MASTER THESIS WITHIN: Business Administration: Finance NUMBER OF CREDITS: ECTS 30

PROGRAMME OF STUDY: Civilekonomprogrammet AUTHORS: Joakim Eriksson & Leila Mandzukic TUTOR: Fredrik Hansen & Toni Duras JÖNKÖPING May 2021

An event study approach performed with announcements from

the Swedish Government and the Public Health Authority

Is Covid-19 Affecting Swedish Real

Estate Companies?

Master Thesis in Business Administration, Finance

Title: Is Covid-19 affecting Swedish Real Estate Companies? – An event study approach performed with announcements from the Swedish Government and the Public Health Authority

Authors: Joakim Eriksson & Leila Mandzukic Tutor: Fredrik Hansen & Toni Duras

Date: 2021-05-24

Key Terms: Covid-19, Real estate, Event study, Stock Market

___________________________________________________________________________

Abstract

Background: The Covid-19 pandemic has been affecting the world in some or another way both when

it comes to individuals and the adaption to a new lifestyle as well as economic and financial impacts on the global markets. The outbreak started off in China in the late 2019 and spread across every country in the world within three to four months. Living and working standards has since then changed due to restrictions with more people working from home and with impacts on the daily business of companies. The attention is brought upon the real estate sector because of the uncertainty followed by the new norms in societies which makes it an interesting sector on which to study the financial impact.

Purpose: This paper aims to investigate how 13 chosen dates regarding the Covid-19 pandemic from

announcements of the Swedish Prime Minister, Stefan Löfven and The Public Health Authority has affected the real estate sector in Sweden by using an event study approach. The dates were divided into three categories namely restrictions, work from home and financial support to see whether these specific announcements have a financial impact on Swedish real estate companies.

Method: For this study, a deductive approach was applied along with the philosophy of positivism since

this is most suitable for quantitative methods. The event study methodology was used in order to observe the data on how the stock market in Sweden reacts on the impact of the outbreak concerning Covid-19 and how this might affect the real estate sector with the selected dates from the announcements.

Conclusion: The findings from this study indicated that there were two significant results when

calculating the abnormal returns for each individual company over all event dates with all others being not significant, since all other t-tests that were applied did not show strong enough results to provide significance concerning the real estate sector and the effects of Covid-19. Although, one should keep in mind that this is a short-term analysis and that in the long-term these results might differentiate, therefore, this thesis could be a guideline for future research when more data and information concerning the pandemic is available.

Acknowledgement

We would like to take the opportunity to thank everyone who contributed to this thesis including our tutors Fredrik Hansen who provided us with guidance and discussion along with Toni Duras who stood for statistical path showing. Thanks also go out to our seminar group which enabled us to think

outside the box with critical and creative inputs to our work.

__________________ __________________ Joakim Eriksson Leila Mandzukic

Table of Contents

1 Introduction ... 4 1.1 Background ... 4 1.2 Problem ... 5 1.3 Purpose ... 6 1.4 Research Questions ... 6 1.5 Delimitations ... 6 2 Literature Review ... 8 2.1 Event Studies ... 82.2 Efficient Market Hypothesis ... 9

2.3 Capital Asset Pricing Model ... 11

2.4 Market Model ... 12

2.5 Cumulative Abnormal Return ... 13

2.6 Previous Research Within the Field of Finance ... 13

2.6.1 Event Studies Within the Financial Market ... 14

2.6.2 Event studies concerning Covid-19 ... 15

2.6.3 Other Approaches to Measure the Effects of Covid-19 on the Financial Market .... 19

3 Method ... 22

3.1 General Approach ... 22

3.2 Timeline ... 23

3.3 Abnormal Return ... 25

3.4 Selection Criteria and Data ... 27

3.5 Hypotheses ... 30

4 Empirical Findings ... 31

4.1 Good News ... 31

4.2 Bad news ... 32

4.3 No news ... 34

4.4 Length of Estimation Window ... 34

4.5 Real Estate Stock Market During the Time Period ... 35

4.6 Descriptive Statistics ... 36

5 Analysis ... 37

5.1 Discussion ... 38

5.2 Future Research ... 40

7 References ... 44

8 Appendix ... 51

8.1 Appendix 1, Timeline ... 51

1

Introduction

1.1 Background

The Covid-19 pandemic has affected the entire world financially, mentally and physically for over a year. Koley and Dhole (2021) examined the first responses of the pandemic that started off in China in the late 2019 and spread across the entire world within three to four months, causing death and frailty and affecting the life and lifestyle of almost everyone all around the world. In order to examine the effects of the virus, statistical data from the World Health Organization (WHO) was provided such as the number of confirmed cases and deaths which indicates the most heavily affected areas and provides guidance to governments and authorities. Although, the outbreak of Covid-19 is a widespread subject with a lot of attention the data and results differentiate frequently over time which makes drawing conclusions a difficult task. Moreover, with the ongoing developing restrictions companies and their financial performance have an uncertain future from restrictions and speculations (Shlaes & Lynn, 2020).

The Swedish Government and the Public Health Authority (Folkhälsomyndigheten) has during this time launched different restrictions regarding the ability to attend work physically. This leads to more people working from home and therefore fewer working spaces being used, both because of social distancing and because of the possibilities of working and completing tasks just as effectively from home or from a distance (SCB, 2020a). Restrictions have also been presented to restrict the number of people in the same area in restaurants, at social gatherings and in private gatherings. At the same time, the Swedish Government have tried to ease the financial impacts this has on companies with different packages of financial support.

The rapid occurrence of the pandemic has caused uncertainty to the global economy and the uncertainty has in order affected the various investors increasing the volatility of the financial market (Njindan, 2020). Several measures have been taken by the governments around the world, such as financial support, closing schools, social distancing and restrictions to prevent the spread of the virus. These measures will not only control the spread of the virus, but it will also indirectly reduce the uncertainty among people and help to restore the global economy that is affected (Phan & Narayan, 2020).

There have already been performed a couple of studies on the financial effects caused by the outbreak of Covid-19. Some of these studies have used the event study approach and have

Heyden (2021). They both report findings with the help of event studies regarding the government interventions measures such as social distancing and containment measures which indicate a negative effect on the financial market earnings. Another event study worth mentioning is Cazan (2017) where the referendum date of Brexit was studied to see how it affected the London Stock Exchange Market. He et al. (2020) also created an event study but with the aim of isolating and connecting financial effects to the one specific date when the first cases of Covid-19 was discovered in China, January 2020.

With the help of the same approach, namely an event study, an investigation will be conducted on how a number of chosen dates regarding announcements from the Swedish Prime Minister Stefan Löfven and the Public Health Authority during the time of the Covid-19 outbreak especially have affected the real estate sector in Sweden. The societal change with more people working from home along with financial uncertainty and new adaptions that could possibly affect the market of real estate and in term real estate companies which will be investigated further through this study.

1.2 Problem

The Covid-19 pandemic is an ongoing topic globally and has affected the Swedish economy and its market sectors in many ways (SCB, 2020b). The real estate market is no exception. The Swedish Government lead by Prime Minister Stefan Löfven as well as other governmental authorities are regularly issuing press releases with new announcements regarding restrictions concerning Covid-19. The real estate market which is dependent on companies and people renting their buildings has during earlier crises endured financial impacts (Shlaes & Lynn, 2020). The pandemic with its following adaptations and restrictions could therefore also have contributed to significant financial effects (SCB, 2020b). As Oravský et al. (2020) discuss, earlier pandemics such as the Spanish influenza and SARS had economies in depression with financial impacts that countries had to fight to survive economically. It is urged how Covid-19 could see a development which would mean financial impacts just like earlier crises and pandemics. How does the restrictions followed by Covid-19 affect the Swedish real estate stock market? The pandemic is a relatively new phenomenon since it started in early 2020 but have already seen a fair share of initiated research. However, the Swedish real estate market has not yet been under any substantial investigation.

