J

Ö N K Ö P I N GI

N T E R N A T I O N A LB

U S I N E S SS

C H O O LJÖNKÖPING UNIVE RSITY

Spin-off Performance

Does the subsidiary perform better on its own?

Bachelor Thesis within Finance Author: Gustav Liedgren

Josefin Olofsson

Sofie Zetterlund

Acknowledgements

The authors of this thesis would like to thank the companies in the sample for participating in this study by providing material. Without the information gath-ered from the prospectuses, the making of this thesis would never have been possible.

Further, the authors would like to express gratitude to the tutor Urban Österlund at JIBS and the opponents in the seminar group for their supervision and support throughout the thesis.

The authors would also like to express deep appreciation to Professor Thomas Holgersson at JIBS for his assistance with the statistical testing conducted in the empirical analysis. Finally, the authors would like to thank to Joakim Fredriksson at Nasdaq OMX who supplying the authors with historical share prices in the cases that these where not available online.

Bachelor thesis within Business Administration

Title: Spin-off performance – Does the subsidiary perform better on its own?

Authors: Gustav Liedgren, Josefin Olofsson, Sofie Zetterlund Tutor: Urban Österlund

Date: 2008-05-30

Subject Terms: Spin-offs, Divestitures, Lex Asea, Financial Performance

______________________________________________________________________ Background: A spin-off is a strategic instrument used to restructure an

or-ganisation and thereby maximize shareholder value. Advocates argue that spin-offs generate improved financial performance for the parent company as well as for the divested unit. Previous studies on the topic have primarily focused on the perspective of the parent company and little attention has been given to the post spin-off performance of the divested unit, in particular on the Swedish market. Consequently this study focuses on the per-formance of divested units of spin-offs performed on the Swed-ish market.

Purpose: The purpose of this study is to compare the financial perform-ance of the divested unit prior versus post the spin-off event in order to find potential performance alterations.

Method: The study is conducted through an inductive approach based on quantitative data. In order to fulfil the purpose, four financial ra-tios are used; Return on Assets, Market-to- book ratio, Sales Growth and Share Price. Subsequently statistical sign-tests are conducted in order to find possible significant alterations in the financial performance.

Results: The statistical tests display unified results in which no statistical significant change in performance post the spin-off event can be found for any performance ratios. However negative tendencies were found for Return on Assets and positive tendencies were found for the variables M/B ratio and Sales Growth. The fourth variable, Sales Growth does not show tendencies in any direc-tion. Similar results are found when classifying the sample into relative size and timing of the spin-off event.

Conclusion: Spin-off units on the Swedish market do not on average perform better as stand alone entities. Vague positive tendencies could however be found on the variables connected to market expecta-tions, and negative tendencies could be found for the variables measuring efficiency and profitability.

Table of Contents

1

Introduction ... 1

1.1 Background ...2 1.2 Problem...2 1.3 Purpose ...3 1.4 Delimitations...4 1.5 Research design...4 1.5.1 Research philosophy...4 1.5.2 Research approach ...4 1.5.3 Quantitative data ...5 1.5.4 Secondary data ...5 1.6 Literature review...52

Theoretical Framework... 7

2.1 Definitions...7 2.1.1 Sell-off ...7 2.1.2 Spin-off ...7 2.2 Lex Asea ...82.3 Principal Agent Theory ...9

2.4 Motives for divestitures...10

2.4.1 General motives for divestitures ...10

2.4.2 Motives for spin-off as divestiture mode ...11

2.4.3 Risks and barriers with divestitures ...12

2.5 Performance Variables ...14

2.5.1 Use of financial ratios ...14

2.5.2 Return on Assets (ROA)...14

2.5.3 Sales Growth...15

2.5.4 Market-to-book ratio (M/B)...15

2.5.5 Share price ...15

2.6 Previous studies ...16

2.6.1 Studies on the parent company...16

2.6.2 Studies on the subsidiary ...17

3

Method... 19

3.1 Sample selection ...19

3.2 Data Collection ...20

3.2.1 Criticism...21

3.3 Technique for analysis...21

3.4 Adjustment of performance variables ...23

3.5 Method evaluation ...23

3.5.1 Reliability ...23

3.5.2 Validity and generalizability ...24

4

Empirical findings and Analysis ... 25

4.1 Motives for spin-off ...25

4.2 Financial Performance prior versus post spin-off ...26

4.2.1 Return on Assets...27

4.2.2 Market-to-book ratio ...28

4.2.4 Share price ...30

4.3 Subclassifications...31

4.3.1 Relative size ...32

4.3.2 Timing...33

4.4 Results compared to previous studies...35

5

Conclusion... 37

5.1 Reflection on the Study ...38

5.2 Suggestions for further research ...39

References ... 40

Appendicies

Appendix 1: Financial performance variables formulas... 43

Appendix 2: Financial data ... 44

Appendix 3: Motives ... 46

Appendix 4: Tables from SPSS; Complete Sample... 47

Appendix 5: Tables from SPSS; Classifications ... 49

Figures

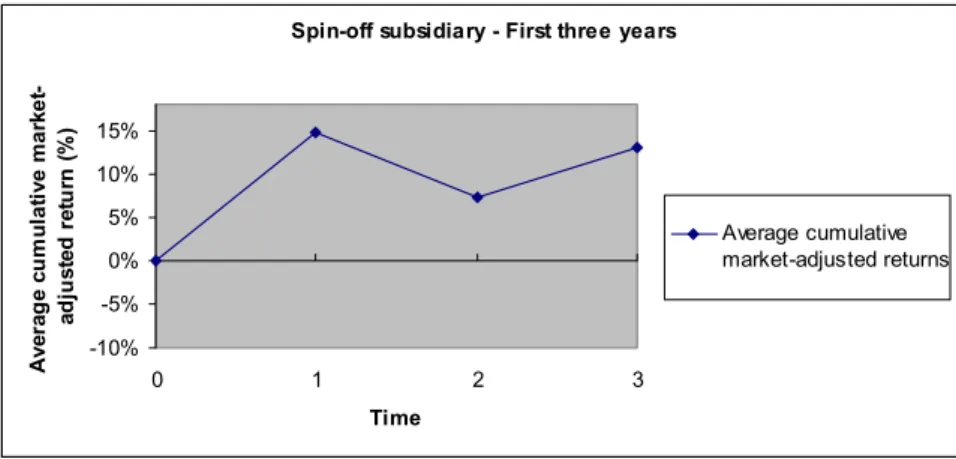

Figure 1: Spin-off structure...8Figure 2: Return on asset graph...28

Figure 3: Sales growth graph ...30

Figure 4: Share price graph ...31

Tables

Table 1 Spin-offs included in the sample ...20Table 2 Motives...25

Table 3 Results – complete sample ...27

Table 4 Subclassifications of the sample ...32

Table 5 Results – subclassification relatively large ...33

Table 6 Results – subclassifcation relatively small...33

Table 7 Results – subclassification 1991-1997 ...34

1 Introduction

“Smart apple farmers routinely saw off dead and weakened branches to keep their trees healthy. Every year, they also cut back a number of vigorous limbs – those that are blocking light from the rest of the tree or otherwise hampering its growth. And, as the growing season progresses, they pick and discard some perfectly good apples, ensuring that the re-maining fruit gets the energy needed to reach its full size and ripeness. Only through such careful, systematic pruning does an orchard pro-duce its highest possible yield. “

(Dranikoff, Koller, Schneider, 2002, p. 75).

