I

N T E R N A T I O N E L L AH

A N D E L S H Ö G S K O L A N HÖGSKO LAN I JÖNKÖPI NGB u s in e s s v a lu a t io n

Valuation of IT-companies in the area of Jönköping

Master’s thesis within Finance Author: Emma Jonsson

J

Ö N K Ö P I N GI

N T E R N A T I O N A LB

U S I N E S SS

C H O O L Jönköping UniversityF ö r e ta g s v ä r d e r in g

Värdering av IT-företag i Jönköpingsregionen

Filosofie magisteruppsats inom Finansiering Författare: Emma Jonsson

Linda Samuelsson Handledare: Urban Österlund

Master’s Thesis in Finance

Master’s Thesis in Finance

Master’s Thesis in Finance

Master’s Thesis in Finance

Title: Business Valuation

Author: Emma Jonsson and Linda Samuelsson Tutor: Urban Österlund

Date: 5/29/2008

Subject terms: business valuation, acquisition, net asset value approach, net pre-sent value approach, relative valuation approach, IT-company, goodwill

Abstract

Background: In Sweden Internet was introduced in 1983 and IT became a popular phe-nomenon in the 1990s. In the middle of this decade IT-companies had a prosperous period. Many companies acquired competitors frequently dur-ing these years in order to build brand names and stay competitive. More than 400 IT-companies went bankrupt during 2001, due to the burst of the IT-bubble. Today, there is no doubt that IT-companies are willing to acquire other companies in the industry. Before an acquisition both the purchaser and seller do a careful valuation of the current company, using different valuation methods. Lately, there are some IT-companies in the area of Jönköping and its surroundings that have carried out acquisitions. Purpose: In this thesis IT-companies in the area of Jönköping are considered in

or-der to describe what valuation methods that are used when valuing these before an acquisition. Intangible assets are of great importance for this in-dustry. Therefore the aim is also to find out which these are and how they are valued.

Method: In order to fulfill the purpose a qualitative research is maintained. Primary data is collected from two telephone interviews and six face-to-face inter-views. Three of the interviews are conducted with people working at IT-companies that have carried out an acquisition between 2006 and 2008. The other interviews were performed with people working with business valuation on a daily basis.

Conclusion: When valuing IT-companies as well as the intangible assets, where good-will is significant due to synergies, the net present value approach is most commonly used. The relative valuation approach is also useful, especially for companies in the early phase of the life cycle since these do not show any historical facts. Within the IT-industry; P/S, P/E, and value per em-ployee, are all useful. The net asset value approach is the most common

Magisteruppsats inom fina

Magisteruppsats inom fina

Magisteruppsats inom fina

Magisteruppsats inom finan

n

n

nsiering

siering

siering

siering

Titel: Företagsvärdering

Författare: Emma Jonsson och Linda Samuelsson Handledare: Urban Österlund

Datum: 2008-05-29

Ämnesord: företagsvärdering, förvärv, substansvärdering, avkastningsvärdering, relativvärdering, IT-företag, goodwill

Sammanfattning

Bakgrund: I Sverige introducerades internet 1983 och IT blev ett populärt fenomen under 1990-talet. I mitten av decenniet hade IT-företagen en blomstrande period. Många företag förvärvade konkurrenter ofta för att skapa varu-märke och fortsätta vara konkurrenskraftiga. Över 400 IT-företag gick i konkurs under 2001 på grund av IT-bubblan. Idag är det ingen tvekan om att IT-företag är villiga att förvärva andra företag i denna industri. Innan ett förvärv genomför både förvärvaren och säljaren en noggrann värdering av det aktuella företaget med användning av olika värderingsmetoder. Det finns några IT-företag i Jönköpingsregionen som genomfört företagsför-värv på sista tiden.

Syfte: Syftet i denna uppsats är att beskriva vilka värderingsmetoder IT-företag i Jönköpingsregionen använder vid värdering innan ett företagsförvärv. Immateriella tillgångar är viktiga i denna industri. Därför är syftet även att identifiera dessa och se hur de värderas.

Metod: För att uppfylla syftet används en kvalitativ metod. Primärdata är insamlad från två telefonintervjuer och de andra sex på intervjuobjektens kontor. Tre intervjuer genomfördes med personer som arbetar på IT-företag som genomfört företagsförvärv mellan 2006 och 2008. De andra intervjuerna genomfördes med personer som arbetar med företagsvärdering dagligen. Slutsats: Vid värdering av IT-företag såväl som de immateriella tillgångarna, främst

goodwill tack vare synergier, används i första hand avkastningsvärdering. Relativvärdering är också användbar, särskilt för företag i det tidiga skedet av livscykeln då ingen historisk information finns att tillgå. Inom IT-industrin är; P/S, P/E och värde per anställd, alla användbara. Substans-värdering är vanligast vid ett direkt förvärv. I denna studie är indirekta förvärv oftast förekommande.

Special thanks to

Our interviewees at IT-Companies:Mathias Bransmo the CEO of Litium Affärskommunikation Nicklas Dahl the CEO of SYSteam Datakonsult i Småland

Anders Nobrant the CEO of Attendit AB

Corporate finance departments at audit firms: Henrik Jonasson at KPMG

Claes Lindblad at Öhrlings PricewaterhouseCoopers Robert Nordahl at Grant Thornton

Johan Zackrisson at Ernst & Young

Other interviewees:

Leif Garpheden the CEO of Garpco AB

Our tutor:

Innehåll

1

Introduction ... 1

1.1 Background ... 1 1.2 Problem discussion ... 1 1.3 Purpose... 1 1.4 Delimitations... 1 1.5 Definitions ... 12

Method ... 1

2.1 Positivism, realism versus interpretivism... 1

2.2 Inductive versus deductive ... 1

2.3 Primary versus secondary data ... 1

2.4 Qualitative versus quantitative ... 1

2.4.1 Sample ... 1

2.4.2 Interviews ... 1

2.5 Reliability and Validity ... 1

2.6 Choice of theories ... 1

2.7 Criticism towards chosen method... 1

3

Theoretical framework ... 1

3.1 Motives for an acquisition... 1

3.1.1 Acquire undervalued firms ... 1

3.1.2 Diversify in order to reduce risk ... 1

3.1.3 Create synergy ... 1

3.2 Preparing for a business valuation ... 1

3.3 Due diligence ... 1

3.4 Methods for business valuation... 1

3.4.1 Net asset value approach ... 1

3.4.2 Net present value approach... 1

3.4.3 Relative Valuation approach... 1

3.4.4 Alternative valuation models... 1

3.5 Intangible assets ... 1

3.5.1 Goodwill... 1

3.5.2 Value of brand name ... 1

3.5.3 Patent ... 1

3.6 Valuation issues across the life cycle... 1

3.7 Direct and indirect acquisition ... 1

3.7.1 Direct acquisition ... 1

3.7.2 Indirect acquisition... 1

3.8 Previous research of business valuation... 1

4

Empirical findings ... 1

4.1 Underlying facts for valuation ... 1

4.2 Valuation IT-companies... 1

4.3 Valuation of intangible assets... 1

4.4 Acquisition... 1

4.5.3 SYSteam Datakonsult i Småland AB... 1

5

Analysis... 1

5.1 Reasons for acquisitions ... 1

5.2 Valuation methods... 1

5.2.1 Net asset value... 1

5.2.2 Net present value... 1

5.2.3 Relative value ... 1

5.2.4 Valuation across life cycle ... 1

5.2.5 Comparison to previous research... 1

5.3 Intangible assets ... 1

5.4 Valuation of intangible assets... 1

5.5 Finalizing an acquisition ... 1

6

Conclusion... 1

7

Discussion ... 1

7.1 Final remarks ... 1 7.2 Further research... 1References ... 1

Figures

Figure 3-1 - Breaking Down the Acquisition Price ... 1Figure 3-2 - Valuation issues across the Life Cycle ... 1

