How Market Intelligence Helps With Pricing

A qualitative study on Systemair Group

Eyad, Omar - 991130

Mohammad, Shaheen - 840310 Singh, Aryan - 981114

School of Business, Society & Engineering

ABSTRACT

Date: 2021-06-03

Level: Bachelor Thesis in Business Administration, 15 cr

Institution: School of Business, Society and Engineering, Mälardalen University

Authors: Aryan Singh Omar Eyad Shaheen Mohammad (98/11/14) (99/11/30) (84/03/10)

Title: How Market Intelligence Helps With Pricing

Tutor: Ali Farashah

Keywords: Digitalization, Business Intelligence (BI), Market Intelligence (MI), Competitive Intelligence (CI), Pricing, Decision Making, Dynamic Pricing Model, Price Authority

Research Question: How does MI help in pricing decisions of the European market in

Systemair

Purpose: The purpose of this research is to investigate if Market Intelligence (MI) has any effect

on pricing decisions within the European market in Systemair Group. Since the field of MI in pricing decisions is explorative, this study will conduct thorough interviews with the goal of getting a deep understanding of how MI can help with pricing decisions. This study also aims to contribute to the research in this subject.

Method: This study has been conducted in a qualitative manner on the case company Systemair

Group. Primary data was collected through academic articles found via the library of Mälardalen University and scientific databases. The research was based on 5 semi-structured interviews conducted online with employees of Systemair.

Conclusion: MI plays an important role in pricing. It gathers real time market data that is

objective to feelings from the sales team or other employees. Factory capacity will be optimized with the evolution of MI, profit margin will be set higher than before and so this will result in a push in the overall price level of Systemair products. Value-Based Selling points and Resources are an integral part of the dynamic pricing model, specifically in Strategic Input and Data Input respectively.

Acknowledgement

We want to start by thanking our seminar leader Ali Farashah for his guidance throughout the course of the thesis. We would also like to thank the opponents for their brave work as their recommendations made our study stronger.

Most importantly, we would like to thank Taina Horgan, who has been our main contact person throughout the thesis process in Systemair. Henceforth, we would also like to thank all the other interviewees Sofia Jansson, Arkadiusz Augustyniak, Elke Rehmet and Olle Glassel for taking time off their work to help us with our study. This study would be incomplete without these awesome people.

Table of Contents

1. INTRODUCTION 6

1.1 Background Information 6

1.2 Problem Formulation 7

1.3 About The Company 8

1.4 Research Question 8

1.5 Purpose 8

2. LITERATURE REVIEW 9

2.1 Business Intelligence 9

2.1.2 MI and CI - specific subsets of BI 10

2.1.3 Competitive Intelligence 10

2.2 Market Intelligence 11

2.3 Market Intelligence and Decision Making 12

2.3.1 Sales decisions and marketing strategy 12

2.3.2 Inventory management 13

2.3.3 Implementation of market intelligence in decision making 13

2.4 Pricing 14

2.4.1 Cost-based pricing 14

2.4.2 Competition based pricing 15

2.4.3 Customer based pricing 15

2.5 Dynamic Pricing Model 15

2.5.1 Strategic input 16 2.5.2 Data input 16 3. METHODOLOGY 18 3.1 Research Design 18 3.2 Data Collection 18 3.3 Research approach 19

3.4 Interviews with employees of Systemair 19

3.4.1 Introduction of the employees 20

3.5 Operationalization 20

3.6 Reliability and Validity 21

3.6.1 Reliability 21

3.6.2 Validity 22

4. EMPIRICAL FINDINGS 23

4.1 Interview 1 - Taina Horgan (Pilot Interviewee) 23

4.3 Interview 3 - Arkadiusz Augustyniak 29

4.4 Interview 4 - Elke Rehmet 33

4. 5 Interview 5 - Olle Glassel 37

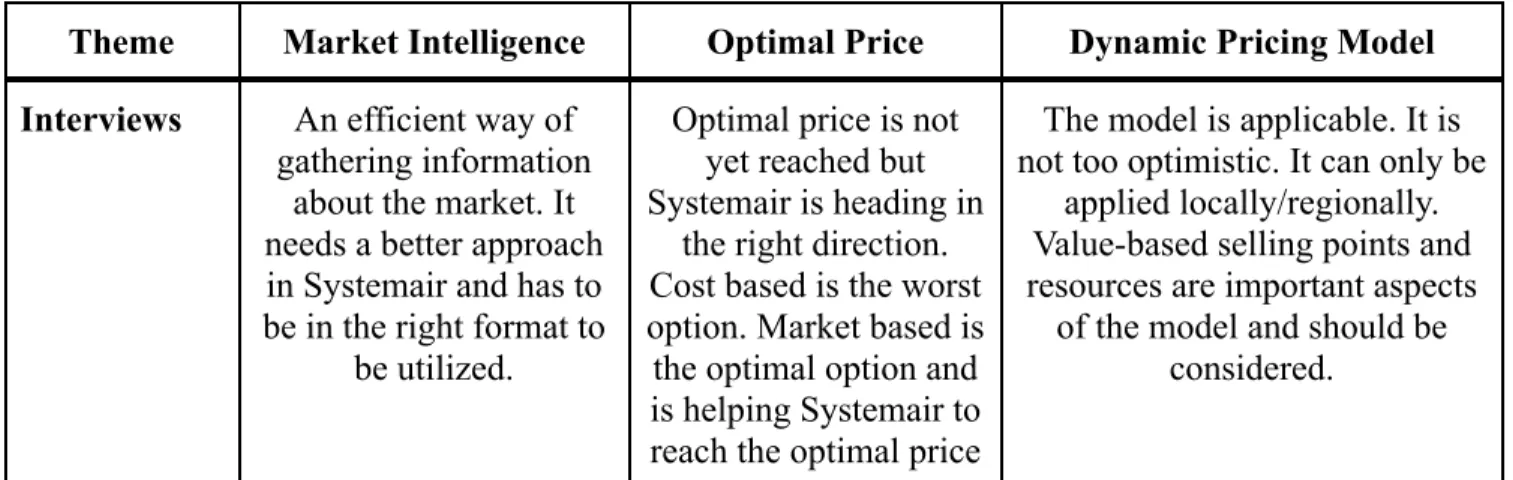

5. DISCUSSION 40

5.1 Market Intelligence and Competitive Intelligence in Systemair 40

5.2 Pricing in Systemair 42

5.3 Dynamic Pricing Model 44

5.4 Summary of Discussions 45

6. CONCLUSION 46

6.1 Theoretical Implications 47

6.2 Practical Implications 47

6.3 Limitation for Future Research 47

REFERENCES 48

APPENDICES 53

Appendix 1.1 - Interview Questions 53

1. INTRODUCTION

1.1 Background Information

Digitalization is continuously growing and more-and-more organizations in recent times, have submitted to the idea of going digital (Hashem et al, 2014). The digitization process is very time-consuming and contains many moving parts. One of these moving parts is data. Digitalization enables market data to be collected on larger scales contributing to the idea that the data will be from numerous sources. Since business data is numerous, it cannot be categorized into regular relational databases. Business data is usually generated, captured and processed rapidly and continuously and this is what Hashem et al (2014) describes as “Big Data”.

To utilize big data, organizations have started to implement Business Intelligence (BI). BI helps organizations to interpret big data. It provides a visualization of the data collected which can be used by managers for a more effective and instant decision-making process. The data can be analyzed in the form of instant dynamic graphs and charts, which are easier to interpret as compared to large disconnected data (Hashem et al, 2014). BI has been around for several years and lately, extensive academic research has been done into the respective field.

