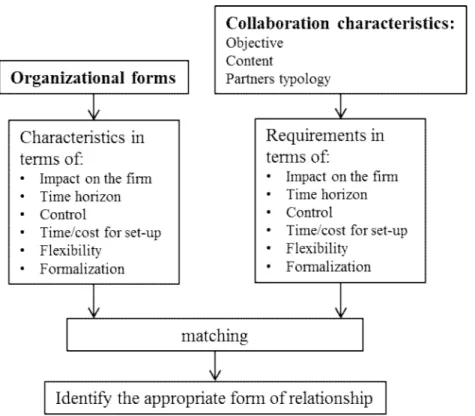

These different modes demand different things from the organizations involved and a good example of this is mentioned by Chiesa and Manzini (1998), the level of integration required differs vastly between an acquisition, outsourcing or a research contracts. This is just one of the factors that have to be considered when deciding the mode of collaboration, but according to Chiesa and Manzini (1998) one can select the mode by look into three different categories. First, the objective of the collaboration, the second is the content of the collaboration and the third is the typology of partners involved. Chiesa and Manzini (1998) have described a process with which a firm can identify the right mode for collaboration, seen

9 in Figure 1. But as firms might have different requirements there are a time were the companies negotiate on what requirements should be included in the collaboration. Chiesa and Manzini (1998) mention that the process for deciding collaboration mode is usually not standardized and formalized within most organizations. If networking is the first step and it would be managed by the business developers, the following evaluation of the potential collaborations would seem to be a natural fit for the people in these types of positions.

Figur 2 As seen in Chiesa & Manzini (1998)

It could be critical for the success of the collaboration if the right mode is not chosen, but one has to remember that these modes are not static. One might start of a collaboration with one form and then change the form as it moves into a new phase and might require new commitments from the participants, these changes could also be due to the learning process that comes from the current collaboration mode. (Chiesa & Manzini, 1998; Håkansson & Ford, 2002) How well a firm can absorb capabilities from the partnering firm depends on the pre-collaboration relationship, and the mode chosen can also be affected by previous success or failure with prior collaborations (Mowery, Oxley & Silverman, 1996).

3. Questions

In order to explore the subject under study and to be able to increase the understanding of business development a few general questions needed to be asked. This was done in order to understand what one does when working with business development. Below are four questions which were discussed with the interview subjects. These were followed by suitable follow up questions which were based on their response and with the theoretical framework in mind. This approach was used to help gain broader knowledge in the area of business

10 development from the interviewee’s perspective, the business developers. I made the questions with a focusing on what the interviewee did and their part in business development.

What do you work with?

Does your organization have a standardized process for handling business development cases?

What is your part in the work with strategy? What is the goal with your work?

4. Methods

This chapter will explain the choice of method in the empirical study undertaken in order to answer the purpose of the paper. The choice of method is clearly depending on the specific phenomena that are under study, which in this case is business development. The chapter will start off with discussing the choice of research approach and method, showing why it suits the need of the study. The chapter will then continue to discuss sampling and data collection to explain the approach taken in those areas. The chapter will then continue with a section on analysis to get you as a reader to understand the continuous process used to analyze the collected empirical data and will then discuss validity and reliability. At last this chapter will cover critique of the methods that has been chosen for this specific paper and the topic covered.

4.1 Research approach and methods

In order to be able to fulfill the purpose of this study an empirical study has been conducted. This is so that I could examine and increase the understanding of a phenomenon, thus a qualitative approach needed to be taken as it answers questions such as “why?” and “how?” (Marshall, 1996; Sachdeva, 2009). It is mentioned by Gerson and Horowitz (2002, p. 199) and Halls (2007) that this approach “aim to discover or develop new concepts rather than imposing preconceived categories on the people and events observed”. And as explained by Malterud (2001, p. 483) “[q]ualitative research methods involve the systematic collection, organization, and interpretation of textual material derived from talk or observation” and as suggested by Gerson and Horowitz (2002, p. 199) “[q]ualitative research always involves some kind of direct encounter with ‘the world’”.

