Note:

Materials in this file

previously marked confidential

are open to researchers.

Please consult staff with any questions.

Colorado State University Libraries

Archives and Special Collections

.. - · - ~- · -=--·

---G-L SYSTEM UPPER END

N

I

--so'I

1>

L-14

t<

t.

2. EQUAL IZER RESERVOI R 3. BOYD LAKE PUMP 4. BOYD LAKE GATE 5. GREELEY FILTER PLANT 6. MA IN DITCH HEADGATE I I I I I

'T

I'"

:11

:t

7. uh11 1 ~ L w u 1; ~ n hE ~uUM t CMl!NBER

ORGANIZATION

WRIGHT WATER ENGINEERS

ENGINEERING CONSULTANTS 2059 BRY.AN T S TR E ET DEN V E R , C O L.O RA DO 8021 1

CACHE LA POUDRE RIVER WATER INVESTIGATION THE WINDSOR RESERVOIR AND CANAL COMPANY

February 1969

TELEPHONE 4 3 3 . e 2 0 1

The Windsor Reservoir and Canal Company was organized in the 18801s and

currently has 1,000 shares of stock owned by approx mately 250 stockholders. The shares are of a single class and share equally in the water distributed

by the Company . Assessments vary~the shares, however, depending upon how

the water is de! lvered. There are 914 shares which receive water through the Larimer and Weld Canal which for 1968 were assessed at $90 . 00 per share, the

assessment Including a carrying charge payable by the Windsor Reservoir and

Canal Company to the Larimer and Weld Irrigation Company . The rema'nlng 86 shares receive water through the Greeley No " 2 Canal and for 1968 were assessed at $70 . 00 per share . These shareholders pay a carrying charge directly to the New Cache la Poudre Irrigation Company which owns and operates the Greeley No . 2 Canal .

Operation of the Company is directed by the Superintendent, Mr . Don Engles, from the Co!ll>any office in Eaton . The ditch company off ice in Eaton Is also

the headquarters for several other CO!ll>anles Including the Larimer and Weld ltrigatlon Company and the qwl Creek Supply and Irrigation Company . The Board of Directors of the Wlndsor Reservoir and Canal Company Is as follows:

Joe Haythorn, President E 1 mer Gustafson Dewey Dar I i ng Carl Magnuson Ben Nix Eaton Eaton Greeley Eaton Eaton

The Board of Directors is elected annually by the stockholders and exercises control and authority over the operations of the company .

WATER

The Windsor Reservoir and Canal Company system consists of four reservoirs

which del Iver water through the Larimer and Weld Canal and through the Greeley~

No . 2 Canal . The Company als~nS)one third of the stock of the Tunnel Water ()t.J~S

Company which owns the

lar~mle~dre

Tunnel . The Laramie - Poudre Tunneldiverts water from the Laramie River to the Poudre River under very senior rights . Reservoirs and storage decrees owned by the Company are I lsted below .

Fact sheets for Windsor Reservoir and Douglas Reservoir are appended to this Report .

The Windsor Reservoir and Canal Company Page 2 of 4

February 1969

Appropriation

Name Priority Date

/ Windsor Reservoir 24

71

8/1890 Windsor Res . 1st En 1 . 4391

9/1901 / Douglas 44 9/15/1901 Reservoir No . 8 53 6/23/ 1903 Res • No. 8 En 1 , 56 7/10/1904 Cobb 120 7/15/1919Note: Decree for Reservoir No . 8 Enlargement No . 8 Annex.

Decree Decreed Reported

Date Amount Capacity

(af) (af) 12/ 9/ 1904 11 '732 17,689 12/ 9/1904 5.957 12/ 9/1904 10,560 8,834 6/15/1906 15,381 14' 181 -6/ 15/1906 2,296 51 3/1930 9. 113 22,300 is for what is known as Reservoir Water from Reservoir No . 8 is delivered by the Larimer and We ld Canal and can be delivered to Windsor Reservoir which in turn releases water to the Greeley No . 2 Canal . Water from Cobb Lake is released to the Water Supply and Storage Company in return for C-BT water from Horsetooth Reservoir . Douglas Reservoir

ls supplied from Dry Creek and the Poudre Valley Canal and can exchange for C-BT water.

Water derived from the Company's storage decrees and operations of

reservoirs is distributed equally to shareholders . For each two shares of ~

stock there is one "right " which entjlles the holder to 30 days of waterj>eYf.<"e..>0 "1

released at a rate of 1 .44 cfs per~~{;'~ . The actual number of days water is run depends on availabll ity, In practice, water is run out of the reservoir system whenever enough "rights" cal 1 for it at a rate of 1 .44 cfs per right and 1.25 cfs per right is delivered to the farm headgate . The 13 percent difference between release and delivery represents river losses . Recorded deliveries ~nd

yield per share for the 19-year period 1950 through 1968 are given in Table 1.

From Table 0 l, it can be seen that the yield per share ranges from a low.4f--

v}<._

6.9 acre feet in 1955 to a high of 33.2 in 1962 and 1968, with an average forthe period of 25.6 acre feet. If valued at $15 0 to $200 per acre-foot, these shares would have an indicated market value of $1,035 to $1,380 per share. No

recent sales have been reported and officers of the Company dee] ine to estimate the current market value .

SUMMARY

The Windsor Reservoir and Canal Company owns four reservo i rs and si x storage decrees plus one-third of the stock of the Tunnel Water Company.

Company water is shared equally by 250 stockholders ownin g the 1,000 shares of stock in the Company. Water is delivered by the Larimer and Weld Cana l and the Greeley No . 2 Canal and ex changed for C-BT water. For 1968, 914 shares of stock receiving water through the Larimer and Weld Canal were assessed at $90. 00 which

includes a carrying charge, and 86 shares served by the Greeley No. 2 were assessed at $70.00 per share,

The Windsor Reservoir and Canal Company

Page 3 of 4

February

1969

TABLE l

WINDSOR RESERV OIR AND CANAL COMPANY DELIVERIES AND YIELD PER SHARE

Total Water

Released From Delivered to

Year Reservoirs Stockholders

(AFl {AFl

Ti)

(2)

(3)

1950

23' 600-

20,600

1951

27,400 /

23,800-1952

34,800 -

30,200-1953

23; 000/

20,000

1954

21'400-

18,600

1955

7.950 -

6,920

1956

13,30~11'600

1957

34' 000 -

29,600

1958

33.300

29,000

-1959

33' 300

29,000

1960

33,000

28,700

1961

33, 100 '

28,800 '

1962

38' 200·

33,200

1963

36, lOO .

31 ,400

1964

33,400

29,000

1965

32,

l00 '

2 7' 900

1966

30,800'

26,800-1967

33,000'

28,700

1968

38,200

33

I 200-Average29,500

I25,600

Yield Per Share (AF}(4)

20,6,....,

23 ,8 ·

30,2-20,0,

18

.6-6.9

11 .6.

29,6

29,0

29

"o-28,7

28

,8-33

.2-3 1

,4-29.

