Can outsiders follow insiders to

beat the market?

An Event Study on the Stockholm Stock Exchange

Paper within Business Administration (Examensarbete)

Author: Erik C.M. Lagerwall

Sebastian B.R. Jakobsson

Tutor: Johan Eklund

Summary

Previous studies have indicated that information asymmetries exist on the financial mar-kets. People with access to non-public information could use that information to their ad-vantage when they trade financial instruments. The Swedish Financial Supervisory Authori-ty (FI) is a public authoriAuthori-ty that works for stabiliAuthori-ty and efficiency on the financial market. In their work for achieving an efficient market is FI trying to minimize the information asymmetries on the market by keeping a record of all trades being done by what the Swe-dish law classifies as insiders. The record is public information and a way to inform the market about insider transactions, which creates the question: Can the public information on

in-sider trades kept by FI help an investor to make better investments? Yes, it can!

In order to examine the question have we performed event studies on different trading strategies that have been based on information from previous studies in the field. The event studies have focused on insider purchases in Small Cap and Mid Cap companies on the Stockholm Stock Exchange during 2007-2009. We choose to focus on insider pur-chases because of its higher relevance for other investors than insider sales. Insiders have several reasons to sell shares in their company, for example portfolio diversification and li-quidity needs, but they have one main reason to buy shares, to earn money on their in-vestment.

We created and tested three different trading strategies based on the insider purchases exe-cuted during 2007-2009. The first trading strategy was based on periods of intensive trad-ing, the second strategy was based on large volume transactions and the third strategy was based on short periods of intensive trading where small purchases were excluded. The first two strategies were applied on Small Cap and Mid Cap separately, while the third strategy was applied on the Small Cap only. We have been using a well-established and highly refer-enced way to perform our event studies. To be able to test the average development statis-tically have the returns been aggregated through time and through securities. The trading strategies have been tested over 5, 10, 30 and 90 day periods.

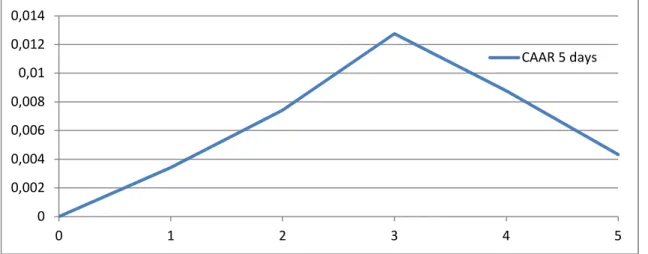

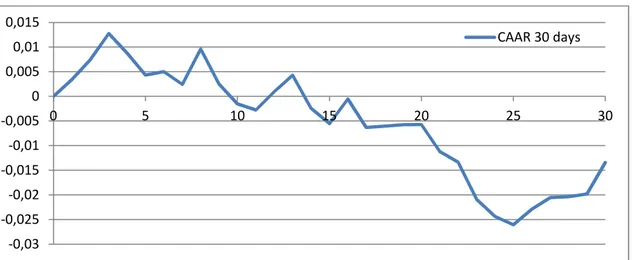

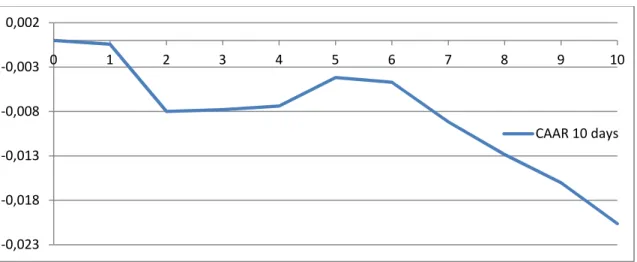

The results that we have found indicate that outsiders have a possibility to earn abnormal returns in small companies by using the information provided by FI. The strongest positive result that we attained by our tests was an 1.367% cumulative average abnormal return (CAAR) for a 5 day period with the intensive trading strategy on Small Cap companies. It was surprising that all the tests executed showed negative abnormal return over 30 and 90 days, with some of them being negative statistically significant. The results imply that the trading strategies would not be successful for a time-period over 30 and 90 days. The large volume transaction strategy and the third strategy for Small Cap companies did not result in any statistically significant results but showed positive development for 5 day event peri-ods.

We conclude through our study that reported insider trading is valuable for outsiders in-vesting in small companies over short time-periods. The results that we found indicate that smaller companies are less efficiently priced than larger companies.

