E-Payments in China and Sweden

—- A Comparative Study of Alipay and Swish

BACHELOR THESIS WITHIN: Business Administration PROGRAMME OF STUDY: Marketing Management TUTOR: Lucia Pizzichini

AUTHOR: Zhaoyin Chen & Xinyu He JÖNKÖPING University May 2020

Acknowledgements

From the topic selection, data collection to the completion of the paper, we have received a lot of enthusiastic help from teachers and students.

First of all, we would love to give our sincere gratitude to Lucia, our tutor who, with extraordinary patience and consistent encouragement, during the writing time, gave us great help by providing advices to us, inspiring us with ideas. Without her suggest and support, we could not finish this thesis.

Secondly, we would like to express gratitude to the people who have participated in the questionnaire. Each of them paid time and energy to think over our questions carefully and gave personal answers. During the outbreak of the epidemic, we still received enough samples successfully

We would also like to thank the professors during the three years of bachelor study. Their professional understanding and knowledge teaching have helped us to move forward in the thesis and even in the future.

Finally, we would like to thank our families and classmates for their care and support in life.

Thanks!

Abstract

With the development of high-speed communication technology and the

popularization of mobile intelligent terminals, E-payments have rapidly been accepted

and applied by many people around the world and greatly changed their life and

financial transaction. At the same time, E-payment still has a lot of spaces for further

development, especially when there are different versions of E-payment platforms and

applications like Alipay in China and Swish in Sweden.

payment users’ experience has become one of the important criteria for the

payment platform development. This paper focuses on a comparative study of two

E-payment platforms, Alipay and Swish, to find out the elements that affects the user

experience for E-payment. Meanwhile, this paper also discusses what suggestions can

be offered to E-payment companies.

In order to achieve the research purpose, based on TAM model by Davis, F. D., a

quantitative and qualitative research methods have been applied to investigate how the

users of E-payment platforms feel concerning perceived mobility, perceived usefulness, perceived ease of use and perceived risk, and the user’s experience satisfaction and willingness to continue using have also been tested.

A questionnaire has been designed and distributed to the interviewees of three

groups: those who only used Alipay, those who only used Swish, and those who used

both. The design of the questionnaire is a combination of quantitative research and

qualitative research, quantitative research of the problem is to confirm that all the

factors effect on the user experience, and the problem that the qualitative research is to

study the users in the use and after comparing two electronic platforms for these factors.

All together there are 180 questionnaire copies of data have been collected. With

the data, the authors use SPSS to analyze quantitative data and inductive method to

analyze qualitative data. With data analysis and research, it can be concluded that

satisfaction experience, while Perceived Risk has a significant reverse effect.

Suggestions based on the results have been put forward.

Content

1. Introduction ... 1

1.1 Background ... 1

2. Research Questions ... 2

3. Purpose of the Research ... 3

4. Definitions... 4

4.1 E-payment ... 4

4.2 User Experience (UE) ... 5

5. Frame of Reference ... 5

5.1 Theoretical Framework... 10

5.1.1 Technology Acceptance Model (TAM): ... 10

5.1.2 Perceived Risk ... 11

5.2 Theoretical Model ... 12

6. Methodology for the Study ... 12

6.1 Theoretical Basis of Philosophy ... 13

6.2 Research Approach... 15

6.3 Measurement Dimensions of Study Variables ... 17

6.3.1 Perceived Mobility... 17

6.3.2 Perceived Usefulness ... 17

6.3.3 Perceived Ease of Use ... 18

6.3.4 Perceived Risks ... 18

6.3.5 Experience Satisfaction ... 19

6.3.6 User’s Willingness to Continue to Use ... 19

6.4 Hypothesis for Study ... 20

7. Data Analysis ... 22

7.1 Basic Data Collection ... 23

7.2 SPSS ... 26

7.2.1 Validity Analysis ... 27

7.2.2 Correlation Analysis ... 27

7.2.3 Regression Analysis... 28

7.2.4 The Influence of Perceived Usefulness, Perceived Ease of Use and Perceived Risk on Experience Satisfaction ... 28

7.2.5 The effect of experience satisfaction on continuous use intention ... 29

7.3 Qualitative Analysis ... 30

8. Conclusion ... 33

8.1 Research Conclusion ... 34

8.1.1 Perceived Mobility Has a Significant Positive Impact on Perceived Usefulness ... 35

8.1.2 Ease of Use Experience Has a Significant Positive Impact on User Experience Satisfaction ... 36

8.1.3 Perceived Risk Has a Significant Negative Effect on User Experience Satisfaction .. 36

9. Discussion ... 37

9.1 Recommendations and Suggestions for E-payment Platforms ... 37

9.1.2 Improvement of Ease of Use ... 38

9.1.3 Reducing User’s Perceived Risk ... 39

10 Implications... 40

10.1 Theoretical implications ... 40

10.2 Practical implications ... 41

11. Limitation and Future Research ... 42

11.1 Limitation ... 42

11.1.1 The Limitation of Research Content... 42

11.1.2 The Limitation of Research Sample. ... 43

11.2 Future Research ... 43

11.2.1 In-depth Analysis of Influencing Factors. ... 43

11.2.2 Add Research Variable Dimensions ... 44

11.2.3 Expand the Scope of the Research Object ... 44

12. Ethical Thinking... 44

Reference: ... 46

1. Introduction 1.1 Background

The field of electronic payment in China has developed rapidly in the past decade,

and it has launched a powerful challenge to traditional cash paper-based payments. In

the worldwide, a few developed countries such as Sweden have realized paperless

payments or a small amount of cash payments.

The electronic payment of China started rather late. In 2005, Alibaba’s CEO Jack

Ma first proposed the concept of a third-party payment platform at the World Economic

Forum in Davos, Switzerland. Therefore, the year 2005 is usually considered the first year of electronic payment in China. Although China’s electronic payment started late, it has developed rapidly. After more than ten years of rapid development, third-party

payment platforms represented by Alipay have initially completed the application

scenario layout and the cultivation of consumer habits. E-payment users of China reached 577.4 million in 2019 which is the world’s largest E-payment user base (Man Chung Cheung, 2019).

With its economic infrastructure, Sweden has always been in a leading position in

the digital transformation of payments in the Nordic region and has made significant

progress in achieving a cashless society. In terms of E-payments, the 7 largest banks in

Sweden jointly launched the instant payment application Swish in 2012. Swish as a

third-party payment platform has been the driving force of the Swedish digital payment

revolution, which has brought Sweden closer to a cashless society. Swish has facilitated

mobile transactions between individuals and businesses through cooperation with some

famous Swedish banks (Andrew Fawthrop, 2019). At present, more than half of

Swedish consumers have registered for this application.

