Stock price volatility

and dividend policy:

The German stock exchange

BACHELOR THESIS WITHIN: Economics

NUMBER OF CREDITS: 15 ECTS

PROGRAMME OF STUDY: International economics AUTHORS: Christopher Karlsson & Alexander von Renteln

ii

Acknowledgements

We, Christopher Karlsson and Alexander von Renteln, would like to take this opportunity to express our appreciation to those that have helped us throughout writing this thesis.

Specifically, we would like to thank Andrea Schneider for her support and guidance, her advice and feedback was extremely valuable for us in writing the thesis.

Secondly, we further appreciate the comments and constructive criticism from our fellow seminar group members who provided us with an outside perspective on our research.

Lastly, we would like to thank our family and friends for their support and encouragement throughout this time.

_________________________________ ________________________________

Christopher Karlsson Alexander von Renteln

Jönköping International Business School May 2021

iii

Bachelor Thesis in Economics

Title: Stock price volatility and dividend policy: The German stock exchange Authors: C. Karlsson and A.von Renteln

Tutor: Andrea Schneider Date: 2021-05-24

Key terms: Stock Price volatility, Dividend Yield, Dividend policy, Stock Market, Deutscher Aktienindex

Abstract

The objective of this research is to analyse if there is a negative relationship between dividend policy and stock price volatility in the German stock market. The data that was collected for this research consists of the 30 biggest companies listed on the German stock exchange Deutscher Aktienindex known as DAX 30 for the period 2000-2020. Fixed effect model estimated by panel data was applied to find the results of this research. The findings showed that the main variables of dividend policy (dividend yield and payout ratio) were negatively significant correlated with stock price volatility which provides evidence for our hypothesis. The results showed that the control variable earnings volatility had a positive significant relationship with stock price volatility. However, asset growth resulted in an insignificant relationship but the rest of the control variables such as leverage, market value and free float percentage showed a significant negative relationship with stock price volatility.

iiii

Table of Contents

1. Introduction ... 1

2. Theoretical Framework ... 3

2.1 Miller and Modigliani theory (MM) ... 3

2.2 Bird-in-hand theory ... 4 3. Literature Review ... 7 4. Data... 11 4.1 Definition of variables ... 11 4.2 Descriptive statistics ... 16 5. Empirical results ... 19 5.1 Methodology ... 19 5.2 Model selection ... 20 5.3 Results ... 21 5.4 Discussion... 24 5.5 Limitations ... 27 6. Conclusion ... 28 Reference list ... 30 Appendix...iv

1

1. Introduction

It has long been debated by investors what effect dividend policy has on the volatility of share price. Baskin (1989) states that establishing an empirical regularity between dividends and stock price volatility would help investors predict risk. Without

concluding whether investors are risk averse or not, volatility still serves as a metric of risk to their investments. This idea becomes fundamental in trying to illustrate dividend yield as a predictor of volatility. It is no secret that investors pay close attention to their dividend returns, as is realized by the companies and that the riskiness of their

investments may affect the valuation of the firm’s shares in the long run (Hussainey et al., 2011). So, if a company’s dividends serve as an indication about the volatility of a stock, it could be used by investors to find out the risk of holding a stock (Hoffmann et al., 2019). Hence, dividend policy and stock price volatility become two imperative aspects within the field of corporate finance due to their interest to shareholders and investors. Taking this into consideration it is not a surprise that this topic has been discussed extensively in the scientific literature (see, e.g., Baskin, 1989; Allen and Rachim, 1996; Hussainey et al., 2011).

The multiple studies conducted on this topic have utilized different theoretical

approaches on the topic, once such theory is provided by Miller and Modigliani in 1961 which will hereafter be referred to as MM. The MM theorem explained that in a perfect capital market, a change in a company’s stock dividend should have zero influence on the stock price. Another theory referred to is the Bird in Hand theory, developed by Gordon (1963) and Lintner (1962) which opposes the MM theorem as their research findings notably conveys contradictions to the findings of MM (1961). Gordon (1963) and Lintner (1962) argued that dividends do have an influence on a company’s stock price. Suggesting investors develop a preference for dividends over capital gains to counter for market imperfections such as information symmetry and limited certainty. Both of these theories have been widely used in the field of corporate finance and found their different followers throughout the years, yet the debate between investors whether dividends influence the stock price or not has not been agreed upon. For instance,

2

Baskin (1989) found that the dividend yield had an underestimated importance and that dividends per se might influence stock market risk. The opposing views on how

dividends affect the stock valuation of a company leads us to further extend this

research by analysing if there is a negative correlation between stock price volatility and dividend policy on the German stock market for the period 2000-2020. We focus on the German market because to the best of our knowledge, we are the first to explore

“whether a correlation between Dividend policy and Stock Price Volatility exists” on the Deutscher Aktienindex also known as DAX 30 or DAX index (GDAX). The Dax 30 is an index of the thirty most powerful stocks listed on the Frankfurt Stock Exchange in Germany where it contributes approximately 75% of the market capital. In terms of the number of companies traded on this index it could be compared to the Dow Jones on the NYSE. Our research aims to investigate the effect dividend payments has on stock prices on the Deutscher Aktienindex. To examine this, we test whether dividend yield and dividend payout ratio affect stock price volatility or not whilst accounting for control variables such as earnings volatility, leverage, market value, asset growth and free float percentage. The control variables are intended to add reliability in interpreting the results and reaching a conclusion. We believe that the results found in our research will contribute to the existing literature and offer consistency and solidity to the

consensus on the topic. The results could prove advantageous and helpful for investors in the German stock market and shed light on how managers could alter or improve their dividend policy. For instance, finding a relationship between dividends and stock price volatility would help predicting a stocks option price at the time dividends get announced, as these prices take the volatility of a stock into account.

The following outline of the thesis is as follows: Section 2 presents the theoretical framework. Section 3 depicts the literature review on the relationship between dividend policy and stock price volatility. Section 4 presents the data and describe all of the variables applied. Descriptive statistics can also be found in section 4. Section 5 discusses the empirical results, methodology initiates this section and conveys the methods and models utilized to answer the research question, followed by the results of the research. The discussion wraps up section five. Finally, Section 6 concludes the whole research done on the topic

3

2. Theoretical Framework

We will for this study direct our focus towards two main theories previously used extensively by scholars in the field of corporate finance. Our theories in focus are Miller and Modigliani theory (MM) popularized by Baskin (1989) when analyzing the relationship between dividend policy and stock price volatility. Bird-in-hand theory is also utilized similarly to the studies of Allen and Rachim (1996) and Hussainey et al. (2011). The selection of the theories can be motivated in their relevance and significance on the topic and although they address the same topic there is a clear difference in the perspectives portrayed in both studies. This becomes useful in the sense that both studies reach different theoretical conclusions and allows us to test if any of theories are applicable to our data. We begin by summarizing Miller Modigliani (MM).

2.1 Miller and Modigliani theory (MM)

In 1961 Miller and Modigliani presented the dividend irrelevance theory. For their theory to hold, MM (1961) presents certain assumptions that the need to be fulfilled. When these assumptions hold it is implied that the relationship between stock price volatility and dividend payouts does not exist. Some of the assumptions presented goes against real world cases and human behavioural tendencies. The assumptions

emphasized by the authors in order for the proposition to hold are that perfect capital markets exists, there are no type of transaction costs, there is either no tax or equal tax rates for both dividends and capital gain. It is further assumed that market information is available to all participants or investors, investors are assumed to be rational and act accordingly to the discounted cash flow approach when evaluating a company.

However, the many instances where investors have not acted rationally or the fact that real world markets involve taxes and transactional costs could be considered to better reflect the realities of the result.