Table of Contents

1

Introduction ... 1

1.1 Insider Trading ... 2 1.2 Problem Discussion ... 2 1.3 Purpose ... 32

Theoretical Framework ... 4

2.1 Efficient Market Hypothesis ... 4

2.2 Random Walk Theory ... 5

2.3 Complementary theories – Behavioral Finance ... 5

2.3.1 Signaling theory ... 6

2.3.2 The Market for Lemons ... 7

2.3.3 Alchemy of Finance ... 7

2.4 Insider Regulations ... 8

2.4.1 Discussion points in the Swedish regulation ... 8

2.5 Quasi insiders ... 9

3

Previous Studies ... 10

3.1 International Studies ... 10

3.2 Swedish Market ... 12

3.2.1 Conclusion from previous studies ... 13

4

Method ... 15

4.1 Methodology ... 15

4.2 Qualitative and Quantitative research methods ... 16

4.3 Data Collection ... 17

4.3.1 Collection of data ... 17

4.3.2 Delimitation ... 17

4.3.3 Trading strategies ... 18

4.4 Event Study ... 19

4.4.1 Defining the event period ... 19

4.4.2 Abnormal returns ... 20

4.4.3 Aggregation of abnormal returns ... 21

4.4.4 Hypothesis test ... 22

4.5 Criticism of method ... 24

4.6 Reliability and Validity ... 24

5

Results and Analysis ... 26

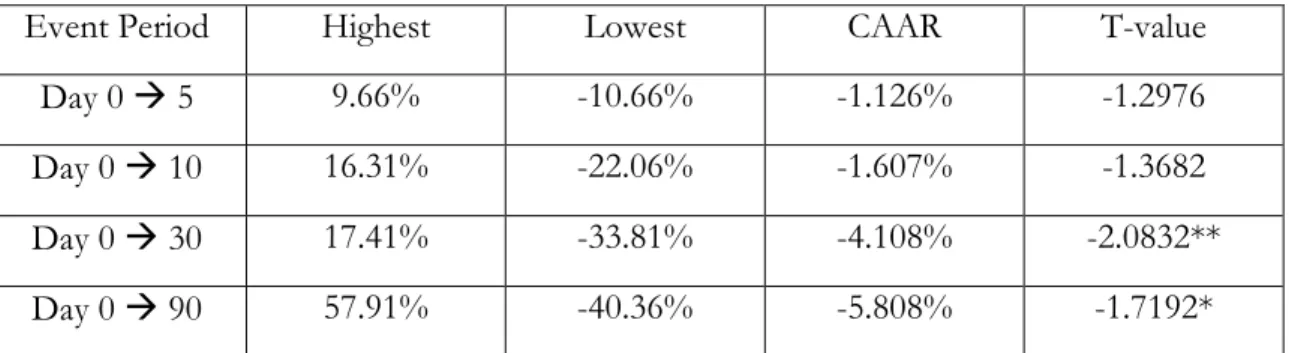

5.1 Intensive trading criteria ... 26

5.1.1 Event study on the Small Cap Data ... 26

5.1.2 Event study on the Mid Cap Data ... 27

5.1.3 Analysis ... 28

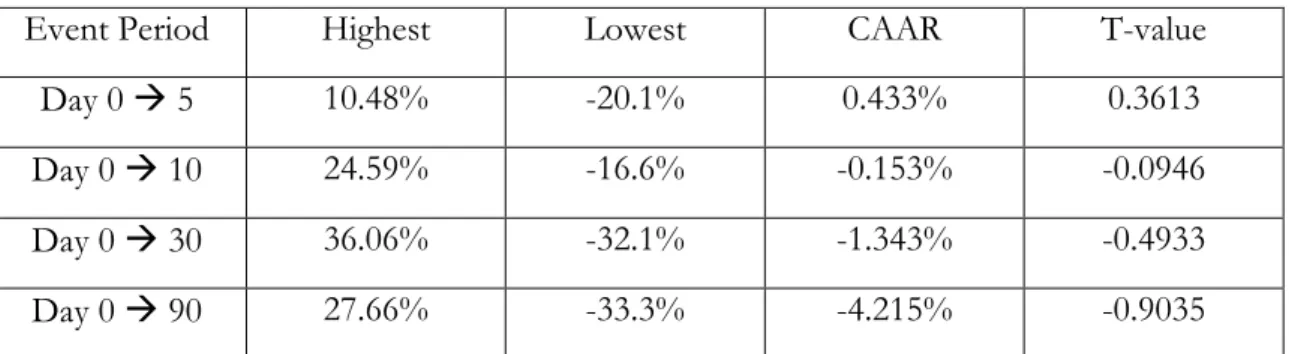

5.2 Large volume criteria ... 28

5.2.1 Event study on the Small Cap Data ... 28

5.2.2 Event study on the Mid Cap Data ... 29

5.2.3 Analysis ... 29

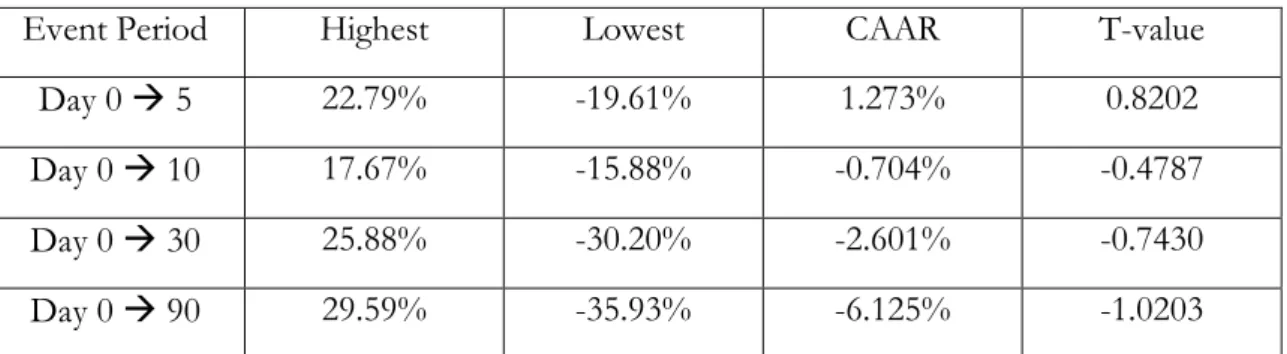

5.3 Intensive and Large Transaction Criteria on Small Cap ... 30

5.3.1 Event study on the Small Cap data ... 30

5.3.2 Analysis ... 31

6

Conclusion and future research ... 35

6.1 Conclusion ... 35

6.2 Suggestions for future studies ... 36

7

References ... 37

8

Appendix ... 40

8.1 Table of CAAR for Small Cap intensive ... 40

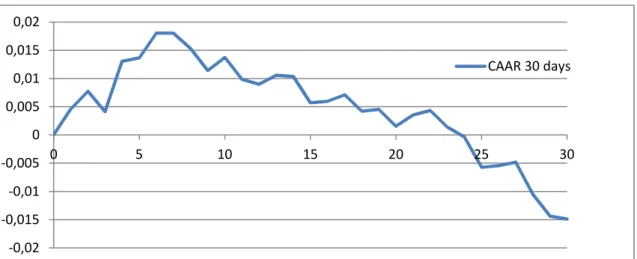

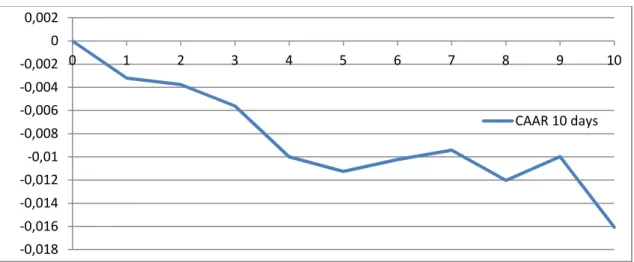

8.2 Small Cap intensive trading graphs ... 40

8.3 Table of CAAR Mid Cap intensive ... 42

8.4 Mid Cap Intensive trading Graphs ... 42

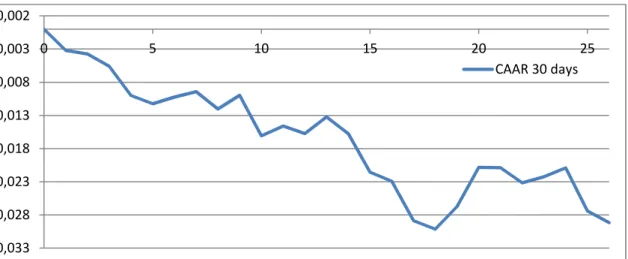

8.5 Table of CAAR large volume purchases, Small Cap ... 44

8.6 Large volume purchases Small Cap graphs ... 44

8.7 Table of CAAR large volume purchases, Mid Cap ... 46

8.8 Large volume purchases Mid Cap graphs ... 46

8.9 Table of CAAR for the third test (intensive criteria + large transactions)... 48

8.10 Third test (intensive criteria + large transactions) graphs ... 48

Definitions Insider

o An insider is a person that either through ownership or position in a com-pany has access to non-public information. We have used the Swedish law on insider trading to define an insider, the law on insider trading is dis-cussed in section 2.4.

Quasi Insider

o Investor that through their position as intermediaries or their close relation-ship with a firm can attain information before it reaches the public.

Outsider

o An outsider is a person that has no access to non-public information. Swedish Financial Supervisory Authority (FI)

o Is a government agency which is by law given the task to regulate and over-see the capital market in order to create and maintain the trust and the effi-ciency of the market.

CAPM

o Capital Asset Pricing Model states that the return on a security is the risk free rate plus the risk premium. Meaning that an investor is compensated for their investment by time value and the risk they are taking.

Days

o When discussing time-periods in this paper is one day equivalent to a day when the capital markets are open for trades.

OMX Stockholm Small Cap (Small Cap)

o The group of companies based on market value which the OMX Stockholm

Small Cap GI index is based on. Companies with a market value below 150 million euro are listed on the small cap list.

OMX Stockholm Mid Cap (Mid Cap)

o The group of companies based on market value which the OMX Stockholm

Mid Cap GI index is based on. Companies with a market value between 150 and 1000 million euros are listed on the mid cap list.

1

Introduction

In the introductory chapter will we define the terms “insider” and “insider-trading” and give background in-formation about some important aspects about the Swedish regulations around insider trading. In the prob-lem section will we discuss the relevant probprob-lem and opportunities within the topic and the purpose section will be used to explain why and how we have done this research.

It is a common view that prices of securities should “fully reflect” all available information since Fama (1970) introduced the Efficient Market Hypothesis (EMH). According to the EMH would only new information change the view of the company and therefore the pric-es of the securitipric-es. The problem with the EMH is if some invpric-estors can get new infor-mation before the rest of the market, which would cause inforinfor-mation asymmetries. Infor-mation asymmetries are discussed in the theoretical framework chapter of this paper. Many researchers have studied the phenomena of information asymmetries in finance, meaning investigating if some investors have more information to base their trades on than other investors, and how they can use such information. There have been numerous stud-ies that have shown that some investors possess extra information, people that posses’ non-public information could for example be board members, large shareholders, key em-ployees, top management and families to all people in those positions. Individuals with special insight of a company are called insiders and previous studies shows that they can use their extra information to gain a higher average return than other investors (Loire & Niederhoffer, 1968, Jaffe, 1974, Seyhun, 1998 and Acosta & Olofsson, 2006).

