MASTER THESIS IN APPLIED MATHEMATICS

MMA891 Degree Project in Mathematics

Pricing European Call Option

in Scott’s Stochastic Volatility Model

by

Hailong Zhao

S.M. Nazmul Hoque

Masterarbete i matematik/tillämpad matematik

Med inriktning i Financial Engineering

DIVISION OF APPLIED MATHEMATICS

MÄLARDALEN UNIVERSITY

DIVISION OF APPLIED MATHEMATICS

_____________________________________________________________________

Master Thesis in Mathematics / Applied Mathematics

Date:

2010-06-10

Project name:

Pricing European Call Option in Scott’s Stochastic Volatility Model

Author:

Hailong Zhao and S.M. Nazmul Hoque

Supervisor:

Anatoliy Malyarenko

Examiner:

Anatoliy Malyarenko

Comprising:

30 ECTS credits

_____________________________________________________________________

DIVISION OF APPLIED MATHEMATICS

MÄLARDALEN UNIVERSITY

Abstract

In this paper, we derive pricing equations for the European call option under

Scott’s stochastic volatility model and achieve a price for the European call

option by creating a JAVA applet. Through certain times of simulating we can

observe the tendency of the options price, as a result, which it can provide the

necessary data for implementing the optimal strategies of investment.

Acknowledgement

During the period of writing our master thesis we have learned many useful

skills and knowledge in different aspects, such as programming and research

abilities. Specially thanks for the help and encouragement from our supervisor

Anatoliy Malyarenko, so we can finish our master thesis perfectly. Overall, we

are grateful to all our professors, teachers and friends in Mälardalens University

for giving us knowledge and wonderful studying time.

Västerås May 27

th, 2010

Content

Introduction ... 6

1. Scott’s Stochastic volatility model ... 8

2. Deriving Solution Procedure ... 9

3. User’s Guide of JAVA Applet ... 16

4. Numerical Results and Analysis ... 20

Conclusion ... 32

Reference ... 33

Introduction

The goal of this paper is to calculate the price of European call option under the

Scott’s stochastic volatility model, as well as its implementation in a JAVA

applet. Some basic concepts concerned are introduced below:

Definition 1: An option

is a contract that gives the holder the right, but

not the duty, to make a specified transaction, to buy (for a call option) or

sell (for a put option) a specific amount of a given stock, commodity,

currency, index, or debt, at a specified price (the strike price) during a

specified period of time.

According to the different exercised date, options can be ranged to European

option and American option and so on. European options can only be exercised

at the expiry date of the option; however, American options can be exercised at

any time between the purchase date and the expiration date. According to the

right of owner options can be ranged to call option and put option. In this paper

we concern European call option.

Definition 2: Stochastic volatility model is used in the field of

Mathematical finance to evaluate derivative securities, such as options.

The name derives from the models' treatment of the underlying security's

volatility as a random process and governed by state variables, such as the

price level of the underlying security. The tendency of volatility to revert

to some long-run mean value, and the variance of the volatility process

itself among others.

As we known, the famous and major model to deriving price of the option is the

Black-Scholes model. However, the application of this model is clumsy in real

options trading because it is under the assumptions of no dividend payment,

constant volatility, and a constant interest rate. By this means, stochastic

volatility model is one approach which can resolve a shortcoming of the

Black-Scholes model. In particular, this model assumes that the underlying volatility is

constant over the life of the derivative, and unaffected by the changes in the

price level of the underlying security.

In the former parts of this paper, we will focus on introducing and deriving the

Scott’s stochastic volatility equation, furthermore, calculate the results of this

model to pricing the European call options. Then we adopt a JAVA applet to

simulating and pricing the numerical result of options.

The structure of this paper is organized as following: the first section provides a

brief description of Scott’s stochastic volatility model; in the second section

deriving method will be presented; then in the third section solutions will be

given by calculating; section 4 is the JAVA applet user guide and the last not the

least section 5 is about numerical results and analysis part.

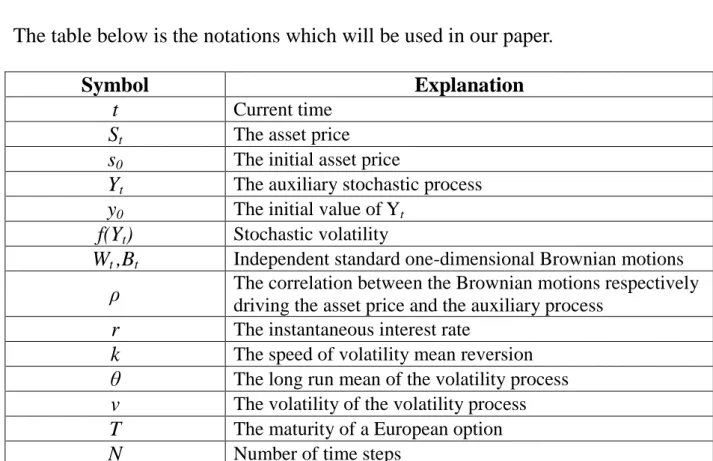

The table below is the notations which will be used in our paper.

Symbol

Explanation

t

Current time

S

tThe asset price

s

0The initial asset price

Y

tThe auxiliary stochastic process

y

0The initial value of Y

tf(Y

t)

Stochastic volatility

W

t,B

tIndependent standard one-dimensional Brownian motions

ρ

The correlation between the Brownian motions respectively

driving the asset price and the auxiliary process

r

The instantaneous interest rate

k

The speed of volatility mean reversion

θ

The long run mean of the volatility process

v

The volatility of the volatility process

T

The maturity of a European option

N

Number of time steps

Table 1 List of Notations

1. Scott’s Stochastic volatility model

In order to evaluate derivative securities, such as options, the stochastic

volatility model is used as an approach to resolve the shortcoming of the

Black-Scholes model. It derives from how the underlying security's volatility as a

random process to be governed by state variables, such as the price level of the

underlying security and the tendency of volatility to revert long-run mean value,

as well as the variance of the volatility process itself.

In our paper, we focus on Scott’s study in pricing European options. The Scott’s

stochastic volatility model has the general form as below

0 0 0 0 2,

)

(

)

(

0

),

1

(

)

(

y

Y

dW

Y

σ

dt

Y

b

dY

s

S

dB

ρ

dW

ρ

S

Y

f

dt

rS

dS

t t t t t t t t t t

(1.1)

Where r is the instantaneous interest rate, and B

tand W

tare independent

standard one-dimensional Brownian motions, ρ is the correlation between the

Brownian motions and the process Y

t, f is transformation function with value e

y

,

b(y) is a function about the speed of volatility mean reversion with the long run

mean of the volatility process and value of auxiliary stochastic process which

equal to k (θ – y), and volatility function σ (y) = v.

