http://www.diva-portal.org

Postprint

This is the accepted version of a paper published in Economics of Innovation and New

Technology. This paper has been peer-reviewed but does not include the final publisher

proof-corrections or journal pagination.

Citation for the original published paper (version of record): Holgersson, T., Kekezi, O. (2018)

Towards a multivariate innovation index

Economics of Innovation and New Technology, 27(3): 254-272

https://doi.org/10.1080/10438599.2017.1331788

Access to the published version may require subscription. N.B. When citing this work, cite the original published paper.

Permanent link to this version:

1

Towards a Multivariate Innovation Index

Thomas Holgersson & Orsa Kekezi*Abstract: This paper argues that traditional measures of innovation as a univariate phenomenon

may not be dynamic enough to adequately describe the complex nature of innovation. Consequently, the purpose is to develop a multidimensional index of innovation that is able to reflect innovation enablers and outputs. The index may then be used (i) to assess and quantify temporal changes of innovation, (ii) to describe regional differences and similarities of innovation, and (iii) serve as exogenous variables to analyse the importance of innovation for other economic phenomena. Our index is defined in a four-dimensional space of orthogonal axes. An empirical case study is used for demonstration of the index, where 44 variables are collected for all municipalities in Sweden. The index spanning the four-dimensional innovation comprises size, accessibility, firm performance, and agglomeration. The proposed index offers a new way of defining and analysing innovation and should have a wide range of important applications in a world where innovation is receiving a great deal of recognition.

JEL classification: O31, C38

Keywords: regional innovation, multivariate index, factor analysis.

* Corresponding author

Thomas Holgersson (thomas.holgersson@lnu.se) is professor of statistics, Linnaeus University, Växjö and Jönköping International Business School, Jönköping University;

Orsa Kekezi (orsa.kekezi@ju.se) is a doctoral student in economics, Jönköping International Business School, Jönköping University.

2

1. Introduction

Innovation is one of the most important driving forces behind the creation of welfare on firm, regional, and national levels (Schumpeter 1934; Van de Ven et al. 1999). Since the rise of the New Growth Theory, long-run economic growth could not be understood without looking at the characteristics, geography, causes, and consequences of innovation (OECD 2005). Despite such essential reasons why it is important, researchers are still struggling with the issue of how to quantify and measure innovation due to its complex nature.

The purpose of this article is to take a first step into developing a multidimensional regional innovation index. While the method can be applied to any economy, we apply it on Swedish municipalities for demonstration. This index is constructed from a combination of several input variables that capture how resources are allocated to enable innovation and output variables to measure how much innovation is realized in a region. The regional dimension is crucial in explaining innovation, due to the role that location plays in the creation of tacit knowledge and capacity to exploit it (Lundvall and Borrás 1997). Research further shows that firms’ capacity to innovate and be competitive is highly influenced by territorially embedded characteristics (Maskell and Malmberg 1999; Rodríguez‐Pose 1999; Navarro et al. 2009).

Traditionally, innovation has been studied as a one-dimensional phenomenon. R&D was usually considered to be the main innovation input indicator and the innovation outputs were proxied by productivity, patents, or innovation counts. These variables are, however, unable to capture the innovation potential of the region1 (Eurostat 1996), they are biased towards only seizing radical innovations (Evangelista et al. 2001), and they also exclude sectors which are less formal in their innovation processes, especially services (Gråsjö and Ejermo 2008). Other innovation measures include innovation surveys (OECD 1992), new firm formation and survival (Audretsch and Vivarelli 1996), wage or employment growth (Glaeser et al. 1992), etc. Even though such studies have strongly contributed to our ability of measuring innovation, they are insufficient to adequately describe the dynamics of the whole process. Innovation is not a smooth, well-defined or homogenous phenomenon. Instead, it is highly uncertain, chaotic, complex and subject to many changes. Therefore, treating it as being one-dimensional, and letting a single variable represent innovation, is inappropriate (Kline and Rosenberg 1986). In general, it is necessary to use several indicators to seize the complexity of the innovation process and to effectively describe it (Hollenstein 1996, 2003).

To take such issues into account, another development in this field involves composite measures of innovation. Acknowledging that individual variables are insufficient, composite indices consist of several innovation measures, each of which is a partial indicator of total innovation efforts. Innovation is therefore treated as a latent variable, and instead of assuming that single indicators are fair measures of innovation, one can proxy innovation in a more informative way that improves measurement validity and reliability (Makkonen and Have 2012; Hagedoorn and Cloodt 2003). However, despite existing works, there is still a gap in the literature regarding multidimensionality (Carayannis and Provance 2008), and we lack a clear and consolidated measure of innovation (OECD 2005).

Previous literature on multidimensional indices of regional innovation is quite scarce. One of the first papers in the field is the one by Buesa et al. (2006), who examine the capacity of regional innovation systems (NUTS 2) in Spain between 1994 and 1998. Through factor analysis, they identify four innovation axes: the regional and productive environment, the

1 For instance, the amount of R&D that multiplant firms operate is allocated to their headquarters rather than to where these activities happen. The same is true for patent counts.

3

university, the Civil Service and innovating firms. Pinto (2009) studies instead the diversity of innovation in the European Union by analysing 175 European regions. The four factors extracted are technological innovation, human capital, economic structure, and labor market availability. After the dimensions had been identified, regions that showed similar profiles were grouped together. The author further argues that physical proximity plays an important role in the innovation process. Makkonen and Have (2012) use innovation counts as a baseline to compare individual proxy indicators of innovation and innovation indices (constructed with principal component analysis). That study was conducted on local administrative units in Finland during a 10-year period. Results indicate that innovation indices perform better than univariate variables, but with only marginal superiority. A newer study, however not peer-reviewed, is the European Union’s Regional Innovation Scoreboard, which aims to create a regional innovation index. It measures the performance of the EU regional systems of innovation by using several indicators of innovation and groups them into enablers, firm activities, and outputs. The report considers regions on the NUTS 2 level. From the variables included, a so-called ‘Summary Innovation Index’ is created (Hollanders et al. 2014).

To analyse innovation as a phenomenon that consists of many dimensions simultaneously, we consider factor analysis for creating the index. A unique dataset involving 44 variables across Sweden’s 290 municipalities in 2004 is used to demonstrate the method.2 Besides data availability, a key reason why Sweden is the country of investigation is because Swedish regions were among the regional innovation leaders with an innovation performance above the EU average (Hollanders et al. 2014). Thus, deeper innovation research of Swedish regions can provide important outcomes for policy makers in other countries as well. Naturally, the proposed method for designing this multivariate index is not restricted to any specific state or region, it applies to any economy and any geographical scale.

This study contributes to the literature in several ways. The data used here are on the municipality level, a smaller geographical division compared to the levels used in previous literature, which increases the precision of the index. Moreover, to the authors’ knowledge, no previous work has incorporated so many variables in creating the index.

The proposed innovation index shows the potential tendency of regions to innovate in different aspects. It can be used to compare different regions and to analyse spatial or temporal dynamics. Another application concerns descriptive analysis, by which the proposed index is well suited for presenting innovation visually, such as through maps. The index does not only allow identifying innovation heterogeneity between regional units (municipalities in our case), but also comparing different axes of innovation within a given unit. Further, whenever data are available for a sequence of years, there is also an option of analysing temporal shifts. In such cases, one may use the proposed index in econometric modeling, such as, for instance, analysing the dynamics between relevant economic factors in relation to innovation index or its lags. Because of the way the index is constructed, the axes (dimensions) of innovation are orthogonal and thereby resolve issues of multicollinearity. Moreover, the orthogonality constraint allows for modeling of marginal innovation axes in a straightforward manner: the absence of cross correlation greatly simplifies parameter interpretation of, e.g., regression coefficients because cross-equation dependencies are already controlled for, allowing multivariate models to be replaced by univariate ones.

