ScienceDirect

Available online at www.sciencedirect.com

Procedia Computer Science 130 (2018) 142–149

1877-0509 © 2018 The Authors. Published by Elsevier B.V. Peer-review under responsibility of the Conference Program Chairs. 10.1016/j.procs.2018.04.023

10.1016/j.procs.2018.04.023

© 2018 The Authors. Published by Elsevier B.V.

Peer-review under responsibility of the Conference Program Chairs.

1877-0509 Available online at www.sciencedirect.com

ScienceDirect

Procedia Computer Science 00 (2018) 000–000

www.elsevier.com/locate/procedia

1877-0509 © 2018 The Authors. Published by Elsevier B.V. Peer-review under responsibility of the Conference Program Chairs.

The 9th International Conference on Ambient Systems, Networks and Technologies (ANT 2018)

A Criteria-Based Approach to Evaluating Road User Charging Systems

Paul Davidsson

a,b,*, Jan A. Persson

a,baDepartment of Computer Science and Media Technology, Malmö University, Malmö, Sweden bInternet of Things and People Research Center, Malmö University, Malmö, Sweden

Abstract A set of important criteria to consider when evaluating potential road user charging system (RUCS) are identified.

These criteria are grouped into five categories: charging precision, system costs & societal benefits, flexibility & modifiability, operational aspects, and security & privacy. The criteria are then used in a comparative analysis of five RUCS candidates for heavy goods vehicles. Two solutions are position-based systems and one is based on tachographs. The two remaining solutions are based on fuel taxes. For each of the solutions we estimate how well it fulfils each of the criteria. One way of making general comparisons of the approaches is to give each of the criteria a specific weight corresponding to how important it is. We show that these weights heavily influence the outcome of the comparison. We conclude by pointing out a number of important issues needing attention in the process of developing RUCS.

© 2018 The Authors. Published by Elsevier B.V.

Peer-review under responsibility of the Conference Program Chairs.

Keywords:intelligent transport systems, connected vehicles, system evaluation, road user charging

1. Introduction

The systems for charging Heavy Goods Vehicles (HGV) for road usage are currently undergoing a change. An important reason is to make the road users compensate for the external costs that are caused by their transportations. It has been argued that current systems do not achieve this and new systems should be explored12. Earlier, most Road User Charging Systems (RUCS) for heavy goods vehicles have been based on a yearly flat fee, whereas the current developments are towards systems using modern IT that are able to charge the users for the distance driven with the potential to discriminate between road type, time of usage, environmental performance of vehicles, etc. Such systems would, in addition, enable basic forms of traffic control.

The purpose of this work is to identify important criteria to consider when evaluating different RUCS and to illus-trate how these can be used to make a structured assessment. A study made by Vonk Noordegraaf et al.18 was based on our preliminary analysis and added some criteria, some of which we have incorporated in our analysis. In addition

* Corresponding author. Tel.: +46-706-174011. E-mail address: paul.davidsson@mau.se Available online at www.sciencedirect.com

ScienceDirect

Procedia Computer Science 00 (2018) 000–000

www.elsevier.com/locate/procedia

1877-0509 © 2018 The Authors. Published by Elsevier B.V. Peer-review under responsibility of the Conference Program Chairs.

The 9th International Conference on Ambient Systems, Networks and Technologies (ANT 2018)

A Criteria-Based Approach to Evaluating Road User Charging Systems

Paul Davidsson

a,b,*, Jan A. Persson

a,baDepartment of Computer Science and Media Technology, Malmö University, Malmö, Sweden bInternet of Things and People Research Center, Malmö University, Malmö, Sweden

Abstract A set of important criteria to consider when evaluating potential road user charging system (RUCS) are identified.

These criteria are grouped into five categories: charging precision, system costs & societal benefits, flexibility & modifiability, operational aspects, and security & privacy. The criteria are then used in a comparative analysis of five RUCS candidates for heavy goods vehicles. Two solutions are position-based systems and one is based on tachographs. The two remaining solutions are based on fuel taxes. For each of the solutions we estimate how well it fulfils each of the criteria. One way of making general comparisons of the approaches is to give each of the criteria a specific weight corresponding to how important it is. We show that these weights heavily influence the outcome of the comparison. We conclude by pointing out a number of important issues needing attention in the process of developing RUCS.

© 2018 The Authors. Published by Elsevier B.V.

Peer-review under responsibility of the Conference Program Chairs.

Keywords:intelligent transport systems, connected vehicles, system evaluation, road user charging

1. Introduction

The systems for charging Heavy Goods Vehicles (HGV) for road usage are currently undergoing a change. An important reason is to make the road users compensate for the external costs that are caused by their transportations. It has been argued that current systems do not achieve this and new systems should be explored12. Earlier, most Road User Charging Systems (RUCS) for heavy goods vehicles have been based on a yearly flat fee, whereas the current developments are towards systems using modern IT that are able to charge the users for the distance driven with the potential to discriminate between road type, time of usage, environmental performance of vehicles, etc. Such systems would, in addition, enable basic forms of traffic control.

The purpose of this work is to identify important criteria to consider when evaluating different RUCS and to illus-trate how these can be used to make a structured assessment. A study made by Vonk Noordegraaf et al.18 was based on our preliminary analysis and added some criteria, some of which we have incorporated in our analysis. In addition

* Corresponding author. Tel.: +46-706-174011. E-mail address: paul.davidsson@mau.se

2 Author name / Procedia Computer Science 00 (2015) 000–000

to the new criteria and extended case study, an analysis of the relation between the criteria and the motives for intro-ducing a RUCS are provided. We are focusing on evaluating the technology of the RUCSs rather than other non-technical factors (cf. article1 for a comprehensive list). Examples of comparative studies of RUCSs can be found16, which, however, does not clearly connects to the system objectives. Most RUCSs are complex systems involving many actors, a lot of functionalities, sensitive information, etc., which makes it important to consider additional system criteria than just the primary criteria, i.e. achieving charging based on road usage and system costs. This is important in order to get acceptance among the involved actors and for political decision-making.

There are many different potential goals of RUCS, such as, reduction of emissions, energy consumption, conges-tion, and noise. This is closely related to the goal of many governments to internalize the external costs of transports, i.e., to let the price paid reflect the societal costs, including e.g. road wear, noise, accidents, emissions, and conges-tions17. Often, internalization of external costs has a desired effect on the mentioned goal. Hence, we assume that if a certain RUCS supports the internalization of the external costs, it can have a positive impact on the associated goal as well. For practical reasons, however, it is not possible to internalize all external costs exactly. They simply depend on too many parameters. Furthermore, it may not be desirable to distribute costs exactly. For instance, the external cost of accidents should not only be distributed to those involved in an accident but rather, as is often the case, to all vehicles and possibly to driven distance17. A general goal for RUCSs may be energy efficiency, i.e., to reduce the amount of energy consumed by transports. However, one should also take into account that the RUCS itself may consume energy. An additional potential motive for introducing a RUCS is traffic control, e.g., to steer HGVs away from the local road network to the designated main roads when possible. This motive may include the possibility to control traffic dynam-ically, e.g. to reduce congestion. However, there are different views on whether road pricing on heavy vehicles actually have a significant effect on congestion or not15. Another potential purpose of a RUCS is to generate a general (tax) income for the government, or special financing of e.g. new roads and terminals. Additional motives for introducing a RUCS may be to stimulate the development of new technology, which may be beneficial in other areas of society. Also, the RUCS may support the introduction of additional ITS services8, e.g., by serving as a platform for hosting multiple services. Furthermore, a motive of RUCS is fairness between different road users, in particular between do-mestic and foreign haulers9. A general discussion of the impact of RUCSs is provided by Sui and Liwei14.

