”The greatest illusion of mankind”

International Business and Entrepreneurship

By: Matthias Holmstedt & Tatiana Golubnic (801125

reatest illusion of mankind”

Master thesis in:

International Business and Entrepreneurship

By: Matthias Holmstedt & Tatiana Golubnic (801125-6610) (840316-T147)

Tutor: Love Börjeson Code: EFO705

29/05/2009

reatest illusion of mankind”

1

Abstract

“Money is controlled by a market; I trust the government has control. I do not think you are right, of course the government has the control and they would not do like this, it cannot be true that my savings is not real, I work hard for them! But just stop it I just do not want to make these kinds of questions to myself; I just need a house, go traveling and have some fun, I do not want to go around and worrying”.

(Anonym comment)

This comment by a person with university degree in business and middle manager at one of the larger Swedish companies, when discussing the thesis you are about to read, without the person having reading it in advance, actually seems representative for the overall knowledge about what is really going on in the financial system today and the willingness of people question it. The knowledge you will obtain and the result you will experience after finished your reading is challenges of basic “taken for granted assumptions” of businessmen, academics or people in general within the society today, for the purpose of understanding the system and its role in society. You will experience a unique critical presentation of the financial system today, and also discover that this knowledge about the financial system is not a knowledge the majority should possess, even one of the important principles of the system might be just that the majority do not possess this knowledge.

The financial system, when the time of writing, suffer from large global problems. This thesis is examining the foundation of the system, such as the concept of money, and the forces and principles within the system. The research goes from how the system has developed historically to how it is constructed and maneuvered today. Money is described as trading tools which value is only an illusion of value for persons in the society. The financial system is further broken down into three different subsystems in order to understand the term financial system. From the perspective of the three subsystems the financial system is described as a deceiving system fooling the participants that they possess value in forms of bank notes and coins. Further the thesis shifts the focus to how the system looks today by categorizing actors and tools in the system, how state authorities is trying to maneuver the system and create a network model of the Swedish financial system, the conclusion became that no one can escape the system and do not have a chance not to enter the system, the chapter also reveals how no one really has the power to control and influence the system. Finally the thesis provides foundations for the reader to make his own opinion if the gambling within the system has been taken to long, if the financial system could be labeled as a pyramid scheme, if the system has provided more benefits than drawbacks to society and finally some speculation in consequences if the system would crash and speculation of how historians in the future would describe the present version of the financial system. But before starting reading, think about the message from the director Alan Alda:

“Your assumptions are your windows on the world. Scrub them off every once in a while, or the light won’t come in”

(Citation: Alan Alda, Quoteland, n.d)

Keywords

Money; Exchange valued money; Use valued money; Financial System; Money Allocation System; Money Transfer System; Money Assurance System; Network model; History of money; History of Financial System; Illusion; Deceive; Prison

Acknowledge

This final version of the master thesis you are about contributors having various role in t

First of all, the help was obtained from the

Stadsbibliotek, which provided a great assistant in ordering books not available at the library (Even buying a book that became one of the main sour

obtaining books in their old magazines for our history review, always professional and with a friendly approach.

Next up is Dr. Allen Tien at Mdlogix

free license used in illustrating of one of the network models, a great program and easy to use which we really recommend for network research.

The ones not to be forgotten is also the seminar group helping with critics and encourage to our work in the Master thesis c

We also would like a thank Dr. Gunnar Widforss

and friend full attitude in trying to solve a problem with the program for visualizing network, even if the network was showed to be a problem without solution and was not used in the thesis, their support and helpfulness is admirable and s

the Doctors at the university.

Last, and the most significant contributor to this final thesis is our tutor

whose great encouragement and interest in the thesis had mean a lot for us. Also his hel contributing with critic, theoretical sources, network program, and suggestions for literature sources has been a great influence of the final thesis.

Thank you all for your contributions!

Matthias Holmstedt

2

This final version of the master thesis you are about to read is created with help of several contributors having various role in the process.

First of all, the help was obtained from the Librarians at Mälardalens University and Västerås , which provided a great assistant in ordering books not available at the library (Even buying a book that became one of the main sources in this work), and their assistant in obtaining books in their old magazines for our history review, always professional and with a

at Mdlogix for providing the network program VizuaLyzer

used in illustrating of one of the network models, a great program and easy to use which we really recommend for network research.

nes not to be forgotten is also the seminar group helping with critics and encourage to our work in the Master thesis courses.

Dr. Gunnar Widforss and Dr. Aleksandrar Dimov

and friend full attitude in trying to solve a problem with the program for visualizing network, even if the network was showed to be a problem without solution and was not used in the thesis, their support and helpfulness is admirable and should stand as a role model for some of Last, and the most significant contributor to this final thesis is our tutor Dr. Love Börjeson whose great encouragement and interest in the thesis had mean a lot for us. Also his hel contributing with critic, theoretical sources, network program, and suggestions for literature sources has been a great influence of the final thesis.

Thank you all for your contributions!

Tatiana Golubnic

Matthias Holmstedt

read is created with help of several Librarians at Mälardalens University and Västerås , which provided a great assistant in ordering books not available at the library ces in this work), and their assistant in obtaining books in their old magazines for our history review, always professional and with a for providing the network program VizuaLyzer with a used in illustrating of one of the network models, a great program and easy to use nes not to be forgotten is also the seminar group helping with critics and encourage to and Dr. Aleksandrar Dimov for their help and friend full attitude in trying to solve a problem with the program for visualizing network, even if the network was showed to be a problem without solution and was not used in the hould stand as a role model for some of Dr. Love Börjeson, whose great encouragement and interest in the thesis had mean a lot for us. Also his help of contributing with critic, theoretical sources, network program, and suggestions for literature