The analysis identifies four factors although these need not represent the only dimensions of innovation. The model serves as a useful starting point that can be developed and refined further

2 The choice of 2004 as the year of study is due to data access we have for some specific variables. We conducted the analysis for later years as well, and factors extracted remained the same.

4

on. However, four factors should be rich enough to capture the most relevant aspects of innovation:

i. A size factor that serves as a control variable, in the sense that it captures the size of the municipalities. Large municipalities will, for example, dominate in measures of human capital. Hence by letting the first factor control for size, all subsequent factors orthogonal to it may be thought of as ‘real effects’ of innovation.

ii. Accessibility, which quantifies the easiness of spatial interaction and the potential

opportunities of interaction. Hence it is associated with the possibility of exchanging knowledge through face-to-face contacts (Andersson and Ejermo 2005).

iii. Different sources of agglomeration economies are identified as agglomeration. They can be seen as sources that facilitate knowledge spillovers across economic actors and thus create possibilities for innovation.

iv. Firm performance measures dynamics in the municipality with respect to both input

variables, such as a firm’s relative size and density in a municipality, and output variables including average productivity, profit, or sales.

2. Innovation

2.1.The Geography of Innovation

While Krugman (1991, p. 5) argues that economic activity is ‘remarkably concentrated in space’, Feldman (1994) discusses instead that concentration is even more evident for innovative activity. This observation puts strong emphasis on researching the geographic dimension of innovation and more precisely on what determines the tendency to innovate (Audretsch and Feldman 2006). It is rarely the case that innovation is the product of individual firms. Instead, innovation is the output of assembled resources, knowledge, and other inputs that are localized in specific places. Consequently, geography is key in such a process since input clustering in the form of R&D investments, firms in related industries, and providers of business services may generate economies of scale and enable knowledge diffusion through face-to-face interactions (Feldman and Florida 1994).

Concepts like innovative milieu and regional innovation systems have appeared in the literature arguing that the ability to innovate is moderately influenced by local culture, institutions, and markets (Cooke, Heidenreich, and Braczyk 2004; Crevoisier 2004). From this perspective, innovation is dependent on the institutional environment and a is locally embedded process (Malmberg and Maskell 1997). Regional innovation systems are characterized by cooperative innovation activities among different actors in the market and the innovation-supportive culture that facilitates the development of firms and systems over time (Doloreux and Parto 2005). Economic research often conceptualizes the creation of new knowledge to be derived from the stocks of existing knowledge in the form of codified knowledge (Griliches 1990; Birkhaeuser, Evenson, and Feder 1991). While that is important (Zucker et al. 2007), following the regional innovation systems line of literature, it can be argued that the flow of tacit knowledge plays an even more crucial role in innovation capacity (Audretsch 1998). As tacit knowledge is embodied in skilled individuals, it is created and transferred through informal interactions and direct contacts (Feldmann 2000). Such human capital spillovers were already mentioned by Marshall (1890) as knowledge that was “in the air” and crucial for innovation and development. The flow of tacit knowledge is key, because innovation is highly dependent on communication and collaboration of individuals, firms, sectors, and regions, which do not operate in isolation (Edquist and Johnson 1997; Tödtling and Trippl 2005; Decarolis and Deeds 1999). Geographical proximity enables them therefore to exchange ideas and reduces their uncertainty

5

of working in new fields (Audretsch and Feldman 2006). Consequently, the local environment provides an arena for the distribution of tacit knowledge, which is still found in the literature to be rather localized (Iammarino and McCann 2006; Gertler 2003). Even if we live in a global economy with very high levels of information usage and communication technologies, innovative activity is yet very dependent on geography (Asheim and Isaksen 2002). Innovation is neither uniform nor randomly distributed across the geographical landscape. In contrast to what could have been predicted from the declining costs of information, communication, and transportation, spatial concentration has become more evident with time. Nowadays, innovation cannot be properly understood unless regions, proximity, and concentration are taken into consideration (Asheim and Gertler 2005).

2.2. A Regional Innovation Production Function

To frame the regional innovative capacity, a wide range of variables should be incorporated in the model. One way to approach the innovation process is through a production function, where innovation outputs are a function of innovative inputs. A standard knowledge production function, as suggested by Griliches (1979) and Jaffe (1986), can be used to model regional effort for innovation. This function is a modification of the Cobb-Douglas production function and has the following form:

𝐼𝐼𝑖𝑖 = 𝛼𝛼𝑅𝑅𝑅𝑅𝑖𝑖𝛽𝛽𝐻𝐻𝐻𝐻𝑖𝑖𝛾𝛾𝜀𝜀𝑖𝑖, (1)

where Ii denotes the degree of new technology produced in region i, RD presents R&D

investments, and HK is stock of knowledge in terms of human capital. This baseline model can be further expanded with input variables, which has been discussed in the literature, and with determinants of innovative output:

𝐼𝐼𝑖𝑖 = 𝛼𝛼𝐻𝐻𝐻𝐻𝑖𝑖𝛼𝛼𝐸𝐸𝐸𝐸𝑖𝑖𝛾𝛾𝐴𝐴𝐴𝐴𝐴𝐴𝑖𝑖𝛿𝛿𝐹𝐹𝑖𝑖𝜙𝜙𝑁𝑁𝐼𝐼𝑖𝑖𝜑𝜑𝜀𝜀𝑖𝑖, (2)

where Ii is a vector of innovative output in the municipality where we include firm performance

variables and intellectual property applications aggregated on a municipality level. HK denotes human capital levels in the municipality, EX includes the vector of externalities, ACC represents the vector of accessibility variables, F means firm activities in the municipality and NI denotes a group of variables that identify sources of non-innovation.

2.2.1 Innovation Inputs

Human Capital

Research in economics, geography, and social science is in consensus when discussing that human capital, in the form of highly skilled and educated people, is among the key factors for regional development (Rauch 1993; Florida, Mellander, and Stolarick 2008). Innovative regions are also often characterized by a rich variety of skills, ideas, and technologies, embodied in the human capital of the labor force in the area and in the regional industrial structure and firm dynamics (Faggian and McCann 2006).

Ever since the work of Marshall (1890), geographical proximity and knowledge spillovers have been treated in the literature as crucial for enabling innovation. However, it is the interaction of these highly skilled individuals who are in close spatial proximity with one another that facilitates the spillovers necessary for innovation. Interactions between people with human capital, skills, and expertise are the mechanisms by which knowledge spillovers are realized (Feldmann 2000; Stolarick and Florida 2006; Lucas 1988). The resulting cumulative learning

6

effects create the basis for innovation in a region (Acs and Audretsch 1990; Jaffe, Trajtenberg, and Henderson 1993; Porter 1990).

Externalities

In the process of creating knowledge, three main externalities are recognized: specialization, diversity, and competition (Glaeser et al. 1992). The underlying idea is that geographical proximity plays a crucial role in the exchange and diffusion of knowledge that brings regional innovation and growth. However, the authors differ on whether it is the industry concentration, variety, or competition that matters the most.

As early as 1890, Marshall observed the concentration of similar economic activities over space and concluded that industries benefit when concentrating geographically. Proximity to the same market helps knowledge diffusion, reduces transport costs, and allows firms to have access to a more efficient labor market. Co-location of similar firms creates possibilities for them to achieve increasing returns to scale. If that were not the case, economic activity would be dispersed over space to save transportation costs (Fujita and Thisse 2002). Due to the advantages of these intra-industry knowledge spillovers, firms locate in close proximity to each other by creating clusters, concentrations in space of similar firms with the power to enhance innovation by facilitating spillovers of knowledge (Porter 1998).

Another approach is the one by Jacobs (1969), who argues that it is the inter-industry knowledge spillovers that create larger returns to new economic knowledge. The diverse industries that exist in a region create more chances of interaction, imitation, modification, and recombination of ideas. Hence, this variety of industries triggers innovation and economic growth. A diverse economy gives rise to so-called urbanization externalities. The Jacobian tradition is similar to the Marshallian one regarding the importance of knowledge transfer. However, the source of this model comes from the local production environment, which focuses on economies of scope rather than scale.

