h

Market entry strategy

Four case studies of Swedish IT-businesses entering in Norway

Bachelor‟s Thesis within Business Administration

Author: Edip Sarac

Pernilla Karlsson Zaid Mohsen

Tutor: MaxMikael Björling

i

Bachelor‟s Thesis within Business Administration

Title: Market entry strategy – Four case studies of Swedish IT-businesses en tering in Norway

Author: Edip Zaid, Pernilla Karlsson, Zaid Mohsen

Tutor: MaxMikael Björling

Date: 2012-05-18

Subject terms: Market entry strategy, Choice of form of establishment, Freedom of establishment, Internationalization

Abstract

The trade today consist of global trade. Businesses are exercising cross-border activities and businesses tend to establish themselves in foreign markets. Many choices and factors affect a business choice of country to enter, and its choice of form of establishment in the new market.

Therefore the thesis will examine the market entry strategy of the four Swedish businesses Lundalogik AB, Infobric AB, Funded-by-me AB, and PayEx AB in the information tech-nology (IT) industry that have established their businesses in Norway. The authors believe that Norway is an interesting country to study as it is one of Sweden‟s most important ex-port markets and the IT-sector stands for approximately 13% of all Swedish exex-ports to-wards the whole world.

The purpose with the thesis is to explore and understand the market entry strategy used by the above mentioned four Swedish IT-businesses when entering the Norwegian market. With help of the purpose of the thesis the authors intend to answer what the underlying reasons for the four businesses were when entering the Norwegian market and its choice of form of establishment.

As this is an explorative study the research method applied is an inductive approach with influences from the grounded theory. An inductive approach is when observations help to formulate a theory whereas the grounded theory is when a theory is discovered from social research. The reason why an inductive approach is better suited for the thesis is due to the flexibility in deciding which theory to choose after analyzing the primary data.

After analyzing the four case studies it can be concluded that no pure internationalization strategy exists among the companies, instead a variety of customer follower and market seeker strategies are common. Moreover, the choice of form of establishment has many factors. Credibility, market knowledge, design of business and existing business relation-ships were the four most common factors identified by the authors affecting the case stud-ies‟ choice of form of establishment.

ii

Acknowledgements

We want to thank all respondents for their participation in the thesis for taking the time for the interviews which enabled us to conduct the thesis.

The participants that we want to give our gratitude to are; Kenneth Johansson the CEO of Infobric AB, Daniel Daboczy the CEO of Funded-by-me AB, Nils Olsson the Norwe-gian sales manager in Lundalogik AS which is a subsidiary of Lundalogik AB, and fi-nally John Martinsson the Norwegian sales manager in PayEx Finance AS which is a subsidiary of PayEx AB.

Lastly, we would like to thank our tutor MaxMikael Björling and the opponents for giv-ing us great feedback throughout the whole semester.

____________________________ Edip Sarac ____________________________ Pernilla Karlsson ____________________________ Zaid Mohsen

3

Table of Contents

1

Introduction ... 6

1.1 Background and problem discussion... 6

1.2 Purpose ... 6 1.3 Research questions... 7 1.4 Perspective ... 7 1.5 Delimitation ... 7 1.6 Definitions ... 7

2

Method ... 9

2.1 Contrasting elements with existing research studies ... 9

2.2 Methodology ... 9

2.3 Data collection ... 10

2.3.1 Introduction ... 10

2.3.2 The choice of adopting case studies... 10

2.3.3 Choice of businesses ... 11

2.3.4 The interviews and the choice of questions ... 11

2.3.5 Execution of the case study ... 12

2.4 Limitations ... 13

2.5 Reliability and the merits of chosen method ... 14

2.6 Validity ... 16

3

Frame of reference ... 17

3.1 Europe ... 17

3.1.1 The European Union ... 17

3.1.2 European Economic Area ... 17

3.2 Freedom of establishment ... 18 3.2.1 Introduction ... 18 3.2.2 Subsidiary ... 18 3.2.3 Agent ... 18 3.2.4 Branch office ... 19 3.2.5 Partnership ... 19

3.3 The market in Norway ... 19

3.4 Theories ... 20

3.4.1 Internationalization strategies ... 20

3.4.2 Credibility ... 22

3.4.3 Market knowledge... 24

3.4.4 The design of the business ... 27

3.4.5 Existing business relationships ... 34

4

Empirical studies ... 40

4.1 Funded-by-me ... 40

4.1.1 Background of the business ... 40

4.1.2 Entrance in Norway ... 40

4.1.3 Factor behind the choice of form of establishment ... 41

4.2 Infobric ... 42

4.2.1 Background of the business ... 42

4

4.2.3 Factor behind the choice of form of establishment ... 44

4.3 Lundalogik ... 44

4.3.1 Background of the business ... 44

4.3.2 Entrance in Norway ... 46

4.3.3 Factor behind the choice of form of establishment ... 46

4.4 PayEx ... 47

4.4.1 Background of the business ... 47

4.4.2 Entrance in Norway ... 48

4.4.3 Factors behind the choice of form of establishment... 49

5

Analysis and discussion... 50

5.1 Funded-by-me ... 50

5.1.1 Internationalization strategy ... 50

5.1.2 Credibility ... 51

5.1.3 Market knowledge... 51

5.1.4 Design of business ... 52

5.1.5 Existing business relationships ... 55

5.1.6 Summary of the market entry strategy ... 56

5.2 Infobric ... 56

5.2.1 Internationalization strategy ... 56

5.2.2 Credibility ... 57

5.2.3 Market knowledge... 58

5.2.4 Design of business ... 59

5.2.5 Existing business relationships ... 62

5.2.6 Summary of the market entry strategy ... 63

5.3 Lundalogik ... 64

5.3.1 Internationalization strategy ... 64

5.3.2 Credibility ... 65

5.3.3 Market knowledge... 65

5.3.4 Design of business ... 66

5.3.5 Existing business relationships ... 70

5.3.6 Summary of the market entry strategy ... 71

5.4 PayEx ... 71

5.4.1 Internationalization strategy ... 71

5.4.2 Credibility ... 72

5.4.3 Market knowledge... 73

5.4.4 Design of business ... 74

5.4.5 Existing business relationships ... 78

5.4.6 Summary of market entry strategy ... 78

Common findings ... 79

5.5 79 5.5.1 Strategies used to enter the Norwegian market ... 79

5.5.2 Choice of form of establishment in Norway ... 81

6

Conclusions ... 89

7

Discussion and reflections ... 91

5

9

List of references ... 94

Appendix - Questions asked to the businesses ... 98

6

1

Introduction

The introduction chapter provides the reader with a background and problem discussion of the subject mat-ter in order for the reader to create understanding of the subject in the thesis. Furthermore, the introduction chapter provides the purpose and the research questions of the thesis and lastly the chapter consists of the perspective and delimitation used in the thesis and definitions that are need to be explained to the reader.

1.1

Background and problem discussion

According to Holmvall and Åkesson (2010), they explain the phenomenon of global trade which is executed all over the world where different economies are increasingly depending on each other. Since businesses are exercising cross-border activities, they tend to establish themselves in foreign markets. European Union is a cooperation among different econo-mies in the continent, with the aim of making it easier for their businesses to enter a new market within Europe (TFEU – 1).

