MASTER OF SCIENCE, 30 CREDITS, SECOND LEVEL STOCKHOLM, SWEDEN 2020

A Global Real Estate Securities

Fund

–

focused on the Residential sector

An assessment based on fund managers' expertise

JOEL AJNE

Title Author(s) Department

Master Thesis number Supervisor

Keywords

A Global Real Estate Securities Fund

– focused on the Residential sector

Joel Ajne & Johannes Felden

Real Estate & Construction Management TRITA-ABE-MBT-20567

Andreas Fili & Jonas Hallgren

Real Estate Investments, Global Real Estate, Real Estate Securities, Real Estate Securities Fund, Residential Real Estate Investment

Abstract

An investment vehicle that holds listed real estate securities that focus on residential properties globally, is currently not available. The study’s purpose is to determine the feasibility of such a product, its potential advantages and disadvantages. This thesis applied a qualitative research method by conducting semi-structured interviews with professional fund managers in Sweden and Germany that manage real estate funds.

The literature review and theory consist of fundamentals and academics in real estate investing, investment vehicles, portfolio theory and lastly investor types and their behaviour.

The authors conclude that the majority of experts interviewed considered the proposed vehicle as interesting but lifted concerns that need to be addressed in further research. The political risk, especially on a global scale, was stated as the major risk. Furthermore, experts have divided opinions regarding the maturity for listed real estate companies on the financial markets. What type of investment vehicle that would be the most suitable will depend on investment tactic, investors and the current status of the global economy and the financial markets.

The overall investigations result is that experts view the proposed idea as positive and feasible. It poses a good foundation for further research and might find its place in the sphere of real estate investments.

This Master thesis has been written during spring 2020 and is the concluding moment of the Master of Science program in Real Estate and Construction Management, with a specialization in Real Estate Economics at KTH Royal Institute of Technology in Stockholm, Sweden. We would primarily like to thank our supervisors Andreas Fili and Jonas Hallgren, who have contributed with guidance and assistance with this thesis.

Moreover, we would like to thank our classmates as well as the staff at the Department of Real Estate and Construction Management.

We especially want to thank all the professional people and firms in Sweden and Germany, who, through interviews, have contributed and made this thesis possible.

Stockholm, Sweden 5th of June 2020

Titel Författare Institution

Examensarbete Master nivå Handledare

Nyckelord

En global fastighetsaktiefond - Inriktad på hyresfastigheter Joel Ajne & Johannes Felden Fastigheter & Byggande TRITA-ABE-MBT-20567 Andreas Fili & Jonas Hallgren

Fastighetsinvesteringar, fastigheter globalt, fastighetsaktier, fastighetsaktiefond, hyresfastighets investering

Sammanfattning

En investeringsform som innehåller noterade fastighetsaktier globalt, där bolagen är fokuserade på hyresfastigheter, är förnärvarande inte tillgängligt på marknaden. Uppsatsens syfte är att avgöra om en sådan inveteringsform är genomförbar samt undersöka dess fördelar och nackdelar. Denna uppsats har applicerat en kvalitativ metod genom semi-strukturerade intevjuer med profesionalla fondförvaltare som förvaltar fastighetsaktiefonder i Sverige och Tyskland.

Litteraturstudien och teorin innehåller akademisk forskning och fundamentala teorier inom fastighetsinvesteringar, investeringsstrukturer, portfölj teori och till sist investeraryper och dess beteende.

Författarna konstaterar att majoriteten av experterna ansåg att den förslagna investeringsformen är intressant, men belyste också svårigheter och risker som bör adresseras i forstsatt forsking på ämnet. Den politiska risken, speciellt på ett globalt plan, ansågs vara den största risken. Experterna hade delade åsikter angående mognaden för globala fastighetsaktier på de finansiella marknaderna. Vilken investeringsstruktur som är bäst tillämpar beror enligt experterna på investeringstaktik, investerarna och det nuvarande klimatet i världsekonomin och på de finansiella marknaderna.

Studien resulterade i att experterna ser på den försglagna investersformen positivt och som genomförbar. Förslaget innehar en godgrund för fortsatt forskning och kan i framtiden hitta sin plats i sfären av fastighetsinvesteringar.

Denna masteruppsats har skrivits under våren 2020 och är det avslutande momentet för Masterprogrammet inom Fastigheter och Byggande, inriktning Fastighetsekonomi på KTH Kungliga Tekniska Högskolan i Stockholm, Sverige.

Vi vill först och främst tacka våra handledare Andreas Fili och Jonas Hallgren, som har bidgragit med vägledning och assistans i denna uppsats.

Ett stort tack till våra klasskamrater och alla anställda på avdelningen för Fastigheter och Byggande på KTH.

Slutligen vill vi tacka alla profesionella fondförvaltare och fondbolag i Sverige och Tyskland som, genom att ställa upp på intervjuer har gjort denna uppsats möjlig.

Stockholm, Sverige 5 Juni 2020

Glossary ... 7

1 Introduction ... 1

1.1 Background ... 1

1.2 Purpose & Research Question ... 2

1.3 Outline ... 3 1.4 Delimitations ... 4 2 Methodology ... 5 2.1 Research Methodology ... 5 2.2 Research Approach ... 6 2.3 Interview questions ... 6 2.4 Interviewees ... 7

2.5 Methodology Criticism & Reliability ... 8

3 Literature Review & Theory ... 10

3.1 RE Investment ... 10

3.1.1 Ground rules - RE investment... 10

3.1.2 Valuation - RE investment ... 11 3.1.3 History - RE investments ... 12 3.1.4 Segmentation - RE investments ... 12 3.1.5 Investment strategies ... 13 3.2 RE Sectors Diversification ... 14 3.3 RE Geographical Diversification ... 16 3.4 Direct Investment ... 16

3.4.1 Private/ Direct Ownership... 16

3.5 Indirect Investment ... 17

3.5.1 Real Estate Operating Company (REOC)... 17

3.5.2 Mutual Fund ... 20

3.5.3 Hedge Fund ... 22

3.5.4 Exchange Traded Fund (ETF) ... 22

3.5.5 Benchmarks & Index ... 23

3.5.7 Real Estate Investment Trust (REIT) ... 26

3.6 Direct vs. Indirect RE Investments ... 29

3.7 Portfolio Theory ... 31 3.8 Investors ... 33 3.9 RE Hedging ... 33 3.10 Investor Behavior ... 34 3.10.1 Home Bias ... 34 3.10.2 Pecking-Order Theory ... 34 4 Results ... 36 4.1 RE Sectors ... 36

4.2 Residential Pros & Cons ... 38

4.3 RE Securities Fund – Supply ... 39

4.3.1 Geographical Diversification ... 39

4.3.2 Sector Diversification ... 40

4.4 RE Securities Fund - Demand ... 41

4.4.1 Feasibility of the Proposed Product ... 41

4.4.2 Investment Vehicle ... 41

4.4.3 Inflow & Distribution ... 42

5 Discussion ... 44

6 Conclusion ... 47

6.1 Further research ... 49

References ... 50

Glossary

RE Real Estate

REPE Real Estate Private Equity

REOC Real Estate Operational Company

PE Private Equity

ETF Exchange Traded Fund

NPV Net Present Value

IRR Internal Rate of Return

MBS Mortgage Backed Securities

EPRA European Public Real Estate Association

GP General Partners

LP Limited Partners

US United States

NAREIT National Association of Real Estate Investment Trusts

AUM Asset Under Management

1.1 Background

The real estate industry is the largest asset class in the world. Including private ownership, corporate property holdings, and the financing of those. One sector in the sphere of real estate is residential. It is a core function to provide housing for humanity to live and thrive in. Amongst the property sector, residential provides the most stable returns due to its relatively stable demand compared to other property sectors.