But as the phenomena of business development is fairly new and not yet sufficiently researched (Davis and Sun, 2006) an exploratory study was undertaken as it is a “study of an unfamiliar problem” and “it is similar to a doctor’s initial investigation of a patient suffering from an unfamiliar malady for getting some clues for identifying it” (Krishnaswami & Satyaprasad, 2010, p. 12). This is also in line the thoughts on exploratory studies by Hair, Money, Page and Samouel (2007, p. 154), who state that they are “designed to discover new relationships, patterns, themes, ideas and so on. Thus, it is not intended to test specific research hypotheses”. This exploratory research approach leads me to the method with which I will gain the necessary information needed, which is through individual semi-structured interviews (Schdeva, 2009; Hair et al., 2007) and will be further explained in the section data collection.

11 4.2 Sampling

As the study is qualitative the sample will be smaller than if the study would have been quantitative, when the sample generally is bigger, but the sample will be big enough to provide sufficient data to answer the research question (Marshall, 1996; Cooper & Schindler, 2011). This approach requires “a flexible research design and an iterative, cyclical approach to sampling, data collection, analysis and interpretation” (Marshall, 1996, p. 523).

There are different ways of sampling or sampling methods and I have used a combination of two of them, judgement sampling and convenience sampling. Judgement sampling is when one does a “deliberate selection of sample units that conform to some pre-determined criteria” (Krishnaswami, 2010, p. 77; also mentioned by Gerson & Horowitz, 2002) and my criteria have mainly been people who are labeled as business developers (or equivalent). Convenience sampling is “involving the selection of the most accessible subjects” and there is “an element of convenience sampling in many qualitative studies” (Marshall, 1996, p. 523). (Krishnaswami, 2010; Marshall, 1996)

As mentioned above the samples are taken from a pre-determined group that is identified as business developers. The group consists of people who I have met at exhibitions or have in my personal/professional network, but it also consists of people that have been referred to me by my supervisor Anders Melander. This gives the sampling the mix between judgemental and convenience sampling mentioned by both Krishnaswami (2010) and Marshall (1996). The subjects are spread over a large geographical area, this is due to that in the sampling phase I worked in Washington DC, USA and used both personal and professional contacts.

My sample exists of the subjects seen in Figure 3 Interview subjects and company facts:

Name Title Company Turnover Empl. No. Country

Joseph Evans Vice President of Strategy and Business Development

Saab North America (Part of th Saab Group)

24 billion SEK

12 500 USA

Patrik Lindqvist Head of M&A (in the Strategic Business Development team) Sandvik Material Technologies (Part of the Sandvik Group) 83 billion SEK 47 000 Sweden

Ryan Downs Business Development Manager

MPR n/a 170 USA

Michael Thorzén Business Development

Realsec n/a 35 Spain

Gösta Hesslow Business Development

Leax Group 1 billion SEK

450 Sweden

Figur 3 Interview subjects and company facts

4.3 Data collection

There are two sources of data, primary and secondary data. Primary data consists of data collected by the researcher himself using different kinds of methods, it is data collected for the particular study. This primary data “is a reliable way of collect data because the

12 researcher will know where it came from and how it was collected and analyzed since he did it himself” (Sachdeva, 2009, p. 109). The method used to acquire the primary data for this study has been interviews.

“In qualitative research, interviews are usually taken to involve some form of ‘conversation with a purpose’” (Mason, 2002). Interviews is mentioned by Krishnaswami (2010, p. 99; also mentioned by Halls, 2007) as “one of the prominent methods of data collection. It may be defined as a two-way systematic conversation between an investigator and an informant, initiated for obtaining information relevant to a specific study”.

In this study semi-structured interviews, also called focused interviews, have been used in order to get knowledge of business development from people working with this phenomenon on a daily basis. This is in line with Saunders, Lewis and Thornhill (2009) who state that semi-structured of unstructured interviews should be used when conducting an exploratory study. The method, semi-structured interview, was selected because it creates a freedom by allowing the questions to be asked in any order and the depth in each question can be selected depending on the interviewee. This can help create a flow in the interview and thus make the most of the time available. Due to the wide spread geographical area of the subjects the interviews have been conducted over the phone. (Mason, 2002; Krishnaswami, 2010; Sachdeva, 2009) The upside with a phone interview is that it keeps costs down and saves time for the researcher. The downside is the loss of the non-verbal signs that can help read the respondent, making the researcher rely more on verbal signs. (Saunders et al., 2009) During the interviews notes were made and summarized after each interview. This was done to minimize interviewer bias that can occur during an interview, the tone of the respondent might make the interviewer question the given information (Saunders et al., 2009). The bias might also come from the respondent, this could be due the more flexible way a semi-structured interview is and might feel uncertainty to the potential probing questions in some areas (Saunders et al., 2009).