Market conditions are continuously going through changes and the need for real time data is becoming increasingly sought after. Having access to real time data serves a great advantage to managers when companies aim to expand their presence globally. This real time data can easily be collected with the help of Market Intelligence (MI) (Igbaekemen, 2014).

More specific to BI, is market intelligence (MI). MI helps with providing a clearer picture of what the customers want and enables the company to adapt their operations and business models (Chari et al, 2017) which is the focus of this paper. This paper chooses to narrow down its focus on pricing decisions and the role of MI in it. Pricing authority can differ quite a lot in organizations. Submitting to the digital side provides real-time, ready to analyze market data to pricing managers. As for now, there is limited research based on pricing decisions in relation to MI or BI and current research shows that MI is still in its early stage compared to BI.

This paper will investigate to what extent MI can help with pricing decisions in the European market of Systemair Group. Part of the research will also touch upon competitive intelligence since this paper will also take into consideration the industry and competitors of Systemair group in the European market.

1.2 Problem Formulation

According to Mochtar and Arditi (2001), there are some of the limitations that come along with the market intelligence models, one of them being the causality of the system. Due to the system’s causality, relevant and important information could easily be missed or used in the wrong format, as it is time consuming and expensive, which might cause loss of valuable information. This is one reason why it is not implemented in all departments of the organization. Another possible reason could be that in order to have a competitive advantage, information needs to be gathered as quickly as possible from all kinds of sources such as news, market trends, sourcing companies, customers etc. If the information arrives later than expected or in the hands of a competitor, the advantages of such a system cannot be utilized to the best of its potential (Mochtar and Arditi, 2001).

Price is considered to be a sensitive topic and disclosing the pricing data to other human agents has been considered as unfavorable and unsecure in earlier research (Fu et al, 2017). Salesmen can have different skill-set and different requirements which might go against the organization’s long-term goals and relationships. Hence the salesmen’s skill set of negotiating price is termed as a complicated process which does not necessarily consider different organizational dimensions crucial to finding the right price for the company (Fu et al, 2017). This is where the importance of MI comes into picture. MI provides market data considering different organizational dimensions, giving the authority to pricing managers concerned with finding the right price based on the company's uniqueness/customization of product as well as customer demands and expectations.

1.3 About The Company

With its headquarters located in Skinnskatteberg Sweden, Systemair employs 6200 employees worldwide, 200 of which are located at HQ and has a turnover of SEK 8 billion. There are 155 subsidiaries in the Systemair AB corporate family and the company has its operations in more than 50 countries. The product range of Systemair consists of HVAC (Heating, Ventilation & Air Conditioning) systems. The company decided to keep the brand names of a few alliances that had a strong presence in a given market – for example Frico having its 80 years of expertise in air curtains and heating solutions, Fantech being a niche in residential ventilation in Americas and Menerga’s focus on swimming pools, mainly in the German market. More importantly, unlike any of its competitors, Systemair is in the full line of ventilation products starting from Air handling units (AHU), Residential and non-residential ventilation, air curtains, air distribution, air conditioning and fire safety, which makes it a market leader in the ventilation industry. (Systemair Annual report, 2019-2020)

As of now Systemair uses Qlicksense as their current BI tool for collecting and compiling market information and Infor M3 as their globally implemented Enterprise Resource Planning (ERP) system (see interviews).

1.4 Research Question

How does MI help in pricing decisions in the European market of Systemair Group?

1.5 Purpose

The purpose of this research is to investigate if Market Intelligence (MI) has any effect on pricing decisions within the European market in Systemair Group. Since the field of MI in pricing decisions is explorative, this study will conduct thorough interviews with the goal of getting a deep understanding of how MI can help with pricing decisions. This study also aims to contribute to the research in this subject.

2. LITERATURE REVIEW

2.1 Business Intelligence

Companies and organizations are becoming more aware of Business Intelligence (BI) as they try to make sense of the variety of data collected, both internally and externally (Işık et al, 2012). Ain et al (2019) state in their article that BI is commonly known as a suite of technological solutions that helps organizations to analyze big data and understand their strengths and weaknesses. BI can be defined as systems that combine; data gathering, data storage and knowledge management. BI is widely known and used as a decision making tool as it helps reduce uncertainty in the decision making process and is very similar to the definition of Decision Support Systems (DSSs) (Ain et al, 2019; Negash and Gray, 2008).

The term business intelligence was first used in 1989. Ever since, it has gone through a series of innovations resulting in what is commonly used today (Negash and Gray. 2008). One BI system combines several different tools, namely, data warehouse, online analytical processing (OLAP) and dashboards as seen in Figure 1. Data warehouse gathers scattered, accurate and numerous data from multiple sources for an in depth analysis. OLAP on the other hand, supports multidimensional analysis and gives companies the opportunity to apply operations such as aggregation and filtering for details such as customers, countries, regions. Dashboards are described as a server that presents companies with data visualization and performance management in the form of graphs, charts and tables (Ain et al, 2019).

Business intelligence gathers a lot of accurate data but also numerous data. Therefore dividing BI is necessary to maximize efficiency of different departments. Two subsets of BI are competitive intelligence (CI) and market intelligence (MI).

2.1.2 MI and CI - specific subsets of BI

Market intelligence is defined as the gathering of information from the market, which can be used to make effective change in the business structure. Market intelligence includes customer review, product prices, promotion, and many more factors (Popkova and Parakhina, 2018). Competitive Intelligence is defined as the gathering of information about competition. Competitive Intelligence includes the evaluation, analysis and presentation of the competitive environment of the industry that the business is taking place in (Maune, 2014).

Business intelligence has a broad focus on internal and external factors of an organization. Business intelligence mostly includes billing rates, headcounts, processes, etc. Business intelligence means collecting data of the organization to monitor the state and health of the organization in general (Lorentz et al, 2020). Thus, Market Intelligence and Competitive Intelligence are specific subsets of Business Intelligence.

2.1.3 Competitive Intelligence

According to Negash and Gray (2008), CI refers to monitoring of the competitive environment and as mentioned in Maune (2014), it is different from Market Intelligence in a way that market intelligence provides a “road map of current and future trends in customer’s needs and preferences - new markets and creative segmentation opportunities, and major shifts in marketing and distribution” while competitive intelligence is an “evaluation of competitive strategy - competitor’s structure, new product substitutes and new industry entrants''. Jamil, (2013) discusses the complementarities of these two Decision Support Processes. As the study showcased with the help of 16 companies in the Brazillian IT market, the complementarity of the processes does hold true with CI’s focus on strategic decision making and MI’s focus on strategic marketing decisions.

2.2 Market Intelligence

Market Intelligence refers to all the information that is appropriate for the market of the company. Such as competitors in the market, monitoring of customers, market trends, etc., which are summarized in one place and then analyzed. This process enables companies in proper decision-making (Gebhardt et al, 2019). Proper decision-making refers to accurate and confident decision-making in terms of determining strategies in different areas of the company like market development, short-term strategies, long-term strategies, and market opportunity.

Market Intelligence involves gathering up appropriate market information, which is found by using updated market- and competitive intelligence methods and tools (Thierer et al, 2017). Market Intelligence is a very crucial part of technological development for organizations. It helps companies gather data from external sources such as different websites and surveys. It also helps in studying the collected data, understanding what needs to be improved and making appropriate, more accurate decisions for the company (Jermsittiparsert et al, 2019).