However, the severity of these assumptions to hold are eased by the authors conveying these propositions as a convenient analytical framework in analyzing dividend policy. The theory remains relevant to our study because an important aspect of the theory put forth by Miller and Modigliani argues that the value of the firm depends on the firm’s

4

earnings, implying that all decisions results from the investment policy and not the dividend policy. To see if our research is applicable to this theory this statement would have to hold, meaning that the dividend policy such as the dividend yield and the payout ratio would have no effect on the stock price of a company.

Worth noting however is that Miller and Modigliani (1961) did acknowledge that a change in dividend rate is often followed by a change in the share price which goes against the idea of the dividend irrelevancy theory. This is explained as a result of investors interpreting the change in dividend rate as a change in managements views of future profit prospects for the firm, by either generating higher earnings or higher opportunity growth. As a result of this it is explained that investors might be mistaken in interpreting the dividend change. This might really only be management changing its payout target or possibly even attempting to manipulate the stock price, thereby

signaling false information to potential investors. So, the importance of highlighting that certain imperfections can affect a manager’s decision when choosing particular policies under certain circumstances becomes an imperative part of its theory.

2.2 Bird-in-hand theory

A bird in hand is worth two in the bush phrases that it is better to already have

something safe to hold onto rather than risk everything to attempt looking for something better. The bird in hand theory which was established by Gordon (1963) and Lintner (1962) says that investors prefer to invest in stocks that pay out current dividends rather than investing in stocks that have potential future capital gains. Due to uncertainty times and information asymmetry in the world, investors prefer the “bird in hand” which is the safe choice in terms of dividends rather than the uncertain “two in the bush” potential capital gains. As the dividends are increasing, the risk (beta) and stock price volatility will decrease. Higher dividend yield is preferred by investors due to the fact that the risk becomes lower and is a more certain investment for a longer period of time. A decrease in dividend by 1% requires the capital gains to increase with more than 1% due to the fact that investors will require some kind of compensation for the decrease in dividends and this will put pressure and more responsibilities on the managers that they need to deliver a better return in the future, and that is not trustful.

5

The bird in hand theory states that the markets are not perfect in reality. Gordon (1963) and Lintner (1962) came with the following assumptions, firstly that the company is all equity financed meaning that the company has no debt and finance all investment with retained earnings. Secondly, it is assumed that the tax rate is zero. Internal rate of return, retention ratio (growth rate of earnings) and cost of capital is assumed to be constant. Gordon (1963) developed the Gordon Growth Model, which Baskin (1989) presented in his study. The model is used to calculate the value of a stock today with the stock’s future expected dividends. It is used by investors for comparing the predicted stock value in the future against the actual market price of the stock to see if the stock is under or overvalued in the stock market. The model is more effective when it is used for large and stable companies in a mature market that have a predicted growth of dividend. Baskin (1989) showed in his study that if dividend yield increases the price volatility will decrease, this is the basic idea of the duration effect and can be illustrated through the Gordon Growth Model. In the model expected dividends growth is at a constant rate and cost of equity discount rate is constant.

The index of this research is DAX 30 so the Gordon growth model can be easily used because the companies of DAX 30 is large and includes all the aspects that the model requires. Baskin’s remake of the model that Gordon (1963) developed shows how the Gordon growth model can be used to be able to see how dividend yield is affected by the discount rate and through that see how the variables will affect the price volatility. The theory presented by Baskin (1989) shows that the lower dividend yields the more sensitive the stock will be to movements in discount rates resulting in that the price volatility will become higher. We have to consider the dividend growth as a constant variable in order to figure out what a fair price is to pay for the stock today based on the future dividend payments. From this there are two important aspects to take into

account. Firstly, according to Baskin (1989) that interest rate sensitivity is representing mainly undiversifiable risk. Secondly, Lintner (1956) identified that dividend yield needs to be stabilized due to the variable dividend growth to be constant.

Finding support of the Bird in hand theory and its significance in this paper are highly expected due to the assumption that there is a significant number of investors who are

6

more likely to invest in stocks with dividends than having uncertain capital gains in the future. It is by the nature of riskiness that investors prefer stocks that pay high dividends which provides a safer income rather than unsure future capital gains.

By looking at previous studies, the majority showed that there is a negative relationship between stock price volatility and dividend policy, for detailed review of the literature see section 3. We expect to find the same results as the majority of previous similar studies for this study.

7

3. Literature Review

Baskin (1989) noted in his research that there were no published U.S studies examining the effect of dividend yields on stock risk. Although Beaver et al. (1970) and Rozeff (1982) examined cross-sectional variation in dividend payout ratios and CAPM beta coefficients, Baskin (1989) is the first paper that provides a structural analysis of the relationship between dividend policy and the volatility of common stock. The dividend payout ratio and dividend yield was utilized in analysing dividend policy. Baskin (1989) and later Allen and Rachim (1996) applied different models which relate dividends to stock risk. They use the duration effect, the arbitrage effect and the rate of return effect. The first model states that high dividend yields imply more short-term cash flow and are therefore expected to show lower price volatility (Allen and Rachim, 1996). The

arbitrage effect is built on the assumption that the financial market may be materially inefficient and have found support in the literature from Shiller (1981), Black (1986) and Summers (1986). Baskin (1989) ultimately demonstrated that stocks with high dividend yields may provide a greater realizable return over a finite time period when they are selling below their intrinsic price in inefficient markets and are therefore less susceptible to irrational under-pricing. According to the first two models, the dividend yield and not the payout ratio is the relevant measure. However, the rate of return effect states that a firm with low payout and low dividend yield may tend to be valued more in terms of future investment opportunities than as assets in place (Baskin 1989).

Essentially explaining that both dividend yield and payout matter, therefore, in order to examine the linkage between dividend policy and stock price volatility all three models were taken into consideration by both Baskin (1989) and Allen and Rachim (1996).

The research conducted by Baskin (1989) on the U.S market aimed to show that dividends per se might influence stock market risk. Baskin investigated the effect of dividend policy on price volatility from 1967 to 1986 using 2344 U.S stocks. Variables such as dividend yield and payout ratio were used to control for the effect and the results obtained was that of a negative relationship between dividend yield and stock price volatility. This inverse relationship established that dividend policy does in fact have an impact on stock price volatility, hence proving that there was no evidence for MM theory of the study.

8

Baskin (1989) is therefore seen as an extension of the Bird in Hand Theory because his research provides evidence supporting that managers may be able to reduce volatility by increasing the target payout ratio, which is also known as an implication of the

information effect. An idea stating that dividends convey information, a rather old idea which has found extended support in Miller and Rock (1985) who state that the

difference in investments and payouts reflects the parameters governing the

effectiveness of dividends as signals. In line with this Baskin (1989) notes that investors might have greater confidence that reported earnings reflect economic profits when earnings announcements are accompanied by ample dividends. So, in accordance with the Bird in Hand theory which suggests that companies with a high dividend yield are preferred by investors since they are perceived as less risky, a negative sign in the dividend yield is expected.

However, clearly Miller and Modigliani have had an indisputable impact on the field of analytical finance, as illustrated by writers in the field of analytical finance frequently quoting their work. So, it makes sense that despite the flaws, the influence of MM’s irrelevance theory cannot be understated. Ang and Ciccone (2011) notes in their article on dividend irrelevance theory that despite being pioneers within their field that MM’s dividend policy research suffered from limitations. Like Black and Scholes (1974) and Brennan (1971), MM were limited by the empirical tools of their time. Dividends were researched without the aid of modern analytical techniques, data and computing power (Ang and Ciccone, 2011). Thus, most likely explaining the different conclusions seen in more recent research on dividend policy and stock price movements.

The results of Baskin (1989) are shared by the wide consensus in the literature such as, Hussainey et al. (2011), Albaity et al. (2015), Ahmad et al. (2018) and Rogers et al. (2021) who all find a negative link between dividend policy (dividend yield and payout ratio) and stock price volatility illustrating a negative correlation between the two variables. Meaning that an increase in dividend yield and the payout ratio results in a decrease of stock price volatility, corresponding to the Bird in Hand framework. The majority of these studies were based on the work of Baskin and his research methods were applied to investigate the relationship between dividend policy and stock price

9

volatility on stock markets in different countries. Control variables such as, size, debt and earnings volatility are common controls and will therefore be used in our analysis.