Through Scott’s stochastic volatility model we can calculate the price of an

European option with good convergence properties while we assume that

functions f , σ and b are smooth in return when we construct and analysis simple.

2. Deriving Solution Procedure

Through five steps we can derive and calculate European option price. In these

five steps we describe how to derive the model and find solutions for the model.

First, our main idea is to make a rotation of stochastic integral involving the

common Brownian motion W

tin the model. Then we use Itô’s formula to

achieve the new form of model without common Brownian motion W

t. Next

deriving the solution for the equation of model which we obtain after Itô’s

formula and then construct a discretization scheme in order to allow for a weak

convergence on the whole trajectory order one and avoid simulating the iteration

of stochastic integrals.

Step 1 We make (1.1) logarithmic change of variables for the asset: X

t= lnS

t.

After arrangement the model has the form (2.1) below

0 0 0 0 2 2,

)

(

)

(

)

ln(

),

1

)(

(

)

2

/

)

(

(

y

Y

dW

Y

σ

dt

Y

b

dY

s

X

dB

ρ

dW

ρ

Y

f

dt

Y

f

r

dX

t t t t t t t t t(2.1)

Here we use the asset price process X

tto substitute the stock price.

Step 2 Then we define the primitive F(y) as

F

y

yf

σ

y

y

dy

0(

)

)

(

)

(

(2.2)

From ( 2.2), we can calculate F(y) by

y y y y y ye

v

v

dy

e

v

dy

y

f

y

σ

dy

y

f

y

F

0 0 0 01

)

(

)

(

)

(

)

(

(

1

)

1

)

(

1

0

y ye

v

e

e

v

(2.3)

Step 3 Now it is the most important step that we apply Itô’s formula to (2.1).

In terms of the Itô process (2.4) and a new process (2.5)

dY

μ

(

Y

t,

t

)

dt

σ

(

Y

t,

t

)

dW

t(2.4)

Y

(

t

)

f

(

Y

(

t

),

t

)

(2.5)

We can obtain

dY

μ

y

dt

σ

y

dw

t

(2.6)

Then we apply

Itô formula to (2.6), we can have

t

dW

y

f

σ

dt

σ

y

f

μ

y

f

t

f

dF

2 2 22

1

(2.7)

Since we know

)

1

(

1

)

,

(

)

(

)

,

(

)

(

)

,

(

e

y

v

t

y

f

y

σ

t

y

σ

y

b

t

y

μ

Then we can calculate first and second derivative the function

f(y,t) with

respect to y.

y

e

v

y

f

1

y

e

v

y

f

1

2

2

And we can substitute

y

f

and μ

to (2.7) and then we can get

(

)

1

y

σ

e

v

σ

y y

So that the formula becomes

t

e

σ

y

dW

tv

dt

y

σ

y

b

e

v

Y

dF

y y)

(

1

)

(

2

1

)

(

1

)

(

2

(2.8)

Continue to simplify (2.8) with previous value of f(y) and σ (y) in (1.1)

dt

y

f

y

σ

dY

y

σ

y

f

dt

y

σ

dY

y

σ

y

f

dW

y

σ

dt

y

σ

dt

y

b

y

σ

y

f

Y

dF

t t t t t t t t t t t)

(

)

(

2

1

)

(

)

(

)

(

2

1

)

(

)

(

)

(

)

(

2

1

)

(

)

(

)

(

)

(

2 2

(2.9)

Since

(

)

)

(

)

(

)

(

)

(

)

(

)

(

2 t t t t t t t yy

σ

y

f

y

σ

y

σ

y

f

y

σ

y

f

v

e

So that

σ

Y

dY

σ

Y

f

Y

f

Y

σ

Y

dt

Y

f

Y

dF

t t t t t t t t(

(

)

'

(

)

(

)

'

(

))

2

1

)

(

)

(

)

(

(2.10)

We substitute (2.10) into (2.1), therefore the model becomes

0 0 0 0 2,

)

(

)

(

)

ln(

),

(

)

(

1

)

(

)

(

y

Y

dW

Y

σ

dt

Y

b

dY

s

X

t

dB

Y

f

ρ

dt

Y

h

Y

dF

ρ

dX

t t t t t t t t(2.11)

Where

(

(

)

'

(

)

(

)

'

(

))

2

1

)

(

)

(

)

(

)

(

2

1

)

(

2σ

y

f

y

f

y

σ

y

y

σ

y

f

y

b

ρ

y

f

r

y

h

(2.12)

Furthermore, since we know

y y

e

y

f

v

y

σ

y

θ

k

y

b

e

y

f

)

(

)

(

),

(

)

(

,

)

(

Then we can get

/

2

(

)

/

2

)

(

2 y y yve

v

e

y

θ

k

ρ

e

r

y

h

(2.13)

Now we change this model (2.11) equation without common Brownian motion

W

t,where this equation expressed by k and θ are strictly positive constant, which

are the speed of volatility mean reversion and the long run mean of the volatility

process respectively. Then we can figure out solutions of our model by

integrating the first equation in (2.11).

Step 4 After integrating the first equation in (2.11) we have the following

solution for the model:

s t s t s t t

s

ρ

F

Y

F

y

h

Y

ds

ρ

f

Y

dB

X

0 0 2 0 0)

(

(

)

(

))

(

)

1

(

)

ln(

(2.14)

As we can see from (2.14), there are only two integrals left which respect to

time which can be treated by the use of a trapezoidal scheme and a stochastic

integral which is independent of the Brownian motion.

If we let

δ

N

T

/

N

be the discretization step and for any function V, we define

ys

v

ds

y

v

ζ

0(

)

)

(

and

(

,

)

(

(

))

1y

v

ζ

t

ζ

y

t

v

η

V

where

ζ

is a primitive of 1/v, and then the solution can be written as

η

.

