Choice of Financing in Family Firms

Master Thesis- 30 Credits

Paper within: Master Thesis in Business Administration

Author: Ashkan Mohamadi

Supervisor: Francesco Chirico Jönköping December 2012

i | P a g e

Acknowledgements

I take this opportunity to show my deep gratitude and profoundrespects to my

supervisor Francesco Chirico for his constant encouragement and guidance throughout

this assignment. In addition I am obliged to the companies which answered the

questionnaire for the valuable information provided by them. I also take this

opportunity to thankalmighty my parents and my friends, especially my mother and my

uncle, for their support and encouragement without which completion of this thesis

would not be possible.

Ashkan Mohamadi

ii | P a g e Summary

Family Businesses build up a large proportion of businesses all around the world. Scholars, therefore, put much effort to study family firms. One common fact on which many scholars agree is the important role of non-economic factors in decision making processes in family firms. A theory called socioemotional wealth is developed to explain the role of non-economic factors in family firms. It suggests that the main goal of family firm, rather than maximizing shareholders’ value, is to preserve their socioemotional wealth. Socioemotional wealth can be in forms of control, identity, social relations, emotions, or passing the company to the next generations. Due to the importance of these non-financial factors in family firms, their decision making process can be different than that of non-family firms. Financing activities is one of the essential decisions in the business.

The goal of this research is to find out if there is difference between choices of financing in family and non-family firms. In order to do that a questionnaire is designed and sent to Swedish companies. 171 companies, 73 of which are family firms, replied to the online questionnaire. Four regression models are designed to examine the difference in preference over 11 different sources of financing between family and non-family firms. Using the regression models and interaction graphs, moderating effects of firm size and firm age are also investigated.

Result shows that family firms are different in choosing internal sources of financing and debt. They prefer those financing sources more than non-family firms. Result on external sources of financing in comparisoncannot be generalized for all external sources. Moderating effect of firm age is in a same position, which means although it is supported for some sources, for others the result is not significant. Additionally Resultdoes not support the hypothesis about moderating effect of firm size on the relationship between being a family firm and use of different sources of financing. Key words: family firm, family business, socioemotional wealth, internal source of financing, external source of financing, debt, firm size, firm age

iii | P a g e Contents 1.Introduction ... 1 1.1. Background ... 1 1.2. Problem ... 3 1.3. Purpose ... 4 1.4. Delimitation ... 4 1.5. Definitions ... 5 1.6. Disposition ... 6 2. Theoretical Framework ... 8 2.1. Family Business... 8

2.2. Socioemotional Wealth and Financing Decisions ... 13

2.3. General Financing Issues ... 17

2.4. Research Hypotheses ... 20 3. Methodology ... 27 3.1. Research Approach ... 27 3.2. Data Collection ... 28 3.3. The Questionnaire ... 29 3.4. Data Analysis ... 30

3.5. Validity and Reliability ... 33

4. Result ... 35

4.1. Descriptive Analysis and Correlations... 35

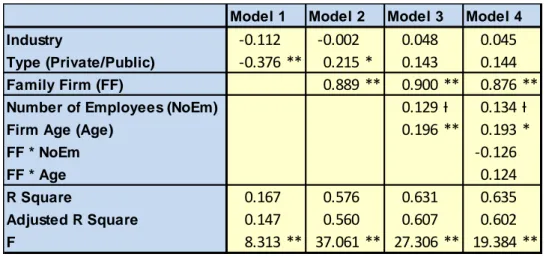

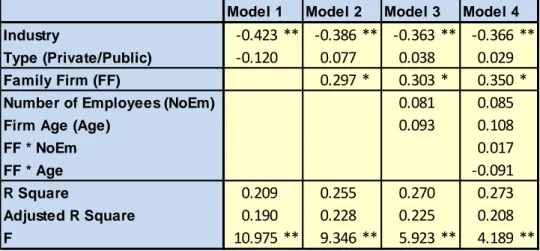

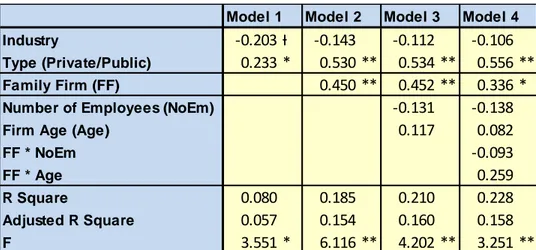

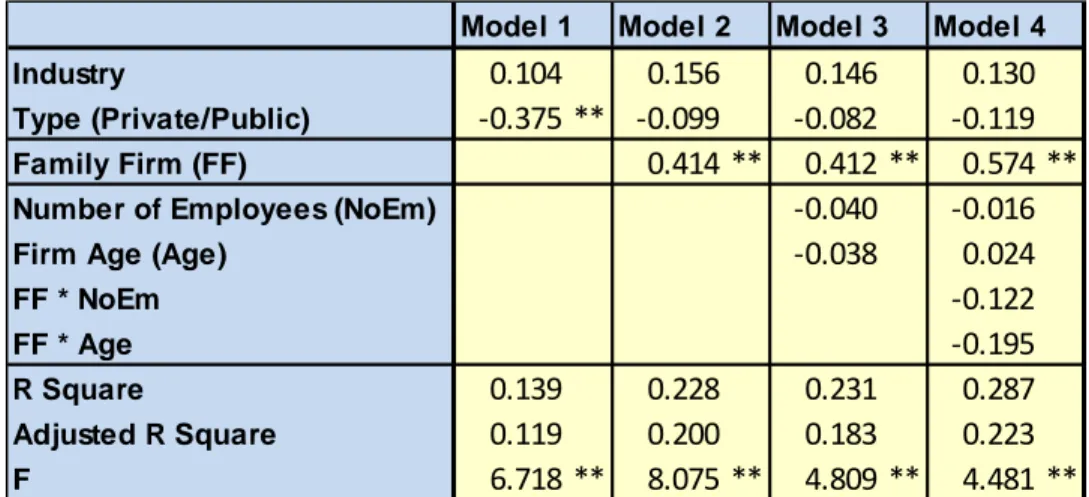

4.2. Internal Sources of Financing ... 37

4.3. Debt ... 40

4.4. External Sources of Financing ... 41

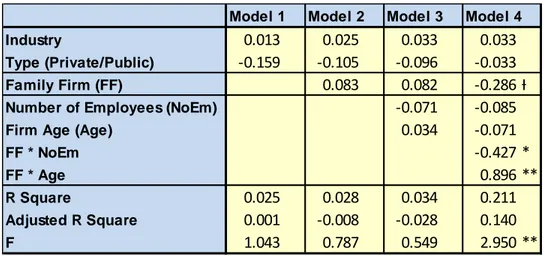

4.5. Moderating Effect of Firm Size ... 43

4.6. Moderating Effect of Firm Age ... 45

5. Discussion ... 48 5.1. Conclusion ... 48 5.2. Discussions ... 50 5.3. Contribution ... 54 5.4. Limitations ... 56 5.5. Future Research ... 58 References ... 60 Appendices ... 64

1 | P a g e

1. Introduction 1.1. Background

Family businesses are one of the most common forms of business in the world. Their role in economies of nations including both developed and developing countries is undeniable. Many of the existing companies have started as a family business at the beginning. Because of their importance, in academia many authors have studied family firms. Still the study of family firms is at its early stage and scholars are investigating and finding new aspects of it (Miner, 2010). Family businesses are worth being studied in particular since they act sometimes differently than non-family businesses. So in the literature on non-family firms, topicsother than general business issuesare investigated.

