The forgotten

accounting choice

MASTER THESIS WITHIN: Business Administration NUMBER OF CREDITS: 30 ETCS

PROGRAMME OF STUDY: Civilekonomprogrammet AUTHOR: Wilma Johansson

JÖNKÖPING May 2021

Master Thesis in Business Administration

Title: The forgotten accounting choice: a study about Attention to Detail in the note disclosure.

Authors: Wilma Johansson

Tutor: Andreas Jansson & Fredrika Askenmalm Date: 2021-05-24

Key terms: Notes, footnotes, conservative accounting, Attention to Detail.

Abstract

Background: Investors does seldom use the information provided within the notes when

making investment decisions even though it is evident that notes impact the organisations share price. The reason is unclear, though hypothetically it is possible that the unawareness of potential advantages and disadvantages might be the problem. Thus, this report will aim to increase the investors and other stakeholders’ knowledge by measuring the Attention to Detail in organisations notes. Attention to Detail is in this report a measure proclaimed to align with the conservative accounting which then will measure the degree of detail the organisations’ display.

Purpose: The purpose is to develop a measurement for ‘Attention to Detail’ and thereafter try

to investigate what explains the Attention to Detail within the notes. Thus, the research question is stated as follows: What organisational factors impact companies’ Attention to Detail in their

notes?

Method: This report applies a deductive and positivistic approach where accounting theories

are used to formulate hypothesises. The theories used are PAT/Agency Theory which participated in constructing two hypothesises regarding variable compensation and financial leverage, the Upper Echelon Theory that contributed to establishing a hypothesis concerning women in top position and the Institutional Theory that sympathised in the creation of industry differences hypothesis. A qualitative approach was conducted where data from a total of 175 firms was collected from their 2019 annual reports. To be able to investigate if the hypothesises established had any significant relationships with Attention to Detail, a Pearson correlation and Regression analysis was created.

Conclusion: It was found that financial leverage and different industrial sectors had a positive

relationship towards Attention to Detail. It could also be concluded that the Institutional Theory had an explanatory power over the outcome of all the hypotheses and therefore is the most prominent accounting theory to explain the application of detail, in this study.

Acknowledgements

I would like to thank my enthusiastic supervisors Andreas Jansson and Fredrika Askenmalm that has always stood by my side and provided me valuable knowledge, comfort and have

guided me in the right direction. This thesis would not have been possible without your support, and I will forever be grateful.

I would also like to thank my wonderful family and friends that have encouraged me to continue the project when I went through personal difficulties. You were the fuel that kept me

moving all the way to the finish line and you mean the world to me. Thank you all.

________________________________ Wilma Johansson

Contents

1. Introduction ... 1

Legislation ... 2

Problematisation ... 2

Purpose & research question ... 5

2. Literature Review ... 5

Positive Accounting Theory ... 6

2.1.1 Criticism towards PAT ... 7

Agency Theory ... 7

Upper Echelon Theory ... 12

Institutional Theory ... 15 2.4.1 Isomorphism ... 15 2.4.1.1 Coercive isomorphism ... 16 2.4.1.2 Mimetic isomorphism ... 16 2.4.1.3 Normative isomorphism ... 17 2.4.2 Decoupling... 17

2.4.3 Criticism towards Institutional Theory ... 17

3. Methodology ... 20

Research design ... 20

Data collection and method ... 21

Sample ... 22

Measures ... 23

3.4.1 Dependant, independent and control variables ... 23

3.4.2 The notes to evaluate ... 24

Ethical reflection... 33 Analytical Method ... 33 Method criticism ... 35 4. Results ... 35 5. Analysis ... 43 Variable compensation ... 43 Financial leverage ... 45

Women in CEO and CFO positions ... 45

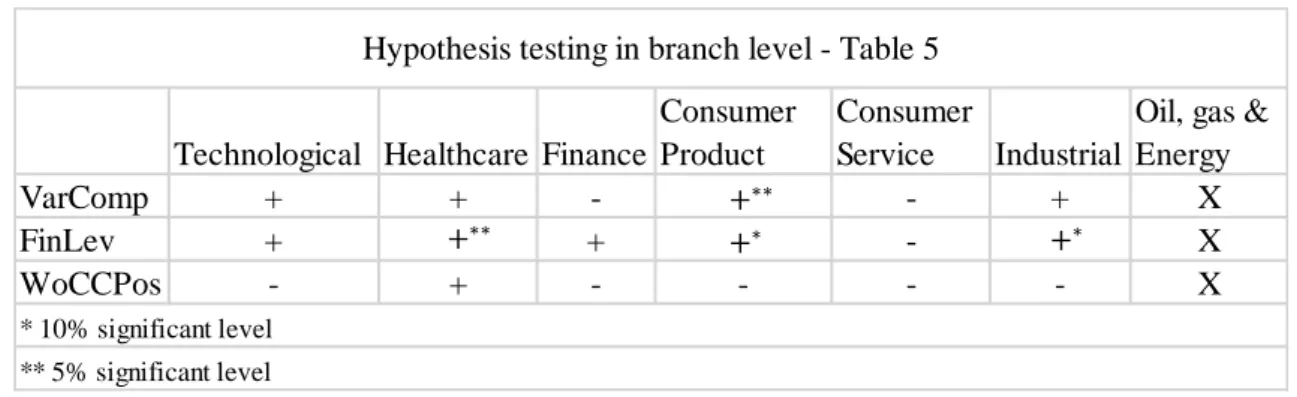

Different sectors. ... 46 6. Discussion ... 47 7. Conclusion ... 50 8. Reference list ... 55 9. Appendix ... 60 Tables Table 1 ………. 34 Table 2 ………. 35 Table 3 ………. 38 Table 4 ………. 40 Table 5 ………. 41

Definitions

IFRS

International Financial Reporting Standards is an internationally foundation that works with developing and implementing high qualitative accounting standards. The objective with their standards is to provide productivity, transparency, and responsibility to the market.

IAS

It is an abbreviation for International Accounting Standards. These where predecessors for IFRS standard and now they are included in the IFRS regulatory.

FAR

It is a Swedish accounting institution that helps accountants and auditors to interpret new standards. They also work as advisory and supervisor for organisations when they have questions concerning accounting.

Earnings management

This phenomenon occurs when the managers influence the financial statement in an attempt to either mislead the investors and other stakeholders or to gain a personal benefit.

Opportunistic behaviour

It is used as a synonym to earnings management. When managers behave opportunistically, they have their self-interest in mind.

Aggressive accounting

This is the term when managers apply accounting choices which results in inflation of the values in the financial statements. This approach is often connected to earnings management and opportunistic behaviour.

Conservative accounting

Accounting choices applied that results in a careful approach towards different valuations in the financial statements. Organisations that apply more conservative accounting have a worst-case scenario mindset, where negative effects will be directly presented in the financial statements, even though they have not yet occurred. On the other hand, positive events will not be presented unless they have evidence the will or have already happened.

