Automotive Manufacturers: Branding Strategy and

Consumer Perceptions around the Globe:

Volvo Case Study.

BACHELOR’S DEGREE PROJECT THESIS WITHIN: Business Administration NUMBER OF CREDITS: 15

PROGRAMME OF STUDY: Marketing Management

AUTHOR: Mihail Milev-971108-5499 and Banzragch Solongo-930107-8359 JÖNKÖPING September 25, 2020

2

Bachelor Thesis in Business Administration

Title: Automotive Manufacturers: Branding Strategy and Consumer Perceptions around the Globe: Volvo Case Study. Authors: Mihail Milev and Banzragch Solongo

Tutor: Lucia Pizzichini Date: 2020-09-25

Key terms: Volvo, customer perception, LDC, HDC

Abstract

This thesis explores how Volvo’s branding strategies affect customer perception worldwide, primarily when comparing countries regarding the state of their economic development (LDCs, BRICs, HDCs). Based on the results of our quantitative (survey) and qualitative (interviews) studies, we have reason to believe that the price might not be the most vital factor in customer behavior since cultural differences and stereotypes influence the business opportunities in a market of a different culture. Thus, we surmise that Volvo benefits from the fact that people deem it a European car manufacture, which led to successes in the Asian market while still keeping its satisfying position in the market of origin - Sweden. On the other hand, with a rather undifferentiated marketing strategy and low amounts of advertising efforts worldwide, the brand seems not to have fully optimized its marketing strategies informing about the environmental and design-related innovations. This seems to prevent the company from depicting a different layer of branding than the usual focus on safety and the primary target group – families and older people. In this context, we recommend that the brand better localizes the strategies and improves their communication with (potential) customers in order to stabilize its success in the long run. For example, in countries requiring vehicles with greater safety due to infrastructural problems (i.e. the LDCs), Volvo could find ways to produce cheaper, but still, safe vehicles in order to capitalize on the need for more reliable mode of transport. In developed countries (i.e. the HDCs), Volvo could better market its substantial environmental side and the innovations regarding the new cars with youth-oriented design.

3

Acknowledgments

First and foremost we would like to thank our thesis supervisor Lucia Pizzichini. We want to thank her for providing us with all the necessary guidelines and feedback that made our research possible. Furthermore, she guided us through the process, answering any questions or concern that we might have had in terms of our research and thesis development.

Additionally, we also want to express our deepest gratitude towards two other people that were in the base of our data collection and formulation of the thesis - Anita Ivanova from the Bulgarian Infiniti Marketing Department and Vendella Hall from the Volvo Marketing

Department. They were kind enough to provide us with enough valuable information that was crucial for the development of our research.

Finally, we want to thank Jonkoping International Business School and all of its employees for the support and motivation throughout both our thesis and education in the past 3 years. Thank you for your continued trust in us, we are proud to call ourselves alumni of Jonkoping University.