Market intelligence is made up of different ways of collecting data. Data can be collected by undertaking surveys, questionnaires and observations of the marketplace. (Boselli et al, 2018). These primary sources of data collection were used in the past and are still used, but with additional technological upgrades.

Market intelligence can be defined as the data or the information of an organization derived from the market to determine the market segment, penetration and market opportunity (Carson et al, 2020). Market intelligence plays an important role in understanding the state of the market and it provides the organization with an idea of its competitors surrounding the market.

The use of market intelligence may differ according to the needs/requirements of people working in the organization, as the information gathered could be analyzed and visualized in various

ways-1. Data Collection

The first step is data collection. It is very important to collect the right data, which will be helpful for the organization to make plans. (Bisson and Tang Tong, 2018)

2. Analysis

After collecting the data, the next step is to analyze it. The analysis is an important step to understand what is happening around.

3. Visualization

After the analysis of the collected data, it is very important to visualize the data collected analyzed (Colace et al, 2019). According to the visualization of the collected data, the changes will be planned.

4. Execution

After the above mentioned three steps, the plans were made for the execution and changes to be made in the organization (Dignum, 2017). The execution step is where changes will be made.

2.3 Market Intelligence and Decision Making

Market intelligence is used by many medium and large scale organizations to enhance productivity for better investment plans. In addition, market intelligence supports increasing profit and generating better returns on investment. It has been noted that organizations have experienced an increase in sales growth as a result of implementing enterprise resource planning software or ERP systems within their business (Chen, 2010).

There are many ways in which Market Intelligence helps in making managerial decisions for different departments within the organization. In this section, a brief background on how business intelligence helps in making future decisions for different departments is discussed.

2.3.1 Sales decisions and marketing strategy

With the help of MI, companies are able to modify the sales trends, which depend on customers’ choices, preferences, the experience of shopping, interest in online shopping, habits of purchasing, and the reactions to promotions. When it comes to devising marketing strategies, the buying behavior of customers can easily be observed. The implementation of MI helps a company to take major decisions based on their promotions and campaigns. It helps keeping track of buying behaviour of the customer and gives a brief analysis of different trends, which

helps to predict future sales of the company and the understanding of upcoming opportunities in one or more product lines. (Katsikea et al, 2019)

2.3.2 Inventory management

Inventory Management is a process that is involved in supply chain management that concentrates on laying out the inventory or the non-category items. Making decisions on reducing the exorbitant inventory to control the cost of effectiveness, is one of the biggest benefits of using MI. It can help manage storage costs and highly effectivize the import and export of goods across warehouses (Işık et al, 2013).

2.3.3 Implementation of market intelligence in decision making

In any organization, the estimation, which includes market intelligence, is bound within the organizational parameters. The representation of the modules is taken under the consideration of the data analytics process. In terms of retail industries, the synchronization of the market intelligence technology has a huge scope to enhance themselves in the implementation process. For any kind of large business firm, the engagement of market intelligence is always a blessing for the higher authorities. This brings in the success factors of MI as discussed in Işık et al (2013).

In the section of the digital marketing department, the implementation of market intelligence has shown a great response for higher authorities. The decision-making process is taken under the consideration of organizational behaviour, which can be mitigated by using market intelligence. Accuracy is one of the most vital parts, which has to be taken under consideration to meet certain goals. Decision making also focuses on this type of criteria. Every employee has to concentrate on his or her own decisions, which can be very useful especially with the help of market intelligence. Every company has to extract the data from their supply chain, to maintain the balance in the organization. If any form of breach takes place in the organization, most commonly data loss, then it can result in a risk of uncertainty regarding validity of market data and competition knowledge (Su et al, 2004).

It is important to understand where the standing point of the company is. The incorporation of the technology, which includes market intelligence, is very vital and needs to be focused on, by the decision-makers of the organization. This type of system is the main key area for the higher authority of the organization to fix the issues arising in the context of breaching (data). This is like a platform generating software that can be modulated in any kind of situation. The authenticity of the software is one of the most important points, which is focused on by the technical team of the organization. Decision-making is also engaged in this type of technical issue. The cybersecurity department of the organization encapsulates synchronization of the vital facts regarding the decision-making process (Chen, 2010).

Simplification of the process is very vital to replicate the market intelligence in terms of decision-making scenarios. The decision-makers of the organization always try to fix the issues and always focus on the mitigation process. Business modification of certain terminologies is kept under the violation of the facts to run the organization. This type of process is very important to implement market intelligence technology.

2.4 Pricing

Pricing is part of every company and can have a large effect on revenues. Different types of organizations use different types of pricing strategies depending on the industry and location of the business. There are some major pricing strategies usually followed by organizations. Common pricing strategies are cost-based pricing, competition based pricing and customer based pricing (The 5 most common pricing strategies, 2021).

2.4.1 Cost-based pricing

Cost based pricing is when a company sets the price of an item depending on the cost of production. This is one of the most common forms of pricing strategies that organizations follow, as it allows a firm to be financially prudent (Simon et al, 2008). The prudential nature of this strategy lets the profit margin be directly in line with its products and services. Revenue, units and total costs are checked to be in line with profit objectives of the company. This helps justify the price level of a particular product or service (Urdan, 2005).

2.4.2 Competition based pricing

Competition based pricing is when a company examines the competitors prices with the intention to match the competition's pricing level. The company may choose to have a lower price compared to its competitors in order to attract more customers and compete for market share. However this might lead to pricing conflicts/price wars as it does not take into consideration the demand aspect of the market (Heil & Helsen, 2001).

2.4.3 Customer based pricing

The mark-up and margins follow the customers rather than the competitors (Schlinder, 2012). The strategy places the customer's perception of using the product/service and the benefits of using the product/service and weighs it with the price set. If the perception goes in line with the customer’s relationship with price of the product, then this is known as perceived value based pricing (Ingenbleek et al, 2010). Unlike other pricing strategies where the focus is directly towards increase in profitability, this form of strategy has its focus towards customer satisfaction and hence provides an indirect approach towards increase in profitability (Cressman, 2012). This is more of a modern form of pricing approach as also mentioned in Liozu. (2013) as it bases its focus on the customer’s perception.

