J

Ö N K Ö P I N GI

N T E R N A T I O N A LB

U S I N E S SS

C H O O LJÖNKÖPING UNIVERSITY

F i n a n c i a l I n s t i t u t i o n ’ s M e d i a S t r a t e g y

- W i t h r e s p e c t t o t h e S w e d i s h f i n a n c i a l m a r k e t

Bachelor Thesis in Business Administration Authors: Arvidsson, Ola

Johansson, Markus Zerihoun, John Tutor: Gunnar Wramsby Jönköping Fall 2007

J

Ö N K Ö P I N GI

N T E R N A T I O N A LB

U S I N E S SS

C H O O LJÖNKÖPING UNIVERSITY

F i n a n s i e l l a I n s t i t u t i o n e r s M e d i a S t r a t e g i

- M e d r e s p e k t t i l l d e n s v e n s k a f i n a n s i e l l a m a r k n a d e n

Kandidatuppsats inom Företagsekonomi Författare: Arvidsson, Ola

Johansson, Markus Zerihoun, John

Acknowledgements

First and foremost, special thanks go to the financial institutions, broadcasting companies and Cision Sverige AB that have participated in this thesis. Without the access to primary data and key personnel, this thesis would not have been possible to carry out.

Further, we sincerely would like to thank our discussant group that provided us with guid-ance needed in order to implement this thesis.

Bachelor Thesis within Business Administration

Title: The Financial Media Environment

Author: Arvidsson, Ola Johansson, Markus Zerihoun, John

Tutor: Wramsby, Gunnar Date: December 2007

Subject terms: Media strategy, financial institutions, gatekeepers, analysis

Abstract

Financial experts from various financial institutions are often seen in media. Media’s objec-tive towards the society is to report occurring events of interest to its audience. Media ap-pearances through giving expert opinions, is for financial institutions costless and a reason-ably effective way of promoting their top analysts and strategically position their firms. For the financial institutions, there exists competition for being allowed to participate and give expert reports when media is in need for a comment, and therefore a media strategy is con-sidered required.

The purpose, used as guidance in this thesis, is to describe the Swedish financial media en-vironment and analyze why certain financial institutions are more active than others.

The method when conducting research in this thesis is a combination of both an inductive and deductive approach. The underlying factor behind this choice, rests in the strive to ful-fill the purpose in most satisfying manner and receive as valid and reliable data as possible. The study also uses both quantitative and qualitative data. Statistical research in media companies’ databases and interviews with persons with key positions at the financial insti-tutions has been conducted.

The thesis stresses the fact that the broadcasting companies approach strategies towards the Swedish financial industry differently. However, this thesis proves that another reality governs. In truth, all the broadcasting companies have common references for the most appealing financial expert when asking for expert opinions.

The financial institution’s standpoints differ in the area of media appearance. The thesis concludes that financial institutions with the most prominent desire to participate and comment a broad range of financial segments in media are proved to be successful in this area. In general though, as a financial institution on the Swedish market, this thesis shows no correlation between having an outspoken media strategy and being successful in this field.

This thesis concludes that when discussing which financial institutions that is more suc-cessful than others, the size of the company is important to take into consideration. The study has also proved that financial experts, often equivalent with the analyst, are appeared to be vital for any financial institution in order to succeed in media.

Kandidatuppsats inom Företagsekonomi

Titel: Det Finansiella Media Utrymmet

Författare: Arvidsson, Ola

Johansson, Markus

Zerihoun, John

Handledare: Wramsby, Gunnar Datum: December 2007

Ämnesord Media strategi, finansiella institutioner, gatekeepers, analyser

Sammanfattning

Finansiella experter inom olika finansiella institutioner syns ofta i media. Medias uppgift gentemot samhället är att rapportera om olika event av intresse till dess publik. Delta i me-dia genom expert utlåtande, är för finansiella institutioner ett mindre kostsamt och ett skä-ligen effektivt sätt att promota deras topp analytiker och strategiskt positionerna sig. Mellan de finansiella institutionerna existerar en konkurrens om vem som ska få medverka i media och uttala sig. Det kan därför finnas ett behov av en mediastrategi för de finansiella institu-tionerna.

Syftet, som verkar som vägledning i denna uppsats, är att beskriva den svenska finansiell mediamiljön och analysera varför vissa finansiella institutioner är mer aktiva än andra. Metoden som har använts vid studien under denna uppsats är en kombination av både in-duktivt och dein-duktivt tillvägagångssätt. Den bakomliggande faktorn bakom detta val är en strävan att tillfredsställa syftet på bästa möjliga sätt och erhålla så giltig och pålitlig data som möjligt. Studien använder även både kvantitativ och kvalitativ data, då statistiska undersök-ningar har gjorts i mediebolags databaser och intervjuer med personer med nyckelpositio-ner på de finansiella institutionyckelpositio-nerna har utförts.

Denna uppsats lyfter ämnet om TV-bolagens strategi gentemot den svenska finansiella in-dustrin är olika. Emellertid, denna uppsats bevisar att så är inte fallet. Sanningen är att alla TV-bolag har samma referenser gällande vilka finansiella experter som används.

De finansiella institutionernas ståndpunkt skiljer sig inom området för media medverkan. Denna uppsats sammanfattar att finansiella institutioner med det mest uttalade önskemålet att delta och kommentera ett brett utbud av finansiella frågor i media är bevisade att vara mer framgångsrika. Generellt visar dock denna uppsats att det inte finns någon korrelation mellan uttalad media strategi och att vara framgångsrik inom detta område.

Denna uppsats klarlägger vid diskussion om vilka finansiella institutioner som är mer fram-gångsrika än andra, att storleken av företaget är viktigt att ha i åtanke. Studien visar även att finansiella experter, oftast ekvivalent med analytikern, är till synes mycket viktig för vilken finansiell institution som lyckas med sin mediastrategi.