Voluntary disclosure Information provided by the organisation that is not required.

Attention to Detail

This is the dependant variable and designed specifically for this thesis. Attention to Detail measures the degree of detail organisations applies in their notes. High Attention to Detail signify higher level of accounting conservatism.

1. Introduction

Have you ever bought shares you were certain would increase in value but in the end did not manage to achieve your expectations? In that case, you might have been misled by the accounting choices applied by the company. This study will inspect the explanatory notes from annual reports which contain different accounting choices and other useful information that cannot be found in the income statement, balance sheet or cash flow. The aim is to examine the level of details in the notes and how those are affected by different accounting approaches.

Explanatory notes, also known as footnotes/notes to a financial statement [from here on ‘notes’] are an essential part of the annual report (De Franco et al., 2011). The purpose is to present additional information to decision-making investors, shareholders and other stakeholders (Henderson, 2019) while also introduce the accounting policies used by the company and the financial situation the company experience at the current point of time (Chen & Tseng, 2020). Examples of areas where notes expand the information gap are in tax expenses, debt covenants, lease obligations, acquisition and merger, investment instruments, benefits for employees and contingencies (Ibid.).

Notes cannot be viewed as substitutes to the financial statement in an annual report but rather as an explanatory addition (Al Jifri & Citron, 2009; Espahbodi et al., 2002). Although, research has provided evidence that notes create value to the firm in form of share price (Davis-Friday et al., 1999; De Franco et al., 2011).

There is still a lot of exploration to be done in the research area focusing solely on notes. During recent years, an upspring of note studies has seen the light where readability has been the focal point (Abernathy et al., 2019; Salehi et al., 2020) which has the potential to become a new research trend. The lack of literature on the topic of notes leaves future research and studies with much freedom due to not being dependent on earlier theories and results within the area. One of the objectives of this thesis is to contribute to a transformation of the research area where more academics become more open to participate in the note research area.

Legislation

The paragraphs 112-116 in IAS 1 regulate the notes to the annual report. According to IAS 1, notes should be used to present supplementary information that has not been presented elsewhere in the financial statements or annual reports. Furthermore, the standard also presents the notes objectives that was mentioned in earlier paragraphs. The legislation also requires the organisations to present mandatory information based on IFRS requirements. It is important that companies establish a systematic manner where the comparability and understandability of the financial statement are in focus. Some examples provided by IFRS are “a) giving prominence to the areas of its activities that the entity considers to be most relevant to an understanding of its financial performance and financial position, such as grouping together information about particular operating activities; (b) grouping together information about items measured similarly such as assets measured at fair value; or (c) following the order of the line items in the statement(s) of profit or loss and other comprehensive income and the statement of financial position” (114 §). Finally, the law states that notes should involve calculations or explanations on how the financial statement is prepared. (IAS1, 2001)

Due to the inconsistencies of different regulations on national level, it was decided that the investigation will only take place in a Swedish context. Even though notes are regulated, they are still relatively unregulated compared to other sections of financial legislation. The Swedish law ‘Årsredovisningslagen’ addresses in chapter 3 paragraph 1-3 the formation and what should be included in the profit & loss statement and balance sheet (ÅRL, 1995). The law includes every aspect that ought to be involved and the company does not need to provide additional information. Contrasted to this, notes have more freedom of what type of information to include. Hence, it is not surprising that studies exploring voluntary disclosure sometimes are based on information found in the notes (e.g., Hwang & Sarath, 2018; Shima & Fung, 2019).

Problematisation

When debating whether to conduct research about notes or not, one question frequently asked is if notes are an interesting research area or not? It is understandable where this insecurity comes from since a study made by Arnold et al. (2010) found that the usage of

note is quite low from both professional and hobby investors. Furthermore, the author explains that even though 68% of the professional investors used one of the notes (only 30% of nonprofessional), they preferably collected the information from other parts of the annual report. The average number of notes used by professional investors per annual report was 4.4 while hobby-investors used 1.7 notes per annual report (Arnold et al., 2010). Does this prove that notes are irrelevant to study? In conjunction with the findings from Davis-Friday et al.’s (1999) and De Franco et al.’s (2011) articles, that information from the notes impacts the share price, it is remarkable that investors seldom use the notes in decision-making. But how come the investors does not choose to utilize them? Notes are regulated and together with the financial statement they are being audited which validates and creates trustworthiness in the disclosed information (Karim & Sarkar, 2019). One theory could be that since the research supply regarding notes is low, investors of various kinds do not understand the potential advantages and disadvantages of note disclosure. If this area were to expand, the usage and understanding of the notes would probably increase. Therefore, this report aims to provide a further understanding of the organisations’ note practice and perhaps conduce in a development of investor note use. The result might even contribute to a knowledge increase for other stakeholders as well.

As mentioned above, notes are under regulation. However, it could also be considered as an accounting choice due to only being partly regulated and with room for interpretation. The literature has previously had a major focus on accounting choice but not in the light of notes. The peak of research was at the beginning of the 21st century (Fields et al., 2001) which could have been caused by an increase in fraudulent behaviour within financial reporting (Desai et al., 2006). Depending on the nature of the applied accounting choice, different results will be achieved. For instance, fraudulent behaviour within accounting has characteristics such as underestimation of bad debts provisioned, increased speed of sales (Dechow & Skinner, 2000) and early realization of profit from long-term contracts (Kasznik & Lev, 1995). Those, and other similar accounting choices or behaviours can create financial statements that does not portray a fair and true picture of the company. This is noted to be more common in firms close to bankruptcy (Serrano-Cinca et al., 2019). Accounting behaviour which results in the company being portrayed better than the true status of the company, is known as aggressive accounting (Dechow & Skinner, 2000). From a study based in the US, 20 % of a total of 375 companies actively choose

to contort their internal earnings through their accounting methods (Dichev et al., 2016). The financial ratios which investors use for decision-making can easily be manipulated by managers through different accounting choices (Serrano-Cinca et al., 2019). Such actions impair the accounting information (financial ratios) and make it less trustworthy (Beaver et al., 2012). It is also more common for a new CEO that has been recruited from outside of the organisation to try to increase the earnings to prove his/her competence (Kuang et al., 2014). Desai et al. (2006) have found evidence that managers that have applied aggressive accounting choices experience consequences such as losing reputation, power, influence, and having difficulties regaining another job.

