Impact of financial leverage on the

profitability of real estate companies

A quantitative study from Swedish Stock Exchange

BACHELOR DEGREE PROJECT

THESIS WITHIN: Business Administration

NUMBER OF CREDITS: 15 credits

PROGRAMME OF STUDY: International Management,

International Marketing

AUTHORs: Vladyslav Deboi, Harbi Kurmakhadov, Meng Li JÖNKÖPING May 2021

Bachelor Thesis in Business Administration

Title: Impact of financial leverage on the profitability of real estate companies: A quantitative study from Swedish Stock Exchange

Authors: Vladyslav Deboi, Harbi Kurmakhadov, Meng Li

Tutor: Ulf Linnman

Date: 2021-05-24

Key terms: Financial leverage, Profitability, Capital structure, Real-estate industry, ROA

Abstract

Prudent usage of financial leverage by managers can significantly impact business operations and a corporate’s performance. Thus, the determination and the understanding of the influence of financial leverage on the profitability of a corporation are intrinsic and indispensable for not only maximising the value of a firm but also improving its financial performance. This study adopted a quantitative research method, in which the theories were tested by multiple regression analysis in line with the positivism paradigm and deductive measure. Moreover, ontology belongs to the objectivist perspective, in which the authors viewed reality as a mechanism from the outside and focused only on observable and measurable facts. The authors investigated the capital structure and profitability of the 18 largest listed real estate companies in Sweden from 2016 to 2020. Leverage essentially consists of total liability to assets, short-term liability to assets and long-term liability to assets. Profitability is defined as the rate of return on assets (ROA), which represents the company's degree of profitability relative to total assets from an overall business perspective widely used for financial analysts. In order to accomplish the trustworthy study in the regression model, control variables were also introduced that comprised company size, liquidity and solvency. The result of this paper reveals that financial leverage is irrelevant for determining ROA in the real estate industry in Sweden.

_____________________ _____________________ _____________________ Meng Li Vladyslav Deboi Harbi Kurmakhadov

Table of Contents 1. INTRODUCTION... 5 1.1PROBLEM BACKGROUND... 5 1.2PROBLEM DISCUSSION ... 8 1.3RESEARCH QUESTION ... 10 1.4PURPOSE ... 10

1.5PERSPECTIVE OF THE STUDY ... 10

1.6DELIMITATIONS ... 11

1.7DEFINITIONS ... 12

2. FRAME OF REFERENCE ... 15

2.1LITERATURE REVIEW ... 15

2.2MODIGLIANI AND MILLER ... 19

2.3THE STATEMENTS MADE ON CAPITAL STRUCTURE ... 20

2.4TRADE-OFF THEORY ... 20

2.5PECKING-ORDER THEORY ... 21

2.6HYPOTHESIS ... 22 3. METHODOLOGY ... 26 3.1RESEARCH THEORY ... 26 3.2EPISTEMOLOGY ... 26 3.3ONTOLOGY ... 26 3.4RESEARCH STRATEGY ... 27 4. METHOD ... 28 4.1SAMPLING METHOD ... 28 4.2DATA COLLECTION ... 28

