J

Ö N K Ö P I N G

I

N T E R N A T I O N A L

B

U S I N E S S

S

C H O O L

JÖ N KÖ P I N G U N IVER SITY

F D I a n d G R O W T H

T h e C a s e o f T u r k e y

Bachelor Thesis within Economics

Author: Bengü Kaya

Supervisor: Per-Olof Bjuggren

Deputy supervisor: Andreas Högberg

i

Acknowledgements

I would like to thank my supervisor Per-Olof Bjuggren and deputy supervisor

An-dreas Högberg for the help, guidance and support during the process of writing this thesis.

I would like to thank especially to my parents, my brother, my boyfriend and my

daughter Asya for their great patience. Without their support, love and encouragement I

would not finish my Bachelor thesis.

June, 2009, Jönköping, Sweden

Bengü Kaya

Foreign Direct Investment, Economic Growth, Eclectic

Para-digm, Turkey, Granger Causality, Time Series

JEL Classification F21, F43, 053, C01, C22

iii

Table of Contents

1

Introduction ... 1

2

Background ... 3

2.1

Turkey’s Economy ... 3

2.2

Overview of FDI in Turkey ... 3

2.3

Previous Studies ... 6

3

Theoretical Framework ... 8

3.1

Definition of FDI ... 8

3.2

Different Types of FDI ... 8

3.3

Benefits and Disadvantages of FDI ... 9

3.4

Determinants of FDI ... 10

3.5

FDI Theories ... 11

3.5.1

The Evolution of FDI Theories ... 11

3.5.2

The Eclectic Paradigm ... 11

3.5.2.1Ownership Advantage (O) ... 11

3.5.2.2Location Advantage (L) ... 12

3.5.2.3Internalization Advantage (I) ... 12

3.6

Location Advantages of Turkey ... 13

4

Method ... 14

5

Empirical Analysis ... 16

5.1

Descriptive Data ... 16

5.2

Granger Causality ... 16

5.2.1

Data Statistics ... 17

5.2.2

Unit root test ... 17

5.2.3

Granger Causality ... 17

5.3

Regression Results and Analysis ... 18

6

Conclusion and Suggestions for Further

Research ... 21

7

References ... 22

8

Appendices ... 27

8.1

Determinants of international products ... 27

8.2

Summary of Previous Studies ... 28

8.3

Turkey’s location advantages for FDI ... 29

8.4

Correlation Matrix of FDI and Growth ... 29

8.5

FDI Inflows % and GDP %, 1970-2007 ... 30

8.6

Descriptive statistics of Granger Causality ... 30

8.7

D (FDI) Correlograms Table ... 30

8.8

D (GDP) Correlograms Table ... 31

8.9

Level and First differences of FDI and GDP ... 31

v

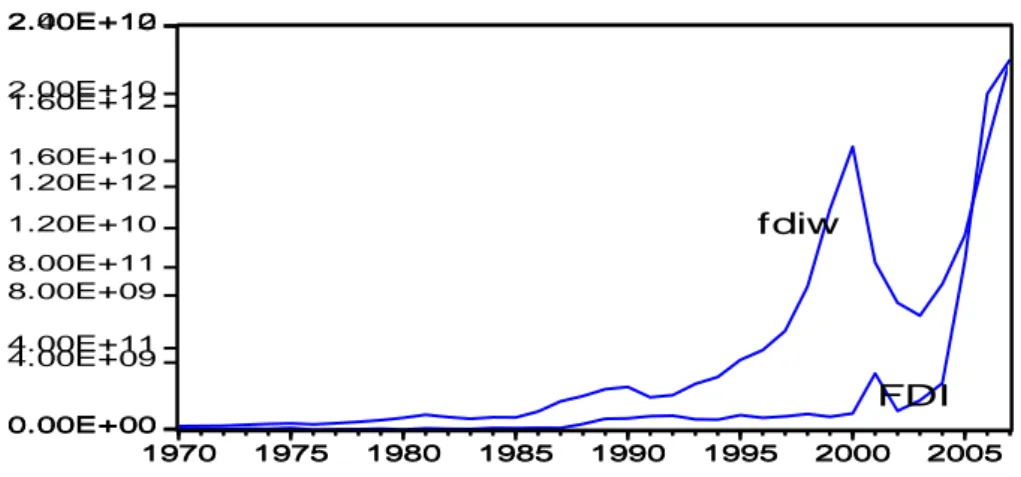