2. Evaluation Criteria

To choose between different types of RUCS, there are a number of relevant criteria that can be used. Together with stakeholders in a project preparing for a Swedish RUCS (www.arena-ruc.com), we have identified a set of such crite-ria. Some are similar to those identified by Expert Group 9 (EG9)13 supporting the European Commission’s work on RUCS. We first introduce a set of criteria related to charging precision, i.e., how good is the system at charging the road user the intended fee. We are here assuming distance-based RUCS, but the proposed method is general, criteria can be added or removed to adapt to any charging principles.

Distance accuracy – How accurately can the system compute the distance a vehicle has moved? Vehicle differentiation – How well can the system differentiate between different types of vehicles? Time differentiation – How good is the system at determining when a vehicle has used a road? Road differentiation – How good is the system at identifying which road segments a vehicle has used? Target accuracy – Avoiding False Negative (AFN) – To what extent does the system charge all road users

targeted, e.g., are also foreign users charged?

Target accuracy – Avoiding False Positive (AFP) – To what extent does the system avoid charging road users not targeted?

Next we discuss the relations between the RUCS motives with suggested criteria for charging precision. Road wear is mainly influenced by distance accuracy and vehicle differentiation, e.g. a truck with high maximum laden weight driven long distances influences the wear more than a truck with few kilometers driven and low maximum laden weight. Further, since some roads may be more sensitive to wear, also road differentiation is a potential influencer, but weaker. Noise, on the other hand, is influenced mainly by vehicle, time, and road differentiation, e.g. a heavy truck on a city street during the night time influence heavily the problem of noise. The relation to accidents is somewhat complex since the causes may vary significantly. A major influencing criterion is distance accuracy, i.e. kilometers driven17, but also vehicle, time, and road differentiation as the probability of accidents may be affected by the vehicle type, time of the day, and the road used. Local and global emissions are mainly related to vehicle and road differenti-ation as well the distance driven. As local emissions might be most important to consider during certain times of the

Paul Davidsson et al. / Procedia Computer Science 130 (2018) 142–149 143

ScienceDirect

Procedia Computer Science 00 (2018) 000–000

www.elsevier.com/locate/procedia

1877-0509 © 2018 The Authors. Published by Elsevier B.V. Peer-review under responsibility of the Conference Program Chairs.

The 9th International Conference on Ambient Systems, Networks and Technologies (ANT 2018)

A Criteria-Based Approach to Evaluating Road User Charging Systems

Paul Davidsson

a,b,*, Jan A. Persson

a,baDepartment of Computer Science and Media Technology, Malmö University, Malmö, Sweden bInternet of Things and People Research Center, Malmö University, Malmö, Sweden

Abstract A set of important criteria to consider when evaluating potential road user charging system (RUCS) are identified.

These criteria are grouped into five categories: charging precision, system costs & societal benefits, flexibility & modifiability, operational aspects, and security & privacy. The criteria are then used in a comparative analysis of five RUCS candidates for heavy goods vehicles. Two solutions are position-based systems and one is based on tachographs. The two remaining solutions are based on fuel taxes. For each of the solutions we estimate how well it fulfils each of the criteria. One way of making general comparisons of the approaches is to give each of the criteria a specific weight corresponding to how important it is. We show that these weights heavily influence the outcome of the comparison. We conclude by pointing out a number of important issues needing attention in the process of developing RUCS.

© 2018 The Authors. Published by Elsevier B.V.

Peer-review under responsibility of the Conference Program Chairs.

Keywords:intelligent transport systems, connected vehicles, system evaluation, road user charging

1. Introduction

The systems for charging Heavy Goods Vehicles (HGV) for road usage are currently undergoing a change. An important reason is to make the road users compensate for the external costs that are caused by their transportations. It has been argued that current systems do not achieve this and new systems should be explored12. Earlier, most Road User Charging Systems (RUCS) for heavy goods vehicles have been based on a yearly flat fee, whereas the current developments are towards systems using modern IT that are able to charge the users for the distance driven with the potential to discriminate between road type, time of usage, environmental performance of vehicles, etc. Such systems would, in addition, enable basic forms of traffic control.

The purpose of this work is to identify important criteria to consider when evaluating different RUCS and to illus-trate how these can be used to make a structured assessment. A study made by Vonk Noordegraaf et al.18 was based on our preliminary analysis and added some criteria, some of which we have incorporated in our analysis. In addition

* Corresponding author. Tel.: +46-706-174011. E-mail address: paul.davidsson@mau.se

ScienceDirect

Procedia Computer Science 00 (2018) 000–000

www.elsevier.com/locate/procedia

1877-0509 © 2018 The Authors. Published by Elsevier B.V. Peer-review under responsibility of the Conference Program Chairs.

The 9th International Conference on Ambient Systems, Networks and Technologies (ANT 2018)

A Criteria-Based Approach to Evaluating Road User Charging Systems

Paul Davidsson

a,b,*, Jan A. Persson

a,baDepartment of Computer Science and Media Technology, Malmö University, Malmö, Sweden bInternet of Things and People Research Center, Malmö University, Malmö, Sweden

Abstract A set of important criteria to consider when evaluating potential road user charging system (RUCS) are identified.

These criteria are grouped into five categories: charging precision, system costs & societal benefits, flexibility & modifiability, operational aspects, and security & privacy. The criteria are then used in a comparative analysis of five RUCS candidates for heavy goods vehicles. Two solutions are position-based systems and one is based on tachographs. The two remaining solutions are based on fuel taxes. For each of the solutions we estimate how well it fulfils each of the criteria. One way of making general comparisons of the approaches is to give each of the criteria a specific weight corresponding to how important it is. We show that these weights heavily influence the outcome of the comparison. We conclude by pointing out a number of important issues needing attention in the process of developing RUCS.

© 2018 The Authors. Published by Elsevier B.V.

Peer-review under responsibility of the Conference Program Chairs.

Keywords:intelligent transport systems, connected vehicles, system evaluation, road user charging

1. Introduction

The systems for charging Heavy Goods Vehicles (HGV) for road usage are currently undergoing a change. An important reason is to make the road users compensate for the external costs that are caused by their transportations. It has been argued that current systems do not achieve this and new systems should be explored12. Earlier, most Road User Charging Systems (RUCS) for heavy goods vehicles have been based on a yearly flat fee, whereas the current developments are towards systems using modern IT that are able to charge the users for the distance driven with the potential to discriminate between road type, time of usage, environmental performance of vehicles, etc. Such systems would, in addition, enable basic forms of traffic control.

The purpose of this work is to identify important criteria to consider when evaluating different RUCS and to illus-trate how these can be used to make a structured assessment. A study made by Vonk Noordegraaf et al.18 was based on our preliminary analysis and added some criteria, some of which we have incorporated in our analysis. In addition

* Corresponding author. Tel.: +46-706-174011. E-mail address: paul.davidsson@mau.se

2 Author name / Procedia Computer Science 00 (2015) 000–000

to the new criteria and extended case study, an analysis of the relation between the criteria and the motives for intro-ducing a RUCS are provided. We are focusing on evaluating the technology of the RUCSs rather than other non-technical factors (cf. article1 for a comprehensive list). Examples of comparative studies of RUCSs can be found16, which, however, does not clearly connects to the system objectives. Most RUCSs are complex systems involving many actors, a lot of functionalities, sensitive information, etc., which makes it important to consider additional system criteria than just the primary criteria, i.e. achieving charging based on road usage and system costs. This is important in order to get acceptance among the involved actors and for political decision-making.