2.5 Dynamic Pricing Model

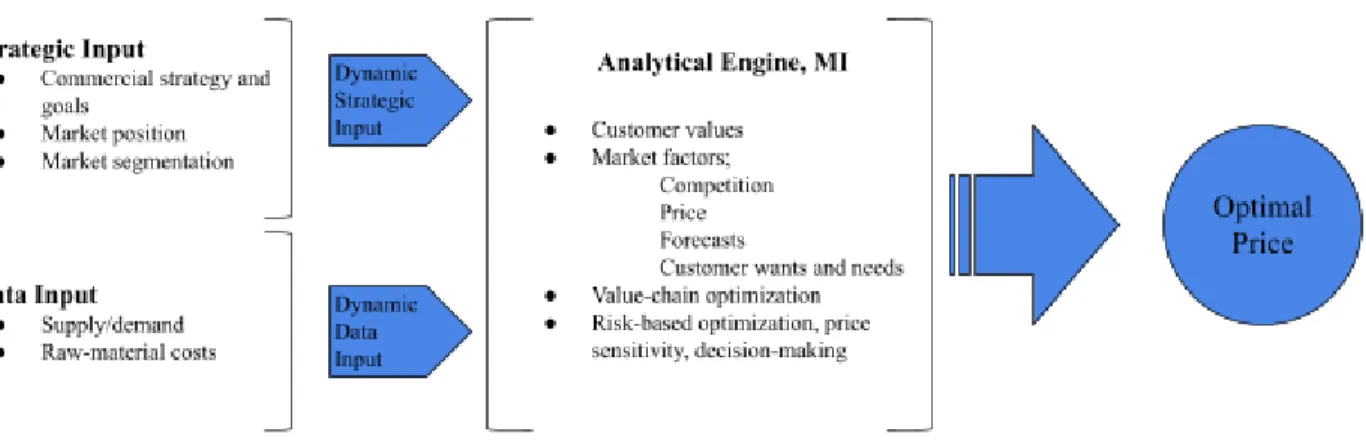

Often when managers set a price for an item, they use one of the above mentioned strategies. However, there is another model called the dynamic pricing model. Dynamic pricing uses different digital and advanced analytical tools to adapt a price, see figure 3 (Bages-Amat et al, 2019). This model can be particularly helpful when the business environment is changing, i.e more companies are submitting to the digital idea or during a pandemic such as COVID-19. The current pandemic has affected some businesses harder than others and their pricing decision data has gone through a hard reset. Thereby, market based decisions on pricing has become an unstable factor (Columbus, 2020). The dynamic pricing model implements the digital side and the strategic side when setting a price. The digital side (data input) includes; supply/demand, capacity utilization and raw material costs. The strategic side includes; commercial strategy and

goals, market position and market segmentation. The dynamic pricing model puts both sides together for an advanced analysis, thereafter providing an

ompital price (Bages-Amat et al, 2019; Columbus, 2020).

Figure 3 - Dynamic pricing model. Made by authors, inspired by (Bages-Amat, et.al 2019) The dynamic pricing model shares a lot of similarities to the pricing aspect of MI in the sense that it combines market data (data input) and strategic input.

2.5.1 Strategic input

According to earlier research based on markets in supply management literature such as (Handfield, 2006), Supply Market Intelligence (SMI) (Lorentz et al, 2020) has been deemed as a central element in gaining valuable knowledge about supply markets. The concept takes into account the task equivocality and Information Processing theory (IPT) (Galbraith, 1974 & 1977; Tushman and Nadler, 1978) to know the amount of information needed to measure where the market is positioned and segmented and where it is expected to head in the future. The Information Processing Theory takes a contingency approach towards organizational research (Morrow, 1981).

2.5.2 Data input

One of the many common SMIs that is taken into consideration in order to gather information about raw materials is price dynamics (Lorentz et al, 2020). Dynamic pricing can be traced back to the article by Arnoud V. den Boer (2015), in which the author states the various types of dependencies of dynamic demand over price derivatives. One of the things that can be noticed is the time derivative of price acting as a function with respect to current supply and current price

which ends up controlling current demand but also future demand. Hence, it showcases demand as a time derivative function of price.

The pricing model seen in figure 3 is a framework from the chemical industry perspective. However, it is still applicable in other cases such as companies struggling during the COVID-19 pandemic (Columbus, 2020).

Pricing of a product can be done using several tools ranging from the traditional major strategies to using different technologies like BI or MI. The dynamic pricing model combines data and strategy in the price. Figure 3 shows how data input from 2 different ends are combined to make an optimal price. This research will use figure 3 as a theoretical framework to look at the research question. Figure 3 may change depending on the data gained from the interviews but will still be used as a scope for this study.

3. METHODOLOGY

3.1 Research Design

For the purpose of data collection in this paper, the method followed in this research is of qualitative nature. A qualitative approach was chosen for this study as it aims to gain a deeper understanding of how MI helps with pricing. This research will be a case study research on Systemair. Systemair Group is a great case company for this research as they have started to implement MI in some of their systems and are looking to make it more standardized. Therefore Systemair fits the research purpose as they want to expand their use of MI, partly in pricing. Primary data will be based solely on interviews from different departments of Systemair. The interviewees were selected because they work with MI and pricing. The majority of the interviewees implement MI into their day to day activities. Hence, the relevance of these interviewees were crucial for the purpose of making the interviews reliable, with respect to the research question.

3.2 Data Collection

The company Systemair was specifically selected due to the relevance of the research combined with the access of primary data collection.

The primary data of this study is based on five interviews. The primary data was collected through online interviews conducted via Microsoft Teams and not face-to-face due to the current pandemic COVID-19. The interviews were held during a two week period. Each interview was held for approximately forty-five minutes each.

The data used in the literature review of this study was mostly obtained from scientific articles and other literature. It was found using tools such as Google Scholar and other official databases provided by the school library of Mälardalens University. Information about the case company was gained through an internship prior to the writing of the thesis and through Systemair’s official website.

3.3 Research approach

There are two forms of approaches in research methodology literature , depending on the method used (Bryman and Bell, 2005). For reaching a conclusion of a hypothesis, the approach is generally deductive (broad theory deduced to a single conclusion). For creation of a new theory, the approach is generally inductive (a specific theory broadens the generalization of a conclusion). As discussed above, the research for this paper follows a qualitative study and the approach that is used in this paper can further be specified as an inductive approach.

The research will be a combination of Thematic Analysis as Saunders et al (2016) also suggests how systematizing patterns works perfectly well with the help of “coding”. Coding did not just help in making sense of large qualitative data sets such as the interviews, but also linking these data sets together to categorize themes and form relationships. (Saunders et al, 2016 pp. 582). (see appendix)

3.4 Interviews with employees of Systemair

The interviews conducted were semi-structured. While the interviewee could speak freely and openly, the conversation followed the questions made by the authors. The semi-structured interviews enabled a free conversation and follow-up questions that added to the results. The interview questions were sent out to the candidates prior to the interview in order to give them preparation time and an expectation of what would be discussed.

The same interview questions were asked to all interviewees. The authors were prepared for different answers from different respondents depending on the departments they work in.

All the interviewees are Europe based and answered the questions from a European point of view. Therefore this study is strictly limited to the European market as the research question states.

3.4.1 Introduction of the employees

Table 1Name Experience (years) Position Based In

Taina Horgan 30+ Vice President

Business Development

Sweden

Sofia Jansson 20+ Logistics Director Sweden

Arkadiusz (Arek) Augustyniak 17+ Business Development Director Poland

Elke Rehmet 35+ Export Director Germany

Olle Glassel 20+ Vice President of

Sales Sweden

Table 1 shows the interviewees’, their work experience and position in Systemair. The interviews were conducted in the order of the table. More about the interviewees and their work experiences can be found in chapter 4, Empirical Findings

3.5 Operationalization

Operationalization concerns how the research is measured, what steps are taken and how they answer the research question (Saunders et al, 2016 pp. 46). The questions used were based on the knowledge attained in chapter 2 Literature Review. The questions were specifically designed to not be too complicated and knowledge based in order to be answered with ease by the interviewees.