Global residential real estate is a vital store of wealth for private households and investors. Residential property is by far the most significant asset class held by households. In the US alone, it is estimated that

$

29,3 trillion of dollars are held by households and non-profit organizations. This makes up 75% of the household’s non-financial assets in the United States (Federal Reserve, 2019). Adding the total value of residential assets owned by investors, with the purpose of renting it out to create an income-producing asset, residential real estate makes up a staggering part of the world’s total wealth.Moreover, United States citizens spend on average 25 to 50 percent of their disposable income on rent. In some cases, which is affected by income level and the attractiveness of the city, citizens can spend up to 80% of their income on rent (JCHS, 2020). With this said, rent payments towards residential property owners make up a large portion of society’s monthly consumption.

The idea of housing has been around as long as humans have, from caves to large residential complexes. At this period in history, there is still a need for humans to rent a place that they can call their home. This creates a solid ground for residential since investments are affected by the current demand and supply. With this said, in the near future residential real estate might have a good probability of maintaining its demand in attractive markets where people want to live and work. However, how we live, sleep, and work is in constant change, it is not certain that the current demand for housing will be a present as it is today.

How has residential property performed? The author's attention was caught by the study: The

Rate of Return on Everything, 1870–2015, it examined the aggregated real return of asset

classes from 1870 to 2015. The study showed that residential real estate has been giving the highest risk-adjusted return compared to stocks, bonds, and commodities (Jordà et al., 2019). This is also supported by other researchers such as (Melser & Hill, 2019), who sustained the characteristics of low risk and steady returns that residential real estate creates. These studies lighted a spark of inspiration for constructing a financial product that, in the future, could deliver the returns presented in the studies. An investment vehicle consisting of listed residential property companies could perhaps give investors a smooth and trouble-free access

An investor has a universe of ways to invest in real estate. Either by purchasing individual properties directly, resulting in no geographic or sector diversification. Purchasing a property physically usually causes low liquidity, little diversification, and high transaction costs. It also requires some level of knowledge and expertise in how real estate investing works. Furthermore, an investor can buy stocks of listed real estate companies (REOC) or real estate investment trusts (REITs). Lastly, one could invest in a real estate fund that invests in the RE universe in several ways, mainly via direct investments or in listed vehicles. This can be a private fund, listed mutual fund, or an ETF. These vehicles could be both passive or actively managed. The investor must take a rational investment decision on which geographical markets and property segments to invest in. If an investor feels comfortable with residential properties and wants it to be diversified globally – a single financial product that fulfills these criteria, is surprisingly, not available. Somewhat interesting, since residential real estate is the largest asset class in the world.

1.2 Purpose & Research Question

An investment vehicle that allocates into global listed RE securities with a focus on residential properties.

The financial market offers many listed RE investments but is lacking the proposed construct above. The authors started looking for reasons. Consequently, the authors decided to approach it and conducted a study on the advantages and disadvantages of the hypothetical investment vehicle if it were to be launched in the financial market.

The main research question is:

• How could such a financial product be established, and what are the advantages and disadvantages of such a product?

1.3 Outline

The thesis is subdivided into chapters to maintain a clear structure. The Chapters are introduced below.

Chapter 1 – Introduction

The first chapter provides the reader with the framework of the study. A part of this is the background, the purpose, and the research question. These parts primarily address the why, which is essential for the reader. The how is restricted in the delimitations, serving as an overview for the reader and clarified in Chapter 2.

Chapter 2 – Methodology

In the methodology the authors explain how reliable data for the study was generated. The results are based on data from semi-structured interviews. These interviews are conducted with experts in the industry, primarily fund managers (RE securities funds). The structure of the interviews is explained in the methodology chapter.

Chapter 3 – Literature Review & Theory

The literature review is engaged to address the field of the study. The subject of the study is listed RE securities. Listed RE is primarily valued according to the underlying physical assets (properties). Therefore, the basics of investing in income-generating properties are explained. The proposed vehicle comprised of a set of securities, in other words a portfolio. The primary investment vehicles that hold portfolios of real estate in the market are therefore elaborated. In the context of diversification and RE, two segmentations are identified and addressed, sector and geographical diversification of properties. Furthermore, other related topics, such as portfolio theories, investors, and investor behavior are addressed. Since there is no such vehicle yet, research has not been done on this topic. Conducted studies on relevant topics are elaborated.

Chapter 4 – Results

The results section comprises of data provided from interviews with fund managers. The results are categorized into sub-categories based on the interview questions (Appendix 1).

Chapter 5 – Analysis & Discussion

In the discussion, the expert's notions are discussed and analyzed. Additionally, touchpoints in today’s literature are mentioned.

Chapter 6 – Conclusion

Subsequently, a conclusion is made to address the research questions regarding the proposed vehicle.

1.4 Delimitations

As mentioned in Chapter 1.2, the hypothesis relates to a vehicle of listed RE securities. RE

securities are defined as listed ownership in a company with the purpose of generating revenues

from properties. It is referred to as indirect ownership in the literature review.

Direct (physical) ownership is essential to understand the underlying asset of RE securities and other comparable vehicles. A special case is if a company has the purpose of generating revenue from properties, but is privately held by one or a small group of individual(s) and not listed anywhere. Since it is not listed, it is considered direct ownership in this thesis (special case). Amongst all the possibilities to indirectly invest in RE, merely the most common vehicles are outlined. One example in this context is the delimitation in RE equity. RE debt lends money purposely for someone to invest in RE, real estate debt is mentioned but not discussed further. The methodology is limited in its own nature of a qualitative analysis. No quantitative analysis has been conducted. The data collection is carried out through interviews with experts in the portfolio management and alternative asset management industry. Experts are mainly limited to two European countries, Germany and Sweden, plus one participant from the UK and one from Norway. The interviews were conducted during the first and second fiscal quarters of 2020.

2 Methodology

2.1 Research Methodology

The methodology comprises of semi-structured interviews, to conduct a qualitative analysis with regards to empirical social science. The interview partners are professionals in the asset management industry, primarily focused on RE securities and RE funds. Onwards, they are referred to as experts, interviewee, participants, or professionals.

“Good qualitative study based on semi-structured interviews relies on the knowledge, skills, vision and integrity of the researcher doing that analysis.”(Rabionet, 2011)

The development of semi-structured interviews, until the review of results, can be subdivided into the following steps:

1) Type of interview 2) Interview guide 3) Execution interview 4) Review findings (Rabionet, 2011)

Semi-structured interviews were selected to get a broad view of the expert’s opinion on the topic. One aim was not to limit anyone’s horizon of ideas through closed multiple-choice questions. This approach involves a great deal of preparation for the interviewee. First, the questions should neither be to narrow nor too broad. The interviewee should face the experts on an equal knowledge level, from a literature perspective. Thereby, the expert is comfortable giving in-depth answers and undermine statements with examples from their own experiences. Secondly, the evaluation is very intensive due to the broad orientation of personal opinions. Every interview participant has their own character, background, and experiences.

The interview guide acts as a framework to provide the rules and limitations. Furthermore, formalities regarding privacy are particularized and put into writing. The core of the guide is the questions themselves.

The execution was carried out during the COVID-19 pandemic, present in Europe, USA and China during the time of conduction. Interviews were conducted over the phone or through video call. Upfront, the interview guide was dispatched to the participants. Part of the execution is the protocolizing of the audio files. The authors collaborate on this to increase the level of validity and reliability.