4.3MULTIPLE REGRESSION ANALYSIS ... 29

4.4DATA ANALYSIS ... 30

4.5MULTICOLLINEARITY ... 31

4.6HOMOSCEDASTICITY ... 31

4.7SPURIOUS CORRELATION AND NON-STATIONARITY ... 32

4.8VALIDITY AND RELIABILITY ... 33

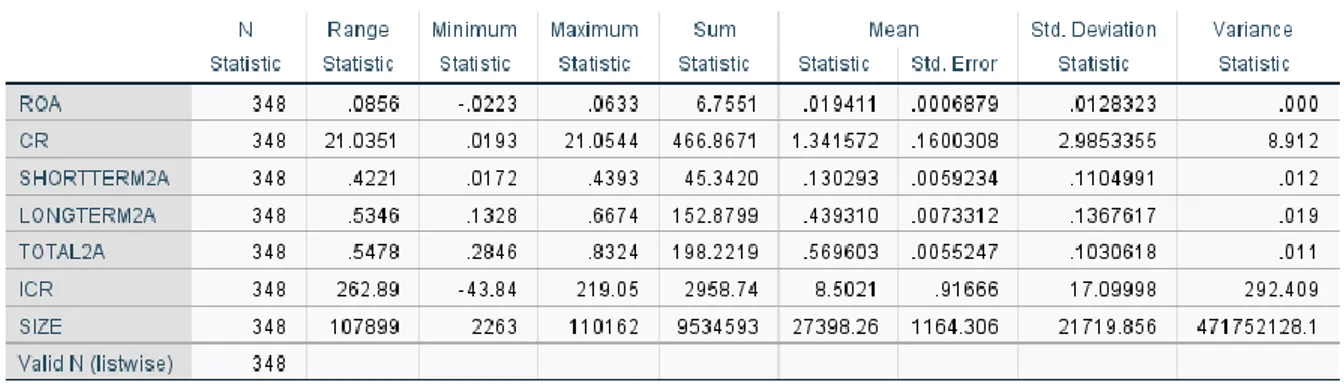

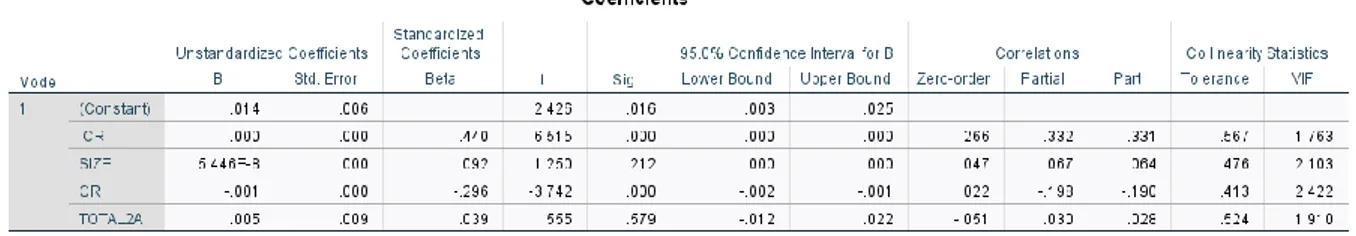

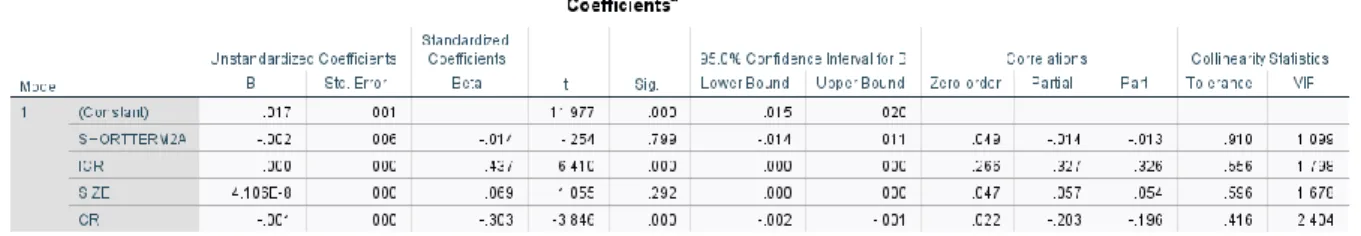

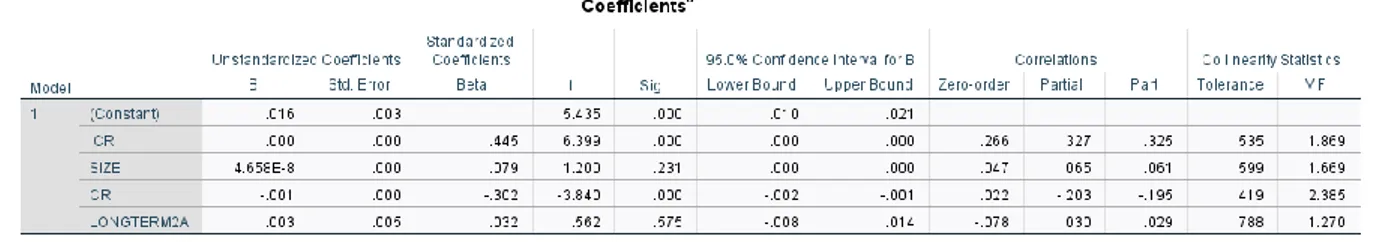

5. EMPIRICAL FINDINGS & ANALYSIS ... 35

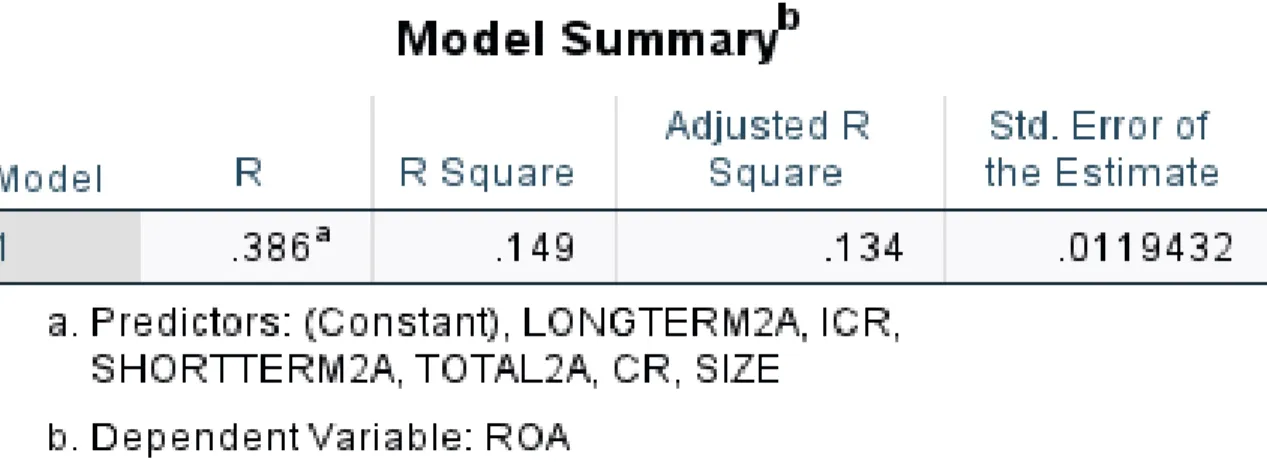

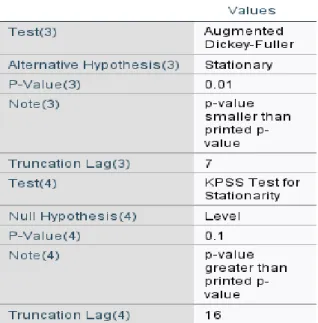

5.1MULTICOLLINEARITY ... 35 5.2DESCRIPTIVE STATISTICS ... 36 5.3HETEROSCEDASTICITY ... 37 5.4MODEL SUMMARY ... 37 5.5STATIONARITY ... 38 5.6COEFFICIENTS ... 39 5.7CONTROL VARIABLES ... 43 6. CONCLUSION ... 45

6.1SUMMARY OF THE FINDINGS ... 45

6.2THEORETICAL AND PRACTICAL CONTRIBUTION ... 47

6.3SOCIAL AND ETHICAL CONSIDERATIONS ... 47

6.4LIMITATION ... 48

6.5SUGGESTIONS FOR FUTURE RESEARCH... 48

7. REFERENCE ... 50

1. Introduction

1.1 Problem background

In retrospect, it can be observed that profitability has always been an indispensable and intrinsic aspect that gauges and determines a firm’s performance as keeping the profitability at an adequate level is imperative for a company’s long-term success and survivability. Ergo, a plethora of researchers illuminated below have been minutely scrutinising and avidly discerning the core drivers behind profitability.

McGahan and Porter (1997, p. 29-30) made a deduction that the firm-specific effect, which indicates the slow gradual changes in the industry structure, is less persistent in comparison with the industry effects. Another researcher scrutinised the impact of financial leverage on industry profitability, and he concluded that companies, which had a low degree of financial leverage, received systematically higher returns (Baker, 1973., p. 503). Additionally, two researchers Dewenter and Malatesta (2001) endeavoured to analyse the dichotomy between state-owned and privately-owned corporations in the form of labour intensity, leverage and profitability. The researchers discerned that privately-owned companies have in general a relatively lower degree of leverage and higher profitability in comparison with the state-owned companies, which is in line and aggrandise the credibility of the results found by Baker (1973) (Dewenter & Malatesta, 2001., p. 321-322). However, they emphasised the fact that governmentally owned companies do not have the possibility of issuing stocks and therefore have a reliance on borrowed capital provided internally generated funds are not adequate (Dewenter & Malatesta, 2001, p. 321)

The findings emphasised above implies that profitability can differ depending on the factors i.e., firm’s characteristics, privately or publicly owned, and industry. Ergo, it is imperative to consider these aspects in the conduct of the research to increase the probability of fully comprehending generated outcomes.

Moreover, it is possible that earlier empirical outcomes differ, due to the various ways of measuring profitability. The choice of a profitability measure varies throughout previous studies, and a measure that has been common in previous research is Return on Assets or abbreviated ROA, which is an indicator that reveals how profitable a company is relative to its

total assets (Le & Phan, 2017; Simerly & Li, 2000; Gill et al., 2009; Barton & Gordon, 1988; Ahmed Sheikh & Wang, 2013, Nguyen et al., 2019). Additionally, another measure that can be seen in previous research is Return on Equity or abbreviated ROE, which is an indicator that reveals how profitable a firm is relative to its total equity (Le & Phan, 2017; Chaklader & Chawla, 2016; Abor, 2005). Albeit, as it was aforementioned that both ROE and ROA are the most frequently utilised measures, it can be also observed that such measure as EBIT to Total Assets is also used in a research conducted by Margaritis & Psillaki (2010). The three measures mentioned above are not superior to each other, and the choice of a measure depends on the stakeholders that intend to utilise the data as well as the perspective of the research (Margaritis & Psillaki, 2010). Additionally, it is emphasised by the authors that ROA also indicates how effectively and efficiently assets are managed to generate revenue. Thus, the measure is mostly suitable for all stakeholders and managers of the firm. Alternatively, ROE reveals and indicates how effectively and efficiently the management of the organisation is utilising shareholders’ invested capital or shareholders’ equity to generate revenue, and therefore is more suitable and of utter interest to investors.

A plethora of factors exist that explains the achievement of maximal profitability. The imperative and frequently debated factor for maximising profitability is the choice of capital structure. Brealey et al (2013, p. 427) asserted that the core resource of a company is the cash flow generated by its assets, which can be categorised as safe cash-flow-stream that goes to debtholders and risky cash-flow-stream that goes to stockholders, and this financing mix of equity and liability in a company is called capital structure. In the process of measuring a capital structure, leverage is often utilised in studies as the aspect explains the extent to which companies have a reliance on debt in financing their business (DeMarzo & Berk, 2013, p. 39).

As it was aforementioned, leverage has been frequently utilised in previous studies and many researchers have scrutinised and examined how profitability is dependent on capital structure (Nunes et al., 2009; Khan, 2012; Kester, 1986; Avci, 2016; Margaritis & Psillaki, 2010; Abor, 2005, Nguyen et al., 2019). Different conclusions were made, where Margaritis & Psillaki (2010), Abor (2005) and Avci (2016) discerned that a positive relationship exists between profitability and leverage, and it implies that companies with a higher degree of debt are more profitable. Contrarily, the researchers Nunes et al. (2009), Khan (2012) and Kester (1986) found and made a conclusion that financial leverage and profitability have a negative relationship, which implies that companies with a low degree of leverage are more profitable.

However, a significant aspect to shed light upon is that the relationships mentioned above do not claim causality, which explains that it is arduous to assert that leverage influences profitability, and vice versa. The phenomenon is called reversed causality and it is imperative to consider as both profitability and leverage possibly impacts each other over the years.