Secondary data is already established data that are acquired from various databases and produced for a different purpose than the one intended by the researcher. This is the fastest and least costly way of acquiring data but might not fulfill all the requirements necessary. (Sachdeva, 2009) In this study I tried to acquire statistical data from Monster.com (one of the world’s biggest search engines for jobs), I tried to get their statistics on how many job-ads with titles including “business development” and “business developer” over a period of time to see if trends could be detected, but I have not received any data from them.

4.4 Analysis

According to Yin (1994) analyzing data or evidence is the least developed and also the most difficult in qualitative studies. One way it can be done is in three steps: “data reduction; data display; drawing and verifying conclusions” (Saunders et al., 2009, p. 503 from Miles & Huberman, 1994). These steps have continually been used in the analysis of the different interviews. The data reduction is done in order to get a condensed set of data from each and every one of the interviews, this will help to get a better overview and simplify the data display. This reduced and summarized data is the most important information from the interviews and will serve as the empirical findings and base for this exploratory study. There is always a risk of loss and bias when reducing data but in order to continue the analysis this

13 is a necessity, but through the awareness of this risk it is somewhat reduced. The second step is to further simplify the data; this is done by put the data in matrices or networks in order to get a more visual form of the empirical data. “A display allows you to make comparisons between the elements of the data and to identify any relationships, key themes, patterns and trends that might be evident. These will be worthy of further exploration and analysis.” (Saunders et al., 2009, p. 505) In this study I have displayed the data by writing a focused text from each of the interview summaries. This approach is according to Saunders et al. (2009, p. 505) a systematic and structured one and can “help to interpret the data and to draw meaning from it”. This approach to analysis for qualitative data is seen as an interactive and continuing process and a fairly structured and systematic one. By having all the interviews down to a focused text helped me to find patterns and also to verify my findings with help of the theoretical framework. This was not done to test the theory but as mentioned, verify my findings in some degree to make shore that they make sense and if they are credible. Looking for patterns was done in order to find similarities between the different interviews and by doing so find similarities or characteristics for business development. These findings will help to deepen the understanding and knowledge of business development as a phenomenon.

4.5 Validity and reliability

I believe that the data collection and sampling methods described earlier in this section gave me interviewees who, by their position, had knowledge and ability to provide valid information of the phenomena under study. The internal validity in qualitative studies is according to Miles and Huberman (1994, p. 278) “Do the findings of the study make sense? Are they credible to the people we study and to our readers? Do we have an authentic portrait of what we were looking at?” Or more simply put, do the findings match the reality currently under study. This is not something that remains static as it involves human beings. To increase the internal validity I have summarized the findings after each interview and had the interviewee read it in order to assure its accuracy.

Miles and Huberman (1994) also mention the external validity or the generalizability of the findings. This is how transferable the study is to other settings outside of the samples presented in the empirical findings. This study is not made in order to generalize the results of our findings but to increase the understanding of a phenomenon that needs to be further explored.

To ensure reliability of the study is to ensure that the research findings from one specific investigation can be recreated by someone else and achieve the same results again (Miles & Huberman, 1994). This can be increased by having a clear view of what the aim of the study is, in this case to increase the understanding of the phenomena business development. Replication is harder to manage as a qualitative approach involves judgement, both when it comes to the findings but also in the analysis (Hair et al., 2007). And according to Golafshani (2003), as reliability is a criterion in order to assure validity, validity is sufficient to ensure reliability.