Figure 5-1 - Life cycle including the acquired companies... 1

Tables

Table 2-1 - Interviewees... 1Table 3-1 - Multiples and Companion Variablesa... 1

Table 4-1 - Acquired IT-companies according to the interviewees... 1

Appendices

Appendix 1 – Questions business valuators ... 1Appendix 2 – Questions Robert Nordahl... 1

Appendix 3 – Questions IT-companies ... 1

Appendix 4 – Inkomstskattelag (1999:1229) ... 1

Introduction

1

Introduction

This chapter is an introduction to the thesis. First a background is given followed by a problem discussion leading to the research questions and purpose of the thesis. Last delimitations and definitions are presented.

1.1

Background

Internet was introduced in Sweden in 1983 and the first e-mail arrived to a Swedish mail-box this year. Thereafter, the first Swedish domain address (enea.se) was created in 1986 and in 1987 Internet was used in research and development divisions mainly at universities. This development involved many people in 1990s and IT became a popular phenomenon this decade (Uvell, 1999).

Between 1994 and 1998 the IT-companies had a prosperous period with a yearly increase in turnover of 30 per cent on average. The large companies and the government bought new systems and web pages and it was also in these years the e-commerce companies were founded. Many companies acquired competitors frequently in order to build brand names and stay competitive in the market. Most of the acquired companies were valued according to EBITDA (earnings before interest, taxes, depreciation and amortization) which shows profit before investments. Many argued that this measure was equivalent to cash flow. Yet, the problem is that EBITDA does not consider the investments done or how much of the profit that is “real” money. Even though, this cash flow method was used to value thou-sands of IT-companies. In these years many IT-companies listed on the Stockholm stock exchange were overvalued according to the actual value (Fagerfjäll, 2003). The entire IT-industry was valued incorrectly and the intellectual capital within these companies could not provide additional values to the company if not any return could be presented (Nilsson, 2000). According to Steneberg (1999) IT-companies are not valued in the same way as companies in other industries. For example, the new IT-companies Framfab and Icon Me-dialab were valued on the same level as the established companies such as SKF and Atlas Copco (Lindstedt, 2001). Icon Medialab had a great increase in the development but was still facing large losses (Steneberg, 1999). Framfab was an IT-company that grew from a few employees to a large concern of companies. Until year 2000 Framfab had a positive development with introduction on the stock exchange and had an extreme increase in val-ue. Yet, in 2000 this successful development turned where the expansion became a fall. Framfab became one of many companies which had to illustrate the so called “burst of the IT-bubble” (Willim, 2002).

In 2000 many IT companies waited to enter the Stockholm stock exchange but this never became reality. In March 2000, around 40 IT-companies decreased their market value by 50 per cent due to a significant drop in the stock exchange. For example, Ericsson’s stock price decreased by 70 per cent implying that the stock was overvalued and many investors lost a lot of money. In April many employees had exited the IT industry due to the burst of the bubble. During 2001 more than 400 IT companies went bankrupt, mainly small com-panies (Fagerfjäll, 2003). After the burst of the bubble the Stockholm stock exchange de-creased by 69 per cent from 2000 to 2002. This was followed by an increase in the stock exchange by 112 per cent on average until 2005 (Malmqvist, 2005)

According to Berglund (2008a), there is no doubt that companies in the IT industry are willing to acquire others in this industry, especially communities. Berglund (2008a) has

Introduction

quisitions (Berglund, 2008a). There are also those who trigger the communities to sell their business and works only to increase the numbers of visitors on a special web-page. Thus, the acquirer will only pay for air because it was not long ago the IT-bubble burst (Berglund, 2008b).

It is obvious that acquisitions in the IT-industry are in progress even if there are worries at the Stockholm stock exchange. The rest of the year 2008, when it comes to acquisitions, is dependent upon the development of the stock exchange. The value of Swedish IT-companies is forced down which makes these IT-companies attractive to acquire. In the cycli-cal part of the market one can still own much money while the value has dropped signifi-cantly. This is a good starting point to make an interesting acquisition (Privata affärer, 2008).

Previous studies have been carried out to see what variables within the relative valuation methods that are useful when valuing listed companies within the IT-industry. Also, previ-ous research about how to value companies within different industries has been found. Since no previous studies about business valuation within the IT-industry in the area of Jönköping have been found we think it would be interesting to do a research about this with a focus on private limited companies, leading to the following problem discussion;

1.2

Problem discussion

In connection with an acquisition it is common that both the acquirer and the target want to do a careful valuation of the current company (Lundén & Ohlsson, 2007). The buyer wants to pay as little as possible and the seller does not want to be ripped off (Woodstock, 1992). Business valuation is not an exact science. One cannot value a business in an objec-tive manner. The valuation is always depending upon the person who do the valuation and at which time (Lundén & Ohlsson, 2007). There are many reasons for valuing a business as well as there are many ways to calculate the value of a business (Hochberg, 1993). Liquida-tion, introduction to the stock market, granting for credits, inheriting and gift tax of com-panies and shares are also important reasons for valuing a company. It is significant to know the reason for valuing a company before the valuation is carried out since different valuation methods are used for different valuation reasons (Holmström, 2005). There are some IT-companies in Jönköping and its surroundings that have done acquisitions lately. Since this sector is attractive at the moment when it comes to acquisitions, the first re-search question is;

• What valuation methods are used to value private limited IT-companies due to an acquisition?

Except from the tangible assets, there are many questions that need to be answered before acquiring a company (Köpa företag, 2008). Management, markets, technological skills and products are factors that may be involved before an acquisition takes place (Pratt, 2000). Other factors of concern are the business idea, growth possibilities, trademark, and cus-tomers but also information about workforce and sick leave is important to take into ac-count (Köpa företag, 2008). However, what is actually being acquired in a later stage is the stream of prospective economic income (Pratt, 2000). IT-companies are well aware of the

Introduction

When using the traditional valuation models, brand name and other intangible assets are wrongly considered. Often analysts tend to define assets too narrow and only identify those assets that can be measured such as plant and equipment. The intangible assets such as a particular technology, accumulated consumer information, brand name, reputation and corporate culture are invaluable to the company’s competitive power. These invisible assets are the only source of competitive edge that can be sustained over time (Damodaran, 2002). According to this it is interesting to see how these assets are valued, which leads to the last research question;

• How are the intangible assets in IT-companies valued?