Table of Contents

1

Introduction ... 1

1.1 Background ... 1

1.2 Problem & Research Questions ... 2

1.3 Purpose ... 2

2

Method ... 3

2.1 Conducting our Research ... 3

2.2 Research Approach ... 3

2.3 Research Method ... 3

2.4 Sample ... 4

2.5 Data ... 4

2.5.1 Limitations ... 5

2.6 Validity and Reliability ... 5

2.7 Participants in this Report ... 5

2.7.1 Media Companies... 5

2.7.2 Financial Institutions ... 6

3

Theoretical Framework ... 9

3.1 Outline ... 9

3.2 Corporate Communication ... 9

3.2.1 Identity, Image & Reputation ... 9

3.3 What is a Strategy? ... 10

3.4 Agenda Setting Theory ... 11

3.5 Source of Information ... 13

3.6 Effective Public Relations ... 13

3.7 The Analyst and the Firm ... 14

3.7.1 Information, Technology and the Analyst’s Role ... 14

3.7.2 The Role of Financial Analysts ... 15

3.8 Communication between Management and Analysts ... 16

3.8.1 Finding the Appropriate level of Disclosure ... 16

3.9 Herd Behavior in Financial Markets ... 17

3.10 The need of a Marketing/PR Strategy ... 18

3.10.1 The Link between Marketing and Financial departments ... 18

3.10.2 Changes in Marketing Strategy within the Banking Sector ... 18

4

Empirical Findings ... 20

4.1 Television Media... 20

4.2 Statistics Summary TV Media ... 24

4.3 Statistics Online Publications ... 25

4.4 Statistics Summary Total Media ... 27

4.5 Personal Communication- Broadcasting Companies ... 27

4.6 Interviews - Financial Institutions ... 28

4.6.1 Media Strategy ... 28

4.6.2 Gatekeeper ... 30

4.6.3 Herd Behavior ... 31

5

Analysis ... 32

5.3 Prominent Vs. Indistinct Strategy ... 33

5.4 Financial Institutions Media Appearance ... 33

5.4.1 The Financial Experts Role ... 34

6

Conclusions ... 36

6.1 Suggested Further Studies ... 36

Appendices

Appendix 1 Questionnaire Media Companies Appendix 2 Questionnaire Financial Institutions Appendix 3 Expert Report Statistics

Table of Figures

Figure 1 Three dimensions in strategic position (Dewit & Mayer) ... 11

Figure 2 the agenda setting function (McQuail & Windahl) ... 12

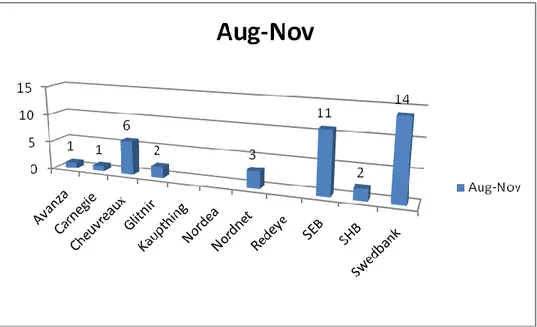

Figur 3 SVT statistics Aug- Nov ... 20

Figur 4 SVT statistics Aug- Nov 2 ... 21

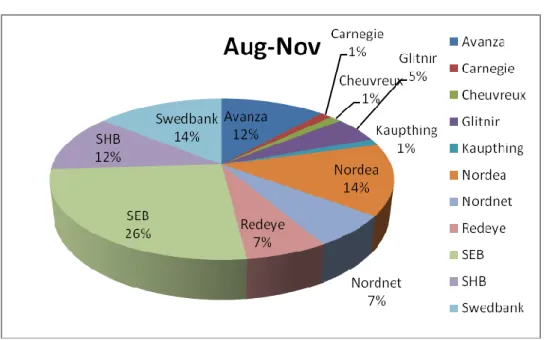

Figur 5 TV4 statistics Aug- Nov ... 22

Figure 6 TV4 statistics Aug- Nov 2 ... 22

Figure 7 TV8 statistics Aug- Nov ... 23

Figure 8 TV8 statistics Aug- Nov 2 ... 24

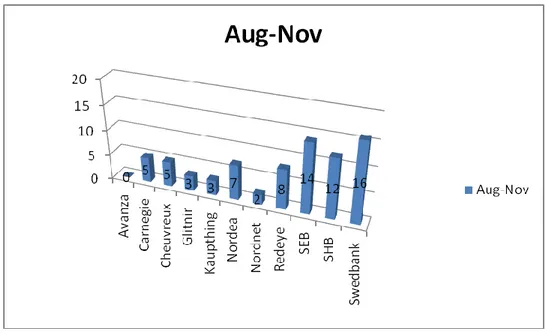

Figure 9 TV media statistics Aug- Nov ... 24

Figure 10 TV media statistics Aug- Nov 2 ... 25

Figure 11 Statistics summary online Aug- Nov... 25

Figure 12 Statistics summary online Aug- Nov 2 ... 26

Figure 13 Total media statistics Aug- Nov ... 27

Figure 14 SVT statistics August ... 44

Figure 15 SVT statistics September ... 44

Figure 16 SVT statistics October ... 45

Figure 17 SVT statistics November ... 45

Figure 18 Online statistics August ... 46

Figure 19 Online statistics September ... 46

Figure 20 Online statistics October ... 47

1

Introduction

Media’s task in society is to report occurring events of interest to its audience. In the finan-cial setting, media turn to expert opinions from finanfinan-cial institutions for an up-to-date analysis. Coverage in media is a costless and reasonably effective way of promoting your top analysts and strategically positions your firm. In any given period of time, there is only a certain amount of space in media, thus only a few analytics can be given the chance to provide their analysis. This implies the presence of competition between institutions and consequently the need of a media strategy.

Interesting questions arises concerning the interaction between the different actors in the media coverage within the financial market. Who are they? Is there a certain characteristi-cally patterns with respect to media strategy for the financial market?

This paper’s red thread is outlined through a discussion covering fundamental theories on strategy and Public Relations (PR). The paper then takes a closer look on media in the fi-nancial market. An empirical study is conducted, which is divided into two parts.

First, a quantitative research consisting of primary data from the media institutions covering financial news in Sweden.

Second, a qualitative research consisting of interviews with the major financial insti-tutions divided into following segmentations: Commercial Banking, Investment Banking, Online Brokers and Research firms.

This paper concludes by discussing the implications between the empirical findings and the theoretical framework.

1.1 Background

Media strategies are perceived differently in the financial industry than in other industries. This is statement is strengthen by Baldwin and Rice (1997) that concludes that long lasting and trustworthy relationship between the media and financial operators are of more impor-tance than in other sectors.

Most of the financial institutions in Sweden have established strategies for approaching the media. However, media appearance is often determined by relations rather than their strat-egy. Media rather contact people they know at different financial institutions instead of necessarily finding the most suitable one (Picard, R. 2007).

A countless number of studies have been done in the field of public relations. However, to the author’s knowledge, until this day no single research has touched upon the subject of media appearance of the Swedish financial industry. This papers objective is to examine fi-nancial institution’s micro and macro -market analysis in media, under a given time period. The fact that the combination between fairly conservative media strategies aligned with the development of the new information technology society has definitely affected how finan-cial institutions are participating in today’s media world (Baldwin and Rice, 1997).

The underlying hypothesis is; financial institutions implement into their media strategy the advantages of appearing in financial media coverage’s.

1.2 Problem & Research Questions

There is a tendency of certain financial institutions being more effective in their media strategy then others. No previous researches, to author’s knowledge, have discussed the specific issue, thus this paper aim to address this very problem.

This rises following questions:

Do the financial institutions use a prominent or an indistinct strategy for approach-ing the media?

What is the media companies’ strategy towards the financial institutions?

Which financial institutions are successful concerning media appearance and atten-tion and why?