Reviewing the findings is summarized in Chapter 4. Within this chapter, the answers will be

clustered and analyzed in regards to the interview and research questions. The interpretation of the answer is still one dimension in the context of the interview. Subsequently, in Chapter 5, a

2.2 Research Approach

The interviews were conducted over the phone for safety purposes (in times of the COVID-19, a global pandemic). To minimize the risk for biases, the interview questions were sent to the experts beforehand. The Interview consists of 10 questions. On average, a duration of 45 to 60 minutes per interview was conducted.

The interview guidelines are structured according to the requirements for qualitative analysis. The existing knowledge, summarized in the literature review, has fundamental use for the interview guidelines. Some experts mentioned information about confidential data points (not allowed to be presented in this study). Respectively, a trustworthy basis and sufficient validation can be assumed.

2.3 Interview questions

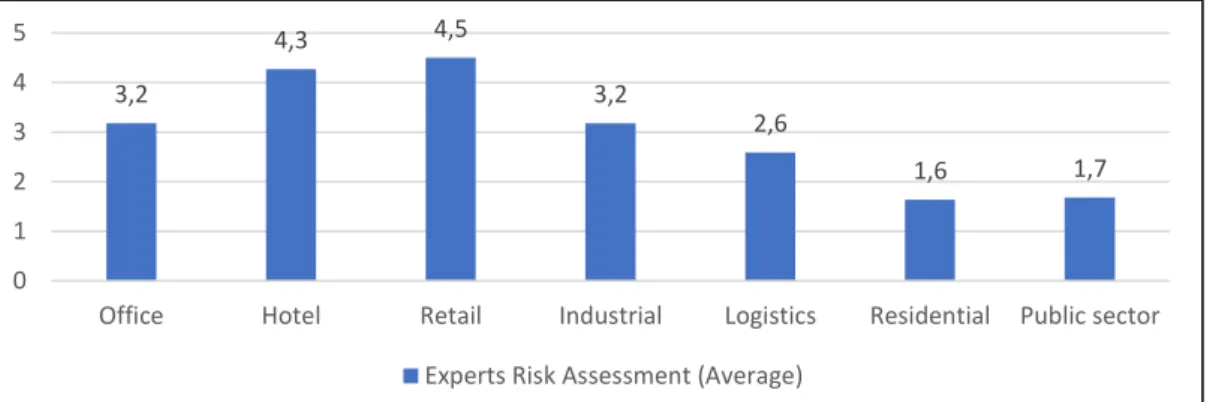

The Interview outline is structured as followed: • Introduction of interview participant • Assessment of RE sectors

• Supply: RE Securities Fund • Demand of proposed product • Experts notations

In the first part, Introduction of interview participant is used as a so-called ‘ice-breaker’ for the dialogue.

Assessment of RE sectors is aiming to get the expert's opinions on risks associated with different

RE sectors.

The Supply RE Securities Funds addresses the current supply of RE securities funds and the drivers of asset managers issuing these. The reason for this is to verify findings but also critically question the current supply on the market.

The demand for the proposed product is the core of this study's hypotheses. Tunneling the questions towards the proposed investment product, the professional’s opinion is of crucial value. Reviewing the literature is merely providing the framework and necessary tools to draw a conclusion. Professionals who deal with financial vehicles, investor's behavior, and governmental regulations on a daily basis are the most valuable source.

Expert's notation can be ideas or hints of problems of any sort. This might be new perspectives

2.4 Interviewees

The information disclosed as a part of the interview varies amongst the experts. A large number of experts wished not to be mentioned during this study. The diversification of experts brings challenges. Comparing Germany and Sweden, privacy and data transparency have different relevance in the degree of protection in their societies. The German society is stricter with regards to privacy than the Swedish. Hence, none of the German experts wanted to display their name and experience in this thesis.

Noteworthy, the interviews were conducted between mid-March and late April. At the same time, humanity and consequently the global economy was hit by COVID-19, a global pandemic. Experts in the financial industry struggle to predict the dimensions of damage, but the losses are enormous. Due to such an exceptional situation, the assessment of questions might be affected even though the extension is hard to quantify.

Interviwee 6: Peter Norhammar – Länsförsäkringar Fastighetsfond Norden/Europa

Peter har an M.Sc. degree from KTH in Real Estate Economics and an MBA from Stockholm School of Economics, he has worked with property valuation at Catella Corporate Finance, property analyst & portfolio manager at SEB. Norhammar is currently a portfolio manager at Länförsäkringar where he actively manages two real estate funds in the Nordics and Europe. At Länsförsäkringar peter first managed a real estate fund with a Nordic mandate but wanted to widen the investment scope to Europe which resulted in a Real Estate fund focused on the European property market. The fund's mandate can invest in listed real estate companies in Europe and the Nordics across all property sectors and can also include construction companies.

Interviewee 7: Jonas Andersson – Carnegie Fastighetsfond

Jonas has an M.Sc. in civil engineering at Lund University. Andersson has worked as an equity analyst at Hagströmer & Qviberg, Nordea, Danske Bank and ABG Sundal Collier. Most recently he has been the portfolio manager of Alfred Bergs's real estate fund which is now under Carnegie Fonders umbrella. Carnegie Fastighetsfond Norden is an actively managed mutual fund and invests in listed real estate securities focusing on the Nordic markets. The fund can also own construction and infrastructure stocks.

Interviewee 8: Marie-Anne Meldahl – SEB Fastighetsfond

Marie-Anne Meldahl has an M.Sc. in Industrial Engineering & Management from KTH and a master’s in business & economics from Stockholm University. Marie-Anne has worked with risk and portfolio management at RPM Risk & Portfolio Management AB. Meldahl I currently

where SEB Fastighetsfond is one of them. The fund is an actively managed quantitative fund that invests in listed Real Estate securities globally in developed countries.

Interviewee 9: Tommi Suominen – United Bankers Real Estate & Infrastructure funds

Tommi holds a Bachelor of Business Administration from the Helsinki Metropolitan University of applied sciences. Suominen has over 13 years of experience from mutual funds investing in listed real estate securities. Tommi has been working as a fund assistant, analyst and is now a portfolio manager for the following funds at United Bankers: UB Asia REIT Plus, UB Global REIT, UB European REIT and UB North America REIT. All funds invest in listed REIT and property stocks and are well diversified by company, country or sub-sectors. The funds are actively managed.

Interviewee 10: Øystein Bogfjellmo – ODIN Fastighet/Eindom

Øystein Bogfjellmo holds a master’s degree in Investment Management from CASS Business School and a BSc in Finance from BI Norwegian Business School. Øystein has a background as an analyst at Carnegie Investment Bank, Equinor and SEB. He is currently a portfolio manager at ODIN Asset Management for the following funds: ODIN Fastighet/Eindom, ODIN High Yield. The fund ODIN Eindom is an active mutual fund that invests in listed real estate stocks in the Nordics.

2.5 Methodology Criticism & Reliability

A limitation of this study is the amount of research in the field of residential real estate from a global perspective. The majority of the research on this subject tends to be very local. Since the property industry is a local knowledge business, most of the relevant research is based on one core market and not global. Therefore, few general theories in global residential could be classified as accepted in academic terms.