1.3

Purpose

The purpose of this thesis is to describe what valuation methods that are used by IT-companies in the area of Jönköping due to an acquisition. Since intangible assets are of great importance for these companies the aim is also to find out which these are and how they are valued.

1.4

Delimitations

In this research only Swedish companies acquiring Swedish companies are considered. The acquiring IT-companies are situated in the area of Jönköping. Two of the target companies are situated in Jönköping while the other two are situated in Stockholm.

What happens after the acquisitions and whether the company was correct valued is not evaluated in this research. Therefore it is not considered whether the specific synergies ac-tually have arisen. Since the acquisitions evaluated in this thesis have been generated re-cently this would not even be possible to consider.

The valuation process is looked upon from the buyer’s perspective. Therefore, only acqui-sitions are taken into account. Whether the acquisition is done for the purpose of a merger or to build a concern is not considered.

The IT-industry contains a large range of companies offering different products, such as hardware, software, and consulting firms. The acquired companies in this thesis are pro-ducers of software. Therefore the definition of IT-industry has been limited to contain only the software business.

1.5

Definitions

Acquisition:

When acquiring a company the purchaser buys the entire company or at least a part that is large enough to give the purchaser a controlling interest in the company (Gaughan, 2002).Private limited company:

Companies which stocks are not offered on a stock exchange(Nationalencyclopedin, 2008).

Information technology (IT):

In a narrow definition IT is the technology component of an information system. A broader definition is that it is the collection of the computing systems in an organization (Turban, Leidner, McLean, & Wetherbe, 2006). In this thesis theMethod

2

Method

In the method chapter the reader will get an understanding of what technique that has been used in order to fulfill the purpose of this thesis. The main focus is on how the data needed to fulfill the purpose is collected.

2.1

Positivism, realism versus interpretivism

According to Saunders, Lewis & Thornhill (2003) positivism emphasizes on a highly struc-tured methodology to simplify reproduction and quantifiable observations that lend them-selves to statistical analysis. The attempt is to get in-depth information about business ac-quisition rather than to make generalizations, therefore the positivistic philosophy is ne-glected here. Realistic researchers believe that reality exists and is independent of human thoughts and beliefs (Saunders et al. 2003). The focus is on reality when it comes to busi-ness valuation of IT-companies, yet the believe is that it is dependent upon thoughts and believes of humans. Therefore the interpretivistic philosophy is more suitable, which ac-cording to Saunders et al (2003) emphasize the fact that the world is complex and business situations are both complex and unique. As can be seen in section 2.4 this is a qualitative research. Even though the focus is on valuation of IT-companies in the area of Jönköping there is a belief that each valuation is unique. This since Lundén and Ohlsson (2007) argues that the valuation is always depending upon the person who do the valuation, and at which time, and that business valuation is not an exact science.

2.2

Inductive versus deductive

The deductive reasoning is closely related to the ”theory comes first” view while the induc-tive reasoning is similar to the ”theory comes last” view (Mason, 2002). By using a deduc-tive approach the researcher usually generate a proposition or hypothesis in advance and test it by using empirical data. The inductive adherent on the other hand will develop a theoretical proposition out of the empirical data. In reality most research strategies proba-bly use a combination of different research approaches (Saunders et al. 2003).

Different theories will be used in order to see whether the IT-companies analyzed use these theories or not when valuing firms and see which ones are the most commonly used mean-ing that a deductive research approach is used. Also, it might be the case that some theories are not used at all. Out from this the aim is also to use an inductive research approach. This to see if there are any pattern on which methods that can be used when and how they are combined if more than one valuation method is used.

2.3

Primary versus secondary data

Secondary data is data that has originally been collected for another purpose (Saunders et al. 2003). Secondary data can be divided into internal and external sources where external sources are further divided into published and commercial (Ghauri & Grønhaug, 2005). In order to get a pre-understanding of business valuation and to find theories that are relevant when valuing IT-companies, published external sources are used mainly in form of books

Method

Primary data is collected for the specific research project (Saunders et al. 2003). The usual ways to collect primary data is through observations, experiments, surveys, and interviews (Ghauri & Grønhaug, 2005). When using primary data it is important to understand how much knowledge the source actually has about the subject (Holme & Solvang, 1997). Pri-mary data is collected through interviews, see section 2.4.2. The interviewees are collected according to their work positions, see section 2.4.1. Therefore it is reasonable to assume that the sources have accurate knowledge about valuation of IT-companies. To fulfill the purpose it is seen as significant to use primary data since valuation of IT-companies is complex, making it hard to find relevant information in secondary data. This, especially since the area of Jönköping is looked upon and this type of information is not often public.

2.4

Qualitative versus quantitative

Whether a qualitative or quantitative research should be conducted is dependent upon the research question. Quantitative research is suitable for hypothesis testing. Then a survey with fixed questions is appropriate (Silverman, 2000). This type of research is based on meanings derived from numbers and expressed through diagrams and statistical analysis. Qualitative data on the other hand cannot be collected in a standardized way (Saunders et al, 2003). The data is expressed through words and often collected through interviews, ob-servations and participation (Mason, 2002).

In order to get a deeper understanding of how IT-companies carry out a business valuation before an acquisition the use of qualitative data is supposed to be most suitable to collect appropriate data. Semi-structured interviews are conducted, see section 2.4.2. The aim is to consider valuation methods rather than specific values of different acquisitions. Therefore, analyzing non-standardized data is argued to be more appropriate than to undergo a statis-tical analysis.

2.4.1 Sample

The purpose is to look upon how IT-companies are valued in connection to an acquisition. The persons who have been involved in these valuation processes are believed to have most knowledge about this. Therefore people working at IT-companies in Jönköping and its surroundings that have carried out an acquisition during 2006, 2007, and/or 2008 were contacted for interviews. The persons that were involved in these acquisitions are believed to have great knowledge about that is up to date and in line with valuation of the specific industry. To get in touch with the right people the staff at each company was asked to transfer us to people that were involved in the valuation processes.

Litium Affärskommunikation, and SYSteam Datakonsult i Småland AB were con-tacted at Next Step, a labor market day at Jönköping International Business School. At Lit-ium Affärskommunikation, that acquired Dobase in 2008 and Dupoint in 2006, the CEO, Mathias Bransmo, was interviewed. SYSteam acquired DTS Solutions in 2008, Infogate, Logsys, NPC System, and Modulera in 2007. To get information about these acquisitions Nicklas Dahl was interviewed. The focus during this interview was on the acquisition of Logsys, since this was done by SYSteam Datakonsult i Småland AB, where Nicklas Dahl is the CEO.

Method

Attendit AB was found at the webpage of Science Park in Jönkping. Among the IT-companies situated at Science Park Attendit AB was the only one, except from Litium, which had gone through an acquisition recently. The CEO, Anders Nobrant, was inter-viewed to get information about the acquisition of Datalink Nordic AB.

