1

The dynamics of rent gap formation in

Copenhagen

– an empirical look into international investments in the rental

market

Martin Bonde-Hansen

Urban Studies

Master’s Programme (Two-Year) 30 Credits

VT2020-US660E-US513 Supervisor: Guy Baeten

3 Summary

This paper investigates the practices of Blackstone in the private rental housing market of

Copenhagen. Blackstone has in the last two years been under heavy scrutiny by the Danish media and politicians for speculating in the private rental market of Copenhagen and driving up rents an obscene amount. The result has been that changes to the housing regulation law has been made, in order to make it more difficult to speculate in the rental housing market in the future. There is however still little empirical data on the rental housing market of Copenhagen and much of data is based on estimates. Therefore, this paper sets out to collect data by web scraping the largest website for listing rental apartments in Denmark in order to analyze the data and compare it to the renting prices of Blackstone.

One of the mechanisms to raise the rent of rental apartments in Denmark is to renovate apartments built before 1992 to a certain standard (specified in section 5.2 of the housing regulation law). The ability to raise the rent of old apartment buildings a large amount, could appear to be a case where a rent gap is present. Therefore, the empirical data of the paper is analyzed through the lens of rent gap theory. Rent gap theory posits that apartment buildings and thus neighbourhoods loses value over time, due to both natural decay and in some cases deliberate disinvestment from landlords and other actors. As the value of apartments continue to decline, the value of land may rise due to being centrally located for example. But since the value of the property continues to decline, the landlord cannot capture the actual value of the land – that is what is called a rent gap. When the rent gap is sufficiently large, there is a possibility that gentrification starts to occur where apartments are being torn down and new ones are built or old apartments are being renovated to new standards. These actions often lead to the displacement of the previous tenants, since they can no longer afford the new and higher rent. The paper aims to investigate whether this can be said to be the case for Blackstone’s practices in Copenhagen.

By web scraping boligportal.dk for rental apartments listed in Copenhagen and Frederiksberg throughout August to December 2020, data was gathered on 4.720 rental apartments. Those apartments was used to create a baseline to compare with 43 apartments listed by Kereby, the Danish subsidiary of Blackstone. There are however some challenges to analyze rent gap in Copenhagen because of the fact that land and housing values have not been updated by the government since 2012 because of issues with their evaluation system. So other means have to be used as proxy to evaluate if Blackstone is capturing a rent gap.

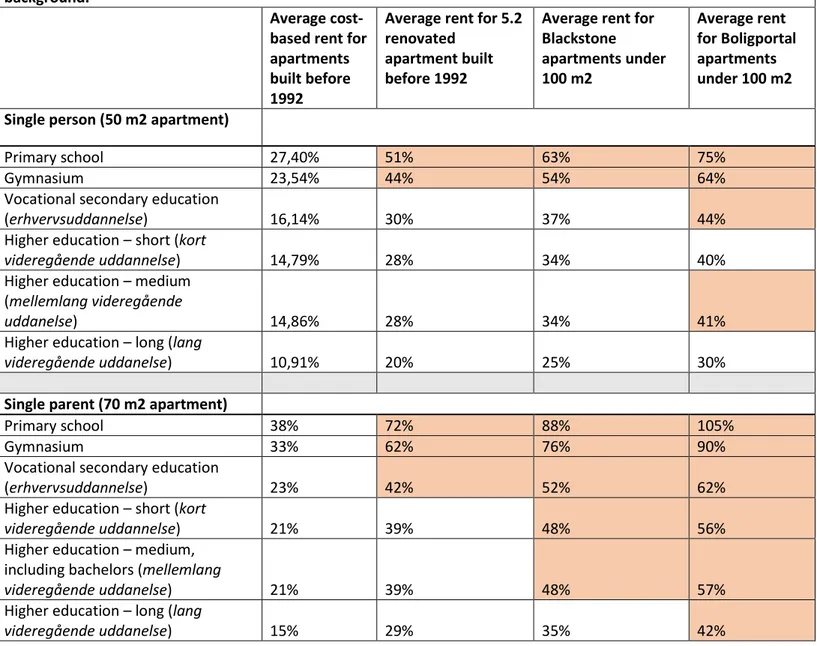

Analyzing the data, we find that the data gathered from web scraping boligportal.dk lacks some observations in the outskirts of Copenhagen and is skewing slightly higher than other reports and estimates of the average price per square metre in Copenhagen. Despite those shortcomings, the data still provides good opportunity for further analysis. The analysis reveals that the average rental price on Boligportal is markedly higher than the average price in Copenhagen in total. This suggests that some of the cheapest apartments, which has not been renovated yet and are therefore still under rent control, are being traded through social networks or through other ways. Surprisingly, Blackstone is renting out at a slightly lower price on average than the average of Boligportal, but still markedly higher than the average of rent-controlled apartments. This suggests that Blackstone is indeed making use of section 5.2 renovations but so are many other landlords that list their apartments through boligportal.dk. Finally, the analysis compares these average rental prices from Boligportal and Blackstone with the average disposable income of various demographics, which concludes that many citizens in Copenhagen would have to pay substantially more than 40% of their disposable income each month to rent out one of the listed apartments, which is what is commonly defined as the upper limit for affordable housing.

4 Key words

Rent gap theory, gentrification, housing, urban economics, web scraping, GIS, big data, Blackstone Acknowledgement

This thesis is dedicated to Eli Marie Bonde-Eriksen. May you grow up in cities where the concrete feels softer and the streets are full of compassion.

5

Table of Contents

1.0 Introduction ... 6

1.1 Problem statement and research question ... 8

1.2 Previous research on the Danish housing market ... 9

1.3 Layout of the paper ... 10

2.0 Method ... 11

2.1 Research design and methods applied ... 11

2.2 Limitations of study ... 13

2.3 Primary data ... 14

2.4 Reliability of data ... 14

3.0 Theory ... 16

3.1 Rent gap ... 16

3.2 Critique of rent gap ... 18

3.3 The empirical challenges of rent gap ... 18

3.4 The scale of rent gap theory ... 19

3.5 Rent gap theory in a Danish context ... 20

4.0 The housing market of Copenhagen ... 21

5.0 Analysis ... 24

5.1 The data from Boligportal ... 24

5.2 The apartments of Blackstone ... 31

5.3 Section 5.2 and the liveability of Copenhagen... 34

6.0 Conclusion and discussion ... 37

6.1 Conclusion ... 37

6.2 Discussion ... 37

7.0 References ... 41

6

1.0 – Introduction

Introduction

Since 2019 there has been a large focus from Danish media and politicians on the company Blackstone - an international investment firm with investments in real estate - and their recent investments in rental apartment buildings in Copenhagen. There has been criticism that the company is using aggressive and predatory means to acquire, renovate and rent real estate at a much higher rate for profit at the expense of tenants and the general liveability of Copenhagen. The criticism of Blackstone is also present outside of Denmark. In 2019 the documentary Push was released. The movie follows the UN rapporteur Leilani Farha as she documents an increasingly excluding housing market in various cities around the world, to the extent that UN considers it a humanitarian crisis. Farha also visits various local citizens and politicians to learn more about the methods they apply to try and resist this development of displacement. The antagonist of the documentary is the company Blackstone and throughout the movie Farha attempts multiple times to get in contact with representatives of the firm with the hope of making them change their ways. This conversation never occurs in the documentary.