1.3 Purpose

The purpose of this thesis is with the use of an event study to investigate how chosen dates in time with new decisions especially have affected the real estate sector within the financial market in Sweden. The Swedish Government lead by Prime Minister Stefan Löfven as well as the Public Health Authority has during the Covid-19 pandemic presented different restrictions. The restrictions have regarded matters such as maximum number of people in public and private spaces and recommendations of working from home and financial support of companies in Sweden. This has then led to the consequence of fewer working spaces being needed both because social distancing is needed and because of the possibilities of working and completing tasks just as effectively from home or from a distance. The intent of this thesis is to study the Swedish real estate market by incorporating all the listed companies on OMX Stockholm Large Cap, OMX Stockholm Mid Cap, Spotlight stock market and Nasdaq First North belonging primarily to the real estate sector.

1.4 Research Questions

Our research is meant to resolve the following research questions:

• Do the chosen events with public announcements by the Swedish Government Offices and the Public Health Authority in the presenting timeline affect the Swedish real estate sector on the stock market?

• Is there evidence of abnormal return from the companies' stocks selected?

1.5 Delimitations

The number of large listed Swedish real estate companies is low. This means that companies of smaller scale with lower trading volumes are incorporated and can disrupt the calculations of beta. However, this is accepted due to the interest of involving different listings and not just Stockholm OMX Large Cap into the event study to have a wider look at the Swedish financial market. Further, the announcements that are taken into consideration in this study are solely from Swedish Authorities with impacts in Sweden. The event window is delimited to one specific day instead of a longer window in order to narrow down results to the effects of the specific announcement investigated. The announcements from press releases during the pandemic consists of hundreds of announcements regarding the pandemic with some of them

Folkhälsomyndigheten, 2021). The number of press releases used in this study are limited to 13 and are viewed to be the most critical towards real estate companies.

2

Literature Review

2.1 Event Studies

According to MacKinlay (1997), the applications of event studies are many. It is commonly used to measure how affected a firm’s value is by an economic unexpected event with the use of data from financial markets. The idea is, when assuming the market is rational, effects from an event will induce direct changes in the prices of securities. Possibly the first event study being published is reported by MacKinlay to be dated back to the 1930’s. In the coming decades event studies developed for the better. Bakay (1948) and Ashley (1962) were both examples of early studies within the field of how events would affect financial markets and came with improvements such as separating market confusing happenings and discarding general movements of stock market prices.

However, Corrado (2011) writes about how the event studies was not really brought to attention by the broader public until the 1960’s with Ball and Brown (1968) followed by Fama et al. (1969). This was the newly added core parts for the event studies modernization during its early stages. MacKinlay (1997) further explain how Ball and Brown (1968) and Fama et al. (1969) developed the event study to what it essentially is today, with Fama et al. reporting about stock split effects when disregarding coinciding increases in dividend and Ball and Brown (1968) specialized in the information of earnings. Ball and Brown did with the backing of evidence from at the time recent reports confirm the efficient market hypothesis when they looked at how annual reports affected securities on the financial market.

The methodology behind event studies presented by Fama et al. (1969) was first manufactured within the field of finance where its main task was to see how unanticipated events would change a corporation’s return. Then you would investigate if this “abnormal return” was a product of the event or activity recorded. From the work made by Fama et al. (1969) and forward in time the same method has as mentioned been in regular use. According to Kothari and Warner (2007) there are two main changes which reads how daily statistical samples are now commonly used instead of monthly as a part of seeing more precise results and effects from more through abnormal returns and cumulative abnormal returns. The second one considers the ability to estimate abnormal returns which is more useful when dealing with long-horizon event studies.

The applications of event studies are growing and not only within finance. For example, in marketing such as Johnston (2007) that discusses the implementation of the approach and within financial management research with De Jong and Naumovska (2016). For an event study to work properly in any of the fields there are two assumptions that must be fulfilled. The first is that the market must be efficient which means that all information is to be considered leading to a relevant price of a stock enabling financial effects to be observed. The second is that events, decisions or actions studied must be unanticipated for investors actions to mirror expectations of a business future value (Wang and Ngai, 2020).

Ball and Brown (2019) revisited the subject 50 years later to see how their old successful work when replicated. Similar to their previous work, by looking at 17 countries they investigated how accounting earnings was affected by the information that is incorporated into stock prices throughout the time period looked into. They concluded that their study replicates well and that the results and approach of their half a century older paper Ball and Brown (1968) still is credible. There are though some changes that have occurred between then and now. Ball and Brown (2019) express that the reporting lag has lessened internationally along with some weakening changes that affect how credible event studies can be with researchers tampering with results. They mention HARKing which is the act of changing hypothesis to better fit their already known results. P-hacking which is described as tampering with results and switching models until a significant result is shown. Both articles are believed to have emerged because of the fact that studies with insignificant result are more scarcely published which in turn invites for result tampering.

2.2 Efficient Market Hypothesis

In a well-known article about efficient capital markets Fama (1970) describes an efficient market as one where the prices of securities will always completely reflect all the information available which will stand as an assumption of future value of the security concerned. The ideal is clear signals represented by market prices indicating where to put resources. Fama further develops three categories of hypothetical tests. The weak form where all information used is built upon historical prices. The semi-strong form which includes if prices of securities are adjusting in an efficient manner from information known to be available to the public such as stock splits, annual earnings and other announcements. Thirdly and last is the strong tests and concerns if groups or investors have special access acting as monopolistic information with

level of information the hypothesis of the efficient market would break down. This was one of the steppingstones towards Fama (1970)’s theories about the efficient market hypothesis and more precise the weak form of testing. Later Fama (1991) would rephrase the titles of the semi-strong and the semi-strong tests to event studies and tests for private information where he denotes how event studies are the purest form of showing that markets are efficient from reactions due to information acquired.

The EMH has endured criticism such as Lo and MacKinlay (1999) that finds evidence to reject the random walk theory that which is a theory states how the market is unpredictable. This was shown in the form of serial correlations in the short run not being zero together with too many moves successively towards one direction. One year later Lo et al. (2000) also see patterns through the usage of sophistic techniques of statistics which shows possibilities of predicting stock prices.

Brown (2020) argues about several factors within behavioral finance being roots to why the EMH is still to this day very disputed among academics and professionals. The crash of the stock market in 1987 put a real dent in many believers of the EMH view of the theory with showings of how the way securities are traded actually do effect prices which is the opposite of what the EMH states. This also showed signs of behavioral tendencies influencing trading decisions such as irrationality and in turn might have been some of the factors actually breaking loose the financial crash according to Ferguson (1989). Shiller (2000) was just in time before the dot com bubble and also wrote about irrational behavior. After this, the topic behavioral finance was often included in later financial and economic papers and kept the EMH disputed. Eakins and Mishkin (2012) discuss how unexpected good or bad news lead to investors overreacting and acts as a psychological effect that disrupts the EMH. They also mention how this effect seems more prominent when bad unexpected news occurs rather than when good, unexpected news does.