4.6 Critic of method

The sample selection has been designed in order to insure a good validity, the sample can always be bigger but it is inconclusive if that would shed any more light to the study, but

14 it might have increased the external validity. The data collection mode (semi-structured interviews) has been selected in order to get the most out of the time with each interviewee, but also to ensure an even quality of information from the different interviewees to insure reliability of the study (Miles & Huberman, 1994). The interviews will be conducted over the phone, which is a good way of getting access to respondents that are geographically inaccessible or at least costly and time consuming to visit in person. But this can according to Saunder et al. (2009, p. 349), “(reduce) reliability, where… participants are less willing to engage in an exploratory discussion”. This issue can be helped by creating a relationship prior to the actual interview, though e-mail correspondence. (Saunders et al., 2009)

5. Empirical findings

In this chapter we will take a closer look at five people who are working with business development on a daily basis. This information will then work as the basis for the analysis, to see if there are any similarities between the different respondents when it comes to what they do and how they do it.

5.1 Sandvik Material Technologies

Patrik Lindqvist works in the strategic business development (SBD) team and is responsible for merger and acquisitions (M&A). The SBD team is organized as a stab function for Sandvik Material Technology (SMT), one of five business areas within the Sandvik group. The Sandvik Group is a global high technology enterprise with 47,000 employees in 130 countries. Sandvik’s operations are concentrated on five core businesses: Sandvik Construction, Sandvik Machining Solutions, Sandvik Mining, Sandvik Materials Technology and Sandvik Venture – areas in which the group holds leading global positions in selected niches. (Sandvik, 2012)

According to Mr. Lindqvist (2012-01-07 at 12:30pm) the SBD team “is the CEO’s right hand in the organization…, what is important for the company is important for the strategic business development team”. The M&A role include mergers, acquisitions and divestments.

One of SBD responsibilities and tasks includes too frequently evaluate the company's product portfolio to secure that is fits with the strategy and objectives set by the management team and board of directors. It is a deep analysis that concludes e.g. which product segments SMT may need to exit, make further investments or initialize other initiative to keep the company's leading position, the analysis also identifies potential future cash cow. These findings will then result in different projects that will either end in a divestment, acquisitions or focus recourses where needed. Besides this cyclical path the M&A team continuously receive potential prospects that are interesting from their subsidiary companies to be evaluated. The subsidiaries are the ones closest to the market and hence are the ones, besides the management team, to identify M&A prospects and opportunities.

When the M&A team have clearance to go forth with and initiative they have a standardized project process both for M&A’s and divestments. To optimize resources and the same time secure project objectives, the processes is being evaluate and challenged after each finalized project which continuously improve SMT´s way of working with M&A projects.

15 As mention earlier the strategy is used as a guideline for how to evaluate different prospects, always having the bigger picture, where are we heading, in mind. The M&A team is, as a part of SBD team, a big part in the strategic work, both when it comes to making it but also when it comes to evaluating and reforming it. The SBD team is the one who handle the big strategically important projects and initiatives. The main goal with business development in SMT is according to Partrik Lindqvist to “increase and secure profitability and growth” (2012-01-07 at 12:30pm).

5.2 Realsec

Michael Thorzén works with business development at Realsec, it is a technology company that “develops systems and security solutions to protect the information of public and private companies” (Realsec.com, 2012-01-09, retrieved at 6:00pm). Realsec is a privately owned company with about 35 employees active in 15 countries on three different continents.

Mr. Thorzén primarily works towards the financial sector and is responsible for the Italian market. He works close to the market and are responsible to find new opportunities and prospects in his market, he is also responsible for the whole process from prospect to final sale. Besides being responsible for that, he is also responsible for planning the marketing activities in his country of responsibility, how and where they should display their products in regards to conventions and other events. According to Mr. Thorzén (2012-01-09 at 5:00pm), it is good to be seen on events or to be speakers talking about IT-security in general, “people trust a face more than just a voice”. He also stresses the importance of networking on these events, how they can work as an initial contact, creating new opportunities for partnering or sales.

Another part in his work is to explore new markets to see if it would be a good time to enter. This could, according to Mr. Thorzén be done by exploiting established channels on these markets but could also be a direct approach where Realsec goes in on their own and tries to establish themselves. The later is usually harder as it requires more resources and time to create totally new relations.