Many studies have shown that there are some differences between family businesses and non-family businesses (Aronoff, Astrachan, & Ward, 2002; Bertrand & Schoar, 2006; Chrisman, Chua, Pearson, & Barnett, 2012). Unlike other kindsof business, a family business is operated by members of a family. This causes the decisions made in the business to be affected by family norms and culture (Bertrand & Schoar, 2006). Poza (2004) for example claims that family businesses do not want to give up control of the business. As a more precise example, by mentioning the cultural beliefs in the family businesses Bertrand and Schoar (2006) stated that legacy may instill the desire to insure the family control and survival at all cost. This is an example of what Chrisman et al. (2012) called family centered non-economic goals. To make it more clear, sometimes in the family businesses the decisions are not made based on the economic goals. They are instead based on non-economic goals which include family culture and beliefs.

Since non-economic goals play an important role in the case of family businesses, their behavior is to some extent different than other types of business. One of the behaviors is their choice of financing and the structure of their capital. Romano, Tanewski, and Smyrnios (2001) have done a research to see how some of the differences in the family businesses make different in their capital structure. They

2 | P a g e

checked family firms’ choice of financing based on the size of the firm; age of it; industry; age of the CEO; family control; and business planning.

Capital structure is an issue in any kind of business. The classic definition of capital structure is the ratio of debt and equity in the total value of a firm (Bodie, Kane & Marcus, 2004). Debt increases the leverage while it is theoretically less expensive than equity. By increasing leverage, debt increases financial risk of firm. Debt usually doesn’t lead to involvement of external financiers. Equity on the other hand, if it is funded by non-family sources, leads to the involvement of the external financiers. However, equity has some advantages as reducing the risk and availability of outside advice (Smith, Smith, & Bliss, 2011; Bodie et al, 2004). The general theory which explains how firms decide on their capital structure is explained by the optimization of Net Present Value (NPV) and Weighted Average Cost of Capital (WACC). In general, theoretically individuals’ behavior is explained by their effort to maximize their gained value and at the same time to reduce the risk they face (Preve & Sarria-Allende, 2010). Beside that general theory, scholars have discussed the issue in more detail. Smith et al. (2011) for example stated that firms’ decision on the source of financing depends on issues like stage of growth of firm, urgency of the financial need, and amount of it. Smith et al. (2011) also make a list of different sources of financing, and then they make a model in which they relate each of the sources to situation of the firm. For example if the firm is in its early growth stage, the need is not urgent, and the amount is small, firm will probably go for existing shareholders, friends and family, and angel investors as equity funding and for boot-strapping and government programs as debt financing. Some of the listed sources of financing in different entrepreneurial finance books including that of Smith et al. (2011) cause involvement of the external financiers. Those include angel investors, venture capitalist firms and public offering. There are in contrast some internal sources of financing such as unpaid dividends which do not lead to involvement of outside investors. As discussed earlier, debt including asset based lending and many forms of the commercial bank lending usually does

3 | P a g e

not lead to loss of control of the business in most of the time. Equity on the other hand, if it is financed by an external source causes to lose some of the control over the firm because the financiers want to make sure they will have the best compensation by the best possible management. So they monitor the firm and give advice to it (Smith et al., 2011). There are however some kinds of equity which do not necessarily lead to involvement of other parties. Family, boot-strapping, and current shareholders are the examples.

To sum up, due to the different attitude of the family firms from non-family ones, they have some economic goals which cause their behavior to differ from non-family businesses (Chrisman et al., 2012). One of their important attitudes is to insure the family control over the firm (Poza, 2004; Romano et al., 2001; Bertrand & Schoar, 2006). This can impact their choice of financing for example, since some of the sources of financing take the control from the current owners (Smith et al., 2011).

1.2. Problem

There are some differences in decision making process of family firms and non-family firms. For example many scholars mentioned that the non-family businesses intend to keep the control of the firm within their family (Poza, 2004; Romano et al., 2001; Bertrand & Schoar, 2006). Though the other types of business might have such intention as keeping the control with the entrepreneur, the stronger role of culture and the norms and non-economic goals can make the family businesses more eager to keep the business within the family (Zellweger, Nason, & Nordqvist, 2011a). If so, it can be expected that family businesses intend not to finance their needs by sources which lower their control over the business. In other words, ceteris paribus, if we compare two similar firms one of which is a family business and the other one is not, the family business has less willing to share their equities. Based on other characteristics of family businesses also, there could be other differences in financing activities of family firms. This issue is worth being investigated and examined more. It is indeed worth seeing whether

4 | P a g e

evidencesupportsdifferent choice of financing in family firms. In fact studying how different family and non-family firms are in case of financing can support or weaken previous studies on family firms.To put another way there can be some contributions as empirical studies to examine the existing theories about family firms. Especially in recent years new theories are developed to discuss the decision making processes in family firms. Also for financing choices in family firms there are opposite arguments in the literature. So putting more effort to recognize the real relationship between different factors in financing decisions of family firms can be valuable.

1.3. Purpose

As an empirical study this paper intends to find out the potential difference in financing choices in family firms and non-family ones. The data however will be gathered only from Swedish family and non-family firms. In other words, investigating businesses in Sweden, this paper attempts to find how different family firms choose each of common sources of financing. To do this, primary data is collected by the mean of questionnaires which are sent to different businesses in Sweden. Conducting a quantitative research, by analyzing their answers to the questionnaires, the purpose is to find how important each of sources of financing is to family and non-family firms. Based on the result, it can be concluded if family and non-family firms are different in choosing source of financing. Also different theories in family firms can be supported or weakened by the result of this paper. In summarythis paper attempts to answer the following question:

Do family firms differ in their choice of sources of financing compared to non-family firms?

1.4. Delimitation

The goal of this research is to find out if there is a difference between choice of financing in family and non-family firms. Additionally if the difference exists, this paper attempts to find out why it does. This paper, on the other hand, does not

5 | P a g e

investigate the process of family firms’ decision making in case of financing. It is a quantitative research which seeks the difference and some factors affecting it. It is not a qualitative research which asks family businesses directly on how they decide on their choice of financing. As a result it is not about how family firm owners think step by step to choose their choice of financing.

1.5. Definitions

Family Firm:There are many definitions for family firms. Generally a family firm is

a business in which one or more families are the owners and/or the managers. In this paper a family firm is referred to as a business “in which two or more extended family members influence the direction of the business through the exercise of kinship ties, management roles, or ownership rights” (Chua et al., 1999, p. 21).