Within this step we can calculate

η

v

(

t

,

y

)

and

η

v

0(

t

,

y

)

, where

V

(

s

)

σ

(

s

)

and

V

0(

s

)

b

(

s

)

σ

(

s

)

σ

'

(

s

)

/

2

Since we know

V

(

s

)

σ

(

s

)

v

y

vx

x

v

y

v

ds

y

v

ζ

y

0)

(

and

ζ

v

x

vx

)

(

1Then, we can obtain that

vt

y

v

y

t

ζ

y

v

ζ

t

ζ

y

t

v

η

V V

)

(

))

(

(

)

,

(

1 1(2.15)

As well as, from

V

0(

s

)

b

(

s

)

σ

(

s

)

σ

'

(

s

)

/

2

k

(

θ

s

)

We can calculate

xk xk xk y y y y

e

e

θ

y

e

y

θ

θ

kx

y

θ

θ

x

y

θ

θ

k

θ

k

y

θ

k

s

θ

k

s

θ

ds

k

s

θ

k

ds

s

v

ds

y

v

ζ

)

1

(

ln

ln

1

ln

1

)

ln(

1

)

(

ln

1

1

)

(

)

(

)

(

0 0 0 0 0 0

Finally, we can derive inverse

ζ

0

(

)

(

1

)

1 xke

θ

x

v

ζ

(2.16)

Then substitute (2.16) into the equation ηv

0(t,y),

(

)

1

1

1

)

ln

1

(

))

(

(

)

,

(

ln ) ln 1 ( 1 0 1 0 0y

θ

e

θ

y

θ

θ

e

θ

e

θ

e

θ

y

θ

θ

k

t

ζ

y

v

ζ

t

ζ

y

t

v

η

xt xt y θ θ xt y θ θ x t x V V

(2.17)

At last, we get the solutions for the volatility of time and the initial value of the

auxiliary stochastic volatility. In final step we figure the discretization scheme of

Y

twhich is an auxiliary stochastic process and apply to the JAVA programming

in order to calculate asset price accurately.

Step 5 The discretization scheme of Y has the form as below.

0 0

y

Y

N

1

0

))),

,

2

(

0

,

(

,

2

(

0

1 1

Y

k

N

N

T

v

η

W

W

v

η

N

T

v

η

Y

t t tN N t k k k kAs well as the discretization scheme of X has the form

G

v

ρ

m

y

F

Y

F

ρ

s

X

TN N T N T N T

ln(

0)

(

(

)

(

0))

(

1

2)

where

1 0 12

))

(

)

(

N k N t N t N N T k kY

h

Y

h

δ

m

1 0 1 2 22

))

(

)

(

N k N t N t N N T k kY

f

Y

f

δ

v

And G is a standard normal random variable. Furthermore,

X

TNis a Gaussian

random variable with mean

TNN T

F

y

m

Y

F

ρ

s

)

(

(

)

(

))

ln(

0 0and variance

(

1

ρ )

2v

TNconditionally on

k N N tkY

0 .3. User’s Guide of JAVA Applet

A JAVA applet is designed to calculate the European call option and the

simulating price graph is plotted as well. Within this JAVA applet we

programmed different financial and mathematical parameters in order to input

data to calculating different results. The applet layout consists of Input, Control

and Output panels.

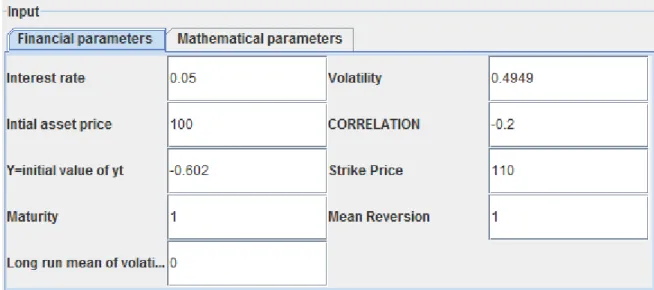

3.1 Input Panel

The input panel contains two parts which are Financial and Mathematical

Parameters. They are shown as below:

Figure 3.1.1 Input Financial Parameters

For all input data values into a field should satisfy the type of input value which

is programmed. If a wrong type of data is input, an error warning window will

emerge and the value of this field will return to default automatically. For

example, if a negative number is entered into the interest rate field, the error

dialog window will show up as Figure 3.1.3.

Figure 3.1.3 Interest Rate Error Dialog

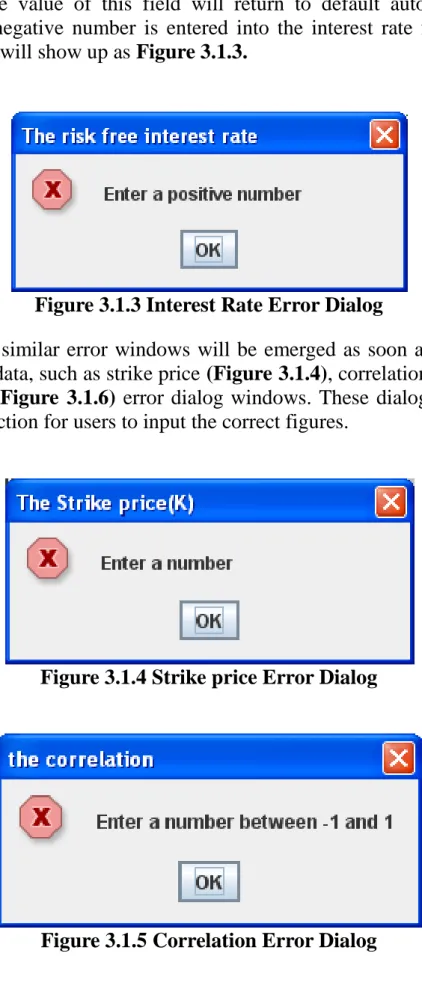

Other kinds of similar error windows will be emerged as soon as users enter a

wrong type of data, such as strike price (Figure 3.1.4), correlation (Figure 3.1.5)

and time step (Figure 3.1.6) error dialog windows. These dialog windows can

provide a protection for users to input the correct figures.

Figure 3.1.4 Strike price Error Dialog

Figure 3.1.6 Time Steps Error Dialog

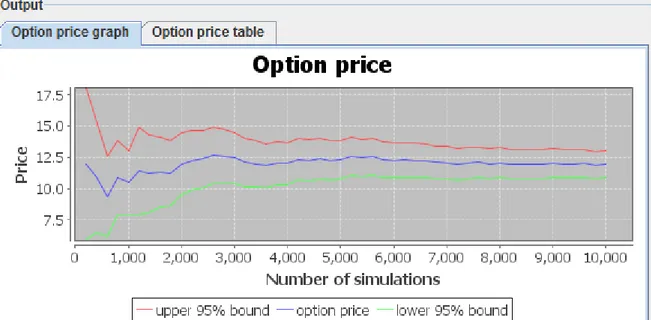

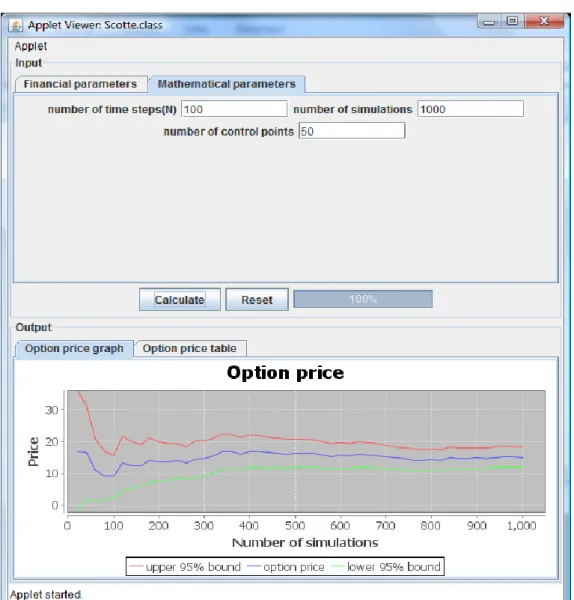

3.2 Control and Output Panels

A Calculate button and a Reset button lay on the control panel. After users input

data they can press the Calculate button to calculate the results of price and

press Reset button to return default value. After calculating option price, a

simulating price graph will show in the output panel (Figure 3.2.1) as well as

the option price table will emerge (Figure 3.2.2), as following:

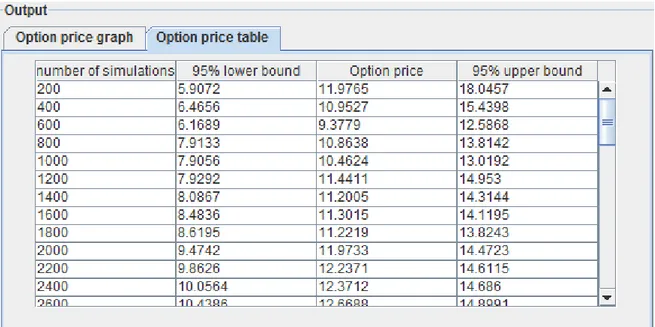

Figure 3.2.2 Option Price Table

The prices on this table are classified by the control points of number of

simulations. The lower price bound and upper price bound are listed as well.

Besides, both lower and upper bound are plotted in the option price graph.

4. Numerical Results and Analysis

In this section we examine the different parameters of calculation of European

option pricing. Through changing parameters we can analysis different

numerical results and provide us data to predicting the price of options.

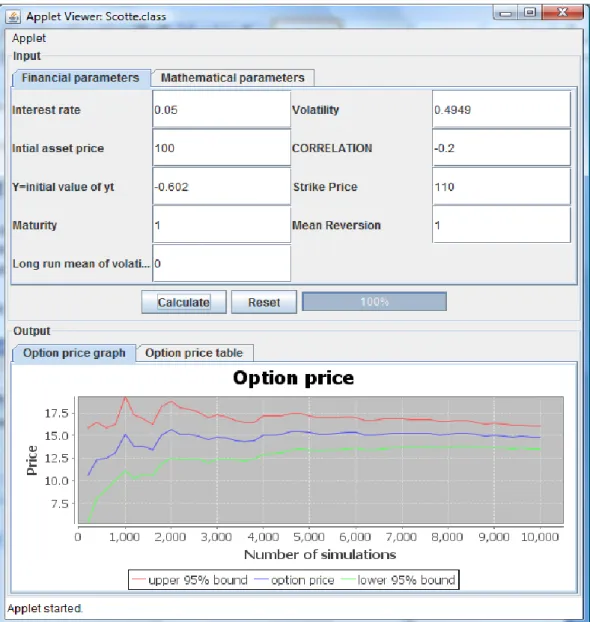

CASE 1 Increase Interest Rate (г)

In this case we only increase interest rate and remain others parameter same in

order to figure out the effect of changing interest rate. The flowing option price

with certain amount of simulation is obtained on interest rate is 0.05:

Figure 4.1.2 Mathematical Parameters of JAVA Applet

Figure 4.1.3 Option Price Table with Interest Rate 0.05

As we can see from output, we have different option price which is blue line in

(4.1.1) after different times of simulation. And the more times of simulating, the

less fluctuation of option price. As well as we give the upper and lower bound

which are red and green line respectively in (4.1.1).

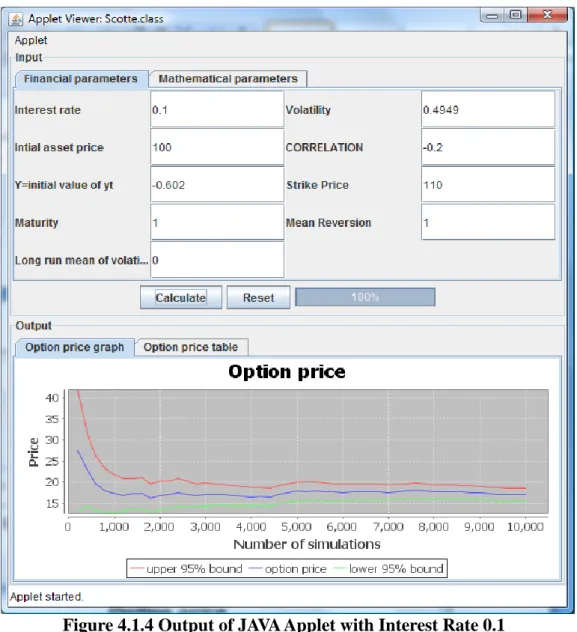

Figure 4.1.4 Output of JAVA Applet with Interest Rate 0.1

We can see from figure 4.1.4 and figure 4.1.5 that when the interest rate

increases the option price increase as well. In order to observe the change of

increasing interest rate we make once more calculate which increasing the

interest rate to 0.5 and others parameters obtained.

Figure 4.1.6 Output of JAVA Applet with Interest Rate 0.5

As we can see, the option price increases sharply when the interest rate increase.

In the market investors purchase call option and make more profit while interest

rate increase.

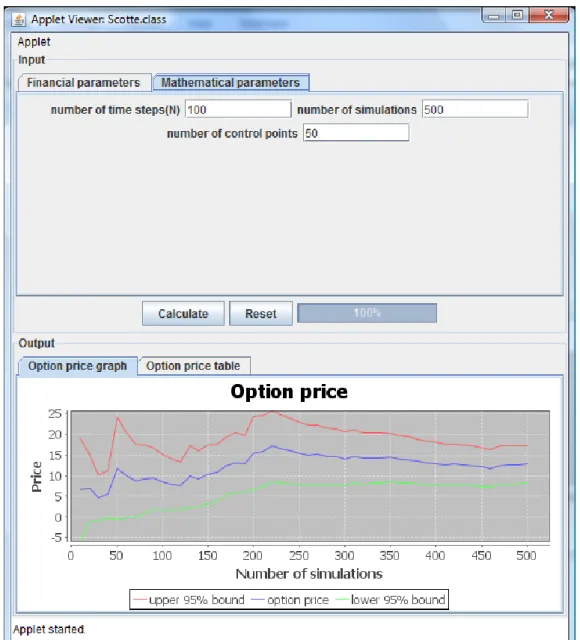

CASE 2 Increase Numbers of Simulation (N):

The number of simulations can affect the accuracy of the option price. With the

certain number of simulating the option price curve tend to be even and closed

to the mean of real option price. Then we use four numbers 500, 1000, 5000 and

10000 to test the result of simulations.