The management of a company ultimately has one goal; to maximize the share-holder value (Ross, Westerfield, Jaffe, 2002). The shareshare-holders are the owners of the company and are thus in control of the company. They are undertaking a risk when investing and consequently they want to receive a fair return on their in-vestment. The main task for the management of a company is therefore to make strategic decisions aimed to increase the value of the organization (Ross et al., 2002).

As firms today face increasing pressure due to tougher competition, more de-manding shareholders and employees that are harder to please, they have to find new ways of restructuring its organization. In the last decades, we have seen sig-nificant restructuring of various scopes being performed in firms in order for them to cope with the increasingly competitive world (Bowman, Singh, Useem, Bhadury, 1999; Capron, Mitchell, Swaminathan, 2001). There are several different strategies for restructuring a company including mergers and acquisitions and various forms of divestitures. Studies have however shown that many mergers and acquisitions result in strategic misfits and subsequently lead to divestitures (Capron et al., 2001). In fact, most merger activities add very little value and of-ten fail to reach their objectives (Kay, 1993; The Economist, 2008). Concequently, mergers & acquisitions and other tactics conducted to increase the size of the or-ganization have declined sharply and instead restructuring activities that decrease the size have heaved, particularly the use of divestitures (Comment & Jarrell, 1995; Kay, 1993).

Divestitures are nevertheless still a strategic intsturment that is often overseen by managers (Dranikoff et al., 2002). When divestitures are conducted, they are of-ten performed too late and thus shareholder value can be lost through a depreci-ated exit price. Few corporations today actively consider whether they are adding value to each of their businesses. By doing so they can actually be harming the performance of units that may have the potential to function better as independ-ent independ-entities (Dranikoff et al., 2002).

The notion of divestitures is wide and diverse and there is no one definition to the concept. In fact, it includes all activities where the aim is to decrease the size of the company. The different modes that fall under this label are sell-offs, split-ups and spin-offs as well as various hybrids of these forms.

1.1 Background

In the last decades, the interest for divestitures surged significantly (Gaughan, 1996). Advocates of divestitures argue that the process of divesting units is far more beneficial than engaging in other restructuring strategies. They suggest that organizations ought to divest business units that lack synergies with the parent firm routinely, since that will enable them to focus all efforts on their core com-petence and be more flexible to the prevailing business climate. This is believed to generate improved financial performance and increased shareholder value (Pearson, 1998).

Recently the number of activist investors has increased in Sweden. Christer Gardell from Cevian is a prominent activist investor and advocator of divestitures, who often makes statements in the financial press concerning restructuring pro-cedures that companies should undertake (Svensson, 2007). These type of in-vestment funds specifically put pressure on companies to focus on their core competences and divest business units that lack synergies with their main busi-ness in accordance with the statement above.

One type of divestiture that often receives extra attention is the off. A spin-off takes place when a parent company divests one of its business units and si-multaneously introduces it on the stock exchange. In the spin-off event the shares of the subsidiary are simply transferred to the shareholders of the parent company and thus do not include any transfer of cash nor ownership. Husqvarna, PEAB Industri, and Vostok Nafta Investment are all recent examples of companies that have been spun offin Sweden in the last years in order to cap-ture the benefits of core competence focus.

In an article in Dagens Industri, Adler (2006) stated that companies that where spun off have shown better stock returns than their former parents. Adler further argues that there are several examples that clearly show that subsidiaries perform better as stand-alone entities. Furthermore, in an article in Affärsvärlden Blecher (2006) states that the market tends to underestimate the subsidiary when it is a part of a larger organization. The parent company is thus traded on a discount because the true value of the subsidiary is hidden within the parent company (Blecher, 2006). The performance of the subsidiary after the spin-off event and the question of if it is really performing better as a stand-alone entity is some-thing that has not yet to the authors´ knowledge been studied in the Swedish market. This fact combined with the overall surging interest of divestitures has been the authors´ main motivation for conducting this study.

1.2 Problem

Previous studies within the field of spin-offs have primarily focused on the initial market reaction to the spin-off announcement (Miles & Rosenfeld, 1983; Schipper & Smith, 1983; Eriksson & Ho, 2006). The results of the studies have proven im-mediate positive abnormal returns as a reaction to the announcement. These studies are however primarily focused on the financial performance of the parent firm post the spin-off and little attention has been given to the performance of the divested unit. As a spin-off generates new shares in a newly created company

to the existing shareholders, it should be of equal interest to examine the per-formance of the divested unit post the spin-off.

Although research on the divested unit is limited, there are a few American stud-ies that have focused on the performance of the spin-off unit. These studstud-ies dis-play very conflicting results. The first known study conducted by Woo, Willard, and Daellenbach in 1992, examined spin-offs conducted in the American market between the years of 1975-1986. The results of this study show that the financial performance of the divested units did not improve and was just as likely to de-cline after the spin-off event. Converse results were found in a later study by Desai, Nixon, and Wiggins (1999). In their research the results show some sig-nificant performance improvements for the spin-off subsidiaries in the years fol-lowing the transaction. The lack of research on this problem in Sweden, com-bined with the conflicting results of earlier studies, makes it highly interesting to explore this topic further.

Focus of this study will lie on examining the financial performance of the di-vested units of all spin-offs conducted in Sweden between the years of 1991 and 2004. The study will further attempt to discover if there are any specific factors that can be identified as having an impact on the financial performance of the di-vested unit post the spin-off. These factors will be the relative size of the subsidi-ary to the parent company, and if the year of the spin-off event has any impact on the performance of the spin-off unit. Additionally, the motives behind the spin-off will be examined in order to get an enhanced understanding of why Swedish companies engage in this transaction. The study will examine which motives that are mentioned most frequently and whether or not these motives confirm existing theory.

Based on the problem discussion above the following research questions will be examined:

• What are the main motives that trigger a spin-off on the Swedish mar-ket?

• Does the financial performance of the divested unit improve post the spin-off event?

• Does the relative size of the divested unit in relation to its parent firm have any significant impact on the financial performance post the spin-off event?

• Does the timing of the spin-off event have any significant impact on the financial performance post the spin-off event?

1.3 Purpose

The main purpose of this study is to examine the financial performance of di-vested units post the spin-off event. It also aims to examine the potential impact that relative size and timing of the spin-off event might have on the financial per-formance of the divested units. Furthermore, the study aims to examine which motives that are most frequently mentioned for spin-offs on the Swedish market and if these motives confirm the overall existing theory.

1.4 Delimitations

This study will only consider spin-offs on the Swedish market between the years 1991-2004. The divesting companies have to, at the time of the spin-off, be listed on the Large or MirdCap list on the Stockholm Stock Exchange. Further, all spin-off cases included in the study has to be in accordance with the tax legislation Lex Asea1 which was implemented in 1991.