Capital Structure:Capital Structure is the mixture of debt and equity used in a

company to finance its activities (Clayman et al., 2012). If V represents value of a company, D represents its debt, and E stands for its equity, the following statements are used to present capital structure of a firm:

D + E = V 𝐷

𝑉+ 𝐸 𝑉 = 1

Pecking Order Hypothesis:Pecking order hypothesis (Romano et al., 2001; Zhang

et al., 2012; Tappeiner et al., 2012) suggests that firms are likely to finance their activities firstly by internally generated funds. They prefer debt after the internal financing and only then, they go for private equity.

6 | P a g e

Socioemotional Wealth:Socioemotional Wealth is a new concept mainly discussed

by Gómez-Mejía et al. (2007). Socioemotional Wealth refers to non-financial wealth of family firms preserving which is the main goal of them. Socioemotional Wealth is “non-financial aspect of the firm that meets the family’s affected needs such as identity, the ability to exercise family influence, and the perpetuation of the family dynasty” (Gómez-Mejía et al., 2007, p. 106).

Family Business Triangle:Sometimes some conflicts exist among the owners of a

family firm. The conflicts are about selling a part of company to the outsiders in order to be able to raise capital and stay competitive in the market place. On the other hand some of the owners do not want to re-invest in the company and just want their dividends and liquidity. What impacts these decisions is the family’s concern about keeping control of the firm within family members. The relationship among capital, liquidity, and control is referred to as Family Business Triangle (de Visscher et al., 2011).

Figure 1.2. Family Business Triangle

Patient Capital:Patient capital is defined as “equity provided by family owners who

are willing to balance the current return on their business investments with merits of a well-crafted, long-term strategy and continuation of the family tradition and heritage” (de Visscher et al., 2011, p. 16).

External Financing Debt Intenal Financing Control Liquidity Capital

7 | P a g e

1.6. Disposition

Introduction: In this chapter a background on family businesses, their difference to

non-family firms, general issues on how firms decide on their financing sources, and the potential difference of family firms on this issue is discussed. Then based on the background the problem and purpose on this research is presented. Definition of key terms and a disposition is presented after stating the delimitation of this study.

Theoretical Framework: Different theories by different authors are presented and

structured in the theoretical framework chapter. They are structured in a way that the research hypotheses can be generated in order to find the potential differences in choice of financing of family and non-family businesses. Lastly the hypotheses are stated.

Research Methods:This section presents how this research is done. In detail, how

the sample in chosen, how the data is gathered, how the data is analyzed, and how trustable the results are, are discussed in the research methods chapter.

Result: The result of the empirical study, i.e. the regressions on the data gathered

from the questionnaire, is presented in this section. The result is shown by different tables and graphs for different models used to analyze the data.

Conclusion:The conclusion is made based on the result. If the result is not in

accordance with the research hypotheses, the possible reasons are discussed in this section. The reasons might include the limitations of this study which also are presented in conclusion section. For the result which supports the hypotheses, the relevant theory behind the hypothesis is claimed to be supported. Some suggestions are also made for future research on the topic of this research based on what is found interesting, important, and limiting.

8 | P a g e

2. Theoretical Framework

2.1. Family Business

Studying family businesses is to some extent different from non-family businesses (Craig & Salvato, 2012; Gómez-Mejía, Haynes, Núñez-Nickel, Jacobson & Moyano-Fuentes, 2007). One reason for the difference is that family businesses involve families which in turn have their own characteristics. In other words, families have special behaviors which cannot be seen in other institutions. Family and business are two different types of social organizations (Zellweger et al. 2011a). To study the two different organizations together, a new set of theories and research would be required (Miner, 2010).The fact that family business consists of family and corporation makes the field to be diverse. In other words, family business research is positioned in the boundaries of different fields.It involves Economics, Management, Psychology, Sociology, etc. (Craig & Salvato, 2012). There are many studies merely on business. There are, on the other hand, a lot of theories on family behavior. However, studying family business can make creative perspectives to view the phenomena (James, Jennings & Breitkreuz, 2012; Miner, 2010). For example in classical study of business many of the behaviors are explained by maximization of shareholders’ value (Miner, 2010); while in studying family businesses behavioral theories are mostly used (Chrisman et al., 2012; Berrone et al., 2012; Chua, Chrisman, & Sharma, 1999); though Astrachan and Jaskiewicz (2008) suggest that the general term of maximization of utility function in Economics can be a general theory to explain all the institutions. In this case the utility function can consist of financial and non-financial interests such as emotional joy or psychological gratification. However behavioral theories are widely used in family business research (Chrisman et al., 2012;Berrone, Cruz & Gomez-Mejia, 2012). Based on behavioral theories Chrisman et al.(2012)note that rather than a single financial goal, family businesses have diverse set of goals which include family centered non-economic goals. Gómez-Mejía et al.(2007) present a developed version of behavioral theories called socioemotional wealth. To Gómez-Mejía et al.(2007) the main goal of family firms is to maintain the socioemotional wealth. They define socioemotional

9 | P a g e

wealth as “non-financial aspect of the firm that meets the family’s affected needs such as identity, the ability to exercise family influence, and the perpetuation of the family dynasty” (Gómez-Mejía et al., 2007, p. 106). However, the term of socioemotional wealth is developed further by Berrone et al. (2012). The explanation of the developed version of socioemotional wealth is discussed later in this chapter. In generalfamily business literaturesuggests that family members are emotionally involved in the business rather than only thinking about the financial outcomes (Craig & Salvato, 2012; Gómez-Mejía et al., 2007; Astrachan & Jaskiewicz, 2008).

Considering behavioral theories, the family entrepreneurs are seen as humans with all the feelings, emotions, and passions (Craig & Salvato, 2012). For example,socioemotional wealth of Gómez-Mejía et al. (2007) can be in form of satisfaction of needs of affect, intimacy, and belonging. Mentioning the importance of emotions, Astrachan and Jaskiewicz (2008) formulate a model to assess the value of family firms. In the model, they included emotional returns and emotional costs. Emotional returns can be warmth, love, tenderness, happiness, consolation, etc. (Berrone et al., 2012). Emotional costs including anger, sadness, fear, loneliness, anxiety, disappointment (Berrone et al., 2012) can be a result of family conflicts, stress, and rivalry (Astrachan & Jaskiewicz, 2008). Stamm (2012) discuss the term of psychological ownership in the family businesses. In this regard, Stamm (2012) suggests that there is an emotional perspective on family business ownership which in fact gives identity to the family (Stamm, 2012). Family members in the family firm not only own the business legally, but they store part of themselves in the business (Stamm, 2012).