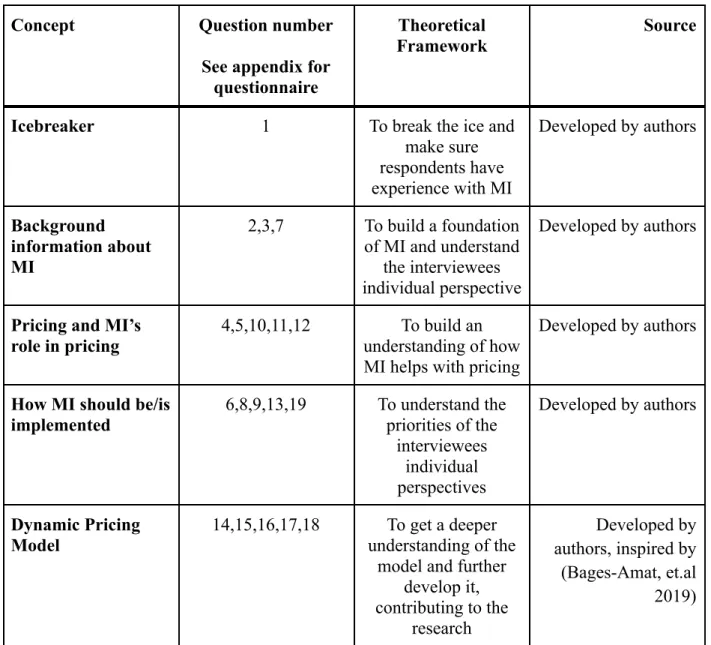

The 20 interview questions were divided into the four following parts; background information about MI, pricing and MI’s role in pricing, how MI should be implemented and the dynamic prcingin model. The questions were asked in no particular order to keep the interviewees open minded and give them freedom in how to answer or approach the questions.

Table 2. Operationalization for interviews

Concept Question number See appendix for

questionnaire

Theoretical Framework

Source

Icebreaker 1 To break the ice and make sure respondents have experience with MI Developed by authors Background information about MI 2,3,7 To build a foundation of MI and understand the interviewees individual perspective Developed by authors

Pricing and MI’s role in pricing

4,5,10,11,12 To build an understanding of how MI helps with pricing

Developed by authors

How MI should be/is implemented 6,8,9,13,19 To understand the priorities of the interviewees individual perspectives Developed by authors Dynamic Pricing Model 14,15,16,17,18 To get a deeper understanding of the

model and further develop it, contributing to the research Developed by authors, inspired by (Bages-Amat, et.al 2019)

3.6 Reliability and Validity

3.6.1 Reliability

According to Saunders et al (2016), reliability refers to replication and consistency. If a researcher is able to recreate an earlier research design and achieve the same findings, that research would be considered reliable. The authors of this paper can not ensure that a similar

research can be replicated does exist, however the authors cannot guarantee that a similar approach would yield the same results, depending on different factors such as different experiences of interviewees and personal opinions on the topic. The research was also conducted in a qualitative manner which adds the uncertainty that a similar study would show the same results.

3.6.2 Validity

Validity in research generally concerns whether the appropriate measures are used to answer the intended research question, the accuracy of the analysis and the results and what the findings represent (Saunders et al, 2016)

To maximize the validity of this paper, the authors spent a lot of time gaining knowledge about the subject area. The authors then used the knowledge learned to form a literature review and a theoretical framework as a scope.

The questions were open minded giving the respondents a choice of how to approach the question. Even though the questions were open, they were specified to a degree to cover and attain the required data to form a valid study and answer the research question. The interview questions were “pilot tested” by a researcher who is also the supervisor of this paper Ali Farashah, and an employee of Systemair with moderate knowledge in the field of MI. The questions were modified after the pilot test to better fit the interviewees, research and strengthen the validity.

To ensure maximum validity, the interviews were recorded and listened to only by the authors. Notes were also taken during the interviews in order to easier interpret the contents of the interviews as well as asking follow-up questions. When conducting interviews with representatives of a company, there are some factors that can affect the validity. Namely, secrecy or maintaining a good public face of the company. Even though authors of this paper and interviewees are multilingual, the interviews were held in English to minimize confusion or misunderstanding.

4. EMPIRICAL FINDINGS

4.1 Interview 1 - Taina Horgan (Pilot Interviewee)

Taina Horgan (Vice President Of Business Development, Systemair AB), Ms. Horgan has been operating as a sales manager in the construction business for the last thirty years. She has been the chief sales officer in Systemair Sweden and hence she has been involved with pricing strategies. Part of the pricing strategies includes the implementation of MI into day-to-day sales processes in regards to a wide range of products.

Ms. Horgan is a pilot interviewee, which means that the interview’s approach would be exploratory in nature in order to set a base for further interviews.

When Ms. Horgan was asked if Sales and MI are connected, the answer was an obvious yes. “There are multiple things to consider, one must consider the cost and the landed price/cost (when you export to other markets) market price and what competitors there are and how active they are in the market.”

For Ms. Horgan, the meaning of MI is to get as familiar with the market as possible, not just for existing markets and products but also new ones. “It is about knowing your market, knowing the market where you are operating, all the way from the end-user who is using your product. What applications are they going to be in? What solutions are available in the market, what is the price level in the market. What are they doing with it? We have been in contact with MI from day one. It has to be implemented a lot to gather information about the market. It's not only used nowadays, there is a bigger need now since we are selling into so many markets. It is important to know what is happening. Important to know how big the market is, the potential, size and customer structure. Not only when going into a new market but also when launching a new product.”

When Ms. Horgan was asked how she would use MI if she had access to all the information in the company, she said the following. “MI would be used in the strategy to know where to go and where not to go. Let's say there is a product in a market and there is a new product where you can clearly see that the market will be dead in three years, then maybe that market chase is not the best choice to go ahead with. Good to know the market and have a good portfolio and know

Ms. Horgan also describes how using MI to its full potential makes a big difference in pricing. “MI does make a huge difference in deciding if you are going to enter a market or not. It can save money to know if you are going to enter the market or not. Knowing the market price is important, are you a high price or a middle price or a low price actor? If they’re in a high place in the market and suddenly enter a market with a low price, then that might set up a bad rep. You have to be in the right price segment, Systemair is in the upper-medium level.”

The interview further investigated what Ms. Horgan’s opinion on pricing was. She mentioned it depends on cost, as that was the first thing that came to her mind. She mentioned“There are 3 types of costs in production - In source, Own Manufactured or Services. Then of course we have standard cost and landed cost which is the cost of moving the product from the production site to the dissolution center to the country you’re selling into. Then of course we have the market price to follow, which means the local price level of the market and that varies from market to market.”

Then the question about the current pricing strategy of Systemair arose and Ms. Horgan was given 3 options to choose from - Cost based, Customer based or Competition based, based on major pricing strategies. She said that it depends on the product. She said “If you look at our products, there are 2 type of products, one is a basic product model in which you just sell a product in a box. In this type of selling, it mainly depends on the availability of the product. Depending on the availability of the product, we can charge a higher price to the customer. The other type is project-based in which we combine a lot of products and this part is more leaning towards competitive-based. If you look at our business traditionally, we started from manufacturing and we were cost-based but now cost-based is something that companies are moving away from. You really try to look at the market price” Ms. Horgan was further asked some questions about why this cost based way of viewing the market was not the best choice and why multinational companies such as Systemair are moving from cost-based to market-based to which she exemplified her statement with an example of Apple. “If you look at Apple, they charge the same rate for their phones irrespective of which country the phone is produced in. For example if they sell a phone for €8000 in Spain, it doesn't make sense for them to sell it for €800 in China just because it is manufactured there. This way they have more margin. They make more money.”

When Ms. Horgan was asked if figure 3, the dynamic pricing model had significant relevance to the discussion, she answered the following: “The model is strong in some areas and needs improvements in others.” When asked which areas need improvement her reply was risk-based optimisation and price sensitivity. She said, “At the moment, we have a global crisis of raw material availability in the world which is a big problem, as it means that the cost of raw materials are going up very fast. For example, there is a lack of electrical/electronic products because some places shut down their factories during this period of Covid. When there is a lack of products, the prices go up. All the industries suffered due to this, especially the construction industry in which we operate and the car industry. I think Volvo and Volkswagen closed for a week because they didn't have access to sufficient electrical products.”