Also other persons who work with business valuation on a daily basis were contacted to give a general view of how a valuation is carried out, yet with a focus on the IT-industry. Ernst & Young, Grant Thornton, KPMG, and Öhrlings PricewaterhouseCoopers are all audit firms. All but Grant Thornton have a corporate finance department in Jönköping. In order to get in touch with people working with business valuation at each of these audit firms the student contact persons at the offices in Jönköping were contacted. Those gave us the names of the people to contact, why Johan Zackrisson at Ernst & Young, Henrik Jonasson at KPMG, and Claes Lindblad at Öhrlings PricewaterhouseCoopers were inter-viewed.

The Transaction Advisory Services department at Ernst & Young works with acquisitions, dispose of businesses in different areas, transactions, and valuations. Since Ernst & Young acts on a global market it is possible to give the customers a wide range of services both in Sweden and world-wide (Ernst & Young, 2008b). Ernst & Young operates in 140 countries and is the third largest audit firm in Sweden (Ernst & Young, 2008a).

KPMG has a corporate finance department that due to its network has access to specialist competences both in Sweden and internationally. The group within KPMG corporate fi-nance offers assistance within many acquisition related areas in both the buyer’s and the seller’s perspective (KPMG, 2008b). KPMG operates in 145 countries world-wide (KPMG, 2008a)

The corporate finance department at Öhrlings PricewaterhouseCoopers can help the customers through the entire process of the transaction chain. This starts with analysis, valuation, and due diligence and can be further developed to counseling and problem solu-tions in relation to business transfers, re-structuring, and financing (Öhrlings Pricewater-houseCoopers, 2008b). Öhrlings PricewaterhouseCoopers co-operate with an international network in 150 countries (Öhrlings PricewaterhouseCoopers, 2008a).

Robert Nordahl is working at the corporate finance department at Grant Thornton in Stockholm. Since he is a specialist at valuing trademarks, he was interviewed in order to gather more specific information about how intangible assets are valued. This since IT-companies are often faced with intangible assets rather than tangible assets. The corporate finance department at Grant Thornton works with large international transactions as well as small Swedish projects. Due to the membership in the organization Grant Thornton In-ternational the company operates in 113 countries (Grant Thornton, 2008).

Leif Garpheden is the CEO and founder of Garpco AB. He has great experience of acqui-sitions, since he has been involved in the valuation and acquisitions a number of times. Garpco AB is a holding company and also the parent company of the Garpco Group which was founded in 1996 and the head-office is located in Jönköping. The company’s growth consists of the development of its subsidiaries but also through acquisitions of small and medium-sized companies. Garpco AB contributes with tasks such as; expert

Method

Name of inter-viewee

Company Position Interview

type and date

Mathias Bransmo Litium Affärskommunika-tion

CEO Face-to-face

2008-04-29 Nicklas Dahl SYSteam Datakonsult i

Småland AB

CEO Face-to-face

2008-04-29

Leif Garpheden Garpco AB CEO Face-to-face

2008-05-06

Henrik Jonasson KPMG Senior manager at

cor-porate finance depart-ment

Face-to-face 2008-04-30 Claes Lindblad Öhrlings Pricewaterhouse

Coopers

Corporate finance con-sultant

Face-to-face 2008-04-30

Anders Nobrant Attendit AB CEO Telephone

2008-04-24 Robert Nordahl Grant Thornton Corporate finance

con-sultant

Telephone 2008-04-24

Johan Zackrisson Ernst & Young Manager Face-to-face

2008-04-28

Table 2-1 - Interviewees

2.4.2 Interviews

Interviews can be carried out through mail, telephone, and personal meetings. Interviews through mail are useful when conducting a structured interview (Ghauri & Grønhaug, 2005). All but two of the interviews are conducted face-to-face. The one with R. Nordahl is a telephone interview, since he works in Stockholm. A. Nobrant at Attendit AB also pre-ferred a telephone interview since he did not want to book a specific time for the interview, but rather carried it out when he got some extra time. The rest of the interviewees work within the area of Jönköping, why the interviews are carried out face-to-face. Mail is not used since it is considered to be hard to get in-depth answers by using this method and the response rate is usually as low as 30 per cent according to Saunders et al. (2003).

The different interview methods that can be used in order to maintain qualitative data are in-depth, semi-structured, and loosely structured interviews (Mason, 2002). Here all inter-views carried out to collect primary data are semi-structured. When using semi-structured interviews the researchers have a list of questions to cover that may differ depending on in-terviewee (Saunders et al. 2003). The interview with R. Nordahl is less structured than the other interviews. This since the intention is to get a deeper understanding of valuation of intangible assets from the point of view of a specialist. Intangible assets are also discussed with the other participants using the same questions. Yet, R. Nordahl is asked to give more detailed answers.

When preparing for an interview it is important that the problem is stated and related to theories, since the interview will be formed according to these factors (Lantz, 2007). Before conducting the interviews much effort was put into the questionnaire that was discussed with the tutor. This to ensure that the questions are well related to the problem and

theo-Method

is to get all the information needed at the interviews to limit the need of extra questions af-terwards in order to clarify some details. This since it is time consuming for both parts if the interviewers need to contact the interviewees again after the interviews are conducted. However, all the interviewees are asked whether it is fine to contact them again for com-plementing questions or if something need to be clarified, and all answered yes.

When using closed questions there are a specific amount of alternative answers of which the interviewee has to chose. Open questions on the other hand encourage the interviewee to provide an extensive and developmental answer (Saunders et al, 2003). As written above semi-structured interviews are used in order to collect primary data. The questions were de-termined in advance and contain four closed and 17 open questions. In the interview with R. Nordahl one of the seven questions is a closed end question. The intention with these interviews is to encourage the interviewees to speak free about the subject, even though the direction is pointed out according to the questions asked about valuation of IT-companies. There are three different questionnaires. Yet they are all constructed in a similar manner. The questionnaire to those working at the audit firms in Jönköping and L. Garpheden the questions are general about valuation of IT-companies, see Appendix 1. For those working at the IT-companies the questions are more specific in order to get information about the particular acquisitions, see Appendix 3. These questionnaires are divided into four parts, including; background information, valuation of IT-companies, valuation of intangible as-sets in IT-companies, and carrying through. The questionnaire to R. Nordahl only con-tained the third part; valuation of intangible assets in IT-companies, see Appendix 2. The background information part contains questions that are supposed to increase the un-derstanding of the IT-industry, why a valuation takes place, and how to prepare the process including the due diligence. The questions about valuation of IT-companies gives informa-tion about how the acquiring IT-companies carry out the valuainforma-tion overall. The quesinforma-tions about valuation of intangible assets in IT-companies give more specific information about these valuable assets that are important within this specific industry. Last, the part of carry-ing through gives information about whether there is somethcarry-ing else than the valuation that is important to have in mind before the acquisition takes place and how the company is acquired.

