MNC Growth in Emerging Markets

Based on Understanding of Customer

Behaviour and Development of Reliable

Distributor Network

A Case Study on EPLSG, Russia

Authors:

Paraskevas Paraskevas

Olena Dorokhova

Svetlana Fotina

Tutor:

Ass. Pr Dr Joachim Timlon

Program:

Growth Through Innovation

and International Marketing

Subject:

Business Administration

Level and semester: Masterlevel Spring 2008

Baltic Business School

Table of Contents

Abstract...8

Chapter 1- Introduction...9

Introduction to the Case Company EPLSG and Describing of the Problematic Situation...10

Problem Discussion...11

Confronting the Problematic Situation with Current Literature...16

Purpose of the study...18

Chapters Outline...18

...19

Chapter 2-Methodology...20

Research Approach...20

Choosing among alternative Approaches...20

Discussion on Abductive Approach...21

Research Strategy...22

Selection of Case Study as a research strategy...22

Case Study Design...23

Overall Intent...23

Case Study Type: Single-embedded Case Study...24

Sampling ...25

Choice of the Region for the Investigation...26

Researcher’s role...28

Data Collection ...28

Data Analysis...30

Ethics of Research...30

Research Quality: Validity & Reliability...30

Construct Validity...31

Internal Validity ...31

External Validity ...31

Research Model...32

Chapter 3-Theory...33

1. Growth Potential in Emerging Markets...33

Sources of Growth ...33

Factors affecting Growth and major trends...33

Constraints on Growth...34

Assessing potential of growth...34

2. The Importance of the Institutional Environment Framework Analysis for the Understanding of Emerging Markets...34

Government Role...35

Legal Regime...36

Culture & Business Mores...36

Conclusion on this section and Selection of an overarching model for our institutional analysis...37

3. Customer Behaviour - Different theories that can explain Customer behaviour in a B2B context...38

The Buying Centre & Factors of Influence on OBB...38

More about the Decision maker ...40

The Buyer-Seller Dyad ...42

Organizational Adaptation to Customer Expectations - An Organizational Learning Approach...43

Organizational Adaptation to Customer Expectations – A Market Orientation Approach...44

Customer Satisfaction...45

Customer’s Price Sensitivity-Responding to customer’s needs through Pricing...48

Creating Customer Value through pricing ...50

4. Network theory...51

Network Perspective: The IMP Group –The Interaction, Relationship, and Networks Paradigm...51

Relationships within Networks in Industrial Markets...51

How to develop reliable and trustworthy relationships within networks...51

Distributorship in the context of Network organization...54

Designing & Mapping Distribution Networks...56

5. Promotion & Brand Equity ...59

Brand Equity in the context of B2B...59

A Single Promotion approach for B2B...60

Overall Conclusion on Theory ...61

Problem Analysis Model...65

Chapter 4 - Description of Data Collected in the Field...68

1. Growth Potential...68

2. Institutional Environment...69

3. Customer Behavior ...70

Equipment & Laundry Process...71

Factors of Choice...72

Price sensitiveness...75

Customer Categories...76

Importance of the Clean Linen for the Hotels’ Customer (EPLSG 2nd tier customer) ...77

Customer Satisfaction...78

4. Network Organization (Distributorship)...78

Russian Main Office ...78

Sochi Local Dealer ...80

5. Promotion and Brand Equity...82

Promotion and Organized Marketing...82

Sources of Information for the PLS Customer ...83

EPLSG Awareness...83

Summary of empirical data...84

Chapter 5 - Analysis...87

1. Growth Potential...87

2. Institutional Environment...87

3. Customer Behavior...90

Factors of Influence on OBB...90

Equipment & Laundry Process...92

Decision Making Process...93

Factors of Choice...96

Price sensitiveness...99

Customer Categories...101

Importance of the Clean Linen for the the Hotels’ Customer (EPLSG 2nd tier customer)...102

Customer Satisfaction ...102

4. Network Organization (Distributorship)...104

Distributor linkage...104

Relationship with Customer...108

Flows of information within the network...109

Organization Network...110

5. Promotion and Brand Equity...110

Promotion and Organized Marketing...110

Brand Equity...111

Sources of Information for the PLS Customer ...112

Brand Promotion...112

Summary of the Analysis...113

Chapter 6 – Conclusions and Recommendations...118

Conclusions...118

Recommendations...124

Chapter 7 – Suggestions for Further Research...129

References...131

Appendix...139

The University of Kalmar...161

Tables

Figures

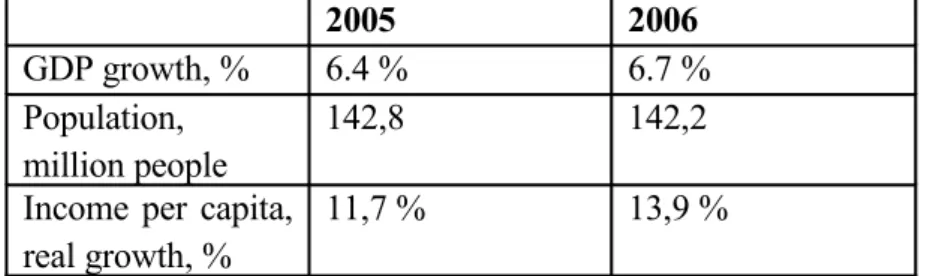

Table 1. Russian Economy Rates (Russian Governmental Statistics Report 2007)...92. Research Model...32