3

Table of Content

Chapter 1: Introduction ... 6

1.1 Relevance and importance of the topic ... 6

1.2 Problem statement for the investigations ... 8

1.3 Conceptual framework ... 8

1.4 Philosophical approach and method of research ... 9

1.4.1 Defining approach in philosophy ... 9

1.4.2 Ontology ... 10

1.4.3 Epistemology ... 11

1.4.4 Methodology and design of investigation ... 11

1.4.5 Method ... 13

1.5 Practically conducted research ... 14

1.5.1 Gathering data ... 14

1.5.2 Analyzing ... 16

1.5.3 Writing up and documentation ... 17

1.6 Limitation of the project ... 17

Chapter 2: The Illusion of money ... 18

2.1 History of Money ... 18

2.1.1 A world without money ... 18

2.1.2 How money was introduced... 20

2.1.3 The development of money ... 23

2.2 Conceptualization of money ... 26

2.2.1 Categorization of types of payment ... 26

2.2.2 Theoretical conceptualizations of money ... 27

2.2.3 Thesis conceptualization of money ... 29

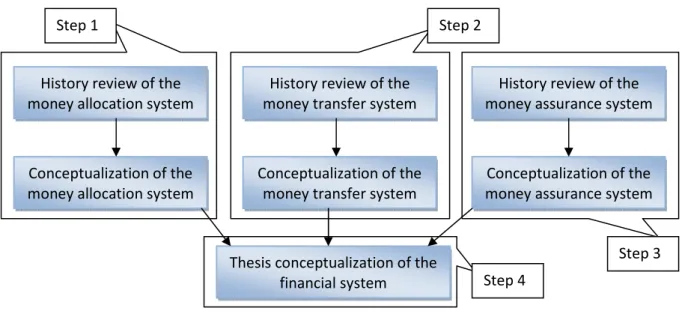

Chapter 3: How the illusion is implemented into a deceiving system ... 31

3.1 History and Conceptualization of the Financial System ... 33

3.1.1 History of the Money Allocation System ... 33

3.1.2 Conceptualization of the Money Allocation System ... 38

3.1.3 History of the Money Transfer System... 41

3.1.4 Conceptualization of the Money Transfer System ... 43

3.1.5 History of the Money Assurance System ... 46

3.1.6 Conceptualization of the Money Assurance System ... 47

3.2 Conceptualization of the financial system ... 48

Chapter 4: The system as a prison ... 51

4.1 How the system is maneuvered ... 51

4

4.1.2 How state authorities work to manage the financial system... 57

4.1.3. Conceptualization of how the system is maneuvered ... 65

4.2 How everybody is forced to stay in the system ... 65

4.2.1 The network model of the financial system ... 65

4.2.2 You have no chance to choose ... 67

4.2.3 Conceptualization of financial network... 68

4.3 Conceptualization of the financial system today ... 68

Chapter 5: Concluding remarks ... 70

5.1 Has the gambling been taken too far? ... 70

5.2 Is the financial system a pyramid scheme? ... 71

5.3 Is the financial system really that bad? ... 74

5.4 What happens if people stop believing? ... 75

References ... 76

Appendix list:

Appendix 1: Search keywords and sources 82 Appendix 2: Literature foundation sort by question in problem hierarchy 84 Appendix 3: Categorization of tools depending of characteristics 88 Appendix 4: Categorization of tool depending in the time perspective 89 Appendix 5: Detailed description of categorized tools 90 Appendix 6: Detailed description of actors and documentation to actors 94 Appendix 7: Specification how every actor use the different tools 107Appendix 8: Matrix table for relationship in network models 115

Appendix 9: Attribute table for size on nodes in network models 116

5

Figure list:

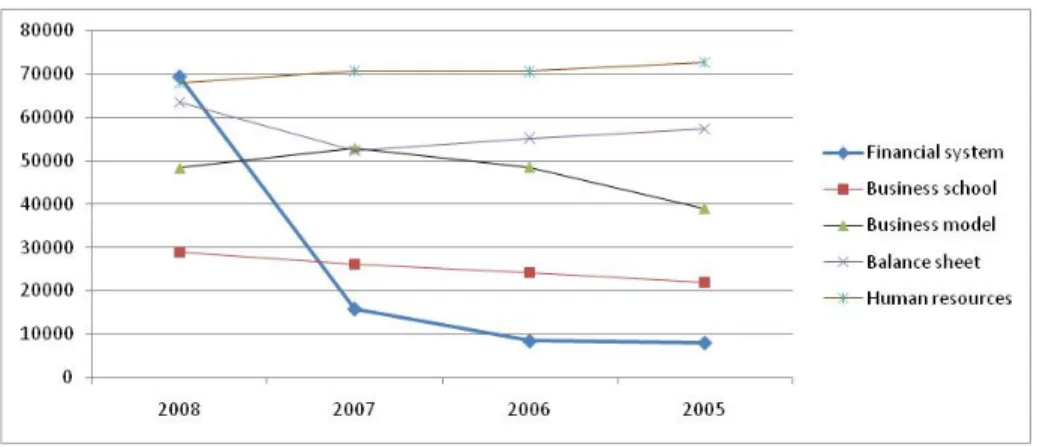

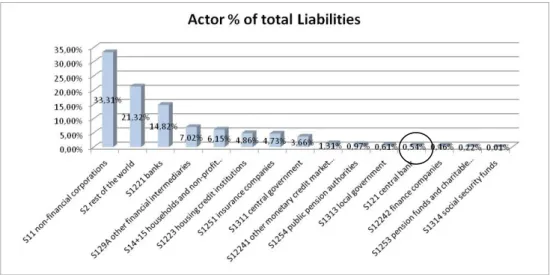

Figure 1: Problem hierarchy, own model _____________________________________________________________________ 8 Figure 2: Conceptual approach to the investigation, own model __________________________________________________ 9 Figure 3: Method approach, Source: Alvesson & Deetz (2006), p 148 _____________________________________________ 12 Figure 4: Attacking plan for conceptualizing money, own source _________________________________________________ 18 Figure 5: The Nukak-Makú tribe, source: survival-international.de _______________________________________________ 18 Figure 6: Image of Russian Revolution, source: Spartacus.schoolnet.co.uk _________________________________________ 19 Figure 7: Aztec god with cacao bean, source: erowid.org _______________________________________________________ 20 Figure 8: Lydian coin, source: livius.org _____________________________________________________________________ 21 Figure 9: A Roman Aureus coin, source: romancivilwar.com _____________________________________________________ 21 Figure 10: Coin from Sigtuna 995, source: myntkabinettet.se____________________________________________________ 22 Figure 12: Copper coin from 1644, source: myntcabinettet.se ___________________________________________________ 23 Figure 11: Kreditivsedel of 1666, source: myntkabinettet.se _____________________________________________________ 23 Figure 13: Yap stone money, source: antoranz.net ____________________________________________________________ 25 Figure 14: Fort Knox, source: davidpride.com ________________________________________________________________ 25 Figure 15: Frequency illustration of the word “Financial system”, source: news.google.se _____________________________ 31 Figure 16: Attacking plan for conceptualizing the financial system, own model _____________________________________ 32 Figure 17: Templar, source: hiddenknowledge.info ____________________________________________________________ 34 Figure 18: Share in East India Company from 1626, source: solarnavigator.net _____________________________________ 35 Figure 19: Stockholm Banco anno 1657, source: historiesajten.se ________________________________________________ 35 Figure 20: Money printing machine, source: localhistory.scit.wlv.ac.uk ____________________________________________ 36 Figure 21: Image of women worrying during great depression, source: chicousd.org _________________________________ 37 Figure 22: Delegation of the Bretton Woods conference, source: worldbankimflib.org _______________________________ 37 Figure 23: Liabilities of all actors in the Swedish economy, own model based on data from scb.se ______________________ 40 Figure 24: Illustration of Medici’s business, source: theauteurs.com ______________________________________________ 42 Figure 25: First ATM, source: answers.com __________________________________________________________________ 42 Figure 26: Image of use of Internet bank, source: rcbc.com _____________________________________________________ 43 Figure 27: Image of Roman society with trading ships, source: wkrac.org __________________________________________ 46 Figure 28: Painting illustrating the great fire in London, source: wilsonsalmanac.com ________________________________ 46 Figure 29: Illustration of modern brokers, source: fotosearch.com _______________________________________________ 47 Figure 30: Attacking plan for investigating how the financial system is maneuvered, own model _______________________ 51 Figure 31: how the tools % in term of value are used in financial system, own sources based on data from scb.se _________ 52 Figure 32; Categorization of tools depending of time perspective, own model based on data from scb.se ________________ 53 Figure 33: Liabilities of each categorized actor, own source based on data from scb.se _______________________________ 54 Figure 34: Asset of each categorized actor, own source based on data from scb.se __________________________________ 54 Figure 35: Net Asset/Liabilities of each actor, own model based on data from scb.se ________________________________ 56 Figure 36: Payment system in Sweden, source: riksbanken.se ___________________________________________________ 58 Figure 37: Model visualizing how the interest affects the economic system, source: riksbanken.se ______________________ 59 Figure 38: Hierarchy chart of state authorities maneuvering the financial system, own model based on data from

regeringen.se, riksbanken.se, riksgälden.se, fi.se, imf.org _________________________________________________ 64 Figure 39: Network model of all relationship in the financial system, own model based on data from scb.se ______________ 66 Figure 40: Network model with weighted relationship in the financial system, own model based on data from scb.se ______ 67 Figure 41: Index graph of Sweden development in money compare to various economic factors, own model based on