1.5 Research

design

1.5.1 Research philosophyIn order to fulfil the purpose of this study the authors decided upon a research philosophy and approach. Research philosophy is concerned with the authors’ view of the research process. The philosophy captures the different assumptions in which the researchers view the world and subsequently affects the research design, data collection and analysis of the study. There are primarily three views that dominate the literature; realism interpretivism and positivism (Saunders, Lewis, Thornhill, 2003). Realism is based on the notion that there is an existing reality that is independent of the subjective reality of the research object. Thus the philosophy emphasizes the importance of examining the subjective reality in the context of a broader social reality (Saunders et al., 2003). This philosophy does not capture the authors’ assumptions nor aim for this study since the study does not examine the subjective realities of the sample in a deeper perspective. Researchers who adopt the principles of interpretivism focus on qualitative ob-servations that allows for a deeper understanding of the subjective reality of the research object (Saunders et al., 2003). As the interpretive philosophy merely is a simplification of realism it is also to be discarded for this study. The philosophic view for this study mainly reflects the principles of positivism. The researchers are focused on objective and quantifiable observations that can be statistically analyzed and result in law-like generalizations (Remenyi et al., 1998). The aim of the study is to examine the retrieved data in a statistically and numerical manner, in the search for results that may yield answers about the financial performance of the divested unit post the spin-off event.

1.5.2 Research approach

Research approach refers to the theoretical design of the research. There are two main approaches that may be employed, the deductive approach and the induc-tive approach. The deducinduc-tive approach has a well structured design in which ex-isting theories are examined through hypotheses testing. In contrast, the induc-tive approach is concerned with collecting data and building theories as a result of the data analysis. The inductive approach should be adopted when research-ers seek a deep undresearch-erstanding of the research object and a close undresearch-erstanding of the research context (Saunders et al., 2003). The authors in this study seek to create objective and measurable results that can be statistically analyzed and gen-eralized. In the light of this, the inductive approach may be discarded in favour

1

Lex Asea is a tax legislation regulating spin-offs, for further information see Theorethical Frame-work section 2.2

for the deductive approach. The approach is closely aligned with the selected philosophy and is the most suitable approach to employ to this particular study. In accordance with the deductive outline, theories concerning spin-off perform-ance will be tested and analyzed through hypotheses.

1.5.3 Quantitative data

The research conducted within this study is based upon quantitative data. Quan-titative data refers to all such data that is numerical and that can be quantified to fulfil the purpose of the study and answer the research questions. It can range from simplified counts such as frequency of a particular occurrence to more complex data (Saunders et al., 2003). This quantitative kind of data is subject to quantitative analysis, which in this study takes its form in statistical testing. Other types of quantitative analysis techniques are diagrams, tables and other forms of more complex statistical testing (Saunders et al., 2003). The nature of this study clearly requires quantitative data since financial measures will be compared and the study aims at displaying results of either improving or declining trends in fi-nancial performance. The other type of data that is possible to gather is qualita-tive data, which is non-numerical and non-quantifiable as a contrast to quantita-tive data according to Saunders et al. (2003). In this study the collection of the motives can be seen as qualitative data, but the data is processed in a quantifi-able way using frequencies and ranks.

1.5.4 Secondary data

Secondary data is data that has already been collected for another purpose than to serve as data in this particular study. The most obvious advantage of making use of secondary data is that it is already processed and that it is available. How-ever since the data originally was composed for other intentions it might yield a bit of a distorted picture. The disadvantages of this kind of data will be further explained in the chapter of limitations. Secondary data can include what most companies collect and store to support their operations such as minutes of meet-ings, payroll details, etc (Saunders et al., 2003). In this thesis annual reports for the divested units have been used together with the prospectus for the spin-off. These types of secondary data are the prime sources of information. The annual reports have been collected from Bolagsverket that is a government authority that handles all registrations of new companies in Sweden. Bolagsverket handles all types of changes in registration of existing companies as well as keeping and providing annual reports of all publicly listed companies.

1.6 Literature

review

Reviewing existing literature is essential before writing a research project (Saun-ders et al., 2003). Therefore, the first step in this study was to conduct a literature review on spin-offs to examine what earlier researchers have focused on. The purpose of the literature review was to deepen the authors’ general understand-ing in the field, as well as to identify areas on the topic which where previously unexplored.

Initially, articles from Scientific Journals where gathered using different electronic databases. According to Saunders et al. (2003), journals are a vital source of in-formation for any research. The use of multiple databases was obtained through

searching on Google Scholar, but a significant amount of articles where acquired from JSTOR and ABI Inform. The fact that several databases where included in the search, minimizes the risk that any important scientific articles where missed out. Keywords used were “Spin-off(s)”, “Performance”, and “Divestiture(s)” as well as different combinations of these. The articles were evaluated by reading the abstract to decide whether or not they were relevant and sufficient for this study. The relevant articles were read through, with special emphasis on the method and the results. As a second step, theses from Sweden were collected at

www.uppsatser.se to get a grasp on what had been studied in the Swedish mar-ket before by researchers in the same situation. These theses were found using keywords such as “avknoppning(ar)” and “spin-off(s)”.

When revising the relevant articles and theses, additional articles were found that were referenced to by the authors of the original articles. These articles where also included in the research, and a pattern could often be noticed with some ar-ticles being referred to in several studies. This technique, often referred to as “snow-balling technique” is an effective way in ensuring that no important arti-cles are missed out due to insufficient search technique (Saunders et al., 2003). The literature review felt complete as the authors had a pleasing knowledge in the field and the problem was formulated.

The scientific articles and theses where complemented with different financial text books. Although financial textbooks are often written in a more structured way, they can be very general and do often fail in providing a deeper insight into specific topics. To get a more recent picture on the subject, articles from the Swedish business press were obtained from papers such as Affärsvärlden and Dagens Industri. These newspapers are highly reliable and acknowledged as two of the best financial publications in Sweden.

2 Theoretical

Framework

2.1 Definitions

Divestitures can be said to include all actions that a company is carrying out to downscale and/or downscope (Desai et al., 1999). It is difficult to state an abso-lute definition of the term divestiture since it can be carried out in a number of different ways, and moreover, different authors have their own criteria of the di-vestiture process. Joachimsson and Thorell (1988) have three different criteria for divestitures. They state that the parent company and the divested part to be must divide assets and debts between them, that the new companies that will arise must be independently owned and managed, and that the parent company should be devaluated with the assets and debts that has been transferred to the divested units.

According to Scheutz (1988), divestitures could be described as the sale of one already existing part in a corporation to a third party or that one already existing part within a corporation will become an independent unit. According to Scheutz (1988) there are three different ways that a divestiture can be conducted through; sell-off, leveraged buy-out, and spin-off. As the leveraged buy-out is not neces-sarily only associated with divestitures, we will not discuss this type of divestiture any further.

2.1.1 Sell-off

A sell-off occurs when a unit is being sold in exchange for cash or shares of an-other corporation. The purchasing corporation will now own the asset that is ex-changed through the transaction of cash or shares. The shareholders in the for-mer parent company will be without all control that they forfor-merly had over the divested unit. This can be seen as a reversed merger in which the selling com-pany in general is the active part and the unit that has been divested either be-comes a detached unit or a part of the buying corporation (Scheutz, 1988).