Norway is a country located in Europe and is a part of the European Economic Area (EEA). However, Norway does not belong to the EU cooperation, but as a member of the EEA enables their businesses to have access of the European market (TFEU – 1). Norway is financially strong even after the financial crisis, in contrast to rest of European econo-mies which were severely affected; it can therefore be assumed that Norway is a good country for setting up a business (regjeringen.no).

Norway is one of Sweden‟s most important export markets and derived from the Swedish trade‟s statistics of exported goods and services, the IT-sector stands for approximately 13% of all Swedish exports towards the whole world (swedishtrade.se - 1). There are many factors relating to a successful outcome of cross-border activities and it should be pointed out that not all businesses are doing well when they enter a foreign market. The strategy re-garding the international trade for a business needs to decide which country to enter and the form of establishment.

The thesis will examine the market entry strategy of four Swedish businesses in the infor-mation technology (IT) industry that have established their businesses in Norway. The purpose is to examine the businesses‟ market entry strategy in order to map the factors af-fecting the choice of Norway as a market and the form of establishment. The case studies are examined with Lundalogik AB, Infobric AB, Funded-by-me AB and PayEx AB.

The thesis deserves the attention to be studied, since it involves one of the most important markets to Sweden, Norway, and focuses on a vital industry for the Swedish exports, the IT-sector. The construction of the thesis is also of interest to be studied, since the case studies vary in size, product and service. The authors‟ goal is to map the common factors regarding the companies‟ choice of market entering strategy and the form of establishment in the Norwegian market. It is the aim of the authors that the findings and conclusions made from this thesis can address to vital topics for the Swedish IT-businesses who wants to establish in the Norwegian market, as well as for other academics who wants to further research in the subject.

1.2

Purpose

The purpose with this thesis is to explore and understand the market entry strategy used by four Swedish IT-businesses when they entered the Norwegian market.

7

1.3

Research questions

RQ 1: What underlying reasons exist for the Swedish IT-businesses to enter the Norwegian market?

RQ 2: What essential factors affect the Swedish IT-businesses‟ choice of form of estab-lishment?

1.4

Perspective

The perspective is from the CEOs and the region managers, because they know their mar-ket entry strategy best within their organizations. Another reason of choosing the specific viewpoint is that the in-depth interviews are conducted with CEOs‟ and region managers, which is why they are represented in the thesis.

1.5

Delimitation

The market entry strategy is a large area to explore. Due to the fact that the extent of the work shall be covered within a bachelor thesis, the authors have chosen to limit the thesis to investigate specific questions within the market entry strategy. The market entry strategy has been limited to include the choice of market and the choice of form of establishment for the businesses in the new market.

Moreover, the authors choose to conduct case studies on four Swedish businesses. The reason is that the number of businesses is high enough to cover different forms of estab-lishments while the authors will be able to conduct in-depth case studies on a bachelor the-sis level.

1.6

Definitions

Group; A group consist of associated companies such as parent and subsidiaries under a

common control.

Establishment; An establishment can be defined as an institution that is created with the

purpose to conduct business. There are different forms of establishments to choose from.

Market entry strategy; A market entry strategy consist of planning the method used to

deliver and distribute the company‟s goods or services to the target market.

Internal market; The internal market is the market within the EU where all business

lo-cated within the area has the right to move freely and exercise their right to start and run a business wherever within the EU.

Word-of-mouth marketing; A phenomenon where the reputation of a brand, company

or product is spread through conversations among people.

CRM-systems; Customer-relationship-management, is a concept focusing on increasing

the sales towards present and potential customers. Furthermore, it emphasis the need of taking care of the relationships with the customers. A CRM-system enables a business to handle their current information of their present and potential customers in a more effi-cient method, which enables them to have a better relationships as well as increased sales.

8

Crowdfunding; Ordinary people that decide to invest in a venture project by an

9

2

Method

This chapter begins to explain why the thesis earns to be studied, due to its inductive approach with influ-ences from the grounded theory, which is a rare method-technique conducted in the subject. Later on, the reader will be guided through the method; from the collection of initial data to execution of the case studies and analysis of the data. Beside the execution of the thesis the reader will be provided with information re-garding the limitations of the thesis and also how reliability and validly are obtained in the thesis.

2.1

Contrasting elements with existing research studies

Before conducting the thesis in answering the research questions, the authors conducted a small literature review of existing research regarding the market entering strategies, in order to get inspiration of how to formulate the purpose and the design of the thesis. Surely, it is a broad and well developed subject with many useful theories, but as the authors under-stand the researchers of other studies get heavily influenced from existing literatures of network relationships and internationalization processes (Coviello & Munro, 1997, Bridge-water, 1988 and Moen, Gavlen & Endresen, 2004).

However, in relation to this thesis the authors state that it is important of not being theo-retical influenced to a high degree from existing literatures while conducting quantitative research. More specifically, the authors argue that existing literatures tend to colour the au-thors‟ own perspectives regarding the interviewees‟ stories. Referring to Thomas Kuhn (1970) concept of paradigm where many conceptions can be derived from one reality. Therefore the authors want to stay as true as possible to the „paradigm‟-concept of Kuhn (1970) to see as many possible conceptions from the empirical data through adopting an inductive approach with influences from the grounded theory (Glaser & Strauss, 1967). As far as the authors know, any interpretation-technique with influences from the grounded theory has not yet been applied in the topic of market entering strategy. Therefore, the the-sis earns to be studied due to it‟s uniqueness of differentiating itself from other research re-garding its inductive method of the subject.

2.2

Methodology

The authors adopt a similar mindset as the conventionalism described by Keat and Urry (1982), which says that there does not exist right or wrong explanation of a particular phe-nomenon. Positivism on the other hand, tries to find a more justified theory in relation to other theories on the same subject (Popper, 1976). The authors believe they are subjective in collecting information, due to their prior background such as beliefs and theoretical knowledge as well their personalities, which will substantially affect the results and conclu-sions (Johnson & Duberly, 2000 ). The primary data is collected through interviews, where the outcome will be partly based on the authors‟ prior background, thus the primary data will be subjective. Strengthening the fact that researchers tend to be subjective when col-lecting data, the authors refer to Thomas Kuhn‟s (1970) concept of „paradigm‟ in his work, The Structure of Scientific Revolution. Kuhn states that several conclusions can be drawn from the same reality due to the different background that individuals have when interpreting it. Regarding the approach of selecting theories the authors have decided to use an inductive approach and influences from the grounded theory. An inductive approach means that a hypothesis or theory is formulated after a number of observations (Mathison, 2005). The procedures of generating theories to be used when analyzing the primary data, will take the

10

similar coding-procedures from the grounded theory (Glaser & Strauss, 1967). The reason-ing of choosreason-ing an inductive approach is based on the authors‟ explorative thesis. The au-thors will not know how the empirical data will be in advance, therefore an inductive ap-proach is better suited since the selection of theories will be based on the empirical data, which hopefully generates a better analysis. In contrast, a deductive method would have its hypothesis or theory tested on a collected data to see whether it holds true or not (Vogt, 2005). Furthermore, a deductive approach tends to limit the theoretical perspective regard-ing the collection and the analysis of the empirical data. Whereas an inductive approach en-ables the authors to select a more appropriate theory due to the influences from the cod-ing-procedures of the grounded theory, which will in the end generate a better analysis on the primary data (Glaser & Strauss, 1967).