When we simulate for 100

When we simulate for 1000

Figure 4.2.2 Result of 1000 Simulations

From figure 4.2.1 and figure 4.2.2 we can observe the curve of option price

becomes even in figure 4.2.2 which is unlike the fluctuant curve in figure 4.2.1.

Then we do more tests with large number of simulation.

When we simulate for 5000

Figure 4.2.3 Result of 5000 Simulations

When we simulate for 10000

Figure 4.2.4 Result of 10000 Simulations

According to our tests, we can observe that the curve becomes even which that

means the option price is quite closed to the real price.

Case 3: Change Volatility (σ):

What will happen if we change the volatilities? We test the different value of

volatilities and to see what happen for the option price.

Calculate for Volatility is 0.60:

Figure 4.3.1 Result of Volatility 0.60

Option price for volatility 0.90:

Figure 4.3.3 Result of Volatility 0.90

Figure 4.3.4 Option Price Table for Volatility 0.90

Repeat to test some others value of volatility we create an inductive table as

below:

Volatility

Call Option prices

0.4949

15.4113

0.60

17.1398

0.70

21.3289

0.80

24.9266

0.90

27.5769

From the table 4.3.1 we can easily see that option price increase with the value

of volatility increase. Since the market becomes risky, inventors have bigger

chance to make profit than in a stable market.

CASE 4 Change of Correlation (ρ):

We know the correlation ρ

[-1, 1]

is between the Brownian motions respectively

driving the asset price and the auxiliary process. In this case we examine the

sensitive of change of option price with correlation.

When the correlation is -0.7

When the correlation is -0.2

Figure 4.4.2 Option Price when correlation is -0.2

When the correlation is 0

When the correlation is 0.5

Figure 4.4.4 Option Price when correlation is 0.5

As we can see from these four figures, the price is low when the correlation is

less than zero since the asset price has inversely correlated with the auxiliary

process. With the correlation increase the option price increase as well.

Furthermore, the increase of option price is sharp which this means investors

can have a good payoff when the correlation more than zero.

Conclusion

In this paper, we use Scott’s stochastic volatility model to price European call

option through applying JAVA programming. Through deriving the model

expression we explain the characteristic of this model with strong convergence.

With the implementation of JAVA applet, option price can be visible in a graph

and a price table with different parameters. The analysis for changing different

parameters shows how sensitivity of option price changing with parameters,

such as the option price increase sharply when the correlation ρ more than zero.

To conclude, we should mention that this model assumes that the underlying

volatility is constant over the life of the derivative, and no effect by changing in

the price level of the underlying security.

Reference

High order discretization schemes for stochastic volatility models

By Benjamin Jourdain and Mohamed Sbai arXiv:0908.1926v2 [math

.PR]Efficient Simulation of the Heston Stochastic Volatility Model

By Leif Andersen (January 23, 2007). Available at SSRN:

http://ssrn.com/abstract=946405

Option from

http://economics.about.com/cs/economicsglossary/g/option.htm

Last visit 2010/06/05

Stochastic volatility from

http://en.wikipedia.org/wiki/Stochastic_volatility

Last visit 2010/06/10

Itô formula from

http://www.theponytail.net/wiki/pmwiki.php/Main/ItoFormula

Appendix

JAVA Code for Pricing European Call Option

/*** @(#) Scotte.java 1.0 03/05/2010 *

* Copyright (c) 2010 Mälardalen University

* Högskoleplan Box 883, 721 23 Välterås, Sweden. * All Rights Reserved.

*

* The copyright to the computer program(s) herein * is the property of Mälardalen University.

* The program(s) may be used and/or copied only with * the written permission of Mälardalen University * or in accordance with the terms and conditions * stipulated in the agreement/contract under which * the program(s) have been supplied.

*

* Description: pricing European call option in Scott's * stochastic volatility model

* Jourdain, B., Sbai, M. High order discretization * schemes for stochastic volatility models.

* arXiv:0908.1926v1 [math.PR] 13 Aug 2009 * @version 1.0 03 May 2010

* @author S.M. Nazmul Hoque and Hailong Zhao * Mail: */ import java.awt.*; import java.awt.event.*; import javax.swing.*; import java.text.*; import java.util.*; import org.jfree.chart.*; import org.jfree.chart.axis.*; import org.jfree.chart.plot.*; import org.jfree.data.xy.*; import org.jfree.data.statistics.*;

public class Scotte extends JApplet implements FocusListener, ActionListener {

// Class variables

// Panels

private JPanel inputPanel = new JPanel(); private JPanel controlPanel = new JPanel(); private JPanel financialPanel = new JPanel(); private JPanel mathematicalPanel = new JPanel(); private JPanel outputPanel = new JPanel();

private ChartPanel graphPanel = new ChartPanel(null); private JPanel tablePanel = new JPanel();

// Tabbed panes

private JTabbedPane inputPane = new JTabbedPane(); private JTabbedPane outputPane = new JTabbedPane();

// Buttons

private JButton calculateButton = null; private JButton resetButton = null; // Progress bar

private JProgressBar bar = new JProgressBar(JProgressBar.HORIZONTAL); // Labels

private JLabel label = null; //private JLabel label1= null;

// Text fields

private JTextField interestField = new JTextField(); private JTextField volatilityField=new JTextField();

private JTextField intialassetpriceField= new JTextField(); private JTextField correlationField= new JTextField();

private JTextField initialvalueofytField = new JTextField(); private JTextField strikepriceField = new JTextField(); private JTextField maturityField = new JTextField(); private JTextField meanreversionField = new JTextField();

private JTextField longrunmeanvolatilityField = new JTextField(); private JTextField numberoftimestepsField = new JTextField(10); private JTextField numberofsimulationField = new JTextField(10); private JTextField numbercontrolpointsField= new JTextField(10);

// table model

private TableModel prices = new TableModel();

// tables

private JTable pricesTable = new JTable(prices);

// Scroll panes

private JScrollPane pricesPane = new JScrollPane(pricesTable); // Number formatter