The empirical research has been carried out through semi-structured interviews; this method is itself associated with certain drawbacks. An empirical study that is based on personal interviews will be affected by the interviewee's subjectiveness (Saunders et al., 2008). Therefore, the result might only capture opinions and speculations from our set of interviewees, which might give the result a fragmented view of the topic. To address this, the interviewees were thoroughly analyzed. To qualify as an interviewee for this thesis, an extensive track-record and expertise in the field had to be met. The experts in the study all have extensive experience in the financial industry in managing (RE) funds and portfolios. The respondent’s answers from the interviews are not connected to them personally in the result. The reason for this is that it could affect the reliability in the interviewee's answers and the credibility of the thesis. On the contrary, since the results from the interviews are anonymous, it could also affect the credibility of the results since certain answers and opinions is not connected to a specific source.

The number of interviewees in this study could be criticized, semi-structured interviews are time-consuming, and this paper could not have covered every fund manager specialized in real estate on a global scale. To make the study reliable, the number of interviews pursued has been maximized concerning the thesis time frame and academic level. The interviews were recorded and afterward transcribed to avoid any subjectiveness in the answers received. Every participant was presented with the same open-ended questions to avoid misleading data.

3 Literature Review & Theory

3.1 RE Investment

Real estate investments in nature have to be separated into income-producing and non-income-producing assets (Baker & Chinloy, 2014a). In this essay we focus solely on income-non-income-producing investments. Property investments act as an individual organization. The structure is similar to companies. It incorporates income and expenditures (recurring and non-recurring). Furthermore, it requires certain management.

3.1.1 Ground rules - RE investment

Serval financial metrics can be taken into account. For example, internal rate of return (IRR), net present value (NPV), and capitalization rates (Cap rates) (Goddard & Marcum, 2012). To specify the ground rules for income streams, the NOI is commonly used. NOI (Net Operating Income) is the generated income through operations (rent), losses from vacancies and expenses. Expenses for maintenance and operations comprise of taxes, insurance, management, maintenance, repairs, legal matters and others (Capozza & Lee, 1995). Payables, such as energy supply and internet connection, are transitory items, rerouted to tenants. Though, the management of such expenses is classified as operational expenses.

Important for an investor is the cash flow generated, especially the future cash flows. The cash flow can be calculated in the following order:

+ Net operating income (NOI) - Debt payments

- Improvement expenditures + Other income from the property = Cash Flow Before Taxes

Table 1 – Cash flow calculation properties

Expenditures are clustered in debt payments and improvement expenses. Debt payments comprise of interest and amortization repayments. Improvement expenditures are constructional actions which are not essentially necessary but aim to increase the value of the property.

Based on the cash flow, the Net Present Value is derived. The NPV can be explained by discounting future cash flows:

𝑁𝑃𝑉 = ∑𝐹𝑢𝑡𝑢𝑟𝑒 𝐶𝑎𝑠ℎ 𝐹𝑙𝑜𝑤𝑠 (1 + 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑟𝑎𝑡𝑒)𝑁

The discount rate is set according to assumptions regarding inflation, opportunity costs and the risk of default. N is the number of years (Kien Hwa, 2008).

Another primary metric is the Internal Rate of Return (IRR). IRR is an interpretation of the discount rate. Summarized, it is the rate of return that generates an NPV equal to zero. This

assumption is made for comparison purposes. The rate is used to identify projects profitability. The higher the IRR, the better (Berk & DeMarzo, 2016). Investors have to be aware of the weaknesses of IRR. First, when comparing projects, the IRR does not consider the actual profit (derived from the total investment volume). Therefore, relative rates can be misleading. Second, multiple numerical solutions can be the outcome which can cause confusion (Baker & Chinloy, 2014b).

3.1.2 Valuation - RE investment

To determine the value of a property, the industry offers different approaches: 1. Comparable sales approach

2. Income approach 3. Cost approach

The comparable sales method is based on benchmark prices. This reference price is generated from transactions from the past with similar characteristics. Similarities can be observed with other financial rates when comparing stock performances. Such ratios are Price to Earnings (P/E) or Price to Book (P/B) and more. However, Real Estate is a heterogenic asset which is hard to compare. Characteristics such as location, size, age, type of use, and tenant(s) primarily determine the price but are not reflected in the method appropriately. For this reason, the first method is generally considered as a pre-valuation only unless relevant comparables are found. The cost approach is derived from the replacement costs to rebuild the same building today. This method has strong weaknesses that cause skewed calculations. A new property has lower maintenance costs and repairs, but mainly the present prices are hard to compare to construction costs from the past.

The income approach is the most common valuation method for properties that generate income. It is therefore the most applicable method in our case (Baker & Chinloy, 2014c; Baum, 2017).

The income approach can be separated into three methods:

First, the Gross Income Multiplier (GMI), the simplest method. Straight forward, the sales price is divided by the gross income. Given the fact that no expenses are considered, this method is recommended to be used for small properties with long term stable incomes.

Second, the capitalization rate (cap rate), which is derived from the NOI and sales price.

𝐶𝑎𝑝 𝑟𝑎𝑡𝑒 = 𝑁𝑂𝐼 𝑆𝑎𝑙𝑒𝑠 𝑝𝑟𝑖𝑐𝑒

In other words, the cap rate is the yield on a one-year investment horizon. Important to notice is that the formula refers to the current market value of the property, which is considered a weakness due to the sensitivity of market changes (Goddard & Marcum, 2012).

Third, the discounted cash flow (DCF) method. Total expected future cash flows discounted to derive the current value. As for the discounting, the weighted cost of capital (WACC) can be used to reflect inflation, opportunity costs, and risk of default. This method is appreciated because it can handle long investment horizons. Furthermore, the DCF neglects characteristics regarding the property’s uniqueness or qualities of the location (Goddard & Marcum, 2012).

3.1.3 History - RE investments

Until the end of the 19th century, the form and scale of real estate investment stayed quite simple, consisting of direct individual investments. Over time, syndicates were formed to purchase properties with combined capital. In the 19th century, groups saw the opportunity to raise capital and increase their investment activities through the issuance of securities. The general public was exposed to securitized RE equity. Investors were offered to purchase such securities, which represents small shares and ownership. According to the relative ownership, investors are entitled to gain from generated profits (Brounen & Koedijk, 2012). In 1850, the first European Real Estate company was listed on a public stock exchange. A new investment category was created, illiquid assets publicly traded, listed RE companies (Baker & Chinloy, 2014b).

In most cases, real estate companies were active in construction as well. In 1960, Real Estate Investment Trusts was introduced to enhance investment that purely focused on managing income generating properties. REITs, as an investment vehicle commercialized the investment sphere in RE. The trusts are listed but are primarily generating returns from RE management. The vehicle offers the stability of RE investments but is highly liquid (Brounen & Koedijk, 2012).

3.1.4 Segmentation - RE investments

An investor can directly invest in RE through various ways. The segments differ in return patterns and risks. The first segmentation will be debt and equity. Secondly, the separation between private and public.

RE debt is the process of raising capital to acquire and finance real estate. The debts value is

derived from discounting future payments by the mortgage holder. The interest rate and the risk of default influence the discount rate of debt instruments. Debt comes in different types and forms, such as mortgages, mortgages backed securities (MBS), and bonds to name a few (Baker & Chinloy, 2014a).

RE Equity can be segmented in direct and indirect ownership of equity. Direct property owners

are listed as owners in the land register. Whereas an indirect owner possesses shares of companies that own properties, so called Real Estate Operating Companies (REOC). These

companies generate their primary income from properties. Respectively, those shares in ownership are traded differently, in private or public markets.