2.1.2 Spin-off

When an organization conducts a spin-off, the divested unit will be introduced on the stock exchange and the unit will independently be available for trade. The shares of the divested unit will be distributed to the current shareholders of the parent company and no transaction of money occurs. According to Schipper and Smith (1986) the most refined form of a spin-off is when these shares are distrib-uted to the shareholders of the parent company on a pro-rata basis. In this event, the structure of the ownership will be maintained as it was before the spin-off but the management team of the parent company will be without any formal control of the divested unit. However, even though the structure of the owner-ship will be maintained in theory Chemmanur et al. (2001) argues that there is a great risk of change to come in the ownership structure. This would happen due to the fact that the shares of the divested unit might not be suitable with the strategies for some of the shareholders portfolios, and thus those shares will be at risk of being sold instantly.

Figure 1: Spin-off structure

Equity carve-out is a category within spin-offs that has a slightly different ap-proach than the earlier defined “refined spin-off”. When conducting an equity carve-out the parent corporation sells a marginal of the subsidiary, often less than 20%, through an initial public offering to buyers on the stock exchange. This is done to facilitate the buyers on the stock exchange to obtain specific parts of the corporation (Ross et al., 2002). When this study refers to a spoff it will not in-clude the equity carve-out type of spin-off.

When a spin-off is performed in the United States, the distribution of shares of the divested unit is tax-free if certain criteria are met, that is until the sharehold-ers sell the stock received on the market (Schipper & Smith, 1983). This has not been the case in Sweden until 1991 when the divestiture of Incentive made by Asea urged a new set of rules that was later named Lex Asea. The implication of Lex Asea will be discussed in more depth in the following section.

2.2 Lex

Asea

Lex Asea is the name of the set of rules that were set into action in 1991 in order to ease the split of Asea. In this particular case Asea was merged with the Swiss company Brown Bovery creating the brand new company ABB, and as a part of this transaction Incentive was divested (Berndtsson, 1991).

Lex Asea considers parent companies, their subsidiaries and the effect of tax when distributing the shares of the subsidiary to the shareholder of the parent company. Lex Asea enables the shareholders to avoid paying income tax at the time of the distribution of shares. The tax on the surplus distributed by the sub-sidiary shares is instead paid when those shares in turn are being sold. This en-ables companies to distribute the subsidiary shares to the owners of the parent company without income tax effects (www.skatteverket.se, 2005).

These set of rules are highly applicable when a company conducts a spin-off, i.e. distributing the shares of the subsidiary to the shareholders of the parent com-pany. However, certain criteria needs to be fulfilled in order for an organization to be able to use Lex Asea, and the criteria are:

• The distribution of the shares in the subsidiary needs to be in relation to the shares possessed in the parent company.

• The shares of the parent company are listed and publicly traded on the market.

• The entire amount of shares of the subsidiary is to be distributed.

• A company in the same company group as the parent company is not go-ing to possess shares in the subsidiary.

• The subsidiary is a Swedish joint stock company or a foreign company • The branch of industry that the subsidiary operates in must have a

busi-ness activity as their main source of income or posses shares of companies that have a business activity as their main source of income. In this par-ticular case business activity is referred to as other business than holdings of cash, securities or similar assets, which are seen as included in the business activity if they are seen as a means to fulfil the objectives and not the objectives in themselves (www.skatteverket.se).

2.3 Principal Agent Theory

The agency problem is a well-known phenomenon and the theory is based upon the dynamic relationship between the management and the shareholders of a company. Jensen (1976) defines this kind of relationship in his study “Theory of the firm: Managerial behaviour, agency costs and ownership structure”. He de-fines it as a contract under which one or more persons, the principal(s), engage another person, the agent(s), to perform some service on their behalf, which in-volves delegating decision-making authority to the agent.

Although managers are employed to run the firm in the best possible manner to maximize shareholder value their objectives are sometimes in conflict with the objectives of the principals (Butler, 2000). The principal can never reassure him-self that the agent will do what benefits the principal the most. When this conflict of interest between agents and principals occurs, we have an agency problem that is generating costs. The shareholders can discourage the managers from act-ing in their own interests by devisact-ing appropriate incentives for managers and/or monitoring their behaviour. Different incentives can be wage, pension schemes, bonuses and other benefits. Monitoring costs can include formal control systems, information collection and budget mechanisms – all of this will be on the ex-pense of the shareholder value and are known as agency costs. Other agency costs are residual losses – the loss of wealth of the shareholders due to divergent behaviour of the managers (Ross, Westerfield & Jaffe 2002).

According to Joachimsson and Thorell (1988) monitoring managers is possible in small and less complex organisations where the number of mangers to monitor is restricted or in those extreme cases where managers and shareholders are the same person. In contrast, more diversified companies with a lot of people in ex-ecutive positions need to decentralize the organisation in order to monitor the managers and keep agency costs at a low level.

Another agency problem is that of asymmetric information between the share-holders and the managers as well as the finance providers. Shareshare-holders and fi-nancial providers do not always have the same kind of direct access to the inter-nal information regarding a company’s plan of investments and long-term strate-gies. Occasions in which information is given to the shareholders can have long

intervals in between them and the management team can also be selective of which data to present to the shareholders. The management team most often also has a different time horizon than the shareholders in terms of decision-making. The most obvious and common example is that managers gives priority to short-term investments since the management teams employment is time limited and bonus systems sometimes benefits short-term profits (Wramsby & Österlund 2004).

Schipper and Smith (1983) suggested that a spin-off would decrease these agency costs substantially due to new information sources by the new publicly traded firm. These information sources include the daily price activity of the divested firm's common stock as well as its separate financial statements and reports and which all increases the transparency. The performance of the spin-off unit would no longer be consolidated with that of other divisions or concealed beneath vari-ous corporate layers (Woo et al., 1992). This makes the monitoring of this unit significantly easier and gives the shareholders more reliable information.

Woo et al. (1992) also suggest that a spin-off would lead to a decrease in agency costs by reducing the monitoring costs, but also by reducing the bonding costs. Bonding costs are those agency costs that are borne by the agents in order to guarantee that their behaviour and actions are in the best interest of the principal. In the case of a spin-off, these costs would be reduced thanks to the fact that di-vision managers - when the subsidiaries are divested from the parent company - do not have to pursue the interests of corporate managers and sector managers that might have a different agenda for the subsidiary.

“To the extent that spin-off eliminates contradictory objectives, provides grater

clarity of purpose and allows managers to focus on external challenges, agents may experience less conflict and constraints in optimising the performance of the division”– Woo et al., 1992 p. 436

2.4 Motives for divestitures

2.4.1 General motives for divestituresThe motives for divestitures are both numerous and diverse. Frequently men-tioned motives are changing corporate strategy or focus, a desire to exit under-performing businesses, a lack of fit, regulatory concerns, and greater access to capital markets (DePamphilis, 2005). Empirical results on the Swedish market shows that the most mentioned motives by the companies themselves were fo-cus, to increase growth prospects, and to decrease information asymmetry (Eriks-son & Ho, 2006). These motives are briefly discussed below.