During the same period, with the rapid development of mobile Internet, the

consumption behavior of smartphone users is changing, and E-payment will enter a

E-payment model and allowing users to better experience the convenience of E-E-payment

is an effective measure to promote the rapid popularization of E-payment.

E-payment is in a period of rapid development, and various technologies are

becoming mature. Therefore, the user experience needs to be focused on. Only by

taking the user as the center to design a reasonable interaction method and bringing user’s easy-to-use and secure payment products can promote the development of E-payment. We believe that with the popularization of mobile internet and smartphones,

with more and more convenient humanized payment methods and new user experiences,

E-payment will still have a lot of room for further development. At the same time, there

are many existing problems that lead us to explore and solve. This is a challenge as well

as an opportunity.

There are many forms and products of E-payment. Competition for homogenized

products has intensified. The number of functions is no longer the only criterion for

measuring the quality of E-payments. While using E-payment to meet functional

requirements, users pay more attention to the experience and feeling for E-payment

application. The experience of the product becomes more and more important for the

choice of the users. The purpose of the research is to provide suggestions for how to

provide users with high-quality, easy-to-operate and good user experience E-payment

services through an interactive comparison of the user experiences of Swish and Alipay.

2. Research Questions

With the development of high-speed communication technology and the

popularization of mobile intelligent terminals, mobile Internet has become the industry

with the fastest development and the largest market potential in the world today.

Relying on economic development and technological progress and driven by the tide of

e-commerce, third-party E-payments have been generated and rapidly popularized. The

emergence of third-party payment solves problems such as the trust mechanism in the

of e-commerce. The development of third-party E-payments provides consumers with

a more convenient payment experience.

It is necessary to explore the influence of various variables on the consumer experience of consumers. Only by starting from the user’s needs and centering on users through improving the users’ experience and making them feel pleasant and valuable. Then, E-payment can be truly integrated into the lives of users.

With the rapid E-payment development happening in Europe and China, it is

understandable that it has led to a sharp increase in research in this area, including the

study of E-payment user experience. But among them, a comparison study of the user

experience of Alipay and Swish, which are two main E-payment applications in Sweden

and China respectively, cannot be spotted much. Because of this, the authors decided

to conduct a research focusing on the research questions:

From the background introduction, it can be seen that the rapid development of

E-payment has led to a booming increase in research in this area. However, the

comparative study of popular payment application on the user experience of

E-payment has not been much delivered and presented. Based on the study of former

research of user experience and the new field of E-payment application, two

research questions have been selected:

1) Which are the elements in the research of the consumer experience that affect the

user experience in Alipay and Swish?

2) What suggestions can be offered to E-payment companies from the comparative

study on the user experience of Alipay and Swish?

3. Purpose of the Research

In the modern era of rapid development of economy, E-payment has gradually become an inseparable part of people’s lives. How to improve the user experience based on technology is an issue that all E-payment companies must consider. The user

experience contains a variety of user needs, including product interaction experience,

privacy protection, and so on. Among them, different target groups will have different

needs for this. What are the important elements in user experience for Alipay and Swish

and how to improve the E-payment applications on the basis of a correct understanding

of user experience are the main purpose of this thesis research. The research involves investigating which elements in Alipay and Swish’s products will affect the user experience. Meanwhile, researchers hope to find and confirm more conducts through

the study and practice which can help E-payment products bring a better user

experience from a comparative study of the two platforms. The results of the research

as well as suggestions can offer to E-payment platforms are hoped to be significant for

the future design and development of E-payment applications.

4. Definitions 4.1 E-payment

Kalakota and Whinstone has brought out a general definition of electronic

payment, “electronic payment is a form of financial exchange between the purchaser

and the seller facilitated by electronic communications, and e-commerce electronic

payment is a financial transaction in an online environment” (Kalakota & Whinston,

1997). Taking advantage of the development of science and technology, electronic

payment gradually becomes a settling way for people to replace traditional payment in

modern life, which brings about a tremendous change to the financial exchange method

related to social economic practice. According to the different settling methodologies,

E-payment includes telephone payment, mobile payment, website payment, etc. Via

telephone payment, people make phone calls to the bank or the financial institutions to

complete their transaction. Website payments refers to the monetary transaction

conducted via banking website. Mobile payment, which is becoming more and more

popular in E-payment, offers the opportunity for people to complete their deals via

smart phone applications. During this process of E-payment, people will have different

important for user’s adaptation of electronic payment and the development of different E-payment application.

4.2 User Experience (UE)

E-payment user experience refers to the subjective experience formed by the user’s

use of payment products or payment services. Although there is no consensus on the

concept of user experience, many people and organizations still define user experience

from different perspectives. Donald Norman invented the term user experience in the

1990s, “user experience includes all aspects of end-user interaction with companies, services and their products” (Donald Norman,1993). The ISO 9241-210 standard defines user experience as people’s cognitive impressions and responses to products,

systems, or services that they use or expect to use. Therefore, the user experience is

subject and it focuses on practical applications. User experience has much broader

effects in our lives than most people realize. It does not only apply to the use of the

latest technology. The user experience affects people every day. The user experience

covers culture, age, gender and economic class (Tom Tullis; Bill Albert, 2008). The

various definitions of user experience indicate that user experience refers to the

multi-attribute, multi-angle and multi-factor experience formed when a user interacts with a

product. Therefore, user experience can be defined as a purely subjective psychological

feeling established by users in the process of using a product or a service.

5. Frame of Reference

With customers and business professionals increasingly using mobile devices,

e-commerce has become not only a trend but also a phenomenon today (Chen, 2008).

E-payment is becoming the main method for making a purchase. In the field of monetary

transaction, E-payment system in particular has emerged allowing users to pay for

goods and services wherever they go, using their mobile devices (especially mobile

model, many researchers have also begun to study the advantages and disadvantages of

E-payment and have produced different ideas about e-payment (Kim, 2010).

From the previous research, it can be seen that most of the studies are positive

about the development of electronic payment, in spite that transaction security remains

people’s concern for E-payment platforms. However, Ondrus and Pigneur proposed

that with the popularity of mobile commerce, E-payment will continue to promote

security between organizations or individuals (Ondrus; Pigneur 2006). E-commerce

transactions are undoubtedly good for market development.

The research of E-payment user experience is closely related to that of the

technology acceptance in that it is telecommunication technology make E-payment a

reality and relate people to the no-cash payment. Among the research of technology

acceptance, the Technology Acceptance Model (TAM) was first proposed by Davis in 1989. It is a basic theory that studies users’ acceptance intentions and behaviors of information systems, as is shown in table 1.1 (Davis, F. D., 1989). TAM model attempts

to explain and predict the key influencing factors of individuals’ use of new technologies. The core point of TAM model is that consumers’ actual use of a product or service is affected by behavioral intentions, which are determined by consumer

attitudes.