Are there any underlying factors to participate in a larger extent in media?

1.3 Purpose

Our purpose is to describe the Swedish financial media environment and analyze why cer-tain financial institutions are more active than others.

In this chapter, research methods and research approaches are introduced. This thesis uses a combination of induction and deduction when approaching the research area. In this chapter a presentation of quantitative and qualitative data is made, how the data, both quantitative and qualitative, is gathered through statistic-al research and personstatistic-al interviews, and finstatistic-ally how it is processed.

2

Method

2.1 Conducting our Research

In order to fulfill the purpose, the need of gathering knowledge in this subject was essen-tial. The field of research was definitely of interest. Robert Picard, a Professor in the De-partment of Economics at JIBS, provided a deeper understanding in the subject and also gave some guidance on how to find further research.

2.2 Research Approach

When doing a scientific research it is essential to consider the right choice of approach. The deductive approach implies that theory is subject to a test, meaning that theory is complied in advance before a comparison to collected data. By first create a hypothesis concerning the relationship between the variables; one should then express the hypothesis in measureable variables. Most often a test of the hypothesis is used in the form of empiri-cal findings. One should then examine the outcome of the test to be able to confirm or realize a justification of the theory. Modifications of the theory might be necessary when findings deviate from the original plan. By using the deductive approach one can produce useful outcomes. The possibility to explain the relationships between variables is the most common reason for using the approach; another one is to control the testing of the hypo-thesis (Saunders, Lewis & Thornhill, 2003).

The inductive approach differs from the deductive approach in most circumstances, since the inductive approach implies that the theory follows the data and not the other way around. Using the inductive approach, your goal is to build up a theory that evolves from a number of related cases. The inductive approach is a more flexible, and allows changes as the research progresses (Saunders et al, 2003).

This thesis will use a combination of both inductive and deductive approach. Theories will be created through facts acquired (Ghauri, Grönhaug & Kristianslund, 1995) from differ-ent TV channels which are considered to be induction. The deductive approach will be used when theories will act as guidance when searching for explanations (Ghauri et al, 1995) from the data gathered through personal interviews.

2.3 Research Method

When conducting a study, one can use either qualitative or quantitative research approach-es. In this thesis both quantitative and qualitative research methods will be used. Qualita-tive research reflects collecting, analyzing and interpreting data through observations the human behavior. Quantitative research on the other hand refers to counts and measures of things. The choice of a combination of the both methods, is founded in that qualitative re-search explains the how and why, whereas the quantitative rere-search has a more clear focus on what, where and when.

Qualitative data are more subjective, and its concepts are characterized by their richness and fullness bases on your opportunity to explore a subject (Saunders et al, 2003). Through talking to experts and conducting interviews, the need to satisfy the explorative studies, try-ing to find out how the financial media works. Accordtry-ing to Saunders et al, 2003, this is a method where valuable information will be acquired, at an efficient and low cost way.

2.4 Sample

In this paper two different samples will be used one with various participants from the me-dia industry and the second one representing different financial institutions. When ap-proaching financial institutions a form of non-probability sampling was used when choos-ing which ones to contact. Non-probability means that a particular unit will be included in the sample is unknown (Ghauri et al, 1995). We dissected the financial industry into smaller segments, such as commercial banks, online brokers and investment banks. The selection of participants to contact is founded in the intentions to find a sample that will represent the financial institutions most active in media in best possible manner. By doing this trust-worthy information that is representational for the financial industry will be received. Throughout this paper, the focus will be on macro, currency, savings and market analysis. In Sweden there are several different medias. This thesis has chosen limit itself to have a sample consisting of TV and online publications. By covering both TV and online publica-tions, this thesis will receive a coverage that is satisfying and representing, since the online publications of choice consists of 457 different publication where many of them also exist in printed copies. The online publications are also representative for radio stations, news agents and pure online magazines.

2.5 Data

Since there is no previous research done within the area of focus for this paper, there is li-mited secondary data. Instead new raw data called primary data is collected specifically for the purpose only for this paper.

The collection of qualitative data is done through semi-structured interviews. Semi-structured interviews goes about a procedure where topics and issued to be covered, sam-ple size, peosam-ple to interview and questions to asked have been determined on beforehand (Ghauri et al, 1995). Due to the fact that the interviewees occupy top positions at their or-ganization and have hectic schedules, telephone interviews were the most suitable proce-dure to use. In some cases interviewees felt that they did not have enough time for a tele-phone interview, so another procedure where we emailed them the questions and they emailed back response were used.

The quantitative data was gathered through gained access to the Cision Sverige’s web agent, which is a tool for conducting different media analysis and through this tool it was possible to retrieve valuable statistics. The procedure works as follows; one create a so-called agent by choosing what company to analyze, further on one write down specific key words for that company in order to find articles matching ones goals. The next step in the process in-volves choosing what online publications to involve in ones search, in this paper every possible publication (457) which offers a great deal of business news was included. This step is repeated for all the financial institutes in which this paper has an interest in and when finalized a statistical process is engaged. Here one choose what time span to use, which agents to involve and this will lead one to a diagram displaying the different financial institutions number of times they are published.

2.5.1 Limitations

The financial institution Carnegie has a misleading statistical appearance due to events oc-curring before stated period. Any news in media covering these events is not covered in this paper, since they hold no relevance.

A financial institution that was supposed to be included in this report was ABN Amro. ABN Amro is a bank rooted in Europe. The company is in the middle of a consolidation phase and it future as a sovereign bank is ended. Thus holds no relevance to this paper. The commercial bank Nordea is represented in the statistics, but not in the interview part of the empirical chapter. This is so, since the bank consistently refused to take part in an in-terview and the decision was taken to leave them out.

2.6 Validity and Reliability

The purpose with conducting interviews was to receive valid and reliable data; however there are several characteristics that influence the data. According to Saunders et al. (2003), validity refers to the extent to which the researcher gains access to their participants’ knowledge and experience, and meaning representing the participant intentions. Through the usage of an introduction to the subject and easy to understand questions to all inter-viewees increased the validity of the data in this paper. Since interviewing several managers for both financial institutions and media companies with great knowledge about the re-search area, they will provide their own view on the topic and help to increase the validity of this paper.

The term reliability refers to whether the data collection will yield consistent findings which also would be made or concluded by other researchers or there is transparency in how the sense was made from the raw data (Saunders et al., 2003). By using asking the same ques-tions to all interviewees creates useful and reliable data, and the answers will also provide different opinion that is helpful analysing the data. Since the interviewees working at differ-ent organizations, it can be questionable if they are trying to bias their answers in order to make their organization to look better. This paper has tried limited risk for biased results through by following up the qualitative data with quantitative, and in this way see if the re-sults are reliable.

2.7 Participants in this Report

2.7.1 Media Companies

The purpose of interviewing the media companies was to map out their strategy when de-ciding on which financial institution that would get the chance to comment a certain busi-ness situation. We were also eager to collect statistics that showed which and when certain financial institutions appeared in the ten to fifteen minutes long business news.