A divestiture will increase the organization’s focus because of its effects on bu-reaucratic controls. A large firm is difficult and time consuming to control and this leads to high degrees of bureaucracy and controlling costs. A smaller firm is in less need of formal control systems and the degree of bureaucracy is lower, and as a result this can have positive effects on its performance (Desai et al., 1999). The subsidiary can sometimes have restricted growth opportunities be-cause of the relationship with its parent company. This can be bebe-cause a larger company is generally slower in decision-making, has higher administration and coordination costs. If the unit is spun off, it can act more entrepreneurial and thus increase the degree of innovation. A higher degree of innovation should

im-ply higher growth prospects and thus increased performance of the firm (Desai et al., 1999).

Some companies have no, or even negative, synergies between its business units. When synergies exist, the combined parts are worth more together than they would be as stand alone entities, i.e. 2+2=5. When there are negative synergies, this means that the parts are worth more separately than they are within the company’s existing structure, i.e. 4-1=5 (Gaughan, 1996). The management must continuously evaluate their portfolios to asses the synergies that exist between its business units. If no synergies exist, the unit would be more valuable alone or as part of other owners (Pearson, 1998). When two companies merge, that is often because there are significant synergies to be realized and cost savings to be made. Over time, these synergies can erode and if there are little or even no syn-ergies left, the company has to carefully consider whether or not to keep the business unit or to spin it off (Pearson, 1998).

Another argument for divestitures is that the subsidiary fits poorly together with the rest of the parent company. The parent may have other strategic targets than its subsidiary and thus they may experience conflicting goals. It can also be the case that the parent wants to move out of a particular line of business and feels that the subsidiary is mature enough to operate as a stand-alone entity (Gaughan, 1996).

In early divestiture cases, tax was often a motive for the transaction. In the US, spin-offs where long considered as a dividend, and got regulated in 1969 (Schip-per & Smith, 1983). In Sweden, spin-offs initially got regulated in 1991 after Asea’s attempt to spin off Incentive. The implication of this case is that investors now can postpone the taxation on the spun-off part until they sell the securities and realize the capital gain or loss.

2.4.2 Motives for spin-off as divestiture mode

As mentioned above, a spin-off is a pro rata distribution of the shares of a firm’s subsidiary to the existing shareholders of the firm. There is neither a transfer of cash nor ownership from the current shareholders. Spin-offs thus are a unique mode of divestitures since strengthening the balance sheet or paying off debt cannot motivate them, as the case can be with other types of divestitures. The parent company in this case is motivated by increasing the value of its shares by displaying a subsidiary on its own (Blecher, 2006).

A spin-off does also lead to a reduction in information asymmetry between the management and the market. A stock market analyst trying to capture the value of a company with many different business units has to closely determine the in-ter-relationships among them. The market can have a hard time evaluating all synergies between the parent and the unit. Sometimes the company has such a large organization that the unit almost is an invisible part for outsiders (Blecher, 2006). The management of the company might think that the market cannot value the company correctly as one entity and thus decide to split it up. The spin-off will imply that results of the unit will be directly visible, more easily measurable and more directly linked to the performance of the specific unit (Woo et al., 1992). As a publicly traded firm, the spin-off unit would also have to disclose detailed financial information, and that would as well lead to more in-depth precise assessment in the market. According to Krishnaswami and

Subra-maniam (1999), this implies that spin-offs improve the firm’s market value be-cause investors are able to view the value more clearly as a stand-alone unit. In addition to the motives for divestitures listed and explained earlier, spin-off has additional benefits to the company since it creates a new listed company. The unit now has its own stock to use for possible acquisitions. The manager of the unit is now CEO of a publicly listed company and thus has a greater incen-tive to improve the unit’s performance. There is empirical evidence that managers and CEOs of business units immediately buy substantial amount of stock in their own company following a spoff. This relates to the information theory that in-siders know more about the hidden values that may exist within the business than the market does (Allen, 2001).

DePamphilis (2005) argues that there are several factors that make spin-off the most attractive divestiture strategy for shareholders. First, a spin-off is tax free to the shareholders since they do only receive stocks of the new entity and are later taxed on their possible profit. This is in contrast with an outright sale to a third party, which would be taxable to the parent to the extent that a profit is realized. Additionally, when a company gets cash infusion it must be able to invest the af-ter-tax proceeds in a project that has a reasonable likelihood of returning the company’s cost of capital. If the company chooses to return the cash proceeds to shareholders as a dividend or through share repurchase, the shareholders has to pay taxes on the capital gain that they are making. A second advantage of spin-offs to shareholders is that it enables the shareholders to decide when to sell their shares in this particular subsidiary. Third, a spin-off is less dramatic than a sell off would be, since that would imply that a new corporation controls the company. This may imply uncertainty about the future and thus employees might leave and customers may not renew their contracts until the new owner is known (DePamphilis, 2005).

A company can also decide to spin-off a subsidiary, even though it might want to pursue a sell-off to another company. This is to display the subsidiary in the market to let it determine a fair value of the company and thus make it easier for another company to acquire it. Empirical studies in the American market show that one third of all spin-offs are acquired within three years after the unit is spun off by the parent (DePamphilis, 2005).

2.4.3 Risks and barriers with divestitures

“When you buy a company you marry, when you sell a company it is like a di-vorce“

Henry Kravis, Founder KKR

As the above quote states, it is not always easy to carry out a divestiture since it down-scopes the company. A commonly mentioned barrier against divestitures is the management’s own objectives. Managers generally tend to take personal pride in controlling large corporations and thus they can oppose a sale of a sub-sidiary (DePamphilis, 2005). Even though this is a very questionable argument for keeping a business unit that would be better off alone it is too often imple-mented. The managers can argue that there still are synergies between the parent company and the unit, and that these would be lost if a divestiture would be conducted.

The synergies that are associated with economies of scale achieved in an inte-grated business model, would be lost if the unit would be separated from the parent firm (Woo et al., 1992). It is very hard to estimate the exact synergies that exist between the two units since all synergies are not visible and consequently cannot be assessed in advance. The loss of synergies is a real and substantial risk and is one of the first that needs to be assessed for a company evaluating whether or not to proceed with a divestiture. To base the spin-off purely on syn-ergies is very risky due to the nature of the synsyn-ergies and the assumptions be-hind them. Another risk with divestitures is the risk that the employees in the spun off unit will lose motivation and inspiration from not being part of a large company anymore. Frankel (2005), argues that divesting a business is a very dramatic professional and personal event for everyone involved in the firm.

2.5 Performance

Variables

2.5.1 Use of financial ratiosFinancial ratio analysis permits a not so complicated comparison with similar companies, such as those in the same industry and of similar size (Gaughan, 1996). Ratio analysis can be calculated from the financial statements in order to determine the performance of the company, whether it is solvent and healthy, to assess the risk of its financial structure, and to analyse the returns generated to shareholders (Watson & Head, 1998). The use of financial ratios is extensively used in Strategic and Financial research for establishing a broad picture of a company. An advantage of ratio analysis is that it standardises the financial data so that factors such as sheer size are reduced (Gaughan, 1996).