The indication that insiders possess extra information have created a big interest about in-sider trading from money managers which has lead to the creation of systems and newslet-ters with the purpose of providing the market with information about insider trades (Lakonishok & Lee, 2001).

The reason for the attention is summarized by this quote from an Individual Investor

"Company executives and directors know their business more intimately than any Wall Street an-alyst ever would. They know when a new product is flying out the door, when inventories are piling up, whether profit margins are expanding or whether production costs are rising... You always hear about the smart money. Generally, that is the smart money." (Individual Investor, Feb. 1998, p, 54 cited in Lakonishok & Lee, 2001).

Is all the interest about insider activities necessary? The information presented in this sec-tion implies that insiders possess extra informasec-tion and that it could be favorable for other investors to use the information from insiders in their own trading, could it? This paper is investigating the possibilities to earn abnormal returns for outsiders by following invest-ment strategies based on insider trades.

The tests performed in this study conclude that insider purchases contain information that can help outsiders to earn statistically significant abnormal returns over short time-periods.

One trading strategy showed average abnormal return of 1.367% over 5 days. The results are non-positive over longer time-periods of 30 and 90 days.

1.1

Insider Trading

An insider is an individual that for different reasons have special insight in a company and have access to non-public information. We have been using the Swedish law which is regu-lating insider trading and its definition of an insider to define people as insiders in this pa-per. It is important to state that being an insider is not a crime, it is the way an insider uses the information that determines if the person is committing a crime or not.

In Sweden, insider trading is regulated by a law which is upheld by the Swedish Financial Supervisory Authority (FI). Companies that are listed on the Swedish Stock Exchange have to provide a list of people that have access to inside information of the company to the FI. People that are listed as insiders are by law obliged to provide FI with information about their trades and holdings of financial instruments for the company that they are listed as in-sider in. The list of inin-siders and the information about their trades and holdings is public information and available for everyone. The purpose of having these regulations is to pre-vent people with access to inside information in a company to trade on non-public infor-mation. The regulations are also a system to maintain an efficient capital market without in-formation asymmetries.

The laws and regulations for insiders will be presented in more depth in section 2.4.

1.2

Problem Discussion

Previous research (Lorie & Niderhoffer, 1968, Jaffe, 1974, Seyhun, 1998 and Acosta & Olofsson, 2006) has found that insider has the possibility to earn abnormal returns because of information asymmetries between investors, which are contradictory to the EMH. The EMH is one of the most well-established and tested hypothesis in finance and it will be discussed more extensively in the theoretical framework section of this paper.

One of the tasks that FI has is to publish insider trades that have been executed on the cap-ital market. The purpose of the publishing is to minimize information asymmetries and create a transparent market. This creates an opportunity to examine the possibility for an outsider to use the information from insider activities to earn abnormal returns. Can this opportunity be exploited to earn abnormal returns on the stock market?

Sjögren (2008) found signs that outsiders could benefit from imitating insiders in small firms, but the study failed to show results that was statistically significant. We will examine the opportunities by using a longer time-period and therefore have the possibility to use more data to create a more extensive test in our attempt to create a successful trading strat-egy based on insider trades.

There are three good reasons to study insider trading: profit, science and policy (Jeng, Metrick and Zeckhauser, 2003). The reason to study the profits from insider trading is to

create a trading strategy to earn abnormal returns by following the trades of insiders. Sci-ence investigates the implication the results of the study have on market efficiency. The policy studies is investigating the trading regulations, how effective they are and how the possible advantages insider has effect market performance and the fairness of the market.

1.3

Purpose

The purpose of this thesis is to investigate the possibilities to create a successful trading strategy based on the published insider purchases on the Stockholm Stock Exchange. Event studies are performed on different trading strategies in order to fulfill our purpose. The event studies are examining the possibilities to earn abnormal return for outsiders by following the insider purchases published by FI. The tests are focused on insider purchases since there are several reasons for insider sales, such as portfolio diversification and/or li-quidity needs (Lakonishok & Lee, 2001). Previous studies support that view when they conclude that insider purchases contains more information for outsiders than insider sales (Lakonishok & Lee, 2001 and Jeng et al. 2003). We have used an intensive trading criteria to filter out some of the insider transaction since previous studies (Jaffe, 1974, Seyhun, 1985 and Jeng et al. 2003) concluded that such a criteria was the best filter rule to disregard noise in the observations. Since there are recent studies (Lakonishok & Lee, 2001, Jeng et al. 2003) that concludes that high-volume transactions are containing more information about future stock price movement have we also conducted a test based on large volume purchases.

The companies were further divided into lists based on the OMX-listing on market value, and tests were done separately on the small cap and the mid cap lists to evaluate if and which of our trading strategies that would be the most successful. Companies listed on large cap were excluded from this research since a similar research on a big part of that group has already been done (Lindgren & Ohlsson, 2008), and because previous studies stress the fact that insiders transactions earn higher returns in smaller companies (Elliot, Morse & Richardson, 1984, Seyhun, 1985, Lakonishok & Lee, 2001 and Jeng et al. 2003). Section 2 in this paper will present theories connected to the topic regarding prices of secu-rities and introduce the Swedish law on insider trading. Section 3 will go on and present previous studies in the field of return and information from insider trading both interna-tionally and in Sweden. Section 4 will explain the methods used in our research and provide information on how the tests were performed. Section 5 will present the results of the tests and the analysis of those results. Section 6 will conclude the findings from this research.

2

Theoretical Framework

The theoretical framework section will present important theories connected to efficient markets and informa-tion asymmetries which is relevant for our study. The secinforma-tion will also discuss insider trading in greater depth, and the rules and regulations regarding insider trading.

2.1

Efficient Market Hypothesis

Fama (1970) introduced the Efficient Market Hypothesis (EMH), according to the EMH is the capital markets primary role to allocate the capital of the market. The EMH is one of the most dominant and discussed theories in finance, it defines a market as efficient when the prices of the securities fully reflect all available information. Since the theory is hard to apply in reality did Fama (1970) introduce the following conditions as sufficient for a mar-ket to be considered efficient:

1. There are no transaction costs for trading securities 2. All information is free to access for all market participants

3. All market participants agrees on the implication of current information on current price and distribution of future prices.

The definition has through time changed to take transaction costs in to account and a more fair definition would be that prices should reflect information until the marginal costs of obtaining information and trading no longer exceed the marginal benefit (Elton, Gruber, Brown & Goetzmann, 2011). The stated conditions are sufficient for an efficient market, but not requirements. Meaning that it is enough that a sufficient number of investors agree on implication of information in price, and a sufficient numbers of investors have free ac-cess to the information for the market to be considered efficient (Fama, 1970).

Fama (1970) introduced three different forms of the EMH since the hypothesis that an ef-ficient market would “fully reflect” all available information in security prices was very strong. The three different forms of EMH were first introduced 1970 but have been adapted through time when new evidence has been presented. The three form of EMH are: Weak form, the weak form states that all historical information is reflected in the prices of securities. Tests on the weak-form are generally done by using trends and historical values to try to predict future movement in stock prices.

Semi-strong form, the semi-strong form states that all publicly available informa-tion is reflected in the prices of securities. Tests on the semi-strong form are often done by using event studies to examine how efficiently new information is incorpo-rated in prices.

Strong form, states that all information, public and private will be reflected in the prices of securities. Tests on strong form are generally done be examining if insid-ers and/or mutual fund managinsid-ers has the possibility to earn abnormal returns,

which would indicate that they possess information that is not incorporated in stock prices.