There are many different potential goals of RUCS, such as, reduction of emissions, energy consumption, conges-tion, and noise. This is closely related to the goal of many governments to internalize the external costs of transports, i.e., to let the price paid reflect the societal costs, including e.g. road wear, noise, accidents, emissions, and conges-tions17. Often, internalization of external costs has a desired effect on the mentioned goal. Hence, we assume that if a certain RUCS supports the internalization of the external costs, it can have a positive impact on the associated goal as well. For practical reasons, however, it is not possible to internalize all external costs exactly. They simply depend on too many parameters. Furthermore, it may not be desirable to distribute costs exactly. For instance, the external cost of accidents should not only be distributed to those involved in an accident but rather, as is often the case, to all vehicles and possibly to driven distance17. A general goal for RUCSs may be energy efficiency, i.e., to reduce the amount of energy consumed by transports. However, one should also take into account that the RUCS itself may consume energy. An additional potential motive for introducing a RUCS is traffic control, e.g., to steer HGVs away from the local road network to the designated main roads when possible. This motive may include the possibility to control traffic dynam-ically, e.g. to reduce congestion. However, there are different views on whether road pricing on heavy vehicles actually have a significant effect on congestion or not15. Another potential purpose of a RUCS is to generate a general (tax) income for the government, or special financing of e.g. new roads and terminals. Additional motives for introducing a RUCS may be to stimulate the development of new technology, which may be beneficial in other areas of society. Also, the RUCS may support the introduction of additional ITS services8, e.g., by serving as a platform for hosting multiple services. Furthermore, a motive of RUCS is fairness between different road users, in particular between do-mestic and foreign haulers9. A general discussion of the impact of RUCSs is provided by Sui and Liwei14.

2. Evaluation Criteria

To choose between different types of RUCS, there are a number of relevant criteria that can be used. Together with stakeholders in a project preparing for a Swedish RUCS (www.arena-ruc.com), we have identified a set of such crite-ria. Some are similar to those identified by Expert Group 9 (EG9)13 supporting the European Commission’s work on RUCS. We first introduce a set of criteria related to charging precision, i.e., how good is the system at charging the road user the intended fee. We are here assuming distance-based RUCS, but the proposed method is general, criteria can be added or removed to adapt to any charging principles.

Distance accuracy – How accurately can the system compute the distance a vehicle has moved? Vehicle differentiation – How well can the system differentiate between different types of vehicles? Time differentiation – How good is the system at determining when a vehicle has used a road? Road differentiation – How good is the system at identifying which road segments a vehicle has used? Target accuracy – Avoiding False Negative (AFN) – To what extent does the system charge all road users

targeted, e.g., are also foreign users charged?

Target accuracy – Avoiding False Positive (AFP) – To what extent does the system avoid charging road users not targeted?

Next we discuss the relations between the RUCS motives with suggested criteria for charging precision. Road wear is mainly influenced by distance accuracy and vehicle differentiation, e.g. a truck with high maximum laden weight driven long distances influences the wear more than a truck with few kilometers driven and low maximum laden weight. Further, since some roads may be more sensitive to wear, also road differentiation is a potential influencer, but weaker. Noise, on the other hand, is influenced mainly by vehicle, time, and road differentiation, e.g. a heavy truck on a city street during the night time influence heavily the problem of noise. The relation to accidents is somewhat complex since the causes may vary significantly. A major influencing criterion is distance accuracy, i.e. kilometers driven17, but also vehicle, time, and road differentiation as the probability of accidents may be affected by the vehicle type, time of the day, and the road used. Local and global emissions are mainly related to vehicle and road differenti-ation as well the distance driven. As local emissions might be most important to consider during certain times of the

144 Paul Davidsson et al. / Procedia Computer Science 130 (2018) 142–149

Author name / Procedia Computer Science 00 (2015) 000–000 3

day, there may also be a relation to time differentiation. Since congestion occurs at certain times and locations, it is mainly related to time and road differentiation. Similarly traffic control is mainly related to time and road differentia-tion, but also to the type of vehicles. Energy consumption is mainly related to the distance travelled and the type of vehicle, but also when the transport is made and what roads are used could influence the consumption due to congestion and speed limits. General tax income is mainly connected to distance accuracy, whereas the special financing is more connected to road differentiation. Also, there are weak connection to vehicle differentiation and target accuracy (AFN) for both tax income and special financing. Finally, fairness can be viewed in many ways, but given it is about to what extent are all road users equally treated by the system, it is mainly connected to target accuracy (AFN and AFP).

The next set of criteria concern system costs and societal benefits:

System cost – What are the costs for government, haulers, and other actors? There are: Investment costs, Op-erational costs, and Enforcement costs (including both opOp-erational and investment costs)

New equipment – How large is the need for introducing and installing new in-vehicle equipment? Communication need – How much data communication is needed?

Time to deployment – How long time does it take to develop and deploy the system?

Fostering competition – To what extent does the system offer incentives for a multitude of system providers? Stimulating technology development – To what extent is the development of new technologies required? Flexibility and modifiability

Ability to adapt – To what extent could the system be adapted to changing requirements? Scalability – How well does the system handle large increases in the number of users, roads, etc.? Support for additional services – How easy is it to add new services?

Integration with services (interoperability) – How well does the system cooperate with other relevant systems? Technological lock-in: communication and positioning – How well does the system avoid dependence of the

chosen communication and positioning technology?

Enforcement possibilities – What are the possibilities to implement different type of control schemes? Update effort – How much effort is needed when new road sections are introduced, the tariff is changed, etc.? Operational aspects

Availability – How robust and reliable is the system? Maintainability – How easy is it to maintain the system?

User friendliness – How easy is it for the end-user to use the system, e.g., in terms of the manual procedures or providing information to the user regarding the fee to be paid?

System complexity – How complex is the system, e.g., in terms of the equipment needed? Environmental impact – How large is the environmental impact of the system itself? Visual intrusion – How visually intrusive is the system?18

Security and privacy

Risk of sabotage – How large is the risk of system sabotage and how easy would it be?

Fraud resistance – How difficult is it for users to circumvent security measures to escape taxes? Risk of information theft – How easy is it to steal information from the system?

Integrity protection – How well does the system protect reliable information? Privacy protection – How well does the system protect user sensitive information?

I addition to the above criteria, one may also consider legislative restrictions. However, as laws and regulations can be changed, we do not view this as a direct criterion but rather an aspect of time to deployment.

3. Case Study: Potential Solutions

In order to illustrate the proposed evaluation framework, we apply it to a case study where the situation in Sweden is considered. There are proposals in Sweden, e.g. a governmental committee proposal2, about a distance-based tax covering both domestic and foreign heavy goods vehicles. This tax should cover all public roads, and it should be possible to differentiate between different types of vehicles, time of the road usage, and between different roads. This makes the system more complex than those in operation at the moment. Moreover, it should be harmonized with other European systems existing and under development. This implies that system should adhere to the EFC-directive 2004/52/CE with the purpose of achieving a European Electronic Toll Service (EETS) that is interoperable.

