Master Thesis WITHIN: Marketing NUMBER OF CREDITS: 15

PROGRAMME OF STUDY: International marketing AUTHOR: Nabeel Javeed Butt & Nayyab Ahmad Tutor: Jalal Ahamaed

JÖNKÖPING December 2020

Firm heterogeneity and its effects on

Firm performance:

A study of Pakistani importing firm’s

performance

Title: Firms’ Heterogeneity and Its Effects on Firm’s Performance Authors: Nabeel Javeed Butt and Nayyab Ahmad

Tutor: Jalal Ahamed Date: 2020-11-20

Key terms: Importing Firms, Firm Heterogeneity, Firm Performance, Importing Firms in Pakistan

Background: Research on the firm's heterogeneity is a well-developed concept in the export context; literature can found in the export context. Previous research can found on firm heterogeneity and firm performance, but they are in export context. On the other hand, importing firms' heterogeneity is less sought in the literature, which we believe as a clear gap in the export-import research stream. Limited research has done in the context of importing firms.

Purpose: The purpose of our thesis is to explore the different forms of heterogeneities that Pakistani importing firms' practices are gaining a competitive advantage. Furthermore, our goal is to examine the extent of heterogeneity dimensions to what contributes to their performances. There is a significant gap in the research field of import. As there is less research in the import context, this will be a fundamental goal of research towards firms' heterogeneity and the importance of a country.

Method: We are using a qualitative research process followed with an exploratory research design. The methodology which used called thematic analysis. The thematic analysis method is a research method used to generate themes from the conducted interview. Themes developed based on code. Several codes generated to finalize the themes that helped us to build the framework of our study.

Conclusion: we developed a firm heterogeneity model based on four dimensions, i.e. price, production, technology and innovation. We have shown how these dimensions are inter-related to each other, which results in firm heterogeneity and performance.

Thesis writing at the master’s level is quite tricky. The journey becomes joyful when you have generous support from your supervisor. Our supervisor for Master thesis is Mr Jalal Ahmed. We want to express our honest gratitude to our supervisor and mentor Prof. Jalal Ahamed for his continuous support, patience, time, motivation, encouragement, and immense knowledge. His guidance helped us in a long process of writing a thesis. His detailed and in-depth feedback enabled us to dig deep to find something knowledgeable in our thesis. We are grateful to have him as our advisor and tutor for our Master thesis. Beside our advisor, we would like to express thanks to resting our thesis committee and all other faculty members who have delivered a useful lecture about every thesis chapter that was helpful in our thesis completion. Our sincere thanks to our participant companies from Pakistan, who have shown courage and commitment to be able to finish our thesis on time. The current situation of lockdown globally has affected all the markets. It is appreciable that the Pakistani market has shown support in a difficult time, so we get the in-depth knowledge that helps us to came out the conclusion of our thesis.

Lastly, we are grateful to our families, especially to our parents and siblings who have shown trust in us and give us this opportunity to go and explore the world of education that looks like beyond our expectation. This thesis would be not possible without their Physical, Moral, Financial, and emotional support. Thank you so much for everything. Spring Semester, 2020.

Table of Contents

1. Introduction ... 1

1.1 Background ... 1 1.2 Problem discussion ... 4 1.3 Research Purpose ... 5 1.4 Research questions ... 6 1.5 Delimitation ... 62 Literature review: ... 7

2.1 Heterogeneity ... 7 2.2 Heterogeneity Dimension ... 10 2.3 Firms performance ... 12 2.3.1 Financial performance: ... 14 2.3.2 Strategic Performance ... 15 2.3.3 Relationship Performance ... 162.4 Firms Performance and Heterogeneity Dimension... 18

2.5 Heterogeneity conceptual model ... 19

3 Methodology ... 22

3.1 Research Method ... 22

3.2 Research Approach ... 23

3.3 Research Design... 24

3.4 Data Collection Method ... 25

3.4.1 Interview ... 25 3.4.2 Selection of Interviewee ... 26 3.4.2.1 Company A ... 27 3.4.2.2 Interviewee B ... 27 3.4.2.3 Interviewee C ... 27 3.4.2.4 Interviewee D ... 28 3.4.2.5 Interviewee E ... 28 3.4.2.6 Interviewee F... 28 3.5 Analysis ... 30 3.6 Ethical Consideration ... 32 3.7 Research quality ... 33

4 Findings and Analysis ... 35

4.1 Cost leadership ... 35 4.1.1 Profit maximization ... 35 4.1.2 Direct buying ... 36 4.1.3 Monopoly ... 36 4.1.4 Price Variation ... 37 4.2 Product diversification ... 37 4.2.1 Product range ... 38 4.2.2 Bulk quantity ... 38 4.2.3 Market Coverage ... 39 4.2.4 Business Expansion ... 39 4.3 Technological innovation ... 40

4.3.1 New technological models ... 40

4.3.2 High Demand ... 40

4.3.3 Competitive advantage ... 41

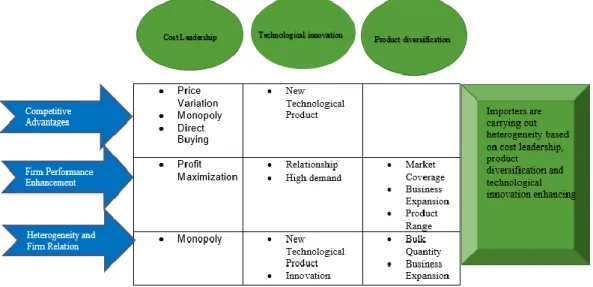

5 Analysis ... 44

5.1 Competitive Advantages ... 44

5.2 Firm Performance Enhancement... 47

5.3 Firm Performance and Heterogeneity ... 50

6 Framework of Importing Firms’ heterogeneity and Firm’s

Performance ... 54

7 Discussion and conclusions ... 55

8 Implications ... 59

8.1 Theoretical implications ... 59 8.2 Practical Implications ... 60 8.3 Future Research ... 61 8.4 Limitation ... 619 References ... 63