4

Table of Contents

1. Introduction ... 6

2. Theoretical perspective ... 7

2.1 Delimitation ... 7

2.2 Definition of key words ... 7

2.3 Consumer Behavior ... 8

2.4 Branding and Globalization ... 10

2.5 Brand equity ... 11

2.6 Segmentation & Targeting and Positioning as branding strategy in automotive industry .... 12

2.7 The Importance of Safety and Fuel-Efficient Cars in Developing Countries ... 13

2.8 Infiniti – comparative analysis to Volvo ... 15

3. Method & Research approach ... 15

4. Results ... 17

4.1 Company Background ... 18

4.2 Volvo Brand pyramid ... 19

4.3 Volvo segmentation ... 20

4.4 Targeting and positioning as branding strategy ... 21

4.5 Results from Infiniti ... 21

4.6 Results from questionnaires ... 23

5. Trustworthiness ... 27

5.1 Gaining Trust ... 27

5.2 Credibility ... 27

5.3 Reliability ... 28

5.4 Ethical Issues ... 28

6. Discussion and Conclusion ... 29

6.1 Future Research ... 31

6.2 Conclusion ... 31

7. References ... 32

8. Appendix ... 39

5

List of Tables

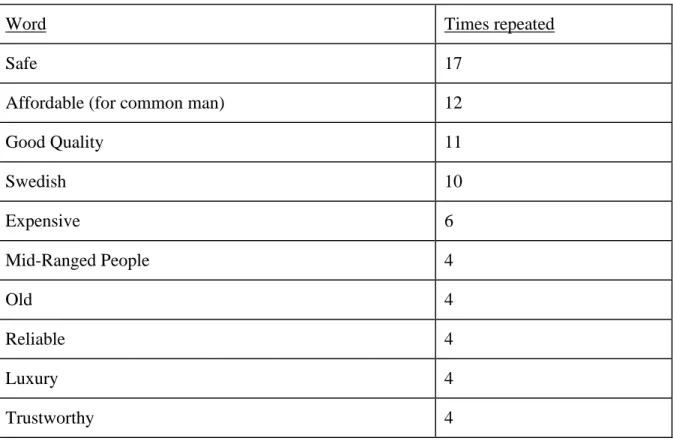

Table 1 - Most common associations with Volvo ... 23

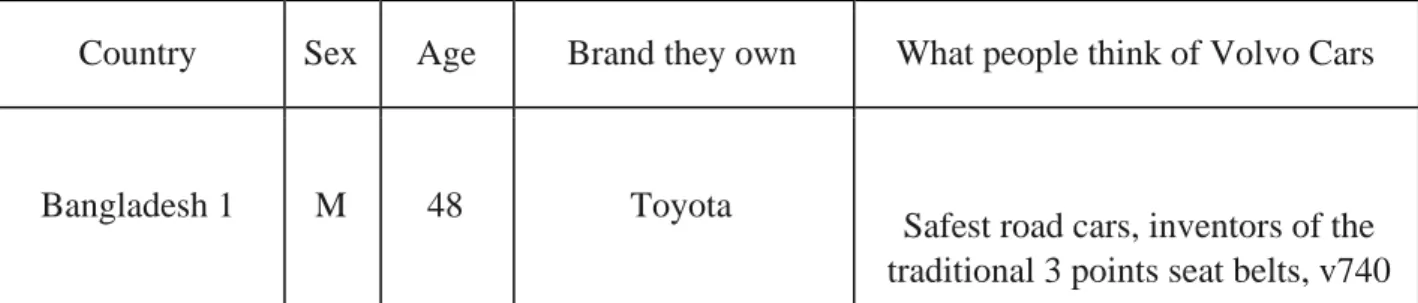

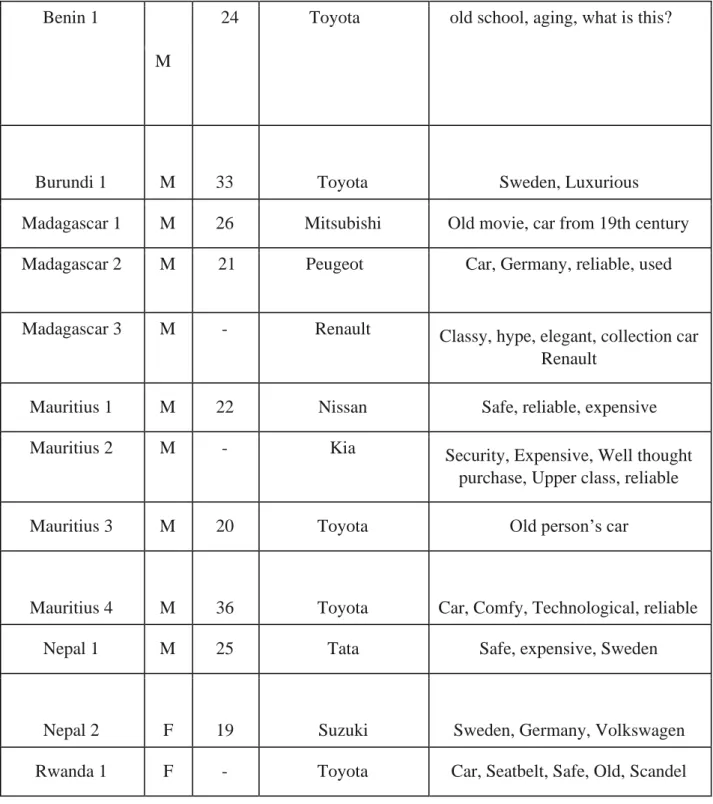

Table 2 - Volvo Associations in LDCs ... 39

Table 3 - Volvo Associations in India (BRIC) ... 40

Table 4 - Volvo Associations in Sweden (HDC) ... 43

List of Figures

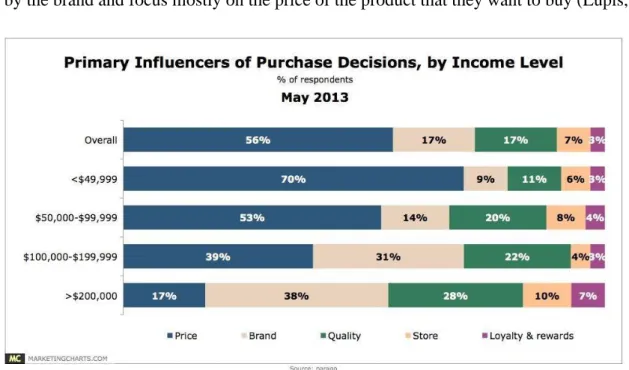

Figure 1 -Influencers of Purchase Decisions (Lupis, 2013) ... 96

1. Introduction

The topic that was researched is how the branding strategies of the automotive manufacturer Volvo affects customer perception around the globe, especially when comparing low developed countries (LDCs), developing (BRICs) and highly developed countries (HDCs). In the context of purchasing decisions, the basic economic rule is deemed true – the higher the income, the higher the amount of the purchases and the interest in the brand’s quality, services, and extras (Lupis, 2013). Another factor which should be taken into consideration is the country of origin since people still tend to evaluate such goods as cars better when they originate from industrialized, developed countries (Qasem & Baharun, 2012). Therefore, one should consider various factors when naming reasons for a given customer perception. The target markets differ from one another especially because of price and culture as well as the different needs and wants pertaining to the people there, and hence, companies have to seek information about and comprehend the cultural aspects in their target countries before implementing any marketing strategies (Jansson, 2013: 37).

The reason why Volvo was chosen as a subject for the case study was not only due to the fact that they are located in Sweden and have been a very large brand for many years, but due to the fact that face-to-face contact could have been made if it was needed during the period of research. In Europe, Volvo ranks third in terms of average car price (Mock, 2018: 80) and hence, it was essential to explore how they service less financially developed markets where people usually cannot afford such high-class cars. For that reason, we analyze whether Volvo has a differentiated marketing strategy relating to the needs and wants of the people in developed (Sweden), developing (India), and underdeveloped (e.g. Bangladesh, Nepal, Madagascar) countries, and survey people from these countries to discover whether the strategies have been successful.

No matter how good the branding is, for companies like Volvo that are higher up on the price spectrum it might be difficult to gain a market share in LDCs due to the fact that even financial incentives and leases can only help so much. Therefore, we assume that…

…potential sales are correlated with the income of potential customers or country.

Another aspect we explore is whether the perception of car brands from the West is generally positive while ‘Asian quality’ tends to be neglected in Europe because of cultural stereotypes. Hence, the second assumption is…

...the perception of the country of origin’s inherent quality has more impact on sales than the real, technically proven quality of the brand.

7 This will be mostly seen from the comparison between Volvo and Infiniti. Because the research area is broad, we formulated a research question to explore what is yet unexplored: What is the marketing strategy of the automotive company and do consumers' perceptions differ in countries depending on the country's development? We explain more about our research methods in the methodology part.

2. Theoretical perspective

2.1 Delimitation

Studies have shown that when buying luxury cars in developing countries, consumers deem the country of origin (the West with a positive connotation) a vital factor showing trustworthiness and social status (Sari & Kusuma, 2014: 60). In terms of revenues of luxury cars worldwide the German premium vehicles (BMW, Mercedes, and Audi) are a constant in the top 3 worldwide and thus, they account for huge revenue values (IMF, 2020). We chose to study the Swedish brand Volvo because it relates to the aforementioned stereotypical parameters (Western country of origin = quality) and in this context, we explore the reasons why it lacks the recognizability of the German giants. Regarding the sales of premium cars, Volvo ranks first in Sweden (Statista, 2020) and fifth in India (Taumar et al., 2019). Another aspect of our analysis is whether Volvo, after its acquisition by the Chinese company Geely in 2010, is still perceived as a ‘car from the West’ and whether the acquisition has positively changed their revenues in Asia or negatively in Europe.

2.2 Definition of key words

What exactly do we mean when we say “Brand”? We define this as anything and everything that has to do with how people see a company, and their products. An example of this would be the first words that jump into your head when you hear their name or see their logo, as reliable, safe, or eco-friendly, or the brand’s name, symbols and motto that companies use to distinguish their product from others. A combination of one or more of those elements can be utilized to create a brand identity. Legal protection given to a brand name is called a trademark (Kenton, 2020). We then look at how the brand is managed, in other words, what strategies they use to try and influence their brand’s perception in the eyes of the consumer or just the general public. This includes how the strategy changes depending on the geographical location, culture, income, and other factors.

We also define what are most developed and least developed countries and how we apply them to our research below. A list of the most and least developed countries is used, known as HDCs and LDCs. An LDC is a country with a relatively low economic development which can be seen with low incomes, poverty, illiteracy, poor health, inefficient industry and agriculture, low levels of social security, cultural atrophy, social anomalies, low political participation, and

8 onerous bureaucracy (Kindra, 2015: 15-25). In this context, we analyze customer behavior and perception in countries such as Benin, Burundi and Madagascar. The opposite can be said for HDCs, for example, high income, low levels of poverty, efficient industrial situation, etc. (ibid.). The UN classifies countries as developed (HDC), developing (MDC or BRIC) and underdeveloped (LDC) (UN, 2014: 143-150). By studying an HDC (Sweden), BRIC (India), and various LDCs, we manage to compare two extreme economic examples, LDC and HDC, while also analyzing a BRIC as a balancing point in order that any differences would be clearly and representatively manifested.

2.3 Consumer Behavior

Understanding consumer behavior opens the doors for marketers in a competitive marketplace to become successful. Since human wants and needs grow rapidly day to day, consumer behavior is one of the most important factors in marketing and it has always been there through the times and evolved together with that specific product and services provided by organizations. Companies study consumer behavior because different needs and wants, and spending opportunities make companies rethink the fundamentals of positioning and creating appropriate strategies for that target market (Jansson, 2013). Therefore, analyzing the potential purchasing power and the consumer behavior of that country is vital for car brands so that the companies are always ready to come up with a solution to meet customers' needs and they have to reflect their business on consumers’ buying behaviors. Comparing Sweden (HDC), India (BRIC), and Bangladesh (LDC) in terms of their GDP illustrates a huge difference – Sweden’s value is around 55,000$, India’s – 7,000$, and Bangladesh’s – 5,000$, which shows how close a BRIC is to an LDC in terms of purchasing power (WB, 2019). Hence, in both the interviews and questionnaire, we expect that Volvo would be deemed affordable in Sweden and expensive in India and the LDCs.