A third and more recent externality is competition, pioneered by Porter (1990). He considers the intensity of competition to be a crucial incentive for firms to be innovative as it enables the search for and fast adoption of innovation. Firms need to be innovative to survive, which in turn increases growth.

Several research papers put these sources of knowledge spillovers against each other to examine which is the most important externality for innovation, but empirical results are not unanimous (see De Groot, Poot, and Smit (2009) for an overview).

Accessibility

Regional innovations are dependent on two factors that are directly connected with accessibility: the speed of knowledge transfer from one region to another, and the easiness of knowledge exchange between regions. Accessibility is a distance decay measure that measures potential opportunities. The recognition of the link between accessibility and innovation highlights the connection that exists between a transportation network and a human interaction network. All else equal, a region with high accessibility levels to relevant opportunities is more likely to produce new knowledge and to have higher innovation rates. The well-known axiom that interaction decreases with distance is of crucial importance to accessibility. However, in the context of knowledge networks, distance should be seen in terms of time rather than physical distance. If two municipalities have the same physical distance to a third one, the municipality that has the best infrastructure will have higher accessibility and larger opportunities. Hence, an important reason for using time distance is that it considers regional infrastructure quality (Andersson and Karlsson 2004).

7

To define accessibility, consider a set of n municipalities. The total accessibility (𝐴𝐴𝑖𝑖𝐷𝐷) of the chosen municipality i to opportunity D is:

𝐴𝐴𝑖𝑖𝐷𝐷 = 𝑅𝑅𝑖𝑖(𝑐𝑐𝑖𝑖𝑖𝑖) + 𝑅𝑅1(𝑐𝑐𝑖𝑖1) + 𝑅𝑅2(𝑐𝑐𝑖𝑖2) + ⋯ + 𝑅𝑅𝑛𝑛(𝑐𝑐𝑖𝑖𝑛𝑛) (3)

Equation (3) indicates that the total accessibility to an opportunity for a municipality is not only its internal accessibility to opportunity D, but also its accessibility in the rest of the municipalities to the same opportunity. 𝑓𝑓(𝑐𝑐) is a distance decay function that controls how the value of the accessibility is connected with the cost of reaching the opportunity. Johansson and Klaesson (2001) apply the following exponential form to 𝑓𝑓(𝑐𝑐):

𝑓𝑓 (𝑐𝑐𝑖𝑖𝑖𝑖) = exp�−𝜆𝜆𝑡𝑡𝑖𝑖𝑖𝑖� (4)

By combining Equations (3) and (4), an accessibility measure of municipality i to opportunity

D is derived:

𝐴𝐴𝑖𝑖𝐷𝐷 = � 𝑅𝑅𝑖𝑖𝑒𝑒𝑒𝑒𝑒𝑒�−𝜆𝜆𝑡𝑡𝑖𝑖𝑖𝑖� 𝑛𝑛

𝑖𝑖=1

(5)

Despite innovation being dependent on spatial proximity, the link between accessibility and innovation is rarely seen in the literature. The innovation process is highly dependent on accessibility to producing firms, producer service suppliers,3 customers, skilled labor, universities with a suitable R&D agenda, and R&D institutes (Andersson and Karlsson 2004). Besides, proximity to international airports is crucial to innovation because they enable linkages to international markets and facilitate face-to-face contacts with international actors and frameworks (Simmie and Sennett 1999; Simmie 2002). Accessibility to harbors is another important variable due to its role in the location decisions of exporting firms. Therefore, it may indirectly affect innovation since it has the power to change the firm structure in the municipality. Since much of the innovation is imported, accessibility to import values is also included in the model. Literature shows a positive relationship between import and innovation activity (Liu and Buck 2007; Coe and Helpman 1995). Accessibility to gross regional product is further added to the model as a broader measure of market demand.

Firm activities

Literature on innovation has long focused on the characteristics and performance of high-technology industries, which are usually seen as being at the front of innovations and technological advances. Furthermore, innovations made by such industries tend to spread to other firms and improve productivity in the market (Acs and Audretsch 1990). Besides being highly innovative, what is striking about these industries is that they tend to cluster in locations like Silicon Valley, Boston Route 128, Southern California, etc. Literature argues that regional clusters matter in the innovative process and innovation happens easier in areas that are highly concentrated (Porter 1998). The local industrial structure in which several firms compete in similar industries and collaborate across related industries activates learning and innovation processes. In such regions, there are higher chances for firms to get in touch with one another and allow the flow of the tacit form of industry-related knowledge (Malmberg and Maskell 2002).

Another branch of literature argues that the size of firms matters for regional innovation. While some studies claim that the concentration of many small establishments is optimal for regional

8

innovation (Aydalot and Keeble 1988; Saxenian 1994; Acs 2002), others show that it is instead the clustering of large firms that promotes innovation (Cantwell and Iammarino 2005; Cohen and Klepper 1996).

Entrepreneurship, in the form of new firm formation, has been long linked to innovation. Schumpeter (1934) saw innovation as a recombination of existing knowledge and resources that creates opportunities for starting new firms and future innovations. Thus, entrepreneurship is directly connected with something new and progressive. Besides, new firms also have the power to push inefficient firms out of the market due to increased competition. At the same time, they also pressure the existing firms into coming up with new ways of being more efficient (Fritsch and Mueller 2004). Further, they cause structural changes since they explore new markets and increase the number of products due to innovative entries. The result is then a higher innovation level and at the same time economic rejuvenation (Karlsson and Koster 2010).

Variables of Non-Innovation

It may be argued that if one can quantify innovation, one should also be able to identify sources of non-innovation. Such variables are difficult to measure; the variables chosen in this paper are unemployment and crime levels. High unemployment is one of the major reasons why people decide to move to another area that offers more opportunities (Fagerberg, Verspagen, and Caniëls 1997). This leads to a reduction in the level of human capital in the specific region and is hence a barrier to innovation. Crime is also a negative phenomenon of large regions. A high crime rate makes investments riskier and hence business profitability is affected. Furthermore, an increase in the level of crime would in turn increase the level of insecurity in the region. This brings a decrease of capital accumulation and hence a decrease in growth (Capasso 2005). Since growth and innovation usually go hand in hand, innovation may be affected negatively as well.

2.2.2 Innovation Outputs

Intellectual Property – Patents

A patent is the exclusive right to use an invention, thus the producer of a new technical invention has monopoly power to use it for a limited amount of time. Due to a lack of variety in innovation data, patents have often been used as indicators of industrial innovation. The advantages include the availability of data over a long time, classification, their novelty being checked by examiners, lack of problems regarding confidentiality, and the easiness of accessing the data online (Kleinknecht and Reinders 2012).

However, results obtained from patent data should be interpreted with great care. From one point of view, patents create incentives for innovation while from another a patent that is strongly protected and lasts for a long time can slow down economic progress. Nonetheless, it can be generally accepted that the above views on patents and innovation depend entirely on the type of sector. There are areas in which patents would encourage productivity and create more knowledge spillovers. On the other hand, there are also areas in which the effect of patents would be the opposite (Mazzoleni and Nelson 1998).

Firm Performance

Firms are innovative because they want to maximize profits. As a result they are constantly looking for new ways and opportunities to raise sales and reduce the costs of production (Greenhalgh and Rogers 2010). Consequently, researchers measure innovative output as the

9

success of firms. However, firm success can come from other factors than innovation, hence these variables are not perfect measures of innovation (Rogers 1998).

An analysis of Community Innovation Survey (CIS) data in the Netherlands shows that innovative firms usually perform better in terms of total sales, employment growth, and productivity compared with non-innovative firms (Klomp and Van Leeuwen 2001). Charles, Leif, and Maureen (2001) focus on how innovation affects firm performance and conclude that innovation creates productivity growth, even if capital productivity is mostly affected by product innovation and labor productivity by process innovation.