In regards to strategy Mr. Thorzén state that he uses strategy as a guide to where the company is heading when making larger decisions. He is not part of the creation of the long term strategy but gives important feedback on the strategy as he works close to the market and see major changes as they appear.

5.3 Leax

Gösta Hesslow works with business development at the Leax Group, Leax is a contract manufacturer for heavy commercial vehicles and automotive, mining- and construction industry. As they are a contract manufacturer they do not have any products of their own, but produce their customer’s products more efficient they can do on their own, mainly products that transfer rotating energy. Leax Group has a turnover of more than 1 billion SEK and has approximately 450 employees. They have had a high annual growth rate since the start in the beginning of the 1990’s, over 35% per year, through both organic growth and through acquisition. (Leax, 2012)

16 Mr. Hesslow mainly works with business development and he does this in three different ways: through acquisitions, partnerships and building relationships with suppliers. The search for prospects is done in different ways, through a corporate mediator but also through cleaver advertising. One example is when Leax used an ad in an industry paper but made it look like an interview, stating that they were looking for companies to acquire. Besides his focus on external events he is also a big part in evaluating internal investments and the risk involved. According to Mr. Hesslow the difference between an external and internal investment is small when it comes to risk evaluation, making him a good source with experience from complex acquisition evaluations.

Mr. Hesslow likes to look at other things than just the financials when a prospect is being scrutinized, he likes to go and see the company physically, to see if it is what they say it is? When Mr. Hesslow decides to look closer on a prospect he assembles a team to handle the due diligence, Leax uses a process to evaluate the different opportunities. This process is standardized on a high level but as every opportunity is unique, the lower levels are different in all the cases. As the process of acquiring a company takes a long time, sometimes years, Mr. Hesslow mentions that there are usually half a dozen prospects in different stages on a normal basis. But he also mentions that only about 20% of these prospects turn out to become part of the group.

As Leax uses acquisition to expand to other countries they also try to influence the suppliers to co-expand with them. This is to minimize cost of establishment but also to minimize supply chain cost by co-locating the facilities in the new countries. The Leax Group expands to countries where their customers are present, “the goal is to grow in order to be able to continue to be a good partner” (Gösta Hesslow, 2012-01-16 at 19:20pm).

Mr. Hesslow state that “it is important to shape the future and not become slave under the strategy” (2012-01-16 at 19:25pm), but he also mentioned that strategy is something that should guide you in the right direction. He is responsible for the strategy when it comes to acquisition and strategic procurement and also part of running the long-term strategic process, helping the board and CEO shape this.

5.4 MPR

Ryan Downs is the business development manager at the Federal Services sector at MPR in Washington DC. MPR is an engineering services company with focus on four sectors, energy, federal, nuclear and product development, and they have more than 170 engineers working in and driving projects for their customers. (MPR, 2012)

Mr. Downs is together with the Vice President of the sector responsible for the sectors business development efforts. According to Mr. Downs, he is constantly searching for new opportunities and networks with clients. One big part of his job is to get clients to understand what kind of capabilities they have, because according to Mr. Downs “if you tell people you work at Ford, they know you make cars. But when you say you work with engineering services, people usually do not understand what it means” (2012-01-23 at 19:00pm). To make this easier to grasp they have according to Mr. Downs, made changes is two different ways, first they narrowed down their services to three or four in things in their sector which are core capabilities that they do really well, but also what the market demanded. They then turned from looking inward to looking outward, to push this more focused service offering to their

17 current and future clients, creating positions for full-time business development efforts. Before this re-focus was completed MPR usually had two really good years and two lean years in a cyclic pattern. This was because during the good years no one had time to look for new opportunities as they had their hands full with their projects, but as new business in this industry takes about two years to wheel in they had to endure two lean after they had finalized their projects as it was first then they tried to find new business.

As mentioned a big part of Mr. Downs work is about finding new opportunities, but finding opportunities is not enough. These opportunities must be turned into business and this is also part of Mr. Downs’s responsibilities. According to Mr. Downs, MPR uses a standardized process in which they critically evaluate each opportunity. But due to the differences between all the opportunities the process is only standardized on a high level. When getting a case from a client they try to see the problem from the client’s perspective and not just give them what they ask for, but to try to give them what they really need.