The liquidity of an asset and the process of acquisitions play a central role. Direct property ownership shares are not traded on any stock exchange. Those are purchased directly from the owner of the asset. These shares are heterogenic in the sense of the uniqueness of each property. Properties have to be considered as organizations. They generate income, expenses, and requires management. Furthermore, the process of private acquisition takes time; it involves various legal matters and is therefore cost-intensive. Compared to real estate stocks that are publicly traded, which requires less effort to purchase. Listed RE companies are the direct owners of properties. They manage the underlying asset on behalf of the investor and generate returns through the properties. For most investors, the major advantages of indirect equity investments are the simplification of acquisition due to homogeneity and higher liquidity (Baker & Chinloy, 2014a).

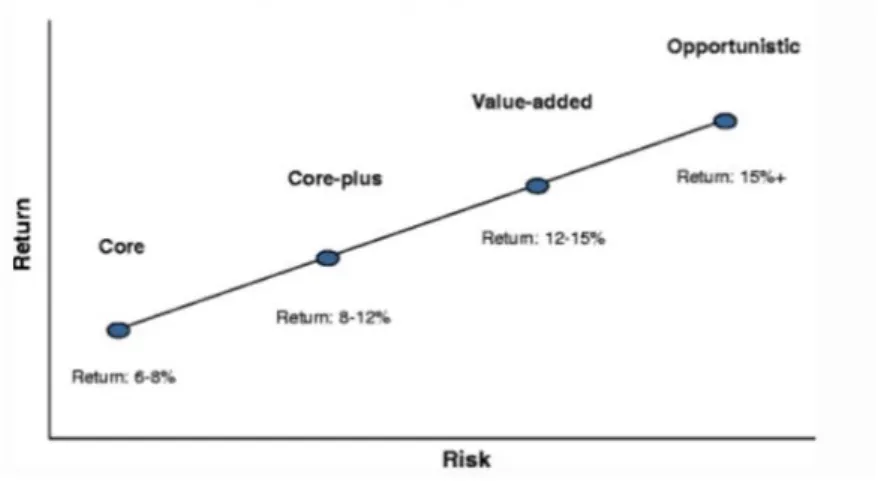

3.1.5 Investment strategies

RE investments can be clustered into three main strategies: 1. Core

2. Opportunistic 3. Value-added

The core strategy focuses on properties in prime locations and top quality. These properties show the highest occupancy rates and generate the most secure income but usually have less growth and value potential. Such investments can be compared to bonds with fixed coupons. The capital appreciation is not a key driver with this strategy. In practice, the leverage of such investments is relatively low.

The opportunistic strategy is mainly about capital appreciation. These properties often require a commitment of capital used for renovations. The demand for leasing is based on assumptions and are associated with risk. Additionally, this strategy involves higher leverage, aiming for substantial income gains through revaluations.

The value-added strategy is a mixed approach. On one side, properties with potential for added value are purchased. On the contrary these are valorized with minor effort, for example, change in management. Opposite, properties with secure income are demanded but realized with significant use of outside capital (Baker & Chinloy, 2014b).

RE is considered an alternative asset because it has a relatively low correlation to other asset classes in the market. Real estate is also used by many to hedge their portfolios against inflation. Investors strive to diversify within asset classes too. For direct ownership investments

3.2 RE Sectors Diversification

The two main RE segments are Residential and Commercial properties. Residential properties provide accommodation. In the context of income-producing properties, these can be leased properties, single & multi-family houses, student residences, residential care homes. On the contrary, commercial properties serve business purposes. Those subsegments can be divided into retail, office and industrial spaces, public sector, and hotel. The subsegments differ sharply from an investment perspective. Such differences can be explained in the structure of the leases. The most common RE investments are seen in the office sector; it offers high average yields, and large units, which is favored by professional investors. The high returns come alongside with volatility as higher exposure to economic market movements plus bulk risk with larger rented space per tenant.

Retail rentals tend to be more stable due to the dependence on location. Nowadays, the trend

for retail is declining due to an e-commerce and delivery services boom. This affects retail property prices significantly.

Industrial properties favor different locations attributes, instead of inner-city locations,

accessibility and strategic environment matter. Furthermore, they differ strongly according to their utilization. Subsegments in the industrial sector are manufacturing, storage/warehouses, logistics and research and development. Industrial properties feature lower maintenance, management and operational costs. Besides the major property segments, leased properties can be infrastructure, parking, hotel, or healthcare (Baker & Chinloy, 2014a).

For the economy, residential real estate is the most significant type of real estate. The majority of space in cities across the world is in use for housing purposes. One study from 1984 estimates

the percentage of housing in urban areas up to 90% (Barkham, 2012).

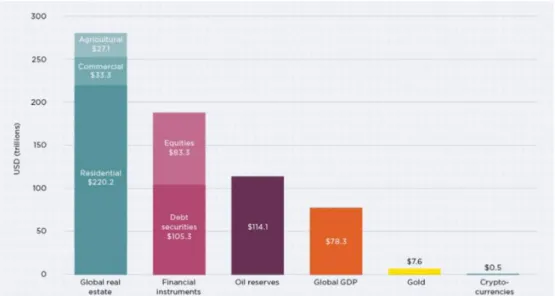

According to a study conducted by Savills, the global housing sector stores more wealth than all financial instruments combined (securities & debt securities).

Figure 1 - Global real estate universe in comparison. (Savills, 2019)

With regards to the market size, it is worth mentioning that a significant share of residential RE is in private ownership. According to statista.de, in 2018, the European average (EU-28) was 69,3%. However, investment potentials are substantial. Some experts even refer to a higher potential in the residential sector compared to commercial sectors (Barkham, 2012).

The macroeconomic influence of the residential RE sector accredits to positive investment qualities:

• Indirect influence on private consumer markets. For a large group of private homeowners, the concentration of capital lies in the mortgage for their home. Therefore, fluctuations in the market directly affect the owner's interpretation of wealth and sequentially their consumption behavior.

• The construction sector is a substantial pillar of the overall GDP. The sector is strongly affected by the demand for housing, which is derived from the growth rate of housing prices.

• The lenders, primarly mortgages to private homebuyers.

(Barkham, 2012) highlights negative aspects as well. Mainly two characteristics stand out; it is management intensive (which creates another source of risk), and a bad reputation. Residential RE is widely associated with bad publicity. Furthermore, comparing different residential markets is not quite easy. Not all measurements apply equally across markets (Barkham, 2012).

3.3 RE Geographical Diversification

Geographically the RE sector differs strongly in regulations, risks and returns. All sorts of drivers: economically, formally, and technically, are exposed to different environments and show strong contrasts. Properties themselves are associated with local forces, plus regulations are not the same globally. Primarily, the economic situation affects the NOI. Feasible rents differ as well as operating and maintenance costs. Furthermore, the costs of capital and governmental regulations play a central role for investors (Baker & Chinloy, 2014b). Hence, benefits from cross-border diversification can be assumed.

3.4 Direct Investment

The different strategies account for speculative and value approaches. An investment is considered as speculative if the investors aims to generate profit with a higher sales price than the property was purchased for, the recurring income streams are neglected. In the following, we focus on the contrary, value investments. This approach implies more accurate analysis focused on the recurring income and expenses with long investment horizons (Goddard & Marcum, 2012).

3.4.1 Private/ Direct Ownership

Direct ownership means owning a property. The asset is registered on the investor's name in

the land registry. As mentioned above, properties have to be considered as corporations. De facto, direct ownership brings along the responsibility of property management. This can be an opportunity for the owner but can also create certain risks (Baker & Chinloy, 2014a).

