How do gym-brands differentiate in a crowded market?

CHOUHAN, RIKESH

YAKOUB, JOHANNES

School of Business, Society, Engineering

Course: Bachelor thesis in Business Administration Course code: FOA230

Credit: 15cr

Supervisor: Edward Gilmore Date: 2nd June, 9th June

ABSTRACT

Date: 9th of June 2020

Level: Bachelor thesis in Business Administration, 15 cr

Institution: School of Business, Society and Engineering, Mälardalen University Authors: Rikesh Chouhan Johannes Yakoub

(97/04/13) (96/09/02) Title: How do gym-brands differentiate in a crowded market? Tutor: Edward Gillmore

Keywords: Advertisement, Brand perception, Competitive strategies, Branding.

Research Questions: How are the major gym companies differentiating in order to attract new customers and keeping their old customers? What views do customers have on the different actors in the gym sector?

Purpose: The study is conducted to see how gym-brands can differentiate and survive in such a crowded market.

Method: A Mixed method, deductive study has been conducted. The authors collected their data through secondary sources on the internet and through a survey.

Conclusion: The paper confirmed that the perception gym companies create are the same perception that members have of the targeted gym. Factors such as cost, flexibility and family/friends are key to get new customers. By using advertising and competitive strategies to differentiate they succeed to present their perception.

How do gym-brands differentiate in a crowded market? ABSTRACT 1 1.Introduction 4 1.1 Background 4 1.2 Problematization 6 1.3 Purpose 7 1.4 Research Question 8 2. Theoretical framework 8 2.1 Advertisement 8 2.2 Branding 9 2.2.1 Brand perception 9 2.3 Competitive Strategies 10

2.3.1 Cost leadership strategies: 11

2.3.2 Focus strategies: 12

2.3.3 Differentiation strategies: 12

3. Method 13

3.1 Research approach 13

3.2 Epistemology 14

3.3 Context of the study 14

3.4 Reliability and validity 15

3.5 Data collection 16

3.5.1 Primary- and secondary data 16

3.6 Data analysis 17 3.7 Ethical considerations 17 3.8 Limitations 18 4. Empirical Findings 18 4.1 Friskis&Svettis 18 4.2 Nordic Wellness 20 4.3 Fitness24seven 21 4.4 Gymmet Sverige 22

5. Findings from survey 23

5.1 Case 1 (Friskis&Svettis) 29

5.2 Case 2 (Nordic Wellness) 30

5.3 Case 3 (Fitness24seven) 31

5.4 Case 4 (Gymmet Sverige) 32

6. Discussion 33

6.1 Comparison of the sample responses: 33

6.2 Within case study analysis 36

6.2.1 Case 1 (Friskis&Svettis) 36

6.2.3 Case 3 (Fitness24seven) 37

6.2.4 Case 4 (Gymmet Sverige) 38

6.3 Comparison between the cases 39

6.3.1 Case 1 (Friskis&Svettis) 39

6.3.2 Case 2 (Nordic Wellness) 39

6.3.3 Case 3 (Fitness24seven) 39

6.3.4 Case 4 (Gymmet Sverige) 40

7. Conclusion 40

References 42

1.Introduction

To train and take care of your body is very important both for your mental health and physical health, all types of activity is healthy for you, everything from taking a walk or take a run, to heavier weight training at the gym (Engström, 2020). According to Engström (2020) the blood circulation increases, you get less stressed and you get better sleep. The brain also gets affected positively and the risk for diseases decreases (CDC, 2020). The authors of this study have noticed that people today have a bigger understanding of the benefits of training and an active lifestyle, the fitness-culture has gotten bigger and bigger. People care more and more about their lifestyle and health, especially in Sweden which is with their 2,1 million gym-members the country in Europe with the most gym-members (Arvidsson, 2018). According to Arviddson (2018) there are 1620 gyms in Sweden, that is an average of 1321 members per Gym. Although not every member is an active member there is clearly a big understanding of the benefits of the positive impact of a healthy lifestyle, according to Dagensanalys (2019) 73% of the Swedish population are active and trained at least once a week.

1.1 Background

Today there are a lot of gyms that a customer can choose between, there are many options when it comes to what type of gym, CrossFit or bodybuilding, price class and location of the gym. Many of these gyms are bigger franchise gyms meanwhile others are smaller local gyms (McCurry, 2017). All of the gyms strive towards promoting wellbeing through an active lifestyle, but as any other business all gyms also need to be profitable. Many gyms go bankrupt today, the competition between gyms is hard and there are a lot of things to think about when starting and trying to establish a gym (Lindström, 2018). One good example of how big the competition between gyms are according to Lindström (2018) is to just google ‘’gym i uppsala’’ which means gyms in Uppsala and you get over 20 hits.

Many of the big brands are opening up multiple gyms in the same city, for example Member 24 which is a swedish chain of gyms in Sweden has three gyms within a 5 min walk away from each other in the city of Västerås (member24, 2020). So how are major gym firms differentiate to stay competitive in a crowded market? If you ask us we have our own thoughts of each brand, and that is through the brand perception we have of each gym, but both of us have different gym memberships and are getting targeted by different types of advertising and differentiation strategies. Most of these gym-companies have many gyms in the same city for example Nordic Wellness has according to their website at the end of 2020 built up 7 gyms in Västerås (nordicwellness, 2020). What do they do in order to stay competitive in the market? By having big openings and creating some kind of hype around their new openings and offering a limited time cost-reduced membership is their way of getting a lead in the market (wellnessliving, 2019). Not all of the gyms are opening up new gyms every year in the same city, but they still manage to stay in business, and this is by continuously changing their advertising and creating new promotions depending on the season (Jones, 2007). According to Wellnessliving (2019) a clear example of how all the gym-companies differentiate is during the new year, when many have decided that they want to start training. That is the perfect time for the gyms to sign new customers, and during that period of time the advertising is very high. Gyms might decrease their price for a limited time, they will start to promote their niched service and offer benefits that members get if signed with that particular gym all this to stay active in the market, a market that is very standardized with major brands offering the same basic package, a solution where people can workout in different variations (wellnessliving, 2019). Since all of the gyms are mostly offering the same service and are quite generic, the author's problem statement is how they are perceived differently, to different customers.

Today we live in a time and era where many people are getting more and more health cautions. People focus more on eating healthy, building good habits and exercising more (Arvidsson, 2018). Sweden has the most user penetration when it comes to gym goers, with 3,1 million users and is nr 1 with

30,7% of the population having some form of gym-membership (Statista, 2020). Three of the biggest gyms in Sweden is Friskis&Svettis, Nordic Wellness and Fitness 24/7, where Friskis&Svettis has 110 gyms in sweden, Nordic wellness 260 gyms in sweden and fitness 24/7 162 gyms in sweden (Friskissvettis, 2020; Nordicwellness, 2020; fitness24seven, 2020). These three gyms are also the ones which the authors will focus on, as well as one smaller gym called Gymmet Sverige which according to Gymmet (2020) has five gyms in Sweden, the choice fell on these four gyms since they could be found in the author's hometown Västerås (Friskissvettis, 2020; Nordicwellness, 2020; fitness24seven, 2020; Gymmet, 2020). Also due to the situation today with the corona pandemic the authors researched the gyms instead of interviewing key people at the gyms and these gyms were the ones which they found most information about.