Appendix 1 ... 67

List of Tables and Appendices

Figures

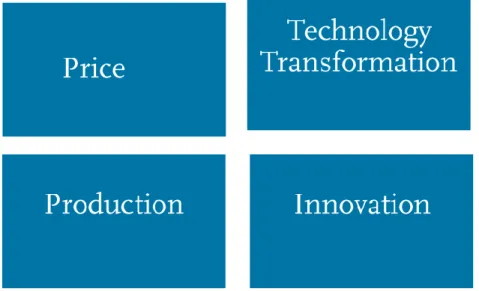

Figure 1. Heterogeneity dimension (Literature)………12

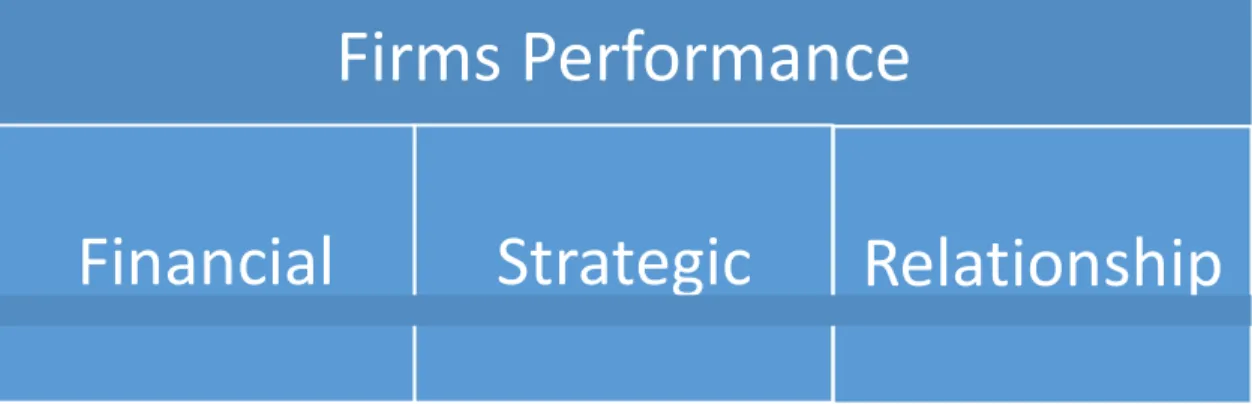

Figure 2. Firm performance (literature)………...13

Figure 3. Codes and Themes……….31

Figure 4. Additionally, Supplementary Information……….43

Figure 5. Framework of Importing Firm Heterogeneity and Firms Performance……….54

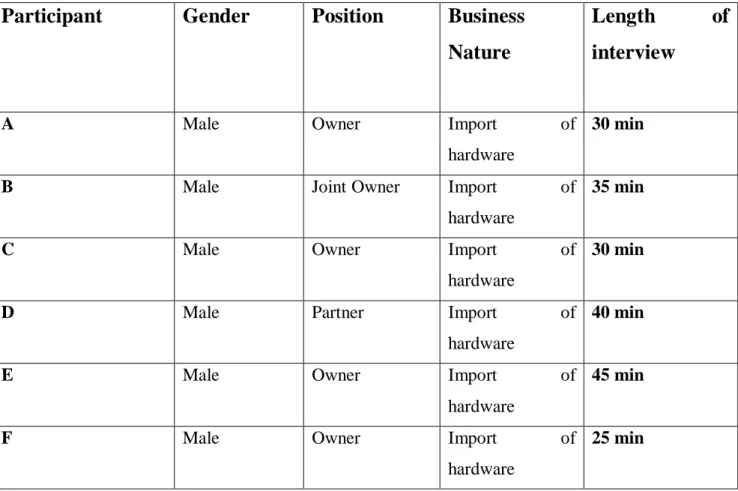

Tables Table for Qualitative Interview……….29

Appendix Protocol for Interview……….………...67

1. Introduction

Global exchange is among the principal channels through which firms enter into new and valued relationships that further allow them to develop knowledge and facilitate advancement (Grossman & Helpman, 1991). The primary involvement of our paper is to present how firm heterogeneity matters and affects importing firms’ performance. Not only the relation of dissimilarities between related segments but also the differences in terms of characteristics and attributes to firms that belong to the same local sector or industry. The distinct outcome of different firms in a definite area results in a firm’s heterogeneity.

A well-accepted documented that firms with diverse specialties exist in the same industry even if the industry was tiny (Bernard & Jensen, 1995). Export and Import have a significant result in firms’ heterogeneity within an industry. Less consideration has shown towards a potential relationship between firm heterogeneity and other major monetary factors (such as gross margin or trade performance). The concept of firms’ heterogeneity has important implications both at a micro and macro-economic level. Firms with greater volume perform analytically better alongside several propositions, such as survival rate, advanced activities, and contribution in international trade. At a macro level, the difference and granularity of the firm volume supply affect the cumulative productivity, welfare practices from trade, and the effect of distinctive and methodical shocks (Melitz & Redding, 2015). Firms in the local sector or industrial cluster might be heterogeneous (Clausen, 2013). Firms can act as a recipient and source of domestic knowledge equally (Alc'acer & Chung, 2013).

1.1 Background

Firms are heterogeneous in nature. In an industry, firms can create heterogeneity no matter how big or small firms it is. This heterogeneity of firms can then lead to firm performance. Firm heterogeneity has an impact on the overall evaluation of competitiveness which encompasses the production of both trade and productivity performance. A lot of research has done on the firms’ heterogeneity. Many researchers conducted several types of studies to understand the concept of firm heterogeneity. In the past, models developed by many researchers for firm heterogeneity. These models and theories by researchers presented in the exporting and trading context of the firm. Firms

differ tremendously in size, estimated productivity, and export performance, particularly in the smaller industries. From the exporting sectors, very few companies export and the ones that do are more extensive and more competitive. Melitz (2003) presented the most famous model which developed regarding firm heterogeneity and trade point of view. In the beginning, a trade mode developed by Krugman (1980). The model of trade integrated imperfect competition and growing return towards scale was developed by Paul Krugman (Krugman, 1980). In this model, Krugman (1980) considers the firms within the same industry to have the same level of production and have the exact fixed cost. The main consequence behind this assumption was the export condition of the country. This model does not fit well according to practical observation, and Krugman criticized a lot.

Furthermore, after the criticism of Krugman’s (1980) model. Later, a model was presented by Bernard and Jensen (1995) which explained the heterogeneity concept even in small firms with different production volumes. In an industry, heterogeneity can exist no matter if the firm is big or small. It all depends on how the firm production level is and on what basis they have a competitive advantage through exportation. Based on this background Antras and Helpman (2004) introduced a model to explain different production levels that leads to multiple organization forms. Their model also explains organization structure and supplier’s relation. The model suggests that a firm’s productivity level would influence their strategic choice of outsourcing and insourcing of organization. According to´ Antras and Helpman (2004) in an industry when importing technology takes place between two countries then the firms which are importing are heterogeneous. Heterogeneity exists among firms because of the Import.

One most recent study conducted by Costantini and Melitz (2007) mentioned the firm heterogeneity with an innovative way to adjust trade liberalization. Firms’ heterogeneity helps different firms to improve in relevant fields. Exporting firms perform differently in comparison to non-exporting firms in several pertinent aspects. Like exporting firms are more productive, pay high wages, more innovative, and more capital (Brakman et al., 2019). Furthermore, another study done by Meltiz and Ottaviano (2008) explain the close relationship between the market and price that will allow incorporating pro-competitive effects from trade liberalization.

On the contrary, a consumer takes benefits of a cheaper product due to international trade as they import products at a lower cost (Blaum, Lelarge , & Peters, 2018). The imports of goods also used in the process of final goods. Firms who have access to the foreign market can trade for cheaper or for a higher quality product from abroad. In addition to this, importing trade reduces the cost of production of the firm and benefits them to produce cheaper products locally. In this sense, heterogeneity is developed in firms as they have an advantage in an industry over imports. Importing creates a competitive advantage over non-importing firms based on low-cost production and high-quality products.