4 Author name / Procedia Computer Science 00 (2015) 000–000

A RUCS should perform some basic functions: (1) measure the road usage for the individual vehicles and record characteristics that are relevant for determining charges, (2) calculate charges, (3) communicate data for billing pur-poses, and (4) enforcement. As we will see below, this can be carried out in very different ways. As some proposals of RUCS in Sweden2, does not suggest to differentiate between time of the road usage and between different roads2, it is relevant to consider RUCS proposals that are not able to fully differentiate between road usage and time of usage6. One approach is to use the digital tachograph and another is to simply use a fuel tax. The fuel tax option is relevant for comparison, since it at least has the potential to capture the emissions rather accurately. Below five proposals are described:

A. In the open thin client solution vehicles report their positions to a central system (e.g. an EETS provider), whenever the mandatory On-Board Unit (OBU) knows that the vehicle is in Sweden. The OBU is able to record Global Navigation Satellite Systems (GNSS)10 positions and transmit them to a central server. The solution builds upon signed track logs including position data from the OBU using public mobile networks. Communication between two parties will be carried out by securing identity of the parties and that the messages are secured against message modification and fabrication. This solution allows for an open system architecture in terms of solutions for retriev-ing position data and sendretriev-ing these to the central server, either as a stream or in bulk transfer. Control functionality is carried out by real-time communication using Dedicated Short Range Communications (DSRC) and by control of reported position data in comparison with other sources of information. Border crossing is dealt with by DSRC registration and stored information in the OBU of country borders. The solution is similar to solution 1 by EG913. B. The closed thick client solution is similar to the thin client, but with maps and tariffs stored in the OBU together with a tax calculation capability. It is similar to the solution 3a by EG913. An important part of the control func-tionality is to make sure that no manipulation has occurred, e.g. by compliance check using DSRC. The system is closed in the sense that the OBU need to be certified. Border crossing is dealt with by using the maps in the OBU. C. The digital tachograph, see Kågeson6 for a proposal. The core of the system is to use electronic devices for

record-ing vehicle movements. Originally, the tachographs were mainly motivated by the need to ensure that the time regulations for lorry drivers are obeyed and is mandatory for new lorries in Europe. The suggested control is carried out at regular vehicle safety check-ups and possibly road-side control. Border crossing can be dealt with by letting drivers register, either electronically or as in case of the analogue tachograph by a picture taken by a camera. The exact dealing with foreign trucks and the enforcement in Sweden is not specified in the proposal.

D. We make a distinction between two solutions based on fuel tax. Fuel tax system (D1), a special tax for fuel diesel usage in Sweden. Fuel sold in Sweden is taxed and the enforcement by controlling the national fuel distribution system. Fuel tax system (D2). In order to avoid a situation where a significant part of road transports is performed using fuel bought abroad, a declaration is done for trucks entering and leaving Sweden. We assume that there are efficient ways of controlling this declaration, e.g., electronic devices that measure the amount of fuel in the tank. There are of course a large number of additional solutions to the problem of distance-based road-user charging. Some are provided e.g. by Hatcher et al.5, Cottingham et al.3, and de Palma & Lindsey11. Here we focus on those that have been discussed for the Swedish RUCS, but the criteria and evaluation method are generally applicable. Finally, there may be negative effects of combining a fuel tax system with distance-based RUCS 7.

4. Case Study: Evaluation

We will now analyze the five candidate solutions using the different criteria presented above.

Charging Precision: With respect to distance accuracy, the solutions A, B and C, all have good potential for com-puting correct distances. However, for A and B, the accuracy depends on the frequency of position recording and the corresponding map matching algorithms, whereas C is sensitive to systematic errors in the tachograph. D1 and D2 are both dependent on the fuel consumption per kilometer which differs between vehicles and is difficult to estimate accurately. The ability to vehicle differentiation is rather good in A to C, but there is a need to include methods for identification of vehicle configuration, i.e., whether a trailer is connected to the truck or not. A and B have greater flexibility in handling additional vehicle aspects than C. Solutions of type D cannot handle this differentiation unless it is closely related to fuel consumption, but it may in fact estimate the environmental external effects (emissions) of an additional trailer rather well through increased fuel consumption. A to C should be able to handle time differentia-tion rather well. However, C cannot perform time differentiadifferentia-tion in combinadifferentia-tion with road differentiadifferentia-tion. Road dif-ferentiation can only be handled by A and B. Target accuracy – avoiding false negative, i.e. all targeted users should pay, can only be fully achieved in A and B, whereas it cannot fully be expected for C. In D1, it cannot be achieved at

day, there may also be a relation to time differentiation. Since congestion occurs at certain times and locations, it is mainly related to time and road differentiation. Similarly traffic control is mainly related to time and road differentia-tion, but also to the type of vehicles. Energy consumption is mainly related to the distance travelled and the type of vehicle, but also when the transport is made and what roads are used could influence the consumption due to congestion and speed limits. General tax income is mainly connected to distance accuracy, whereas the special financing is more connected to road differentiation. Also, there are weak connection to vehicle differentiation and target accuracy (AFN) for both tax income and special financing. Finally, fairness can be viewed in many ways, but given it is about to what extent are all road users equally treated by the system, it is mainly connected to target accuracy (AFN and AFP).

The next set of criteria concern system costs and societal benefits:

System cost – What are the costs for government, haulers, and other actors? There are: Investment costs, Op-erational costs, and Enforcement costs (including both opOp-erational and investment costs)

New equipment – How large is the need for introducing and installing new in-vehicle equipment? Communication need – How much data communication is needed?

Time to deployment – How long time does it take to develop and deploy the system?

Fostering competition – To what extent does the system offer incentives for a multitude of system providers? Stimulating technology development – To what extent is the development of new technologies required? Flexibility and modifiability

Ability to adapt – To what extent could the system be adapted to changing requirements? Scalability – How well does the system handle large increases in the number of users, roads, etc.? Support for additional services – How easy is it to add new services?

Integration with services (interoperability) – How well does the system cooperate with other relevant systems? Technological lock-in: communication and positioning – How well does the system avoid dependence of the

chosen communication and positioning technology?

Enforcement possibilities – What are the possibilities to implement different type of control schemes? Update effort – How much effort is needed when new road sections are introduced, the tariff is changed, etc.? Operational aspects

Availability – How robust and reliable is the system? Maintainability – How easy is it to maintain the system?

User friendliness – How easy is it for the end-user to use the system, e.g., in terms of the manual procedures or providing information to the user regarding the fee to be paid?

System complexity – How complex is the system, e.g., in terms of the equipment needed? Environmental impact – How large is the environmental impact of the system itself? Visual intrusion – How visually intrusive is the system?18

Security and privacy

Risk of sabotage – How large is the risk of system sabotage and how easy would it be?

Fraud resistance – How difficult is it for users to circumvent security measures to escape taxes? Risk of information theft – How easy is it to steal information from the system?

Integrity protection – How well does the system protect reliable information? Privacy protection – How well does the system protect user sensitive information?

I addition to the above criteria, one may also consider legislative restrictions. However, as laws and regulations can be changed, we do not view this as a direct criterion but rather an aspect of time to deployment.

3. Case Study: Potential Solutions

In order to illustrate the proposed evaluation framework, we apply it to a case study where the situation in Sweden is considered. There are proposals in Sweden, e.g. a governmental committee proposal2, about a distance-based tax covering both domestic and foreign heavy goods vehicles. This tax should cover all public roads, and it should be possible to differentiate between different types of vehicles, time of the road usage, and between different roads. This makes the system more complex than those in operation at the moment. Moreover, it should be harmonized with other European systems existing and under development. This implies that system should adhere to the EFC-directive 2004/52/CE with the purpose of achieving a European Electronic Toll Service (EETS) that is interoperable.