1.2 Problematization

We can see that more and more people are getting active, and more health conscious and this results in people getting into the gym and seeking out a new gym membership (Engström, 2020). This is something gym companies are noticing and are opening up more and more gyms around in the cities of Sweden (Lindström, 2018). You can see the same gym having several different spots next to another because they are getting so crowded one example is Member 24 who has opened multiple gyms in Västerås (Member24, 2020). In order to gain market share, gym-brands have to create some type of differentiation and something to focus on in order to trigger the buyer but also to always try to develop and be original. Brand perception is a big factor for a customer when choosing a product or service and in this case choosing a gym, people are influenced by advertising and marketing strategies from the company but can also be influenced through word of mouth, from friends and families (Berger, Draganska & Simonsson, 2007). If you look at some of the main franchise gyms in Sweden observed through each website, in this case Friskis&Svettis, Nordic Wellness and Fitness24seven, they all offer very similar services so you can see that they are very standardized. Observed through their websites it is clear that these three gyms has a couple of standard offerings;

- Frontdesk with personal working in the gym, signing new members and organizing the gym area.

- Weight equipment, gym machines, cardio equipment and a variety of classes.

- Personal training and service to help people get in shape. (Friskissvettis, 2020; Nordicwellness, 2020; fitness24seven, 2020)

Even though they are very standardized they focus on different customers and they differ in price, opening hours, staffed hours, gym equipment and facilities. (Friskissvettis, 2020; Nordicwellness, 2020; fitness24seven, 2020). The authors want to look into this phenomenon and see how gyms want to be perceived. As mentioned above these gyms are very similar in what they offer inhouse, how do the consumer perceive them and what is important for the customers when choosing a gym how do they utilize their advertising in order to create a different brand perception when the perception should be very similar from brand to brand because it is a very standardized product/service. What are they doing to differentiate and what brand perception does consumers have towards the different gyms? The problem the authors want to adress is what are the gyms doing to differentiate and what brand perception does the customers have towards the different gyms, does the way gyms want to be perceived match the customers perception of them?

1.3 Purpose

With this study the authors want to find out how gyms differentiate and how they want to be perceived by customers. The authors also want to find out what perception the customers have towards different gym-brands and what they are looking for when deciding which gym to use. A survey is conducted to study how people perceive the targeted gyms and information about the gyms is gathered to find out what how they want to be perceived. The collected data from the survey is then compared to the information about the gyms. The study is conducted to see how gym-brands can survive in such a crowded market.

1.4 Research Question

How do gyms differentiate and how do they want to be perceived? What views do customers have on the different actors in the gym sector?

2. Theoretical framework

2.1 Advertisement

Advertising which is a type of communication that companies use to increase exposure and sales of a service or product can be done in a couple of different ways. It is used to leave an impression that it is permanent on targeted customers and which creates an attraction towards a product or a company (Green, 2012). According to Tellis (2004) advertisement can be done through TV, radio, newspapers, on the internet but also through movies and computer-games nowadays. Some advertisements can be easy to find and can be easy for a person to know that it is an advertisement but sometimes the advertisement is hidden and not so easy to recognize (Brennan, Dubas & Babin, 2015). Social media is a tool used to advertise a product or a service (Parment, Kotler & Armstrong, 2016). The goal of advertisement is to attract new customers but also to increase knowledge about the company and the products to existing customers. To attract the right market segment the company can use influential people who can advertise to people around them (Kotler, Armstrong, Harris & Piercy, 2017). Newer types of advertisement are through the internet which for some companies might be the best way to attract customers. A lot of companies use Google, Facebook and other types of websites to target customers (Parment, Kotler & Armstrong, 2016) According to Kotler et al. (2017) it is important to know customers and their preferences to be able to create a value for them and attract them to you. It is also important to know the market that the company is operating in. Advertising is according to Green (2012) something that always needs to be adopted and developed, it should always be a process of change to keep up to date.

2.2 Branding

To understand the idea of branding we first need to understand the definition of products and brands. A product is according to “Broadly, a product is anything that can be offered to a market to satisfy a want or need, including physical goods, services, experiences, events, persons, places, properties, organizations, information and ideas” (Kotler & Keller, 2015). Second word that we need an explanation for is brand, the definition of brand is “A brand is a name, term, design, symbol or any other feature that identifies one seller’s good or service as distinct from those other sellers' '. Brand is an image or idea that people have in their mind when thinking about a specific product or service (Clifton, 2009). With these two words defined we can move forward to the definition of branding, “Branding is endowing products and services with the power of a brand” (Kotler & Keller, 2015). Branding is the process when you give meaning to a specific organization, product or service by creating and shaping a brand inside the consumers minds. It’s something that will make consumers link a product or service with a specific brand quickly in order to get a competitive advantage in the market.

2.2.1 Brand perception

To have a good brand perception is crucial for a company, the company should therefore have it as a priority to have a strong brand perception towards customers (Timney & Chamberlain, 2017). A company can through their advertising and marketing strategies affect how a customer sees and perceives the brand, the image of a brand plays a huge part in how a consumer perceives a brand. The brand image is made up by everything from their own knowledge of the brand to what they have heard or seen of the brand (Koll & von Wallpach, 2009). The awareness of the brand is also important, to be the brand that people first think of when they think about a product, a person would rather buy from a company that they know than a company that is for them unknown (Koh, Lee & Boo 2009). Advertisement is important to use by a company to affect the consumers and to make the

consumers perceive the brand in a way that the company wants, the advertising creates a picture to the consumer and must therefore be taken seriously and prioritized (Malone & Fiske, 2013).

Brand perception has the effect to create brand loyalty which is very important for companies in order to grow and reach new customers.

2.3 Competitive Strategies

According to Kippenberg (1998) Porter states a market for a company always changes and thus a company needs to be flexible so that they can adapt to the fast changes of the market and of the competitors. For a company to differentiate and be the leading company in the market they have to implement a strategy and also master porter's five forces which are competitive rivalry, supplier power, buyer power, threat of substitution and threat of new entry (Porter, 2008). According to Prahalad & Hamel (1998) a company gains competitive advantage by building core competencies that help them produce products faster and to a lower cost than their competition. A core competence of a company shall fulfill three criteria’s, it should contribute to the overall benefit that a customer gets from a product. It should potentially give access to new markets and it should be hard to imitate by competition. Prahalad & Hamel (1998) talks about building a strategy based on the company’s resources they have, the four resources are according to Prahalad & Hamel (1998) :

Organizational, these resources are the history and culture of the company. Human, these resources are the competences of the individuals of the company. Financial, these resources are the financial capabilities a company has.

Physical, These competences are the equipment and the machines used by the company (Prahalad & Hamel, 1998).

Competitive rivalry, if there are many companies in the market the company has less power in the market. When the competition is low and the companies are fewer, a company can have more power and thus sell their products at a higher price.

Supplier power, the supplier manages and supplies the inputs that a company uses for their products. The power of the supplier increases the more unique the input is, the fewer suppliers there are in the market or if it is expensive to change to another supplier. By having more power the supplier can increase their prices of their inputs and thus the production cost for the other company increases. Buyer power, By having more buyers a company's power increases, when a company has fewer buyers that they are depending on or if it is easy and cheap for the buyer to switch to a competitor they have less power. By having more buyers and thus more power they can increase the price of the product.

Threat of substitution , are there other substitution products that the buyer can use instead of your product, is it easy for the buyer to do what you do or find another way. The less substitutions there are, the more power a company has.

Threat of new entry , Is it easy for a competitor or another company to enter the market, the easier and cheaper it is to enter the market the less power a company has. The harder it is to enter the market the more power a company has and the more they can charge for their product.

Porter (1998) argues that there are three core strategies that a company can use to gain competitive advantage and do better than other companies in the same market or industry. These three strategies are according to Porter (1998), Cost-leadership strategies, differentiation strategies and focus strategies.

2.3.1 Cost leadership strategies:

This strategy is implemented when a company tries to cut down on all cost through programs in the company to gain a competitive advantage. By reducing and cutting down on all costs while still

retaining quality and service a company can offer a product or service to a lower price than competitors. The cost reducing operation are made by optimizing processes and operations, the company is always trying to find cost reducing alternatives. This strategy is not always easy to implement, usually the companies that uses this strategy are big firms with much power and influence but also a big market share, the big company can negotiate a lower price from suppliers by buying bigger stock from them compared to their competitors (Porter, 1998).