On the opposite, management can choose to account for news carefully by implement authentication before accounting for good news, known as a conservative accounting approach (Basu, 1997; D'Augusta & DeAngelis, 2020; García Lara et al., 2007). In other words, organisations using this method tend to bring up unwelcome news in their financial statement beforehand while good news will be realized only when actual evidence is provided demonstrating that a definite profit can be confirmed. As a result, earnings will seldom become exaggerated if this type of accounting approach, known as conservative accounting, is applied (Bernstein & Siegel, 1979). According to Kim et al. (2013), more conservative accounting reduces information asymmetry in the financial statements. Other intended advantages that accounting conservatism include are firstly an increased equity offering returns (Kim et al., 2013), secondly, a reduction in the share returns volatility (García Lara et al., 2014) and lastly a reduction of the risk of the shares crashing (Kim & Zhang, 2016). Stakeholders such as the members of the board of directors (Ahmed & Duellman, 2007), external auditors (Cano-Rodríguez, 2010), and shareholders would like the organisation to implement more conservative accounting to reduce opportunistic behaviour in the management (D'Augusta & DeAngelis, 2020; Lafond & Roychowdhury, 2008) as well as improve the information quality in the financial statements (Cano-Rodríguez, 2010).

In summary, organisations can make accounting decisions that will either point towards being more aggressive or the other way around, more conservative. This report will be one of the first to apply this view on notes while having an investor perspective. Notes have in recent years started to gain attention in the literature. However, most of the papers

direct their focus on the readability of the notes from an audit perspective but the result differed (Abernathy et al., 2019; Salehi et al., 2020). Salehi et al. (2020) argue that due to lower level of readability, the auditors chose to not spend extended time on reporting their opinion which results in the auditing fee not increasing. On the other hand, Abernathy et al. (2019) state that low readability instead increases the reported auditing which results in an increased auditing fee. Furthermore, Chen & Tseng (2020) argues that since notes include disclosures that participate in portraying the company’s value, managers experience a greater incentive to negatively influence the information within notes to present the information they want the reader to see. Readability often suffers when managers want to hide information from the reader (Chen & Tseng, 2020). The lack of readability results in fewer investors taking time to read the notes (Henderson, 2019) which contradicts their functional purpose (Henderson, 2020).

Attention to Detail is a measurement created in this report. It aims to determine the degree of conservativism displayed within the notes by evaluating various requirements in a point system which will indicate if the organisation is public or sealed in its information disclosure. Thus, if an organisation achieves a high score, the information within the notes indicates a conservative accounting approach. This paper will not focus on the readability aspect of the note but rather Attention to Detail as a complement to readability that hopefully will aid the interest of investors to use the notes in their decision-making.

Purpose & research question

The purpose of this thesis is to develop a useful measurement for ‘Attention to Detail’ and thereafter investigate what explains the Attention to Detail within the notes.

Hence the research question is as following:

What organisational factors impact companies’ Attention to Detail in their notes?

2. Literature Review

There are two groups of theories within accounting; The Normative accounting theories which try to explain why certain accounting choices are suitable, and the Positive

accounting theories which try to clarify or foresee why certain accounting methods are applied by the management (Deegan & Unerman, 2011). Numerous accounting theories have been developed in the light of the two different orientations. However, the normative accounting theories is not applicable on this thesis and therefore only an overview of various positive accounting theories will be presented. These will subsequently be applied to determine the hypothesis for this report.

Positive Accounting Theory

The Positive Accounting Theory (PAT) is part of the group of accounting theories with the same name. It was developed as a theory in 1978 by the researchers’ Watts and Zimmerman (Deegan & Unerman, 2011). The objective of PAT is not to determine what the most appropriate accounting method to use is, but rather to understand which accounting practice firms will or will not chose to apply (Watts & Zimmerman, 1986). Over the years, PAT has developed, and three different hypotheses have been established and are repeatedly presented in the literature: the management compensation hypothesis, the debt hypothesis, and the political cost hypothesis (Watts & Zimmerman, 1990). The management compensation hypothesis states that managers that have a bonus plan will apply accounting choices to increase the income during the current period (Watts & Zimmerman, 1990). Managers with a bonus plan will receive an increasing compensation when the organisation is performing well and this would therefore explain certain opportunistic decisions made by the managers (Deegan & Unerman, 2011). The debt hypothesis argues that the greater the debt ratio is, the more expected it would be for managers to insert accounting methods that increase the income (Watts & Zimmerman, 1990). The logical thinking behind this statement is that if a company have loan agreements with a lender who have included debt covenants, the managers will choose accounting methods that would try to mitigate the potential effects of the limitations (Deegan & Unerman, 2011). Finally, the political cost hypothesis emphasis that the market share size is a variable that attracts political attention (Watts & Zimmerman, 1990). An method known as PESTLE is commonly used by organisations to estimate the political, economic, socio-cultural, technological, legislative, and ecological environment (Cordell & Thompson, 2019). By using the PESTLE approach organisations can identify how these environments might affect the firm and thereafter build a suitable strategy (Ibid.). Hence, the political cost hypothesis believes bigger sized companies to choose

accounting methods that decreased the income in the current period to avoid the political and economic pressure (Watts & Zimmerman, 1990) that the government can apply through taxation (Cordell & Thompson, 2019).

2.1.1 Criticism towards PAT

Even though PAT is probably one of the leading accounting theories in the research, it is not perfect, and some researchers have pointed out flaws in the theory. Fields et al. (2001) discuss the lack of development of the theory over the years. They argue that it is not valid to study a specific accounting choice and try to explain the thinking behind it because the decision could be part of a bundle of accounting choices. Those choices are chosen to achieve a certain goal which therefore would create a faulty result. The authors further explain that the opportunistic conclusion sometimes overtakes the literature. An accounting choice should not automatically be branded as opportunistic because it has an income increase effect. Even though an increased income shown in the financial statement could increase the managers’ compensation, the decision to this behaviour might have been taken to avoid other consequences (Fields et al., 2001).

The second criticism towards PAT is that the theory is only on ‘averaged’ supported (Watts & Zimmerman, 1978), meaning that sometimes assumptions within PAT are supported and other times they are rejected by different articles. This especially applies the hypothesises within PAT: the political cost hypothesis, the debt hypothesis, and the bonus hypothesis (Deegan & Unerman, 2011). Christenson (1983) argues that it should not be accepted by a theory to only find significant relationships occasionally and yet state that they are true.

Agency Theory

A fundamental theory underlying PAT is the Agency Theory (Deegan & Unerman, 2011) and it was developed by Jensen and Meckling in 1976. Agency Theory is commonly used to explain accounting decisions made by managers, the relationship between agents (managers) and principals (i.e., owners) (Jensen & Meckling, 1976) and present directions on how to solve opportunistic problems that may arise due to those factors. (Lambert, 2001). It is believed that every agent has self-interest and will aim to increase their own wealth (Deegan & Unerman, 2011). The relationship between owners and