2.3

Data collection

2.3.1 Introduction

The thesis is an explorative study, in which the authors settle out to understand more about its purpose (Saunders, Lewis and Adrian, 2007). Specifically, the authors want to explore and understand some of the underlying factors affecting an entering-strategy for a company that want to establish their business in another country. In order to answer the purpose, the authors have decided to conduct four case-studies.

The data collection in this thesis was taken from majorly two sources: primary and secon-dary data. The primary data was conducted through interviews of selected companies. The secondary data is collected from other persons than the authors themselves (Lewis-Beck et al., 2004). The authors majorly used secondary sources to find suitable theories to be ap-plied on the case studies.

2.3.2 The choice of adopting case studies

The reasons of adopting case studies are mainly due to three factors:

Firstly, conducting a case study enables great access to rich information from a company, hopefully answering the questions of the topic in terms of; why, what and how (Saunders et al., 2007). The authors want to approach the topic from a few and selected companies‟ perspective, rather than pursuing a questionnaire that would tend to become general and require many participants.

Secondly, the case studies fit well together with the purpose of the thesis, where the authors aim to explore and understand the underlying factors affecting a market-entering strategy.

Thirdly, there was little freedom in the authors‟ choice of adopting other alterna-tives in comparison to case studies, regarding time and resources. Accomplishing case studies was itself a great difficulty, in order to find participants who fitted into the purposive sampling. The companies who were willing to participate and ful-filled the criterion of the purpose sampling were four Swedish IT-companies which were found through the authors‟ personal networks. Before finding the participants for the thesis, the authors went as far as going through alphabetically of a members list of Sweden‟s largest business network of IT and telecom companies, IT &

Tele-11

komföretagen. The authors contacted 15 companies who fitted into the criterion of the purposive sampling from the members list (it was from capital letter A to H), but without any success. In terms of adopting a quantitative method such as ques-tionnaire, would be difficult for the authors to accomplish due to the practical mat-ters such as time, resources and the low general enthusiasm among the potential participants.

2.3.3 Choice of businesses

The selection of the companies as case studies in this paper is regarded as purposive sam-pling, (Neuman, 2000). The companies had to fulfill the criterion the authors have settled out, in order to answer the research questions. The first criterion was being a Swedish firm that has opened up their business in Norway. Secondly, the Swedish firms must be within the IT-industry. Furthermore, the authors wanted to have a heterogeneous group of par-ticipants who contrasts each other in term of software and hardware products combined with services and the sizes of the firms. The characteristics of the firms are summarized be-low in the figure 1. According to Patton (2002), it is believed to contribute more to a paper with a heterogeneous sample of cases, since it may be possible to observe key characteris-tics among the case studies. Despite the fact that a small sample of case studies could con-trasts to each other, it may be seen as a benefit since it provides uniqueness to a thesis.

Companies Revenue 2012 Employees

2012 Established markets Type of business

PayEx AB 250,000 MSEK 500 Norway, Finland,

Denmark and Swe-den

Provides IT-solutions for bill-ing processes

Infobric AB 33MSEK 20 Norway and

Swe-den Provides solutions IT- re-garding security at construction-sites

Lundalogik AB 100MSEK 104 Norway, Finland

and Sweden Provides CRM-systems Funded-by-me

AB - 2 Norway and Swe-den Provides a plat-form for crowdfunding Fig. 1. MSEK = million Swedish Krona (SEK). Funded-by-me is in its first year as a business, therefore the revenue is unknown.

2.3.4 The interviews and the choice of questions

The interviews were recorded and transcribed, in order for the authors to capture all the essential facts given from the case studies. The structure of the interview questions is semi-structured, where the authors have a set of theme questions towards the participants, but having the ability to adopt the interview through spontaneous explorative questions based on the company‟s unique story (Lewis-beck et al., 2004). The interview-model consists mainly of open questions, where the participants can describe their stories. However, if the

12

authors explore a specific topic in the interview to be more of interest, then the authors will adopt more spontaneous questions that are probing.

The reasoning of having a semi-structured interview is the ability of comparing the case-studies‟ answers from the theme questions, in order to see if there are key characteristics from the data. At the same time, the semi-structured interview also enables the authors to become explorative through spontaneous questions adapted to the participant‟s previous answers on the theme questions, in which we are able collect unique data from the chosen companies.

2.3.5 Execution of the case study

The execution of the case studies is a vital component of the method in this thesis, which is mostly influenced from Glaser and Strauss‟ (1967) grounded theory model.

After the interviews were conducted, recorded and transcribed, the authors adopted a similar method to the open coding process: each author was assigned a case study, to find and highlight the essential factors answering the purpose of the the-sis. Here the authors were aimed to find common codes from the empirical data. The next step which was influenced from the axial coding procedure: the au-thors met and discussed the case studies in order to answer the following questions;

o why the specific company decided to enter the market. o which factors were essential in entering the market.

o which factors were essential in the choice of form of establishment.

When all the necessary key results of each case study were written on the white board, the authors discussed together to find common subject categories that occurred in all or major-ity of the four case studies. For instance, if all the interviewees mention car, motorbike and airplane then the subject category would be transportation. However, if the participants mention Volvo, Volkswagen and Nissan, then the subject category would be cars (Payne & Payne, 2004).

The last step was inspired from the selective coding procedure or theoretical

sampling: When the subject categories were clearly defined, the authors aimed to

find suitable theories from existing data, to be applied on the case studies. The sub-ject categories were the following: market knowledge, credibility, the design of the business and existing customer relationships.

Each of the authors was assigned to find relevant articles or course literature related to the subject categories, which consist of applicable theories to use on the case studies. The au-thors used majorly the database Scopus and relevant course literature. The period the arti-cles were published was 1990-2012. From the search results, the authors ranked the artiarti-cles after number of citations they got and made sure they were peer-reviewed and accepted. Based on the title of the articles and the given abstracts, the authors decided which papers were of interest to read and to use for the thesis. Furthermore, the authors‟ supervisor also suggested some vital course literature that had interesting theories which the authors found to be useful. Additionally, the authors used course literature studied in prior courses taken at Jönköping International Business School, however the time frame of the publication is not limited. One of the chosen theories in the thesis that is not limited regarding its publi-cation date is the theory of Mintzberg‟s organizational structures from 1980, since it

oc-13

curred in a course literature. The authors had to use the primary source of Mintzberg, in order to maintain the credibility of the thesis. The chosen theories from existing literature will be explained through the primary data, which leads to the analysis and conclusions, thereby answering the purpose of the thesis.

2.4

Limitations

There are several limitations of this thesis, which will be explained in the following para-graphs:

Authors’ subjectivity

According to the authors‟ point of view, their subjectivity is the most influential factor lim-iting the study regarding the following decisions made in the thesis;

The reasoning of choosing companies. The structure of the interviews.

The authors‟ interpretation of the qualitative data.

The theoretical sampling of essential articles in analyzing the case studies.