Regional Income

Innovation activity has the power to shape the relative economic development of a region. This is the traditional view in economics; innovation enhances the competitiveness of firms, which in their turn create economic development as they pay higher wages to their employees and create greater demand in the economy. These claims regarding the positive relationship between innovation and economic success are also supported by empirical data (Oughton, Landabaso, and Morgan 2002; Porter 1990).

3. Data and Variables

Based on the literature review mentioned above, the 44 variables included in the factor analysis are presented together with data sources in Table 1. All variables are in their level form with no mathematical transformation.

Table 1 – List of Variables Included in the Factor Analysis

Variables Source

Human Capital

Day population*

Statistics Sweden Post-secondary education less than three years

Post-secondary education at least three years Number of Ph.D. degrees

Day population with a high education in science or technology R&D staff Employment in KIBS Municipal Income Total income Statistics Sweden Income per capita

Firm Activities

High-tech manufacturing firms*

Statistics Sweden Number of firms

New firm formation Firm exit

Mean establishment size of firms* Own calculation

Firm Performance

Growth in average wages

Statistics Sweden Growth in average net sales

Growth in average value added Growth in average gross investments

Growth in average operating profit Growth in average employment

Reorganizations

Accessibility

Accessibility to educated labor force Accessibility to producing firms

Own calculations Accessibility to KIBS

Accessibility to gross regional product Accessibility to universities

10 Accessibility to customers

Accessibility to university R&D investments Accessibility to firm R&D investments

Accessibility to airports Accessibility to harbors Accessibility to imports Commuting Externalities HHI*

Statistics Sweden & Own calculation Inverse HHI* Related variety* Unrelated variety* Population density Diversity* Firm density Intellectual Property

Patent applications The Swedish Patent and Registration Office

Granted patents

Non-Innovation

Unemployment The Swedish Public Employment Service

The Swedish National Council for Crime Prevention Crime

* Notes:

Day population comprises individuals who work in the municipality. Almost one third of the

Swedish labor force commutes across municipality borders for work reasons (Håkansson 2010). What is important for innovation are people who work in the municipality, and in order to take such issues into consideration we include day population rather than individuals who live there.

High-technology manufacturing firms include (i) pharmaceuticals, (ii) office, accounting, and

computing machinery, (iii) radio, TV, and communications equipment, (iv) medical, precision, and optical instruments, (v) aircraft and spacecraft (OECD 2007). KIBS include (i) computer and related activities, (ii) research and development, (iii) legal, technical, and advertising activities (Schricke, Zenker, and Stahlecker 2012).

Mean establishment size is a measure of the proportion between the number of employees in

the municipality and the number of firms.

Related variety (RV) and unrelated variety (UV) are calculated as shown in Frenken, Van Oort,

and Verburg (2007). RV is the weighted sum of 5-digit levels within each two-digit group which measures variety within sectors that comes from regional knowledge spillovers. The underlying idea is that innovation comes from the recombination of existing knowledge. Frenken, Van Oort, and Verburg (2007), argue that this is the best estimate of Jacobs externalities. UV measures the variety as a portfolio, i.e., risk spreading. For example, if an unexpected shock in a sector occurs, the regional economy as a whole will not be disturbed by this portfolio diversification effect.

The Herfindahl-Hirschman Index (HHI) is a measure of concentration. It ranges from many small firms (value close to zero) to a single monopolistic producer (value of one). A high value means that employment is concentrated in only a few sectors while a lower one shows an even distribution of employees between sectors and hence more diversification (Essletzbichler 2007). The inverse of HHI can be seen as a measure of diversity (Henderson, Kuncoro, and Turner 1995).

11

Diversity is measured by the total number of different firms on a five-level NACE industry

code.

4. Factor Analysis

It seems unreasonable that the economic space of innovation should be generated by a huge number of unrelated and independent yet relevant economic factors. Rather, one may expect that a few factors exist that determine most of the unique variation in variables of innovation. In case one attempts to single out a few specific observable variables, say 𝐱𝐱 = {𝑒𝑒1, … , 𝑒𝑒𝑟𝑟}, that ‘explain’ or ‘capture’ the essentials of innovation, one immediately runs into trouble. For example, by what criteria should one select {𝑒𝑒1, … , 𝑒𝑒𝑟𝑟}, and in what sense is this set of variables more representative than an alternative set of variables 𝐱𝐱′= {𝑒𝑒1′, … 𝑒𝑒𝑟𝑟′}? Moreover, the variables in 𝐱𝐱 will almost surely be correlated with those in 𝐱𝐱′, and the question of how to distinguish the two sets, and hence their economic implications, arises. Considering the fact that the economic literature acknowledges hundreds of elements of direct relevance to innovation, one might ask if there are any common innovation factors, say 𝝋𝝋 = {𝜑𝜑1, … , 𝜑𝜑𝑘𝑘}, 𝑘𝑘 ≪ 𝑟𝑟, that determine the essence of the information contained in {𝑒𝑒1, … , 𝑒𝑒𝑟𝑟}, {𝑒𝑒1′, … 𝑒𝑒𝑟𝑟′} , or in any other reasonably identified set of innovation variables. Put differently, there should exist a set of factors 𝛅𝛅 such that 𝐱𝐱 = 𝛗𝛗 + 𝛅𝛅 and 𝐱𝐱′= 𝛗𝛗 + 𝛅𝛅′ , where 𝛅𝛅 and 𝛅𝛅′ are merely noise terms containing little or no relevant information. This is certainly one (but not necessarily the only) way of explaining the overlapping amount of information in 𝐱𝐱 and 𝐱𝐱′. In fact, if indeed 𝑘𝑘 ≪ 𝑒𝑒, then there will be not only an intricate decision on how to choose between 𝐱𝐱, 𝐱𝐱′′, 𝐱𝐱′′′, etc., but also a redundancy within any choice of 𝐱𝐱. From this perspective, one may prefer to use a proxy of φ for the analysis. To make the idea more specific, we express our index in terms of a fixed-dimension factor model described by

𝐗𝐗i− 𝛍𝛍 = 𝐋𝐋𝐋𝐋𝐋𝐋′𝐅𝐅𝐢𝐢+ 𝛆𝛆𝐢𝐢, (6)

where 𝑖𝑖 = 1, … , 𝑛𝑛 , 𝐗𝐗𝑖𝑖: 𝑒𝑒 × 1 is a vector of observations, 𝛍𝛍 = 𝐸𝐸[𝑿𝑿𝑖𝑖], 𝐋𝐋: 𝑒𝑒× 𝑘𝑘 a matrix of factor loadings, 𝐅𝐅𝑖𝑖: 𝑘𝑘× 1 a vector of random factors, 𝐋𝐋: 𝑒𝑒× 𝑘𝑘 an orthonormal matrix, and ε: 𝑒𝑒× 1 a random vector of idiosyncratic error terms.

The dimensions of the data used in this paper are determined by 𝑒𝑒 = 60, 𝑘𝑘 = 4 and 𝑛𝑛 = 293. Although it is theoretically possible to allow for correlations of the factors in (6), we will constrain them to be orthogonal (i.e., 𝐋𝐋′𝐋𝐋 = 𝐈𝐈) since one of the objectives of the paper is to design a multidimensional index with clearly separable components. It should also be mentioned that although data are available for a number of years, there is no justification for pooling the data into a single model, because here the entire population is included and hence parameter imprecision due to sampling variance is not a concern. Furthermore, there are no obvious parameterizations that incorporate temporal variations in a natural way in the factor model. Hence we will here restrict ourselves to a single year (cross-section data), 2004.