The purchase of high-class automobiles, such as Volvo, in Sweden is determined by the citizens’ high standard of living, the low population density, long distances and a significant cultural element – Swedes’ holiday traditions involve summer vacations in houses in the country side and/or going skiing in the winter. Nevertheless, the demand for cars with lower fuel consumption and solid environmental friendliness increases through the years. (Sprei & Karlsson, 2012: 497).

Apart from financial predictors, the consumer behavior in India is influenced by the brand and its image as well as by good advertising. In terms of the purchasing of luxury brands, Volvo constitutes a value less than the German giants (Mathur et al., 2018: 470-472). In India, perception is directly related to the consumer’s satisfaction of the brand and perception changes over time as their satisfaction decreases (Mohanraj, 2013).The study of Rezvani et al. (2012) has also shown that the country of origin is important for brand quality, which means that

9 customers often check for the country of origin before making a decision as it makes them believe that car is trustworthy.

Moreover, since the car manufacturing industry is highly competitive due to the fact that many car brands are achieving global success, one is required to understand the preferences of potential consumers (especially in LDCs where these industries are still unfamiliar to the people there) and take action in order to meet their needs. In general terms, when it comes to purchasing a car, customers’ preferences are often focused on the price, safety and comfort, power and speed but also the style of the car (Shende, 2014). International marketers need to understand and study the gender differences because the perception of male and female customers differs; for example, gender differences occur when a costumer chooses a car based on its color (Kahle & Kim, 2006: 301). Another aspect of general consumer behavior is that as the income of customers increases so does their desire for differentiation. Income elasticity of demand supports this as the demand for general and luxury goods increases (Kenton, 2020). The effect on incomes is especially important in this study as it deals with how people in less developed nations have less income to spend meaning they will probably be even less affected by the brand and focus mostly on the price of the product that they want to buy (Lupis, 2013).

Figure 1: Influencers of Purchase Decisions (Lupis, 2013)

As we see from the graph, the higher the income – the higher the interest in brand and quality of the product while the influence of the price diminishes (Lupis, 2013).1 However, for some luxury goods (when a car is deemed luxurious and a few people can afford one) the demand rises with the price – the so-called Veblen effect. In this context, the price connotes quality to the buyer who is inclined to purchase these goods because they differ from what is commonly preferred which would improve their social image. (Galatin & Leiter, 1981: 25-26). To bolster their self-image, some people buy luxurious items since they emphasize their interest in the

10 symbolic than the utilitarian, and present themselves more differently (or positively) than the others through materialistic possessions (Cisek et al., 2014). According to research, nearly 40% of urban Indians see exclusive items as an instrument of adding value to themselves (Jain et al., 2019).

2.4 Branding and Globalization

A brand is one of the most important words in the business world, it has more meaning than what regular people understand. Brand is a name, symbol, sign, design and its role is to identify itself within a group of people/ organizations and also identifies products and services from its group or other sellers in order to differentiate its products and services. (Roberts & Cayla, 2009). It is safe to say that brands have become very important in the integral part of the company and it is what connects individuals with companies and creates long-term customers. Brand also gives consumers an increased perception and understanding about the value that is provided (ibid.) Therefore, from the company's side, a brand can work as a signal.

Globalization allows companies to lower the market cost. For example, some companies use the same suppliers in different locations or depending on the case, if a global reach is not needed, the locals take over the supplying chain and ultimately the company lowers its costs along the SCM (Humphrey & Memedovic, 2003) but at the same time increase the marketing scope and enables consistent brand image by leveraging ideas and experiences helping them implement marketing strategies effectively (Keller & Swaminathan, 2019: 60-70). The competition among car brands has come into a new phase; globalization has pushed the companies to develop adaptive strategies but since all automotive companies compete in the same industry and environment, their strategy in the field is also very similar, even though many studies prove that there is not one best way to target all markets and hence the need of differentiation and localization (Bergouignan et al., 2000: 49-51). This phenomenon resulting from the shifting market relations makes it more challenging for the companies because no single organizational model can create a competitive advantage with complete certainty. Companies which have successfully differentiated their product and standardized their brand are able to reach economies of scale in distribution or lower marketing cost and also establish a compelling brand image (Egan, 2015). However, it is still a challenge for marketers to create a brand awareness since the brand perception differs from country to country. For example, consumers still evaluate products from industrialized countries more favorably than those from newly industrialized or less developed nations (Qasem & Baharun, 2012: 1404). Taking this general consumer perception into account, the analysis of Volvo, as originally a Swedish brand and now Chinese, might show us which factor is more vital for one’s perception – the country of origin or the origin of the current shareholders.

Carlberg & Kjellberg (2018) state that a company which sets their brand image earlier in the minds of the customers than the competitors tend to sell the car faster than its competitors.

11 Creating a brand attachment between the customer and the brand is important in the automotive industry because a car is considered to be a high level of investment and its ‘longevity’ is longer than most of the other products (Haddock & Tse, 2007). Depending on where you live one brand could symbolise a completely different thing than another place, even though it is exactly the same product. This is done on purpose to take advantage of adapting your marketing and specifically in this case, your brand depending on the market you want to enter. This is useful as it can increase the number of potential customers you would have depending on the place, because of a difference in culture. This is because different cultures value different things more or less. An example of this would be how Swedes do not strive for status, as it is more of a feminine culture, compared to India and the LDCs which are a lot more masculine. This is known because of models and research such as the Hofstede model for comparing countries. The dominant values in a masculine society are achievement, success (status brands and luxury goods are purchased to show one’s success) whereas in a feminine society - caring for others and quality of life (de Mooij & Hofstede, 2010: 89). One can observe the striking differences between the HDC representative – Sweden, and the BRIC and LDC representatives – India and Bangladesh, respectively. Sweden is a very feminine country and therefore values others and the quality of life more (in our context – car safety, environmental care) whereas the other two are masculine where achievements and status are valued more (in our context – purchasing luxury cars for status). Moreover, Sweden is less power-distant and more individualistic (Hofstede Insights, 2020). These differences could mean that to have the most efficient marketing and branding strategies, they would have to be changed for the new market.

Actual examples of companies changing their marketing and branding strategies when entering a new market would be Levi’s jeans where in the United States they are seen as jeans for a person that has an active lifestyle and likes the outdoors, however, in other countries, they are seen as stylish wear that scream “freewheeling and daring self-expression.” (Johansson & Carlson, 2015: 55-60). An actual example from another car manufacturer would be how “BMW is “The Ultimate Driving Machine” in most countries, but at home in Germany “Fahrfreude” (Driving Pleasure) is used, softening the image and making the brand appealing to a broader base, even though the cars in both countries are exactly the same (ibid.). This also applies to Volvo which can use it to its advantage in poorer countries.

2.5 Brand equity

Branding strategy usually helps business to reach their goals and through an effective branding strategy companies reach standardization of strategies easier than companies who lack an effective branding strategy.

Brand equity is an important part of the role and to develop a brand equity has become more common nowadays because research specialists have studied that brand itself is seen as an important asset of any firm (Mkhitaryan, 2014: 43).