The thesis is greatly influenced from the subjectivity of the authors, due to their back-ground, experiences and knowledge (Johnson, Duberly, 2003). An example is the choice of questions given to the companies, which influences the received information. Perhaps there were other questions the authors missed out, which could shed light upon other vital sub-ject categories to be included in the analysis. Another example of the authors‟ subsub-jectivity is during the theoretical sampling, in which the choice of search-words depends on the choice of the authors‟ association to the subject categories. For instance, one of the categories is the design of business, which can be searched through by many means in the database Scopus; “tangible and intangible and continuum” or “product and service and business”, and so on. Depending on the choice of search words it will impact the articles received from Scopus. Furthermore, Scopus was the only database the authors used, since it enabled them to rank the results after number of citations, but it limits the theoretical sampling from other data-bases, which could potentially have important articles for the thesis. According to the au-thors, their subjectivity is an asset as it is a liability.

Only one industry explored

There were only four firms interviewed and all of them are within the IT-industry. This makes it difficult to use the results towards other industries. The four case studies are too small to be generalized and therefore it is very subjective (the authors do not want to try generalizing their data).

Multiple case studies vs. single case study

The authors adopted a multiple case study rather than one in-depth case study. It can be argued whether the authors could miss out rich information through several interviews from one company. In comparison, it is questionable whether the authors could have re-ceived less or more information from four case studies through only one interview per par-ticipant. The collection and the quality of the primary data of the four case studies were heavily dependent on conducting a well-designed interview model. There was only one chance to receive satisfying data; surely the authors were given the chance to complement the data through emails with the participants. On the other hand, through a one in-depth case study the authors would not have been as dependent on the collection of the

inter-14

views, as they would have been able to complement the primary data to a larger extent from the participant through several meetings.

The Norwegian market is the only market explored

The choice of only interviewing companies established in Norway have several limitations, in the following paragraphs the authors will discuss those facts in detail;

Norway is not a member of the EU (eu-norway.org - 1), which can affect the pri-mary data due to the expensive customs duties. In relation to companies who are established in Denmark who is a member of EU and does not have expensive cus-toms duties as Norway. Interesting results could occur between companies who are located in Denmark or Finland due to the lack of custom duties in comparison to Norway who has custom duties.

The close geographical distance between Norway and Sweden may affect the em-pirical data compared to Swedish IT-companies established in Taiwan (given as an example).There could have been more contrasts in the data if the authors re-searched about the underlying factors of entering the market in Taiwan comparing to Norway.

Norway and Sweden shares together a unique Scandinavian history and have com-mon similarities in their languages. However, in comparison to other countries with an even more contrasting culture, history and language towards Sweden, could it af-fect the empirical data? This is another limitation of the study, since it does not ex-amine Swedish IT-firms established in other countries, but only in Norway.

According to United Nations information service (2011), Norway is one of the wealthiest countries according to their human development index (HDI), (unis.unvienna.org). This particular fact may shape the empirical data of the case studies. If the authors instead examined companies established in a country that has a low HDI-value, for example Congo, it may generate a different primary data to the thesis.

2.5

Reliability and the merits of chosen method

According to Easterby-Smith (2002), he explains that reliability refers to the design of the data collection, whether it will give the similar results if other researchers adopt the same method (cited in Saunders et al., 2007). Marshal and Rossman (1999), argues that adopting a case study, its‟ results will only exists for that specific period since the data will change with time. However, there is no reason of not carrying out a planned and structured method regarding the collection of primary data (cited in Saunders et al., 2007). It is not re-alistic to state that other researchers are able to generate the same results as a conducted multiple case study. Since it is a non-standardized and qualitative paper, due to the complex and dynamic circumstances that exists when interviewing the participants (Saunders et al., 2007). Robson (2002) states that there are four matters to be discussed regarding reliability (cited in Saunders et al., 2007);

Subject or participant error, refers to whether the quality of the participants‟

an-swers can vary depending on external factors, such as the time or mood of the par-ticipants when the data was collected.

15

Subject or participant bias, means whether the participants‟ answers can be

bi-ased due to specific circumstances stated by their surroundings. The participants cannot tell the whole “truth” or all the facts and have to be selective in sharing their information in order to put their organizations in a positive outlook.

Observer error means if there any chance for the authors to conduct the research

in various ways, which results to different, received data. For instance, during an interview, there could be at least three different ways to ask the questions towards the participants.

Observer bias, refers to the authors‟ tendency of interpreting the findings

differ-ently. For example, there could be different ways of interpreting the participants‟ answers.

In the following sections, each part will be discussed on how each reliability-problem has been handled and the merits of the thesis‟s method.

Subject or participant error limited by preparation and purposive sampling

Regarding the subject or participant error, the authors argues that the error is relative low in the thesis, due to the fact of preparations and selection of enthusiastic participants. The authors believe that the quality of the interviews could differ greatly of when it would take place, thus affecting the quality of the participants‟ answers. All of the participants were busy and had intense schedules, in order to avoid poor answers the authors booked the in-terviews in one or two weeks ahead. This enabled the participants to handle their schedules and set aside one or two hours for the interview. The selection of companies has been car-ried out carefully, in order to collect relevant data to the thesis‟ purpose. The participants fulfilled the criterion of the authors; being a Swedish firm within the IT-industry, entered and established their business in the Norwegian market. More importantly, in addition to the fulfilled criterion, the participants‟ enthusiasm to be involved with the thesis was of great benefit to the thesis.

Subject or participant bias limited by the positive purpose of the thesis

Referring to the subject or participant bias, the authors believes it does not affect the reli-ability of the thesis, due to the purposive sampling. All the participants successfully entered and established their businesses in the Norwegian market. The companies do not risk any-thing by explaining the reasons behind the market entering strategy and form of establish-ment that have already taken place. Rather, the participants will be put in a positive light in the thesis due the focus on their success of entering the Norwegian market. The core ar-gument relating to the subject or participant bias is that the companies do not risk anything by telling the truth, but instead will have the possibility of being put in a positive light through academic channels. However, the majority of the case studies conduct consulting-business, thus the answers can tend to be similar regarding their market entry strategies and setting up their businesses in Norway.

Observer error limited by the design of semi-structured interview model

The observer error in this thesis does exist, all of the authors could ask three different ways of the same questions. The observer error is reduced through common decision-making by the authors in choosing the structure of the interview-model and which questions were of most interest. The construction of the interview was semi-structured, enabling the authors to both collecting answers of the theme questions and asking spontaneous questions when interesting topics occurred. All the authors were available during the interviews; they re-corded the conversations and later transcribed the interviewees in order to prevent missing

16

out any important information that could be vital for the thesis. The companies will also be provided with the empirical results, in order to adjust the information to give a more cor-rect description of the case study. Two of the four representatives from the companies were CEOs, and the other two were held responsible for the business activities in the Norwegian market.

Observer bias limited through joint decision-making and its discussions among the authors

The observer bias is difficult assess, since the authors in this qualitative study are supposed to be subjective when interpreting the results. Due to the authors jointly decision-making upon important elements throughout the thesis, the observer bias is limited. The authors met and discussed the four case studies‟ results, in order to decide which common subject categories existed between the case studies. Once the common subject categories were jointly decided, then the theoretical sampling could start and the theories were selected. Af-terwards the authors met again and discussed if the theories actually could be applied upon the case studies, thus be included into the thesis. The authors believe that the observer bias is handled due to the several discussions took place among them and jointly deciding on important elements of the thesis.