The research of Hussainey et al. (2011) investigated companies listed from the London stock exchange in the period of ten years 1998-2007. Albaity et al. (2015) researched 319 companies listed from the stock exchange of Kuala Lumpur in Malaysia for a period of eleven years from 2003-2013. The work of Ahmad et al. (2018) researched 228 firms for a period of seven years 2010-2016 from the Amman Stock Exchange. A recent study by Rogers et al. (2021) researched a sample of 357 companies listed on B3 (Brazil, Bolsa and Balcao) which belongs to the Brazilian Stock Exchange for a period from 2010 to 2018.

Although the majority of papers finds evidence in line with Baskin (1989), there are some exceptions. Allen and Rachim (1996) reworked Baskin (1989) in an Australian context, they however found results that contrasted markedly with Baskin (1989). They found that no link exists, thus suggesting that there was no significant relationship between stock price volatility and dividend yield. A sample of 173 Australian listed companies for a period from 1972 to 1985 were examined through a cross-sectional regression analysis that tested the relationship between dividend policy and stock price volatility after controlling for firm size, earnings volatility, leverage and growth. Albeit no relationship was found between dividend yield and stock price volatility it was noted that earnings volatility as well as leverage had an expected significant positive

correlation to stock price volatility. Like Allen and Rachim (1996), Rashid et al. (2008) found similar result that no link exists, resulting in that there was no significant

relationship between stock price volatility and dividend yield. Rashid et al. (2008) researched a sample of 104 non-financial firms listed on the Dhaka Stock Exchange in Bangladesh for a period of eight years from 1999 to 2006. The result is consistent with the earlier study of Allen and Rachim (1996).

Although the studies of Allen and Rachim (1996) and Rashid et al. (2008) indicated no relationship between dividend yield and stock price volatility, they were not exactly proponents of MM (1961) dividend irrelevancy theory (they still found payout ratio to have a negative correlation with stock price volatility). MM (1961) did however find

10

support in its ideas by scholars such as Black and Scholes (1974) which found support in the dividend irrelevance theory by reaching the conclusion that it was not possible to demonstrate what effect, if any, a change in dividend policy would have on a company’s stock price. Brennan (1971) takes a similar standpoint when examining the Miller and Modigliani (1961) contention that dividends are irrelevant. Brennan (1971, p. 1119) found that MM’s argument is upheld when scrutinizing Gordon’s (1963) proof of the relevance of dividend policy.

Summarizing, the majority of researchers around this topic have seen similar results in the conclusions, namely that dividend policy has a negative relationship to stock price volatility. The reason behind these results could be that they share the same control variables that are very much in line with those Baskin (1989) originally used. The studies on this topic used for our research has been spread out from the late eighties to as recent as 2021 and the majority of results are in accordance with each other. It would seem that the institutional differences among the countries show no significant

differences in the overall preferences for investors when interpreting their results between dividend policy and stock price volatility.

11

4. Data

For our research analysis of the German stock exchange (DAX 30) between the period 2000-2020, panel data was used with yearly basis. The Dax 30 was chosen because it belongs to one of the largest markets in Europe and is to the best of our knowledge relatively unexplored in analysing the relationship between dividend policy and stock price volatility. The time period of 21 years was chosen because we want to analyse during recent times and the longer time period the more reliable and trustworthy results we will get due to more data and observations. Due to more data and a longer period of time our research will provide clearer trends in the results and reduce the effect of economic turbulent times. We have utilized 30 firms that have been in and on DAX over the whole period.

The analysis of stock price volatility and dividend policy (dividend yield and dividend payout) are the main variables for our study. We include some control variables that we think can impact the dependent variable, stock price volatility. These variables are earnings volatility (EV), leverage (LVG), market value (MV), asset growth (AG) and free float percentage (FFP). All the data that we have used in our study is taken from the platform Thomson Reuters DataStream.

4.1 Definition of variables

Stock Price Volatility (SPV) This is our dependent variable and is a measure of a stock’s average annual price

movement to a high and low from a mean price for each year. Stock price volatility is based on the annual range of adjusted stock price obtained directly from Thomas Reuters DataStream, for each year. The range is then divided by the average of the highest and lowest prices obtained in the year and then squared (Hussainey et al., 2011). Stock price volatility is calculated in the field of finance and is very useful for a lot of investors. Stock price volatility shows in a way how risky the stock is and if it is a stable and trustful investment.

12

Dividend Yield (DY)

This is our focused and one of our independent variables and it expresses the dividend per share as a percentage of the share price. Data were directly obtained from Thomas Reuters DataStream where it was explained that the dividend yield is calculated on gross dividends i.e., excluding tax credit. The average was then taken for all available years. The majority of previous studies (see Sec. 3) find a negative relationship between stock price volatility and dividend payout (e.g., Hussainey et al., 2011, Albaity et al., 2015 and Rogers et al., 2021). We expect a similar result in our empirical analysis.

Payout ratio (PAYOUT)

This is also one of our focused independent variables which is included in dividend policy. The payout ratio is expressed as a percentage of a company’s earnings paid out to the stockholders in dividends. The outputs were directly obtained from Thomas Reuters DataStream in percentage, so we did not have to calculate it from scratch. Previous studies presented in our literature review got the relationship between stock price volatility and dividend payout to be negative, for detailed results of the literature see section 3. We also expect to find a negative relationship between payout ratio and stock price volatility.

Earnings Volatility (EV)

Earnings volatility is a measure on how much the earnings of a company is changing, if a company’s earnings volatility is fluctuating a lot, it is resulting in a riskier investment. We have followed Baskin (1989) for the calculation formula of earnings volatility.

√∑(𝑋 − 𝑋 ̅ )

2

𝑁 (1)

Where X is Earnings before interest and taxes (EBIT) divided by the total assets. In this case we obtained EBIT and total assets of every firm and year from Thomas Reuters DataStream where we later on could calculate X. 𝑋 ̅ is calculated by taking the average of EBIT divided by total asset. For the average of EBIT, we calculated it for every

13

company separately to get the correct and trustful results. N represents the total number of observations.

Based on all previous studies in our literature review, we expect the relationship between stock price volatility and earnings volatility to be positive.

Leverage (LVG)

Leverage means how much debt a company uses to expand or finance assets from investments through borrowing money. This control variable is calculated by dividing long-term debt with total assets for every annual year. Long-term debt and total assets were directly obtained through Thomas Reuters DataStream where we could later on calculate leverage. Based on previous studies in our literature review, the majority found that leverage have a positive relationship with stock price volatility which we also will expect in our study.

Logarithmic Market Vale (MV)

The definition of market value is basically the number of outstanding shares multiplied with the current stock price. The market value is transformed using the base 10

logarithm to get variables that reflects order of magnitude (Baskin, 1989). Market value were directly gathered through Thomas Reuters DataStream and after that we calculated the logarithm with a base of 10 to get the final data for every company and year

similarly to Baskin (1989) and Allen and Rachim (1996). We expect a negative relationship between the market value and stock price volatility.

Asset Growth (AG)

This control variable is calculated by the change in total assets from the previous year divided by the total asset of the previous year. Where 𝑌𝑡 is the current year and 𝑌𝑡−1 is the previous year.

𝐴𝐺 =𝑌𝑡− 𝑌𝑡−1 𝑌𝑡−1

(2)

In line with previous studies e.g., Allen and Rachim (1996), we expect the relationship between asset growth and stock price volatility to be positive.