6

Chapter 1: Introduction

1.1 Relevance and importance of the topic

The economic world is a very complex and complicated phenomenon, which can be difficult to understand. It requires deep knowledge and understanding of financial processes which take place in contemporaneous business. But together with the sophisticated economic procedures there a lot of simple, at the first sight, practices which people execute day-by-day and do not ask questions about basic principles and concepts for those transactions. To these concepts and principles can be attributed such important notions as understanding of what is money, what is the function of money, how do the financial system function, what is their role and functions in the society, who and why is involved in the network together. Lack of knowledge among people about these basic concepts can create a really difficult situation in the time of economic crises or other difficulties, which can take place in the economy.

One of the greatest examples of the problems experienced by simple people during economic and political reconstruction is the collapse of Soviet Union in 1991 during the presidential governing of Mihail Gorbachiov. People all over former U.S.S.R. used to hold their savings in the banks, which were public-owned and had a great popularity and credibility among citizens; and used only a little amount of cash-money to satisfy their current needs. Taking into consideration that level of salaries in former Soviet Union was really high but availability, diversity of products was extremely low people had possibility to save a great amount of money, which had been increased year by year. Thus, people were sure that they are really rich and have a lot of wealth at their deposits in banks. But when Soviet Union collapsed people wanted to extract their deposits from the banks. They could not because political instructions and instable economic situation in the country banks were not able to face their liabilities towards people. Those citizens, who a little time ago considered them rich even millionaires, lost all their financial savings and did not have financial means for living! People living in the west world today have none or just minor experience of crisis like described above. Majority of people and especially young generation have no experience about how the financial system constructed by the contemporaneous institutions and might have never experienced the lack of trust in the present system. The greatest part of them probably would be fully disoriented and paralyzed if a serious crisis would occur. Nowadays people believe in the financial system without thinking of the possibility of its collapse and negative consequences which the collapse can bring, and many claim to understand the system. The contemporaneous people’s believe in safety of the financial system can be compared to the belief of Soviet people and government in modern, powerful nuclear power station Chernobyl safety. Like the futurologist James Bellini explained the situation:

“In March 1986, a nine-page article about the Chernobyl nuclear installation appeared in the English-language edition of Soviet Life, under the heading ‘Total Safety’. Only a month later, over the weekend of the 26-27 April the world’s worst nuclear accident – thus far – occurred at the planet”

(Bellini in Giddens, 1990, preface).

Thus, not everything which seems to be safety is safety in the reality. Having read the elaborated paper and also taking into consideration the negative experience of the former Soviet Union citizens, the contemporaneous society would understand the foundation of the system and find alternative solution for protecting their properties if a crisis like the one in the former U.S.S.R. would occur.

7

Taking into consideration all expressed above can be concluded that the theme raised, discussed and analyzed in the elaborated Master Thesis represent not only an interesting topic for academic purposes but also an invaluable, priceless information about the nature of the financial system, the basics, mechanism, functions and role of it, which further can be compared with the previous understanding about the system and will provide a valuable ground for further thinking about the situation in which the system will collapse or meet some difficulties. Not only for people involved in business, government, non-profit organization but also for every citizen being involved in the system.

One important purpose, like you will experience when reading, is that most of the actors in the system maybe should not possess specific knowledge about the system, the most important part is maybe that the financial system seems to be something abstract not understandable by most of the participants. The thesis thereby also illustrates the importance of protecting knowledge about the structure and principles about the system for the mass population.

The debate about a collapse of the system has further suddenly become relevant after the 15th

September, 2009 when Lehman Brothers went bankrupt (in the USA was used term of “search for Chapter 11”, which means a form of bankruptcy) and the side effects have starting to take place globally. Several decision-makers and economist have claimed to understand the situation and tried to interpret what was happening as well as to forecast the consequences that might occur. For example, Nouriel Roubini professor of economy at New York University often referred as “Dr Doom”, comment interpreted by e24, a Swedish economic newspaper on Internet :

“I fear the worst is yet to come! When this man predicted a global financial crisis more than a year ago, people laughed. Not anymore...”

(Citation with own translation, e24.se, 2009)

As another example can serve the Dr. Marc Faber’s forecast about the future of the today’s crisis, cited by e24:

"The crisis between 1929 and 1932 will appear as gentle"

(Citation with own translation, e24.se, 2009)

And finally, like Swedish Minister of finance Anders Borg expressed his concern about the Swedish society, cited by the internet newspaper nyheter24.se:

“We risk to face a second stage of the crisis when unemployment arise, corporate result decrease, and the overall slowdown lead to increase in credit loses”

(Citation with own translation, Nyheter24.se, 2009)

Instead of investigating the benefits of the system or consequences of a collapse, the purpose is to provide information about how the financial system is constructed and controlled in order to understand the basic foundations of the system and to explain why crisis like one expressed above might happens.