The Innovation Diffusion Theory (IDT) was presented and developed by Rogers

in 1962 and he extended the theory in 1995 (table 1.2). The core viewpoint of IDT

theory is that the innovation process of a thing is a process in which users continuously

eliminate uncertainty by acquiring as much information about the thing as possible from

external. Rogers (1995) pointed out that innovative adoption is the user’s decision to

fully use an emerging thing and also proposed five keys that influencing factors for user

adoption intentions and behaviors, including relative advantage, compatibility,

complexity, trial-ability and observability.

Leida Chen (2018) has integrated the TAM model and IDT theory in order to analyze the factors that affect consumers’ acceptance of E-payments. The results show

that perceived usefulness, perceived ease of use and compatibility have a significant

positive impact on consumers’ intention to use E-payment. In contrast with the positive

factors, perceived risk has a significant negative impact on intention to use E-Payment.

The study also found that perceived transaction convenience and perceived transaction

speed have a significant positive impact on perceived usefulness (Leida Chen, 2018).

Meanwhile, perceived usefulness and ease of use have a remarkable positive impact on

intention to transact (Paul A. Pavlou, 2014).

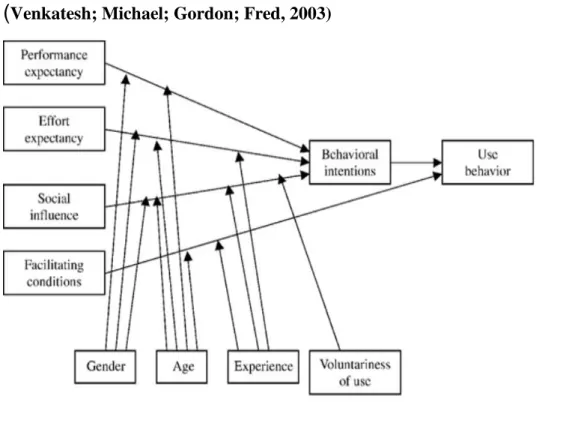

The research model of Unified Theory of Acceptance and Use of Technology

(UTAUT) was proposed in 2003 (Venkatesh; Michael; Gordon; Fred, 2003). There are

four core dimensions of the UTAUT model including performance expectancy, effort

expectancy, social influences and facilitating conditions which are the main factors

affecting behavioral intention and use behavior (Venkatesh et.al, 2003). Meanwhile,

the UTAUT model also includes four control variables (gender, age, experience and

involuntariness of use) that significantly affect the core dimension (Venkatesh et.al,

2003).

Shin (2009) constructed a modifiedUTAUT modelby introducing security, trust,

social influence and self-efficacy factors into an integrated technology acceptance

model. The research results show that the regulating effect of demographic variables is

significant. Usefulness and ease of use pronounced effect on consumers’ intention to

use E-payment. Meanwhile, compatibility and mobility have significant positive effects

on individuals’ attitudes and behavioral pressures on E-payments. Trust, perceived

usefulness and perceived ease of use have greatly affect users’ attitudes (Changsu Kim;

Mirsobit Mirusmonov, 2010). Lee (2010) divided mobile users into early adopters and

late adopters when studying the consumers’ adoption of E-payments. A comparative

analysis shows that the main factors affecting early users intention to use the

M-payment are individual knowledge of M-M-payment and perceived ease of use. Late

adopters pay more attention to accessibility and perceived easy to use of E-payment

applications. Research has also demonstrated that individual innovation sense,

ease of use. In addition to perceived benefits and perceived risks, perceived benefit,

perceived convenience and herd mentality for convenience are also three outstanding

factors that influence the use of the third-party E-payment. These studies can help

researchers sort out the impact of various factors on consumers’ intention to use

E-payment. At the same time, it also explores whether there is interaction between some

factors.

Through exploring external influences, ease of use, attitude, usefulness, trust and

risk, we study the different degrees of influence of consumer adoption of E-payments.

By using age as a moderator, the study discovered that the age of users has a significant

effect on the perceived trust and perceived ease of use (Francisco Liébana-Cabanillas;

Juan Sánchez-Fernández; Francisco Muñoz-Leiva, 2014) However, other researchers

(Yanli Pei; Shan Wang,; Jing Fan; Min Zhang, 2015) have studied the factors affecting

Chinese users’ perception and adoption of electronic payment based on TAM and trust

theories, and they found that the perceived risk is not significant impact on the intent to

use the E-payment. It is further inferred that Chinese users do not pay much attention

to the perceived risks when choosing an electronic payment system. The reason for the

different conclusions is believed that the researchers were inclined to including bias in

the questionnaire design and did not consider the demographic characteristics of the

respondents. In addition, the authors did not explore further for the reason why

perceived risk has no significant effect on Chinese users’ intentions.

By reviewing the research literature in the field of E-payment, it is concluded that

the current research in this field mainly has the following characteristics. The current research is mainly focused on consumers’ acceptance of E-payment. There are only few literatures studying the users’ intention to use E-payment platforms from the

perspective of user experience. Moreover, the research on E-payment users in the

literature is mostly limited to TAM (Technology Acceptance Model), IDT (Innovation

Diffusion Theory) and perceived risk to build research models and supplemented by a survey of user acceptance factors (questionnaire) to explore consumers’ intention to use E-payment services. But it does not combine the characteristics of the E-payment

platform. Most literature chose perceived usefulness, perceived ease of use, security

concerns and perceived valuable when extracting influence variables for empirical

research. However, the factors that affect the user experience have not been classified

in accordance with the principles, which caused some important variables to be omitted

in the research. There is even literature that studies only variables in a certain area (for

example, the research only studies the dimensions of perceived risk).

Existing literature does not distinguish between potential users who have used

mobile platforms and those who have not used E-payments when researching the early adopters’ intention to use the E-payment. At the same time, there is no comparative analysis of the indicators that affect the two types of groups, and there is also no

corresponding countermeasure for the use of these two types of groups.

By consulting relevant literature, it can be found that previous researches generally

used E-payment as the research object to conduct a comprehensive study. Current

researches have focused on consumer acceptance of E-payments. The previous

researchers usually also study user experience from the perspective of E-payment

product designers and lacks user experience from the perspective of users’ own

application practice. Researches on third-party E-payment is relatively few and the

analysis of factors affecting consumer user experience is also incomplete.