In this day and age, several theories on the optimisation of companies’ capital structure exist. Modigliani and Miller (1958) presented and illuminated a proposition, which stated the irrelevance of capital structure. The theory established by the authors implied that the choice of capital structure does not influence a company’s cost of capital in a perfect market. However, the theory was revised by the researchers a few years later, which included the statement that the degree of leverage was relevant (Modigliani and Miller, 1963). The theory vividly conveyed the fact that a company can increase its profitability and value in a form of a tax shield begot by financial leverage, indicating that companies should imply a high degree of debt in their capital structure to maximise the firm’s value.

Another prominent and intrinsic theory in the field related to the capital structure is the Pecking-order theory established by Myers and Majluf (1984) that states that companies prefer internal financing to fund business operations. However, external financing is required in cases, and companies firstly issue the safest security viz. debt, and equity will be issued as a last resort (Myers, 1984, p. 581).

In contrast to the Pecking-order theory, the Trade-off theory illuminated the statement that companies can attain an optimal degree of leverage, in which tax shields’ benefits are offset by expenses from financial distress (Myers, 1984; Kraus & Litzenberger). Thus, a deduction can be made based on the theory that firms should balance the capital structure and swap debt for equity and vice versa to reach the maximisation of the value of the company (Myers, 1984, p. 577).

The theories aforementioned are central and crucial in the sphere of capital structure and imply that a certain correlation and relationship is expected between profitability and financial leverage. The irrelevance of financial leverage in the cost of capital illuminated by Modigliani and Miller in 1958 would indicate that a certain relationship is not expected. The revision of the theory established by the authors in 1963 and the Trade-off theory presented by Myers in 1984 do state that a higher degree of debt is preferable to increase a firm’s value, which begets

an expectation of a positive relationship between profitability and financial leverage. Last but not least, the Pecking-order theory presented by Myers and Majluf in 1984 suggests internal financing, which leads to a relatively low degree of financial leverage and indicates a negative relationship between profitability and leverage.

This paper will scrutinise and investigate the real estate industry in Sweden that has seen a gradual growth in the past year. The relevance of capital structure in the real estate industry is relatively unknown as well as its relationship with profitability. Moreover, as it was already presented above, the findings on the relationship between profitability and financial leverage vary depending on the context of research. Ergo, it gives the basis for the choice of discerning how profitability is related to financial leverage in the real estate industry in Sweden, which is a relatively unexplored industry on the mentioned topic.

1.2 Problem Discussion

In the section “the problem background”, it is illuminated the imperativeness of capital structure and its debated relationship with profitability as well as established theories that shed light upon the relation between the two variables in order to provide relevant theoretical background. The following section has an aim to examine further the previous study on the relationship between profitability and leverage as well as to link the problem background to the real estate industry in Sweden.

As it was mentioned above, earlier studies have generated different results on the relationship between profitability and financial leverage. No relationship between the two variables for companies listed in the Johannesburg Stock Exchange in South Africa was found by two researchers Mashavave and Tsaurai (2015, p. 85). Another study conducted by Moahammadzadeh et al. (2013, p. 576) found a negative relationship between financial leverage and profitability for pharmaceutical companies listed in Iran. Additionally, previously mentioned researcher Abor (2005, p. 443) found a positive relationship between the two variables by scrutinising listed companies on the Ghana Stock Exchange. Moreover, Gryčová and Steklá (2015, p. 39-40) came to the conclusion that there is a negative relationship between the variables in the agricultural industry. Last but not least, two researchers Yazdanfar and Öhman (2015, p. 113) examined and analysed Swedish SMEs (Small and Medium-sized Enterprises) and made a deduction that a negative relationship exists between both short-term/long-term debts and profitability.

The following study has an aim to investigate the real estate industry in Sweden. Palm (2016) refers to a definition of real estate as a property consisting of land and the facilities on it as well as its natural resources i.e., minerals, water, crops. The intrinsic factor to emphasise is the imperativeness of the real estate industry in countries’ economy as the collapse and formation of real estate bubbles have a significant influence on political and economic trajectories (Edvinsson et al., 2020). With the benefit of hindsight, it can be concluded that the bursting of the real estate bubble in Japan in the early 1990s begot a long-term economic stagnation, and one of the major causes of the Great Recession was the collapse of real estate prices (Edvinsson et al., 2020).

In retrospect, the recent financial crisis of 2008 can be taken as an instance that vividly conveys the detrimental and atrocious impact caused by the burst of the real estate bubble, which is elaborately explained and analysed in the book “The 2008 Global Financial Crisis in Retrospect” written by Aliber and Zoega (2019). The authors emphasised in the book that the global financial crisis led to the most severe decline in employment, production and in world trade since the Great Depression. The catalysator that ignited the financial calamity was uncontrolled lending of capital by financial institutions to individuals and companies that took significant financial leverage but were not solvent enough (Aliber and Zoega, 2019).

Swedish real estate industry has been growing and flourishing especially since the 1960s (Edvinsson et al., 2020). According to the data provided by analysts at CEIC, the Swedish real estate industry saw a growth of an average of 7,4% during the period of March 1987 – December 2020, which is also estimated and supported by Edvinsson et al. (2020) (CEIC, 2021). The capital structure in the real estate industry can be characterised by relatively high capital intensity and due to the significant amount of tangible assets in the form of real estate, it can be seen as a relatively high book value of assets in relation to the revenue earned by the company. The nature of the capital structure of the companies operating in the real estate industry is an interesting area to analyse and investigate as it may augment the existing knowledge and theories related to capital structure. Additionally, our endeavours to find research that analyses the relationship between financial leverage and profitability of Swedish real estate companies were to no avail, which begets an assumption that the area is unexamined.

In light of the above, the problem background and the problem discussion have built the foundation for the underlying research question of the study.

1.3 Research Question

The authors’ goal is to fill the research gap conveyed in the previous sections. Thus, this study will investigate how financial leverage is related to profitability for real estate companies in Sweden. The research question that will be explored throughout the thesis is:

Is there a relationship between profitability and financial leverage of real estate companies on the Swedish market?

1.4 Purpose

The aim of the following study is to analyse and explore the relationship between financial leverage and profitability of publicly owned Swedish real estate companies. Total debt is the core variable for leverage in order to answer the research question and fulfil the purpose. Additionally, the study has a sub-purpose, which is to scrutinise the relationship between short-term and long-short-term debt with profitability. It is believed that the research will contribute to the existing literature and the results will be of utter interest as well as beneficial not only to managers working in the real estate industry that have to be cognisant of maximising the impact of the degree of financial leverage on profitability, but also to investors that can have a benefit of understanding whether a company’s management is utilising its leveraged capital prudently.

1.5 Perspective of the Study

Moreover, the goal of the study is to present the results that would be helpful and beneficial for managers operating in the real estate industry to determine the degree of financial leverage in the capital structure of real estate companies. Due to the fact that it is aimed towards managers, Return on Assets (ROA) is suitable for taking as a profitability measure. It is also stated by Penman (2013, p. 371) that ROA is of interest to managers as it accounts for the return on total capital.

It was also aforementioned that the study is also beneficial for investors as public Swedish real estate companies are scrutinised. Although ROE would be a more suitable measure as it gauges the return on shareholders’ equity and reveals how efficient the management is utilising the company’s capital to generate profit, ROA is also helpful and of interest to investors as it measures a company’s efficiency to allocate its assets (DeMarzo and Berk, 2013, p. 42). Thus,

it can be asserted that investors can also use the findings of this research as ROA is often utilised and can be put into comparison with other industries to give useful implications.

1.6 Delimitations

This section of the research aims to provide a narrower scope on the purpose and research question of the study. Moreover, another vital goal of the delimitation is to provide specified and relevant outcomes that will beget a more graspable, comprehensive and focused conclusion. As it was written in the problem background section, profitability can differ depending on the factors i.e., firm’s characteristics, privately or publicly owned, and industry. Thus, it is important to take these aspects into consideration in the conduct of the research to increase the probability of fully comprehending generated outcomes.