2.3.2 Focus strategies:

This strategy is used when a company focuses and targets a specific group. The company targets the specific group and focuses on satisfying the target group better than their competitors can. By succeeding with this strategy, the company gains a competitive advantage. The company can focus on different things when choosing the target group, one example is to target the consumers where the competitors of the company are weakest and where it's easiest to gain bigger market share (Porter, 1998).

2.3.3 Differentiation strategies:

This strategy is used when a company makes something different with their service or product, something that differentiate them from their competitors and that consumers see as new or unique. The differentiation can be a couple of different things, for example it can be the design or the technology. By differentiating and gaining competitive advantage consumers gets loyal towards the company and thus are not as sensitive in the price that the company takes for the product, they see a value in paying more because of the differentiation. There can however be disadvantages in differentiating and that can be to gain bigger market share, to differentiate it usually requires something more and better, something exclusive and this does not go hand in hand with big market share (Porter, 1998).

3. Method

3.1 Research approach

There are two different approaches used when conducting a study, quantitative approach and qualitative approach. Bryman & Bell (2017) talks about and introduces the differences between the approaches, quantitative approach is when quantitative and empirical data is collected, the data is then analyzed. A qualitative approach is when texts are analyzed and interpreted. In this study the authors have chosen to use both a qualitative method and a quantitative method, the data collection tool used is a quantitative tool while all the other information regarding the gyms is a qualitative approach. This is done so that the authors can get as much information to be able to compare the gathered information and get a good result and to be able to answer the two research questions.

Bryman & bell (2017) writes about and explains the differences between deductive and inductive approach. A deductive approach is when you start from the theoretical part, a theory is brought up and tried to be proven to reality. An inductive approach is when reality is studied first, then the theoretical framework is tried to be connected to the reality or event (Bryman & Bell, 2017). So the difference between the two are that after the social phenomena has been detected the deductive approach developes a theory which is used to explain the phenomenon and then the theory is tested while in the inductive approach collection of data is done, the data is then analyzed and a theory is made and presented to explain the phenomenon (Bryman & Bell, 2017). In this study the authors have gathered information about the gyms to see how they present themselves in their advertisement to their consumers and how the gyms want people to perceive their brand. At the same time as gathering this information and writing it down the authors sent out a survey which was directed to people who train at gyms. The answers of the survey were then analyzed and compared to the information that the authors gathered regarding the gyms to see if the consumers perception of the gyms was the same as

the gyms wants to be perceived as. According to Bryman & Bell (2017) a deductive study is when a hypothesis is compared to real life results. The gathered information about the gyms is equivalent to a hypothesis or a theory and for that the authors see that the study conducted is a good example of this approach which shows that this study is conducted in a deductive approach.

3.2 Epistemology

Epistemology is what knowledge is, how can we know something, it is the doctrine about knowledge or the theory of knowledge. It is also about what differentiates an opinion from knowledge. The perception of reality or philosophy of existence which is called ontology goes hand in hand with epistemology. Knowledge is described as the understanding of something, a phenomenon but it can also be about a skill (Audi, 2010). One branch in epistemology is constructivism which talks about the reality and everything that is observed is not the same for everyone, instead each individual has its own reality based on what they have observed and everyone observe it in their own way (Smith, 2005)

The study is conducted in a positivistic philosophy, this approach is appropriate when a subject is examined and compared which in this study is the information about the gyms compared to the collected data from the survey (Saunders, Lewis and Thornhill, 2015). To get a credible result, the conducted study is objective and no personal feelings and values are involved when gathering the data, according to Bryman & bell (2017) this is a positivistic approach. The authors also have constructivism in mind regarding the conducted survey, people have observed the gyms and everyone have their own reality and perception of it which the authors want to find out.

3.3 Context of the study

Both of the authors of this study are very much into fitness and gyms, both authors train several days a week at gyms and have changed their gym-cards a couple of times between different gyms. There are several reasons why they chose this subject and why they chose these gyms. Different preferences

were developed the more the authors trained at gyms, after a period the authors noticed that not only they but many of their friends had changed gyms or trained at different gyms. An interest was developed in finding out how it is possible that there are that many gyms and how different preferences & perceptions affect the choice of gym made the authors choose this study. The gyms that were chosen to study are the following, Friskis&Svettis, Nordic Wellness, Fitness24seven and Gymmet Sverige.

3.4 Reliability and validity

Reliability is a measurement for how consistent the data conducted in the research is. By creating the research again the results yielded should be the same (Heale, 2015). In this thesis the tools used are considered reliable since the survey could easily be conducted again because attached in the appendix (Bryman & Bell, 2017). However the results might differ since they are affected by each individual's perception towards the gyms. That's why the results might be different each time the survey is conducted.

Validity is defined as the extent to which a concept is accurately measured in a quantitative study (Heale, 2015). In this study the research questions is “How do gyms differentiate and how do they want to be perceived?” and “What views do customers have on the different actors in the gym section?”. To measure the validity on the survey the authors have used the right methodology in order to answer the second research question. The responses from the survey questions answered the perception that customers had towards different gyms by presenting a picture of each brand logo. The first research question was answered through both answers form the conducted survey and the findings from each website. With this said the data collected has a content validity since the research tool measure the intended construct (Heale, 2015).

3.5 Data collection

The authors sent out a survey so that they can gather information from customers and see what view they have on the different actors in the gym sector. Google forms were used for the survey, it was then built up with a couple of questions where the information was then analyzed and presented. Facebook and other social media were used when the survey was sent out. The question used in the survey was discussed and formed to gather as good and useful information as possible, they are formed so that the authors could see how individuals perceive the gym. This was then compared to the information that the authors had gathered about the gyms to see if it was correct. As mentioned, in addition to the survey, information was gathered about the gyms. The information was gathered from the gyms websites, their social media and from articles where key people have been interviewed. The authors chose four gyms to research, these four gyms were the best suited because they were all big gyms, the authors read about a variety of gyms but the chosen gyms felt best suited for this study.

3.5.1 Primary- and secondary data

Bryman & Bell (2017) states that Data that is gathered are either primary or secondary data, according to Saunders et al. (2019) data that is gathered directly by the author are primary data while data that is gathered by others and used in the study are secondary data, for example scientific articles and studies which are secondary sources. There are different advantages of both methods, primary data are often more reliable but takes more time because of the whole process from preparing to conducting and analyzing the data while secondary data takes less time but are less reliable and might not be suitable for the specific study (Saunders et al, 2019). In this study the authors have used both primary and secondary data. The conducted survey is an example of primary data where the survey was sent out to gather data directly from people who answer the survey while the theoretical framework and the

information about the gyms are examples of secondary data where the authors have found and gathered data that others already gathered and wrote about. The secondary data have been gathered through the schools database and through google Scholar but also through the gyms websites and news articles about the gyms.

3.6 Data analysis

To be able to analyze the data and compare it to the gathered information the authors will use a comparative approach which according to Bryman & Bell (2017) means that you analyze and compare two or more variables to each other to recognize differences or similarities. The information is gathered and analyzed as cases. Each gym is a case, the cases are analyzed to see what happens inside the case, how the questions are answered and what answers the authors got. Then the cases are compared to each other to see what happens between each case and to find out similarities and differences. By doing this the authors aims to find out how the brands are perceived by their customers and competitor’s customers. The authors then compare it to the information gathered about the gyms to see if it matches how the gyms wants to be perceived.

3.7 Ethical considerations

The data gathered through the conducted survey was totally anonymous and only used for this study. The authors stated in the survey that they sent out that the survey is anonymous and that the people that answer the survey should not write their name or anything that can be traced back to them in the survey. The secondary data that was gathered were all referenced and acquired from trustworthy articles, literature and from the gyms own websites.