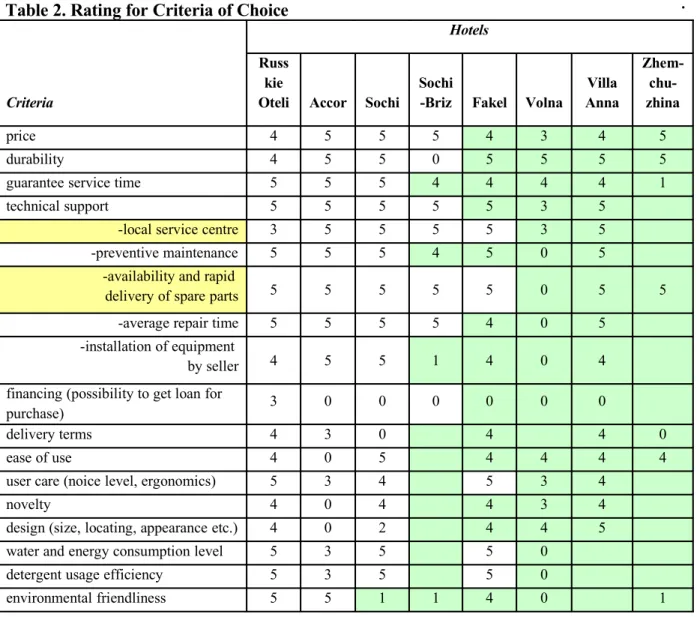

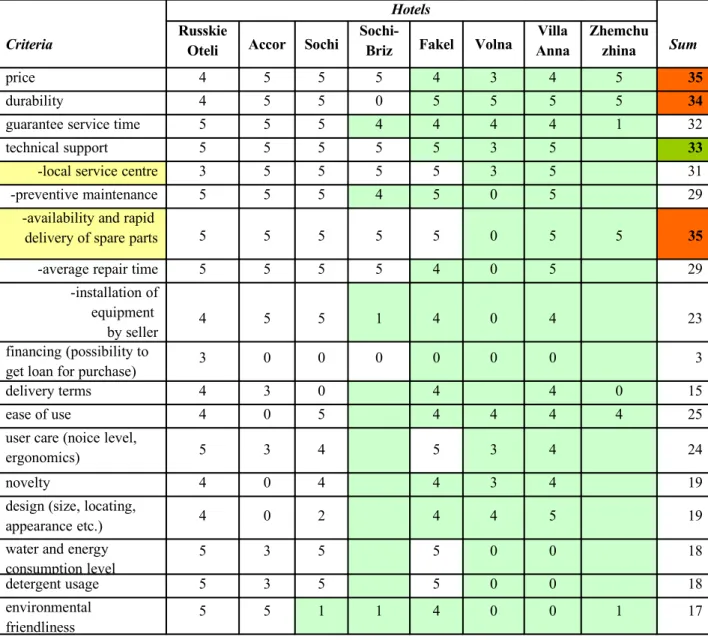

Table 2. Rating for Criteria of Choice...73

Acknowledgements

We would like to thank our academic supervisor Dr. Joachim Timlon for his relentless support throughout this project. Furthermore, we would also like to thank Professor Hans Jansson for his research work on emerging markets and teaching during our master course in International Marketing. Finally, we are grateful for his remarks on methodology as well as his preliminary courses on thesis writing that were delivered during the spring semester in the University-College of Kalmar, Sweden.

With regard to the case company we would like to thank Mr. Sven Kallin and Mr. Stanislav Batalov for their feedback and information regarding Electrolux Professional Laundry Systems Group, both in Sweden and Russia. We also appreciate the sharing of some information that was classified. Their trust honours us and creates a responsibility on our behalf to deliver a thesis that can be exemplary in academic terms.

We cannot forget to express our acknowledgments to the staff we interviewed in various hotels in the Sochi region as well as in Moscow. Their openness and willingness to share valuable information for our project was essential for the completion of our thesis.

Finally, we would like to thank our friends and relatives that have helped us throughout this project with their support and piece of advice when required.

Kalmar,Sweden, May 2008 Svetlana Fotina, Olena Dorokhova & Paraskevas Paraskevas

List of Abbreviations

PLS – professional laundry systems

EPLS – Electrolux professional laundry systems

EPLSG – Electrolux Professional Laundry Systems Group EPLSGRu – EPLSG representative office in Russia in Moscow Stanislav – the head of EPLSGRu

NAS – the head of the EPLSGRu official dealer ‘Biplan’ in Sochi OBB – Organizational Buying Behaviour

IMP – Industrial Marketing and Purchasing DMP – Decision Making Process

DMU – Decision Making Unit

Abstract

In this thesis we examine the issue of growth in emerging markets and in specific how MNCs can achieve growth by understanding the customer and building a solid distributor network on the example of EPLSG in the Russian market. In this context we investigate the correlation of the growth potential with institutional environment, customer behaviour, distributorship and brand equity. But let us briefly examine the structure of the thesis chapter by chapter.

Chapter one explains the five main themes that structure our thesis from a theoretical and an empirical point of view. Chapter two is an account of the methodology used for the conducting of the empirical research as well as of the whole thesis. Chapter three outlines the theoretical background of the thesis while chapter four is a description of the empirical data found on the field. Chapter five is the analysis of the empirical findings and in chapter six the reader can see the conclusions and recommendations for the case company. Finally, chapter seven gives directions for further research.

Overall, the authors of this thesis purport that in emerging markets an MNC can grow if it can effectively gather and analyze customer and market data as well as build appropriately a distributor network that can deliver the product to the customer and fully capture the market potential. What differentiates this thesis from other studies is the holistic appreciation of the problems that an MNC faces in an emerging market. The building of theory was based on this perspective as well as the recommendations for the case company. That is why, in chapter seven the recommendations for the case company should be read not as individual ones but as set of interconnected tactics that can allow an MNC to grow.

Chapter 1- Introduction

Fast economic growth in emerging markets attracts a lot of MNCs giving them opportunities to expand their business and achieve business growth. GDP growth in these country markets is much higher than in developed ones, for example, in Russia GDP growth in 2005 was 6,4 %, in 2006 – 6,7 %, while in high income OECD income countries it was 2,5 % and 2,9 % respectively (World Bank,2007). At the same time, along with this rapid economic growth some of emerging countries possess vast population, while their affluence have been also increasing accordingly, giving rise to the purchasing power of the population and providing opportunities for MNCs to expand their customer base.

Table 1. Russian Economy Rates (Russian Governmental Statistics Report 2007)

2005 2006

GDP growth, % 6.4 % 6.7 %

Population, million people

142,8 142,2

Income per capita, real growth, %

11,7 % 13,9 %

Furthermore, according to projections of the World Bank, in 2025, income per capita in Russia will be ahead of all BRIC countries (Goldman Sachs Economic Research, 2005).

In other words, the Russian market exhibits both present and future growth potential in terms of increasing purchasing power of the population.

However, despite this great growth potential, not every MNC can successfully operate in emerging markets (a case that also entails Russia) due to the different and underdeveloped institutional environment, lack of market knowledge and inability “to articulate a value proposition that resonates with the customer” (Inkpen and Ramaswamy,2007: 9). Moreover, the enormous geographical span of some of these countries (with Russia as the biggest one in terms of territory and the fourth in terms of population) makes building of distribution network vital, and poses trustworthy relationships within this network as one of the core issues in MNCs’ marketing strategies in order to gain strong market positions.

Thus, the overall purpose of this study is to analyze, explore and explain how MNCs can achieve business growth in emerging markets (and especially in the Russian market) by making strategic recommendations based on understanding of customer behavior, needs and preferences and establishment of a reliable distributor network.

This chapter begins with the case company introduction and describing of its problematic situation in the Russian market concerning business growth. The case company presentation is

then followed by a problem discussion, referring to the issue of achieving business growth in emerging markets through customer investigation and reliable distributorship establishment, but in the framework of a changing and complex institutional environment. Afterwards, confrontation of the empirical findings with current literature will be given. Finally, the chapter closes with the purpose of the study.

Introduction to the Case Company EPLSG and Describing of the Problematic Situation

The Parent Company

Electrolux Professional Laundry Systems Group (EPLSG) is a part of the Electrolux Group, which is the world’s largest producer of powered appliances for kitchen, cleaning and outdoor use. The company headquarters (i.e. EPLSG) are located in Sweden, while its production units are in France, Sweden, and Thailand.

The Company’s business presence in Russia

Initially, EPLSG has gone to Russia in 1992, and now it has representative office there. The office is very small in terms of employees, but at the same time, it exhibits one of the highest profitability rates among the rest of EPLSG subsidiaries around the world. Russian office works with customers both directly as well as through distributor channels, while parent company in Sweden has close to 100% control over each order placed in Russia. The subsidiary also cooperates with a network of technicians in order to provide service to the equipment sold. The presence of the subsidiary on the Russian market allows the company to better cope with the country’s institutional environment and better respond to the ongoing changes.

Main Segments of Business Activity

EPLSG is working in six main segments: hospitality, healthcare, leisure & sports, professional laundries, house apartment laundries and dry cleaners.

Customers

Most EPLSG customers are enterprises, therefore in its activities the company concentrates on Business-to-Business (B2B) relationships, where general advertisement and wide-public promotion are not extensively applied as in Business-to-Consumer (B2C) marketing.