14

Free Float Percentage (FFP)

The definition of free float percentage is the number of shares that is available for the public. It is the number of shares outstanding minus the restricted shares the company has and cannot be traded also called locked-in shares, for example shares held by the government and company managers and other private parties. According to Catherine (2019) “Increasing the minimum public float reduces market volatility, which helps in

better price discovery. Large and dispersed shareholdings lessen the risk of collusive market action, hence encouraging good governance.” So, a company with high free

float percentage tend to have a better corporate governance since the publicly

shareholders have more rights of the company and the government has less influence. Companies with small free float percentage tend to be more volatile than companies with high free float percentage. With a low free float percentage, the stocks available for the public are very small, and that can cause the liquidity to be limited with a wider bid and ask spread because of the small number of shares available, the impact of a trade can be very high to the stock price. This will affect investors because it is a riskier investment to invest in stocks with a low free float percentage, therefore they prefer stocks with a larger free float percentage which is less volatile and more stable.

Our expectation of the relationship between stock price volatility and free float

percentage is that there will be a negative relationship, meaning that the higher free float percentage the lower stock price volatility and according to the information above, it should be negative.

15

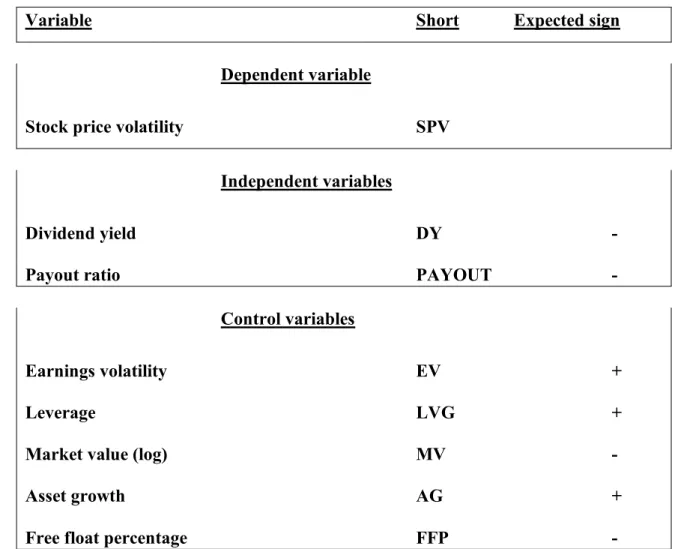

Table 1. Variables and expected signs

Variable Short Expected sign

Dependent variable

Stock price volatility SPV

Independent variables

Dividend yield DY -

Payout ratio PAYOUT -

Control variables

Earnings volatility EV +

Leverage LVG +

Market value (log) MV -

Asset growth AG +

16 4.2 Descriptive statistics

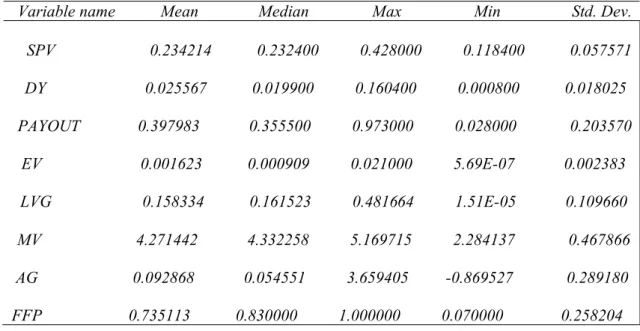

Table 2. Descriptive statistics

Variable name Mean Median Max Min Std. Dev. SPV 0.234214 0.232400 0.428000 0.118400 0.057571 DY 0.025567 0.019900 0.160400 0.000800 0.018025 PAYOUT 0.397983 0.355500 0.973000 0.028000 0.203570 EV 0.001623 0.000909 0.021000 5.69E-07 0.002383 LVG 0.158334 0.161523 0.481664 1.51E-05 0.109660 MV 4.271442 4.332258 5.169715 2.284137 0.467866 AG 0.092868 0.054551 3.659405 -0.869527 0.289180 FFP 0.735113 0.830000 1.000000 0.070000 0.258204 Observations: 491

Table 2 shows the descriptive statistics of our dependent, independent and control variables with columns containing the mean, median, maximum and minimum value and standard deviation.

The descriptive statistics in table 2 displays the data collected for the German stock exchange between 2000 to 2020, it is a broad description of the characteristics of the variables used in this study. The first variable in the table is stock price volatility which has a mean of 23.42 percent. It is assumed by Allen and Rachim (1996) that if stock prices follow a normal distribution whilst ignoring the effect of a firm’s going ex-dividend, then the standard deviation of stock market returns is equivalent to the

measured volatility of our study. The constant derived by Parkinson (1980) was used by Baskin (1989), Allen and Rachim (1996) and Hussainey et al. (2011) to find this result. By multiplying our stock price volatility of 0.234214 to the constant from Parkinson 0.6008 we get the result, 14.07 percent. Although in comparison a slightly smaller percentage, it still goes in line with the result of Hussainey et al. (2011) who got 17.66 percent, Allen and Rachim’s result of 29.42 percent and Baskins result of 36.9 percent.

17 Table 3. Correlation between variables

Correlation SPV DY PAYOUT EV LVG MV AG FFP SPV 1 DY -0.090518 1 PAYOUT -0,236058 0.477076 1 EV 0.284403 -0.234668 -0.179623 1 LVG -0.073909 0.072763 0.072450 -0.060399 1 MV -0.157102 0.206503 0.302385 -0.344911 0.103464 1 AG 0.048481 -0.235484 -0.143448 0.029439 0.075663 -0.081042 1 FFP 0.113140 0.215375 0.228823 -0.082891 -0.069464 0.275788 0.041959 1

Table 3 displays the correlation between the variables used for our study. By looking at the table it is conveyed that the correlation between stock price volatility and dividend yield is negative (-0.0905) as was expected from scrutinizing previous literature.

Although the result is somewhat smaller than the corresponding literature it still goes in line with the results presented by Baskin (1989) of -0.643, that of Hussainey et al. (2011) who got -0.2583. The studies of Albaity et al. (2015), Ahmad et al. (2018) and Rogers et al. (2021) also find a negative correlation between the two variables. Our findings however contrast those of Allen and Rachim (1996) which got a positive result of 0.006. The payout ratio is also part of the dividend policy and as expected we see a negative correlation to stock price volatility of -0,23605 which goes in line with Baskin (1989), Allen and Rachim (1996) and Hussainey et al. (2011) which respectively got -0.542, -0.210 and -0.4446. It was noted by Baskin (1989), Allen and Rachim (1996) and Hussainey et al. (2011) that because dividend yield and the payout ratio are both part of a firm’s dividend policy they might suffer from high multicollinearity, which might be a potential problem. In fact, a problem that proved quite severe for Baskin (1989) which had a correlation coefficient of 0.754 resulting in him dropping the payout ratio variable from further regression specifications. Looking at table 3 we can see that the variables exhibiting the highest correlation between each other is in fact dividend yield and payout ratio. Our correlation of 0.477076 causes us to be aware of a potential multicollinearity problem between the two variables of dividend policy. The

18

previous literature. As expected, earnings volatility shows a positive correlation to stock price volatility. Furthermore, it is intuitively sound that large companies should be more diversified, have more tangible assets and be more subject to market scrutiny (Allen and Rachim 1996), meaning that they can support more debt. This view is reinforced by the significant negative correlation of – 0.344911 between market value (size) and earnings volatility. As expected, there is a negative correlation between earnings volatility to dividend yield and payout ratio. Hussainey et al. (2011) explain this conformity as firms with volatile earnings are recognized to be riskier and are expected to pay lower

dividends to have enough retained earnings for years when earnings are poor; thereby affecting dividend yield and the firm’s dividend policy in general. The leverage variable is based on long term debt and does not seem to go in line with the expected sign of the theory.