managers often starts with a contract where the principals appoint the decision-making process to the agent (Jensen & Meckling, 1976) and from this point on, information asymmetry might occur which creates agency costs (Deegan & Unerman, 2011). Jensen & Meckling (1976) explain that agency cost originates from the relationship between the agent and principal and their different interest. The authors’ further state that if the principals would like the agent to act in their interest they need to implement monitoring over the manager. The monitoring added with the energy cost of bonding for the agents and residual loss will represent the agency cost (Jensen & Meckling, 1976). There might also appear disputes between the agent and principals. Some reasons for this are due to manager indolence, unnecessary perilous behaviour by the manager and managers trying to increase profit in the present period which creates losses in the future (Lambert, 2001). There is also one assumption that principals are aware of the managers greedy incentives and to counteract the potential agency costs they will give a smaller salary to the managers (Deegan & Unerman, 2011). Therefore, agents themselves would like to implement monitoring to prevent opportunistic behaviours in exchange for increased compensation (Watts & Zimmerman, 1986). Other methods that could reduce earnings management are governmental legislation that prevents earnings management (Jouber & Fakhfakh, 2014), provide managers with shares in the firm to align the principals and agents' interest (Harris et al., 2019; Henry, 2010) and, by increasing the managers’ identification with the organisation would prevent opportunistic behaviour (Abernethy et al., 2017). By improving the quality of the published information, agents can reduce the information asymmetry and strengthen the relationship with principals (Jensen & Meckling, 1976). Furthermore, Fama (1980) states that it is believed that the entire organisation is viewed as a ‘nexus of contracts’ that have an aim to align all involved parties (agents and principals) objectives, to maximize the value of the organisation and prevent conflicts of interest. The contracts establish rights and boundaries between the parties, and these are known to be managers, shareholders, employees, customers, and suppliers (Deegan & Unerman, 2011). Watts and Zimmerman (1986) state that if it became known publicly that managers are establishing opportunistic methods, they would suffer by receiving a negative reputation.

Summary of PAT

The objective of Positive Accounting Theory (PAT) is to understand why organisations choose some accounting choices over others. There are three hypothesises in PAT and the one relevant for the forthcoming hypothesis development in this report is the management compensation hypothesis. It is believed that managers will make the accounting choices that will contribute to increasing their bonus, by for instance preferring accounting practices that improve the income.

PAT is built on Agency Theory which displays the relationship between the principal and agent and the contract between them. Agents have their self-interest, which the principals know about and that could result in information asymmetry. To prevent opportunistic behaviour and reduce agency costs the principals can decrease the agent’s salary. An outcome from this preventative action of the principal could be that agents invite more monitoring to prevent themselves from opportunistic behaviour in exchange of increased compensation. Managers could also be reputationally harmed by opportunistic behaviour. Lastly, the Agency Theory views the organisation as a ‘nexus of contract’ trying to align all stakeholder’s objectives and prevent feuds between them.

The impact of Variable compensations on Attention to Detail.

According to the Swedish labour union ‘Unionen’ (n.d.), variable compensation is known to be a salary that fluctuates over time. Unionen (n.d.) explain that this compensation can be based on individual accomplishments and/or through the organisation's performance. PAT believes that variable compensations might contribute to an increase in opportunistic behaviour by the manager and accordingly, develop information asymmetry by withholding information from the stakeholders. Variable compensations provided to managers are Examples of bonus which is an additional payment that occasionally is distributed when the organisation has made a positive result or when an individual has performed extra well (D'Oliwa & Flemström, 2021), and stock options (Harris et al., 2019). The Swedish law (ÅRL 5:40 2st), states that the executive’s variable compensation should be presented in the annual report (ÅRL, 1995).

The question is if the variable compensation impacts the Attention to Details in the notes? No such study could be found and therefore the hypothesis will be formulated depending on other literature.

Legislation in various countries has shown that variable compensation impact managerial behaviour differently, and in Europe incentives created from variable compensation has a positive relationship with the quality of corporate governance (Jouber & Fakhfakh, 2014). Why organisations offer this type of compensation is to attract and keep the most experienced manager (Pfeiffer & Shields, 2015), and, to motivate desired behaviours of managers (Frydman & Jenter, 2010). However, variable compensation does mostly end up in an opposite effect where egoistic incentives for the manager is created. They ended up engaging in earnings management (Harris et al., 2019; Henry, 2010) and to receive their bonus they increase the organisational performance (Dias et al., 2020; Henry, 2010), sometimes even through misreporting (Abernethy et al., 2017; Burns & Kedia, 2006). Managers also tend to engage in riskier behaviour to accomplish an increase of the firm performance (Frydman & Jenter, 2010; Harris et al., 2019; Kline et al., 2017; Uhde, 2016).

The fact that managers develop an opportunistic view when put in a position where they can gain a personal monetary opportunity is an argument from PAT that have been supported from the literature above. When it comes to note disclosure, one could argue that the aggressive accounting formed through i.e., misreporting would have a bad influence on the Attention to Detail. It is believed that managers that apply aggressive accounting, which is aligned with earnings management, would withhold information from the principals of the organisation for their own benefit (Deegan & Unerman, 2011; Lambert, 2001). Hence, the detail in the notes would be quite low since the Agency Theory assumes that information asymmetry frequently appears when conflicts between agents and principals is occurring (Jensen & Meckling, 1976). Therefore, it is believed that the information provided in the notes can be limited by managers with high variable compensation.

H1: CEOs variable compensation has a negative relationship to the Attention to Detail in the notes.

Organisations financial leverage impact on Attention to Detail.

PAT and Agency Theory have different views on how organisations will act when possessing a higher amount of leverage. PAT assumes that the debt hypothesis holds true which assumes that organisations with high debt will try to increase their income in an attempt to mitigate the loan covenants. The Agency Theory instead focuses on the contractual interaction between agents and principals (in this case lender). The higher amount of leverage an organisation possesses, the greater the risk that a conflict would arise between the firm and the bank (Hamrouni et al., 2019; Yuliarti & Yanto, 2017). The Creditors will increase their monitoring of companies with higher leverage since it could be economically insecure to lend money to firms with opportunistic managers (Sari & Augustina, 2021). Hence, a solution for this agency cost problem would be for the manager to publish more information and improve its quality (Jensen & Meckling, 1976).

Like the findings that shareholders demand more conservative accounting (Lafond & Roychowdhury, 2008) it has also been proven that creditors demand organisations with higher leverage to apply more conservative accounting by increasing the information supply (Salama & Putnam, 2015). Companies could also benefit by providing more conservative accounting since it increases the trust from creditors which could result in future loan opportunities (Hamrouni et al., 2019). Haddad et al. (2020), Hamrouni et al. (2019) and Fahad & Nidheesh (2020) found that organisations with higher leverage do indeed provide more information.

The amount of leverage has proven to have a positive relation to conservative accounting (Salama & Putnam, 2015; Yuliarti & Yanto, 2017). This report draws a parallel line between Attention to Detail and conservative accounting which means that a higher Attention to Detail score indicates a more conservative accounting method applied in the notes. Therefore, it is hypothesised that leverage will have a positive relationship to Attention to Detail since the notes are used to provide further information than just the financial statement which the creditors can use which decreases the information asymmetry.