We will conduct an unrestricted factor analysis in two stages. First, a regular principal component analysis (PCA) will be conducted as a preliminary investigation of the data and for determining the number of factors to specify. Second, when the number of factors has been specified, a rotated factor analysis is conducted to identify (label) the factors. We set 𝐋𝐋 = �ℓ𝑖𝑖𝑖𝑖� = Λ�Γ , where 𝚲𝚲� is the matrix of unrotated sample loadings and Γ is chosen to minimize

the expression ∑𝑘𝑘=1𝑘𝑘 ∑ �ℓ𝑖𝑖𝑝𝑝 𝑖𝑖𝑘𝑘2 − 𝑒𝑒−1𝑑𝑑𝑘𝑘�2, where 𝑑𝑑𝑘𝑘= ∑𝑝𝑝𝑖𝑖=1ℓ𝑖𝑖𝑘𝑘2 , 𝑘𝑘 = 1, … 𝑘𝑘.(Anderson, 2003). Our factor model is then defined as

12

𝐗𝐗i− 𝛍𝛍 = 𝐋𝐋𝐋𝐋′(𝐋𝐋𝐅𝐅𝐢𝐢) + ε𝐢𝐢 = 𝐋𝐋𝐋𝐋′𝐅𝐅𝐢𝐢∗+ ε𝐢𝐢, E[ε𝐢𝐢ε𝐢𝐢′] = 𝚿𝚿, 𝑖𝑖 = 1, … , 𝑛𝑛, (7)

where 𝐅𝐅i∗ = 𝐋𝐋𝐅𝐅i is defined above. The PCA has also included a robustness analysis (outlier detection, etc.). No serious anomalies were found and further details of this analysis are omitted from the paper. The factor scores, representing the innovation index, are obtained by using Bartlett’s estimate (Anderson 2003) defined by

𝐟𝐟̂i = �𝐋𝐋̂𝛙𝛙�𝐋𝐋��′ −𝟏𝟏𝐋𝐋�𝛙𝛙�′ −𝟏𝟏(𝐱𝐱i− 𝛍𝛍�x), (8)

where 𝐋𝐋̂, 𝚿𝚿� , and 𝛍𝛍� are the maximum likelihood estimates of 𝐋𝐋, 𝚿𝚿, and 𝛍𝛍 respectively (Anderson 2003).

5. Findings and Discussion

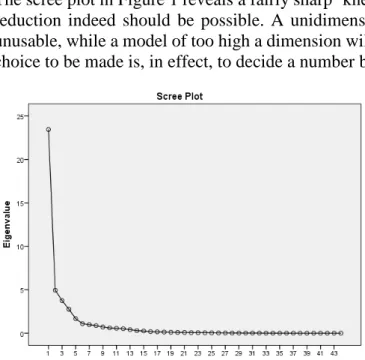

The scree plot in Figure 1 reveals a fairly sharp ‘knee’, indicating that a meaningful dimension reduction indeed should be possible. A unidimensional model is already ruled out as being unusable, while a model of too high a dimension will not allow for a simple interpretation. The choice to be made is, in effect, to decide a number between two and five factors to extract.

Figure 1 – Scree Plot

According to Table 2, it is seen that the first four factors together extract 79 percent of the total variation whereas including further components does not seem meaningful (a five-factor model only contributed with an additional 3 percent of the variance extracted). In the factor analysis a Varimax rotation of the factor space (Anderson 2003) was used on the four factors, meaning that they are constrained to be orthogonal. This restriction has the advantage of providing a simpler interpretation of the factors and also avoids the problem of multicollinearity in case they are to be used as predictors in a regression model or other subsequent analyses. The outcome, in terms of the loadings, is also presented in Table 2.

Table 2 – Total Variance Explained

13 T ot al P er cen ta g e o f var ianc e C u m u la tiv e p er cen ta g e T ot al P er cen ta g e o f var ianc e C u m u la tiv e p er cen ta g e T ot al P er cen ta g e o f var ianc e C u m u la tiv e p er cen ta g e 1 23.44 53.28 53.28 23.44 53.28 53.28 16.95 38.53 38.53 2 4.94 11.24 64.52 4.94 11.24 64.52 9.36 21.28 59.81 3 3.75 8.52 73.04 3.75 8.52 73.04 4.54 10.32 70.12 4 2.76 6.26 79.30 2.76 6.26 79.30 4.04 9.18 79.30 The factor loadings from the rotated factor analyses can be found in Table A1 in the Appendix. The four factors in the model, and hence our index, are identified as follows:

Size

The variables belonging to this factor merely reflect population size. It is, naturally, the factor that explains most of the variance in the data (around 39 percent). Although not of primary relevance, the size itself is sometimes considered an important factor in innovation. This is because larger regions are able to attract more human capital and firms. Firms will see an opportunity to establish there following the logic of the home market effect, which argues that larger regions are assumed to attract a more than proportional share of the firms to its characterizing sector in order to achieve economies of scale. This would increase production as well as job opportunities. In turn, more human capital would be more attracted to moving into those areas and as a result, the education variables that target human capital levels are in this group (Krugman 1980). Population variables, wage levels, and number of patent applications fall into this category. Firm startups are also part of this component, confirming the issue of attractiveness. A large municipality will attract more new firms in the market as they see the high increase for different goods. Apart from the size factor’s own contribution to innovations, it serves as a control variable in the sense that the remaining factors are orthogonal to size.

Accessibility

The variables belonging to the second component involve accessibility measures. The local market is not always the only one of importance for face-to-face contacts and knowledge spillovers. Due to improvements in infrastructure, people commute daily. In order to take the movements not only of workers but also of goods and information into consideration, some measure of proximity needs to be used. Naturally, interaction between firms in two different municipalities is most probably weaker than one within the municipality due to the distance (Rosenthal and Strange 2003) but may still be very important for the innovative power of firms. This is the reason why a total accessibility measure is calculated to account for the possibility that knowledge spillovers happen across municipalities. Close proximity to a number of actors is argued to be important for incentives to innovate and that is exactly what this factor captures. Population density and commuters outside the municipality are also parts of this factor.

Agglomeration

The third factor includes variables regarding agglomeration, which measures different sources of knowledge spillovers. Empirical research has not yet come to a unanimous result regarding these different sources and still keeps arguing about the importance of each and every one of them. As different measures for all these externalities were included in the factor analysis, it is important to notice that all of them fall under the third component. This can be an indication that one cannot really choose between them, and a municipality should be able to somehow

14

combine all of them for innovation to be successful. Besides the different market structures, this factor also includes accessibility to harbors and airports. Even if it might look surprising at a first glance, we argue that accessibility to harbors and airports is directly connected with firm location decisions instead of enabling innovation directly. This might be the reason why these two accessibility measures end up in this factor.

Firm Performance

The fourth component comprises firm performance variables. The variables of this group include output elements such as mean firm turnovers, productivity, costs, or employment. Furthermore, when firms have made any type of innovations, they should increase their productivity levels and be able to employ even more workers by further expansion. Hence, innovative propensity does not only positively affect firms but also the whole municipality. If other firms see that a specific municipality is good in innovations and firms there tend to grow, they would want to locate there or in proximity to that area. Human capital would also be tempted to move to this region by improving the municipality’s propensity to innovate even more. To sum up, as firm-level innovation plays a crucial role in the whole area’s ability to innovate and grow, a factor that takes this into consideration is of great importance.

5.1 Swedish municipalities on the multivariate index

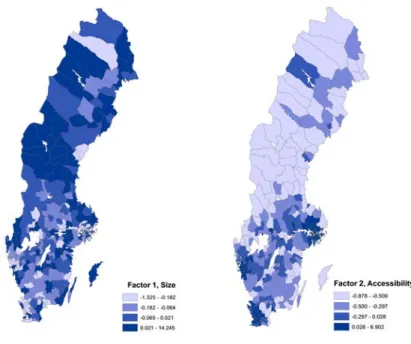

Figures 2–5 show how the Swedish municipalities are doing on the four dimensions of the innovation index. As expected, the four maps are rather different from one another, the factors being orthogonal and hence uncorrelated to each other.