According to Fama (1970 & 1991) have tests on the different forms shown a strong sup-port for the EMH in the weak and semi-strong form while inside information is not re-flected in prices, meaning that insiders can use that information to earn abnormal returns – contradictory to the strong-form of the EMH.

2.2

Random Walk Theory

The random walk theory shares some of the main points with the EMH. The random walk theory is based upon that future development cannot be predicted by past actions (Malkiel, 1999). The random walk theory assumes that securities are fairly priced, meaning that the prices are reflecting the available information. If a price is too high or too low, it would be forced up or down by investors using the mispricing to earn money until the price is fair (Fama, 1970). An assumption of fair prices would mean that the only price changes occur when new information reaches the investors, and since new information is unpredictable will also the movement of prices be unpredictable. Because of the random movement, the only way for investors to earn higher return is to expose themselves to a higher risk.

2.3

Complementary theories – Behavioral Finance

The research within financial theories has developed substantially since the EMH was first presented and seemed like the main and dominating theory within finance. When the re-search has evolved have new theories been presented and one of the most vital and studied topics the last 15 years has been the behavioral finance theory, which is contradictory to the EMH in many levels and therefore offers explanations to facts that the EMH cannot explain (Shleifer, 2000 and Shiller, 2003)

Behavioral finance is addressing problems from a social perspective, using psychology and sociology to explain financial markets and economy (Olsen, 1998 & Shiller, 2003). While the EMH assumes that investors acts rational, behavioral finance researchers (Kahneman & Tversky, 1979, Olsen, 1998, Shleifer, 2000, Shefrin, 2003 & Shiller, 2003) tend to think the opposite. For example do investors tend to be more risk-averse about possible gains, and more risk-seeking about possible losses, and not all investors manage to solve compli-cated optimization problems (Shiller, 2003), therefore are investors in many cases trading on noise instead of information (Shleifer, 2000). In many cases investors deviate from the passive buy and hold strategy that the EMH assumes uninformed traders are using. Kahneman and Riepe (1998) conclude that investors will deviate from assumed decision models for a numbers of reasons, for example: they follow the advice from financial gurus, they fail to diversify, they actively trade stocks, and they follow stock price patterns and other popular methods (cited in Shleifer, 2000).

The EMH is acknowledging that irrational investors exists, but argue that their effect on the market is limited because they trade randomly, and that the informed investors will take

opposite action keeping securities at their fundamental value (Shleifer, 2000 and Shiller, 2003). The argumentation for behavioral finance completely denies the argument that irra-tional traders are cancelling each other out. Behavioral Finance instead argues that these deviations from rationality tend to go in the same way (Kahneman & Tversky, 1986). Unin-formed investors buy and sell actions are highly correlated and many of them would buy and sell the same securities at the same time, a problem that becomes even stronger when the investors are listening to rumors and following the trades of experts and analysists (Shiller 1984 in Shleifer, 2000). Shleifer (2000) also presents some examples of when pro-fessional money managers not behave fully rational. They may base their investment deci-sion to minimize the risk of a worse result than the benchmark, and by basing trades on what competitors do they are creating a herd behavior.

Shleifer (2000) also present some theories arguing that the arbitrage theory is not working as efficient as it would have to do to fully compensate for the actions from uninformed in-vestors and bring the prices back to fundamental values (efficient market). Arbitragers who sell, or short sell overpriced securities must be able to buy a similar security that can be used as a substitute which is not overpriced to create a fully arbitrage opportunity. There exist close substitutes for many securities, for example futures and options, but stocks and bonds arbitrageurs as a whole has a limited ability to bring prices back to fundamental val-ues because of the lack of obvious substitutes. Shleifer (2000) also points out that funda-mental risk remains with imperfect substitutes since surprises can occur on both sides of the trade. Even if arbitrageurs has the possibility to create a perfect hedge they still have to be prepared to accept the costs of the mispricing getting worse before it disappears, making a perfect arbitrage more risky and less desirable.

The behavioral finance is not trying to disregard EMH totally, but it provides a useful re-flection that markets do not always work well and reflect the available information. There-fore should the interaction and psychology of investors be taken into account when analyz-ing financial markets.

2.3.1 Signaling theory

A part of the market’s psychology is based on how the market reacts to signals from the companies. Such signals can for example be the choice of dividend policy and the selection of capital structure. The effects from signaling are based on the perception that the people taking the decisions (company managers) have more information than the rest of the mar-ket, and that they are signaling their attitude and beliefs through the decision they take (Levy & Lazarovich, 1995).

From the signaling theory is it possible to argue that the transactions made by insiders are signals on how insiders perceive the future of the company and that their action give the rest of the market a signal they can take in to account or ignore.

2.3.2 The Market for Lemons

One important discussion to have in mind is the discussion about information asymmetries among investors trading with financial papers, Akerlof (1970) introduced the discussion about information asymmetries on the market and was later awarded the Nobel Prize for his contributions to the field (nobelprize.org, 2012).

Akerlof (1970) used the market for used automobiles to make an example of the discussion on the problems with information asymmetries on a market. On the market for used auto-mobiles will the seller that has used the product (the car) know more about the quality of the product than the buyer. The information asymmetry between the seller and the buyer will make the seller accept the buyers valuation (offer) if the product is of lower quality (value) than the offer and reject the buyer’s offer if the product is of high quality (value) compared to the buyer’s offer.

Information asymmetries presented above can be directly connected to what we are dis-cussing in this thesis, information asymmetries on the financial markets would mean that insiders possess more information about the company (the product) and therefore have a higher possibility to make good valuation.

Information asymmetries undermine the trust of the market (Akerlof, 1970). A market with high uncertainties, lack of trust and information asymmetries will make business suffer, therefore are the regulations and rules of the market governed by FI important to be able to keep a stable and safe market.

2.3.3 Alchemy of Finance

The fund manager George Soros is presenting the importance of reflectivity for investment theories and strategies in his book “The Alchemy of Finance”. Soros (1994) does not be-lieve that the stock prices are reflecting fundamental values, or that the prices is moving towards its fundamental value. Soros (1994) instead assumes that

Markets are always biases in one direction or another Markets can influence the event they are anticipating

Soros (1994) means that the combination of the two assumptions can explain why the market can seems to be correct when anticipating events.

Soros (1994) also discussed the underlying trend which influences the movement of the stocks, whether it is recognized or not by investors. When stock prices reinforce the under-lying trend it is called reinforcing and the when the opposite happens, it is called self-correcting. When a trend is reinforced it starts to accelerate and the deviation between ex-pectations and the actual stock prices movement gets wider and the opposite happens when it is self-correcting.

Soros (1994) means that the market is not able to reach equilibrium and that it is not even moving towards equilibrium. Depending on trends and the bias of investors’ will the reac-tion of events going to be different depending on such factors. Soros (1994) theories mean that an outsider that tries to shadow insiders also has to consider the underlying trends in the market and in the industry, as well as the bias among investors in the company.

2.4

Insider Regulations

The provision (2000:1087) “Lag om anmälningsskyldighet för vissa innehav av finansiella instrument” of the Swedish law is regulating which kind of activities that has to be reported to FI, and which people that is obligated to report.

The law defines what kind of people/companies that are considered to be insiders and are obliged to report their financial standings in a company.

1. Board representative or alternate member in a company or the mother company 2. CEO or vice CEO in the company or the mother company

3. Auditor or alternate auditor in the company or the mother company 4. Owner of a trading company

5. A person with a role in the company that gives access to insider information that may have an effect on the stock price

6. A person with a role in an affiliated company that gives access to insider infor-mation that may have an effect on the stock price

7. An investor that owns at least 10% of the shareholder equity or voting rights 8. Relatives to the owner such as wife, husband or children which owns at least 10%

of the shareholder equity or voting rights.