Another part of Mr. Downs work is to understand the competitive landscape in the industry they are in, understanding the capabilities that MPR have and what kind of capabilities the competition has. See where they have the upper hand and where they do not.

Mr. Downs mention that he is part of making the strategy for his sector in the company, but with the way he works also part of revising it. A big part of the strategy the past year has been to re-focus the company in order to build a stable foundation to stand on when trying to grow in a sustainable way. He mentions that the main goal with his position is to “generate a steady flow of new business to the company so that we can grow” (Ryan Downs, 2012-01-23 at 19:20).

5.5 Saab North America

Joseph Evans is the vice president of strategy and business development at Saab North America, which is part of the Saab Group (Saab). “Saab constantly develops, adopts and improves new technology to meet changing customer needs. Saab serves the global market of governments, authorities and corporations with products, services and solutions ranging from military defence to civil security.” Saab has about 12 500 employees spread around all continents and five different business areas; Aeronautics, Dynamics, Electronic Defense Systems, Security and Defense Solutions and the last one is Support and Services. Saab has a yearly turnover of 24 billion SEK. (Saab, 2012)

Mr. Evans is together with the head of strategy and business development and one more person responsible for Saab’s business development activities in North America, which according to Mr. Evans are separated, in an organization point of view, from marketing and sales activities. This separation is done mainly from three perspectives, first is the time perspective which for business development is from around 2 to 4 years compared to marketing and sales time line, from the present until about 2 years. Second, the focus for business development is on new customers while marketing and sales focus on existing customers. Thirdly is the way business development scans the boundaries of the company’s capabilities that are not used in the North American market, to find new opportunities while the marketing and sales team focuses on current capabilities that exist in the portfolio and are on the market. These steps can be taken either alone or with a partner in order to get capabilities that complement Saab’s or to gain access to markets which could not be accessed

18 or addressed alone. Saab’s business development team has three different focus areas in which they try to build relationships or influence; these are the US government (mainly Department of Defense), the US defense industry and think tanks.

Mr. Evan mentioned that they develop and nurture an opportunity to a certain point, about when it is time to the final capture and the business development team then hands it over to the marketing and sales team in order not to cross the line that keeps them apart.

A standardized process for handling business development cases are currently not used, today experience are guiding the business development team. Although a process is under development on corporate level and will, according to Mr. Evans, who is part of developing this, be implemented in the whole Saab Group.

Mr. Evans and the business development team are the responsible for strategy in the North American market. Here they focus on things like, how do we leverage being an American company but with strong Swedish roots, still selling parts of the portfolio straight from Sweden but adapting to US requirements in the US subsidiaries. And how do we get perceived as an American defense company in order to get to compete on the classified programs. A big part of the strategic work also involves how Saab should find synergies with US partners; how to use Saab’s big international experience and US footprint as leverage to get to be a part of big American opportunities.

Mr. Evans mentioned that the goal with his work it “to identify and bring in new customers for our companies capabilities. Where the key is NEW!” (2012-01-23 at 21:10pm).

6. Analysis and discussion

From the literature studied and presented in the theoretical framework we gained information concerning business development. In this chapter of the study I will analyze and discuss the empirical findings to see if I can distinguish any patterns that repeatedly occur, but also to see if the empirical findings are in line with the theory presented. This is done to later be able to draw conclusions and to answer the purpose of this study, which is to examine and increase the understanding of the phenomena business development.

All the subjects have mentioned that they have a part in their organizations business development efforts, for the whole organization or for a part of it. This was as mentioned in the method chapter a criteria for the sampling.

As seen the empirical findings shows how the different interviewee works with business development in their company. Even though they did this in a different way one could easily find similarities in what they tried to do, find new opportunity in different ways, this is line with Davis and Sun (2006), Giglierano et al. (2011) and Garvin and Levensque (2006) but also others, but they were also responsible for evaluating and exploiting these opportunities, both external and internal. Some of the respondents were also responsible for the relationships with suppliers and their partners, showing the importance of networks as mentioned by Chiesa and Manzini (1998) and Håkansson and Ford (2002). The focus on business development seemed to differ between the respondents as some also had other responsibilities, such as a marketing planning and a sales responsibility in the case of Realsec and internal investments evaluation for Leax. This might be reflected by that both these companies are smaller than some of the others, showing that business development focus can

19 be a question of resources. Because when looking at the Saab situation they separated the business development from marketing and sales activities, supporting the theory that activities included in the scope of business development can be a question of resources or just that it is still a rather undefined area as mentioned by Giglierano et al. (2011).