Therefore, based on the literature review, it is necessary to improve and perfect

some problems in the current research of E-payment.Based on the current development

status of E-payments in China and Sweden, a more systematic study of the user

experience satisfaction of E-payment platforms will fill the research gap and improve

the study in the field. At the same time, some more practical and targeted conclusions

can be drawn through quantitative and qualitative research in order to provide better

5.1 Theoretical Framework

Previously the researches on individual users’ adoption of technology is mainly based on consumer behavior and social psychology. It is usually from the perspective

of the users, using individual attitudes and choices to influence individual willingness

to use and ultimate actual behavior. The premise assumes that individual differences can only affect the individual’s willingness to use and behavior through their intrinsic values and beliefs. At present, there are many models in this field to study the users’

willingness and behavior. The technology acceptance model (TAM) is widely used in

the field of electronic commerce and mobile commerce. Meanwhile, the theory of

perceived risk has been mentioned in many studies. The theory of TAM and perceived

risk theory will be discussed in order to provide a theoretical basis for building a user

experience model for E-payment platform.

5.1.1 Technology Acceptance Model (TAM):

When it comes to the E-payment or traditional online payment, both of them need to

be through the network medium to work. The most widely used research on the

adoption of high-tech products or information systems is the Technology Acceptance

Model (Davis, 1989). In 1986, Fred Davis proposed a behavior acceptance model — technical acceptance model which is widely used to study people’s acceptance or adoption of an information system. The TAM model considers that the user’s intention to use determines whether the user will actually use the information system. The user’s

attitude towards product or system adoption and perceived usefulness of the product determine the individual’s willingness to use of the product and service. The perceived usefulness and perceived ease of use are the two key elements of technology acceptance

model. The earliest introduction of the TAM model into the field of e-commerce was

Lin & Judyo (2000), who applied the TAM model to study consumer acceptance and

Paul’s study (2003) found that there is a great deficiency of TAM model when it is applied to predict the extent of consumer acceptance of e-commerce activities. Paul

believes that TAM should combine the characteristics of e-commerce. Because when

e-commerce is compared with traditional commerce, trust and perceived risk are the

most important to users. Therefore, Paul introduced the trust and perceived risk factors

into the TAM model in order to improve the TAM model in the field of e-commerce.

The results of research have shown that the more trust consumers have in e-commerce,

the stronger their intention to choose to use online shopping. At the same time, the less

the consumer perceives the risk of using an e-commerce platform, the stronger the

intention to choose to use it.

Vijayasarathy (2010) added four variables of subjective norms, privacy, security,

and self-efficiency to the TAM model in order to better predict the consumer acceptance

of online shopping.

5.1.2 Perceived Risk

The concept of perceived risk was proposed by Bauer (1960) at Harvard University. In

the research, he found that consumers might not be able to determine whether their

expected results are correct after any purchase. These results may bring some feeling

such as unpleasant thoughts or unsatisfactory evaluation to consumers. Uncertainty in

the results in fact produces a sense of risk, which is the initial manifestation of perceived

risk. The sources of consumer perceived risk are mainly from two aspects: the severity

of the consequences of wrong decisions and the uncertainty of expected results. Coxl

(1967) thought that consumers will have a psychological expectation on products before consumption. If the product does not meet the consumer’s psychological expectations, consumers will perceive the existence of risk. Coxl (1967) believes that

the formation of perceived risk is a process. First of all, rational consumers will consider

the pros and cons of the consumption before actual consumption. That is, the degree of

risk that consumers take before consumption occurs. Then, after the expected risk becomes a reality, consumers’ ability to take losses caused by consumption.

Combined with the previous definition and researches on perceived risk, in this

study, the perceived risk of E-payment platform users is defined as,

Perceived risk of E-payment platform users is the anxiety which users may have

when they are facing to various uncertain factors or possible serious consequences in

the process of using a E-payment platform. Since people tend to avoid risks

subconsciously, users will take actions to reduce risks as much as possible.

5.2 Theoretical Model

Based on the TAM model, this study will start from the perspective of the user

experience. The study will analyze the entire process of E-payment practice that affects

the user experience. According to the time dimension, the study will expand the analysis

from before use, during use and after use. In order to build a theoretical model of user

experience for payment platform, the study will combine the characteristics of the

E-payment platform from the three dimensions: user perceived of mobility and usage

scenarios before use, product function experience in use and comprehensive experience

satisfaction after use. For the part of before-use, the research is mainly carried out from

two aspects: user perceived of mobility and usage scenarios. As far as during-use is

concerned, the factors of perceived usefulness, perceived ease of use and perceived risks should be as the important factors that can be influence of user’s experiences. As for after-use, the experience satisfaction should be considered as an important factor to

reflect whether users are satisfied. A good experience will increase user loyalty to the brand, which in turn will increase the user’s willingness to continue using the product or service.

To sum up, this study will use the TAM model as the basic theoretical framework

and incorporate the user perceived of mobility, perceived risks and experience

satisfaction. In order to build a new model: the user experience of E-payment model

(table 1.4).

In the study, in order to achieve the research purpose, the selected methodology will

be based on the TAM model. At the same time, through the elements of model analysis,

a qualitative questionnaire and a quantitative scale will be designed. The questionnaire

will be discussed with the users and cover the relevant elements. At the same time, it

will also include some basic information of the interviewees, such as age, gender etc.

Researchers will choose the probability sampling method to choose interviewees,

conduct the interviews face to face if possible or online using skype or WeChat and

send the questionnaire to the interviewees through social media (such as Facebook and

WeChat, etc.) and collect back the questionnaires the same way. The respondents are

divided into three categories: the first category has only used Swish; the second

category has only used Alipay and the third category has used both of Alipay and Swish

platforms. Through these three categories, the data obtained will be classified, and

strictly control the number of samples in each category by taking the data of the first

60 people who submitted the survey and strictly control the number of samples in each

category by taking the data of the first 60 people who submitted the survey. Then the

data will be sorted out and corresponding analysis will be conducted. Among them, the

researchers will consider the privacy of users when designing the questions and scales

and explain the purpose and whereabouts of data to all the participants. The limitation of this method lies in the fact that researchers’ social network friends have certain biases (for example, most of them are students), which may lead to some limitations in the results of researchers’ research.

6.1 Theoretical Basis of Philosophy

As for the methodology of this study, first of all, the theoretical basis of philosophy

should be determined according to the factors and purposes to be observed. The

theoretical basis of research philosophy is generally divided into three categories, positivism, interpretivist, and post positivism. “Positivism is a way of thinking --- an epistemology --- that seeks explanations of events in order that their underlying laws

controlled. On the basis of these predictions it becomes possible, by manipulating a

particular set of variables, to control events so that desirable goals are achieved and undesirable consequences eliminated” (Carr and Kemmis 1986). Positivism is generally used for quantitative analysis, mainly for data collection and data analysis after putting

forward assumptions. In this process, researchers need to consider using primary data

(questionnaire, etc.) or secondary data (company annual report data, etc.), while

interpretivist uses qualitative analysis to do research, and obtains a reliable conclusion

through interviews and other situations. The third is post positivism. Unlike positivism,

post positivism does not make assumptions.