It could be useful to ask the people who are interviewed at the IT-companies to give in-formation about the companies they work at along with inin-formation about the acquired companies. Yet, this information can easily be accessed through their specific web-pages and is therefore excluded from the questionnaire. Since the interviewers are interested in getting information about the valuation process and methods used rather than specific numbers no such questions are asked. This to make the interviewees feel comfortable and reduce the risk that they do not want to participate. The interviewees are informed about this before the interview takes place.

Some of the questions included in the questionnaires are asked to get a better understand-ing of the subject rather than to answer the research questions and fulfill the purpose. This is true for mostly of the questions about background information and how the process is carried through. The question about what persons that are involved in a business

acquisi-Method

this thesis are participants of all the interviews, even though both were able to but only one spoke during the telephone interviews. This increases the value of the interviews from many points of views. Both are able to take notes which is important when the interviews are not recorded. Also it increases the value of the questions as such since both can clarify the questions in order to reduce the misunderstandings. At the same time both can ask questions in order to make the answers given by the interviewee clearer. The interviewee is asked when contacted the first time if he is comfortable with this. Also, those being inter-viewed through telephone are informed that there are two persons listening to the conver-sation, even though only one is speaking.

In order to give the interviewees the opportunity to prepare for the interviews the ques-tionnaire together with the research questions and purpose of this thesis are sent to the in-terviewee a couple of days before the interview takes place. It is believed that this leads to the fact that more information is retrieved from the interviews. This is seen as extra impor-tant for the interviews with the people working at the IT-companies since they may need to refresh the memories about the specific acquisition. Yet, most of the interviewees asked us to send it to them, why it was sent to everybody in order to make the interviews smoother. The interviews are conducted in Swedish. This since the mother tongue of both the inter-viewers and the interviewees is Swedish. Both the questionnaire and the information re-ceived from the interviewees are translated into English afterwards. A disadvantage with this is that there can be some errors in the results due to language difficulties when translat-ing. Yet, it is believed that the value of the ability to speak more free in Swedish is greater than the loss of information due to the translation.

Before ending the interviews the interviewees were asked whether they want to read through the texts before handing in the thesis, which all but A Nobrant wanted. This is an advantage since it reduces the misunderstandings. Both, since it is always a possibility that the interviewees misunderstand the questions and the interviewers misunderstand the an-swers. Also, after each interview is conducted a report is written from the notes taken at the interviews. This in order to reduce the loss of information.

2.5

Reliability and Validity

It is hard to find the connection between theory and empirical findings. Yet, this is neces-sary, since the research will be meaningless otherwise. This is connected to the validity of the research (Svenning, 2003). Before the interviews took place the questions were well de-fined and checked in order to make sure that they would give the information needed to fit the theories used and fulfill the purpose of this thesis. The information received must con-tain the information that is assumed by the researchers in order for the validity to be high (Saunders et al. 2003). The interviewees at IT-companies have been involved in acquisi-tions. The other interviewees work with business valuation on a daily basis. The validity is decreased, though, by the fact that neither of these interviewees have special competence when it comes to valuing companies within the IT-industry. Yet, they have knowledge about business valuation and about the IT-industry. Therefore it is reasonable to assume that the information received from the interviewees is appropriate. Also, the fact that both authors of this paper participated and took notes at the interviews increases the validity since this reduced the loss of information.

Method

Reliability is high if it is reasonable to assume that other researchers would get the same in-formation if the same methods were used (Saunders et al, 2003). The interviewees often gave similar answers independent of each other. This increases the reliability of this re-search since this makes it reasonable to assume that other rere-searchers would also get the same information with this method. The reliability can be affected due to a lot of reasons, such as mistakes in the questionnaire. Other factors that can affect the reliability are the in-terviewer or the surrounding (Svenning, 2003). Also the reliability is increased due to the fact that the questionnaire was discussed with the tutor in order to decrease the mistakes and make sure that the questions are correctly understood. All the interviewees had the possibility of conducting the interview at their workplace in a relaxed surrounding. The in-terviewers did not speak a lot during the interviews but rather listened, wrote notes and asked questions mostly to clarify certain answers. This is also argued to increase the reliabil-ity.

Both the validity and reliability are increased by the fact that the interviewees got the possi-bility to read through the thesis before the final deadline. It is assumed that this lead to the fact that the information received is correct. Also the misunderstandings that can be due to mistakes in the questionnaire are believed to be reduced.

2.6

Choice of theories

The theory part starts with motives for an acquisition to give the reader a better under-standing of why an acquisition takes part rather than to fulfill the purpose, see section 3.1. This is followed by a description of how to prepare for an acquisition, which also gives in-formation of when the valuation is carried through, see section 3.2. In relation to an acqui-sition it is important to carry out a due diligence, which is the third part in the theory chap-ter, see section 3.3.

There are lots of different valuation methods available for business valuation. In this re-search the focus has been on net asset value approach, net present value approach, and rel-ative valuation approach, see section 3.4. There are many sub valuation methods within the net present value approach and the relative value approach. Since it is unrealistic to bring up all these the main focus was to include those that are brought up during the interviews. The focus is on valuation methods before an acquisition therefore the liquidation valuation method is not included. In order to find out what intangible assets that are related to IT-companies and how these are valued the intangible assets; goodwill, trademarks, and pat-ents are brought up in section 3.5.

Valuation issues across the life cycle, and indirect and direct acquisition are described in sections 3.6 and 3.7. It can be argued that these do not have much to do with the valuation methods. Yet, these are all important factors to take into account before an acquisition takes part. Therefore it is argued that these are important to clarify the subject of acquisi-tion. Also the valuation method and value of the firm may differ depending upon where in the life cycle the firm is situated. Last, previous research are brought up in section 3.8, in order to give the reader information about what conclusions other persons have come to regarding business valuation.

Method

2.7

Criticism towards chosen method

An advantage when using primary data is that the researcher collects information that is up to date and contains the information needed for the specific research question. Secondary data on the other hand is previously collected for another purpose and may not match the need for this specific research. A disadvantage with primary data is that it usually is time consuming and expensive to gather compared to secondary data (Ghauri & Grønhaug, 2005). Since the focus is on a specific industry, collection of primary data is most appropri-ate. The cost of collecting primary data is seen as relatively low compared to the biased re-sult that the usage of secondary data could give. This since most secondary data contains information about business valuation in a broad perspective, rather than valuation of com-panies in the IT-industry. A lot of the secondary data used in this thesis is English and American. This is a limitation since the sample looked upon is IT-companies in the area of Jönköping.

The way that the sample of IT-companies is found is questionable. First Swedish Compa-nies Registration Office, Statistics Sweden, Swedish Institute for Growth Policy Studies, The Confederation of Swedish Enterprise, and Swedish Competition Authority were con-tacted. Yet, neither of them could give information about companies that had gone through acquisitions. Instead Blue Range Technology AB, Litium Affärskommunikation and SYSteam are found at J-nytt.se. Pdb is found in Jönköping.nu and Attendit AB at the webpage of Science Park. When doing a research about what valuation methods that are used to value IT-companies it is of great importance to get in touch with these companies. Therefore these interviews are valuable even though the sample could have been outper-formed in a better manner.