3.8 Limitations

The authors chose this method because it was best suited in this time and with the prevailing situation with COVID-19. This pandemic limited the authors who wanted to conduct interviews with key people in the gyms to gather their information instead of obtaining it from the websites and social medias. The authors could have got information from the managers at the gyms on how the gyms use advertising to attract new customers, how their loyalty programs works, how they want people to perceive the gym but also how and what they do when targeting a specific group. All this information was obtained and had to be analyzed through websites and social medias of the different gyms. The research question, purpose and aim would also be different but at this time this method was best suited. If the interviews would have been conducted better information and knowledge would have been gathered and thus the authors would have had more time to spend on the survey. Time was limited when conducting this study, the survey was published and data was gathered for 10 days, with more time a deeper and more thorough research could have been made. The survey would have gotten more answers and thus a more reliable and credible study would have been done.

4. Empirical Findings

In this chapter the qualitative findings regarding the gyms and the quantitative findings from the conducted survey

4.1 Friskis&Svettis

Friskis&Svettis was founded in 1983 as an association. It is not a profit-seeking company but an organization funded by the membership fees. This means that anyone who is a Friskis&Svettis

member can attend the yearly meeting and get their voice heard in the meeting. It all started with the idea of having “jympa” classes and evolved throughout the years into complete gyms with weight rooms, spinning classes, yoga classes and other different forms of training. They totally have 80 different training forms and each gym can pick which classes they would like to have at their location but the founding “jympa” can be found throughout all locations (friskissvettis, 2020).

According to Friskissvettis (2020) they have 556 540 members in Sweden within their 109 gyms. But they are also located in Norway with 42 gyms and nine more gyms internationally, with a total of 575 430 members and 160 gyms around the world. Since Friskis is a non-profit foundation many of the people working there are volunteering. Around 14000 people are volunteering in the organization and it could be leaders, coaches, hosts or front desk workers. Any profit that is made from the membership fees goes straight back to the members through education of new leaders/coaches, refurbishing of the gym, new equipment or other types of benefits for the members. The membership to enter the gym and classes is 2950 kr/year and for students/retired it's 2360 kr/year. (FriskisSvettis, 2020)

According to FriskisSvettis (2020), it is a gym that wants to be perceived as an accessible and welcoming place for any type of gym-goer, everyone should feel welcomed, whether you are a competitor in bodybuilding, just want to stay active or even if you just want a place to hangout. Friskis&Svettis want to provide a feeling where members feel like home by providing a good service and a clean area (friskissvettis, 2020).

When it comes to advertisement Friskis&Svettis is like many other gym companies providing offers throughout the year. By looking into their website 7th June 2020, the authors observed that Friskis&Svettis is advertising a summer offer, where you can train the whole summer period at a reduced price. This is something they are doing in order to differentiate from other gyms (Friskissvettis, 2020).

4.2 Nordic Wellness

Nordic Wellness is one of Sweden’s biggest gym chain with 260 gyms with around 325 000 members according to nordicwellness (2020). Nordic wellness offers a big variety of trainings forms, with weight-rooms, cardio equipment, dancing classes and other fitness related sessions.

Nordic Wellness have also taken into consideration the different lifestyles of different people when starting up each gym. Nordic has three different types of gyms – Express, family fitness and exclusive (Nordicwellness, 2020).

Express – Smaller gyms for basic strength and cardio training.

Family Fitness – Gyms with a big variety of cardio and weight machines, multiple rooms for classes, tanning beds, spa and also babysitting so the parents can train while their kids play in the “Kidzclub”.

Exclusive – This is Nordic Wellness luxurious gyms where you have to be 20 years old to enter.

Nordic have a reward program which contains rewards depending on how much you train, and you will get rewards in form of, t-shirts, bags, waterbottle etc when you reach the requested points (nordicwellness, 2020).

Stated by Nordicwellness (2020) membership to access all gyms in Sweden costs 5388 kr/year and for students its 299/month = 3588 kr/year

In Nordic Wellness webpage it is stated that they are a company with a core value of fun, movement, strong, together. Their goal is to be perceived as the best alternative when it comes to training and health by providing good service, well-educated trainers and high quality equipment (nordicwellness, 2020).

Nordic Wellness gives out one free week to try out their gym before the customer decides if he/she wants to purchase a membership. This is Nordic Wellness way of advertising and differentiating from

many of the other established gym companies. Nordic Wellness also has a summer campaign similar to Friskis&Svettis (as mentioned above), where at a reduced price a customer can train at any of the facilities in Sweden (nordicwellness, 2020).

4.3 Fitness24seven

Fitness24seven is a gym open 24 hours a day with the front desk being open during daytime. Their vision is according to fitness24seven (2020), “We lead people to a healthier life no matter who you are or where you live”. That’s where they can be found from south to north in Sweden.

Year 2020 Fitness24seven have 230 gyms in Sweden, Norway, Finland, Poland, Colombia and Thailand. An important mission according to fitness24seven (2020) is that they want to provide the best value through availability, hospitality and functionality at an attractive price. An attractive price is something very important for the brand and therefore they have a very low price compared to the competitors, but they almost offer the same service as many of the other gyms in Sweden. Fitness24seven have cardio machines, weight rooms and also different types of classes. They also have a loyalty program GOLD and BLACK. You get a GOLD card after having a membership for three years and after 7 years you get a BLACK card. The different levels give you rewards like bringing a friend for free, discount on personal training and also 10-20% discount on training supplies/supplements. The price for a membership is 229 kr/month = 2748 kr/year and for students/seniors it's 199 kr = 2388 kr/year (fitness24seven, 2020).

Fitness24seven is a company with a mission to provide the best value option in the fitness industry in Europe, Asia, Central- and South America. This will be done through three points, hospitality, functionality and attractive price. Hospitality will be achieved by having the focus on the customers,

functionality is achieved by having gyms in different nations and by being open 24 hours, lastly they want to be perceived as a price-friendly gym that anyone can afford (fitness24seven, 2020).

Below is one of fitness24sevens advertisements, according to Koll & von Wallpach (2009) a company can use advertising as a tool to attract new customers and to mediate how they want to be perceived which through this advertisement shows that they want to be perceived as a low priced flexible gym. One membership to all facilities, open 24/7 to a great price. By presenting these benefits its a way for them to differentiate since none of the other gyms are offering that low of a price and are not open 24/7.

Figure 4.1

[Untitled illustration of advertisement] | Fitness24Seven. (2020). Retrieved 23 May 2020, from https://se.fitness24seven.com/

4.4 Gymmet Sverige

Gymmet Sverige is a gym with five gyms from north of Sweden to Stockholm. The gym is niched to have the top gym equipment and is a gym where anyone from beginner to professional athlete can

train. Their gym located in Stockholm has been nominated three times to compete for the best gym in Sweden according to gymmet. By looking at Gymmet Sveriges Instagram page it is clear to see that they have a big variety of people training there but you can also see very quickly that many members are into the bodybuilding lifestyle. A membership at Gymmet is 4995 kr/year and student/senior is 3995 kr/year (Gymmet, 2020).

Gymmet Sverige is a gym with focus on good equipment that wants to be perceived as a welcoming gym for anybody that wants to develop and become more healthy in an environment with high class equipment Gymmet, 2020). According to Redebo (2018) Anna Ståhlnacke the owner of Gymmet Sverige states that they are relying heavily on advertisement through their instagram page and also through her own instagram page towards her followers but do not use advertisement in magazines and newspapers.

5. Findings from survey

Total responses that the survey gave was 63. All of the findings is based on the 63 responses Question 1

What is your age?

Figure 5.1: Age (according to generation)

The pie chart above shows us that 57.1% was between the age of 23-38 years and this yields to 36 responses, 39.7% was between 15-22 years and that 25 responses and the last 3.2% is between 32-54 and yields to 2 responses.