The municipalities which come on top of the first factor are Stockholm, Gothenburg, and Uppsala, which in terms of population are among the largest municipalities in Sweden. But the size factor of innovations is also strongly dependent on university culture, and it is seen from Figure 2 that the historically strong university cities (Uppsala, Lund) assign high index scores on this factor. Expectedly, the physically large northern municipalities also achieve high values in the size dimension of innovation. As for the bottom values in the list (Staffanstorp, Burlöv, Sundbyberg, and others), they are not the smallest municipalities per se, but are close to large cities, suggesting that highly educated individuals might work there, leaving the smaller municipalities rather behind.

Next, having projected the size factor off the other dimensions, we may proceed to factor 2, which represents the first ‘conceptual’ innovation factor. Figure 3 shows that the accessibility factor is in general higher in the southern part of Sweden. Not surprisingly, the municipalities with the highest accessibility are those in close proximity to Stockholm (Solna, Sundbyberg, Danderyd, and others). Even if some of the municipalities have low scores on factor 1, their accessibility to a large market creates much opportunity for their innovation potential. The units receiving the lowest scores on the accessibility axis are those geographically distant from the larger markets and lacking well-developed infrastructure.

15

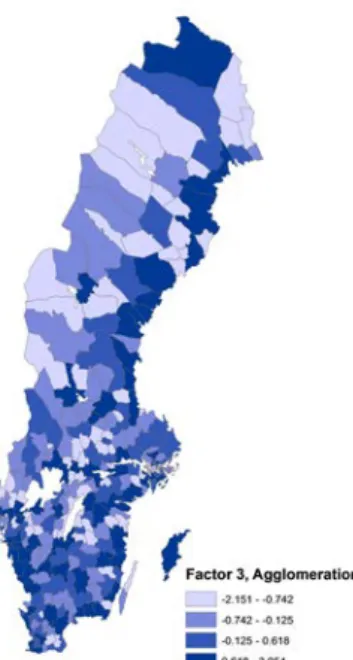

Figure 2 – Size Figure 3 – Accessibility

Proceeding to the next dimension, agglomeration, Figure 4 also shows a clear pattern. The top three municipalities on this factor (Helsingborg, Västerås, and Halmstad) are located next to cargo ports, which makes itP much easier for firms located there to trade internationally. In fact, many of the municipalities with high scores on agglomeration seem to be located either on the coast or along canals and river systems (Göta canal, etc). These are areas that were the first ones populated since medieval times, which reveals an interesting persistence in agglomeration. The bottom municipalities on this axis are those populated relatively lately and also rather distant from large markets.

When moving on to the fourth dimension of the index, firm performance, the reasons for municipalities to rank highly on the scores are less obvious. This is to some extent a consequence of the relatively small value of the eigenvalue corresponding to this factor. While this factor is noisier than the preceding three ones, it yet forms a clearly distinguished factor, which is largely a measure of growth (Table A1, Appendix). Municipalities achieving high scores on this factor are mainly those that started to grow relatively recently whereas those with low scores are those that have remained rather static in their economic and entrepreneurial development.

16

Figure 4 – Agglomeration Figure 5 – Firm Performance

6. Summary

Empirical economic research involving innovation will in one way or another require the use of some specific observable variable(s) argued to represent innovation. The problem, however, is that there is no variable called “innovation”. Researchers will necessarily have to use proxy variables and hope that these really represent innovation in a relevant manner. In this paper we tackle this ambiguity by proposing an index representing innovation. Due to the complexity of the phenomenon of innovation, we argue that unidimensional measures cannot adequately capture the essentials of innovation. Moreover, the common treatment of including several innovation variables in, e.g., regression and other analyses faces the problem of intercorrelation, in the sense that innovation variables contain overlapping information. Interpretation of marginal effects and descriptive statistics then becomes problematic. There is, as argued in this paper, a natural treatment of the issues of which specific innovation variables to include and how to handle intercorrelation. By applying a common factor analysis we propose a four-dimensional index of innovation. An empirical application demonstrating the index is presented. Municipality level data are used since this allows for including regional aspects of innovation. Although Swedish data are used in this paper, the index can be applied in a similar way to any region or country. The four dimensions, or axes, of the proposed index are the following:

(i) The first factor includes variables related to the size of a municipality. For example, large municipalities will have more human capital, more firms, and more patent applications. This factor is therefore merely meant to control for size, and so the rest of the components may be thought of as the ‘real effect’.

(ii) The second component is accessibility. In order to take into consideration knowledge spillovers that happen beyond the municipality border, this paper uses accessibility, a distance decay measure. In that way, potential interactions for innovation that may occur between actors across municipalities as well as potential movements of people, goods, and information are considered.

17

(iii) The third factor regards agglomeration. The variables in this category enable the spread of knowledge through different mechanisms and therefore allow for innovation to happen

(iv) The last component is firm performance. It aims to capture the part of innovation that has to do with firms. If a municipality has many innovation firms, it will have more chances to grow and as well be very attractive for new startups.

The four axes of innovation can then be used to, e.g., be included in development of theoretical models or in spatial and/or temporal econometric analyses. In this paper, we apply the index in a descriptive analysis comparing and contrasting innovation across municipalities presented in maps.

The proposed index has been labelled as an ongoing project (“towards a multivariate innovation index”) rather than as a fixed, final measure cut in stone. Although the multivariate index is by construction robust to the specific selection of variables being used to calculate it, further refinements of the index could involve addition of further variables to the analysis, such as, e.g., trademark and copyright applications, new products which enter the market, proxies for technological development, new publications in scientific journals, etc. Furthermore, we have designed the index to have orthogonal axes, i.e., the marginal factors describing innovation are uncorrelated by construction. While this property has several advantages, using oblique axes could offer a more flexible index at the cost of being more complicated mathematically. We leave these matters to future research.

References

Acs, Zoltan J. 2002. Innovation and the Growth of Cities. Cheltenham, UK: 'Edward Elgar Publishing, Inc.'.

Acs, Zoltan J, and David B Audretsch. 1990. Innovation and Small Firms. Cambridge, CA: Mit Press.

Anderson, Theodore W. 2003. An Introduction to Multivariate Statistical Analysis. Edited by Wiley Series in Probability and Statistics. 3 ed. New York: Wiley.

Andersson, Martin, and Olof Ejermo. 2005. "How Does Accessibility to Knowledge Sources Affect the Innovativeness of Corporations?—Evidence from Sweden." The Annals of

Regional Science 39 (4):741-65.

Andersson, Martin, and Charlie Karlsson. 2004. "The Role of Accessibility for the Performance of Regional Innovation Systems." In Knowledge Spillovers and Knowledge

Management, edited by Charlie Karlsson, Per Flensburg and Sven Åke Hörte, 283.

Asheim, Bjørn T, and Arne Isaksen. 2002. "Regional Innovation Systems: The Integration of Local ‘Sticky’ and Global ‘Ubiquitous’ Knowledge." The Journal of Technology

Transfer 27 (1):77-86.

Asheim, Bjørn T., and Meric S. Gertler. 2005. "The Geography of Innovation." In The Oxford

handbook of innovation, edited by Jan Fagerberg, David C. Mowery and Richard R.

Nelson, 291-317. New York: Oxford University Press, Inc.

Audretsch, David B. 1998. "Agglomeration and the Location of Innovative Activity." Oxford

Review of Economic Policy 14 (2):18-29.

Audretsch, David B, and Marco Vivarelli. 1996. "Firms Size and R&D Spillovers: Evidence from Italy." Small Business Economics 8 (3):249-58.

Audretsch, David B., and Maryann P. Feldman. 2006. "Knowledge Spillovers and the Geography of Innovation." In Handbook of Regional and Urban Economics, edited by J Vernon Henderson and Jacques-Francois Thisse. North Holland.

18

Aydalot, Philippe, and David Keeble. 1988. High Technology Industry and Innovative

Environments: the European Experience. London: Routledge.

Birkhaeuser, Dean, Robert E. Evenson, and Gershon Feder. 1991. "The Economic Impact of Agricultural Extension: A Review." Economic Development and Cultural Change 39 (3):607-50.