Two of the IT-companies that were contacted decided to stay out of this research. Blue Range Technology AB acquired CML Data in 2007. Yet, when speaking to the CEO he claimed that no proper valuation was conducted before the acquisition. CML Data con-tained the owner and one employee. The previous owner felt uncomfortable with his posi-tion, which led to a lot of extra work. Therefore Blue Range Technology AB paid him a price for CML Data, which did not include much more than two employees and a list of customers (N, Mehlin, personal communication, 2008-04-16). Pdb, that acquired iBizkit in Stockholm in 2007, also decided to stay out of this research. Both these non-responses are limitations to the research. Yet, since not much effort was put into the valuation of CML Data, this is not believed to affect this research significantly. Hence, it would have been valuable to get in contact with these two companies. This since the sample would be more appropriate if more IT-companies participated. In this research there are five people work-ing with business valuation in general, compared to only three persons who have done a proper valuation of an IT-company. It is believed that the trustworthiness would have in-creased with more interviews at IT-companies since these are assumed to have more know-ledge about how a valuation process is actually carried out within this specific industry. An advantage with telephone interviews compared to face-to-face interviews is that it is more time effective. An advantage with face-to-face interviews on the other hand is that more information can be achieved due to the use of body language and a closer connection between the people involved (Ghauri & Grønhaug, 2005). To maintain an interview in Stockholm is argued to be too time consuming compared to the extra advantage of a face-to-face interview. Also it is argued that a telephone interview with A. Nobrant is highly val-ued compared to no interview at all.

Method

A disadvantage with sending the questions to the interviewees in advance is that the an-swers can be manipulated (Saunders et al. 2003). Yet, this is not assumed to be the case here since no questions about sensitive information are asked. It is believed that the extra information that can be received due to this is more valuable since the interviewees get the chance to read through and think about the answers in advance.

Theoretical framework

3

Theoretical framework

The theoretical framework starts with different motives for an acquisition, followed by preparation for a business valuation. Afterwards different valuation methods are presented along with intangible assets.

3.1

Motives for an acquisition

There are a number of motives for acquisitions which are based on a strategy that the ac-quiring company develops. The most common ones are described below.

3.1.1 Acquire undervalued firms

If a firm is considered as undervalued by the financial markets it can be acquired by com-panies that recognize this mispricing. The surplus for the acquirer is the difference between the value and the purchase price. There are three components that need to come together for this to work:

1. A capacity to find firms that trade at less than their true value. The acquirer needs to find better information than is available to other investors or better analytical tools than those used in the market.

2. Access to the funds that will be needed to complete the acquisition. Even if the acquirer knows that the firm is undervalued does not necessarily imply that he has capital to carry out the acquisition.

3. Skill in execution. If the acquirer drives up the stock in the process of the acquisition, and the price is beyond the estimated value there will be no value surplus from the acquisition (Damodaran, 2001a).

3.1.2 Diversify in order to reduce risk

Earnings volatility and risk can be reduced if the managers acquire firms in other busi-nesses in order to diversify. There are two ways of diversification that play a significant role. The first is private firms in which the owner has all his wealth. Since the owner alone is exposed to all risk it is more important to diversify into multiple businesses. Second, firms that are closely held since the managers have the bulk of their wealth invested in the firm. These managers can diversify through acquisitions in order to reduce their exposure to total risk (Damodaran, 2001a).

3.1.3 Create synergy

The synergy is the potential additional value from combining two firms. There exist two types of synergies, operational and financial.

Operational synergies allow firms to increase their operating income, increase growth or in some case both. These operational synergies can further be divided into four types;

1. Economies of scale – the new firm becomes more cost-efficient and profitable. 2. Greater pricing power – by reduced competition and higher market share the firm

Theoretical framework

3. Combination of different functional strengths – arise when the acquirer and the target possess different strengths which result is successful.

4. Higher growth in new or existing markets – arise from the combination of the firms and results in increasing sales (Damodaran, 2001a).

Financial synergies are the payoff in the form of either higher cash flows or a lower cost of capital. There are three common cases where financial synergies arise;

1. If the acquirer has excess cash (and limited project opportunities) and the target has high-return project (and limited cash) this will result in a higher value for the new firm. This synergy is most common when large firms acquire smaller firms or when listed firms acquire private firms.

2. Increasing the debt capacity because the earnings and cash flows may become more stable and predictable after the acquisition. It is also possible to borrow more mon-ey after the acquisition since one big firm is stronger than two small and this will create tax benefits.

3. By taking advantage of tax laws from the use of net operating losses to shelter the income, tax benefits will arise. If a profitable firm acquires a money-losing firm the acquirer may be able to use the net operating losses of the target to reduce the tax burden. A firm can also be able to increase its depreciation charges after an acquisi-tion to save taxes and increase its value (Damodaran, 2001a). Yet, the Swedish law states that the parent company must have been a parent company to the subsidiary for the entire taxation year or since the subsidiary started its business to be allowed to carry out group contribution (Kap 35, 3, 1st, 3p “Inkomstskattelag (1999:1229)”),

see Appendix 4.

3.2

Preparing for a business valuation

Before doing a business valuation it is important to start with a detailed discussion of the process. By doing this, surprises such as risk factors that may impact the value and lack of control, can be avoided. In order to ensure a smooth valuation process there are certain fi-nancial reports that a company should have in place before the valuation process takes place. The most important is the financial statement which should be prepared in accor-dance to present accounting standards for the company. According to Mellen and Sullivan (2007) there are generally four phases in business valuation process which are the follow-ing; the introductory phase, the engagement phase, valuation procedures and the report phase. The introductory phase includes the following different questions in order to continue the process (Mellen & Sullivan, 2007):

• What is going to be evaluated precisely? • Why is the evaluation needed?

• How many classes of stock are there? • When is the report needed?

Theoretical framework

It is important to define value since the conclusion will be different depending on how val-ue is defined (investment vs. fair market vs. liquidation valval-ue). In the engagement phase the business appraiser will prepare the engagement contract. Thus, documents which include the main points of the valuation assignment where the effective valuation assignment, sub-ject interest to be valued, time requirements, fees and retainers are stated (Mellen & Sulli-van, 2007).

The valuation phase comprises the gathering of information needed to complete the assign-ment where the client needs to provide company information. This information includes historical financial statements, tax returns, and corporate documents and also answers to a questionnaire. If much time is spent on this phase it will result in a high-quality valuation (Mellen & Sullivan, 2007).

The last, report phase consist of writing the report using the information gathered from the previous phases. The report do not only include what the business is worth but also what economic and industry environment in which the company operates, its strengths, weak-nesses, opportunities and threats, its financial performance and its market position. The business valuation can be used as a planning and control tool that provides foundation and direction of the company’s strategic plan (Mellen & Sullivan, 2007).