In this study, there are seven hypotheses have been put forward and the researchers

will design the questionnaire based on these seven hypotheses and make inferences

after collecting the data.

Positivism has been decided to be adopted in this paper. Why has positivism been

selected instead of the other two? First, positivism can make specific guesses. In this

study, the necessary elements are identified according to the user experience model

for e-payment platform based on TAM model. In order to verify the real impact of

these factors on user experience, seven hypotheses are proposed. Based on the data

collected from the questionnaire, conclusions are drawn after analysis the data. In the

process of sampling, researchers are directly in contact with all user groups, and

randomly select samples to do the interviews and questionnaires. It is possible for

get the most real feelings of users and the first-hand data. It makes a foundation for a

large number of analysis in the second phase and increases the reliability of the

research. Second, a questionnaire based on speculation can break the time limit. The

questionnaire can bring up questions to the experienced users without setting time

requirement.

The users can consider and give feedback at any time. They can not only

understand their views on the facts and behaviors of the two products, but also

from some concepts of subjectivity, the data collected will be more objective and the

trust is supposed to be higher. However, the data may have a certain impact on the

empirical part due to the limitations of the study. For example, most of the users

interviewed may be Swedish or Chinese, while the users of other nationalities will be

relatively few. So, it may unable to collect comprehensive data, which may lead to

certain bias.

6.2 Research Approach

There are two research approaches in this study: qualitative research and

quantitative research. Saul and Mcleod have brought out the definition of quantitative research, “Quantitative research gathers data in a numerical form which can be put into categories, or in rank order, or measured in units of measurement. This type of data can be used to construct graphs and tables of raw data.” (Saul McLeod, 2019). Denzin and Lincoln have put forward the definition of qualitative research, “Qualitative research is multi-method in focus, involving an interpretive, naturalistic approach to its subject

matter. This means that qualitative researchers study things in their natural settings,

attempting to make sense of, or interpret, phenomena in terms of the meanings people bring to them.” (Denzin and Lincoln, 1994). Qualitative research focuses on the characteristics and nature of specific social phenomena and a subjective interpretation

of specific phenomena. Therefore, qualitative research is a process of inductive

reasoning. Through the description of the supervisor of a specific phenomenon, a

general conclusion can be drawn from a specific situation. Therefore, qualitative

research pays more attention to the flexibility and particularity of research methods.

The main research methods commonly used are participation observation and in-depth

interview; the data collected and sorted out are expressed in the form of words.

Quantitative research is to explore the regularity of phenomena under the guidance of

positivist methodology. Quantitative research is the process of deductive reasoning,

from the study of general phenomena to special situations. In addition, quantitative

form. Therefore, quantitative analysis is more likely to use questionnaires to collect

data.

In this study, qualitative and quantitative methods are both used. First, through the

self-built model that based on the TAM model, it is can be find some factors that may

affect the user experience. These factors can be applied to design the questions in the

questionnaire. Among these questions, some will be designed in the form of scale and

answered by users in the way of grading level and others will be explained by users in

the way of text answer. Most of the data predicted by the researchers and some of the

text answers will be included.

The purpose of using this method is to better understand the needs of users. First

of all, the combination of the two methods will make our research more professional

and complete. Researchers can not only get social data through observation and

discussion, but also get quantitative data through professional mathematical model.

From observing and contacting users, researchers can put forward questions that need to be answered in words to understand users’ feelings about the two platforms. The questions that need to be graded will help the whole study collect quantitative data to

support the conclusions. Combined with the obtained text data and the analyzed digital

data, the final conclusion is drawn.

This advantage lies in, firstly, the complementation between qualitative and

quantitative research. Because the number of samples in qualitative research is

relatively small, often only a dozen people (copies), which will bring about the

universality problem. In other words, it is doubted to what extent its conclusions can

explain the problem, how large groups it can represent, and whether they are universal

or limited to individual cases. In this study, if a sole qualitative study is adopted, only a dozen data will not be enough to support most users’ experience when the user groups of the two products are huge. The conclusion will not be convincing enough. If

researchers only do quantitative research and only have data support, it will lead to a

experience. Second, qualitative research provides theoretical basis for quantitative

research. When designing a questionnaire, it is impossible to design a questionnaire

suitable for two products by quantitative method alone. Although both Alipay and

Swish are E-payment platform, Alipay is more likely an international product, while

Swish stays more as a localized product. The positioning of the Alipay and Swish

platforms is different and the market development is different. In order to design more

suitable questions for each user, qualitative research plays an important role in the early

questionnaire design. Therefore, the choice of qualitative and quantitative research path

is the most suitable method for this topic.

6.3 Measurement Dimensions of Study Variables

When designing the questionnaire, the relevant questions are raised for each part

of the user experience of E-payment platform model.

6.3.1 Perceived Mobility

The study defines perceived of mobility as the ability of users to use E-payment

platforms regardless of time and place. For perceived of mobility, two questions should

be included in the questionnaire.

Q1: When I am outside, I can use mobile phone or other types of electronic mobile

devices to complete payment through E-payment platforms anytime and anywhere.

Q2: I think mobility is a typical advantage of E-payment platforms.

6.3.2 Perceived Usefulness

Perceived usefulness can be considered as a key part of the user experience, but it

is not the only factor that determines the user experience. By the opinion of Tractinsky

& Hassenzahl (2006), if the product or service has high level of usability, which means

perceived high level of pleasure and satisfaction. Based on the perceived usefulness,

three questions will be mentioned in the questionnaire.

Q3: E-payment platforms is helpful to my life.

Q4: Using an E-payment platform enables me to complete various transactions or

purchases faster.

Q5: Using an E-payment platform can reduce the inconvenience of having to carry cash

or credit card to complete the payment.

6.3.3 Perceived Ease of Use

If the user feels the convenience of the operation when using a product or service

such as learning to use in a short period of time, it will greatly promote the user’s

willingness to continue the use of this product or service. This study defines the ease of

use as the degree to which users perceived easy to use and operate when using an

E-payment platform. The easier it is to use service of the E-E-payment platform provide, the

more users will tend to use and rely on it. Then, it is easier to cultivate user habits.

There are two questions should be taken account into the questionnaire.

Q6: The operations related to the E-payment platform are really simple.

Q7: For me, it is easy to learn the process of using a E-payment platform.

6.3.4 Perceived Risks

The study of users’ perception of risks needs to combine with the platform’s characteristics. Considering the same and different characteristics of the services

provided by Alipay and Swish. Four questions will be asked in the questionnaire.