Question 2

What is your legal gender?

Figure 5.2: Gender (legal gender)

Most responses of the survey was from men and resulted with 69.8% and 30.2% was female, equal to 44 males and 19 females.

Question 3

What is your educational level?

As seen on the pie chart, 60.3% equal to 38 responses that have a bachelor degree, 23.8% equal to 15 responses have a high school education, 9.5% equal to 6 responses have a masters degree and lastly 6.3% equal to 4 responses have no other education.

Question 4

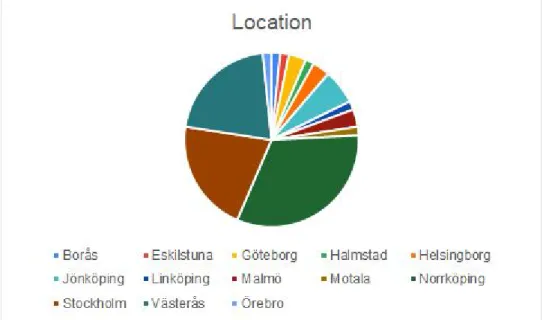

What is your city of residence? (please specify your location)

Figure 5.4: City of residence

The pie chart above shows that the majority of responses came from Norrköping with 32% (20 responses), 21% (13 responeses) came from Stockholm, 21% (13 responeses) came from Västerås and the 18 other answers came from, Borås, Eskilstuna, Göteborg, Halmstad, Helsingborg, Jönköping, Linköping, Malmö, Motala and Örebro.

Question 5

Do you have one or multiple memberships?

Figure 5.5: Multiple memberships

82.3% yielded to 51 answers have only one membership, 14.5% equal to 9 responses have 2 memberships and 2 responses have 3 or more membership at different gyms.

Question 6

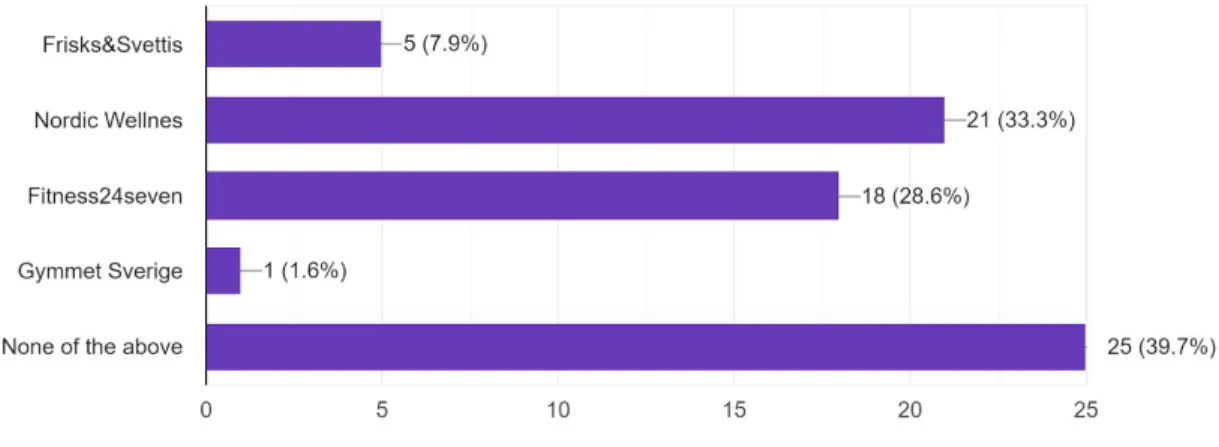

In what gym/gyms do you have a membership?

Figure 5.6: Which memberships do the respondents have

The most dominated gym is Nordic Wellness with 21 points. Second is Fitness24seven with 18 points. Third is Friskis&Svettis with 5 points and lastly Gymmet Sverige with 1 point. But then 25 people don't have a membership at any of the gyms above.

Question 7

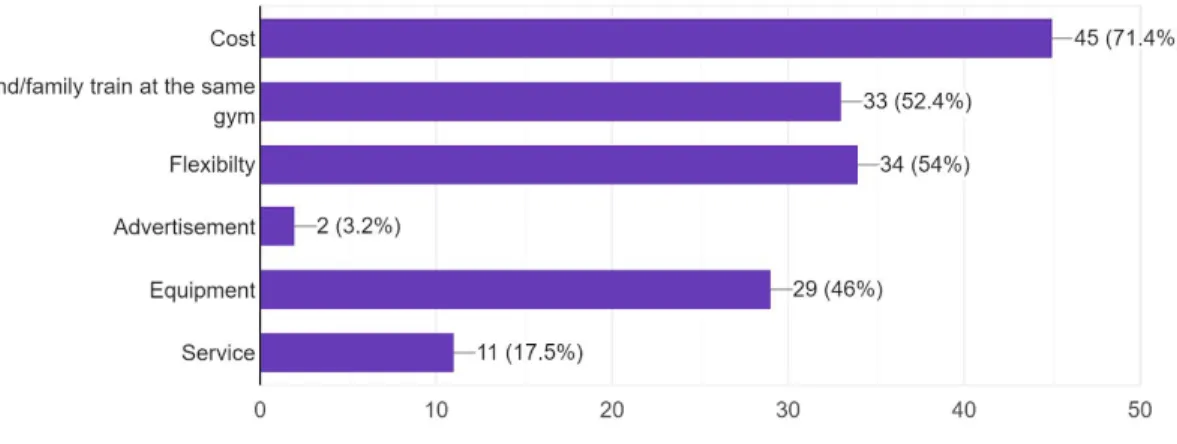

What factors affected you when you bought the membership/memberships?

Figure 5.7: Factors that affect when buying a membership

One factor ruled all of them and that is cost, with 45 responses answering that it's an important factor. Second is flexibility with 34 responses. Third factor is that they have a friend or family in the same gym and 33 responses out of 63 choose that. Fourth on the list is equipment with 29 responses and fifth is service with 11 responses. Last on the factors is service with only 2 responses saying that its a factor for them to choose a gym.

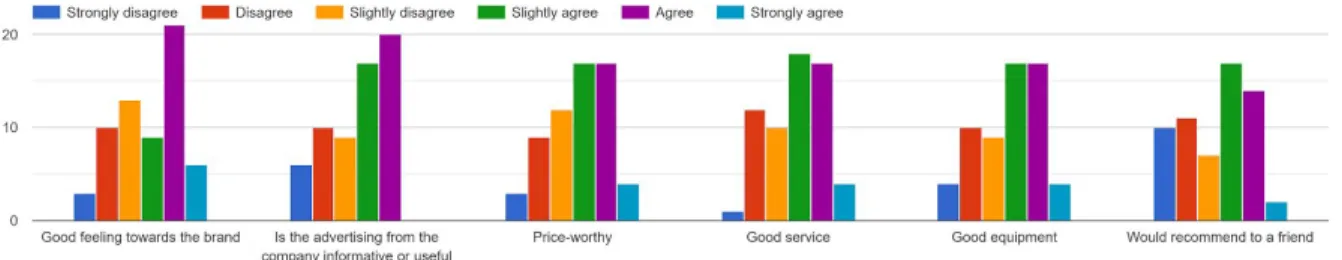

The authors asked the question what do you think when you see this? (then below the authors showed four pictures of different gym-brands). The authors have written the results in 4 cases which are presented below.

5.1 Case 1 (Friskis&Svettis)

Figure 5.8: Friskis&Svettis logo

[FriskisSvettis Logo] | (2020). Retrieved 16 May 2020, from https://www.friskissvettis.se/

Figure 5.9: Friskis&Svettis

By looking at the results from the question regarding what responders think about Friskis&Svettis it is that mostly the purple bar is dominant which results in responders agreeing with the statement written below the bars. Peoples who have answered the survey mostly agree which results in a positive brand perception.