Buesa, Mikel, Joost Heijs, Mónica Martínez Pellitero, and Thomas Baumert. 2006. "Regional Systems of Innovation and the Knowledge Production Function: the Spanish Case."

Technovation 26 (4):463-72.

Cantwell, John, and Simona Iammarino. 2005. Multinational Corporations and European

Regional Systems of Innovation. London: Routledge.

Capasso, Salvatore. 2005. "Crime, Inequality and Economic Growth." In Innovation,

Unemployment, and Policy in the Theories of Growth and Distribution, edited by Neri

Salvadori, Renato Balducci and Publishing Edward Elgar, 168-87. Cheltenham, U.K. Northampton, MA: Edward Elgar.

Carayannis, Elias G, and Mike Provance. 2008. "Measuring Firm Innovativeness: Towards a Composite Innovation Index Built on Firm Innovative Posture, Propensity and Performance Attributes." International Journal of Innovation and Regional

Development 1 (1):90-107.

Charles, Edquist, Hommen Leif, and McKelvey Maureen. 2001. Product Innovations and

Employment. Innovation and Employment Process versus Product Innovation.

Cheltenham, UK: Edward Elgar Publishing, Inc.

Coe, David T, and Elhanan Helpman. 1995. "International R&D Spillovers." European

Economic Review 39 (5):859-87.

Cohen, Wesley M, and Steven Klepper. 1996. "A Reprise of Size and R&D." The Economic

Journal 106 (437):925-51.

Cooke, Philip, Martin Heidenreich, and Hans-Joachim Braczyk. 2004. Regional Systems of

Innovation: The role of Governance in a Globalized World. London: Routledge.

Crevoisier, Olivier. 2004. "The Innovative Milieus Approach: Toward a Territorialized Understanding of the Economy?" Economic Geography 80 (4):367-79.

De Groot, Henri L.F, Jacques Poot, and Martijn J Smit. 2009. "Agglomeration Externalities, Innovation and Regional Growth: Theoretical Perspectives and Meta-Analysis." In

Handbook of regional growth and development theories, edited by Roberta Capello and

Peter Nijkamp, 256-81. Edward Elgar Publishing.

Decarolis, Donna Marie, and David L. Deeds. 1999. "The Impact of Stocks and Flows of Organizational Knowledge on Firm Performance: An Empirical Investigation of the Biotechnology Industry." Strategic Management Journal 20 (10):953-68.

Doloreux, David, and Saeed Parto. 2005. "Regional Innovation Systems: Current Discourse and Unresolved Issues." Technology in Society 27 (2):133-53.

Edquist, Charles, and Björn Johnson. 1997. "Institutions and Organizations in Systems of Innovation." In Systems of Innovation. Technologies, Institutions and Organizations., edited by Charles Edquist, 41-63. London: Printer.

Essletzbichler, Jürgen. 2007. "Diversity, Stability and Regional Growth in the United States, 1975–2002." In Applied evolutionary economics and economic geography, edited by Koen Frenken, 203 Cheltenham, Northampton: Edward Elgar Publishing Limited. Eurostat. 1996. "The Regional Dimension of R&D and Innovation Statistics." In.

Louxembourg: EU Commission.

Evangelista, Rinaldo, Simona Iammarino, Valeria Mastrostefano, and Alberto Silvani. 2001. "Measuring the Regional Dimension of Innovation. Lessons From the Italian Innovation Survey." Technovation 21 (11):733-45.

19

Fagerberg, Jan, Bart Verspagen, and Marjolein Caniëls. 1997. "Technology, Growth and Unemployment across European Regions." Regional Studies 31 (5):457-66.

Faggian, Alessandra, and Philip McCann. 2006. "Human Capital Flows and Regional Knowledge Assets: a Simultaneous Equation Approach." Oxford Economic Papers 58 (3):475-500.

Feldman, Maryann P. 1994. The Geography of Innovation. Dordrecht: Kluwer Academic. Feldman, Maryann P., and Richard Florida. 1994. "The Geographic Sources of Innovation:

Technological Infrastructure and Product Innovation in the United States." Annals of

the Association of American Geographers 84 (2):210-29.

Feldmann, Maryann P. 2000. "Location and Innovation: the New Economic Geography of Innovation, Spillovers, and Agglomeration." In The Oxford handbook of economic

geography, edited by Gordon L. Clark, Maryann P. Feldman and Meric S. Gertler,

373-94. New York: Oxford University Press.

Florida, Richard, Charlotta Mellander, and Kevin Stolarick. 2008. "Inside the Black Box of Regional Development—Human Capital, the Creative Class and Tolerance." Journal

of Economic Geography 8 (5):615-49.

Frenken, Koen, Frank Van Oort, and Thijs Verburg. 2007. "Related Variety, Unrelated Variety and Regional Economic Growth." Regional Studies 41 (5):685-97.

Fritsch, Michael, and Pamela Mueller. 2004. "Effects of New Business Formation on Regional Development over Time." Regional Studies 38 (8):961-75.

Fujita, Masahisa, and Jacques-Francois Thisse. 2002. Economics of Agglomeration: Cities,

Industrial Locations, and Regional Growth. Cambridge: Cambridge University Press,.

Gertler, Meric S. 2003. "Tacit Knowledge and the Economic Geography of Context, or The Undefinable Tacitness of Being (There)." Journal of Economic Geography 3 (1):75-99.

Glaeser, Edward L, Hedi D Kallal, Jose A Scheinkman, and Andrei Shleifer. 1992. "Growth in Cities." Journal of Political Economy:1126–52.

Greenhalgh, Christine, and Mark Rogers. 2010. "The Nature and Importance of Innovation." In

Innovation, Intellectual Property, and Economic Growth, edited by Christine

Greenhalgh and Mark Rogers. Princeton University Press.

Griliches, Zvi. 1979. "Issues in Assessing the Contribution of Research and Development to Productivity Growth." The Bell Journal of Economics 10 (1):92-116.

———. 1990. "Patent Statistics as Economic Indicators: a Survey." Journal of Economic

Literature 4:1661–707.

Gråsjö, Urban, and Olof Ejermo. 2008. "The Effects of R&D on Regional Invention and Innovation." Working Paper, Centre for Innovation, Research and Competence in the

Learning Economy (CIRCLE), Lund University, Lund.

Hagedoorn, John, and Myriam Cloodt. 2003. "Measuring Innovative Performance: Is There an Advantage in Using Multiple Indicators?" Research Policy 32 (8):1365-79.

Henderson, Vernon, Ari Kuncoro, and Matt Turner. 1995. "Industrial Development in Cities."

Journal of Political Economy 103 (5):1067-90.

Hollanders, Hugo, Nordine Es-Sadki, Bianca Buligescu, Lorena Leon Rivera, Elina Griniece, and Laura Roman. 2014. "Innovation Union Scoreboard." In. Belgium: European Commission.

Hollenstein, Heinz. 1996. "A Composite Indicator of a Firm's Innovativeness. An Empirical Analysis Based on Survey Data for Swiss Manufacturing." Research Policy 25 (4):633-45.

———. 2003. "Innovation Modes in the Swiss Service Sector: a Cluster Analysis Based on Firm-Level Data." Research Policy 32 (5):845-63.

20

Iammarino, Simona, and Philip McCann. 2006. "The Structure and Evolution of Industrial Clusters: Transactions, Technology and Knowledge Spillovers." Research Policy 35 (7):1018-36.

Jacobs, Jane. 1969. The Economy of Cities New York: Random House, Inc.

Jaffe, Adam B. 1986. "Technological Opportunity and Spillovers of R&D: Evidence From Firms' Patents, Profits and Market Value." American Economic Review 76:984-1001. Jaffe, Adam B., Manuel Trajtenberg, and Rebecca Henderson. 1993. "Geographic Localization

of Knowledge Spillovers as Evidenced by Patent Citations." The Quarterly Journal of

Economics 108 (3):577-98.