Q8: The use of E-payment platforms may cause financial losses. For example: the

system may deduct excess amounts or charge service fees in transactions.

Q9: Compared with traditional payment methods (cash or credit card), using

Q10: Compared with traditional payment methods (cash or credit card), using

E-payment platforms takes me a long time.

Q11: When using an E-payment platform, there will have some security issues. For

example, when presenting a QR code for payment, the funds may be stolen by others

due to the exposure of the QR code.

6.3.5 Experience Satisfaction

Fomell (1992) defined customer satisfaction as the customer’s overall evaluation of a product or service after they use it. Customers have a psychological expectation before purchasing a product or service. The customer’s satisfaction with the product is obtained after comparing with previous psychological expectations. Whether the

customer is satisfied with the product or service after use is always obtained after

comparing with previous psychological expectations. From the perspective of

experience satisfaction, there are two questions will be raised in the questionnaire.

Q12: After using E-payment, I am satisfied.

Q13: After using E-payment, I feel pleased.

6.3.6 User’s Willingness to Continue to Use

The continuous usage intention is defined as one’s intention to continually use a system or reuse a system (Bhattacherjee, 2001). According to the definition of the

continuous usage intention and combine the characteristics of E-payment platforms. The study defined the user ’s willingness to continue to use as the subjective willingness of E-payment platform users to use E-payment for the second or continuous use in the

future after using E-payment (for the first time or more times). Therefore, the study will choose three questions for the aspect of user’s willingness to continue to use into the questionnaire.

Q14: If I feel satisfied and pleased after I use an E-payment platform, I would like

Q15: If I feel satisfied and pleased after I use an E-payment platform, I would like

to recommend the E-payment platform to my friends.

Q16: If I feel satisfied and pleased after I use an E-payment platform, I would like

to continue to use the E-payment platform.

6.4 Hypothesis for Study

Kim (2010) believes that compared with the traditional e-commerce, the greatest

feature of the mobile technology is mobility. Mobility refers to the ability to receive

services anywhere and to complete transaction tasks by connecting wireless

communication networks with mobile devices. Mobile technology gives users more

freedom in terms of time and space. The E-payment platform also has the characteristic

of mobility. E-payments allow users to complete payments, regardless of time or place.

Mobility greatly improves the useful experience of the E-payment platform. The

convenient and fast payment experience bring by mobility will promote users to accept

and continue to use E-payment platforms. Perceived mobility can directly affect the user’s perceived usefulness.

According to the TAM model, perceived usefulness and perceived ease of use can directly affect users’ attitudes to use. Perceived ease of use refers to the degree to which a new product is considered difficult by potential users (Moore and Benbasat, 1991).

This article studies the two dimensions of user experience influencing factors from the

perspective of product functionality: usefulness experience and ease of use experience. This research is mainly from the perspective of users’ awareness of the functions of E-payment platforms. The more users perceive the product or service as useful, the

stronger their willingness to choose to continue using it. Meanwhile, when a customer

using an E-payment platform in the initial stage, the simpler of the payment process, the better the user’s experience with the product. Venkateshet (2003) believes that the more users perceive a product or service can improve the quality of life and work efficiency, the stronger the user’s willingness to adopt the product. E-payment platforms improve users’ payment efficiency, the more users will find the product

useful and happy to use it. Venkateshet (2003) believes that the more helpful of the

product or service perceived by users to improve the quality of life and work efficiency,

the stronger of the user's willingness to adopt the product. Similarly, when the users are

facing a new product or application, the simpler and faster of use, the more inclined

users are to use it. Conversely, if a user perceives that E-payment operations are

complicatedly to uses or the operation process is not clear enough. Then users tend to

abandon the product or service.

The main determinants of perceived risk are identified as perceived information

asymmetry, perceived technical uncertainty, perceived regulatory uncertainty and

perceived service intangibility (Yongqing Yang; Yong Liu; Hongxiu Li; Benhai Yu,

2015). As mentioned before, this study defined the perceived risk of E-payment

platform users as: in the process of using an E-payment platform, users may have

anxiety when they are facing to various uncertain factors or possible serious

consequences. Since people tend to avoid risks subconsciously, users will take actions

to reduce risks as much as possible. When Yongqing Yang; Yong Liu; Hongxiu Li;

Benhai Yu (2015) researched consumer E-payment adoption behavior based on

cross-channel, they found that perceived risk has a significant negative impact on E-payment

adoption behavior. Because people have a subconscious tendency to avoid risks. When

the user feeling more uncertain about the possible consequences of using E-payment,

the lower his willingness to actively use the payment. When consumers use

E-payment platforms, they may worry about some situations such as: the funds in bank

card funds may reduce by some reasons and personal privacy information may be leaked. It may also affect the user’s final decisions on whether to use the E-payment platform.

A large number of research results show that consumer satisfaction with products

or services can predict the consumer behavior. In the field of technology acceptance

model research, Bhattacherjee (2001) regards experience satisfaction as an important

variable for continued use willingness. Cronin (1992) research found that customer

repeat purchases or continue to use this product or service. Satisfaction is particularly

important for service industries such as banking and catering. When users are not

satisfied with the product or service, they will switch to other brands. Studies by

Parasuraman (2005) and Lee & Lin (2005) also confirm that satisfaction has a significant positive impact on users’ behavioral intentions.

To sum up, the study proposes the following hypothesis:

H1: Perceived mobility has a significant positive impact on the customer's

perceived usefulness of E-payment platforms.

H2: The usefulness has a significant positive impact on user satisfaction of

E-payment platforms.

H3: The ease of use has a significant positive impact on user satisfaction of

E-payment platforms.

H4: Perceived risk will have a negative impact on user experience satisfaction of

E-payment platforms.

H5: Experience satisfaction will have a positive effect on user's willingness to

continue to use the E-payment platform.

H6: Alipay is superior to Swish in terms of perceived ease of use and perceived

usefulness.

H7: Alipay and Swish users have the same concerns about the perceived risk.

7. Data Analysis

In the data analysis part of this study, the quantitative analysis is mainly conducted

by the application of SPSS. After all the data have been collected, they are integrated

in an Excel table, and then poured into SPSS for the further analysis. The analysis

method used is frequency analysis. Firstly, descriptive statistics are used to summarize participants’ responses to the questionnaire, and factor analysis is used to identify

potential factors to explain the main sources of variation in the questionnaire responses.

At the same time, SPSS can help researchers perform multivariate data analysis to

detect whether the background variables (work, education background, etc.) of

participants will affect their user experience of the two products. It can also verify the

authenticity of these answers.