8

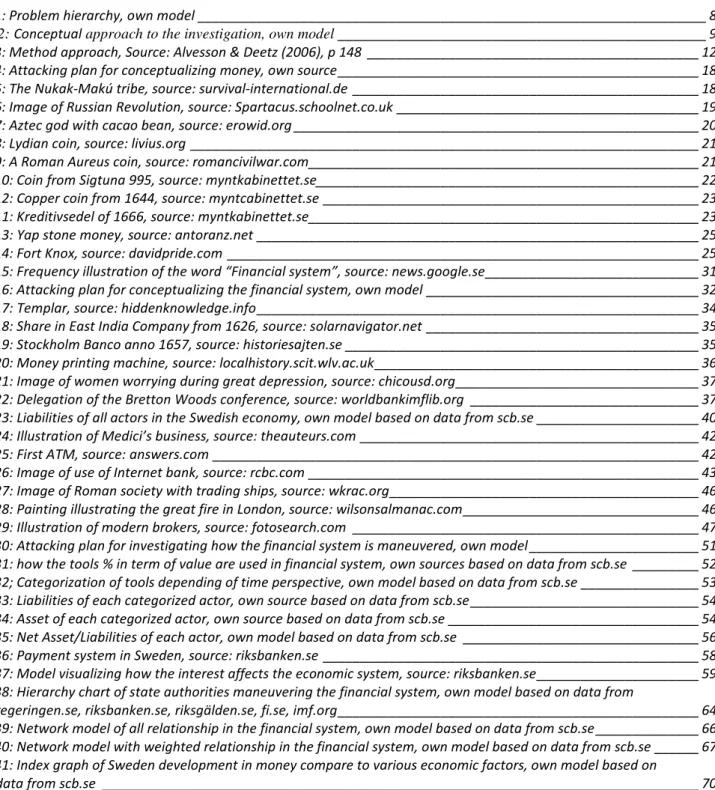

1.2 Problem statement for the investigations

Like the previous chapter reveals the thesis will handle principles the financial system is based upon and its role in society. The problem of not understanding the financial system and it forces can be a brutal lesion for people experiencing a financial crisis, the problem can also be that people miss opportunities that could create higher income, which could be transformed to better living standards or for example power in the society. But to understand the finical system it is important to understand the foundation of the system, thereby understanding of money will be a critical issue point for making a conceptualization of the financial system. To understand both money and financial system and its foundation it is important to start from the beginning, how the concepts were created in society and developed to have the functions principles and forms they have today.

First then, when the foundation is clear the understanding how and why state authorities performs different actions for controlling and managing the system is discussed. But to further understand these actions it is important to see how the system connects different actor to each other in order to create an understanding of how the system is constructed. When the understanding of all these fundamental parts are conceptualized, first then an understanding of which role the financial system plays in the society can be understood. Based on the discussion the following problem statement hierarchy is formed:

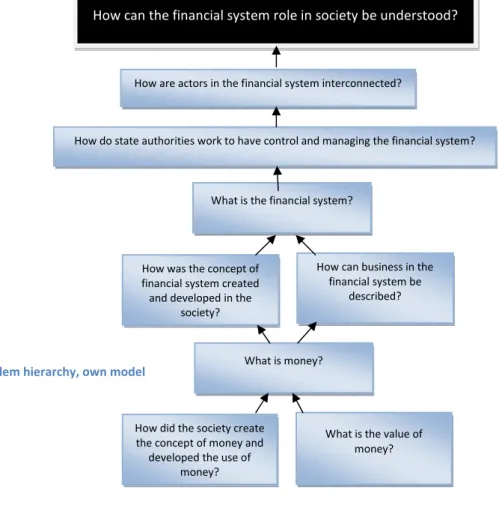

1.3 Conceptual framework

The conceptual approach to investigation is meant to provide an overview of theories and directions used for conducting the analysis. With base in the problem hierarchy concepts, theories and perspectives are identified that will guide the research. From this research the following model is presented:

How are actors in the financial system interconnected?

How do state authorities work to have control and managing the financial system?

How can business in the financial system be

described?

What is the value of money? How was the concept of

financial system created and developed in the

society?

How did the society create the concept of money and

developed the use of money?

What is money? What is the financial system?

How can the financial system role in society be understood?

9 Figure 2: Conceptual approach to the investigation, own model

Presented figure aims to guide the executed project to the correct path and to stress the key terms and concepts which have to be analyzed. The foundation of the conceptualization of research is the hierarchy of problem statement. As it reveals from the figure, the whole paper is divided into four basic zones, directions:

1. Money. In order to thoroughly understand the conceptualization of money, in the

presented block the history of its formation, development and stabilization as well as value and functions of money will be analyzed;

2. How money is put in a system. This block is will do research how money is being

used in the society and how tools have became formed used, for doing this a history review of the use will be conducted, how business have used money.

3. Network, which is divided into two areas: Swedish financial system and international financial system. Here actors, which are involved into network, will be presented. Also the interconnections between economic agents as well as what type of ties connecting them.

4. Control, the last block is how the system is been control and managed.

1.4 Philosophical approach and method of research

1.4.1 Defining approach in philosophy

There seems to be an overall agreement among social scientist that have carefully thought through the philosophical approach in research, which is of high importance for the quality of the investigation. One of the larger problems in this philosophical mind exercise is that most of these philosophical terms have no universal definition, and there seems to be different meanings for different writers. Easterby-Smith, Thorpe and Lowe address the situation as follows:

Money

Networks

Functions Value

History History Businesses Functions

Actors Ties

Maneuvering the system

Financial system

10

“Unfortunately, some philosophical terms are used interchangeably and consequently there is confusion about their meaning”

(Easterby-Smith, Thorpe & Love, 2002, p 31)

The main term of addressed in social science research is methodology, the philosophical term which handles the scientific debate about what types of methods are the most suitable for acquiring knowledge and understanding about different phenomena. Even if the term is often referred as universal, there is a dissension among authors writing about methodology concerning what is a part of the term is and what is not. For example Fisher defines the term as follows:

“Methodology is the study of methods and it raises all sorts of philosophical questions about what it is possible for researchers to know and how valid their claims to knowledge might be”

(Fisher, 2007, p. 40).

At the same time, Easterby-Smith, Thorpe and Lowe have a slightly different approach to the term and define it in a minor contrast to Fisher’s definition:

“Methodology is the philosophy about combination of techniques used to enquire into a specific situation”

(Easterby-Smith, Thorpe & Love, 2002, p 31)

The overall agreement among the authors is about the fact that they view methodology as a study about techniques of investigation. However, Fisher includes in the term the features of studied phenomena which are possible to know and claims to knowledge; Easterby-Smith, Thorpe and Lowe have a more narrow approach of the term and argue that methodology is only one part of a broader philosophical debate and is an outcome of the ontology and epistemology philosophy. They argue that the debate has the starting point in the researchers’ assumptions of reality (Ontology), and then assumptions about what is possible to have knowledge about (Epistemology). When these two starting points are decided, assumptions concerning the best approach to the knowledge are made (Methodology), and finally the individual techniques used to collect and analyze the knowledge are found and set into practice (Method). Since the approach to methodology provided by Easterby-Smith, Thorpe and Lowe is more specific in how to address the philosophy of the investigation than Fisher, this approach is used to clarify the philosophical stand of this research.

1.4.2 Ontology

The overall assumption made for the project about the nature of reality is that the financial system of the world we have today, is an outcome of historical solutions to make trade between people more effective as well as to allocate and secure their property. The system is created and developed by humans in order to create higher livings standards at present and for the future for them as being a part of the system. Further, the term “financial system” is only a label created by humans and does not really have a universal meaning for people instead the understanding of this label is individual for each human and is based on each individual’s experiences concerning what they referred as a part of the financial system. Practically this means that the term financial system might mean for a German politician the system might be the solution for increasing effectiveness in the German society, for an Asian businessman the financial system perhaps might be a source for reducing risks in the business operations, and finally for a Greenpeace activist the financial system might be something invented by the Western World to obtain power and explore the nature.