Melitz (2003) developed the basic model of firm heterogeneity. In addition to this, Melitz (2003) comes in support of Krugman, who introduced the concept of firm heterogeneity and established a relationship with sunk cost to enter the foreign market. Melitz (2003) developed a theoretical model that emphasizes production and defines productivity as a crucial factor. He stated that firms should be productive enough to cover their market expense to enter the foreign market. Firms need to fulfil the demands when demand for a specific item of a firm’s maximum production exceeds. Not only for importing firms, but the exporting firms also needed to import to finish their raw material in ending goods. There are two main findings. First, high productivity is a critical need to go for international trade, but not the only thing which affects the importing of goods. Firms’ other characteristics, like the firm size, also affect the decision.

Few concepts lead to firm heterogeneity within the market even though the market is tiny. Sources on which firms compete with each other are cost reduction, quality, innovative technology, high-profit margin, and production. Firms produce horizontally differentiated goods, which allow them to benefit from some degree of market power, typical of monopolistic competition. Firms vary in terms of productivity that is in the amount of labour needed to produce the goods. If the productivity level is too low, expected profits are harmful, and the firm is better exiting, thereby losing the entry sunk costs. Alternatively, the firm operates in the domestic market and possibly in some foreign markets. It explains that those firms with the highest productivity levels are also bigger than average firms and export abroad, which is consistent with empirical facts. A reduction in trade barriers (lower transport costs, import tariffs, etc.) makes it profitable for more firms to export. The increased competition drives smaller, relatively inefficient domestic firms out of the market.

The other source of heterogeneity is based on quality. Within the industry, the quality of imported goods results in heterogeneity. As a result of the firm’s heterogeneity, new technology can use for local markets that can be differentiated. The importing of a large number of goods helps them to have a big stock that shows high production that will present them as a giant producer in the industry. Importing cheap goods from other countries can benefit in increasing profit margin and creates a separate market reputation. The concept heterogeneity developed in a firm because of different things like quality, production, etc. Quality and presentation are a few of them. Firms have high-quality products from foreign countries through import results in heterogeneity in industry. Similarly, firms that are importing can have high production as Import lowers the labour cost. Firms having high show can leads to heterogeneity as well. Heterogeneity is produced in the industry when firms have diversity. Diversity can relate to production, quality, cost, or anything.

1.2 Problem discussion

International trade becomes an integral part of the global world, as Import and export are the media of international trade and both export and Import have a significant result in firms’ heterogeneity within an industry. Export contributed and showed significant effects on firms’ heterogeneity. Several studies can found in the export context explaining a firm’s heterogeneity. Research on firms’ heterogeneity is a well-developed concept in the export; literature can found in export context (Melitz, 2003). One most recent study revealed that exporting firms perform differently in comparison to non-exporting firms in several relevant aspects. Like exporting firms are more productive, pay high wages, more innovative, and more capital intensive (Brakman et al., 2019). Similarly, another study conducted by Costantini and Melitz (2007) mentioned that firms’ heterogeneity with an innovative way to adjust trade liberalization. Firms’ heterogeneity helps different firms to improve in relevant fields.

Firm heterogeneity is a highly consumed topic in international trade and especially in the export context. Different contexts have been found in the literature that shows the characteristics of exporting firms and how they are different in markets. The model of Melitz (2003) highlights the importance of export and shows how trade influences a more productive producer to go for export. Most of the study conducted in the export context and developing countries has a quantitative method. On the other hand, importing firms’

heterogeneity is a less sought topic in the literature, which we believe is a clear gap in the export-import research stream. According to the importation point of view, there is no detailed and particular study found in the developing country context. This study focuses on the importation of developing of country, to see either importer have the same advantages as an exporter, which is hard to find in a developing country context. While comprehensive data of a particular industry is hard to find, the estimated import value of Pakistan is 539,359.1 (Million Rupees) as of January 2020 (Pakistan Bureau of Statistics, 2020). However, the export has shown 136,129.2 (Million Rupees), a minimal number of values in comparison to imports.

One rare study conducted in Pakistan is “An investigation of Firm Heterogeneity and Constraints to Development and Growth” by Moghal and Pfau (2009) a quantitative study showing the barriers that are going to be looked over by local traders. However, our study focuses on ground factors. Limited research has done in the context of importing firms. To analyze the factors affecting importers’ performance and those who create differentiation among firms. The literature reviewed which shows rare positive signs of Import and the firm’s heterogeneity. Research shows Articulate that imports are a significant channel through which technology can transfer from developed to a developing country (Keller & Yeaple, 2003).

1.3 Research Purpose

This study aims to examine heterogeneity dimension and firms performances. We address the following research questions, “how DO heterogeneities affecting FIRMS performance, what IS the relationship BETWEEN heterogeneity dimension and firms performances, and how THE FIRMS heterogeneity HELP to BUILD FIRMS’ competitive advantages. The contextual study of the electronics industry of Pakistani firms investigated to find out the heterogeneity existence. There are a few main aspects of our research, does heterogeneity exist in Pakistani firms?

How Import helps them to be heterogeneous in the market? and To what extent they differ in the market? Since the enhancement of trade and rapid increase in the market growth, there is a gap to study the context of developing countries, the effect of Import, and the basis on how they are different in the market. This study fills the gap that will be useful for local firms to go for import and foreign business to enter the Pakistani markets while considering basics on which they can compete.

This thesis uses qualitative methods to analyze how importing firms are competing in the market, how Import helps them be different on the ground. To discover the outcome of the market, we opted the exploratory study is going to be used to find out the actual reality from the experience and observation of the importers. This study involves 6 cases from the market to add some universal significance to this phenomenon. Besides all this, we will recommend some suggestions for future work and will provide a model that will be useful for the Pakistani market.

1.4 Research questions

1. How different heterogeneities help them (the Pakistani importing firms’) to have competitive advantages over others?

2. What extent the importing firm’s heterogeneity affect their performances?

3. How are heterogeneity dimensions and importing firm performance related?

1.5 Delimitation

• This study has mainly focused on the following delimitations. • This study primarily focuses on Pakistan.

• We selected respondents through snowball sampling, who is the importer of Pakistan.

• We developed a protocol for a semi-structured interview.

• This study is qualitatively based using the thematic analysis method to produce a theory.

2 Literature review:

In this chapter, we are going to provide a wide previous frameworks and researches that base the concept of heterogeneity, that have relation with the purpose of our study. Within the area of Firms’ Performance and Heterogeneity. It started with the detailed information about Heterogeneity in industry, and different types of performance that are related to heterogeneity.