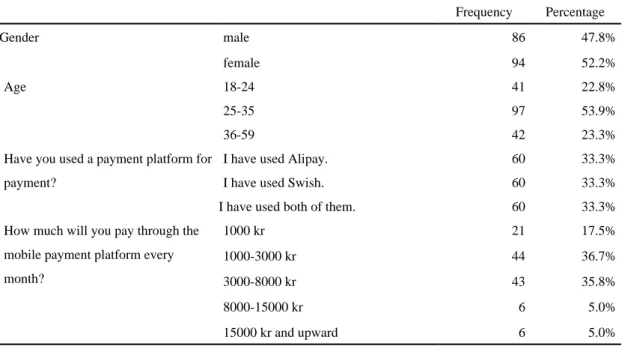

7.1 Basic Data Collection

From the data collected, researchers sorted them into categories. In the

questionnaires we have done, we collected a total of 180 copies of data. Everyone has

read the instructions for the survey. If they feel uncomfortable during the survey, they

can withdraw from the research. In the designed questionnaires, the first question asks

about gender. In the result, there are 86 respondents were male, accounting for 47.8%

of the total number. While 94 of the participants are females, accounting for 52.2% of

the total number (chart 17).

The second question which is about age, respondents aged from 18 to 24-year-old

respondents accounted for 22.8%, and 25-35-year-old respondents stands at 97,

accounting for about 53.9%, and they are the main research object. And there are 39

people aged 36-59, accounting for about 14.9% (chart 18).

In the third question, people who have only used Alipay have reached the number

of 60, accounting for 33.3% of the total. People who have only used Swish submitted a

total of 60 questionnaires, which accounted for 33.3%. People who have used both

payment platforms reaches 60, which accounts for 33.3% of the total number of people

surveyed.

In the fourth question, only 0.8% of people think that they are very dissatisfied of

the E-payment platform. The level of 3 and 4 (generally satisfied and satisfied) is 5%

and 26.7% respectively. The most popular response is very satisfied, accounting for

In the fifth question, there is only 8% of people think that mobility is not the most

typical advantage of E-payment, while there is no respondent think that mobility has no

huge advantage. There are 5% of people think that the degree is 3 and 30.8% of people

think that mobility does have a certain advantage (degree 4). The largest proportion of

63.3% of people unanimously believe that mobility is indeed the most typical advantage

of payment platforms.

In the sixth question, there is no respondent thinks that the electronic payment

platform has not or not much improved his life. There are 10% of people think that

some parts of their life have been improved (degree 3) and 23.3% of respondents think

that the degree is 4. The most people still think that the electronic payment platform has

indeed improved their lives, occupying 66.7%.

Among the 180 respondents, a very small number of people believe that electronic

payment platforms can quickly complete transactions and transactions (level 1 accounts

for 0% and level 2 accounts for 1.7%), while some people do not feel much (level 3

accounts for 3.3%). There are 95% respondents think that E-payment enables them to

complete various transactions or purchases faster (level 4 accounts for 23.3% and level

5 accounts for 71.7%).

This situation also appears in the next question. Only a few people think that mobile

platform payment cannot reduce the inconvenience of cash or credit card payment

(level 1 is 0% and level 2 is 0.8%). There are 8.3% of people do not feel much about it.

The vast majority of people still think that E-payment can indeed reduce the

inconvenience of cash or credit card payment.

In the next question, it is can be seen that most people think the operation of the

electronic payment platform is very simple (people with a degree of 4 or 5 account for

a total of 90%), and only a few people think that the operation is not simple (level 1and

level 2 accounting for 3.4% of the total). At the same time, most people think that

learning the process of an E-payment platform is very simple. On the contrary, only a

Compared with traditional payment methods, 74.2% of respondents think that

using electronic payment platforms will not or relatively not make users feel anxious,

but 9.1% of people think they will feel very nervous and anxious. There are 16.7% of people don’t feel much about it.

A similar situation occurs in the last two questions. A certain percentage of people

who use the electronic payment platform is believed to cause economic losses.

Although most people still do not think that this situation will occur, the data ratio

shows the reality. From the previous question, we can see that people have different

ideas on this issue. Many people think that there will be some security problems when

using the electronic payment platform, such as the leakage of information by QR code

payment. Although the proportion is not large (degrees 4 and 5 together account for

10%), it can still explain that many people still cannot fully rest assured of the electronic

payment platform.

Even so, in the next question, it can be seen that 57.5% of the people are still very

satisfied with the use of electronic payment and gave a very satisfactory answer, while

the remaining people chose level 4 or level 3 (accounting for 32.5% and 10%,

respectively). Interestingly, in this question, no one chose level 2 or 1. That is to say,

although people are not very satisfied with online payment, there is not a single person

who are completely dissatisfied with online payments.

However, in the next question, the situation is slightly different concerning whether

people are pleased after using online payment. Although up to 64 people (accounting

for 53.3%) choose the degree of 5, which is very satisfied, and 35 people choose the

degree 4 (accounting for 29.2%). But the number of people with a degree 3 has

increased a lot. There are 19 participants who choose degree 3 (accounting for 15.8%),

and two participants selected level 2 (accounting for 1.7%).

When they are satisfied and pleased, 68.3% of the participants will be very willing

to use this payment platform as a common used payment method in life and the

There are only 8.3% respondents chose level 3. In this problem, no one chooses degree

2 or 1, it can be seen that when online payment brings satisfaction and pleasure, people

will very quickly accept this payment method as a common used payment method in

life.

In the next question, the respondents are asked if they feel satisfaction and pleasure

after using an e-payment platform, would they willing to recommend it to their friends?

There are 65% of respondents choose to very willing recommend this platform to their

friends and there are 21.7% chose level 4 (willing to recommend this payment platform

to others). In contrast, there are 10% of participants chose level 3, there are 2.5% people

chose level 2, and one chose level 1. There are some respondents still have some

hesitations about recommending the E-payment platform to their friends for personal

use.

In the last question, up to 68.3% of people are very willing to continue to use the

platform after feeling pleased and satisfied after using the platform, while 25% of

people are willing to continue to use the platform . There are 5.8% of people are not

very concerned and 0.8% of respondents are not willing to continue to use the platform,

it can be seen that the user experience has a great impact on user viscosity.

7.2 SPSS

Reliability, also known as the degree of reliability, is used to analyze the stability

level and consistency level of the results obtained by the measurement method and use

this as an index to evaluate the reliability of the measurement method scale. Its

evaluation methods mainly include internal consistency reliability, retest reliability and

copy reliability.

This paper adopts internal consistency to test the reliability of the questionnaire.