Secondary data; the merits of using the database Scopus and its citation ranking-system

The conduction of the theoretical sampling was done through searching words associated to the subject categories in the database Scopus. The authors argue the reliability of the thesis is valid, due to the citation ranking-system of Scopus. From the results occurred from the search words, only those articles with a relative high number of citations among the other results, relevant title and abstract were chosen. Other secondary sources are course literatures, whereas the Internet sources are mainly taken from governmental, in-structional and internationally known publisher such as Sage publications ltd.

2.6

Validity

A simple definition of validity is “whether the findings are really about what they appear to be about.” (Saunders et al., 2007, p. 150). More specifically, can the findings from a study explain the cause-and-effect relationship between two variables (Lavrakas, 2008). Additionally, the method of data collection really measures what it is suppose to measure (Saunders et al., 2007). The vital question is whether the semi-structure interview model of the thesis is good enough to collect the relevant answers relating to the purpose? The authors argue it is, since they collectively decided which questions were of importance. The collected an-swers were both from theme questions and spontaneous follow-up questions towards the companies when interesting answers occurred from the theme questions. More importantly the participants were selectively chosen for the thesis and were interested to give reliable information to the thesis, thus the answers from the companies are of great value.

The second problem of validity is; whether the findings appear to be what they truly are. The study is a qualitative study, in which the authors are supposedly to be subjective when interpreting the data. There could be several perspectives interpreting the findings, but the authors had the possibility of comparing the case studies‟ data with each other. The proce-dure of comparing the case studies resulted into generating subject categories that are true for all of the businesses. Finally, using the previous argument; due to the purposive sam-pling of the companies, the authors were able to collect answers that are essential towards the thesis.

17

3

Frame of reference

The chapter of frame of reference can be said to be two folded. The first three subchapters explain the mar-ket in Europe, the freedom of establishment and the Norwegian marmar-ket. The information is needed in order for the reader to understand the background of the markets that the businesses in the case studies are active in and also to understand the rules at hand regarding the right to establish a business in another country. The last five subchapters consist of the theories. The first theory could explain why the businesses entered the Norwegian markets while the other four theories could explain the factors affecting the businesses choice of form of establishment. The theories have been chosen after the conducted interviews with the businesses through the grounded theory. The categories selected forming the theories are internationalization strategies, credibility, market knowledge, design of the business and existing business relationships.

3.1

Europe

3.1.1 The European Union

The EU consists of 27 member states. The EU is one of the biggest trade blocs in the world and the EU exercise more than 20 percent of the trade in the world (Holmvall & Åkesson, 2010). The EU has an internal market which means that persons, services, capital and products have the right to move freely within the EU (TFEU - 2). Moreover, busi-nesses have the right to run and establish their business wherever they want in accordance to the rules in the country of establishment and the country of establishment cannot have any further restriction for the foreign business (TFEU - 3). The idea is that the EU should be seen as a single market and not 27 different markets. The internal market makes it easier for businesses to exercise cross-border activities (Holmvall & Åkesson, 2010).

The freedom of establishment has made it easier for businesses to exercise their operations wherever it is most suitable. However, there are many challenges when exercising cross-boarder activities, for example the difference in culture and language between the member states and the difference in compliance rules. The internal market has harmonized rules in order to make it easier to exercise cross-boarder activities. Harmonized rules means that all the member states have common rules that they need to comply with and their national rules within that area are secondary. (TFEU – 4).

It is clear that the internal market makes it easier for businesses to trade and establish their business within the EU compared to countries outside the EU. The reason is because out-side the EU the businesses need to comply with different rules and customs in all countries that the business want to enter.

3.1.2 European Economic Area

Norway is not a part of the EU due to the fact that they voted no to a membership twice 1972 and 1994 (eu-norway.org - 1) However, Norway is a part of the EEA which include all 27 member states of the EU and Norway, Iceland and Liechtenstein (eu-upplysningen.se).

The goal of the EEA is to set up a system that can ensure equal conditions of competition among the members. The EEA agreement allows the members access to the internal mar-ket, for Norway who is not a part of the EU, persons and businesses will still have access to the right of free movement within the area. However, the EEA is not a customs union

18

which means that trade policy towards non-EU countries falls outside the EEA. (eu-norway.org - 2 and eu-(eu-norway.org - 3). The EEA is beneficial due to the fact that members are able to be a part of the internal market but there are many common rules and other ad-vantages that are offered to EU members that EEA members do not have access to such as common harmonized rules.

3.2

Freedom of establishment

3.2.1 Introduction

A business can establish their business in another country within the EU, due to the right to move freely within the internal market. A business has many forms of establishments to choose from (Holmvall & Åkesson, 2010).

The forms of establishment that will be explained below are those forms that are used in the case studies or mentioned by interviewees, in order for the reader to follow the reason-ing. The forms will be discussed are subsidiary, agent, branch office and partnership.

3.2.2 Subsidiary

A subsidiary means that the business open up their own business in another member state. The business in the other member state will operate under the main business in Sweden and the main business will have complete control over the new business. Moreover, a sub-sidiary is a separate legal entity. However, there are disadvantages as well such as financial due to the fact that there is costly to invest in both new facilities and new employees in the new market. (Holmvall & Åkesson, 2010)

A subsidiary can either be created by the business from scratch or through an acquisition of an existing business. To build a subsidiary from scratch can be called green-field and it means that nothing exist from the beginning. The business need to find workers, facilities and equipment and so on. The business need to get to know the new market, create rela-tionships with both customers and other businesses that can be off importance for the sub-sidiary (Barkema & Vermeulen, 1998, cited in Johansson et al., 2002). Acquisition of an ex-isting business means that the business takes over the exex-isting business including workers, the relationships the business have with other business that is needed in order for the busi-ness to function properly. In other words, the busibusi-ness buys a complete package that can be used directly (Johanson et al., 2002).

It is clear that it is more time consuming to use green-field than to acquire an existing busi-ness but on the other hand the busibusi-ness can be structured in a way that pleases the owners and in a way that correspond to the whole corporation. The owners can follow the devel-opment within the business step by step and the owners can learn from their mistakes. When a complete business is acquired, it is difficult to make the business fit into the or-ganization, in other words to integrate the business into the whole corporation (Andersson, Havila & Salmi, 2001, cited in Johnson et al., 2002). It is faster than green-field to acquire an existing business and it is a package deal where networks and relationships are obtained and thereby the internationalization process is faster (Johanson et al., 2002).

3.2.3 Agent

An agent can be either a person or a business that is representing the business locally in the new market. The task of the agent is to have contact with the buyers but the transaction as

19

such and the payment is made from the main business. Normally the agent is representing the business legally and therefore the agent can make the business responsible for his ac-tions. For this reason it is important that the business can trust the agent. (Holmvall & Åkesson, 2010)

3.2.4 Branch office

A branch office is a kind of an extension of the business in Sweden to the market abroad. It is easier than to open a subsidiary but the branch office is not a separate legal entity and therefore the main business in Sweden will be legally responsible for everything that is happening in the branch office. (Holmvall & Åkesson, 2010)

3.2.5 Partnership

A business can also choose to establish their business in another member state through an-other business. The businesses then become partners as they join a partnership. The part-nership is built on an agreement that they will work together towards common goals. However there are two different types of partnerships; general and limited partnership. In a general partnership the partners share the responsibilities for the business both in good and bad and they manage the business together. (entrepreneur.com.)