Interviews were held with the broadcasting companies concerning their strategy regarding which financial participants that were asked for expert reports and pure statistics were ga-thered too.

Sveriges Television

Sveriges Television (SVT) ranks high as the most trusted Swedish media and enjoys a very good support from the Swedish TV audience.

(http://www.svt.se/svt/jsp/Crosslink.jsp?d=7830&lid=about_SVT&from=menu)

Sabine Römer is the business news manager for the public service TV channel SVT. The business news broadcast at SVT is called “A- Ekonomi”.

TV4 AB

TV4 has entertained and engaged the Swedish audience since 1990, and is today the largest TV-channel in Sweden. (http://www.tv4.se/omtv4/)

Rafaela Lindeberg is the manager for the program editingatthe business news department at the Television channel 4.

TV8 AB

TV8 profiles as a source of knowledge and trustworthy supplier of news and trends on the financial market, history literature, science, technology and deeper social journalism. (http://www.omtv.se/tabla/TV8/)

Olle Zachrison is the business news manager for the Television channel 8. TV8 is highly focusing on business and financial news which was important for us to cover.

Cision Sverige

Cision is a world leading media analysis service company. Cision help professional opera-tors all over the world to maximize their communication efficiency. Cision offer their clients improvement in their integrated services and software solutions, concerning reputa-tions and campaign management, media monitoring and research of media contacts. Its world-leading offering makes it easier for clients to understand and proactively influence their media image and reputation in the market. With proven methodologies and an exten-sive infrastructure to manage international clients, in combination with a strong client base, Cision commands a unique position in this growing segment.

(http://www.cision.com/templates/Page.aspx?id=6687)

Cision offered us access to their online web agent, to be able to retrieve statistics from on-line publications concerning financial institutions that have been appearing when giving expert reports.

2.7.2 Financial Institutions

Interviews were held with the financial institutions concerning their media and PR strategy for approaching the media. In order to retrieve best possible information, key personnel within the PR or marketing area was prioritized to get a hold of when setting up the inter-views at each institution.

Handelsbanken

Handelsbanken (SHB) is a so called universal bank, which means that is delivers services within all of the banking area. SHB has today a strong position on the Swedish market, and has the last decades established activity in the Nordic countries and Great Britain. (http://www.handelsbanken.se/shb)

Johan Lagerström is the press and PR manager at SHB.

Nordea

Nordea’s vision is to be the leading bank in the Nordic countries. They offer a wide selec-tion of products, services and soluselec-tions within banking, capital markets and insurance. Nordea is considered to be the largest bank in Sweden.

(http://www.nordea.com/sitemod/default/index.aspx?pid=52062&rw=1)

Skandinaviska Enskilda Banken

Skandinaviska Enskilda Banken, SEB is a northern European financial group that serves companies, institutions and private customers. SEB offers an individual, active and devel-oping bank relationship, through combining products and services that meets the custom-ers’ needs. (http://www.seb.se/pow/wcp/sebgroup.asp?website=TAB1&lang=se)

Elisabeth Lennhede is the Press and PR manager at the marketing and communication de-partment at SEB.

Swedbank

Swedbank is one of the largest banks in Sweden, and offers complete range of financial services for private person, companies, organizations, municipalities and country council. Swedbank is also market leading within several significant market segments in Sweden. (http://www.swedbank.se/sst/inf/om-swedbank/0,,4280,00.html)

Anna Sundblad is the Press and PR manager at Swedbank.

Nordnet

Nordnet is an online broker, whose business idea is through innovation and service im-prove and simplify private stock-, fund- and pension savings. All trading is conducted in real time with middlemen. (

http://org.nordnet.se/undersidor/om-nordnet/om-nordnet.html)

Per Hednert is the marketing manager at Nordnet Sweden.

Avanza

Avanza is today Sweden’s largest online broker, and is used to trade stocks and funds. Their goal is to provide their customers with the best decision foundation, with analysis, news and software. (http://www.avanza.se/aza/omavanza/index.jsp)

Claes Hemberg is the information manager at Avanza Bank which is a fully- owned subsid-iary of Avanza.

Carnegie

Carnegie is an independent Nordic investment bank with a strong position in securities broking, investment banking, asset management, and private banking, as well as in pension advices. (http://www.carnegie.se/templates/Page.aspx?id=2023)

Andreas Koch is the head of PR capital markets and analysis at Carnegie.

Kaupthing

Kaupthing Bank is a northern European bank that offers integrated financial services to in-stitutional investors, companies but also individuals. The services offered ranges from cor-porate banking, investment banking and capital markets services to comprehensive wealth management for private banking clients.

(http://www.kaupthing.se/Hem/Om-Kaupthing/About-Kaupthing) Erik Nyman is the director for institutional analysis at Kaupthing Bank.

Glitnir

Glitnir is an online broker with strong focus on Scandinavia and the Baltic countries. They provide daily recommendations for their customers, in order to serve their customers in the best manner. Glitnir also manages a trading section that is an independent department. (http://www.glitnir.se/default.asp?ml=7295)

Ola Asplund is the head of analysis at Glitnir.

Cheuvreux

Cheuvreux is an investment firm, a subsidiary of Calyon and a member of the Crédit Agri-cole SA group. Cheuvreux is exercising its expertise in fields such as; European equity re-search, execution services on international markets and broking for the private clientele of Crédit Agricole's Regional Banks and LCL network.

(http://www.cheuvreux.com/static.nsf/Overview)

Rodney Alfvén is the head of analysis at Cheuvreux and expert within the banking sector.

Redeye

Redeye is an independent analysis company, which focuses on small and medium sized companies in numerous industries. They provide their customers with high quality analysis for highly competitive prices for both professional and private investors.

Urban Ekelund is one of the founders, with previous work experience from Finanstidnin-gen and DaFinanstidnin-gens Industri. (http://www.redeye.se/site/om/)

In this chapter, the theoretical framework presents what a strategy is for a company. The need of experts within financial industry continued how the important role the analyst for financial institutions in media fol-lows. The chapter is rounded off with certain behavior that is differentiated for financial institutions.

3

Theoretical Framework

3.1 Outline

Maitland (1999, p.15) defines media as following: “an all- embracing term used to describe any me-dium that enables one party to transfer a message to other parties”.

And his definition of PR: “those media that allow us to put over a favorable story and/or image to our customers and the outside world; and without charge” (p.15).

This paper covers traditional public relations with an emphasis on media relation theories. In this section of the paper a general picture of how media relations are operated. Since one know that the relationships between media and financial institutions differ in several aspects, it is essential for the report and research to include theories that deals with media strategies within the financial industry (Picard, personal communication, 2007).