Because some ratios are defined in different ways, it is important to make sure that the ratios have been calculated on a similar basis. Watson & Head (1998) point out that it is very important in ratio analysis to compare “like with like”. However, this is something that is often very hard to do in practise. Even though the ratios are calculated in the same way for different companies, the balance sheets can be structured in different ways and in some cases they might be im-proved by the use of “creative accounting measures”. Further flaws with the use of financial ratios is pointed out by Shapiro (1990), who argues that financial analysis is more art than science and frequently causes more questions than an-swers. However, he continues by stating that trends in raw data and in ratios can indeed provide us with a good picture of the firm’s performance, as long as one takes the biases into account before making any bold judgements. An important point is made by Shapiro (1990) when he states that ratio analysis is only useful as a comparative tool. Comparison can be made against other similar firms, against an industry average, or against the firm itself over different time periods. The firm is successful if it outperforms its peers or if it shows significant im-provements over time.

In this study, four financial ratios will be analysed as performance measures. These are Return on Assets, Market-to-Book value, Sales Growth and Share Price. Below is a discussion on each of these measures and their respective advantages and disadvantages. Their formulas are displayed in the Appendix 1.

2.5.2 Return on Assets (ROA)

ROA is a profitability ratio that measures how much profit the company has gen-erated for every unit in assets. It is basically a measure of how well the company is using its assets to produce more income and value for its shareholders. It fo-cuses on the earnings power of the ongoing operations, as the income figure normally excludes income or loss from transactions outside the ordinary course of business such as depreciation, amortization and taxes. Thus the upper the earnings variable is equal to the company’s EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortisation). ROA can be said to measure the effi-ciency of the operations and productivity of the firm’s asset base. A high ROA can be attributable to a high profit margin, a rapid turnover of the assets, or a combination of both.

ROA is advantageous to other profitability ratios, such as Return on Equity (ROE), since it includes all of the company’s assets including those that are liabilities to

creditors as well as those that are contributions made by investors. It is important to note, that ROA is not a perfect performance measure in any way since many factors can have great impact on the outcome, not the least the company’s de-gree of capitalization. Despite this disadvantage, ROA is still a performance measure that is extensively used in financial and strategic management research (Woo et al., 1992).

2.5.3 Sales Growth

Sales Growth is a specialised ratio that can be favourable to use when determin-ing a companies financial performance in a short-term perspective (Gaughan, 1996). Every company has to show some kind of sales in order to generate prof-its. A comparison of the average sales growth before and after the spin-off event shows an indication of the degree to which management was able to exploit the autonomy provided through the spin-off to expand its operations.

2.5.4 Market-to-book ratio (M/B)

The market-to-book ratio is a market-based ratio that compares the market value of the company with the value of the company that is displayed in its books. An advantage with market based ratios is that they contain the market’s assessment of the financial well-being of the firm as well a projection of the future ability to provide investors with a profitable return on their investment. If the M/B ratio is larger than 1, this means that the market is expecting the future growth for the company to increase. A management can be said to be successful if it has a ratio of over 1, since that demonstrates that the market believes in the business. A problem with this ratio is that the market value is based on future earnings while the book value reflects the company at a specific point of time. This can be ad-justed by using a moving average of the market value of the company (Gaughan, 1996).

2.5.5 Share price

The share price reflects the market view of the value of a company. As the mar-ket values the company on a day-to-day basis and adjusts the share price accord-ing to the performance of the company, this measure is too important to exclude from this study. The share price gives an indication to whether the company has created or destroyed value during the period. A positive and significant im-provement in share price would be consistent with the assumptions that the per-formance improves after a spin-off. However, a share price by itself does not give any indication of how the company has performed against the market. When there are favourable market conditions, it is not unlikely that all stocks will in-crease more or less. Therefore, instead of using the pure share price, it is rec-ommended to use some kind of market-adjusted return in order to get compara-bility over different time periods and to be able to judge whether the stock has outperformed the market (Gaughan, 1996).

2.6 Previous

studies

2.6.1 Studies on the parent company

Within the field of divestitures a lot of research has been focusing on the parent company and the market effect that a spin-off would have. The studies have in particular examined the effect that the announcement of a divestiture has and if that in result creates a cumulative abnormal return for the shareholders of the parent company. Miles and Rosenfeld (1983) examined the effect that the an-nouncement of a voluntary spin-off had on the wealth level of the shareholders. The term voluntary spin-off refers to a spin-off that is not forced due to a court order or a certain need to gather capital. The sample in the study by Miles and Rosenfeld consists of 55 companies that have performed voluntary spin-offs in between 1963 and 1980 on the American market. The results from this event study showed that there were abnormal positive returns in relation to a spin-off announcement – basically: a spin-off will improve shareholder wealth.

With a similar research approach Schipper and Smith (1983) examines the an-nouncement effect that can be derived from a spin-off. They found that a statisti-cally considerable positive average share price response was recognized in their sample of 93 spin-offs that were performed between 1963 and 1981. The positive reaction that was recognized can be derived from benefits given by tax compen-sation, improved productivity and assets transfers from bondholders to share-holders. Furthermore Krishnaswami et al. (1999) explores the phenomenon of spin-offs and their possibility to create value. The research questions that are ex-amined in their study also take into account the level of information asymmetry between the parent company and the divested unit. The results shows that in-formation problems decrease considerably post a spin-off. In the cases of firms with a lesser amount of negative synergies between divisions the positive relation between information asymmetry and the gains of a spin-off is even more explicit. The studies that are referred to above are all conducted on the American market. Of particular interest for this thesis is Scheutz (1988) who investigated the mo-tives and the consequences of all spin-off divestitures in Sweden. Scheutz study examines all the divestitures in Sweden during the years 1983 and 1984, 23 in to-tal, and it also contains eight in-depth case studies that represent different types of companies in terms of size and industry. Scheutz reached a conclusion similar to the other studies presented above, i.e. when a company divests a unit it is possible to recognize positive abnormal return on the stock of the parent com-pany. However, in this case the results where a bit volatile and not as definite as in the previous presented studies. Owning to these results Scheutz argues that in many cases there will be a positive abnormal return as a result of a divestiture but one should be careful to say that this would happen automatically in all of the cases. Scheutz also came to the conclusion that motives for conducting a di-vestiture are, as a rule, of both an operational and a financial nature. Indifferent to whether the main motive is operational or financial, their aim is to produce a compelling argument that the result of the spin-off will be a strategically signifi-cant development of the company, that it will encourage the management and the employees and most importantly and that it will give the shareholders finan-cial gains. When this study was conducted in 1988 Lex Asea was not imple-mented, and thus all divestitures that Scheutz are investigating are equity carve-outs. In his analysis he makes a comparison with the United States where similar

rules as Lex Asea were already established. Scheutz states that at this time in Sweden the parent company most often controls a majority of the shares of the divested unit after the spin-off while in the United States the parent company dis-tributes all the shares of the divested unit to its shareholders. This difference was due to a different set of tax rules between the two countries. Scheutz argues that the tax rules in Sweden at that time were beneficial when performing a merger but when conducting a divestiture they are evidently at disadvantage to both companies and shareholders.