A RUCS should perform some basic functions: (1) measure the road usage for the individual vehicles and record characteristics that are relevant for determining charges, (2) calculate charges, (3) communicate data for billing pur-poses, and (4) enforcement. As we will see below, this can be carried out in very different ways. As some proposals of RUCS in Sweden2, does not suggest to differentiate between time of the road usage and between different roads2, it is relevant to consider RUCS proposals that are not able to fully differentiate between road usage and time of usage6. One approach is to use the digital tachograph and another is to simply use a fuel tax. The fuel tax option is relevant for comparison, since it at least has the potential to capture the emissions rather accurately. Below five proposals are described:

A. In the open thin client solution vehicles report their positions to a central system (e.g. an EETS provider), whenever the mandatory On-Board Unit (OBU) knows that the vehicle is in Sweden. The OBU is able to record Global Navigation Satellite Systems (GNSS)10 positions and transmit them to a central server. The solution builds upon signed track logs including position data from the OBU using public mobile networks. Communication between two parties will be carried out by securing identity of the parties and that the messages are secured against message modification and fabrication. This solution allows for an open system architecture in terms of solutions for retriev-ing position data and sendretriev-ing these to the central server, either as a stream or in bulk transfer. Control functionality is carried out by real-time communication using Dedicated Short Range Communications (DSRC) and by control of reported position data in comparison with other sources of information. Border crossing is dealt with by DSRC registration and stored information in the OBU of country borders. The solution is similar to solution 1 by EG913. B. The closed thick client solution is similar to the thin client, but with maps and tariffs stored in the OBU together with a tax calculation capability. It is similar to the solution 3a by EG913. An important part of the control func-tionality is to make sure that no manipulation has occurred, e.g. by compliance check using DSRC. The system is closed in the sense that the OBU need to be certified. Border crossing is dealt with by using the maps in the OBU. C. The digital tachograph, see Kågeson6 for a proposal. The core of the system is to use electronic devices for

record-ing vehicle movements. Originally, the tachographs were mainly motivated by the need to ensure that the time regulations for lorry drivers are obeyed and is mandatory for new lorries in Europe. The suggested control is carried out at regular vehicle safety check-ups and possibly road-side control. Border crossing can be dealt with by letting drivers register, either electronically or as in case of the analogue tachograph by a picture taken by a camera. The exact dealing with foreign trucks and the enforcement in Sweden is not specified in the proposal.

D. We make a distinction between two solutions based on fuel tax. Fuel tax system (D1), a special tax for fuel diesel usage in Sweden. Fuel sold in Sweden is taxed and the enforcement by controlling the national fuel distribution system. Fuel tax system (D2). In order to avoid a situation where a significant part of road transports is performed using fuel bought abroad, a declaration is done for trucks entering and leaving Sweden. We assume that there are efficient ways of controlling this declaration, e.g., electronic devices that measure the amount of fuel in the tank. There are of course a large number of additional solutions to the problem of distance-based road-user charging. Some are provided e.g. by Hatcher et al.5, Cottingham et al.3, and de Palma & Lindsey11. Here we focus on those that have been discussed for the Swedish RUCS, but the criteria and evaluation method are generally applicable. Finally, there may be negative effects of combining a fuel tax system with distance-based RUCS 7.

4. Case Study: Evaluation

We will now analyze the five candidate solutions using the different criteria presented above.

Charging Precision: With respect to distance accuracy, the solutions A, B and C, all have good potential for com-puting correct distances. However, for A and B, the accuracy depends on the frequency of position recording and the corresponding map matching algorithms, whereas C is sensitive to systematic errors in the tachograph. D1 and D2 are both dependent on the fuel consumption per kilometer which differs between vehicles and is difficult to estimate accurately. The ability to vehicle differentiation is rather good in A to C, but there is a need to include methods for identification of vehicle configuration, i.e., whether a trailer is connected to the truck or not. A and B have greater flexibility in handling additional vehicle aspects than C. Solutions of type D cannot handle this differentiation unless it is closely related to fuel consumption, but it may in fact estimate the environmental external effects (emissions) of an additional trailer rather well through increased fuel consumption. A to C should be able to handle time differentia-tion rather well. However, C cannot perform time differentiadifferentia-tion in combinadifferentia-tion with road differentiadifferentia-tion. Road dif-ferentiation can only be handled by A and B. Target accuracy – avoiding false negative, i.e. all targeted users should pay, can only be fully achieved in A and B, whereas it cannot fully be expected for C. In D1, it cannot be achieved at

146 Paul Davidsson et al. / Procedia Computer Science 130 (2018) 142–149

Author name / Procedia Computer Science 00 (2015) 000–000 5

all, since vehicles which buy fuel abroad will often be able to avoid being charged altogether, which is not the case for D2. In the case study, we address the current situation where HGV use diesel as the fuel source, which may not be the situation in the future. As a fuel tax will probably affect others than the intended target group who are using diesel for other purposes, e.g., light trucks, cars and other types of machinery, the target accuracy – avoiding false positive, is the lowest for D1 and almost as low for D2 and high for the other solutions.

System Costs and Societal Benefits: The system cost is anticipated to be the highest for A and B since they require central computing facilities and heavy use of the communication infrastructure, as well as the introduction of new equipment in vehicles either on a permanent basis or when entering the country. We anticipate their operational and enforcement cost to be high due to their advanced structures, whereas C has the potential to use equipment already in the vehicle. The operational costs for C can still be of significance since it is likely that a new system for reporting tax is needed and the frequency for regular vehicle checkups may need to be increased. We believe that D has the lowest costs since no new equipment is needed in the vehicles and no new ICT infrastructure needs to be developed and deployed. D2 is more expensive than D1, in particular with respect to enforcement cost. We anticipate a higher need of new equipment in cases A and B, where the need is the highest for B, where existing in-vehicle equipment cannot be used to the same extent as in A. The communication need is rather high for A, since the amount of position data that needs to be communicated to a central server is significant. Solution A communicates the majority of information in upstream direction, which in general offers less capacity as compared to the downstream. A significant part of the traffic in B is assumed to be related to communication in downstream direction of, e.g., software and tariffs. The downstream communication for vehicles entering Sweden may be significant if all map and tariff information is needed. B has the potential to aggregate the position information into tax calculations in the upstream communication. The communication need between vehicles and central servers is marginal for D2 (only declarations of fuel at borders) and non-existing in D1. Limited information needs to be reported from the digital tachograph for tax computations in C. We estimate the time to deployment to be shorter for D1 and C (no equipment in vehicle), but not for D2 due to development of fuel declaration system and not to be ignored, the process of ensuring adherence to (and potentially changing) the law. For A, interfaces need to be developed, and for B, more complex equipment needs to be developed. The highest degree of fostering of competition is achieved in A due to openness, and C (well defined units which can be produced by a number of providers), whereas B has the characteristics of a complex and closed system raising the bar for those planning to enter the market. We regard D1 as negative in this respect since there are no system providers between whom competition can occur. D2 does not allow for much competition since it will probably be a very spe-cialized solution used at border crossings. We believe that A is stimulating technology development the most due to its flexibility in technology choices, while neither C nor D stimulate any significant development of new technology. Flexibility and Modifiability: The ability to adapt is the highest in A, since it has a more open structure allowing the use of different technologies. C and D are hampered by the inability to adapt to new requirements. Solution A has limits with respect to scalability, due to the need of communication and the fact that computations are done centrally, potentially in a single-point-of-failure structure. B imposes slightly less computational needs on central level. D solu-tions have no problem with respect to this whereas some limits exist for C due to the central processing of information from tachographs. A has good support for additional services due to its open architecture and positioning capability. B is also good due to the inclusion of both positioning capability and maps. C and D have strong limits on additional services, which often requires position information. See the project GIROADS4 for examples of such services. Inte-gration with services, for instance road tolls, is naturally only possible with A and B, but not easily with C and D. In comparison, B has the greatest risk of causing technological lock-in due to communication due to is closed structure, whereas A is more tolerable to other means of communications. There is hardly any communication needed in C and D (however some need in case of D2), and hence, the risk of lock-ins is rather small. The situation is similar with technology lock-in with respect to positioning, except that no substantial difference between A and B can be foreseen. A has requirements on non-tampered messages and secured identity and B the requirement of a certified OBU. We believe the enforcement possibilities and control possibilities are equally large for A due to a rich availability of position data at central server to control, and B due to more reliable method to read the state of the OBU. The situation is worse for C due to less rich information to control and unavailability of efficient status checks, e.g., by DSRC. For D, the information availability is even less. The update efforts are significant for B, but less for A. For C, changing to new tachographs causes update efforts, while for D1, no effort is required, but some for D2.