0-2 7

'9'26,8

28 , 7

~25.6

The Windsor Reservoir and Canal Company Page 4 of 4

February 1969

Eastman Kodak already owns two shares of Windsor Reservoir and Canal Company stock and additional acquisitions would be advantageous because of the Company1s

storage water and ownership of reservoirs. The annual cost based on average yield in relation to C-BT water is sunmarized below:

Source

Windsor Res. & Canal Co , Colorado-Big Thompson Current Annual Assessment $ 70-$ 90/ share $4.5 0/unit Ave rage Annual Yield (acre-feet) Annual Cost ($/AF) $2.74-$3.52 $5 .

77

If valued at $150 to $200 per acre-foot and based on the low year yield of 6 . 9 acre feet per share, the indicated market value is $1,035 to $1 ,380 per share. Information on recent sales or current market price is not available oWRIGHT WATER ENGINEERS

By

Leonard Rice LR:dls

Windsor Reservoir 1 • Decrees

Amount

Pri or i ty App1n. Date Decree Da te (AF)

24

7/8/1890-

12/9/1904

11

'732-43

9/9/ 190 L

12/9/ 1904

5,951

2.

Reservoir is located in Sec.33,

T7

N, R67

w.

3.

The reservoir is supplied from the Larimer & Weld Canal whose headgate is situated on the left bank of the Poudre in Sec.33,

T8

N, R69

W.4. The reservoir )s owned by Windsor Reservoir & Canal Co,

5.

The reservoir superintendenl is Don Engles, Phone No.454-2693

1n Eaton.6,

The reservoir has an estimated capacity of17,689

Acre Feet. At a depthof

37

feet the water surface area is1000

acres. 7. Water yie l ds are estimated as fol lows:8.

Average Dry Year Wet Year(47-67)

(1954)

( 1958)

12,957

Acre Feet6,200

Acre Feet17,300

Acre Feet Comments on usability for Eas tman Kodak(a ) (b) ( c) ( d) ( e) (f)

Water can be released indirectly to Windsor Lake

Headgate is above Boxelder Creek and Fort Col 1 ins sewage plant Water may be exchanged for Co lorado-Big Thompson units

Reservoir wel l situated for Windsor site use

Suitable for exchange with Fort Collins and Greeley

Ownership in the Windsor Reservoir & Canal Co, provides a prorated portion of a l 1 of the Company water, incl uding Douglas, Reservoir #8,

and Cobb,

•

Douglas Reservoir 1 • Decrees

Amount

Priority App1n Date Decree Date (AF)

44 9/15/1901 12/9/1904 10,560

2. Reservoir is located in Sec, 35, T 9 N, R 69 W.

3. The reservoir is supplied by Dry Creek and through the Poudre Valley Canal whose headgate is situated on the left bank of the Poudre in Sec. 15. T 8 N, R 70 W.

4.

The reservoir is owned by Windsor Reservoir & Canal Co,5. The reservoir superintendent is Don Engles, Phone No. 454-2693, Eaton. 6. The reservoir has an estimated capacity of 8834 Acre Feet.

7.

8.

At a depth of 30 feet the water surface area i s 586 acres. Water y ields are estimated as fo 1 lows:

Average (29-67) 5962 Acre Feet Dry Year ( 1954) 2800 Acre Feet Wet Year (1958) 8300 Acre Feet Comments on usabilit y for Eastman Kodak

(a)

(b)

(c) (d) (e)

Headgate is in Poudre Canyon with good qua! i t y water Water may be exchanged for Colorado-Big Thompson uni ts Exchanges are possi ble with cities, but complex

Reservoir is far removed from stream

Ownership in the Windsor Reservoir & Canal Co, provides a prorated portion of all of the Compan y water, including Douglas, Reservoir #8,

...

~..

WRIGHT WATER ENGINEERS

ENGINEERING CONSULTANTS

20 59 BR Y ANT S T ~EET

DE NVER . C O LO RA DO 8 0211

CACHE LA POU DRE RIVER WATER INV ESTIGATIONS THE WILLI AM JONES IRRIGATION COMPANY

June 1969 ORGANIZATION

The Wil 1 iam Jones Irrigation Company ls a mutual ditch company operating th e Jones Ditch which diverts from the south bank of the Cache la Poudre River

in Section 36, T 6 N, R 67 W, about 8 miles west of Greeley . There are 200 shares of stock in the Company owned by the fol lowing si x stockholders:

Tewksbury/Herbst Bud Clemons Harry Lowe George Firestien D. C. Hendricks Chari ie Woen Greeley Greeley Greeley Greeley Windsor Windsor 62

47

32 30 16 _J] 200Mr , Firestien is President of the Company, Mr . Hendri c ks is Treasurer and Mr , Reynold Her bst, Greeley 352-2293, is the Ditch Rider.

WATER

Current annual assessment is $1 , 00 per share.

The Company owns on e direct flow decree as follows: Prior ity No,

Decree Date Appropriation Date Amount 24 Apr i 1 l l , 1882 Sept. 1, 1867 15.52 cfs

Water diverted by the Company is distributed on a pro-rata basis according

T[L[l'HOHE

433 - 6201

to the number of shares owned . Table 1 shows the monthly and seasonal diversions and the annual per share yield assuming a 5% loss. Losses are low because the dit ch is approx imately 2 miles long . Maintenance problems are minimal as Indicated by the low annual assessment.

Colorado-Big Thompson water can be delivered by the ditch but at the present time there are no stockholders owning C-BT units.

'

TABLE 1

L-O-lr>c: OJ ::r OJ ::J lO ('1) () ('1) (1) ::r

THE

WILLIAM JONES IRRIGATION COMPANY

~ (1)- N -·

JONES DITCH

\.D--0--0-0J

\.D -;-, -·

OJ "

(all values in acre-feet)

W 30c:

'- 0..

0 .,

::J (1) (1)

Per Share

"' ;;o -·Yie ld

-< ., (1)Direct Flow Diversions

Assuming

~

-Year

Apr i 1

~June

~ ~ ~Oct.

- -

Total

5% Loss

OJ OJrt rt -· ('1)

( 1 )

(2)

( 3)

(4)

(5)

( 6)

( 7)

(8)

(9)

( 1 0)

0 ., ::J n ::J1951

0

436

886

1026

760

608

0

3716

17 .65

0 < 3 (1)1952

0

678

854

898

912

816

162

4320

20.52

"O "' OJ rt195 3

0

570

95 0

842

930

830

120

4242

20 . 15

-< ::J -· lO1954

648

686

856

826

822

734

184

475 6

22.59

OJ rt1955

180

752

526

794

666

878

22

3818

18

u14

-· 01956

142

546

896

904

856

636

174

4154

19 . 73

::J"'