One primary characteristic of direct ownership is liquidity. As such, it is considered an illiquid asset because of the transaction process. Liquidity reflects the duration to convert an asset into money. According to (Devaney & Scofield, 2015): “The median time for purchase of real estate from introduction to completion was 104 days”. Bonds, stocks, and other listed assets take less than a second to buy or sell. Selling a private property is time-consuming due to the lack of digitalization and multiple security loops and instances. One example is the land registry. Furthermore, the fact that real estate is physically heterogeneous it varies in legal characteristics (Devaney & Scofield, 2015). The involvement of different parties leads to high transaction costs.

Commonly, the investor takes up external capital in the form of a mortgage. Individual agreements with a financial institution have to be made before the transaction. The mortgage is the primary document, between the financial institution (the borrower) and the investor (the

lender). The document secures the pledge of the property by the investor to the borrower,

phrased according to legal requirements (Goddard & Marcum, 2012).

Amongst direct RE investments, some comparative advantages should be considered. The geographical location of the property is, in this case, the most obvious, others are not as easy to quantify. The job industry, which is present in the area, is also an essential factor. The companies in the area have to be quantified in terms of size and professionalism regarding their

3.5 Indirect Investment

Investors can purchase a range of liquid vehicles to diversify their portfolio. The oldest way to pool capital from multiple investors for RE investments is through property funds. The variety of funds is quite diversified nowadays and the fund selection should be carefully considered. Purchasing RE company’s securities is another possibility. RE companies usually have local knowledge in-house. RE stocks can also have exposure to the construction sector since many RE companies started as construction companies. The construction sector is vulnerable to a higher degree of failure due to construction risks and labor markets. To concentrate on properties and eliminate construction risks, REITs are a good alternative. REITs are highly regulated to shelter investors.

Figure 2 - Size Global Real Estate Securities Market (2014) (Garay, 2016).

3.5.1 Real Estate Operating Company (REOC)

Real Estate Operating Company (REOC), or real estate stock, is a type of investment that is

often compared to REITs, but there are regulative and strategic differences. The main difference is that a REIT is a regulated vehicle for a specific reason (generating profit form RE), whereas the REOC is a listed company governed by general governmental rules, like any other company. REOC differs much more in strategy compared to REITs due to the legal structure.

REOCs can be active in RE development projects, whereas others solely operate and manage properties. For an investor, the company’s strategy is important. The strategies result in different cash flow streams. RE development is appropriate for high growth investments

shareholders. Furthermore, REOC generally reinvests earnings, whereas REITs are obliged to pass along earnings due to a different taxation structure (Morri & Jostov, 2018).

Literature shows that REOC is more volatile than the underlying property assets, which should be expected for serval reasons. First, it is common practice for such companies to use leverage in the projects. This leverage increases the risk and volatility of the stock price. Secondly, REOC often operates as developers due to high returns. According to common knowledge, the return is accompanied together with risk. Subsequently, the volatility of RE development projects is higher due to uncertainty. Lastly, appraisal smoothing is present in RE valuation, resulting in lag and uncertain prices. Securities, on the contrary, are priced by the market based on transparency (Barkham, 2012).

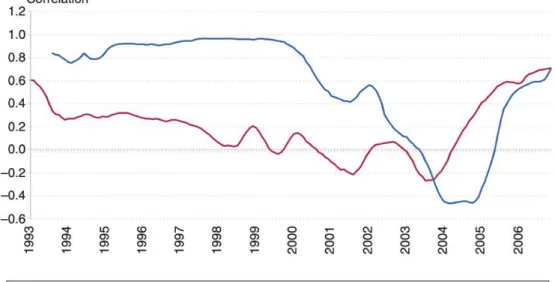

Figure 3 – Correlation between property and property shares (Barkham, 2012).

Figure 3 – Correlation between property and property shares (Barkham, 2012). shows the 5year rolling correlation between property and property shares. To be specific, the rolling (5 years) correlation that shows correlations of time series from 1993 to 2007 (Barkham, 2012).

A regression analysis done by (Barkham, 2012), shows that the performances are cointegrated. In other words, short term gaps might emerge, but over time the security and the underlying asset move together. This means that short term performances can differ, but long-term, it replicates the property values (Barkham, 2012). For historical RECO stock performances, the US market is the most comprehensive regarding data sets (Morri & Jostov, 2018).

The figure below is part of a study conducted by EPRA in 2018 that indicates the strong long-term performance of listed RE as mentioned above. The total return is referring to the stock’s performance including dividends.

Figure 4 - Annualized total return (EPRA, 2018)

In the context of corporate finance, the capital structure of RE companies varies. Equity, debt, or both is used to finance projects. RE investments are usually financed with external resources to a large extent (Ottet et al., 2005).US REITs are financed less than 10% of their investments through internal resources (Morri & Jostov, 2018).

Determinants such as interest rate and maturity of debt come into play. The maturity of debt is often used for analysis to derive assumptions. (Barclay and Smith, 1995) defined a relationship between debt maturities and progression opportunities. Whereas (Guedes and Opler, 1996) argue that overvalued RE companies (high market-to-book ratios) remark opportunities for growth but also short liabilities (debts).

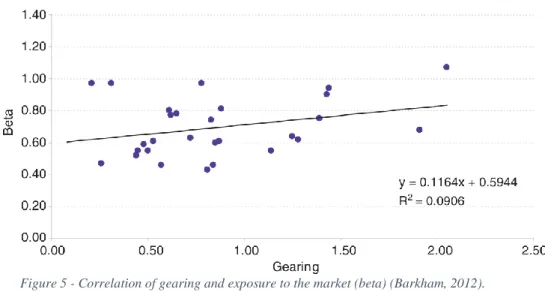

Literature lists certain drivers that influence the beta of REOCs. The following indicates the most influencing parameters:

• Leverage: The higher the leverage applied in the capital structure, the more sensitive the company is to market changes. See figure 4 below.

• Yields: High yields entail unstable short term lease contracts and weak debt covenants. Studies prove this leads to more sensitivity in beta due to economic changes.

• Proportions of developments: RE developments are exposed to trends in construction costs and tenant demand. Those trends are correlated to short-term market performance. • Time period: Primarily, the correlation of interest rates and REOC’s dependence on market performance (beta’s). In times of low interest rates, the economy is expected to grow and tenants tend to be more risk taking.

Figure 5 - Correlation of gearing and exposure to the market (beta)(Barkham, 2012).

3.5.2 Mutual Fund

Mutual funds are the most popular investment amongst commercial investors. “Mutual funds are the largest financial industry in the world, having assets of over $12 trillion” (Fink, 2009a). The definition of a mutual fund is a rather broad term for an investment vehicle with many varieties. All have one thing in common, they bundle up securities to create a portfolio. Terms for mutual funds used in the financial market can be: investment trusts, investment funds, funds,

closed-end funds, open-end funds, mutual investment companies, mutual funds, unit investment trusts, fixed trusts, exchange-traded funds (ETFs), and hedge funds (Fink, 2009a).

Such investment vehicles above are a construct for investors to diversify their capital with one investment and getting professional management in return for a percentage fee. The management can invests in all sorts of assets, stocks, bonds, and more. Investments are combined in a portfolio, like a basket of securities. Investors then own shares of the fund but not the underlying securities themselves. The main advantage for investors is the diversification created which decreases the risk. Furthermore, investors benefit from simplicity and accessibility. One fund creates access to many different companies.

The American Securities and Exchange Commission (SEC), monitors the market and sets regulations, with regards to pooling investment vehicles the Investment Company Act from 1940 applies. According to this Act, three segments have to be separated.