3.2 Corporate Communication

When discussing corporate communications this paper mainly focus on the organization communication which is a general term that basically describes all communication that is used by an organization except marketing communication. This field includes essential communication areas such as non- marketing fundamentals of PR but also internal com-munication in the organization.

In order for PR managers to get successful concerning media appearances and attention one should possess several competences. The creation of trustworthy relationships are in-dispensible and an important task for the PR manager. Having inspirable visions is often a key to achieve this, but also shows a willingness to anticipate, engage and initiate change and newsworthiness (Davis, 2004).

3.2.1 Identity, Image & Reputation

Images do not necessarily agree with reality, rather, it is the public’s interpretation of the organization. Images change rapidly over time which means that the current image is what matter for the organization and PR managers works on how the organization would likely be perceived (Davis, 2004).

According to Van Riel (1995, p.27), a corporate identity differs from its image since the identity “denotes the sum total of all forms of expression that an organization uses to offer insight into its nature”. Davis (2004) elaborates that the corporate identity can be seen as a presentation of the company based on a desired image and is often times used trough symbols and logos. The identity is based on several characteristics such as presentation, personality, behavior, communication and connections the corporate reputation differs from the image in one important aspect; the reputation is based on experiences while the image is existing without experiences.

Even though the reputation is an essential part of any organization, this paper will leave out the discussion since the paper are focusing on how financial institutes are building im-age and identity through media rather than customer’s experiences affect a company’s repu-tation.

3.3 What is a Strategy?

Until this day there are no straightforward definitions of strategy, meaning there are no rules that can be memorized and applied (De Wit & Meyer, 2005).

According to Quinn (1998),a strategy is a pattern or a plan which is integrated in an organ-izations superior goal, politics and occurrence to an entity. He continues by stating that a well defined strategy helps to control and divide a company’s resources to a unique posi-tion which is founded from the company’s internal competencies, accepted changes in the surroundings and the competitors’ adjustments.

Explicit acknowledgment of multiple definitions can help people to maneuver through this complicated field. Henry Mintzberg (1998) provides five dimensions of strategy:

Strategy as a plan is consciously deliberate course of procedures on how to deal with a situation. The plans are made before taking actions, and are with determination developed.

Strategy can also be a ploy, which means that it is a tactic with the intentions to out-smart a competitor.

Strategies can be deliberate as those two mentioned above, however they can also be the fruit from realization. Strategy as a pattern is an emergent strategy, where the lack or development of intentions forms from a pattern.

When using position as strategy, it focuses on a company’s surrounding environment, for example markets share or the company’s geographical coverage. Niche strate-gies, where companies focus on a really narrow market segment are a further de-velopment of the position strategy.

The fifth and final dimension is strategy as a perspective. This dimension concentrates on the importance on how the company perceives and considers the surrounding. Ideas and thought from the employees stresses the company’s intentions and ac-tions. It is important to understand that it is not the perspective that creates the strategy; instead the perspective is a result from the strategy

Roos et al (1998) argues that in reality, many strategies contain more than one of the five dimensions mentioned above. This is a result from combining at least two in order to understand entirety of a company

Figure 1 Three dimensions in strategic position (Dewit & Mayer)

Figure 1 above, illustrates De Wit and Meyer (2005) three dimensions in every strategic po-sition. According to them, the strategy process is concerned with the how, who and when of strategy.

The how illustrates if the strategy is formulated, analyzed, implemented or dreamt-up.

The who and when is essentially who should take part in the activities and when they should be performed.

The product of the strategy process is referred to as the strategy content and is concerned with the what of a strategy, and should be the strategy for the company. De Wit and Meyer (2005) further states that the set of circumstances under which both the strategy process and strategy content are determined is referred to as the strategy context. That section is concerned with the where, in which firm and what environment are the strategy process and strategy content rooted (De Wit & Meyer, 2005)

For most organizations the comprehensive overall goal is profit-maximization, strategy is a planned, rational and creative way to achieve that goal. Organizations surroundings are very dynamic and change is crucial, the better adaptation enhances the possibilities for a more satisfying profit (Roos, Krogh & Ross, 1998).

3.4 Agenda Setting Theory

According to Cohen (1963), the press may not be successful much of the time in telling people what to think, but it is stunningly successful in telling its readers what to think about.

When analyzing the media space, agenda setting describes a powerful influence, in other words, it tells us what issues that are important. The theory originates from investigations on US presidential campaigns in the seventies, where McCombs and Shaw (1972) focused on the two elements; awareness and information. They attempted to find out the relation-ship between what voters said was important, and the actual content of the media messages used during the campaign. The result was that voters were under tremendously influence from what the mass media aired (McCombs & Shaw, 1972)

Figure 2 the agenda setting function (McQuail & Windahl)

Agenda setting is part of the construction of public awareness, and is one of the most es-sential issues, part of the news media. The agenda-setting function consists of numerous components which are showed in figure above by McQuail and Windahl (1993).

Media agenda, issues discussed in various media channels such as newspapers,

tel-evision and radio.

The public agenda, issues discussed with personal relevance to the members of the public,

Whereas issues that the policy makers or legislators believe to be important are found in policy agenda.

These agendas are interrelated; however two basic assumptions underlie application of agenda-setting:

First, is that media does not reflect reality instead they filter and shape it.

Second, assumption revolve around the media concentration on a few issues and subjects, influences the general public to perceive them more important than other issues. (McCombs, 1982)

Since the theory is fairly old there have evolved improvements, and the theory has been di-vided in to two levels.

The first level is the traditional agenda-setting theory and has to do with the priority and frequency of different objects, in other words what the public should think about the amount of coverage.

The second level concerns how different attributes are prioritized, which means that the media suggest how the people should think about the issue. (McCombs, 2004)

Finally, the effect from agenda settings varies from the different media, but helps us to ex-plain how persuasive media can be (McCombs, 2004).

3.5 Source of Information

Journalists always need statements and comments from professionals within their area of expertise, and often their list of experts are fairly short (Karaszi, 2005). Similar to a snow-ball effect, journalists’ acts on a rather similar way, if one starts using an expert, the others are soon to follow (Gurton, 1998). Becoming an expert in an area, requires that one is quite knowledgeable within the subject, which qualifies several person, however many so called experts do not market themselves as one, often due to unwillingness or ignorance know-ledge about how the medias way of working (Karaszi, 2005).

There are many ways one can become an expert, through writing books, getting various ar-ticles published or being a writer for a union magazine (Karaszi, 2005). There are also some positive synergies by being considered an expert or an authority; by building yourself into an expert or “rent-a-quote” you will effectively and quickly raise your profile and that of your product (Gurton, 1998).