5.2 Case 2 (Nordic Wellness)

Figure 5.10: Nordic Wellness logo

[Nordicwellness Logo] | Nordic Wellness. (2020). Retrieved 16 May 2020, from https://nordicwellness.se/

Figure 5.11: Nordic Wellness

As case nr 1, again the purple bar is very dominant in this case and showing that the brand perception towards Nordic Wellness is positive. One diagram is very dominant by the purple bar and that is the “good equipment” statement, which results in responders agreeing that Nordic Wellness provides good equipment in their gyms.

5.3 Case 3 (Fitness24seven)

Figure 5.12: Fitness24Seven logo

[Fitness24seven Logo] | Fitness24Seven. (2020). Retrieved 16 May 2020, from https://se.fitness24seven.com/

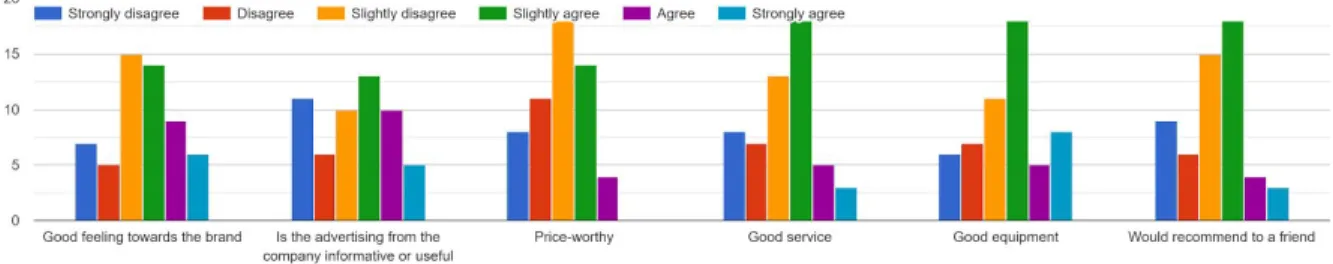

Figure 5.13: Fitness24Seven

Fitness24seven has a wide-spread range of answers. Responders have very different perception of the brand when it comes to the different statements. Except the “price-worthy” statement, where 27 answered that they strongly agree with Fitness24seven being price-worthy.

5.4 Case 4 (Gymmet Sverige)

Figure 5.14: Gymmet Sverige logo

[Gymmet Logo] (2020). Retrieved 16 May 2020, from https://www.gymmet.nu/

Figure 5.15: Gymmet Sverige

Last case is Gymmet Sverige with responses being all over. But it is clear to say that yellow (slightly disagree) and green (slightly agree) are the most dominant columns in this question. Gymmet Sverige is a “niched” gym and therefore many responders might not have the deepest knowledge and therefore answered yellow or green bar.

6. Discussion

6.1 Comparison of the sample responses:

After collecting all the data many connections could be found by analysing the responses. By analysing question 1-7 the authors will present the connections found from the survey.

First of let's start by looking into question nr 1 and how age affects certain decisions. The survey response gave the authors 25 responses from people between the age of 15-22 years. Out of these 25 answers, 16 have a or is getting a bachelor degree and 2 of them are getting a master. Which means that the majority of these 25 responses are students in some way. When these respondents were asked the question “What are the most important factors when buying a membership”, 24 out of 25 have checked the option “cost” as one of the factors. So this triggered a connection with students having a limited amount of money and therefore cost being a very important factor, that's why when analysing its clearly seen that these 15-22 year old respondents only have 1 membership and that this membership is either on Friskis&Svettis or Fitness24seven which is the two cheapest ones in this case. These 15-22 year old responders were from all over Sweden, Helsingborg, Motala, Norrköping, Göteborg, Västerås, Stockholm, Jönköping, Malmö and Eskilstuna.

Then let's look at the 23-38 years of age, that was 36 responders. All variations of males and females and living across Sweden. When these were asked “what are the most important factors when buying a membership”, 72% (26 responses) reacted to the cost also being a big factor to their choice but another big factor was that they had a friend/family that was training at the same gym or that it had some flexibility. This was a major point that differed from the younger sample as these people might not be students and have more money to spend and therefore can spend a bigger amount on a membership. That's why all of these 36 responders in the 23-36 age group had a membership in Nordic Wellness or another gym that is not defined in the question.

By looking at the top 3 answers we can get an idea of what the top priorities are when picking a gym to sign up for and how this preference is creating a brand perception in their head. Figure 5.7

1. Cost (71,4%) 2. Flexibility (54%)

3. Friends/family train at the same gym (52,4%)

Cost is the biggest factor when signing up for a membership, and why is that? After conducting this survey the amount of students/younger audience was high. A younger audience most likely suggests that they are students and are still not having a fixed income every month, therefore they need to be aware of their costs and finding a cheap membership is a priority. All of the participants between 15-22 years marked the cost which indicates that they were the ones that cared the most regarding the price. This relationship between age, cost awareness and membership can be seen through the empirical data conducted in the survey. These youth participants have all got a membership on fitness24seven or Nordic Wellness and these two gyms are the most value for the lowest price. Fitness24seven with its extremely low price and Nordic Wellness with its very discounted price for students.

Flexibility was also another important factor to where people decide to buy a membership. And it is clear that Nordic Wellness and fitness24seven were clear winners in this, both of these companies having a big variation of gyms from north to south of sweden and providing the same service across all gyms in the brand. Flexibility was divided 50/50 across the two ages groups of 15-22 and 23-38.

The reason why 15-22 checked the flexibility box is because they might be students, have unusual lifestyles and might like to workout on odd hours or even travel around in sweden and then need access to a gym wherever they are. Therefore flexibility is very important so that they know that the

gym is always going to be open and they just slightly have to adapt to the gyms opening hours, unless it's fitness24seven which is open all the time. While 23-38 is still within student range but also they might have jobs that require traveling, unusual work hours and other factors that might affect their training. They could also be in the stage where they might have kids and they have to be flexible with finding time to train, and therefore its very important to have a gym where flexibility is key. By looking at the four gyms that are used in this paper, three of them provide a 4-5am opening with a membership card and are then open to 10-12pm, then we have fitness24seven that is open 24/7 and you can access the gym through the individual card.

Lastly we have the friends and family's reason for why they picked the specific gym. Since people are very susceptible to recommendation from family and friends it is very important that they have someone at the gym they are planning to sign up for. We know that according to Forbes word of mouth marketing is a very powerful tool in marketing and that is one way the gym brands are creating a perception at a already existing member and then making his/her visit so good that they will recommend the gym to a friend/family and since the survey clearly showed that having someone known at the gym is important the gyms are definitely using word of mouth marketing.

6.2 Within case study analysis

6.2.1 Case 1 (Friskis&Svettis)

By looking at the first case regarding Friskis&Svettis, it is clearly stated that the majority have a good feeling towards the brand and are finding the advertisement from the brand informative and useful. Friskis&Svettis had a price of 2950 kr/year which is agreed on to be price-worthy by the larger number of people answering the survey. Overall the feeling and people's perception towards Friskis&Svettis is very average. Answers are within the mid range of the options provided and survey participants don't seem to have a bad perception of the company, but when asked if they would

recommend it to friends/family, almost 55% of the participants answered either strongly disagree, slightly disagree or disagree.

After reviewing the 6 participants that have a membership at Friskis&Svettis all of their answers were positive towards the brand and their perception of the brand was therefore positive. Since Friskis&Svettis want to be perceived as a positive brand it is clearly shown in the survey that they have succeeded with the respondents, as the majority of respondents have stated that they agree with the good feeling towards the brand. The advertisement Friskis&Svettis provide is seen as informative and useful so the company has succeeded with its advertising.