2.1 Heterogeneity

In recent years there is a massive increase in the number of studies on firm heterogeneity due to the fact of blooming availability of datasets of the Firm. Firms are heterogeneous through diversification and popularity of the goods, the popularity fluctuates across markets, and in each market, and firms are ambiguous about the popularity of their goods. Heterogeneity is a term that refers to the composition of a service. Heterogeneity causes fluctuations from one service to another or changes in the same benefit from day to day or from one customer to another. Firm heterogeneity is the distinct outcome of different companies in a given field. The recent research of firm heterogeneity in companies and macroeconomics has presumed that firms can compete under the pre-requisite of monopolistic competition (Meltiz & Ottaviano, 2008). A well-documented theory was proposed by Bernard and Jensen (1995) that suggested the idea interprets the presence of organizations with various strengths in a similar sector, even though the industry was little.

Import and export have an essential impact on the heterogeneity of companies in the industry. Theoretical research in global trade has increasingly emphasized the preferences of individual factories and companies in understanding the enthusiasm and penalties for comprehensive trade. The extension of smaller data sets and the progression of new theories have pushed forward the people over the previous decade to consider moving towards firm heterogeneity. In addition to that, the field of global communications and macroeconomics has changed. Recent and previous research had many impact and influence of the changes in firm performance, including differences in productivity, associating applicants in the execution of a company, and comparisons of the degree of innovation have considered. For instance, product quality (Melitz, 2003), markups

(Johnson, 2012), fixed costs (Loecker and Frederic, 2012), and the ability to supply multiple products (Arkolakis, Costinot, and Clare, 2012).

Paul Krugman's (1980) basic model is one of the production models with economies of scale, and the company can reduce the cost of product differentiation. Trade theory enlightens the actual trade patterns among countries with similar values, such as factor counts, grades, and technology, as opposed to the classic trade theory between countries with different end values. It involves monopolistic competition in product differentiation or differentiation, mass production, reducing costs, or increasing returns. In this model, each Firm has specific monopoly power, but entering the market will reduce the monopoly profit to zero. If two imperfectly competing economies are allowed to trade, even if these economies have the equivalent liking technology and factors, the increased returns will generate trade and profit from it. Krugman's (1980) formalized internal economies of scale argument allow economists to point out the particular perspective of global trade that were not formerly explained by Richard's comparative advantage. Suppose there are internal economies of scale and the company has monopolistic competition. In that case, the market will provide a certain number of companies (less than the number of companies in a fully competitive market), and each company will produce more output than a similar competitive company. In these cases, even if there is no difference in relative cost, liking, or technology, the trade will benefit at lower prices and greater product diversity.

Furthermore, Melitz demonstrates conceptual heterogeneity. The international trade model with heterogeneous firms illustrates export productivity and the relation between productivity and export decisions (Melitz, 2003). The model Melitz (2003) presented is a dynamic industry model that associates the heterogeneity of firm productivity into the monopoly competition framework of (Krugman, 1979). The model presented by Krugman (1979) explains that in each country, industry occupied by firms that differentiated by productivity, and classifications that produced by the exporter. In addition to this, Melitz (2003) developed a theoretical model that emphasizes production and defines productivity as a critical factor. He enlightens that companies should have sufficient productivity to pay for their market costs of entering foreign markets. In the industry, almost every company faces the risk of future production. The trouble is making

the irreversible expensive investment decisions to enter the foreign market. In addition to joining the foreign market, firms should produce with different productivity levels. The least productive company encounters negative profits and therefore exits. Due to the high export costs, only companies with relatively high production capacity (among surviving companies) chose to export, while the remaining companies only served the domestic market. For these companies, exports are not profitable, either because it involves fixed or sunk costs, or because import demand is driven to zero when prices are lower than delivery costs. Once the market for a particular company's maximum output exceeded, the company needs to import to meet the demand. This is not only for importing companies, but exporting companies also need to import to complete the raw materials in their final products. The cost of entering the export market is too high, but companies must first understand their productivity after deciding to export. The basic idea of Melitz (2003) is that only high-productivity companies can make enough profits to cover the enormous fixed costs required for export operations.

The concept of heterogeneity has changed a lot. There can be several industries in the market, and, you cannot judge a firm based on its size. The difference between the firms in an industry is because of the heterogeneity concept. A Firm having heterogeneity not only creates differences but is also far more competitive than other firms in an industry. They can be marginally more productive than other firms and have had enough time to grow and exploit this advantage (Luttmer, 2010).

2.2 Heterogeneity Dimension

Heterogeneity has several dimensions. Since Bernard and Jensen (1995) have done empirical work regarding heterogeneity. Their documents model explains the heterogeneity concept even in small firms with different production volumes. Firms within the same industry are very much different from each other based on the cost of production, Work efficiency, Value-added per labour, productivity, and export and import status (Brakman et al., 2019). To test these facts, the researcher has chosen a model to see the firms' heterogeneity in the export business. These models based on factors like size and productivity vary from market to market (Johnson, 2012).

From the literature, we have found several dimensions that different exporter and importer are practising. We have chosen some of them to use in our study. For our research, we have decided to select four dimensions: Price, Production, Technology Transformation, and Innovation. The data and the importance of these dimensions have found in the literature. Firstly, price used as a source of heterogeneity. Price is a valuable asset concerning product quality. This information works very profoundly in the firms' heterogeneity, especially in the field of exporting firms (Johnson, 2012). Furthermore, Melitz (2003) used price as a standard in his model. Price also has a direct effect on production.

The next dimension is productivity. In addition to this, Melitz (2003) Developed a theoretical model in which he describes productivity as a crucial factor. He explained that the firm should be productive enough to bear the cost to enter the foreign market. The firm that produced more is more capable sufficient to handle the sunk cost. It is now a big and established research plan using micro-level data that confirmed the strong self-belief of higher productive firms in the export market. More recently in the literature branch found the evidence for learning by exporting aspect

The other dimension to discuss here is a technology transformation. Through trade, technology has transferred from one country to another. Several studies by international economic literature show great interest in businesses and technology transformation (Saggi, 2002; Keller, 2000). Research has focused on other promenades of technology transformation like export, import, and foreign direct investment. Researchers Eaton and Kortum (1996) Collect data from Organizing for Economic Co-operation and development and analyzed that more than 50% of growth in a few countries

originated from innovations of different countries like the USA, Japan, and Germany. More literature included, country-level data that shows international technology scope spread through different means, and trade plays a vital part to extend this technology (Coe & Helpman 1995; Coe, Helpman, & Hoffmaister 1997).

Firms improve their efficiency after entering the export market. Innovation is also a significant step-up in heterogeneity. Firms that want to make more trade, those firms are investing more in their research and development department. Few researchers like Costantini and Melitz (2007) and Atkeson and Burstein (2010) explained the importance of developing a model of heterogeneous firms, by describing innovation concerning the export market. The research paper of Costantini and Melitz (2007) and Atkeson and Burstein (2010) explains the situation when firms are productively different initially and when the innovation opportunity arises, and then the productive differentiation evolve. After the innovation in the Melitz model, research shows that exporters invest a lot in design and those firm who are entering in export market invests more in their research and development department (Vannoorenberghe, 2008)

For our research work, we have selected these dimensions to study in the developing country context to see either these dimensions have the same effects for importers. Our heterogeneity model will base on these dimensions showing how and what extent these dimensions are helping importing firms to gain advantages over others.