Upper Echelon Theory

The primary aim with the Upper Echelon Theory was to intertwine ‘the actions by managers in strategic situation after they applied their own interpretation’, with ‘their interpretations being created in individualised personalities, values, and experiences.’ Hence, to understand organisational actions or performances one should investigate the biases at the top management team. (Hambrick and Mason, 1984)

Thereafter, the original paper suggested two research orientation to continue future research which both gained popularity afterwards (Hambrick, 2007). The first

proposition was to continue the research on the top management teams characteristics. To include several executives might increase the understanding of the organisational outcome. The second suggestion involved researching different demographical characteristics such as personal background, education level, tenure, age,

socioeconomic roots, and the operational industry to assist in estimating the cognitive frames. (Hambrick and Mason, 1984)

Two decades later, Hambrick updated the model further. In the new article (2007) he discussed two views that could be applied. Either that managers choices have an impact on the organisation which is supported by the Upper Echelon Theory or that managers do not influence the organisation since it is affected by external forces and social norms. The amount of discretion a CEO has will distinguish which view to apply. Discretion is the level of freedom in decision-making for organisations and manager’s discretion can be limited through restrictions such as legislations. In industries where the discretion amount is restricted, the executive’s characteristics do not impact the organisational outcome. Oppositely, in industries where discretion exists liberally, characteristics from the executives will influence the organisation’s outcome. Another finding is the

executive job demand’s (EJD) impact on decision-making. The EJD is created by three factors: the ambition of the executive, task challenges and performance challenges. Thus, a higher amount of EJD would impact the manager’s decision quality. For example, if the manager needs to decide quickly and have a lot of other pressure on his/her shoulder, he/she tend to take mental shortcuts and establish earlier decisions that have been successful in comparable situations previously. On the contrary, when an

executive does not feel stressed and pressured of i.e., work tasks, he/she could take time to present the most rightful decision for that specific situation. (Hambrick, 2007)

Another critical point discovered by Hambrick in the updated Upper Echelon Theory is that it is important to distinguish the relevant individuals from the TMT depending on the research question. Instead of analysing the entire TMT for a certain decision in an organisation, one should focus on the characteristics of the persons who would include their perspective in that decision and exclude the rest to obtain the most accurate result. (Hambrick, 2007)

The Upper Echelon Theory has been tested and lot of studies have verified the assumption that TMT demographics have a relation with organisational outcome (Bassyouny et al., 2020; Lee et al., 2016; Oppong, 2014; Plöckinger et al., 2016; Wang et al., 2016). Although, many earlier studies that compared demographics in TMT usually combined them to one ‘variable’ in relation to organisational performance, however, since each demographic (e.g., age or gender) can independently corelate different (either have negative or positive relationship) to the outcome in organisation they should be investigated one by one (Olson et al., 2006). One variable that have been examined more in the light of Upper Echelon Theory is gender (Abatecola & Cristofaro, 2018) which will be in the focus in the forthcoming hypothesis.

Summary of the Upper Echelon Theory

The upper echelons original belief was that focus should not solely be on the CEO in the organisation but the entire top management team. It is assumed that their different demographics such as education, socioeconomic roots, age etc. will impact the decisions and be portrayed in the information provided. Later the theory was further developed, and new insights was made. For instance, it was stated that you should not only look at the top management team, but the individuals in the top management team that was involved in a specific decision. Furthermore, executive job demand which involved the executive’s ambition, task challenges and performance challenges will impact the quality of the decision-making. Lastly, it was also believed that either the top management teams demographics will impact the information, or the organisation is put

under such external pressure that the individual’s cachet will not be present in the provided information.

CEO’s and CFO’s gender effect upon attention on detail on the notes

Agency Theory promotes the idea that CEO’s have a self-interest and will engage in opportunistic behaviour. According to the Swedish law ‘Aktiebolagslagen’ chapter 8 paragraph 4 and 29, CEO and the board of directors are liable for the annual report (ABL, 2005). However, what often is forgotten when it comes to accounting and disclosure is that the CFO has the main responsibility for the preparation of the information (Habib & Hossain, 2013; Jiang et al., 2010) and characteristics from the CFO might be reflected in the statement produced (de Almeida & Lemes, 2019). This follows the assumption from the Upper Echelon Theory that characteristics from the relevant individuals of the TMT should be included when examining their relationship to different accounting choices. There is research which provides evidence that CFO’s experience higher equity incentives (Jiang et al., 2010) and are involved in more opportunistic internal purchases (internal trading) compared to CEO’s (Ozkan & Trzeciakiewicz, 2014). Therefore, by finalizing, it should be reasonable to include the characteristics of both the CFO as well as the CEO when creating a hypothesis around note disclosure. It is assumed, in this report, to be the two more prominent participants from the TMT involved with the information provision of notes and therefore they should both be included in the investigation.

As mentioned previously, one demographic that have been examined through the Upper Echelon Theory are the gender diversity and the differences between gender have proven to be significant in various situations. For instance, it has been recognized that compared to their equivalents, women managers characterize more ethical behaviour (Butz & Lewis, 1996; Ho et al., 2015; Mason & Mudrack, 1996) and risk aversiveness (Ho et al., 2015; Khlif & Achek, 2017). Moreover, female CEO has shown to portray more conservative accounting methods than male CEOs (Ho et al., 2015) but only when the equity-based compensation is low, otherwise they are tended to participate in

earnings management which mitigates the conservatism (Harris et al., 2019). On the other hand, there are evidence that female CFOs are more conservative in their accounting choices compared to male CFOs (Francis et al., 2015; Peni & Vähämaa, 2010). They often decrease the dividends, shift investment from intangible to tangible

assets and abstain themselves from equity-based compensation (Francis et al., 2015). Overall, the association between female managers and conservatism accounting choices would be a positive influence in the earnings equity (Khlif & Achek, 2017; Krishnan & Parsons, 2008), a quality increase in some disclosures (Janahi et al., 2021) and

improvement of the market performance (Eduardo & Poole, 2016). Therefore, since females in TMT positions seems to have a more conservative accounting approach, it would be solid to assume that they would contribute to more detailed notes compare to organisations where only men have the CEO an CFO position.

According to the literature that discusses women in CEO and CFO positions and their influence on accounting choices it is evidential that they increase information quality and establish practises toward the conservative accounting orientation. Since the Attention to Detail measure is connected to the conservative accounting approach it is reasonable to assume that females in CEO or CFO positions would have a positive impact on the information provided in the note.

H3: Women in CEO and CFO positions will have a positive relationship with the

Attention to Detail in the notes.

Institutional Theory

The Institutional Theory has received increasing attention within the accounting research (Dillard et al., 2004) and it explains why industries and comparable

corporations appear similar to each other (DiMaggio & Powell, 1983; Larrinaga, 2007) has the same assumption as legitimacy theory, that the organisations are controlled by expectations, values, and norms (Carpenter & Feroz, 2001). Organisations tries to change alongside expectations since they would be rewarded with legitimacy if they succeed (Scott, 1987). Another way to retain legitimacy is to create a ‘formal structure’ that is based on the society’s norms and expectations (Dillard et al., 2004) that would result in a homogeneity actions within industries (Larrinaga, 2007). The Institutional Theory can be divided into two perspectives which both explain the reporting choices of firms, isomorphism, and decoupling (Deegan & Unerman, 2011).