- The first limitation to shed light upon is that the research will focus only on publicly

owned real estate companies listed on OMX STOCKHOLM REAL ESTATE GI (abbreviated as SX35GI). The research was narrowed down to the index as it measures how share prices develop and also takes into account all share dividends that companies pay. The return index thus provides a clearer picture of the total return (Nasdaq, 2021). - Corporations included in the research will be limited companies that are listed on the

Stockholm Large Cap in order to reduce the risk of the results and scrutinises being afflicted by potential outliers from differing characteristics that these companies may possess.

- The research will explore and analyse companies within the timeframe of 2016-2020

except for a company named Nyfosa as it was established in 2018 and does not show the results for the period of 2016-2018.

Based on the delimitation aforementioned, eighteen conglomerates in the real estate industry were identified that share the same characteristics. In the commencement of writing this research paper, it was assumed to utilise the annual reports of these companies to find the relationship between financial leverage and profitability. However, the number of observations that amounted to 88 was insufficient, which would beget unreliable results and errors in the research. Thus, a conclusion was made by the authors of this paper to discern the relationship between the variables by retrieving the secondary data from quarterly reports, which consequently limited and increased the number of observations to 348 and reduced the probability of committing the error in the research.

1.7 Definitions

Financial leverage

Financial leverage is a financial term that refers to how much debt is utilised by a company to finance its assets, due to the lack of cash flows for short-term debts or a need for more capital to finance investment (Myers, 1984).

Capital structure

Gangeni (2006) stated that the capital structure attempts to explain the mix of securities and financing sources used by corporations to finance real investment. Also, the author highlighted that internal finance sources i.e., retained earnings and stock issuance as well external finance sources i.e., loans and bonds can be utilised by a firm to finance the investments required to maintain its business operations and enhance its survivability on the market (Gangeni, 2006).

Net income

According to McCamish (2021), the term net income is the amount of money that’s left after taxes and certain deductions are made from gross income. It is also known as net profit, the bottom line, and net earnings.

EBITDA

McCamish (2021) stated that earnings before interest, tax, depreciation, and amortisation (EBITDA) is a measure of a company's operating performance. In practice, it is utilised to evaluate a firm’s performance without factoring in financing decisions or tax environments. McCamish (2021) acronym EBITDA by the following components: “Earnings” - stands for the income; “Before” - excludes the following items from the metric: “Interest”, which depends on the financing structure of a company; “Taxes”, which are set by the geographic location of a company; “depreciation and amortisation” based on past investments.

Return on Assets (ROA)

Return on assets (ROA) is a financial ratio that can help to analyse the profitability of a company. ROA measures how much profit the relative total assets generate for the business. The calculation and tracking of ROA allow investors, analysts, and managers to analyse if the company provides a good return on assets. Additionally, return on assets is a comparison metric that can be used to examine the past performance of a company (McCamish, 2021).

Return on Equity (ROE)

It is mentioned by Fridson & Alvarez (2011) that return on equity or abbreviated ROE is a measure of a company’s financial performance that is calculated by dividing net income illustrated in the income statement by shareholders’ equity that can be found on the balance sheet. ROE is conceived as a measure of the profitability of a company in relation to stockholders’ equity (Fridson & Alvarez, 2011).

Variance Inflation Factors (VIF)

The variance inflation factor (VIF) is a method of detecting the severity of multicollinearity by looking at the extent to which a given explanatory variable can be explained by all the other explanatory variables in the equation (Studenmund, 2016, p. 234). In the application of Statistics VIF, if the value is greater than 10 there is multicollinearity (Pallant, 2016).

Market capitalisation

The aggregate dollar market value of a company's outstanding shares of stock is referred to as market capitalisation (Fridson & Alvarez, 2011). The authors emphasise that it is determined by multiplying the current market price of one share by the total number of a company's outstanding shares (Fridson & Alvarez, 2011)

Long-term debt

According to Porter & Norton (2015), long-term debt is an obligation that will not be paid or otherwise satisfied within the next year or the operating cycle, whichever is longer, is classified as a long-term liability, or long-term debt. Additionally, the author emphasises that notes payable and bonds payable, both promises to pay money in the future, are two common forms of long-term debt.

Short-term debt

Short-term debt/liability or current liability is an obligation, which comprises such aspects as accounts payable, wages payable, income taxes payable that will be satisfied within the next operating cycle or within one year if the cycle is shorter than one year (Porter & Norton, 2015). Short-term debt + Long-term debt = Total Debt

The addition of long-term and short-term debt is equal to total debt, which is the whole debt that a company possesses.

Current ratio

Financial analysts often compare a firm’s current assets and current liabilities to assess whether the firm has sufficient working capital to meet its short-term needs (Berk & DeMarzo, 2017). This metric is widely used across the industry to access the ability of liquidity. And the formula is shown as:

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑅𝑎𝑡𝑖𝑜 = 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

Interest coverage ratio

Financial analysts and debt collectors assess a firm’s ability to meet its interest obligations by comparing its earnings with its interest expenses using an interest coverage ratio (Berk & DeMarzo, 2017, p.72). It is the ratio indicating the ability of a company to pay off its long-term debt and the interest on that debt (Goel, 2016). Insolvency, which is widely used for financial risk analysis determining the outcomes of companies' long-term survival (Goel, 2016). The formula is shown as:

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑐𝑜𝑣𝑒𝑟𝑎𝑔𝑒 𝑟𝑎𝑡𝑖𝑜 = 𝐸𝐵𝐼𝑇 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐸𝑥𝑝𝑒𝑛𝑠𝑒

2. Frame of reference

This section takes a deep look at the previously published research as well as theories to be utilised in the empirical studies of this paper. The frame of reference structure has two main parts. In the first part, the authors of this paper read the conducted studies finding both positive, negative and absence of correlation and relationship between profitability and financial leverage. Additionally, the aspects such as the date of publication, industry, country classification in the world's economies, and theories applied are considered to draw up the full picture of the investigated topic. In the second section, the most common theories applied in the previous studies i.e., Modigliani and Miller, Trade-off theory and Pecking-order theory are presented, described and discussed. Finally, the formulation of the hypotheses to be tested is presented for answering the research question.

2.1 Literature review

A number of papers are published on the subject of financial leverage and its impact on profitability. Sundry and numerous ways exist for the measurement of profitability, and the choice depends on the group at which the research is targeting. Thus, the choice of the measure utilised in this research is selected based on relevant previous studies.

In Kujaca and Pygman’s (1988) article “Financial leverage in real estate investing”, it was mentioned that the use of leverage permits broader diversification of a fund’s real estate portfolio, and the diversified investment minimises the risk of large losses. Moreover, in the studies made by Margaritis & Psillaki (2010), in which French textiles and chemicals manufacturing firms were investigated, it was found a positive relationship between capital structure and firms’ financial performance. To identify the relation the regression model was applied, and the result showed that the influence on profitability appears to be more powerful for firms with higher leverage. The same positive result was in the research conducted by Avci (2016), who examined Turkish manufacturing firms from 2003 through 2015. The author shed light upon the fact that the industry defines the composition of capital structure that influences the relationship. Thus, based on his observations, consulting companies are less capital intensive compared to manufacturing firms that require heavy investments in long-term assets. Similar results were obtained by Abor (2015) who found a positive relationship between leverage and profitability retrieving the data from Ghana Stock Exchange companies. In his