Profitability & Market Share

Despite high profitability in comparison with other EPLSG subsidiaries, estimated market share of the parent company through the representative office is rather low (10-12%). Furthermore, the company lacks market data and works mostly as a product specialist without strong orientation on customer needs. In addition, EPLSG products are in above the average price range, while Russian business environment in the segment is characterized by intensive and mostly price-based competition.

Emerging Empirical Key Issues

As it was already mentioned above, the company works in the market as a product specialist, i.e. it sells technically advanced industrial products with low adaptation to individual customer needs. It satisfies a common need for a functionally high as well as consistent quality. It also possesses high engineering design capabilities since product development is critical. The company concentrates its capacity on the product rather on the customer. It can be assumed that closer position to the customer will help the company to identify its development potential, to strengthen its market position and increase its market share. Therefore, customer investigation is of primary importance.

Furthermore, EPLSG in Russia sells both directly to the customer and through the distribution network. Since customer knowledge becomes a crucial point in the strategy, development of reliable relationships with distributor also increases its importance, because distributor on the one hand represents the company and on the other has direct connection to the customer and gets primary knowledge about customer needs, preferences, and satisfaction. The importance of reliable distributorship is even more enhanced due to the fact that the company operates in the B2B sphere, where long and trustworthy relationship with the customer is one of the core prerequisites of success. Expanding distribution network and development of trustworthy relationships within it therefore seem to be critical for EPLSG, in order to increase its market share, and better reach the customer as well as to obtain customer knowledge.

Problem Discussion

This section aims to capture critical issues related to MNC growth in emerging markets based on understanding of customer behaviour and establishment of reliable distributor network through a brief overview of the literature.

Primarily, one of the most important aspects with regard to growth in emerging markets is the effect of institutional environment on the former.

Many authors stress the difference (from mature markets) and underdevelopment of institutions in emerging markets (Jansson, 2007; Steenkamp and Burgess , 2006; Fletcher and Melewar , 2001). Furthermore, institutional environment in these markets is changing while it is also complex and hardly predictable (Ibid.). And despite fast economic growth, the institutional environment poses certain risks and challenges, for the companies operating in the emerging country markets.

Some authors stress that there is a negative effect of the institutional environment on growth (Khanna et al., 2005; Khanna and Paleppu, 2006; Jansson, 2007; Svensson and Fisman, 2005). As an example of, Khanna and Paleppu (2006) stress the importance of this aspect by explaining that

these ‘institutional voids’ (Ibid., 3) can negatively affect the companies’ ability to source capital (i.e. financial) and talented human resources:

‘Because of institutional voids – the absence of specialized intermediaries, regulatory systems, and contract-enforcing mechanisms – corporations in emerging markets cannot access capital or talent as easily or as inexpensively as European and American corporations can. That often makes it tough for businesses in developing countries to invest in R&D or to build global brands.’ (Ibid., 62)

In addition, Khanna & Paleppu (2006) stress the significance of market imperfections that arise out of a weak institutional capacity in these markets. In particular, imperfection of such basic and essential institutions as financial and legal systems, considerably restrain possible business growth. For example, absence of special financial intermediaries like investment banks or leasing companies make it more difficult for companies to source finance in order to grow, while loan interest rates in these markets are much higher than in mature ones. Besides, weak contract enforcing mechanisms can deter market actors to sell by providing credit to the customers. In this way, customers in these markets are having fewer opportunities to purchase products, and consequently the companies face lower sales volumes, hampering growth prospects . Briefly, institutional voids can make it difficult for companies to access all potential customers in emerging markets.

Moreover, weak institutional environment hampers marketing research in these markets causing weak understanding of the customer and thereby limiting access to customers.

‘Because of the institutional voids in developing countries, multinational companies find it difficult to serve anything but the market’s global tier. In product markets, the lack of market research makes it tough for multinational companies to understand customers’ tastes.’ (Khanna & Paleppu, 2006: 64)

Therefore, institutional voids negatively affect growth in the emerging markets by hampering access to customers and understanding of their needs.

Another important aspect related to growth in emerging markets within the complex and changing institutional environment is the specificity of customers or the ‘idiosyncratic customers’ needs and tastes’ (Khanna and Paleppu, 2006: 64). Of course, this argumentation has also been reiterated by Russian researchers. As an example of, Karpova et al. (2007) argue about specific customer behavior in many post socialist countries and especially Russia. For example on a marketing research the authors performed regarding apparel consumption habits, they came up to particular conclusions regarding the peculiarities of Russian customers. In specific, their view on quality, country of origin and gender issues were country specific and different from mature markets consumers. Steenkamp and Burgess (2006) note that the emerging market customers are characterized by higher price sensitivity, lower per capita income and therefore different

consumption patterns. However, as we have noted in the beginning of this chapter on the example of Russia, the population income per capita is increasing, which in turn raises the purchasing power of customers. Furthermore, in many emerging markets there are customers who have never consumed specific products before and are more susceptible to advertising in comparison to the knowledgeable customers in mature markets, thus opening up new opportunities for MNCs to expand their customer base and unveil the great potential of these markets. Thus, companies that want to grow in these markets must have the capacity to understand the customer needs. Furthermore, selection of the apposite marketing promotion strategies for approaching the ‘idiosyncratic’ customer of the emerging markets and effective communication channels are subsequent but nevertheless important steps in company market strategy. The neglect of them will give the local companies a competitive advantage over foreign MNC’s, as local companies can be better equipped to understand and communicate with the customer.

Sakarya et al. (2006), introduce a specialized approach to assess emerging market complexity and potential, which incorporates micro-analysis at customer level into country level macro-analysis. The authors propose measurement of customer receptiveness to the product of the foreign industry and country of its origin as critical for companies that seek growth opportunities in emerging markets. Ogawa and Piller (2006) identify ‘faulty understanding of customer’ (2006:65) as the main culprit of new product commercialization failure, and advocates targeting of specific customer preferences and requirements through niche-marketing or micro-segmentation. They address the necessity of niche identification, ‘as these niches often provide the only path to growth’. Accommodating the small (niche) market allows the company to focus and to better understand the (niche) customer needs and provide the customer with the product that satisfies those specific needs. Other writers, (Shapiro and Bonoma,1984; Khanna and Palepu, 2006; Sinha and Prasad, 2005) further stress the development of strategies, plans, and programs based on primary identified customer segments as the means for the company to profitably meet the needs of different market segments and gain a distinct competitive advantage.

Furthermore, Ogawa and Piller (2006) advocate ‘collective customer commitment’ (2006:65) that lies in involving customer in innovation process, and soliciting new product ideas from the customer in order to achieve MNC growth through primary thorough investigation of customer needs and preferences. Woodruff (1997) states the need of organization to apply information collection techniques extending beyond simple customer satisfaction measurement to include higher-order goals of the customer during information collection, synthesis and response stages. The implication is that success of a company operations and its ability to grow is directly correlated with learning and understanding of the customer expectations. Cavusoglu and Raghunathan (2007) argue for product customization as means ‘to meet diverse

customer tastes, partly to target market segments (yet) unserved or poorly served by existing products.’ (2007:12) Thus, customer role in current business is becoming more and more central within highly competitive environment while customer power is increasing in terms of purchasing power, product knowledge and more sophisticated demand. Hence, taking into consideration that customer behavior in emerging markets differs from one in developed markets (Jansson, 2007; Ogawa and Piller, 2006; Steenkamp and Burgess, 2006) understanding the customer becomes essential for MNCs (and especially for the non-domestic ones) in order to capture market potential and to achieve business growth.