12 A common description of brand equity is a well-known brand name, it is the initial value of the brand and the level of popularity of the brand. Furthermore, Aaker (2016) has also explained that brand equity is directly related to the product and services provided by the firm and depending on how well-known the brand is, it is deducted or added to the value of the product and services.2 Also according to Aaker (1991), brand equity can be looked at from the customer’s perspective to identify what the brand means for consumers. Consumer metrics of brand equity is derived from different brand related elements shown below:

1. Brand image: the observations of brand and associations that consumers bear in mind or the bundle of beliefs regarding the value of a firm's product and services, which form the customer’s perception (Nandan, 2004: 265). Furthermore, brand image plays an important role for consumers' decision making process and therefore it is directly related to consumer behaviors (Dobni & Zinkhan, 1990). This is also the intangible value established in consumers’ mind and therefore, brand images are a presentation of what consumers think and feel about that specific brand in the long run.

2. Brand identity: the brand’s individuality and distinctiveness that a marketer has to communicate to all its relevant publics or the consumer needs that a brand can satisfy as well as mediating the brand’s role in society and its functional and symbolic values (Nandan, 2004: 266) Further the relation between brand identity and brand image is based on components such as: log signage, marketing collateral, communication, etc. The main point of creating brand identity is to reach customers' perception which also is directly related to consumer behavior (Mindrut et al., 2015). Companies use branding strategies in order to deliver the message of their identity (value) to potential customers. 3. Brand awareness: Keller & Aaker (1992) has defined that brand awareness keeps the brand identity and recognition in customers’ mind. A common agreement between marketing specialists is that the brand awareness builds strong long-term relationships and enhances the company’s competitive advantage and their reputation, credibility. 4. Customer perception: Perception is explained by Madichie (2012) as a process of

interpretation of sensations and a direct response to people’s behaviour. Consumer perceptions of any brand focuses on the brand's functional and symbolic attributes such as what the brand promises, delivers and the brand image described above. Moreover, what consumers perceive is a result of what the brand means for them and that meaning is constituted by the product’s market position.

2.6 Segmentation & Targeting and Positioning as branding strategy in

automotive industry

According to Kotler & Armstrong (2017), marketing segmentation is a part of the positioning strategy where marketers investigate and divide the market place into sub-group of customers with a similar interest, behavior, habits, needs and desires. For organizations it is important to

13 identify those segments because each segment is based on individuals who share the same characteristics and it helps the organization to target that specific segmented group in order to develop a strategy that is best suitable. Furthermore gender has become one of the most important factors for segmentation, because females oftentimes make decisions based on emotional appeal of the brand, its durability, reliability and affordability whereas males are more into the design and the technical side of the brand (Edmunds, 2016).

Managers are available to understand the customer needs and wants more accurately which has its own benefit such as that the marketer now has an open door to customize their marketing activities and link it to the individual customers through its channel networks. On the other hand, it has a competitive advantage over its competitors such as by analyzing competitors’ strengths and weaknesses which helps them identify more lucrative opportunities in the chosen market (Camilleri, 2018: 71)

The three alternatives of marketing strategies:

1. Undifferentiated Marketing strategy: Concentrates on one single segment ignores any differences in the market

2. Differentiated Marketing strategy: Concentrates on different market segments, and creates a different positioning strategy for each segment.

3. Concentrated Marketing strategy: Similar as undifferentiated but it concentrates its resources on only one or a few segments which the company thinks are the best (Camilleri, 2018: 77)

Positioning simply refers to how brands deliver their value to customers in a way that the customers feel connected and interacted with the brand. The positioning process is conducted through continuous marketing strategies that affect and improve customer perceptions (Camilleri, 2018: 81). Perceptions of the brand which are developed in consumers’ minds is linked to the brand awareness which is linked to the positioning strategy of product and services. Effective strategy positioning has ability to differentiate its product and services in a way that it develops a competitive advantage among competitors (Latif et al., 2014: 598).

2.7 The Importance of Safety and Fuel-Efficient Cars in Developing Countries

Developing countries have quite unsafe roads. To put it into perspective, in Sweden, one of the safest countries in the world when it comes to road safety had 4.6 deaths per 100,000 motor vehicles during the year of 2018. In the same year, India had 130.1 deaths per 100,000 motor vehicles. This is a stark difference, and in poorer countries it can be one of the leading death causes. “Safe vehicles play a critical role in averting crashes and reducing the likelihood of serious injury” (WHO, 2020).

Another aspect is the fact that older cars and trucks that are common in developing countries are a lot less fuel-efficient meaning their environmental impact is much higher. It is said that

14 “older cars are responsible for most of the pollution” and, compared to the majority of other countries, in India, Bangladesh and Nepal, there are the most deaths attributable to air pollution (Ritchie & Roser, 2017). Even though the efficiency of internal-combustion engines has not increased that much from older cars as most of the energy is still wasted as heat, there have still been modifications that help dramatically decrease emissions. For example, the most obvious environmental shift in recent years is the reliance on electrical batteries, either completely like in Teslas where they do not possess any other type of power source, or in hybrids where up until a certain speed it uses battery power and then switches over to a normal combustion engine once more power is required. This would be a great choice for city commuting due to lots of starting and stopping and relatively slow speeds. Another example is the invention of the positive crankcase ventilation valve that helped reduce up to 60% of the pollution created by cars in the 1950’s. Another example is the invention of electronic ignition to reduce inaccurate spark control and stop misfires which cause unnecessary emissions. This came to be in most cars during the early 1970’s. Or the catalytic converter which was invented in 1973. This took carbon monoxide, oxygen and unburned fuel and turned it into carbon dioxide and water which made a very substantial difference in the amount of emissions produced (Lachman et al., 1975). It is said that “Emissions regulations have been progressively tightened to the extent that just one car sold in the 1960s would have produced as many harmful exhaust emissions as one hundred of today's automobiles equipped with catalytic converters.” (IPA, 2020).

However, these innovations would not be helpful if the vehicles used in developing countries have been manufactured prior to these inventions, that is, the emissions are immensely higher than the potential ones if people, especially in the LDCs abounding with environmental issues, could afford the more expensive, environmentally-friendly cars.

This shows a highly profitable market opportunity for Volvo due to their brand which symbolizes a premium brand focusing on safety and environmental protection, in opposition to other car manufacturers. Since 2019, Volvo became the first and only major manufacturer to launch only electric or hybrid car models which, however, means that customers are required to pay an ‘environmental premium’ and hence, they need to pay more than 15,000 EUR more for a new Volvo than the previous diesel models (Vaughan, 2017). India represents only 1% share of all the electric vehicles in the world – just for comparison – the US - 51%, Europe – 24% (Frost & Sullivan, 2012 cited by

Beltramello, 2012: 51). Therefore, for customers in countries such as India and LDCs lacking but needing environmentally friendly cars to fight pollution, with higher costs for hybrids/electrics than their usual purchasing choice - diesel cars, it would be even ‘more’ impossible to afford those vehicles. Although protecting the environment denotes a trending socio-political topic, such marketing is still at its nascence due to the low awareness of consumers in India (Sharma & Maheshwari, 2014: 75).

15 In the methodology section, we illustrate what scholarly instruments we employed to examine the success of the company’s strategies within the various markets.