An investor defined as an insider by the law has to report their financial standings in the company when:

When the company becomes publicly listed When the investor gets classified as an insider Changes their financial standing in a company

When they are informed that a relative changes their financial standing

Insiders have to leave reports regarding changes in their possession of financial instruments within 5 bank days. People described in point 1 to 3 above are by the law forbidden to trade 30 days before an financial report is released including the day of the release. The law also states that FI has to keep a record of insider transaction and as soon as possible make the information public to the market.

2.4.1 Discussion points in the Swedish regulation

The insider regulations in Sweden have been a topic of discussion over a long period of time. One of the most discussed problems with the Swedish insider regulations is how the law is handling usage of foreign intermediaries and accounts to hide trades from the FI. There exist several possibilities for legal insiders to avoid supervision from the FI, for ex-ample by usage of endowment policy (Larsson, 2006).

The opportunity the endowment policy creates for insiders is a problem which FI is aware of and trying to control (Spängs, 2012 and Tidningarnas Telegrambyrå, 2012).

2.5

Quasi insiders

As stated before is one of the main objectives for the FI to uphold the trust and the effi-ciency of the Swedish capital market. The regulation of insider trading is one way to deal with one factor that creates an inefficient market, information asymmetries. When financial actors can trade on non-public information they have a comparative advantage to other in-vestors. The comparative advantage is something that the regulations of insider trading try to prevent in order to have a market where every actor on the market has access to the same information.

The current financial regulation presented in the previous section only regulates the actions from some actors that may have access to inside information. Quasi insiders are not classi-fied as insiders by the law, it can for example be analysts, banks and other actors on the market that can gain non-public information through their close relationship with a certain firm. Lerner (1995) defines two specific quasi insiders, banks and venture capitalists. Banks and venture capitalists have access to detailed knowledge about firms they invest in through their role as financial intermediaries.

Hirschey, Slovin and Zaima (1990) studied the banks role as quasi insiders. They argued that banks could be quasi insiders, they could receive private information through their re-lationship with different firms. Banks can be classified as quasi insiders and if an outsider knows what to search for could inside information be conveyed by the positions a bank takes in a firm. A loan from a bank with a good reputation is a signal to the market that the bank classified the company as stable and trustable. Hirschey et al. (1990) found evidence that if a firm has a large amount of bank debt when an unexpected managerial decision such as selloff is taken will the market react positively. That is because in such a situation the bank will take a considerable position in the firm to support their own evaluation of the firm.

Wong, Cheung and Wu (2000) concluded that quasi insiders on the Hong Kong stock market could earn abnormal return in small firm with relatively high insider trading volume. In their research they defined a quasi insider as an investor that had the means to gain in-formation about insider trading at the transaction date, before the inin-formation became public.

The positions and amount of quasi insiders on the market is interesting because it changes the structure of the market and adds another step of information asymmetries. Quasi insid-ers are hard to sort out and classify and will not be a part of our tests, but they play an in-teresting role in the financial markets.

3

Previous Studies

The previous studies section will present different studies that have focused on insider trading. Most studies have focused on the US market but we have included studies from other markets as well. However is the re-search regarding the Swedish market much less comprehensive. The results from previous studies are diverse, and the studies are covering different time-periods and have different approaches on how to divide the trades done by insiders. We will present studies in the field in chronological order.

3.1

International Studies

In his research, Jaffe (1974) presented studies from Rogoff (1964) and Glass (1966) which showed that intensive insider trading in a company was a good prediction for the stocks development the following 6-7 months, similar results were found by Lorie and Niederhoffer (1968). Wu (1962) presented a study which concluded that there is no rela-tionship between insider trading and future development in stock price (cited in Jaffe, 1974).

Because of the different results and problems with the previous studies (outdated, too small sample) Jaffe (1974) made his own test using more recent data and more powerful tools. The research showed that insider had information that could make them perform better than the average investor on the market. Periods with intensive insider trading gen-erally resulted in abnormal returns after transaction costs. Further did the research show that outsiders could use the information from intensive insider trading periods to make an average of 2-3% higher return than the market after transaction costs.

Penman (1982) showed that insiders used their information to take profitable positions be-fore earning announcements. Elliot et al. (1984) concluded that there was a bigger possibil-ity for insiders in smaller firms to earn abnormal returns because the information was not accurately reflected in the stock price to the same extent as in larger firms.

Seyhuns (1985) extensive research with over 60 000 insider transactions supported previous research from Lorie and Niederhoffer (1968) and Jaffe (1974) which showed that insiders was good at timing the market, and that the most profitable insider trading occurred in small firms. The result from the study further supported the conclusion Jaffe made 1974 regarding that increase in abnormal profits was correlated to an increase in net number of insider purchases/sales, and that there was no clear relationship between size of insider transaction and value from the transaction. The research however showed that size of in-sider transaction could be a signal of future abnormal changes in stock price if the transac-tion size was measured in relative terms to the size of the company and the average size of the trades done by that insider. The test further showed that insiders who are expected to have more knowledge about the company were more successful in predicting future stock changes, the test showed that the board of directors was more successful than other insid-ers on many occasions.

Seyhun (1985) also examined the possibilities for other investors to follow the trades done by insiders to earn abnormal returns, the results were negative when transaction costs and the time-lag for making the information public were taken into account. Seyhun further tried to create a selective trading strategy based on his finding regarding the identity of in-sider, the volume of trades, the frequency of trades and the size of the company. The result from the selective trading strategy did not show any abnormal returns after transaction costs.

Rozeff and Zaman (1988) did further tests on the possibilities for outsiders to earn abnor-mal returns by using information about insider trades. They used an intensive trading crite-ria to reduce potential noise from trades because of portfolio rearrangement and diversifi-cation. They concluded that corporate insiders abnormal return was on average 3%-3.5% after transaction costs, which was statistically significant. For outsiders using the infor-mation from insider trades was abnormal profits non-existing or negative for 1, 3 and 6 months holding period using 2% round-trip transaction cost, but over a 12-month period an excess return of 3.7% per year was presented for outsiders following insider trades. Chowdhury, Howe and Lin (1993) concluded that insiders use a contrarian strategy, mean-ing that they tend to go against the actions taken from other investors. Even if insiders have the ability to find profitable investments they are to a high degree caused by macroe-conomic factors, meaning that the mispricing they find is in many cases not a mispricing of the specific security but rather the whole market, a similar observation was also presented by Seyhun (1985). The limited ability of insiders to find specific mispricing in their own companies mean that outsiders cannot use insider transactions to make a profitable predic-tion about the future.

Seyhun (1998) did a new test with new data and a longer time-period and concluded that aggregate insider purchases are follow by higher than average return for the coming 12 months, and insider sales are followed by lower return than average for the coming 12 months.

Eckbo and Smith (1998) used three different performance measures for insiders on the Os-lo Stock Exchange and concluded that insiders did not earn abnormal returns.

Lakonishok and Lee (2001) made a comprehensive research using all insider stock trades for all companies on the NYSE, AMEX and NASDAQ during 1975 to 1995. The conclu-sions were in many ways similar to the results from previous research, for example that ag-gregate insider trading predicts future movement in stock prices. They explained that small companies are less efficiently priced than larger companies and therefore were insiders in smaller companies better at predicting future price movements than insiders in larger com-panies. The research also explained why purchases are more informative than sales. There could be several reasons for selling a stock, for example portfolio diversification or liquidity problems, but there is probably just one main reason to purchase stocks, and that is to earn money. Further did the research conclude that manager’s trades were more informative

than large stakeholders and that companies with extensive insider purchases outperformed companies with extensive sales with 7.8% for the first 6 month after the transaction, with 2.3% the second year after the transaction, while there was no difference during the third year.