195 7

0

0

410

690

864

666

0

2630

12 .49

1958

0

60

586

770

872

716

0

3004

1

'-1-.2 7

1959

0

360

872

884

830

658

0

3604

17 . 12

1960

2 ?'-+

776

890

844

926

812

12

4534

21 .54

1961

0

328

180

846

914

580

0

2848

13 .53

1962

272

780

404

808

928

874

0

4066

19 . 3 1

e

1963

424

932

738

932

712

274

0

4012

19. 06

1964

0826

694

938

950

796

8

'-+2 12

20. 01

1965

150

792

328

674

850

292

0

3086

14 .66

1966

0

796

754

876

858

118

76

34 74

16 .52

1967

102

626

208

720

864

306

0

2826

13 .42

1968

0

684

844

900

898

654

236

42 16

20.03

Average

122

590

660

843

856

625

55

3751

17 .82

Cache la Po ud re Rive r Wa ter In vest ga tions The Wi 11 iam Jones Irr i ga t ion Company

Pa ge 3 of 3

June 1969

The data in Ta b l e 1 ind ica t e that the Jones Dit ch has a dependable yield of water . In 1954, t he s econd driest year of record f or the Poudr e at Fort Col 1 ins, th e Jones Ditch r eco r ded its f'1a,, ir.1um annual and Apr : 1 divers ion and

its s econ d highes t Oc tobe r diversion , A pr i n:: ipal reason for t h is dependa b ility is the d i t ch loca ti on whi c h is such that a large portion of its supply is derived from return flows. Thus, at times whe n d ivers ions to the B" H. Eaton Ditch up-st rea m dry up the r ive r there is water availab le from return flow for the Jones Ditc h . This fact must be considered when assessing the availa b ility of Jones Dit ch wa ter t o Kodak .

For Kodak to use Jones Ditch water it would be necessary to arran ge an exchange t na t would not ca us e wa t e r no rmally diverted to the Jones Ditch to be taken out upstream. Suc h an exchan ge could be worked out wi th the Greeley Number 3 Ditch whi c h r eporte0ly owns Fossil Creek water, by Kodak taking water

relea s ed fr om Fossil Creek Reservoir in return for Jones Dit ch water diverted to the Gree le y Number 3 Ditch .

If appraised at $1 75 per acfo6t on the average year yield of 17 . 8 ac re-feet, the in d i cated value is $1,360 per share. The low year yield is not sig-nifi cant in t he case of the Jones Dit ch because the low years co rr espond to ye ars of a bove average flow in the r iver when water was availa b le but not needed for i rr i gation . No recent figures on current market or rransa c tions are available ,

The comparative annual cost of Jones Ditch shares and C- BT units is summarized be low: Source Jon es Ditch Co lorado-Big Thompson LR/egc Current Annual Assessment $1 .00/ Share $4 . 50/Unit

Average Annual Yield (acre-feet)

$17 .82 0.78 WRIGHT WATER ENGINEERS By

Annual Cost ($/acre-feet)

$ 0 . 056 $5. 77

Dear Mr. Burns: ·

Enclosed are five cop·ies of a report on the Larimer -and Weld Irrigation Company, made under our continulng investigations of the Cache La Poudre River'. Also enclosed are five copies of ·our report on the Louden l.rr i gating Cana 1 . and Resevo Ir Company. The Loud~n ·

report was submitted previousfy, but we have now added ·an. Appen.dlx covering the Louden· Extension Ditch and Reservoir Company. ·

We are contJnulng ~ur eva)uatl~n of the four parcels ~f proper~y ·

.offered to Eastman· Kodak and wi 11 be forwarding our report shortly.· Very truly yours,

WRIGHT WATER ENGINEERS

ENGINEIERING CONSULTANTS

ZOU 9111YANT STltEET OENVl[lt, COkOltADO 80211

CACHE LA POUDRE RIVER WATER INVESTIGATIONS

Tll.llPHON&

•••- •ao1

THE LARIMER AND WELD IRRIGATION CO.

APRIL 1969

ca~nut.~lt{~st.

~()\

tOR

ORGANIZATION

The Larimer and Weld irrigation Company Is a ditch organization diverting

water from the Cache La Poudre River at La Porte, Colorado, for purpose of

Irri-gation of lands extending to east of Aulto The ditch also carries water from

Horsetooth Reservoir (C·BT), for the Larimer and Weld Reservoir Co., Divide

Reservoir and Canal Company, and for Windsor Reservoir. The Company has its

main office in Eaton, Colorado. The officers are listed as follows:

Joe Haythorn, President

Fred Brunner, Vice President

Tom Nicks, Director

Elmer Gustafson, Director

Al Harrington, Director

Don Engles, Secretary

Eaton, Colorado

Windsor, Colorado

Eaton, Colorado

Eaton, Colorado

Greeley, Colorado

Eaton, Colorado

The Company has 365 stockholders owning a total of 1,423 shares of which

there are four shares owned under the original 1864 decree for 3o0 second-feet.

The Company does not own any shares In other companies nor does It own any

forelgn·water nor any Colorado-Big Thompson water.

The Board of Directors manages the affairs of the Company through Hro Don

Engles, Secretary, Eaton, who does the bookkeeping and business affairs, and

through Mro John Johnston, Superintendent, Fort Collins, Colorado.

Routine administration Is handled directly by the Board In accordance with

established budgets, but significant actions such as assessments and major

expenditures are handled by vote of the stockholderso

Assessments for the year 1969 are $10.00 per share for 1,419 shares and

$2.50 per share

fo~the four shares covered under the original decree. The 1968

assessments respectively were $5.00 and $2.500

Water from the Company's decrees Is distributed to the shareholders on the

basis that for each four shares of stock there Is one "right" which entitles the

holder to a 25-day run per season released at the rate of 1.44 cfs. On . this

basis, a full right would amount to seventy-two acre-feet per seasono The

actual number of days water Is run depends on availability. Losses are computed

at 25 percent which Indicates that the farm headgate delivery Is 1.25 cfs per

day per right for the length of run.

The Company charges a fee of $2.00 per day per right for the carriage of

foreign water which Is one-half of a ditch right or 1.25 acre-feet per day

f lgured at the farm headgate.

The Larimer and Weld Irrigation Coo Page 2 of 3

March, 1969 WATER

The Company owns these decreed direct-flow water rights for diversion out of Cache La Poudre River:

Priority Appropriation Decree Amount

Number Date Date (cfs~

(1) (2) (3)

(4)

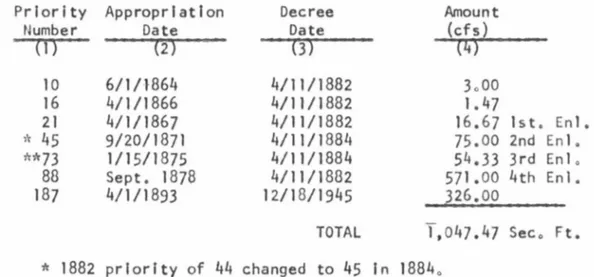

10 6/1 / ·l864 4/11/1882 3o00 16 4/1/1866 4/11I1882 l. 47 21 4/1/1867 4/11/1882 16.67 1st. Enl. lt 45 9/20/1871 4/11/1884 75.00 2nd En I. **73 1/15/1875 4/11/1884 54.33 3rd Enlo 88 Sept. 1878 4/11/1882 571.00 4th En I. 187 4/1/1893 12/18/1945 326.00 TOTAL T,047.47 Sec o Ft.*

1882 priority of 44 changed to 45 In 18840 *l'r 1882 priority of 69 changed to 73 In 1884.Table 1 shows the monthly and seasonal diversions under these decrees and the annual diversion per share and the yield per share based on a 25 percent loss for the period 1951 through 1967. The lowest yield per share of 4.64 acre-feet occurred In 1954. Other low yields were 4.68 acre-feet per share In 1966; 6.59 acre-feet In 1963; and 7a55 acre-feet In 1955. The average yield was 16025 acre-feet per shareo

Completely dependable water under direct diversion right from the Cache la Poudre River requires an appropriation date of 1864 or earlier and must have been adjudicated In 1882, the year of the first adjudication proceeding . Nearly all of the water furnished by these decrees is under later appropriation dates. This explains the reduced availability of water In August and September.