2.8 Infiniti – comparative analysis to Volvo

Infiniti has been chosen for a comparative analysis to Volvo. It shows how another premium but Eastern manufacturer struggles to make bonds in Europe because of cultural differences. Infiniti’s sales report highlights a gradual increase of its market share worldwide - the brand experiences major success in Asia but in Europe, its businesses plummet (Nissan Global, 2018). Therefore, the brand decided to pull out most of their businesses in Europe and shift its focus to Asia (mainly China) and preserve its smaller operations in Eastern Europe and the Middle East (Tisshaw, 2019). Partly based on the ‘blinkered’ purchasing behavior of Europeans (people usually buy the same brand), Infiniti failed to capitalize on the high quality of their products and present a unique and aspirational brand identity since the German premium brand dominance never ceased to exist. Moreover, the decision to pull out their marque was prompted by the substantial investment required to meet the new EU Co2 legislation (Axon, 2019). Thus, Infiniti’s market situation makes for a powerful counter-comparison to Volvo. Infiniti is an Asian brand which attempted to penetrate European markets and failed; Volvo is originally a Western-European brand which, after its acquisition from a Chinese company in 2010, immensely approached the Asian market – in the beginning the business was not going well (2010-2012), however, in 2013, Volvo catalyzed local production in China and their market share and sales increased incredibly (Carsalesbase, 2020). This positive development resulted from strong environmental campaigns and successful capitalization on the premium quality of the cars and, after the brand took market share from their main competitors, China became Volvo’s largest market (Volvo Car Group Annual Report 2014, 2015). Based on the interview in section 4.5, the comparison with Infiniti will show whether the ‘cultural mark’ influences the consumer behavior based on our assumption that the perception of ‘European quality’ is generally positive while ‘Asian quality’ tends to be neglected in Europe because of cultural stereotypes.

3. Method & Research approach

This thesis used an explorative research approach since both our assumptions – the price being the most essential factor for purchasing decisions (Kenton, 2020; Lupis, 2013; Shende, 2014) and the huge role that country of origin (West vs East) plays in those decisions (Sari & Kusuma, 2014; de Mooij & Hofstede, 2010; Qasem & Baharun, 2012), cannot be completely confirmed or rejected given our limited data – two industry interviews and 70 survey respondents. Still, we examine preexisting theories and draw partial conclusions based on our quantitative and qualitative research.Moreover, by employing our research question ‘What is the marketing

16 depending on the country's development?’ we discuss other topics such as the brand’s marketing strategies around the globe (Camilleri, 2018; Nandan, 2004), the customer perceptions such as gender (Kahle & Kim, 2006; Edmunds, 2016) and environmental care (Sharma & Maheshwari, 2014; Sprei & Karlsson, 2012) or behaviour such as purchasing goods for status (Galatin & Leiter, 1981).

Research conducted by Allen-Meares & Lane (1990) states that to explore interactions and transactions of people with their environments – such as in the case of brand management – it is important to use both qualitative and quantitative analyses. The main approach for the research is qualitative due to the fact that the thesis explores decisions and thought processes influencing customer perception and also the factors that can be perceived as positive or negative depending on the brand in question. Furthermore, the thesis has also used some quantitative methods due to the fact that statistics and data regarding sales of certain brands in different markets are important to compare and see to what extent brand management influences sales. This was the primary research element in the questionnaires. Based thereon, we made various comparisons between the countries studied (Sweden, India, and various LDCs) in terms of gender, purchasing power, possession of a Volvo, etc.

As mentioned, we have collected data from 2 different companies by interviews and additionally we have collected data from customers (n=70) by surveying them. The qualitative primary data was collected by interviewing the marketing managers in Volvo and Infiniti. We deem the direct contact with the companies and the people responsible for the marketing immensely vital especially because they have the knowledge about the reasons and the solutions concerning the financial factors and the factors influenced by the country of origin. The interviews were based on both open-ended questions and partly closed questions which required ‘yes’ or ‘no’ answers. It studied consumer’s decision making processes in different countries through analyzing the various marketplaces. Furthermore, the interview questions were based on the company’s background, brand positioning, customer perception, and vision and mission such as what they strive for and what value they provide. A semi-structured approach was used for the interviews and a more casual approach was used rather than a formal one. The interview with Ms Hall (Volvo) was conducted on the phone and in English and with Ms Ivanova (Infiniti) on the phone and in Bulgarian, in order to make them more comfortable and get a deeper and better understanding of the information that they provided.

We conducted an interview with Volvo’s current brand manager in Sweden in order to obtain more insight about Volvo’s differences in strategy and segmentation in the various countries and the brand’s usual core values and how they implement them in each country. This interview is essential for two reasons – firstly, we asked the manager questions about the brand whose answers could not to be found in the theory about the brand (e.g. pyramid of core values, prioritization of investments, marketing differences before and after the acquisition by Geely), which provides us with additional layers to our research question. Secondly, Volvo’s manager’s

17 answers are compared with the results from our questionnaire in order to compare the strategies implemented with their success within the consumer’s mind. For example, the questions we asked the brand manager regarding our assumption about the price being the most important factor for purchasing decisions are later compared with the same questions we ask our respondents.

Our comparative interview with Infiniti has the purpose to provide us with more insight about the assumption that the country of origin is an extremely vital factor for customer behavior. The interview shows how another premium but Eastern manufacturer struggles to enter the European markets successfully because of cultural differences and ultimately gives us more information about the differences a company from the West and from the East experiences when approaching the opposite market. Furthermore, a number of questions were asked, some of which concerning Infiniti around the globe and others which concerned the overall branding strategies and specifics of the automotive sector in the Balkan Peninsula.

Finally, our questionnaire represents the quantitative side of our analysis. By surveying people from Sweden, India and various LDCs, we attempt to discover the differences in the respondents’ answers regarding our two assumptions and examining how variables such as gender, nationality, possession of a Volvo, etc. impact the answers. The questionnaire consisted of five questions (country of origin, gender, age, brand of car they possess and thoughts on Volvo), which were believed to be neutral and did not influence the participants in any direction. We found a sample of respondents by sending out the questionnaire to people of different backgrounds, lifestyles and countries. However, due to the research occurring during the COVID-19 pandemic it had severely limited the ability to conduct face-to-face interviews and other forms of primary data like questionnaires. And due to it being a long-lasting event, this resulted in the research having to deviate from the original plan. The solution to this issue was done by taking the questionnaires online. Different online forums, such as Reddit, were used to get in touch with people from different countries, i.e., LDC’s, India and Sweden. Apart from the country of origin, the other essential criterion for a respondent to be ‘eligible’ was to understand and write in adequate English. Overall, we had 103 respondents; however, within the answers of 33 of them we saw that the respondent struggles with the language and/or provides completely off-topic answers. Therefore, we removed those respondents and ended up with 70 written answers.

4. Results

The authors start by defining the background of Volvo and then the findings of the primary and secondary data including consumer perceptions in different countries and also the branding strategy conducted by Volvo in those different countries.

18

4.1 Company Background

One of the most iconic brands in Sweden, would be Volvo. It is one of the most recognizable brands in the world when it comes to automobiles, symbolizing safety.

It was founded in 1911, originally manufacturing ball bearings, and in 1924, Gustav Larson, Volvo’s founder, and Assar Gabrielsson, Volvo’s co-founder, decided to build their first car that “could withstand the rigors of the country's rough roads and cold temperatures.”(Volvo, 2011). It was not until 1927 and having built ten prototypes that Volvo manufactured its first car for the public, the Volvo ÖV 4.