Another problem the MNCs face in emerging markets is defining the market potential for their growth. Inkpen and Ramaswamy (2007) have noted that ‘global companies have begun to realize the potential of these (emerging) locations as significant markets’ (2007:5)The authors provide the following example: General Electric expects 60% of its revenue growth over the next decade to originate in emerging markets. However, the MNCs choose ‘the path of least resistance’ by focusing only on the wealthiest sub-segment of the population, and not addressing the less affluent segments, which greatly underestimates the market potential, since: ‘it (wealthy market) doesn’t leverage the true purchasing power of the masses at the bottom of economic pyramid’ (Inkpen and Ramaswamy, 2007:9). Though such approach makes the companies less vulnerable to price wars, it hampers their growth opportunities, as the mid to low-end segments are the ones that exhibit future potential to become even more profitable (Chen, 2004). The consequences of neglecting them by Western MNCs is that many local MNCs from emerging markets have followed a consistent strategy to target these segments and have managed to outperform western MNCs. Subsequently many domestic MNCs in emerging markets became stronger in financial terms and with price wars managed to push out of the market SMEs and to cut down the market share of western MNCs (e.g. Haier in China). As a result, the western MNCs in emerging markets have been facing fierce competition and have been pressed to increase their innovation efforts so that they can stay competitive (Ibid.).Thus, competition is another factor that can not be neglected in the light of business growth, as many MNCs are trying to either enter first in these markets or rapidly grow so that rival companies can remain in low levels of market share. As the customers in emerging markets are more price sensitive and particularly attentive to the price/performance ratio of a product or service (Prahalad and Lieberthal, 2003), it is especially important for the companies to apply appropriate pricing strategies to tackle those issues carefully in order to retain their presence and achieve growth in these markets.

The specificity of the product markets creates a dilemma for many companies working in emerging markets: whether to create local strategies for growth or transplant existing business models from mature markets? For example, Prahalad and Lieberthal (2003) stress that companies

are facing a problem moving away from global branding strategies rather than local ones, thereby hampering growth potential. Big multinationals like Coca-Cola are facing difficulties securing growth in emerging markets just because they select to transplant existing business models from mature markets (Ibid.).

Furthermore, ‘product markets often turn out to be hard to penetrate because companies need specialized infrastructures, distribution channels, or delivery systems to meet customers’ needs. Most multinational companies, we find, are ill equipped to pioneer the development of such systems.’ (Ibid.)

With regard to business growth, Chen (2004) also refers the distributor channel effectiveness. He notes, that usually MNCs in emerging markets focus on developing their distribution networks around the capitals or areas with the highest economic growth. In this way they lose growth potential from other areas that are more peripheral in economic and geographical terms. Khanna and Paleppu (2006) also note the paucity of developed distribution networks as the main problem that makes it impossible for the companies to deliver products to the customers in the hinterland.

Inkpen & Ramaswamy (2007) describe distribution as one of the constituents of MNC market strategy necessary to overcome infrastructural challenges that are common to emerging markets in order to realize the true potential of the market. Furthermore, Axelsson and Easton (1992); Gadde and Mattsson (1987) explore relationship longevity and strength in the context of other relationships, within the framework of external as well as internal environment. The authors conclude that strong bonds provide more stable and predictable structure that can withstand change within the external environment. In sum, the strength and longevity of actors’ relationships secures stability and sustainability of the company development within the context of dynamic institutional environment. Hadcroft and Jarratt (2007) further conclude that organization has to be ‘intra-connected’ in order to achieve the highest degree of market responsiveness, by linking the horizontal and vertical stakeholders in knowledge sharing and relationship building which modifies the firm’s responsiveness to its customers. Jansson (2007) explains the critical role of reliable and trustworthy relationship in the context of triadic relationships when the agent (distributor) provides the seller with a linkage to the market. The author exemplifies a weak, unbalanced triadic relation between the seller company, distributor and final customer, characterized by lack of trust, high uncertainty, and low information sharing about the customer: distributor tries to keep the seller in the dark about the customer at the risk of being replaced by another agent or taken over by the seller. Thus, low communication and commitment, few adaptations, low experiential knowledge of each other, large cultural and social distances are exemplified as hampering the seller growth in the market. All these factors lead to difficulty in

increasing trust between the parties. As a consequence, the seller is less prone to invest in such relationship. On the contrary, the high degree of experiential learning and reduced or controlled level of uncertainty in seller-distributor relationship are necessary in order (for the exporter) to expand its business and encourage the latter to invest more resources in the market (Ibid.). Kim (2001) also stresses the importance for the supplier to gain distributor commitment since the latter has closer interface with customer and therefore can help a supplier to deal with customer heterogeneity.

Furthermore, manufacturer-distributor interdependence makes the choosing and developing of relationship with distributor an essential marketing task. The highly committed distributor is more likely to provide market intelligence to the manufacturer, to have willingness to market only a single manufacturer’s family of products or, alternatively, to actively promote the concrete manufacturer within multiple product families situation (Gundlach and Murphy, 1993).

Finally, the distributor issue can not be conceived without taking into account its integration with customer issues. For example, Kim (2001) also argues that “customers are the sine qua non of any distribution system, and satisfying the needs of customers is the primary reason for a distribution system to exist” (Ibid., 88). Mutual commitment between supplier and distributor helps to serve customer needs better and consequently to get more profit, to increase the customer switching costs, and to develop competitive advantage (Ibid.).

Confronting the Problematic Situation with Current Literature

From the literature we can observe that many MNCs are interested in expanding their business in emerging markets, while at the same time they face there specific problems and have to pay close attention to particular issues in order to successfully operate and grow in these markets.

First of all, imperfect institutional environment challenges western MNCs that have mostly initiated their businesses and then have operated and grew in developed country markets with efficient and well-organized institutions. This institutional imperfection and difference from the mature markets makes the market investigation crucial in the development of MNCs’ marketing strategies.

Authors also stress special and different from the mature markets customer behavior. In particular, customers in emerging markets are more price sensitive and pay particular attention to the price-performance trade-off. Therefore customer investigation as the means of gaining customer knowledge is argued to play significant role in MNCs’ successful operation and growth in emerging markets.

Since EPLSG operates and aims to expand in Russian market within complex, changing and underdeveloped institutional environment and since the company works as a product specialist without strong orientation on customer needs and preferences, it seems, that professional laundry

systems (PLS) customer investigation will help the company to understand its market position better, to define potential for development and to identify strategic approach for the most efficient expansion in the Russian market.

At the same time, some authors state underestimation of the emerging market potential by western MNCs due to weak market knowledge. For example, many MNCs focus only on the wealthiest sub-segments of population skipping the less affluent ones aiming to avoid uncertainty and failure risks as well as to save costs. As a result, they do not capture all possible market potential and consequently lose potential profits.

Another threat that MNCs are challenged to cope with in emerging markets, is fierce competitive environment. The latter involves both domestic and foreign companies aiming to enter or expand their business there. Moreover, the competition is intensified because domestic companies can better understand the country specific institutional environment and customer behavior in particular. Consequently the latter again enhances the importance of customer investigation for the foreign MNCs to understand customer better and satisfy their needs in order to stay competitive.

In Russia there is a domestic manufacturer of PLS called “Vyazma” that possesses big market share (estimated is around 40 %) and very low price products which are at the same time of rather low quality. And it seems reasonable to investigate the customer in order to understand the customer and consequently attract the Vyazma customers in particular.