Lakonishok and Lee (2001) further studied the information from insider trades to find the best signals for outsiders. By implementing an intensive trading criterion they showed that insider’s purchases in small and medium companies was predicting future results, infor-mation which could be used by other investors. They ended their research by concluding that insiders performed better than the average investor and that their trades were informa-tive about future development, especially for small stocks. Unfortunately did they not per-form any test on the possibilities for outsiders to earn abnormal returns by using infor-mation from insider trades. The researchers concluded that a strategy should be focused on low value stocks, and trading such stocks are costly, and therefore were they very doubtful about the performance of such a strategy.

Jeng et al. (2003) presented an extensive research that showed that a portfolio consisting of insider purchases outperformed the market with 11.2% per year, ¼ of the abnormal return occurred during the first five days after the trade and ½ of the abnormal return had oc-curred within a month after the purchase. The research did not find any evidence that in-siders in a certain position would perform better or worse than any other investor. Further conclusion from the research showed that insider sales did not earn abnormal returns, that insider purchases in firms with low market value earned more than insider purchases in larger firms, and that larger purchases generally earned higher abnormal returns than low volume purchases.

Jeng et al. (2003) did not test how informative insider activities are for outsiders, meaning if other investors could use the information to earn abnormal returns. The researchers how-ever conclude that an intensive trading criteria would be the ideal tool for outsiders that are trying to gain advantages from information about insider trading.

3.2

Swedish Market

There have been previous studies on the Swedish market, some of the studies have showed indications that the information from insider trades could be useful for outsiders, but that it is hard for outsiders to know how to value the information from insider trading.

Acosta and Olofsson (2006) did a study on smaller companies on Aktietorget and Nordic Growth Markets and found that insiders in these markets earned a higher average return than the market, they did not study the possibility for outsiders to use this information. Lindgren and Ohlsson (2008) tried to create an investment strategy based on insider trad-ing for OMX30, although they found a relationship between insider transactions and de-velopment of stock price they were not able to present a trading strategy for outsiders that

earned abnormal returns. Sjögren (2008) did research on the Stockholm Stock Exchange small cap list but could not find statistically significant evidence that is was possible to use the information from insider trading to earn abnormal returns.

3.2.1 Conclusion from previous studies

Table 1.

Summary of previous studies in the field. Researcher(year)

Market Conclusion Can Insid-ers/Outsiders earn

ab-normal returns

Jaffe (1974) U.S. Insiders earn abnormal returns, intensive trading periods con-tains more information.

Yes/Yes

Seyhun (1985) U.S. Insiders earn abnormal returns, outsiders cannot create a suc-cessful trading strategy based on insider transactions.

Yes/No

Rozeff & Zaman (1988)

U.S. Outsiders can create a trading strategy earning abnormal re-turns in a long-time horizon based on intensive insider trad-ing.

Yes/Over long time-period

Chowdhury, Howe and Lin

(1993)

U.S. Outsiders cannot use infor-mation from insider transac-tions to earn abnormal returns over an 8-week period.

Yes/No

Eckbo and Smith (1998)

Norway Insider does not earn abnormal

returns on their investments. No/Did not test Lakonishok &

Lee (2001)

U.S. Insider perform better than the average investor, it is not rea-sonable that an investment strategy based on insider trans-actions would be successful.

Yes/Did not test, but not reasonable

Jeng et al. (2003)

U.S. Insiders outperform the mar-ket, most of the abnormal re-turns occur close to the trans-action.

Yes/Did not test

Acosta & Olofsson (2006)

Sweden Insiders in small firms earn

ab-normal returns. Yes/Did not test

Lindgren & Ohlsson (2008)

Sweden Outsiders cannot earn abnor-mal return by basing their in-vestments on insider transac-tions.

By studying the previous research did we create a good foundation from where we based our own research. Most researchers in the topic seems to agree that insiders possess infor-mation that can make them perform better than the market, but there is no clear consisten-cy regarding which opportunities that create for other investors. One reason is that the stock prices quickly absorb the information of an insider transaction when it is announced and that outsiders have a short period of time to act on it.

Several researchers concluded that insider trades in small firms earned higher abnormal re-turns than in larger firms (Elliot et al. 1984, Seyhun, 1985, Lakonishok & Lee, 2001, Jeng et al. 2003). Which is explained by a lower liquidity in small firms which means that an insider transaction have greater effect on the stock by itself. The general knowledge on the market regarding small firms is lower than regarding larger firms, which increases the information asymmetries between insider and outsider for smaller firms. The previous studies showed that intensive trading periods are containing more information about the future (Jaffe, 1974, Seyhun, 1985 and Jeng et al. 2003). The recent studies from Lakonishok and Lee (2001) and Jeng et al. (2003) indicated that larger transactions contained more information about the future and that insider purchases were better at outperforming the market than insider sales.

With all respect to the previous research on the Swedish market did we want to create a strategy that was considering the findings from previous studies to a bigger extent (not fo-cus on just large companies), and that was covering data for a longer time-period than Sjögren (2008). Previous research has also used different ways to handle transactions costs and to create their replication strategies and therefore did we think that there was a gap in the research on the Swedish market. We have tried to create strategies for how to follow insiders by using the knowledge we have gained from previous studies.

One important discussion to have in mind regarding the discussion of the results from in-sider transactions is that inin-siders probably have more knowledge about financial market than the average investor. Their positions in companies are probably attained because of high knowledge and good analyzing-skills. With that in mind could abnormal returns earned by insiders possibly be explained by a knowledge-gap compared to the average in-vestors instead of an information-gap regarding the certain company. If insiders abnormal returns can be explained by superior skills, inside information or if it is a mix of both is hard to evaluate. Following insiders to try to use their knowledge is nevertheless an inter-esting trading strategy.

4

Method

The method section will describe the methodology and research methods that have been used in the thesis. The reader will receive insight to different approaches and methods as well as argumentation for why some methods have been chosen and others have been disregarded.

4.1

Methodology

There are two major paradigms called positivism and interpretivism, these are two frameworks in how we interpret the world around us. The positivism sees the world objectively which is governed by universal laws in a value free context. Researchers that are positivists stay separate from the subject they are studying and use quantitative methods and deductive reasoning to reach a conclusion. The interpretivism view the world subjectively where people experience and have individual interpretation of the world. Researchers that belong to

inter-pretivism are very connected to the subject they are studying and use flexible and qualitative research to reach a conclusion (Burns & Burns, 2008).

Positivism has 5 major standpoints according to Müllern (2012): 1. Believes in a homogenous universe

2. All parts of the universe can be explained

3. We can learn and gain knowledge about the universe 4. We can build a system of knowledge

5. Mathematics is the universal language

Through positivism the world can be seen from two different perspectives, induction and

de-duction. Induction is based on the idea that a serial of separate events occur and from that one can make generalizations about the world and establish a framework (Andersen, 1990). More precisely we can say that inductively thinking is that we see something happening over and over again in different surroundings and the effects are the same. From that we can learn that the outcome will always will be the same, and we can generalize the world around us. Induction is a very popular scientific approach, but also in our everyday life, we tend to learn from what we experience (Graziano & Raulin, 2004). For a generalisation to hold according to induction:

1. Large enough number of observations

2. The observations has to be repeated in different circumstances 3. No observation can deviate from the generalization

(Walliman, 2001).

Deduction is that one perceives the world from an established theory and what happens is a consequence of the established theory/principles. Deduction moving from the general to the single, drawing a conclusion which usually built on logic, and the conclusion is valid through the proposition (Andersen, 1990). It can be seen as trial and error, a theory is tested and either accepted or rejected. If it is rejected then a new theory is proposed and the fittest theory survives. When using the deduction a hypothesis has to be stated in order to

test the validity of the theory. A hypothesis has to be falsifiable, meaning that it has to be logical (Walliman, 2001). Deductive thinking can then be seen as one starting from a cer-tain generalisation of the world and applies it to predict future observations (Graziano & Raulin, 2004).