Barberis and Thaler (2003) writes about the psychological aspects when it comes to deviating from rational behavior and how then irrational traders makes securities stray from their “fundamental value” which is what the price is called when it fully reflects all information available. Rational investors are then expected to eliminate this “mispricing” that has occurred when taking opportunity of the beneficial trading opportunity presented making the market efficient once again. Although, this process can sometimes be too costly or take too much time, making the rational investors unable to correct the prices, hence the limits to arbitrage is

marching through behavioral finance research. Later studies such as McLean (2010) find that idiosyncratic risk together with transaction costs further develop mispricing as well as Stambaugh et al. (2012) who argue how prohibiting short selling in the long rung is connected to overvalued securities, hence disrupting the efficient market hypothesis.

2.3 Capital Asset Pricing Model

The capital asset pricing model (CAPM) was initiated by Sharpe (1964) and was meant to give the answer to how an investments risk would affect the expected return of an asset. Sharpe writes about the capital market line where it is described how an investor with procedures of rationality can attain any point on this line, however in order to achieve a higher expected return

the investor will also have to incur more risk. Following is the CAPM-model where ERi is

expected return, Rƒ is the risk-free rate, ßi is the investments beta and (ERm – Rƒ) represents

the market risk premium. With ERm representing the market index.

𝐸𝑅! = 𝑅"+ 𝛽!(𝐸𝑅#− 𝑅") (1)

It is however argued by Dempsey (2013) that the capital asset pricing model does not have any real validation empirically. Dempsey argues that if investors have concern about their exposure to risk but not towards how the risk is expressed in any chosen stock represented by the beta, the factors as seen in Fama and French (1996)’s three-factor model representing risk are doubtfully correct.

A consistent estimator of beta in the presence of nontrading was developed by Scholes and Williams (1977). Given the availability of data, more powerful tests of the capital asset pricing model are achievable. Although, potentially serious econometric problems are encountered. Since reported closing prices signify trades prior to the actual close of the trading day, the returns that are measured often deviate from the true returns. Also, they present an indication that nontrading-adjusted securities that have a low trading volume have a beta that is ten to 20 percent larger than unadjusted estimated but for those securities that are frequently traded this problem is close to being irrelevant. Williams concludes that in the market model with nonsynchronous trading of securities, OLS estimators of coefficients are both biased as well as inconsistent.

2.4 Market Model

There are according to MacKinlay, (1997) several statistical models such as the market-adjusted return model and a variation of multifactor-models with different index models that factor in for example industry classification which can be applied when calculating the normal return. One commonly used type of a statistical model is called the factor model. This type of model is driven by reducing the variance of the abnormal returns and these specific factors are usually selections of traded securities. One believes that when the variance from the abnormal return is reduced it could potentially increase the chances of a rise in the ability to distinguish the effects of the chosen events. When selecting a suitable model for the study, the estimation window needs to be described. Usually, the estimation window is selected when using the period that is prior to the event and in this case if choosing the market model, the parameters could be assessed over the 120 days prior to the event. Also, the most common factor model used is the market model, which follows a linear specification, see formula below (MacKinlay, 1997).

𝑅!" = 𝛼! + 𝛽!𝑅#" + 𝜀!" (2)

The variables imply different data. Firstly, the 𝑅!" stands for the actual return for stock i at time

t, 𝑅#" is the return for the market portfolio at time t. The 𝛼! implies the unsystematic risk for

stock i whereas the 𝛽! implies the systematic risk for stock i. Lastly the 𝜀!"which stands for the

error term.

After the use of the market model, one can calculate the abnormal return. The abnormal return implies the difference between the actual return and the normal return in the event window. Accordingly, it stands for the error term of the regression which can be seen from the formula above. The following formula presents the abnormal return (MacKinlay, 1997):

𝐴𝑅!" = 𝑅!"− 𝛼! − 𝛽!𝑅#" (3)

The variables indicate different data, starting with the 𝐴𝑅!" that stands for the abnormal return

2.5 Cumulative Abnormal Return

MacKinlay (1997) examines event studies in the economic and finance field and shows that it is important to take into consideration how obstacles can evolve when using various models to analyze different types of information. When using a single day abnormal return one obstacle that needs to be considered is the leakage of information. In order to use the concept of cumulative abnormal return one needs to apply a multiple period event window. When observing each day of the event window, the normal returns are in comparison with the observed returns and the difference between these is namely the abnormal returns (AR). The ARs that are calculated are then summarized over the event window, and this outcome gives in turn the cumulative abnormal returns (CAR) of the chosen event. The reason for calculating the CARs of the events is to investigate whether they vary from zero. If that would be the case, one could conclude that the event has an impact. The following formula presents how to calculate the CAR and is simply done through cumulating the abnormal returns of the securities for each event day represented by tau.

𝐶𝐴𝑅𝒊(𝜏1, 𝜏2) = +𝐴𝑅𝑖𝜏 𝜏2

𝜏=𝜏1

(4)

MacKinlay (1997) points out that in order to receive useful results, one event is not enough to investigate. Therefore, one needs to aggregate, meaning that the calculated abnormal returns need to be aggregated for the chosen event window and within the findings of the event. Furthermore, when conducting this type of aggregation, one presumes that there is no overlap in the following event window of the incorporated securities, and this is in other words called clustering.

2.6 Previous Research Within the Field of Finance

Since the understanding concerning the Covid-19 pandemic is still quite limited and as the virus is still spreading research is still in the process of being conducted. Therefore, studies within this field are still in a research area with various methodologies being applied and many of the studies are still unpublished working papers. Event studies concerning the financial market and the real estate market along with other methodologies being used will be discussed in this section. Although, many findings and studies are starting to be presented regarding the

virus and different fields within finance, it is hard to interpret the results and the effects due to the early stage. We will return to this development in the discussion part.

2.6.1 Event Studies Within the Financial Market

Corporate social responsibility (CSR) is an ongoing topic around the world and Wang et al. (2011) studied how financial investors tend to respond to firms CSR in the extent of their investing behaviors. They used an event study to see how CSR affects the behaviors of the investors and the stock prices before and after the public announcement concerning the melamine contamination occurrence which took place September 11, 2008. The post-event window consisted of the days after the selected event which may be used for examining longer term effects on performance of financial securities. This study used 22 days, being the amount of trading days in one month, also the same number of days was used for a pre-event window to get a better comparison. Their findings showed that there was no significant relationship concerning the degree of CSR performance in firms and investors selling and buying behaviors when looking at the pre-event window. Also, when examining the impact between the behavior of the investors on the stock of the firms with or without the measured degree of CSR activities, Wang et al. could see that there was no significant difference in this comparison either. Although, conducted data showed that at the post-event window, there were significant effects on CSR activities on the behaviors of the investors. More precisely, this finding indicated that the selling and buying behavior of the investors was in some extent affected in a short period of time but only after the event.

The United Kingdom has been a very important financial center in Europe for many years. In 2016 the political environment was seriously challenged when they determined to leave the European Union. Therefore, a study was performed by Cazan (2017) to examine the Brexit implications over the English banking system. To investigate this, Cazan used an event study approach with the use of a panel of 11 financial institutions listed on the London Stock Exchange. For the data, the event day that was used was June 23, 2016, since this was the date when people of the United Kingdom voted to leave the European Union. Also, an event window of ten days was used with an estimation period of 221 days. The results show that for the first day after the announcement, namely the EU referendum date, the AR and CAR have dropped significantly, which indicates that the event has had a negative effect. A takeaway from this study is how in short-term, the small banks will be more affected than the larger ones. There is still uncertainty in the UK economy, and it will be easier to evaluate in the upcoming years

how affected the investors behavior are on a global scale. Since Brexit was the trigger of a systematic shock, these effects will be extended over a long period of time.