Operational aspects: The availability of the system for the user is the highest for D (at least D1) and almost as high for C due to rather simple equipment. For A and B the availability is lower due to a more complex technology, and A may also suffer from its single-point-of-failure structure. C and in particular D have the highest maintainability score

6 Author name / Procedia Computer Science 00 (2015) 000–000

due to their simplicity. B has reduced maintainability due to its more complex OBU. Due to its simplicity, D1 has the highest user friendliness, followed by D2 due to extra work at border crossings may occur, and C. Due to the com-plexity, including difficulty to install, the user friendliness in A and B is lower. B is probably better than A in this respect due to a potential ability to inform user of current taxes. As indicated, A and B have the highest system com-plexity, and D represents the least complex solution. A and B also cause the largest environmental impact since they make heavy use of communication equipment, whereas D1 does not cause any additional environmental impact at all. Regarding visual intrusion, the enforcement system of A and B require some road-side equipment.

Security and privacy: The risk of sabotage, including the magnitude of potential consequences, is the highest for A and B due to their high complexity. The magnitude is higher for B due to that all OBUs are exactly alike: Once a method is found to compromise one OBU, all can be compromised. The risk is lower for C and in particular for D due to their simpler structure. The Fraud resistance is comparably high for the simplest solution (D1) and less for the others. The risk of information theft is highest for A and B since more sensitive data (e.g. positions) is included in complex systems and less in C and D, where the least sensitive data exists in D. Likewise integrity protection is the highest for D1 and lowest for A and B due to the occurrences of essential information. From the individual perspective, the level of privacy protection is similar but somewhat worse for A since position data, is sent to a central server.

We have quantified the assessment using a 5-grade scale, see Table 1. It is relative in the sense that the grade for a certain criterion for a particular solution depends only how the other solution performs with respect to this criterion.

Table 1. Summary of assessment using a relative scale from “--“ (indicating very low merit of the solution) to “++” (very high merit). Criteria type Criteria A B C D1 D2

Charging precision Distance accuracy ++ ++ + - -

Vehicle differentiation + + 0 - -

Time differentiation ++ ++ ++ -- --

Road differentiation ++ ++ -- -- --

Target accuracy - avoiding FN ++ ++ + -- +

Target accuracy - avoiding FP ++ ++ + -- -

System costs and societal

benefits Investment costs Operational costs -- -- -- -- + 0 ++ + ++ +

Enforcement costs - - + ++ 0

New equipment - -- + ++ +

Communication need -- -- + ++ ++

Time to deployment - - + ++ 0

Fostering competition + 0 + -- -

Stimulating technology development ++ + 0 -- -

Flexibility and modifiability Ability to adapt + 0 - -- -

Scalability - 0 + ++ ++

Support for additional services + + - -- --

Integration with services + + -- -- --

Tech. lock-in: communication - -- ++ ++ ++

Tech. lock-in: positioning - - ++ ++ ++

Enforcement possibilities + + 0 - -

Update effort + -- + ++ +

Operational aspects Availability - 0 + ++ ++

Maintainability 0 - + ++ ++

User friendliness -- - + ++ +

System complexity - - + ++ ++

Environmental impact - - + ++ +

Visual intrusion - - + ++ +

Security and privacy Risk of sabotage - -- 0 ++ +

Fraud resistance 0 0 0 ++ +

Risk of information theft - - + ++ ++

Integrity protection - - 0 ++ +

Privacy protection -- - 0 ++ ++

5. Discussion

It is clear that the simplest candidate systems, i.e., D1 and D2, has obvious advantages in some areas like system cost, operational aspects, and security and privacy. On the other hand, they have some serious problems, like low charging precision and flexibility. Almost the same applies for C, but with some additional security and privacy issues. A and B have their main merit in achieving excellent charging precision and drawbacks in high system cost, potential

all, since vehicles which buy fuel abroad will often be able to avoid being charged altogether, which is not the case for D2. In the case study, we address the current situation where HGV use diesel as the fuel source, which may not be the situation in the future. As a fuel tax will probably affect others than the intended target group who are using diesel for other purposes, e.g., light trucks, cars and other types of machinery, the target accuracy – avoiding false positive, is the lowest for D1 and almost as low for D2 and high for the other solutions.

System Costs and Societal Benefits: The system cost is anticipated to be the highest for A and B since they require central computing facilities and heavy use of the communication infrastructure, as well as the introduction of new equipment in vehicles either on a permanent basis or when entering the country. We anticipate their operational and enforcement cost to be high due to their advanced structures, whereas C has the potential to use equipment already in the vehicle. The operational costs for C can still be of significance since it is likely that a new system for reporting tax is needed and the frequency for regular vehicle checkups may need to be increased. We believe that D has the lowest costs since no new equipment is needed in the vehicles and no new ICT infrastructure needs to be developed and deployed. D2 is more expensive than D1, in particular with respect to enforcement cost. We anticipate a higher need of new equipment in cases A and B, where the need is the highest for B, where existing in-vehicle equipment cannot be used to the same extent as in A. The communication need is rather high for A, since the amount of position data that needs to be communicated to a central server is significant. Solution A communicates the majority of information in upstream direction, which in general offers less capacity as compared to the downstream. A significant part of the traffic in B is assumed to be related to communication in downstream direction of, e.g., software and tariffs. The downstream communication for vehicles entering Sweden may be significant if all map and tariff information is needed. B has the potential to aggregate the position information into tax calculations in the upstream communication. The communication need between vehicles and central servers is marginal for D2 (only declarations of fuel at borders) and non-existing in D1. Limited information needs to be reported from the digital tachograph for tax computations in C. We estimate the time to deployment to be shorter for D1 and C (no equipment in vehicle), but not for D2 due to development of fuel declaration system and not to be ignored, the process of ensuring adherence to (and potentially changing) the law. For A, interfaces need to be developed, and for B, more complex equipment needs to be developed. The highest degree of fostering of competition is achieved in A due to openness, and C (well defined units which can be produced by a number of providers), whereas B has the characteristics of a complex and closed system raising the bar for those planning to enter the market. We regard D1 as negative in this respect since there are no system providers between whom competition can occur. D2 does not allow for much competition since it will probably be a very spe-cialized solution used at border crossings. We believe that A is stimulating technology development the most due to its flexibility in technology choices, while neither C nor D stimulate any significant development of new technology. Flexibility and Modifiability: The ability to adapt is the highest in A, since it has a more open structure allowing the use of different technologies. C and D are hampered by the inability to adapt to new requirements. Solution A has limits with respect to scalability, due to the need of communication and the fact that computations are done centrally, potentially in a single-point-of-failure structure. B imposes slightly less computational needs on central level. D solu-tions have no problem with respect to this whereas some limits exist for C due to the central processing of information from tachographs. A has good support for additional services due to its open architecture and positioning capability. B is also good due to the inclusion of both positioning capability and maps. C and D have strong limits on additional services, which often requires position information. See the project GIROADS4 for examples of such services. Inte-gration with services, for instance road tolls, is naturally only possible with A and B, but not easily with C and D. In comparison, B has the greatest risk of causing technological lock-in due to communication due to is closed structure, whereas A is more tolerable to other means of communications. There is hardly any communication needed in C and D (however some need in case of D2), and hence, the risk of lock-ins is rather small. The situation is similar with technology lock-in with respect to positioning, except that no substantial difference between A and B can be foreseen. A has requirements on non-tampered messages and secured identity and B the requirement of a certified OBU. We believe the enforcement possibilities and control possibilities are equally large for A due to a rich availability of position data at central server to control, and B due to more reliable method to read the state of the OBU. The situation is worse for C due to less rich information to control and unavailability of efficient status checks, e.g., by DSRC. For D, the information availability is even less. The update efforts are significant for B, but less for A. For C, changing to new tachographs causes update efforts, while for D1, no effort is required, but some for D2.