The role of self-identity in family firms plays an important role in their behavior (Gómez-Mejía et al., 2007). Identification is defined as the way self-conception and the social categories to which people perceive themselves to belong (Gómez-Mejía et al., 2007). Gómez-Mejía et al. (2007) also present the term of organizational identification for family businesses. They claim that people would have a deep

10 | P a g e

psychological gratification when their beliefs about their organizations become self-defining or self-referral. Maybe that’s why family firms tend to keep the control of the corporation within the family (Berrone et al., 2012; Gómez-Mejía et al., 2007). According to Gómez-Mejía et al. (2007) because of socioemotional wealth family firms try to maintain family control and exercise authority even if it means avoiding a better performance. For example, Sirmon and Hitt (2003) claim that family businesses don’t have access to some main sources of financing which is available to non-family firm due to the fact that families don’t want to share their equity. Maintaining the family control applies to long term perspectives also. In other words, to preserve socioemotional wealth or the family identity, family is likely to keep and successfully run the firm in the future.

Family’s attitude towards the survival of firm is like protecting the family’s identity. Discussing this, Poza(2010)suggest that while managing a family firm, the managers should be totally aware of the long term ownership perspective of family members towards their business. According to Gómez-Mejía et al. (2007) socioemotional wealth can be in form of the perpetuation of family values and the preservation of family dynasty. The long term perspective causes some different behaviors in family firms. Difference in financing activities is one example. According to Sirmon and Hitt (2003), the long term perspective can impact the financial activities in family firms. They have an effective financial structure in order to be able to perpetuate the business for future. This causes patient capital presented by Sirmon and Hitt (2003). Patient capital, which is one of the capitals available to family businesses, is defined as the capital invested without the threat of long term liquidation (Sirmon & Hitt, 2003). Since U.S. financial markets are not structured for these kinds of financing, patient capital could be a source of advantage for family firms (Sirmon & Hitt, 2003). Patient capital is not the only resource available to family firms. Businesses which arerun by family members provide a combination of resources which might not be available to non-family businesses. In this regard, Craig and Salvato (2012) state that one of the main distinctions between the family and non-family businesses is

11 | P a g e

the resource management possibilities. There are some resources in the family that can be available to a potential business. These resources are called family capital in the literature (Sorenson & Bierman, 2009). Family capital can be in the forms of social, human, or financial capital.Sirmon and Hitt (2003)name patient capital and survivability capital instead of financial capital.As Sorenson and Bierman (2009) show human and financial family capital can be hired or imported into non-family businesses. In fact social family capital is what makes family business different. Social capital is available only to families because there are unique relationships within family members that cannot be easily reproduced elsewhere. The relationships for example make trust within the business. Open dialogue is another example. The family members can discuss the business issues during lunch for instance. A related issue about the specific relationships within family is structure of the family. In factCraig and Salvato (2012)claim that one of the differences between family and non-family business research is the context and structure of the family firms. Studying the role of structure in family firms,James et al. (2012) applied two theories from family studies: structural functionalism and symbolic interactionism.Structural functionalism refers to the fact that families are units of the societywhile the interactions within the family can identify the role of family in the society. Symbolic interactionism, on the other hand, explains how relationships and roles in the family shape the identities of individuals in the family. During the process of shaping identities, values are affected and the behavior will be in consistent with values and identities(James et al., 2012). These family related theories can explain some of the behaviors of family firms by explaining the relationships and interactions within family.

Although these emotions, identities, and relationships exist in non-family businesses as well, they are strong enough in family businesses to make the family firms different from non-family firms (Berrone et al., 2012). Making a same point, Chrisman et al. (2012) stated that the social affiliated goals, solidarity, and social values (Miner, 2010; Gómez-Mejía et al., 2007) may be what differentiate family and non-family firms.

12 | P a g e

A relevant theory that can sum up all the above mentioned points is socioemotional wealth theory of Gómez-Mejía et al.(2007). There are two reasons for stating socioemotional wealth theory. First, as Berrone et al. (2012) mentioned, it is based on widely-used (Chua et al., 1999; Chrisman et al., 2012) behavioral theories. That means, in explaining family firm behaviors, non-financial goals should be considered. However, socioemotional theory suggests that there is only one goal for family firms, which is preserving family’s socioemotional wealth (Gómez-Mejía et al., 2007). Second, it is comprehensive enough to consist all of the points made earlier in this paper. Berrone et al. (2012) define five dimensions for socioemotional wealth which can be represented in word FIBER. According to Berrone et al. (2012) F stands for family control and influence. As mentioned earlier families are likely to keep the control and authority of strategic decisions within the family (Gómez-Mejía et al., 2007; Sirmon & Hitt, 2003). The control can be direct by a family CEO for instance or indirect by presenting in top management team (Berrone et al., 2012).de Visscher, Aronoff, and Ward (2011) divide control into two types: management control and ownership control. In Berrone et al. (2012)’s model, I stands for identification. As discussed earlier identification and preserving it in the family can alter the way in which family firms act. To give an example, a family’s image about themselves can be to treat the employees very well. This might lead not to firing employees in economic recessions even if it is financially beneficial or legally allowed. This behavior is explained by socioemotional wealth as the family wants to preserve its identification which is one dimension of socioemotional wealth. B means bonding social ties. In this case the socioemotional wealth theory is related to social family capital. According to Berrone et al. (2012) social ties can be internal or external. Internal social ties refer to the relationships inside the family while the external ties are relationships with outsiders like partners, customers, etc. Binding social ties can fulfill people’s need for social relations, closeness, and interpersonal solidarity (Berrone et al., 2012). E in FIBER refers to emotional attachment. Emotional attachment is defined as “psychological appropriation of the firm by the family in order to maintain a positive self-concept” (Berrone et al., 2012, p. 6).However, the feeling and emotions, as presented by Astrachan and Jaskiewicz (2008) as emotional

13 | P a g e

returns and emotional costs, can be negative or positive. The last letter of R stands for renewal and dynasty succession. The long term perspective of the family firms and the impact of that perspective on family firm’s behavior exist due to this dimension of socioemotional wealth.

2.2. Socioemotional Wealth and Financing Decisions

Each of the five dimensions of socioemotional wealth can have impact on financing decisions of family firms. Generally according to Zhang, Venus and Wang (2012) family firms do not behave the same as others in case of choice of financing. The first dimension of socioemotional wealth, control, is one of the most influential reasons. In almost every research on financing decisions in family firms desire to keep control over the firm is stated as a significant factor (Romano et al., 2001; Sirmon & Hitt, 2003, de Visscher et al., 2011; Zhang et al., 2012; Tappeiner, Howorth, Achleitner, & Schraml, 2012; Wu, Chua & Chrisman, 2007). In other words, in making financing choices families are likely to keep the control of firm within family. Zellweger et al. (2011b) argue that without control, families cannot have the other aspects of socioemotional wealth. Control and influence are what gives the family emotional attachments and the organizational identity (Zellweger & Astrachan, 2008). In their model on capital structure of family firms, Romano et al. (2001)present the desire to keep family control as one of independent variables; which shows the importance of the issue in the model. Control allows families to pursue their interest inside the business (Zellweger et al., 2011b). Zellweger et al. (2011b) state that control in present and future is one of the most important issues for firms. They also argue that the longer the family has control over the business, the more emotional ties it has over the firm. As time goes by, family feels more attachment to the business. Preserving the extent of control can impact the actions, such as financial ones,made by family firms (Romano et al., 2001). Berrone et al. (2012)report some existing empirical findings to show how maintaining control can impact the decisions in family firms. They mention how it can make the family businesses to take lower financial risk, change management structure of company,