Figure 1: FDI Inflows to Turkey and World ... 1

Table 1: Augmented Dickey-Fuller Test ... 17

Table 2: Unrestricted Cointegration Tests ... 17

Table 3: Pairwise Granger Causality Tests ... 18

1

Introduction

Figure 1: FDI Inflows to Turkey and World

Source, WID (2008), where fdiw represents FDI inflows in world and fdi is representing inflows in Turkey.

0.00E+00 4.00E+09 8.00E+09 1.20E+10 1.60E+10 2.00E+10 2.40E+10 1970 1975 1980 1985 1990 1995 2000 2005 FDI 0.00E+00 4.00E+11 8.00E+11 1.20E+12 1.60E+12 2.00E+12 1970 1975 1980 1985 1990 1995 2000 2005 fdiw

2

Background

This section is divided into three parts. The first part presents Turkey’s economic history starting

from 1960s and continuing until the present time. The effect of FDI in Turkey is introduced in the second

part. And in the last part the previous empirical studies are presented.

2.1

Turkey’s Economy

6

2.3 Previous Studies

8

3

Theoretical Framework

This section is divided into six parts. First part gives brief different definitions of FDI. In the

second part types of FDI are introduced. The following part presents advantages and disadvantages of the

FDI inflows by the view of MNEs and host country. The fourth part presents the theories of FDI and

growth. The most common used FDI theory, eclectic paradigm, is presented in the fifth part with its specific

advantage stages. And finally in the sixth part location advantages of Turkey is introduced.

3.1 Definition of FDI

10

3.4 Determinants of FDI

3.5 FDI Theories

3.5.1

The Evolution of FDI Theories

3.5.2

The Eclectic Paradigm

12

’

ö

3.5.2.2

Location Advantage (L)

3.5.2.3

Internalization Advantage (I)

14

4

Method

2 The explanatory variables did not give any significant results on the dependent variable. Due to getting the best result all variables are lagged one year.

16

5

Empirical Analysis

In the first part of this section descriptive data of GDP growth and FDI inflows are presented.

The log-run and short-run relationship of economic growth and FDI is analyzed in the second part. And

finally in the last part the regression model analysis is presented.

5.1 Descriptive Data

5.2.1

Data Statistics

’

5.2.2

Unit root test

Table 1: Augmented Dickey-Fuller Test

Variable

t-statistic

Probability(5% level)