Induction and deduction is found in all types of theories but the theories tend to be drawn to one or the other. Inductive theories are characterized by that it tends to follow the data very closely and see where it leads. While deductive theories are based on certain beliefs, data is collected and the believes are tested through hypothesis testing.

In this paper have we approached the reality from already existing financial theories, so we have used a deductive approach for our research.

4.2

Qualitative and Quantitative research methods

A research can be based on qualitative or quantitative research methods or a combination of both. Quantitative method is used when a research starts with a theory or hypothesis and through various tests either confirm or reject the hypothesis or theory (Newman & Benz, 1998). Quantitative research methods emphasizes that data must yield proof or strong confirmation for a hypothesis to be true (Burns, 2000).

Quantitative research which is highly linked with positivism is using highly controlled re-search and experimentation to establish general laws or principals. The method is very strict in its framework and uses numerical data to do hypothesis testing to either confirm or reject an already existing theory or establish a new one. The data that is used have to strongly prove the theory or hypothesis. A researcher using the method knows clearly in advance what he/she is trying to find and the data is generalized in numbers and statistics but may lack in unveiling significant information (Burns & Burns, 2008).

Aliaga and Gunderson (2002) define quantitative research method as:

“Explaining phenomena by collecting numerical data that are analyzed using math-ematically based methods (in particular statistics).” (Citied in Mujis, 2004)

Quantitative research methods use numerical data and analysis to explain the phenomena that is being studied. The method takes its starting point from the idea that the world around us is governed by a set of rules. A researcher using quantitative research methods is not trying to develop new laws or theories about the world, the researcher is merely trying to find, or confirm the principles/laws. It uses statistics and numerical data to test different laws of the world to statistically accept or reject them based on the outcome. Quantitative research methods are strictly objective when it comes to the analysis and the researcher should be careful of not waging in personal theories that are not statistically significant. Qualitative research methods employs a more lose control over the research setting. Using this kind of method the research can capture softer data such as feelings, values, needs etc which is not seen in the quantitative data. The researcher is the instrument of data

gather-ing and usually only have a rough sense of what he/she is lookgather-ing for. The data collected is tough to generalize and it requires a significant amount of time to unfold all the infor-mation (Burns & Burns, 2008).

Qualitative research method has a different approach, it relies on the experience of individ-uals and subjectivity, the social reality is created of individual awareness. The method is not as structured as quantitative research methods, and less formal (Burns, 2000).

In this thesis is a null hypothesis used to examine if the abnormal returns from the trading strategies are different from zero. Since hypothesis testing is the best way to conduct the study was a quantitative method to prefer over a qualitative research.

4.3

Data Collection

Primary data is newly collected data for the specific research by the researcher. Secondary data is already collected data that have been collected by someone else such as govern-ments, analysists and/or researchers. Secondary data is usually studied before any type of research is started since it gives some insight about the topic (Burns & Burns, 2008). Our data is collected from FI and the Stockholm Stock Exchange and is thus secondary data.

4.3.1 Collection of data

This study is based on secondary historical data in form of daily closing prices of stocks and indexes and registered insider transactions from 2007-01-01 to 2009-12-31, during this period of time has the indexes experienced periods of both increase and decrease which will help to assess the strategies. The development for the indexes during 2007-2009 can be seen in appendix 8.11.

The historical daily closing prices for stocks and indexes have been collected from the web-site for the Stockholm Stock Exchange. The stock prices are adjusted for actions taken by the companies (stock split, etc) by the Stockholm Stock Exchange. In this research will the breakdown of the companies with respect to their size be the same as on the stock ex-change, the companies are divided into one small cap list and one mid cap list.

The data on insider purchases have been collected from FI’s public register of insider trades, further was the insider purchases divided in to lists depending on what list (small cap or mid cap) the company was quoted on at the beginning of 2007.

4.3.2 Delimitation

As explained previously (section 1.3), is this study focusing on insider purchases because of its higher relevance than sales for outsiders, and since previous studies (Lakonishok & Lee, 2001 and Jeng et al. 2003) concluded that insider purchases better predicts future price movements than insider sales. We have accepted those results and the explanations made in previous research and therefore chosen to not include insider sales in our test, it could have been interesting to have the sale transactions included in some way but that would

have meant more data to process and we have chosen to study data for a longer time-period instead.

In the few cases where we have had missing observations in our data for either stock price or index price have we assumed the same closing price as the previous day, those occasions were very few and it is reasonable to assume that the closing price from previous day are the best observation to use.

4.3.3 Trading strategies

From the collected data have we divided the data into different categories and formed sub-samples to examine different trading strategies we have found interesting. All insider pur-chases that we have collected have first been divided in to a small cap list or a mid cap list depending on which list the company is quoted on at the Stockholm Stock Exchange. The first test was based on an intensive trading criteria. The two subsamples are small cap and mid cap and are containing one event for every time three different insiders report a purchase in the same company within 5 bank days. The event day is defined as the publica-tion date of the informapublica-tion that the third different insider had executed a purchase. We have been using an intensive trading-criteria since previous studies have (Jaffe, 1974, Seyhun, 1985 and Jeng et al. 2003) have found that it is one of the best ways to reduce noise in the registered insider trades.

The second test in this research was done on samples based on large volume transactions. The two subsamples based on large volume transactions are containing one event every time an insider made a purchase of 400 000 stocks or more. The event day is defined as the publication day of a purchase containing 400 000 stocks or more. We are using large vol-ume purchases since recent studies from Lakonishok and Lee (2001) and Jeng et al. (2003) indicates that larger transactions contains more information about the future.

The third trading strategy conducted in this research was based on the results we obtained from the first two strategies, the third strategy is a mix of the two previous strategies. It is containing insiders purchases of 50 000 stocks or more in order to exclude noise created by smaller purchases, and is based on a short-term intensive trading criteria where two differ-ent insiders had to purchase a stock within three days for the evdiffer-ent to occur. The third strategy is only focusing on the small cap list since the positive results in the previous stud-ies was attained on the small cap. The event day in the third strategy is classified as the re-port of a second individual insider who purchased more than 50 000 stocks in a company within 3 bank days.

Transaction costs are not included in the calculations since differences exist in transaction costs among investors. Previous studies (Jeng et al. 2003 and Lindgren & Ohlsson, 2008) have also excluded transaction costs from their calculations because it is hard to calculate exactly and since different investors face different transaction costs, although it is im-portant to remember that the transaction will come to some cost.

4.4

Event Study

Fama’s article from 1970 introduced event studies, which has become the most common way to test the EMH. An event study examines the effect an event has on the return on se-curities. By looking on the development of the return on a security after a special event and compare that to a benchmark are the effects of the event evaluated.

A null hypothesis is set up to test if a market is efficient in reflecting information, and also to examine the wealth change for shareholders under certain events. The idea of event study is to examine the reaction on the market and specific stocks when events happens (MacKinlay, 1997).

MacKinlay (1997) presented a guideline for event studies in finance which this study is based on, following steps have been a part of the study.

1. Definition of event and time-period of event. The definitions of events for the different strate-gies were discussed in section 4.3.3. 5 days, 10 days, 30 days and 90 days time-periods have been used to estimate possible abnormal returns for different time-periods.

2. Selection criteria of data. This study includes all reported insider purchases on the Stock-holm Stock Exchange from 2007-01-01 to 2009-12-31. Further have all the daily clos-ing prices of stocks and indexes for those companies which had reported insider pur-chases between 2007-01-01 and 2009-12-31 been collected.

3. Define the measure of abnormal return. The adjusted market model is the measure of ab-normal return in the tests, section 4.4.2 is discussing the choice and other measures. 4. Define estimation window. This study is based on a 1 month estimation window to estimate

the variance and standard deviation of abnormal returns, which have been used in the statistical test.