2.6.2 Event studies concerning Covid-19

Event studies are used to analyze the effects of a specific event, and usually the financial effects are studied. However, there are other application areas in which this type of research can be used. In a study which is currently a working paper by Juranek and Zoutman (2020) they did exactly this and studied the effect of social distancing measures on the demand for intensive care due to Covid-19. They investigated three Scandinavian countries namely, Sweden, Denmark and Norway. The are several factors for focusing on these three countries. To begin with, they are comparable when it comes to culture, health care institutions, climate and institutional framework. Second, the geographical proximity is quite the same along with economic influences and it is reasonable that this could have affected the spread of the pandemic around the same time for each country. Third, the social distancing differs between the countries in a large extent, Sweden imposed light restrictions in comparison to Denmark and Norway which imposed strong distancing measures. However, the measures were introduced at roughly the same time. Lastly, when observing hospitalization and patients in ICU the numbers in Sweden are over the top or at least very close of the first peak compared to the numbers in Norway and Denmark that have essentially peaked. The authors use the event study approach for their study, where they distribute the data into five-day periods starting from March 18, 2020, by referring to March 12, 2020, as the lockdown date, since this is the date where most of the restrictions in Norway took place. A pre-period was used the first ten days which is approximately six to 15 days into the lockdown period. The authors believe that this period would not have any effect on hospitalization and ICU patients and the trend for the following countries should look quite mutual. About 15-20 days into the lockdown period the assumption holds, and the findings show that the countries have similar Covid-19 hospitalization. The results show that the stress on the health care system drops when operating stricter actions and when comparing to Sweden the lockdown actions also reduce the amount of intensive care patients per capital and hospitalizations. Moreover, the study examines the counterfactual effect of Denmark and Norway having the same type of restrictions as Sweden and concludes that the numbers would have caused twice as many intensive care patients and hospitalizations at the peak, meaning that the two countries would have received their maximum capability.

Turning to financial effects, one previous event study is He et al. (2020) regarding the cause of the Covid-19 pandemic on the stock prices. They looked across different sectors in China with the use of the market model. The news about the Covid-19 outbreak started off in the Southern China seafood market in Wuhan the December 30, 2019. Therefore, the event day for this study was taken from reported news by the official media regarding the closure of Wuhan on January 23, 2020, since this could be seen as the date concerning the outbreak of the Covid-19. Furthermore, 160 trading days were selected before the occurring event date as the forecast period and every five trading days around the event occurrence date were chosen as the event window period. The time period for this study was from June 3, 2019, to March 13, 2020, with a selected sample from the Shanghai and Shenzhen A-share market which consists of 2895 listed companies. The results that were found on the stock prices indicated negative results on the Shanghai Stock Exchange while it showed positive findings on the Shenzhen Stock Exchange. To keep in mind, the Shanghai Stock Exchange mainly consists of traditional industries whereas companies listed on the Shenzhen Stock Exchange consists of high-tech companies. The authors used 18 sub-sectors to be able to examine the effect of the pandemic in a larger extension. The findings for some sectors on the given event day showed that stock prices concerning agriculture, construction, mining, electric and heating industries significantly declined. The market value for some businesses decreased on the day of the outbreak and for following days, some of the companies were transportation, real estate and environmental industries. Also, catering and business services were also affected but just in some extent. Moreover, the findings show that the traditional industries of China are more negatively impacted by the pandemic whereas new opportunities were created for the development of high-tech businesses such as education and health. Although, the large economy in China and the strong supporting capabilities as well as other factors helped the country to rapidly repair from the causing effects of 19 and the study also points out that the impacts of Covid-19 are still quite unknown.

Yan and Qian (2020) performed an event study based on the consumer industry to examine the impact of Covid-19 on the Chinese stock market. On January 22, 2020, patients were identified and reported to be infected by the virus and the State Council Information Office held the first official conference regarding Covid-19 the same day meaning that this could signify to be the start of the outbreak in the country. Thus, this date was chosen as the event day for the study with 140 trading days before the event as the forecast period with different lengths for the event windows in order to maintain as much information for the findings as possible. The paper

examines the short-term impacts of the pandemic on the Shanghai Stock Exchange 80 Index and the results signifies a negative impact on consumer stocks at the very start of the outbreak. Mainly the second day after the occurrence indicated significantly negative impacts on the consumer stocks. Although, as mentioned previously from He et al. (2020) the negative results on the consumer industry do not hold for a longer time since the governments effective monetary policies in China helps the country to recover quite fast from the outbreak.

Sayed and Eledum (2021) studied the short-run response of Saudi Arabia stock market due to the outbreak of the Covid-19 pandemic by using an event study. The main event date for this study was March 2, 2020, as on this date the first confirmed case of Covid-19 was found in Saudi Arabia. Moreover, a secondary event date January 20, 2020, was used to examine the effects on the stock market in the country. The estimation window for the study was 120 trading days before the secondary event date and to be able to examine the effects in different periods, seven event windows consisting of 90 trading days were used. The time periods of the event windows were for instance when cultural, entertainment events were cancelled and dates where authorities as well as the Saudi Ministry declared the closure of schools, restrictions and curfews. Also, 21 industry groups within the Saudi stock market were used to calculate the cumulative abnormal returns for the trading days after the announcement of the Covid-19 in both Saudi Arabia and China. There were several findings from the study, starting with the estimated CARs for the following industry groups which indicated that they were not statistically significant. Accordingly, the Saudi stock market did not respond quickly when the announcement concerning the first case of the Covid-19 appeared in the country. Although, there was a negative but not significant effect on the Saudi stock market when the announcement about the first Covid-19 case appeared in China. By using an event window of nine days post the event day, the result from the first confirmed case in Saudi Arabia had a negative and significant effect on the Saudi stock market. All in all, there were some industry groups that had been more negatively affected than others, for instance banks, consumer services and capital goods whereas others were more positively affected in some event windows such as telecommunication services, food and beverage.

By an event study Alam et al. (2020) investigated eight factors affected by the pandemic on the Australian stock market. For the event study, the authors used a ten-day event window along with 120 days as an estimation period prior to the announcement of the Covid-19 outbreak in Australia on February 27, 2020. The results indicate a variation among the several

at a significant level namely pharmaceuticals, healthcare and food. Furthermore, one of the factors that was examined was the real estate market where the demand for the real estate industry has been affected by the economic slowdown in the world. In addition to this, wage cuts could have a significant effect on the demand for housing and as people try to hold on to their money to meet the daily needs the demand will be affected in this case as well. According to the authors it is important to take into consideration how the impact on the pandemic on the real estate industry should be taken seriously. The findings show that the real estate index is the only industry that does not show any clear evidence by the impact of the Covid-19 in the short-run. Although, it could be affected in the long run and the authors points out that this study could lead researchers to investigate this topic in the long run as more data will be available by time.

Bash (2020) examined the effects of the first registered case of Covid-19 for 30 stock market indices by using the event study approach. The market model is used in the study to calculate the CARs for all the chosen countries and the daily data regarding the stock index is used from EOD Historical Data and Morgan Stanley Capital International. The dates for all the 30 countries concerning the first registered case of the virus, including Sweden are taken from the European Centre for Disease Prevention and Control and these dates are also the event day for the analysis. The author uses different lengths for the event windows and the findings from the study indicate that the response on the stock market indices for the following countries are significantly negative. Also, the findings indicate that the stock market returns face a downward trend due to the pandemic.