According to both Roberts and Berry (1985) and Chiesa and Manzini (1998) it is important to work in a structured way when deciding to either go into a new market, launch a new product or partner with another company. This is also partly in line with Kiel, et al. (2008) who mainly focused on relatedness of partner to evaluate a partnership. Most of the respondents answered that they do have a standardized process for handling business development cases, which is in line with what Chiesa and Manzini (1998) mentions, even though the process sometime where only standardized on a general level, Sandvik evaluates the process after each time they have used the process to constantly improve it. None of the respondents wanted to mention a specific process other than that some of them mentioned that they used certain gate that an opportunity has to pass through, e.g. a criteria stating future growth potential or profitability.

Zook (2007) mention the ever-changing market and that the core business which provides most of the income today may not do so tomorrow, this is exemplified by Christensen and Kagermann (2008) who shows how Hilti changed business model instead of exiting a market that would otherwise not be profitable. This is reflected by how both Sandvik and MPR worked with evaluating the company’s portfolio in order to ensure that it is in line with the company’s strategy (Porter, 1996; Zook, 2007), but also so that the market still has growth potential. Zook (2007) also mention that it is dangerous to try being in too many markets as it might spread the resources thin, that is why companies divest some parts, to be able to put resources in potential growth areas and to get a focused portfolio with core business (also supported by Grant and Baden-Fuller (2004), in order to grow one must sometimes shrink first.

As business development can be a complex matter it is suggested by Burgers et al. (2008) that these cases are to be run in project form in order to enable a large number of different departments to be part of the process in a structured way, Burgers et al. (2008) also mentions that these projects varies in length depending on scope and if other companies are part of the process. This is mentioned by Leax and indicated by Saab, that some of these cases can take years for them to get through from prospects to contract signing. Realsec also mentions that depending on the way of entering a new market the time-frame might vary considerably on when one opportunity has resulted in a finished project. That is why Leax mention that they try to have a number of them in the pipeline in different stages, Leax also mentions that only about 1 in 5 opportunities pan out to actually become a deal for them.

From the empirical findings one can see that the business development people continuously or cyclically searches and evaluates opportunities, this is in line with what Drucker (1985) talks about when it comes to innovation, you have keep looking in order to find something and it seems like the same is applicable to business development opportunities.

The strategy should not be a static thing, and according to Porter (1996) and Collins and Porras (1996) one must be able to adapt the strategy to fit the evolution of the market in order to stay competitive. This is clearly shown in all the interviews, all the respondents mentioned

20 how they either were part of creating the long term strategy or that they have a big part in evaluating it, partly due to their closeness to the market and partly because that they use the strategy as a guide to where the company is heading. The way these people work gives them god knowledge on long term strategy and markets looks and evolves. In order to be able to evaluate different opportunities knowledge of the market and strategy might not be enough, what the company offer to the market should also be part of the knowledge needed to understand if the opportunities have potential or not. All this knowledge gives the business development people a good position to find what Kim and Mauborgne (2004) labels as the blue ocean, uncontested ground. This is scenario is probably a dream, but look at the success Apple had when they launched the iPhone. This was a market that no other company in the smartphone segment had thought of, give the general public part of what the business world uses but create a package that combines ease of use and design.

As mentioned the respondents evaluated and or were part of creating the strategy, but some respondents were also in charge of driving the projects that had a big strategic importance for the future of the organization, this might be a way to increase the financial return that can be as low as 63% according to Mankins and Steele (2005) and Neilson et al. (2008).