5. Statistical tests. The test is a hypothesis test of the possibility of making an abnormal re-turn, the statistical test is discussed in more depth in section 4.4.4.

6. Interpretation and conclusions of the results from the statistical test. The results have been sum-marized and interpreted to examine the possibilities for outsiders and are presented in chapter 5 and 6.

4.4.1 Defining the event period

This research is based on four different event periods trying to examine the effects over time. The estimation period before the event period which is used to estimate different pa-rameters do not overlap with the event period because the papa-rameters estimated should not be affected by the movement caused by the event (MacKinlay, 1997)

The parameter that has to be estimated to perform the research is based on an estimation period of the month before the event occurs. In event studies is it common that the event

period starts before the actual event day to capture movement just before the event takes place, in this specific research is the movement prior to the event date not important since this study is examining the possibilities for outsiders and those possibilities starts after the event takes place.

There are four event periods that have been examined in this research to study the possibil-ity of earning abnormal return based on our trading strategies.

1. Day 0 Day 5, which is a short term view to see how the market reacts to the sig-nals sent from the insiders.

2. Day 0 Day 10, is also short term view where it can be examined if the reaction from the 5 day period is continuing or drops off.

3. Day 0 Day 30, is used to study the effect over a longer perspective.

4. Day 0 Day 90, is the longest event period that has been used in our research. This semi-long view is used to examine the development of the stock-price over a longer period.

In our opinion could an even longer time-period also be interesting to examine to see if insiders possesses information of a long-term perspective for the company, but such a test has to be done with another approach since the use of event studies and its measures for abnormal returns creates a bias in a long-term perspective (Brown & Warner, 1985).

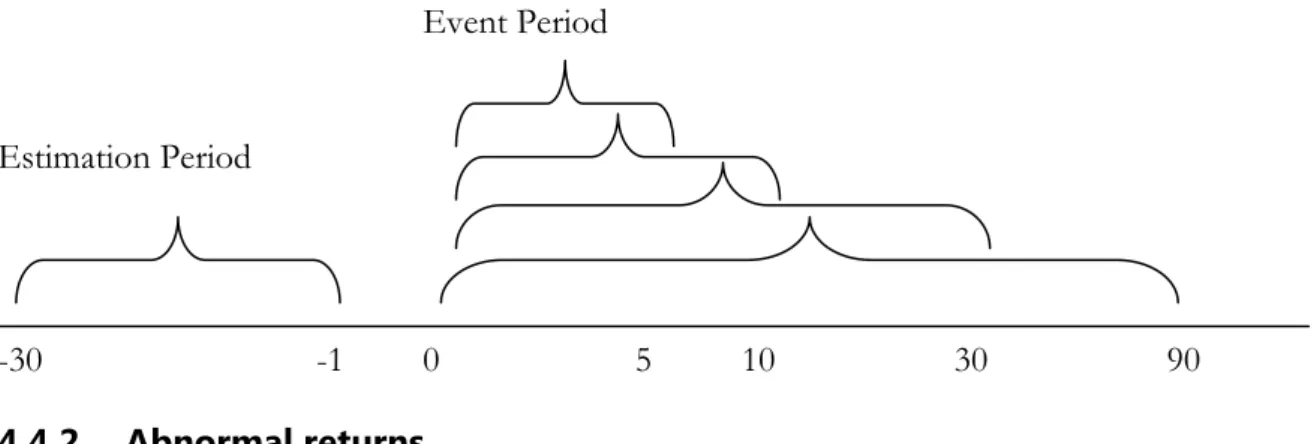

Figure 1.

Description of event periods.Event Period

Estimation Period

-30 -1 0 5 10 30 90

4.4.2 Abnormal returns

Since the abnormal return is defined as the actual return minus the expected return (MacKinlay, 1997) has the actual return to be measured against a benchmark which will represent the expected return (Brown & Warner, 1980). There are several ways to calculate and estimate expected return and from the expected return can the abnormal return be cal-culated by

= − ( ) (1)

Where stands for the individual firm for time period . is the abnormal return which is based on which is the actual return while and ( ) which is the expected return for the time period.

There are different approaches to define and calculate the expected return. The most common in a historical perspective is the Capital Asset Pricing Model (CAPM) (Jaffe, 1974) but recently has the market model been the most used and argued for model (Rozeff & Zaman, 1988). The market model assumes a linear relationship between market return and security return.

The market model:

= + + (2)

is the return on the security while the is the return on the market portfolio and is the error term. , and are the parameters for the market model. Indices are typi-cally used to represent the market portfolio.

This study has used a simplified version of the market model, the adjusted market model. The adjusted model is a more restricted form of the market model, where is equal to ze-ro and is equal to 1. The adjusted market model is used in similar event studies (Lakonishok & Lee, 2001) and the difference in results between different methods are very small (Brown & Warner, 1985). Even though the adjusted market model misses the estima-tion for systematic risk, it does provide an eliminaestima-tion of the movements caused by move-ment on the market, and the fact that two different indexes have been used should place securities with similar risk against the same benchmark.

The adjusted market model assigns an index as the expected return of the security, which means that the calculation of abnormal return is:

= − (3)

Where the abnormal return for day t is, is the return of the individual security at day t and is the return of the index on day t.

To calculate the daily return of the indexes and the securities has equation 4 been used.

ln ( / ) (4)

The OMX Stockholm Small Cap GI index for the small cap events and OMX Stockholm Mid

Cap GI index for mid cap events have been used as the expected return in the abnormal re-turn calculation. Two different indexes have been used because it increases the accuracy in the definition and calculation of the abnormal returns.

4.4.3 Aggregation of abnormal returns

To be able to draw conclusions from an event study using abnormal returns has the normal returns to be accumulated (Brown & Warner, 1980 and MacKinlay, 1997). The ab-normal returns are aggregated both through time and through securities. The aggregation of abnormal returns of an individual security is done by calculating the cumulative

abnor-mal return (CAR). The CAR capture movements in the stock return, it adds the previous cumulative abnormal return to the daily abnormal return.

The CAR formula is:

= + (5)

Aggregation of abnormal returns are also done through securities, the cumulative average abnormal return (CAAR) is the average abnormal return for all the events for the event pe-riod. The formula for CAAR is:

=∑ (6)

CAAR is used in the hypothesis testing.

4.4.4 Hypothesis test

The hypothesis testing is used to statistically test if there is a possibility to earn abnormal returns by using information from insider purchases. The null hypothesis states that the abnormal return should be equal to zero, the hypothesis testing in this research are stated: H0 = 0 The null hypothesis is not rejected and we reject the possibility that the abnor-mal returns earned by the trading strategy are different from zero.

H1 ≠ 0 The null hypothesis is rejected and we accept that the abnormal returns earned by the trading strategy are not equal to zero.

One important note is that the test is examining if it is possible for an outsider to earn ab-normal return after the insider have made the purchase. To not reject the null hypothesis would state that the outsider cannot shadow the insider and make an abnormal return. With that said, insiders could still earn abnormal return.

The results and CAAR obtained using the trading strategies have to be measured statistical-ly to evaluate the significance of the results. In order to test the hypothesis and evaluate the significance is a t-test performed. In order to perform the t-test is a measure of standard deviation for the events calculated in the estimation period just before the event occurs. The formula for calculating the standard deviation for the event periods is a four step pro-cess based on the work of MacKinlay (1997). First is the variance on the abnormal return from the estimation period for each event calculated. The reason for not calculating the variance based on the abnormal returns in the event period is because of the influence the event can have on the variance. The formula for calculating the variance of abnormal re-turn for each security during the estimation period is shown in equation 7.

= ( − """" )

(7)

is the abnormal return for a security, and """" is the average abnormal return for a se-curity.