Operational aspects: The availability of the system for the user is the highest for D (at least D1) and almost as high for C due to rather simple equipment. For A and B the availability is lower due to a more complex technology, and A may also suffer from its single-point-of-failure structure. C and in particular D have the highest maintainability score

due to their simplicity. B has reduced maintainability due to its more complex OBU. Due to its simplicity, D1 has the highest user friendliness, followed by D2 due to extra work at border crossings may occur, and C. Due to the com-plexity, including difficulty to install, the user friendliness in A and B is lower. B is probably better than A in this respect due to a potential ability to inform user of current taxes. As indicated, A and B have the highest system com-plexity, and D represents the least complex solution. A and B also cause the largest environmental impact since they make heavy use of communication equipment, whereas D1 does not cause any additional environmental impact at all. Regarding visual intrusion, the enforcement system of A and B require some road-side equipment.

Security and privacy: The risk of sabotage, including the magnitude of potential consequences, is the highest for A and B due to their high complexity. The magnitude is higher for B due to that all OBUs are exactly alike: Once a method is found to compromise one OBU, all can be compromised. The risk is lower for C and in particular for D due to their simpler structure. The Fraud resistance is comparably high for the simplest solution (D1) and less for the others. The risk of information theft is highest for A and B since more sensitive data (e.g. positions) is included in complex systems and less in C and D, where the least sensitive data exists in D. Likewise integrity protection is the highest for D1 and lowest for A and B due to the occurrences of essential information. From the individual perspective, the level of privacy protection is similar but somewhat worse for A since position data, is sent to a central server.

We have quantified the assessment using a 5-grade scale, see Table 1. It is relative in the sense that the grade for a certain criterion for a particular solution depends only how the other solution performs with respect to this criterion.

Table 1. Summary of assessment using a relative scale from “--“ (indicating very low merit of the solution) to “++” (very high merit). Criteria type Criteria A B C D1 D2

Charging precision Distance accuracy ++ ++ + - -

Vehicle differentiation + + 0 - -

Time differentiation ++ ++ ++ -- --

Road differentiation ++ ++ -- -- --

Target accuracy - avoiding FN ++ ++ + -- +

Target accuracy - avoiding FP ++ ++ + -- -

System costs and societal

benefits Investment costs Operational costs -- -- -- -- + 0 ++ + ++ +

Enforcement costs - - + ++ 0

New equipment - -- + ++ +

Communication need -- -- + ++ ++

Time to deployment - - + ++ 0

Fostering competition + 0 + -- -

Stimulating technology development ++ + 0 -- -

Flexibility and modifiability Ability to adapt + 0 - -- -

Scalability - 0 + ++ ++

Support for additional services + + - -- --

Integration with services + + -- -- --

Tech. lock-in: communication - -- ++ ++ ++

Tech. lock-in: positioning - - ++ ++ ++

Enforcement possibilities + + 0 - -

Update effort + -- + ++ +

Operational aspects Availability - 0 + ++ ++

Maintainability 0 - + ++ ++

User friendliness -- - + ++ +

System complexity - - + ++ ++

Environmental impact - - + ++ +

Visual intrusion - - + ++ +

Security and privacy Risk of sabotage - -- 0 ++ +

Fraud resistance 0 0 0 ++ +

Risk of information theft - - + ++ ++

Integrity protection - - 0 ++ +

Privacy protection -- - 0 ++ ++

5. Discussion

It is clear that the simplest candidate systems, i.e., D1 and D2, has obvious advantages in some areas like system cost, operational aspects, and security and privacy. On the other hand, they have some serious problems, like low charging precision and flexibility. Almost the same applies for C, but with some additional security and privacy issues. A and B have their main merit in achieving excellent charging precision and drawbacks in high system cost, potential

148 Paul Davidsson et al. / Procedia Computer Science 130 (2018) 142–149

Author name / Procedia Computer Science 00 (2015) 000–000 7

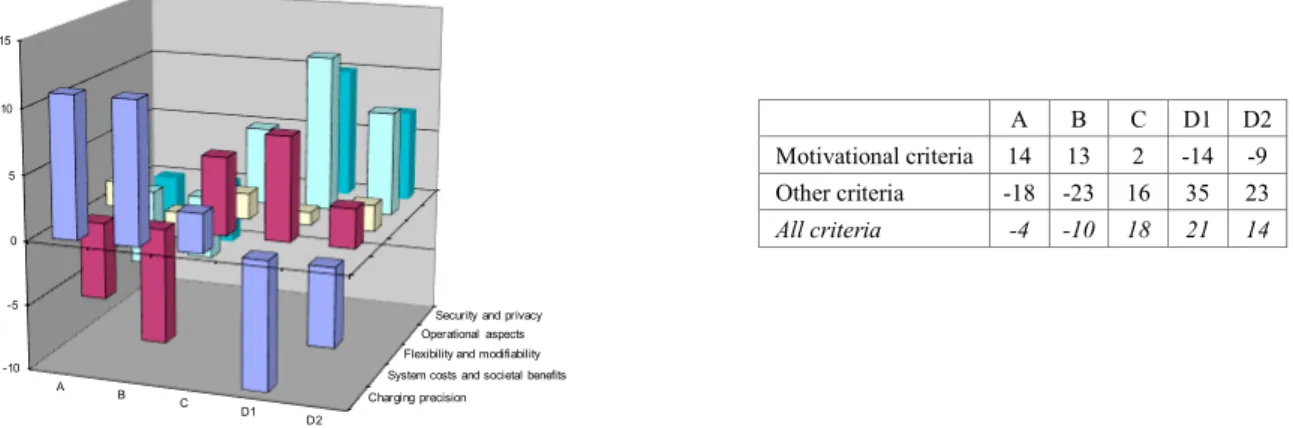

scalability problems, and security and privacy issues. By applying the value of 2 for ´++´, 1 for ´+´, 0 for ´0´, -1 for ´-´, and -2 for ´--´-´, we can compute some summary quantitative relative measure for the different solutions. Fig. 1 illustrates the results when all criteria are given equal weight.

A B C D1 D2

Motivational criteria 14 13 2 -14 -9 Other criteria -18 -23 16 35 23 All criteria -4 -10 18 21 14

Fig. 1. Diagram of evaluation scores when the same weight is given to all criteria. Left: Summation of the evaluation scores.