19

5. Empirical results

5.1 Methodology

Like similar studies of Baskin (1989), Hussainey et al. (2011) and Rogers et al. (2021) researching this topic we have utilised multiple least square regressions to analyse the relationship between stock price volatility and dividend yield whilst also considering for the payout ratio in the regression. In light of the recommendations by Baskin (1989) we included a number of control variables to account for factors that might influence our dependent variable of stock price volatility. The resulting model was evaluated annually over the period 2000 to 2020 to measure the periodic effect of dividend policy on stock price volatility. Several regression analyses were performed to test these relationships, pooled OLS and Fixed effect model are specifically two of the models that were used.

The first and most basic test involved regressing the dependent variable stock price volatility (SPV) against the two independent variables dividend yield (DY) and payout ratio (PAYOUT). This initial phase provides a crude test of the relationship between our dependent variable and both our independent variables. The following regression was adopted where we only controlled for DY and PAYOUT:

SPVit = 𝛽0+ 𝛽1𝐷𝑌𝑖𝑡+ 𝛽2𝑃𝐴𝑌𝑂𝑈𝑇𝑖𝑡+ 𝛽3𝐸𝑉𝑖𝑡+ 𝛽4𝐿𝑉𝐺𝑖𝑡+ 𝛽5𝐿𝑜𝑔(𝑀𝑉)𝑖𝑡+ 𝛽6𝐴𝐺𝑖𝑡+ 𝛽7𝐹𝐹𝑃𝑖𝑡+ 𝑢𝑖𝑡 (3)

Index ”i” captures the firm and index “t” the year. Baskin’s (1989) study showed a

significant negative relationship between both the variables above and stock price volatility. The rather close relationship between dividend yield and payout ratio which can be observed in our correlation matrix may pose as an issue as there are a number of factors that influence both dividend policy and price volatility (Hussainey et al., 2011). This issue can however be dealt with by including a set of control variables, therefore the regression was modified as shown below:

SPVit = 𝛽0+ 𝛽1𝐷𝑌𝑖𝑡+ 𝛽2𝑃𝐴𝑌𝑂𝑈𝑇𝑖𝑡+ 𝛽3𝐸𝑉𝑖𝑡+ 𝛽4𝐿𝑉𝐺𝑖𝑡+ 𝛽5𝐿𝑜𝑔(𝑀𝑉)𝑖𝑡+ 𝛽6𝐴𝐺𝑖𝑡+ 𝛽7𝐹𝐹𝑃𝑖𝑡+ 𝑐𝑖+ 𝑑𝑡. (4)

This regression is a Fixed effect model where the complete set of control variables are accounted for. The control with “i” captures the company fixed effect and “t” captures

20

the time fixed effect. We run the model in two specifications – first, with firm fixed effects only, i.e., without 𝑑𝑡 , and then, with firm and time fixed effects, i.e., 𝑐𝑖 and 𝑑𝑡.

The hypotheses of this study are:

Hypothesis 1: Dividend policy affects stock price volatility.

Hypothesis 2: A higher dividend yield and payout ratio leads to a lower stock price

volatility.

The first hypothesis rejects the MM theorem, whilst the second tests if the main aspects of Bird in Hand Theory hold.

5.2 Model selection

For our multi regression model we can apply several methods, but since the regression model utilizes panel data, we have to consider which model we should use between Pooled OLS, Random effect model (REM) or Fixed effect model (FEM).

According to Hoffmann et al. (2019) using a pooled OLS method fails to provide the nature of the panel data. It collects all the data for all available companies and years together and runs an OLS regression on that. We find that the pooled OLS does not suit our data and provides us with insignificant values. In line with this we try for fixed effect model or random effect model.

Hansen (2020) explained that using a fixed effect model allows us to compare data over time and by doing so, we can compare the values of the dependent variable between time periods. This is one explanation why we should use fixed effect model as well, because we are observing same samples along different period of time, our sample is the 30 companies, and the time period is 21 years and therefore fixed effect model is the most appropriate model to use.

If we don’t control for the unobserved correlation in and a cross time then we get completely different result as we can see in the pooled OLS column with control variables, the variables become insignificant, and we can therefore not rely on that

21

model. We use Hausman test to check what panel estimation model we should apply. The Hausman test shows us if we should use random effect model or a fixed effects model. We can see in table 2 in the appendix that fixed effect model (FEM) is more appropriate for us to use.

5.3 Results

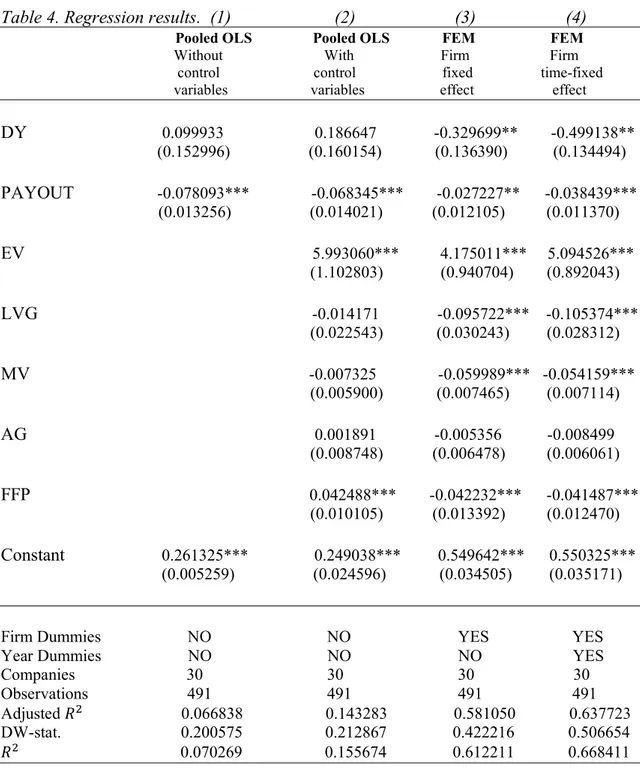

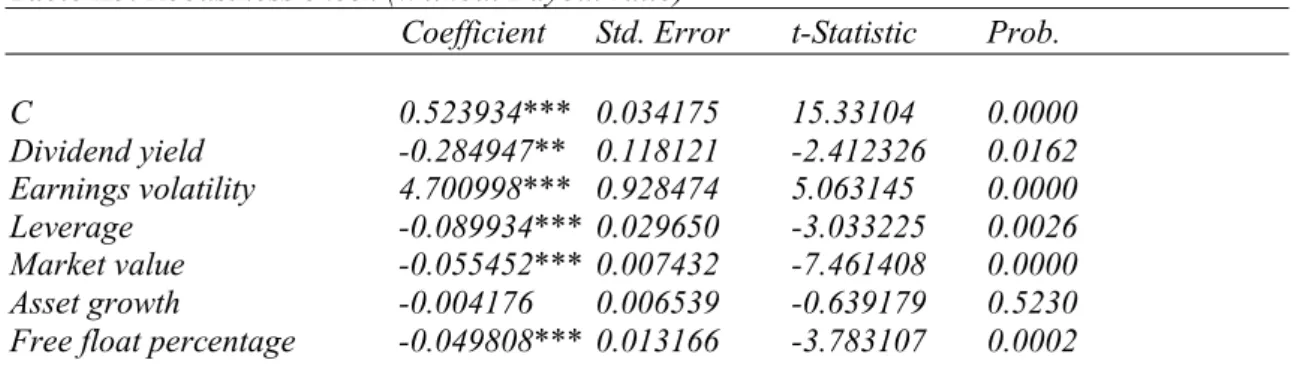

Table 4. Regression results. (1) (2) (3) (4)