Factors such as the tow water yield, the frequency of low water yields and questionable dependability must be considered when evaluatln9 the potential worth of the water supply under this ditch system.

If valued at $100 to $150 per acre-foot, based on the average year yield of 16.25 acre-feet per share, the Indicated worth would be $1625 to $2437 per shareo The tow year yield of 4.64 acre-feet per share at a value of $150 to $200 per acre-foot would Indicate a value of $695 to $928 per share.

The superintendent reported that two shares have been sold during the last two years for $1500 per share, lndlcatJ[lg that the water Is priced In the range reflecting agricultural uses and demands.

The Larimer and Weld Irrigation Co. Page 3 of 3

March, 1969

Larimer and Weld Irrigation Company ownership presents opportunities for

exchange. i'ts ditch headgate Is located upstream from Fort Collins,

Colorado-Big Thompson water could be obtained by exchange with the North Poudre Irrigation Company to provide water in Horsetoot h Reservoir. Company water could also be exchanged, with C-BT owners under the canal In a slml Jar manner . Wa ter from the canal can be carried to the Windsor area directly, using the ex isting system of canals and ditches.

The comparative annual cost of the Company shares and C-BT units Is surmiarized below:

Source

Larimer &,Weld Irrigation Co , Colorado-Big Thompson SUMMARY Current Annual Assessment $10.00/share $ 4.50/unit

1. Number of shares -- 1,423 by 365 stockholders. 2. Annual assessment -- $10.00 .

Avera9e Annual Yield (ac.ft.)

16.25

0. 78

3. Critical water yield -- 4.64 acre-feet per share per year. 4 . Average water yield -- 16.25 acre-feet per share per year. 5. Indicated worth, low yield -- $695 to $928 per share.

Indicated worth, average yield -- $1625 to $2437 per share . 6. Reported recent sale -- $1500 per share .

Annual Cost $/AF $ 0.625 $ 5 , 77

7. Exchange possibilities -- favorable due to location of the canal. WRIGHT WATER ENGINEERS

TABLE I

THE LARIMER AND WELD IRRIGATION COMPANY YIELD OF DIRECT FLOW RIGHTS

(All Values in Acre-Feet)

Per Share

Direct Fl ow. DI versions Yield

Assuming

Year April May June July Aug. Sept. Oct. Total

~SS

(i)

(2)

(3)(4)

(5)

(6)

(j)

m-

(9)

(1951

0

13850

20320

16

l10

2362

1268

0

53910

28.41

e

1952

0

6088

31990

2738

1074

628

0

42518

22.41

1953

0

2602

22630

2132

1350

316

0

29030

15.30

1954

0

3554

3020

904

264

228

836

8806

4.64

1955

0

2716

8354

1734

1250

264

014318

7.55

1956

0

16310

22070

1320

978 ·

106

162

40946

2 I .58

1957

0 030070

21410

2340

1844

44

55708

29.36

1958

0

9778

14530

1490

1030

406

0

27234

14.35

1959

010130

21810

2936

1124

722

0

36722

19.35

1960

554

10310

24670

7.770

720

110

0

39134

20.63

1961

0

9460

12880

3622

1544

4378

0

31884

16.80

1962

2362

16040

13010

1908

1178

690

0

35188

18.55

1963

132

3050

6256

1048

1206

816

0

12508

6.59

1964

0

9112

18340

2386

632

38

0

30508

16.08

1965

110

7682

12570

13160

1936

1906

0

37364

19.69

1966

0

2232

4744

1180

332

392

0

8880

4.68

e

1967

0

1532

8336

7884

...D!±

...2.QQ

_._Q19446

1o.25

Ave.186

7320

16212

4984

1183

883

61

30830

16.25

... u

THE LOUDEN

WRIGHT WATER ENGINEE"S ICNGINl:ICIUNG CONeULTANTS

ao•• •RYANT •Tlllll:T DJNVl:R, COLORADO •O&l 1

IRRIGATING CANAL AND RESERVOIR COMPANY LOVELAND, COLORADO

March, 1969

(Appendix Added April, 1969)

CON

f\

Ot.N1\l\l

t{Ol fQR RELEl\SE

The Louden Irrigating Canal and Reservoir Company Is a mutually owned company having 600 shares of stock owned by approximately 203 stockholders. Operation of the Company Is by the Secretary-Treqsurer-Superintendent, Mr. Ralph Benson, 925 West 29th Street, Loveland, 667-2027. The Board of Directors of the Company consist of the following seven men:

Clarence Svedman, President Gordon Dyekman, Vice President VI c tor Beebe

Fort Col I Ins Loveland Love land Love 1 and Love 1 and Loveland Fort Collins Mar t I n A 1 1 a rd Clarence Stump, Jr. Arthur T. Kolderway Stanley Blehm

The current annual assessment is $30.00 per share.

Diverting from the left bank of the Big Thompson River northwest of Loveland in Secti,on 12, Township 5 North, Range 70 West, the Louden Ditch runs north and east passing north of Boyd Lake and south of Fossil Creek Reservoir, eventually

terminating in Section 26, Township 6 North, Range 68 West, about 3.5 miles south-west of Windsor. The Company has the following direct flow rights decreed In

Water District No. 4.

DIRECT FLOW RIGHTS

Appropriation Decree Amount

Prlorit:z: Date Date ~cfsl

1 10- 1-1861 5-28-1883 7.0

18 10- 1-1871 5-28-1883 " 40.0

38 11- 1-1877 5-28-1883 15'1t.3

51 9-17-1883 5-29-1884 123.478*

*Reported by the Superintendent to be beyond the ditch capacity and never used.