14 | P a g e

make the families to less diversify their business activities especially to high technology industries, and have more attention on environmental issues.Maybe the most important impact of desire to keep control is the conservative financing strategies by family firms (Zhang et al., 2012). Family firms “avoid becoming dependent on outside creditors or shareholders who might thereafter to remove ownership and control” (Zhang et al., 2012, p. 98). Zhang et al. (2012) also argue that keeping control and ownership as the most important objective for family firms prevent them to use venture capital and equity financing. Even if there is a fear that debt can lead to loss of control, family firms are likely to have lower level of debt (Zhang et al., 2012).Otherwise if debt is less control taking than equity financing, family firms prefer debt (Croci, Doukas & Gonenc, 2011). In addition, intend for internal financing is much higher than external financing in family firms for the same reason (Zhang et al., 2012; Tappeiner et al., 2012).The preference order of internal financing, debt, and equity is known as Pecking Order Hypothesis in the literature (Zhang et al., 2012; Tappeiner et al., 2012; Croci et al., 2011). Although Pecking Order Hypothesis is defined for any firm, in family firms it is argued to be in different extent (Tappeiner et al., 2012).In another model called Family Business Triangle which explains the financial issues in the family businesses, one of the dimensions is control (Dreux IV, 1990; de Visscher et al., 2011).De Visscher et al. (2011) explain how family firms need to balance their capital and liquidity needs in order to keep the control inside the family. In fact, control, liquidity and capital are the three dimensions of Family Business Triangle (Dreux IV, 1990; de Visscher et al., 2011). Zellweger et al. (2011b) on the other hand, present three aspects of control: the extent of family control over the firm; the duration of control; and the transgenerational control. They show that the most important aspect of control is the third aspect which is transgenerational control. Usually families have desire to pass on the control over the business to the next generations.

Family firms try to pass the firm to the next generations (Berrone et al., 2012; de Visscher et al., 2011). Control and succession are not only important to the purposes of this paper, but according to Zellweger et al. (2011b) they are the core of

15 | P a g e

socioemotional wealth concept. Transgenerational control is one of the reasons for the long term perspective of family businesses. “A feature of many family firms is the intention to pass on the business to successive generations, [which is] an aspiration that requires long term perspective” (Lumpkin & Brigham, 2011, p. 1149). Intentions to maintain transgenerational control is such important that some scholars consider it as main distinguishing feature of family firms (Zellweger et al., 2011b; Lumpkin & Brigham, 2011; Zellweger et al., 2011a). Scholars (Dreux IV, 1990; Zellweger et al., 2011a; Sirmon & Hitt, 2003; Lumpkin & Brigham, 2011) investigate the role of long term perspective in decision making process in family firms. Introducing the term of Long Term Orientation, Lumpkin, and Brigham (2011) define three dimensions for it: futurity, continuity, and perseverance. They explain futurity to be look to the future, continuity to be the bridge from past to future, and perseverance to be decisions in present which affect future. Families count on future and succeeding generation’s benefits as part of their socioemotional wealth (Berrone et al., 2012; Zellweger et al., 2011b). As a result, due to their longer horizons, family firms sometimes make some decisions such as financial investment that other companies would avoid (Lumpkin & Brigham, 2011).So, as Sirmon and Hitt (2003) state their financing choices are different from non-family firms. Sirmon and Hitt (2003) argue that the positive aspect of financing family firms is the patient capital. As mentioned earlier, family’s intention for the long term outcomes rather than short term outcomes, which are considered more in non-family firms, there is an effective way of managing financial resources in family firms. This effective way of managing financial capital is coincided with patient capital (Sirmon & Hitt, 2003). Patient capital is a key advantage of family firms (de Visscher et al., 2011). In addition to the earlier definition, de Visscher et al. (2011, p. 16) define patient capital as “equity provided by family owners who are willing to balance the current return on their business investments with merits of a well-crafted, long-term strategy and continuation of the family tradition and heritage”. According to de Visscher et al. (2011) some of patient capital attributes are: stability of capital structure, presence of family values in the organizations, tangible and intangible return on equity, increasing cost of patient capital as company passes to the next

16 | P a g e

generation, etc. Family firms, in fact, avoid certain short term gains in order to attain solid long term growth (de Visscher et al., 2011). As a result they can access to low cost capital. De Visscher et al. (2011) develop a model to show how family firms have less expensive capital. In their model cost of patient capital is a function of both financial elements and an element called ‘Family Effect’. In fact there is a negative relationship between cost of patient capital and family effect. De Visscher et al. (2011, p. 31) define family effect as “family members’ level of satisfaction and confidence in, and dedicated and commitment to the business”. They argue that by each generation the level of family effect decreases and patient capital would cost more.

There are few papers investigating the role of other dimensions of socioemotional wealth (emotions, social ties, identity) on financing choices of family businesses. One of those few works is done by Chua, Chrisman, Kellermanns, and Wue (2009). Chua et al. (2009) examine the role of social capital on cost of financing for family firms. They argue that the social capital and relationships can reduce the borrower-lender agency problems. They mention the role of other socioemotional dimensions as well. For example feelings such as altruism cause family members to support each other strongly when each of them is in trouble. Knowing that, creditors charge less when they lend to family firms. Identity related issues also can impact financing in family businesses. In that regard, family firms have intention to keep their reputation. As a result they avoid financially risky projects (Croci et al., 2011; Anderson, Mansi & Reeb, 2003; Chua et al., 2009).Although they are usually undiversified (Croci et al., 2011; Berrone et al., 2012; Anderson et al., 2003), family firms are less risky because of their caution about their reputation (Croci et al., 2011; Anderson et al., 2003). That is in fact another reason for reducing the agency cost for family firms. Usually there is a conflict between shareholders and creditors. While shareholders intend to invest in high risk high return project, bond holders don’t want to pay for the failure. Bond holders prefer low risk low return investments (Anderson et al., 2003; Croci et al., 2011; Romano et al., 2001). However in case of

17 | P a g e

family firms, since intrinsically they avoid risky project, the agency cost of borrowing decreases. As a result they will have less expensive debt available.

Figure 2.1 is presented as a summary of theoretical reasoning for the different process of financing decisions in family firms.