Pooled OLS Pooled OLS FEM FEM

Without With Firm Firm control control fixed time-fixed variables variables effect effect DY 0.099933 0.186647 -0.329699** -0.499138** (0.152996) (0.160154) (0.136390) (0.134494) PAYOUT -0.078093*** -0.068345*** -0.027227** -0.038439*** (0.013256) (0.014021) (0.012105) (0.011370) EV 5.993060*** 4.175011*** 5.094526*** (1.102803) (0.940704) (0.892043) LVG -0.014171 -0.095722*** -0.105374*** (0.022543) (0.030243) (0.028312) MV -0.007325 -0.059989*** -0.054159*** (0.005900) (0.007465) (0.007114) AG 0.001891 -0.005356 -0.008499 (0.008748) (0.006478) (0.006061) FFP 0.042488*** -0.042232*** -0.041487*** (0.010105) (0.013392) (0.012470) Constant 0.261325*** 0.249038*** 0.549642*** 0.550325*** (0.005259) (0.024596) (0.034505) (0.035171)

Firm Dummies NO NO YES YES Year Dummies NO NO NO YES Companies 30 30 30 30 Observations 491 491 491 491 Adjusted 𝑅2 0.066838 0.143283 0.581050 0.637723

DW-stat. 0.200575 0.212867 0.422216 0.506654 𝑅2 0.070269 0.155674 0.612211 0.668411

22

Pooled OLS without control

The first column of Table 4 above shows the result of Pooled OLS regression without any control variables, only the main variables are displayed. These are the results estimated from part of equation 3. The result of the regression displays that the relationship between stock price volatility and dividend yield is positive but insignificant. One explanation for this might be the previously mentioned high

correlation between dividend yield and payout ratio. The fact that dividend yield has a positive sign raises suspicion but not concerns since the correlations reported in table 3 suggested otherwise. Dividend payout has a significant negative relationship with stock price volatility, this result goes in line with Hussainey et al. (2011). The Durbin-Watson statistics is roughly 0.20 which is quite low and that can be a sign for positive

autocorrelation which we should be careful about. Further we will add multiple control variables to our regression for more results. We have a very low R2 which might

indicate that the model does not fit the data and therefore we should later on analyse if there are better regression methods for this.

Pooled OLS with control

The next step was to determine whether the correlations presented in table 3 are

weakened by the addition of control variables. The result of the pooled OLS, column (2) in table 4 with control variables shows that the main variables have the same correlation outcome as the first column without any control variables, with both the significant level and sign. Earnings volatility (EV) and free float percentage (FFP) are positively significant at 1 percent level. Leverage (LVG), market value (MV) and asset growth (AG) are insignificant. Since we control for unobserved correlation in and across time the pooled OLS model gives us unreliable results where the variables become

insignificant. When interpreting the results, it is therefore not the model we rely on, but we decided to keep the output to display the difference in result in comparison to the better fitting fixed effect model. Our analysis shows that the results of the pooled OLS and FE model differ significantly. We find that in order to make the result as robust as possible we should try for FE model.

23

Fixed effect model (firm fixed effects)

The column (3) in table 4 above shows the fixed effect model with firm fixed effect which includes control variables and dummies. Here equation 4 was estimated. The results of table 4 column 3 showed that earnings volatility (EV), leverage (LVG), market value (MV) and free float percentage (FFP) are significant at 1 percent level. Dividend yield and dividend payout are significant at 5 percent level. The only variable that is insignificant is asset growth (AG), similar to the findings of Hussainey et al. (2011). Baskin (1989) mentions that the rate of return and duration effect are likely to be correlated with the growth rate in a firm’s capital. We see that the variable asset growth barely affects stock price volatility as shown by the coefficient of -0.005356, the p-value implies an insignificant coefficient of asset growth. Thus, we find that asset growth provides us with no evidence of the rate of return and the duration effects.

A 1 unit increase in any of the control variables will make the dependent variable stock price volatility change with its respective coefficient. We can see in column 3 that dividend yield drives the stock price volatility by -0.329699 which means, with a one unit increase in dividend yield, stock price volatility will decrease by -0.329699 units. Payout ratio drives stock price volatility by -0.027227 units. The same logic could be applied for interpreting the rest of the variables. Furthermore, we can see a big factor that seems to drive stock price volatility is the earnings volatility, this can be explained by the more volatile a firm’s earnings and the higher their leverage, the more volatile the stock price (Allen and Rachim, 1996 and Hussainey et al., 2011). This relationship is also in accordance to results from the correlation matrix in table 3. However, the variable of leverage we found similar to the correlation matrix to have a negative value. We recall that leverage is how much debt a company use to expand or finance assets from investments through borrowing money. Ben-Zion and Shalit (1975) argues that the larger debt in the firm’s capital structure, the higher the risk of default, the lower is the valuation of its equity. Furthermore, Berk and DeMarzo (2017, p.524) illustrates that leverage increases the risk of equity even when there is no risk that the firm will default. Thus, we find intuitively as the negative sign of this variable means that as leverage increases the stock price volatility decreases quite surprising. We find that this is not in line with our theory nor is it in line with the studies of Baskin (1989), Allen and Rachim (1996) and Hussainey et al. (2011). The coefficients signs of dividend yield, dividend

24

payout, market value and earnings volatility go in line with the findings that Baskin (1989) and Hussainey et al. (2011) had in their studies. The Durbin-Watson statistic is very low, roughly (0.42) which indicates that there might be sign of autocorrelation. The R2 (0.61) is showing much higher number than previous regressions without control

variables which indicates that the data fits better into the model.

Fixed effect model (firm time fixed effect)

The last column of table 4 shows us the result of fixed effect model including firm and year dummies. We have used time fixed effect because according to Gujarati & Porter (2008) the regression model changes over time due to different factors for example the economic environment if it is a recession or a boom, or regulations in the economy. In these cases, time fixed effect model can be applied. We applied the time effect for the years during this research period and found similar results to those in the third column in regard to signs and significance levels. The variable result in the last column is an extended version of the third column with year dummies included which might provide more time specific result. We can see that including time dummies does not change the results qualitatively. The Durbin-Watson statistic is low, around (0.50) which indicates that there might be sign of autocorrelation over some variables. The R2 is roughly (0.67)

which is a bit better as indicates that the data fits better into the model.

5.4 Discussion

The results we found tells us to not reject our first hypothesis; dividend policy affect stock price volatility, indicating that dividend yield and payout ratio has a correlation to stock price volatility. This result allows us to reject the dividend irrelevant theory presented by Miller and Modigliani (1961) as we can see that dividend policy does in fact have an effect on a company’s stock price. If we now look on the bird in hand theory relative to the result we got from the relationship between dividend policy and stock price volatility. The result showed a negative relationship which means that there is a negative correlation between dividend policy and stock price volatility which means that the higher dividend yields and payout ratio the lower stock price volatility. Not only is this in line with the bird in hand theory but it is also the reason we don’t reject our second hypothesis; a higher dividend yield and payout ratio leads to a lower stock price

25

volatility. Stock price volatility is a measure of risk and therefore holding a stock with high dividend yield makes the stock more attractive to investors for long-term investing because there is less risk which goes in line with the terms of the bird in hand theory. As mentioned before “bird in hand is worth two in the bush” where investors prefer “bird in hand” which is the safe option in terms of dividends rather than “two in the bush” which is the uncertain potential capital gains and this links to what our result showed.