These events and more has lead to a recent push for changes to housing laws in Denmark and scepticism towards investment firms and in particular Blackstone. The PR nightmare has become so bad for the firm, that they announced that their Danish branch will change their name to Kereby (a sort of portmanteau of caring city or to care for the city) and they decided to decrease the rent for 300 of their tenants (Christiansen, 2020).

These developments and this current political focus on the rental housing market in Copenhagen raises various questions. While Blackstone has taken the brunt of the criticism, it is simply one of many private actors working within the existing (and legal) capitalist system called the housing market. In order to discuss the question of if and how the housing market should be regulated, there needs to be an empirical foundation documenting the situation (and its historical development) to provide a shared and well researched starting point for conversation.

Inflation in the Danish housing market

The housing market in Denmark consists of approximately 2,9 million dwellings. These homes can be divided into a tenure structure of four types. There is owner occupied, private cooperatives, private rental and non-profit associations (which is a form of rental). Of these 2,9 million dwellings,

approximately 1,2 million are rental apartments (private rental and non-profit associations), where about 600.000 of those apartments have cost-determined rent in accordance with Danish housing laws, i.e. the rent is controlled (Transport- og Boligministeriet, 2020).

Since the 1980’s the average price for renting an apartment has increased more than consumer prices and more than single family homes and condominiums. Particularly from 1997 to the financial crisis in 2007 the real (inflation corrected) price of private rental apartments increased substantially, with an increase of 12% a year on average. In 2017 the average rent for private rental apartments had reached the previous peak level of 2007. (Transport- og Boligministeriet, 2020).

These developments has lead to concerns about the affordability and livability of Danish cities and particularly the Danish capital, Copenhagen. The difference in average consumer expenses of a home (renting or owning) between Copenhagen and the rest of Denmark has been increasing the last decade. In 2008 the average consumer expenses of a home was about 20% higher in

7 Copenhagen compared to the rest of the country, in 2017 that figure was 43% higher (Københavns Kommune, 2020, p. 36).

Section 5.1 and 5.2 of the housing regulation law

A report from 2020 evaluating the existing law concerning rental control and proposed amendments to the law, commissioned by the Danish government, concludes that this dramatic increase in prices from 1997 to 2007 was “undoubtedly connected to an increase in newly built apartments as well as

two essential changes to the law regarding rental control of private rental apartments1”. The two

laws the report refers to are the law that any apartment built after 1991 is not subjected to rent control and section 5.2 of the housing regulation law (boligreguleringsloven), which states that extensive improvements to a tenancy built before 1992, allows the owner of the tenancy to lease the apartment at a higher rent than previously.

Section 5.1 of the housing regulation law states that the rent agreement of a tenancy may not exceed an amount that covers “necessary operating expenses” and “return on the value of the property” (which is a defined percentage of the property value dependent on the year which the property was built). This is generally referred to as cost-determined rent (omkostningsbestemt leje) in Danish law. For properties with added improvements to the tenancy, the landlord may add an increase to the rent which reflects the increased value of the property due to the improvements made, this will be referred to as section 5.1 renovations. In addition to this, section 5.2 specifies that if “extensive improvements” are made to a tenancy, then a rent agreement can be set to “the value of the tenancy”2, which is often close to a free market price. It should be noted that the law refers to

a lease (lejeaftale) and not rent in section 5.2 of the housing regulation law, which means that rent increase as part of section 5.2 can only occur if new tenants move in, since rent agreements are made during the initial signing of a lease (Bekendtgørelse af lov om midlertidig regulering af boligforholdene, 2019).

There are some specifications to the concept of “extensive improvements to a tenancy” in section 5.2 of the housing regulation law. The economic investment of the improvements has to reach a certain threshold. The threshold changes yearly, in 2019 it was 2.255 DKK pr square metre or 257.894 DKK in total. These expenses are however tax deductible for the owner of the tenancy, which can result in a lower net expense in the end. The improvements also have to be made over a maximum of a two-year period. And the tenancy has to follow certain standards of energy efficiency.

1 Translated by the author

2 In Danish law the terminology is expressed in negative terms, i.e. that the rent agreement “may not exceed

8 In short, there are three types of rent models for private rental apartments in accordance with Danish law3:

Amendments to section 5.2

In response to the many stories of Blackstone and other international companies abusing the system, the government passed an amendment to section 5.2 of the housing regulation law in January 2020 which took effect in June 2020. The three most impactful changes were 1) if an apartment building gains a new owner, it is now only possible to charge a section 5.2 rent five years after the change of ownership, 2) to charge a section 5.2 rent, improvements made must now ensure that the apartment in question is at a C level energy efficiency and 3) section 5.2 rent is no longer allowed to be 10% higher than the value of the apartment (instead it has to be at the level of the value)4.

1.1 - Problem statement and research questions

Problem statement and research questions

In the last decade, apartment prices in Copenhagen have risen tremendously, and recently many are accusing international investors like Blackstone for being the cause of it by abusing an existing system, but little data is available regarding rental housing prices. The thesis seeks to provide a detailed understanding of the Copenhagen rental property market in order to assess to what extent Blackstone is using this system and what it does it do to the liveability of Copenhagen as a city?

- What is the price situation of the private rental housing market in Copenhagen, in terms of publicly listed rental apartments?

- Can it be empirically tested whether Blackstone is raising the rents of their apartments using section 5.2 of the housing regulation law?

- What are the effects of section 5.2 renovations to rental apartments on the pricing level of the city?

3 There is technically a fourth model called “the regulated value of the tenancy” (det lejedes regulerede værdi)

which affects rental properties with less than six apartments in total. The rent is however set based on comparison to determined tenancies, so for simplicity’s sake, these tenancies are regarded as cost-determined rental tenancies in the following pages.

4 Due to the wording of the previous law, a loophole existed where landlord were allowed to charge 10% more

than the value of the apartment

Cost-determined rent (omkostningsbestemt leje): rent control that affects rental apartments built before 1992 and it ensures that the rent may not exceed necessary operating expenses and a percentage of the property value.

The value of the tenancy (det lejedes værdi): affects rental apartments built before 1992 which has had extensive improvements. The rent may not exceed the value of similar tenancies based on comparisons to type, size, location, quality and condition. In cities with a large

demand and limited supply of affordable housing, the value of the tenancy can reach levels similar to market value.

Market value (markedsleje): affects rental apartments built after 1991. The rent is not restricted by any of the above mentioned rules. The rent can be set to what the tenant is willing to pay, as long as it is not “unreasonably high”.

9 Blackstone as an object of research

It might appear reactionary to focus on the firm Blackstone as an object of research, considering that Blackstone operates within the boundaries of the law and on the same terms as any other

investment firm. Indeed, in this paper Blackstone should be considered an emblematic case of a more general trend. To name one example of others practicing the same, Danish pension fund PFA Pension spent a record 6,6 billion DKK in 2018 on investing heavily in the housing markets of large German cities, like Hamburg and Berlin (PFA Pension, 2018), which drives up the prices of

apartments locally. The reason for paying particular interest to Blackstone in this paper, rather than multiple actors or the whole housing market, is threefold.