Figure 2.1. Theoretical Reasoning Utility maximization

(Astrachan & Jaskiewicz, 2008)

Behavioral theories (Chrisman et al., 2012; Berrone et al., 2012; Chua et al., 1999)

Emotional value

(Zellweger et al., 2011b; Astrachan & Jaskiewicz, 2008) Socioemotional wealth (Gómez-Mejía et al., 2007; Berrone et al., 2012) etc. Control (Zellweger et al., 2011b; Gómez-Mejía et al., 2007) Identity (Gómez-Mejía et al., 2007; Berrone et al., 2012) Social relations

(Sorenson & Bierman, 2009; James et al., 2012) Emotional ties

(Stamm, 2012; Astrachan & Jaskiewicz, 2008; Zellweger & Astrachan, 2008)

Succession

(Lumpkin & Brigham, 2011; Zellweger et al., 2011b)

Comparing to non-family firms, non-family

firms decide differently in case of

financing

2.3. General Financing Issues

There are a number of theories in the literature to explain how firms choose their financing. The very first theory suggested by economists is the rational theory. This theory suggests that, with the assumption perfect market, in which the prices reflect

18 | P a g e

all information, behaviors are explained by the fact that goal of firms is to maximize their shareholders’ value (Smith et al., 2011; Romano et al., 2001). Later on some other theories were suggested to explain the more real behavior of firms in choosing financing. Among them, agency theory (Romano et al., 2001; Chua et al., 2009; Wu et al., 2007) is a popular one. According to this theory, level of debt is determined by level of conflict of interests, or the agency cost, between creditors and shareholders. Level of optimal debt is determined by optimization of benefits of debt and cost of distress (Romano et al., 2001). A complementary concept to agency theory and conflict of interests is asymmetric information (Romano et al., 2001; Chua et al., 2009). Insiders know more about the situation of company than the investors do. Pecking order hypothesis (Romano et al., 2001; Zhang et al., 2012; Tappeiner et al., 2012) also form part of our knowledge about capital structure. It says firms prefer internally generated funds. If they need more capital they go for debt. And only after their debt capacity is fulfilled they use private equity. According to Tappeiner et al. (2012) static trade-off model adjust pecking order in the way that it suggest that firms may go for private equity even before their debt capacity is full.

In addition to these theories, the impact of several factors has been investigated by scholars. For example, in Romano et al. (2001)’s model, size of firm, industry, age of firm, age of CEO, and business planning are introduced as the factors which impact firms’ capital structure. Dreux IV (1990) on the other hand, name the size, risk-return profile of investments, nature of business, economic conditions, market condition, and the purpose of fund raising as the influential factors on the firm’s capital structure. Ownership structure is highlighted by some authors such as Croci et al. (2011). Smith et al, (2011) emphasize the developing stage of the firm, and the emergency and size of the financial need. Age of the firm, for example, has an important role in how it finances its activity. As the firm gets older and next generations control the firm, it becomes more professional(de Visscher et al., 2011). Also due to the Family Business Triangle, which is about the conflicts related to external financing and liquidity issues, family firms lose the intention to keep the control (de

19 | P a g e

Visscher et al., 2011). So the family business becomes more similar to non-family business in case of financing.

In this reasearchthe level of preference and importance of different sources of financing in family and non-family firms is investigatedin order to compare them. Each source of financing is categorized. The categories are internally generated income, debt financing, or external financing. These three categories are the Pecking Order Hypothesis’s elements. Figure 2.2 shows different common sources of financing, their definitions, and their category within pecking order hypothesis’s elements.

Figure 2.2. Different Sources of Financing

Financing Source Defenition Category

Friends and Family Investments

Investments made by friends and family Internal

Bootstrapping Finding ways to avoid the need for external financing through creativity, ingenuity, thriftiness, cost-cutting, obtaining grants, or any other means (Barringer & Ireland, 2008).

Internal

Current Shareholders

Re-investments by current owners. This includes unpaid dividends also.

Internal

Leasing To allow somebody to use a property for a specific period of time in exchange for payments (Barringer & Ireland, 2008).

Internal

Lendingfrom commercial banks

Bank loans. Debt

Friend and Family Loans

Loans from friends and family Debt

Other loans They might be government loans, asset based lending, trade credit, publishing bonds, or any

20 | P a g e

other source, borrowing from which is important to your company.

Angel investors Individuals who invest their personal capital directly in start-ups (Barringer & Ireland, 2008).

External

Venture Capital firms

Venture Capital firms are limited partnership of wealthy individuals, pension plans, university endowments, foreign investors, and similar sources which raise money to invest in growing firms (Barringer & Ireland, 2008).

External

Strategic partners To receive financial, marketing, distribution, and other kind of support from a partner company in exchange for a specialized technical or creative expertise (Barringer & Ireland, 2008).

External

Public Offerings Sale of stock to the public (Barringer & Ireland, 2008).

External

2.4. Research Hypotheses

Pecking order hypothesis suggests that firms are likely to finance their activities firstly by internally generated funds(Romano et al., 2001; Zhang et al., 2012; Tappeiner et al., 2012). They prefer debt after the internal financing and only then, they go for private equity. Reviewing literature, this paper suggests that pecking order hypothesis is more extreme in case of family firms. That means family firms’ intention for internal financing is higher than non-family firms and they use private equity less frequently. The three elements of pecking order hypothesis are discussed in the following paragraphs.

As discussed in the previous section, keeping influence and transgenerational control within the family determine many of family businesses’ actions.Zhang et al. (2012) claim that the main consequence of desire to keep control is conservative financing strategies. By financing the firm internally, the chance of preserving the

21 | P a g e

control over the firm and pass the firm to the next generation increases. Furthermore, because of intention for succession and long term view of family businesses, they prefer internal financing to have more long term return though they might lose short term benefits of other financing ways (Sirmon & Hitt, 2003). So it can be expected that family firms use more internal finances than non-family firms. Unlike using internal sources of financing, private equities lead to involvement of outsiders in the company. Family firms “avoid becoming dependent on outside creditors or shareholders who might thereafter to remove ownership and control” (Zhang et al., 2012, p. 98).Although private equity has some advantages such as providing advice (Smith et al. 2011), managerial and support skills (Dreux IV, 1990), smart money (Tappeiner et al., 2012), and lower cost for the family firms (de Visscher et al, 2011), family firms prefer the internal financing and debt. Due to families’ willingness to preserve control currently and for the next generation, they are less likely to use external sources of financing (de Visscher et al., 2011; Romano et al., 2001; Zhang et al., 2012; Wu et al., 2007; Croci et al., 2011). This fact is indeed the cause of family business triangle (de Visscher et al., 2011). On one hand family firms tend to preserve control over the firm, on the other hand they need capital to grow and compete. That means they are concerned about the control issue when they are in need of capital (de Visscher et al., 2011). So it can be assumed that family firms intend to use less external sources of financing.

H1: Family firms useinternal finances more than non-family firms. H2: Family businesses useexternal financing less than non-family firms.