1) fixed trust or unit investment trust 2) closed-end investment companies/ funds

3) open-end investment companies/ funds or mutual funds.

A fixed trust or unit investment trust has fixed terms with regards to the number of shares and the portfolio of securities (Fink, 2009a).

Closed-end funds started off as investment companies. The first closed-end fund in the U.S.

2009). These funds are characterized by active portfolio management and have shares that are publicly traded. Investors can purchase shares where the number of issued shares is fixed. These shares can be traded at any time in the stock market. Respectively, it is considered a liquid investment. Still, there are several disadvantages.

First, the value of the fund can deviate from the total value of the underlying assets. This is due to the fact that the fund's share price is priced independently from the underlying securities by the demand and supply at the stock exchange. This mechanism leaves room for arbitrage because the fund shares are traded at premium or discount prices (Fink, 2009a). According to (Rottersman & Zweig, 1994), in 1929, “the average investment trust was selling for 47 percent above the liquidating value of its portfolio”. Secondly, those funds used to have high leverage and many speculators in the early days. The issuance of senior securities was the tool used to generate leverage. The leverage is used to boost the returns and management fees. Leverage is considered positive during a bull market but in bear markets much worse. Lastly, those funds were often owned by security firms, which put them in a strong position to abuse the ownership (Fink, 2009a).

Lastly, open-end investment companies/ funds or mutual funds got introduced. These mutual funds are flexible in creating or redeeming shares according to the market's demand. The main advantages are unaffected, diversification, and professional management are the same as with closed-end funds. The disadvantage of funds trading at an overvaluation is not present in these funds. The great depression in late 1929, caused significant losses for closed-end funds and initiated the rise of open-end funds (Fink, 2009b). In the ’70s, the cost of investments caught the attention of investors and caused and adaption of the mutual funds. As a result, the first low-cost index fund was created in 1971, set up by the Wells Fargo bank. This and the Investment Company Act Release No. 17809 of 1990 set stone for a new subsegment, the exchange-traded fund (Ferri, 2009).

When investing in a fund, a major decision is the cost. Fees are structured in different ways, there are no universal rules. The total expense ratio may involve recurring and non-recurring fees.

For recurring fees, in practice, funds refer to it as expense ratio, management fee or operational fee. Fees charged by the funds differ according to the type of fund, the industry and the management. A few things have to be considered: Actively managed funds logically have more costs than passive funds. Funds that operate internationally have more costs than the ones in a domestic environment. Companies with small market capitalization on average are pricier to research and require more effort to buy or sell. Fund companies with almost identical funds may have different fee structures too.

Expense ratios can be expressed in percentage (%) or basis points and refer to the amount you invested. One basis point equals 0.01%. According to the 2018 Morningstar Fee Study, the average expense ratio for actively managed funds dropped down to 0.67% in 2018 (2018

Morningstar Fee Study Finds That Fund Prices Continue to Decline | Morningstar, n.d.). 3.5.3 Hedge Fund

Hedge Funds is a type of mutual fund that has unique characteristics and limitations. Hedge funds are usually organized as limited partnerships with a minimum investment amount. Due to its limitations, hedge funds are subject to less regulation compared to traditional mutual funds. This gives hedge funds a broader spectrum in what and how they can invest in, including long and short positions, with the aim of creating absolute returns regardless of the market’s overall performance or its current condition. Hedge Funds can be niched towards a variety of markets and asset classes. Some can be specialized in stocks, bonds, options, macro and more (Mishkin, 2016).

Real Estate is traditionally not a core asset class amongst hedge funds. However, this does not mean that Hedge Funds is not exposed to the real estate market, through various securities hedge funds will, from time to time, have exposure towards the property market. A study by (Ambrose et al., 2016) showed that 1,321 out of 3,669 hedge funds had significant exposure to the real estate market, even though the hedge funds were not classified as a real estate hedge fund. The study showed that funds with significant real estate exposure do not outperform funds that did not have any real estate exposure. In conclusion, the authors find that real estate is not a source of hedge fund managerial skills. This could explain why there is not a hedge fund that focuses primarily on real estate (Ambrose et al., 2016).

3.5.4 Exchange Traded Fund (ETF)

Literature shows that most professionally managed funds fail to outperform the market. These insights caused doubts in professionally managed funds and the desire to replicate the market performance. Subsequently, the boom in passive investing started. So called ETF’s enable investors to replicate a benchmark, i.e., a stock index with very low costs (Blitz, 2011). The Exchange Traded Fund (ETF) is an investment product that is based on a traditional open-end fund. The portfolio is not actively managed, which differs from an open-open-end mutual fund. Instead, the ETF is replicating a benchmark, usually a stock index such as the S&P 500. An index is a pool of clustered stocks (or other assets) that is used to monitor market movements. Another difference between an ETF and a mutual fund is the disclosure to the public. ETF’s have to disclose the securities and the weightings in the portfolio on a daily basis.

In contrast, mutual funds reveal that information only periodically, to protect their strategies (Ferri, 2009). Investors purchase shares of the ETF on the stock exchange, just like company stocks. These shares facilitate the ownership in the fund. Unlike company stocks the amount of issued ETF shares changes constantly. This is to prevent the fund from being priced differently than the underlying assets, respectively, chances for arbitrage arises (Ferri, 2009).

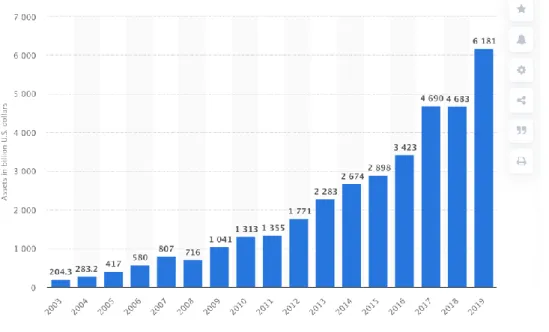

ETF has witnessed a strong inflow in recent years. In 2018, the ETFs held approximately 6.18 trillion U.S. dollars in assets globally. (Assets of Global ETFs 2019 | Statista, n.d.).

Figure 6 - Development of assets of global Exchange Traded Funds (ETFs) from 2003 to 2019 (in billion U.S. dollars).

(Assets of Global ETFs 2019 | Statista, n.d.)

Since ETFs are passive vehicles, the funds do not require active management. Therefore the costs are significantly lower than active funds. Nonetheless, certain costs still exist, in practice known as total expense ratio or expense ratio. This expense ratio includes:

• Management fees • Share registration fees • Fees payable to auditors • Legal fees

• Custodian fees

According to the 2018 Morningstar Fee Study, the average expense ratio for passive funds dropped down to 0.15% in 2018 (2018 Morningstar Fee Study Finds That Fund Prices

Continue to Decline | Morningstar, n.d.). 3.5.5 Benchmarks & Index

In the context of ETFs, benchmarks and indexes are mentioned. These are not an investment vehicle, they are used to measure and compare investments. In fact, the application of benchmarks goes back before the rise of ETFs. Therefore, benchmarking became common practice for actively managed funds (Blitz, 2011).

example, the S&P 500 index, which clusters US large-cap stocks together. Such indexes are used as benchmarks for professionally managed funds. The aim is to outperform the market, in other words, beat the average investor (Blitz, 2011).