2.4.1 Isomorphism

that forces one unit in a population to resemble other units that face the same set of environmental conditions”. Isomorphism generates further homogeneity and help adjust dependent on the society’s anticipations (Carpenter & Feroz, 2001). The isomorphism can be divided into three separate perspectives, coercive-, mimetic- and normative isomorphism (Deegan & Unerman, 2011). Although, it is important to consider that these three can all be present in different situations and sometimes it is difficult to distinguish them apart (DiMaggio & Powell, 1983). Furthermore, Carpenter and Feroz (2001) states that organisations can implement different practices and structures with an aim to achieve legitimacy. However, this could negatively affect the efficiency of the organisation (Carpenter & Feroz, 2001; DiMaggio & Powell, 1983).

2.4.1.1 Coercive isomorphism

The coercive isomorphism is related to power (Deegan & Unerman, 2011) and thus, occurs when external factors affect the organisation, for instance prominently stakeholders, regulation, and groups with political power (Tuttle & Dillard, 2007). These factors could request change from the firm and thereafter pressure it through (Deegan & Unerman, 2011). The pressures can appear different, sometimes it might feel like a collusion invitation, at times like persuasive convincing and occasionally like force (DiMaggio & Powell, 1983). If the source of pressure is acutely powerful the change might become obligated (Tuttle & Dillard, 2007). Neu and Ocampo (2007) showed an example where the World Bank required implementation of particular accounting practising towards the countries, they lent capital to. This resulted in a similar accounting practice even though the nations where heterogenous (Neu & Ocampo, 2007).

2.4.1.2 Mimetic isomorphism

When a company experience uncertainty within different areas in the organisation, a ‘solution’ to the problem is to imitate stronger actors in the market (DiMaggio & Powell, 1983; Unerman & Bennett, 2004). This is how the mimetic isomorphism is formulated and the aim with the imitating is to receive legitimacy and gain competitive advantages in the market (Deegan & Unerman, 2011). Failure to follow the norms of practices could result in lowered legitimacy in relation to similar companies (Unerman & Bennett, 2004). However, the objective is not always to successfully implement the strategies but to demonstrate a desire for the society to achieve progress in the right

direction (DiMaggio & Powell, 1983). In the end, Unerman and Bennett (2004) explains that mimetic isomorphism would not exist unless the coercive isomorphism created pressure on organisations.

2.4.1.3 Normative isomorphism

DiMaggio and Powell (1983) argue that the normative isomorphism degenerates from professionalization, which implies that different individuals with similar or the same occupation strive to shape the norms and rules of how to operate their work properly. These individuals are also pressured by a similar coercive and mimetic force as the organisations are. Hence, these pressures result in comparable occupations are being practiced similar. Other factors that increase the normative isomorphism are firstly the knowledge obtained through universities or institutes for professional training. This knowledge helps establish norms and a universal practice choice among employees. The second factor that increases the normative isomorphism is the employee filtering that implies that organisations require certain knowledge or skills which aligns with the norms within the occupation. The outcome of employee filtering is that a specific individual is sought for when applying new employees that has a similar mindset as the ‘standard’ worker for that position. Hence, the occupations on the market will be almost identical. (DiMaggio & Powell, 1983)

2.4.2 Decoupling

Decoupling is the phenomenon when the organisations formal practise or structure is deviant from the actual practice (Dillard et al., 2004). In other words, the organisation present disclosures that indicates that they will act aligned with the shareholders expectations, however, in the end they secretly do not (Deegan & Unerman, 2011). Examples could be that companies present proper environmental disclosures, but they do not actually care about their participation of pollution (Ibid.).

2.4.3 Criticism towards Institutional Theory

Meyer & Höllerer (2014) explains that the literature written based on the Institutional Theory shapes the theory’s design. The authors believe for instance that the word ‘institution’ is incorrectly used in the research which has resulted in limited

investigations concentrating on actual institutions. On the other hand, Greenwood et al. (2014) argues that institutional research focuses too much on institutional process and

deprioritise the original perspective, examining institutions from organisations

viewpoint. A few reports agrees that studies implementing Institutional Theory should increase their focus on internal organisational aspects to further develop the theory toward an appropriate direction (e.g., Greenwood et al., 2014; Meyer & Höllerer, 2014; Suddaby, 2010). What is often forgotten in Institutional Theory is that there are

different individuals incorporated in organisations (Suddaby, 2010).

Summary of Institutional Theory

Institutional Theory tries to explain why companies within an industry appear similar to each other. Organisations have a reason to adjust depending on the external expectations to remain legitimate in the market. The Institutional Theory contains two perspectives, isomorphism, and decoupling. Isomorphism further includes three directions, coercive-, mimetic- and normative isomorphism. Coercive isomorphism is related to power from external actors or factors which puts pressure on organisations to live up to their expectations. The mimetic isomorphism explains that organisations tend to imitate leading entities in the industry to achieve legitimacy or even competitive advantages. Lastly, the normative isomorphism believes that institutional practices create norms on how individuals should behave and these shapes the organisations to resemble each other.

The industry’s effect on Attention to Detail in the notes.

The fourth and last hypothesis will surround industry differences and hence try to figure out how industries could impact the Attention to Detail of the notes. Although, the literature is a little dispersed.

Johnsen and McMahon (2005) found that the financial behaviour varies between industries for small- to medium sized enterprises. Hence, it is not unexpected that industries might impact the fluctuation of profitability, that is business specific (McGahan & Porter, 1997). Following the Institutional Theory, this is not surprising due to the different isomorphisms. Smaller firms tend to mimic behaviour from larger actors in their sectors and since various industries are different in terms of growth rate (Christensen & Gordon, 1999) or legislation etc, the behaviour might differ significantly. Different industries do also vary in R&D investment. Cockburn and Griliches (1988) argues that similar R&D investments might have different outcomes depending on the industry.

Flöstrand and Ström (2006) could not find a significant relationship between the preparation of non-financial disclosure and different industries. Neither could Karadag (2017) find a correlation between industries and the CEOs financial performance in small to medium sized enterprises. These findings speak against the Institutional Theory since they could not find sectorial differences. Why this result was reached could not be assured, however, one explanation might be that the non-financial disclosure is unified similarly between industries which therefore does not create a disparity between industries. That could be a result of legislation and society’s norms which is part of the coercive isomorphism, and the expectation of the accountants work which is part of the normative isomorphism. There is also no significant relationship between intellectual capital disclosure and organisations with both high and low levels of intangibles (Oliveira et al., 2010). However, organisation within high-tech industries tend to disclosure more intellectual capital information compared to industries where technology does not create value to the same extent (Rimmel et al., 2009).