Figure 1. Firm performance (literature)

2.3 Firms performance

The firm performance is a problematic term that may include different shadows of meaning as long as it relates to organizational performance, functioning of the firm, and outcomes of its operations. Usually, the firm's performance implies the organizational performance, including the manufacturing of products and services, the functioning of different units of the firm, the performance of its employees, and the outcomes of their work in total. At the same time, the firm's performance can view in a broader context as part of the business development of the firm. What is mean here is the fact that the business development mirrors the firm's performance and allows it to assess the extent to which the organizational performance is significant.

Figure 2: Firm Performance (literature)

Performance variations in companies are frequently the concern of academic lookup and government evaluation (Meyer & Verreynne, 2010). Traditionally, at the industry level, there has been attention in considering various measures in firm performance, considering that the organizational characteristics of the industry provide significant homogeneity among firms within that industry subsequently to a more extensive extent firm performance (Howell & Frazier, 1983). Performance explains the success of a company over time. Investors and stakeholders always consider the company's performance for investment. Firm performance reflects the results, efficiency, and effectiveness of the organization's activities.

This thesis will conceptualize the Pakistani importing firms' performance based on the categorization from different perspectives, including financial performance and non-financial performance (Ngyten, 2019). This chapter will help you better understand the term firms' performance and how we have categorized firms' performance into financial and non-financial performance. In addition to this, elaborating firms' performance will help the reader to understand the performance categories which are affected by the heterogeneity in industry.

Firms Performance

2.3.1 Financial performance:

A performance evaluation system is a concise set of metrics (financial or non-financial) that supports the organization's decision-making process by collecting, processing, and analyzing quantitative data on performance information (Gimbert, Bisbe , & Mendoza, 2010).

The core of the firm's effectiveness is financial performance such as profit maximization, maximizing profit on assets, and maximizing shareholder's benefits (Mohammad & shah, 2014). Financial performance is the financial state of the business over a specified period that involves the accumulation and use of funds evaluated by multiple indicators of capital adequacy ratio, liquidity, debt, solvency, and profitability. Financial performance is the management and control capacity of the company's capital. It involves measuring the accumulation and use of capital in various ways.

Financial performance is a way of measuring the amount of income, profit, or revenue a corporation is capable of making. The financial statements consist of; (a) Balance Sheet, (b) Income, (c) Cash flow, (d) Changes in the capital. Financial statements are financial records that cover cash flows, balance sheets, loss of income, and adjustments to resources. These changes are essential for company managers who follow the company's financial policies. Financial reports are the company's financial state comprising the balance sheet of profit/loss calculation, and other financial information, such as cash flows and retained earnings.

Financial performance is the financial achievement of the company; the managers of the company must understand financial performance. The ratio of liquidity, solvency, profitability efficiency and leverage can use as a benchmark of financial performance. The data can extract from the financial statements; cash flow, balance sheet, profit-loss, and capital changes but also fundamental and technical analysis.

The financial performance measures differ from each other in several ways, and many questions concern the choice of which particular financial action to adopt. For example, metrics can be absolute (e.g., sales, profit), revenue-based (e.g., profit/sales, profit/capital, profit/equity), internal (e.g., profit/sales), external (e.g., company Market value), the level of a single period (such as one year), the average cost or the variability of the average growth rate or trend. A countless number of ways have brought forward to measure the firms' financial performance, and among them, profit margin and return on revenue are

the measures that mostly used. Accountants and subject calculate profit margins to standards set by the industry. Therefore, influenced by accounting practices as various methods used to evaluate tangible and intangible assets (Kapopoulos & Lazaretou, 2007). Profitability is a critical component of financial performance. The word profitability described as the effectiveness of management's use of total and net assets recorded on the balance sheet. Effectiveness can observe by associating net profit with the assets used to generate profit. From the owner's perspective (in the case of the company, the shareholder), profitability refers to the return obtained through management's efforts on the funds invested by the owner.

Profit margin is a percentage measurement of profit that expresses the amount of a company earns per sales. A relatively high-profit margin is desirable because it corresponds to a lower expense ratio relative to sales. Small profit margins are not necessarily bad. For instance, lowering the sales price usually increases the number of units, but the profit margins will decrease. Total profit may still increase due to increased sales (Ross, Westerfield, & Jordan, 2010).

2.3.2 Strategic Performance

Due to their global and complicated nature of measuring a firm’s performance, the majority of researchers take the financial and economic parameters to define a firm’s performance. Finding a suitable methodology to gather data is not easy due to the diversity of the industry. To determine the firm’s success and failure in small level firms and privately held-firms are due to a lack of clearly defined performance data.

The strategic measure is a measure which includes achievement of more significant, long term objective such as building capabilities, entering a new market, and retaliating a competitor. Furthermore, Strategic performance measurement help organization to define, then achieve their strategic goals, align behaviour and attitude have a positive effect on organization performance (Micheli & Manzoni, 2010). All previous studies that explained a firm’s performance with sale and profit only, and do not consider strategic and goal achieving model were later criticized a lot by (Aaby & Slater, 1989; Zou & Cavusgil, 1994). The most popular measure to evaluate a firm’s performance is economical and financial. Still, for accessing a small level firm’s performance, subjective measures or strategic measures are often become necessary to evaluate a firm’s performance. The Researcher Cavusgil and Shaoming (1994) identified four components

that lead an organization to achieved strategic goals. Various studies prove that Strategic performance measurement is very efficient and useful for an organization to improve organization performance. Research has proven that with appropriate measures of performance, an organization can take advantages.

Since 1990, a lot of organizations have started investing more money and resources for measuring performance. Several reports show that a company with an average sale of one billion dollars spends on 25000 people a day per year for planning and measuring the firm’s performance. The research also did in the public sector, the recent establishment of “New Public Management” reforms in several OECD countries, the government has paid great attention to measure strategic performance. United Kingdom department freshly evaluates that they have spent 150 million pounds to monitor development on national targets.

2.3.3 Relationship Performance

Relationship performance is considered a non-financial performance. A non-financial firm performance means how the firm is performing other than money evaluation. The relationship performance of a firm is a customer relationship with the firm how the firms develop a relationship with their customer and business partner social capital. Customer relationship considered as it is relevant to the research of the thesis topic. Customer relationship defines as the customer's trust and commitment to the company. Customer trust and loyalty reduces the uncertainty of customer transactions (for example, customers avoid unpredictable performance and useful interactions with services), and enhance meaningful connections, such as the customer's connection with the company's brand, Customers connected with future businesses (Bendapudi, 1997). Customer relationship is increasingly important to firms as they seek to improve their profits through longer-term relationships with customers (Coltman, 2010). Customer relationship is becoming an essential issue in marketing to gain customer loyalty, improve customer retention rates, as well as increase profits (Shang, 2012). Firms can generate profits and can also add value to their business, not in terms of money only but also through relationship performance. Customer relationship plays a vital role in generating profitability and loyalty towards the firm.