Growth

-6.860497 -2.948404FDI

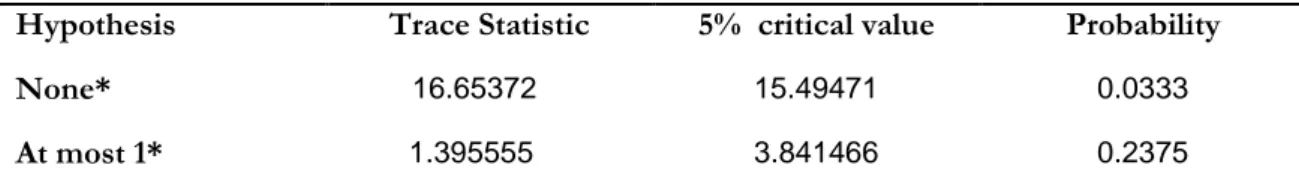

-3.705381 -2.951125Table 2: Unrestricted Cointegration Tests

Hypothesis

Trace Statistic

5% critical value

Probability

None*

16.65372 15.49471 0.0333At most 1*

1.395555 3.841466 0.2375*denotes rejection of the hypothesis at 5% level

18

Table 3: Pairwise Granger Causality Tests

Hypothesis

F-Statistics

Probability

GROWTH does not Granger Cause FDI

4.27135

0.04644

FDI does not Granger Cause GROWTH

0.22509

0.63823

5.3 Regression Results and Analysis

20

Variable

1

2

3

4

5

6

GROWTH

t-1 2.97E+08(1.48) 2.31E+08 (1.45) 2.41E+08 (1.58) 76424570 (0.52) 1.14E+08 (1.71)* 1.11E+08 (1.70)*

OPEN

t-1 2.17E+10(4.71)*** 8.99E+09 (1.18) 1.02E+10 (1.51) -1.27E+09 (-0.39)

POP

t-1 -4.98E+09(-2.05)*** -4.80E+09 (-2.21)** -3.04E+09 (-3.03)*** -2.76E+09 (-3.98)***

INFL

t-1 -65459375 (-3.07)*** -20010950 (-1.90)* -20731002 (-2.02)*FDI

t-1 1.042268 (11.09)*** (11.73)*** 1.030671R

2 0.059010 0.431012 0.495159 0.609888 0.921540 0.921157Adj.R

2 0.032125 0.397542 0.449262 0.561124 0.908885 0.911302N

37 37 37 37 37 37 DW Stat. 1.859655 1.83766122

7

References

Berkoz, L. & Turk, S.S (2007). Yabancı Yatırımların Yerseçimini Etkileyen Faktörler: Türkiye

örneği, from

http://www.itudergi.itu.edu.tr/tammetin/itu-a_2007_6_2_L_Berkoz.pdf

Doğrudan

ı

24

http://www.fdimagazine.com/news/fullstory.php/aid/1266/EU_entry_poses_threat_to_f

ree_zones.html

http://www.econ.ku.dk/Research/Publications/pink/2004/0430.pdf

ö ö

’

TUIK (2008). Statistics Data

http://www.turkstat.gov.tr/AltKategori.do?ust_id=4

Turkish Embassy (2007). Recent Economic Developments and Buying Property in Turkey,

presentation paper written by Aziz Dogan on June, 5, 2007, from

http://www.turkisheconomy.org.uk/TBCCI_Presentation.pdf

26

’

Türkiye için Doğrudan Yabancı Yatırım Stratejisi’ne Doğru, from

http://www.iaw.uni-bremen.de/~jtholen/tagungen/papers/Yilmaz.pdf

8

Appendices

8.1 Determinants of international products

Types ofin-ternational production

Ownership

advantages Location ad-vantages Internalization advantages Strategic goals of MNEs Types of ac-tivity that favor MNEs Natural re-source seek-ing Capital, tech-nology, access to markets. Possession of natural re-sources. To ensure stabil-ity of supplies at right price; con-trol markets. To gain privi-leged access to resources vis-a-vis competitors. Oil, copper, bauxite, bana-nas, hotels. Market

seek-ing Capital, tech-nology, man-agement and organizational skills; surplus R&D and other capaci-ty; economies of scale; trademarks. Material and labor costs; market size; government policy. Wish to reduce high transaction or information costs, buyer un-certainty, etc; to protect property rights. To protect exist-ing markets, counteract be-havior of com-petitors; to prec-lude rivals from gaining new markets. Computers, pharmaceuticals, motor vehicles, cigarettes Efficiency

seeking As above but also access to markets. Low labor costs incen-tives to local production by host govern-ments. The economies of vertical inte-gration As part of re-gional or global product rationa-lization and to gain advantages of process spe-cialization. Consumer elec-tronics, textiles and clothing, cameras, etc. Strategic asset

seeking Any of first three that of-fer opportuni-ties for syner-gy with exist-ing assets

Any of first three that of-fer technology, markets and other assets in which firm is deficient Economies of common gover-nance; improved competitive or strategic advan-tage; to reduce risks. To strengthen global innovato-ry or production competitiveness; to gain new product lines or markets. Industries that record a high ra-tio of fixed to overhead costs and which offer substantial economies of scale.