More recent studies that have examined spin-offs on the Swedish market (Ho & Eriksson, 2006; Nordin, Jonasson & Daneshvar, 2005; Bjordal & Maksod, 2006) have all taken Lex Asea into consideration. These studies have, just like most of the American ones, primarily focused on the parent company and the possible abnormal return that the announcement of a spin-off might yield. The examina-tions are conducted by the use of event studying which is a commonly used technique when investigating the effect that a certain event will have on the prices on the market. The results from the research by Bjordal and Maksod (2006) clearly show a positive abnormal return for the parent companies when announcing a spin-off. Furthermore, Nordin et al. (2005) compares the results on the market of a spin-off event and an equity carve-out event. The study shows that a spin-off creates a higher rate of positive abnormal return than an equity carve-out. In addition to these findings, different industries were also compared. The results points out that the manufacturing industry benefits the most of a spin-off compared to an equity carve-out in contrast to the service industry where no such differences could be documented.

2.6.2 Studies on the subsidiary

As mentioned before the prime focus on preceding studies within the field of spin-offs has been the performance of the divesting company and cumulative ab-normal return as a measure of that performance. Studies using long-term, more realized performance measures with a focus on the actual divested unit has been absent from the literature with an exception of the work of Woo et al. (1992) and Desai et al. (1999). In the study Spin off performance: A case of overstated

expec-tations (Woo et al. 1992), the authors have focused on four different performance

measures (Return on Assets, Market-to-book ratio, Sales Growth and Share Price) in order to investigate how the divested unit function as an independent com-pany. A sample of 51 voluntary spin-offs across a period of two years prior to the spin-off event and three years post the event was collected. The authors further divided the sample into two groups, related and unrelated spin-offs in their rela-tionship with the parent. The only measurement used in this study that generated a result that was statistically significant was Return on Assets. This variable could be established to decline post the spin-off event, the other measurements used showed no significant results. What they show on average though is that per-formance of the divested unit did not improve post a spin-off and was just as likely to decline after the event. These findings were held true for both related and unrelated businesses.

Desai et al. (1999) build on the research made by Woo et al. (1992), by examin-ing both the parent companies and the divested subsidiary when conductexamin-ing a spin-off. In the study the authors investigated 133 spin-offs in USA within the years 1975 to 1991. They categorize the spin-off performance as downscoping or

downscaling. In this study the different financial performance measurements Re-turn on Assets, Market-to-book ratio, Sales Growth and Capital Asset Pricing al-pha ahs been used and the spin-offs has been studied three years prior the event and three years post the event. The findings of the study are rather conflicting with those of Woo et al. since they show that it is possible to see an enhance-ment in performance of the subsidiary and parent company due to the spin-off. The results show that when the spin-off was downscoping there were significant performance improvements for both the parent company and the subsidiary. However, if the spin-off only resulted in downscaling no such improvements could be found.

3 Method

In this section, the chosen method for conducting the study will be presented. Topics such as how the sample was chosen, how the data was gathered, and how the test was made are described. Finally, the method will be evaluated and discussed from a critical point of view.

3.1 Sample

selection

In most research studies, collecting data from all possible case members is im-possible and thus there is a need to draw a sample (Saunders et al., 2003). The objective with this thesis is to contrast the performance of the spin-off business before and after the spin-off event. To conduct a meaningful study that can be subject to statistical inference, a number of criteria were imposed for the sample.

• Only “pure” spin-offs are included, i.e. they should be consistent with the definition of a spin-off stated above and be consistent with the tax regula-tions of Lex Asea. The subsidiary should be completely owned and con-trolled by the parent until the day of the spin-off, when 100% of the out-standing shares of the subsidiary should be distributed. In the popular press sometimes other forms of reorganisation activities are referred to as spin-offs, but this study will only focus on spin-offs according to the defi-nition above.

• A spin-off would be excluded if it involved any kind of financial institu-tion, including both the parent and the subsidiary. These spin-offs are most often motivated by tax reasons, and the potential gains from such a transaction are then only due to improvement in the tax structure of the firm. This is consistent with earlier studies (Woo et al 1994; Desai et al 1999).

• A spin-off that could not display data for seven years was excluded. As a result, spin-offs that were founded as business units less than three years before the spin-off event; spin-offs that where merged or acquired within three years after the spin-off; and spin-offs that went bankrupt within three years after the event could not be included in our study. This time-frame of three years before and three years after the spin-off ensures that the data from the spin-offs are based on three data points and would thus hedge the results from short-term fluctuations in the comparison between pre and post spin-off performance.

• Focus of this study is not companies that are recently founded and that are of a speculative character. To measure the performance from a finan-cial perspective, the companies must have a functioning business and show profits. Thus, only spin-offs being listed on the Large and Midcap list on the Stockholm Stock Exchange will be included in this study (former A-listan and O-listan).

• Spin-offs from 1991 until 2004 were included. The starting year of 1991 was chosen because it was the year when the first spin-off in Sweden was conducted according to the new tax regulation Lex Asea. The last year of the study was chosen to be 2004 since a time frame of three years post the spin-off event was needed in order to carry out the study. However,

since the spin-offs conducted between the years of 2002-2004 were not in line with the above listed criteria they where excluded from the sample, and consequently the last year included is 2001. As a result, the study in-cludes data collection covering a 16-year period from 1988 until 2004. Following the criteria listed above, companies relevant for this study was selected using secondary data. A list from Skatteverket (2008) was obtained that contained all stock dividends according to Lex Asea 1991-2005. This list can be said to rep-resent the population in the study. Then a purposive sampling technique was used by imposing the criteria listed above. A purposive technique for sampling is useful when working with small samples and when the researchers want to clude cases that they know are informative (Saunders et al., 2003). This list in-cluded 85 cases, but only 44 of these could qualify as spin-offs according to our definition. Of these, further two cases were eliminated where either the parent or the subsidiary could be classified as a financial institution. Next, incomplete fi-nancial information and/or listings on the wrong exchange led to a further reduc-tion of 24 cases, trimming our populareduc-tion down to 18 spin-off cases, as seen in the table below. With a more homogenous sample, the study should be able to go into further depth (Saunders et al., 2003).

Year Parent Subsidiary

1991 Asea Incentive

1992 Esselte Scribona

1996 Kinnevik Netcom

Volvo Swedish Match

1997 Latour Fagerhult

Latour SäkI

Electrolux Gränges

Bylock & Norsjöfrakt Gorthon Lines

Kinnevik MTG

1998 Humlegården Fastigh. Sweco Gruppen 1999 Active Biotech Wilh. Sonesson

Perstorp Perbio Science

2000 Beijer G&L Beijer Electronics

Bure Capio

2001 Atle Studsvik

Perstorp Pergo

Lundin Oil Lundin Petroleum

Bergman & Beving Addtech Table 1 Spin-offs included in the sample

3.2 Data

Collection

The financial data on the companies was gathered using a two-step process. Ini-tially, data for the years prior to the spin-off event was obtained by examining the prospectuses of the stock listings. A prospectus is a detailed presentation that a company has to publish prior to being introduced on the stock exchange. Within, detailed pro forma calculations are exhibited that describes the financial

situation of the subsidiary, as it would have been a stand-alone entity in the years prior to the spin-off event. Additionally, the board of the company here explains the reasons and motives for making the spin-off. The prospectuses were acquired by contacting the parent company or the subsidiary involved in the spin-off. Next, financial data after the spin-off event was obtained by looking in the com-panies’ annual reports. These were downloaded from respective company’s web-site when they were available there. In those cases it was not possible, the an-nual reports were ordered from Bolagsverket.