11 1.4.3 Epistemology

The ontological approach looks at the system as something made and handle by many individual humans rather than a machine that is not affected by individuals, means that understanding of human behavior rather than mathematic models is the essential to obtain knowledge of the financial system. Since the system is created by humans the only way to have knowledge about the financial system is to understand decision made by humans affected the design of the system and why these decisions were made in generally. Also since humans are the only participants in the system, knowledge concerning the reasons of their participation in the system is of importance for understanding how it is constructed. While an assumption is made that an individual behavior is not possible to understand and analyze directly, instead behavior of a group of people activating in past can be indirectly be viewed and logically interpreted for attaching upon the understanding. This epistemology and also the ontological approach are close to what Fisher names critical realism (Fisher, 2007, p. 284-286). Practically this meant that there is no universal truth about what the financial system really is, but still it is relevant to the understanding of people’s interpretation of the system. The sources used for analysis can thereby not be treated as universal truths only personal interpretations based on the authors conceptualization of the system and drawn conclusion can thereby never be argued to be universally valid since it is only the researchers’ interpretation of the system based on the available information.

1.4.4 Methodology and design of investigation

In this philosophical part there are two major contrasting schools that debate how knowledge should be obtained and analyzed. The first school is positivism created by Auguste Compte in 1853 (Easterby-Smith, Thorpe & Love, 2002) which foundation is that the phenomena exist externally and should be measured by objective methods. The next school is interpretivism, also often referred to as social constructionism, first created by Beger and Luckman 1966 (Easterby-Smith, Thorpe & Love, 2002) and pays attention on how people make sense of and experience the phenomena. Since the phenomena cannot be viewed from outside, language, in written or oral form, is the only medium of information accumulation and interpretation of the information is the only way for obtaining understanding of the phenomena.

Based on the epistemology and ontology approach the interpretative approach is a natural choice of methodology, since the assumption that the financial system is and people’s definition of its aspects are individual instead of universal. For example, the treatment of historical occasions that is described as facts in the literature is, by the approach, an interpretation of an event affected by the person’s understanding of the situation, which might be described differently by persons with an alternative experience. Still the description is important because it provides an indirect foundation for understanding of the importance of the event creating an opportunity for the authors to do logical reasoning and to drawn valuable interpretations.

Thus, having justified the choice of methodology, it is important to provide an insight into its particular characteristics, techniques and details in order to lead the research in correct direction and to extract the most important particularities of the chosen methodology. Interpretative research calls for careful consideration of all empirical and theoretical material from a multitude of angels. In this context, the evaluation of chosen material for its relevance and strength for making interpretation and transformation beyond local, existent meaning is very important (Alvesson & Deetz, 2006).

12

The discussed multitude of angels may lead to more systematic research, in which all steps may be thought through more clearly, more aspects can be explicitly considered providing the reader with more clear logic of the studying phenomena.

(Alvesson & Deetz, 2006, p. 165)

Also, Alvesson and Deetz provide steps, directions of leading the interpretative research, which can be presented as follows (Alvesson & Deetz, 2006):

Following the logic from the presented figure the main steps of interpretative research executed in the Master’s Thesis are be inferred as follows (Alvesson & Deetz, 2006):

1. Paying attention to studied phenomena (financial system) and giving a particular “close-to-surface”, but not obvious meaning to it. In this stage the overall presentation of financial system will be made and main used terms will be defined. (Nevertheless, the chosen for the project methodology is an interpretative research, the basic, allover accepted terms do not have to be interpreted, but instead carefully defined);

2. Creating a shape or image of the studied phenomena. This stage presupposes a deeper understanding of financial system, its characteristics, particularities and details which shape it. Also, in order to create the overall picture of the financial system will be analyzed the history of creation, development, contemporaneous existence of the whole system and its component elements;

3. Either exploring the meaning or pointing at an additional, deep meaning of studied

phenomena, throwing a new unexpected light on it. At the last step of the research the overall investigation of the financial system meaning, role, function, economic actors involved in the financial network will be done.

Taking into consideration the nature and topic of the elaborated project, it is significant to choose an interpretative grid (Fisher, 2007). As it was discussed earlier, the most suitable for the analyzed phenomena interpretative grid is critical realism, which represents a research whose general where the aim expressed by Alvesson and Deetz slike following:

“Disrupt ongoing reality for the sake of providing impulses to the liberation from or resistance to what dominates and leads to constrains in human decision-making”

(Alvesson & Deetz, 2006, p. 1)

Presented grid has a basis for the raised in the Master’s Thesis issues and aims to provide directions of critical interpretations of reality. According to critical realism, the social phenomenon is seen not just as a natural occurred event, but as a historically formed and developed object. Thus, it is not sufficient to relay only on one, broadly accepted and self-evident meaning of the financial system, instead it is important to view it from historical perspective, to examine all aspects and component parts in order to produce a critical analysis

Interpretative research

2. Perspectivization / imagination

1. Non-obvious description 3. Insightful revelation of the phenomena

13

and alternative understanding of the studied phenomenon. It is not satisfactory to take for granted events, which seem to be natural, self-evident, unproblematic and unavoidable since they can favor certain interests and the reality can, as a consequence, be obscured and misrecognized; instead it is significant to investigate them in minor details (Alvesson & Deetz, 2006).

1.4.5 Method

The method handles the practical approach of gathering and analyzing information to get knowledge for answering the research questions set for the project. The method in the research is affected by the chosen methodology and also is influenced by three main factors:

1. First of all, it is significant to decide upon the nature of the executed research, which can

be qualitative and quantitative. Taking into consideration the researched in the project area, quantitative research which requires analysis of studied phenomenon through various mathematical and statistical models may not be considered as appropriate, expressed by Alvesson and Deetz:

“Instead the qualitative research which is typically oriented to the inductive study of socially constructed reality, focusing on meanings, ideas and practices.”

(Alvesson & Deetz, 2006, p. 1)

Since the aim of the elaborated project is to provide a deeper understanding of financial system and its component parts, the qualitative research is a proper one since it is sensible to ideas and meanings of individuals and provides a greater possibility of developing, enriching existent theories, concepts and directions concerning studied objects and represents a higher interest for the reader comparative to quantitative research. Taking into consideration the necessity of defining and explaining the key concepts related to financial system and explaining the very nature of the system, the allowance within qualitative research to start with cultural questions of “what is it?” which naturally precedes any question of “how much?” or “what has relationship with what?” (Alvesson & Deetz, 2006) represents an obvious value for the research;

2. Secondly, there is an assumption that the phenomena of financial system and its aspects is

a discussed area by academics and professionals and these sources provide sufficient information in order to interpret conclusion. Personnel interviews in written or oral form is thereby valued as not crucial for obtain sufficient knowledge, instead these different secondary sources can be read, combined, developed and evaluated against each other to make valuable conclusions. This type of method is named by Fisher documentary research (Fisher, 2007). This choice is justified by the fact that the financial system is a regular debated and discussed phenomena in books, newspapers, TV and other media by people claiming to have understanding about the system.

3. The third aspect influences the method of searching for the information is affected by what

Fisher refers to as “the differences between discoverers and surveyors” (Fisher, 2007). By discoverers Fisher means an approach going into something unknown and without proper understanding what to find until the phenomena is investigated. This means that an open approach in method of gathering data is necessary. Instead of having a pre-made conceptual framework at start of the investigation it would instead develop during the process when insight appears. By using a surveyor approach in contrast the researcher

14

know enough about the phenomena to be able to structure and classify part of it in advance and then measure classifications to understand and document the phenomena. The method is thereby much related to the purpose of the research and the authors previous knowledge. Since the authors had only minor earlier experience of the financial system and a purpose to discover new personal knowledge what it is really about, the discoverer approach is chosen for the investigation. This means practically that the design of the research will have a grounded theory approach at beginning, which will be incrementally developed towards a more structured approach when an insight to the financial system increases.