On the other hand in a limited partnership there are both general and limited partners. The responsibilities are divided among the partners, where the general partner own and operate the business and the partner is legally responsible for the business. The limited partner has no control over the business and no legal responsibilities towards the business but the lim-ited partner serve more as an investor. (entrepreneur.com.)

Even though it is more beneficial with regard to the common rules for a Swedish business to establish their business in a member state of the EU many businesses establish their business in Norway. What choice of form of establishment a business chooses depends on many factors such as financial, need for control, connections, experience and network (Holmvall & Åkesson, 2010). Through the in-depth interviews with the four chosen busi-nesses the authors hope to be able to determine the factors behind the busibusi-nesses choice of form of establishment in Norway. The market of Norway will be further explained below.

3.3

The market in Norway

Norway is among the richest economies with a GDP per capita of 483,725 SEK (2007) (swedenabroad.com- 1), which makes it the 7th strongest economy in the world (cia.gov). In Norway the inflation rate in March 2012 was 1,2 % (tradingeconimies.com) and the GDP in 2011 was 3,304 billion SEK 1(swedenabroad.com- 2). In comparison to the

infla-tion rate in Sweden, that was 1,9 % in the beginning of 2012 and the GDP in 2011 was 3,495 billion SEK (ekonomifakta.se).

Norway is categorized as a mixed economy; hence, it is featured by a combination of free market activity and government intervention. The government controls key areas, such as the vital petroleum sector, through large-scale state-majority-owned enterprises (norge.se).

20

Due to their huge oil and gas extraction, which accounts for 50 % percent of their econ-omy, their economic welfare has been strong, and the economic growth has remained sta-ble at around 3,5 % growth each year since 1990. The strong economic welfare is signified by the high private consumption, which in 2011 were 36,067 USD per capita. Since Nor-way is ranked, globally, as number six in the doing business rank list and categorized as a high-income country, the Norwegian market is beneficial for Swedish businesses (doing-business.org). Country indicators have determined that Swedish export to Norway has in-creased by 7% between 2009 and 2010 (swedishtrade.se-2).

Of Sweden‟s total percentage of total export value of 463 billion USD, 13 % was in the IT and communication area (2010). Norway is Sweden´s second largest export trading partner with a total of 10 % of Sweden´s export and Swedish exports to Norway during 2010 were approximately 113,2 billion SEK (swedishtrade.se-2)

In recent years, the demand for labour in Norway has been higher than the supply. Sweden has been a significantly important country for Norway regarding labour force with 25,000 registered Swedes in Norway. One of the reasons why so many Swedish people choose to work in Norway is the significantly higher wages they are offered comparing to Sweden. (swedenabroad.com-2).

Through the interviews with the four chosen businesses the authors hope to be able to de-termine the factors behind the businesses choice to enter the Norwegian market. The next sections concern the theories that have been found to explain the business choice to enter the Norwegian market and their choice of form of establishment.

3.4

Theories

3.4.1 Internationalization strategies

Johanson et al. (2002) have identified three different internationalization strategies;"Market seekers", "customer follower" and "following John". The three different internationaliza-tion strategies are used to explain the reason behind businesses entering new markets in other countries which is summarized in figure 2.

Market seekers

Market seeking can also be considered as network seeking since those businesses normally approaches foreign markets without knowing much about the market. Market seekers use the judgments from their own management regarding what the business is capable of and what knowledge that the business have and lack. The strategy of market seekers is risky due to the fact that the business lack any experience regarding international business and knowledge regarding foreign markets. However, due to the lack of experience and knowl-edge many businesses conduct market research before entering the market. The informa-tion received from the market research might not always be reliable because the business lacks the knowledge that is needed in order to analyze the data collected. It should be pointed out, that this strategy is time consuming and costly, partly due to the execution of the market research but also because of wrongly made decisions due to the lack of net-works and wrongly chosen resources due to lack of knowledge from managers.

Customer follower

There are many ways that a business can follow their partners or customers. Johansson et al. (2002) provides a few examples such as that the business have partners that is foreign

21

or partners that have developed connections with the foreign market or the fact that the business have customers located in a foreign market. By following a partner or a customer into a foreign market the business avoid costly and time consuming processes which is need in order to obtain important information about the new market and the information obtained from the partner or customer will be reliable.

Johansson et al. (2002) provide an example of a business that has used the customer fol-lower strategy to enter the international market. It is a Swedish company called Nefab who produces packaging for the telephone communication industry. Nefab started cooperation with Ericsson and they became to have a mutual dependence. Ericsson became Nefab larg-est customer and Ericson became dependent of Nefab because no alternative suppliers ex-isted for Ericsson. When Ericsson expanded to markets outside Sweden Nefab followed in order to serve its most important customer. Due to the cooperation with Ericsson and the knowledge Nefab developed through the cooperation with Ericsson Nefab have gained other big customers such as Nortel and Alcatel. The example points out how a close coop-eration between buyer and seller where the parties are not replaceable to each other be-come an internationalization strategy.

This strategy means that the business have knowledge about the foreign market due to its partners or customers. In contrast to the market seekers strategy the customer follower al-ready have a position in an international network. The international network has been cre-ated through the cooperation with the partner or customer at the home market. Through that cooperation the businesses have gained experience-based knowledge about the foreign market, for example by delivering the business products abroad. Johansson et al. (2002) states that a business can lose its key customers if the business cannot deliver the products to the customer‟s foreign subsidiary. By having some knowledge about the international market the business reduces it risks and cost in the market entry process.

Following Johan

This strategy means that the business imitate each other. When only a few actors exist on the market businesses are likely to follow their competitor to a foreign market. If one busi-ness move and establish their busibusi-ness in a new market other busibusi-nesses will follow. Those businesses already have extensive knowledge and international networks. According to Jo-hanson et al. (2002) the different establishments made by the business normally is a way for the businesses to divide their resources among many businesses and thereby reduce their total costs. In other words, the movement is only a strategic decision due to economic of scale.

Market seekers Customer follower Following John Network No established

net-works Established networks Established networks Obtaining

market knowledge Collect and interpret in-formation yourself Learning through co-operation Focus on competition Establishment

process Time consuming and costly Quickly and inexpen-sively Economies of scale Fig.2: Modification of Johanson et al. (2002) summary of the different internationalization strategies, p. 101.

22

The study examines reasons and strategies behind businesses internationalization and what factors that can affect internationalization. In other words, the study explains the reasons behind why a business choose to enter a new market in another country.