28

Author Data Method Result

Balasubrama-nyam et al. (1996) Cross-section data ,46 developing countries between 1970-1985

OLS regressions. FDI has positive effect on export supported countries rather than im-port substituting

Borensztein

et al. (1998) Cross-section data, 69 countries between 1970-1989

Regression analysis. FDI and growth are positively related if the host country has high level of human capital

Alfaro et al.

(2004) Panel data, data set of credit market and eq-uity market indicators in OECD and non-OECD countries be-tween 1975-1995

OLS regression. FDI affects the growth positively, if the country has good financial market

Chowdhury and Mavrotas (2006)

Time series, Chile, Malaysia and Thailand between 1969-2000

Toda and Yamamoto

causality test FDI and growth affect each other only in Chile; other two countries have only bidirectional causality.

Johnson

(2005) Cross-section panel data. 90 devel-and oping and developed countries between 1990 and 2002

OLS regression and

REM FDI inflow and domestic investment have positive effects on economic growth in developing countries but not in developed ones. FDI is affected by corruption negatively in developing countries.

Hansen and

Rand (2006) Panel data, 31 coun-tries between 1970-2000

Granger causality test If the gross capital of FDI increases, the growth will increase too.

Pramadhani

et al. (2007) Cross-section Indonesia between data, 1994-2000

Granger causality test FDI and exports are positively related.

Busse and Groizard (2008)

Panel data, 84 coun-tries between 1994-2003 Cross-country growth regression, generalized method of moments (GMM)

Growth and FDI have limited relation by government regulations.

Carkovic and

Levine (2002) Panel section data, 72 coun-and cross-tries between 1960-1995

Dutt (1997) Cross-country data, North- South coun-tries between 1985-1994

GLS There is no significant relationship be-tween FDI and growth.

Basu et al.

(2003) Panel data, selected 23 developing countries, between 1990-1999

Two-way causality test In closed economy the short-run cau-sality is bidirectional but in the long-run it is from growth to FDI.

De Mello

(1997) Survey Analysis The direction of causality between FDI and economic growth depend on the impacts of FDI determinants. De Mello

(1999) Cross section data, 32 OECD and non-OECD

Causality test In the non-OECD countries FDI and growth have no significant relation-ship.

8.3 Turkey’s location advantages for FDI

Key location factors Competitive position

Market seeking FDI Economic size Economic growth Population size Per capita incomes Efficiency seeking FDI Labor cost

Labor productivity Regional integration zone Labor skills and supply Asset seeking FDI

Supply of engineers and technicians R&D and innovation base

FDI enabling environment Independent FDI Privatization FDI Facilitation process Political commitment Incentives Investment promotion Institutional-Political environment Economic stability Policy certainty

Political interference and corruption Justice system and intellectual property rights

Internal social tensions

Strong Strong Strong Medium Strong Strong Strong Strong Strong Weak Strong Weak Medium Weak Strong Weak Weak Weak Weak Weak Weak

Adopted from Loewendahl & E-Loewendahl (2001)