When it comes to finding new business and exploiting new opportunities networks can, according to Evans and Volery (2001) be a good start. Chiesa and Manzini (1998) mention conferences and other events as a good place to establish these networks. This is just in line with what some of the respondents have mentioned, that networks and relationships are important for business and business development in order to achieve the objectives, to grow. And that business is at the end of the day made between people. Realsec specifically mentions conferences and other events, either by participating or to be a speaker who talks about the industry in general. To be known as an expert in your field is something that can create an interest around your company and what you do. One thing was not mentioned by the respondents were that networks can restrict a company in certain ways, this is mentioned by Håkansson and Ford (2002), but this does not mean that it does not occur. It can be information that the interviewees felt did not fit the scope of the interview.

Collaboration between companies is according to Kale et al. (2000), established in order to access new knowledge, new markets, to get the benefits of economies of scale or share risk and uncertainty. Part of this was mentioned by Leax, that they try to minimize cost when establishing themselves in other countries by asking their suppliers and partners to go-locate in or close by their new facilities. By doing this they can lower not only the cost of establishment but also minimize cost in some parts of the supply chain. By doing this they can be more competitive when it comes to price and thus gain advantage over their competition. Today price has become so important that a company has to select what to be really good at, to focus on their core business (Zook, 2007). Saab mentions the importance of partnerships to get access to otherwise higher ground. This is supported by Håkansson and Ford (2002, p.137) in their statement, “[n]o company has sufficient resources itself to satisfy the requirements of any customers” but also supported by Grant and Baden-Fuller (2004, p. 61) who state that “[o]ne of the most important trends in industrial organization of the past quarter century has been the growth of collaboration between independent companies”.

21 This focus on networks and collaborations steers us in to what many companies use these networks and collaborations for, namely growth. There are, as mentioned in the theory, a number of different ways of growing, both internally and externally (Sharma & Chrisman, 1999). But growth does not always mean more of everything; it might mean less, as mentioned by Zook (2007). This approach of less can create more was mentioned by both Sandvik and MPR, Sandvik with their cyclic manner of evaluating the portfolio and MPR when they re-focused their business.

Most of the respondents focus not only externally but also internally, as I have mentioned, when it comes to growth. This takes form in different ways, Sandvik evaluated their portfolio and different prospect to merge with or to acquire and MPR re-focus their offerings and cares for the relationships with partners and clients, Leax evaluated not only external investments but focus also on internal as they according to Mr. Hesslow are not that different from each other, Mr. Thorzén at Realsec are responsible for finding new opportunities and partners but also to run and finalize the sales process.

An interesting thing is that none of the respondents mentioned a certain way that they choose to collaborate with other companies, they rather mentioned as every opportunity is unique; it might require a different mode each time or due to the different scope of the potential collaboration/acquisition. This is in line with what Chiesa and Manzini (1998) mentions about the different modes of growth, it depends on the objective, the content of the collaboration and on the typology of the other company that are involved. But it is important to understand that these modes of collaboration can evolve and grow in different phases of the collaboration. And the respondents did not mention in what organizational structure these opportunities would take when they are finalized as discussed by Garvin and Levesque (2006). By this I mean if they would let them be a standalone organization, an external venture, supported by the mother organization or within the mother organization as an internal venture. There are up and down sides with both of these structural ways and there is no one way that can be said to be better than the other, it all depends on the venture itself.

When asked what the goal with their job was, they all answered in a similar manner: to increase the profitability and growth, to increase business, to continue grow in order to be a good partner to the customers, generate a steady flow of new business to the company so that we can grow, to identify and bring in new customers for our companies capabilities. Where the key is NEW! Here one can clearly see the connections to Davis and Sun’s (2006, p. 146) definition and view on business development “as a capability comprised of routines and skills that serves to enable growth by identifying opportunities and guiding the deployment of resources to extend the firm’s value-creation activities into technological or market areas that are relatively new to the firm”. But it is also in line with Kuratko et al. (1990, p. 49) and their views on corporate entrepreneurship, “[t]he implementation of corporate entrepreneurship is becoming an important activity for growth –oriented businesses” as it can generate “new combinations of productive resources – in the firm” (Burgelman, 1983, p. 1350). This is clearly showing that business development is about growth and that it is to be viewed as a part of or a branch of corporate entrepreneurship. It also shows the consistency of my empirical findings when it comes to the main goal of what they do, which is business development.