In addition to direct flow rights, , the Company owns a ~-interest In Donath

Lake, a 3/4-lnterest In Rist

&

Benson Reservoir, and 20 rights In Lake Loveland.The Louden Irrigating Canal and Reservoir Company Page 2 of 3

March, 1969

Reservoir Louden

Rist & Benson Louden Enlargement Rist & Benson

STORAGE RIGHTS Priority 2 38 41 52 Appropriation Date 2-24-1883 4-26-1903 6-16-1907 12-31-1930 Decree Date 3-22-1890 lt-14-1939 tt -14-1939 tt-14-1939 Amount (AF) I, 148 374 l, 148 118 Water from storage accounts for less than to percent . of the Company's average annual water supply. Diversions to the Ditch normally start in mid-May and usually run into the middle of October. The Company owns no Colorado-Big Thompson water but de! ivers C-BT water through its canal for $0.25 per acre-foot and a JO percent water loss. The estimated yield per share for the 13-year period 1954 through 1966 is given below:

ESTIMATED YIELD PER SHARE

' Vear AF/Share 1954 20.2 1955 11. 5 1956 12.8 1957 29.8 1958 14.3 1959 20.8 1960 24.2 1961 15.5 1962 29.0 1963 14.3 1964 15.0 1965 24.7 1966 8.4 Average 18.5

Shares in the Louden Irrigating Canal and Reservoir Company would be

advantageous to Eastman Kodak because of the relatively good water yield and the favorable position with respect to exchanges with Greeley and others. Water

acquired through the Louden Ditch could be exchanged to either Greeley or Loveland d-irectly or could be exchanged for an equivalent amount of C-BT units with other users on the stream.

If valued at '50 per acre-foot for the low year yield of 8.4 acre-feet per share, the indicated worth is $1260 per share. The Company superintendent. Mr. Benson, reported a recent sale at $1000 per share, indicating the shares may be underpriced. The Company will buy shares back at $300 per share, if no market

The Louden Irrigating Canal and Reservoir Company Page

3

of3

March, 1969

In summary, the Louden Irrigating Canal and Reservoir Company would be an advantageous acquisition for Eastman Kodak. Average yield is 18.S acre-feet per share and low yield is 8.4 acre-feet per share with approximately 90 percent of the average annual yield being derived from direct flow rights from the Big Thompson River, and the remainder derived from storage. The Louden Ditch is favorably located for making exchanges to Loveland or Greeley or for exchanging for C - BT u n i t s •

Current market priee is reported to be $1,000 per share which ls equivalent to $119 per acre-foot based on the low year yield of 8.4 acre-feet per share.

APPENDIX

LOUDEN EX TENS I ON DITCH AND RES ERV.Of R COMPANY

The louden Extension Ditch and Resevoir Company operates the Louden Extension which is a branch of the Louden Ditch. The Company owns 3/4 interest in Donath

Lake, the remaining 1/4 interest being owned by the Louden Irri gating Canal and Resevoir Company.

There are Ill shares in the Company owned by approximately 21 shareholders. The annual assessment in 1969 is reported to be $12.00 per share. Officers of the Company are:

Aaron Dickinson, President George Schulke ~ Secretary

Ferd Michels Kenneth Thayer Jim Svedman

Available records in d icate that for the 13-year period 1954 through 1966 there were three years when there were no de! iveries from Donath lake. The average yiel d of a 75% interest for the period would be 4.9 acre-feet per share with the maximum being 8. l acre-feet per share in 1960. If valued at $100.00 per acre-foot on the average yield, the indicated worth is $490 per share. Information on recent sales

Ml!MBER

INTRODUCTION

WRIGHT WATER ENGINEERS

ENGINEERI N G CO NS U LTANTS 2059 BRYANT STRFE ~

OSf'.VE R :::: OLORA C O <.!0.!'

CACHE LA POUDRE RIVER WATER rNVEST!GATIONS NEW CACHE LA POUDRE IRRIGATING COMPANY

and the

CACHE LA POUDRE RESERVOIR COMPANY known as the

GREELEY NO , 2 CANAL February 1969

TELEPHONE 433 -15 20 1

The Greeley No . 2 Canal system is comprised of two separately organized companles--the Cac he la Poudre Reservoir Company which owns Timnath Reservoir, and the New Cache la Poudre Irrigating Company which owns the Greeley Number 2 Canal o Both companies have their main office at 708 8th Street in Greeley and are governed by an elected board of directors o The secretary for both companies

is Mr o Ho Eo Meyers, and the current board of d i rectors for each company Is as fol lows:

Dewey Lo Dari ing, President Robert So Davis, Vice-Pres o

J o Bo We 11 s Roy Johnson Co W o Kirby Greeley Greeley G i 11 Greeley Windsor

Ope rat ion of the two co1npan i es is comp 1ete1 y integrated a 1 though the owner-ship is not identicalo Owners of stoc k in the Reservoir company are entitled to water yielded from Timnath Reservoir, which is de] ivered through the Greeley No o 2 Canal o Stockholders of the Irrigating Company are entitled to water derived

from direct flow rights on the Poudre River o In addition to direc t flow water the Irrigating Company also delivers w ~ter owned by its stockholders in Fossil

Creek Reservoir, Windsor Res e rvoir, Timnath Reservoir and the Colorado-Big

Thompson Project, al 1 for a carryi ng charge of $1 050 per cfs per day.,($0 . 75/AF) o The organization and water rights of the two companies are described in the following sections ,

THE NEW CACHE LA POUDRE IRRIGATING COMPANY

A mutually owned company founded originally in 1870 as part of the Union Col(Oly which settled Greeley, the New Cache la Poudre Irrigating Company has 2500 shares of which 2499 are outstanding and one is unaccounted for . There are approx imately )00 stockholders which shar ~ equally in the water dividends

declar·ed by the company and delivered through the Greeley No o 2 Canal 0 The

company owns and operates the Greeley No o 2 Canal which serves stockholders of both the Irrigating and Storage company o Water owned by stoc kholders in Fossil. Creek Res•rvoir, Timnath Reservoir and Windsor Reservoir (not Windsor Lake) is

New Cache la PoudFe Irrigating Company Cache ia Poudre Reservoir Company Page ·2 of 6

Fe_bruary' 1969

delivered for a daily running charge of $1.50 per cfs cal led for plus approxi-mately 2Cflo water loss . C-BT water· Is also delivered for the same daily carry-ing charge and water ~loss plus a 5% loss if exchanged with other reservoirs or 10% if released from Hors e tooth .Reservoir . The company uses Windsor Lake at Windsor as a short-term equalizing reservoir i~ its operation under an

agree-me~t with the Kern Re~ervoir and Ditch Company.