Since real estate generally do not transact on a regular basis and public market pricing is not available, many real estate indices rely on appraisals to calculate their index. Solely relying on appraisals when constructing an index creates problems due to the nature of the appraisal process. For the NCREIF Property Index (a widely used benchmark for commercial real estate assets), these problems could be observed during the 1990s recession when the volatility on the market was high. The issues resulted in the index reporting higher risk-adjusted returns compared to the actual risk-adjusted returns on the US commercial real estate market. Appraisal based indices tend to have less volatility and lag changes in the market and are therefore not entirely suitable for risk measurement (Shilling, 1993).

The first reason, appraisal-based indices tend to have less volatility because properties are not actually revalued each quarter, although property values are reported quarterly to the stakeholders through quarterly and annual reports. Investment managers, who are the ones reporting their values, simply do not wish to spend the time and money that an appraisal requires each quarter. Thus they may only adjust for capital expenditures for quarters where they believe that there is no significant change in the property value.

The second issue is that appraisals tend to lag the transaction price due to the nature of the appraisal process. This means that market conditions often change more rapidly than can be reflected in the data available to the appraisers, which results in appraisals lagging changes in the market. This tends to make appraised values higher than the transaction prices when there are a market downturn and vice versa.

There is also a possibility of appraisals being biased since property owners and investment managers pay the appraiser for the valuation. Evidence for biased appraisers has been found by Downs and Güner, who concludes that there is a possible correlation between the number of appraisers and higher price ratios (Downs & Güner, 2012). Moreover, research has also shown that the appraiser relationship affects valuation bias (Zhu & Pace, 2012).

3.5.6 Real Estate Private Equity (REPE)

First, Real Estate Private Equity (REPE) and Private Equity Real Estate (PERE) are the same. REPE highlights RE as the asset and is widely used by individuals from the RE industry (Anderson et al., 2016).

A REPE fund is an investment vehicle that in most cases are not listed. The investment horizon is usually fixed. Furthermore, coupon payments are unusual since the fund wants to maximize the return. Investment horizons of 3 to seven years are common practice. A REPE fund consists of General Partners (GP) and Limited Partner (LP). General partners are holding a significant

number of shares and actively manages the fund. LPs are the common investors in the fund (Achleitner & Wagner, n.d.).

REPE has distinguishing features regarding the strategy. The return within the fund is primarily driven by profit generated from an increase in selling price instead of the rent. As explained above, this is considered a value-add strategy. Such investments usually apply high leverage. RE is acquired, upgraded and sold with rather short durations. Respectively, properties are selected according to reasons for undervaluation, which can be upgraded (Rottke, 2004). In other words, value is generated through active management modifications. This can pay-off well, but the risk potential is significantly shifted away from the property itself and relies on the fund’s management capabilities (Anderson et al., 2016).

REPE funds in practice are categorized in risk strategies: • Core

• Value-Added • Opportunistic

The strategies differ in accordance with the type of properties, management, location, structure of rental agreements, refurbishment, leverage, and acquisition strategy (Fisher & Hartzell, 2016). The correlation of risk and return for REPEs is illustrated below.

Figure 7 - REPE correlation of risk and return (Fisher & Hartzell, 2016)

Most REPE funds aim for returns in the region of 10% and above. Value-add and opportunistic approaches involve high leverage and a significant change in lease structure or redevelopment to add value. Undeveloped land or properties in emerging countries carry even more risk, but then also higher returns (Fisher & Hartzell, 2016).

A comprehensive analysis of REPE is complicated for two reasons. First, this investment approach is rather young, therefore less data is available. Second, their private nature restricts them from publishing information (Anderson et al., 2016). Robust studies of REPE performance analysis can be found with (Alcock et al., 2013), (Bond & Mitchell, 2010), (Hahn

adjusted return is according to the study the highest for value-added funds, resulting in a positive alpha (Alcock et al., 2013).

3.5.7 Real Estate Investment Trust (REIT)

REITs have grown to become a global sensation in the real estate industry. REITs have qualities that benefit all types of investors. It can yield high risk-adjusted returns and at the same time produce steady and predictable cash flows. Compared to Germany, who adopted the REIT structure in 2007, the policymakers in Sweden has shown a negative approach towards implementing REITs on the Swedish market.

The classification of REITs is according to their revenue streams. They can be classified as equity or mortgage REITs. Equity REITs own properties directly. Mortgage REITs obtain income from interest on investments in debt. These can be mortgages or mortgage-backed securities. Not every REIT is publicly traded, some are publicly registered but not listed on any stock exchange. Others are not registered at all and act as private companies.

REITs operate under a certain set of rules implemented by the American IRS: 1. Structured as a mutual fund

2. Considered as a corporation according to international revenue code 3. Primarily owned by shareholders

4. Principal strategy to own or finance Real Estate 5. Must have a long investment horizon

(Learn About REIT Basics | Nareit, n.d.). The REIT as a corporation has to have:

• A minimum of 75% of the income generated by RE. Either RE interest or capital appreciation.

• 75% of the corporation’s assets under management have to be properties. • 95% has to be declared as passive income.

• Be qualified as a taxable corporation. • At least 100 shareholders.

• A healthy distribution of shares. Max 50% held by five or fewer shareholders. • Board of directors/ trustees.

(Learn About REIT Basics | Nareit, n.d.).

Furthermore, the use of earings is regulated. A REIT has to distribute at least 90% of the income to shareholders annually, as taxable dividends. Same as with mutual funds, REITs do not pay taxes on the entities level if 100% of income is distributed. Respectively, the shareholders pay taxes according to ordinary rates (Baker & Chinloy, 2014a & Shleifer & Vishny, 1997). NAREIT (National Association of Real Estate Investment Trusts) lists 13 sectors of REITs: office, industrial, retail, lodging, residential, timber, health care, self-storage, infrastructure, datacenter, diversified and specialty REITs (Baker & Chinloy, 2014b).

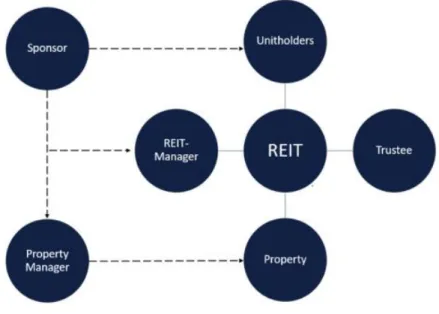

There are two main ways to structure a Real Estate Investment Trust, internal and external structure. An internal structure is when the asset management is carried out internally, both on the fund- and property level. The second structure is when the fund- and property management is outsourced to a second party.

Figure 8 - Illustration of an externally managed REIT (Sundin & Hallsten, 2018).

Many REITs also have a property company which is called sponsor. The sponsor then provides the REIT with RE assets and are often the most prominent owner in the REIT. If the fund has applied an external structure, the sponsor often owns the company in charge of property management and the company in charge of fund management. The trustee in a Real Estate Investment Trust works as a board of directors. It is the board of director's job to overlook and maintain the manager's work so that they work towards the company’s guidelines (Sundin & Hallsten, 2018).

The internally managed REIT’s is more popular in mature REIT markets: US, Canada, Australia. While the internal model is more often applied in the Asian markets (EY Global Real Estate, 2017). The external structure creates a robust operational control since the sponsor can own both the fund management and the property management. This is an excellent advantage for the sponsor but also for the other unitholders since the sponsor could provide properties to the REIT fund. However, this could also create a principal-agent problem due to transactions between the sponsor and the REIT Fund, an extensive protocol and guideline should be implemented to reduce this risk (Sundin & Hallsten, 2018).

A disadvantage with external managed REITs is that the asset management fee is connected to the price and return of purchase, renovation, and exit. This also creates a principal-agent problem since the asset manager's interest can differ from the unitholders. Overtime, the