Volvo steadily grew, along with its product range, which involved trucks and even airplane engines, but for the most part saw success only domestically. However, after World War II, it started gaining traction outside of its home country and started making its way to the globally recognized brand that it is today. However, along the way, in 1999, it was bought by Ford General Motors, and then it was changed hands once again in 2010 to the Chinese company Geely Holding. However, Volvo is still one of the most recognizable car brands in the world, and is still doing well, having won over 50 awards in just 2019 from all over the world including the “European Car of the Year” which was the “XC 40”. One aspect that is important to discuss

is the fact that Volvo actually bankrupted multipletimes and one of the main reasons a Chinese

company bought Volvo was because “Geely is an unknown low-quality and low-price automobile player with a small size located in China, and Volvo is a well-known luxury car producer with much bigger size located in Sweden.” (Wang, 2011). Chinese companies would find it difficult to export their brands to the West as they would have trouble gaining trust as, mainly influenced by the negative media coverage, people deem Chinese products inferior (Fang & Chimenson, 2017: 497). The solution to this issue is to invest in a brand that the West already knows and trusts, which they did by acquiring Volvo.3

The brand has always been a symbol of being a premium car manufacturer, new breaking edge technology and most importantly, safety. In 2016, they even said they were planning on having

death-proof cars by 2020 (Valdes-Dapena, 2016). It was a Volvo engineer named Nils Bohlin

that invented the now iconic three-point seatbelt in 1959 which could be argued as one of the

most important inventions for automobile safety (Volvo’s (Many) Safety Innovations, 2016),

which they gave away to the world by making it publicly available for all car manufacturers to use. It has been estimated to have saved over a million lives, and that number would be even

higher if people used it more (Volvo Buses, 2019). This just includes one of the myriad other

safety innovations that Volvo made or was a part of – e.g. the cyclist detection with auto brake (Coelingh et al., 2010).

19 Volvo has a global presence when it comes to their cars and their brand recognition. An example of this would be how, during just the year of 2018, they sold almost 650,000 cars in over 100 countries (Global Presence, 2019).

4.2 Volvo Brand pyramid

This section as well as sections 4.3 and 4.4 are based on our interview with Vendella Hall, Volvo’s current brand manager. If we interpret her words according to our assumptions by discussing additional theoretical sources, it is explicitly noted.

According Ms Hall, Volvo has a very strong brand reputation connoting quality and safety and they are not only providing a safe drive for its customers but also considering the environment (e.g. less pollution). We illustrate Volvo’s brand pyramid below containing all the values which the company deems essential.

The pyramid shows us the company’s competitive advantage which is safety. The middle part is modern Scandinavian design and environmental care which is where Volvo differentiates itself from other car brands. The most important driving force for Volvo’s brand pyramid is its base as it requires broad focus on premium quality, customer experience, and driving dynamics. Safety has become the most valuable asset for each and every one of Volvo’s integral car designs; environmental safety is also emphasized as an important value in the company’s long-term strategies and Volvo has been the first company that has a car remanufacturing system called VOLVO GENUINE Exchange, and a Figure 2: Volvo’s brand pyramid, Interview with Vendella Hall

20 three-way catalytic converter, which converts toxic and pollutant gases in the

engine into much less harmful ones.

With a big name and image in the automotive industry, Volvo has many competitors and due to a highly competitive market place, Volvo had to change their marketing strategy in a way that is more customer-oriented. They did this by providing more innovative, safe and

environmentally friendly cars, for example, the Volvo V60. Furthermore, according to research

done by Jansson (2013), thebrand was losing its image due to their excessive focus on families and older purchasers; therefore, in order to also appear as innovative and oriented at young people, Volvo focused more on a ‘sports’ design, especially of the cheaper, smaller-sized models. In 2006, Volvo launched Volvo C30 whose fuel-efficiency was deemed as optimal as in the other automotive brands such as Audi A3 and the BMW series 1 (Jansson, 2013). The design of the C30 was implemented to appeal to young customers who also cared for the environment and safety. Advertising the Volvo C30 model is an integral part of the positioning strategy in order to deliver the core value and the initial mission of Volvo to potential customers around the world (The New Volvo C30, 2006). Moreover, Volvo made special short movies and other TV commercials with colourful and strong images which have seen huge amounts of

success or featuring ambitious young people representing the main audience of the C30.4 Still,

however, Volvo puts an immense reliance on their initial target group, i.e., their customer core – families and middle-aged people. The company keeps innovating its relationships with the core stakeholders, other companies and shareholders.

4.3 Volvo segmentation

Branding strategy development at Volvo requires identifying the potential customers and dividing them into segments in order to understand the basic behaviors of those customers and develop an effective branding strategy for them. Volvo uses segmentation technique in order to narrow down the target audience into very specifically identified groups with a common characteristic (Haasbroek, 2007). The next process after identifying customer behaviors is to divide the market into small homogeneous groups by exploring geographic and demographic, psychographic characteristics or behaviors of the target audience. The geographical segmentation is occuring in a traditional way; Volvo divides the customers depending on areas such as country, city, region whereas the demographic segmentation is based on customer characteristics including age and gender, ethnicity and level of income, GDP per capita. Furthermore, perhaps the most important segmentation is behavioral segmentation where customers are divided based on the statistics of frequency of purchasing a car, and most importantly perception of Volvo which is connected with brand loyalty. By presenting the results of our questionnaire in section 4.6, we show how the aforementioned segmentation strategies have formed the opinion of the customers.

21

4.4 Targeting and positioning as branding strategy

The next step after segmentation is to choose the right target group, and for Volvo it is important to choose the target considering the company’s resources, vision, and competitive advantages and growth capabilities. Moreover, Volvo approach the market in BRIC countries and hence,

they need a differentiated positioning strategy as the potential customers in BRIC countries are

not the same. The company uses private marketing specialists in BRIC countries in order to study the country and customer’s behaviour in BRICS. For example, creating a good brand positioning in China is different from creating it in Sweden and therefore the products have to be differentiated in a way that suits customers’ daily life routine and behavior best.

Furthermore, when it comes to positioning, the most important thing is to deliver the knowledge about the value, quality of the product since the brand wants to make sure that each customer knows for what he/she gives out their finances. Volvo employs different marketing strategies to find consumers who can identify themselves as ethical, responsible, and environmentally friendly drivers. The brand focuses on the target audience and deems their value the same as the brand’s and in so doing, the brand becomes the best option and solution.

Since Volvo is Swedish and very well-known among the people in Sweden, Volvo doesn’t advertise that much in Sweden compared to other countries simply because it has been Volvo has the most purchased car brand in Sweden for several years. Indeed, there are other factors that influence Swedish customers to choose Volvo, i.e., the quality of the materials used to build the cars. According to research, Swedish people value safety above all else when buying cars – car prices in Sweden are negatively correlated with the car’s inherent risk level (Andersson, 2005). Safety and family-oriented targeting go hand in hand and thus, Volvo’s marketing policy proves to be well-suited for their primary target customers.

India is considered to be a part of BRIC countries, with its infrastructure but also its automotive industry is huge because of the population size and multiple marketplaces, therefore many global companies are entering Indian market and Volvo Group is one of them and Volvo’s foundation in India is getting stronger with its trucks, buses, construction equipment since 2006. Compared to Sweden, Volvo has been hitting hard on India as it is a whole new journey for them and today Volvo

has its manufacturing facilities in India, close to Bangalore. As India has huge amount of traffic

accidents, its mission of delivering safety was successful in India as the brand has focused on reducing the traffic accidents and focusing on providing a transport solution as well as environmental solutions such as decreasing pollution in India (Creating Value in India, 2020).