research, he found that both the short-term debt and total debt reveal a positive relationship with profitability in comparison to long-term debt that reveals a negative relationship with profitability (Abor, 2005, p. 443). Thus, the results showed that the short-term debt serves as the primary financing way in the given case. Another research made by Gill et al. (2011) analysed how leverage impacts profitability considering the sample of 272 U.S. companies from 2005 to 2007 as well as the regression model that was applied in the research. It showed that the debt to total assets has a positive relationship with profitability in the manufacturing companies. In Sarda studies (2016), a linear regression model was utilised to measure the relationship between leverage and companies’ profitability. A sample of 32 large private manufacturing companies performing in Ethiopia from 2006 to 2010 was utilised and a positive relationship appeared to exist between debt and profitability. In the analysis made by Akhtar (2012), the relationship between financial leverage and financial performance was observed in Pakistan within the energy and fuel field. The author presented a positive association between financial performance and financial leverage of the firm, and thus proved that the companies with higher profitability can improve their performance by utilising high levels of financial leverage. Moreover, this study has a plethora of evidence which states that the internal stakeholders are able to strengthen their financial position on the energy and fuel market due to external funds such as financial leverages. The imperative aspect for the company's future flourishing is the willingness to make strategic decisions related to the choice of capital structure. In another research, the author Al-Taani (2013) investigated the relationship between capital structure and firm's performance including in sample 45 Jordanian manufacturing firms available on Amman Stock Exchange from 2005 to 2009. The variables utilised in the study were the following: return on assets, profit margin, total debt to equity, total assets to short term debt ratios, and long-term debt to total assets (Al-Taani, 2013). The dependent variable represented by return on assets and profit margin as indicators for financial execution, and independent variables such as long-term debt to short term debt to total assets represented for capital structure. Consequently, Al Taani’s (2013) study found that no significant relation among Short Term Debt to Total Assets and Return on Assets, Total Debt to Equity and Return on Assets, Short Term Debt to Total Assets and Profit Margin, long term debt to total assets and Profit Margin, and Total Debt to Equity and Profit Margin. Based on Asif (2011) statement, the growth and earning from leverage are significant. Looking from the market perspective, companies that tend to use loans increase their market value. Moreover, the wealth of the shareholders is maximised when the firm is able to employ more debt (Memon, Fozia & Bhutto, 2012).

In contrast to the findings above, multiple authors Kester (1986), Friend and Lang (1988, p. 275, 277) and Nunes et al. (2009) concluded a negative relationship between leverage and profitability. Looking from Jarrow (2012) perspective, the capital structure that consists largely of loans has the danger of default and the less worthy of its capital. Authors Titman & Wassels (1988) stated that firms that utilise the firm's earnings generate more profit compared to others that rely on outside capital. The price of a company's stock defines its performance, and when the stock price is high, instead of relying on outside capital companies may choose to issue equity to cope with the leverages. In the research made by Wald (1999) the drawn-up result was that the debt to assets ratio has a significant negative relation with the firm profitability. The findings were based on the capital structure of firms in such countries as France, Germany, the United Kingdom and the United States taking into consideration firm size, growth and firm’s riskiness as explanatory variables (Wald, 1999). In addition, Mandelker & Rhee (1984) made it clear in their study that in most business sectors, the companies with high profits have the lowest leverage ratio. In fact, the greatest returns are experienced by a company's stockholders when such events as a stock repurchase or debt for equity exchange occurs rather than issuing stocks. Although Nguyen et al. (2019) that analysed the real estate industry in Vietnam found a negative relationship between the dependent variable ROA and financial leverage, it has been shown to be insignificant. It was reported by Amsaveni (2009), after the examination of the relationship between leverage and growth utilising a dataset of 20 years, about the existence of a negative relation. The reasons stated are either the unrecognized growth opportunities by the capital market or the inability to overcome the leverage overhang. When analysing the relationship of these variables in Malaysia companies, Ting et al. (2011) selected the data from 1997 to 2008 and utilised a panel data analysis to build a regression model which helped them to conclude that the total debt and tangible assets had a positive relationship, but the profitability was influenced negatively. Looking at the long-term debt it was found the negative influence on profitability and tangible assets, and the short-term showed significant negative effects. Additionally, Jordanian public companies from the Amman stock market investigated by Soumadi and Hayajneh (2015) with the time frame of 5 years (2001-2006), and multiple regression models applied in the research showed that both leverage and capital structure had a negative impact on companies’ execution and financial performance. The imperative aspect to shed the light upon was that the financial leverage is the same between the low-growth and high growth companies for the Jordanian companies. In the research by Vijeyaratnam and Anandasayanan (2015), in which the manufacturing companies in Sri Lanka

analysed between 2008 to 2012 years, the concluded result stated that the non-debt tax shield had an imperative negative impact on the profitability of these companies. Another interesting finding was in the research made by Yinusa & Rodnonova (2018) in which he selected up to 115 Nigerian companies in the period of 1998 to 2016 and studied the relationship between profitability and leverages. It was concluded in the research that the companies’ performance was negatively related to leverages. The proof is found in Dalbor and Upneja (2002) reports that enhanced firm quality and growth opportunities were related negatively to long-term debt usage.

Looking at the profitability, Chaklader & Chawla (2016, p. 271), which made an investigation of the determinants of capital structure where ROE was utilised as one of the core independent variables, made a deduction that more profitable companies would use internal funds and issue debt to benefit from the tax shields, the authors’ motivation to utilise ROE as the measurement of profitability was unclear in their research. Another researcher Le & Phan (2017) that scrutinised the impact of capital structure on profitability had ROE as the core element for analysing. However, unlike the study priorly mentioned, the authors included other variables that convey profitability i.e., ROA and Tobin’s Q. The target group in this research, which are managers of the real estate industry, paved the way for the choice of ROA as the core measurement of profitability as this ratio is ubiquitously and frequently utilised by managers and stakeholders and is an adequate measure that reflects return controlled by management (Bettis, 1981, p. 384). Furthermore, another author Simerly & Li (2000, p. 40) asserted that ROA is as intrinsic as ROE, due to the fact that the latter measure ignores that influence begot by certain types of resource investment. Thus, the researchers concluded that ROI (Return on Investment) and ROA are more appropriate measurements of profitability for capturing a company's contribution to the more general investment of resources. Finally, asserting that ROA is superior to ROE would be misleading as the choice of the ratio depends on the type of research conducted and the target group. In the case of this study, it was decided to utilise the ROA as the core measurement of profitability due to the arguments aforementioned.

The following theories, which also have been mentioned in most previous studies are central for the area of capital structure:

• The Trade-off theory (Myers, 1984) does in general advocate higher debt levels for increasing firm value, which leads to a positive relationship between leverage and profitability,

• The pecking-order theory (Myers & Majluf, 1984) suggests internal financing, leading to relatively lower debt levels and a negative relationship between leverage and profitability”.

In the light of the above mentioned, a plethora of sources has been reviewed and analysed to provide solid information to be used in the further discussion part of this paper. The review vividly shows how such factors as time frame, countries’ economy and financial systems, industry, methods and applied theories impact the result of the studies. The proof is retrieved from McGahan and Porter (1997, p. 29) who said that the drivers of profitability may vary depending on the industry as well as in the composition of capital structure”. Due to this reason, researchers have not reached a consensus. In Sweden, which is the research focus in this study, there is a limited number of studies related to our topic. However, the research conducted by Kokko (1990) emphasised that the number of real estate and financial companies grew fast as businesses were financed by borrowed funds. By scrutinising and utilising the data retrieved, it allowed us to formulate precise hypotheses, and write the proper analysis that fills the found gaps and provide tremendous value to the existing research.

2.2 Modigliani and Miller

Modigliani and Miller presented its prominent paper in 1958 where the researchers shed light upon the choice of capital structure and the way of implying it on the businesses (Modigliani & Miller, 1958). Modigliani and Miller gave compelling arguments for the irrelevance of the company's capital structure based on a few assumptions. However, five years later, the authors revised, altered the theorem and presented it in the article named “Corporate Income Taxes

and the Cost of Capital: A Correction”, where they concluded that capital structure is relevant

(Modigliani & Miller, 1963). It can be thought that the theorem is obsolete, however, the theorem of Modigliani and Miller has been at the core in the field related to capital structure and is still taught at educational institutions in this day and age. Due to the intrinsic role the theorem has been having in the discussions of capital structure, the authors of the following paper concluded to include the theorem as a core theorem for the theoretical framework.