DecimalFormat myFormatter = null; // String constants

private final String FINANCIAL = "Financial parameters";

private final String MATHEMATICAL = "Mathematical parameters"; private final String INPUT = "Input";

private final String OUTPUT = "Output";

private final String CALCULATE = "Calculate"; private final String RESET = "Reset";

private final String GRAPH = "Option price graph"; private final String TABLE = "Option price table"; private final String INTEREST = "Interest rate"; private final String VLATILITY = "Volatility";

private final String INTIALASSETPRICE="Intial asset price"; private final String CORRELATION = "CORRELATION";

private final String INITIALVALUEOFYT ="Y=initial value of yt"; private final String STRIKEPRICE ="Strike Price";

private final String MATURITY = "Maturity";

private final String MEANREVERSION ="Mean Reversion";

private final String LONGRUNMEANVOLATILITY= "Long run mean of volatility";

private final String NUMBEROFTIMESTEPS=" number of time steps(N)"; private final String NUMBEROFSIMULATION ="number of simulations"; private final String NUMBERCONTROLPOINTS="number of control points"; private final String LOWER_BOUND = "95% lower bound";

private final String UPPER_BOUND = "95% upper bound"; // Tooltips

private final String INTEREST_TOOLTIP = "The risk free interest rate"; private final String VOLATILITY_TOOLTIP= "The Volatility";

private final String INTIALASSETPRICE_TOOLTIP ="The initial asset price";

private final String CORRELATION_TOOLTIP = "the correlation";

private final String INITIALVALUEOFYT_TOOLTIP="Y=initial value of yt"; private final String STRIKEPRICE_TOOLTIP= "The Strike price(K)";

private final String MATURITY_TOOLTIP =" the Maturity date(T)"; private final String MEANREVERSION_TOOLTIP = " the mean reversion"; private final String LONGRUNMEANVOLATILITY_TOOLTIP =" the long run mean volatility";

private final String NUMBEROFTIMESTEPS_TOOLTIP ="The number of time steps";

private final String NUMBEROFSIMULATION_TOOLTIP ="the number of simulations";

private final String NUMBERCONTROLPOINTS_TOOLTIP="the number of control points";

// Error messages

private final String NOT_A_NUMBER = " Enter a number";

private final String NON_POSITIVE = " Enter a positive number"; private final String NOT_INTEGER = " Enter an integer number";

private final String NOT_A_CORRELATION = " Enter a number between -1 and 1";

// Numerical constants

private final double INTEREST_RATE = 0.05; private final double VOLATILITY_RATE=0.4949; private final double INTIALASSETPRICE_So= 100.0; private final double CORRELATION_p= -0.2;

private final double INITIALVALUEOFYT_yt=-0.602; private final double STRIKEPRICE_K= 110;

private final double MATURITY_T= 1.0;

private final double MEANREVERSION_VALUE =1.0;

private final double LONGRUNMEANVOLATILITY_VALUE=0.0; private final int NUMBEROFTIMESTEPS_VALUE=100;

private final int NUMBEROFSIMULATION_VALUE=10000; private final int NUMBER_CONTROL_POINTS = 50; // Numerical variables

private double interestRate = INTEREST_RATE; private double volatility= VOLATILITY_RATE;

private double initialassetprice =INTIALASSETPRICE_So; private double correlation = CORRELATION_p;

private double initialvalueofyt = INITIALVALUEOFYT_yt; private double strikeprice = STRIKEPRICE_K;

private double maturity =MATURITY_T;

private double meanreversion =MEANREVERSION_VALUE;

private double longrunmeanvolatility = LONGRUNMEANVOLATILITY_VALUE; private int numberoftimesteps = NUMBEROFTIMESTEPS_VALUE;

private int numberofsimulation = NUMBEROFSIMULATION_VALUE; private int numbercontrolpoints= NUMBER_CONTROL_POINTS; // random number generator

private Random generator = new Random(); // Class methods

// Initialise decimal formatter

DecimalFormatSymbols symbols = new DecimalFormatSymbols(); symbols.setDecimalSeparator('.');

myFormatter = new DecimalFormat("###.####",symbols); // get content pane

Container contentPane = getContentPane(); // set layout

contentPane.setLayout(new GridLayout(0,1)); contentPane.add(inputPanel);

contentPane.add(outputPanel);

inputPanel.setLayout(new BorderLayout());

inputPanel.setBorder(BorderFactory.createTitledBorder(INPUT)); inputPanel.add(inputPane,BorderLayout.CENTER);

inputPanel.add(controlPanel, BorderLayout.SOUTH); calculateButton = new JButton(CALCULATE);

calculateButton.addActionListener(this); controlPanel.add(calculateButton);

resetButton = new JButton(RESET); resetButton.addActionListener(this); controlPanel.add(resetButton); controlPanel.add(bar); bar.setStringPainted(true); bar.setValue(0); bar.setIndeterminate(true); inputPane.add(financialPanel,FINANCIAL); inputPane.add(mathematicalPanel,MATHEMATICAL); outputPanel.setLayout(new BorderLayout());

outputPanel.setBorder(BorderFactory.createTitledBorder(OUTPUT)); outputPanel.add(outputPane,BorderLayout.CENTER);

outputPane.add(graphPanel,GRAPH); outputPane.add(tablePanel,TABLE);

financialPanel.setLayout(new GridLayout(0,4));

label = new JLabel(INTEREST); financialPanel.add(label);

interestField.setText(myFormatter.format(INTEREST_RATE)); interestField.setToolTipText(INTEREST_TOOLTIP);

interestField.addFocusListener(this); financialPanel.add(interestField); label = new JLabel(VLATILITY); financialPanel.add(label);

volatilityField.setText(myFormatter.format(VOLATILITY_RATE)); volatilityField.setToolTipText(VOLATILITY_TOOLTIP);

volatilityField.addFocusListener(this); financialPanel.add(volatilityField);

label = new JLabel(INTIALASSETPRICE); financialPanel.add(label); intialassetpriceField.setText(myFormatter.format(INTIALASSETPRICE_So)); intialassetpriceField.setToolTipText(INTIALASSETPRICE_TOOLTIP); intialassetpriceField.addFocusListener(this); financialPanel.add(intialassetpriceField); label = new JLabel(CORRELATION);

financialPanel.add(label);

correlationField.setText(myFormatter.format(CORRELATION_p)); correlationField.setToolTipText(CORRELATION_TOOLTIP);

correlationField.addFocusListener(this); financialPanel.add(correlationField);

label = new JLabel(INITIALVALUEOFYT); financialPanel.add(label); initialvalueofytField.setText(myFormatter.format(INITIALVALUEOFYT_yt)); initialvalueofytField.setToolTipText(INITIALVALUEOFYT_TOOLTIP); initialvalueofytField.addFocusListener(this); financialPanel.add(initialvalueofytField);

label = new JLabel(STRIKEPRICE); financialPanel.add(label);

strikepriceField.setText(myFormatter.format(STRIKEPRICE_K)); strikepriceField.setToolTipText(STRIKEPRICE_TOOLTIP);