1.5 Practically conducted research

1.5.1 Gathering data

Taking into consideration that Master’s Thesis is based on documentary research and the chosen methodology is interpretative research with critical realism grid, the directions of information presentation and analysis can be shaped according to the Alvesson and Deetz aspects of critical realism (Alvesson & Deetz, 2006):

1. Insight – looking on details;

2. Critique – looking at the total;

3. Transformative re-definition – finding alternative ways of imaging and relating

finding to what already exists.

Insight presupposes activity of gathering knowledge about event and aims to provide awareness of how knowledge about studied phenomenon as well as about the seemingly objective character of objects and events are formed and sustained; and the ways people perceive this knowledge. Most of the time, members of the society take for granted knowledge of established meanings and formed nature of objects and events without looking into details and trying to deeply understand the real nature, characteristics and principles of their functioning. Exactly insight provides the overall definitions of studied phenomenon trying to break it into component parts and further analyze them in minor details in order to present a critical and not commonly accepted understanding of the analyzed object. In order to provide the necessary details and to form general understanding of the event, it is important to gather and construct empirical and theoretical material in an open manner and to analyze how this material fits together, what creates favorable conditions of seeing, pointing out and understanding of implicit meanings (Alvesson & Deetz, 2006).

In order to execute a successful interpretation of the analyzed in the Master’s Thesis financial system a provided in it insight has to:

• Address financial system, its role, functions and component parts as something

non-obvious. Taking into consideration that existent knowledge about financial system do not give the absolute possibility of enlarging people penetration into it (the concept called by Giddens “discursive penetration”), the system has to be viewed as unknown and unobvious phenomenon. In this sense the researchers aim to overcome practical restrictions and various mechanisms of discursive closure and to define critically financial system (Alvesson & Deetz, 2006). The gathering of data consists of keyword search in internet data bases, and using the references in gathered data to obtain sources. When initial sources contain key concepts and events that need more clarification further research was made for addressing the concepts or back up insights. The use of interviews

15

and documentary published in the WWW was also used for insight in the subject but not as sources in the thesis. See key the most important key words used in research and applied data sources in Appendix 1.

• Make necessary definition and sense of the financial system. Here, the researchers aim to present the overall picture of financial system and its basis through the summary and analysis of the data. For creating an initial definition of a word the Illustrated Oxford Dictionary was used, the dictionary is meant for the thesis to represent a knowledge base much higher than the average citizen in a society. When definitions are unclear in Oxford Dictionary, Webster’s New Twentieth Century Dictionary was used. If these two sources was not sufficient Dictionary of Business and Management, International Encyclopedia of Business & Management and finally Cambridge advanced Learner’s Dictionary was used. For defining actors in the system The New Palgrave dictionary of money and finance was used for provide to solve the problem.

• Tend to enrich the understanding about the financial system through presenting implicit

particularities and details of the system. For doing this, sources was compared to each other and discussed for creating a initial conceptualization.

Critique, which is built upon insight, represents the process with main focus on description of studied phenomenon as a historically appeared event. It is argued that ideas, meanings and concepts have to be evaluated in terms of historical situatedness. In this sense, exactly the historical development of an event provides the understanding of its nature in the present. The relevant established theories and earlier empirical research may offer an interesting point of reference and comparison of the contemporaneous phenomenon with one in the past (Alvesson & Deetz, 2006).

At the same time, critique aims to provide an overall understanding of the studied phenomenon through counteracting the dominance of taken-for-granted goals, ideas, ideologies and discourses, which influence the overall understanding of financial system. Here can be injected the Derridian concept of “deconstruction”, “which denies the univocal products of the intellectual, the result o methods and procedures, and common sense of the public; and instead it opens the movements in and between them” (Alvesson & Deetz, 2006). It means that overall picture accepted by public and taken-for-granted about financial system has to be critically assessed and analyzed. For doing the critique the phenomena investigated was twisted and tried to be understand from different angels, form different academic views and in different circumstances.

Transformative re-definition is the process of development critical knowledge and practical understanding that enables change and provides skills for new ways of operating (Alvesson, Deetz, 2006). Thus, transformative re-definition aims to provide a new insight into existent already definitions, reconnect them in various ways and extract new ideas, visions and understanding of the studied phenomenon. In this context the final goal of transformative re-definition lies in creating novel concepts and practices for members of the society and to provoke further thinking about them. As it is noticed by Alvesson and Deetz, “critical analysis leading to transformative re-definition means encouragement of the development of the competing discourses, embracing constructive conflict and participating in agenda setting, reality definition and decision making” (Alvesson & Deetz, 2006).

Taking into consideration the aim of the transformative re-definition and the researched in the project area, will be made an attempt to critically (but trying not to over-critique) present the

16

contemporaneous financial system with its component parts with possible defining and re-shaping of the very essence of it.

Also, in order to execute the practical analysis of the obtained data, will be used such techniques as (Alvesson & Deetz, 2006):

• De-familiarization – is the technique which avoids acceptance of social phenomena (financial system) as a self-evident and familiar phenomenon and rather to analyze it as an unknown and strange object, which requires interpreting and observing studied events in a different compared to overall perception way. In order to rich de-familiarization, it is important to execute the following actions: to use creativity and imagination, to create distance (to look on the studied phenomenon with the fresh eyes), to work with negations (by negating the existent order of events it is possible to see an object in a novel way) and to base the research not only on informational sources concerning financial system, but also on anthropological and historical text related to the financial system;

• Dissensus – is a technique through with the hidden essence of the studied phenomenon is found. Using dissensus various implicit meanings of financial system and its component parts may be found and further novel understanding of it can be drawn;

• An illustration – is a technique through it is possible to illustrate the whole financial system, its component parts, role in the society, basis and functions.

To illustrate the mentioned process, a reflection could be made on how many times the problem hierarchy and the conceptualization has changed for this final version. In total 5 different modifications hade bean made to the problem statement, and 3 different conceptualizations. In fact the final project is not at all restricted to banks which was the initial start of the project but has developed to meet the challenges of de facilitate the project.

1.5.2 Analyzing

Even if the analyzing part is happening simultaneously with the gathering part in critical research and there is no natural divide, it is still considered important to breakout some of the part to allow them to be critical targets of investigation by the reader and illustrating key points in the written material.

Historical data, the analysis is made from interpretation of key events in books and articles describing the financial history. Fort the findings used there is tried to have multiple sources for the finding, but if the finding is logical and the writer conducts a reasonable argument some findings are attached with only singular source. Year number and “who was first” is usually not double checked between sources because they are not valued as key facts for the conclusion. Instead the purpose of the historical part is to provide a foundation and overall picture of the development. The overall foundation for the historical part is well known and well discussed sources written by academics in history, anthropology and finance.

Theoretical discussion, the theoretical sources for discussing phenomena are chosen from the authors developed insight in the subject as the sources most used in theoretical discussion earlier and the ones being viewed as most recognized. Not all theoretical sources used are presented in this paper because of similarities to other academics or they are evaluated to have an unclear knowledge about the subject.