There are many measurement methods of internal consistency, and Cronbach’s coefficient is the most commonly used method for estimation. Cronbach’s coefficient is between 0 and 1. The closer to 1, the higher the reliability level. When Cronbach’s

coefficient is greater than 0.7, the reliability of the data is relatively high. If the

coefficient is greater than 0.6, the data is acceptable. If the coefficient is lower than

0.35, the reliability is low, and 0.5 is the lowest acceptable reliability level.

Firstly, the overall reliability of the questionnaire was measured. The total Cronbach’s coefficient of the questionnaire was 0.757, which was very reliable.

Secondly, the reliability of each dimension variable was measured respectively, and the results are shown in the following table. The Cronbach’s values of each variable are above 0.7, indicating that the reliability of the survey data of each dimension in this

study is very high.

7.2.1 Validity Analysis

Validity refers to the degree to which the measuring tool can effectively measure

the characteristics to be measured. It refers to the degree to which the questionnaire

can accurately measure the variables to be measured. By measuring the validity, the

accuracy of the measured results can be effectively estimated. The evaluation of

validity is mainly reflected in the KMO value, which is between 0 and 1. When the

value of KMO is greater than 0.9, the structure validity is very good. A value between

0.7 and 0.9 indicates good validity. A value of 0.6-0.7 is general and a value less than

0.6 is unacceptable.

The following is the KMO test of the data. According to the results, the KMO value

is 0.799, indicating that the structural validity of the questionnaire is good.

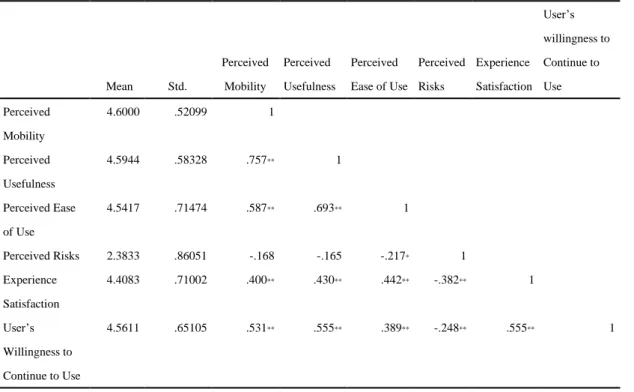

7.2.2 Correlation Analysis

Correlation analysis refers to the analysis of two or more variables with correlation,

correlation coefficient is mainly used for correlation analysis. If the P value of

significance is greater than 0.05, there is no correlation; if the P value is less than 0.05,

there is a correlation.

According to the correlation analysis in the following table, there is a significant

correlation between perceived mobility and perceived usefulness (P<0.05), and the

corresponding regression coefficient is 0.757. Perceived usefulness, perceived ease of

use and perceived risk are significantly correlated with experience satisfaction (P<0.05),

and the corresponding correlation coefficients are 0.430, 0.442 and -0.382. There is a

significant correlation between experience satisfaction and continuous use intention

(P<0.05) and the corresponding correlation coefficient is 0.555.

7.2.3 Regression Analysis

The effect of perceived mobility on perceived usefulness. On the basis of significant

correlation analysis, the relationship between various variables is further studied.

Firstly, researchers conducted regression analysis with perceived usefulness as the

dependent variable and perceived mobility as the independent variable.

From the model population parameter table, it is can be known that the regression

equation can explain 56.9% of the total variation, and the corresponding Anova F value

is 158.168, reaching a very significant level (P<0.05). According to the regression

coefficient and significance test table, perceived mobility has a significant positive

effect on perceived usefulness (P<0.05) and the corresponding regression coefficient is

0.847.

7.2.4 The Influence of Perceived Usefulness, Perceived Ease of Use and Perceived Risk on Experience Satisfaction

Researchers conducted regression analysis with experience satisfaction as the

the independent variables.

From the model population parameter table, it is can be known that the regression

equation can explain 29.1% of the total variation, and the corresponding Anova F value

is 17.289, reaching a very significant level (P<0.05). Through the regression coefficient

and significance test table, it is can be known that perceived usefulness, perceived ease

of use, perceived risk has a significant influence on experience satisfaction (P < 0.05).

The corresponding regression coefficients are 0.280, 0.217, 0.245. The perceived

usefulness, perceived ease of use has positive influence to experience satisfaction. The

perceived risk has a negative effect on experience satisfaction.

7.2.5 The effect of experience satisfaction on continuous use intention

Researchers conducted a regression analysis with continuous use intention as the

dependent variable and experience satisfaction as the independent variable

According to the model population parameter table, it is can be known that the

regression equation can explain 30.2% of the total variation, and the corresponding

Anova F value is 52.404, reaching a very significant level (P<0.05). As can be seen

from the regression coefficient and the significance test table, experience satisfaction

has a significant positive effect on the intention of continuous use (P<0.05), and the

corresponding regression coefficient is 0.508.

According to the above regression analysis of the influence relationship among

various variables, it is comprehensively obtained the hypothesis conclusion as shown

in the following table:

Numbering Hypothesis Conclusion H1 Perceived mobility has a positive effect on perceived usefulness. Confirmed H2 Perceived usefulness has a positive effect on experience satisfaction. Confirmed H3 Perceived ease of use has a positive effect on experience satisfaction. Confirmed H4 Perceived risk has a negative impact on experience satisfaction. Confirmed

H5 Experience satisfaction has a positive effect on continued use willingness. Confirmed

7.3 Qualitative Analysis

In this part, the research selects all participants who have used both Alipay and

Swish to complete some more questions. The purpose is to achieve the comparative

study and compare the advantages and disadvantages of the user experience of the two

E-payment platforms.

The first question is: When you are facing payment platforms of Alipay and Swish,

which one is your first choice? There are 80.3% of the interviewees chose Alipay and

19.7% people for Swish. The big data gap demonstrates the obvious advantage of

Alipay in user preference. The research has further inquired about this issue.

The second question is: Why do participants prefer this payment platform? This is

a multiply choice question. The result shows that 68.6% of the interviewees choose the

platform because it is more popular. There are 30.7% of respondents showing that the

platform has lower risks and 62% of the interviewees choose the platform because it is

simpler and easier to use. Finally, there are 62.8% of respondents prefers certain

platform due to its more usefulness for their life.

From here, it can be seen that people’s first choice for platform is based on its popularity, followed by the applicability of the electronic payment platform and the

degree of its importance for their life. The last point of why people choose one of the

E-payments is that the risk of the platform is comparatively lower.

In the next question, the researchers ask the participants who have used both two

payment platforms to briefly write down some words on the advantages and

disadvantages of the two platforms.

In the relevant description of Alipay, the frequent written advantage is the affirmation of Alipay’s applicability and accessibility. In the eighty-one answers which have been submitted and collected, there are twenty-nine people mentioned that