2.3 The statements made on capital structure

Two prominent researchers Modigliani & Miller (1958, p. 268) made a statement that a company’s capital structure has no relevance with its total value. However, the statement was based on the assumption that companies operate in a perfect market, which means that companies operate in a market where there are no taxes and where the cost of capital is equal amidst companies in the same class, bonds give a constant return etc. (Modigliani & Miller, 1958, p. 266-268, 273-274). Albeit the theorem aforementioned is unrealistic, it is intrinsic to understand what degree of capital leverage would be most optimal for a company.

After strong criticism towards the theorem due to the exclusion of taxes in the research, the authors revised their theorem in 1963. Modigliani & Miller (1963) emphasised and confessed that the negligence of taxes in their research was a mistake as the tax shield accompanying debt had relevance with the firm's value. The authors continued with the statements that arbitrage is not just a function of an expected net-tax return, but also of the degree of leverage and tax rate (Modigliani & Miller, 1963, p. 434). Consequently, the researchers concluded that a company can increase its value by maximising its financial leverage and as a result utilise the benefits begot by tax shields (Modigliani & Miller, 1963, p. 434).

The theorem is at the core of this study, which indicated that a positive relationship between profitability and financial leverage is expected.

2.4 Trade-Off Theory

On the contrary, opposed to Modigliani and Miller’s theorems related to capital structure and their statements on the relevance of financial leverage on company performance, two researchers Kraus & Litzenberger (1973) introduced the trade-off theory, which states that companies can attain and maximise their value by having an optimal capital structure. In lieu of having companies unlimitedly rising levels of leverage to maximise company value, the trade-off theory asserts that companies have a particular capital structure to strive for reaching the point of having the highest possible and maximum company value. Consequently, it begets a form of balancing where companies deliberately should increase the level of debt or decrease it to reach the optimum (Myers, 1984, p. 577). The balance of capital structure emphasised above stem from the profit gained from tax shields and the expenses of potential financial

distress and bankruptcy, where the optimum is met when the benefits of tax shields are counterbalanced by the expenses related to debt (Myers, 1984).

Kraus & Litzenberger (1973, p. 911) endorsed the proposition made by Modigliani & Miller (1958) that capital structure is irrelevant under the assumption of the perfect market. The authors asserted that bankruptcies, taxes and other imperative aspects in the imperfect market do have an impact on the capital structure and its effect on company value. Moreover, the researchers stated that the benefit of tax shields stems from the tax-deductibility of interest expenses, where financial leverage causes a decrease in a company’s income tax liability and an increase in after-tax profit. Ergo, the implication of the trade-off theory established by Myers (1984) asserts that an increase in a company’s financial debt is beneficial but to a certain level or limit. The excess in the financial leverage that exceeds the limit beget costs that erode the benefits (Myers, 1984).

The theory indicates that the level of financial leverage has initially a positive relationship with profitability, however, the relationship becomes negative after costs of financial distress and benefits from tax shields reach a point of break-even. Thus, it can be asserted that the traditional approach of the theory established by Myers (1984) has a concave relationship with profitability than linear.

2.5 Pecking-Order Theory

Myers and Majluf (1984) established a fundament for the pecking-order theory that shed upon a different view on capital structure in comparison with the trade-off theory. The theory established by the researchers endeavours to illuminate how companies choose their capital structure. One of the core ideas proposed by Myers and Majluf (1984) was that the fact that managers have access to insider information that is not available to stakeholders can affect the managerial decision-making in what project to undertake and how it should be financed. As it is asserted by the authors, issuing stocks to generate more equity to finance the business operations can be perceived as a negative sign and news for shareholders, thus managers may relinquish a positive NPV (Net Present Value) opportunity to shy away from giving inadequate and potentially unpleasant signals to shareholders (Myers & Majluf, 1984, p. 188).

The researchers mentioned above concluded that if investments possibilities occur over time, then shareholders will conceive the financial slack as valuable as the company can benefit from

these opportunities. However, if the company does not have availability to low-risk debt or an adequate amount of internal funds, then it might be reasonable for a company to omit projects to shy away from issuing risky securities, albeit they have a positive net present value (Myers & Majluf, 1984).

Myers (1984, p. 581) drew the dichotomy between the trade-off theory and pecking-order theory and asserted that in lieu of endeavouring to balance and find the optimal degree of financial leverage, the company will follow a particular financing pecking order. The pecking order states that companies will primarily utilise internally generated funds when financing is needed. The theory also states that if the requirement of external funding is inevitable, then companies will initially issue debt; the second option will be the issuance of mixed hybrid securities, and the last option will be the issuance of additional equity (Myers, 1984, p. 581).

2.6 Hypothesis

Short-term debt and profitability

By scrutinising the literature aforementioned, it can be observed that earlier empirical results and conclusions came to various outcomes on the relationship between profitability and short-term debt as such authors as Khan (2012), Zeitun & Tian (2007), Yazdanfar & Öhman (2015) found a negative relationship between the variables whereas Gill et al. (2011) and Abor (2005) came to the deduction that there is a positive relationship between profitability and short-term debt. However, it is imperative to emphasise that the authors priorly mentioned who found a positive relationship between the variables utilised Return on Equity as a measurement of profitability, which might impact the conclusion the researchers made. Albeit it can be seen different results on the relationship between profitability and short-term debt, it can be asserted that a relationship exists, and this begets the following hypothesis:

H0: No relationship exists between short-term debt and profitability

HA: A relationship exists between short-term debt and profitability

Long-term debt and profitability

In retrospect, it can be concluded that earlier empirical results made by Abor (2005), Yazdanfar & Öhman (2015) indicated a negative relationship between profitability and long-term debt whereas Gill et al. (2011) that analysed the firms in the manufacturing sector found a significant positive relationship between the variables.

The real estate industry can be observed to have a high degree of long-term debt and it is of utter interest to analyse and see the impact of long-term debt and its significance in relation to profitability. Thus, the following hypothesis was established:

H0: No relationship exists between long-term debt and profitability

HA: A relationship exists between long-term debt and profitability

Total debt and profitability

There is a significant number of research and theories in regard to total debt. As it was observed, in the research by Margaritis and Psillaki (2010, p. 628) authors found that total debt to assets has a positive and significant relationship with profitability and efficiency. The same result about the positive relationships was found in the study by Gill et al. (2011) and Abor (2005). In comparison to these findings, both researchers' Khan (2012) and Nunes (2009) found a negative relationship between total debt and profitability. Since the research proved to show the discrepancy in results as well as variation of theories to forecast the relationship between total debt and profitability, it becomes necessary to enquire about the relation existence and compare findings to the theories utilised previously. From the previously mentioned theories, the Modigliani and Miller (1963) and the Trade-off theory established by Myers (1984) are true when a positive relationship exists while the Pecking-order theory is false by supporting the negative relationship (Myers & Majluf, 1984)

H0: No relationship between total debt and profitability

HA: A relationship between total debt and profitability

Size

Multiple researchers found a negative correlation between size and profitability (Yazdanfar & Öhman, 2015; Goddard et al., 2005). On the other hand, some studies found the opposing relationship when size is positively related to profitability (Chadha & Sharma, 2015; Simerly & Li, 2000). There are previous studies in which size was calculated in a variety of ways. In this study, market capitalisation takes the place since it captures the potential value to be created in real estate companies. Based on the relationship shown in the results from studies before, it is assumed that some form of relationship between size and profitability exists. Thus, the following hypothesis should be considered:

H0: No relationship between size and profitability

HA: A relationship between size and profitability

Liquidity and profitability

Financial analysts and creditors examine a firm's current assets and current liabilities to estimate where the firm has sufficient working capital to meet its short-term need (Berk & DeMarzo, 2017). Liquidity has been selected as one of the control variables by many previous researchers. Andersson & Minnema (2018) selected the current ratio for the control variables, Goddard et al. (2005), found the positive relationship between liquidity and profitability, and Samo & Murad (2019) also indicates that there is a positive relationship between liquidity and profitability in their research. Previous research elaborates various relationships between liquidity and profitability. Hence, this research adopted the same notion, and the following hypothesis is established:

H0: No relationship exists between liquidity and profitability

HA: A relationship exists between liquidity and profitability Solvency and profitability

Solvency denotes the ability of a company to pay off its long-term debt and the interest on that debt (Goel, 2016). It also indicates tremendous importance for financial risk analysis, which determines the outcomes of companies' long-term survival (Goel, 2016). The financial ratio used in this research is the interest coverage ratio. It is commonly used to discover how efficiently a company can pay interest on outstanding debt, considering that all real-estate companies have high leverage.