Simulation models, the simulations models you will experience in the thesis is made for trying to reduce a large and complex society to a minimal society more easy to understand.

17

The models use simple mathematics of addition and subtraction with the double book keeping principles to explain forces and changes in a society.

Network models, the program tools for conducting the visualization of the networks is made from two different program offering two different functions. Because of lack of avalible programs easy to interface, two sources was necessary to verfy important points to the network. The program “VisuaLyser 2.0 for Windows” was used for illustrating the double relationship most of the actors in the network has. The program “Ucinet 6 for Windows” with the application “NetDraw” was used to visualize how strong the ties between actors is, by using a quantification function creating broader lines in the network.

1.5.3 Writing up and documentation

The final version of the report has to some extend a contrasting appearance comparative to a regular presentation of master thesis. The form of presentation is made to provide the reader with a structure that requires building of conclusion rather than a more regular passive approach drawing up the conclusion. This different approach of writing up comes from the experience of reading a high amount of articles, books and dissertation and the idea how the presentation a format more interesting and active for the reader. Still Fisher guide is used for securing that the formal standards follow in academic writing. The references system used in the project is APA system due to school requirements for the master thesis. Because sources are used in with multiple references within different concepts a literature foundation, the literature foundation divided by the concept and an overall critique are visualized in Appendix 2.

1.6 Limitation of the project

Perspective

The thesis foundation of history and conceptualization will be based on what is often referred as the “Western Society of the World” with special emphasis on the Swedish society. The western society can more precisely describe nation in today Europe and North America. At the same time, some few special events in history are used outside this perspective when important events have influenced directly the “western system”.

Money

Limitations concerning the explanations of the history of money will be based only on key facts and will not analyze chronological episodes in various countries in minor details. The analysis will be based on illustrative examples for which the development of money in some countries, regions and/or nations can be used. Also, while discussing the value, role, functions and history of money the most recognized theoretical sources will be used.

Financial system

The analysis of financial system history will be based, as well as one of money, on key facts and episodes. Also, mostly empirical history sources one will be used to analyze the actors business units, their role, functions and history of development.

Networks

The investigation of banks network will analyze their external network due to our research question, the internal network is not a part of or angle of investigation. The external network is going to be divided between the banking system in Sweden and their International relationship. Also, taking into consideration the information provided in secondary sources, will be made a generalization of all foreign financial institutions to International ones, without dividing them into countries and regions. Types of ties will be limited to financial bonds among actors. This is made due to the main purpose of the project, which consists in the analysis of financial system rather than investigating social, legal, and cultural or other types of ties among actors in society.

18

Chapter 2: The Illusion of money

This rather provocative heading of the chapter repeats the conclusion of the chapter. The chapter aims to provide a conceptualization of the term “money”, but before starting history review, analysis and conceptualization one initial definition of the term is needed as a foundation for the analysis. Illustrated Oxford Dictionary defines the word like following:

Money – a current medium of exchange in the form of coins and banknotes

(Illustrated Oxford Dictionary, 1998, p 525)

While the Webster’s New Twentieth Century Dictionary defines the word like following:

1. Standard piece of gold, silver, copper, nickel etc, used as medium of exchange 2. Any substance or article used as money as banknotes, checks etc

(Webster’s new twentieth century dictionary, 1979, P 1160)

The thesis choose Webster’s definition more as a suitable one compared to Oxford, because emphasis that the starting point is that money is more than coins and banks, as far as it is accepted as medium of exchange in a trade. With the Webster’s definition as foundation the initial definition of money is formed like following:

Money is an umbrella term for the trading tools having a characteristic of a single item is accepted by a society to sets the value for all the other items.

The starting point is that money can have many different types of shapes as long as it is an item, meaning that abstract things like labor or decision do not represent an item and thereby they cannot be called money. There is further no restriction to the term society which came to be a tribe with limited number of citizen as well as addressing the entire population of the earth.

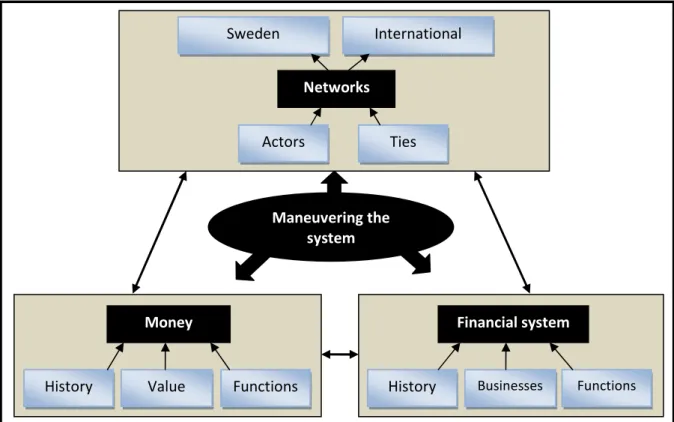

This chapter will has the following structure for facing the phenomena of money and creating a conceptualization:

Just as the model implies the historical progress and theoretical views about the concepts of money will be investigated in order to create a thesis conceptualization about the term “money”. First of all is the historical review:

2.1 History of Money

2.1.1 A world without money

Depending on the historical perspective money can be regarded as a modern and new phenomenon, a fine example of this longer perspective contrasts with a recent occasion is when the tribe Nukak-Makú unexpectedly found their way out of Amazonas in

2003. Totally restricted from the modern society, they have lived Figure 5: The Nukak-Makú tribe,

source: survival-international.de

History review of money Theory review on money

Conceptualization of money

19

on hunting monkeys and collecting fruit in the forest (Ferguson, 2008). Hunter tribes like the Nukak-Makú have no need for money; they eat what they find and did not save anything (Ferguson, 2008). The hunting societies have also no intention for trade; instead protecting their resources from stranger tribes was a main motivate for survivor (Ferguson, 2008).

But when the hunting society developed to societies where agriculture activities started to be an increasingly important source for surviving, trade between tribes instead of violence starts become a better solution for survivor. The solution for the first types of trades was changing the surplus of goods breed by the tribe against shortage types of goods. When the agricultural society further developed trade, it seemed to become a gradually more important tool for surviving. Thus trade developed further and became a source for enrichment of the living standard among the tribe citizens.