1) The Blackstone Group was considered the largest private equity firm in the world 2020, with 95 billion dollars in capital raised over the last five years (Private Equity International, 2020). The real estate branch of the company has a portfolio with a value of 341 billion dollars and operates in a large number of countries internationally (Blackstone, 2020). Blackstone has also previously dubbed themselves “the fastest growing real estate portfolio in Copenhagen”, and 83% of all acquisitions in 2019 were made by foreign investors (DR, 2019). Blackstone is therefore representative of a new type of actor in terms of investments in rental apartments and the international flow of capital5, which has

not been previously seen at this level in Denmark.

2) In 2019 and 2020 Blackstone has been mentioned multiple times by mainstream media and politicians when discussing housing politics and the current developments of the housing market in Copenhagen. After many reports of tenants being evicted or mistreated by Blackstone, their name has quickly become a shorthand for the downsides of international housing investments for many Danes. The newly passed amendment to section 5.2 of the housing regulation law has also been the referred to as the “Blackstone law” by politicians and media alike (see e.g. Sommer, 2020, Kastberg, 2020 or Risager 2020). Blackstone can therefore be considered a partial catalyst to an increased interest in housing politics and the subsequent change in law. One of the aims of this paper is to evaluate whether Blackstone’s practice is out of the norm in a Danish context or if they became a target of a more generalized practice.

3) Two recent papers investigate Blackstone’s operations in Barcelona (Garcia-Lamarca, 2020) and in Madrid (Janoschka et. al, 2020) respectively and what part the political framework played in this development. This existing research allows for a greater comparison and discussion of any findings this paper might produce.

1.2 - Previous research on Danish housing market

There has been some research about the Danish housing market, but most of it has been focused on either private homeownership or private housing cooperatives. Larsen and Lund Hansen (2015) details how political interventions has commodified private housing cooperatives and thrown this apartment ownership type thoroughly into the real estate market economy and how non-profit housing associations are in the beginning stages of a commodification process as well. Similarly, Clark et al. find that the commodification of private housing cooperatives has been exacerbated by the financialisation of the built environment which has occurred in Denmark since the 2000’s (2016). Clark and Lund (2000) evaluates the globalization of the Danish commercial property market and

5 Multiple apartments that are advertised on the website of Blackstone’s Danish daughter company Kereby, is

owned by DK Resi Holdco 1-5. Each of these holding companies have at the time of writing between 10 and 150 daughter companies themselves. These holding companies are in turn owned by a holding company called Calder Holdco in Luxembourg,

10 concludes that after a decrease in international investments in the late 1990’s, that there are

indications of an increased securitization of the market which would lead to more international investments in the Copenhagen commercial property market. It is interesting to note, that Clark and Lund remarks that the introduction of REITS on the stock exchange would lead to an increase in foreign investors (2000, p. 474), which is exactly what allowed Blackstone to gain a large market share of the commercial property market in Barcelona fifteen years later (Garcia-Lamarca, 2020). While this research is fundamental to understanding the housing market in Denmark, it does not include any research about the rental property market. Each of the housing types in Copenhagen should be treated as separate entities, since they are each subject to different laws, capital flows, supply-demand relations, social values attached and more. Supply of one housing type in

Copenhagen has shown to have an effect on the demand and prices of other housing types, but the degree and direction of the causal relationship varies (Copenhagen Economics, 2018).

1.3 - Layout of the paper

The paper is structured so that the methodology will be presented first. Here it will be detailed how the three data sets of the paper was gathered and how the data was cleaned and improved

afterwards, in order for it to be convertible into Qgis and further analysis made possible. Considerations of the limitations of the methodology and reliability of the data will also be presented.

Afterwards, the theory section will give a description of rent gap theory and the application of the theory. Considerations of operationalization and local context is given special priority, as these are some of the challenges in this paper.

Then an overview of the housing market in Copenhagen will follow. The aim of this chapter is to set the scene for the analysis and provide the reader a greater understanding of the overall

developments in housing availability and prices in Copenhagen the last decade.

In the analysis chapter the data from Boligportal and Blackstone will be analyzed. First the data web scraped from boligportal.dk will be analyzed both in terms of what it tells us about the private rental market in Copenhagen and in terms of the reliability of the data compared to other sources. Then the data on apartments rented out by Blackstone will be analyzed and compared to the Boligportal data. Finally, the average prices of the data will be compared to the average of cost-determined rent to evaluate how these practices effect the livability of Copenhagen.

The final chapter includes a conclusion and the discussion. The conclusion summarizes the findings and the discussion section reflects on how the methodology could be improved, the benefits and challenges of applying rent gap theory, and the effects of the new changes to section 5.2 of the housing regulation law.

11

2.0 - Method

2.1 - Research design and methods applied

Research design

This paper is based on a quantitative exploratory research design and case study of Copenhagen’s housing market. The goal is to test whether web scraping and big data can be an asset in solidifying and improving our information about the private rental market, which is currently the least

documented ownership type of the Copenhagen housing market (Københavns Kommune, 2018). Furthermore, this paper aims to test whether said data on the private rental market can be used to evaluate whether the private investment firm Blackstone is making use of section 5.2 renovations to raise the rent of their properties.

The three datasets

This paper will make use of three different dataset that compliment each other. The data set

concerning the overall rental apartment housing market of Copenhagen based on web scraping from boligportal.dk, a data set containing many of the apartment buildings owned by Blackstone in Copenhagen based on publicly available data from Central Business Register (det centrale

virksomhedsregister), and a data set of Blackstone apartments that are currently being listed on the

website of Kereby (the Danish daughter company of Blackstone) Web scraping – dataset 1

The data collection part of this paper was done by writing a code to web scrape boligportal.dk, the largest Danish website for leasing out apartments. The code is written in Python and can be viewed in appendix A. Web scraping is a method which allows a user to collect large amounts of data from websites by means of an automated program run by a script or code (Salganik, 2017). By specifying the data of interest, the script can for example log the data into predefined categories or variables. In the case of this paper, a script was written which logged all available apartments listed on boligportal.dk in Copenhagen and Frederiksberg Municipality with intervals of a week from August to December 2020. The script recorded a list of 50 variables attached to each listed apartment such as monthly rent, size, location, whether pets were allowed and more. The script originally recorded 7.641 observations.

Blackstone’s portfolio in Copenhagen – dataset 2

There are some difficulties in gaining an overview on exactly how many apartments that Blackstone own in Copenhagen. Visiting the website of Kereby, the daughter company of Blackstone, it is possible to find some of the apartments that Blackstone are currently offering to rent. The website does not give any information about apartments owned by Blackstone already being occupied. As mentioned in the introduction, Blackstone has a very complex company structure, which also entails a large amount of holding company for many of the apartments they own and all these companies are part of a holding company based in Luxembourg called “Calder Holdco 2”. Looking at Calder Holdco 2 in the central business register it is possible to gain some clues to the portfolio of Blackstone in Copenhagen.

By going through each major daughter holding company of Calder Holdco 2 (called DK Resi Holdco 1-5) and subsequently looking at each and every daughter company of those firms, it is possible to track many of the apartments of Blackstone because the holding firms are named after the

12 apartments they own. So for example, DK Resi Holdco II has eleven daughter companies and each of those companies are named after owned apartments, like the holding firm DK Resi Propco

Smallegade 34 ApS, indicating that Blackstone owns Smallegade 34. Cross referencing this data with apartment data from The Danish Business Authority confirms that those apartments are owned by the very same holding firms.