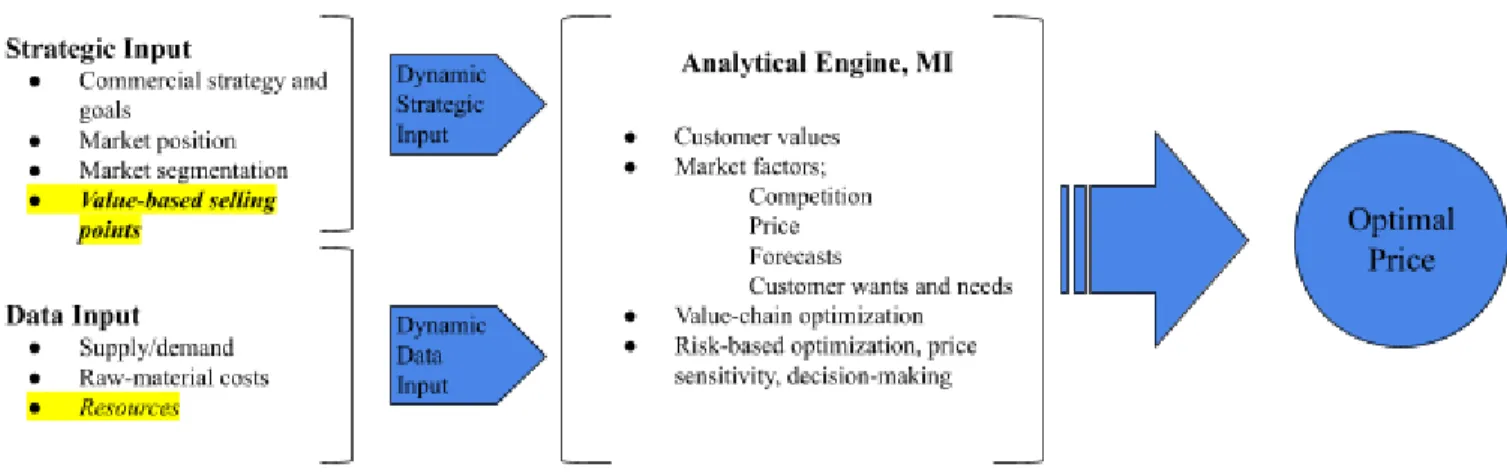

The questions were then directed towards optimal price and this was her take on it. “Optimal price has not yet been reached and can be improved.” When asked how it could be improved, or with the help of what, her reply was “Using MI for Regional pricing. They are still working on different solutions, but this is the main area. MI is mostly needed in the local market for market evaluation.” When asked if she would like to add some more bullet points to the model, her reply was, “Market segmentation is very broad so I would like to add product segmentations. For example in HVAC, we have air conditioning and heating, we segment that and from that we break it down again into further segments. So the product needs to be on the strategic input. But apart from products, I think applications should also be on the strategic input as we offer that too. As you know IT and AI is getting more and more important and this is also happening in buildings where we are delivering our products so we’re not delivering a product anymore, we are delivering a system.”

When asked if the model is too optimistic or realistic, Ms. Horgan said “Most companies have some kind of tool like this. Maybe not exactly the same but they start from the Optimal Price and move backwards. We need a profit and need margins which is the main point. If you are entering a market and there is a similar competitor then you should analyze them to know more about them. Then undercut them with lower prices, like LIDL does with Ica. Or you add more tech to it and increase the price, for e.g. Apple and Samsung. There are different strategies depending on how you want to enter the market. Systemair normally takes competitors into consideration when

they enter the market. Therefore MI is important when deciding on price. Market size is very important, if there is no need on the market then why even be there.”

When asked about advantages and disadvantages of using this dynamic pricing model in all parts of Systemair, Ms. Horgan said “The disadvantage is sometimes you don't have market info available. If you don't know the market and the competitor then you are just guessing. You need market info and not just a guess. If it is a new product in the market and you only look at data input it can be risky. You need to look at the market price and your own costs so that you don't go too high, which can be a challenge. Dynamic pricing model does not necessarily apply to the solution side of systemair. For example, in certain product areas of Systemair that are different in nature like - solutions to hospitals, data centers, tunnel and metro and so on. It depends and the model is a little bit different for pricing of those types of projects. There are other models that fit together with this. If you put a lot of products in a package then you don't look at the prices of every product individually, you look at the package price. You need the strategic input and the data input and analyse it to see if there is a project. You need both inputs to determine what is best and do a risk analysis. You’re investing a lot of money. Its basically there to save time for colleagues you know, for e.g. an engineer should not spend time on finding out how big the market is in Europe or North America or Asia. They should find it very easy to find relevant info so they can focus on what they are supposed to do. That's where the real advantage of using this model is.

4.2 Interview 2 - Sofia Jansson

Ms. Jansson has worked in Systemair for twenty years. She has been working as a Logistics Director in the headquarters for Systemair companies. She started with sales exports and went over to purchase. She has been working with M3 implementations in different countries in Systemair. For the past seven years she has worked solely with logistics, which includes master data management.

“In Systemair we have a pricing council, where we have our MADS (Market Area Directors), our product area directors, we have the sales managers for the group. It’s a big team of group members who are handling the pricing. Both internally and externally.” Ms. Jansson mentioned “with MI we change focus from cost-based pricing to more market based pricing. You can achieve more in different markets. You should not have the same price around the world. You should have the price that the customer is willing to pay.” Ms. Jansson mentions that the pricing council discusses competitors and what competitors want to pay. She also adds that customer demand is important and that factors like COVID-19 pushes prices.

If Ms. Jansson had access to all MI information; she would use it to see where Systemair stands in the market in terms of pricing, she would also use MI to see the demand of different products. Ms Jansson would also consider the competitors, to see what the customers expect out of them and what delivery times the competitors have. Ms. Jansson mentioned that she would prioritize the competitors if she had access to all market information. In doing so, she would learn everything about them and would be able to place Systemair in the perfect market position. Ms. Jansson says that the dynamic pricing model is not too different from the one they use in Systemair. “I can definitely recognize everything from our pricing council, everything that you have marked here is something we are discussing.”

During the interview, Ms. Jansson said that MI needs a better approach. “It’s not set so everybody is doing it the same way.. It’s too much information to collect and we don’t have the tools to have it in a good way.”.

Ms. Jansson highlights how much easier MI has gotten. “Before you had to pull out all data from the system, you had to prepare an excel file and that would take weeks. Now you can just open

and everybody is checking the same figures… It’s more safe, we know that everyone is seeing their own products but it is calculated in the same way… It’s both quicker and safer.” Ms. Jansson says that she does not have access to all information, she only sees the MI data that she is responsible for. The same goes for the whole organization. She does not believe that everyone should have access to all information. “It's better to focus on your area. In the Systemair group we have 9 different business areas, and some things are not even connected or comparable… Of course you should have access to everything you are involved in.”.

According to Ms. Jansson, the dynamic pricing model is realistic. “It’s a matter of finding the information… Everybody is presenting in different ways.” She would not like to change the model or the models input, however she thinks it is important to consider factors that can affect the model, such as COVID-19.

Ms. Jansson does not believe the optimal price is reached. She says there are a lot of moving parts in the sales division. She adds that there is data missing from the competitors and customers, “time and structure, having the data and analyzing the data is what we are missing… I would like to see something so we are comparing apples to apples.. A tool that compares in the same way, we are not there yet.”