By using an event study Harjoto et al. (2020) examined the market reactions to Covid-19 on global stock markets as well as the stimulus from the government policy. The authors used two event dates for their study, first the WHO announcement on March 11, 2020, as this date was when they declared the outbreak of the virus as a global pandemic. Second, they used the Federal Reserve Bank announcement on April 9, 2020, since the Federal Reserve Bank announced a huge 2.3 USD trillion lending program to help smaller businesses to be able to continue with their firms and maintain their workers. Some of the data that the authors used was daily stock indices for developed countries, emerging markets and US firms with both small and large market capitalization. Also, they studied the CARs for ten days prior and ten days after the two chosen event dates with different estimation windows. Furthermore, for the first event they used the period February 26 to March 25, 2020, and for the second one they

estimation period. The findings for both the events show that the abnormal returns for the emerging markets are significantly negative and lower than for the developed markets. After the second event date, the US accomplished more positive abnormal returns comparing to the developed countries excluding US, meaning that the stimulus had a positive effect on the US equity markets. Although, when taking the first event date into account the findings show more negative abnormal returns for small market capitalization compared to larger ones. The CARs for the developed countries showed positive results while the emerging markets indicated negative results. One may conclude that the Covid-19 affects the stock market indices more negatively for the emerging markets compared to the developed markets and small companies tend to experience larger negative shocks caused by the virus than for larger companies.

2.6.3 Other Approaches to Measure the Effects of Covid-19 on the Financial Market

Chang et al. (2021) examined the effects of the governments responses to fighting the Covid-19 virus on the returns in the stock market index. To be able to explore the effects of the government responses to the pandemic on the stock market, a panel data is used consisting of 20 countries with a timespan from January 2 to July 21, 2020. The mix of the sample contains many diverse countries that account for a large share of total world capitalization, whereas one of the countries in the sample is Sweden. Four policy indices are applied to the study by Hale et al. (2020) namely, government response, stringency, containment and health, and economic support indices. All these indices are combined with a simple preservative method based on many specific policies, for instance workplace or school closures. First, the overall government response index which reviews all dimensions of government policy response, counting containment and closure as well as health systems and economic response. Second, the stringency index which signifies to information on containment and closure, testing policy and public information campaigns. Third, the containment and health index which signifies to containment and closure, testing policy, public information campaign and contact tracing. Fourth, the economic support index which signifies to income support and debt/contract relief for households. The findings of the above-mentioned indices show that the overall government response index has a positive impact on the stock market returns. The containment and health index and stringency index signify positive results on the stock market returns as well. However, the findings propose that not all policies are able to increase the stock market returns. If looking at the stock market, one can see that it reacts positive to workplace closures, restrictions on gathering size, restrictions on international travel and public events cancellation,

interventions in the health system. The results from this study could provide important findings for policymakers in each country as well as indicating that government response might have a positive value for the economy.

Narayan et al. (2021) also studied the Covid-19 effect on the Australian stock market returns to investigate how the pandemic predicts stock market returns at different quantiles for different sectors. Since all sectors are not affected negatively, they use a quantile-based analysis, which according to the authors is appropriate to use for such a study. The quantile regression framework is suitable in this case since it helps distinguishing the effect on the market regarding the pandemic, meaning when the effects on the market are positive and when they are negative. 11 sectors are examined that fit to the Australian stock market and the sample covers data from April 1st to September 10, 2020. The findings indicate a negative impact on the market. Some sectors have been positively affected such as information technology and health, whereas finance, communications and energy have been negatively affected. Although, four sectors have been unaffected namely materials, industrial, utility and real estate. The reason for this could be due to the Australian government and the implemented policies concerning the Covid-19 and the financial support that have been applied for businesses and for those individuals that have lost their jobs due to the pandemic.

De Toro et al. (2021) studied the effect on the real estate market in Naples (Italy) due to the Covid-19 crisis by using two surveys and a cross-tabulation analysis which is a quantitative method good for comparing two or more variables when using surveys in research. The metropolitan area of Naples has been used from 2009 to 2020 as well as two surveys in order to conduct the data that is required to investigate the aim for this study. The purpose of the surveys was to apprehend two different perspectives. First, one that is linked to demand and the varying needs of the community and second, one that is directly working in the real estate market meaning intermediary between supply and demand. The authors also investigated the pre-covid real estate market in Italy, which provided clearer trends due to more knowledge compared to the post-covid period since that period is still being studied and only conceivable perspectives can be proposed. From the financial crisis 2008 and where effects are still being sensed today to the Covid-19 crisis nowadays the real estate market has changed in Italy. The change in the trends is because of several factors that could be related to for instance lockdown, lower incomes, change in lifestyle and working conditions but the real estate trend in Naples is also affected by the decrease in tourism and due to this in related rents as well. As mentioned

research regarding the real estate market the data will change, and other factors will be considered. Also, the new data that will be collected for further studies when more information is received will help to adapt to the development of the health situation and this will in time make it achievable to face plans and recovery policies, helping to decide how and where to lead on new investment.

3

Method

3.1 General Approach

When conducting research, there are three different ways in how one may approach theory development. These methods are called the inductive, deductive and abductive approaches. An inductive approach indicates to build a theory whereas a deductive approach aims to test a theory. Lastly, the abductive approach which is dependent of them both and is frequently used in the context of business and management research (Saunders et al., 2016). Hence, the inductive method suggests that the researcher mainly observes the reality and then tries to build up an insight of the subject in question (Holme & Solvang, 1997). The deductive method suggests that the researcher starts out from existing theories on how reality works and with the help of the theories the researcher can collect further information on the subject in the question. This means that for the inductive method the researcher initiates the studies in order to achieve scientific evidence for the models while for the deductive method the existing theories are then tested and subsequently either confirmed or further developed (Holme and Solvang, 1997). Based on the purpose of this thesis, a deductive approach to theory development was pursued. Since the hypothesis for this thesis will be based on previously elaborated finance theories this will correspondingly be the baseline for the process of retrieving data and in turn the hypothesis will be tested.

A method can further be either quantitative, qualitative or mixed methods (Saunders et al., 2016). The quantitative method is formal and structured and is characterized by selectivity and the approach merges on numerical observations, the analysis of the chosen data is essentially performed with statistical tools (Holme & Solvang, 1997). Saunders et al. (2016) states that the quantitative methods are often connected with the philosophy of positivism, which indicates highly structured, large samples and where a range of data can be analyzed. Contrary to positivism, interpretivism does not believe in discovering general laws to how individuals act in situations and this philosophy is typically inductive with small samples and is associated with a qualitative method of analysis. Furthermore, a qualitative method aims to recognize how their respondents make sense of their world and allow for a more complex and elastic understanding of data than quantitative methods.

Since this thesis will require mostly data to be gathered and analyzed the most suitable method when conducting such a study is the quantitative method (Holme & Solvang, 1997). According

to MacKinlay (1997) a useful approach for a quantitative study of a certain event’s influence on the stock market is the event study methodology. With the use of the financial data, it is achievable to observe how the stock market is reacting on the impact of the Covid-19 and how this in turn is affecting the real estate market.