Finally, literature emphasizes the importance of effective distributor network and reliable relationships within it for the companies’ successful operating and growth in emerging markets. Well-organized and trustworthy distributor network helps the company to overcome infrastructural drawbacks, to better reach the customer as well as to obtain customer knowledge through the reliable ties with the committed distributor. Moreover, it even helps the company to cope with changing, unstable institutional environment. The quality of communication within the distributor network influences the suppliers willingness to invest in such a relationship and consequently to expand its business. Weak distributor network in turn, negatively effects the company’s every day activity as well as limits the market potential and hampers business growth.

In EPLSG’s case the distributorship issue seems to be even more important, since Russia is the biggest country in the world in terms of territory, while the country infrastructure is still underdeveloped. Furthermore, in the B2B sphere personal relationship with the customer and commitment of the latter are substantial, and since in triadic structure this relationship has been developing not directly, but through the distributor, reliable and trustworthy relationship with the latter becomes crucial.

• Is there a growth potential for PLS market in Russia?

• Where (geographically and/or by segment(s)) EPLSG can concentrate its business activities in order to achieve growth?

• How does the Russian institutional environment affect EPLSG growth? • What is the PLS customer behavior in the defined area?

• What is the customer receptiveness of the EPLSG products?

• What are the customer price sensitiveness and buying behavior determinants? • How to build an effective distributor network in order to better reach the customer? • How to achieve commitment and reduce uncertainty level within the

company-distributor relationship?

According to the stated research question the current thesis is structured in the five research themes: Growth Potential, Institutional Environment, Customer Behaviour, Network Organization (Distributorship), Promotion and Brand Equity.

Generally speaking, the guiding question of the thesis is: how MNCs can achieve business growth in emerging markets (Russian market) by developing business marketing strategy based on the understanding of customer behavior, needs and preferences and establishment of reliable distributor network.

Purpose of the study

The overall purpose of this study is to analyze, explore and explain how MNCs can achieve business growth in emerging markets (on the example of Russian market) and propose strategic recommendations based on understanding of customer behavior, needs and preferences and establishment of reliable distributor network.

The overall purpose can be presented as three-fold:

1. to describe customer behavior, needs and preferences in the Russian market

2. a. to analyze strategic opportunities for MNCs’ business expansion based on the understanding of the customer behaviour, needs and preferences

b. to analyze and explore ways to establish efficient distributor network to better reach the customer

3. to provide strategic recommendations for the case company to achieve business growth in the Russian market based on the PLS customer understanding and building of reliable distributor network

Chapters Outline

Chapter 2-Methodology

The Methodology chapter of our thesis aims to introduce the reader to the methods and techniques applied by the researchers in the course of the research. We will choose the most

suitable methods for our study problems among the scientific literature and prove the appropriateness of their application for our research. We will discuss our research approach and

strategy, research design, overall intent, sampling, problem analysis and data collection. We will also present our research model and look into the researcher’s role in the study as well as assess

its overall quality and validity. This chapter also aims to help the researchers in aligning the research techniques with the overall purpose of the study as discussed in the Introduction and

developing further their research skills.

Research Approach

Choosing among alternative Approaches

Among the alternative research approaches Fisher (2004) highlights the following:

• ‘Ivory tower – knowledge is valuable in itself, doesn’t necessarily lead to action; • Realist research – research identifies and evaluates options for action;

• Interpretative research – provides a context for thinking about action; • Action research – changing knowledge comprises action;

• Critical social research – changing mass knowledge to bring social change’ (Ibid.) Now what is important before choosing a research approach is to understand how the research problem guides the choice of the approach. Since our main research problem concerns itself with ways for advancing business growth for EPLSG in Russia then we also need a research approach that will allow us to identify ‘options for action’ , that is providing strategic recommendations for the company to achieve business growth. The approach that matches our objective is the realist one and in the following paragraphs we will explain why we selected this approach and why we turned down the others.

Realist research implies that knowledge we gain through research can mirror the reality and give good indications of what should be done. However, the mirror image may be distorted by the ‘intrusion of subjectivity into the process of knowing’, Fisher (2004, 35). The realist research looks for associations between variables and tries to establish chains of cause and effect. Typically, this research type involves structuring a problem with further breaking it into constituent parts (Ibid.).

The research approach we apply for this study is realist research as we try to identify, formulate and evaluate strategic recommendations for growth for our case company. Within the context of the realist research we apply cause and effect analysis in order to identify which are the

reasons behind lack of business growth in Russia for our case company, i.e. EPLSG. Taking insufficient business growth as an effect, we identify the causes of it which range from complex institutional environment, lack of customer knowledge, insufficient geographic coverage of Russian market (distribution), and organizational factors. But how did we do the cause-effect analysis? We used a recognised Project Management tool that is called problem analysis, allowing us to map cause and effects of reduced business growth for EPLSG. In our study, we define the main problem as insufficient MNC’s business growth in an emerging market (in our case – Russia) and then divide the problem into problem areas (cf. Research Model) and further into research questions (cf. Introduction). Problem areas are inter-correlated and influence each other. Furthermore, according to the realist research approach, the relationship between defined parts should then be studied. In our study, we examine closely the interconnection and mutual influence of the defined sub-problems.

However at this point the reader can wonder why we did not use interpretative research, action research or other methods. For example ivory tower research sees ‘knowledge as an end in itself’ Fisher (2004:34). But in our case we seek to make strategic recommendations for our case company and not merely increase the body of scientific knowledge that is extant in the field of marketing. Interpretative research on the other hand is a method for understanding a context (whole country, a specific culture etc.) that is why it is usually used in ethnography. We have not only defined the overall context of our research by identifying for example that institutions, customer investigation, distribution and promotion are important issues for achieving growth in emerging markets, but also analyzed the relationship and influence of the fore-mentioned factors. Furthermore, we didn’t use the critical social research method as we are not seeking to make radical actions (like business process reengineering, or complete organizational overhaul) and cause deep organizational change in EPLSG. Finally, we didn’t perform action research as we are not actors within the EPLSG environment (i.e. acting as employees or delegates of EPLSG) and our potential actions couldn’t trigger any organizational effect as we lack power within the organization.

Discussion on Abductive Approach

In our study we use the abductive approach, when both apply certain as well as modified theory in the company’s real life context and find, combine and develop theory applicable to solve the problems derived from the case company data investigation. Dubois and Gadde (2002) advocate ‘systemic combining’ as an approach of continuously moving back and forth between empirical observations and theory as the means to expand researchers understanding on both theory and empirical phenomena. As we mentioned in the previous chapter, our main research problem is ‘how MNCs can achieve business growth in emerging markets (on the example of

Russian market) by developing business marketing strategy based on the understanding of customer behavior, needs and preferences and establishment of reliable distributor network.’ The complexity of our main research question necessitates a combination of both inductive and deductive approach. We have modified our theoretical framework to account for the main institutions affecting EPLSGRu expansion in Sochi, Russia. The insights from the interviews resulted in unanticipated data, for example low customer knowledge of EPLSG, which led us to search for complementary theoretical concepts on promotion and brand equity. Thus we have applied, added to and modified our theoretical findings in the course of empirical research, which gave us deeper understanding of both theory and empirical data. We believe that such interaction and mutual adaptation between thesis parts make our research more holistic, and applicable in practical use.

An important aspect to consider in our study is what research strategy to apply. In the next section, we will delve deeper in case study research, and discuss its appropriateness among other research strategies for our research.