This method is not exhaustive of all apartment buildings owned by Blackstone, since some

apartments were listed on Kereby.com, which this method did not reveal. Nonetheless it adds to the number of observations. The total number of apartment buildings recorded in this process was 113. Blackstone apartments currently for offer – dataset 3

Out of the 113 apartment buildings found to be owned by Blackstone, there were 42 apartments in those buildings that was being leased in the period of August to December 2020. The data on those 42 apartments was gathered by visiting the website kereby.dk and manually recording the same variables as the ones available in the data set from boligportal.dk

Data treatment

After the initial data collection, there were still an important variable lacking. That is the year of construction for the apartment buildings. This is important because rent control or lack thereof is determined by construction year of the apartment, as described in chapter 2. This information is available through DAWA (Danmarks Adresse Web API), which is an API6 that provides information on

buildings for all Danish addresses.

In order to pair the data on rental apartments from boligportal.dk and DAWA, some conversions had to be made. Boligportal does not provide the specific address for listed apartments, but it provides a map showing where the tenancy in question is located, so potential buyers can get a sense of the location. The map which is used for each apartment by boligportal.dk does store the latitude and longitude for all listed apartments, even though this information is not visible to users. By requesting this data through the API of boligportal.dk, I was able to gain the exact location of all the apartments listed in Copenhagen and Frederiksberg. DAWA also stores the longitude and latitude of most buildings in Denmark. I then wrote a code that requested address data from DAWA based on

longitude and latitude for each data entry in my dataset. With the exact address for all data entries, I wrote another code that requested the construction year for each address in my data set, which allowed for a dummy variable in the data set that distinguishes between apartments (observations) built before and after December 31. 1991.

For various reasons DAWA does not contain data on year of construction for all buildings in Denmark, in some cases the API returned either “not available” or “0” for the year of construction on specific addresses that appeared in the dataset from Boligportal. So to clean out the data, all datapoints without a construction year or the construction year 0 was removed from the dataset. That exercise removed approximately 1.500 apartments from the data set.

There appeared some duplicates in the dataset, because the script does not register if an apartment has been recorded during a previous activation. This meant that if an apartment was listed for more than a week, it would be counted again next week by the script. Every listed apartment does

6 An application programming interface (API) can be considered an information database with specific

13 however have a unique ID attached to the listing. By checking for duplicates of the same ID, it was possible to remove duplicate observations.

Another point of concern is that some of the tenancies that has been listed for a long time, are ones that are too expensive or otherwise unattractive for people to rent. Looking manually through the listings for Copenhagen and Frederiksberg on Boligportal at any given point in time, one will find that there is a handful of apartments that was put on the website more than two years ago and about twenty that was listed more than year ago. To gain a dataset consisting of apartments that are competitive and respond to demand, apartments listed more than a year ago were removed. The data set from Boligportal contains a variable with a Unix timestamp for when the apartment in question was listed. A Unix timestamp is the number of seconds between a particular date and January 1, 1970. By converting the Unix timestamp into calendar dates, and cross-referencing when the data was collected, the apartments that had been listed more than a year was removed from the dataset.

A variety of variables of no interest to this paper were removed from the data set. These variables included whether online showings of the apartment were possible, the text description of each apartment, and whether it was possible to contact the landlord by email.

After cleaning the data, the final dataset consists of 4.778 apartments reduced from the original 7.641 apartments found via the script over the course of August to December 2020. Each apartment from Boligportal has 19 variables attached to it. See appendix B for the list of variables.

2.2 - Limitations of study

Traditionally studies of rent gap theory are historical and longitudinal because the rent gap is created over a period of neglect and disinvestment followed by reinvestments at a later point in time, when the rent gap makes it economically advantageous for landlords or investors. Although the data collection process of this paper has been carried out over five months, this study should still not be considered longitudinal, because of the long time frames for changes to housing markets - the average time tenants stay in the same apartment is 6,5 years on average, which is the lowest of all forms of homeownership (Transport- og Boligministeriet, 2020, p. 53). Because of the limited availability of historical data on rental prices, it was therefore not possible to track changes in value (and the possibility of rent gaps) in the same location over time in this paper.

As discussed in the theory section, the difficulty in testing the rent gap theory is distinguishing between ground value, building value and prices. While this is an issue for any research on rent gap theory, it is particularly difficult in Denmark because value assessments of land and housing has not been updated since 2012 because of issues with the government’s evaluation system. This means that using tax assessments, like e.g. Clark (1988) does in his research, is not feasible. Instead, this paper will primarily focus on increased rents through renovations of existing homes by means of section 5.2 in the housing law, i.e. renovating in order to capitalize on both the improved housing value but also the land value which previously has not been actualized fully. While this approach can easily fall into a trap of estimating rent increased by improved building value as a rent gap, the method operates under the assumption that there is a rent gap present at all apartments built before 1992 in Copenhagen because the rent control prohibits actualizing the land value which has increased over time.

14 But this raises another limitation of the study, as there currently is no precise data on how many apartments in Denmark has been renovated to an extent that allows for a section 5.2 rent increase. It is therefore necessary to use other means to estimate whether apartments have been renovated according to section 5.2 standards. That will mainly include comparing averages for price per square metre of non-renovated and renovated apartments to the observations at hand. This will provide evidence towards whether an apartment is charging rent according to section 5.2 or not.

Ethics of web scraping

One of the challenges that sociologist often face, is that doing observational studies, people tend to change their behaviour if they know they are being observed. One of the benefits of collecting data online, is that the object of study is often not aware that their information is being collected and therefore one can assume that that people are non-reactive, i.e. does not react to being observed (Salganik, 2017). While this is beneficial in terms of the reliability of the data, is does raise some questions in terms of the ethics of studies where data is being scraped online without people’s knowledge or consent (Favaretto et al, 2020). The greatest ethical concerns are when social media is being analyzed and people’s identities are connected to opinions and statements that they put forth, and researchers should be cognizant of not incurring any harm to participants because of their (unknowing) inclusion in research (Mancosu & Vegetti, 2020). Vegetti and Mancosu (2020) suggests that researcher adhere to three basic requirements when scraping data: when collecting the data of human subject’s make sure to preserve the user’s privacy, comply with all legal regulations that protect individual’s data online (in the case of Europe that would be GDPR7), and comply with the

terms of service of the website that you are collecting data from. All these requirements are followed in this paper. Terms of Service of Boligportal is followed as well as general GDPR rules. Furthermore, the data collected through boligportal.dk is not connected to individuals. While addresses are being collected and categorized, the addresses are not being related to specific individuals and the person and/or firm renting out the apartment is not being recorded (only in the case of apartments rented out by Blackstone). The other data sets are consisting of data describing the assets of Blackstone which is publicly available.

2.3 - Primary data

As mentioned previously, the primary data of this study will be the quantitative data on housing prices, and their characteristics gathered through web scraping the apartment leasing platform boligportal.dk, as well as data concerning the location of apartment buildings owned by Blackstone, as well as a subset of those apartments where the price of rent and square footage is known.

2.4 - Reliability of data

While collecting data through code is an efficient way of collecting large amounts of data without observational errors, that humans would ordinarily make, there are still some considerations to be made about the reliability of the data in terms of what data is actually being collected, what it represents and what data one might miss.