The development of customer relationships has enabled the company to increase profits not only in short-term, but also in the long-term because customers who establish strong

relationships with the company spend more money O Brien and Jones (1995), and provide a stable future customer flow (Oliver, 1999). Companies can improve performance by developing strong customer relationships. Customer relationships are considered essential firms' resources (Bendapudi, 1997). According to the commitment-trust theory of relationship marketing, researchers conceptualize relationships as relationships characterized by trust. For instance, when a party has confidence in the reliability and integrity of its partners Morgan and Hunt (1994), and commitments (such as long-term parties' long-term positioning of partners. (Morgan & Hunt, 1994; Srivastava, 2001), believed that the establishment of a loyal and committed relationship between a company and its customers is a vital relationship resource. Corporate performance and shareholder value, as "any organization has the potential to develop close relationships with customers so that competitors may be relatively rare and difficult to replicate (Srivastava , 2001).

Due to the advancement of technology, companies have invested in technology and developed customer relations software. These customer relationship technology helps firms to get a better relationship with their customers in terms of data and loyalty. Customer relationship management refers to a management approach that seeks to create, develop, and enhance relationships with carefully targeted customers to maximize customer value and corporate profitability (Shang, 2012).

2.4 Firms Performance and Heterogeneity Dimension

One of the essential priorities in economic analysis in firms' performance is productivity. The prosperity of an economy conclusively depends on its productivity which, consecutively relies on the success of firms. Several factors affect the firm's performance. The central aspect from the literature that selected for study is the heterogeneity dimension which resulted in the firm's performance enhancement. In this section, we are going to study how these dimensions are going to increase a firm's performance.

The four factors are price, technology, production, and innovation. One of the central and most essential elements in the management of firms' performance is productivity. Productivity generally considered to be an efficient use of the organization (Pilat & Schreyer, 2002). At the company level, productivity is a measure of a company's ability to use its inputs to produce as much output as possible. Increased productivity may lead to better profitability for the company (Ngyten, 2019). Productivity means the relationship between production and input over the same period (Mohanty & Rastogi, 1986). Productivity has many positive impacts on firm performance, and the significant impact is on and ultimately on a firm's financial performance. Fisher's Principle developed by Metcalfe (1994) discusses the aspects regarding productivity is the value of total income as a ratio of cost. In addition to Fisher's theory (Metcalfe, 1994), one of the collective and, of course, the most widely used explanations is the ratio of productivity to input. In this analysis, productivity is a corresponding operation of productivity relative to overall all employees: the output of each worker.

The other factor regarding firm performance is technology, which is also one of the vital elements in firm performance. "Technological capability" is a term which referred to as "the capability to achieve any appropriate technical function or volume activity within the firm as well as the ability to develop new products and processes and to operate facilities effectively" (Teece, Pisano, & Shuen, 1997). In the recent decade, Firms achieve a competitive advantage within the industry, particularly in high tech industries. Firms gaining a competitive advantage is because of technological capability, which is an essential strategic resource (Duysters, Geert, & Hagedoorn, 2000). There is a direct and robust correlation between technical competence and a firm's effective performance (Vache, 2000). Finally, Tsai (2004) empirical analysis of a seven-year panel dataset of 45 large manufacturing firms quoted on the Taiwan stock market provides statistical

evidence that technological capability is a critical determinant of a firm's performance in the electronic field. The study suggests from these opinions and arguments on firm performance, and technological capabilities have a positive influence (Etemad & Lee, 2001; Afuah, 2002). Another important factor and element in the firms' performance are innovation. Firms acquiring innovative products result in positive performance (Rubera & Kirca, 2012). The literature of innovation shows many aspects on firms' but the most important that design is one of the important elements for firms' success and survival (Cho & Pucik, 2005), and sustainable competitive advantage (Mumford & Licuanan, 2004; Bartel & Garud, 2009; Standing & Kiniti, 2011).

There are four types of innovations that result in the firm's performance, i.e. product innovation, process innovation, marketing innovation, and organizational innovation, which results in firm performance. The critical performance ignition is pricing. The implementation of a pricing strategy is, however, problematic. Pricing plays an integral part as an enabler or obstacle to firm performance. The analysis of Dutta, Zabaracki, and Bergen (2003) is concluded in this way that pricing is an essential factor, and a resource can result in a continuous competitive advantage.

2.5 Heterogeneity conceptual model

The one source of heterogeneity is the price. Price use as a source of a firm's heterogeneity separating them from completing the model. The exporting selection shows the bilateral relationship of trade and price. Evaluation of participation, trade, and price shows the relations for a broad range of countries and section helps to fill the gaps. Price also has a direct link to productivity. Higher productivity shows an in-direct relationship with the price. High productivity lowers the price of the marginal cost of output.

On the other hand, import also has a role in reducing the price of a product. In the conceptual model of heterogeneity, price considered as financial performance. Price decision is one of the most critical decisions of management because it affects profitability, company returns, and market competitiveness. Price has a significant impact on the company's profitability and pricing strategies widely between different industries and market conditions. Pricing is related to financial performance because it is one of the main factors, which is the critical element of firm profitability. The firms that have direct access to foreign markets can buy the product from another country at a lower price and can have a competitive advantage in the market. The other dimension of heterogeneity to

discuss is productivity. Production is a crucial factor (Melitz, 2003). Productivity raises the profit of the firm (Melitz, 2003). Melitz (2003) explained that profit also reallocated towards more productive firms. The firms that produced more are the ones who can sell more, and that automatically raises their profit. Not only in terms of profit locally. Melitz (2003) Focused his study on productivity and explained the firms that produced more are more interesting to enter the foreign market. The firms that have higher productivity are strong enough to enter the foreign market. Productivity is considered as financial performance as it is a source of getting the right profit margin. In terms of company performance, having good productivity gives its competitors a substantial competitive advantage.

As a result, the overall company's performance cannot improve with increased productivity. In recent literature, studies show that productivity affects the international market as well as in the domestic market. Studies from Taiwan (Aw & Chung, 2000; Clerides, Lach, & Tybout, 1998), have found strong evidence that more productive firms self-selected themselves into the export market. The other ways have found to describe heterogeneity about productivity. Researchers Aw and Chung (2000), show that the exposure of trade for some firms forces the other least productive firms to quit the industry. Furthermore, Pavcnik (2002) did research towards market share reallocation in Chile after trade liberalization, and she finds that market share reallocation significantly contributed to productivity and in the trade sector. A related study by Bernard and Jensen (1995) in the USA, finds that share reallocation towards more productive firms contributed 20% of exporting plants within a sector industry.