strikepriceField.addFocusListener(this); financialPanel.add(strikepriceField); label = new JLabel(MATURITY);

financialPanel.add(label);

maturityField.setText(myFormatter.format(MATURITY_T)); maturityField.setToolTipText(MATURITY_TOOLTIP);

maturityField.addFocusListener(this); financialPanel.add(maturityField);

label = new JLabel(MEANREVERSION); financialPanel.add(label); meanreversionField.setText(myFormatter.format(MEANREVERSION_VALUE)); meanreversionField.setToolTipText(MEANREVERSION_TOOLTIP); meanreversionField.addFocusListener(this); financialPanel.add(meanreversionField);

label = new JLabel(LONGRUNMEANVOLATILITY); financialPanel.add(label);

longrunmeanvolatilityField.setText(myFormatter.format(LONGRUNMEANVOLATILITY _VALUE));

longrunmeanvolatilityField.setToolTipText(LONGRUNMEANVOLATILITY_TOOLTIP); longrunmeanvolatilityField.addFocusListener(this);

financialPanel.add(longrunmeanvolatilityField);

label = new JLabel(NUMBEROFTIMESTEPS); mathematicalPanel.add(label); numberoftimestepsField.setText(myFormatter.format(NUMBEROFTIMESTEPS_VALUE)) ; numberoftimestepsField.setToolTipText(NUMBEROFTIMESTEPS_TOOLTIP); numberoftimestepsField.addFocusListener(this); mathematicalPanel.add(numberoftimestepsField); label = new JLabel(NUMBEROFSIMULATION);

mathematicalPanel.add(label); numberofsimulationField.setText(myFormatter.format(NUMBEROFSIMULATION_VALUE )); numberofsimulationField.setToolTipText(NUMBEROFSIMULATION_TOOLTIP); numberofsimulationField.addFocusListener(this); mathematicalPanel.add(numberofsimulationField);

label = new JLabel(NUMBERCONTROLPOINTS); mathematicalPanel.add(label); numbercontrolpointsField.setText(myFormatter.format(NUMBER_CONTROL_POINTS)) ; numbercontrolpointsField.setToolTipText(NUMBERCONTROLPOINTS_TOOLTIP); numbercontrolpointsField.addFocusListener(this); mathematicalPanel.add(numbercontrolpointsField);

// add column titles to the table

prices.addColumn(NUMBEROFSIMULATION); prices.addColumn(LOWER_BOUND);

prices.addColumn(PRICE);

prices.addColumn(UPPER_BOUND);

// put call table into the scroll pane

pricesTable.setPreferredScrollableViewportSize(new

Dimension(500,200));

// add it to table panel

tablePanel.add(pricesPane);

}

public void focusGained(FocusEvent e) {} public void focusLost(FocusEvent e) { // Obtain source

Object source = e.getSource(); // if interest rate field

interestRate = readPositive(interestField, interestRate, interestField.getToolTipText()); return; } // if volatility field if (source == volatilityField) { volatility = readDouble(volatilityField, volatility, volatilityField.getToolTipText()); return; }

// if initial asset price field

if (source == intialassetpriceField) { initialassetprice = readPositive(intialassetpriceField, initialassetprice, intialassetpriceField.getToolTipText()); return; } // if correlation field if (source == correlationField) { correlation = readCorrelation(correlationField, correlation, correlationField.getToolTipText()); return; }

// if the initial value of yt field

if (source == initialvalueofytField) {

initialvalueofyt = readDouble( initialvalueofytField, initialvalueofyt,

initialvalueofytField.getToolTipText());

return; }

// if the strike price field

if (source == strikepriceField) {

strikeprice = readPositive (strikepriceField, strikeprice,

strikepriceField.getToolTipText()); return;

}

// if the maturity field

if (source == maturityField){

maturity = readDouble (maturityField, maturity,

maturityField.getToolTipText()); return;

// if the volatility mean reversion field if (source == meanreversionField) { meanreversion= readDouble(meanreversionField, meanreversion, maturityField.getToolTipText()); return; }

// if the long run mean of volatility process field

if (source == longrunmeanvolatilityField){ longrunmeanvolatility= readDouble (longrunmeanvolatilityField, longrunmeanvolatility, longrunmeanvolatilityField.getToolTipText()); return; }

// if the number of time steps field

if (source == numberoftimestepsField) { numberoftimesteps= readInt(numberoftimestepsField, numberoftimesteps, numberoftimestepsField.getToolTipText()); return; }

// if the number of simulation field

if (source == numberofsimulationField){ numberofsimulation = readInt(numberofsimulationField, numberofsimulation, numberofsimulationField.getToolTipText()); return; }

// if the number of control points field

if (source == numbercontrolpointsField){ numbercontrolpoints = readInt(numbercontrolpointsField, numbercontrolpoints, numbercontrolpointsField.getToolTipText()); return; } }

private double readPositive(JTextField field, double oldValue, String title) {

boolean isOK = true; double newValue = 1; try { // test input

newValue = Double.parseDouble(field.getText()); }

catch (NumberFormatException e) { // ERROR message

JOptionPane.showMessageDialog( null, NOT_A_NUMBER, title, JOptionPane.ERROR_MESSAGE); isOK = false; }

if (newValue <= 0) { // ERROR message

JOptionPane.showMessageDialog(null, NON_POSITIVE, title, JOptionPane.ERROR_MESSAGE); isOK = false; } if (isOK) { return newValue; } else { field.setText(Double.toString(oldValue)); return oldValue; } }

private double readDouble(JTextField field, double oldValue, String title) {

boolean isOK = true; double newValue = 1; try { // test input

newValue = Double.parseDouble(field.getText()); }

catch (NumberFormatException e) { // ERROR message

JOptionPane.showMessageDialog( null, NOT_A_NUMBER, title, JOptionPane.ERROR_MESSAGE); isOK = false; } if (isOK) { return newValue; } else { field.setText(Double.toString(oldValue)); return oldValue; } }

private int readInt(JTextField field, int oldValue, String title) {

boolean isOK = true; int newValue = 100; try { // test input

newValue = Integer.parseInt(field.getText()); }

catch (NumberFormatException e) { // ERROR message

JOptionPane.showMessageDialog( null,

title,

JOptionPane.ERROR_MESSAGE); isOK = false;