3.2 Timeline

The event study for this paper will be based on 13 dates that are taken from announced press conferences mainly from Prime Minister Stefan Löfven and the Public Health Authority. The following dates that have been chosen according to how extensively they are believed to affect the performance of Swedish real estate securities and are also divided into three categories that fit under the “good” and “bad” news described in event study methodology. The three categories are namely “work from home”, “restrictions” and “financial support”. These three categories are perceived as the most critical types of announcements with the biggest impact on the Swedish society, both positive and negative during the pandemic and are all found on the given event dates below.

o 2020-03-16 – Recommendations of working from home are issued. For those employers that have the possibility for their employees to work from home should consider recommending this since this might have a decreasing effect on the spreading. (announcement) (Folkhälsomyndigheten, 2020a) (work from home).

o 2020-03-25 – To mitigate the consequences the pandemic has caused on the Swedish economy the government has presented an emergency package for smaller companies and workplaces as well as other measures. (announcement) (Regeringskansliet, 2020a) (financial support)

o 2020-03-27 – An announcement regarding prohibition against public gatherings or public events with more than 50 participators was issued. Although, the restriction tends to take place the March 29, 2020. (announcement) (Regeringskansliet, 2020b) (restrictions).

o 2020-04-30 – The Swedish Government presents further measures to decrease the spreading of the Covid-19 virus and the consequences it has caused on the jobs and companies in the country. This time the measurement is an adjustment support of total 39 billion Swedish kronor. The Ministry of Finance states that approximately 180000 companies will have the right to the support. (announcement) (Regeringskansliet,

o 2021-07-30 – The Public Health Authority are recommending for those who can work from home to carry on working from home. Moreover, the recommendation indicates that everyone that can work from home should continue with it through the fall as well. (announcement) (Folkhälsomyndigheten, 2020b) (work from home).

o 2020-09-21 – Once again, the Swedish Government presents further measures due to the pandemic. The budget bill is announced to be 11 billion for next year, 2021, to financial security, strengthen competence and improved job opportunities. The focus is on the unemployment therefore, the government is proposing measures for those who lose their job to get the opportunity of education, adaption and enhanced job opportunities. (announcement) (Regeringskansliet, 2020d) (financial support).

o 2020-11-03 – Stricter restrictions are publicized for stores, gyms and cafeterias as well as all other places that offer food. Regardless of selling alcohol or not, all places that offer food should close 20.30, however they are allowed to have takeaway. Furthermore, rules are imposed regarding the maximum number of people, which state that a maximum number of eight people are allowed by the same table at every restaurant in Sweden. (announcement) (Regeringskansliet, 2020e) (restrictions). o 2020-11-16 – The government is worried that people are not taking the spreading

seriously. Therefore, the restrictions are stricter than they were before. The new ones imply that a maximum of eight people is allowed in social gatherings. (announcement) (Regeringskansliet, 2020f) (restrictions)

o 2020-12-08 – Before the Christmas celebrations, new restrictions took place. A maximum number of eight people were allowed in private gatherings, to prevent the spreading. Although, this was just a recommendation for people to follow and it would keep on being recommended until New Year’s Eve as well. (announcement) (Regeringskansliet, 2020g) (restrictions).

o 2020-12-18 – The situation regarding Covid-19 is sincere. Therefore, new actions are taking place. Alcohol sales are forbidden as from 20.00 at every place that offers food, the maximum number of people at restaurants are changed from a maximum number of eight people to four people only. Shopping malls, gyms and shops need to set up their own restrictions on account of how large their facilities areas are, no crowding is allowed. Online lectures and working from home are still a recommendation for those that have the possibility. (announcement) (Regeringskansliet, 2020h) (restrictions). o 2020-12-22 – More and more people are working from home, but there is still a huge

authorities start a mission to ensure that people able to work from home fulfil this. (announcement) (Regeringskansliet, 2020i) (work from home).

o 2021-01-08 – Restrictions concerning the maximum number of people are further reinforced. The new rules are to decrease the crowding in gyms, parks, swimming facilities and shops. The provider of each of these activities needs to calculate the maximum number of allowed visitors or customers that can attend the facilities area at the same time. The people responsible needs to make sure that every visitor has a minimum of ten square meters at their disposal. (announcement) (Regeringskansliet, 2021b) (restrictions).

o 2021-01-18 – A strong financial support for companies that are affected by the lockdown is presented. For those companies that are unable to conduct their business as a result of a decision on closure under the new pandemic law must be able to receive financial support to cover their fixed costs during the closure. (announcement) (Regeringskansliet, 2021c) (financial support).

3.3 Abnormal Return

As mentioned by MacKinlay (1997) there are reportedly a number of models available for calculating the abnormal return. The model that is selected to conduct this event study is the market model in order to calculate abnormal return of financial securities which was chosen over the simpler adjusted market model (see formula 3 and 5 mentioned earlier). In combination with this, a regression analysis is performed to find the alpha and beta. The event window used is 120 days with ten days before the actual event date removed. Only the event day is used when calculating abnormal return instead of an event period. For each of the chosen securities the market model is as mentioned earlier in equation 2 as follows:

𝑅!* = 𝛼!+ 𝛽!𝑅#*+ 𝜀!*

𝐸(𝜀!*= 0) 𝑣𝑎𝑟(𝜀!*) = 𝜎+, (2)

Security i’s period t-return is represented by Ri𝜏 and the market portfolios by Rm𝜏 .𝛼i and βi are

parameters assessing risk in the market model while 𝜀i𝜏is the error of security i. Formula 3 is

𝐴𝑅!*= 𝑅!*− 𝑅#* (5)

Formula 5, the adjusted market model is the simpler model used to calculate abnormal return and does not take alpha and beta into consideration which means no adjustments to risk in this case.

𝐴𝑅!" = 𝑅!"− 𝛼! − 𝛽!𝑅#" (3)

The next step as seen in the earlier mentioned formula (3) the sample abnormal return is calculated by deducting the “expected return” from the securities return on any chosen day

with 𝐴𝑅!" being the abnormal return that deviates from what the rest of the index or market

compared with is showing.

𝐶𝐴𝑅𝒊(𝜏1, 𝜏2) = +𝐴𝑅𝑖𝜏 𝜏2

𝜏=𝜏1

(4)

Since multiple periods are investigated the cumulative abnormal return will be compulsory, in short (CAR) to have a broader view of how Covid-19 has affected the chosen real estate companies in Sweden with the abnormal returns cumulated.

𝐴𝐴𝑅 =𝐴𝑅,,,,𝜏 = 1

𝑁+𝐴𝑅𝑖𝜏 𝑁

𝑖=1

(6)

Followed by the cumulative abnormal return each abnormal return of securities is aggregated from our chosen time periods and are averaged into average abnormal return (AAR).

𝐶𝐴𝐴𝑅 =𝐶𝐴𝑅,,,,,(𝜏1, 𝜏2) = +𝐴𝑅,,,,𝜏

𝜏2

𝜏=𝜏1

The cumulative average abnormal return is then calculated (CAAR) and is the average of the previous formula (6).

𝑆𝐴𝑅𝒊𝝉 = 𝐴𝑅𝒊𝝉

𝑆𝐷(𝐴𝑅𝒊𝝉) (8)

In order to see the significance of the findings a standardized t-test will be performed as seen above in formula (8) where SD is standard deviation. The confidence levels that will be used to test the t-values are 0.1, 0.05 and 0.01. The standardized abnormal return was originated through Patell (1976) and later Dodd and Warner (1983) and divides the abnormal return with the standard deviation of the chosen securities return on any chosen time event.