Technology transformation is another dimension which causes heterogeneity in industry. Technology considered as a relationship performance in the conceptual heterogeneity model. The constant changes in the market, influenced by technological advancement, and by increasing growth in the customers' expectations, are leading organizations to continually search for new products to continue being profitable and competitive. Therefore, many firms in developing countries go through a learning process after importing new technology which eventually enables them to build their technologies. Firms providing technology to their customers create a relationship between them. Through technology, transformation firms use more advanced products to gain advantages over others. Studies in the past show the importance of technology

transformation. Most of the growth in developing countries is due to the usage of technology transformation from other countries (Eaton & Kortum, 1996). Latest estimates that include industry-level data Keller (2000) or the general data of trade they separated from capital goods trade. Xu and Wang (2000) shows the role of technology transfer in productivity. Recent work by (Blalock & Gertler, 2002; Javorcik, 2004) finds that an external entry generated in the local market within the same industry produced new technology for clients and suppliers.

Lastly, innovation is the dimension found in the literature, and we used for analysis. Innovation considered as relationship performance. Innovation and production of new products is a way to distinguish them from competitors, that added values to a product or service to achieve a better outcome. Thus, the production of new products, the innovation in products and processes are the essential factors in organizational performance to keep business competitive and profitable in the market. Firms innovating their products create a sense of strategy to perform better and attract the market.

3 Methodology

In this chapter, the research method and methodology have discussed our research purpose. We start by describing our research method and explain our reasoning of choice to follow the research approach. We further explain our research design as we used the exploratory nature and inductive approach for our study. The research method is fundamental to every academic study. The accuracy, certainty, and confusion can maximize if the research method conducted critically and carefully. Furthermore, the reliability of the result is not underline (Bell, Bryman, & Harley, 2018). A well-chosen method and a good research design will affect the reliability of the latter outcomes in this thesis. The methodology is a mixture of methods used to enquire about a specific situation.

3.1 Research Method

There are two basic techniques used for conducting research that is Quantitative research and Qualitative research. They both have advantages and preferable usage in different situations. Quantitative research used for numeric data, and qualitative is more of intention and actions. The quantitative research process gives reliable information used for the larger populations and actions of people. This information is might more accurate but does not give interpretations about personal intention (Steckler et al., 1992). Quantitative research calls for objectivity (Easterby-Smith et al., 2018). The other way of research conduction is qualitative research.

The research method we took for this particular topic was qualitative research. Qualitative research methods have chosen as they are used to answer questions about experience, meaning, and perspective, from the point of view of participants. These data are usually not amenable to counting or measuring. Qualitative research techniques include small-group discussions for investigating beliefs, attitudes and concepts of normative behaviour. Semi-structured interviews conducted to seek views on a focused topic or, with critical informants for background information or an institutional perspective, in-depth interviews to understand a condition, experience, or event from a personal perspective and analysis of texts and documents, such as government reports, media articles, websites or diaries, to learn about distributed or personal knowledge. The

Qualitative research technique used to collect data is semi-structured interviews, as our primary goal is to gather views on a focused topic.

Qualitative research is a creative process, which aims to gain the knowledge that respondents share from their personal experience. If the research did well, the process of data collection could be proven beneficial for everybody involved in the process. In qualitative research, detailed information gathered from respondents and their perspectives can be obtained and intact. The qualitative analysis is a continuous process through which new questions generated. The study of our nature is exploratory. As the nature of the study is exploratory, semi-structured interviews were selected to gather useful information. It may help us to generate new phenomenon which can be proven helpful for other Pakistani local traders and also for some foreign exporter. Also, secondary data that existed has provided comprehensive information collected through a developed country, but not in the context of developing countries like Pakistan.

No literature has found regarding this study, and the practical value of trade is not reliable in Pakistan as they have not maintained previous records. The numeric figure is quite hard to collect as the Pakistan Bureau of Statistics does not keep any proper records that can use in quantitative analysis. Also, the respondent we took in our interviews is a micro part of the industry, so that is why the qualitative approach is better for us to find out the factors that influence the development. Qualitative research gives us the flexibility to discover the factors that might prove helpful in our study (Murphy & Mattson, 1992).

3.2 Research Approach

To accomplish the purpose of our study, we have to establish a research approach. For the case study, three main approaches identified. Deductive, Inductive, and abductive are the main approaches. These three approaches have their terms and have shown different characteristics. These approaches connected with propositions that developed from existing theory or theory that is produced from collected data during the case, or add findings and improve existing theoretical models.

Deductive reasoning is the logical process of developing a conclusion from a known statement or something recognized as real (Ghauri, Grønhaug, & Strange, 2020). The deductive approach is to test the theory while creating a hypothesis that we know it is true. It is more likely to test the existing theory to have new findings. An inductive approach is systematic reasoning of establishing a general proposal that bases on

observation and specific facts (Ghauri, Grønhaug, & Strange, 2020). In inductive reasoning, the new theory has emerged from the selected case. The gathered data from the case were observed with specific facts to come out with a conclusion. The third type of reasoning is called abductive reasoning, and this type of reasoning is not that familiar with business research as compared to deductive and inductive. Abduction discusses the theoretical explanation of a practical problem that can guide to the establishment of a new theory (Ghauri, Grønhaug, & Strange, 2020).

For our thesis, we use the inductive approach. The topic of the thesis is new, and research questions that developed are on the problem. The deductive approach is a process by which a researcher can draw a general conclusion from individual instances or observations. The benefits of an inductive approach, as seen for example, in the case study, that it allows flexibility, attends closely to context, and supports the generation of new theory.

The most famous approaches to research design are deductive and inductive. The deductive approach is basically to test the hypothesis or test the existing theory. In this particular case, this approach is not suitable as the nature of the study is exploratory (Sternberg, 2011). The thesis aims to draw a general conclusion from the collected information from the case. The inductive approach is more suited for this type of research (Copi, Cohen, & Flage, 2016). Furthermore, the research question based on “how” and “why”, whom answers we are looking to explore.

3.3 Research Design

Research design has provided the structure for research activities that can enhance the achievement of completing the research aim. Exploratory research is a valuable way to find out what is going on to pursue more in-depth insights”. Similarly, a person can ask questions and can measure new phenomena in a novel light. Through the literature review, phenomena of a firm’s heterogeneity and importing firms’ performance identified as a gap of research in the existing literature for developing country context. An exploratory study design adopted for the research. As our purpose of the study is to find out importing firms’ performance in Pakistan industry.

Furthermore, most of the recent researches on Firms heterogeneity has made in Europe, and all these were in the context of export. Like, in the Netherland, Brakman et al. (2019), in Italy, Castellani and Serti (2010), Melitz (2003) export model, and many others. There

is hardly any study in South Asia, especially in the import context. Lamentably, minimal research has done on firms’ heterogeneity in Pakistan and there is scarce information found in an import context. For the given reason above, this is an exploratory nature as we are trying to dig deep towards firms’ heterogeneity and importer performance phenomena in Pakistan.