3.2.1 Criticism

Since our criteria listed above led to the exclusion of 26 spin-offs, we have now a fairly small sample to base our study upon. This can lead to obvious problems in the reliability of our study but the authors still believe that the imposed criteria are well motivated and justified. The results from the statistical test have to be weighed against the fact that our sample is small.

3.3 Technique for analysis

There are numerous statistical methods that may be used in order to conduct sta-tistical analysis on quantitative data. The methods can be either parametrical or non parametrical. Parametrical methods require certain assumptions about the na-ture of the population, in particular the existence of normal distribution (Aczel & Sounderpandian, 2006). Non-parametric methods require less strict assumptions of the population and may be used when the sample does not meet the required criteria of a parametric test. Since non-parametric methods require fewer assump-tions it makes the tests somewhat less powerful and accurate than the corre-sponding parametric test (Aczel & Sounderpandian, 2006).

The sample within this study is relatively small and consequently normal distribu-tion cannot be assumed. This implies that the required criteria of parametric tests are not fulfilled and that a non-parametric method is to be used instead. The aim of this research is to compare two different populations; the financial perform-ance of business units prior and post the spin-off event. In order to obtain a ver-satile representation of the financial performance of the populations, the calcula-tions will be based upon four financial measures that will be subject to separate testing:

• Return on Asset (ROA) • Market-to-book ratio (M/B) • Market-adjusted stock return • Sales growth

Normally when comparing means of two populations, parametric t-tests are con-ducted, a good non-parametric alternative is the sign test (Aczel et al., 2006). The sign test is a method that is used to measure trends and correlations between two populations. According to Aczel et al. (2006) the sign test is stated in terms of the probability that values of one population are greater than values of a paired sec-ond population.

p = P(Y>X)

P is defined as the probability that Y will be greater than X. In this study X refers to the first population, the pre spin-off financial performance, and Y refers to the second population, the post spin-off financial performance (Ace et al., 2006). In those cases where Y exceeds X the pair is denoted with a plus sign and con-versely in the cases where X is greater than Y the pair is denoted with a minus sign, hence the name sign test (Aczel et al., 2006). The sample in this study is based upon observations three years prior to and three years after the spin-off event. Thus, the X in this study will represent the mean of the financial perform-ance of the divested unit three years prior to the spin-off event. Respectively Y will represent the mean of the financial performance of the divested unit three years post the spin-off event. Subsequently the negative signs will be deducted from the total sample and this will result in the test statistic.

When the test statistic (T) is determined, a level of alpha will be chosen, in this case it is set to be 0.1 to reach a confidence interval of 90%. The hypothesis test-ing in the sign test can be either two tailed, right tailed or left tailed. In this par-ticular study the test will be of a two-tailed nature since this enables the re-searchers to capture information about the potential financial improvement as well as the potential decline in financial performance. The assumption of a two-tailed test is that the probability of each outcome is equal to 0.50 (Aczel et al., 2006). In order to answer the second research question the following hypothesis is to be tested:

H0: There is no significant difference in the financial performance of the

subsidi-ary post the spin-off event

The statistical test is to be carried out in SPSS. If the null hypothesis is to be ac-cepted the financial performance has not altered and conversely if the null hy-pothesis is to be rejected the financial performance has altered. In order to see weather the financial performance has improved or declined frequency tables are used. In the frequency tables the exact number of positive respectively negative differences is displayed and hence it is possible to see in which direction the re-sults are heading. The theoretical framework of this study implies that a rejection of the null hypothesis with a majority of positive differences would be expected, since a spin-off should generate an improvement in the financial performance of the subsidiary.

The third and fourth research question of this study will be examined in a similar manner. The same tests will be conducted with the data divided into different categories in order to find similarities and/or differences among the categories. The data will be categorised according to the timing of the spin-off event and the relative size of the subsidiary to its parent. In the timing category, spin-offs from two time frames will be compared, the first group including spin-offs from 1991-1997 and the second group including spin-offs from 1998-2001. The relative size group is divided by comparing the total assets of the subsidiary to the total assets of the parent company. Here, the subsidiaries with total assets of less than 15% of the parent company will fall into the “relatively small” group, whereas sub-sidiaries with total assets of more than 15% of the parent company will fall into the “relatively large” sub-group. After the tests are conducted, the test statistics of the two subgroups will be compared against each other to find out if the factors have any significant impact on the financial performance post spin-off.

3.4 Adjustment of performance variables

When calculating the financial ratios for this study, some restrictions concerning the performance variables have to be made. When calculating ROA, the spin-offs EBITDA (Earnings before interest, taxes, amortization and amortisation) have been used to ensure that focus is upon the company’s ongoing operations and that no one-time write downs will affect the ratio. Market-to-book value (M/B) is calculated at the last day of the accounting year because of difficulties in finding the company’s equity value at the first day of trading on the stock exchange. The share price is adjusted to the market by comparing it to the Stockholm OMXS30 index. This index is chosen because our sample only includes compa-nies listed on the two largest lists on the Stockholm stock exchange (now OMX) and it is an index that has been present during the entire time span of the study. The shares that have exhibited an extraordinary market-adjusted return over the sampling period were closer analysed to ensure that there were no splits or other types of corporate actions that may have affected the share price. No such events were found for the spin-offs included in this sample. Another concern when cal-culating the market-adjusted return is that the beta of the share is not taken into account. In this study, the beta factor will not be taken into account, but it could be included if future researchers wish to expand the results of this study further.

3.5 Method evaluation

The quality of a research should always be revised both by the authors them-selves and objective external readers. Several issues might affect the findings in a negative way causing a reduction in the actual quality of the examination con-ducted. Conclusions should not in all cases be seen as absolute and should be questioned (Saunders et al., 2003). These potential issues will be examined in this chapter.

3.5.1 Reliability

Reliability is concerned with the fact that data is autonomous and independent from external conditions. The question that the authors should as themselves is what the probability is that other authors would come up with the same results (Saunders et al. 2003).

The data that is being processed in this study is as earlier stated of a secondary nature. The reliability and validity of such data is first and foremost concerned with the sources from which the data is retrieved. When sources are being re-viewed it is referred to as examining the authority or reputation of the source. Other disadvantages with secondary data is that it is originally collected for a purpose that do not match the need of this thesis and that the authors have no real control over the quality of the data. However in this case the source of the data is a government authority and it is highly unlikely for them to publish data that is questionable in its quality. The annual reports are always revised by certi-fied accountants and should be seen as an accurate and qualicerti-fied source for this type of financial information. The fact that the data is not collected primarily for the purpose of this study should not be seen as a source of lack of quality in our data. The financial figures that are used in our study are objective in their nature and cannot be a source of subjective interpretations.