3.4 Selection Criteria and Data

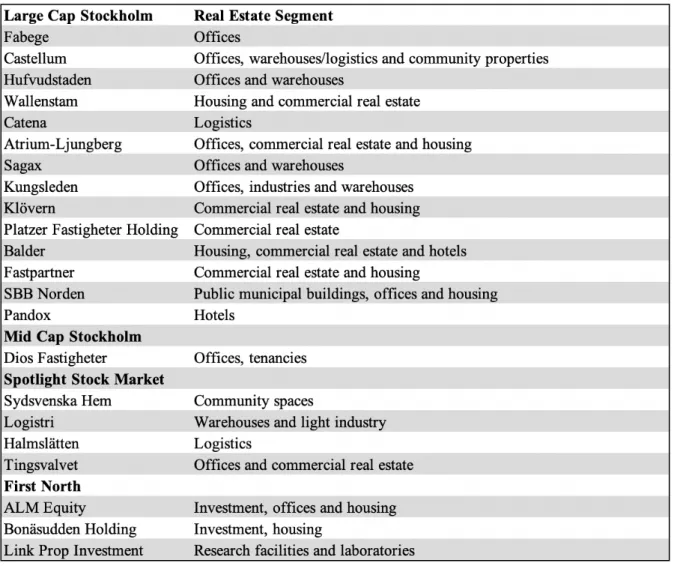

To be able to collect the data needed concerning the effects of announcements regarding Covid-19 all the press releases from the Swedish Government lead by Prime Minister Stefan Löfven as well as the Public Health Authority have been investigated to find critical points where the announcements would have a big impact on Swedish real estate companies. Three categories were chosen as follows: directives of working from home, new restrictions regarding maximum number of people at restaurants, public and private gatherings and lastly when announcements of financial support of Swedish companies was established by the government. The announcements were narrowed down and compared after relevance. The first two categories are expected to have negative consequences on the stock market while the last one is expected to have a positive outcome. A total of 13 different dates of events was finally noted with the ones assessed to be the most crucial announcements from the start of the Covid-19 outbreak in early 2020 up until February 2021. 21 among the largest Swedish real estate companies have been chosen from data availability and main business field being solely real estate. Seven of the companies are from smaller listings to capture more than one listing on the Swedish financial market. 14 of the total amounts of companies are listed on the OMX Stockholm Large Cap, one on OMX Stockholm Mid Cap, three on Spotlight Stock Market and three on Nasdaq First North which gives insight on how the real estate sector behaves comparing to multiple indexes. The full list of companies as well as their respective business field within real estate is shown in the table below.

Table 3.1 Full list of real estate companies

All indexes were downloaded through Data Stream except for Spotlight Stock Market which was sent over by Spotlight Stock Market themselves after a request was sent out to them. The indexes are all price indexes which means they are not adjusted to dividends. The smaller indexes were not possible to attain adjusted, which is why all the indexes are unadjusted to give similar results. The indexes are summarized in table 3.2 down below. The stock prices from each company were also downloaded through Data Stream. From start, 22 companies were selected and through checking availability and trading frequency Tingsvalvet was removed with the reason of unavailable data and a too thin trading pattern. Tingsvalvet is listed on Spotlight Stock Market and is missing price information for several important trading days for this event study and cannot be incorporated.

Table 3.2 Indexes

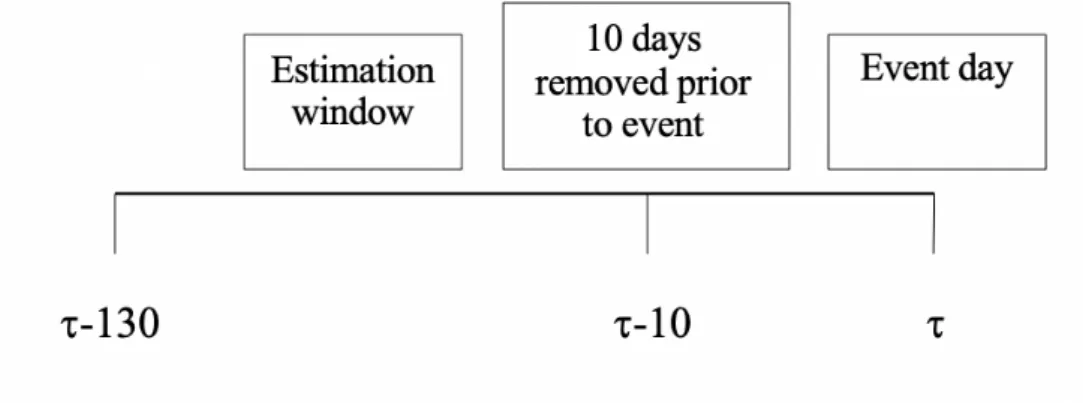

MacKinlay (1997) suggests the approach that concerns 120 days back from the event day which is the number that will be used in combination with the recommendation of Klassen (1996) that performed a method where ten days prior to the event day are discarded to eliminate eventual insider trading. Figure 3 show the selected event window approach with ten days removed before the event day, and with an estimation window of -120 that reaches back a total of 130 days in time. To get more specific results on how each individual announcement affects the return of the real estate companies an event day is used instead of an event period which would incorporate more days and could possibly be easier to find results with, however the aim is to isolate the possible effects and one event day does that better with only the return on that day being compared to the normal return. Choosing one day instead of several also evades the problem of clustering with event days overlapping as described by MacKinlay (1997).

Figure 3 Event Window

Dividends are accounted for, and the returns of the securities are adjusted to not disturb any calculations of beta affecting results of abnormal return on the event dates presented. During the time of the pandemic some dividends have been announced and then cancelled, which in this case is assumed to not have a disrupting effect on the findings of this study based on the assumption that the cancellations are expected.

3.5 Hypotheses

• There is no abnormal return recorded for the different securities when good news is announced.

• There is no abnormal return recorded for the different securities when bad news is announced.

4

Empirical Findings

In this section, presentations will be made of the quantitative and statistical results discovered when conducting the event study on how Swedish real estate companies have been affected financially during the first year of the Covid-19 pandemic. The results were then analyzed with the help of a test statistic with three different levels of confidence to see if the abnormal returns of the chosen securities are significant enough to hold or reject the null hypothesis that was presented in the methodology section.