Direct flow rights owned by the company are 1 i~ted betow:

NEW CACHE LA POUDRE IRRIGATING COMPANY DIRECT FLOW DECREES

Priority Appropria- Decree Amount

Number- t ion Date Date (cfs)

( 1) {2) (3) (4) 37 10/25/1870 4/11/J882 110 44 9/15/1871 4/11/1882 170 72 11/10/1874 4/11 /1882 184 83 9/15/1877 4/11I1882 121 585

Table

J

shows the monthly and seasonal diyersions under these decrees and the annual per share yield based on a 20"/o loss, for the period 1951 through 1967. The lowest yield per share of 7. 6 ac re-feet occurred in 1966, with the average for the period bein g 11.:.2-acrrleet per share. It should be noted, however, that because of the relatively late appropr ia tion dates of the decrees the supp ly is not dependa b le in Augus t and September. This factor must be con-sidered when evalwat i ng the potential worth of supplies such as the Greeley No. 2 system . To be completely dependa ble a direct flow right on the Poudre must have an appropriation date of early 1864 or earlier, and must have been adjudicated in the f irst adjudi cation for irrigation purposes In Water District 3, which was the Apr i l 11, 1882 proceeding .The New Cache la Poudre lr~igatin g Company also rents water from Greeley

which is In excess of Greeley's needs . The rental water has not been Included in the yield figures.

lf valued at $100 to $150 per acre-foot based on the average year yield, the indicated wo rth would be $1390 to $2085 per ?hare . The low year yield of 7. 6 acre-feet per share at p value of $150 to $200 would indi cate a value of

$1140 to $152 0 per share . A sale at $750 per share is reported to have occurred five years ago, and the sec retary reports that four shares have recently been offered for sa 1 e for a to ta 1 of $ 3600 ($900 per share) •

The 1969 assessment is $14.00 per share, up from $13.00 per share for 1968.

"

"'

'"Tl\:IC"l:Z (DQIQli CT ID 0 _. -,(9:r c: (D nTABLE

1

.,

QI \I.I QI -n -<OGl:r -ti (DNEW CACHE LA POUDRE IRRrGATING COMPANY

\0<7'0--·

.,,

YIELD OF DIRECT FLCM RIGHTS

C7' c: Ill\0 ~~

{all values in acre feet}

11> 0Per Share

;;o c: 0.Yield

(D .,Ut 11>

Direct Flow Diversions

Assuming

\.,

ct-

e

Year

Az~)l

-N-

June

Julr

Aur6r

~

Oct .

Total

20"t

Loss

< ., 0 .,(i}

(4}

(5

(("8)

(9)

1 o)

-, ID QI n ,..1951

0

11. 14o

22.680

23,030

14,960

2,

l

08

0

73.918

24.7

o-3 ::i1952

0

13. 150

25,780

16, 080

3,222

556

0

58,788

18.8

"'C IQ1953

0

5,436

26,340

7 ,454

3,920

128

0

43,278 .

13.8

-< 0 ~\-,1954

0

11. 400

11 ,820

2,084

186

0

0

25 ,490

8.2

3 "'C1955

0

9,664

15,4o0

6,746

3,278

1,096

100

36,284

12. 0

QI ::i1956

1,372

18,620

19, 170

4,720

2,328

24

0

46,234

14.8

-<1957

0

0

17,64o

30,54o

9,560

9o4

0

58,644

18.8

1958

0

6, 124

22. 14<>

7,696

1,096

,356

0

37,412

12.0

1959

0

10,24o

23,790

10,020

3. 126

228

0

47.~0415 . 2

1960

622

13,920

21'150

13. 180

1. 002

64

0

49,938

16. 0

1961

0

3, 134

11, 970

13,920

5,992

614

0

35,630

11.4

1962

4,620

21,000

10,130

14,370

3,560

440 .

0

54, 120

17.9

1963

306

12,490

11,84<>

2,982

5,286

1, 066

0

33,970

11. 3

e

1964

0

11,480

15,760

9,466

1, 120

182

0

38,00S

12. 2

1965

208

7,502

8,604

20,870

6,o42

944

0

44, 170

14.2

1966

0

11 ,460

8,464

1,924

836

956

0

23,64<>

7. 6

1967

0

4,774

6,012

13,000

936

1,o48

0

25, 770

8.2

Ave..-age

419

109~016,394

11, 652

3,909 .

630

6

43,100

13·.9

Average/Share

0.2

4.o

6.6

4.6

1.5

0.2

-

17. l

/•

e

New Cache la Poudre Irrigating Company Cache la Poudre Reservoir Company

Page 4 of 6 February 1969

THE CACHE LA POUDRE RESERVOIR COMPANY

In 1892 the Cache la Poudre Reservoir Company was organized as a separate company from the irrigating company because many stockholders in the Irrigating company did not wish to share in the cost of reservoir construc tion. In 1892 the company acquired the site of Homer's Lake and subsequently constructed Timnath Reservoir having the fol lowing storage decrees:

CACHE LA POUDRE RESERVOIR COMPANY TIMNATH RESERVOIR STORAGE DECREES

Priority Appropria- Decree Amount

Number tion Date Date (af}

( l) (2) (3) (4)

28 3/17/1892 12/9/ 1904 8380

61 12/1/1902 4/22/1922 1740

l 36T 12/31/1923 9/10/1953 5948

A data sheet for Timnath Rese rvoir is appended to this Report.

There are 3000 shares in the Cache la Poudre Reservoir Company owned by approx imately 300 stockholders . For each eight shares of stock there is one "right " which e'.ltitles the owne r to 12 cfs or 24 acre -feet of water per season depending' on ava i la bil ity . The recorded allotments and pe r share yield from 1951 through 1968 are given in Table 2 .

Water rel eased from Timnath Reservoir is delivered through the Greeley No. 2 Canal by the New Cache la Poudre Irrigating Company for · the $1 .50 carrying charge and 2Cf/o wa ter loss previously described. Because th e reser-voir water can be used to supplement the direct flow wa ter available from the

irrigating company, a majority of the farmers under the system own shares In both companies.

If valued at $150 to $200 per acre-foot based on the average year yield the indicated market pr ice would be $315 to $420 per share . Based upon the low year yield, however, the indicated value would be $150 to $200 per share. No recent sales have been reported and no current estimate of market value of reservoir company shares is available.

It should be noted that Timnath Reservoir is favorably located with respect to the Kodak site at Windsor . The yield t0 Kodak of Timnath Reservoir water could be increased above that shown by construction of a pipe 1 ine from the reservoir to the site, thereby el imlnating transit losses .

The 1969 assessment for reservoir company stock is $7 . 00 per share, which is the same as for 1968.

SUMMARY

The New Cache la Poudre Irrigating Company and the Cache la Poudre Reservoir Company are companion companies owning Timnath Reservoir and the Greeley No. 2 Canal. Direct flow r-ights of the irrigating company have a critical year yield of 7.6 acre-feet per share and an average yield of 13.9 acre-feet per share.

New Cache la Poudre Irrigating Company

Cache la Poudre Reservoir Company

Page

5

of6

February 1969

Year

1951

1952

1953

1954

1955

1956

1957 '

1958

1959

1960

1961

1962

1963

1964

1965

1966

1967

1968

TABLE 2

CACHE

LAPOUDRE RESERVOIR COMPANY

TIMNATH RESERVOIR YIELD

Per Share

A11 otment

(af)3.0

3, 0

2.5

1.5

1.25

1.5

3.0

3,0

3.0

2.5

3.0

3.0

2.5

3.0

3.0

2.75

3.0

H-Per Share Yield

Assuming

20"/oLoss

(af)

2.4

2.4

2.0

L2

1.0

1.2

2.4

2,4

2.4

2, 0

2.4

2.4

2, 0

2,4

2. 4

2. 2

2. 4

2.4

2.T

New Cache la Poudre Irrigating Company· Cache la Poudre Reservoir Company

Page 6 of 6 February 1969

The yield is not dependable in August and September, however. There are 2499 share of stock in the irrigating company, which, if valued at $150 to

Hoo

per share, have an indicated market price of $1140 to $1520 per share o The current annual assessment is $14000 per share oThe Cache la Poudre Reservoir Company owns Timnath Reservoir o Reservoir water is delivered by the Greeley No o 2 Canal for a carrying charge of $1 o50 per day and a 2Cf/o water losso There are 3000 shares of reservoir company stoc k with a critical year yield of l oO ac re-feet per share which, if valued at $150 to $200 per share, have an indi cated market price of $315 to $420 per shareo The current annual assessment is $7 . 00 per share.