3.4.2 Credibility

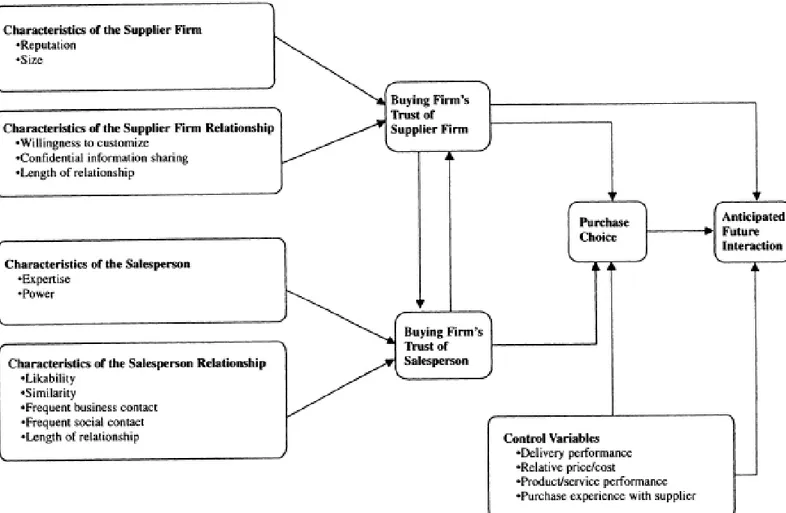

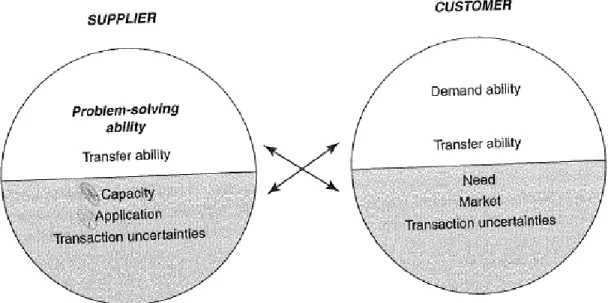

According to Anderson & Narus (1990) members satisfaction increases and conflicts re-duces when the buyer has trust in the supplier (cited in Doney & Cannon, 1997). Custom-ers can trust either the business or the salespCustom-erson or both. It has been showed that trust lead to more commitment and long-term relationships (Anderson & Weitz, 1989 and Mor-gan & Hunt, 1994, both cited in Doney & Cannon, 1997). Doney & Cannon (1997) defines trust as credibility and benevolence (referred Ganesan 1994, Kumar, Scheer, & Steenkamp, 1995). Credibility is the expectation that both vocal and written words of the party can be trusted and relied on (Lindskold, 1978, cited in Doney & Cannon, 1997). Benevolence con-cerns the interest in the other party´s welfare and the motivation of combined goals. The figure 3 below shows an overview of the study conducted by Doney & Cannon (1997) and the antecedents and the consequences will be explained below. It should be noted that only the characteristics of the supplier is explained below because the characteristics of the salesperson is not of relevance of the thesis.

Fig. 3: Doney & Cannon (1997), An Examination of the Nature of Trust in Buyer-Seller Relation-ships, p. 39.

23

Characteristics of the Supplier firm

Supplier reputation is described as the degree of which both people and firms within the spe-cific industry believe that the supplier in question is honest and genuinely care about its customers. It means that buyers‟ trust of a supplier depend on the beliefs of people and firms within the industry (Doney & Cannon, 1997). For example, if a buyer believes that the reputation of a supplier is well deserved, then trust will be established due to the history of the supplier‟s relationship with other buyers.

It should first be pointed out that the supplier size includes both the overall size of the busi-ness and the market share position that the busibusi-ness has. According to Hill (1990), the size of the supplier give signals to the buyer that they can be trusted. The reason for this is that the size indicates that other buyers trust this business enough to do business with it. It also implies that the supplier keep its promises otherwise they would not be able to maintain its position and size on the market (cited in Doney & Cannon, 1997).

Characteristics of the supplier firm relationship

Supplier willingness to customize means that they are willing to offer or make personal in-vestments in the relationship with the buyer. Personal investment from the supplier means specialized or adapted equipment or processes in order to meet the needs of the buyer (Doney & Cannon, 1997). According to Lindskold (1978) and Strub & Priest (1976), the willingness of the supplier to customize its products and thereby take risk to produce a product only made for that buyer gives the buyer an incentive that the seller are interested to cooperate (cited in Doney & Cannon, 1997).

According to Doeny & Cannon (1997) confidential information sharing, describes the amount of private information that the supplier are willing to share with its customers. To share private information shows that the seller have faith in the buyer.

There are two processes that are considered to build trust that can explain that trust be-tween the parties‟ increases over time. The first process explains that time is an investment that none of the parties want to lose. The second process is that prediction grows over time and to have history with the relationship, the previous outcomes works as a frame-work of future outcomes (Dwyer, Schurr, & Oh, 1987., Scanzoni, 1979., Williamson, 1985., and Anderson & Weitz, 1989, all cited in Doney & Cannon, 1997).

Role of trust in future purchase intentions

A relationship built on trust means that the buying business can rely on the supplier that they trust, in other words, the supplier will act in the best interest of the buyer. For a long-term relationship to work the key component is trust due to the fact that the focus of a re-lationship is on the future. The intentions of the buyer to stay and continue the rere-lationship is build on trust (Ganesan, 1994, cited in Doney & Cannon, 1997).

The result from the study conducted by Doney & Cannon (1997) shows that that supplier size and supplier‟s willingness to customize have a positive impact in the buyer‟s trust in the supplier‟s business. However, the result shows that the supplier's willingness to share confidential information and length of the relationship had no impact in the buyer‟s trust in the suppliers business. Moreover, the result shows that the trust of the selling firm plays a significant role in the future interaction between the buyer and the seller (Doney & Can-non, 1997).

24

The study shows that it is important to have trust and thereby credibility in a business. If a supplier wants to have strong relationships with the buyer it is important that the relation-ship between the parties is built on trust. Furthermore, the study shows how different ante-cedents can affect and increase the buyer‟s trust of the supplier.

3.4.3 Market knowledge

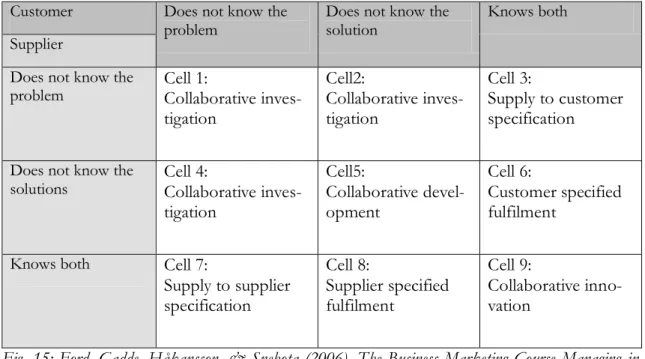

The relationship between market knowledge competence and new product advan-tages

The studies conducted by Li & Calantone (1998) demonstrate the relationship between market knowledge competence and new product advantage and the study will be accounted for below. Li & Calantone (1998) define market knowledge as information about a specific market where the information is organized and structured. In this context, the term organ-ized stand for a systematic process and structured stand for data that is meaningful. Mar-ket knowledge competence is considered as the process that is needed in order to reach market knowledge (Li & Calantone, 1998).

The model of market knowledge competence and new product advantage consist of three dimensions namely environmental antecedents, contributing factor and outcomes, see the figure 4 down below (Li & Calantone, 1998). It should be noted that in order to conduct the analysis of the cases in chapter five only the components in the market knowledge competence is of importance and therefore will the other components in the model not be explained in this thesis.