}

if (newValue <= 0) { // ERROR message

JOptionPane.showMessageDialog( null, NON_POSITIVE, title, JOptionPane.ERROR_MESSAGE); isOK = false; } if (isOK) { return newValue; } else { field.setText(Integer.toString(oldValue)); return oldValue; } }

private double readCorrelation(JTextField field, double oldValue, String title) {

boolean isOK = true; double newValue = 1; try { // test input

newValue = Double.parseDouble(field.getText()); }

catch (NumberFormatException e) { // ERROR message

JOptionPane.showMessageDialog( null, NOT_A_NUMBER, title, JOptionPane.ERROR_MESSAGE); isOK = false; }

if (Math.abs(newValue) > 1) { // ERROR message

JOptionPane.showMessageDialog( null, NOT_A_CORRELATION, title, JOptionPane.ERROR_MESSAGE); isOK = false; } if (isOK) { return newValue; } else { field.setText(Double.toString(oldValue)); return oldValue; } }

private double getEta(double t, double y){ return volatility*t+y;

}

private double getEtao(double t, double y){ return longrunmeanvolatility-(Math.exp(-1*initialassetprice*t)*(longrunmeanvolatility-y)); }

return interestRate- Math.exp(2*y)-correlation*(meanreversion*

(longrunmeanvolatility-y)*Math.exp(y))/volatility+volatility*Math.exp(y)/2; }

public void actionPerformed(ActionEvent e) {

// Obtain source

Object source = e.getSource(); // if calculate button

if (source == calculateButton) { // Program mathematics

// prepare progress bar

bar.setMaximum(numberofsimulation); bar.setValue(0);

bar.setIndeterminate(false); // introduce variables

double[] y = new double[numberoftimesteps+1]; y[0] = initialvalueofyt; double w = maturity/(2*numberoftimesteps); double w1 = Math.sqrt(2*w); double m = 0; double v = 0; double z = maturity/numberoftimesteps; double l = Math.log(initialassetprice); double f = (Math.exp(y[0])-1.0)/volatility; double o = 1.0-correlation*correlation; double sampleMean = 0; double sampleVariance = 0;

int[] number = new int[numbercontrolpoints];

double[] upperBound = new double[numbercontrolpoints]; double[] estimate = new double[numbercontrolpoints]; double[] lowerBound = new double[numbercontrolpoints]; int step = numberofsimulation/numbercontrolpoints; for (int i=0; i<numbercontrolpoints; i++) {

number[i] = step*(i+1); }

// Delete old rows, if any

int rowCount = prices.getRowCount(); for (int i=rowCount-1; i>=0; i--) {

prices.removeRow(i); }

int n =0;

// simulation loop

for (int i=0; i<numberofsimulation; i++) { for (int k=0; k<numberoftimesteps; k++) {

// calculate y[k+1]

double temp = getEtao(w,y[k]);

temp = getEta(w1*generator.nextGaussian(),temp); y[k+1] = getEtao(w,temp); m += (getH(y[k])+getH(y[k+1]))/2; v += (Math.exp(2*y[k])+Math.exp(2*y[k+1]))/2; } //calculate x m *= z; v *= z; double x = l+correlation*((Math.exp(y[numberoftimesteps])-1.0)/volatility-f); x += m; x += Math.sqrt(o*v)*generator.nextGaussian();

double securityPrice = Math.exp(x);

double optionPrice = Math.max(securityPrice-strikeprice,0); sampleMean += optionPrice;

sampleVariance += optionPrice*optionPrice; if (i==number[n]-1) {

estimate[n] = sampleMean/number[n];

double variance = sampleVariance/number[n]; variance -= estimate[n]*estimate[n];

double dif = 1.96*Math.sqrt(variance/number[n]); upperBound[n] = estimate[n]+dif; lowerBound[n] = estimate[n]-dif; bar.setValue(number[n]); bar.paint(bar.getGraphics()); n++; } } // Show results // create dataset

XYSeriesCollection dataset = new XYSeriesCollection(); // create series

XYSeries upper = new XYSeries("upper 95% bound"); XYSeries price = new XYSeries("option price"); XYSeries lower = new XYSeries("lower 95% bound"); double minResult = Double.POSITIVE_INFINITY; double maxResult = Double.NEGATIVE_INFINITY; // fill series and table

for (int i=0; i<NUMBER_CONTROL_POINTS; i++) { upper.add(number[i], upperBound[i]);

if (upperBound[i]<minResult) minResult = upperBound[i]; if (upperBound[i]>maxResult) maxResult = upperBound[i]; price.add(number[i], estimate[i]);

//fielsd

if (estimate[i]<minResult) minResult = estimate[i]; if (estimate[i]>maxResult) maxResult = estimate[i]; lower.add(number[i], lowerBound[i]);

if (lowerBound[i]<minResult) minResult = lowerBound[i]; if (lowerBound[i]>maxResult) maxResult = lowerBound[i]; // add new row

Object[] row = {new String(myFormatter.format(number[i])), new String(myFormatter.format(lowerBound[i])), new String(myFormatter.format(estimate[i])),

new String(myFormatter.format(upperBound[i]))}; prices.addRow(row);

}

// add series to data set

dataset.addSeries(upper); dataset.addSeries(price); dataset.addSeries(lower);

JFreeChart chart = ChartFactory.createXYLineChart( "Option price", // chart title

"Number of simulations", // x axis label

"Price", // y axis label

dataset, // data

PlotOrientation.VERTICAL, true, // include legend

true, // tooltips

false // urls

// change y axis

XYPlot plot = (XYPlot)chart.getPlot(); ValueAxis rangeAxis = plot.getRangeAxis();

rangeAxis.setRange(minResult-0.05, maxResult+0.05); // show graph graphPanel.setChart(chart); graphPanel.setVisible(true); return; } // if reset button if (source == resetButton) { interestRate = INTEREST_RATE; interestField.setText(myFormatter.format(INTEREST_RATE)); volatility= VOLATILITY_RATE; interestField.setText(myFormatter.format(VOLATILITY_RATE)); initialassetprice =INTIALASSETPRICE_So; intialassetpriceField.setText(myFormatter.format(INTIALASSETPRICE_So)); correlation = CORRELATION_p; correlationField.setText(myFormatter.format(CORRELATION_p)); initialvalueofyt = INITIALVALUEOFYT_yt; initialvalueofytField.setText(myFormatter.format(INITIALVALUEOFYT_yt)); strikeprice = STRIKEPRICE_K; strikepriceField.setText(myFormatter.format(STRIKEPRICE_K)); maturity =MATURITY_T; maturityField.setText(myFormatter.format(MATURITY_T)); meanreversion =MEANREVERSION_VALUE; meanreversionField.setText(myFormatter.format(MEANREVERSION_VALUE)); longrunmeanvolatility = LONGRUNMEANVOLATILITY_VALUE; longrunmeanvolatilityField.setText(myFormatter.format(LONGRUNMEANVOLATILITY _VALUE)); numbercontrolpoints = NUMBER_CONTROL_POINTS; numbercontrolpointsField.setText(myFormatter.format(NUMBER_CONTROL_POINTS)) ; return; } } }