15 The first point of note should be that the rental prices listed at boligportal.dk are what landlords are asking for to rent their apartments, not necessarily what people are paying in reality. A tenant could hypothetically negotiate the price down after contacting a landlord. However, considered the high demand on rental apartments in Copenhagen, it seems unlikely that landlords would need to lower their asking price. Another anomaly in the data could be prices that are not competitive, and therefore not being leased out to anyone. Such observations would still be registered by the script since the apartment is listed. As a remedy for this weakness, apartments that had been listed for more than a year was removed from the data set.

Because of the high demand, there is a possibility that some apartments are being leased through word of mouth rather than a website like boligportal.dk. When there is a strong demand for apartments that is not being met by supply, then the need for assistance finding tenants using websites like boligportal.dk or realtors is less, because there are so many interested buyers. Anecdotal evidence confirms that many people in Copenhagen are posting on their social media either offering an apartment or looking for one. A report on housing availability in Copenhagen also observed that the apartments in highest demand were being traded through social networks (Københavns Kommune, 2018). These apartments will not be included in the data set because they are not listed on boligportal.dk. This raises an interesting point in terms of accessibility of housing in the city and social networks, but for the purpose of this paper, it will simply be noted that some apartments were not observable. The dataset is thereby more representative of the experience of a person without a strong social network, the lack of capital to buy an apartment and without

seniority in waiting lists for non-profit housing associations.

One of the hallmarks of big data collection systems, which web scraping usually is a part of, is that in many cases it is “always-on”, meaning that the system is continuously collecting data without a break (Salganik, 2017). That is not the case for this paper. The data has been collected with an interval of a week. While it is possible to write a code that checks the website boligportal.dk every minute for example, the logistics of it requires a computer that is dedicated to data collection only. Since this was not possible, a manual activation of the code every week was the solution instead. The reliability of the data is affected by this method because there is a distinct risk that the most sought after apartments are listed and leased out before the code logs it (between two points of activating the code). This would have the effect of the dataset missing the apartments with the highest demand, such as apartments with the lowest or most competitive prices or apartments at locations that are very attractive. This could affect the dataset to skew prices higher than the actual average of rental apartments in Copenhagen.

In summation, there are some considerations to be made about whether the dataset will skew housing prices a bit higher than the actual reality of the rental housing market in Copenhagen.

16

3.0 - Theory

In particular, the need to earn a profit – [is] a more decisive initiative behind gentrification than consumer preferences – Neil Smith (1979, p. 540)

This thesis will draw theory primarily from the concepts of rent gap theory and gentrification. As such, I will first detail the concepts and its history and thereafter summarize and the relation to the context and research at hand, i.e. the contemporary housing situation in Copenhagen, Denmark.

3.1 - The rent gap and gentrification

Gentrification

Originally the term gentrification is coined by Ruth Glass (1964) to describe how the gentry began to purchase tenancies in run-down neighborhoods in London, with the aim of rehabilitating these buildings and begin to live in them.

Gentrification can be understood as transformations of traditionally working-class neighborhoods in the inner city into middle-class residential areas or for commercial use. Gentrification is therefore also marked by rapid increase in property values, which often displaces low income, working-class and/or minority groups (Marcuse, 1985).

The rent gap

The rent gap theory originates with Neil Smith (1979, 1996) and is concerned with the phenomenon of gentrification of urban areas. Rather than simply looking at gentrification, and radical increase in housing prices for a neighborhood, as the result as changing consumer preferences, rent gap theory has its focus on supply-side factors to explain the disinvestment and redevelopment of urban areas. Smith (1979) argues that historically the explanations for changes to housing stock and prices, and particularly the movement of middle- and upper-class from the suburbs to city centres, has fallen under one of two categories, either economical or cultural explanations. The cultural explanation puts emphasis on cultural changes such as dropping fertility rates, postponed marriages and

increased divorces rates all leading to a shift in housing needs and therefore a return to urban areas from suburbia. These changes to preferences and demand shape the urban space in terms of land allocation, use and prices.

The economic arguments revolve around the fact that increasing distance from the city centre as cities expand and the increasing cost of constructing houses leads to reinvestments in urban centres rather than urban expansion because of the lower cost of buying degraded buildings in inner city areas and rehabilitating them (Smith, 1979).

These two explanations were often used in conjunction at the time, to account for the resurgence of middle- and upper-class return to inner city areas. But for Smith, these explanations were

insufficient. While he acknowledges that it is a symbiosis of consumption preferences and the interest of producers, the relationship is dominated by production in his view (1979, p. 540). If gentrification is observable in a city, a theory of gentrification must also explain why gentrification occurs at various speeds and in some locations before others.

According to Smith (1979), there is a cyclical nature of disinvestment and reinvestment in urban areas. Neglect, concerted disinvestment and natural decay of buildings leads to a long period of deterioration and lack of investments in residential inner city neighborhoods which in turn will lead

17 to potential for high returns from new investments because of the high value of centrally located plots of land. The main driver for gentrification is this search for high returns on investments into the built environments in urban areas and not changes in consumer preferences.

Smith separates the relationship between land value and building value in four separate concepts. House value, sale price, ground rent (and capitalized ground rent) and potential ground rent. House value is the cost of building the house (in Marx’s terms “the value of a commodity is

measured by the quantity of socially necessary labor power required to produce it”) (Smith, 1979, p. 542). Housing value is therefore separate from housing price, which is the final sale price that a consumer will pay to own (or rent) a house/apartment. There are many variables that can affect the difference between housing value and housing prices, such as consumer preferences, scarcity and location. Smith also defines sale price as house value plus capitalized ground rent. So the sale price for a tenant is paying a monthly fee both for the value of the house but also paying a fee for the use of the land (which is related to the value of the location).

Ground rent is the rent that landowners charge to the use of their land (and their buildings). Capitalized ground rent specifically is used to denote the actual amount of ground rent that a landowner is earning in a given instance – or what Smith refers to as “the present land use”. Potential ground rent is then used to conceptualize the hypothetical difference between the capitalized ground rent and a hypothetical ground rent if the land use was different and under “the highest and best use”, i.e. there was made changes to the existing building(s) on the land,

demolishing or erecting new building(s) and/or changes to what the land is being used for8. Smith

argues that location is often the underlying factor for changes to and differences between capitalized and potential ground rent.

The rent gap is then used to denote the disparity between capitalized ground rent and potential ground rent. This gap increases over time, but it is not merely due to natural decay over time. Smith (1979) argues that depreciation of capital is also due to human agency. At first an apartment building is newly constructed and the house value is therefore high. The capitalized ground rent will often rise in the beginning if it is a new neighbourhood because of surrounding urban development. The value will slowly fall due to improvements in production efficiency (it becomes cheaper to build better), the architecture goes out of style and/or physical deterioration. As physical wear and tear starts to show it will often be repaired, especially in recently constructed apartments. However, over time some landlords may find that they can receive a higher profit by undermaintaining their

properties, since the rent remains the same and their expenses become lower. If this occurs to some apartment buildings then it may spread in a neighbourhood because of a ripple effect. In some cases this can lead to active disinvestment, ghetto formation and even abandonment of apartments if landlords can no longer collect enough rent cover their expenses.