Debt, comparing to private equity, does not lead to losing control by the family (Croci et al., 2011). As a result, using debt as a source of financing, family firms are not much concerned about involvement of outsiders in the business. Additionally, since the level of conflict of interests between lenders and family owners are less (Anderson et al., 2003; Chua et al., 2009), the cost of debt is less for family firms.As a reminder, scholars suggest that the level of agency cost or conflict of interests is less in family firms because of their social capital and also because of their attitude

22 | P a g e

toward keeping their identity and reputation (Anderson et al., 2003; Chua et al., 2009). Preserving identity as a socioemotional wealth dimension impacts financing in family firms. Family businessesintend to keep their reputation. Consequently they avoid financially risky projects (Croci et al., 2011; Anderson, Mansi & Reeb, 2003; Chua et al., 2009). Again there is a conflict between shareholders and bondholders. Shareholders intend to invest in high risk high return project whilecreditors don’t want to take the risk of paying for the failure. Creditors prefer low risk low return projects (Anderson et al., 2003; Croci et al., 2011; Romano et al., 2001). In addition, to preserve their image, family firms try to pay their duties in order to keep their credibility. Knowing this, financiers provide them with lower cost debt. The role of feelings in family firms also causes less expensive debt to be available to family firms (Chua et al. 2009). Family members intend to support each other strongly when each of them is in trouble. Lenders know this fact, in addition to family firms’ intention to preserve their image. Lenders therefore are more confident that they will receive the money (Chua et al., 2009).Social capital of family firms is another factor that leads to less expensive debt since it reduces agency cost of borrowing (Chua et al., 2009). Since family firms have stronger relations, which is a dimension of socioemotional wealth, more information is shared between them and lenders. In summary since family firms usually avoid risky projects and they have stronger social ties, the agency cost of borrowing decreases. Additionally lenders know that family firms intend to preserve their image and have feelings among their members. Due to these facts family firms have less expensive debt available.Since debt is less control taking and less expensive for family firms, they use debt more than non-family firms. So the third hypothesis of this research is stated as follows:

H3: Family firms usedebt more than non-family firms.

Figure 2.3 summarizes the hypotheses H1 to H3 about the different levels of preference for different sources of financing in family and non-family businesses. Although both follow pecking order hypothesis, family firms tend to prefer more

23 | P a g e

internal sources of financing, more debt, and less external sources of financing than non-family businesses.

Figure 2.3 Hypotheses 1, 2, and 3

There are other factors which influence these relationships. Firm size is an important factor which influences the choice of financing in firms (Romano et al., 2001; Dreux IV, 1990). According to Romano et al. (2001) Pecking Order Hypothesis applies specially for small businesses because the cost of external financing is higher for small firms. “Small firms, compared to large, tended to be more self-financing, had lower liquidity, rarely issued stock, had lower leverage, relied more on bank financing and used more trade credit and directors' loans” (Chittenden,Hall & Hutchinson, 1996, p. 60). To put another way, applying pecking order hypothesis especially for small firms means that they use more internal financing, more debt, and less external equities. Chittenden et al. (1996)explain why firm size matters when firms decide on their source of financing: because of their stage in firm life cycle, small firms have lack of access to capital market.In the first stages of growth, in which firms are small, they use self-financing. Most of what they have available is internal sources of financing (Chittenden et al., 1996). However this

24 | P a g e

source of financing is not enough especially when the company is experiencing rapid growth (Chittenden et al., 1996). If they survived the dangers of under- capitalization they can use other sources of financing such as short-term loans from banks (Chittenden et al., 1996). “Not only is a stock market flotation expensive to arrange but initial public offerings are subject to underpricing which seems to be particularly severe for smaller firms.Having obtained a stock market flotation small firms are likely to find themselves the victims of the small firm effect which results in their having a higher cost of equity, for a given level of risk, than larger firms” (Chittenden et al., 1996, p. 61). Chittenden et al. (1996) also discuss how asymmetric information and agency cost are more in small firms. So the cost of external equity for small firms increases further. “Monitoring could be more difficult and expensive for small firms because they may not be required to disclose much, if any, information and, therefore, will incur significant costs in providing such information to outsiders for the first time. Moral hazard and adverse selection problems may well be greater for small firms because of their closely held nature.” (Chittenden et al., 1996, p.61)These agency problems add to the cost of external equity available to small firms. The more expensive external financing available to small firms the less external sources of financing they use. Internal sources of financing, on the other hand, are the most of which is available to small firms (Chittenden et al., 1996). Consequently when the firm is small, it uses more internal sources of financing. Sometimes, however, internal sources are not sufficient to satisfy the financial needs in the time of company growth (Chittenden et al., 1996). Growing small companies, then, usually use other sources of financing such as short term bank loans and trade credit and directors' loans (Chittenden et al., 1996; Romano et al., 2001). Generally small firm have less access to external financing. If they want to use external equity, it would be more expensive to them. As a result they intend to use more internal financing, and when they are in need of more financing they have to go for debt. Since firm size matters in financing choices of firms, it affects the relationship between being a family firm and use of different sources of financing. If the family firm is large, or firm size is high, then it uses more external sources of financing. This happens because when the firm grows it has more access to capital

25 | P a g e

market and lower cost external equity (Chittenden et al., 1996). In other words, firm size positively moderates the relationship between being a family firm and use of external sources of financing. In comparison due to the fact that internal sources of financing are the most available source to small firms (Chittenden et al., 1996), in which firm size is low, and the next available source to them is debt (Romano et al., 2001; Chittenden et al., 1996), firm size negatively moderates the relationship between being a family firm and use of internal sources of financing and debt.

H4: Firm size negatively moderates the relationship between being a family firm and use of internally generated financing and debt.

H5: Firm size positively moderates the relationship between being a family firm and use of external financing.

Firm Age can also impact the relationship between being a family firm and the preference for each source of financing. Business cycle discussions are not only related to firm size, but also to firm age. At the first stages, when firm age is low,as Chittenden et al. (1996) and Romano et al.(2001) have discussed,firms intend to use self-financing. Since they need more financing sources to fund the growth they will have to use bank loans (Chittenden et al., 1996; Romano et al., 2001). As discussed before, at the beginning stages, when firm age is low, they do not have access to external equity (Chittenden et al., 1996). “At inception businesses’ major sources of finance are owner funds, with these being supplemented by relatives and friends. At growth and maturity stages, bank funding, secured against personal assets, tends to be employed, while equity is used for the expansion and growth of an enterprise.” (Romano et al., 2001, p. 293) In addition there are some other issues related only to family firms. For example according to de Visscher et al.(2011) family firms become more professionally managed as they become older and next generations become in charge of the business (de Visscher et al., 2011). In the first generation family firm owners use all what they have to run and support the business without considering the professional management tools and sources of financing. However, the next generations think about professional management techniques and other sources of

26 | P a g e

financing (de Visscher et al., 2011). According to Romano et al.(2001) first-generation owners are more likely to reject external sources of financing. This fact is reflected into Family Business Triangle conflicts.The need for liquidity increases in the next generations, and as a consequence the intention for keeping the control within the family decreases as the firm gets older (de Visscher et al., 2011). To sum up, firstly, with the same argument as firm size, firm age have the same influence on the relationship between being a family firm and use of different sources of financing as firm size. Also it can be argued that as firm age grows and next generations become the owners of the company, they consider issues such as capital and liquidity other than control, according to Family Business Triangle concept (de Visscher et al., 2011). Additionally first generation uses more internal sources (Romano et al., 2001) and next generation use more professional sources (de Visscher et al., 2011). So they use more external equity and less internal sources of financing and debt by which control of firm is kept within the family. So it can be expected that as the family firm grows and firm age increases, the relationship between being a family firm and use of external sources is positively affected. On the other hand, the relationship between intention to keep control and use internal sources and debt on one hand and being a family firm on the other hand is negatively affected as firm age grows. These arguments are consistent with the ones similar to firm size.