Research Strategy

Selection of Case Study as a research strategy

In order to answer our research questions and carry out our research, we need, first of all, to define our research strategy. Yin (2003: 5) identifies the following research strategies: ‘case study, experiment, survey, archival analysis, and history’. Whereas Merriam (1998, 12) defines such types of qualitative research as basic and generic, ethnography, phenomenology, grounded theory and case study. In order to determine the most suitable research strategy for our research, we have applied three conditions: the type of research question, the control investigator has over actual behavioural events and the focus on contemporary as opposed to historical phenomena. (Yin, 1994,1).

Our main research problem, how MNC’s can achieve business growth in emerging markets, requires us to focus on the micro level (specific MNC i.e. EPLSG) as well as the macro level (the various factors in the Russian environment that affect the micro level). The case study method with its focusing capacity allows us to delve deeper into these issues in pursuance of our main problem. The main reason for selecting the case study method is to analyze our main research problem in the context of real-life example of EPLSG, Russia, analyze and evaluate EPLSG customer and distributor network, interpret their inter-relation and propose options for action aimed at expansion of distribution network and customer base to achieve sustainable EPLSG growth.

Moreover, our research questions are of the type ‘how’ and ‘why’ (Sf. Chapter 1 Research Questions), and focus mainly on contemporary events, namely the present opportunities for growth

for EPLSG, but do not require control over behavioral events. Yin (1994, 3) also notes that case studies are also appropriate for exploring and describing social phenomena, something that is particularly useful for our choice of subject and case company. All these elements qualify for the selection of a case study as our research strategy.

So, what is the strength of case study as a research strategy? As Yin (1994,8) notes, it is the ability of case studies to apply all sources of evidence, such as documents, artefacts, interviews and observations. Some drawbacks of the case study are researcher’s bias influencing the study, length of time and ‘massive unreadable documents’ as a result; as well as little basis for generalization (Yin, 1994, 10). We will give more attention to the fore-mentioned issues in the separate sections (cf. Quality of the Research). However, we should point out that we consider the conducted interviews to be a strength of our research, as we have gained a unique understanding of Sochi Customers and Distributor, as well as an insight on the relationship between EPLSGRu – Sochi Distributor – Sochi Customer accounted for by first-hand actors, namely Stanislav (head of EPLSG Russia), NAS (head of distribution office in Sweden) and Customers (representatives of the existing and potential EPLSG customers, who are the participants of DMP). In the next chapter, we will delve into the design of our case study.

Case Study Design

We design our case study with the goal to create an action plan logically connecting the initially set research problem and research questions with the ultimate results. Yin (1994: 28) defines the ultimate goal of research design as to provide a strong guidance for the researcher in determining what data to collect and what strategies to apply for its analysis.’ Thus we design our study as a roadmap for EPLSG in Russia, by determining the potential for company growth, both geographically and by segment, and analyze distribution and customer linkages within the organization network of EPLSG. So, what is the overall intent of our case study?

Overall Intent

In this chapter, we will define the overall intent of our case study in order to design it effectively and align all the constituent parts accordingly, to achieve consistency and internal validity. First, we will give account of the various purposes of case studies identified in the literature, and then define the type of our own case and prove the logic of our choice. Merriam (1998: 38-39) classifies case studies as descriptive, interpretive and evaluative, depending on the various goals pursued throughout the research, namely: to describe; to describe and analyze; and to describe, analyze and judge respectively. Yin doesn’t focus specifically on the case study intent. The author identifies journalistic case studies, and also mentions along the lines such possible purposes of case studies as to develop or to test a theory (1994, 27). For our research, our intent is

to describe and analyze the customer and distribution network and evaluate strategic opportunities for MNC’s to achieve growth in emerging markets by strengthening the customer and distribution linkages. Thus, our case resembles most closely evaluative case study type as described by Merriam (Ibid.).

Case Study Type: Single-embedded Case Study

We should hereby clarify the constructive elements of our case study, and explain to the reader our rationale in designing and conducting our case study. A research study can include both single- and multiple-case studies based on the number of studied cases. Yin (2003: 39-42) points to particular circumstances when case studies devoted to a single case are applicable:

• Critical case – testing a well-formulated theory, containing clear set of propositions as well as circumstances under which the propositions are believed to be true; • Extreme or unique case – the rareness and importance of the case make it worth

documenting and analyzing, for example a case on prosopagnosia syndrome; • Representative or typical case – the objective is to capture everyday situation; • Revelatory case – when investigator has a chance to observe a previously

inaccessible phenomenon;

• Longitudinal case – studying the same case at two or more different points of time; The author points out that single-case study can hardly be generalized into the whole theory, but it provides strong real-life-based recommendations for particular company in certain situation, and gives grounds and incentives to investigate some ‘gray’ fields in theory. Thus, our study provides particular investigation of PLS customers and distribution network within the framework of, unique institutional environment of Sochi, the resort and Olympic capital of Russia (cf. Sochi Potential). Yin (1994, 2003) further distinguishes between holistic (no sub-units can be identified; theory has holistic nature) and embedded (sub-units are studied within a single case) case studies. Thus, we define our case study to be a single, embedded case study due to the following features: our case centers around one company, EPLSG, and embeds a number of sub-units within the single case. By the latter we mean EPLSG Russia – the subsidiary of EPLSG Sweden in Russia, PLS Customers and distribution network. Below, we will illustrate the position of our case according to the model of Yin (1994: 39):

Single-case designs

Multiple-case designs

Holistic (single unit of analysis)

TYPE 1

TYPE 3

Embedded (multiple units of analysis)TYPE 2

TYPE 4

1. Case Study Type

Such case study design allows us to conduct a ‘real-life’ study of EPLSG, while at the same time concentrate on separate actors (chosen sub-units) critical within the organization network for company expansion in Russia. In the following section we will discuss in detail how we have selected our samples or sub-units and defined the main research problem.

Yin(1994, 28) notes that the case study begins and depends on the preliminary theory development, Merriam (1998) also stresses the importance of theory construction in a research study. We realize the weight of a well-structured theoretical framework for our research, as Merriam notes (1998:45): ‘It would be difficult to imagine a study without a theoretical framework.’ In designing our theoretical framework, we applied ‘systematic combining’ (Dubois and Gadde, 2002), as our theoretical themes were modified in the course of empirical findings. In the pre-study, we applied brainstorming, problem analysis, and previously conducted interviews with EPLSG Sweden and EPLSG Russia to understand EPLSG problems, the company view on its problems. The empirical pre-study was a starting point for us; then we conducted a literature review in the areas and the main problem identified in the problem analysis to find their reflection in the existing theory and relevance to other MNC’s operating in the emerging markets. By confronting our empirical findings with the theoretical ones, we were able to define our research questions, which further led us to our purpose (cf. Introduction) and consequently the units to be studied. In the next section we will delve deeper into the sample selection.

Sampling

Sampling in research studies involves the definition of the unit(s) of analysis, selected in order to solve the general problem. Merriam (1998) distinguishes two types of samples, namely probability and non-probability sampling. Probability sampling is most common for quantitative research, as it allows the researcher to generalize on the findings; while non-probability sampling

is commonly used in qualitative research. Given the case company from the beginning of the research, we have identified the following units of study:

• Geographic area with the PLS potential

We will discuss the choice of region in the separate section.