When this gap is considered large enough gentrification may be initiated by various actors such as landlords, investors, financial institutions or state actors. Smith argues that this process occurs not at the individual consumer level but at the neighborhood level in most cases. In other words, while the rent gap theory cannot tell us anything about middle class gentrifiers that move in to redeveloped apartments and neighborhoods, when one investigates the process of gentrification or cases of such, then one needs to look at the rent gap to fully understand the drivers of gentrification. It is supply side theory that takes it object of study as the property owners, developers, bankers, state and

18 municipalities and scrutinize their agency rather than the people moving into the flats, which are often the ones that are being the target of condemnation.

3.2 - Critique of rent gap

There are detractors of rent gap theory, and for the sake a more measured discussion of findings in this paper, these points of critique will be briefly summarized.

Bourassa (1993) is critical of rent gap theory because it wholly relies on the distinction between actual and potential land rent. His complaint is that the distinction does not provide any insight into why changes occur to land use or the timing of those changes. There are many examples of

neighborhoods decaying for many years and the capitalized ground rent thereby dives, according to rent gap theory there should be an increasing divide between capitalized and potential ground rent in these areas. But the theory does not explain why a developer decides to invest at a certain point in time, what specifically tips the scale into redevelopment so to speak. Bourassa argues that “the

magnitude of the rent gap has at best imprecise implications for the location or timing in land use or occupancy” (Bourassa, 1993, p. 1734).

Clark (1995) responds to this critique by questioning whether this level of precision is required in order for a theory to be useful. It is true that rent gap theory cannot predict the exact moment that redevelopment will occur or the sequence of redevelopments within a city for example. This is because, as Clark puts forth, it is inherent that the “potential” in potential ground rent, may not be actualized. In the word potential there always lies the possibility of something not occurring, that it is not reified. In the same vein, it is possible and even plausible that not all rent gaps will be closed, that redevelopment will not occur everywhere. Clark notes that potential rent gap is not a physical attribute to be uncovered but rather “it resides in the determination of agents with power and a

direction to realise [it]…” (1995, p. 1497). Rent gaps should therefore not be considered deterministic

but rather as a part of the explanation of the causal chain of when subjective actors start gentrifying a neighborhood. Rent gap theory is very cognizant of the fact that individuals and group dispositions are bound together with larger collective social relations and investments and they are in an

interdependent relationship (Slater, 2015).

Bourassa (1993) also challenges Smith’s use and understanding of his concept of capitalized ground rent because his use of capitalized is in contradiction with Marxist and neoclassical economists’ use of capitalization, which in their discourse means converting a stream of future rents into a present value. This discrepancy is noted but for the sake of continuity I will not make changes to the names of Smith’s concepts.

3.3 - The empirical challenges of rent gap theory

A third point of critique from Bourassa (1993) is that there are difficulties in applying the theory, translating it into a methodological approach and testing it empirically. When reviewing four papers that attempt to empirically research rent gaps, Bourassa notes that actual rent is hard to come by as data, potential rent is difficult to measure and local property tax appraisals are unreliable and slow to reflect changes in land value.

Clark (1988) also remarks on the lack of empirical support of rent gap theory. In an attempt to amend this, he analyzes historical data of Malmö in order to test rent gap theory. His approach is to study six land areas in Malmö from 1860-1985 from pre-development to redevelopment while trying to chart building value, capitalized ground rent and potential ground rent. Clark operationalizes the three terms the following way: he uses tax assessments to operationalize building value, sales price

19 minus building value to measure capitalized ground rent, and the difference between sales price prior to development and sales price prior to redevelopment as a measure of potential ground rent. Bourassa (1993) rebuts that tax records cannot be used to represent capitalized ground rent, since tax assessments are based on the site’s “highest and best use” rather than it’s current use, and tax assessments are therefore more apt to explain potential ground rent, according to him. In a later paper Clark (1995) responds that historical evidence indicates that in the case of Sweden, real estate appraisal is still affected by current use to a greater extent than hypothetical “highest and best use”. Ley (1986) tests rent gap theory and other theories of gentrification using data from 22 metropolitan areas in Canada (Census Metoropolitan Areas or CMAs). Ley uses a range of variables to test for correlations between gentrification and other factors, but in particular to test for rent gap he uses two variables; the ratio of inner-city housing values compared to metropolitan wide house values in 1971 and the ratio of inner-city rental costs compared to metropolitan wide rental costs in 1971. Bourassa (1993) is critical of this operationalization because he believes that even if there is a large discrepancy between inner-city costs and metropolitan wide costs, it doesn’t explain whether and why that is the case, i.e. whether a rent gap is existing or why the potential land rent isn’t being capitalized. Smith (1987) and Clark (1988) are also critical of Ley’s operationalization of the rent gap and therefore also his conclusion that the rent gap is not present in Canada. They point out that Ley’s variables refer to house and apartment prices and not land rents, and that the data shows a geographical disparity but not whether there is a rent gap in a particular space or not.

Badcock (1989, 2001) uses sales prices on land with apartments as proxies for rent and thereby actualized ground rent and sales prices on bare land as proxy for potential ground rent. By showing that bare parcels of land were being sold at a higher price than parcels of land with existing

buildings, Badcock proves that there was a rent gap present in Adelaide in the 1970’s. Bourassa (1993) argues that this is not proof of a rent gap because, as Badcock details, restrictions made by the government prohibited landlords from redeveloping small apartments into larger apartments in higher demand. Since the rent gap was induced by legislation, and the rent gap was consequently filled after the legislation was changed, Bourassa claims that it cannot be considered an example of a rent gap existing.

Kary (1988) tries to test whether the rent gap exists by comparing relative house prices in Toronto between inner-city houses and suburban houses, and by comparing relative house prices over time. Bourassa (1993) takes umbrage with this study because Kary does not showcase that there at any time was a potential ground rent that was different from the actualized ground rent. Therefore, Kary does not prove the rent gap theory exists according to Bourassa.

In summation, there are many considerations and reservations with the operationalization of the rent gap for both proponents and critics of the theory. In order to truly analyze whether there is a rent gap, one has to keenly distinguish between land value, building/housing value, sales price, capitalized ground rent and potential ground rent – and the variables used as proxies to represent these concepts.

3.4 - The scale of rent gap theory

Rent gap theory is primarily focused on gentrification at the neighborhood level. But there is no reason why the concept of rent gap cannot be transferred to a larger scale (the city) in a globalized economy. Tom Slater (2015) introduces the term planetary rent gaps to conceive of a more

20 has been quite dramatic shifts in the world since rent gap theory was originally written, and

planetary rent gaps is meant to encapsulate this new interscalarity between the local and a greater global presence from international actors and flows of capital. The more easily capital can be transferred and invested throughout the world, the more plausible the idea of targeted investments in certain cities, where there is a rent gap, appears to be. As Slater puts it “Landowners have

everything to gain from the global circulation of interest-bearing capital in urban land markets, and from the municipal absorption of surplus capital via all kinds of debt-financed urbanization projects

(2015, p. 130). Such urbanization projects are also present in Copenhagen in the form of the metro-system which is financed by selling plots of land owned by the municipality. These public goods which are financed by the municipality increases the value of plots of land in close proximity to the new metro stations for example.

The targeted investment in specific cities is also described by García-Lamarca researching Blackstone in Barcelona (2020) and Janoschka et al. (2020) researching Blackstone in Madrid. While these authors do not make direct reference to rent gap theory, it still illustrates how investment into property markets from investments firm, hedge funds and the likes are becoming increasingly globalized.