8.4 Correlation Matrix of FDI and Growth

Correlation FDI GROWTH

30

8.5 FDI Inflows % and GDP %, 1970-2007

8.6 Descriptive statistics of Granger Causality

Variable Mean Maximum Minimum Std. Deviation

GROWTH 0.037491 12.54641 -12.47193 5.809606

FDI 5.94E+08 9.96E+09 -2.22E+09 2.08E+09

8.7 D (FDI) Correlograms Table

Autocorrelation Partial Correlation AC PAC Q-Stat Prob . *| . | . *| . | 1 -0.161 -0.161 1.0366 0.309 . *| . | . *| . | 2 -0.068 -0.096 1.2251 0.542 .**| . | .**| . | 3 -0.226 -0.262 3.3858 0.336 . |* . | . | . | 4 0.128 0.035 4.1065 0.392 . |**. | . |**. | 5 0.197 0.199 5.8574 0.320 . | . | . | . | 6 -0.040 -0.004 5.9301 0.431 . | . | . |* . | 7 0.003 0.082 5.9306 0.548 . | . | . | . | 8 -0.053 0.044 6.0730 0.639 -40 -30 -20 -10 0 10 20 30 1970 1975 1980 1985 1990 1995 2000 2005 gdp% -100 0 100 200 300 400 500 1970 1975 1980 1985 1990 1995 2000 2005 FDI%

8.8 D (GDP) Correlograms Table

Autocorrelation Partial Correlation AC PAC Q-Stat Prob ****| . | ****| . | 1 -0.548 -0.548 12.038 0.001 . |* . | .**| . | 2 0.095 -0.293 12.410 0.002 . |* . | . | . | 3 0.094 0.002 12.788 0.005 .**| . | .**| . | 4 -0.281 -0.289 16.230 0.003 . |**. | . *| . | 5 0.225 -0.131 18.517 0.002 . *| . | .**| . | 6 -0.175 -0.229 19.940 0.003 . |* . | . | . | 7 0.139 -0.046 20.872 0.004 . *| . | .**| . | 8 -0.146 -0.288 21.934 0.005

8.9 Level and First differences of FDI and GDP

-4.00E+09 -2.00E+09 0.00E+00 2.00E+09 4.00E+09 6.00E+09 8.00E+09 1.00E+10 1.20E+10 -4.00E+09 -2.00E+09 0.00E+00 2.00E+09 4.00E+09 6.00E+09 8.00E+09 1.00E+10 1.20E+10 1970 1975 1980 1985 1990 1995 2000 2005 dfdi -15 -10 -5 0 5 10 15 -15 -10 -5 0 5 10 15 1970 1975 1980 1985 1990 1995 2000 2005 dgdpgrowth 0.00E+00 4.00E+09 8.00E+09 1.20E+10 1.60E+10 2.00E+10 2.40E+10 0.00E+00 4.00E+09 8.00E+09 1.20E+10 1.60E+10 2.00E+10 2.40E+10 1970 1975 1980 1985 1990 1995 2000 2005 FDI -8 -4 0 4 8 12 -8 -4 0 4 8 12 1970 1975 1980 1985 1990 1995 2000 2005 gdpgrowth

32

FDI GROWTH OPEN POP INFL

Mean 1.89E+09 4.462564 0.284083 2.009154 46.23112 Median 4.81E+08 5.150450 0.252861 2.068482 47.89100 Maximum 2.20E+10 10.46118 0.568831 2.593257 103.0160 Minimum 10000000 -5.697477 0.083215 0.617152 7.084290 Std. Dev. 4.88E+09 3.977765 0.145387 0.446993 27.84345 Skewness 3.423021 -0.895921 0.444170 -0.909220 0.228418 Kurtosis 13.54841 3.203863 2.127382 3.821983 1.914954 Jarque-Bera 250.3838 5.149409 2.455135 6.305432 2.194539 Probability 0.000000 0.076176 0.293005 0.042736 0.333781 Sum 7.20E+10 169.5774 10.79515 76.34784 1756.782

Sum Sq. Dev. 8.80E+20 585.4368 0.782083 7.392715 28684.54

Observations 38 38 38 38 38

8.11 Correlation Matrix of Estimated Model Variables

FDI

GROWTH

OPEN

POP

INFL

FDI

1

0.098791741

0.624087039 -0.576680624 -0.374071302

GROWTH

0.098791741

1

0.085678947 -0.053968863 -0.354011396

OPEN

0.624087039

0.085678947

1

-0.832385391 -0.050119850

POP

-0.576680624 -0.053968863 -0.832385391

1

0.052812134

8.12 Summary of Variables

Variable Explanation Data Source, Period Expected sign

Dependent variable

Explanatory variables