Solvency has not been widely used in previous research to profitability. However, Hapsari et al. (2016) drew the conclusion in their research that solvency has no significant influence on profitability. Another study from Sucipto & Chasanah (2019) also states that the solvency ratio measured by the interest coverage ratio has no effect on profitability. Thus, the following hypothesis is established:

H0: No relationship exists between solvency and profitability

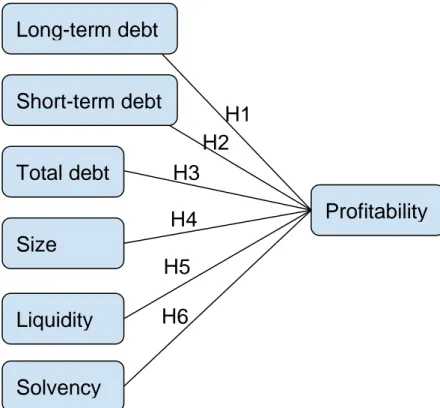

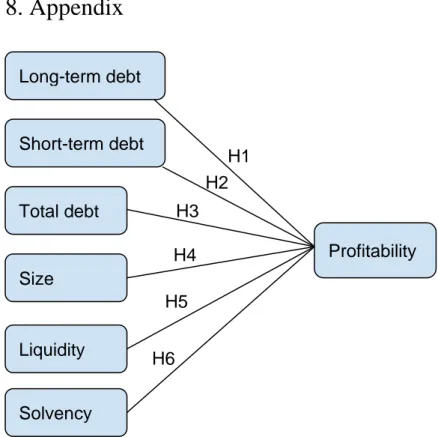

Figure 1. Summary of Hypothesis

Long-term debt

Short-term debt

Total debt

Size

Liquidity

Solvency

Profitability

H1

H2

H3

H4

H5

H6

3. Methodology

3.1 Research theory

The deductive theory is defined by Bryman and Bell (2015) as representing the most common view of the nature of the relationship between theory and research. In general, the process of deduction is very linear, and can be summarised in six steps-theory, hypothesis, data collection, findings, a hypothesis confirmed or rejected and revision of theory (Bryman & Bell, 2015, p.11). Another approach to the research theory is called inductive, which is the process of induction involving drawing generalisable inferences out of observations (Bryman & Bell, 2015, p.12). Oppositely, induction is the reversed process whereas deduction, from observations to theory (Bryman & Bell, 2015). The characteristics of this study are suitable to deductive measure, which the essential emphasis in our thesis is to examine the applicable hypothesis between profitability and capital structure for real-estate companies in the Swedish market based on existing theories, not endeavour to generate new theory. Hence, the six steps method as mentioned above in deduction is indicated for this thesis.

3.2 Epistemology

It was lucidly demonstrated by Van de Ven (2007) that the definition of any frame of research is a philosophy of science that acquaints a scholar’s approach to the essence of the phenomenon examined (ontology) and methods for understanding it (epistemology). In another expression, an epistemological issue is regarded as acceptable knowledge in a discipline (Bryman & Bell, 2015). This research paradigm belongs to positivism, which is an epistemological stance that advocates the application of the methods to study social reality in natural sciences (Bryman & Bell, 2015, p. 15). The study purpose is to discover the relationship between capital structure and profitability rely on empirical findings and theoretical framework. In line with the positivism paradigm, the authors maintained an objective, and value-free approach throughout the whole research paper, which the authors will not try to discover the reason in depth from an interpretive perspective.

3.3 Ontology

The question of social ontology is regarded with the nature of social entities, which the orientation is whether social entities can and should be viewed as objective entities that have a

reality external to social actors or be considered as social constructions built up from the perceptions and actions of social actors (Bryman & Bell, 2015, p. 20). These positions are referred to respectively as objectivism and constructionism (Bryman & Bell, 2015, p. 20). Objectivism refers to the ontological view that implies that social phenomena are beyond our reach or influence for people as external facts (Bryman & Bell, 2015, p. 21). An alternative ontological position, constructionism, implies social phenomena and categories are not only produced through social interaction but also that they are in a constant state of revision (Bryman & Bell, 2015, p. 22). This study involved an objectivist perspective, in which the author views reality as a mechanism from outside and focusing only on observable and measurable facts.

3.4 Research Strategy

Quantitative and qualitative research both refer to the useful methods of business research. The distinction between quantitative and qualitative are majorly different in their distinctive cluster of research strategies (Bryman & Bell, 2015). Quantitative research can be construed as the research strategy that emphasises quantification in the collection and analysis of data, which orientation of the research belongs to deductive, testing of theory, positivism and objectivism (Bryman & Bell, 2015, p. 27). By contrast, qualitative research was a research strategy that usually emphasizes words rather than quantification in the collection and analysis of data, which correspondingly are inductive, generation of theory, interpretivism and constructionism (Bryman & Bell, 2015, p. 27).

Hence, according to Bryman and Bell (2015), the chosen approaches are adequate and suitable for conducting a quantitative study, in which the theories would be tested by regression analysis in quantitative research in line with the positivism paradigm. The authors of this research maintained an objective and value-free approach throughout the whole paper to demonstrate the impact between leverage and profitability for public real-estate companies in Sweden.

4. Method

4.1 Sampling method

Non-probability sampling refers to the non-random selection of cases for a study (Bryman & Bell, 2013). Based on the characteristics and application conditions of our research objects, a type of non-probability sampling called judgemental sampling is selected as an appropriate sampling method that fulfils the purposive sampling function in this study. Judgemental sampling refers to the measure in convenience sampling that the population are chosen by the researcher`s criteria (Malhotra, et al., 2017). The researchers exercised the expertise to choose the certain companies to be included in the sample because we believe the similar characteristics of the public companies are representative of the population in study purpose without potential interference from outliers. Thus, sorted companies by market capitalisation, and select companies with a market capitalisation in large and exclude companies that have just gone public or will be privatised.

Determining the sample size is a crucial measure for a regression model, that is, with small samples examination might obtain results not generalised with other samples (Pallant, 2016). Ergo, we implemented the notion from Tabachnick & Fidell (as cited in Pallant, 2016) that intaking independent variables attended to the minimal requirement of N > 50 + 8M, where M indicates a number of the independent variables and N represents a number of the observations.

4.2 Data collection

The data utilised in this research paper is secondary data that is already being collected for specific purposes (Malhotra, et al., p. 111). We practice the advantages of secondary data in terms of relatively inexpensive and quickly obtained. The population for this study is real-estate public companies floated in OMX Stockholm Real Estate GI and corresponding data were collected directly on the official website of each company. Researchers of this study have selected 5 years interim reports and financial ratios for purposely selected companies in the REAL ESTATE index of X35GI, for our study sampling, in which 18 companies (see below as figure 4) in the entire index that fulfil the criteria of large capitalisation. All require sufficient debt capacity and considerable turnover to eliminate the risk of misleading results. The span of this study started from 2015 to 2020, meanwhile in total 348 observations have been collected

to meet the study purposes since the continuous five-year data can avoid temporary effects and improve reliability.

However, a few data were missing in the original report. The researchers utilised the solution of interpolation, which accordingly the missing variable was theoretically substituted by proxy variables due to the proportionality of regression analysis relationships between changes among variables, rather than the absolute level of the variables (Studenmund, 2016, p. 346). Moreover, the potential error and inaccuracy of secondary data also have been considered. The data used in the research is public external secondary data that the audit company has notarised. Therefore, it provides a significant degree of accuracy and credibility for the present study. When collected data, the entry process is applied directly to the Excel table created from the website and then imported into the SPSS analysis software. To improve the overall operability, the researchers also conducted manual screening to ensure that the correct data was collected for the target population.