3.3

Due diligence

According to Holmström (2005) an acquirer has almost the same obligation to examine the acquired company as a buyer of a house. This is referred to as the concept of due diligence, meaning that the buyer has to maintain a detailed examination of the acquisition project depending upon what is reasonable and possible in reality. For example inventory lists and the record of fixed assets should be studied in order to control the trustworthiness of the balance sheet (Holmström, 2005). Even though the seller can initiate an investigation by offering the buyer information a due diligence is often started by the fact that the buyer send a list with the information he need (Gorton, 2002). To fulfill the due diligence the buyer may carry out interviews with present and previous employees. Also auditors, law-yers, and tax jurists can be interviewed. This in order for the acquirer to get an own picture of the company and its value before starting the negotiation with the seller (Holmström, 2005).

3.4

Methods for business valuation

Each time a valuation takes place subjective estimates has to be made, that affect the final value. Some factors are related to the length of life of the assets, future prospects, and cost of capital requirements. Also the motives of the buyer and seller influence the value of the company. The acquirer may be willing to pay a high price due to rationalization gain, and synergy effects, see section 3.1.3. The seller may be willing to sell fast at a low price due to lack of money (Holmström, 2005).

The appraiser also need to add other information such as industry data, relevant economic information, market data on similar transactions and rates of return available on investment of similar risk (Mellen & Sullivan, 2007). It is hard to do an internal analysis of a company since only the external information is presented in the public annual reports. Here one should look upon factors such as present situation, surroundings, the market, competitors, accounts, and press bulletin (Holmström, 2005).

Theoretical framework 3.4.1 Net asset value approach

When using the net asset value approach the assets in the firm are valued individually. The net asset value in the balance sheet is the taxed equity and the untaxed reserves minus the deferred tax liabilities (Gorton, 2002). The value of specific assets and liabilities are thereaf-ter adjusted due to differences between book value and market value. To do this valuation a starting point must be to assume that the business is a going concern (Öhrlings Pricewa-terhouseCoopers Gruppen AB, 2005). The valuation can be done in two ways. Either the assets are valued according to the sales value if the business is closed down, or it can be va-lued depending upon what it would cost the buyer to purchase equivalent assets to be able to carry on the business (Gorton, 2002). The value of each share is called the net asset val-ue (NAV) and is calculated by the formula (Bodie, Kane, Marcus, Perrakis & Ryan, 2005);

Cited in Bodie et al. 2005, pg. 104

The valuation of assets is more complicated for knowledge-based and service companies. In these companies much of the assets are intangible and not accounted for in the net asset value. No good methods to value human capital are developed yet. However, there are many companies that try to put a value on their most important employees by the use of present value calculations of future salaries (Holmström, 2005).

According to Gorton (2002) the net asset value approach seems to be most useful when the purchaser intend to close down the business and sell the individual assets. Lundén & Ohlsson (2007), on the other hand, states that it is common to value a company by using the net asset value approach to start with. This to compare the value using the net asset ap-proach with values received when using other valuation methods (Lundén & Ohlsson, 2007).

3.4.2 Net present value approach

Capital budgeting is all about trying to determine whether an investment, once it is in place, will be worth more than it costs. Net present value (NPV) is a measure of how much value that is created or added today by undertaking an investment, and the capital budget process can be seen as a search for a positive NPV. The risk with the NPV is that there is no guar-antee that the estimates will turn out to be correct. Also, it is easier to make an investment decision when the market contains other assets that are similar to the one taken into con-sideration. It gets complicated when not even the market price for roughly comparable in-vestments can be observed (Ross, Westerfield, & Jordan 2008).

According to Lundén & Ohlsson (2007) the net present value approach is mostly used in knowledge intensive companies, in which the balance sheet does not include many assets. The profit is rather based upon staff, business idea, market or other things that lies outside of the balance sheet. Yet, the net present value approach is not usable when valuing com-panies that experience a loss. When valuing these comcom-panies other valuation methods have to be used (Lundén & Ohlsson, 2007). When valuing a business according to the NPV the

Theoretical framework

Discounted cash flow:

The objective when using the DCF valuation is to find the value of assets, given their cash flow, growth, and risk characteristics. The expected cash flow is discounted back at a rate that reflects the riskiness of the asset in order to estimate its val-ue. What is calculated is the present value of the expected cash flows on that asset. This by using the formula (Damodaran, 2001a);Where; N = years

r = discount rate that reflects both the riskiness of the cash flows and financing mix used to acquire the asset.

Cited in Damodaran, 2001a, pg. 751

When valuating an entire firm the expected cash flow to the firm is discounted by the weighted average cost of capital (WACC). WACC is used in order to weight the market value proportions of the different components of financing used by the firm. This leads to a slightly different formula (Damodaran, 2002);

Cited in Damodaran, 2002, pg. 13

When using the DCF, the NPV is the difference between the present value (PV) of the fu-ture cash flows and the cost of the investment. If the DCF gives a higher value than the cost of the investment a purchase should be carried out. This is quoted by Ross et al. (2008, pg. 267) as; “The net present value rule: An investment should be accepted if the net present value is positive and rejected if it is negative.” This also means that one would be indifferent between making the investment or not if the NPV turns out to be exactly zero (Ross et al. 2008). When using the net present value approach the firm is given a value that is dependent upon future return. Profits from previous years, turnover, conditions within the market, competi-tiveness of the firm, and the economic situation are usually important factors to take into account. This method is most appropriate to use if the purchaser is planning to continue the business and earn a high yield on invested capital. Many of the factors used in this valu-ation are uncertain. Therefore, it is useful to combine the net present value approach with net asset value approach or market value approach (Gorton, 2002).

3.4.3 Relative Valuation approach

Relative valuation focuses on valuing assets based on how similar assets are priced in the market at that time (Damodaran, 2001a & Öhrlings PricewaterhouseCoopers Gruppen AB, 2005). This model consists of two components. First, prices have to be standardized often by converting them into multiples of earnings, book values, or sales, to value the assets in a relative way. Second, there are no identical firms in the market which means that it is diffi-cult to find similar firms in the same industry since they differ on risk, growth potential and cash flow (Damodaran, 2001b). Compared to the DCF valuation there are multiples used

Theoretical framework

to value equity and firms that require far fewer assumptions, see Table 3-1 (Damodaran, 2001a).