• Triad network, including EPLSGRu – Sochi Distributor - Customers

The selection of the sub-units within the triad network was made accordingly:

o EPLSGRu – was given (by the company), as the Representative Office of EPLSG in Russia

o Distributor – was also given, as the official EPLSG distributor in Sochi region

o Customers were selected according to the following criteria: Hotels

Presence of business operations in the region (Sochi) Rank 3-5 stars

Presence of own laundry

However, not only Sochi hotels have established or plan to expand their business in Sochi, the region attracts international hotel chains and investment companies. We have selected both local companies and the ones that unite several potential or existing customers in the region (as hotel chain managing companies, hotels developing companies, consulting companies etc.). All the units were selected not as an average, but as to give us the most insight and contribute to the main research purpose, thus our sampling is purposive. Furthermore, on the customer level, we have selected the participants of the DMP for PLS to be our key informants. In the next section we will provide a brief account of the region selection, the more detailed analysis is provided in the Appendix.

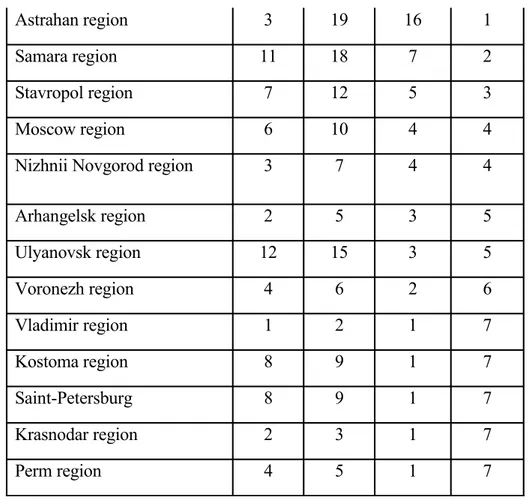

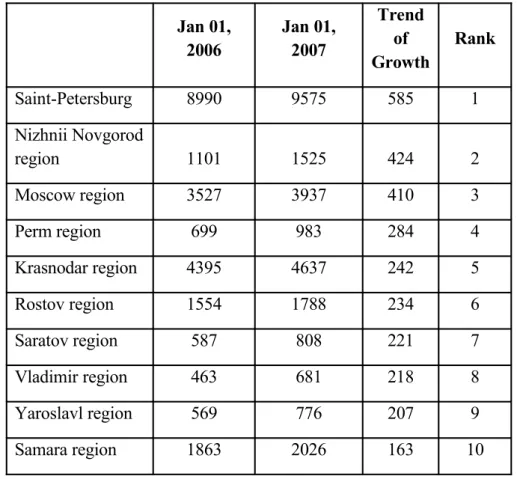

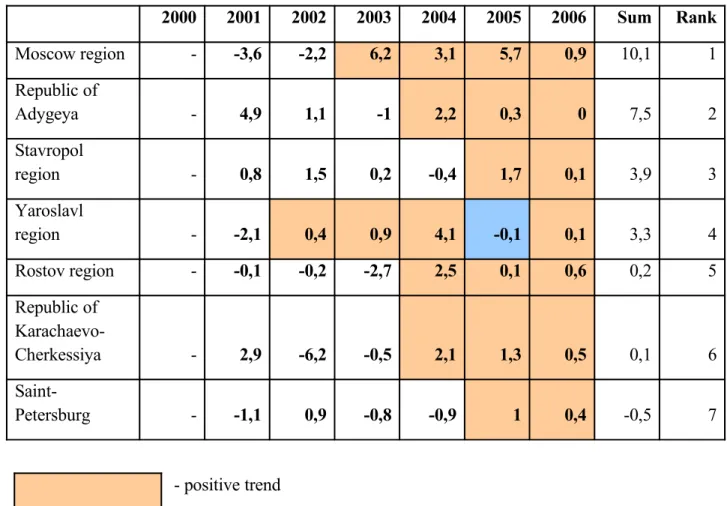

Choice of the Region for the Investigation

In order for EPLSG to achieve growth, taking into account the enormous size of Russia, we were challenged to select the region where the investigation should take place that should possess a potential for the EPLSG growth; particularly in the segment(s) of EPLSG interest (cf. chapter 1). The best criteria for the assessment of regional potential would be quantity of companies working in the main company’s market segments for the last five or at least three years; and, for instance, their turnover or capacities, as they present the potential for EPLSG expansion. For the region potential assessment we have used secondary sources, namely Governmental Statistical reports and forecasts in the news, articles, governmental reports etc. Unfortunately, the Russian statistics doesn’t provide information structured according to our chosen criteria. Therefore for the

evaluation we have used available criteria; some of them are directly linked with the company’s areas of interest, others indirectly influence these areas and/or show the overall business environment in terms of development and growth in a region.

For the first type of factors, on the basis of available statistical data we have identified the five main ones:

1. Capacity of dry cleaners and laundries per region, trends for the several last years 2. Quantity of hotels and restaurants per region, trends for the last two years

3. Investments into fixed capital in hotels and restaurants in 2006 4. Hospital places per region, trends for the several last years 5. Building of houses in 2006

In order to get the more sufficient results, the main criteria have been supported by the supportive ones which mostly show the general state and/or development trends of the business environment in the region. These criteria are:

1. Growth of the population of the regions 2. Growth of the urban population in the regions 3. Low unemployment and its trend of decreasing 4. High Income and fast income growth

5. Small share of poor population (under 15%) 6. Quantity of firms and trend of growth

7. Growth of small size enterprise (quantity) 2005/2006 8. Small Share of unprofitable enterprises 2006

9. Investment into fixed capital, amount and trend of growth

For the second type of factors we have applied the expert forecasts and hospitality industry news reports as well as municipality statements to further deepen the regional potential evaluation.

As a result, 12 regions were identified as the most potential for the EPLSG growth in Russia. Final region selection was made by the head office EPLSG in Sweden together with the Russian main office in Moscow. They chose the Krasnodar region and the Sochi region within it as the main focus area for the current research. Furthermore, it was decided to concentrate on the hospitality segment, the later being one of the main segments of EPLSG interest, and hotel sector within the hospitality segment. The reasons are: rapid development of the hotel industry, as supported both by Russian Governmental Statistics and qualitative data (cf. Appendix). In the next section, we will provide an account of sub-units selection within the distribution network.

Researcher’s role

Merriam (1998: 20) refers to researcher as the ‘primary tool of data collection’, who ‘can respond to the situation by maximizing opportunities for collecting and producing meaningful information’. We understand that the findings of our research depend on our skills as researchers: such as asking meaningful questions, being good listeners, developing trustful relationship with the informants and comprehensively presenting the findings to the reader. We have also tried to ensure the subjectivity of our research (sf. Research Quality). Any research that threatens to reveal particulars about the studied unit, threatens to create dissonance, both personal and political. As for our research, some companies considered it as an opportunity to meet us and were quite open during the interviews. However, other organizations were not easy to reach and considered our enquiry as an intrusion in their affairs while stating that their policy and decision making were private and closed to outsiders. Many interviewees were quite interested in concrete business proposals, discounts and prices and regarded marketing research as a waste of time. Marketing research with establishing direct contact with the clients is not very common in Russia, while some sales agents are trying to act under the pretence of researchers, which makes the true research more difficult. Thus it was not easy for us to establish trustful relationship with the interview. Yet, we could note throughout the interviews that some customers really appreciated the interest in their work issues and were willing to share with us. Yet, some organizations were ‘over-busy’, especially with the arrival of IOC to Sochi and didn’t find our research important enough to meet with us. Moreover, the schedules of some of the interviewees were continuously changing thus some of the interviews had to be rescheduled or cancelled. We have noted the unsteadiness and lack of attention to the research. However, the international hotel chains and consulting companies were more open and ‘available’ and gave meaning to our research. Fisher (2004: 51) describes most suitable for our research role as ‘the academic – harmless drudge,’ when a researcher, has no involvement in the organization other than being kindly allowed access. In order to ‘win’ the desired interview, as well as establish trustful relationships with the interviewees, we communicated explicitly the benefits of our research, furthermore in the course of the interview we tried to establish friendly atmosphere and did not ask questions that concerned confidential information. In case of unclear responses, we paraphrased our question as well as compared the different interviewee responses and accounted for possible mistakes.