4.3 Interview 3 - Arkadiusz Augustyniak

Mr. Augustyniak has been with systemair since 2004. Mr. Augustyniak started working in the logistics department, and gradually moved to the position of MD in Poland. As of now Mr. Augustyniak is working as MD. For the last five years he has been working with the group as a business development director for twelve countries and fifteen companies within Systemair. Mr. Augustyniak is familiar with MI and has been working with MI for quite some time, to collect and analyse data for taking strategic decisions although he says that earlier it was not called MI, it was just called collecting information “At that time when we started using this, we did not call it as market intelligence, it was more that we were trying to collect as much information as we could from the market and based on this, create some kind of strategy for taking decisions and now of course we know the abbreviation MI as an explanation to the decisions/direction that we would like to take as a company, in a particular set of countries.” MR Augustyniak thinks MI is gaining popularity recently because of the transformations in the market “Well, I think this is somehow correlated with the transformations of the market. If I can focus on HVAC, but I think it would be the case for other industries as well, we have access to a lot of information right now so we need to somehow understand them and put them in the right boxes and use them in the proper way, so this market intelligence approach gives us guidelines, it gives us better picture and understanding for the collected information, so I think this is why it has become so popular. 21st century and also now with the Covid times, with all these pandemic problems and uncertainty, taking the right decision and not just any decision is what matters.” When asked about the usefulness of MI in pricing Mr. Augustyniak said “In 2017, we were more or less independent of the country, to decide about the price policy, but now we’re trying to keep it on a bit more global scale and leading by the headquarter in Sweden. We want to shift from the company who was basing its price as cost-plus to be more accurate for price levels of different markets now. Different products mean different positions in different markets. If you look for e.g. at Kfans, our first product or the main product that we invented in Systemair, the cost of this product in Sweden will mean something totally different than in Romania or Poland for e.g., for the customer” Mr. Augustyniak said“We would like to be a more customer-driven company and

respect to market position“MI gives a lot of info about competition and customer expectation and market development, when you gather all this information, you can position yourself better than others and get an advantage over others, if utilized correctly. So I would say it provides a strong base when deciding on pricing levels for any company, not only for us but for other companies as well.”

Mr Augustyniak mentioned that MI is implemented to compete in the market, but would like to see it’s benefits in other areas as well, such as in product development and structure development. “When you collect information from the market about trends, then you know where product development should be directed. And when you look at the structure, you know where to put more resources, in order to compete with market expectations. So, at least in my opinion, it should be utilized for a better understanding of the market, more than just pricing. But of course pricing is just one of the things to start with.” When asked how using MI is beneficial as compared to the old ways of collecting market information Mr. Augustyniak mentioned “It depends on what tools we have been using. If I compare it to the years, say 2007-2010, with what we have now. We have a strongly operating CRM system on a global scale. We have a very strongly implemented M3, which is a global ERP system for almost all our companies, then of course it's a huge difference. You can work with them on different levels, not only MD or management level but also on the more local scale in the markets or regions so, it's a pretty good shift I would say.” When asked what problems Systemair faced in 2007-10 when they were using a different CRM system or different kinds of tools for data management, Mr. Augustyniak mentioned “Yes, we were quite decentralized as an organization, so at that time all the countries were not standalone, but there was a lot of freedom of taking decisions and at the time, they used different tools and different CRM systems, even different operating systems. So to change all of that from many to one, in such a big organization, it always brought more problems with itself. Firstly you need to deal with people. The companies and the people, they resist change. That’s quite a human being approach. So you have to convince them. It takes time. Then you need to deal with system errors. At the beginning these global systems are not perfect. You need to adapt them to your own needs. It takes so much time and resources, so yes that was quite difficult in the beginning. More than that, getting over it and showing the benefits of using this was the most difficult part. So I would say that it is still a journey. It is still transitioning. We are not done yet. There are still many challenges we need to deal with. There are still many changes that are

required that we see ahead of us.” When asked how Mr. Augustyniak would use MI best if he had access to all information he said “Well, if I have to use it best, I would say I would use it to really define market positioning in a single country. Because we are now saying that we can now split Europe in a different part. But in my opinion, we have to go even deeper with the split because every single country has a different expectation from the suppliers, so we have to dig in even more. If I have access to all the data, I would utilize it on a local level, not just on an EU level but on a more regional level.”

When Mr. Augustyniak was asked which factor (customer demands, competitors, costs or margin) comes to mind when he wants to put a price on his product, he replied, “All of them. There is really no priority we can give to either one to set a price on our product. Why? Well, because we can create the best product ever but it might be too expensive for the customer. They will not see the benefits in this to pay extra. Somewhere at the end we will face the customer demands. We have to really take a wide approach and see it from every angle. To take the right decision, how to set up the price.”

When asked if the strategic shift of pricing from cost-based to market-based approach in Systemair is something that Mr. Augustyniak agrees with, he mentioned, “Yes, I think it was a group decision taken 4 years ago to shift from cost-plus to more market-oriented pricing. And as I also mentioned before, it takes time. Because it’s easy to have a price list and add the expected gross margin and then release the price list. But to set up the price correctly, let's say on the market level, the first thing for any single subsidiary is to get their homework done correctly. So get the information right. What is the expected market price value? What is behind this value? So, in some countries, they are already doing this, some not, some of them are half way.”

When Mr. Augustyniak was asked how he would like MI to be fully implemented in Systemair, he mentioned “Well, if I dream about this, I would like to have a platform where I can dig in all this information for all these countries and also work on this. We want to have the same function in all countries, the same points, the same style, the same form of viewing trends. For such an adjective, an MI system would be good to have to see if we make the right decisions or not.” When asked if Qliksense was doing the job, Mr. Augustyniak said “It is trying but Qliksense is not released completely yet. We are still working on it but definitely that would be the platform

When asked about his opinion on the dynamic pricing model, Mr. Augustyniak said “Yes, I think its like a school book for us, I would say.” However, one thing Mr. Augustyniak thought was missing in the model was value based selling points. “Ok, you have value chain optimization but you don't have value based selling points. It should be there somewhere because you can have a different price level, but you still need to explain to the customer the value which is behind the price. So I would say it should be attached somewhere in this model” Overall, Mr. Augustyniak finds the model very convincing. So when asked the question if he finds the model optimistic/realistic or that he has been using a similar kind of model in Systemair, he said “Yeah, I have found similar models in my studies but, I wouldn't call it optimistic. I would call it optimal for us to use, especially if we can have this value based selling points, then the question is of course if the organization is ready to follow this. Here we have to take into consideration not only the willingness but also the resources for that.” When asked where he would like to position this value based selling points in the model, he said “I think I would add the value based selling points in the strategic input. In my opinion, this is something we should know. What value is created for the customer from our product? And that should be in the strategic input before we set up any prices.”

4.4 Interview 4 - Elke Rehmet

Elke Rehmet has worked in the fan business of Systemair Germany for 35+ years. She has always worked in the exports division and is currently an export manager. Ms. Rehmet deals with a great deal of additional tasks including pricing, both internal and external.

Ms. Rehmet has worked with MI and is familiar with the subject. She says it is not only needed for pricing, “You need to know about the sales, about the competitors, the benefits they have against us. Know their product, the main players and the economic situation of the market”. Ms. Rehmet mentions that MI is gaining popularity because it makes many processes easier. “First of all, nowadays it's much easier with the internet. Much easier to find out about competitors and their prices, everything is much more transparent.” She adds by saying that globalization also affects this. “Working in exports and selling outside your home country was exotic in the olden days. Today almost every medium sized company has an export department and sells outside. If you don’t have market intelligence, you can do things like trial and error, but that can be costly. You can be completely out of expectations of the market and the customers, either too high or even too low. Too low is also bad. You would probably sell but you would also give away money. You would lose the margin.”