4.5 Results from Infiniti

To understand the factors that influence which branding strategy a company may pursue, it was important to interview someone who was in the field and has experience. This was why Ms Ivanova from Infiniti was interviewed. She mentioned that culture usually plays the most significant role when it comes to the branding strategy a company will use for a specific

22 our assumptions). She argued that culture and cultural affinities play a much bigger role in brand perception and new product purchases. Following this, it was interesting to find out how

a company such as Infiniti maybe able to survive on markets with the average customers having

much lower purchasing power than in more developed countries. For example, despite their huge hopes about their businesses in Italy, Infiniti failed to perpetuate themselves at the Italian car market. In this context, Infiniti could not offer more attractive leasing rates and incentives to motivate consumers to consider more expensive purchases due to the problematic, in this situation, economies of scale. As one can interpret from Ms Ivanova’s words, in low-developed countries, sometimes the Veblen effect is evident - people often buy expensive cars not only

for the physical attributes such as quality, but also for attributes such as ego and status. (Galatin

& Leiter, 1981: 25-26). A fact worth noting as well was that symbols and logos are much more important and play a bigger part in the purchasing decisions in LCDs than in HDCs. Due to this it is also very important to market the car not simply as a product, a machine but rather a lifestyle that you join when you purchase the said product. It creates a sense of community and belonging that is important for many customers. Furthermore she mentioned that even though two countries may be similar in culture, it still does not mean that the branding strategy is the same. She gave an example with Bulgaria, Serbia and Romania, three culturally similar countries which share an analogous historical progression since the Middle Ages. Nevertheless, from a marketing standpoint, the consumers seem to evaluate differently when considering the purchase of a new car based on various factors but often due to a country’s industry situation. Romania, for instance, already comprises productions of a few car brands (e.g. Dacia and Renault) whereas Bulgaria’s car manufacturing is rather unfocussed. Infiniti’s experience in foreign markets highlights that localization of branding always works better than adoption of another country’s branding strategy. Some recommendations that she mentioned regarding

automotive marketing are that firstly, companies should not mimic strategies of competitors. It

rarely leads to positive results due to the intricacy and customer perception of every brand and oftentimes leads to a waste of resources and time. Secondly, automotive manufacturers can also take inspiration from other industries in their branding approaches in order to innovate. An example is how manufacturers can use Virtual Reality in order to enhance customers' experience in pre-purchase showings and window shopping. This is a marketing option that, to Ms Ivanova’s knowledge, only Infiniti and BMW exploit.

Infiniti’s market situation makes for a powerful counter-comparison to Volvo. Infiniti is an Asian brand which attempted to penetrate European markets and failed; Volvo is originally a Western-European brand which, after its acquisition from a Chinese company, had huge success in the Asian market and ultimately became Volvo’s largest market. As expected, following the interview with Ms Ivanova we can assume that Infiniti, as an Asian brand, cannot capitalize on its premium status simply because of cultural stereotypes or basic differences. Consequently, we suspect that quality from Asia seems to be neglected by Europeans whereas, vice versa, the businesses can be so successful that the Asian market can become the most lucrative place for a (originally) European brand.

23

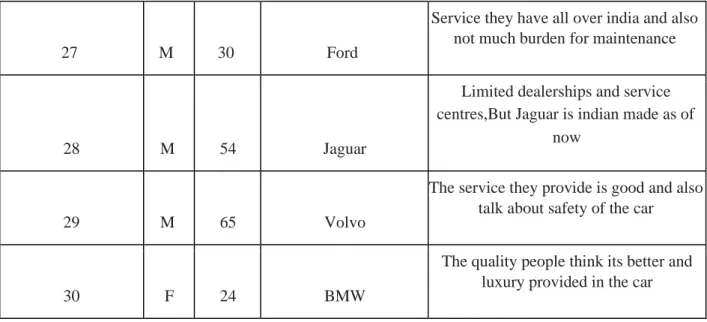

4.6 Results from questionnaires

In this section we introduce the results from our questionnaires collected from individuals from different countries – Sweden (HDC), India (BRIC), and various LDCs. There were a total of 73 responses for the questionnaires. The raw responses were organized in a table (which is found in Appendix). The responses were mainly from Sweden, India, and some from LDCs (Benin, Bangladesh, Burundi, Kiribati, Eritrea, Madagascar, Mauritius, Rwanda and Nepal). In the table below, you can see the most common words people thought of when “Volvo Cars” was brought up.

Table 1 - Most common associations with Volvo

Word Times repeated

Safe 17

Affordable (for common man) 12

Good Quality 11 Swedish 10 Expensive 6 Mid-Ranged People 4 Old 4 Reliable 4 Luxury 4 Trustworthy 4

As you can see from Table 1 above, Volvo cars are best known for their safety with it having been mentioned 17 times. Interesting notes and other comments made by the participants included how a person from Kiribati said “I don’t think many people would really care about what brand of car they have or drive. I would also venture to say at least 75% of people in Kiribati do not own a car.” This statement led to an investigation of the number of motor

vehicles per 1000 people per country. In 2014, Kiribati was 92nd in the world when it came to the number of motor vehicles per 1000 people, with only 146 motor vehicles. Hence, it is even

less than the person said with more than 85% of the population not having cars. Bangladesh

was one of the countries with the least number of automobiles, with only 3 per 1000 people owning a car. In India, possession of a car is still deemed a luxury and only 12 out of 1000 people own a car (Zentes et al., 2011: 87). Comparing this to Sweden, there was no competition, with Sweden having 520, without even mentioning how Sweden’s cars are much newer, safer, technologically advanced and expensive (Nationmaster, 2014).

24 Concerning the general perception of the brand, both sides mentioned similar qualities such as safe, good quality, and reliable/trustworthy and negatives such as bad design or the cars being ‘old and aging’. Proportionately to the number of respondents, LDCs proved to value Volvo’s safety the most (46%). Sweden comes close thereto (40%); however, in India only 1/5 of the respondents highlight their knowledge of the brand’s safety qualities. The quality is most appreciated by the Swedish respondents (30%) in comparison to Indian’s (13%) and LDCs’ (15%) lower values. Moreover, because of the relatively low purchasing power of the country, it is quite surprising that cost-efficiency or affordability are mentioned mostly by the Indian respondents (30%) vis-à-vis the 10% in Sweden. Another curious result is the fact that respondents from LDCs (38%) deem Volvo ‘old and aging’ or badly designed more frequently than in Sweden (28%).

Having analysed the data, there were some clear distinctions between the responses of women and those of men, as predicted by previous theoretical arguments (Kahle & Kim, 2006; Edmunds, 2016). The following results regarding gender have been mathematically balanced into percentual proportions because the male respondents were more than the female (S: 17/13, I: 24/6, LDC: 11/2). In Sweden, the male respondents mention ‘Swedish’ and ‘quality’ more frequently whereas women deem the brand more affordable than the men. In India, the men find the brand badly designed or ‘old and aging’ more frequently and while women mention the brand’s quality more often, even though not a single female respondent drives Volvo (vis-à-vis the 3 men possessing a Volvo). Then again, in both countries, both genders highlight the safety impact of the brand equally. Because of the small amount of female respondents in LDCs, we cannot draw any conclusions with regard to gender there.

In Table 2 in Appendix, the authors have collected and tested consumer perceptions of LDC countries where Volvo does not operate its business but its cars are sold by private importers. The authors have chosen those countries in order to examine if Volvo is known enough in those LDC parts of the world where the company does not operate the sells directly.5 As a result,

none of our respondents in the LDCs own a Volvo and even though their procentual answers are similar to the Swedes and Indians, none of them made a remark about the price of the brand. Hereby we can assume that Volvo’s globalized marketing strategies have reached these customers and established a decent brand awareness; however, the consumers lack a real perception of the brand’s price range since the brand has never been on their markets.