Interpreting our results based on our theoretical framework has found to be adequate in explaining the topic under investigation. However. some control variables for instance are in contrast to our expectations. We found that asset growth of a company displayed insignificant values and barely had any affect on stock price volatility. Asset growth was added as a control variable in line with the recommendations by Baskin (1989). The fact that we found no significant relationship between asset growth and stock price volatility could be due to the companies in our sample being large and mature. Since they are so well established in that they are the top 30 of the highest market

capitalization companies on the German market they can therefore also commit to relatively high dividends regardless of their yearly asset growth, which is similar to what Hussainey et al. (2011) found in his study on the London stock exchange. Another interesting observation was the relationship we found between leverage and stock price volatility. The surprising negative sign indicated that as leverage increased, the stock price volatility decreased. However as mentioned our sample includes large and mature companies that are well established on the market and a common practice as explained by Berk and DeMarzo (2017, p.552) is for companies to use tax deductible interest. Essentially companies must pay taxes on the income they earn and because they pay taxes on their profits after interest payments are deducted, interest expenses reduce the amount of corporate tax firms must pay (Berk and DeMarzo, 2017). This aspect of the tax code creates an incentive for companies to use debt, which could partially explain the logic behind our findings between leverage and stock price volatility. In Germany annual net interest expense of group companies is only deductible at up to 30% of EBITDA for corporation and trade tax purposes (Germany Corporate – Deductions, 2021). This percentage could be sufficient for companies to utilize leverage to pay out more in total to its investors, including interest payments to debt holders. Investors gain from the tax deductibility of interest payments through the interest tax shield which is

26

the additional amount that a firm would have paid in taxes if it did not have leverage (Berk and DeMarzo, 2017). Hence, when a firm uses debt, the interest tax shield

provides a corporate tax benefit each year, signalling stable cash flow that can be paid to investors through the use of leverage, which might further explain the relationship we found between leverage and stock price volatility. At the same time, it is important not to forget that this is only one aspect of the relationship. The risk of default and failing to make interest payments as an example should instead increase stock price volatility.

The rest of the control variables showed no deviations from the results of the majority previous literature such as Baskin (1989), Hussainey et al. (2011), Albaity et al. (2015), Ahmad et al. (2018) and Rogers et al. (2021) and went in line with our expectations. Comparing our results with previous studies we noticed that most of them found a negative relationship between dividend yield and stock price volatility.

We also ran a regression to check the robustness of our result by dropping one of our independent variables as can be seen in table A5 and A6 in the appendix. We found by doing so that our results are strengthened and not driven by multicollinearity between dividend yield or payout ratio. This is due to the fact when only tested for one

independent variable there was barely any difference in their significance from when we included them both in the same regression.

We decided to include the control variable Free Float Percentage (FFP) because no other study have analyzed it before in this context. We found that there was a negative relationship between FFP and stock price volatility, meaning that the more shares available to the public, the less volatile the stock will be. The results were in line with our expectations. No other previous literature has included FFP in their regression with control variables which we thought was interesting as well because FFP has impact on volatility and risk in the stock market and therefore we wanted to analyze it.

Like the study of Allen and Rachim (1996) we also included for companies in the financial sector as despite their specialized regulatory nature they are a significant part of the stock exchange. Their study from 1996 on the Australian market between 1972 and 1985 showed contrary to our findings that there was no evidence of a correlation between stock price volatility and dividend yield. Similar to Hussainey et al. (2011) our

27

study makes use of more recent years, in which most economies have evolved greatly. Hussainey et al. (2011) similar to the results of this paper and the results of Baskin (1989) found a negative relationship between dividend yield and stock price volatility. Although this seems to be the theme for most results found on this topic, the difference in consensus as provided by Allen and Rachim (1996) and Rashid et al. (2008)

exemplifies the need for additional conclusive evidence in this field. Our study contributes to the discussion by researching a relatively unexplored market in this context which means further research can be done to see if the location of the market plays a role in determining the influence dividend policy has on stock price volatility.

5.5 Limitations

The study of Baskin (1989) was one of the earliest researching this topic and although we found similar results regarding the relationship between dividend yield and stock price volatility, his study embraced a larger market. The study included both small and larger companies, whilst we only accounted for thirty of the largest companies trading on the German stock exchange. This can be seen as a limitation as the results we found might not apply to the whole market, since the selection of the companies is biased towards companies that have already succeeded. Although Baskin (1989) worked around this limitation by utilizing a larger market our primary focus throughout this study has been to identify what, if any, relationship exists between dividend policy and stock price volatility for exactly these companies trading on the Deutscher Aktienindex. Another limitation to our study was companies with missing entries of data, a result of retrieving our data only from DataStream. Missing data for certain companies could be retrieved from alternative financial websites such as Yahoo Finance but mixing data sources to find the missing entries for certain years could create uncertainty and comprise the reliability of our results. The lack of data for certain years can be seen as disadvantage in interpreting the overall reliability of the results.

28

6. Conclusion

The study aimed to examine the effect of dividend policy on stock price volatility for the total of twenty-one years from the period 2000 to 2020 on the Deutscher

Aktienindex, consisting of the thirty largest market capitalization companies in Germany. The findings of this study suggest that there exists a significant negative relationship between dividend policy and stock price volatility. We found that by failing to reject our first hypothesis, we do not find evidence that the MM theorem holds for the selected companies during the chosen time period. This is the result of dividend yield and payout ratio having a significant effect on stock price volatility. There is something compelling about dividends and investor behaviour according to our findings, it can be concluded similar to Baskin (1989) that managers may be able to employ dividend policy to lead investors to value and trade stocks differently. Influencing the stocks risk in such a way can have an explanation in that we don’t reject our second hypothesis, stating that the results we found to be consistent with the Bird in hand theory. Meaning that the higher dividend yield, the lower stock price volatility where stock price

volatility is a measure of risk and therefore long-term investors prefer higher dividends as a safer option with lower risk rather than no dividends with uncertain return or loss in the future.

Our findings offer support for those of Baskin (1989) in that our results do not reject the hypothesis that dividend policy affects stock price volatility. We found that an increase in dividend yield decreases stock price volatility and therefore suggesting that our overall findings support the duration and arbitrage effect. Hence, we find that the Gordon growth model can under its required assumptions be used to calculate the value of a stock today with the stock’s future expected dividends. The model is more effective when it is used for large and stable companies in a mature market that have a predicted dividend growth. Investors on the DAX 30 can use the Gordon growth model to compare the predicted stock value in the future against the actual market price of the stock to see if the stock is under or overvalued in the stock market. We recall that the duration effect and arbitrage effect propose that the dividend yield and not the payout ratio is the relevant measure. Our results of a significant negative payout ratio however indicates differently, the result of the payout ratio is in line with the rate of return effect which suggest both dividend yield and payout ratio as relevant measures of dividend

29

policy. In light of this Allen and Rachim (1996) notes that the rate of return effect is likely to be correlated with the firm’s growth rate. If this association is important, then the growth rate or asset growth as we have labelled it should display a significant coefficient. We found that asset growth of a company displayed insignificant values and barely had any effect on stock price volatility, thus it would seem that the rate of return effect is not supported.

The results found in investigating if there exists a negative correlation on the Deutscher Aktienindex also known as DAX 30 was that dividend policy per se influences stock price volatility. Suggesting that companies should consider both dividend yield and payout ratio when deciding their dividend policy in order to signal stable investment returns and reduce risk for the investors.

Now that we found a linkage between dividend policy and stock price volatility as a result on the overall index of DAX 30 it could be interesting for further studies to investigate industry specific results to see what degree the results on dividend policy differs between sectors in Germany. These sectors could for instance be within finance, technology, healthcare, energy, chemicals and industry. Whilst accounting for the same control variables we used, future research could find out if there is a difference in their significance level depending on the sector. This might provide a useful insight for investors when prioritizing which sector to invest in regard to the influence dividend policy has on that sector. This could further be analysed by comparing different market sectors with different countries to check if sector specific results are country oriented or if there are other factors influencing sector results. Some sectors might include smaller companies than the thirty we investigated and so it would be interesting to see the difference in results as smaller companies tend to experience a more volatile stock.

30

Reference list

Ahmad, M. A., Alrjoub, A. M. S., & Alrabba, H. M. (2018). The effect of dividend policy on stock price volatility: Empirical evidence from Amman stock exchange.

Academy of Accounting and Financial Studies journal, 22, 1-8.