Regarding voluntary social and environmental disclosure there are evidence that industries report different amounts (Gao et al., 2005). Industries that practise environmentally tend to include more environmental disclosure compared to industries which do not exercise environmentally friendly action to the same extent (Pahuja, 2009). On the other hand, Al-Qahtani and Elgharbawy (2020) argues that some industries are pressured by stakeholders and other in the society to present further disclosure. For instance, industries that are carbon-incentive are pushed to present greenhouse gas information (Al-Qahtani & Elgharbawy, 2020). That provides further evidence that the coercive pressure holds true where external actors demand further environmental information from organisations that have a harmful manner towards the environment.

Notes are a combination of non-financial disclosure which is legislated and voluntary disclosure where the organisation can decide how much and what information to share to their stakeholders. On one hand, the literature is arguing that non-financial disclosure is not significantly related to the different type of industry. On the other hand, the literature does argue that voluntary disclosure will be delivered in different amounts depending on the organisation and the societies pressure. Due to the divided literature, the hypothesis will be decisive by the Institutional Theory which states that organisations within the same industry will act similar to each other. And as discussed in a previous paragraph,

different industries grow and mature in different pace and therefore it is not surprising that various industries would have unique note disclosure quality.

H4: Attention to Detail in the notes varies between industries.

3. Methodology

Research design

Research philosophy will aid other researchers that is reading this report to understand its viewpoint (D O'Gorman & MacIntosh, 2014). There are two more common directions to choose from, either positivism or interpretivism which are contrasted to each other (Byrne, 2016; Hammond & Wellington, 2021). Although, even if these are two edges of a rope, it is important to know that there are other research philosophies in between, for instance action research and critical realism (D O'Gorman & MacIntosh, 2014; Hammond & Wellington, 2021).

Positivism is frequently exploited in the business research (Duignan, 2016) since the data collected is usually extremely precise and specific (D O'Gorman & MacIntosh, 2014). Hence, positivistic studies are usually quantitative (Byrne, 2016; D O'Gorman & MacIntosh, 2014). What is characterizing for the positivistic view is that it has hypothesis building in focus where either the hypothesises or theories in the end will be rejected or accepted (Byrne, 2016; Duignan, 2016). Hammond (2021) argues that the aim with the positivistic view is to find correlations and connections between variables. The positivistic philosophy is also generally applied in studies where new research areas is developed (Duignan, 2016).

On the other side of the spectrum, you will instead find the interpretivist research philosophy. This viewpoint was developed as a counterpart to the blooming positivistic philosophy usage in the 19th and 20th century (D O'Gorman & MacIntosh, 2014). Shortly explained, the aim with interpretivist philosophy is to create an understanding for the phenomenon instead of only measuring it (Ibid.). Focus will be on the human and the environmental package it carries and how that affect its choices and thought process (Byrne, 2016; Duignan, 2016). Reports with an interpretive view would use qualitative methods (Duignan, 2016).

This report applied a positive research philosophy because a quantitative approach was selected to conduct a study on the Attention to Detail in the notes. Hypothesises were developed which either will be rejected or supported. This study did not have the human intellect in focus and hence did not apply a qualitative method. Thus, it was concluded that the interpretive research philosophy was a miss match for the report’s objective.

Since the positivistic research philosophy was applied the question remained on what research approach to use? There are two directions to choose from, either a deductive approach or an inductive approach. Easily explained, the inductive approach begins with collecting data and ends up by creating a new theory with the help of the result (D O'Gorman & MacIntosh, 2014; Hammond & Wellington, 2021). The deductive approach instead starts with describing theories and develop hypothesises which ends with a confirmation or rejection of the first-mentioned theories (Ibid.). With the report’s objective in mind, to create a measure for AtD, the deductive method was chosen since this approach have a work process which is believed to be suitable to fulfil the thesis purpose.

Data collection and method Introduction and problematization part

Articles used in the introduction and problematization was primarily searched on through Emerald and Business Source Premier since they are databases that primarily focus on collecting and offering business articles. Google Scholar was used as a secondary search engine in cases where Emerald and Business Source Premier could not provide enough material. Although, those sources collected through Google Scholar was not always peer reviewed which might indicate flaws in the content, methodology or analysis. However, these sources are few, approximately five to ten articles and they do only cover small parts of this paper.

Sources about notes are limited. To demonstrate this, a search on “footnote” in the Business Source Retriever resulted in a total of 411 articles from peer reviewed journals. What was problematic is that most literature does not have a solely focus on notes, but instead the notes are included in a package of other types of financial disclosure. That made it complicated to find reliable sources and therefore the search for articles was timely. Another problem that was discovered early in the source finding process was that

when you only searched for the phrase “note*” all different types of articles popped up since note or notes are a verb that similar to ‘remark’ is used to explains a statement from the writer. Hence, by using ‘note*’ as the only search word it was extremely difficult and time consuming to find articles where notes were the main subject rather than solely a subcategory. Even though other words were used in the search criteria such as “financial statement” or “annual report” to narrow the result, it did not help to the extent that it was hoped for. Other search phrases and words used in the search engines were: “footnote quality”, “note quality”, “financial statement note*”, “account* choice*”, “explanatory note*”, and “detail”. By limiting the search result by using the mentioned phrases, it did once again emphasise on the low amount of research articles focusing on note disclosure.

Sample

To decide what companies to include in the study, some ground rules need to be established beforehand to assess a reliable result. Firstly, it was decided to only include firms from one single country to prevent judicial issues on note disclosure between nations. Sweden was the chosen country since it is the nation of origin for the author which benefitted the data collection. Secondly, in an attempt to further limit the legislation problems within the country solely companies that applies IFRS and IAS regulation was collected in the sample. More specifically, only corporations that belongs to the Nasdaq main market. If companies with different regulation were to be included, the result would not be trustworthy unless the aim with the report were to compare the Attention to Detail in companies with separate note regulation. Although that is not the objective in this report.

Hereafter, all public Swedish corporation on Nasdaq was collected in an excel document where a shuffle formula was used to blend the companies in the list. The companies where either from the small- mid- or large cap. Most of the information was collected from the organisation’s annual report from 2019 except the ICB code (industry number) which was collected from Nasdaq (n.d.) and sometimes XE (n.d.) was used to convert currencies in annual reports that used other than SEK. The data collection consists of the first 179 companies in the list. four companies were removed from the list since they either did not present whether the annual report was presented in MSEK or kSEK or if they excluded valid annual report information needed for the control variables or independent variables.

Although, the removed organisations were replaced with the next coming firm in the list which concluded the study with a total of 175 observations.

Measures

3.4.1 Dependant, independent and control variables Dependant variable

This research consists of only one dependant variable, the Attention to Detail. Research within Attention to Detail exists, for instance within IT development (Cappel et al., 2005) and consumer service sector work strategies (Sok et al., 2018), although not in the context of note disclosure. Therefore, the formula used to determine the Attention to Detail is a mix from various articles focusing on notes or accounting conservatism.