Multiple Determining Variables Price/Earnings Ratio Growth, Payout, Risk, ROE Price/Book value

Value/EBITDA

Growth, Payout, Risk, ROE

Growth, Net Capital Expenditure needs, Leverage, Risk

Value/sales Growth, Net Capital Expenditure needs, Leverage, Risk, Operating Margin

a Companion variables are in italics

Table 3-1 - Multiples and Companion Variablesa

Modified version of Table 24.19 in Damodaran, 2001a, pg. 778

Price-earnings ratio (P/E):

The P/E ratio is the ratio of the stock price to last year’s earnings per share. It reports how much the purchasers of stocks must pay per dollar of earnings that the firm generates. It varies a lot across different firms. When using the P/E ratio it is important to take the company’s long-run prospects as well as current earnings per share relative to the long-run trend line into account. A high P/E ratio indicates that the firm has good opportunities to grow. It can also be said that riskier stocks have lower P/E multiples (Bodie et al. 2005). P/E is calculated by the formula (Damodaran, 2001b);Cited in Damodaran, 2001b, pg. 276

Price to book value (PBV):

The estimates of the value of a business often differ a lot be-tween what the market provide and what accountants provide. The book value of assets is heavily influenced by the original price paid and accounting adjustments, such as depreca-tion, made on the asset. It is usual that investors look at the relationship between the price paid for the stock and the book value of equity to see if the stock is over- or undervalued. Depending on the growth potential and the quality of investment the PBV can differ a lot between industries. It is also very influenced by the return on equity (ROE). When valuing an entire business the book value of all assets is used rather than just the equity. The PBV for a stable-growth firm is calculated by the formula (Damodaran, 2001a);Where;

ROE = Return on Equity gn = expected growth

ke = cost of equity

Cited in Damodaran, 2001a, pg. 777

Value to EBITDA:

This multiple is useful for different reasons. Far fewer firms have a negative EBITDA than the number of firms that have negative earnings per share. There-fore this multiple can be used on more firms. Differences in depreciation methods do not affect EBITDA, but it affects operating income and net income. The multiple is also moreTheoretical framework

Where;

EBITDA = Earnings before interest, taxes, depreciation, and amortization

Cited in Damodaran, 2001b, pg. 316

Technology firms often get EBITDA multiples that are very close to price to pre-tax equity earnings. This due to the absence of debt and low depreciation charges (Damodaran, 2001b).

Value to sales (V/S):

The Price to sales (P/S) value is a revenue multiple that is useful for equity investors. In this valuation the value per share is divided by the revenues generated per share. When valuing a firm a better measure is the modified version of P/S which is V/S. Here the numerator is the total value of the firm. Largely as a function of the profit margin in each ratio these ratios vary a lot across sectors. When using revenue multiples it is much easier to compare firms in different markets, where different accounting systems are used, compared to the use of earnings or book value multiples (Damodaran, 2001a). V/S is calculated by the formula (Damodaran, 2001b);Where;

EBIT = Earnings before interest and taxes gn = expected growth

Cited in Damodaran, 2001b, pg. 331

Even though it is not brought up in Table 3-1, it is important to know that the number of employees is one of the most common measure concerning the company’s size and growth. These measures can be divided into different key figures; turnover per employee, value added per employee, employees in different categories etc. (Nilsson, Isaksson & Martikainen, 2002). This measure is suitable when one follows up the company over time and to spot variations from previous years. If the ratio is used to compare the company with other companies it is important that this is done in the same industry (Nilsson et al. 2002).

For personnel intensive companies the measure, growth in relation to employees, can be an important measure since these companies’ results are highly dependent upon the number of employees. Therefore, a prognosis of the number of employees can be a relatively good ground in order to forecast the company’s future (Nilsson et al. 2002).

Theoretical framework 3.4.4 Alternative valuation models

Both the net asset value approach and the net present value approach are associated with different factors of insecurity. Therefore some alternative valuation methods are used that complement these models. The re-production value of a company means that the cost of start-ing up a new company from scratch is calculated. This can be seen as the alternative value of an already existing company. A more risky method is to use the market value. This since the quotation can be influenced by different factors and change a lot in a short time (Holm-ström, 2005). This valuation method can only be used when valuing companies at a stock exchange (Gorton, 2002). A comparing method aim at evaluating the business value depending on the price of shares in comparable firms (Holmström, 2005).

3.5

Intangible assets

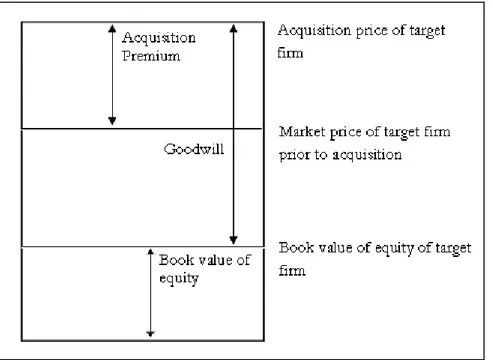

The difference between the acquisition price and the market price prior to the acquisition is called the acquisition premium. The acquisition price is the price that the acquiring firm will pay for each of the target firm’s shares, which is based on negotiations between the acquir-ing firm and the target firm’s managers. If there is more than one firm biddacquir-ing for the same target firm the price may be even higher. The difference between the price paid on the ac-quisition, also referred to as the market value of the firm, and the book value of the equity of the acquired firm can be recorded as goodwill, see Figure 3-1. Goodwill is generated through the acquisition and cannot be generated within the firm (Damodaran, 2001a).

Figure 3-1 - Breaking Down the Acquisition Price

Theoretical framework

According to Feldman (2005) one should consider an acquisition when synergies between the target firm and the acquirer can be expected. Synergies include the fact that the value of the combined companies exceeds the sum of the market values of each as standalone firms. The difference is called synergy or acquisition value (Feldman, 2005). The value of financial synergy can be showed by the formula;

V(AB) > V(A) + V(B) where;

V(AB) = Value of a firm created by combining A and B (synergy) V(A) = Value of business A, operating independently

V(B) = Value of business B, operating independently

Cited in Damodaran, 2002, pg 696

The value of the target does not only reflect the additional cash flows that are expected to emerge due to the combination. Also, any options that the combination may create to be exercised in the future if the circumstances develop that support such execution should be counted for (Feldman, 2005).

3.5.1 Goodwill

According to Holmström (2005) goodwill is the difference of what the buyer pays for the company and equity bought. There are also other definitions of goodwill. The U.S. Finan-cial Accounting Standards Board (FASB) define goodwill as “the excess cost of the acquired com-pany over the sum of the amounts assigned to identifiable assets acquired less liabilities assumed should be recorded as goodwill” (Tollington, 2002, pg. 76). The International Accounting Standards Committee (IASC) state that “any cost of the acquisition over the acquirer’s interest in the fair value of identifiable assets and liabilities acquired as at the date of exchange transaction should be described as goodwill and recognized as an asset” (Tollington, 2002, pg. 76). Listed companies have to follow IASC’s recommendations concerning goodwill which implies that these companies have to carry out an impairment test in order to value goodwill after an acquisition. By doing this the companies find out if the value of goodwill is the same as at the acquisition moment (Lönnqvist, 2006). Private limited companies on the other hand can chose if they want to follow IASCs recommendations or if they want to write off the value of goodwill during a certain period of time which varies between five and 40 years depending on the profitabil-ity of the acquired company (Holmström, 2005).

According to Reilly and Schweihs (1999) there are three components of goodwill which consider the factors that cause goodwill or the reasons why goodwill exists in certain cir-cumstances.

1. The existence of assets in place and ready to use which is sometimes referred to as the going-concern value element of goodwill. This means that all elements of a business that are physically and functionally assembled create value. The elements include capital, labor and coordination which refer to intangible assets for the go-ing-concern business.

2. The existence of excess economic income. Meaning that the level of income is that part which is generated by a business that is greater than the amount of what would be considered as a fair rate of return on all the other tangible and intangible assets that are used in the business. This component relates directly to the concept of goodwill as the value of a business that cannot be assigned to any of the tangible