We structured our three-research questions with our inductive approach and exploratory aims of our study. A qualitative study used as it supports the purpose of the study. Therefore, in this study, exploratory research was considered to understand better if there is any positive impact made through import. The exploratory study is also useful when a few facts are known, but to develop a practical framework, authors need more information (Sekaran, 2003)

3.4 Data Collection Method

There are two necessary sources to gather data, primary data, and secondary data. The data that the researchers collected directly from the interested variable for the particular purpose of the study is called primary data (Sekaran, 2003). The other form of data is called secondary data, which has already existed in literature in which a person has to gather the information (Sekaran, 2003). The primary data for the thesis is the data collected from interviews of an in-field importer who are currently doing imports in Pakistan from different countries like China, Korea, and many other countries. The secondary data we used in our thesis derived from the company’s websites, journals, articles, and textbooks. There are three research methods of data collection, including observing people, questionnaires, and interviews (Sekaran, 2003). For our research, we are using interviews as a research method to collect data from the importer of Pakistan so we can get the ground factor. These interviews will help us to identify the factors that made an impact on firms’ performances.

3.4.1 Interview

We used interviewees as our data collection process. As mentioned above, exploratory nature and qualitative research considered for our study. Interviews conducted to attract someone who is articulate and can tell readers exciting things about the organization, or those people who have been involved in the previous study and therefore have more to tell about the academic research (Easterby-Smith et al., 2018).

A qualitative interview was the best choice for this study. Qualitative interviews conducted to collect rich and detailed data from respondents to share the aspects of their experience, livings, and understanding. It will give the information we need to find out the factors and the effects of imports as well. Nowadays, the situation is more complicated. Moreover, due to Coronavirus, there is a significant change in conducting Interviews that affected our study as well. The interviewees are now more restricted and difficult to conduct, as there is an environment fear all over the globe. Due to lockdown in Pakistan, people restricted to go out, which means they are also avoiding going to their office. Nature affects the whole dilemma. Hence some people hesitated to join our interviewees.

We are doing the semi-structured Interview as we do not want to restrict the answers of participants. The semi-structured interviews give a greater level of confidentiality as respondents give more personal reply in nature. The semi-structured Interviews conducted with an open-ended series of question to our respondents; all these questions were unplanned and will ask as per their responses. By conducting the semi-structured interviews, some main factors brought to the ground, and detailed questions give us particular responses.

We have conducted the interviews through two different mediums, interviews conducted through Skype and WhatsApp. The main reason for conducting the interviews online was the geographical distance. The meeting fixed on text messages. The research purpose of our thesis was shared with the interviewees while conducting the interviews—a surety given to the interviewees for keeping the Interview confidential and anonymous. Six interviews conducted, three interviews conducted on WhatsApp, and while the other three conducted through skype. The duration of the Interview is between 25 to 40 minutes. The interview protocol made for the Interviews which later asked from the interviews, The Protocol of our study attached in Appendix 1 below. Interviews recorded after getting their permission to make sure we understand all the points.

3.4.2 Selection of Interviewee

The strategy we are going to use for selecting multiple cases is Snowball sampling. Snowball sampling is an exact sample structure where the criteria for adding samples are well defined. Those persons who meet the criteria included, and then further entitles will add by asking them either they know somebody. Easterby-Smith et al. (2018) suggets a

sampling involves peoples who are in the social circle of authors and doing business of importation in the industry from different countries. Entitles in our cases are the small firm importer of Pakistan. We have contacted some importers, and their circle has added further. The other reason for choosing Snowball sampling is the current situation, i.e. Covid19 is spreading all over the world and has affected the entire globe.

3.4.2.1 Company A

Interviewee A is the importing business of Office equipment that mainly includes computers, laptops, and other relatable equipment. They have been in this importing business since 2008. They are not only importing but also they are wholesalers in Pakistan. They supply their goods to different companies in Pakistan. Their main office is in Lahore, but they are covering all over Pakistan. They import mainly from the United Kingdom, the United States, and Canada. The success of their business expansion is through the channels of marketing, and they have a good reputation among their customers. Thus, word of mouth plays an important part which creates a sense of brand awareness in the mind of customers.

3.4.2.2 Interviewee B

Interviewee B is doing an importing business of HP printers in Pakistan and have been in this importing business for the last 7-8 years. They import all of these HP printers from china. The main reason for importing products from China is because China sells these HP printers at a very reasonable price. The Interviewee warehouse is in Lahore, Pakistan. In addition to this, they have customers all over Pakistan. In Pakistan, many universities are in demand of these HP printers, and thus, most of the universities are their customers. They have a good reputation in the market, and customers are satisfied with company B. They expand their business through the medium of marketing. By the medium of advertising and promotion, they expand their business which helps them to create a brand in the customer.

3.4.2.3 Interviewee C

The interviewee C is running an importing business of printers and photocopy machine in Pakistan. They import these products from foreign countries like Canada and the United States for 7-8 years. Their main warehouse is in Lahore, Pakistan. They are not only importing in Lahore but also all over Pakistan. The main importing client is

Afghanistan. Their average number of clients in Pakistan is 40-50 roughly. Also, they expanded their business through different marketing channels. According to them, this helped them to grow their business and develop a good reputation with other clients. The relationship with their customers is also very satisfying. The customer’s response to them is good.

3.4.2.4 Interviewee D

Interviewee D is doing a business of import of Hardware electronics in Pakistan by importing hardware items from countries like Canada, Dubai, and sometimes from China as well. They have been doing import business for the past 11 years. They are running through three different channels. They are importing from china to Dubai, and from Dubai to Pakistan, and from Pakistan to their end customers. They have some foreign clients as well. They are expanding their business towards Dubai and china now. In Pakistan, they have roughly around 150 clients who are buying products from them. Their business is growing day by day due to the marketing services they are providing to their customer.

3.4.2.5 Interviewee E

The company is doing a business of hardware equipment purchase from abroad. They are mainly dealing with importing items like printer machine and photocopier. They have been doing this business for the past seven years. The interviewee has business all over the country. They are importing items from abroad mainly from the UK and sometimes from Europe, and selling them as a wholesaler into the market. Company E has roughly more than 100 clients in their country.

3.4.2.6 Interviewee F

Company F is doing business of hardware import in Pakistan. They are doing business for the past 14 years of the importing from Hong Kong and the USA and have more than 300 clients in Pakistan. They have three suppliers from the USA and 5 in Europe. They have started container importation since the import initiative introduced in 2007. Before 2007, they were buying products from abroad through air travel after import permission given in 2007. They start importing from Hong Kong. As they are doing the import, they have expanded the business in Pakistan. For that reason, they moved to America as the demand for products has increased, and the USA is a big market as compared to Hong kong.

Table 1: Table details of Qualitative interview

Participant

Gender

Position

Business

Nature

Length

of

interview

A Male Owner Import of

hardware

30 min

B Male Joint Owner Import of

hardware

35 min

C Male Owner Import of

hardware

30 min

D Male Partner Import of

hardware

40 min

E Male Owner Import of

hardware

45 min

F Male Owner Import of

hardware