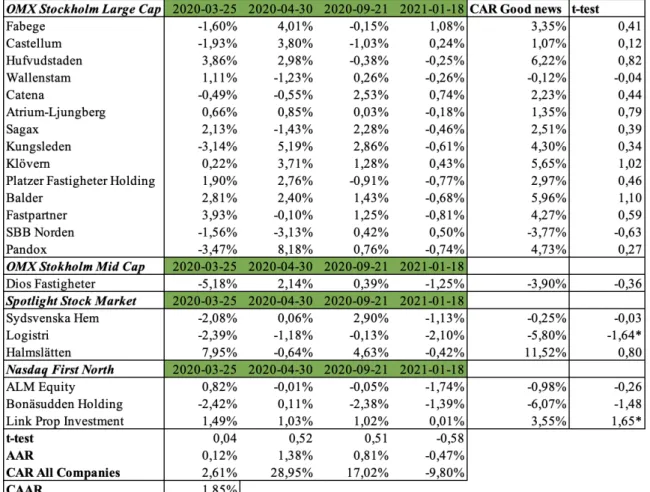

4.1 Good News

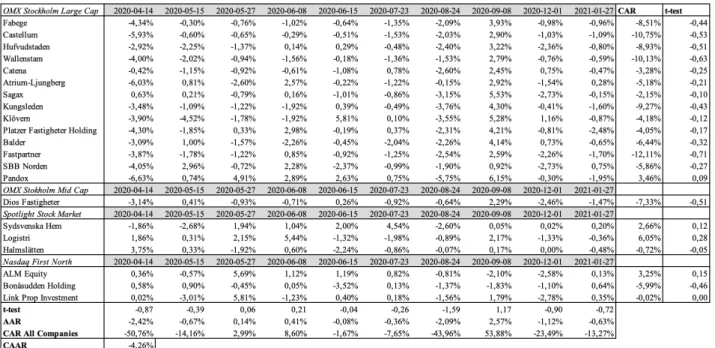

The announcements perceived as good news with a positive impact are the events where the government issue financial support of companies affected negatively by the Covid-19 pandemic. The results are presented in the table below where all the companies abnormal returns are listed for each good news date along with AAR, CAR and CAAR. The t-tests are also performed on all companies for each of the chosen event dates. Only 52,38 percent of the recorded abnormal returns for the good news dates are actually positive with the highest positive abnormal return being 8,18 percent by Pandox and the highest negative by Dios Fastigheter with -5,18 percent. The CAAR was modestly positive with 1,85 percent from the highest CAR calculated for each company over all the event dates achieved by Halmslätten with 11,52 percent and the highest negative by Bonäsudden Holding with –6,07 percent. The CAR for all companies on each individual event date ranged from -9,80 percent to 28,95 percent with three out of four event dates showing a positive CAR.

The standardized t-test showed no significant results on either of the confidence levels for the different positive event dates. The highest test statistic was during April 30, 2020, with a value of 0,52 and the highest negative and only negative one on January 18, 2021, with -0,58. However, the t-test performed on each individual company over all positive event dates showed two significant results with 1,65 for Link Prop Investment giving a p-value of 0,1 which indicates that the result is significant at a 90 percent confidence level. Logistri also showed a significant result with a negative t-value of –1,64 percent which also gives a p-value of 0,1 and is significant at a 90 percent confidence level.

The event date with the highest AAR is April 30, 2020, with 1,38 percent when it is announced that approximately 180,000 companies in Sweden will have access to a shared financial support

Table 4.1 Results from “Good News”

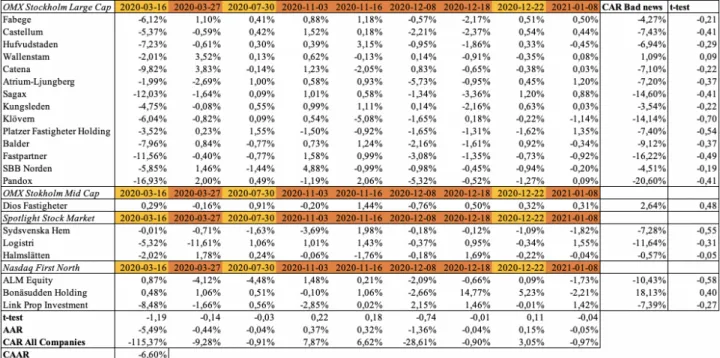

4.2 Bad news

The announcements perceived as bad news with a negative impact are the events where the Swedish Government and the Public Health Authority have made announcements of urgings of working from home and restrictions of maximum number of people in the same area. The table below are presented like the one in the good news section. Only 53,44 percent of the abnormal returns calculated during the bad news events were actually negative with the most positive abnormal return presented by Bonäsudden Holding with 14,77 percent and the most negative by Pandox with –16,93 percent. The CAAR of the bad news events landed on -6,60 percent from the highest positive CAR for each company presented by Bonäsudden Holding with 18,13 percent and the highest negative presented by Pandox with -20,60 percent. The CAR

for all companies calculated on each individual event date ranged from –115,37 percent on March 16, 2020, to 7,87 percent on November 3, 2020, with 6 out of 9 event dates showing a negative CAR.

No significant results were found under the bad news events for either the t-test on each event date or for each company with the highest positive test statistic on November 3, 2020, with a value of 0,22 and the highest negative one on March 16, 2021, with -1,19 calculated on each event date. This is also the event date with the highest calculated negative AAR of -5,49 percent which was the first announcement chosen and are the first recommendations of working from home in order to stop the spread of Covid-19 announced by the Public Health Authority. The t-test performed for each company over all event dates had Dios Fastigheter performing the highest positive t-value of 0,48 and Klövern the highest negative of –0,70.

4.3 No news

The same calculations are performed on ten randomly selected dates during the same time span of the good and bad news with the condition of no news regarding press releases of the Swedish Government or the Public Health Authority in order to conduct a robustness test. This was done in order to see how market movements compared when no news or announcements was made considering Covid-19 restrictions. The CAAR over the ten random dates is -4,26 percent. One significant result is found on August 24, 2020, with a t-value of –1,59 with 90 percent confidence. The CAR ranges from –50,76 percent to 53,88 percent.

Table 4.3 Results from “No News”

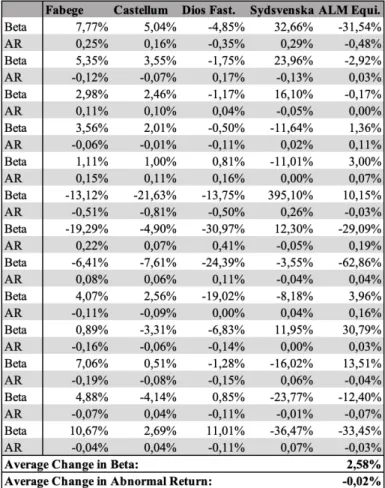

4.4 Length of Estimation Window

In order to see if the estimation window of 120 days played a role in why the results came out insignificant the same calculations was made for five different companies over the same event dates with an estimation window consisting of 100 days of returns. The companies tested were Fabege, Castellum, Dios Fastigheter, Sydsvenska Hem and ALM Equity. As a result, the beta had an average change of 2,58 percent and the abnormal return with a small –0,02 percent change thus no real difference would have been recorded regarding the significance of the event

studies results with a smaller estimation window even though it automatically excludes overlapping dates in some of the cases. In table 4.4 the differences in beta and abnormal return are presented from using a shorter 100-day estimation window.

Table 4.4 100 Day Estimation Window

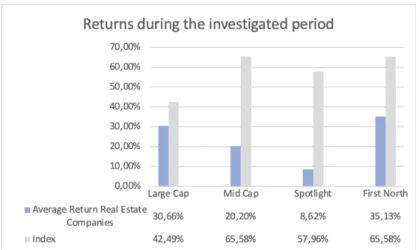

4.5 Real Estate Stock Market During the Time Period

During the time period investigated the stock returns of the real estate companies that was included in the event study all showed negative results during the period of the first event date investigated (March 16, 2020) to the last (January 18, 2021) compared to the indexes of the markets where the companies are listed. In table 4.5 it is shown how the average of the 21 real estate companies fail to follow the respective listings indexes. The Large Cap companies differ with an average cumulative return of 11,83 percent compared to the cumulative return of the index. The Mid Cap index is only compared to the cumulative return of the one company looked at in that market and differs 45,38 percent. The companies listed on Spotlight Stock Market differ with 49,34 percent and the ones on Nasdaq First North differ 30,45 percent.