6.2.2 Case 2 (Nordic Wellness)

Case 2, again it is clearly stated in the chart above that the positive feeling towards the brand is agreed upon and the participants also state that they are finding advertisement from Nordic Wellness informative and useful. The price of 5388 kr/year and answers show that the majority agrees on the membership being price-worthy.

By looking at the chart and all the different diagrams, one bar is very dominant and that is the “good equipment” bar. Nordic Wellness have modern equipment which is stated on their website and we can see that participants agree with the satisfaction of equipment. Nordic Wellness is the gym that provides most of inhouse services compared to the other gyms, therefore a good response on the service is very positive and shows that despite having loads of different services they still achieve with the main thing, having members that think they have good service.

Since Nordic Wellness wants to be perceived as a gym with modern equipment and fun, movement, strong, together they have succeeded according to the results from the survey, because respondents have agreed upon the service being good, having a good feeling towards the brand and also having good equipment.

6.2.3 Case 3 (Fitness24seven)

Case 3, fitness24seven, the gym where most of our participants had membership. One third of all answers had a membership at fitness24seven. The feeling towards the brand was all over the chart as seen above in the first diagram same thing with the advertisement having a very wide range of answers. Looking at the 3rd diagram it is clear that answers point to fitness24seven being a very price-worthy gym with a price of 2748 kr/year being the cheapest in this case and apparently it is appreciated by the members. Good service and good equipment is not clear but it gets an average, but very few answers strongly agree on fitness24seven having “good service” and “good equipment”. Half of the participants answered that they would not recommend fitness24seven to a friend. Fitness24Seven wants to be perceived as a low-priced gym and still provide the necessities to reach your goal and also create a good environment for people to train in. In figure 5.13 it's clearly shown that respondents agree that Fitness24Seven has a good price on the membership. According to figure 5.7, flexibility was important to respondents and those who checked the flexibility option also had a membership at Fitness24seven, so by having a 24/7 gym, they have satisfied the customers.

6.2.4 Case 4 (Gymmet Sverige)

Last case nr 4, Gymmet Sverige. Not a franchise gym and one of the more niched gyms. The feeling towards the brand is not so good, with almost 50% disagreeing and answering that they don't have a good feeling towards the brand. If advertising is useful and informative is hard to read out in this case, but the authors conclude that the advertising is more towards the NOT useful and informative since many participants answered on “strongly disagree”. Gymmet Sverige is one of the more expensive gym with a cost of 4995 kr/year so we can clearly see that the majority slightly disagree with the price or are more towards the disagreeing side. Good service and good equipment is something that is

slightly agreed upon, as presented on the green bar above in the diagram. Again the “would recommend to a friend” question is also a 50/50 answer to agree or disagree.

Gymmet Sverige has succeeded to create a positive perception about the gym, since the majority would recommend the gym to a friend or family. They have also succeeded with providing equipment that is appreciated by the customers according to figure 5.15

6.3 Comparison between the cases

6.3.1 Case 1 (Friskis&Svettis)

Friskis&Svettis is the case where most respondents have agreed upon having a positive feeling towards the brand compared to the other cases. Friskis&Svettis is the leading brand when it comes to the advertising being informative to the customer which means that what they are doing with

advertising is creating a positive brand perception to the customer. By analysing it is clear to see that the answers are more towards the center and slightly favored to the right in all 6 statements.

6.3.2 Case 2 (Nordic Wellness)

Nordic Wellness, another brand that has the customers loyalty and has been able to create a positive feeling around their customers. Nordic is in second place when it comes to good feeling towards the brand and have also succeeded with their advertising. Price-worthy is the same as friskis but they are far behind Fitness24seven and ahead of Gymmet Sverige. Equipment is one statement where Nordic Wellness has succeeded within the company. Respondents are agreeing on the equipment being better than any other gym according to the survey. Recommending Nordic Wellness to a friend is also strongly agreed on compared to the other cases where respondents are agreeing to recommend a friend but they are not strongly recommending it like with Nordic Wellness.

6.3.3 Case 3 (Fitness24seven)

In this case the feeling towards the brand is not that great compared to the feeling participants had towards Friskis&Svettis, Nordic Wellness or Gymmet Sverige. When asked about the advertising Fitness24seven does, the answers were very spread around compared to the other cases where one answer was more dominated. Fitness24seven dominated the question about price-worthiness and had a big increase in the “strongly agree” option, compared to any other case. “Good service” and “good equipment” is two options where fitness24seven is lacking in reference to the other brands, fitness24seven have average answers and not any positive or negative response. 50% would

recommend Fitness24seven to a friend which is not the case with Nordic Wellness or Friskis&Svettis where more than 50% would recommend these gyms.

6.3.4 Case 4 (Gymmet Sverige)

Gymmet Sverige, the only niched gym in our survey. In the first statement many participants disagree with having a good feeling towards the brand, not any other case had this many disagreements. Then, advertising, again strongly disagreeing with the advertising being informative or useful. Most likely because they don't advertise in that big of a scale as these other brands. Price-worthy, with Gymmet Sverige being the most costly membership it is not a surprise that the majority disagree with Gymmet being price-worthy, no other brand has this many disagreements. “Good service” is slightly agreed upon, but when Gymmet does not offer the same type of services it might be hard to see a cashier as a good service when the only thing he/she is cleaning or selling memberships. Gymmet Sverige offers the latest “gym equipment” compared to the other brands therefore the answer is very unexpected and the fact that Nordic Wellness has better equipment in the perception of the customers is a bit strange. Many responders are slightly agreeing with the fact off recommending a friend, but since Gymmet is a niched gym it's understandable that people are just slightly agreeing.

7. Conclusion

There are a lot of gyms opening every year, and many of these gyms are big brand chains. In this paper the authors used 3 of the biggest gym-brands in Sweden and 1 niched gym to see what perception the members have of each gym and how that affects their decision when becoming a member in a gym.

Since most of these big brand gyms are offering similar services of weights, cardio equipment and classes, what are they doing to separate from the other brands? By advertising through different channels and using various differentiating strategies, such as seasonal promotions, try-out periods and giving benefits to the members each company is differentiating.

By conducting a survey the authors asked questions about what perception do members have of their gym and of other gyms and what are the factors when deciding a new membership.

The survey gave clarity to what affected a person who participated in this survey and the top 3 reason to commit to a gym was:

1. Cost

2. Family or friend attends the same gym

3. Flexibility

The survey also showed what strong points each gym had and what the participants thought about the gyms. Friskis&Svettis had the best feeling towards the brand, Nordic Wellness had the best gym equipment, Fitness24seven was the most price-worthy and Gymmet Sverige was the average one.

References

5 Strategies to Maximize Gym Membership Sales this New Years. (2020). Retrieved 7 June 2020, from https://www.wellnessliving.com/blog/strategies-maximize-gym-membership-sales-new-years/

Arvidsson, J. (2020). Svenskar slösar miljarder på oanvända gymkort | SvD. Retrieved 10 April 2020, from https://www.svd.se/svenskar-slosar-miljarder-pa-oanvanda-gymkort

Audi, R. (2011). Epistemology : a contemporary introduction to the theory of knowledge (3rd ed). New York: Routledge.

Berger, J., Draganska, M., & Simonson, I. (2007). The influence of product variety on brand perception and choice. Marketing Science, 26(4),

Brennan, I., Dubas, K. M., & Babin, L. A. (1999). The influence of product-placement type & exposure time on product-placement recognition. International Journal of Advertising, 18(3), 323-337.

Bryman, A., & Bell, E. (2017). Företagsekonomiska forskningsmetoder (Upplaga 3). Stockholm: Liber. Clifton, R. (2009). Brands and branding (Vol. 43). John Wiley & Sons.

competitors.” The free press, New York.