Both Timnath Reservo ir and the Greeley No . 2 Canal are advantageously

located in ·regard to East man Kodak at Windsor and shares in both companies should be acquired . Wate r derived from these shares can be used directly in conjunc-tion with othe r suppi ies or by exc hange. Kodak owns 24 shares of the New Cache la Poudre Irrigating Company acquired from Great Western Sugar Companyo

The comparative annual cost of irrigating company and reservoir company shares and C-BT units is summarized below:

Source

New Cache la Poudre Irrigat-ing Company

Current Annual Assessment $14.00/share Cache la Poudre Reservoir Co o $ 7 o00/share

Colorado-Big Thompson $ 4.50/unit

Average Annual Yield

(acre-feet)

2. 1 0.78

WRIGHT WATER ENGINEERS LR:ej · Leonard Rice Annual Cost ($/AF) $1.01 $3 . 33 $5 .

77

1. Dec 1-ees Prio r ity 28 6 1 '" 136T Timnath Reservoir App 1n. Date 3 /17/1892 12/1/1902 12/3 1/ 192 3 Decree Da te 12/9/ 1904 4/22/ 1922 9/ 10/ 1953 Amount (AF) 83 80 1740 5948 2. Res ervo i1- is l oca t ed in Sec. 25, T 7 N, R 68 W.

3. The re se1-voir is supplied fr urri the l eft bank of the Poudre 1n Sec. 18 , T 7 N, R 68 W.

4. Th e reservoir is mmed by Cache La Poudre Reserv o ir Co.

5 . The reservoir superintendent is Ernest My-er, Phone No. 352-0222 in

Gre e l ev .

6 . The resei-vo ir has an estimated capacity of 10 ,070 Acre Feet. The 1vater suria ce area is 650 acres .

7. Wa ter vit· lds are esti ~1 ate d as fo ll ows :

Avtrage (47 -6 7) 8.905 Acr e Feet Or i Year ( 1954) 6,000 Acre Feet i,./e t Ye.:ir (1 958 ) 10,200 Acre Fee t Driest Year(1955) 5, 300 Ac re Feet 8. Comnents on usabi 1 i ty for Eas tman Kodak

,., Refill deci-ee - Addi t ion.:il ar11ou nt awarded cond i tion a ll y under th i s priorit y for 41 71 AF

(a} Wate r can be re l eased to Win dsor Lake

( L> ) Headgate is above i3oxe l der Creek

(c) Water •'1ay be exchanged for Co l orado - Sig T hompson uni ts ( d ) Reservoir idea ll y l ocated for Wi nd sor site use

2059 BRYANT STREET . . DENVER, COLORADO 80211

February 10,

Mr . Hugh· Bur.ns, Atto'rney

Dawson, age 1, Sherman' & .Howard First National Bank Building 'Denver, C~Jorado 80202,

are ten' copies of a report on the·

w

lndsor . Canal <;ompany made· in connect Ion with our of . the Cache La Poudre . Rlver ~reports wll l follow . as they are completed~

MEMBER

ORGANIZATION

WRIGHT WATER ENGINEERS ENGINEERING CO NSULTANTS

20 ~9 BAVA.NT STRFE T DE NVER , COLO RA. 0 0 ao211

CACHE LA POUDRE RIVER WATER INVESTIGATION THE WINDSOR RESERVOIR AND CANAL COMPANY

February 1969

The Windsor Reservoir and Canal Company was organized in the J8801s and

currently has 1,000 shares of stock owned by approx imately 250 stockholders . The shares are of a single class and share equally in the water distributed

TELEPHONE 433 -152 01

by the Company " Assessments vary on the shares, however, dep'ending upon how

the water ls delivered . There are 914 shares which receive w~tei through the

Larimer and Weld Canal which for 1968 were assessed at $90 "00 per share, the assessment including a carrying charge payable by the Windsor Reservoir and Canal Company to the Larimer and Weld Irrigation Company , The remalning . 86 shares receive water through the Greeley No " 2 Canal and for 1968 were assessed at $70 . 00 per share . These shareholders pay a carrying charge directly to the New Cache La Poudre Irrigation Company which owns and operates the Greeley No . 2 Canal •

Operation of the Company is directed by the Superintendent, Mr . Don ;Engles, from the Company office in Eaton . The ditch company off ice in Eaton is also the headquarters for several other companies including the Larimer and Weld Irrigation Company and the Owl Creek Supply and Irrigation Company . The Board of Directors of the Windsor Reservoir and Canal Company Is as follows:

Joe Haythorn, President Elmer Gustafson Dewey Darling Carl Magnuson Ben Nix Eaton Eaton Greeley Eaton Eaton

The Board of Directors is elected an~ual ly b~ the stockholders and exercises

control and authority over the operations of the company . WATER

The Windsor Reservoir and Canal Company system consists of four reservoirs which deliver water through the Larimer and Weld Canal and through the Greeley

No . 2 Canal . The Company also owns one~third of the stock of the Tunnel Water

Company which owns the Laramie - Poudre Tunnel . The Laramie - Poudre Tunnel

diverts water from the Laramie River to the Poudre River under very senior rights , Reservoirs and storage decrees owned by the Company are I isted on the next page , Fact sheets for Windsor Reservoir and Douglas Reservoir are appended to

--

e

The Windsor Reservoir and Canal Company Page 2 of 4

February 1969

·Appropriation 'oecree Decreed Reported

Name' Priority Date Date· Amount Capacity

I (af) (af)

Windsor Reservoir 24

71

8/1890 12/ 9/1904 11 .732 17,689Windsor Res o 1st EnL 43 9/ 9/1901 12/ 9/1904 5,957

.. Douglas 44 ' 9/15/1901 12/_ 9/1904 10,560 8,834

Reseryoir No o 8 53 6/23/1903 6/15/1906 l 5, 381 14, 181

Res o No o 8 En 1 o 56 7/10/1904 6/15/1906 2,296

Cobb 120 7/15/1919 5/· 3/1930 9, 113 22,300

Note: Decree for Reservoir No o 8 Enlargement is for what is known as Reservoir No o 8 Annex o

Water from Reservoir No o 8 ls delivered by the Larimer and Weld C~nal and

can be delivered to Windsor Reservoir which in turn release~ water to the Greeley

N6o 2 Canal o Water from Cobb Lake is released to the Water Supply and Storage Company in return for t-BT water from Horsetooth Reservoir o Douglas Reservoir

ls supplied from Dry Creek and the Poudre Valley Canal and .can exchange for C-BT water.