Let us now focus on the criteria directly connected to the motives for introducing the RUCS, i.e., distance accuracy, vehicle differentiation, time differentiation, road differentiation, target accuracy, stimulating technology development and support for additional services. We can compute the (unweighted) score for these criteria, and also for all criteria other than those connected to the system motives, and finally for all criteria. To the left in Fig. 1 we see that A and B meets the requirement (the motivational criteria) to a much higher degree than D1 and D2, and that C is between these. However, taking all criteria into account and given the same weight, we get the opposite result.

Obviously the weighting of the criteria heavily influences the results. We first illustrate the effect of simply putting higher weight on the motivational criteria. Here we study the effect of putting weights of 1, 2 and 5 on the motivational criteria and at the same time maintaining the weight of one on all other criteria. The results are illustrated in Fig. 2.

Fig. 2. Left: Diagram of evaluation scores when motivational criteria have been given extra weight (1, 2 or 5); other criteria (non-motivational) have been given the weight of one. Right: Diagram of evaluation scores when one motive has been considered at a time.

It may also be of interest to study how the different solutions achieve the different system motives. We have selected four such motives for illustrating such an analysis: Road wear, Emissions (local), Congestion, and Special financing. If such a motive has a strong connection, its associated motivational criteria was given a weight of two, and in case of a weaker connection, it was given a weight of one. Here we ignore all other non-motivational criteria, i.e. their weights were set to zero. The results are presented in Fig. 2 to the right.

There are a number of the criteria which are directly related to the acceptance of the system, which also is a factor to account for when choosing system and system design. In particular security and privacy aspects and user friendliness should be considered from an acceptance perspective. With respect to acceptance it is useful to look at the criteria from different stakeholders’ perspective. One can at least consider four types of stakeholders: public authorities (including politicians), system providers, organisational users (e.g. trucking companies), and individuals (e.g. lorry drivers). This distinction has not been made in the analysis so far, although the criteria meeting the motives of the system are certainly important for public authorities. One way of taking stakeholder perspectives into account is to apply stakeholder-specific weights to the different criteria.

Charging precision System costs and societal benefits

Flexibility and modifiability Operational aspects

Security and privacy

-10 -5 0 5 10 15 A B C D1 D2 -100 -50 0 50 100 A B C D1 D2 Weight = 1 Weight = 2 Weight = 5 -15 -10 -5 0 5 10 15 A B C D1 D2 Road wear Emissions (local) Congestion Special financing

8 Author name / Procedia Computer Science 00 (2015) 000–000

The criteria are not only partly hierarchical, e.g. maintainability affects system cost, but there are also some interdependencies, e.g. time differentiation is rather meaningless without ability to differentiate with respect to road. There are in particular high dependencies to be found for the criteria:

Target accuracy with Vehicle differentiation, Time differentiation, Road differentiation;

Risk of information theft with System complexity, Risk of sabotage, Fraud resistance, Integrity protection, Privacy protection.

These dependencies may also influence how the different weights should be set in an analysis which may need consideration when setting the values of the weights.

6. Conclusions

We have presented a general multi-criteria approach for evaluation of RUCSs in a broad context. The merit of the approach is not to achieve exact values (scores) of different solutions, but allows for the possibility to relate the characteristics of the solutions to different levels of evaluation criteria, i.e. to relate to a particular criterion (e.g., supporting new services), or a group of criteria (e.g., flexibility and modifiability) or to a general system motives (e.g., reduction of accidents).

Only the solutions A and B (thick and thin client) meets the identified motives of introducing a Swedish RUCS. Our analysis shows, however, that a number of simpler solutions (tachograph and fuel tax based approach) may be more attractive when a number of system motives are ignored, or considered less important. Moreover, we have presented way of making general comparisons of the approaches by giving each of the criteria a specific weight corresponding to how important it is. We showed that these weights heavily influence the outcome of the comparison. We see it as beneficial to proceed with some in-depth analyses. For instance, it is of most relevance to analyse system costs and societal benefits (primarily connected to road usage effects and tax incomes). Such analyses could be important for setting the weights correctly with respect to the situation at hand.

References

1. Anas, A., Lindsey, R., Reducing Urban Road Transportation Externalities: Road Pricing in Theory and in Practice, Review of Environmental Economics and Policy, req19, 2011.

2. Betänkande av Vägslitageskattekommittén: SOU 2017:11, Elanders Sverige AB, Stockholm, ISBN 978-91-38-24562-0

3. Cottingham, D.N., Beresford, A.R., Harle, R.K., Survey of technologies for the implementation of national-scale road user charging. Transport Reviews, 27(4):499–523, 2007.

4. GNSS introduction in the road sector, http://www.gsa.europa.eu/gnss-introduction-road-sector, accessed 28 Dec, 2017.

5. Hatcher, S.G., Bunch, J., Hardy, M., McGurrin, M., Hardesty D., Mileage-based User Fee Technology Study, Transportation Systems Divi-sion, Noblis 2009.

6. Kågeson, P. Förenklad form för svensk kilometerskatt (“Simplified form of a Swedish distance-based road user tax”), 2007. http://docplayer.se/9430648-Forenklad-form-for-svensk-kilometerskatt.html, accessed 28 Dec, 2017.

7. Mandell, S., Proost, S., Why truck distance taxes are contagious and drive fuel taxes to the bottom, J. of Urban Economics, 93:1–17, 2016.

8. Mbiydzenyuy, G., Persson, J.A. and Davidsson, P. Exploring Synergy Relationships Between Telematic Services and Functionalities Using Cluster Analysis. IET Intelligent Transport System, 9(4):366-374, 2015.

9. McKinnon, A.C., ‘Government plans for lorry road-user charging in the UK’, Transport Policy, 13:204–216, 2006.

10. Numrich, J., Ruja, S., Voß. S., Global Navigation Satellite System Based Tolling: State-of-the-art, NETNOMICS: Economic Research and Electronic Networking, 13(2):93-123, 2012.

11. de Palma A., Lindsey, R., Traffic congestion pricing methodologies and technologies, Transportation Research Part C, 19:1377–1399, 2011.

12. Palmer-Tous, T., Antoni R.-F., Structuring road transport taxes to capture externalities: a critical analysis of approaches. Chapter 16, Hand-book of Research on Environmental Taxation, Edward Elgar, 2012.

13. Specification of the EFC application based on satellite technologies, Report of Expert Group 9, EU, 2006. https://ec.eu-ropa.eu/transport/sites/transport/files/themes/its/studies/doc/eg09_satellite_based_eets_application.pdf, accessed 28 Dec, 2017

14. Sui, C., Liwei, C., Research on Lorry Road User Charging Scheme, Research J. Applied Sciences, Engineering and Technology,

4(2):123-126, 2012.

15. Tan, W.H.L. and Subramaniam, R., ‘Congestion control of heavy vehicles using electronic road pricing: The Singapore experience’, Int. J. Heavy Vehicle Systems, 13(1/2):37–55 (2006)

16. Velaga, N.R., Pangbourne. K., Achieving genuinely dynamic road user charging: Issues with a GNSS-based approach, J. Transport Geogra-phy, 34:243-253, 2014.

17. Vierth, I., Johansson, K., Johansson, A., Estreen, M., Hesselborn, P-O., Internalisering av godstrafikens externa effekter, SIKA Rapport 2003:6, http://www.trafa.se/globalassets/sika/sika-rapport/sr_2003_6.pdf, accessed 28 Dec, 2017.

18. Vonk Noordegraaf, D., Heijligers, B., van de Riet, O., van Wee, B. Technology Options for Distance-based Road User Charging Schemes. 88th Annual Meeting of the Transportation Research Board, Washington, DC. Paper No. 09-2477, 2009.