Fitness: från subkultur till miljardindustri. (2020). Retrieved 21 Mars 2020, from https://www.svt.se/kultur/bok/har-tillverkas-samtidens-kropp

Friskis&Svettis. (2020). Retrieved 16 May 2020, from https://www.friskissvettis.se/ Friskvårdspengen göder en växande gymbransch. (2020). Retrieved 13 May 2020, from https://www.sydsvenskan.se/2020-01-06/friskvardspengen-goder-en-vaxande-gymbransch Green, J. (2012). Advertising (First edition.). Rosen Central.

Guzmán, F., Abimbola, T., Koll, O., & von Wallpach, S. (2009). One brand perception? Or many? The heterogeneity of intra-brand knowledge. Journal of Product & Brand Management.

Gym och träning i hela Sverige - testa en vecka gratis | Nordic Wellness. (2020). Retrieved 16 May 2020, from https://nordicwellness.se/

Gymbranschen - en tuff business – Upsala Nya Tidning. (2020). Retrieved 6 May 2020, from https://unt.se/start/gymbranschen-en-tuff-business-4945144.aspx

Gymkedjorna växer - och plockar ut miljonvinster. (2020). Retrieved 19 April 2020, from

https://www.stockholmdirekt.se/nyheter/gymkedjorna-vaxer-och-plockar-ut-miljonvinster/repqad!sVjf@WDact @gD33ggyjIpA/

Gymkort för miljoner används inte. (2020). Retrieved 10 April 2020, from https://www.svt.se/nyheter/inrikes/gymkort-for-miljoner-anvands-ej

Gymträningen ökar – men inte folkhälsan. (2020). Retrieved 27 March 2020, from https://www.svt.se/nyheter/lokalt/orebro/gymtraningen-okar-men-inte-folkhalsan

Heale, R., & Twycross, A. (2015). Validity and reliability in quantitative studies. Evidence-based nursing, https://www.statista.com/outlook/313/154/fitness/sweden#market-globalRevenue

Jättar visar musklerna i allt tuffare bransch. (2020). Retrieved 10 April 2020, from

https://www.sydsvenskan.se/2014-01-25/jattar-visar-musklerna-i-allt-tuffare-bransch?forceScript=1&redirected =1

Johansson, B., & Johansson, B. (2020). GymBusiness.se - Är du redo för den tveksamma motionären?. Retrieved 5 May 2020, from

https://www.gymbusiness.se/index.php/kunskap/marknadsfoering/item/612-ar-du-redo-for-den-tveksamma-moti onaren

Johansson, B., & Johansson, B. (2020). GymBusiness.se - Kommunicera rätt. Retrieved 17 May 2020, from https://www.gymbusiness.se/index.php/kunskap/marknadsfoering/item/570-kommunicera-ratt

Jones, O. (2007): Managing SMEs, „International Journal of Entrepreneurial Behavior & Research Kippenberger, T. (1998). Strategy according to Michael Porter. The Antidote.

Koh, Y., Lee, S., & Boo, S. (2009). Impact of brand recognition and brand reputation on firm performance: US-based multinational restaurant companies’ perspective. International Journal of Hospitality Management, 28(4),

Kotler, P., Armstrong, G., Harris, L., & Piercy, N. (2017). Principles of Marketing European Edition 7th Edn. Harlow, United Kingdom: Pearson Education Canada.

Malone, C., & Fiske, S. T. (2013). The human brand: How we relate to people, products, and companies. John Wiley & Sons.

McCurry, J., & McCurry, J. (2020). The 5 different Types of Gyms and How to Decide Which One is Right for You. — Progressive Performance Strength and Fitness. Retrieved 8 June 2020, from

https://www.progressiveperformance.com/news/the-5-different-types-of-gyms-and-how-to-decide-which-one-is-right-for-you

Pardun, C. (2014). Advertising and society : an introduction (2nd ed.). Chichester, West Sussex, England: Wiley Blackwell.

Parment, A., Kotler, P., & Armstrong, G. (2016). Principles of marketing: Scandinavian edition. Pearson Education Limited.

Physical Activity Prevents Chronic Disease | CDC. (2020). Retrieved 7 June 2020, from https://www.cdc.gov/chronicdisease/resources/infographic/physical-activity.htm Porter, M, E. (1998). ”Competitive Strategy - Techniques for analyzing industries and Porter, M.E. (2008). 'The Five Competitive Forces That Shape Strategy,' Harvard Business

Prahalad, C.K. and Hamel, G. (1990) The Core Competence of the Corporation. Harvard Business Review Redebo, S. (2018). Instagramprofil öppnar gym på löpande band ihop med doldis – STR-T. Retrieved 9 June 2020, from https://www.str-t.com/instagramprofil-oppnar-gym-pa-lopande-band-ihop-med-doldis/

Retrieved 21 Mars 2020, from

https://www.dagensanalys.se/wp-content/uploads/2019/06/Fitnessrapporten-2019.pdf Rörelse är livsviktigt - 1177 Vårdguiden. (2020). Retrieved 6 April 2020, from https://www.1177.se/liv--halsa/traning-och-fysisk-halsa/rorelse-ar-livsviktigt/

Så marknadsför du ditt gym på ett billigt och bra sätt. - Pilus. (2020). Retrieved 9 May 2020, from https://www.pilus.com/sa-marknadsfor-du-ditt-gym-pa-ett-billigt-och-bra-satt/

Sandberg, A. (2020). Nybörjarguide: Sökmotoroptimering (SEO) 🔍 | Adsight. Retrieved 5 May 2020, from

https://www.adsight.se/seo/

Saunders, M., Lewis, P., & Thornhill, A. (2019). Research methods for business students (Eighth edition). Harlow: Pearson Education.

Sex av tio tränar faktiskt regelbundet | Idrottens Affärer. (2020). Retrieved 28 March 2020, from http://www.idrottensaffarer.se/affarer/2014/04/sex-av-tio-tranar-faktiskt-regelbundet

Smith, B. (2005). Scandalous knowledge science, truth and the human . Durham, N.C: Duke University Press. Startsidan-1 - Gymmet. (2020). Retrieved 16 May 2020, from https://www.gymmet.nu/

Timney, T., & Chamberlain, P. (2017). Integrated package design: an interdisciplinary approach to package design that benefits consumer experience and brand perception. Computer-Aided Design and Applications, 14(sup1)

Träning på gym ökar | SvD. (2020). Retrieved 23 March 2020, from https://www.svd.se/traning-pa-gym-okar Träningstrend lyfter gymkedjor. (2020). Retrieved 15 April 2020, from

https://www.di.se/nyheter/pt-trenden-lyfter-de-stora-gymkedjorna/

TT, O. (2020). Friskvårdspengen göder växande gymbransch | SvD. Retrieved 22 March 2020, from https://www.svd.se/friskvardspengen-goder-en-vaxande-gymbransch

What Is Branding? – The Branding Journal. (2020). Retrieved 10 April 2020, from https://www.thebrandingjournal.com/2015/10/what-is-branding-definition/

Whitler, K. (2020). Why Word Of Mouth Marketing Is The Most Important Social Media. Retrieved 14 May 2020, from

https://www.forbes.com/sites/kimberlywhitler/2014/07/17/why-word-of-mouth-marketing-is-the-most-important -social-media/#781b51c754a8

Young people are getting more health conscious: H&H CEO. (2020). Retrieved 15 March 2020, from

https://news.cgtn.com/news/2019-11-21/Young-people-are-getting-more-health-conscious-H-H-CEO-LNZhqR wLuM/index.html

Appendix

1. Age (according to generation) ● 15-22

● 23-38 ● 39-54 ● 55-73 ● 74+

2. Gender (legal gender) ● Male ● Female 3. Education level ● None ● High school ● Bachelor ● Master ● Phd

4. Location (please write your city of residence) ● Open question

5. Do you have one or multiple gym memberships? ● 1

● 2 ● 3+

6. Which gyms do you have a membership in? ● Friskis&Svettis