25

Fig. 4: Li & Calantone (1998), The Impact of Market Knowledge Competence on New Product Advan-tage: Conceptualization and Empirical Examination, p. 15.

Li & Calantone (1998) state that customer knowledge process provides the business with the possibility to explore innovation opportunities through promising market demand. More-over, Li & Calantone (1998) state that customer knowledge process reduce the risk for the product to be mismatched against the need of the buyer. The marketing and R&D interface is the process where marketing and R&D work together and the level of cooperation among those will determine the match or mismatch between the demand and the outcome. As the last pieces of the market knowledge competence is the competitor knowledge process that pro-vides the business with a framework where the business can target its position (Li & Calan-tone, 1998).

The relationship between market knowledge competence and new product advantage has showed to be positive and that market knowledge competence has an impact on the advan-tage of the new product. The study conducted by Li & Calantone (1998) also shows that all three components of the market knowledge competence; customer knowledge process, marketing and R&D interface and competitors knowledge process are important in order to create greater products. However, the marketing and R&D interface will not be used in analysis of the businesses‟ market entry strategy.

The study has explained the positive correlation between market knowledge competence and new products advantages. The study has showed that it is very important to have mar-ket knowledge in order to be successful in a new marmar-ket with a new product or concept. For this reason it is understandable that a business is interested in gaining market knowl-edge when entering a new market and that the market knowlknowl-edge competence can be a fac-tor in the choice of form of establishment. It can be concluded that market knowledge is an important factor in order to succeed in a new market.

Local market knowledge

Lord & Ranft (2000) conducted a study regarding transfer of local market knowledge among the corporation‟s different divisions. According to Inkpen & Beamish (1997) local market knowledge concerns knowledge of the language, culture, politics, economy and so-ciety of the host country (cited in Lord & Ranft, 2000). Moreover, the local market knowl-edge is of importance when both planning and in the implementation of an entry of a new market in order for the business to be successful (Lord & Ranft. 2000).

Lord & Ranft (2000) states that there exist two kinds of local market knowledge namely explicit and tacit knowledge. Explicit knowledge refers to knowledge concerning demo-graphics, macroeconomic statistics and other market research. Tacit knowledge, on the other hand, refers to knowledge based on experience needed in order to understand the cultures, political regimes and socioeconomic systems (Andersen, 1993, cited in Lord & Ranft, 2000). It is obvious that tacit knowledge is most difficult to obtain since it requires local experience that is personal. However, explicit knowledge might be difficult to obtain as well, if well-developed and available sources regarding market information does not exist which might be the case in some countries (Lord & Ranft, 2000). Explicit knowledge can normally be accessed by all businesses since the information is public and therefore is the tacit knowledge more critical for businesses entering a new market. In other words, it is the tacit knowledge that can make the business gains an advantage in the new market (Lord & Ranft, 2000). Andersen (1993) explains that it is the know-how that is of tacit nature that can lead to a successful implementation into the new market (cited in Lord & Ranft, 2000).

26

The result from the study firstly concludes that gaining local market knowledge is complex and individual for all business and depends on both the internal flow of the business and the nature of the knowledge. Moreover, the result shows that tacit knowledge is the most important knowledge for a business to gain and it has been pointed out that is difficult to obtain tacit knowledge (Barkema et al., 1996, cited in Lord & Ranft, 2000). Andersen (1993) points out that due to the fact that tacit knowledge is difficult to obtain the benefit for those businesses that do obtain this knowledge gain increased benefits (cited in Lord & Ranft, 2000).

The study provides information about the importance to obtain market knowledge as well. This study is more specific in what market knowledge that is important to gain, namely tacit knowledge that is based on experience. The study also explains the difficulties that ex-ist when it comes to gain local market knowledge. Due to the importance of the tacit knowledge in order to be successful in the new market it is understandable that the method to obtain tacit knowledge can influence the business choice of form of establishment.

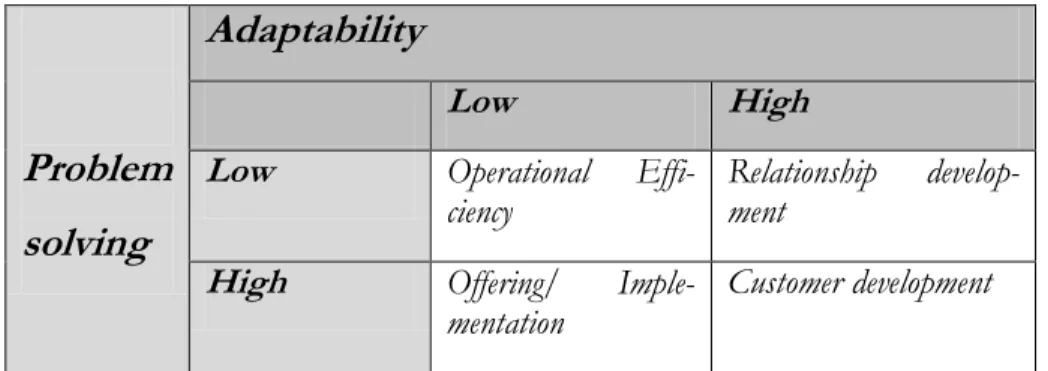

Partner selection

First of all it should be mentioned that alliances is created in order to share risks and re-sources, gain knowledge and to obtain access to different markets (Osborn & Hagedoorn, 1997, cited in Hitt & Dacin et al., 2000). After having determined to join an alliance the next decision is the selection of partner (Hitt & Tyler et al., 1995, cited in Hitt & Dacin et al., 2000). The selection process can vary between businesses and industries. Some busi-nesses might need additional resources, local market knowledge, unique competencies or special skills in order to be competitive in the new market (Hitt & Nixon et al., 1999, cited in Hitt & Dacin et al., 2000).

In the study conducted by Hitt & Darcin et al. (2000), developed markets are represented by Canada, France and the USA while Mexico, Poland and Romania represent the emerg-ing market. Hitt & Dacin et al. (2000) states that businesses in developed market are likely to choose partners with market knowledge and market access. A partnership with a local business can provide the business with access to customers and distribution channels and a local business can also provide local knowledge regarding the government, policies, culture and regulations (Hitt & Dacin et al., 2000). On the other hand, businesses in emerging markets seek partners that have access to new technologies in order for businesses in the emerging markets to build products that can be competitive on both the local and global market (Gillespie & Teegen, 1995, cited in Hitt & Dacin et al., 2000). To sum up, a busi-ness seeks a partner who has what the busibusi-ness lack. Moreover, unique resources are an important factor that needs to be obtained in order to gain and sustain a competitive ad-vantage in the market (Barney, 1991, cited in Hitt & Dacin et al., 2000). Therefore, busi-nesses in developed markets seek partners with unique competencies that can give the business a competitive advantage (Hitt & Dacin et al., 2000).

The result from the study conducted by Hitt & Darcin et al. (2000) shows that market knowledge and market access are important factors in the selection of partners both for businesses in the developed and emerging market. However, the result shows that the crite-ria of market knowledge and market access are stronger in businesses in developed mar-kets. The result also provides evidence that businesses in developed markets strongly pri-oritize unique competence compared to businesses in emerging market who also take the criterion into consideration when selecting a partner but do not put much emphasize on the criterion. To conclude, the most important selection criteria for businesses in emerging