The only documented modern civilization which managed to organize their society and trade without any usage of money is the Incas of Peru (Ferguson, 2008). Instead of some type of money, labor function as the value tool for the society. Even in modern times attempt have been made to organize a society without money, based on Karl Marx and

Friedrich Engels thoughts, rather similar to the principles used be the Incas, the Russians communist after the revolution in 1917 crashed their currency by printing an overwhelming amount of money forcing the currency to collapse (Weatherford, 1998) and (Ferguson, 2008). The motivation for this action was building a society without money, instead a system of rationalization where the state provided coupons to the citizens for obtaining food, clothes, living and other means necessary (Weatherford, 1998). But after just a few years the Communist party came to insight that they needed money and in 1921 started to introduce a new currency system within the country (Weatherford, 1998). The communist nations failing attempt of building society without money is comment by Fergusson like following:

“Yet no Communist state - not even North Korea - has found a practical disperse without money”

(Ferguson, 2008, p 18)

When contrasting the Coupons used by the Russian communist by the definition of money in the introduction, these coupons may still be defined as tool for use in trade, but there is an important factor that is that a coupon for buying clothes could not be used for buying food, thereby they are not an item setting value for all the other items in society, and is thereby not money. The only single proof of a society manage to organize itself without a type of money, this weak single proof contrasted with the earliest form of hunting societies provides a foundation for the rather provocative statement by Gertrude Stein:

“Money is the thing that separates humans from the animals”

(Own translation: Gertrude Stein in Weatherford, 1998, p 17)

The statement can be viewed as provocative in the sense that it defines people as changed from being animals to become humans only after the moment they started to move away from the hunting societies to the agriculture society. Still the important note of the first passage of the history illustrates a significant historical point: societies which have developed form hunting societies have either been forced to do it or have chosen to use a type of money to organize the society and all the processes within it. Thereby a logical reasoning could be made that a world without some kind of money has been incomplete by the solution of having

Figure 6: Image of Russian Revolution, source: Spartacus.schoolnet.co.uk

20

a world with some type of money, due to the new world views trade as a necessary solution and the money as the key to simplify the trade. So next part will explain how this happened and explain the different tools of money that was introduced.

2.1.2 How money was introduced

The Aztec society in Mexico had in some sense a rather regular system of changing goods for goods, but what makes their solution different from other types of system at the time was their use of cacao beans to clear the differences when the goods could not be exchange equally (Weatherford, 1998). One had also the possibility in the system to buy for example fruits, vegetables, meat, slaves, and jewels by the use of only cacao beans. Prices of goods and the value of cacao beans was strict regulated by the rulers in the society, violators against the set rule of trade was punished hard and could even be executed (Weatherford, 1998). The trade was further organized in special markets, strictly govern by the rulers. Also, the use of cacao of beans as a payment instrument had the advantage that the possessor of beans could choose whenever wanted to grind the beans to

have a chocolate drink and make it a consumer good (Weatherford, 1998) and (Berkeley Science Review, n.d). The choice of cacao as the payment instrument seems to be attached with the Aztec mythology that a god discovered cacao and gave it to humans (Berkeley Science Review, n.d). Gods had an high importance for the Aztec society, where the high priest called “tlenamacac” was the ruler of the society and often had for example ceremonies sacrificing children by torturing them and in this way their tears would make the gods provide more rain (Weatherford, 1998).

The use of consumer goods as money is something historically far from uniqueness of the Aztecs. For example in Norway butter has been a tool of payment, also during the medieval dried fish functioned as a term of payment there (Weatherford, 1998). In what is today Philippines, Burma, Japan and other places in East Asia standardized rate of rice functioned as payment, in Greece and Ireland creature was a type of tool for payment (Weatherford, 1998). The word “Capital” even has its origins in the English word “Cattle” meaning amount of creature a shepherd possesses (Weatherford, 1998). Further in North Africa and around the Mediterranean Sea salt functions as the main tool of payment (Weatherford, 1998). The English word “Salary” as well as the Spanish and Portuguese word “Salario” has its origins in the Latin word “Sal” meaning “by salt”, it is believed that Roman soldiers have their payment in salt and these modern words comes from the times they started to express their payments (Weatherford, 1998).

The system of using these kinds of consumer goods had two major weaknesses: storing these types’ of values was problematic. Meat rotten, butter became spoiled and salt was easy to be splintered and also transporting these types of payment means can be problematic (due to the, for example, size of creature) as well as storing problem during the transportation (Ferguson, 2008 and Weatherford, 1998). The solution was found in metal, even if metal today can be seen as a natural tool for payment, it is rather revolutionary to the contrasting consumer goods, because metal is not something you can digestive or use to produce something to digestive. It is only a good to be used to enrich glorification of a person in terms of jewelers or as weapon for hunting or fighting. Because the hunting society has shift into a more agriculture society the logical explanation for people recognizing its value has to be either for use the metal in weapon or only for glorification to express success. If the reasoning is taking even further, looking on what kind of metals are most frequently used, the explanations seems to be the glorifications as an explanation of people accepting metal as a payment since the

Figure 7: Aztec god with cacao bean, source: erowid.org

21

most common metal used as means of payment was gold. Gold had very few areas of use outside decorations and should have been outcompeted by iron in making weapons. But also, if glorification is the reason for acceptance gold, it is logically to assume that the living standard in terms of accessible food within the societies has increased to the extent that survivor do not depend only on limited owned produced raw materials so the self realize has become an important factor in the society. But an alternative explanation to the argument might also be the fact that iron roasts, silver gets darker, but gold stays pure and does not change over the time.

The first known society to introduce a system using metal as payment was the Mesopotamian society in the end of the 2000 century BC. Cuneiform tables witness form the time 2500 BC mentioned silver as a tool of payment (Ferguson, 2008). The system was in contrast to, for example, the Aztec society and did not use the same money standards for the entire society; instead it was only used for tradesmen trading with ship cargos or magazines with goods (Ferguson, 2008).

It seems not to be until the 600 century BC, when the Lydian society standardized the use of metal in size and weight that metal started to have the shaped known today (Chown, 1994), (Ferguson, 2008) and (Weatherford, 1998). The Lydian Empire processed the metal piece in order to make all used metal money have the same weight and size. Also, in order to secure the value the empire made a stamp of the metal consisting of a lion head meaning that the empire engaged the value (Weatherford, 1998) and (Ferguson 2008). The stamp made the metal become flat instead of round pieces used before in trade

(Chown, 1994) and (Weatherford, 1998). This has been proofed by the finding in the Temple of Artemis at Ephesus where archaeologist found coins with gold-silver alloys which represents the oldest findings of coins (Ferguson, 2008). The development provided a revolution within trade, because now the trading actors could only count number of coins instead of time consuming weighing and testing of the quality. An important development occurring in Lydian society was that the standardization of coins increased the trade to the scale that instead of the regular procedure of traveling to each other for exchanging goods, marketplaces was arranged where people meet for trading.

“The marketing system by the Lydian’s can be seen as the forerunner of the medieval markets or today’s large shopping malls”

(Own translation: Weatherford, 1998, p 61)

The metal coins spread over to Greece, where Greeks discovered that money gives the possibility to organize a society in a better way than friendship or violence could do (Chown, 1994) and (Weatherford, 1998). All of a sudden these metal coins became a tool not only for calculating items like goods but also more abstract things such as labor

(Weatherford, 1998). But still the trade with coins remains a tool of payment only of the top of society, meaning that traditional government decision was the main source of organizing citizens. It was not common until the Romans started creating their own coins in 269 BC, metal become the trading tool for the entire society (Weatherford, 1998). The Romans created coins in three different types of metal; gold (Aureus), Silver (Denarius) and Bronze (Sestertius) each valued according to their scarcity (Chown, 1994) and (Ferguson, 2008). Each coin having a stamp of the Roman Emperor on one side and

Figure 8: Lydian coin, source: livius.org

Figure 9: A Roman Aureus coin, source: romancivilwar.com