Once you have established a contact with a journalist, your aim should be to become their specialist of choice. To become and continue being the journalist number one choice, you need possess the following traits:

Reliable – You must be to deliver accurate and legit comments

Available – Make time available to talk to the journalists, with in mind that there are competitors willing to take over your place

Quotable – Be able to deliver your views and opinions in short, snappy statements Controversial and opinionated – Delivers personal views with passion, conviction and wit, without thinking too much about the consequences

Frank and honest – If you lack knowledge or information to tell them, hopefully there will be another opportunity

Some ways to become recognized as an expert is giving lectures and seminars. The easiest way to become an expert is however, through personal contacts directly with editorial staff and offer them help with information and statements. And also keep oneself available fu-ture collaboration (Karaszi, 2005).

3.6 Effective Public Relations

Understanding the media environment and knowing how to deal with the media is essential for any business today. How it is done differs though, between different industries. Build-ing and maintainBuild-ing a long lastBuild-ing relationship, of mutual respect and trust is often one of the key to success for any business. The media strives for digging up news while the analyst appearing in media wants to promote its business. Even though this is true for financial in-stitutes appearing in media, the media often seek high qualitative analysis and the financial

institutes are not taking a huge risk of being misunderstood or deliberately being vilified (Cutlip et al., 2000).

Media relations must be seen as an investment and one must consider the advantages of media relations rather than disadvantages. This is specifically so, in the financial industry. According to Cutlip et al., (2000), the foundation of a successful media relationship can best be accomplished when following five basic rules:

Shoot squarely Give service Do not beg or carp Do not ask for kills Do not flood the media

The expression “Honesty is the best policy” might be a cliché but it is often used when talking about media relations since it has shown to be true. Credibility must be earned, which results in a trustworthy relationship. This line of reasoning is what “Shoot squarely” implies. One should not try to rule the process of how news circulates in media and let the initiative belong to the journalists. Further on, one should not favor a particular journalist or Media Company since no one knows for how long a trustworthy relationship will last (Cutlip et al., 2000).

When giving journalists timely interesting stories when and how they want them is the most reliable way to gain their trust. To give service also means to respect their deadlines and get a deeper understanding of how they work so it is possible to provide news and pic-tures in a form that are easy to use.

To beg and carp only irritates and ruins everything else that one might have done good to-wards the media. Historically, cases where journalists have changed a story due to practi-tioners that have begged to do so are easily counted. It lays a deeply rooted integrity in the journalistic profession which just offense them when one attempt to change their minds and affect a story. One extreme case of this is when practitioners ask the press to kill a sto-ry. This definitely will not work and is highly unprofessional which often brings ill will. The only way to prevent stories that are not beneficial for the business is to not getting into those kinds of situations. In order to, as a business, keep newsworthiness towards media, one should never flood the media. Ultimately, it also leads to that the media looses respect for the practitioner and consider less material as news. (Cutlip et al., 2000)

3.7 The Analyst and the Firm

3.7.1 Information, Technology and the Analyst’s Role

In the financial market, information is power and power is money. This relation is de-scribed by Baldwin and Rice (1997) where they state that Wall Street functions almost en-tirely on information and that the U.S financial services industry underwent a revolution in the 1980s that resulted in a dramatically restructured industry in the 1990s. The integration of new electronic systems into the market and across national markets has increased both the quality of information and the speed at which it is disseminated. Further on, they elabo-rate that in addition, US companies are rapidly globalizing and their international business

operations are becoming a large portion of their revenue and earnings. Investment firms are committing themselves to broad based financial services, such as global equity research, and sales and trading activities. Newer sources of information that cover global economic trends, international mergers and acquisitions are needed. All these changes present Wall Street and its analysts with new challenges.

A product of these new challenges is the phenomenon called “gatekeepers”. Allen (1997) defines gatekeepers as the communication stars in work units within various technological organizations, who serve and facilitate the flow of information. His describes the gatekee-pers as someone charismatic, articulated, have more external contacts, generate more ideas, and engage in more problems solving than non-gatekeepers. Baldwin and Rice (1997) ela-borates further on gatekeepers ability of achieving effectiveness from information systems and understanding of the crucial information role of those communication networks – our primary source for mediated information. The related informal communication patterns are unregulated and spontaneous, usually lateral, but often serving as links among hierarchical levels or as gatekeepers to other network groups.

These gatekeepers keep up more with professional literature, have more professional affili-ations, more external oral contacts, and greater access to information sources in general, and can translate terms and norms across networks. These communication-rich roles de-velop informally over time, and generally foster greater innovativeness and performance. Network building is particularly important for gatekeepers, as it fosters more channels and thus more information and opportunities for action, and especially provides informal expo-sure to significant problems outside formal channels. (Baldwin and Rice, 1997)

Today, analysts have fewer hours to spend on research, and the trend is to write shorter and more frequent reports. Descriptive reports containing historical data have been re-placed by reports formulating profitable investment ideas (Baldwin and Rice, 1997). Their recommendations hold great power, representing a substantial profit, or loss, to the stock-holder and to the company. Successful analysts must act as an economist, an accountant, and a legal expert, as well as an industry specialist. The internationalization of business, along with the ongoing internationalization of the securities markets, has added to the in-formation needs of financial analysts. Financial institutions are interested in analysts who are ranked in surveys because they have name recognition and can bring in money for the firm. It is important that the trading volume the firm does in stocks the analyst covers. Firms rely on the contacts securities analysts have made to direct a large volume of institu-tional trading to the firm.

3.7.2 The Role of Financial Analysts

In the financial environment, analysts are important to a firm because they affect both in-vestor behavior and the firm’s reputation in the business community (Kuperman, 2002). With considerable influence on both investor behavior and the firm’s reputation in the business community, they ultimately affect its long-term ability to successfully implement strategy. This argument is strengthen by Fombrun (1996), where he states that given such importance, it should be clear that a successful implementation of a firm’s pr-strategy re-quires that the firm effectively communicate with these analysts regarding its external communication.

According to Kuperman (2002), the information that analysts provide to investors affects firms most directly at two levels.

First, changes in earnings estimates and recommendations ultimately affect market valuations, which in turn affect a firm’s ability to raise capital, its compensation pol-icies, and its future acquisition strategies.

Second, recommendations and comments materially affect a firm’s reputation in the business community. Analysts have always had an important behind-the-scenes role in making or breaking reputations. They can, for example, serve as respondents in Fortune magazine’s annual corporate reputation survey, which identifies “Ameri-cas most admired corporations” more recently, they have taken on a more public role, with personalities such as Abbey Joseph Cohen and Ralph Acampora gaining celebrity-like status by appearing on television, most prominently CNNs money line and the CNBC financial network. By influencing reputation, analyst affect a firm’s ability to raise capital, attract better employees, and charge premium prices for its products and services. (Kuperman, 2002)

Most firms communicate with analysts and other investors regularly as part of their inves-tor relations (IR) programs. According to Petersen and Martin (1997), only a minority of firms has a separate IR department; however, every firm has someone responsible for in-vestor relations. In smaller firms, the CEO of CFO may be solely responsible for it.