3.5 - Rent gap theory in a Danish context

The cyclical nature of disinvestment and re-investment described by Smith correlates with the history of Copenhagen the last 50 years. In the later 1970’s and 1980s Copenhagen finds itself in the situation of being almost bankrupt. Like many other cities Copenhagen is experiencing

de-industrialization which has lead to an increase in unemployment. Concurrently there is also a flight of affluent residents into the suburbs and companies are relocating to other locations, leaving Copenhagen in deep financial trouble. Through a variety of large scale projects, entrepreneurialism and political decisions throughout the 1990’s, the re-investments began to occur in the metropolis (Andersen & Winther, 2010). Which raises questions of whether a rent gap is still present in Copenhagen or if there were one at a previous point in time.

As described in the previous sections, potential ground rent may be actualized through various means; the rehabilitation of existing structures on the land, complete redevelopment or other transformations of existing uses and structures. For this particular paper, our focus will be on “rehabilitation of existing structures on the land” or more precisely renovations made to existing structures, in the form of improvements made to apartments built before 1992 in order to raise the rent according to section 5.2 of the housing regulation law. While Bourassa (1993) argues that this cannot be considered a rent gap, considering it is “artificially” induced by legislation, I would still maintain that regardless, there is still a hypothetical rent gap in Copenhagen because the current apartments in some areas of the city capitalize a ground rent that is markedly lower than the potential ground rent – i.e. a rent gap is present. While this may not constitute a rent gap according to Bourassa, I would argue that conceptually it is similar to the extent that we should consider it a rent gap even if the causality of the rent gap is different. The potential presence of a rent gap, is also expressed in the report on section 5.2 of the housing regulation law, where the authors conclude that “it is likely, that landlords will have an economic incentive to improve a substantial amount of

these properties according to section 5.29” (Transport- og Boligministeriet, 2020, p. 45).

21

Graph 1, data from Københavns Kommune, 2020

4.0 - The housing market of Copenhagen

The focal point of this paper is the rental housing market of Copenhagen. A subject that the municipality of Copenhagen itself states that they lack knowledge about (Københavns Kommune, 2018). This section of the paper will give a brief overview of the current housing market in Copenhagen.

The availability of housing in Copenhagen Since 2012 there has been built 3.436 new public housing and 5.506 new youth housing10 in

Copenhagen but the majority of new apartments being built are still private rental apartments. A chart based on Copenhagen municipalities own data shows that in the 1980s the percentage of private rental apartments built was fluctuating between 1-10 percent, but after a political decision not to build public housing in the 2000’s11 the production of private rental

apartments has jumped to 30-50 percent of production each year (Københavns Kommune, 2018, p. 14). The current composition of housing in Copenhagen is that 30% are private

cooperatives, 28% are private rental apartments, 22% are privately owned homes, 19% is non-profit associations (public housing) and 1% is state owned (Københavns Kommune, 2020). It is the 28% of the market consisting of private rental apartments, corresponding to 89.528

apartments, that will be the focus of this paper.

Since the 2000’s construction of housing has not kept up with population growth in Copenhagen. Since 2006 an average of 2.100 units of housing has been built, which can shelter approximately an annual population growth of 0,7% but in the same time period the population of Copenhagen has grown with 1,5% yearly corresponding to 5.000 new families each year (Copenhagen Economic, 2018). An analysis of future housing needs in Copenhagen estimates that around 50.000 to 55.000 homes are needed from 2019 to 2031 to match the expected population growth of 96.000 people (Københavns Kommune, 2019). Particularly small apartments are in high demand because of the demographics of the city with many singles and students as well as the fact that few one bedroom apartments has been built the last decade (Copenhagen Economics, 2018).

10 Apartments reserved for students with rental control

11 In 2015 it was politically passed that municipalities can require that property developers build 25% public

housing on land designated for new housing areas.

30%

28% 22%

19%

1%

Housing based on ownership form

Private cooperatives Private rental apartments Privately owned homes Non-profit associations State Owned

22

Graph 2, data from Boligportal, 2020

Prices of owning and renting a home in Copenhagen

The average price pr square metre for condominiums in Copenhagen were 40.072 in 2019, which is a price increase of 94% over a 10 year period from 20.655 in 2009. A similar price increase has

occurred for single-family homes (Københavns Kommune, 2020). The yearly report on trends, statistics and developments in welfare (e.g. housing, employment, education levels) from Copenhagen municipality does not include any data on the rental property market, once again indicating the lack of precise information about this market.

It is however possible to find some data on rental apartment prices. In 2018 TV2 in cooperation with Boligportal (the same website used for the data of this paper) provided a figure that the average monthly price for an apartment with two rooms was 11.030 for Copenhagen and 10.804 for Frederiksberg (Nagy, 2018). Boligportal also released data on the average square footage price for rental apartments in Copenhagen in 2020. Copenhagen ranked the highest of all cities in Denmark. See graph 2 for the precise numbers. According to Bolius the average rent of a two room apartment has increased 55% from 2011 to 2020 in Greater Copenhagen with an average price of 10.655 in 2020. The greatest increase in rent was also in the Greater Copenhagen area. The average cost of renting a one bedroom apartment in Copenhagen in 2020 is equivalent of 90% of students monthly universal student grant (Statens uddannelsesstøtte) (Videncentret Bolius, 2020).

The Danish Ministry of Transport and Housing reports that in 2020 the average rent pr square metre for apartments built before 1991 in Copenhagen was 84,5 DKK and 135 DKK for apartments built after 1992 (Transport- og Boligministeriet, 2020). Their data is based on rental information supplied by citizens applying for economic support to pay rent and is therefore representative of what people actually pay in rent. This data is however not available to the public due to personal information being part of the data.

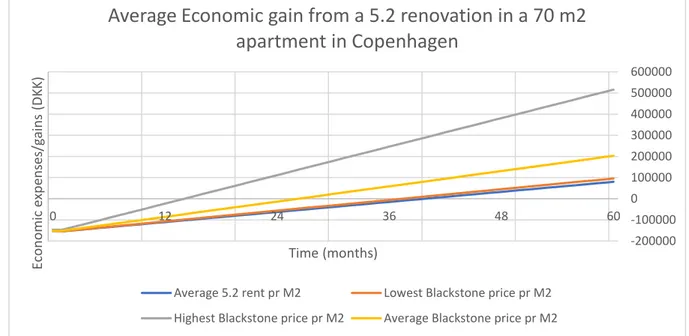

It is estimated that on average 2.875 apartments built before 1992 are being improved according to section 5.2 requirements every year since 2006, which allows to raise the rent based on “the value of the tenancy” (Transport- og Boligministeriet, 2020, p. 53).

In a report on accessibility to housing in Copenhagen, it is concluded that while it has not become substantially more expensive to own a home in Copenhagen the last decade12 “it can be difficult for low income groups to buy a single family home or condominium, if they do not have access to savings or alternative options for a loan” and that the accessibility to rental apartments built before 1992

(without section 5.2 improvements) is low because these apartments are in such high demand, that

12 The reason for the expenses has stayed similar the last decade despite rising prices is because loans have

had a low interest rate overall and the tax assessment of land and housing values has not been updated since 2012 because of issues with the tools used to make value assessment of properties and land.