Water derived from the Company1s storage decrees and operations of

res'ervolrs Is distributed equally to shareholders o For each two shares of

stock there is one 11right11 whkh entitles the holder to 30 days of water per season

released at a rate of l 044 cfs per day o" The actual number of days water Is run depends on availabll lty o In practice, water is run out ·of the reservoir

system whenever enough 11rlghts11 call · for it at a rate of l 044 cfs per right and

)o25 cfs per right is .delivered to the farm h~adgate . The .13 percent difference

between release and delivery represents river losses . Recorded deliveries ~nd

yield per sha~e for the 19-year period 1950 through 1968 are given in Table 1.

F'rom Taole 1, it can be seen that the yield per share ranges from a low of 6.9. acre feet in 1955 to a high of 33 . 2 in 1962 and 1968, with an average for the period of 25 . 6 acre feet . If valued at $150 to $200 per acre-foot, these shares would have an Indicated market value of $1,035 to $1,380 per share. No recent sales have been reported and officers of the Company decline to estimate the current market value .

SUMMARY

The Windsor Reservoir and Canal Company owns four reservoirs and six storage decrees plus one-third of the stock of the Tunnel Water Company.

Company water Is shared equally by 250 stockholders owning the 1,000 shares of stock in the Company . Water Is delivered by the Larimer and Weld Canal and the Greeley No . 2 Canal and exchanged for C-BT water. For 1968, 914 shares of stock

rece~vlng water through the Larimer and Weld Canal were assessed at $90.00 which

Includes a carrying charge, and 86 shares served by the Greeley No . 2 were assessed at ,$70 . 00 per share.

The Windsor Reservoir and Canal Company

Page 3 of 4.

February

1969

TABLE

1

WINDSOR RE SERVO l"R AND CANAL COMPANY

DELIVERIES AND YIELD PER SHARE

Total Water

Released From

De 1 i vered to

Year

Reservoirs

S tockho 1 de rs

(AF)

(AF}

Ti)

(2)

(3)

1950

23,600

20,600

1951

27 ,400

23,800

1952

34,800

30,200

1953

23,000

20,000

1954

21,400

18,600

1955

7,950

6,920

1956

13,300

11,600

1957

34. 000

29, 600

1958

33,300

29,000

1959

33' 300

29,000

1960

33,000

28", 700

1961

33 , 100

28,800

1962

38,200

33,200

1963

36, 100

31,400

1964

33,400

29,000

1965

32, 100

27,900

1966

30,800

26,800

1967

33,000

28,700

1968

38,200

33,200

Average

29,500

25,600

Yield

Per Share

(AF}

(4)

20 .6

23 .8

30.2

20.0

18.6

6.9

11.6

29 .6

29 . 0

29 .0

28 .7

28.8

33.2

31.4

29.0

27 .9

26 .8

28 , 7

33 .2

25.6

The Windsor Reservoir and Canal Company Page 4 of 4

February 1969

Eastman Kodak already owns two shares of Windsor Reservoir and Canal Company stock and additional acquisitions would be advantageous because of the Company's storage water and ownership of reservoirs. The annual cost based on average yield in relation to C-BT water is sunmarized below:

Source

Windsor Res .

&

Can•l Co . Colorado-Big Thompson Current Annual Assessment $70-$90/share $4.50/unit Average Annua I Yield (acre-feet) 25.6 0.78 Annual Cost ($/AF) $2.74-$3.52 $5 077

If valued at $150 to $200 per acre-foot and based on the low year yield of 6 .9 acre feet per share, the indicated market value is $1,035 to $1,380 per share. Information on recent sales or current market price is not available .

WRIGHT WATER ENGINEERS

By_J:.L~~·&.l!ll·Sll!!

....

-z:~~~~~·illl!!!!I....:

_ _

_

' Leonard Rice

.e

Wi ndsor Reservoir

1 •

DecreesAmount Pri or i t y App 'n , Date Decree Da te (AF)

24

7/8/1890

12/9/1904

11, 732

43

9/9/ 1901

12/9/1904

5,957

2.

Reservo i r is located in Sec.33,

T7

N, R67

W.3.

The reser vo i r is s upplied from the Lar ime r & Weld Can a l whose headgate i s situated on the l eft bank of the Poudre in Sec.33,

T8

N, R69

W.4.

The reservo i r is owned by Windsor Reservoir & Canal Co.5.

The reservoir superintenden t is Don Engl es , Phone No.454-2693

1n Ea ton .6.

The reservo i r has an estinated capac i ty of17,689

Ac re Feet. At a depthof

37

feet the water surface area is1000

acre s .7. Water Y,iel ds are est imated as fo ll ows: Average Dr y Year We t Year

(47-67)

( 1954)

( 1958)

12,957

Acr e Feet6,.200

Atre Fee t17,300

Ac re Feet8.

Comments on usa b ili ty for Eas tman Kodak(a) Wa ter can be re lea sed ind i rectly to Windsor Lake

(b) Headgate is above Boxelder Creek an d Fort Co ll i ns sewage plant (c ) Water may be exch anged for C lorado - a ig Thompson units

(d) Reservoir wel l si t uat ed for Wi nds or site use

(e ) Su ita u le for exchange with Fort Co llins and Gree le y

(f) ~1nersh ip in the Windsor Reservo i r & Canal Co . provides a prorated

portion of al 1 of th e Company water , inc l ud ing Dou g l as, Re servo ir #8,

.

.

.e

Doug las Reservoir

1 • Decrees

Amo1m t

Priorit y Aee'n Date Decree Date ~AF}

44 9/15/1901 12/9/1904 10,560

2. Reservoir is loca ted in Sec. 35, T 9 N, R

69

w.

3.

The reservoi'r is suppl ied by Dry Creek anrl throuqh the Poud re Va lle y Canal whose headgate is situated on the left bank· of the Poudre in Sec. 15 , T 8 N, R 70 ,w.4.

The reservoir is owned Dy Windsor Reservoir & Canal Co.5. The reservoir superi-nt enden t is Don Engles, Phone No. 454-2693, Eaton.

6.

The reservo ir has an estimated capacity of 8834 Acre Feel.7.

8.

At a depth of 30. feet the water surface area is 586 acres. Water y ields are es tir1at ed as fo l lows·:

Average (29 - 67) 5962 Acre Feet Dry Year ( 1954) 2800 Acre Fee t Wet Year ( 1958 ) 8300 Acre Feet Co:nmen ts on usabi 1 i ty for Eastman Kodak

(a)

(b)

( c)

(d) ( e )

Headgate is in Pou dre Canyon with good qua! i ty water Water may be exchanged for Co lo rado- Big Thompson un i ts Exchanges are p o ssi ~ l e with cit ies, but complex

Reservoir is far removed from stream

Ownership in the Windsor Reservoir & Canal Co, provides a prorated por t ion of all of the Compan y water, incl uding Douglas, Reservoir #8,