Data Collection

This chapter deals with the methods that were applied in the course of data collection in order to answer our research questions. According to Yin (2003: 83), the data in case studies can be collected from six different sources, which are: documentation, archival records, interviews, direct observation, participant-observation, and physical artifacts. Merriam (1998) presents three

data collection techniques, namely interviewing, conducting observations and ‘mining data from documents’. In addition, Fisher (2004) adds questionnaire and panels or focus groups to the fore-mentioned sources. Interview appears as one of the most common sources of evidence and its strength is in being ‘targeted and insightful’ (Yin, 2003: 86). While Yin points out the open-ended nature of interviews, Merriam (1998) distinguishes between highly structured, semi-structured and unstructured interviews, Fisher (Ibid.) further explains the application of open versus pre-structured approaches in any type of data collection:

• Open approach is most suitable to gain new ideas, and insights, unpredictable responses; • While pre-structured approach is used to compare views of a big selection of informants,

or quantify research material;

We used interviewing as the main source of the data collection, in combination with secondary sources, namely documentaries to support our main findings. We have used semi-structured interviews, that is we have prepared the questionnaires in advance, but they were not strictly followed in the course of the interview. The reason for following this approach were to keep the focus of our study and ensure the data collection concerning our research questions, however we also wanted to allow the interviewees more freedom in their answers. The list which of criteria of choice (cf. Customer Behavior) was handed out to the customers and filled out in written, due to the researchers’ specific interest in all the listed criteria, as essential determinants of the case company growth in Russia. We should note that direct contact establishment initially by phone and then personally, was the most effective in gaining the interviewee feedback, while emails and faxes were fully disregarded.

Yin (2003: 97-105) further defines three principles or techniques which are useful for all the sources of evidence and serve to establish the study’s construct validity and reliability (sf. Research Quality), they are:

• Triangulation – using multiple sources of evidence;

• Case study database – organizing and documenting the data collected for case studies; • Chain of evidence – allowing the external observer to follow the evidence derivation These principles are good guidelines for our data collection phase of research. We have ensured our research quality with the help of data collection database. Each interview was noted down by the researchers, at the same time we have applied tape recorder. Every interview was typed ‘word by word’ from the tape and later compared with the researchers’ notes. Furthermore, in case of unclear phrases, the researchers’ compared their own notes with each other. Furthermore, there was no need to categorize the interviews as the number of conducted interviews were 10, so the interviewees were placed in our empirical database by their names. We have

applied triangulation by applying different sources of evidence such as interviews, as primary, and documents, governmental statistics, reports and predictions. In the next section, we will briefly analyze how we will design our analysis.

Data Analysis

In our data analysis we have developed a theoretical framework, which is the backbone of our research. It combines several theoretical approaches and gives us basic guidelines in analyzing our main study units and answering our research questions. The evidence collected on the field were analyzed by units of analysis within the theoretical framework. However, as we have applied the abductive approach, our theoretical framework was modified in the course of our field research (cf. Abductive Research). Furthermore, the derived framework analyzed each of the study units and the connectivity between them (Problem Analysis Model). The framework is a tool, applied to answer our main problem, namely how MNC’s can achieve growth. It maps the units of study, their connectivity and relationship to each other.

Ethics of Research

The ethics of our research is one of the essential issues, we have to consider, along with validity and reliability of its working methodology and findings. Ethics in our research means first being honest with regard to our empirical findings. The researcher must not only present actually found data without any misleading, but also consider such issues as privacy, sensitivity, and protectionism of the research subjects. As ethical researchers, we treated our informants with respect throughout data collection, we did not intrude into the private or confidential information. Prior to each tape-recording we have asked the interviewees for their permission to record the information. Furthermore, we have received our interviewees’ permission for the interview and for the application of the received information in our research. With the permission of the case company, we will publish the received findings in order to share with the rest of the community and to give the opportunity for future researchers and readers to use them. We are also honoured that our case company had entrusted us with valuable inside information, and we also apply it purely for the research purposes. In the following paragraphs, we will explain how validity and reliability are conceived in the literature and the measures we implemented to safeguard them. Research Quality: Validity & Reliability

The quality of any given research can be determined by trustworthiness, credibility, and dependability of the data. Yin (1994) defines four tests that can be used to establish the quality of any research and are applicable to case studies: construct validity, internal validity, external validity and reliability. We will further examine them and their application in our case.

Construct Validity

Yin (2003: 34) defines construct validity as ‘establishing correct operational measures for the concepts being studied’. We have previously identified some principles of data collection with regard to research quality (Data Collection). We applied study database, which includes case study notes. Our research was constructed to take into account and reduce the effect of subjectivity, such as making mistakes or being biased. We should point out that working in a team, reduces the probability of making the same mistake or being similarly biased. The received information was carefully reviewed and discussed by the researchers according to the research questions, and the notes were compared.

Internal Validity

This term refers to the validity of causal links that the researcher establishes. In particular, every researcher makes some assumptions about his subject that are used in making arguments and inferences. If argumentation is not structured according to true inferences, then the results are not valid. We have ensured the internal validity of our findings by applying the probing technique (Merriam, 1998), as well as using several sources of evidence (ie. Both governmental Statistics and qualitative reports). We can thus conclude that our research has high internal validity, as ensured by the above mentioned techniques and consensus within the research team on the studied research questions, as any unclearness would be jointly discussed and clarified. Even though the researchers account for possible mistakes, the research team was applying known research techniques (cf. Data Collection) to ensure the quality of research in being impartial throughout the research.

External Validity

External validity deals with the ‘generalizibility’ of the researcher’s findings (Yin, 1994). Whether, for example the findings on a micro-level can be generalized to the macro-level. In our case, our study can be applied by other MNC’s operating and expanding in the emerging markets. However, since all the findings were tailored for the case company expansion in Russia, our findings cannot be duplicated as solutions for other companies, however the developed analytical framework (cf. Problem Analysis Model, Chapter 3) can serve as a template for MNCs.

Reliability

Reliability shows the quality of research. Yin (1994) affirms that if another researcher performs the same study, s/he would get the same results. In order to ensure the preciseness of collected information, we have applied probing technique (Merriam, 1998) in asking for more details and examples, in order to understand the true meaning of the interviewee. In our findings, we did not oversimplify or exaggerate the situation, but tried to be very close to the case study reliability by keeping the case study database. We have also tried to be objective in our

conclusions and have built on our findings gradually to lead the reader to the derived conclusions. However, we should account for dynamism of macro-environment and static market development of the emerging markets, which could further deter the reliability of our findings. Thus, we give a brief account of current macro-environment and focus our findings on the defined units of analysis, such as growth, customer and distributor network, within the framework of present macro-economic situation. Below, we will present the research model of our thesis which has provided us with the structure and basic guidelines in our research.

Research Model