3.8 Communication between Management and Analysts

A variety of issues pertain to the content of communications between managers and ana-lysts, including finding the appropriate level of disclosure, providing quantitative data and providing qualitative information that supports the strategy. All centers on the basic ques-tion of how to focus communicaques-tions with analysts and what informaques-tion to include (Ku-perman, 2002).

3.8.1 Finding the Appropriate level of Disclosure

In fundamental valuation analysis, analysts examine such factors as macroeconomic influ-ences, industry effects and company information with the intent of constructing financial models to determine a firm’s intrinsic value. They need a variety of quantitative data and qualitative information to run their financial models, and they depend heavily on firms for most of their information.

A natural tension exits between a firms desire to provide analysts with full information and the need to be careful about its level of disclosure. Although analysts tend to want more disclosure than firms often provide, the firms are reluctant to disclose forward-looking in-formation to competitors. Firms use corporate communications to “signal” to other firms in their competitive environment, and communications intended for analysts may interfere with this “signaling” process. Firms must be careful not to provide stockholders with am-munition for lawsuits. A recent example of this is the lawsuits against the mobile company Ericsson (http://money.cnn.com). Skinner (1997) state this situation where he discusses the possibility of such lawsuits of a firm is deemed by some shareholders to have misled the market through optimistic disclosures. By being more pessimistic or not disclosing at

3.9 Herd Behavior in Financial Markets

In the aftermath of several widespread financial crises, “herd” has again become a pejora-tive term in the financial lexicon. Investors and fund managers are portrayed as herds that charge into risky ventures without adequate information and appreciation of the risk-reward, trade-offs and, at the first sign of trouble, flees to safer havens. Some observers express concern that herding by market participants exacerbates volatility, destabilizes mar-kets, and increases the fragility of the financial system. Bikhcandani & Sharma (2001) raises the questions about why it is surprising that profit-maximizing investors, increasingly with similar information sets, react similarly at more or less the same time. And is such behavior part of market discipline in relatively transparent markets, or is it due to other factors? For an investor to imitate others, she must be aware of and be influenced by others actions. In-tuitively, an individual can be said to herd if she would have made an investment without knowing other investors decisions, but does not make that investment when she finds that others have decided not to do so. Alternatively, she herds when knowledge that others are investing changes her decision from not investing to making the investment.

There are several reasons for a profit/utility-maximizing investor to be influenced into re-versing a planned decision after observing others.

First, others may know something about the return on the investment and their ac-tions reveal this information.

Secondly, and this is relevant only for money managers who invest on behalf of others, the incentives provided by the compensation scheme and terms of em-ployment may be such that imitation is rewarded. A third reason for imitation is that individuals may have in intrinsic preference for conformity. (Bikhcandani & Sharma, 2001)

When investors are influenced by others decisions, they may herd on an investment deci-sion that is wrong for all of them. Bikhcandani & Sharma, (2001) gives a good example on how it may look like:

Suppose that 100 investors each have their own assessments, possibly different, about the profitability of investing in an emerging market. For concreteness, suppose that 20 of the investors believe that this investment is worthwhile and the remaining 80 believe that it is not. Every investor knows only her own estimate of the profitability of this investment; she does not know the assessments of others or which way a majority of them are leaning. If these investors pooled their knowledge and assessments, they would collectively decide that investing in the emerging market is not a good idea. But they do not share their informa-tion and assessments with each other. Moreover, these 100 investors do not take their in-vestment decisions at the same time. Suppose that the first few investors who decide are among the 20 optimistic investors and they make a decision to enter the emerging market. Then several of the 80 pessimistic investors may revise their beliefs and also decide to in-vest. This, in turn, could have a snowballing effect, and lead to most of the 100 individuals investing in the emerging market. Later, when the unprofitability of the decision becomes clear, these investors exit the market. (Bikhcandani & Sharma, 2001)

The above example illustrates several aspects of information cascades or herd behavior arising from informational differences:

First, the actions (and the assessments) of investors who decide early may be crucial in determining which way the majority will decide.

Second, the decision that investors herd on may well be incorrect.

Third, if investors take a wrong decision, then with experience and/or the arrival of new information, they are likely to eventually reverse their decision staring a herd in the opposite direction. This, in turn, increases volatility in the market. According to the definition of herd behavior given above, herding results from an obvious intent by investors to copy the behavior of other investors.

Even though the subject of herding is not the topic of this paper, clarifying its existence and outcome gives a wider perspective to the importance of analysts’ pr-strategy.

3.10 The need of a Marketing/PR Strategy

3.10.1 The Link between Marketing and Financial departments

Every business needs financing, whether through equity stakes or liabilities. The better the communication with actual and potential investors and creditors – the better the chances to “sell” the ideas of proposed projects. The essential precondition for successful communica-tion is to speak in terms familiar to the other side. Consequently, marketing strategy, as it lies at the heart of any business project, should ultimately be expressed in key financial per-formance variables. This is strengthening by Uzelac and Sudarevic (2006) where they state that the same is valid for internal relations between people from the marketing department – and finance and top management. In short, what we do is inseparable from why we do it. They elaborate that both in industry and within the field this simple and logical chain of statement has not yet been widely and fully accepted. In their preliminary literature over-view and by personal experience, it is indicated the existence of certain problems in this re-gard. Among them, the most critical probably are:

Negative attitudes of marketers about the language of financial variables,

Conflicting paradigms of people from marketing (“keep the customer”) and finance (“keep the investor”),

Unrealistic assumptions of academic models. (Uzelac and Sudarevic, 2006)

3.10.2 Changes in Marketing Strategy within the Banking Sector

Uzelac and Sudarevic (2006), also state that the key chain of drivers that directs the changes are as follows:

The greater the intensity of competition, and the greater the requirements and challenges from customers – the greater the importance of both market exper-tise and financial aspects of marketing strategies.

The greater the importance of market expertise- the greater the role of bank marketing

Under the condition of high and increasing importance of financial perfor-mance, and the greater the role of marketing – the stronger the link between marketing strategy and financial performance.

Although each part of this chain of statements deserves to be the object of a brief over-view, it seems that the first one is the most important – because it contains the base for the opportunity. The other two propositions just focus on the ability of people from marketing to exploit them. Uzelac and Sudarevic (2006) emphasize the importance of following the long-term trends, it is reasonable to predict an increasing intensity of competition. It would probably be the outcome of the converging phenomena of deregulation, monetary integra-tion, international openness and fragmented structure. Non-banking entities, like savings associations, mutual funds, insurers and financial subsidiaries of industrial giants, are at-tacking successfully, too.

On the basis of all these expected changes, it could be concluded that under the impact of converging pressure from competitors and customers:

The task of attracting and keeping clients will require more sophisticated mar-ket expertness and

Any proposed strategy becomes more exposed to detailed financial perfor-mance analysis. (Uzelac and Sudarevic, 2006)

Consequently, as the customer is at the heart of marketing expertise, the marketing de-partment at the institutions has the opportunity to take an active role in banks strategic op-erations.