Table 3 in Appendix illustrates people’s perceptions of Volvo cars in India and unlike Table 2, there are actually existing markets for Volvo cars which means the company has all the means to establish a target audience. There has been a limitation of only 30 respondents consisting of 24 male and 6 females. As stated before, Volvo’s mission of delivering safe drive suits the

5 Volvo operates businesses in Bangladesh and hence the one Bangladeshi respondent has been removed from this

25 traffic in India; however, only 20% of the respondents think that Volvo connotes ‘safety’. Surprisingly, Indian respondents deem the brand cost-efficient or affordable the most. There has been one case wherein Volvo was deemed a German car and in a few other cases - a luxury car. Overall, the brand has a very positive image, and a satisfactory brand awareness despite the tough competition in the Indian market where Volvo ranks fifth within the luxury carmakers’ market share (Taumar et al., 2019).

Table 4 in Appendix illustrates how Volvo is seen by Swedish people. There was a sample of 30 people including 17 males and 13 females. As defined above, it seems true that Volvo does not need to market immensely in Sweden since people are already aware of the company. In general, the perception of those 30 participants was positive since each of them has the knowledge about the brand and most importantly, they agree with the brand being high-grade, safe, family-oriented and more suitable for middle-aged people. The Swedish respondents’ main concern with the brand is their ‘old and aging’ design which lacks suitability for younger people.

One of the main parts of Volvo’s pyramid is environmental care; however, only one (Swedish) respondent brought up their environmental friendliness and efforts. For a company this could be a sign that the communication strategy should be better constructed to emphasize the brand’s environmental friendliness. In Sweden, for instance, the demand for cars with lower fuel consumption and solid environmental friendliness increases through the years. (Sprei & Karlsson, 2012: 497). Even if Volvo seems to have frequent buyers in Sweden, a communication strategy accentuating the brand’s environmental side would be beneficial in the long run and for their younger customers so that the brand capitalizes on its total switch to hybrid or electric cars in the last couple of years.

As pointed out by Vendella Hall, Volvo’s current brand manager, Volvo educates the potential customers concerning the product quality, safety, and the environmental side of the brand. Despite Volvo’s ongoing popularization in India and LDCs, the respondents from these countries mention the brand’s quality two times less than the Swedes. In terms of safety, the surveyed in LDCs are more familiar therewith even than the Swedes; however, in India the

awareness of the brand’s safety is still relatively low. According to the Hofstede framework, a

feminine country (Sweden) should show substantial interest in car safety and environmental care whereas a masculine one (India and LDCs) is inherently connected to car purchases for status (de Mooij & Hofstede, 2010: 89). As we can see, respondents neither from Sweden nor India or the LDCs relate to their cultural inherences. Therefore, according to our research, we recommend Volvo to optimize their communication channels through which their potential customers (mainly in feminine countries) can learn about their environmental side as well as improve their strategies focusing on the utilization of each country’s culture-driven purchasing behavior.

26 10% of the respondents in India drive a Volvo and all of them are satisfied with the brand’s safety and offered services, but none of them mention the price of the car – this suggests that the purchasers have been successfully influenced by the brand’s strategies to bolster their image as safe and quality-driven. Nonetheless, this denotes the lack of a Veblen effect – when a premium car is purchased in order to show status and bolster one’s ego because the price of the car implies quality (Galatin & Leiter, 1981: 25-26). Indeed, it is still theoretically possible that the respondents bought the car for status, but decided not to ‘incriminate’ themselves by sharing it in the survey. Thus, a more in-depth customer behavior analysis is required wherefrom one can better infer whether the purchases are influenced by a Veblen effect. We assume this because many of our respondents in India and LDCs, being less than 30 years of age and thus lacking purchasing power, deem the car luxurious and trustworthy due to the country of origin (similarly to Sari & Kusuma, 2014; Rezvani et al., 2012). Akin to what we discovered about Infiniti’s experience, i.e., GDP per capita or the country’s cumulative purchasing power are not always positively correlated with the demand for premium vehicles, the fact that our Indian respondents find Volvo’s cars affordable more frequently than the Swedes opposes our assumption that with income the demand for luxury goods increases or, in our context, price is the determinant factor when purchasing a premium car (vis-à-vis Shende, 2014; Lupis, 2013). Therefore, the theory requires broader analysis of a Veblen effect in BRICs and LDCs focusing more on older people with more capital.

Interestingly, none of our respondents deem Volvo a Chinese brand in spite of their acquisition by the Chinese company Geely in 2010. As Vendella Hall mentioned in the interview, Scandinavian values are still Volvo’s key element of their image. Hence, Volvo seems to continue to bolster their image as a ‘premium car from the West’ which, as could be suspected from our results, subconsciously leads people to connect the brand with inherent trustworthiness, reliability and quality. Therefore, we speculate that consumers still evaluate products from industrialized countries more favorably than those from less developed nations (Qasem & Baharun, 2012: 1404).

Based on the questionnaire, one can assume that Volvo’s marketing strategy is globally undifferentiated (Camilleri, 2018) as the respondents generally mention the brand’s safety and family orientation. To gain the highest market share possible in developing countries Volvo could try and move away from the “signalling high status and prosperity” that they do in general, similarly to how the brand manager mentions that Volvo keeps a consistent brand image and communication worldwide, and move toward strategies accentuating low-cost and heightened reliability in places with huge amounts of car accidents such as India and LDCs. Similar to how local Indian distributors (e.g. Tata) emphasized their low-cost reliability as they came up with a new concept of developing cars for people who previously could not afford one, allowed them to capitalize on the fact that nearly 71 percent of all transportation expenditure (for which the price limit is a motorcycle and never a car) comes from the bottom of the pyramid (EGPL, 2009, p.10). Our survey also shows that customers are usually happy

27 with their experience with the brand and its quality, but ‘environmental care’ and ‘driving dynamics’ hardly appear on our answer sheets – some of the brand’s traits differentiating from their competitors. Hence, because of our assumptions regarding this paper’s results, we recommend a more suitable local ‘pro-safety’ strategy in India and the LDCs, an improved advertising strategy of the brand’s new models targeting potential young customers as well as further communication strategies mediating Volvo’s technological and environmental advances especially in the HDCs.

5. Trustworthiness

This chapter describes the credibility and reliability where the authors made sure that the data we have collected are real and trustworthy.

5.1 Gaining Trust

An important aspect of this research is finding out information that some might see as sensitive as it may give them a competitive edge over their competitors when it comes to brand management. This meant that most companies, including Volvo, would need reasons as to why

they can trust us when it comes to how they manage their brand. Add how we got the managers

of Infiniti and Volvo to trust us. The authors have made sure that the research is based on different sources which has been provided by specialists in the field.

5.2 Credibility

Credibility is the measure of how believable and trustworthy the research is. If the research lacks credibility it would mean that the findings would be discarded because there would be a failure to show why the research can be trusted and the findings are accurate. This was fixed by having transparency in the method, this is useful because it gives people the opportunity to see the process that was used to get the results and critique it.

The weakness of quantitative research is the dependency on people telling the truth when it came to answering the questionnaire. Therefore, qualitative research could have ‘bias’ issues; however, even if not entirely objective, the description of an experience is way more essential. The fluctuations in the answers portray the various opinions forming societal change since on many occasions, there is more than one possible explanation to a phenomenon because the ‘reality’ resulting from qualitative research is more complex and messy than our descriptions of it (Law, 2004). Then again, any excessively strong influence from the qualitative research on the researchers should be neutralized in order to construct scientific, objective stories (Neusar, 2014: 186). Especially due to the fact that it was online, it meant it was not possible to not know for sure whether or not they were answering all of the questions truthfully and not just giving false information; however, we made a quantitative pattern from the qualitative