Johansson, Börje, and Johan Klaesson. 2001. "Förhandsanalys av Förändringar i Transport-och Bebyggelsesystem." JIBS, Jönköping.

Karlsson, Charlie, and Sierdjan Koster. 2010. "New Firm Formation and Economic Development in a Globalising Economy." CESIS Electronic Working Paper Series. Kleinknecht, Alfred, and Henk Jan Reinders. 2012. "How Good are Patents as Innovation

Indicators? Evidence from German CIS Data." In Innovation and Growth: From R&D

Strategies of Innovating Firms to Economy-Wide Technological Change., edited by

Martin Andersson, Börje Johannsson, Charlie Karlsson and Hans Lööf, 115-28. Oxford: Oxford University Press.

Kline, Stephen J, and Nathan Rosenberg. 1986. "An Overview of Innovation." In The positive

sum strategy: Harnessing technology for economic growth, edited by Ralph Landau and

Nathan Rosenberg, 275-307. Washington, D.C: National Academy Press.

Klomp, Luuk, and George Van Leeuwen. 2001. "Linking Innovation and Firm Performance: A New Approach." International Journal of the Economics of Business 8 (3):343-64. Krugman, Paul. 1980. "Scale Economies, Product Differentiation, and the Pattern of Trade."

The American Economic Review 70 (5):950-9.

———. 1991. Geography and Trade Cambridge, MA: MIT Press.

Liu, Xiaohui, and Trevor Buck. 2007. "Innovation Performance and Channels for International Technology Spillovers: Evidence from Chinese High-Tech Industries." Research

Policy 36 (3):355-66.

Lucas, Robert E. Jr. 1988. "On the Mechanics of Economic Development." Journal of

Monetary Economics 22 (1):3-42.

Lundvall, Bengt-Åke, and Susana Borrás. 1997. "The Globalising Learning Economy: Implications for Innovation Policy." In DG XII, Commission of the European Union. Makkonen, Teemu, and Robert P. Have. 2012. "Benchmarking Regional Innovative

Performance: Composite Measures and Direct Innovation Counts." Scientometrics 94 (1):247-62.

Malmberg, Anders, and Peter Maskell. 1997. "Towards an Explanation of Regional Specialization and Industry Agglomeration." European Planning Studies 5 (1):25-41. ———. 2002. "The Elusive Concept of Localization Economies: Towards a Knowledge-Based

Theory of Spatial Clustering." Environment and Planning A 34 (3):429-49. Marshall, Alfred. 1890. Principles of Economics. Vol. 1. London: MacMillan.

Maskell, Peter, and Anders Malmberg. 1999. "Localised Learning and Industrial Competitiveness." Cambridge Journal of Economics 23 (2):167-85.

Mazzoleni, Roberto, and Richard R. Nelson. 1998. "The Benefits and Costs of Strong Patent Protection: a Contribution to the Current Debate." Research Policy 27 (3):273-84. Navarro, Mikel, Juan José Gibaja, Beñat Bilbao-Osorio, and Ricardo Aguado. 2009. "Patterns

of Innovation in EU-25 Regions: A Typology and Policy Recommendations."

Environment and Planning C: Government and Policy 27 (5):815-40.

OECD. 1992. "Oslo Manual: Proposed Guidelines for Collecting and Interpreting Technological Innovation Data." In. Paris: OECD Publications.

21

———. 2005. "Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data." In. Paris: OECD Publishing.

———. 2007. "OECD Science, Technology and Industry Scoreboard 2007. Innovation and Performance in the Global Economy." In. Paris: OECD Publishing.

Oughton, Christine, Mikel Landabaso, and Kevin Morgan. 2002. "The Regional Innovation Paradox: Innovation Policy and Industrial Policy." The Journal of Technology Transfer 27 (1):97-110.

Pinto, Hugo. 2009. "The Diversity of Innovation in the European Union: Mapping Latent Dimensions and Regional Profiles." European Planning Studies 17 (2):303-26.

Porter, Michael E. 1990. "The Competitive Advantage of Nations." In. New York: Free Press. ———. 1998. Clusters and the New Economics of Competition. Vol. 76: Harvard Business

Review Boston.

Rauch, James E. 1993. "Productivity Gains from Geographic Concentration of Human Capital: Evidence From the Cities." Journal of Urban Economics 34:380-400.

Rodríguez‐Pose, Andrěs. 1999. "Innovation Prone and Innovation Averse Societies: Economic Performance in Europe." Growth and change 30 (1):75-105.

Rogers, Mark. 1998. "The Definition and Measurement of Innovation." Melbourne Institute

Working Paper No. 10/98.

Rosenthal, Stuart S, and William C Strange. 2003. "Geography, Industrial Organization, and Agglomeration." Review of Economics and Statistics 85 (2):377-93.

Saxenian, AnnaLee. 1994. Regional Advantage. Cambridge, MA: Harvard University Press. Schricke, Esther, Andrea Zenker, and Thomas Stahlecker. 2012. "Knowledge-Intensive

(Business) Services in Europe " In. Belgium: European Commission.

Schumpeter, Joseph A. 1934. The Theory of Economic Development: An Inquiry Into Profits,

Capital, Credit, Interest, and the Business Cycle. Vol. 55: Transaction Publishers.

Simmie, James. 2002. "Knowledge Spillovers and Reasons for the Concentration of Innovative SMEs." Urban Studies 39 (5-6):885-902.

Simmie, James, and James Sennett. 1999. "Innovative Clusters: Global or Local Linkages?"

National Institute Economic Review 170 (1):87-98.

Stolarick, Kevin, and Richard Florida. 2006. "Creativity, Connections and Innovation: A Study of Linkages in the Montréal Region." Environment and Planning A 38 (10):1799-817. Tödtling, Franz, and Michaela Trippl. 2005. "One Size Fits All?: Towards a Differentiated

Regional Innovation Policy Approach." Research Policy 34 (8):1203-19.

Van de Ven, Andrew H, Douglas E Polley, Raghu Garud, and Sankaran Venkataraman. 1999.

The Innovation Journey. New York: Oxford University Press.

Zucker, Lynne G., Michael R. Darby, Jonathan Furner, Robert C. Liu, and Hongyan Ma. 2007. "Minerva Unbound: Knowledge Stocks, Knowledge Flows and New Knowledge Production." Research Policy 36 (6):850-63.

22

Appendix 1 – Results from Factor Analysis

Table A1 – Results from Factor Analysis

Rotated Component Matrix

Component

1 2 3 4

Day population 0.937

Post-secondary education less than three years 0.939

Post-secondary education at least three years 0.951

Number of Ph.D. degrees 0.880

Day population with science or technology high education 0.946

R&D staff 0.815

Employment in KIBS 0.954

Municipality income 0.918

Municipality income per capita 0.691

High-tech manufacturing firms 0.882

Number of firms 0.939

New firm formation 0.944

Firm exit 0.945

Mean establishment size 0.523

Growth in average wages 0.970

Growth in average net sales 0.942

Growth in average value added 0.936

Growth in average gross investments 0.376

Growth in average operating profit

Growth in average employment 0.966

Reorganizations 0.939

Accessibility to educated labor force 0.908

Accessibility to producing firms 0.871

Accessibility to KIBS 0.401 0.891

Accessibility to gross regional product 0.927

Accessibility to universities 0.460 0.820

Accessibility to customers 0.897

Accessibility to university R&D 0.439 0.748

Accessibility to firm R&D 0.547 0.740

Accessibility to airport 0.578

Accessibility to harbor 0.532

Accessibility to import value 0.409 0.882

Commuting 0.736 0.571 HHI -0.754 Inverse HHI 0.502 0.711 Related variety 0.718 Unrelated variety 0.412 Population density 0.452 0.772 Diversity 0.365 0.836 Firm density -0.405

Incoming patent applications 0.884

Granted patents 0.858

Unemployment 0.882 0.354