183 160 146 135 0 20 40 60 80 100 120 140 160 180 200 One bedroom apartments Two bedroom apartments Three bedroom apartments Four bedroom apartments

Price per square metre per

month (DKK)

23 they often are shared through closed networks and social relations (Københavns Kommune, 2018, p. 41).

In summation, the prices on rental apartments in Copenhagen are the highest in the country and the prices have increased significantly the last decade. In general prices on homes have increased the last 20 years but it has been particularly pronounced for rental apartments. A lack of public housing and demographic changes has put substantial demand on rental apartments. This can make it difficult for low income groups and students to find an affordable apartment in Copenhagen.

24

5.0 - Analysis

The analysis will begin by analyzing the data starting with the general data scraped from Boligportal, thereafter comparing the overall data on apartments in Copenhagen with the characteristics of the apartments owned by Blackstone and finally comparing the rental costs of apartments by Blackstone with the average costs of a rental apartment in Copenhagen.

5.1 - The dataset from Boligportal

Importing the data from Boligportal into QGis allows for a better overview and spatial analysis of the information. Since all apartments recorded in the dataset has longitudinal and latitudinal data information attached, all data points can be placed on a map in QGis. Looking at map 1, a brief look suggests that the 4.778 observations are fairly well distributed throughout Copenhagen, with a slight lack of datapoints in the north and the west of Copenhagen in the neighbourhoods of Valby,

Vanløse, Brønshøj-Husum and Bispebjerg.

The visuals can however be misleading since multiple datapoints from the same building appear as one, so joining the datapoints with polygons of the various neighbourhoods, we can get a better sense of the distribution.

25

Table 1, distribution of observations from Boligportal by area

The distribution of observations

Area Number of observations Percentage of total observations

Amager Vest 1.347 28,19% Vesterbro 851 17,81% Indre By 544 11,39% Valby 525 10,99% Amager Øst 485 10,15% Østerbro 411 8,60% Frederiksberg 242 5,06% Nørrebro 126 2,64% Bispebjerg 109 2,28% Brønshøj-Husum 75 1,57% Vanløse 63 1,32%

Now we can see that while Vanløse, Brønshøj-Husum and Bispebjerg are very low in representation, and Nørrebro as well, Valby is quite well represented in the dataset with 10,58% of all datapoints being located in the neighbourhood. On the other end of the spectrum is Amager Vest with more than a quarter of all datapoints being concentrated in the part of the city. While Amager Vest is also geographically around twice as large as any other area in the city, and four times as large as

Nørrebro, a large part of it is occupied by green areas. Looking deeper into the data, one can see that the reason that Amager Vest is so heavily represented, is because the script has registered 1.104 apartments listed in Ørestad13 in the last five months. It makes sense that Ørestad is well

represented on sites like boligportal.dk since the area is a new housing area, with many apartments being built the last 20 years, and after an initial lack of interest, demand is slowly rising. A heatmap rendering the density of the points (see map 2) confirms that Ørestad is the most represented area in the dataset, while also giving a more accurate visualization of the other hotspots in our data. From the heatmap we can gather that Ørestad, Sydhavn (an old industrial area in Vesterbro being

redeveloped into a housing area), Indre By (the central business district), a new housing area in Valby and a new housing area in Amager Øst are the densest areas in terms of data points. All these areas are new housing areas with the exception of the central business district of Indre By. That new housing areas are well represented in the dataset is also supported by the fact that the majority of the apartments scraped from boligportal.dk were new buildings, with 3.476 (73%) apartments being built after 1991 and the remaining 1.302 built before 1992 (27%).

26

Map 2, density map of observations from Boligportal

The average price of an apartment in Copenhagen

Looking at table 2 we find the average price, apartment size and price per square metre for total observations, observations for apartments built before and after January 1. 1992. The first thing that jumps out, is that the average price per square metre is higher on average for apartments built before 1992 than apartments built after 1991. This runs counter to information from other reports and to the logic that apartments built after 1991 can be set to market prices. Some explanations can be that the data on apartments before 1992 cannot distinguish between apartments being rented out at cost-determined rent (rent control) and apartments rented out at “the value of the tenancy” (section 5.2 renovated apartments), because there is no database for improvements made to

apartments. In effect, this means that some observations of apartments built before 1992 will have a very high rental cost and some will have a very low one, depending on the laws affecting said

apartment. This is also reflected in the fact that the standard deviation on monthly rent for apartments built before 1992 is at 6.553 more than twice as large as the standard deviation on monthly rent for apartments built after 1991, which shows that the fluctuation in price is much greater in the segment of apartments built before 1992 because of these differing regulations for rent. Another explanatory factor could be that while the average size of 99 square metres for observations built before 1992 is higher than observations built after 1991, the standard deviation is again more than twice as large as the standard deviation for observation built after 1991. There is a large span of apartment sizes for apartments built before 1992. Since data shows that the square metre price is higher the smaller the apartment is, one reason for the higher average price of observations built before 1992 could be a greater number of small apartments in that set of observations.

27

Table 2, showing information of total observations, observations of apartments built before and after January 1. 1992 based on own empirical data and calculations.

Comparing the average prices from the dataset in table 2 with price averages from other sources, we can get a sense of whether the collected data differs from previous reports on the housing market in Copenhagen. The first point of note is that averages of our dataset is quite different from the

averages according to the data from The Danish Ministry of Transport and Housing which was 84,5 DKK for private rental apartments constructed before 1992 and 135 DKK for private rental

apartments constructed after 1991 in Copenhagen (Transport- og Boligministeriet, 2020). Our averages of 154,56 DKK for apartments built after 1991 and 159,04 DKK are markedly higher than those numbers. The lowest value for an observation in our dataset is a price of 93,96 DKK pr square metre. One explanation for the large discrepancy can be that the cheapest rental apartments are being shared or traded through social networks and are never listed on a site like boligportal.dk. This assessment is also made by Copenhagen Municipality, where they note that there is an increasing difficulty in gaining access to the cheapest rental apartments in Copenhagen, if not through your social network (Københavns Kommune, 2018, p. 24). While this means that the dataset does not capture the full picture of the rental market in Copenhagen, it does represent the options available for those without a strong social network and without the capital to buy a house.

Another option for the disparity can be that the script gathering the data simply does not “capture” data often enough and that the apartments with the most competitive rental prices are gone from the website again before the script records their data. In order to alleviate this problem, if it was the case, the script would have to be automated and constantly monitoring the website for new

apartments listed.

Dataset Number of observations

Variable Mean Standard deviation First quartile Third quartile All apartments 4.778 Monthly rent (DKK) 15.026 4.397 12.660 16.424 All apartments 4.778 Size (m2) 98,77 32,8 81 111 All Apartments 4.778 Price pr m2 (DKK) 155,78 23,05 140 168,75 Apartments built after 1991 3.476 Monthly rent (DKK) 14.528 3.096 12.800 15.800 Apartments built after 1991 3.476 Size (m2) 95,76 23,07 84 107 Apartments built after 1991 3.476 Price pr m2 (DKK) 154,56 20,64 140,19 165,09 Apartments built before 1992 1.302 Monthly rent (DKK) 16.356 6.553 11.800 19.500 Apartments built before 1992 1.302 Size (m2) 99 49,42 72 129 Apartments built before 1992 1.302 Price pr m2 (DKK) 159,04 28,25 138,46 178,90