Ms. Rehmet agrees that MI definitely plays a central role in pricing but also exemplifies the challenges associated with getting the right information, “Market Intelligence is of course very useful, the challenge is how to get it. It's easier to get more info now because the world is more connected. If I want to know something about the competitors, I can just browse their website. Before it was so difficult. You had to organize a printed catalogue, you never knew if it was the latest version that you got, but now the world is much more open.”

The interview dived a little deeper into the trustworthiness of collecting information from the internet and Ms. Rehmet mentioned the following “Of course, we have to dig much deeper into finding the right price. What you get or what you normally get from the price list, is the gross price level. You never get the net prices. And then you also have to know from each market what the normal discount each industry is working with. And this is something you need to know and you can get instantly. Discount levels can be totally different. That is also a mentality thing if I

net price is not so important anymore. The higher the discount, the more interesting it sounds but that’s not true everywhere. So what you need to know is the gross price and the market. Are they working with 50% on an average or 60% or 20% and from that you get the general feeling of the market price level of your product or a similar type of product.”

When asked about MI’s role in pricing, she said that cost-based is the worst thing one can do. “Cost-based is the worst thing you can do because your customers never know your costs. Customers always expect that you earn a lot of money without knowing what work went behind it. So forget costs” She adds that the major pricing strategy used is ultimately competition based rather than customer based. “In the end, it's more competition focused. It depends on what is available on the market at what price level. Then you compare with 2 or 3 biggest players on the market. Don't just take any company’s prices into consideration if they have no market share. They are not important. So when you try to figure out what the market price level is, always check the first 2 or 3 most important competitors in your range of products and then you have to know are they all working with the same discount structure. In most cases it is similar in one country. Many customers look at the quote and the discount they are getting. You know the higher the discount, the happier the customer.”

Ms. Rehmet highlights that MI needs a better approach in Systemair. “If you don’t really know the market, you can be either too cheap or too expensive and both have negative effects. Collecting the MI data in a big company like systemair is a challenge. There are a lot of moving divisions.” Ms. Rehmet would like a central platform with all MI data where finding information would be much easier. “We have a challenge because we are working in 50 countries all over the world. That’s a challenge. Finding ways of how to collect it centrally and then when we talk about internal transfer pricing- what do our own subsidiaries pay for the product in Australia, in India, in Chile, in Germany. For that you definitely need market intelligence.”

When Ms. Rehmet was asked if she would like a more centralized market intelligence database for pricing she said “Yeah, definitely, there are softwares for pricing and so on, I know but I never looked into detail how useful such a tool would be, but yeah, a lot of info has to go into such a system for making it central.” Then she mentioned about the softwares that she uses daily and how helpful it would be to link them together “You can always make things better. Just the idea of having things centrally where you share these things will be really helpful. We have a central platform, a CRM system. But there is not so much info about market intelligence inside.

And it also differs among countries. Not everyone is using it to the same extent and for the same purpose. We also have a commonly shared ERP system M3. The good thing is that all 50 countries are using the same ERP system for daily work and that is very helpful. So the management can view those things anytime, anywhere in the M3 system. Then there are statistical BI tools such as Qlickview or Qlicksense. So it's all there but it can be improved much more.”

When shown the dynamic pricing model and asked about the relevance of the model to the discussion, Ms. Rehmet mentioned “It's a good model but can only be applied for one market at a time. For e.g. if I have to find the price level for the german market for the next year. For one market, this can be applied, but how to handle it when you have transfer prices for all countries all over the world, from one source? Then I guess this model would not work. You can't have a price list for all the different markets that originate from one source. Even region-wise, let's say Europe, but you can still not define a common price level for Europe, or you cannot define Europe as one common price area. Because even within Europe, there is such a big difference if you look at Scandinavia, West Europe and East Europe, prices differ a lot and so do the competitors. I mean how do you compare competitors from other regions with a different currency?”, Ms. Rehmet argues against fixed prices.

Ms. Remhet believes that the optimal price is not yet reached. “We have to work with price incompetence. There are too many thoughts about costs. The best outcome of a price list is someone making a price list without looking at the costs, trusting the market intelligence. If you are not competitive with your product then you need to go back and do your homework, you have to make it more competitive.” She mentioned that cost-based is the worst and that a clear target is needed. That target should come from MI. She exemplifies why cost based is the worst, with a hypothetical situation “Suppose if you know, my product is sold in this market, for 100 EUR, and I put 100 EUR in my price list. And after that, when everything is done and finished, you look at the cost, and you see my cost is only 20. Very good! But if you would have seen my cost before, maybe you would have put 50 EUR in the price list. So that's why cost-based is never a good tool to use in pricing.”

When asked if Systemair uses a similar model Ms. Rehmet mentioned “We have strategic input, we also have a clear strategy on how we position ourselves in the market. Costing is transparent,

customer values. We must know how products are changing, legal factors and technological advancements. You have to update and modernize components in the product, preparation and added value for the product, but there is also risk associated with it.”

Ms. Rehmet places Systemair in the upper middle price segment. “We are definitely in the upper middle segment of the pyramid. We don’t want to move towards the middle because it is very challenging. When you are in the middle, you are compared to both the bottom and the top. You can be too expensive for the bottom and not fancy enough for the top”. She adds that “the middle or upper segment of price is not the same in different countries, 100 euros can be considered competitive or cheap in one country but not the other. I don't think it is needed to generalize the price level. I think the process of collecting information has to be centralized. So for e.g. if I want to look into Greece, then I can see what is happening today in Greece, based on the market info provided.”

When asked about the various advantages/disadvantages that the model has to offer, Ms. Rehmet said “As I also mentioned before, the disadvantage is that you can only apply it for one market. I don't think it would work for our internal pricing. For one country or for one market, yes it would work very well.

4. 5 Interview 5 - Olle Glassel

Olle Glassel is currently the Vice President of sales and marketing in Systemair Sweden. He has worked in Systemair for 20+ years and has a technical background. He has worked with business development for the last 9 years.

Olle is familiar with market intelligence, he mentioned that Systemair struggles with “picking up market info”. He adds “where we are coming from, it has not been our strength to pick up input from the market when we are building our strategy. We have said for quite many years that we don't really need to know that much about competition in the market. Now however, there is more competition and we need to know more about the market.” He also mentions that their MI data collection needs improvements “this is a huge challenge because we are a big company all over the world with different markets, its a scattered picture. We need to work hard to get it in a format where we can utilize it.”

When asked why MI has gained a lot of popularity, Mr. Glassel said “from a sales perspective, it's not good enough anymore just to provide the customer with the solution that they need, we also need to understand how they can grow their business… You really need to know the larger environment… In short, the competition and the speed of development is the reason”.

Mr. Glassel mentions that MI is implemented in Systemair and focuses on competing and gaining market shares. “Where we are right now, it's to compete in the market and gain market share. But it is important to work with value based selling points, to have the right price for the right value... We should protect our prices more than we do, to do that we need info around us which we get from MI.”

Mr. Glassel mentions that there is so much data available and highlights the importance of having it in the right format. “It is extremely important to have the data in the right format so we can make value of it and focus on doing business rather than translating data.”

According to Mr. Glassel, the biggest challenge and drawback of using MI is maintenance. “Maintenance! To keep it maintained and keep it fresh (have it in real time). Mostly today we keep it manual... We have different tools today for the BI but we don't have much market data