Attention to Detail is a measure that is supposed to evaluate the amount of conservative accounting presented throughout the notes. Specific criterions have been selected which are supposed to define detail. Thus, the more criterions that are met, the more Attention to Detail is the organisation displaying in their notes, indicating on a more conservative accounting approach. Hence, Attention to Detail is something to pursue because if the notes are presented in a more conservative view, the information would be simpler to read and more useful for investors.

Independent variables

A couple of different independent variables have been chosen to test the Attention to Detail model. These are variable compensation, financial leverage, women in CEO/CFO positions and different industries. They are hypothesized to impact the Attention to Detail since these variables are either related to accounting conservatism or opportunistic behaviour. They are presented more thoroughly in the second chapter of the report.

Control variables

The control variables chosen is a mix of ordinary firm characteristics and variables that could be connected to conservative accounting. The firm characteristic control variables chosen for this report are ROA (net income/total assets) and Loss/Profit (1=net income profit) which have been used as control variables by Abernathy et al. (2019), Chen & Tseng (2020) and Salehi et al. (2020) which all have written a note-based study and therefore are suited for this thesis.

CEO ownership and Market-to-Book ratio are conservative control variables that have been chosen from the article by Ahmed & Duellmans (2013). The ownership variable is calculated by dividing the CEO’s shares in the company with the outstanding number of shares in the organisation. CEO’s ownership is related to accounting conservatism since a partial ownership in the firm could result in anaesthetic of opportunistic behaviour (Kim & Lu, 2011). Therefore, it is appreciated from the shareholders point of view that the CEO owns shares in the company (Lafond & Roychowdhury, 2008). However, if a CEO achieve too much ownership in an organisation it could result in a riskless jargon which would slow down the firm's growth (Kim & Lu, 2011).

The last control variable used in the report is the Market-to-Book ratio. It is viewed as a measure of conservatism if the organisation has an aim to account for the equity value instead of net asset value (Roychowdhury & Watts, 2007). It is calculated by dividing the equity’s market value with the equity’s booked value (Ahmed & Duellman, 2013).

3.4.2 The notes to evaluate

Due to the amount of information provided in the entire note disclosure, a selection of some of the most relevant notes must be done to provide a more accurate data collection and interpretation of the result, otherwise the time would not be enough. The motivation behind the note selection was to identify notes that potentially could be subject for opportunistic behaviour such as information asymmetry. It is believed that the Attention to Detail would be more anticipated in the notes with such qualities. The finalised notes to evaluate were the revenue note, intangible asset note, and contingent liability note.

The first note to be evaluated in this report is the revenue note. IFRS 15 covers the legislation for revenue recognition, and it starts by the two parties (organisation and customer) establishing an agreement where all following items must be fulfilled before the organisation is allowed to start recognising the revenue. Firstly, the agreement should have a commercial substance which means that the organisations future cash flow and risk are anticipated to adjust due to the contract. Secondly, the contract should involve the rights each party have regarding the commodity or service as well as identify the term of payment. Thirdly, the organisation shall do an evaluation whether the customer can pay the agreed amount. And lastly, the contract must be approved by both the parties. (9 §) To be able to recognize the revenue in the income statement the agreement must be

fulfilled (when the customer has the product in their possession), or recognition can be made in periods aligned with the completion of the work (31 §). (IFRS15, 2014)

Even though the legislation around revenue have been improved so that fraudulent behaviour should not exist, there still might be incentives for organisations to portray their revenue to be better than it is. As discussed earlier, opportunistic manager would benefit by having information asymmetry since it would be harder for external parties to get a correct and fair picture of the company (Deegan & Unerman, 2011; Lambert, 2001). Meanwhile the stakeholders would like to be provided all information when evaluating the organisation so they would not be fooled to engage with an aggressive accounting applying firm where the manager only has self-interest (Deegan & Unerman, 2011; Fama, 1980). In other occasions it might even be the other way around, that organisations with lot of influence tries to reduce their revenue to prevent the government to regulate further taxation regulation upon them (Cobham & Janský, 2018). These incentives might be reflected in the extra information presented within the notes and if that statement is correct, that this investigation could discover them.

The second note to be evaluated is the intangible asset note. Sometimes this note is divided into different notes such as patent, licenses, goodwill etc. The intangible asset is regulated through IAS 38, where an intangible asset is defined as a non-monetary asset without any physical form that can be identifiable (8 §). However, to be able to account for intangible assets, they need to fulfil three criteria (10 §). Firstly, they need to be identifiable, which implies that the asset can be separated from goodwill (11 §) and that it could be sold, transferred, rented, or exchanged from the company to another (12a §). Secondly, the immaterial asset will contribute to generate future cashflow (17 §). Lastly, to assure the future cashflow the company must have control over the intangible asset, which can be achieved through different means depending on the asset (13 §). Some intangible assets need legal protection to find control (13 §) for instance, patent. Although, all intangible assets cannot be protected through legislation, but the organisation could still be accounted as being in control. Knowledge over the technology and the market (14 §), access to knowledgeable and educated employees (15 §), and customer loyalty (16 §) are all examples on intangible assets that could create future cash flows (13 §). (IAS38, 2004)

Although, the complicated part is the valuation process (Watson, 2010). Intangible assets are allowed to be recognised in the balance sheet if 1) they follow the three criteria above and 2) the acquisition value can be calculated in a trustworthy way (21 §). Either they are acquired through a company acquisition, or they are internally developed (19 §). There are different methods and approaches to choose from for intangible asset valuation (Lerro & Schiuma, 2013; Osinski et al., 2017). However, it is impossible to valuate intangible assets simply objectively (Castilla-Polo & Gallardo-Vázquez, 2016; Osinski et al., 2017), which is one of the criticisms towards the valuation of intangible assets (Castilla-Polo & Gallardo-Vázquez, 2016). Since there seldom exists markets for intangible assets, the organisations could not apply a comparable valuation method and therefore ends up applying subjectivity (Ibid.). Hence, it can be problematic to find the correct information and data to create a truthful valuation (Wernke, 2002, referenced in Osinski et al., 2017). Goodwill is an intangible asset that works as a residual account, where additional value can be stored which is believed to create future cash flows that do not belong in other intangible assets (Seetharaman et al., 2004). It can become problematic if Goodwill valuation is incorrectly done (Lohrey et al., 2017). Since the intangible asset valuation can be done through different methods, and that subjectivity will impact the outcome, surely the intangible asset valuation will vary between different organisations. Hence, it would be interesting to investigate if the Attention to Detail in the intangible asset note between various firms.

The third and last note to be evaluated are the contingent liability note. This note is partly different compared with the other two because this type of liability is not recognised in the balance sheet (Arslanalp & Liao, 2014; Lopes & Reis, 2019). According to IAS 37 (2001) paragraph 10, the definition of contingent liability is:

a possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity; or a present obligation that arises from past events but is not recognised because: (i) it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation; or (ii) the amount of the obligation cannot be measured with sufficient reliability.