H6: Firm age negatively moderates the relationship between being a family firm and use of internally generated financing and debt.

H7: Firm age positively moderates the relationship between being a family firm and use of external financing.

27 | P a g e

3. Methodology

3.1. Research Approach

Walliman (2006) classifies the objectives of a research as follows: to describe, to explain, to compare, to correlate, and to act. Based on this classification, the objectives of this research is to compare family and non-family firms in their choice of financing, to correlate the level of preference of different sources of financing and being a family firm, and to explain if there is a difference between family and non-family firms in their choice of financing. Among these, according toWalliman (2006), correlation objective can be in form of prediction or relation. Since this research attempts to find the potential relationship between the level of preference of using different sources of financing and being a family firm, this paper is a relational research. Unlike other objectives, in correlational research, researchers often work with numbers instead of words, artifacts, or observations (Walliman, 2006).

Using numbers, this paper attempts to deal with the research question through a quantitative approach. To put another way, by analyzing the data gathered from a survey, this research seeks to find out the answer to concerned issues. Walliman (2006)’s explanation on quantitative techniques makes the approach of this research more clear: “Quantitative techniques rely on collecting data that is numerically basedand amenable to such analytical methods as statistical correlations, often in relation tohypothesis testing” (Walliman, 2006, p.37).

Walliman (2006) mentions quantitativeresearch often uses deductive approach to test theories. This fact applies to this paper as well.In a deductive argument a general statement is discussed through a logical argument and based on it a conclusion is derived. The conclusion can be stated as hypotheses which can be tested in the research (Walliman, 2006).In this research the arguments build the hypotheses of this research.The arguments in this work begin with the general theories on family businesses. Then through exploring the literature specific issues such as transgenerational control (Zellweger et al., 2011b), organizational identity (Gómez-Mejía et al., 2007), and pecking order hypothesis (Romano et al., 2001) are

28 | P a g e

discussed in detail. Lastly through logical arguments some hypotheses are derived which will be tested in next chapters of the paper.

The testing of the hypotheses, as it is stated earlier, is through quantitative techniques and by statistical tools. Using statistical tools, the research can be designed in different ways. This research has a cross-sectional design. Cross-sectional methods are often in company with surveys (Walliman, 2006). This research is not an exception and uses surveys to collect cross-sectional data. To put another way, the data are gathered from a sample of many (171) observations and from a single point of time (August 2012).

3.2. Data Collection

The data used in this research is collected through a survey which means the data is from a primary source. A questionnaire is designed to be sent to family and non-family firms in Sweden to ask them about their preferences for different sources of financing.

The process of sampling started with finding the list of all registered companies with an active website in Sweden from database of AMADEUS. Then by assigning a random number to each entry using Microsoft Excel and sorting according to the random number, the first 2600 companies were selected as the sample. This kind of sampling is called simple random sampling which is a kind of probability sampling (Walliman, 2006).Using their websites, all the email addresses of the sample companies were looked up. By the software ‘Smart Serial Mails’ a link of the questionnaire and a request for participating in the survey were sent to each email address. Also two reminders, each after one week, were sent to the companies asking them to participate in the survey if they have not already done that.

Out of 2600, 171 companies responded to the questionnaire in a way that it can be used. The response rate is, so, 6.58%. 73 of the responses are from family firms and the rest (98) are related to non-family firms.

29 | P a g e

3.3. The Questionnaire

Internet or online surveys have increasingly been used by the researchers in the recent years (May, 2011). The recent developments in technology and the use of internet made the process of online surveys much easier. Online surveys also save considerable resource for the researcher (May, 2011). The response rate to the online surveys has declined during last several years due to the increasing number of such surveys (May, 2011). However since online surveys give the respondents freedom of time and place (May, 2011), online surveys are still a proper way of conducting research.

Online survey is what is used in this research. In fact an online questionnaire is designed using Google Doc or Google Drive online service which has a free questionnaire designing tool. The link to the questionnaire can be found in Appendix 1. In designing the questionnaire, different electronic form elements are used. For example textboxes are used for the questions which ask respondents to enter other information. For instance they are asked to enter other sources of financing which they think was important to them. Radio buttons and check boxes are, on the other hand, used for the multiple questions such as their industry or their attitude toward a source of financing.

The questionnaire is attempted to be well structured and clear. It consists of three sections. The first section is classification sector which is also called face sheet information (May, 2011). In this section the companies are asked to answer questions which are related to general information of the company such as the number of employees (as a representative of the firm’s size), industry, firm age, and being public. These questions are used in the analysis as control variables or moderators. The second section is related to being a family firm which is the independent variable in this research. Some factual questions (May, 2011) about being a family firm are asked in this section. The first question asks them if they are a family firm. If yes some other questions regarding the extent of being a family firm, such as generation in control or percentage of family ownership are stated. If not,

30 | P a g e

they are asked to go directly to the last section. The last section is designed to measure the firms’ attitude toward different sources of financing. In order to do that, Likert scale is used. Based on what Siegle (2010) presented, the respondents could choose between: ‘Very Important, ‘Important’, ‘Moderately Important’, ‘of little importance, and ‘Unimportant’. The sections and the instructions are mentioned in the beginning of the questionnaire in order to make the questionnaire clear.

Other than a good structure, choosing the correct wording helps to remove ambiguity and make the research more reliable (May, 2011).There is an analogy in May(2011)’s book which compare questioning people to fishing. Sometimes a particular fish is targeted but without knowing what is happening under the surface, different kinds of creatures are catch. The questions should be clear and free of ambiguity (May, 2011). This is what is tried in this research as well.

Other than to state the questions clearly, it is vital to know what the questions are for. May(2011) has stated the concept of operationalization of the hypotheses as defining “a concept or variable so that it can be identified or measured” (May, 2011, p. 106). So since the purpose of this research is to know the relationship between being a family firm and the attitude toward different sources of financing, the definition of being a family firm and each sources of financing is clearly known and stated in the questionnaire. The questionnaire and a link to itarestated in Appendix 1.

3.4. Data Analysis

The data collected by the mean of Google Drive form, is downloaded as an Excel file. Then they are arranged in a proper way and unusable entries are deleted. Finally the data is imported into SPSS software for further analysis.

The analysis should be in a way that can deal with the research purpose and question. The main purpose of this research is to find a relationship between the level of preference for different sources of financing and being a family firm. Also