4.3 Multiple regression analysis

Regression analysis is utilised by econometricians to make quantitative estimates of economic relationships that previously have been completely theoretical (Studenmund, 2016, p. 5). Multiple regression or multivariate regression is a class of measures to discover the correlation among one continuous dependent variable and two or more independent variables or predictors (Anderson, 2014). Researchers applied the most common analysis in regression named standard multiple regression, in which all independent variables are entered into the model simultaneously (Pallant, 2016). The experimental process refers to the 6-steps regression analysis method, including reviewing the literature and develop the theoretical model, specify the model, hypothesise the expected signs of the coefficients, collect the data, estimate and evaluate the equation and document the results (Studenmund, 2016, p. 66). Equally important, the regression model requires a sound theoretical foundation and conceptual reasons. Whereupon researchers formulated theoretical frameworks by consulting peer-reviewed literature and existing economic models, in which the corresponding financial indicators were implemented representatively as variables and participated in the regression model.

The variables in this study are categorised into variables of interest and control variables. A control variable is not the object of interest in the study. It is rather the regressors included to

hold constant factors, which possibly affect interest variables suffering from omitted variable bias if neglected (Stock & Watson 2020). Standardised Coefficients used in the regression indicates the means that these values for each of the different variables have been converted to the same scale, the unstandardised coefficient values listed as Beta (B) is the major appliance in this study, which elaborate the degree of correlation in the ranges between -1 and 1. R=.10-0.29 is small correlation, R= .30-.49 medium correlation, R=.50-1.0 is large correlation (Pallant, 2016, p. 137). Therefore, the equation described how firm’s profitability Y (dependent variable) is related to the capital structure, solvency, liquidity and size (independent variables) was formed:

Figure 2. Regression formula

Where:

ROA= Return to assets β= Constant

SHORTERM2A= Total liability / Total Assets LONGTERM2A= Short-term liability / Total Assets TOTAL2A= Long-term liability / Total Assets Size= Market capitalisation

Liquidity= Current ratio

Solvency= Interest coverage ratio ε = Error term

i,t= For firm i on year t

4.4 Data analysis

The statistics program SPSS will be used to examine our collected data and offer answers to the hypotheses mentioned above. Initially, we will conduct descriptive statistics of the sample to get an elaborated picture of the sample. Subsequently, a multiple regression will be adopted to test our model’s rationality. This multivariate analysis method helps to explore the relationship between a continuous variable and various independent variables (Pallant, 2016),

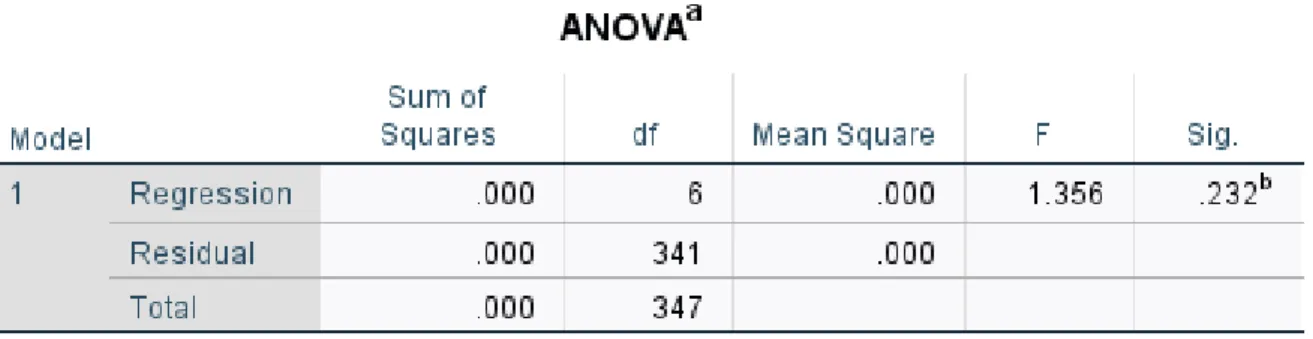

meaning that we could separately identify the correlation between our independent variables and dependent variables as well as the direction of each correlation. According to Pallant (2016), Cronbach’s Alpha needs to be above 0.7. Before examining the actual results of the Multiple regression, the assumptions of multicollinearity, normality and homoscedasticity need to be met (Pallant, 2016). Thereafter, the most commonly used measure called R² or “goodness of fit” applied to the regression model. it can be explored how much of the variance in the dependent variables is explained by the regression model by checking the R² (Pallant, 2016). The higher R², the closer the estimated regression equation fits the sample data, which R² line in the interval 0R²1 (Studenmund, 2016). The R² close to one shows an excellent fit overall. The Standard Coefficients give evidence on which variable makes the strongest contribution to explaining the dependent variable (Pallant, 2016), in this case, profitability. Lastly, possible correlations and their significance as seen in the ANOVA will help to answer each hypothesis individually.

4.5 Multicollinearity

Multicollinearity refers to the correlation among the independent variables, which makes it difficult to make inferences about the individual regression coefficients and their individual effects on the dependent variable (Lind et al., 2006, p. 439). Therefore, it is very essential to check collinearity and also it is the first step the author of this study diagnoses after data collection.

Researchers applied the Collinearity Diagnostics and Coefficients to test collinearity in SPSS. The general rule is if the correlation between two independent variables is between −0.70 and 0.70, it is possible to use both of the independent variables (Lind et al., 2006, p. 440). In the application of Statistics VIF, if the value is greater than 10 there is multicollinearity. Another way is to observe the condition index in the collinearity diagnostics table. When the data is greater than 15 could indicate a problem of collinearity and greater than 30 is a strong sign (Hair, et al. 2013). After the two methods of diagnosis, the research could exclude the influence of collinearity since the data is proved less than the reference value.

4.6 Homoscedasticity

The definition of heteroskedasticity and homoscedasticity indicates the error term ε is homoscedastic if the variance of the conditional distribution of ε given X is constant otherwise

the error term is heteroskedastic, viz. if the distribution at each scatter point in the regression model is almost the same, it is called homoscedasticity, and if the scatter point distribution of each X is different, it is called heteroscedasticity (Stock & Watson, 2020, p. 188). The occurrence of heteroscedasticity will cause problems for the regression model; thus, it needs to be tested and eliminated. The practical implication of the heteroskedasticity diagnosis is whether one should use heteroskedasticity-robust or homoskedasticity-only standard errors and a large number of software programs report homoskedasticity only standard errors as their default setting (Stock & Watson, 2020, p. 188).

The researchers could implement the diagnosis through the observation from the PP-plot from SPSS, see Figure 2. Since the research`s model appears to approximate homoskedasticity, no additional setting needed to be carried out in the software. Just in case, the reachers applied a double check by running the Breusch–Pagan test for squared residual values as a dependent variable in the regression equation since the variance of the conditional distribution of ε given X is constant, the independent variable does not affect the residual value (Studenmund, A. 2016). Test the overall significance with a chi-square test. If the significance in ANOVA shows

P>0.05, then it is homoscedasticity.

4.7 Spurious Correlation and Non-stationarity

One problem with time series data is that if the independent variable has the same underlying trend as the dependent variable, then the independent variable becomes apparently more significant (Studenmund, 2016, p.376-377). Studenmund defined such a problem as spurious correlation (2016), the strong relationship between two or more variables through undetected underlying relationship, hence the regression is likely untrustworthy and overstated. One of the typical problems is nonstationary, which refers to the series having one or more basic properties that do change over time (Studenmund, 2016). As the previous chapter illuminated, heteroskedasticity is one of nonstationary. The major consequence of nonstationary for regression analysis inflates R² and the t-scores of the nonstationary independent variables, which in turn leads to incorrect model specification (Studenmund, 2016, p. 378).

In this study, the data was collected in a seasonal interim report in which all companies followed the approximate same timetable according to the accounting criterion. In the design phase of the experiment, such a test was conducted by the experimenters and the measure for