Albaity, M., Hooi, S. E., Ibrahimy, A. I. (2015). Dividend policy and share price volatility. Investment Management and Financial Innovations, 12, 226-234.

Allen, D. E. & Rachim, V. S. (1996). Dividend policy and stock price volatility: Australian evidence. Journal of Applied Economics, 6, 175-188.

Ang, J. S & Ciccone, S. J. (2011). Dividend irrelevance theory. Baker/Dividends and

Dividend policy.

Baskin, J. (1989). Dividend policy and the volatility of common stock. Journal of

Portfolio Management, 15, 19-25.

Beaver, W., Kettler, P., Scholes, M. (1970). The association between Market

Determined and Accounting Determined Risk Measures. The Accounting Review, 45, 654-682.

Ben-Zion, U., Shalit, S. (1975). Size, Leverage, and Dividend Record as Determinants of Equity Risk. Journal of Finance, 30, 1015-1026.

Berk, J. B., DeMarzo, P. M. (2017). Corporate Finance (Fourth edition, Global ed.). Boston, Mass; London: Pearson.

Black, F., & Scholes, M. (1974). The effects of dividend yield and dividend policy on common stock prices and returns. Journal of Financial Economics, 1, 1-22.

Black, F. (1986). Noise. Journal of Finance, 41, 529-543.

Brennan, M. (1971) A Note on Dividend Irrelevance and the Gordon Valuation Model.

31

Gordon, M. J. (1963). Optimal Investment and Financing Policy. Journal of Finance, 18, 264-272.

Gujarati, D. N., & Porter, D. C. (2008). Basic Econometrics (5th ed.). McGraw-Hill

Education. 597-599.

Hansen, E. H. (2020). Run Forest Run! - A Cross-National Study on the Effect of Property Rights and Liberty on Deforestation, 39–41.

Hussainey, K., Mgbame, C. O., Chijoke-Mgbame, A. M. (2011). Dividend policy and share price volatility: UK evidence. The Journal of Risk finance, 12, 57-68.

Lintner, J. (1956). The distribution of incomes of corporations among dividends, retained earnings and taxes. American Economic Review, 46, 97-113

Lintner, J. (1962). Dividends, earnings, leverage, stock prices and supply of capital to corporations. The Review of Economics and Statistics, 64, 243-269.

Miller, M. H., & Modigliani, F. (1961). Dividend Policy, Growth, and the Valuation of Shares. The Journal of Business, 34, 411-433.

Miller, M. H., Rock, K. (1985). Dividend Policy under Asymmetric Information.

Journal of Finance, 40, 1031-1051.

Parkinson, M. (1980). The Extreme Value Method for Estimating the Variance of the Rate of Return. Journal of Business, 53, 61-65.

Pwc. (2021, February 13). Germany Corporate – Deductions. https://taxsummaries.pwc.com/germany/corporate/deductions

Rashid, A., & Rahman, A. A. (2008). Dividend Policy and Stock Price Volatility: Evidence from Bangladesh. The Journal of Applied Business and Economics

Rogers, Silva Rosa, & de Brito Araújo. (2021). Dividend policy and volatility of the share price of brazilian publicly traded companies. Research, Society and Development Rozeff, M. S. (1982). Growth, Beta and Agency Costs as Determinants of Dividend Payout Ratios. Journal of Financial Research, 5, 249-259.

Shiller, R. J. (1981). Do Stock Price Move Too Much to be justified by Subsequent Changes in Dividends? American Economic Review, 71, 421-436.

32

Summers, L. H. (1986). Does the Stock Market Rationally Reflect Fundamental Values? Journal of Finance, 41, 591-602.

iv

Appendix

Appendix 1 – List of included DAX 30 companies

SAP SE Bayer. Motoren Werke Merck KGAA

Siemens AG Infineon Technologie ENBW Energie Baden

Allianz SE Deutsche Bank AG Heidelbergcement AG

Deutsche Telekom AG Munchener Ruckver Fresenius SE

Daimler AG RWE AG Fresenius Medical CA

Volkswagen AG Continental AG Hannover Reuck SE

BASF SE EON SE Puma SE

Adidas AG Bayersdorf AG Commerzbank AG

Bayer AG Deutsche boerse AG Deutsche Lufthansa

v

Appendix 2 – Hausman Test

Hausman test variables P-value

DY,PAYOUT,EV,LVG,MV,AG,FFP 0.0000

.

Table A1. Pooled OLS regression without control variables

Coefficient Std. Error t-Statistic Prob.

C 0.261325*** 0.005259 49.68638 0.0000

Dividend yield 0.099933 0.152996 0.653172 0.5139

Dividend payout -0.078093*** 0.013256 -5.890975 0.0000

DW-stat. = 0.200575 R2 = 0.070269 Adj. R2 = 0.066838

Notes: *** = Significant at 1% level. ** = Significant at 5% level. * = Significant at 10% level.

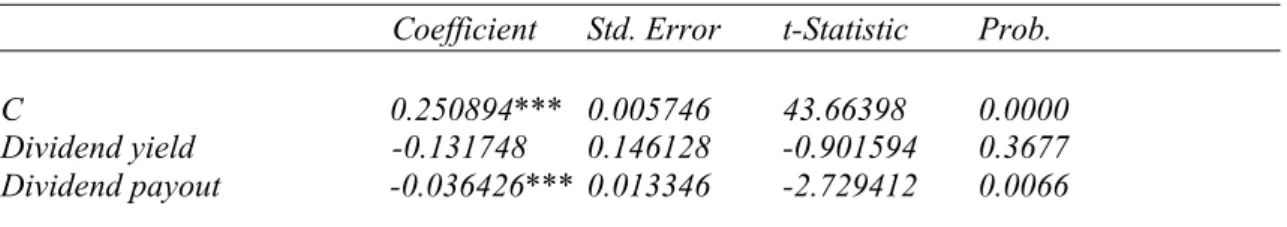

Table A2. Fixed effect model estimation without control variables

Coefficient Std. Error t-Statistic Prob.

C 0.250894*** 0.005746 43.66398 0.0000

Dividend yield -0.131748 0.146128 -0.901594 0.3677

Dividend payout -0.036426*** 0.013346 -2.729412 0.0066

DW-stat. = 0.270429 R2 = 0.436377 Adj. R2 = 0.402317

vi

Table A3. Fixed effect model estimation with control variables

Coefficient Std. Error t-Statistic Prob.

C 0.549642*** 0.034505 15.92942 0.0000 Dividend yield -0.329699** 0.136390 -2.417323 0.0160 Dividend payout -0.027227** 0.012105 -2.249212 0.0250 Earnings volatility 4.175011*** 0.940704 4.438179 0.0000 Leverage -0.095722*** 0.030243 -3.165069 0.0017 Market value -0.059989*** 0.007465 -8.036048 0.0000 Asset growth -0.005356 0.006478 -0.826718 0.4088

Free float percentage -0.042232*** 0.013392 -3.153430 0.0017

F-stat. = 19.64636 DW-stat. = 0.422216 R2 = 0.612211 Adj. R2 = 0.581050

Notes: *** = Significant at 1% level. ** = Significant at 5% level. * = Significant at 10% level.

Table A4. Pooled OLS regression with control variables

Coefficient Std. Error t-Statistic Prob.

C 0.249038*** 0.024596 10.12533 0.0000 Dividend yield 0.186647 0.160154 1.165426 0.2444 Dividend payout -0.068345*** 0.014021 -4.874386 0.0000 Earnings volatility 5.993060*** 1.102803 5.434387 0.0000 Leverage -0.014171 0.022543 -0.628623 0.5299 Market value -0.007325 0.005900 -1.241428 0.2151 Asset growth 0.001891 0.008748 0.216100 0.8290

Free float percentage 0.042488*** 0.010105 4.204584 0.0000

DW-stat. = 0.212867 R2 = 0.155674 Adj. R2 = 0.143283