In this chapter the empirical findings gathered from statistical research at Cision AB’s concerning online publications, and the information from the interviews and personal communication with both the broadcast-ing companies and the financial institutions are presented. The information is presented in an interestbroadcast-ing and enthusing way for the reader.

4

Empirical Findings

The Empirical findings are based on primary data and qualitative data. The primary data is collected directly from broadcasting companies and Cision, a media analysis company. In the qualitative data section of this chapter, interviews with key-personnel on the financial institutions and media companies are presented. The purpose is to provide statistics over the media appearance for financial institutions in Sweden. First, the television media statis-tics are presented, including Sveriges Televison (SVT), TV4 and TV8, followed by online publications statistics and last the interviews with key-personnel.

4.1 Television Media

Sveriges Televison (SVT)

As a state-owned broadcasting company, SVT has a policy of distributing their airtime, with respect to financial analysis, equally over the institutions. The average air time for the financial participants at SVT is between 1.20 and 1.32 minutes long.

Through manual searches in SVT’s archives, it was possible to retrieve statistics in the fol-lowing diagrams.

Figure 3 SVT statistics Aug- Nov

Figure 3, represents the financial institutions share of media appearance at the public ser-vice television company SVT. Only eight out of eleven financial institution (the sample population represent 11 institutions), were represented on air at SVT during the research

cial bank, Nordea, was one of the institutions that did not appear at all. Swedbank together with SEB hold more than 60 % of total media appearance at SVT. One of Sweden’s largest banks, SHB, only had 5 % of total media appearance. Two larger competitors, the financial research institution Cheuvreux and the online broker Nordnet had almost 25 % of total media appearance at SVT.

Figure 4 SVT statistics Aug- Nov 2

Figure 4 above shows the total number of times SVT used different financial institutions as part of their business news, with respect to each month of the period. As mentioned before, the air time is highly dominated by Swedbank and SEB, Cheuvreaux is also fairly active. SHB, one of the largest banks in Sweden appears only in two months and with less than two appearances, which is very surprising. Even more interesting, two financial instituions in the sample population, Kaupthing and Nordea, does not appear one single time.

TV4

Figure 5 TV4 statistics Aug- Nov

Figure 5 above depicts a diagram showing the different financial instituions share of media appearance in the television channel TV4 during the period of August through to the 26 of November 2007. SEB holds more than 25 percent of the total media appearance. Swedbank and Nordea follows, with an appearance of 14 percent, Avanza and SHB trails closely behind them with 12 percent. These five financial institutions are the main actors at TV4, but both Nordnet and Redeye are challengers with 7 percent.

Figure 6 TV4 statistics Aug- Nov 2

Figure 6 depicts a diagram showing the number of times each financial institution appeared on the business news giving expert opinions for TV 4 during the period from August

financial instituion for an expert opinion. They reported on various financial issues ranging currency, interest rates to the issues concerning the stock exchange. The same goes for the other actvie financial institutions, they participated in news concerning various topics within the financial world. Since TV4 is airing news several times everyday, some financial institutions participated more than once on the same day, reported on different topics.

TV8

Figure 7 TV8 statistics Aug- Nov

In diagram 7 above statistics from the financial institutions media appearance share in TV

8 for the period of August 1 through to the 26 of November. Swedbank and SEB is dominating with a share of 21 respective 19 percent. SHB is trailing close behind with 16 percent.

Figure 8 TV8 statistics Aug- Nov 2

The number of appearances each financial institution have made during the period of the 1 of August to the 26 of November is presented in the diagaram of figure 8 above. Unlike the other two TV channels presented above, the participation of the various financial institutions is more equal. It is only Avanza that did not participate at all of the financial instutions.

4.2 Statistics Summary TV Media

Figure 9 TV media statistics Aug- Nov

The total TV media coverage for financial institutions is represented in figure 9 above. Swedbank and SEB are huge participants and covers almost 50 % of total TV media ap-pearance. The two other commercial banks, SHB and Nordea cover approximately 20 %.

The other financial institutions cover quite even parts of the media, where Redeye shows a striking 7 % of total TV media coverage.

Figure 10 TV media statistics Aug- Nov 2

Figure 10 above reprsent the total number of appearences for the financial institutions in the TV media. SEB and Swedbank are participating 96 times during August through November out of a total of 202 media appearances. SHB and Nordea are behind, but still with 41 appearences in total.

4.3 Statistics Online Publications

During the research period, the four major commercial banks in Sweden got 70 % online media coverage in total as can be seen in figure 11 above. Of the large commercial banks, SHB’s media appearance is substantially less than the other commercial banks which also were true in the TV media. Kaupthing, the islandic investment bank, shows an impressive 9 % total online media coverage. The other five financial institutions represent a media coverage between 3 and 6 % each which is illustrated below.

Figure 12 Statistics summary online Aug- Nov 2

Figure 12 above is an summary of the number of articles the different financial instituions are active in. Some articles does not excludingly contain comments from only one financial instituion, instead it is more common that multiple financial institutions are participating in the same article. For the most financial institutions, they are equally active from month to month. Excluding SEB, Nordea and Swedbank from previous statement, where there seem to be a pattern showing, where they give and take from eachother. In other words, if Nordea is increasing, Swedbank is decreasing.

4.4 Statistics Summary Total Media

Figure 13 Total media statistics Aug- Nov

The total media statistics found in the research are illustrated in figure 13. This diagram represent all the television media as well as all the online publications. The four major commercial banks in Sweden stands for 70 % of total media coverage. Nordea and SHB holds much less media coverege than the other two commercial banks though. Avanza, Kaupthing, Nordnet and Redeye all got 5 % media coverage each while Cheuvreux and Kaupthing holds 4 % each.

4.5 Personal Communication- Broadcasting Companies

SVT uses a flagging system, which shall alert when a certain financial institution has been asked for expert reports several times in a row, or been participating exceptionally often during a period of time. In these cases, Ms. Römer asks the reporters to choose a different institution. However, the system is not based on any statistics. It is rather determined by when Ms. Römers’ intuition and reflection over that certain institution has been appearing too often on air.

The media companies have a broad audience to please and entertain and therefore strive to obtain expert analysis from participants that appeal to this audience. Despite SVT’s policy on equal airtime for the institutions, Sabine Römer claims that certain representative’s works better in the media format than others. The access to analysts is also important since covering financial news means short deadlines. Both of these two factors play an important role in choosing which analysts will be used. She also highlight the fact that different banks niche themselves in different areas of the financial market and the media companies knows this, thus the choice of an analyst for a given news is narrowed down. Rafaela Lindeberg (personal communication, 2007-11-27), at TV4, takes the argument further by stating that charisma and access to the analyst is key issue. At TV4 and TV8 they do not have to take any policy of equality into consideration as the state-owned SVT.